I see gasoline prices rising further despite this modest short-term & long-term demand destruction.

By Wolf Richter for WOLF STREET.

The price mayhem going on at the pump is now leading to some demand destruction. We’ve been seeing signs of it. We’re in the beginning of driving season, but gasoline demand is not following the classic pattern of a seasonal surge.

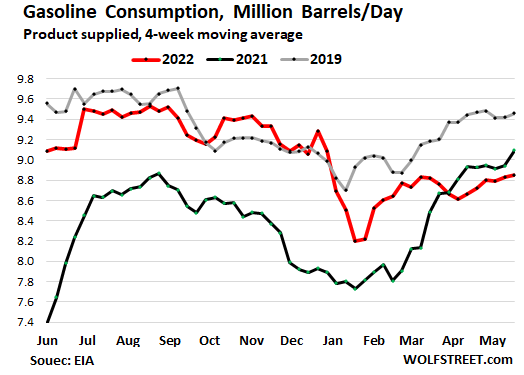

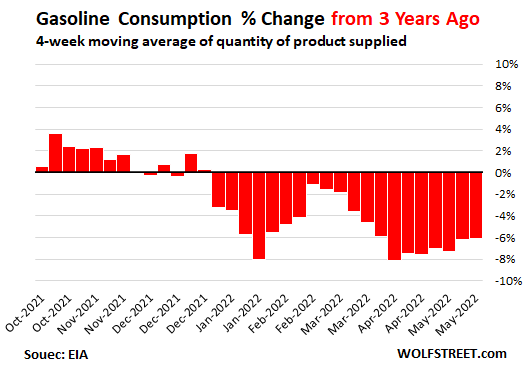

The Energy Department’s EIA reported that gasoline consumption, at 8.85 million barrels per day (four-week moving average) was down by 2.7% from the same period in 2021, and by 6.1% from the same period in 2019. Consumption in 2022 (red line) is not following the summer driving surge: it’s up only 1.3% from early March. But in May 2019 (gray), consumption was up 5.2% from March, and in May 2021 (black), consumption was up 11.9% from March.

Note that the EIA measures consumption of gasoline in terms of barrels supplied to the market by refiners, blenders, etc., and not by retail sales at gas stations.

In October, November, and December last year, gasoline consumption ran above the levels in 2019. It’s when the gasoline price shock started spreading among consumers that consumption took a hit, but it hasn’t taken a big hit yet, and consumers seem to be getting used to the pain, and demand destruction hasn’t worsened over the past few weeks:

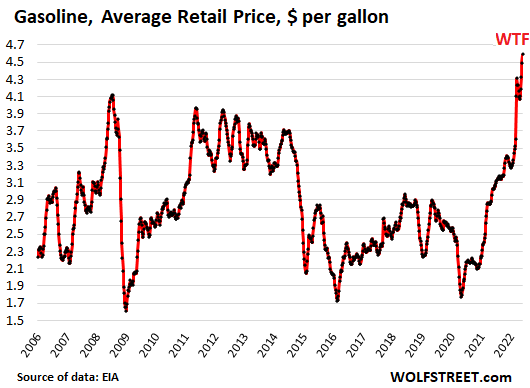

What consumers are facing at the pump is a majestic spike in gasoline prices, that included a little dip in April to confuse everyone and to spread some false hopes that the price spikes were over. In May, the price spikes resurged to new records. On Monday, the EIA’s weekly measure reached $4.59 per gallon of regular:

Long-term demand destruction happening, but it’s a slow process.

The peak years of gasoline consumption were 2016, 2017, 2018, and 2019, all at about 9.3 million barrels per day, and just a tad higher than 2007, with a trough of -6.3% in between. During the summer driving season, the peaks reached 9.7 million barrels per day.

The years 2016-2019 may turn out to have been peak US gasoline consumption. The current price spike is shifting vehicle buying patterns once again to more economical vehicles, including smaller vehicles and hybrid powertrains, and we’re already seeing signs of that. These shifts in buying patterns have long-term consequences on gasoline consumption.

Legacy automakers are finally rolling out EVs, and though large-scale production is still handicapped by the various shortages, particularly the semiconductor shortage that is hitting automakers on all their models, there is huge demand for EVs and long waiting lists. The 1.44 million EVs on the road in the US account for only 0.5% of the 280 million vehicles in operation, but EV sales are booming, and ICE vehicle sales are falling, and every percentage gain in the share of EVs represents a visible drop in gasoline consumption.

And the wave among office workers of working-from-home during the pandemic has turned into a sort-of permanent trend to working at least part of the time from home, with commutes no longer being a daily thing, but may be a thing two or three times a week, which dramatically cuts gasoline consumption for those households, especially households that have long commutes, and enough of those households doing this will take some visible demand off the table.

Short-term demand destruction.

Spiking gasoline prices, when they hit the pocket book enough, trigger some changes in what people do: They start driving less, start taking it easier to conserve gas when they do drive, and start prioritizing the most economical vehicle in their household. They might cancel road trips, and minimize driving while on vacation.

But these are short-term effects, things that people might do this year, or this month, but once they get used to the higher gas prices, and perhaps get a raise that will make those high gas prices less toxic, some of those changes will unwind.

Demand destruction as people revert to mass transit yet?

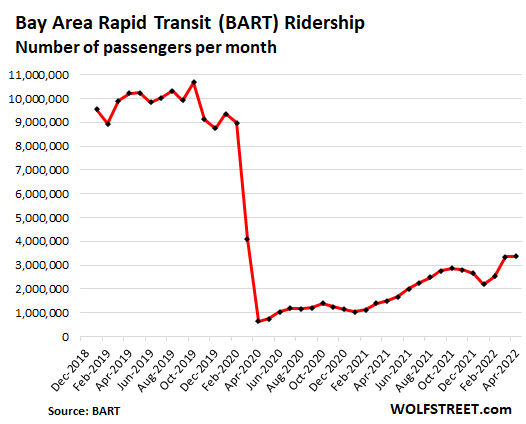

How much will gasoline prices have to spike before people return to commuter trains? The commuter train systems across the US have taken a massive loss in ridership during the pandemic, as people started driving to work or stayed home to work.

