Inflation for Urban Wage Earners & Clerical Workers (CPI-W) = 7.6%. Fed is still pouring fuel on the raging fire. Most reckless Fed ever.

Fed Chair Jerome Powell’s reaction to today’s WOOSH inflation blowout, as captured by cartoonist Marco Ricolli for WOLF STREET.

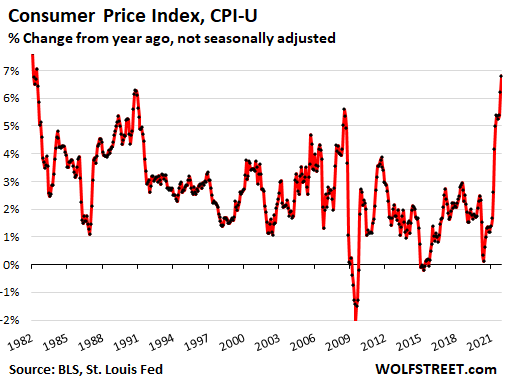

The broadest Consumer Price Index (CPI-U) spiked by 0.8% in November from October, and by 6.8% from a year ago, the highest since June 1982, according to data released by the Bureau of Labor Statistics today.

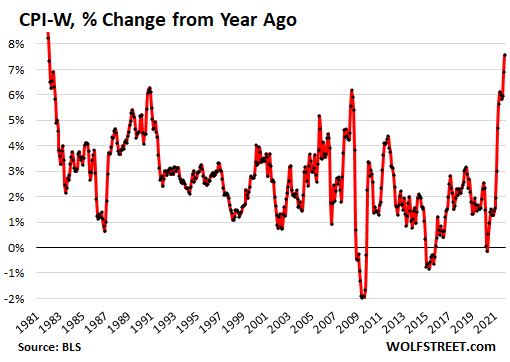

But it gets better. The Consumer Price Index for All Urban Wage Earners and Clerical Workers (CPI-W), the index upon which the Social Security COLAs are based, spiked by 7.6% in November year-over-year — exceeding even Mexico’s soaring inflation rate — and the worst since January 1982.

But in January 1982, inflation was coming down; now inflation is surging. At the time, the Fed’s short-term interest rates were over 13%; now they’re still near 0%, and the Fed is still printing $105 billion in the current period from mid-November through mid-December, though it will reduce the money printing further.

Nearly all interest rates and yields, including on risky junk bonds, are now negative in real terms. This – the Powell Fed that unleashed this monster and has been feeding it month after month – has got to be the most reckless Fed ever.

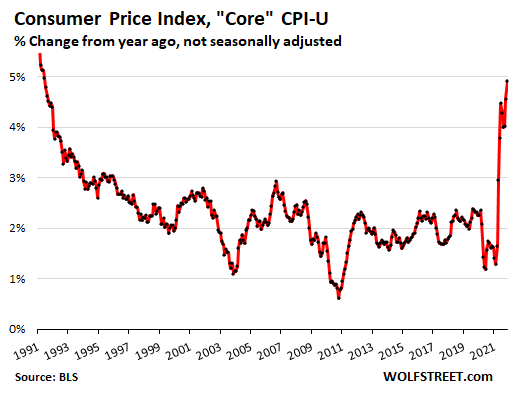

Inflation without food and energy – OK, Americans, go ahead and try to live without food and energy – spiked by 4.9%, the most since June 1991. This shows how embedded inflation is now in the economy beyond energy, and it has started to hit services, which is hard to explain away by jabbering uselessly about “bottlenecks and shortages.”

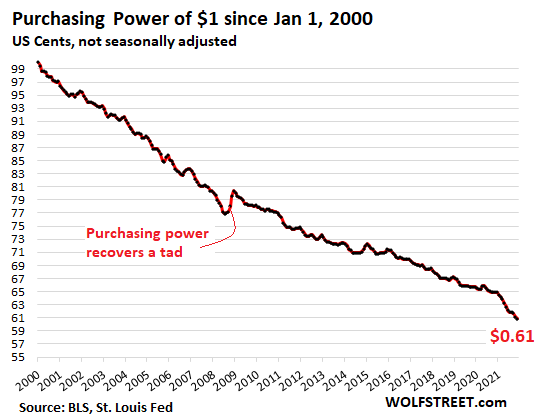

Inflation in consumer prices is another term for the loss of the purchasing power of the consumer’s dollar. In November, the purchasing power of what was $1 in January 2000 dropped to 60.81 cents:

Rent Factors, nearly one-third of CPI, still lag far behind reality but started to rise.

