Even a dead-cat bounce that makes your ears ring would do.

By Wolf Richter for WOLF STREET.

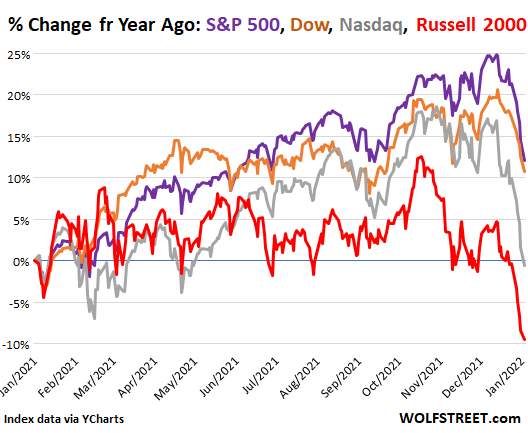

Stocks are down ferociously at midday today, with the S&P 500 Index down 3.8%, the Dow Industrial Average down 2.7% and the Nasdaq Composite down 4.5%. This follows a large-scale and widespread and relentless selloff that for the Dow and the S&P 500 started on the second trading day in January; and for the Nasdaq in November. By this morning, the Nasdaq was down nearly 20% from its intraday high in November.

By Friday at the close, the S&P 500 Index had dropped through the 200-day moving average, and combined with a huge mega-boom of the type stocks had experienced after March 2020, is not a common occurrence, and in the past has been followed by serious selloffs and crashes. By this morning, after the steep losses, the S&P 500 Index was down 12% from its high. This all came in the span of three weeks, with each week having been a loser.

The Nasdaq and the Russell 2000 fell into the negative for the 12-month period, having surrendered all of their gains plus some that they’d obtained over the prior 11 months (gray line). The Dow is still up 10.7% (brown) and the S&P 500 is up 12.8% (purple) for the 12-month period, having surrendered in three weeks about half of their huge gains of the prior 11 months (index data via YCharts):

These kinds of sudden widespread losses day after day, week after week, are screaming for a bounce.

Any bounce would do. Whether this would be what traders call a “dead-cat bounce” that then leads to more losses, or the beginning of something new, well, we’ll see. But there needs to be a bounce. There always is.

Traders are always eager to pick the bottom of the drop if for nothing else but a brief and violent ride up because the craziest rallies occur during the pauses in broad sustained sell-offs, and so they dive in, and they’re buying what others are selling. And for days and weeks, these dip buyers got carried out on stretchers. But some day, there must be a bounce.

This selloff has been particularly brutal for holders of many most-hyped meme stocks, SPACs, and IPO stocks that have collapsed by 60%, 70%, 80% and some by 90% from their highs. And dip buyers were relentlessly beaten up.

And there better be a bounce soon or else I will have to revise the WOLF STREET dictum, immortalized on our beer mugs: “Nothing Goes to Heck in a Straight Line”:

Some of the biggest stocks are down massively. Midday Microsoft was down over 5%, and by nearly 20% from its high in November. Netflix was down over 8% midday, and down 48% from its high in October. These kinds of sustained drops are screaming at least for a dead-cat bounce of sizeable nature.

Here are the 10 biggest losers at midday in the S&P 500 Index and their declines from their 52-week highs:

| S&P 500 Biggest Losers Today | Price | Today % | From 52-Wk High % | |

| 1 | Moderna | $144.36 | -9.8% | -71.0% |

| 2 | Netflix | $365.57 | -8.0% | -47.8% |

| 3 | Signature Bank | $302.14 | -7.4% | -19.2% |

| 4 | Xilinx | $173.99 | -7.4% | -27.2% |

| 5 | DISH Network | $29.57 | -6.9% | -37.1% |

| 6 | Lincoln National Corp. | $63.36 | -6.6% | -18.3% |

| 7 | NVIDIA | $218.76 | -6.4% | -36.8% |

| 8 | Expedia Group | $163.32 | -6.4% | -14.9% |

| 9 | Freeport-McMoRan | $38.46 | -6.2% | -16.4% |

| 10 | Enphase Energy | $118.25 | -6.2% | -58.1% |

No matter what happens to the market over the next few weeks or months or years, one thing we know for sure for sure, Nothing Goes to Heck in a Straight Line, so to speak. That’s my story and I’m sticking to it. And we’re due for a bounce that could make your ears ring.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, you should time-stamp the bottom calls … this one might be legendary. And if not, you can do what the big-propaganda boys do and memory-hole the post!

Cashed in all Feb, March, April puts today when VIX was close to 40. Kept Jun, Sept. Crazy rally maybe coming, or not.

Actually, the market crash that I predicted, with about a hundred others admittedly, may not be as bad as expected: war spending has a multiplier effect. Russia’s and China’s decisions to imitate Fascist Italy and Nazi Germany closely are prompting other nations to rearm frantically.

Russia makes real stuff? Where is it sold so I can see some?

nick kelly,

For example, Russia is the second largest arms exporter behind the US. Sophisticated equipment too, such as fighter jets, anti-aircraft missiles, etc. The defense industry (all state-owned) is huge in Russia. Also, automakers have set up shop in Russia. There are other examples.

nick kelly,

You are aware that German GDP PPP barely edges the Russian one, no? Then, you will be surprised that Russians produces ~2 million cars a year. They are the largest producer and exporter of grain (wheat, ray, oats,…) in the world. They are top 3 producer of gold, silver, platinum, vanadium, nickel, cobalt, and top 10 producer of all other industrial metals. Russia is also the largest holder, exporter, and leading supplier of hydrocarbons to EU and USA. It is sold at your local energy distributor. Their IT dominates the finance, gaming, security, actually EVERYTHING successful in IT is outsourced to Russian developers. They have the code and know how to use it. Losers get the Indian coders. Top armament, robotics, and space explorations are firmly in their hands. They have the greatest % of college/university graduates in the world. So, nick kelly, you are actually buying vastly more Russian product then the average Russian buys American. Depending on the energy, IT and agricultural mix and cost, you possibly buy more Russian than Made in USA stuff. The stuff doesn’t get much more real, no? Except for some fine American crypto, NFTs, on-line education, and inter-sectional sensitivity training.

@Niko,

So, what you say should mean Russia goes into a deep depression upon getting cut off from the SWIFT system, in combination with far deeper sanctions on its imports. ROW (esp. US, OPEC, and India) will be pretty happy about all the extra demand for their products and services. Go ahead Russia… make our day…

WR: of course I knew that Russia was a huge arms maker and exporter, and that’s about it. But when the guy lumped it in with China, ‘THEY make real stuff…’ it implied something like China’s incredible growth of consumer exports. There aren’t any.

And yes, foreign car makers have set up shop in Russia to supply Russians, there being no indigenous maker.

@ Isaac S.

The depression would hit hard in the rest of Europe too. The gas pipelines go where they are, the infrastructure to replace natural gas from Russia is not in place. Makes for a cold and dark winter. With reduced electricity supplies manufacturing in Europe will be hurt too.

Then, if Europa and the USA do cut of the supply of industrial metals, do you think the price will be unaltered if other suppliers exists? China on the other hand can probably do favourable deals with Russia, cutting costs and price their products below the European and US competitors.

Last with Russia good at it, also the malicious side of it, thrown out of the SWIFT system, what about the SWIFT system?

‘you are actually buying vastly more Russian product then the average Russian buys American.’

No doubt Russia buys very little from US or anyone. What would they use to pay for it?

To put some numbers on this: the US imported just $17 billion worth of goods from Russia in all of 2020, which is not even a rounding error in the $2.3 trillion of total US imports.

This reminds of of when U.S. Olympians were bringing in their own bottles of Sriracha because they knew it wouldn’t be for sale in Sochi. It’s always good to plan ahead.

nick kelly

Russia is an invisible giant in IT services.

Telegram, the messenger second only to WhatsApp? St. Petersburg.

Miro, an $18bil IT company making circles after their $400mil Series C? Perm.

Ever used Bumble, the dating app? The engineering platform and the app was done by Russians sitting in Moscow.

EPAM systems, part of S&P 500 with 40k employees? Minsk, Belarus.

Revolut, a $60bil “British” fintech? Moscovites.

Nginx, the web server that runs the bacend of an Internet? Developed from Moscow.