So is the current price spike enough to get people back into trains? Let’s look at the San Francisco Bay Area’s BART trains. Here, drivers face gasoline prices in the $6 range, bridge tolls that have been jacked up, and traffic congestion that is nearly as bad as it was before the pandemic. That would be a big incentive to get back on the BART.

So let’s see. Yup, in March, when gasoline prices spiked to new records, BART ridership jumped by 32% to 3.34 million rides, from 2.52 million in February. And in April, when gasoline prices dipped a little, ridership increased a tad to 3.38 million. And now in May, when gasoline prices at many gas stations are over $6 a gallon – well, we have to wait till the May data comes out. I expect another jump in ridership, similar to March. So gasoline demand destruction by people reverting to mass transit is taking place, but only in baby steps, and ridership remains 67% below the 10 million range before the pandemic:

I see gasoline prices going higher despite this modest demand destruction.

There is some modest demand destruction from short-term changes in driving behavior, from long-term changes in the kinds of vehicles that people buy, and from people reverting to mass transit in baby steps. But it’s not a collapse in demand, just a modest decline that will go on for years.

And the industry can figure this out too, and they’ll continue to cut investment and capacity to deal with this slowing demand. And nothing changes. If it were a suddenly collapse in demand, it would be different. But that’s not happening at these prices.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yeah, I agree public transpo will go up but slowly. Habits take a while to re-learn and sometimes you have to move to take advantage of public transportation without significant hits to your commute time.

A lot more folks will be looking at EVs and Hybrids, especially if supply catches up to demand. Honestly, I’m surprised the Saudis haven’t started pumping more to get the price down and keep that from happening since it’s long term and sticky demand destruction. Also, they are giving a good opening for the fracking survivors to frack more. But the Saudis seem to be under bad management.

True Nate. The problem will be finding any EVs or Hybrids.

—————-

Rivian CEO RJ Scaringe warned that a shortage of electric-car batteries could soon eclipse the issues that the automotive industry has faced from the computer chip shortage.

Semiconductors are a small appetizer to what we are about to feel on battery cells over the next two decades,” Scaringe said, according to a report from The Wall Street Journal.

“Put very simply, all the world’s cell production combined represents well under 10% of what we will need in 10 years,” Scaringe said, according to The Journal. “Meaning, 90% to 95% of the supply chain does not exist,” he added.

Some folks who purport to be EV battery experts believe that BEV production is at its maximum until either new battery technologies (such as solid state) are found, or mines can deliver *far* more lithium, cobalt, and nickel.

So without a technological breakthrough, we can expect to see mineral prices explode well beyond where they already are.

If and when we are serious about BEV infrastructure (and there are no signs that we will be any time soon), copper will also explode upward in price.

Nah. The bottleneck is semiconductors, for both ICE and EVs.

For Wolf

Go to tradingeconomics.com, click on markets, click on the + sign below the word methanol, click on lithium, click on the 5y chart. Look at the price at January 1, 2021 and look at todays price. Lithium carbonate has had almost a ten times increase. That Tesla with a battery costing 100s $ will now be in the $1000s. Pure physics.

Sheesh. You must make an effort to understand the difference between “shortage” and “price spike.” In a shortage, some companies cannot get what they need, no matter what they pay; with a price spike, they just pay more to get what they need.

1. Go look at the price charts of other commodities that are used in vehicle production, such as aluminum and steel, and look at a 5-year chart. It’s the same shit everywhere — “price spikes.” Many prices have fallen from their peaks, as all commodities price spikes do eventually.

2. Battery makers can get lithium just fine, they just pay more. It’s a price spike, and it will come down. Well, the price has already plunged 10% from the peak, so here we go…

3. But automakers and component makers CANNOT GET semiconductors, no matter what the pay. That’s a “shortage.”

4. Look at a long-term chart of Lithium carbonate… the same you want me to look at but click on “All” for the time scale. You will see that there was a spike in lithium prices that peaked 2017, also on this same battery stuff fear mongering, and then the price collapsed by 77% by 2020.

So prices spiked again, but hey, and now they’re falling again, down already 10%.

All this is just fear mongering. Traders are talking their book, which causes commodities to spike, and then they sell to lock in their profits, and prices plunge. Oldest game in town.

Wolf

Since the lithium carbonate chart only goes back to the beginning of 2017, what we can say for sure is that for 4 years the price steadily fell from about $12/lb to $4/lb and from January 2021 to March 2022 it climbed to almost $40/lb. The WSJ commodities page has the price of the five main metals needed to make EV batteries. In the same 2021 to 2022 time frame the other needed metals have increased by 50% to 100%. The point I’m making is simply that the days of cheaper and cheaper batteries are over. With every auto manufacturer in the world going full bore into EVs, the environmentalists in the developed world will never allow the whole sale mining and processing of the required metals needed to meet the assumed demand. Your assuming that metal production will increase to meet demand I’m assuming they won’t.

Here is a lithium chart (China spot price) that goes back to 2015 and you can see how the spike happened, and how it got unwound in 2017. Click on the “1M” to get per-month data points, which extends the chart back to 2015. To get the range per month, click on the candle-stick icon at the top left.

https://www.investing.com/commodities/lithium-carbonate-99-min-china-futures-streaming-chart

” The point I’m making is simply that the days of cheaper and cheaper batteries are over.”

The point I’m making is that commodities prices spike and then collapse, they always do, sooner or later, because a high price boosts investment and production after a while, and then there’s a glut, etc. There are, for example, huge lithium deposits in California. If the price is right, they’re going to get mined. This is the case in lots of places. This happened to oil and other commodities countless times.

A battery is just an electrolytic capacitor. THAT’S IT!

So, just what in the HELL is a “solid state battery”?

The stored energy in a huge tractor tire some kids are going to roll down a big hill into a gated community is a solid state “battery” of sorts. (and testing it would be plenty fun, as all R&D is)

Wolf had a recent article about those crashing “innovative” money sucking short lifetime companies, and one of them was saying or calling itself “solid state battery”. Lawsuits were being filed on it, he also noted, IIRC.