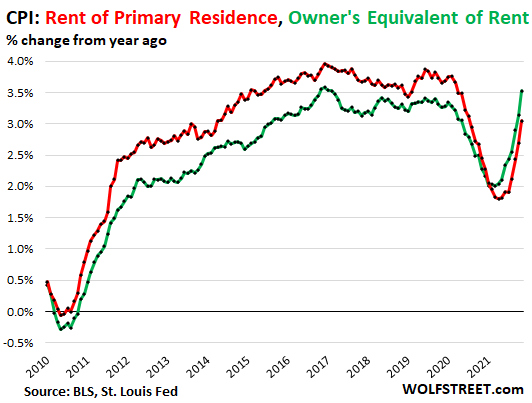

Two measures of rent make up 32% in the Consumer Price Index. In 2020 and early in 2021, these two rent factors dropped sharply and pushed down CPI, even as other prices were surging, thereby keeping CPI from spiking even more. They turned around in June and have been rising every month since then, but they’re still holding down CPI, even as market rents in the 100 largest cities have been spiking for months.

“Rent of primary residence” (makes up 7.6% of overall CPI), rose by 0.4% in November from October, and by 3.0% year-over-year but is still far below where it had been before the pandemic and far, far below the surge in market rents, which are only gradually filtering into CPI (red in the chart below).

“Owner’s equivalent rent of residences” (makes up 23.5% of overall CPI) is used as a substitute for the costs of homeownership. It is based on surveys that ask what homeowners think their home might rent for. It rose 0.4% for the month, and 3.5% year-over-year.

These rent measures are still holding down CPI (6.8% in November), but as they’re catching up little by little with reality in the market, those rent measures will continue to rise, and given their 32% weight in the index will push CPI higher, and it has nothing to do with supply chains and bottlenecks; these are services:

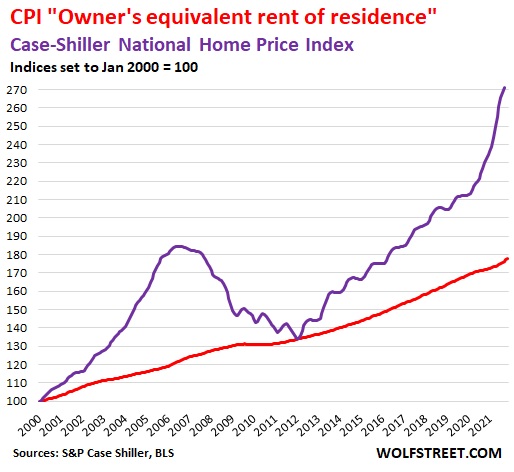

Actual home prices have spiked by historic amounts. According to the Case-Shiller Home Price Index – it tracks price changes of the same house over time and is therefore a measure of house price inflation – has soared by 20% year-over-year (purple line below), while “Owner’s equivalent of rent,” which is supposed to track the costs of homeownership, is just starting to ease higher (red line). Both indexes are set to 100 for January 2000:

Food costs (makes up 14% of overall CPI), jumped 0.7% for the month and 6.1% year-over-year, with the CPI for meats jumping by 16% year-over year.

Energy costs (7.5% of overall CPI) spiked by 3.5% for the month and by 33% year-over-year:

- Gasoline +58.1% year-over-year

- Utility natural gas to the home: +25.1% year-over-year

- Electricity service: +6.5% year-over-year.

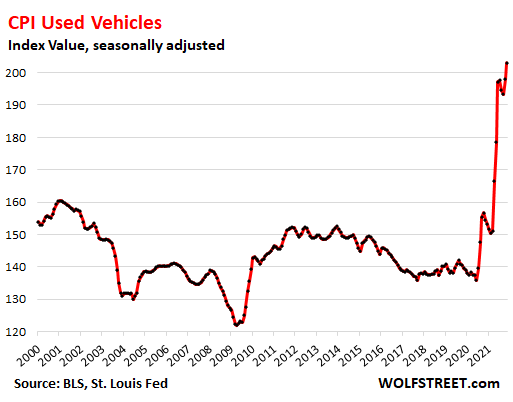

The CPI for used cars and trucks (makes up 3.4% in overall CPI) jumped by 2.5% for the month, and by 31.4% year-over-year.