Flo, a mensies tracking app in use by one in ten American women? Minsk.

And those are the companies founded by Russians – how many more rely on development centres placed in Russia? At Google, Facebook, Intel, Nvidia globaly?

The list goes on, and on, and on, and on. You’d be surprised how many apps you have on your phone are written and maintained by Russians (and probably concerned).

Russia is pretty much the only nation in the world bar US and China that has their own global search, maps and taxi (Yandex); social net with close to a 100% penetration of all Russian speakers (VK); IM (Telegram); public cloud (Sbertech – no AWS or GCP in Russia); ecommerce with global logistics (Ozon – no Amazon in Russia) – their own first-class technological stack. As a result, Russian is the second most used language on the Internet – more than Spanish, French and German combined.

Russia is surprisingly advanced in IT – head and shoulders above Europe, although obv lagging behind the States due to the lack of capital, electronics and the access to global market – cut covering this gap tremendously fast.

And if you’d ever travel through Russia, well… The chances are, the navigation and announcement would be in Russian and Chinese, not in English. The level of cooperatin is astonishing. Samsung, LG, Sony, Apple etc are being rapidly pushed out by Xiaomi and other Chinese brands.

Outside of IT, there’re medical drugs, chemicals, energy production (including nuclear), aerospace, trucks etc etc. Russia actually beat US to produce the first COVID-19 vacine that worked, Sputnik-V, only to be striped of the fame by petit political rivalry. It’s second most spread vacine globally agter Pfizer, apprved in 90 countries. It beats Modena. How many countries globally have the capacity to develop one?

Americans tend to dramatically underestimate Russia, on all fronts, thinking of it as a third-world plutocratic petrostate that slowly dying on its own, akin to Venezualla. But it’s not. That’s getting high on your own supply. It’s a massive country with vast resources and good HDI. It has lots and lots of problems, for sure. None of them are fatal though. What’s more important, it’s one of the very few countries that can stand on its own in almoust every aspect.

@Isaac S.

When airheads start talking about SWIFT… Dude, SWIFT is a Belgian co-op, owned by member financial institutions. You and your geriatric president cannot cut a country off of it – it’s not yours silly billy. (our prime minister is younger but VEEERY slow). UN can pass a resolution with economic sanctions targeting Russian banks, but as we know Russia can veto, and China too. And WTF do you think SWIF is? SWIFT network is like any other network, SWIFT standards are ISO standards, it is a notification system – not even settlement. You can send payment orders via pigeons and settle however you want, not to mention that both Russians and Chinese have the working alternatives. It is not a nuclear option, except for the SWIFT members – you know – the banks. I’d know, I’ve architected solutions around it, also Basel 1,2,3, SOX, FATCA, AML/ATF, and many other across finance and other various industries.

@nick kelly

Majority of car sales in Russia are Russian brands.

Majority of car sales in US are foreign brands.

Again (see WBL), Russians built the critical code for everything of value in this World, even they do not own it, they have it and know how to use it. In the meantime we are importing people from and outsourcing work to India as if they don’t have average -25 IQ below Russian. They are lost in cloud technologies. But hey we’ll make it up on volume, like Tesla, and we also have a Bitcoin to fix that.

We should be worried of this sabre-rattling and airheads arguing “but, but Russia’s GDP is smaller than Italy’s, they are trash”. No they are not. American mil. budget is all salaries and pork, for Russians it’s all R&D and training. It is mutually ASSURED destruction. Where in the last 25 years have we lost the sight of annihilation being assured. Assured. You talk about SWIFT? Russian bear is a small, easily tameable bear? That’s your statement, Kelly?

Also, this Russian hysteria is a red herring. Nothing is real, except for the economic hole under us.

‘Avotvaz

According to Artem Manuykhin, director of the press office at Avtovaz, in 2019 Lada finished vehicles and automotive kits were exported to 35 countries, with 50,000 finished vehicles sold to non-Russian customers, 32% up on the previous year. “Exports tripled as compared with the level we had in early 2017. The most important markets are still Belarus and Kazakhstan, where Lada is the number-one brand in terms of sales,” he says.’

The only countries buying Russian cars are those more backward than Russia. When a 50-100 % duty was placed on Japanese imports, protests erupted.

faj-well said. Remote and non-human soldiery (drones-see effect on traditional armored units in the recent Azeri-Armenian conflict and autonomous kills in Libya) present a serious new wildcard, however…

may we all find a better day.

Check out “Drone Swarms” at Military.com

They say they are considering going “Geneva Convention” and calling them WMDs, but I bet they are dumping a ton of money in them. Would be perfect for Martial Law, too…..which is…..

Very scary stuff. Makes me look at “Self Driving Car Effort” in a brand new light……same hardware, same algorithms.

I didn’t like posting that.

It’s South Park day….gonna chow down and binge out.

NBay- ‘The Economist’ a couple of years ago ran a prescient article, recall its title being: ‘The Rise of the Slaughterbots’…

Our endless quest for more-remote killing abilities dates back to the first thrown rock, but we may be approaching a point where the old verity that a ‘man with a weapon’ is necessary to hold ground even in the face of any techno-shivs no longer applies. Jokers, indeed.

may we all find a better day.

I’m glad the cash I kept on the sidelines is no longer trash.

Once they fall 70% beware of dead cat bounce ,because they might fall more

Nah, at minus 70% the dividend will be like 4%. May happen if you’re lucky.

If it’s USD, it’s close to trash. Your 2000 $1.00 buys 60¢ today…

Buys a lot less than that if you are shopping for assets.

Inflation convinced me to start putting my cash in the S&P 500. Fortunately I’ve been dollar cost averaging it and didn’t lump it! Think I’ll slow those purchases down a bit and see how low things go! hate to be a market timer, but…

I don’t think you’re going to hate being “a market timer” (which isn’t even what you’re doing really). Probably lookin good if you haven’t already bought all in. If you know how you could also sell cash secured puts so that way you either get in at a level better than the market by the premium you sold…or you just make some $ if it goes back up from the sold puts at high vol. Get’s more complicated but can be good “strategery”.

Yep. I am running such a conservative portfolio I am up a few bucks year to date, but that could change tomorrow.

My portfolio is basically logistics equities, pipeline MLPs, farmland, and carbon credits. Up nicely during this recent sell-off, though the land being illiquid makes it hard to mark-to-market. Plan to subdivide and sell building lots, then 1031 proceeds into another field.

Moral of the story…invest in the real, tangible economy. High cost of entry industries with value-added products. Done well so far.

We need to expand that chart to show just how far we haven’t fallen. If this is an old school bear market you don’t need to call this top, there is plenty of time, and the first reflex rally usually retraces most of the losses. Everything is on the table, this isn’t the 2020 Covid plunge on the fear of the unknown. There was plenty of low hanging fruit to sell, SPACS, IPOS, Bitcoin. That much was easy. The real question what’s it all worth; consumer prices, stock prices, oil prices. This market wants to put a number on these things, taking into account the size of the money supply, (add Crypto) what should interest rates be? They should probably lean to the low side. A sudden contraction causes an inflationary shock, which is counter trend. Smart investors will wait, wait to borrow wait to spend. The Fed engineered this inflation and they aren’t backing off (really) because deflation is the ultimate waiting game.

Good gravy. Recovery is on the way. Jerome must have read my earlier post. Plunge Protection Team reporting for duty sir.

Today was the first day that the futures really opened up a hole underneath, and now the day session has reversed their role as driver of the selling. Looks very much like a capitulation moment. There were a lot of technical glitches to resolve. Everything since October has been problematic. The Bull wasn’t on his best behavior. The Fed leaving a huge gap in real interest rates was probably the cause. The market still sees that as manna.

AB

“The Fed leaving a huge gap in real interest rates was probably the cause.”

I think the damage caused by that is extremely understated.

The Fed created this situation….. it is all on them…they were so far behind…….and so accommodative……..

There are too many like minded people on the Fed Board….who was it Former Fed Gov Hoenig that tried to be the dissenting voice for so long?

Did anybody at a Fed meeting say

* We are really hurting people with this low interest high inflation situation

*Maybe the bottlenecks are from businesses reaching for inventory because of the acknowledged and obvious inflation

* Inflation hurts businesses too, with the higher input costs. That’s not good for earnings…..or stock prices.

* What are we doing here?