As far as “solid state energy storage” goes, I have been a believer in pumping water uphill for a long time. The proximity of the Mojave Desert to the Sierras is just begging for it.

Time to post the “Economic Periodical Chart” again, I guess.

https://en.wikipedia.org/wiki/Primordial_nuclide#/media/File:Elemental_abundances.svg

Supply and demand is a spooky thing. If the demand explodes, and if it’s possible, supply catches up.

Shortages and lack of capacity often feel like insurmountable problems. Certainly the sales guy wants you to have a sense of urgency when mulling over whether to make a purchase. Buy now, while you still can! Going out of business! Last chance! That one way to move units and you don’t need to do discounts or incentives.

But manufacturers can scale pretty quickly. Innovators figure out how to grab resources that were once unprofitable or too difficult to access. The USA becomes the Saudi Arabia of shale oil.

So, unless we go through 5 or 10 years of chronic EV vehicle shortages, I’m going to be a bit skeptical that there’s a hard cap of EV vehicles unable to meet demand.

Saudi kingdom is a country not a company, they have other things to consider other than economy and money, Like politics & security and long term relationships with others including the U.S & Russia. I think they doing what exactly benefits them the most.

Saudi has morphed into a fiefdom run by MBS. Saudi is doing what benefits MBS the most. The country will no doubt suffer as a result.

Saudi has been suffering from MBS’s father and uncles for a long time, MBS is no different in the long run. Regardless of how much ppl suffer or not my pervious statement that Saudi is doing what exactly best for Saudi, especially that Saudi is not just the name of the country but its also the family name of MBS.

Saudi has been suffering from MBS’s father and uncles for a long time, MBS is no different in the long run. Regardless of how much ppl suffer or not my pervious statement that Saudi is doing what exactly best for Saudi (not the U.S) is correct especially that Saudi is not just the name of the country but its also the family name of MBS.

So I get it now.

If you post, and then sometimes before the post “settles” (to use a stock trading term, since I hate learning computer menus as bad as Econ) you add something, you don’t get the “you already posted that” message, and it double-posts except for what was added.

Just a personal “aha” moment…..

Very true… the Saudis have ALWAYS used their ability to set the world price for oil as a tool of their foreign policy. Like the Chinese use their manpower and the Americans use their military. Right now the Saudis are getting as much cash as they can out of their oil while Iran’s oil sits in bunkers and on ships due to U.S. sanctions.

Once a nuclear deal gets struck with Iran then the Saudis will turn on the spigots and crash the value of petroleum. There is no way that they want to give a windfall profit to their enemies in Tehran.

The frackers know this as well. it is why they haven’t gone whole hog on developing NEW wells. The increased rig count is due to the frackers exploiting the Drilled but Uncompleted (DUC) wells that were created in the last decade. As the EIA said in their latest report, “Completing more DUC wells kept operating costs low in the near term…” The frackers have been burned TWICE by the Saudis turning on the spigots in the past decade… and they can do the geopolitical math as easily as anyone else can.

Thanks for interesting perspective.

Habits like convenience, safety, cleanliness, duration of trip above driving, etc.

I would think public transit ridership would be going up, but not very much since a lot of that ridership may have been from office workers who can now work from home and therefore have no need to ride public transit to work.

Kind of a nasty thought process – because traveling the world, the country is an absolute must for people to not only become more well-rounded people, but to also feel sovereign, free, maintain that work-life balance. The rich will keep on keeping on, but regular people will suffer. Not everyone can la-dee-daa run out and purchase an EV, or even get their house properly wired for one. Not every municipality has adequate public transportation either.

And come winter many folks won’t be able to warm their houses and will burn garbage instead, which will be so good for the environment. Or how about those who are maxed out on rents and are trying to put food on the table, or make it to work?

Blatant globalist arrogance.

Increasing utilization of public transit isn’t going to make a difference in most of the country. That’s the preference mostly of those who live where it’s convenient or don’t use it at all.

I’ve written this before, but I will write it again. I live in metro Atlanta within a mile of a MARTA rail station but it’s still faster for me to drive the eight miles to work (when I have to go in) than to take it.

I’d have to drive, park, walk to the station, wait for the train to arrive, change lines and wait again, and then walk to my office. The MARTA app and distance to my office (one block) offset it somewhat but not enough, because I can’t stand using the system at all. Buses are even worse. It would take someone hours to go anywhere of any distance.

There was a now-dead website dedicated to this subject (local development) but all the proposals were only that, proposals. It takes forever to get anything done.

But even if the dream transit system of the proponents became reality, I still don’t believe it will change driving patterns noticeably.

The ridership experience will still “suck”, no matter what happens.

This is so true. Transit works great for the handful of dense metro areas built in the 1800s prior to the advent of the automobile, NYC, SF, Chicago, and to a lesser extent Boston, DC, and Philly. And with the exception of Manhattan, most people don’t live in any of those places without a car.

Happy1

Total BS. I live in Montgomery County Maryland, 2 miles outside of Washington DC. We have great public transportation and bicycle lanes on most of the roads near the border of DC. You could live very well with public transportation exclusively if you wanted to and live very well without a car. Many people do. I’ve done so myself several times once back in the days of gas lines and when my car got wrecked in an accident.

Out of curiosity, do public transit numbers include company provided transportation to/from work? My company provides buses from the major towns around here to the worksite (very helpful, since there’s no towns with over 1,000 people within 50 miles), but it isn’t provided by the local government so it probably doesn’t get counted in public transit numbers.

The bottom chart shows the number of people who exited the San Francisco Bay Area BART system through the turnstiles, no matter who paid for the tickets. BART is rail only, and doesn’t included buses or other forms of transportation.

The “Google buses” and “Yahoo buses” etc. have been around for years. They were mostly discontinued during the pandemic when the companies switched to WFH. Not sure what their status is now. Office attendance is still very low. Most of these people are still at least part of the time working from home.

Wolf, totally off topic. From a 5/24 Reuters article:

“Under current projections Fed net income is projected to decline notably. If rates rise even faster the Fed could, for a time at least, be operating at a loss, forced in effect to print money to pay its bills and halting remittances to the Treasury altogether. Fed officials have acknowledged that, should they choose to sell MBS in a higher-interest rate environment, they might realize losses.”