This is going to get worse over the next couple of months because used-vehicle wholesale prices, which lead the CPI by about two months, started spiking again, after a pause, and for November were up 44% from a year ago!

The jump in used-vehicle retail prices picked up by the CPI for November reflects wholesale price gains in roughly September. But in the two months since September, wholesale prices have spiked by another 13.5%, which will hit used vehicle CPI in December and January – something to look forward to (chart shows index value, not year-over-year percent change):

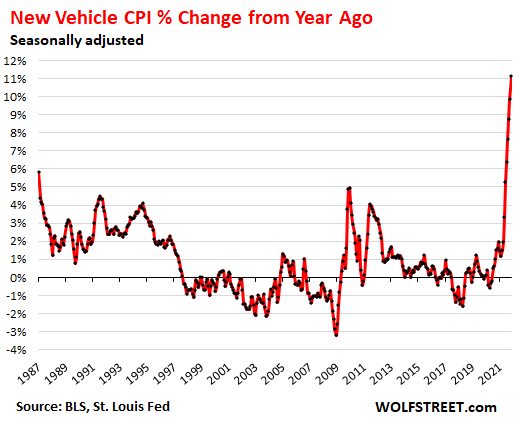

The CPI for new cars and trucks (makes up 3.9% in overall CPI) spiked by 1.1% for the month and by 11.1% year-over-year.

In the history of this CPI, there were only a couple of months in 1975 when new vehicle prices rose even faster topping out at 12.7% in March 1975. We may be looking at what in a few months from now will be the worst-ever inflation in new vehicles as consumers no longer care about price and pay whatever, even thousands of dollars over sticker (chart shows the year-over-year % change):

It’s going to be a bitch to get this under control.

This inflation is spiraling out of control because consumers and businesses are now willing to pay the higher prices. The dam has broken. The inflationary mindset has changed for the first time in decades. And this is happening as nearly unlimited amounts of newly created money washing around the globe has destroyed all sense of price resistance. And the Fed is still making it worse by pouring more fuel on the raging fire.

Trying to get this under control will be tough and will take a long time. Inflation doesn’t even react to monetary tightening for a year or more, and then only gradually. And tightening hasn’t even started yet. The Fed is still repressing interest rates and it’s still printing money – which positions it as likely the most reckless Fed ever. And this inflation isn’t going away under these circumstances.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A VERY common observation seen on the web, “As long as you don’t need cars, housing, food or energy inflation is only 6.8%”. Who really is in control?

They will take care of inflation.

Expect the definition of inflation to be changed.

Very Interesting and insightful. If you have read 1984 by Orwell, they do the same there with changing the definitions/meanings of certain words. It’s hard to believe we are actually getting to see that aspect of the book it in real life.

I get the impression that the corruption within the political/government class is off the charts. I was recently reading that the NIH removed the only section from their website on “Gain Of Function” or something along those lines and there is no documentation on who ordered/why it was removed.

I don’t want to get into the whole Covid mess but it’s just an example of the ruling class changing definitions/reality as it pleases them.

“I get the impression that the corruption within the political/government class is off the charts.”

Welcome to reality. I got that CORRECT impression way back in the mid-1990s from a number of books which exposed that in great detail. As such things go if not widely exposed and punished, it has only gotten worse with time.

Ditto for me as far as the very very obvious corruption, but starting in the 1970s, especially regarding ronny ray gun who had done his ”thing” to impress the oligarchs with his crazy corrupt ”conservatism” — actually the very worst kind of ”reactionary behaviours” while guv of CA by doing the very worst things he could for WE the Peons at every turn of the screw.

Consider tear gassing thousands of innocent non-participants because of proximity to what turned out to be ”planted” trouble makers in otherwise peaceful marches, etc., as just one example…

Closing many of the CA mental health facilities and kicking residents there in onto the streets as another…

RR was a paid political puppet before any others, and WE the Peons are still suffering from his and his owner’s EXCESSES,,, for which he was paid very well of course…

Silverdog, I don’t know what sort of trash you “read” (more likely HEAR) but I get about 173K results from NIH website on “gain of function”.