Of course it’s the Magic Invisible Hand of the market that caused all three markets to recover in exactly the right way to turn an otherwise disastrous stock trading day into a true winning miracle!! The three daily plots even all look the same, demonstrating true divine wisdom accomplished by a single Creator.

No doubt, the Fed, and everyone on Wall Street must be equally astounded and thankful as I am by how such a thing could possibly happen.

For those that agree, I’ve got a great deal for you: Please send a $25 million cashiers check for which I will sell you the Golden Gate bridge, beautifully packaged, from which you will receive a lifetime of daily tolls. Tell me how you want it shipped. I hate to part with it, but as a bonus I’ll even throw in that slightly used beer mug that Wolf Richter personally sent me, which is inscribed with a treasured Wall Street holy verse.

Do you accept bitcoin?

From down 1000+ to only 400+ today… the markets are slowly crawling back. Lets see how MSFT and AAPL earning calls go this week. These two companies aren’t profitless MEMEs or SPACs. The whole markets depend on them doing well along with any positive FED announcements.

Regardless, hold on tight for a roller coaster ride this year!

Show a chart of the 200 day SMA vs. the S&P 475 (the 500 without the highest tech flyers). That will be an interesting look at the truer state of the market.

John, I charted the XLG fund (the top 50 stocks by size) vs. the S&P500 and there’s actually more damage occurring now in the Top 50 than in the lower 450. But the difference is small. XLG was strongest at the end of November (in a relative way). It’s given up 2-3% vs. the S&P 500 since then, with about 1/3 of that coming today.

Yeah I saw this comment and looked up the “S&P dividend aristocrats” – old companies who’ve paid a steady/increasing dividend for a long time, should contain little to no tech. Looks like it closed around the 200 DMA today, after dipping well below that. I guess the John Test is whether that holds.

This has been 13 years in the making. I’ve been fooled before again, again … can’t help but think some garbage strategy will be dreamed up by some revolving door sociopath Wharton business school grad Goldman Sachs SEC Fed d-bags, the wasters and debtors will rejoice with another buying frenzy and my money will continue to die along with the American economy.

haha Wolf, don’t worry I think you’ll still get your nothing goes to heck in a straight line motto validated.

I commented on the other article but like I said, been seeing this picture way too many times and like Dubeyu, fool me twice..not gonna get fool again (follow by a stupid smirk just like Dubeyu). The market is calling Powell boy’s jawboning bluff on raising interest rates and today and last week is for them to put on a show and basically said “Don’t even think Fing dare”

Weimar Powell likely took notice the last couple of days and I fully prepare him to say something like due to deteriorating market condition, we will slow our initial rate hike and tapering purchase projection..blah blah..Market will rejoice and we shoot for Mars instead of the Moon this time.

As a caveat every time, I really hope I am wrong about all of this but unlike March of 2020, I am not betting on this is the new bear market. Think that can will be kick so far down probably beyond my lifetime at this point.

Phoenix_Ikki

‘ I am not betting on this is the new bear market’

I am!

Without FED’s put, there is NO market of any sort!

This is purely traders’ mkt! ( see my comments below)

One could still make money but need to know option trading and judicial use of leveraged funds (both short & long!)

Monday was an intra-day Reversal day, most indices finished the day positive, but just barely. Am sure, since this is 2022 America, land of the manipulated marketplace, that the Plunge Protection Team operating out of the infamous New York Fed, had a hand in this reversal move to keep the lemmings from immediately going over the cliff; have to let their Fed insiders and the monied smart money get out first, heck with us commoners.

Won’t be surprised if we don’t get a failed dead cat reflex rally today since it is not out of the realm of possibilities that the Fed sounds rather hawkish this week, keeping Biden’s approval ratings at least in the low 30’s, and hints at a March Fed Funds increase of 50 basis points; front loading of interest rate moves. Many big inflation numbers coming thru the supply chain python in the months ahead, and these guys are all about appearances, not actions, with double-speak and slight of hand as basic operating principles for the U.S. Federal Reserve. A very tainted financial institution that history will not be kind to.

But the die is pretty much cast for the Stock Bear Market ahead, esp. with the Bond Market raising rates on its own due to surging Default or Credit Risk in a declining economy that is leveraged to its eyeballs. Corporate America has never had so much debt in relation to Total Assets on its consolidated balance sheet.

China is also a Black Duck (vs. Black Swan) via its property development sector and snowballs rolling down very steep hills eventually turn into avalanches. Sell on the rallies. You and I may not live long enough to recover from financial market losses just over the horizon, esp. me at 73, hey, that rhymes!!!

The peasants are slowing awakening in countries across globe. No movie theater necessary.

The pops have pocket cinemas to go with their pocket pizzas. You might say the scratchy arssed masses are still picking their seats, just no longer in the local hall. Coming out of total state of supsension…maybe? But hardly at the point of any revolution of mankind. The costumes department has not been shut down yet. Cherry bon bons are still available. aNd the show must go on.

Followups to yesterday’s post:

1) Based on the historical record, a negative close today removes from consideration some of the prior “bull bounces back” scenarios. That tilts the remaining outcomes towards the looming-crash and/or bear market scenarios.

2) In the 1987 crash, the day after the market landed on the 200-day average, it went down another 5%. And the day after that all heck broke loose. So if the S&P closes down at the lows today, that tracks the worst historical scenarios.

3) In the 2020 COVID plunge, the market cut thru the 200-day on 2/27, threatened a big plunge on 2/28 but rallied off the bottom (closing a lot less down). The market in 2020 did rally for a few days before turning around and plunging again on March 6&9. Today, if the S&P doesn’t swoon further into the close, it’ll look a lot like 2020 and we’d hope for at least a few days of rally and potentially an extended bull-bear battle.

Whoopee Doo! Fed still QEing, S&P and Dow down 9%, and rates are exploding! Oh wait, treasuries(1.72%) are DOWN! LOL

All jawboning and lipgloss!

The talking heads are blaming this all on the Fed threat of four 1/4pt raises.

Gimme a break.

If the threat 1% Fed Funds are the blame, who ever is doing the blaming is CONFIRMING and ADMITTING the fragility of these markets. Can’t handle a 1% Fed Fund rate with 7% inflation?

The markets acted terrible the day before 9/11 as I recall……maybe not this bad…….

This is about Russia and war, or the threat thereof.

But the talking heads all turn to the Fed…..their Savior, their Deity.

Not this time. And rates are all ready pegged at zip…..the make it better buttons all punched.

Yes, Russiaphobia!

Looking forward to the tech stock implosion to the SF housing implosion analysis

The lag is about four months, according to past events. I’ll keep my eyes on it.

Different kinda bounce coming up, especially going into fed meet. Ukraine? Never pays their gas bill when due. Not sure if other countries pay a toll to them. Nordstrom built for that reason.

Wolf

If you have limited original beer mugs left, may it is time to plan for a special edition when you order some more;

Perhaps one with a Hong Kong Hamster on the side to represent retail investors…

I re-ordered them on May 31. Still waiting. The beer mug shortage due to the glass shortage. Same mug, same design.

Maybe it’s passe but you should really consider tee shirts. Better yet hoodies

Hotpants for all sizes… With a line to heck in a striking position??

My short bets were up almost 20 percent intraday while NASDAQ hit -4.50. Bouncing around now. The most leveraged are cleaned out, one tier. A friend messages to say he is down $70,000. A test of nerves now for those intermediate folks who might toss in a towel at the prolonged stress of sustained red (per Mandelbrot, time compresses in ways at these moments, so “prolonged” sort of shows up like a freight train), and say this mini-bounce is an opportunity to get out. It will be fascinating to watch the close, not to mention the week, and I’m back on the trigger to cash in some shorts. But mainly glad I bailed out of lots of longs in November.

The big take away if you read Buffet’s writings is you don’t want to spend your energy predicting stock prices, you want to spend it reading boring SEC filings and building you model of future earnings for the company and figure out an acceptable buy price.

Short and mid term stock prices are unknowable and you better have the balance sheet to handle a market panic.

Will they continue to taper?

Are interest rate hikes still on the table?

Get the band out. First Request.

Don’t cry for me Argentina.

Wolf has reapeatedly covered how serious they are about the situation in front of them. Don’t fight the Wolf, just watch if he wags his tail.