So, the full $95B runoff doesn’t happen until Sept. What scenario creates a situation like this, where the Fed is forced to print money to pay back its obligations? In other words, would the Fed be forced to sell off assets instead of just letting them run off? Would they do this for both treasury bonds & MBS? Last, what happens if inflation remains high & the economy tips into a recession sooner than the Fed expects, and they haven’t had a chance to runoff anywhere near the $2.5 -3T they expect to?

Jay,

I’m really not worried about this.

One thing you have to keep in mind is that the Fed will continue to earn interest on its $x trillions in holdings over time. So if you earn 2% on $8 trillion on average, that’s $160 billion a year. That can pay for a lot of losses that you might incur selling MBS.

In the minutes, the Fed discussed selling MBS outright well after QT has gotten off the ground. I think they will start selling MBS when MBS runoff consistently fails to reach the cap. Most of the MBS will run off via pass-through principal payments, so there is no loss involved. When they sell MBS, it will be a small-ish amount every month, just to fill in the cap.

But yes, the remittances to the Treasury will largely fizzle. So that’s $120 billion a year that the Treasury will not receive, or will receive only a smaller part of, and so the deficit will be a little bigger.

And everyone knows that the Fed can never go bankrupt because it can print its own money – and capital. So I’m just not worried about this whole thing.

It’s only an accounting exercise.

At some point, the FRB may receive political “blowback” when its popularity plummets as the economic environment deteriorates, but this has nothing to do with their solvency.

I can confirm that I have seen the Google buses running where I am but I have no idea if they are back to their pre-lockdown frequency or if they are running less often since most people are going to work 3 days or less a week.

The Microsoft buses are still running in Seattle.

According to the BLS’s CPI calculator, the 2008 peak is around $5.40/gal in today’s money and the peaks in the 20-teens would be hovering around $4.50 to $5/gal.

Seems like there’s still some room for gas to go a bit higher, or at least stay around today’s real price for a while. The means the nominal price of gas certainly has room to run if CPI inflation stays high.

All the folks who ran out and spent their cash-out refi money on those nice shiny $60k+ V8 Ram pickups could be in for a very rough ride. I wonder how long it will be before we start seeing lightly used trucks sitting on dealer lots available at big discounts. Especially if construction slows down, these monstrosities could go out of style with vehicle buyers pretty quickly.

Thanks for the today money quote. Need to adjust peak prices for inflation to see how they relate.

Maybe they do not care what the price of gas is? LOL It is the status symbol. But I do get what you are saying.

I had a boss who bought a high end sports car. While he was showing it off to fellow coworkers someone asked what was the MPG. He laughed, for the price I paid for his car, I don’t care.

FYI – I drive a 22 year old truck that gets about 15 MPG. But I only drive it 6k miles a year.

Fossil fuel companies have bought up all the Star Trek transporter tech so they can keep it off the market, knowing as they do that such advances would put them out of business overnight. You can sign a petition asking the Vulcans to intervene but it probably won’t go anywhere.

But…

How DO you get from your home to the nearest transporter hub?

Don’t you ALWAYS carry a “communicator” (cell phone)?

Sheesh…….hundreds of people know your co-ordinates…….

Those lightly used truck would be snapped up quickly. My local Chevy dealer has very few trucks on their lot for sale.

Nearly all categories of prices are up so that means the Fed and government splashed too much money. Everybody was happy for a while, including companies who had record high profit margins.

The money has got to be bled off so that people have to start choosing a lower standard of living based on their priorities and corporate profits will have to fall as people make tough choices.

Price and price discovery are foundation principle of economics. Printing demand seems like a foolish concept to me.

> “Price and price discovery are foundation principle of economics. Printing demand seems like a foolish concept to me.”

“Printing demand” was reallocating demand, redistributing it. Which defeated price discovery, meaning the masses were continuing to be mispricing risk, which is another name for failing to discover the true price/risk/cost of things. Finally, the solution has reasserted itself, as you say, “The money has got to be bled off so that people have to start choosing a lower standard of living based on their priorities and corporate profits will have to fall as people make tough choices.” Bravo to that. Even the most elaborate frivolities get boring. The season changes.

But here is an alternative: many will blame it all on some current narrow set of politicians, thunder righteously, and bring about some large political shift, which will be a blame/vanity thing and will only stave off the day of awakening, which is true price discovery, for the sake of some new slogans, gimmicks and “solutions.” It is the emperor’s new clothes, new hope in a bottle. Anything but an honest balance sheet and day’s work, I guess. But that noise and reality-testing is a cost of freedom.

The high price of gas seems fitting, to me, for many reasons. I do not have a god-given right to the stuff at a certain price.

(again) an R.A. Heinlein aphorism:

“Self-deception is the root of all evil”.

may we all find a better day.

“Common sense is a collection of prejudices, usually accumulated by about age 18”

-Albert Einstein

By the way, I saw this NEW lifted 4WD Ford truck with BIG tires and exotic rims. Figured it was at least a 250, but no, just a 150XLT.

But on the tailgate it had a fancy model plate that said

“Texas Edition”.

What gas problem?….eh?

And it was in the CVS parking lot…..not exactly a kid hang-out.

“Printing demand seems like a foolish concept to me.”

It’s logically idiotic, except when viewed in the context of “kicking the can down the road”.

Then it makes perfect sense.

That’s how I bought my Ford Expedition in 2006. 19,500 miles for $21,500. I still drive it a couple of times a week.

There are reports that insurance issues will prevent Russia from selling its oil. Moreover, the inability of Russia to maintain its more eastern oil fields, some of which were only possible with Western companies’ technology and support, means that Russia will be selling less oil in the coming months as its production facilities seize up because the Western service companies for these oil fields pulled out of Russia.

I believe those reports are accurate, so expect maybe five million more barrels to be out of the market in the coming months. That shortage will drive oil prices up unless there is a cessation of US exports to the rest of the world. The US faces a choice: protect its consumers from limited price hikes or protect many countries, who will face catastrophic price hikes as both Russia oil and US oil go off the world oil market.

