Buyers moseyed away from sky-high prices but are still there, just a lot lower, while many sellers hang on to illusions.

By Wolf Richter for WOLF STREET.

Inventory and supply of previously-owned homes of all types – single-family houses, condos, co-ops, and townhouses – surged, and sales plunged, amid sky-high prices that have been made impossible by 5%-plus holy-moly mortgage rates. And so the red-hot housing market turns into a “housing recession,” as the National Association of Realtors called it today, after the National Association of Home Builders had already called it that on Monday.

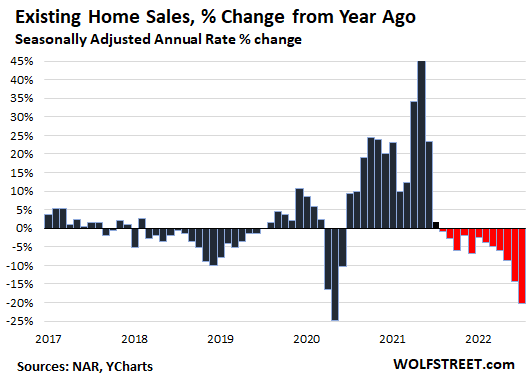

Sales plunged by 5.9% in July from June, the sixth month in a row of month-to-month declines, and by 20% from a year ago, the 12th month in a row of year-over-year declines, based on the seasonally adjusted annual rate of sales (historic data via YCharts):

Sales of single-family houses plunged by 19% year-over-year, and sales of condos and co-ops plunged by 30%, according to the National Association of Realtors.

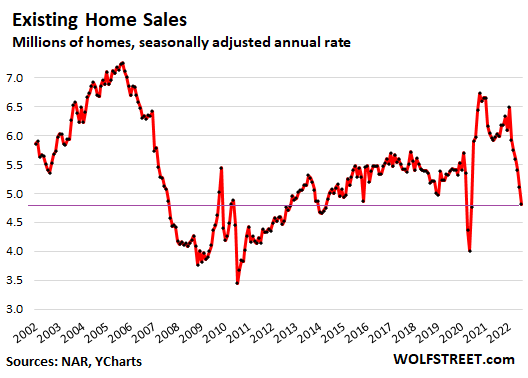

The seasonally adjusted annual rate of sales in July, at 4.81 million homes, was just a hair above the lockdown-June 2020 rate. Beyond the lockdown months of April-June 2020, it was the lowest sales rate since 2014. Compared to peak sales in October 2020, sales have collapsed by 29% (historic data via YCharts):

Sales dropped in all regions on a year-over-year basis:

- Northeast: -16.2% yoy.

- Midwest: -14.4% yoy.

- South: -19.6 yoy.

- West: -30.4% yoy.

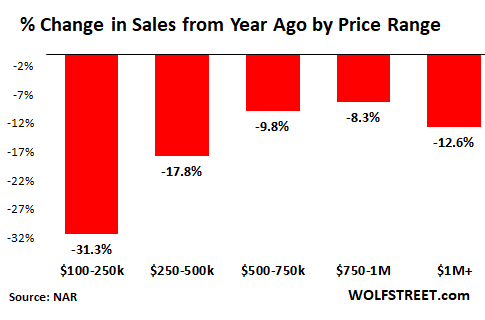

Sales dropped in all price ranges but dropped the most at the low end and at the very high end (over $1 million) for the first time in this cycle.

The drop at the high end is in part related to plunge in sales in the most expensive coastal markets in California, such as the San Francisco Bay Area (-37%), and Southern California (-37%), according to the California Association of Realtors.

Sellers and buyers too far apart on price.

“We’re witnessing a housing recession in terms of declining home sales and home building. However, it’s not a recession in home prices,” the NAR report said.

The fact that sales are plunging like this is an indication that sellers and buyers are too far apart on price, that buyers moseyed away from these sky-high prices, and these buyers are still out there, but a lot lower, while many sellers are still hanging on to their illusions, and deals aren’t happening. Sellers just pull their property off the market after a few weeks to wait for a better day.

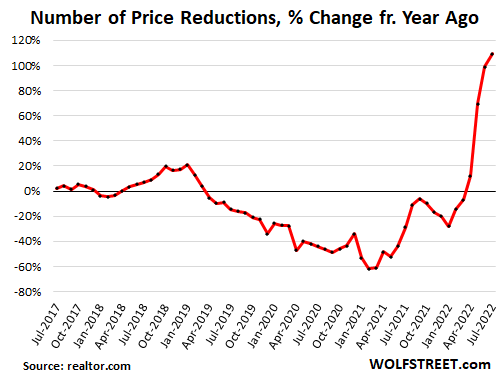

But some sellers are getting the message, and price cuts have been spiking. In July, the number of sellers that reduced prices of their properties on the market spiked by 31% from June, and more than doubled (+109%) from July last year, according to data from realtor.com. If pricing is realistic, a sale will happen, but pricing too often is not realistic yet, as documented by the plunge in sales:

Sales volume has plunged because of unrealistic pricing. But the deals that did get done, got done at still very high prices, which is why so few deals got done.

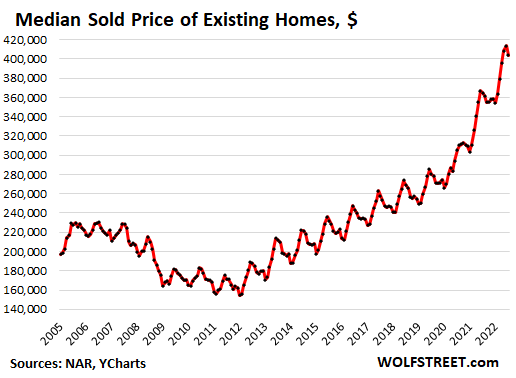

The median price dipped to $403,800 in July, which whittled down the year-over-year increase to 10.8%. As big as it sounds, it was the smallest year-over-year increase since July 2020, after having spiked by 25% last year (data via YCharts):

Inventory suddenly comes out of the woodwork.

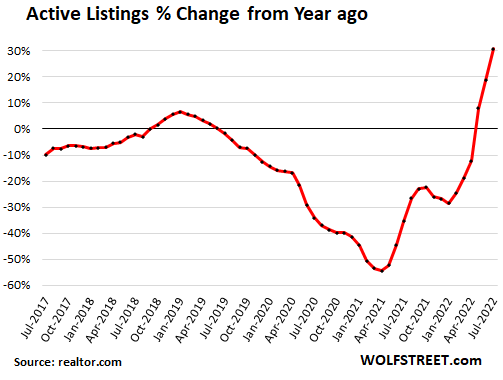

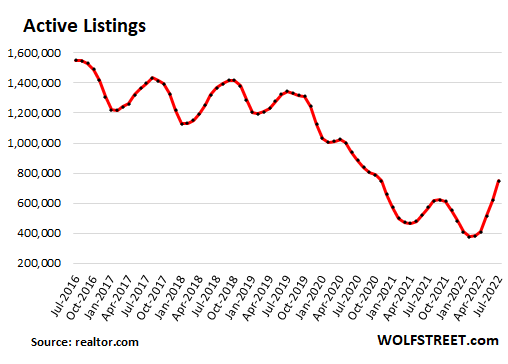

Active listings – total inventory for sale minus the properties with pending sales – jumped in July by 20% from June and by 31% from July last year to 748,000 homes, the highest since November 2020, according to data from realtor.com:

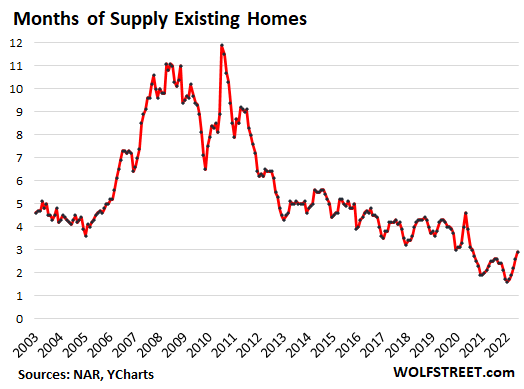

Supply of homes listed for sale, according to NAR data, jumped to 3.3 months at the current sales rate, the highest since June 2020, and up by 27% from a year ago, having more than doubled since January (data via YCharts):

Investors, second home buyers, all-cash buyers pull back.

Individual investors or second-home buyers purchased 14% of the homes in July, down from a share of 16% in June and May, from 17% in April, 18% in March, 19% in February, and 22% in January, according to NAR data. In other words, individual investors and second-home buyers are pulling back faster than others.

“All-cash” sales, which include many investors and second home buyers, dipped to 24% of total sales, down from a share of 25% in June and May, and down from a share of 26% in April.