Wait’ll the pension holders realize that the Smart Money and In Crowd already dumped their Moderna shares into their retirement best laid plans.

Really do wish we see this kind of drop in the Real estate market soon enough. Although like many times before I am not holding my breath, in this crazy world we live in, people will probably end up piling into RE even more as a flight to safety move.

I love living in my new metaverse NFT palace.

I suspect you are right – as stock market crashes, big buck will run into residential real estate market for refuge, inflating prices into stratosphere.

Phoenix Ikki,

Perhaps initially.

I believe there will be opportunities in real estate again, but you better know what you are doing. For most it’s a highly leveraged decision.

The rebound is so strong it feels like we’re positive on the day. Still 1 hr to go, this dead cat could still turn green!

Limit orders, margin calls, stopped out meanwhile. Time for junior to see if parents’ basement is still available. A generational lesson for the wise.

I’m intrigued to see what’ll happen to RE over the next 6 months, just as the Feds supposed interest rate rises come in.

Will they really let RE and stocks tank, in essence to keep salaries down?

Afterall, if inflation is hot and salary rises hot, what is the issue? Isn’t that good for deflating the debt?

Maybe the issue will be less clear one-directional travel, but almost Logarithmic volatility that leads to (despite central bank efforts to countermand disorderly moves) an overall loss of confidence that is difficult to ‘Ken.

Ken = Northern English and West of Scotland dialect for understand

I haven’t the time to look, but it would be interesting to see what proportion of current interest is retail as opposed to other actors, on a background of overall levels of volume of trading.

Don’t think for a moment that it was by mistake that the FED owns 1/3 of all mortgages. They have a plan to try to not allow a free market in housing, propping up prices by not allowing a flood of inventory to hit the market should things turn south. Will it work? Dunno, but they’re sure as hell going to try.

Which begs the question: Why is the FED actively working to destroy the future of the young, and bar them from being able to afford shelter? That action alone should be reason enough for them to go straight to prison for the rest of their lives. That has NOTHING to do with their mandate.

DIJA was under 29k at the start of 2020 and we’re still above 33k! Nothing to get excited about. Expect more gov meddling before it gets there.

Plunge protection team is definitely on overdrive today. Half and hour left and only 300pts down, the way things are going, no doubt it will be positive by end of today.

On a different note, guess that plunge protection team is playing favor to certain stock. Macy up 11% today, WTF? They better get back to work and make sure Tesla close the day above $900 or there will be hell to pay.

investopedia dot com:

“The “Plunge Protection Team” (PPT) is a colloquial name given to the Working Group on Financial Markets […] Conspiracy theorists have speculated that the group executes trades on several exchanges when prices are heading downward”

So apparently they do no such thing and we have free markets, apart from Fed QE. And if you think they do make purchases, you’re a (dun dun dun) conspiracy theorist! Feel free to join me under the bridge, I’ve got an extra tin foil hat.

I do like this line you included “we have free markets, apart from Fed QE” haha the FED is the market…for all those that rail against Socialism…see the irony yet?

I do like the bridge, don’t mind if I rock out to “Under the Bridge” by Red Hot Chilly Peppers while I grab that extra tin foil hat from you.

The PPT is a bit like Santa Claus, and a bit like the Reddit WallStreetBets crowd.

Every adult will say “Santa Claus isn’t real”, and yet every retailer will tell you that Santa Claus moves their markets every year, especially starting after Thanksgiving.

And just like Santa Claus, all it takes is for people to believe in the PPT, and when it’s in their self interest, they act on that belief, just like r/WallStreetBets. And that’s all it takes for the PPT to have the power it’s imagined to have.

WE ARE THE PPT – And spiritual forces do change the world!

Although I’m not entirely sure this is the kind of thing Margaret Mead had in mind when she wrote “Never doubt that a small group of thoughtful, committed, citizens can change the world. Indeed, it is the only thing that ever has.”

‘Plunge Protection Team’

Aww Jeez people, a lifeguard is only as good as the direction they’re looking in.

Who knows, as you point out, which direction ultimately they will be forced to look in.

But…will it matter in the end, really, if enough damage is done flip flopping along the way.

You don’t need a visible whirlpool for people to drown.

Phoneix_Ikki,

“guess that plunge protection team is playing favor to certain stock. Macy up 11% today, WTF?”

Hahaha, no PPT needed. Just traders smelling an opportunity: Macy’s is up because Kohl’s got huge buyout offers from two sides. Kohl’s is up 36% today on the news.

but what explains the larger market? do any traders have the volume to move the market the way it did?

All the sellers that were desperate enough to sell at these beaten-down prices had sold, and there were no sellers left at these prices. This is called capitulation. And when traders see that, they jump in and buy.

This was obvious today. Suddenly, stock by stock, there was nothing for sale anywhere near the last price. The next ask was a bunch higher, and then suddenly someone grabbed it, and then the next ask was a bunch higher. This moved really fast.

It was a case of capitulation from sellers, and when the buying heated up, the desperate sellers were all gone. And new sellers had to be enticed with higher prices. This was classic textbook today.

interesting. but how would a trader know that there were no sellers left, and that any subsequent sales would be for more?

Jake,

There is software that you can buy that shows you depth of market. I think most retail traders are totally outgunned by traders that have the deep pockets to have informational advantage.

I like investing with a window of about 5 years or more because that is an area that most managers can’t play. They have to play the short game.

There’s been a MASSIVE reversal. I guarantee it’s the PPT. I’d bet everything I own on it. They won’t allow a free market. Ever.

Banks get to create money with Fed and FDIC insurance backup. That means cronies are on that train. Nice ‘work” if you can get it.

Now comes the test to see if Powell has any minerals. The history is not encouraging.

JPowell must have made a 1-800-HELP-PPT call!

From minus 1000 to minus 200 must feel like a bounce to the guy who was down 1000.

It was minus 1100

Uncanny timing.

Exactly, it just ripped back up at the exact pace that would allow for just turning green on end of day.

Hi georgist, I was mostly thinking in terms of the timing of this publication, rather than the timing of the market move.

As the article came out the bounce came in.

Saltcreep,

“uncanny timing”

Wolf Street received the information from sources familiar with the matter that the Plunge Protection Team (PPT) was getting ready to do heavy buying in the afternoon. The sources didn’t want to be named because of their close association with the Plunge Protection Team and because of the confidentiality of the matter.

Wolf, I hope you’re being facetious.

Nope.

/sarc

I mean, how can you not have fun with this PPT stuff???

ZH has been having a blast with it for many years.

Didn’t they tell you to keep the information tight when the White House calls you on the red phone?

Hank Paulson is warming up the Bullpin. He’s taking a break from bird watching to reassemble his PPT from 2008.

Old dictums applied to markets. We no longer have markets.

Yeah, I bet the next few days will be mostly green, but the selling will start again next week. The Fruit company (Apple) better deliver this week ……….

The PPT is working furiously to finish in the green today. They got NASDAQ positive now just the S&P and Dow for the trifecta. I am surprised they let gold rise a few bucks but then they are too busy to suppress the price much.

It’s in the green for the close. What a day. That’s a 4.5 percent rise from today’s bottom. Yet the PE multiples are still at nosebleed levels.

I have no idea about plunge protection team, but if you have read about past crisis like Long Term Capital and 1987 crash, the Fed starts getting involved with Wall Street to try to prevent a panic.

Computers have allowed so much financial market warfare to go on at high speed, who knows what is really happening. In the big picture it’s trading friction in the capital allocation process where novices are separated from their money mostly.

Search one of your favorite hey-internet-find-me-somethings for “exchange stabilization fund”.

No need to have an idea. It’s all out in the open. Maybe even Siri knows it.

BS. The ESF has nothing to do with the stock market. YOU go look on the internet and learn something. Well, OK, you won’t, so I hand it to you here to save you time:

“The ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments. All operations of the ESF require the explicit authorization of the Secretary of the Treasury (“the Secretary”).”

https://home.treasury.gov/policy-issues/international/exchange-stabilization-fund

There has been no activity other than earning interest on the SDRs, which the largest asset in the ESF. You can look at the monthly statement and at the annual statements here:

https://home.treasury.gov/policy-issues/international/exchange-stabilization-fund/esf-reports

I guess it’s time for Wolf to do an article on the PPT. (Plunge Protection Team) For those of you that want to know more, a fair bit of info can be found on investopedia.