Gas consumers face worse futures, reportedly, because once the EU manages to reduce its use of Russian gas when Russia must cap many of its gas-producing fields due to the oversupply in its network, it will take many years (again) to bring up those fields into production. Hence, expect world gas prices to rise, albeit as with oil, the US could forbid the export of US and Canadian gas and thereby limit any raises in US gas prices.

Insurance can be resolved and I believe will be if it becomes necessary.

If China’s leadership has any common sense, they presumably know that if they don’t backstop Russia’s economy and it collapses, they are next on the list if the US and “international community” can do it.

China needs energy and Russia has it, so it’s a win-win (at least in theory), for now. Biggest obstacle presumably is the infrastructure to move it from point A to point B, but I’m not familiar with that.

What it means is with the “illegal bought parts” or blackmarket by another name to keep the oil flowing, Russia will be getting far more for its oil than before the start of the war even if sold with a discount… Same for its wheat, sunflower oil, corn, fertiliser, Uranium and specialised steel and nickel products that the West and the rest of the world desperately needs….

If it can’t sell it’s products and starts to fail, then the Russian answer would be for its submarines to take out Washington, New York, Los Angeles and San Francisco and sadly,my home town…. Choose wisely….

Not sure if your ”home town” is on the rush n radar A, but with exception of DC the 4 you mention likely are NOT, nor any of the others of the largest USA cities,,,

Looking closely, that is where MOST of the population is in constant danger of very fast lack of food, etc., and would mostly starve within a few weeks of the closing down of the electrical grid and a very few strategic transportation nodes, etc.

IMHO, IF nukes were to be used against USA, they would be aimed totally at ”defense facilities.”

In fact, I recently mentioned to a neighbor not to worry at all about nukes, etc., because we are less than 5 miles from what is likely to be the number one target and will be vaporized instantly…

The rest will fall quickly on their own, except for a few rural areas where folks are actually prepared, or so I read, for this possibility, and are so spread out it would make no sense to ”nuke em Danno.”

Vehicle fuels have very little price elasticity, meaning changes in prices, even large changes, have small influence on quantity demanded.

For some reason, employers seem to insist on hiring people who will have long commutes, which makes fossil fuel companies very happy.

The Bentley runs on hydrogen and we have very short commutes anyway, so we have no skin in this rigged game. We make it ourselves by electrolysis from the current generated by one of the windmills, the same one that runs the compressor and charges the clock drive for the telescope in the astronomy tower, so it hasn’t cost us anything in years, except for eyepieces and a new camera.

“the semiconductor shortage that is hitting automakers on all their models”

Henry Ford never needed gallium arsenide to make cars, and Enzo Ferrari never heard of Fermi–Dirac statistics. Nowadays vehicles have more electronics than the stereo selection at Best Buy, mostly so they can charge more, which makes it yet another case of Solutions in Search of Problems That Don’t Actually Need Solving.

My chauffeuse doesn’t need gps to get me where I’m going, or a mobile upscale home theatre entertainment/conference center for that matter, and doesn’t want to drive an grossly overpriced cell phone with 4wd or pay lots extra for corporate marketing spyware, which is what most people do.

Gasoline, aka petrol in civilized countries, is mostly composed of low-boiling alkanes, plus some BTEX-type stuff that they leave in, apparently to make large-scale spills easier to track.

I am assuming not all of that was true, but it was well written.

Thanks. I was being sarcastic about the BTEX.

Also, I am puzzled about the assertion that companies insist on hiring employees with long commutes. Working over 40 years in Silicon Valley and watching employees move further and further away to find housing they could afford, my own hiring calculation would be to hire workers closer to work based on my bias that spending less time in commute traffic is a benefit. The person we hired to replace me in retirement had a great skillset and I sensed the fact he lived really close to our company contributed to his accepting our offer. Our offer was competitive but certainly not the best he could expect. What I am describing here is a peripheral benefit of hiring a better candidate than we might expect because the candidate has a short commute. I am generally sympathetic to your sentiments so maybe you could explain why a company might prefer hiring employees with longer commutes. Thanks.

“maybe you could explain why a company might prefer hiring employees with longer commutes.”

– It gives employees less time for constructive activities, like look for a better job.

– It gives hiring managers the opportunity to claim they searched high and low and near and far for the right candidate, something they can’t do with a local hire who was just too convenient and too easy.

Sucking up employee time makes them more dependent, and dependence is the name of the gam. It’s common HR practice to relocate employees away from their familiar family and friend personal support systems. Coca Cola has historically been notorious for this, as have IBM (“I’ve Been Moved”) and a long list of others. It’s well-known to be a heavy contributing factor to the tech company preference for hires from the Asian subcontinent.

They don’t just want to hire you. They want to own you.

He did say “we” and “our”.

The Military also moves people around a lot. Same MO.

Hydrogen = Hindenburg.

Yes, the Hindenberg used Hydrogen. But the fire wasn’t due to the Hydrogen. It was due to the coating on the “skin” (very flammable) and a diesel fire. The hydrogen played such a small role as to be insignificant.

Hope that Bentley doesn’t have a magnesium frame…

Funny, I was just commenting on Fermi-Dirac statistics regarding the behavior of the hybrid battery pack on my Lexus RX450h being temperature and age affected. But no, electrons are not all equal.

Enzo Ferrari would be proud of the application of the physics first detailed in 1926, and as they are applied to the new Ferrari SF90 Stradale.

Here we have a mid-engined twin-turbo V8 combined with a Plug-in Electric Hybrid system that pulls away from a stoplight to 200 kph in 6.72 seconds.

My ICE M4 needs 13.1 seconds. Twice as freaking long to get there! My V4 ICE Italian motor bike is fairly fast at just over 8 seconds to get to a decent “cruising speed.”

Also, as I commented, a Ferrari did the 0 to 200 kph Sunday in Barcelona in 4.82 seconds. But, it only did 27 of the 66 laps before the engine let go. I blame the electrons, eh?