Among the biggest institutional buyers of houses, American Homes 4 Rent has already laid out why it is pulling back from buying in this market where prices have started to drop in many cities where it is active amid a pile-up of inventories, particularly of new houses. “We need to be patient and allow the market to reset,” it said.

Holy-Moly Mortgage Rates don’t work with sky-high prices.

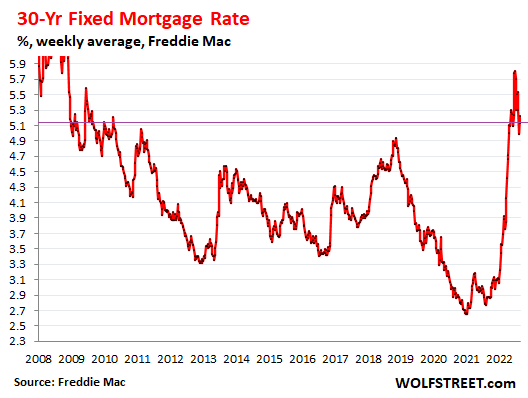

Mortgage rates – called “holy-moly” because of the sounds homebuyers make when they see the potential mortgage payment – have been between 5% and 6% since mid-April. The daily rate tracked by Mortgage News Daily today is 5.48% for the average 30-year fixed rate mortgage. The Mortgage Bankers Associations weekly measure, released yesterday, came in at 5.45%. Freddie Mac’s weekly measure, released today, ticked down to 5.13% for the most recent reporting week. These rates compare to 2.9% a year ago.

These 5%+ mortgage rates are still mind-bogglingly low, with CPI inflation at 8.5%, as the Fed is backing off years of interest rate repression. But home prices are mind-bogglingly sky-high, and the two don’t mix, and prices will have to come down to meet the buyers.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The thing that perplexes me is how so much of the media frame this as bad news. But if you’re speeding down the road at 120 mph, slowing down to a mere 80 is a step in the right direction.

We’re once again in the early stages of achieving more affordable housing, something that the economics establishment always cries for … until it starts to become reality.

Then it’s a crisis that requires aggressive intervention.

Finster,

Yes, peculiar. A while back, when rents in San Francisco plunged (they’d peaked in mid-2019), I called out the San Francisco Chronicle on precisely that.

This is what I wrote without naming names, but they knew what and who I was talking about and they quit doing it:

https://wolfstreet.com/2021/07/27/no-rents-are-not-suddenly-spiking-in-san-francisco-they-fell-again-in-july-and-are-down-27-since-june-2019/

I’m starting to think that some media business models are built on appealing to “glass-half-empty” audiences, people who always want to hear that everything as a problem, and that someone else needs to “fix” it.

That’s sorta the opposite of the “always a good time” folks at the NAR: “However, it’s not a recession in home prices,” the NAR report said. (… omitting the word “yet”)

Hysteria sells…that is why every single chyron on CNN for years (and years, and years) was labelled “Breaking News”.

And it was on the continuously posted chyron because CNN knows that the average channel surfer will only pause there for five seconds before moving on…unless they are duped into some hysterical frame of mind (OMG! What am I missing!!).

They couldn’t have anchors saying something literally stupefying continuously (well, they could try…) but the ol’ reliable lyin’ chyron never let them down.

But times change (especially if owners do) and anchors have been dispatched, Toobin has a *lot* more “time” on his hands, CNN+ was put to sleep, and today the Potato got uprooted.

To be honest, the Wolfstreet crowd here is mostly a half-glass-empty crowd also. A lot

of whiners who don’t see any positives. Such as the recent legislation signed by Biden. Admittedly it won’t decrease inflation, but it is a triumph in eventually decreasing our carbon emissions. Another example was the 1000-pt stock market drop from S&P 4700 to 3700, which I said here was a great buying opportunity. But many here were expecting (hoping for?) a bigger crash and didn’t take advantage of it.

The recent legislation has a 1% tax on stock buybacks, a late addition to secure passage, which to me is the crown jewel of it all. Amazing there’s been no applause about that. Perhaps people really do enjoy financial engineering.

That 1% tax was way too low. It should have been 20%. If Apple buys back $12 billion of its shares, it has to pay 1% tax = $120 million. For Apple, which had $95 billion with a B in net income, $120 million is a rounding error.

This comment is for Wolf. 1% may be low, but it is a “foot in the door” rate which will certainly increase once the politicians’ appetite for easy money has been whetted.

The SF Chronicle has been spinning RE news in favor of financiers for some time. I recently commented on how the SFC celebrated the construction of a new office building in the midst of a glut sufficiently severe that the Craiglist building was 78% unoccupied and the offer price cut 40%.

https://wolfstreet.com/2022/08/17/craigslist-cuts-asking-price-of-class-a-office-building-it-owns-in-san-francisco-by-40-the-building-is-78-vacant/#comment-459767

Has internet brought in “THE misINFORMATION AGE”?

@SS – No, misinformation goes back to at least the ancient Greeks (e.g. Plato’s Cave metaphor in The Republic).

And Mark Twain famously wrote in the 1800s that “if you don’t read the newspapers, you’re uninformed, but if you do, you’re misinformed”.

Perhaps what the internet brings is the ability to see, if you wish, just how misinformed you might be, given the diversity of perspectives presented on any given issue…

On balance, I think the internet is a net gain (especially compared to the local newspaper monopoly, 3 network oligopoly years).

Although more lies get *some* oxygen in the internet era, in the end people are going to weigh what they hear/see against personal experience/knowledge.

And…if more lies get aired…so do more truths, backed up with an avalanche of arguments/evidence that was ruthlessly ignored/aggressively smothered in the oligopoly era.

The Left mostly hates the new era (eagerly embracing an aggressive censorship that it was decrying until 5 minutes ago…and for decades).

Thank you.

Bad news sells. And it is bad news for people who leveraged themselves at the top. If they locked themselves in expecting to consume the house for a long time, as they should have, then they will be fine.

But if they bought because “buying” a home was seen as a way to build wealth, then they will be disappointed about the roi in the near term.

Nate, it was William Randolph Hurst and Joseph Pulitzer who coined the phrase, ” if it bleeds it leads, ” in the late 1890’s. More than anything they were the fathers of the modern news and it’s written form in papers. Their style of sensationalism and overt gross exaggerations news stories present as absolute facts and truth promoted people to derogatorily label their type of news reporting as yellow journalism. There is nothing new under the sun, Pulitzer and Hurst would be proud that their type of journalism is alive, well, and thriving over a hundred years later.

“Sellers just pull their property off the market after a few weeks to wait for a better day.”

Wolf, how much of this inventory would be second homes, vacation homes, rentals, flips, etc.? Those in a hurry to sell can’t use this tactic.

I wonder if they will pull their property as you say, but the flood gates will open once prices really start to plunge.

That usually not how it works.

Folks sell real estate for a variety of reasons, new job, losing a job, growing family, empty nest, death, divorce, need the money, just want to move, etc.

Real estate has substantial holding costs. Principal, interest, taxes, insurance, maintenance, upgrades, HOA, etc.

Most just can’t “pull it” and wait for a unspecified happier day in the future…someday.

Doesn’t matter if most people take them off the market. A few people won’t, and “price is set at the margin.” If there are ten similar houses in a neighborhood, they can all get priced according to the sale of just one. One person will be desperate enough to sell lower, which will drop the price for every other house, which will make more people desperate to sell.

Here in the Phoenix market we are in the top of the pack in decline, as we were in price appreciation the last 2 1/2 years. We have an active inventory now of 19,000 homes and about 10,000 of those are vacant. Half! And that is why our decline will continue to be fast and furious. Open door and investors don’t care, they’ll lower the price by $50k each time till it sells, that then that becomes the new comp price thus exasperating the decline for everyone else.

US RE Prices will plunge. However, given the high inflation for years, I predict that they will not plunge as far as they might have (at least in the lower end of the market), because inflation has not been computed correctly for years after the methods used in the 1980s were abandoned. Also, if the “Fed” raises interest rates as high as Volcker did in the 1980s, given the federal government’s need to sell rolled-over treasuries, the only way that the US federal budget will not crack is if taxes are raised sky-high on the only group able to afford to pay more: the very rich. Fat chance of that! LOL

If you want to see a crash, join me in watching updates of news about China’s real estate market and economy, daily! Oh the humanity… LOL. I now know just how the Hindenburg announcer felt.

As to most Americans’ inability to pay high increases in taxes if interest rates, including interest rates on rolled-over treasuries, were to rise dramatically, read CBS news’ MoneyWatch “Nearly 40% of Americans can’t cover a surprise $400 expense.”