Tl;Dr: Large banks colluding with POTUS and FED to stop market plunges by strategically (aggressively) purchasing index futures.

See WR’s reply above. He’s told you he thinks there is no such thing, it’s a conspiracy theory. (if I’m wrong WR can slap me, it’s happened before )

Look, the Fed f&cked up, lowering rates already the lowest real rates in centuries. while being lashed by the President of the United States to lower them below zero: negative rates. This ‘Individual One’ described JP as ‘worse than China’ for not lowering rates further. The stew we’re choking on today was not cooked yesterday. It took over a year for those deeply negative ( real) rates to explode into today’s inflation.

Now, new game in town. Fed told: ‘control of inflation # 1 priority’. Wall Street will not be happy. It lives on inflation.

Suggestion for WH messaging: ‘We are here for Main Street’. And don’t add the obvious second half. Let the voters add it themselves.

yeah, but pelosi and other pigmen in congress are certainly not there for main street. hopefully the white house has the fortitude to tell them to buzz off.

Important PS I just read over on ZH last nite.

Controlling inflation is part of the Fed’s LEGAL mandate along with promoting employment.

As the ZH writer points out, it would be tough to argue that the US is not already at full employment. So there is no way to justify low rates as a boost to employment. There is no way for the Fed to avoid raising rates if it complies with its mandate.

This is actually one of the most comical things I’ve seen in my life. Such an obvious massive market manipulation has never before been seen.

Back in October ’29, an insider-banker marched up on the NYSE floor and ordered a bunch of US Steel very visibly, to try to rally the market. Now it’s all electronic and instant. Just add zeros.

The 29 attempt to rally failed. As WR as said, nothing goes up or down in a straight line. This rally is a typical bear market rally.

Note: the Fed hasn’t actually done anything yet.

Maybe after last week the market thought the ( non-existent) PPP would come to the rescue or the Fed would defy its guidance or Pelosi complained to JP or…whatever conspiracy your imaginations conjure up.

This “rally” hasn’t succeeded yet either. All it did was arrest a 4.5% plunge.

Tomorrow is a whole new game.

Indeed, a history of direct market intervention and manipulation in 1929 (and 1907), during stock market panics:

“Selling intensified in mid-October. On October 24, “Black Thursday”, the market lost 11% of its value at the opening bell on very heavy trading. The huge volume meant that the report of prices on the ticker tape in brokerage offices around the nation was hours late, and so investors had no idea what most stocks were trading for.”

“Several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor. The meeting included Thomas W. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E. Mitchell, president of the National City Bank of New York. They chose Richard Whitney, vice president of the Exchange, to act on their behalf.”

“With the bankers’ financial resources behind him, Whitney placed a bid to purchase 25,000 shares of U.S. Steel at $205 per share, a price well above the current market. As traders watched, Whitney then placed similar bids on other “blue chip” stocks. The tactic was similar to one that had ended the Panic of 1907 and succeeded in halting the slide. The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day.”

(Source: Wall Street Crash of 1929; Wikipedia)

The play by Whitney is documented in a hundred texts, including Galbraith’s ‘The Great Crash.’

‘The tactic was similar to one that had ended the Panic of 1907 and succeeded in halting the slide. The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day.’

Some student with no knowledge of 29 might imagine, given only the above quote that once again, as in 07, a crash WAS averted. Actually the bankers’ expensive play bought them 24 hrs as the sell off continued.

Was the point that attempts are made to support markets? Happens all the time, especially with attempts to defend currencies.

When Charles Mitchell was seen entering Morgan’s again, there was hope a second attempt at ‘organized support’ was planned.

Alas, as Galbraith explains, the banks were now worried about themselves and Mitchell’s visit may have been for a personal loan.

Whitney had become seriously overextended to buy a cider business, would go BK and serve a prison term. Mitchell would later be arrested twice in one day as States and Fed’s vied for the honor. He avoided jail but had to regurgitate money he’d saved by and ‘transacting’ with his wife.

Re: Richard ‘White Knight of Wall Street’ Whitney and ‘Sunshine’ Charley Mitchell:

Today, the pair makes for a (not so) shocking but fascinating read into the intertwined webs of corruption and elite powers of that era and shows their truly selfish and desperate actions during the 1929 crash.

Richard Whitney was a man who lived beyond his means, surrounding himself with luxury and power, swimming in the richest social circles of New York. Treasurer of the Yacht Club, President of the New York Stock Exchange, he was one of the most powerful men in the country.

“Sunshine Charley”, Mitchell was elected president of National City Bank (now Citibank) in 1921 and in 1929, was appointed chairman. Also in 1921, he was elected President of National City Company, which became the largest security-issuing entity in the world.

Whitney , the ‘White Knight of Wall Street,’ retired as President of the New York Stock Exchange in 1935 but remained on the board of governors. In early March 1938, he was investigated, tried and jailed for embezzlement to cover his mounting business losses and maintain his extravagant lifestyle.

He stole funds from the New York Stock Exchange Gratuity Fund, the New York Yacht Club (where he served as the Treasurer) and $800,000 worth of bonds from his father-in-law’s estate.

Mitchell, In 1933, was investigated by the U.S. Senate’s Pecora Commission as its first witness for his part in tens of millions of dollars in losses, excessive pay, and tax avoidance. In November 1929, U.S. Senator Carter Glass said, “Mitchell more than any 50 men is responsible for this stock crash.”

(Sources: Wikipedia)

So, a former President of the New York stock exchange went to jail? and a New York banking President was arrested twice?!

Oh my, how antiquated yet refreshing to learn of this not too big to fail or jail!

The ‘fines’ (fees and no pleas) of today serve to prevent the greater broadcast and reveals of such steals or I squeals.

the thing is, these types of things are actually emblematic of a third world country. where the leaders don’t even pretend that the economy, permitting, inspections, voting, and everything else isn’t rigged.

we’ve become a third world country.

The tent cities confirm the fact. There was a class war. The rich won. It’s heads they win, tails you lose. Anybody thinking they will be fighting inflation at the expense of their own wealth is delusional. These pigs can never have enough, as evidenced by today’s rigged market.

“There’s a floor under the stock market.”

~Speaker of the House, Nancy P.

yes. it’s basically a situation where they cheat, we know they cheat, and they know we know they cheat. but they’re basically sticking their thumbs in our faces, as if to say “yeah, and what are you going to do about it?”

Jake W,

Succinct and true. Members of Congress and the Federal Reserve System are able to make trades, with leverage, just prior to decision time — where they make the decision — for their own personal gain.

My answer to your rhetorical question is: Never have, nor never will I vote for a member of the Two Party Duopoly who is running for a seat in the U.S. Congress. Never have, nor never will I miss a vote in November.

Depth Charge:

It’s called:

“The Killing Floor!”

(Like in slaughterhouses)

You don’t have to denigrate the third world. Just that the US is corrupt.

And the world remains poor for the same reason: corruption.

A few years back I was on Lake Victoria with my host, a native-born Ugandan. He pointed out two new tourist lodges being built by two Ugandan MPs. One was financed by Belgium with money intended for a low-income housing and the second by Sweden with money intended for new schools.

Evidently not much oversight.

MiTurn,

Yeah, having lived in third world countries for an extended time (Peace Corps), my takeaway was astonishment that the rich donor countries often seem to lack oversight or any significant strings attached.

Maybe it’s because the money is primarily for political influence, not actually helping those in need. And partly because the recipients would cry and accuse donors of unfair big-brothering if they were monitored.

Religions do the same thing. For example, evangelicals in a small up-country town where I worked (West Africa) lived up on a hill above town, totally separated from life on the street. One of the students I sponsored told me that back in his home village, the evangelicals helped people out with medicine etc. only if they converted to Christianity. The student was a smart guy, and an honest Christian.

Amen. The best proof of that is if you check the US banks’ records, if you can access them. A little known fact is that many banks have “forgiven” hundreds of thousands or millions owed by millionaires/billionaires who “coincidentally” happen to be cronies of the banksters or “contributors” to their pet politicians.

How that can be legal is beyond me! The banks receive huge QE commissions, “dividends” from their utterly corrupt “Federal” Reserve that funnels ultra low interest rate loans to them (even while the banks are insolvent after their assets decline in value, or perhaps, because they are insolvent), loans from the “Federal” Reserve when no other, rational lender would ever lend to them, effectively a guarantee that their debts will be paid (which lowers the interest rates that they must pay third parties), etc. Yet, they are “forgiving” the loans of millionaires/billionaires while they are simultaneously going after people that owe a fraction of that on student loans or credit cards.