By the way, my other Italian bike is fueled on coffee, yogurt, banana & omelette power. We went 35 km this morning on a half-tank of fuel.

Whole team of technicians in Chick-A-Go-Go South Side monitored your ride very closely:

35km Time Trial

1.Max power from standing start: 1,200w

2.Sustained average power: 475w

3.Ventilation rate: 230 liters per minute

4.VO2 max (pure oxygen consumption): 85ml/min/kg

5.Pulse: 170bpm

6.Haematocrit: 48% (in your case most likely no EPO blood doping but judgement is still out)

7.Lactate level: 2.5mmol/ml

8.OBLA (Onset of Blood Lactate Accumulation) happened at 400w.

Test result marked GO 😀

Nice one Brent!

I chose not to use EPO and HGH back in the day. My competition was not necessarily doing the same. No real test for it until quite a few years after I retired in 1992. The EPO could have killed me though; blood clots & aneurysms with no supervision by medical staff during sleep when dehydrated.

Sustained power output was more like 280 watts, as today was an easy day. Current stats are 90 kg & 1.91 m. I do process a lot of air when moving, and have a high VO2 max.

In 2006, the Australian cycling federation did some power output testing on a match sprinter, 96 kg, and a kilo rider, 87 kg, that are quite interesting. A power output of 2,500 watts was standard for short periods of max effort.

My mass of 98 kg, plus kit and bike was around 110 kg. For my start burst out of the gate, the numbers are almost unbelievable. I have done the math and physics on them. 0 to 65 kph in 5 seconds and 3.6 m/s2 acceleration tells the tale.

But when the Olympics were in Tokyo last fall, the riders went from zero to 72 kph in 4.5 seconds. The human body can do amazing things.

I turn 60 in August, and 20 mph for an hour is easy on a nice calm day. Wolf swims in the Bay. I ride along the Mississippi.

Brent, wherever you ride, enjoy!

“There are no laws in Biology, only gadgets”

-Francis Crick

But I do respect anyone who tests the limits….. any limits.

Had a good buddy from work who ran the Badwater 14 times, (had to run the Golden State 100 a few times to get invited) and still holds the 70 and up record, I think (was 70 at he time)

Art Webb….lost contact, he’d be 80 now.

I was limited to 32ft/sec/sec….so we just constantly improved our “socializing” abilities.

I’ve been watching the RV/travel blogs etc. closely to see if people are cancelling their trips yet. So far, it doesn’t seem like many, based on my small unscientific sample.

I’m lucky that I can drive short distances in any direction and be in places people spend a lot of money to visit.

Or maybe I’m unlucky that I live where people come to visit.

PDX is a hotbed for companies that do van/sprinter conversions. I make parts for a couple of them and they still seem to be booming. But they might be working off a big backlog.

#Vanlife is very popular on YouTube.

Living in a van, down by the river is now an aspirational goal.

Also Elkhart Indiana

The Colorado Kid,

We’re in the same dilemma. I too have been perusing those same sites!

I’m selfishly hoping that the price increase in fuel has a huge bump-up soon, to discourage those long lines of RVs plugging up the roads in my area. And swamping the campgrounds.

I can’t blame people for wanting an adventure this summer, but I got a bad case of NIMBY.

:)

Expect a lag effect, same as anything else.

Hope the lag comes before the end of summer.

End of summer, all the gas guzzling RV’s will have “For Sale” signs on them.

I’ve been reading that some people are cutting back on their driving trips, maybe 1 instead of 2 or 3 for the summer. Also lots of complaints on how expensive accommodations are compared to previous years. I’m doing my annual van life trip this summer around OR and WA and didnt have too much trouble booking in most areas. Flights are only up about 10% over last year too which with oil where its at means the airlines must be getting their margins hammered.

Good point. Lodging and car rental IMHO are the two items that is making travel more expensive rather than the price of gas. I am making two trips over the next couple of months. Des Moines Iowa will cost me $220 a night for 3 nights. This is in the middle of Iowa. Going to Chicago a suburb of Chicago for 8 days and lodging will costs $2200. No beach or mountains at either place. Just conventions.

Maybe it is just being unlucky that I am picking busy times

Best about Chicago suburbs is the forest preserves if you like to run. No charge.

Apparently all the airlines are cutting flights down over the summer blaming pilot shortages but presumably really so they can keep fares higher. I am seeing way more than 10% increase in prices in the routes I am seeing. We are probably due for one of Wolf’s TSA checkpoint articles soon. I’m curious to see how far travel has rebounded.

TKC-i try to ameliorate those feelings by acting the ‘colorful local’ if encountering the tourists while picking up the mail from my local hamlet’s Post Office (have the advantage of living in one of Black Bart’s operating areas…).

may we all find a better day.

When I found out that my barely middle income in-laws just bought a new Toyota 4Runner my jaw dropped. 16/19 mpg on top of the payments for a $40,000 car? Face palm.

Most retail CEOs are not reporting a drop in sales….just that their profit margins are getting squeezed. Most say demand has not dropped and consumer are still happy paying higher prices….for now.

For what it is worth, gasoline is up 5¢ over last week at my favorite gas station here in Wisconsin ($4.11).

I had to take a 30 mile trip to Appleton today on the Freeway. Very heavy traffic both ways, mostly sedans and SUV’s. The semi-tractors on the road vastly outnumbered the pickups. Plenty of out of state license plates. Did not see one single RV.

Impression I got was a lot of tourists started the Memorial Day weekend early.

Some of the Snow Birds here at the retirement complex still have not come back from Florida. Nobody here seems to know why.

Looks like you didn’t grow up in Wisconsin since you called I-41 a “Freeway.” I still have students remind me that they are called highways, and it’s my California roots that makes me call them freeways.

I lived in 3 states and 4 other cities before moving here back in ’56. We always used “freeway” to describe the 4-lane divided roads with limited access.

Have you driven “Bloody 29” and drunk at the Bubbler too?

Sunday morning, July 3, you can drive across the ‘Super-Slab’ to watch the IMSA race at Road America, Wisconsin. From the Twin Cities, you get off the Interstate at Tomah and go east on 21.