RH,

That’s BS. You just read the headline and not the text of the article you cited. Before you cite an article here, make sure you READ THE ENTIRE ARTICLE you want to cite. Citing stuff of which you have read only the headline is toxic. This headline-spreading-without-reading is a sign of how far the dumbing down of America has progressed.

The question was: “How would Americans cover a $400 expense?”

And this is what the article said that you cited, using data from the New York Fed:

88% can pay for it just fine. 78% wouldn’t even have to borrow at all to pay for it. Only 12% could not pay for it.

78% pay it without borrowing:

45%: with checking or savings account

35% with credit card as payment device that they PAY OFF in full by due date

16% borrow with credit card that they pay over time

10% by borrowing from friend or family

3% bank loan or line of credit

2% payday loan, deposit advance, or overdraft.

6% will sell something (stocks? cryptos?)

12% wouldn’t be able to pay for it right now.

(respondents could choose more than one answer)

It appears to me the environmental/Drought migration from the west has begun.

I sold the family home in Tucson two years ago, we lived there since 1966.

It’s beyond hot there now and the cutbacks of Lake Mead is a harbinger of things to come

We have to ask ourselves a worst case scenario question:

Can our economy even function if a major metropolitan area has no access to water?

How many mortgages will the government have to backstop as banks and Wall Street implode?

Where do people go who can’t sell their homes and can’t use their equity to move somewhere else?

There’s plenty of water for residential bare minimum needs. It’s the agriculture and landscape irrigation that’s in jeopardy. Everything else is just entitlement politics, all posturing and “I got mine” NIMBY stuff.

JP,

It’s not the cities that use up most of the water, in California for sure; it’s agriculture. Probably the same in Arizona, Utah, and maybe Nevada. And that food that is being produced with irrigation gets shipped to other states and other countries. So it’s kind of important.

In CA, cities use about 20% of the water, and there will be plenty of water for cities because we can build desal plants, but it’s going to be EXPENSIVE water for showers, etc. People are going to have a cow when they see the bill for filling up their pool with desal water. There is already a desal plant there. There are other problems with desal plants, not just costs, and cities will have to learn how to deal with them. Recycling of waste water (reclamation) is already being done in cities. So cities can get enough water, it’s just going to be very expensive.

But ag is different; ag in the West needs cheap water. Ag is a HUGE business in California. They grow just about everything, high-value products, not just commodities, that people across the US and the world eat and drink. So the drought is impacting food production a lot more than it impacts housing.

Great Salt Lake is at 25 % and dropping

Human behavior is what I am getting at

Great Salt Lake is at 25 % and dropping

Lake Mead supplies AZ with 40% of its water. It is at 25% and dropping.

You don’t need taps to run dry before enough people decide it’s better to leave than stay.

And so they should just move to where they get wiped by hurricanes? Or tornadoes? Human nature isn’t that way. Human nature is tough. People in hurricane country or tornado country don’t just leave because they’re tired of getting hit by nature.

“Lake Mead supplies AZ with 40% of its water.” ==> Read my comment. Lots of it goes to ag for irrigation. This is a very fertile part of AZ with lots of ag and irrigation.

the G. Salt Lake is not atypically low. The pictures on the news are all super misleading. The way goes through drought cycles. Lucky for us in the west, it’s monsoon season! Let it keep coming. Look at long term charts not shock pictures.

I’m with JP on this. First of all, even though the cities just use 20% of the water, they are asking customers to cut back between 10-35% (I’m happy to send links). Agriculture will also need to cut back but the point is the pain is being spread out.

Secondly, you don’t have to go to Utah to find out what happens when lakes start to dry out. This happened in CA with the Salton Sea down by Palm Springs. By the early 2000s the lake shrunk enough that toxic dust started floating around and now the area around it has serious asthma crisis (twice the rate as the rest of CA). People who could move did so obviously but not everyone is so lucky.

Paiute, I’m not sure how you define “atypically low” but per the Utah’s official website “the average daily value of Great Salt Lake hit a new record low July 3, 2022, when it dropped to 4190.1” (https://water.utah.gov/great-salt-lake/) I would say a new record low (the previous low before 2021 being in 1963) is somewhat atypical.

I am personally concerned about the ongoing drought in the west, since I’m personally affected

But you also gotta realize that reservoirs are made to be used. If a reservoir never went below 50% then it’s not being utilized to its full potential.

It’d be like buying a house and never stepping foot in half of it

People cannot live without drinking water for 2 days and without food for 7 days.

People can live without swimming pools or higher flow showers.

Rare resources like water need to be put in best use.

Why are people arguing about the Great Salt Lake. Nobody is drinking that. And WAY too salty for Ag too. What is the use that you are concerned about??

@SS – Water is not a “rare resource”, it covers 2/3 of the planet and is abundant even in fresh form over most of the rest of the surface too.

Any temporary local water scarcity is due to overuse or poor planning, not rarity or scarcity.

‘is abundant even in fresh form over most of the rest of the surface too’

DRINKING water is specious ‘commodity’ especially in the South West..

Do you know how many ‘Water related companies’ at NY Stock exchange? Being plenty ‘else where’ doesn’t solve the problem.

Water, Water, every where, but NOT a drop to drink!

8ball there is a water crisis, just like climate change. The facts won’t change if you ignore them harder. You can’t just brrrrt water, unfortunately. And for the “it’s not being utilized to its full potential” part – would you use up 100% of your insulin supplies if you had diabetes? No? Too risky, you think? What do you think happens when people run out of drinking water, genius?

This is where the magnitude of red tape is becoming dangerous. Plenty of fresh water falls on the southwest, but almost all of it runs into the ocean. Many of the reservoirs in CA were built between the WPA years and the 70s with a big push in the 60s. The population has grown a lot since then, but very few new reservoirs have been added in the last 40 years or so. Expansion of water infrastructure simply has not kept up with demand. Desalination sounds great too, but a major desal project was scrapped recently by NIMBYs after a couple decades of wasted planning. Good luck getting any new plants planned, much less online any time soon. Then there’s the delta tunnels project which pretty much collapsed under CA Gov. Brown, with Newsome’s smaller version already pretty well gridlocked. We have the technologies needed, and the topography of the southwest is excellent for reservoir building. Seems like government used to be pretty effective at making water projects work, but it just isn’t effective at much of anything anymore.

“But very few new reservoirs have been added in the last 40 years or so.”

There is so much wrong with this post but I’ll start with dams. In short: most of the best dam sites have already been taken. The Teton Dam collapse on the Snake River was an example of the Corps of Engineers being pushed/or pushing itself to build a dam in an unsuitable location. Most of what’s left is either physically unsuitable or doesn’t pencil out financially.

Look up saltwater intrusion risk for the various Sacramento River projects. The fresh water that flows seemingly useless into the sea pushes back the ocean’s saltwater. Saltwater intrusion can take farm land out of service for decades and we’re not even talking about the water table underneath.

The greater problem is the insatiable appetite for cheap subsidized water for agriculture. There is a national security argument for the US having a secure food supply but some crops are just stupid thirsty. There are millions of almond trees in California. One little almond takes gallons to grow. Or alfalfa grown with ground water in Arizona to feed dairy cows, horses, and camels in Saudi Arabia.

This crisis was predicted long ago. Even the late 80’s had a popular book called Cadillac Desert that remains relevant.

I think water won’t effect real estate prices in the short term. Long term I think there will have to be some sort of buyout of irrigation dependent farmers to keep water flowing to cities.

There certainly are technologies that work, the issue is just the sheer scale of the population in those arid Western regions and the pressure this puts on the available technologies. It’s one thing to implement that tech with population as it was in ex. the early 1990’s, it’s quite another with the huge population surge now by the 2020’s. Of course desalination is one form of tech that can help, but even the most optimized desal plants and planning would have a hard time keeping up with the scale of the population growth in the region while making the available water affordable. And there has been a lot of expansion of water infrastructure and reservoirs, just not enough to keep up with population. We’ve been running into this in Texas too, and in Arizona–a lot of new tech and a lot of smart people helping to provide more water, but the pop. growth (and the housing bubble is a part of this) has outstripped what infrastructure in massive natural deserts like that can provide.

It’s just not possible to have such massive unstoppable growth in such huge deserts even with the best technology and urban planners–even with optimized implementation, the costs quickly swallow up whatever gains there might be from the improved tech. At one point there’s just a hard limit to the population the region can sustain at any one point. That’s the exact issue Australia is running into. A huge place, but so terribly dry and arid that even with the best desal and other tech, it can’t support much more than its current population without becoming so wildly expensive that its economy becomes non-viable. Same goes for most of the US Southwest. We drove out to visit family in Arizona and Utah a couple years ago, and most Americans just don’t seem to grasp how crazy barren and dry most of the region is, and it’s another thing all those dumb claims about how “the US could easily have more population density” don’t understand. It’s the reason the drying out of Lake Mead and the other sources downstream of the Colorado River are such a huge threat. (And the monsoons aren’t solving the problem–almost none of that water is really harvestable or able to contribute to reservoirs, it’s doing more harm than good.) Most of the landmass in the US just isn’t habitable, at least not within some reasonable standard of ecological balance and manageable costs.