Some people are really IGNORANT, and like you, it seems, trying extra hard to be more so.

https://pubmed.ncbi.nlm.nih.gov/?term=gain+of+function

Sorry for link, but blatant lies are worse than the political/agenda-driven ones

Yes, they did scrub the page. Reality sends its apologies.

Go to Archive.org, it’s all there

“gain of function virus” leads to pubmed.ncbi.nlm.nih.gov site and several papers describing the process and dangers of it.

Already in the works.

Check Zerohedge web site

Pish Posh

Business is great all around.

People can get jobs easily.

Raises compensating for inflation.

Robust demand causing more supply to be built out.

I see the glass 95 percent full.

This is brilliant policy.

avraam, are you out of your mind? raises are not compensating for inflation. rent is up 20%. salaries are up 4-5%. seriously, what are you smoking?

ZH has morphed into a clickbait site filled w/white trash racists and GQP’rs.

Updated definition: Inflation is good.

Inflation has been good for awhile, but, we have discovered recently, that inflation is good depending on the situation and who is in charge. Powell is clearly the one who understands it and the right guy for the job. That other guy from that other administration will just muck things up. Sure it’s the same guy put in power, from that other administration, but, the current administration gives him the tools he needs to do the job properly.

/s

I’m still deep into deflation territory – which I LOVE – thanks to remote work allowing me to leave NIMBY areas.

Some of us didn’t feel inflation at all thanks to remote work becoming mainstream.

You just cut your expenses by not going to the office. That’s not feeling inflation, that’s cutting back. Wait until you go buy a car or go to the grocery store. Then you will “feel” inflation.

> You just cut your expenses by not going to the office.

Not quite. What I got rid of is the housing inflation caused by NIMBYs which ends up inflating every single cost that’s defined locally. Bought a cheap REO, fixed it, have no rent, no mortgage, property taxes under $1k and homestead exemption that protects the entire property forever.

I also shifted the tax burden to those NIMBYs and my healthcare costs. So killing the 3 biggest fixed costs.

Remote work is here to stay thanks to this dynamic.

My advice to the young: Make the NIMBYs work relentlessly for YOU, not the other way around.

The current situation is a strange one for young retirees. I have decent social security check and around 3/4 million in IRA and savings. No home, no debt.

At 5% negative real rate on savings, your savings really isn’t worth much compared to social security which is indexed to inflation. If you knew negative real rates would persist you would buy durable goods today and not in 10 years.

Thanks for the disclosure….more people should do it…..gives a good idea of how much “lifestyle pain” makes people whine here….providing they are being honest.

IMHO you are doing just fine now…..I hope you enjoyed your youth back when it used to be “NOW”.

Is not it criminal for Fed to do what its doing? I thought FED’s mandate is to achieve full employment and keep inflation under 2%. We are at more than full employment now so FED should now do everything needed to bring Inflation back to 2% target. Why is FED blatantly committing this crime again majority of Americans and enriching themselves and the rich.

Of course, however, the “Federal” Reserve (meaning its trillionaire-family, bankster owners) is now going up against the wall, because more and more Americans have become aware of its shenanigans.

Dear CCP groupies and banksters,

Did you hear how Evergrande reportedly defaulted formally today. What is going to happen to your “investments” with your CCP buddies? Conquering the world and enslaving humanity is looking harder and harder? It must suck to be you.

I forgot to add: “after the dear CCP groupies and banksters,” Most CCP-real estate developers are going to go under as more property prices in China tank. CCP controlled local governments are many dozens of TRILLIONS in debt, which debts cannot be serviced for much longer, because their prime source of revenue (from land sales which are no longer occurring) is gone.

The economic dominoes from these CCP disasters are falling. Their fall is only accelerating day by day, which explains why the CCP is suddenly eager to “wag the dog” and attack a certain independent nation off of their shores to distract the innocent Chinese public from how the CCP’s members defrauded them from most of their savings.

Some observations.

The laws and regulations governing the Chinese banking system is different than the US system.

China have seen fiat currencies come and during their history.

Evergrande defaulted on some of their debt in foreign currency, mostly US dollars.

Expect Chinese law and regulations to protect Chinese entities in China.

Do not expect the same framework apply to handling a financial crisis in China that you expect in the USA.

No not expect China to do very much for foreign investors.

Be not surprised if China have engineered a “swan” black, grey or white that make financial dominos fall, outside China.

There is no property price crash happening in China.