Such “forgiveness” of loans must be reported in 1099s, so the IRS would have records of such loan “forgiveness” by banks for their cronies and their friends. How are those not kickbacks for bribes (called contributions) paid to politicians to protect the banksters’ most precious asset, which they own, not the federal government, their “Federal” Reserve.

Bribery in the USA is just more discreet and judges are bribed just as often which is why the news are filled with incredible criminals, e.g., serial rapists, who get special treatment: e.g., claims that a sloppy public announcement by a prosecutor immunized a wealthy celebrity from being prosecuted later. If a poor person tried that argument, he would have been laughed out of court.

Drifter,

I worked with a guy with an MS in physics. He was also one of the head Jesus Freaks at this old abandoned grammar school. I’d always bug him about believing that stuff and all his proselytizing.

He finally said, “remove drugs, insert Jesus”, with appropriate hand/head gestures”.

I really couldn’t argue with him as far as saving individual young kids from a likely downhill path goes.

His knowledge did one good thing for us. We worked with a lot of Thorium Flouride and kept in it storage cabinets. He raised hell about how it decayed into Radon gas, and forced them to ventilate all the cabinets to the outside. Better than nothing, but we still had to work with it.

If I die from cancer, inhaling that stuff will be the likely reason. They had plenty other nasty chemicals there, but mostly a lot of exotic heavy metals, As, Cd, etc, and very nasty solvents and acids, like Hydrofluoric, several of which are now banned. They were busted big time for dumping stuff outside several years after I left.

Depth Charge,

“Such an obvious massive market manipulation has never before been seen.”

Nah, just a massive bear-market reversal followed by a bounce. There were huge bear-market reversals and much bigger bounces during the March 2020 crash — leading to huge one-day rallies. This is March 2020, S&P 500, daily percent moves, posted March 21, 2020. The craziest rallies happen in bear markets:

but those didn’t occur in the same day, did they? although i guess philosophically, there’s no real difference whether the reversal happens at 2 p.m. on one day versus during the overnight session.

The intraday reversals don’t show on this chart, which only looks at closing data. But there were quit a few of them. The volatility in March 2020 was horrendous. The intraday moves were even bigger than the closes. It was a market horror show.

This one reeks like a trunk load of salmon in the AZ summer heat.

This market action was deliberate. Purpose: to clean out all the losers who had stop losses. Now the market has a basis for a new short term rally so the day traders can make some money. As I said before, I’d rather go to the blackjack table or the horse racing track than play in this corrupt casino.

If it was deliberate, who caused it, and how?

We have such a massive amount of financial products. Computers made stock execution so cheap that Wall Street has to keep coming up with crazier and crazier products so they can have a profitable business.

A broad based etf might have made a little sense to minimize cost. Narrow ETFs like the innovation ETF and the short innovation ETF are really just ways that Wall Street can skin the rookies, both buy the funds expense and then hired guns out smarting retail.

And if 10,000 ETFs aren’t enough let’s have 10,000 crypto coins.

You would think after 2 years of people dip buying you would recognize dip buying. We got a few more bounces before this one bottoms out. Gonna take a while for the inflation dats to filer through. VIX will stay hot.

Tesla closed at $930. All is well with the world and market is aiming for the Mars or perhaps Pluto next for the next bull run.

Putin and Xi and the Iranians called, all want to sing Kumbaya.

Tesla stock holders losing it all, Elon Musk booted as CEO and the the company getting the General Motors bail out will probably mark the bottom of this cycle. At least a guy can hope.

I’ll come in if somebody tells me where the bottom is. :-p

Warren Buffett called it within a few weeks of the Great Financial Crisis bottom although that might have been a once in a life time event. He put a full page op ed in the Wall Street Journal.

If you are a long term investor and things get washed out to the mean Price to Sales ratio, you probably can go in big but you might still be under water for a few years.

A lot of people say let the markets get washed out and then put your risk money into emerging markets as they are already cheap and will get cheaper in a crisis.

Now electronic tulips are joining the party. Shitcoin is back up over $37,000 – a move of $5,000 – and rocketing higher as I type. The party’s back on.

You have to control risk in a portfolio. Remember reading a professor that said once your risk level gets to a certain level, you are going to get wiped completely out it’s just a matter if you die before it happens.

Fed’s got too many people too far out on risk curve and if they stumble a lot of people going to say it’s a rigged game when they lose the lottery.

Well at least the indexes closed in the green!

OK. Now you have your bounce. All Indexes ended day positive, Dollar strong, BTC up, and the 20 year down. But we’re still below the 200 day SMA … barely. Is that going to turn the market down? Or are we looking at more declining markets. From my perspective we have barely made a scratch on more than ten year of insanity.

My mistake … Is that going to turn the markets up?

R Russel

BEAR traps, very common during Secular Bear mkts! Just study the previous bear mkts!

hmm, don’t you mean bull traps?

Nevermind on my question below. BEAR trap it is…misread it in my mind.

‘Nothing Goes to Heck in a Straight Line, so to speak. That’s my story and I’m sticking to it’

This is the typical secular Bear on it’s way down, with frequent and expected bounce backs- Bear trap or squeeze!? But the long trend is DOWN, no matter what!

What day!

DJIA went deep red to -1050 and back to green at+ 99 A 2000 points journey! Wow! This won’t be the last day of gut wrenching volatility!

Today was ‘Xmas in January’ for those nimble,experienced Option trders to make money in both directions. My PUTS and inverse leveraged ETFs did excactly what I expected. Sold them and then bought back at relatively low, just before the end of the day. I was also buying calls when indexes went real deep red, b/c as Wolf says, NOTHING goes down straight! There will so many BEAR traps, which is usually obvious in retrospect!

This is market for nimble traders and NOT for investors either short or long. Long way to the reversion to the mean, with LOWER of the HIGHS and LOWER of the LOWS! Who is willing to catch the falling knives tomorrow!?

“DJIA went deep red to -1050 and back to green at+ 99 A 2000 points journey! ”

That would be an 1099 point journey :-)

Cmon HM,,, the journey counts BOTH ways!!!

At least some of us who have driven across USA hundreds of times count it that way…

SO, yes, it was only 1149 or so ONE way, eh?

And the ”net” distance was only right next door, eh?

Wonder WHY???

Sunny, you might be a little ahead of the game, calling this a “Secular Bear Market” only 3 weeks from the all-time highs!

This is a correction not a bear market. The bear market will not start until after the market tops some time in the fall.

Love reading comments like this – I’m working my butt off to be able to play the market like you do, but am risk averse due to only learning about the market a year ago.

That “screaming” bounce was today. I trade the stock market everyday & I I’ve been fairly successful shorting individual stocks. The key is having a relatively tight stop in case it visciously goes against you – like today.

Just when you thought maybe it couldn’t get any crazier, it does. Just more from the anals of crazy town. I looked at my charts last night and thought maybe the ES at 4500 and GC (gold) at 1880 by Fri. March 2020 wasn’t that long ago. Crazy just equates to business as usual on wall street.

If in fact a claimed PPT is propping prices up at these multiples in vaporware companies, overlaid on the recent abuses of credit, they are gambling with unprecedented drunkenness with our future. They are in the casino tippling with the tin hat bored apes crowd.

phleep

Reflex bounces (dead cat bounce?) are common & expected in ongoing secular Bear mkt. Study previous Bear mkts!

This Salem crowd is determined to see evil hands behind fluctuations in a stock market. WR didn’t predict a rally because he’s a believer in those occult forces. He told us why he did: it’s normal.

“Salem crowd”

Good and fits really well…I’m gonna steal it.

sunny 129

Thanks, I’ll study that. But my comment was really more aimed at reality-testing the conspiracy theory voiced above of a plunge protection team maneuver, and its implications. Hence the opening words “If in fact” …

Meanwhile, back in the real world, inflation is crushing the masses who have absolutely zero exposure to stocks.

Yep, that is true. I am glad the market recovered, because now the Fed can stick with the hiking of rates. No excuses at this point.

not if they use the volatility and “uncertainty” as a reason not to taper and keep zirp in place. these criminals are certainly capable of it.