PGMD, oh please. Teton was a result of bad planning/design, bad management, and bad timing. We’ve built a lot of additional knowledge and have vastly superior construction technologies available to us these days which were not around 50 years ago. Your example is also a project planned in the 60s and built in the 70s, exactly during the period at which I was pointing. We didn’t just run out of places to put dams. But the 70s were a decade of massive growth in environmental regulation (Clean Air Act 1970, Endangered Species Act 1973, etc.). Not saying those are bad things, but big infrastructure and water projects have become extremely difficult to manage from a regulatory perspective, and that really started in the 70s. We also seem to have lost a lot of the political will for whatever reason. Nonetheless, those projects have continued, but only at a snail’s pace compared to population growth and the needs of globalized food production. Even a lot of increased storage and movement of fresh water from wet places to dry places (N. CA to S. CA, for example) is not going to have some cataclysmic impact on salt water intrusion. We’re talking about collecting a miniscule portion of all of the water that runs back into the ocean or evaporates. And guess what we do with the water that we collect or move? Use it, treat it and return it to the ocean, or let it re-enter the water cycle through evaporation and runoff… It’s not like we remove it forever.

Look, all I’m saying is that we are capable of doing big things like piping millions of barrels of oil per day all around the country. We know how to build dams/canals/aquaducts quite well, and we have decades of proven desalination operations that could be scaled up reasonably easily if the political will was there. There is PLENTY of water in this part of the country, and we’d only have to capture a very small portion of it to eliminate most of our water problems.

I’m growing so tired of climate alarmists marrying themselves to technologies which either aren’t fully developed, have massive hurdles to overcome in physics and chemistry, or don’t exist yet. Then when already mature technologies and feasible solutions are presented, there’s a whole bag of weak excuses as to why we can’t do it. The real reasons are almost entirely political.

Here in Northern Michigan lake country there has been no to minimal slowdown in real estate, as even multi-million dollar lakefront vacation property is still selling. I think this region —relative to many others—will be strong for decades.

Good point Miller. How low would Lake Mead be if they only used the water for AG.

If I was a business and trying to efficiently allocate resources,I would move all the people to the midwest were there is plenty of cheap land, houses, and water. Use the valuable water resources for value…..Agriculture. People can live about anywhere but you cannot grow food anywhere. In theory. ;)

Well speaking of red tape, it is never good when a state like CA basically has a one party system controlling them. Competition fuels progress, political monopolies are just as detrimental to growth and progress as corporate monopolies.

Let us not forget that inland desal is not possible because there is nowhere to put the concentrated salt solution that it produces. So even if desal may fix CA’s problems, it’s not going to do squat for AZ and NV.

Israel is fine with paying the high price of desal for municipal use, then the reclaimed wastewater goes entirely to Ag. That is probably CA’s future. Not sure what happens to those of us on the other side of the range.

“Can our economy even function if a major metropolitan area has no access to water?”

Probably not, but little will be done until it’s way too late. The Fossil Fuel Industrial Complex and the Financial Industrial Complex insist on it, and their word is law because they can afford to rent an entire political party. Fact-based projections of severe food shortages by 2030 are routinely ignored even though they cannot be discounted.

It’s a good thing there’s no such thing as catastrophic climate change or civilization would be in very serious trouble.

“they can afford to rent an entire political party”

You mean Democrats, right? Because Republicans vote their way without asking.

Matt, both parties suck and are corrupted from the top down, and both have very little real world solutions that actually make the things they are ” trying ” to solve better. It is amusing to observe some on here, who love to point out one side’s level of suckiness, while ignoring the glaring level of suckiness on the side they support.

Are these like the fact-based projections from Al Gore in 2000?

;) Al Gore created the Internet. I bet he can easily come up with a solution.

Hey Wolf. Sometimes it seems you’ve attracted a higher level of educated, undiversified ideological trolls. It is amusing to hear their views though.

There might be some element of trolling here, but the fundamental issue of water scarcity in the west is more serious than many, including it appears Wolf, realize.

Cadillac Desert is a classic and it has yet to be eclipsed in the almost 40 years since it was written, and no arguments against it have materialized. Sadly, nothing has been done to hedge against the day either. I suppose CA can go back to the courtroom and finish its annexation of the Colombia river as they were planning all those decades ago.

Wolf mentions big ag’s reliance upon cheap water (and in the west that is taxpayer subsidized water), but how can ag afford a desal plant with the current energy prices?Is CA going to fire back up the nuclear reactors? Build new ones? Seems a tall ideological order. Or are we pretending energy prices will revert to 2019? There appear to be quite a few ostriches here, but that’s fine, wait long enough and there will be plenty of sand too.

I moved out of CA to a place where it actually rains, and climate change will “improve” the local climate. I wasn’t the first or the last.

Agreed, Cyrus. I’ve always doubted the wisdom of putting major cities out in the desert where they will always run the risk of drying up and blowing away, but that’s just me. Climate science deniers are entitled to their opinions regardless of the weather, but the weather doesn’t have opinions.

Clearly from any real hard science POV, enough energy from sun falls on earth every day and almost every where to provide all needed for desalination of ocean waters.

Political ”will” is lacking for now,,, but only until the paid political puppets have arranged ALL of their campaign financing, etc., from each and every possible source connected with such solar harvesting, as well as wind and hydro.

Shouldn’t take too much longer, as the bribes, AKA campaign contributions from fossil fuels taper off and go to zero…

”SOLAR” here we come!!!

The climate change is not the Fossil Fuel Industrial Complex renting party affiliation.

Unless u have some basis for the source of the statement.

The world is the source for emissions and the world has gone through droughts and large climate change before.

Someone could argue the issue has been created by the relentless world debt spending and money creation then suppressed interest rates. More and more debt and money creation could be the source of the problem as civilization pursuit of a better lifestyle created by cheap energy.

I’m building a winter home in Tucson, the water situation doesn’t bother me in the least. They get 12 inches/ year, the island I live on in the PNW only gets about 18. My niece built a beach house in Baja, their water is delivered by truck and the area is absolutely booming. Water for industry and agriculture might become a problem and impact the local economy but residential water is not going to be in short supply in my lifetime.

Seems to be the general attitude of the geriatrics currently in power lol.

Problems fade into the distance when you can only see 20 feet, and your continued life expectancy is even smaller number.

Nothing new about gerontic hegemony in the west, but it’s sure taking us to new lows.

Again though, I grew up for a while in Arizona and the comforting assumptions about Arizona’s water supply from decades ago were based around assumptions of a much smaller population. They did NOT take into account the idea of Maricopa County seeing its population soar to almost 4.5 million people, full of water parks and thirsty lawns in the hottest days of July and August. Yes, Pima’s in somewhat better shape but not that much, and Arizona’s water crisis is hitting Tucson too. The whole state has recently received the order that its Colorado River allotment is falling by a fifth, and it’s already leading to crisis alarms–it’s very, very difficult to make up that amount, and Arizona just doesn’t have the reservoirs or reserves for it. Again even with tech improvements and the underground stores, all of those calculations assumed a much smaller and less water intensive population than Arizona has now.

And it’s impossible to just separate out and dismiss the water demands of industry and agriculture in Arizona like that. Even if ag in AZ isn’t as huge and powerful a sector as it is in the Central Valley and California in general, it’s still absolutely central to the Arizona economy, and countless jobs in Arizona depend on it both directly and indirectly. We were treated to a detailed seminar on this a couple years ago, but even seemingly unrelated industries in Arizona like tech and healthcare often have some kind of connection to the economic foundation provided by agriculture, and if the water runs out for that, the rest of the state’s economy falls with it. There have to be some sober-minded discussions and hard appraisals of the population limits the state can actually take on. No amount of tech or ingenuity can overcome the constantly increasing demands of a thirsty population if it goes too far outstripping what the desert around it can support. Much of the US Southwest really isn’t that far from the Sahara or the massive desert that nearly the whole of Australia is in terms of aridity, and things like the housing bubble in and around Phoenix only worsen the ludicrous lack of planning that’s caused this mess in the first place.

Good thing Phoenix has two fabs coming to town to suck up another 6 million gallons of water per day. That’s some A+ central planning right there.