There won’t be any widespread contagion because of evergrande going down.

Real inflation is 25 percent plus on the ground.

People complain about fed because people mistakenly believe that fed works for the common people.

Fed is doing what they ate supposed to do.

The CCP intentionally destroyed as much Chinese history, historical buildings/artifacts, and culture as they possibly could.

The CCP isn’t a continuation of China, nearly everything they know and believe is from outside China; mixed in with the self serving greed of CCP members.

It’s every CCP member (plus their specific family) for themselves. It’s important to remember that the bulk of top ranking CCP members have parts of their family permanently living outside China (sometimes their spouse and all children). I don’t know of any other country with such a large percentage of the nation’s rulers having a backup plan for leaving the country.

If things get really bad in China, there isn’t some master plan to deal with it; many/most (top ranking CCP members) will simply abandon China. At the very least most will send all their children away.

If China simply decides to not pay back foreigners, that means very few foreigners will invest in China again, this also means a lot of the more valuable manufacturing will also leave. China doesn’t have much resources, there are other sources for rare earth metals, their only real way to bring in money in through manufacturing. There are alot of other countries now where manufacturing is alot cheaper.

This whole, China holds all the cards thing, is just a bluff. Right now, in November 2022, the every 5 year meeting, where the “election” of the chairman of the CCP happens, Xi will do anything to win, it’s not about China for him.

China protected its people from Covid, with 4,600 fatalities, whereas the US has lost over 800,000 lives to the pandemic. I would expect China to protect its economy and currency as efficiently as it dealt with the virus. Their system isn’t set up to reward the richest people at the expense of all the rest. We are told by our corporate masters that China is an evil place and that we must crush the commies before they take over the world, but the truth is China is just a convenient enemy for a nation that is failing on numerous fronts.

The way I read oec.world/en/profile/country/chn/ does not entail claims China’s economy is slowing down:

“Growth

In August 2021, the increase in China’s year-by-year exports was explained primarily by an increase in exports to United States ($57.5B or 153%), South Korea ($7.74B or 142%), and Australia ($6.99B or 180%), and product exports increase in Integrated Circuits ($9.26B or 182%), Computers ($7.39B or 79.8%), and Telephones ($4.92B or 40.1%). In August 2021, the increase in China’s year-by-year imports was explained primarily by an increase in imports from Australia ($10.2B or 129%), United States ($7.45B or 113%), and Taiwan ($6.21B or 37.3%), and product imports increase in Iron Ore ($11.2B or 123%), Integrated Circuits ($10.9B or 40.2%), and Crude Petroleum ($9.96B or 71.8%).”

Far more than that died in Wuhan alone, during the first lockdown. We know, because they are videos showing massive stockpiles of urns, being handed out after the first lockdown ended.

The real figures are unknown, because under the CCP system, everyone is supposed to cover things up. There are have been many lockdowns in China throughout the pandemic, with many people, having their doors welded shut; There is of course many videos of this as well. Hospitals don’t want to accept blame, so they will intentionally turn alot of positive results negative. This is also proven by the impossibly low, positive test rate, false positives alone, would be far higher.

As far as “protecting” the people goes, remember that Australia and a certain country off china’s coast, far exceeded them. The issue for China is that their vaccines suck and many people have been hesitant to take them. This means if truly very few people ever got infected, there is no end in sight for the pandemic for them, because far too many people are still susceptible. We know their vaccines suck, because other countries who bought them, have said so.

As far as handling any financial crisis goes, CCP officials are just having other people say that the CCP will just magically fix them, there are no experts explaining the mechanisms for how it would work. There is no secret plan. They are crossing their fingers and hoping it won’t be devasting, as they fight each other.

Congrats on swallowing all of the corporatist propaganda like a good little boy. You’ve really got it all figured out, genius

Yeah phoenix, the good old solid science Null Hypothesis.*

*(that’s when you periodically examine your beliefs and consider the possibility you may be full of shit, or your sources were….

..for the ignorant here)

has REALLY fallen out of favor judging from many of these, (gag, choke) “comments”.

Unless, they are making their final moves.

“They” are running out of time. While the Internet is their second greatest asset, (after the control over currency), the public is slowly learning about the FED and who controls it. They must control the Internet and stop this education of the masses.

The game is soon to be up, for all of us. The Day of Reckoning is about to present itself, and thus, “they” have to collapse the World’s Economy ASAP.