But we have the whole “inflation” thing that the Fed can’t ignore.

they’ll go back to describing it as transitory. powell will “unretire” the word.

Jake W,

“they’ll go back to describing it as transitory. powell will “unretire” the word.”

“Inflation has been somewhat elevated this year, though a portion of the rise in prices seems to reflect transitory factors.”

-FOMC Statement, August 2004

Yes that’s a very interesting point, thought the same myself.

“No excuses at this point.”

they’ll think up something

“You of little Faith,” Jerome replied, “why are you so afraid?”

Then He got up and rebuked the Winds and the Sea, and it was perfectly calm.

Today’s Market was just a pathetic joke …things are so screwed

Fabulous timing on release of this commentary and the bounce prediction.

Some things dropped and bounced.

Some things did not drop.

Some things dropped but did not bounce.

Stock indices all dropped and bounced.

Gold, & some ag commodities held their ground and actually gained

Lumber did NOT bounce

Whatever any of this might mean to experienced market pro’s even a novice can see the machine (combine) is overheating, on fire, leaking oil, missing a wheel, and the operator fell asleep slumped over the throttle lever at full bore.

.

Yeah, Gold really surprised me this time around. It’s probably building a base before going up big the next time the Fed decides to print more money.

Wolf is right = RSI and MACD are screaming oversold. So we bounce…and we retrace either 30% or 50% of the drop before she rolls over again. My thought is to add to the shorts when it has retraced by that amount = now that the new trend is set to sloop DOWN and she stays under the 200 moving average. AAPL or MSFT EPS miss may tip this down some more. After taking it in the shorts last year ….it feels good to be short this year. :-)

bb say’s, ”bounce for the ages,” to follow your suggestion Wolf!!!

Dead cat or other critter,,,, some of us with cash on the side will not go anywhere near this skunk by any name until ALL the indices are back to at least close to reality…

Gonna stick with my suggested numbers from early 2020 if I remember correctly, the remembering part definitely not a done deal,,,LOL

Seem to remember Old School and I somewhat close on our predicted numbers for dow and snp,,,

The Fed can manipulate the market but they can’t stop Putin.

But, over time, markets and their effects on the Russian people might.

LOL. “B Says Russia Can Invade Ukraine So Long As They Avoid Hunter’s Gas Company” [Babylon Bee].

That’s all you need to know. Heck the whole “limited incursion” statement now makes PERFECT sense.

MonkeyBusiness,

The “Babylon Bee” is a satirical magazine, in the style of the Onion. It’s a form of humor. If you take it seriously, you make a fool of yourself — and you become the laughing stock.

Sounds like CNN.

I’m gonna make the call that “News and satire become indistinguishable” when an extraordinary popular delusion tops out and infects the minds of the most people.

Sorta like “permanently high plateau”, or “let them eat cake”, or, “a new business of mutual profit, but no one to know what it is”.

(On that last one – it’s the same as a SPAC – indicating that the SPAC concept originated with the South Sea Bubble in the 1700s…)

The restoration of sanity is going to be really painful.

Here in Denmark most of the relevant and important news and analysis are quite often, and sometimes only, presented by satire programs.

For example the background story around the news that the head of the Danish Military Intelligence Service was jailed right in Kastrup Airport for “revealing information that can damage the security of the country” was widely “satirised”.

The hosts of that show were clearly daring the government to charge them, the whole thing is locked down over “National Security”, everything is Secret.

Using satire, the satirists can get the inside story from someone, when they then tell it, and it is correct, it will be “obvious” if it ever gets to court that they are satirists and those are just pulling random stuff out of their ass, so maybe they just got lucky and guessed? Speculation is not illegal.

If there was a court case raised, that would *confirm* the crazy talking, like, i don’t know, the laughably cray-cray rumours that someone high up was getting jailed over doing his job by telling the *actual official body* overseeing the Danish intelligence services that they are breaking the law by helping NSA spying on Danish citizens and hacking EU politicians, like Angela Merkel – all of which ended up in an official report and BooM :).

I imagine the USSR worked a bit in the same way?

That was one heck of a dip! What were the Buy The Dippers waiting for?

I hope it wasn’t a Flubber coated dead cat.

Or a Hong Kong hamster…

They are teaching the masses to buy the dip.

No matter how deep.

for what purpose?

Because then the Plunge Protection Team doesn’t have to do the buying.

Wall Street loves volatility in stock prices. That’s when fortunes are made (and lost). Not much money to be made by financial industry unless you have some price action.

Bear Market rallies are the most vicious ……

Wolf,

Would love to see an article on Margin Debts and the chart. Thanks!

Qt

The article will come on about Feb. 18, when the January margin debt data is released.

Bloomberg has “Stocks Storm Back…” headline currently and right below it is “Pentagon Readies Troops…”, so a lot of geopolitical events going on right now to scare markets up and down, along with Wed Fed meeting…oh and US carriers massing in the China Sea…so potential two front mega-wars no biggie for the famous JPow Put, for now….HA

Bounce was widely expected before Fed meeting Wednesday, and why I closed my Russell Short hedge EOD last Friday. Good time to be an active trader with 4-5% daily market moves although you get tossed around easily and have to be careful and have trading platforms that don’t shut down during panic and mania active trading days. Futures volumes were 2x normal so the big guys pushed the markets down and up while retail got dragged along for the ride…

Yort:

Fairly clear RU and CH at least in the ”serious teasing strategy” part of their recent re-union, and very likely subsequent partnering, etc., similar to their combinations and early material and other support for outright war during the VN era, following similar egregious errors of diplomacy then and now.

Such will probably continue a la the very similar challenges to the hegemony of the British Empire in the late 1930s; with what subsequent events this time, only time will tell.

For now, with clearly absolutely no control over ”it”,,,

WE the PEONS of both and any side(s) can only hope they, (that would be the ”owners”/oligarchs/”whatever” they,) can settle their differences without killing millions of WE PEONs as happened last time.

So tomorrow, we will see a load up on stock on all the major military contractors and suppliers…more ammo for another bull run.

Covered my short this morning b/c COVID #s dropped a lot Sunday. Maybe a COVID relief rally coming???

COVID numbers are always down over the weekend, due to certain doctors/clinics (non-emergency) not being open.

I will add that yesterday’s you tube posting (Monday) has the study graph’s from NY and CA so you can see for yourself.

He got dinged a few days back by one of the fact check boards. He goes through the qualifications of the fact check board who all 9 are light weight journalists except for one who is a journalist with a science degree. These fact checkers are a joke.

But…

If an engineered rally today occurs just in time to validate a hawkish position tomorrow, might not the the rest of this month’s outlook still turn miserable?

The Olde Wise Mug Dictum is intact. A new crop of players went into the breach on the dip ( supply zone) and more will step in. The Harvest is under way.

“And there better be a bounce soon or else I will have to revise the WOLF STREET dictum, immortalized on our beer mugs: “Nothing Goes to Heck in a Straight Line”:”

Then go for a second edition with a new motto, graphics, and different glass supplier. It’d sell like hotcakes. I’d buy it.

Tomorrow Fed will most likely make a U turn and markets will go crazy. We saw a preview of that today from -5% to +1% in few hours. Add to that easing geopolitical tension and stocks will rally like there is no tomorrow. And life will be as usual, rich becomes richer and poor becomes poorer. More homelessness, more inflation, its like any other sunny day in corrupt US.

This is comical. You actually think the FED is going to decide to just ignore inflation? Are you high right now?

Fed has ignored it for last 6 quarters, lying and making excuses one after other. Fed works for the rich, the sooner you understand the less poorer you will be.

They have no choice. Between crashing stock and asset market and inflation they will always pick inflation.

That’s not what they chose in 2008. They killed inflation even though it crashed the market for a time. But they stayed in power.

The Fed works for the powerful. They have to slay inflation in order to retain their political power.

The powerful lost some wealth in 2008-2009, but the masses lost a lot more. Ask Petunia. Ask anyone who lost everything in that recession; there were millions.

The powerful can always get rich again after a dip, but only if they stay powerful.

“Everybody knows….” Leonard Cohen.

I think the Facebook Medical University graduates may be the funniest thing about the comment section of this blog. Either that, or the people who take ZH seriously–but then there’s probably a substantial overlap.