Cyrus, just think of the new jobs that will be created! /s

Tucson/Arizona will never run out of water. We have a 100 year supply stored underground. We’re better prepared than Calif.

azbigmedia.com/business/here-are-some-fast-facts-on-the-arizona-water-supply/

I spent part of my childhood in Arizona and we got a lot of that “don’t worry, be happy” talk about the water reservoir AZ supposedly had, the problem is those assumptions were based around a period back when the state had a much, much smaller and less water-intensive population than today. None of those comforting predictions took into account the very concept (let alone the actual today) of Maricopa County’s population soaring to nearly 4.5 million, full of thirsty residential lawns begging for water to keep up with the neighbors and satisfy the HOA’s. AZ has just been notified of an order that’s cutting its Colorado River allotment by 21 percent, and that’s already spurring a lot of anxiety because it will not be easy to make up, despite all the past reassurances. Arizona despite some attempts to be more prudent has run into the same issue of growth outstripping water infrastructure as California has, and it’s a non-starter to just turn off the ag industry in Arizona either–an incredible number of jobs in AZ depend on agriculture both directly and indirectly, and if that sector has slashed, much of the Arizona economy (including in Phoenix and Tucson) collapses with it.

I have already corrected this sentiment once on this site so I’ll be brief. You can’t draw substantially more than the inputs without causing subsidence. Not to mention drawing more than the inputs is overall not a sustainable plan. Short term thinking.

@ Storm Steiger

In Tucson, much of the CAP water is fed back into the aquifer. Our neighbor in a Tucson suburb is a retired hydrologist who spent his career at Tucson Water. He is sanguine about the future. Unlike Phoenix, there are no lawns – lots of xeriscaping and desert vegetation. But while the local water supply will be fine, food can only become less abundant and a whole lot more expensive.

I don’t like percent change YOY as comparing now to a different market a year ago just magnifies the issue both up and down.

Better to compare the actual numbers vs year ago or just chart the numbers over time. Just a pet peeve I guess.

On the chart “Medium Sold Price of Existing Homes” the repeating wave form as the price increases from 2012 to 2020 is interesting.

Is this due to the way the data is collected and reported each year or is this a glitch in the overall simulation we live in?

House prices are seasonal – higher in spring/summer, lower in fall/winter. Families want to move when kids are out of school, and a lot of employment is also somewhat seasonal, and that creates the annual waveform.

CreditGB,

I gave you BOTH. Go look at the second chart, not just the first. BEFORE YOU COMMENT.

There are 5 charts in this that are NOT YOY.

Why do people feel compelled to comment on something without even having looked at it???

Because anything longer than one chart or 10 words is TLDR in ‘Murica?

Or TLPTR?

(pretended to read)

Most of your audience reads everything, because you’re an accurate and entertaining reporter. Don’t let the stray comments get you down. They can sometimes also be entertaining in themselves.

Agreed. Wolf’s charts are some of the best economic data-hunting on the Web, it’s THE reason most of us come here.

This doesn’t seem to apply in South Florida and North Texas … not yet anyway. Maybe its all the Cali and NE folks heading east and south with deep pockets.

For those with either short memories or short on experience, 5% is still CHEAP. I’m taking all I can get at that rate.

From 1971 (earliest I could quickly find) and 2010, fixed mortgage rates never went *below* 5%.

Ever.

But Fed manipulation managed to bottom them out at 2.8% during the Plague Boom.

Fed money printing has created a wholly fictional economy that won’t survive long when reintroduced to reality.

As interest rates rose during the 70’s, so did housing prices and wages. The Vietnam War and Cold War were expensive resulting in inflation.

Almost all assets rise during inflation and interest rates follow inflation.

What is interesting, 65% of families own a home. They would rather have their home price go up than down. If you asked them, if we drop the price of gasoline from $5 to $4, would you agree to a drop in the price of your home from $500k to $400k. It would be interesting what the responses would be.

I know people on this board are looking for housing bubble to pop but probably not the 65% home owners.

It is a crazy cycle. If housing drops 20%, you are going to have these 65% of families voting for a politician who has the answer to get house prices to go up again.

ru82, it doesn’t benefit homeowners to have their homes go up in value unless they want to sell OR want a loan.

The people it really hurts as a group are investors.

A lot of people would be glad to have homes go down in value so they can be re-appraised and their owners pay less taxes.

It’s not about winning votes. Many politicians from the town BOS and up and heavily invested in RE. They don’t want to loose their investments, other people be damned. They would prefer to subsidize the homeless and renter poor with other tax payers money than to loose one penny of their own.

Florida is done for. Wait till the next hurricane, or once the CA and NYers finally understand how bad the schools there are, or how ungodly hot it really is for 6 months, or how stupid most of the people are, or how dangerous the roads are…

Give it time.

I know much Floridanians thay ain’t stuuped,

lol, it’s so much like that. And I say that with all the affection in the world for my Floridian cousins.

Sandy anyone?

Schools in NY are better?

Taxes? Hurricane level in NY

Blizzards

Nat Gas $9 now good luck this winter in the NE

No stupid people in NY? Certainly not in NJ

Ungodly cold and cloudy 6 months

I could go on but the enough

FL is NY’s retirement home. They know already. Heat and humidity is the tradeoff from 2′ of snow and ice and, well, the heat and humidity. NYC isn’t exactly 74 and dry year-round.

BB

The West coast of Florida is in a dangerous hurricane zone. The temperatures of the gulf water is 3 deg above normal, providing extra fuel for the hurricanes. Any sucker that buys down there is going to have their home flattened by the next hurricane wave. Even if they survive that, their insurance will exceed their mortgage payment. Don’t come whining to me when this happens.

In front of Gulfport the seawater temperature is 85.6 degrees this morning, matching the August average, and is in a cooling trend, having dropped 1.5 degrees in the past week to ten days and forecasting the same by months end. Florida waters do look warmer. There’s charts and thermal maps of the Gulf. There’s NOAA and j Cantore. There’s buon fortuna. There’s prayer. And there’s Neptune, I shall make humble obeisance. Cover all the bases, it’s storm season.

Anyone moving into hurricane country should be aware of the normalcy bias that causes unpreparedness and then fatal hesitation when it’s time to cut and run as a storm approaches. I live(rent) some 350 steps from the Gulf at mean high tide and I’ve stayed for a strong Two, but that’s my limit. My mother goes inland and I’m packed and can leave in a few minutes if necessary. I’ve known dozens of staying-put stories that turned into impromptu evacuations in waist high debris-laden surge water. “But it’s never flooded here!”. Modern weather forecasting is truly excellent at scale, and does wind pretty well, but can’t say what happens to the water at the beach in front of your house until it’s happened. Most people who are new to storms underestimate the time required to be prepared to ride it out and also to be prepared to flee inland in a prepacked and fueled vehicle and have somewhere to go set up in advance. Evacuation is expensive too. This decision can determine survival and it’s usually a sudden intensification or course change in the storm that necessitates a quick decision to run. And everyone around you that was planning to stay is making that decision too.

Friends I knew in Pass Christian weren’t packed up or gassed up for Katrina and that forced them to stay when things got worse quickly. The survivors clung to trees above thirty feet of storm surge. Allowing lack of preparation to make your decisions about stay-or-run has killed more people than anything else I’ve seen in thirty-plus years of tropical weather. Although generators kill more than storms sometimes now, Darwin nails it again.

One of the main drivers for climate change is the rise in air and water temperature that causes more violent storms and longer lasting droughts. One of the biggest contributors to the rise in temperature is the number of heat islands in major metropolitan areas, particularly those with lots of high rise office buildings and sprawling retail development (i.e., malls). Considering how malls were dying even prior to the pandemic, and with the pandemic causing a huge shift in remote work, there is much less need for enclosed malls or office space. In addition, most suburban malls and office buildings have numerous acres of paved parking lots that rarely if ever are fully occupied at any given moment. We should be focusing on clean energy solutions like wind and solar and building desalination plants, but those will take years to fully implement. In the meantime, however, we could probably dig up half of the parking lots in this country and repurpose it to natural green space for grass and trees. I’m not saying we should completely eliminate all parking spaces around malls and office buildings; instead, we should reduce the size of those parking lots to reflect it’s actual usage patterns which would still accommodate all of the workers and shoppers yet reduce the temperature of the heat islands and allow for natural runoff from rain storms into the ground.

While you are correct that these rates are historically low that really doesn’t mean anything. It’s about rate if change. The rates have risen very rapidly and the corresponding prices haven’t adjusted yet. I keep hearing “rates are still historically low” on commercials for mortgages. What good does historically low rates do if they are double what they were a year ago and now noone can afford the inflated prices.