I personally believe this “EverGrande” event, the chip shortage, the out-lawing of 50% of all Trucks in California, Covid, Supply shortages, etc. etc., are part of the move to destroy the World’s economy. Free Enterprise is so powerful that “they” must go to extraordinary efforts to bring it down. And, so they are.

Only then, can “they” consolidate their power and take final control, declare World martial law (travel controls anyone?), issue a World currency, and establish the control “they” have been working on for decades.

They have had the power for decades. They are now consolidating it. I feel very, very, very sorry for anybody in the Stock Market and has not mentally, emotionally, financially physically prepared for what must come.

There is a phrase used by Religious people about the smartest thing the Devil did was to convince people “he” doesn’t exists. Well, the smartest thing the Conspiracy has done is to convince the people it doesn’t exist.

If the Devil convinced people he doesn’t exist. Then in their mind he would no longer be around to convince them, and soon they would start believing he exists again. Because lesser intelligences need concrete objects or anthropomorphic representations to understand abstract evil or transcendent nirvana.

There is no secret plan.

The USA has inflation and falling living standards because the ideology of each person pursuing their self interest does not produce the best outcome at the national level.

I have a little different take.

I think there’ has long been a general notion of world order among most of the troubled billionaires and corrupt old family wealth elites of our time (these people are sort of faceless pseudo-masters holding immense family fortunes). There is a Kissinger book about this, with high praise from Ms. Hillary. But it seems to me that there really isn’t a coherent grand plan other than: “when there is chaos and dysfunction, control it and order it and keep the global markets and commerce moving, when at all possible. And keep talking up the ideas and words of democracy”.

Based on the last sentence, and knowing the importance of keeping things humming, I actually think most of them really did +not+ want to stop the machine when Covid hit. Certainly if it was Musk and Trump in actual top charge of the world, we would not have had the great shutdown, based on their thinking. But the virus and it’s unknown put the fear into most of the heavy world power people and their advisors, and certainly into Bill Gates. The fear overrode. And so they did what they did.

‘Certainly if it was Musk and Trump in actual top charge of the world, we would not have had the great shutdown,’

I’ve been trying to ignore the usual paranoid crap but this is too much. The NY magazine devoted half an issue to Trump et al overriding experts and turning a likely 250K fatality into a million. That was epidemic specialist Birk’s estimate when it hit the fan: If we get serious now we can hold this to 250K.

The Diamond Princess cruise boat is tied up in Yokohama, with a case. No one is allowed off. Passengers confined to cabins. Should prevent spread, right? No, soon 500 cases. Hmm…maybe airborne? Yup. So halt cruises? Mnuchin has a fit: ‘you can’t you’ll devastate the industry!

WH staff opinion of Birk: ‘they hate her’ Pence senior guy wonders ‘how long will she terrorize America’

All they cared about was the stock market and the polls. The virus could be repelled with bleach and happy thought: ‘One day you’ll wake up and it will be gone’: The Donald.

Then Trump gets it and knowing he’s tested positive he attends meetings anyway and infects others including his family and members of the Secret Service. This sounds like a crime, btw.

Of course he gets the very best care like monoclonal antibodies

which at this point are rare and expensive and not available to the other 300 K cases. Even at that it is now emerging that his O2 levels were dangerously low. He was very fortunate that none of his suggested therapies were employed.

But now this a new Pres who does listen to experts so why are cases still climbing? You only have a brief window to contain a highly contagious agent. The opportunity was blown.

Good comment No Prep,,, please keep sharing with us who love Wolf’s wonderful analyses and the equally wonderful commentariat, of which I am mostly a ”learner”,,, just trying to figure out if I can make some ”rational” investment(s) to help my spouse keep on keeping on after my demise…

OTOH, I will admit to commenting about some of the ”old times” in my life, especially those times in the late ’50s and ’60s, when I was mentored and femtored by many folks of several ”ethnic groups” who were clearly trying to help me understand SO MUCH of what I had, ( clearly to them ) no clue about,,,

What unmitigated horse pucks

Was this the same They that made the Dutch invest so much in tulip bulbs in almost wrecked their economy? Was it the same They who drove the Great Florida Land Boom and Bust?

The same they that made people pay too much for stocks, again and again and again? The same They who made Chinese invest in too much real estate? The same They who make people pay over 50 K for a single group of 0s and 1s stored in computers?