Nice call, Wolf. I think we just got it. Call it a relief rally, dead cat bounce, whatever; but it’s probably a counter trend rally in a bear market. A series of lower lows and lower highs … we may be watching this one a while …

Wow! Would you look at that….It bounced like an overinflated kiddie basketball on a new court! Still nervous Wolf?

To me the interesting thing this morning was that bonds did nothing basically all day long.

Yes – that was strange – treasury yields were basically unchanged all day.

Suggests there wasn’t a huge flight to safety that one would expect if the plunge was due to Ukraine war worries.

Crude oil and natural gas quiet too.

Sherlock Award! (Remember the story about the dog that didn’t bark – because it knew the murderer…)

From everything I can gather by reading hundreds of comments online, people are angry about what happened today, citing it as just another example of how the entire system is rigged for the rich. They won’t even tolerate a bad day, while simultaneously stealing the future of almost everybody else.

right, the problem is that a market with this level of volatility is bad for everyone who doesn’t have inside information or the juice to move the market. obviously, intraday prices can change. but 5% reversals for no reason mean that if your buy or sell order goes in at the wrong time during the day, you’re out real money. a real market shouldn’t function like that.

what is clear to me is that algorithmic trading needs to be banned. i can hardly think of a more parasitic and bad for society activity.

You mean you don’t like the idea of algos trading crypto with entire pension funds riding on it? What could go wrong?

DC

They will steal everything until there is nothing left to steal. Then they will go after your soul.

Wolf asking for the stock market to go up? Hell must have frozen over.

The market is still historically very, very richly valued by P/E, P/S, EV/EBITDA, and just about every other financial metric.

Amazon landed on June 10 2020 fractal zone.

Bear market rallies can last 3 – 5 weeks.

This isn’t a market, this is a rigged system.

That, or some fairly different, divergent future states of the world seem readily possible, and various players are expressing opinions. Which is the very definition of a market.

Such a scenario would explain today’s volatility without sinister actors.

DC

Its rigged alright, you bet

And the house always wins.

Traders had to close the gap down on open, they know the probabilities of closing gaps are extremely high, so might as well get it over with so we can move on down. This bear is just warming up :)

This^. Stoneweapon knows what he/she’s talking about.

Precisely. S&P at 4400 on its way to 2500 true value.

Bonds a 45 degree down slope since last year

S&P a 45 degree up slope!!

Bonds at about same price as before COVID.

S&P double the price at Covid!!

You’ve come a long way up, baby.

And, baby, you’ve got a long way down to go.

Kept my puts placed in late December, and added some on today’s bounce.

Hang on. Don’t get blown out.

At 5000 and if inflation runs above 2% your very long term return is probably going to be around zero.

At 2500 your long term return above inflation is going to be 3% – 5%. If you really want a long term return of 7% or more above inflation you better be hoping for an entry price around 1500.

First time ever in history that the Dow has fallen 1000 points, and reversed back into positive territory, on the same day.

Historic day. Very volatile.

Expect the Dow to fall back down again on Tuesday…

I said this same thing but Wolf said no.

Depth charge,

You didn’t say anything about 1,000 points. What you said was: “Such an obvious massive market manipulation has never before been seen.”

And I replied:

“Nah, just a massive bear-market reversal followed by a bounce. There were huge bear-market reversals and much bigger bounces during the March 2020 crash — leading to huge one-day rallies. This is March 2020, S&P 500, daily percent moves, posted March 21, 2020. The craziest rallies happen in bear markets:”

And I posted the chart of the March 2020 volatility.

There were lots of reversals. The 1,000 points is meaningless because the Dow used to be under 10,000. Now it’s over 30,000. In percentages terms, there have been bigger reversals.

It was one HECK of a show… Like the Bills and the Chiefs yesterday, Amazing!!!

The number of Dow points is irrelevant, it’s the percentage change that counts.

Today’s move was only medium-sized by March 2000 standards, and it was downright small by October 2008 standards.

The correction could be over, or the bear could just be getting up on its legs. Very hard to tell.

Just like the dollar, 1000 doesn’t mean what it used to.

I don’t pick up pennies up off the street anymore. Maybe a dime or a quarter…

I’ve just read the article and the comments, and I must say I’m quite impressed because nobody has asked Mr. Richter that question that always seems to come up….

@ Prophet – Yes enquiring minds want to know…did they ever fix that mangled power pole outside your window Mr. Richter??? HA

Don’t you know yesterday was brutal on some folks using margin on some of the high fliers. Must of had to self medicate to get through the day. Would have been terrible to have jumped out of the window too early.

Hahaha!!!

That’s pretty funny, I bet his poll numbers improve because of it!

It’s actually not funny, and don’t count on his poll numbers improving. This guy is wildly unpopular, and none of his actions have anything to do with making life more enjoyable for the masses. It’s all about totalitarianism and full dominance of human beings – a miserable police state where big brother charges you and makes you wait for permission at every turn.

This guy appears to have an anger management issue, possibly dementia related. He’s WAAAAAAYY too old for the job. His mental faculties are clearly fading. I think there ought to be an age limit of 65 for your first term. That way if you’re reelected, the oldest you could be is 73 on your way out.

Pres T stops over in Hawaii on way to Japan. Makes obligatory visit to Pearl Harbor Monument.

On way over on ferry asks chief of staff Kelly: ‘so what is this about?’

Kelly tells him about attack.

Other nite on Fox, with T, Hannity is laying into current Pres and wonders ‘why he beats his head against a wall?’

T replies: ‘I built 500 miles of Wall, it was all going well until..’

He’s confused a figure of speech with his Wall.

There are hundreds of these. Reagan was no genius but could remember his lines. T may be first Pres who is only semi-literate.

I have to admit feeling some schadenfreude, as well as satisfaction, that I got out of the growth fund bull ride at my 401k (TIAA-CREF) in April last year.

It’s just a small tranche of my savings, but still, seeing it had risen by 14% (early last November) was losing an imagined psychological battle with the fund managers. They had warned clients in late 2020 that staying in cash (money market, etc.) would end up losing money.

Now the growth fund is lower than when I sold – down 15.4 percent from the November high. That gives me a slight pleasant feeling, although such things are often temporary.

Absolutely. It feels good when you get it right and terrible when you get it wrong.

If I feel like I know what I am doing I can sleep well on a losing position and be under water for a long time. It’s the price you have to pay to be a value investor in a hot market.

Question = Is any one going to stop using Petro/ NG and their cellphone?

I don’t know but I have decided I would ride a scooter so the Petro can be better used by Al Gore jetting off to Davos so he can help save the planet.

I punched out the numbers, if I don’t drive my car for 20 years Al can make one round trip to Davos. Seems totally worth it to save the planet.

There is a reason ‘carbon footprint’ is gone from our vocabulary. Flying even once a year is a really awful ‘carbon footprint’. Can’t have that being pointed out.

Only the peasants. The elites will be kept warm & their jets fueled.

Since it is -14F outside, I admit to having my furnace on & burning Nat Gas. The thermostat is kicked up to a comfy 63F. Gotta have enough heat inside the basement to keep the water pipes from freezing, you know.

And, that’s a nice temperature to be on the Kreitler rollers; since it’s a bit cold to ride outside today. (Getting old and not as tough as I used to be …)

“Question = Is any one going to stop using Petro/ NG and their cellphone?”

– Gave up cell phone two years ago = more free time.

– More free time for home upgrades = less NG use.

– More time for home/self upgrades = less car petrol.

– Less car petrol = less chance of accident with cell

phone distracted drivers!

Jan 24th. Totally Predictable Monday market after Weekend Worries current market

1/ 12 36290.32 Fri 1/ 21 34265.37 * vol 532.9*

weekend worriers Monday sell off:

1/ 24Drop bottom 33202.51 @12:35 PM

Dip Buy to close at 34,364.50

Tuesday Excepting News

continued drop toward Fri 28

1) Liquidate, liquidate, liquidate… but wait :

2) SPX weekly log : Feb 10 2020 high to Nov 1 2021 high.

3) A parallel from big red Oct 26 2020 fractal zone to Mon Jan 24 2022 low.

4) A parallel from big green Mar 23 2020 fractal zone.

5) Linear chart.

6) SPX might imitate : Oct 2014 low, Aug 24 2015 low and Feb 2016 low.