The best parts of driving there are being able to listen to Polka music, in stereo, on multiple radio stations. Plus, you can pull into a gas station to fuel up, and buy a six-pack of beer at 10:00 am — on a Sunday.

Lots of German heritage in Wisconsin, you know?

Only as far as Wausau. And before I moved here, I had never heard of a bubbler or the expressions “it’s a horse apiece.”

Back in the end of September 2017 I was on business in Milwaukee. I finished up my work a day early, so I drove up to Green Bay. The drive was beautiful!!! Rolling hills, green fields. The temperature was in the low 70s. I took the tour at Lambeau Field.

Not free in NE Illinois. Tollways from late ‘50s to mid-‘60s were supposed to be paid off 40 years ago – haha!

Was that you on 41? I was on my way to Pine Mountain Ski Jump, to replace a shattered face plate on the GWM.

Noah’s Ark in The Dells was always a family favorite.

Wolf: This just popped into my mailbox and it already has 15 comments. What gives?

Well, I share this website to people I care about. I hope they’re reading.

Its going to take many months for the American consumer to realize and adapt. They don’t realize quickly and they like spending. Household finances are in good shape. People will be travelling because they’ve planned it. CPI to the moon!

Buffett is now holding 10% of his portfolio in the only 2 energy stocks he owns: $25bn in CVX and almost $8bn of OXY since the start of the year. During Q1 when he was buying, he was buying CVX at it’s all-time highs, and OXY at its more recent-ish highs. He’s since almost doubled his money in OXY, and he’s up around 35% on his Chevron.

I wonder why he was buying CVX at its all time highs? Buy high sell higher I suppose…though no ones knows when he will sell or lighten these energy positions. Does he see oil going to $150+ per barrel ala 2008-style?

Very interesting nonetheless.

CVX is the only US company in Venezuela.

Gmac-

Shift from growth oriented market to value, perhaps?

From companies evaluated on discounted future profit hopes, to companies evaluated on controlling tangible commodities and long-lived production facilities, producing revenues and profits in the here and now, with some production costs locked in at last year’s levels.

“Growth” investing has had the upper hand, but Buffet, of all investors, sees the value in “value” investing.

The shift from growth to value investing coincides with the shift to an inflationary mindset, and a fear of shortages.

Part of the commodity supercycle. That too will run its course…

Bout 1975, 55 MPH was the new law even on interstates to conserve fuel. It was like crawling somewhere.

Thankfully today there doesn’t seem to be a shortage of gas or money. Let er rip!

Besides, people today wouldn’t stand for driving 55, road rage would only increase with a lot more shootings.

If acting reasonably results in shootings, I must be in the USA.

Phleep-

If regulatory and tax legislation follows logic, I must NOT be in the United States.

I cringingly expect a legislative push for 55MPH, and a windfall profits tax on oil producers, if gasoline pierces $6.00

Bonus guess: that EV cars will be exempted from 55MPH speed limit.

Blow off top coming in oil and it’s products. This looks just like May/June 2008.

Everything has changed Yancey. Everything. 2008 was 14 years ago. just before COVID the banking system went off the rails. Look for data around September 17th 2019 for the shenanigans. Then COVID a once in a 100 year virus that shutdown the world. Bringing with it shortages of everything from TP to computer chips. Inflation at 40+ year highs. Add a hot war in Europe. Oil is going to do whatever big government and companies want to do. Could gas hit $10/gallon? You bet it can

Blame Russia seems to be the go to model everything except Covid

Good thing polecat installed his domicile staycation when he could still afford it!

Don’t need no RV, Don’t need no Cruise!! … weep suckers! ‘;]

I’m with the polecat on this one. Lines of suckers moaning about gas prices and bumping bumpers, crowding in for some short hurried overpriced “experience”? … weep suckers! ‘;]

Be sure to compare meaningless statistics about those over-featured toys! It raises the entertainment value for me, seeing these mutant apes comparing silliness and wastage scores. It is a rat race to nowhere.

polecat, phleep –

Totally agree. American style vacation / recreation sucks way too much energy as well as money. Plus a heavy dose of existential nausea.

Off subject, but Affirm Holdings (AFRM) is down over 80% from its Q4-21 high. Probably already on the “list,” but I don’t recall seeing it.

AFRM operates in the ”buy now, pay later” space. (Sounds a bit like the Fed’s QE operations!).

Sure bounced today, that thing. +22%. But after the big kathoomph since Nov last year, you can barely see the 22% uptick on the 1-year chart :-]

Wolf, looks like Business Insider plagiarized your article

Yes. The author is a cheap thief.

Thanks. Happens all the time.

Not the first time I’ve seen them do it.

It can be hard for Americans to just sideline a fuel hog just because gasoline prices have shot up. I was glad that Wolf mentioned San Francisco Bay Area’s BART trains having a third more riders. I was wondering about ride share companies… they may be the only alternative people in most places (without public transit) have to substitute a trip in an F-150.

The Twin Cities has a good light-rail system that connects Minneapolis & St. Paul between each downtown, and Minneapolis to the MSP International airport.

It is a bit more used by passengers than it was two years ago, but nowhere near the ridership it had during rush hours before Covid.

Before and after Vikings games, it gets very crowded as it has a stop next the the football stadium, and it also has some Twins fans that ride it now that it’s baseball season. The western edge of the tracks is by the baseball park.

If you run away with the circus when you’re young, and see the whole country, there’s no travel itch to scratch when you get old, and no worries about filling up the RV for hundreds of dollars at every exit.

There’s lots of beauty out there that the circus didn’t visit. Too bad so much of it is monitized Disneyland rides.

I thought the circus is now in a fixed place operation in Washington, D.C.

people here in Florida really don’t care what gas costs. The roads are jammed everyday, $10 a gal, go forth mongers.

They’re all out chasing something, and if they could ever figure out what it is they might be able to catch it.

I got gas the other day, amazingly there was a $0.30 spread between the prices at gas stations on opposite sides of a busy intersection. Both stations had cars at about half of the pumps. Today the spread was $0.05 and a few more cars at the cheaper one. Does everyone here make 10x what I make or are people so resigned to inflation they just pay whatever?