CCCB wrote “This doesn’t seem to apply in South Florida and North Texas … not yet anyway.”

I live in a very affluent suburb in DFW.

In my neighborhood, Zestimates are down 10+% since June.

So North Texas doesn’t seem to be immune.

This small time house flipper has also stopped buying house. I expect to have all current projects finished and listed by November in Massachusetts.

I am surprised that the months of supply for existing homes is not much higher, given the low pace of home sales. It shows that inventory levels are still not that high.

You put your finger on it.

Normal years might see sale listings at 1.4 to 1.5 million over the summer.

Summer 2021 (The Plague Boom) saw listings closer to 500k. (Supply down 65%!!).

Even with unZIRPing, listing inventory is only going up maybe 50k to 75k+ per month (to about 750k+…still 50% off normal)

But perhaps once the currently distorted median sale *prices* start falling, all hell will break loose as supply panics and surges for the exits.

In other good news, the total assets on the FRB’s Balance Sheet have shrunk by $116 Billion since April 13th. And full QT doesn’t start for another 2 weeks.

Progress.

” The median price dipped to $403,800 in July, which whittled down the year-over-year increase to 10.8%. As big as it sounds, it was the smallest year-over-year increase since July 2020, after having spiked by 25% last year”

As an owner of several homes, I wish I had these kind of problems more often. I am not aware of what the historical average price appreciation is here in California, but I am sure we all got more then several years worth in past 24 months. If it slows down to only 10% hard to see that as a problem.

I hope with time, the prices go down, not the rate of increase.

Most of my friends in CA believes that home prices won’t go down although rate of increase would go down from here.

I hope decreased sales volume is beginning and precursor to actual price down.

Homes are completely unaffordable in CA and I can see multiple families living in single family home.

” The median price dipped to $403,800 in July, which whittled down the year-over-year increase to 10.8%. As big as it sounds, it was the smallest year-over-year increase since July 2020, after having spiked by 25% last year”

Using Joe Biden’s calculation methodology (validated as economically sound by Nobel Laureate Paul Krugman):

Median Price fell 25% in July (one month dip annualized).

Sorry couldn’t resist …..

Rents rose 13.4% YOY in the first half of 2022 according to HouseCanary. The supply of rental units did not keep up with demand. Not a good time to be a renter as the 5.6% vacancy rate is near a 39 year low.

Something has to give. Let’s see. I can see home prices went up quite a lot, buyers have left the market as evident from this article.

IN California, rents have been too high for quite some time for average family and Californians have found a way out: multiple families living in single house.

May be this, time, each bedroom would be occupied by one family.

If you want a good laugh search for this video:

I Wish We All Could Leave California (Beach Boys Parody)

Thanks otishertz. That was excellent.

Ditto! ^^^^Thanks!

“Not a good time to be a renter as the 5.6% vacancy rate is near a 39 year low.”

At a 5.6% vacancy rate most people in Melbourne would be having a heart attack.

Our suburb has vacancy rate of less than 1%.

If a house comes up for rent the sign goes up and usually in less than a week a big fat “LEASED” is plastered over the “FOR LEASE” sign.

Yes, and during this heatwave, enormous electric bills are piling onto the plight of people already scraping by from dealing with rent, food, gasoline, etc inflation. A recession in living standards is well underway measured by months not years.

I wouldn’t assume how rents are going to go over the long term. Wolf pointed out the difference between multi-family and single home construction. The builders are thinking the market demand will be more condos and apartments, less single family, so mfd construction is up and sfr is down.

Sure, near term rental likely to go up, but builders also responding to market signals on the supply side. Which is probably a good thing, USA housing density is kind of weird compared to our economic peers.

I suspect in many locations, those living in houses valued at UNDER $400K know they can’t afford to move, and we only see the listing and sales of houses valued higher.

I suspect my landlord and others were/are eager to increase their rents before the bottom falls out of the housing market.

I’m likely dreaming but it would be nice to see home prices drop down to where it is cheaper to buy than rent, which will only happen when a surplus of new homes hits the market.

There is a ton of construction locally, commercial and private. The poor, or should I say the former middle class, can afford neither.

THIS … how many people frittered away (or were forced by adverse circumstances to refi out of) their home equity? How owners, today, could not even afford to move to a house just like the one they live in now, because of the higher mortgage rates and/or lack of down payment?

I don’t think it’s just the under-$400K crowd that’s in that state of pain.

My Anecdotal evidence: i do a 6 mile bike ride through my neighborhood in the bay area I’ve never seen this many houses with realtor signs in front of them: “coming soon”, “for sale”, “open house this sat & sun”, and “sale pending”

Wolf – What do you see the average 30 year mortgage rate getting to in the next 6 months based on your understanding of how high the Fed is currently looking to raise its rates to?

A Realtor told me that in her office they’re talking about 8% mortgages.

But isn’t market expecting a fed pivot,

If rates goto 8%, would ppl go back to 5-7 year arms?

The market is going to get this pivot illusion hammered out of it by the Fed.

I think it’s frigging hilarious that the nouveau housing gurus who have become housing aware in the last few years in an abnormal situation now consider that a return to normal is abnormal….

Oh, the horror… the humanity…

I did that when I bought my first house in 1999, and my 5 year ARM was 7.25%. People will use ARMs again, but even ARMs will be some amount above the FFR. They probably won’t be very cheap either.

My Father bought a house in 1980 where the seller carried the note to maintain his somewhat lower interest rate, which was still 10% at the time. I wonder if people will do that again so they can sell their houses but keep the lower interest rate mortgages currently on the houses, or if the mortgage contracts have been revised to prevent this. Sellers might be able to get a better price if they can offer buyers a lower rate. Of course, the seller is trusting the buyer won’t trash the house (since the seller will stay on the note), and the buyer needs a big enough down payment to cover the seller’s equity. Even if this is still possible, it probably isn’t feasible in most transactions.

This will never happen. Once they get over 6% it will be game over. No one will be afford to buy a home.

Yes they can, but prices will have to come down by a lot, and then they can buy them. It’s a two-part equation. And that’s the purpose.

The real question is, when do home appraisers start cutting appraised values in order to “make a market”, so that their friends in real estate, at banks, etc. can get more business, including themselves.

JeffD

Its already happening

Hmm. I’m not sure it’s going to be as simple as a good old fashioned price crash. Real mortgage rates are hugely negative. If inflation chasing wage rises start bedding in (ie workers have more confidence they will get matching rises), people might start to cotton on that their mortgage is paying itself off rather quickly all by itself. This could easily provide a floor under nominal prices – or worse (for those of us who detest the property ponzi).

IMHO the current market state is due to uncertainty about this new paradigm – for many workers with job security they can probably get the most negative rates that have ever been on offer.

Fed has to prove it would actually set real rates negative. But they are too timid, and my bet is that if they manage to get unemployment up a bit, the politicians will quickly set to work undermining central bank ‘independence’. Basically a version of what is happening in turkey.

I meant to say ‘Fed has to prove it would actually set real rates positive’.

If the interest rate cycle from 1981 really ended in 2020, it doesn’t matter what the FRB tries to do. Interest rates are destined to “blow out” later anyway.

Any attempt to prevent it will crash the FX value of the USD.

No, there is never something for nothing and the US isn’t exempt from the reality which applies to everyone else.

It all boils down to affordability.

It does not matter if real rates are negative.

Unless the Chinese start buying and price all the locals out of the housing market.

They don’t tend to buy in a down turning market. It looks like they are already pulling back.

“Real mortgage rates are hugely negative.”

I don’t think so anymore. 5.5% mortgages vs what is likely 0% house price inflation going forward and core/PCE running maybe in the 3-4% range (no, not vs a year ago, I’m talking CURRENTLY, month to month annual rate).

Keep in mind, too, that the life of the mortgage at 5.5% is likely WAY above the rate of inflation we’ll see over that 30 years. Well, ok, that’s in the base case, not the bear/hyperinflation case in which case future inflation can be anything.

There are a broad range of possibilities between inflation WAY below 5.5% for the next 30 years and hyperinflation. The outcome is unlikely to be at either end of the extremes, but we’ll see.

Maybe. Or maybe the most recent long period of low inflation is the outlier due to stuff like globalization, technology, and China bringing a billion workers into the capitalism world order, which seem to be played out.

Kind of the reverse of the peak oil scares. Oil and gas shale were seen as impossible until they were not. Or similar to the green revolution that increased agricultural production but didn’t wipe out world hunger or wipe out food inflation. Or how Japan didn’t take over the world economy.

Our recent past is unreliable in predicting the future. Stuff ends.

And one more point here. The bond market* doesn’t think inflation is going to be above 5.5% for 30 years. Look at long bonds and TIPS. A 5.5% mortgage looks like a pretty fair spread OVER expected inflation.