Last time I visited a cheap corner, my card got hacked. Just one data point, I know.

Your personal experience is valid, but being anecdata it’s limited.

pardon the off topic…

any comments on this

“SOMA holdings of Treasury securities as a share of the

$22.6 trillion in Treasury debt held by the public (inclusive of

SOMA holdings) increased to 25 percent at the end of 2021,

compared to 22 percent at the end of 2020. Although overall

Treasury debt outstanding increased by $1.6 trillion during

the year, that growth was outpaced in percentage terms by the

increase in SOMA holdings of Treasury securities.25

The sectors with the largest shares of outstanding Treasury

securities held in the SOMA were securities with ten to thirty

years remaining until maturity, at 38 percent, and coupon

securities with up to three years remaining until maturity,

at 30 percent. The SOMA’s share of outstanding Treasury

Inflation-Protected Securities (TIPS) rose from 23 percent to

27 percent—”

May 22 report by the Fed on Open Market Operations in 2022, page 33

https://www.newyorkfed.org/medialibrary/media/markets/omo/omo2021-pdf.pdf

10 to 30 year maturities….38% held by the Fed?

I thought I read somewhere that Britain is imposing a 25 percent windfall tax on oil producers profits “to help fund a 15 billion pound ($18.9 billion) package of support for households struggling to meet soaring energy bills”.

Doubt that would work here since we operate under a system of legalized political bribery and corrupt corporate media.

Politicians in Britain are mostly bought. In the US they can only be rented.

All roads now lead to serfdom, but in the US they have toll booths, and in the future there will be no need for heating subsidies.

Oil and gas companies selling to Britain will counteract with price increases. The lowly citizen will just pay more.

To “help” the oil and gas companies, the British goverment did do the windfall tax but then gave them a 90% tax rebate on investment in new wells in the North Sea. The greenies are going bonkers…..

On VE Day and VJ Day and Memorial Day I honor my father and all who served the call. A toast to all and to the my dad and his place in history with the 6th Marine Expeditionary Force on Okinawa and Tinian and Saipan in WW2. Happy Memorial Day.

Thanks! This war veteran appreciates the post, and my Dad served in the Navy on a minesweeper in the Pacific in WWII.

My Father served on a WWII minesweeper as well Anthony. He served with the American navy in the Mediterranean as part of “Operation Dragoon.”

Ditto, my father served in the Navy in the Pacific in WW2 on several different ships and did occupation duty in Japan postwar. I did a hitch in Air Force a year or so out of high school back when.

I had an uncle (one of three brothers) stationed in Okinawa. Letters home were heavily scrutinized and you couldn’t mention anything about where you were or what you were doing. But, my grandparents (good map readers) knew exactly where he was.

In one of his letters, he said, ” I hope my little sister is OK”.

Very clever.

Good for you and your dad on memorial day…….. My dad, of course, was not in the American forces in WW2, he was in the RAF.

My dad was sent home from boot camp with a pneumonia instead of going to war (WWII). He’d damaged his lungs as a youngster feeding cattle from a hay wagon in NW Colorado in bitter subzero weather. His dad (my grandfather) lost his leg in a ranch accident, so my dad did a lot of the ranch work from the time he was little.

My father passed away last September. He was a PFC in the infrantry in Europe during the last year of WW2.

He was a 1st Infantry Scout. Those familiar with WW2 infantry will know what that means. For the majority of you who aren’t:

“1st Scout” did not indicate a rank – as would be the case for “1st Lieutenant” or “2nd Lieutenant”. Rather, it just meant that he was the first of the two scouts who were sent out on each advance. They needed a 2nd because there was a high probability that he wasn’t going to return. It was a very difficult thing to be ordered to do.

He survived the war, raised a family, and lived a long life. But he never really made it all the way home from Europe.

Father

6th Marines also

29th

I think we should also be sure to honor those who paid the ultimate price in Vietnam, all 55,000 of them, and those who served in Korea. I don’t see many posts honoring them.

Also from reading these posts, it is apparent that many here and elsewhere don’t even know the meaning of Memorial day. Its to honor the fallen, not those who served. The latter is for Veterans day.

Swamp-thank you for pointing out those intended to be honored on Memorial Day. As to so many of our fellow citizens just wanting to move on and forget the fallen and served of Korea and VietNam, i came to expect that some decades ago, be it Memorial or Veterans’ Day…

may the day we all find be a better one.

The Strategic Petroleum Reserve is pushing about a million barrels a day into the US oil market. What happens when that ends?, or when they have to go into the market and replace this drawn down inventory? Also, gasoline refining capacity is aging/dwindling because of government promoted fear that EV’s and carbon taxes will make further capital investment unwise. Governments seem to think they can manipulate the market price down. In the short term they might be right. However, these moves will ultimately have the opposite effect, namely higher gasoline prices through inventory replacement and value harvesting of aging refining assets.

With declining demand in the US, the SPR release ads to exports of petroleum and petroleum products (such as gasoline). All this is global now.

BRK/B boiler room are short time swing traders. The 90 years boss don’t care. No more B&H.

1) Casino royal or entertainment only to gamble in Memorial day :

SPX entered Feb fractal zone, under Jan 24 low.

2) SPX might turn lower next week, before moving up, zigzag up, to close May 4/5 gap.

Options

3) Move higher to Mar 29 high area.

4) To a new all time high.

5) Exogenous causes in June will send SPX down, under 3,800, injuring the stock markets.

One factor that *might* be slowing the rate of demand destruction.

It’s become very expensive or – in many cases impossible – to cancel reservations for air travel and lodgings.

It could be Labor Day before we see more significant demand destruction in gasoline demand.

If China ends its Covid-related lockdowns before that time – things are going to be really, really marginal for oil & gas supply.

Well, if you care about the big picture and caring for the planet, you should root for higher gas prices. There is no negative for society, only for selfish individuals.

As for commuter trains, the one in Seattle feels like only back to 20% of normal. Too much WFH still. I suppose WFH is helpful to the planet too, but at a huge cost to productivity. Certain commenters claim otherwise, but they are exceptions.