* yeah, I know, the Fed IS the bond market.

In 1981, the “bond market” didn’t expect or believe that inflation would be where it later reached in the 90’s or 2000’s either.

“The market” doesn’t see the future or “discount” anything, as it has no collective consciousness or independent existence. It can’t do that because the Efficient Market Hypothesis upon which this idea is based is complete claptrap.

So, basically what I am telling you is that longer term, what this data point is supposedly predicting is irrelevant.

“as the Fed is backing off years of interest rate repression”

A deeply negative real FFR is still interest rate repression. As for the latest Fed minutes, they still did that two-faced thing they love to do. The minutes repeatedly mention their resolute need to fight inflation in one breath, and even some concern that the market may not take them seriously. Then out the other side of their mouths, “many” of them talk about the, “risk that the Committee could tighten the stance of policy by more than necessary to restore price stability.” Really? They’re not even at a 3% FFR and “many” of them are concerned that they may already be overtightening? There’s also this gem, “once the policy rate had reached a sufficiently restrictive level, it likely would be appropriate to maintain that level for some time.” So they’re already talking about a pause coming up. Oh and god forbid they might threaten to tighten “until” they reach 2% inflation… No, their wording is always “on a path to 2%” and there are a lot of potential stops on the path to that destination.

Then Daly comes out today worried about tightening too much too quickly follow by Kashkari saying that a 2023 drop in rates is unrealistic, but they’ll probably pause soon. Yeah, pause at what? A still deeply negative real FFR of 3% while inflation rages on? No wonder the market isn’t taking these clowns seriously. The markets are transmitting exactly what the Fed is tiptoeing around, hovering at 3-3.5% FFR in 2023 with mortgage rates sitting in the 5%-6% range. It’s going to be enough to slow housing down significantly (already has), but not anywhere near enough to bring prices back down to meet the middle class. We will sit on a negative real FFR with only slightly suppressed asset growth until we have completed our transformation into a society of debt slaves ruled by rentiers. We’re already halfway there.

They may pause once FFR is in 4-5% range but that doesn’t mean they will stop tightening.

There’s plenty of scope for accelerating QT once they stop hiking the FFR.

Doubling or tripling QT could easily push mortage rates to 7-8% which should crash the housing market.

If the housing market “crashes”, it would mean that people “only” make 30% over a 2 year period vs the current 50%. In southern California, prices have gone from $400/sqft to $600/sqft in two years. That said, I forecast continued inflation in southern California as the Fed continues to dither, with no chance of a crash unless people start losing their jobs in droves.

At this rate of breakneck inflation, merely wage stagnation, lowered forward guidance, hiring freezes and a general malaise and concern regarding job stability could be enough to sink the market, particularly in concert with continual FFR increases, QT and another leg down in the stock market. No need for massive job destruction. We’re not that far away from rough water. 2024-25ish.

Jingle Mail could happen IF people took out more mortgages value via cash out refi, HELOC or 2nd / 3rd mortgages AND the value of their home is now under water. As the top has been reached in this epic run up of home values and now begins the decent we could begin to see some fireworks

There isn’t going to be an increase in market rates which provides anything close to positive real returns at anywhere near current debt levels because actual economic production is insufficient to sustain it.

Since the 1970’s, the fifty years 30 year mortgage rate look like the Nasdaq collapse between 1997 and 2003.

So, the trend is up, first slowly, then faster.

In 2002 the Nasdaq was 1K. // In Nov 2021: 17K.

We don’t know what will happen next. If this analog somehow work, the risk of hyperinflation is growing.

No, the risk of a deflationary asset collapse first.

Can an asset deflate ( or inflate for that matter)…

My assumption of the terms were appreciate or depreciate…

Because you can have an appreciating asset in a deflationary environment and vice versa…

Sorry if I’m picking a nit but I did understand what you meant…

We have not seen meaningful deflation since the great depression. Even the GFC was a small deflationary blip on the otherwise unstoppable downward slide in the dollar’s value. And there will not be another major bout of deflation in the dollar as long as our current government exists. The Fed will do anything, ANYTHING, to avoid deflation. Inflation is mildly frightening to the Fed, mostly just a political thorn in their side. But deflation is the stuff of their darkest nightmares. They are far more afraid of deflation and if they see anything even resembling the beginning of a deflationary collapse, they’ll drop the FFR to 0% and pump another $5T of funny money liquidity into the economy faster than you can say, “trillion.”

They would “not hesitate” as Powell likes to say.

ME,

Do you believe the FED can taper? From knowing we had one hell of a storm in the financial market even before C19. The banks stopped lending to one another and the Fed had to start offering loans to banks. This all happened right around the time the FED tried to taper off the loans. The markets froze up. Again this happened right after the last large reduction in Fed balance

2019

From March 3 to March 23, the Fed rolled out its playbook from 2009, just larger and faster than ever before. It slashed interest rates to zero. It offered $500 billion in daily repo loans. It opened up so-called swap lines with foreign central banks, allowing those banks to trade their own currency for dollars at a stable rate. The Fed ramped up the quantitative-easing machine, essentially promising to buy an unlimited amount of Treasury bills until further notice. But these emergency measures weren’t enough to keep the markets from continuing to crash.

There is a group of citizens, nearest neighbors applying a chemical analogy to what the hell my point is. Again with the applicable chemical concept of electro-neutrality in a mixture of molecules that extends to the basis of the next generation of computing, quantum computers.

The markets are in disequilibrium. Uncertainty is at a peak as the failed paradigm fails and the next paradigm establishes itself. Life is the doubtful miracle

That being said as a prelude to my sentiment on the recent stock market gyrations.

I feel that the Fed is comparable to the societal calamity of over parenting. They went on vacation to Wyoming and left the kids at home, with mutual agreement what, and more importantly what is not acceptable behavior while the parental units were on vacation.

They left their checkbook, with $5T in the account, with an understanding that that money would not be used to extend the Fed keggar another day.

Obviously, the party began as soon as Mom and Dad left the premises.

The Fed has positioned itself as the fool in a Shakespearean drama, the Ben Bernanke enabler.

A fool sponsoring the hijinks establishing the misguided, and discredited, philosophy of Milton Friedman. QE.

One of those nuisances of life is believing while disbelieving the agenda, like “free markets” are going to make America richer.

I am in the category of observer, an old man without the strength to protest aggressively.

There are a number of sociopaths in our congress. One that comes to mind, is one, who made his fortune by lobbying the congress to reduce the fiduciary rate required for pension and retirement funds to something like 4% from 8 % meaning that every pension solvent fund was over valued by 50% and the cash could be grabbed by buying control of the company.

Who now, as a religious official, thinks that Social Security is the problem.

His access was as the entitled son of his senator father.

The 95% of us struggling with the economic life of society, want to have a level playing field.

I admit that recklessness has been my response to the protocol demanded by the merchants that are trying to train us.

Thank goodness I wasn’t drafted to fight for America’s honor in 1970 or I may be bitter rather than full of hope for the future.

One of the mysteries of the universe that I am perplexed by is how credit card charges are, universally coordinated, at interest rates usually attributed to loan sharks while the Fed gives them zero percent cash.

The con depends on convincing us, that we as losers, are less than the winners. Pay and shut up.

Do I think that house prices will fall 40+pct, maybe like that last bursting of a housing bubble. Possibly.

Who can afford the asking prices without qualifying for a loan, the price of which has doubled. Not many of my brothers and sisters.

I am not promoting the crash that is likely to come. I am simply waiting to see what happens.

My old man, awarded a silver and a bronze and earned a purple heart being shot in the face in Germany told me that it was a decision that I would have to make, that he really had no opinion about what I should do. He just said that war was like nothing you have ever seen.

I was lucky that my lottery number was 350 or so, so I wouldn’t be drafted to fight in Vietnam. A dilemma that one, today, doesn’t have to think about.

My grandfather was a Regimental Sergeant Major and enlisted underaged in the first World War. He loved war not never got over the end of World War II. He always used to say I wish the war never ended.

That certain politician use to be a predatory venture capitalist whose god has always been money and his own vanity. A very good grifter, liar, swindler, and fraud. Outside of Utah where he used his ” religion ” to grift off the people of Utah and retain some form of political power, he is hated, especially within his own party.

I studied Chemistry at university, and I have a basic understanding of quantum mechanics.

I have no idea what, “Again with the applicable chemical concept of electro-neutrality in a mixture of molecules that extends to the basis of the next generation of computing, quantum computers.” means.

I studied physics but didn’t get that either :)

But what I have been always wanting to ask from dang was to think it over and write all the essential in one comment! But tot a string of 20.

Well, still seeing last gasps from enough Desperate Dans to make things seem less like a recession and just a slower boil…the kind what needs lancing. Speaking of, I a house I watching in neighboring Kalamazoo just went pending for $475K having sold in 2014 for $245K. Just plain nuts.

In June AAPL reached $130. What will happen to the Bay area if AAPL

breach $100 and stay below.

Well, AAPL employees are required to spend 3 days a week in the office starting September 5th. At 100 and below, management can always dangle the WFH carrot to get workers to stay.

The herd psychology is shifting to a very negative mood regarding housing. Unless the Fed does a pivot very soon, which I think is very unlikely, this will have an accumulating effect that grows slowly but is unstoppable. Prices are already falling in many places month to month during a time of year when the opposite is normal. YOY declines will soon be headline news, and then the bubble truly pops.

I just don’t see this — at least not from an “on the ground” perspective. Everyone still talks about residential real estate estate positively and champions buying — at least here in Austin

Bulfinch in one comment states:

“ I a house I watching in neighboring Kalamazoo just went pending for $475K having sold in 2014 for $245K. Just plain nuts.”

Now Bulfinch says:

“ Everyone still talks about residential real estate estate positively and champions buying — at least here in Austin”

Can there be two Bulfinch handles or is it just one geographically deficient troll?

Rocky Squirrel,

Good catch.

Both comments were made by same commenter. I expect Bulfinch to say next that neighbors “here in San Diego” or wherever just sold their house for 10% over asking, LOL

Hah! It was my lame attempt at a play on words — Lansing to Kalamazoo. Eh.

That said, I really have seen crazy pending sales with price jumps like that in various states (from WA to TN) and can gladly supply the Zillow links. I’m both incredulous and dismayed. Austin is harder to track, TX being a non-disclosure state, but the sentiment I’m witnessing around here —including snippets picked up from overheard chats at the bar, as people in Austin can’t shut up about their g*^%#mn’d houses — suggests that reality lags perception by several legs; people are falling but they think they’re flying kinda deal.

Meanwhile, to atone for my atonal attempt at wordplay, I will now donate to Wolf’s site…

Bulfinch, Sentiment is one thing, pending reality is another. Austin is one of the cities at the top of the list for the most over valued and over inflated housing markets in the country. Sentiment will most definitely turn when impending reality is apparent for all to see. There were many on Wall Street on September, 4 1929 whose sentiment to the sell offs that began was not that of an impending doom. Many brashly said that the sell offs wouldn’t last long…not many predicted or believed an October 24, 1929 would actually happen.

@ Wolf –

CB is not cb. Different commenters. Your site should avoid this type of confusion.

Yes, many Mikes here. I don’t have a way of blocking logins, with a sentence such as: “‘cb’ is already used by another commenter, please choose a different login.”

One way to avoid this is to add some numbers, such as cb01, as in the original cb. That generally takes care of it.

Thanks to CHIPS – Central Ohio is being considered bubble protection. Yet, 25% of the purchasers of the single family homes are investment organizations. The local National Real Estate Agents are expecting another 40% growth in prices. Yes, our new homes are sitting empty and they have no foot traffic to tour. The news is reporting a different scenario. Additionally, several builders bumped their prices up another 1%. Crazy times! Still waiting on the side lines.

“25% of the purchasers of the single family homes are investment organizations”

Gabby, not doubting you, but where is your source for that? I’d love to find those numbers for Ca.

Over here in SoCal, people are still paying top dollars to live near SocalJim!!!!

Socaljim:

Well done…enjoy the beach.

“ Over here in SoCal, people are still paying top dollars to live near SocalJim!!!!”

Do you still have the sign out front that says

“ George Clooney lives here”….. :)

Hi Mr. Wolf,

Apparently 223 million new credit accounts were opened in the last quarter, adding $312 billion to consumer debt.

I recall your mentioning that total credit card debt is around $1.15 trillion with only $55 billion in additional debt accruing per quarter due to the fact that most balances are paid in full before due date is past.

It looks like the consumer debt situation is much worse than you suggested?

Art,

Clueless BS. You don’t know what you’re talking about. Opening a credit card account means that someone got a new credit card that pays 1.5% cash back to replace the card that pays 1.0% cash back or just bonus points. It adds zero nada zilch to credit card balances.

For most people, credit cards are just a modern payment method, instead of cash or checks, not a borrowing method. People who confuse “opening credit card accounts” with “increasing debt on credit cards” are morons.

The amount added to credit isn’t from credit cards – and is unrelated to the opening of these credit accounts — but is mostly due to MORTGAGES (higher home prices to be financed, and in small part due to auto loans (more expensive vehicles). People who connect the opening of credit accounts (mostly credit cards) to the increase in mortgage balances are insidious liars.

US consumers spend about $1.5 trillion per quarter using their credit cards as payment method, and NEARLY ALL of it gets paid off EVERY month and no interest accrues. They never pay interest on their credit cards because credit cards are just a payment method, instead of using checks or cash.

Even the credit card balances in the chart below include the several weeks of charges that people will pay off on due-date, and will pay zero interest on. So if there is a travel boom, people buy tickets on their credit cards (how else are you going to pay for your tickets??), and those tickets bought in the past four weeks will show up in the balances before they get paid off in full. So more spending will increase credit card balances because that’s how people pay for stuff. But nearly all of it gets paid off the next month.

Credit card balance have been roughly stable for 15 years despite inflation and population growth, which tells you that people use credit cards as payment method predominantly, and not as borrowing method.

In other words, you are saying that the $312 billion in newly made credit purchases will get paid in full for the most part, before the monthly due date on those freshly minted 223 million credit/credit card accounts.

Correct me if I’m wrong, Mr. Wolf.

You’re wrong because you didn’t read my comment. Re-read my comment! The new credit accounts (credit cards) have nothing to with the $312 billion increase in mortgage balances. YOU put these two together, and that’s BS.

Wolf,

I agree that many (most?) “people use credit cards as payment method predominantly, and not as borrowing method.”

But unless we were not privy to the total comment, Art did not say “$312 billion increase in mortgage balances”. Art said “adding $312 billion to consumer debt” in the “last quarter with 223 million new credit accounts.”

I do not know where his numbers came from or if they are correct but just wanted to clarify.

TXRancher,

I know the numbers because I reported on them. The numbers are from the NY Fed. And I know what they were for. Just because Art didn’t read my articles on these topics, doesn’t mean I didn’t write them.

Here are the mortgages:

https://wolfstreet.com/2022/08/04/trip-back-to-reality-starts-mortgages-helocs-balances-delinquencies-foreclosures-in-q2/

Here are the auto loans:

https://wolfstreet.com/2022/08/02/auto-loan-delinquencies-and-repos-are-not-exploding-they-rose-from-record-lows-and-are-still-historically-low/

Here are the credit cards:

https://wolfstreet.com/2022/08/03/people-trying-to-dodge-legal-usury-credit-card-balances-delinquencies-third-party-collections-and-bankruptcies-in-q2/

And here are the student loans:

https://wolfstreet.com/2022/08/07/are-federal-student-loans-even-loans-from-forbearance-to-forgiveness-to-taxpayer-expense-fairer-solution-allow-bankruptcy/

Also, new credit cards tend to come with enticing offers like introductory low interest rate for 6 months or so, free balance transfer. Transfering existing cc debt at 25%+ APR to one with an introductory 3.99% APR for six months, that balance is likely going to get paid off much faster.

If anything a new CC may be helping reduce debt in the short term for people who ran their balances up a bit if prudently used.

Limited Von Schtupp,

You are suggesting that banks continue to provide easy credit terms to holders of unsecured credit lines, just like when we were under ZIRP conditions. Maybe so, banks doling out credit to possibly technically bankrupt individuals, on the same generous terms that they provide to their best corporate customers worthy of receiving prime LIBOR interest rates.

Not sound fiduciary management of bank shareholders’ capital perhaps?

According to the scenarios of the financial conditions that await us in 6 months or so, depicted here and elswhere?

This is 2022 and not 2010?

Limited Von Schtupp. How devistatingly clever.

‘Suggesting… perhaps…’ A set up of fortitude to come in response? Shade that doesn’t scream confidence but drips snark is always fun online.

Doesn’t take an MBA to know people with certain credit scores (they check that for cc’s these days, and even back then too) get introductory offers on new credit lines from banks they have a relationship with, or maybe don’t, next time check your junk mail before it hits the shredder, you’ll see.

The new accounts you say are opening up just maaaaaaybe indicate people are (re)building their credit saving money during the student loan pause, WFH saving $15k+ a year in childcare/gas/lunches out, stimulus checks paying down balances… in other words, building credit worthiness.