Along with the never ending human desire to get rich quick there is a tendency to blame the resulting problems on a malevolent They or It.

Collectivism guarantees everyone will be poorer. No one is entitled to minimum living standards at anyone else’s expense.

“…. the ideology of each person pursuing their self interest does not produce the best outcome at the national level”

+1

The unchecked greed is the biggest outcome we have to show for it

Every move will be telegraphed 3-6 months in advance because the Fed’s secret mandate is plunge protection and they will never “spook” markets,

I thought …. ”

There is no rule of law. Get that through you thick skull.

You are small, they are big.

That’s why there will be a quick reversal starting Wednesday next week. The music only has 2 more trading days before it stops.

Djreef

Don’t count on it!

This Fed is captive to vested interests who want this everything ‘bubble’ keep floating as long as they could.Even 7% inflation hasn’t been taken seriously by the mkt action today, so far! Weaning the addiction to easy-peasy money is that easy. Fed is consistently reluctant to administer the bitter medicine. It will be too little and too late!

The smart money is already rotating out and pushing the buy buy buy narrative to the unsuspecting mom and pop and junior in mom’s basement stockbro rubes.

I guess we’ll see next week.

the markets aren’t taking it seriously because they don’t believe the fed will ever stop printing. i guess we’ll see next week.

I really hope you are right. The few have benefited at the cost of many.

It seems as though the market is delirious

We are not at full employment. That said the economy is booming and pressuring prices upwards as a result of that and the supply bottlenecks. Wolf has his hair on fire and projects there will continue to be a linear extension of the price hike trajectory. Not likely, IMO. The trends will ‘roll over’ once the bottlenecks are repaired. That said it would be nice if wages continue to improve.

perpetual perp

“Wolf has his hair on fire and projects there will continue to be a linear extension of the price hike trajectory.”

Not sure about the hair. But in terms of the “linear extension of the price hike trajectory”: On the contrary. I have said many times that the price spikes in vehicles cannot go on. And so far, I’ve been wrong every time I said it :-]

But each individual price spike cannot continue. Someday I’m going to be correct with that assertion.

What will happen that will continue to power CPI higher: housing costs (1/3 of CPI will gradually push up CPI, though they’re still pushing down CPI. Check out above what I wrote about it.

And then there will be other prices that suddenly spike. Prices will take turns in spiking. It will be a game of whack-a-mole. Energy might go down, and suddenly food prices and healthcare prices spike, etc. This will cause CPI to speed up and to slow down only to speed up again.

That’s how it was last time (1970s & 1980s). It caused a lot of false hopes that inflation would go away — and back then interest rates were much higher already. Right now the Fed is still fueling inflation.

I am not here to claim ‘this time is different’. But there are some things that aren’t the same as the 70’s. Our economy is so much less based on manufacturing. So much manufactured stuff comes form China.

In the 70’s a far greater amount of what we consumed was domestically produced, compared to now, and that was directly impacted by domestic inflation. This time, foreign producers are not necessarily going to be on the same inflation trajectory as we are. Just because our economy has inflation, it doesn’t mean theirs will, or at the same level. (However if another currency has less inflation than ours then over time theirs should appreciate vs ours, making those imports more expensive). Anyway, vs domestic production, inflation in imports will be more indirect, and maybe easier to quash.

Unions were stronger in the 70’s, with strikes more effective at locking in wage increases that were demanded because of inflation and fed back into creating more inflation. I’m watching Kellogg to see what happens there, if they can get away with destroying their union and maintain their production then I’ll be surprised, but that will mean strikes are going to be much less effective than in the 70’s.

So while I’m certainly not certain, I think it might be a little easier to break the feedback between wages and prices this time. Once they actually start trying, that is.

Yes, Mr. Richter, automobile supply will eventually catch up when normal production resumes (maybe in two years?). Think about those who have automobile leases ending. They will probably be better off purchasing their lease vehicle than trying to find a new one. As for residential housing it is probably more economical to by an existing home than to build a new one. As for petroleum & NG, who knows!

@Perpetual

The economy is far from booming….unless your definition of that includes speculation, rising costs, greed, leveraging, and instability…..which could result in this going on for some time. At some point, folks are gonna have to get honest with themselves that this economy is screwed up at best.

Eastwind

Here is what is different between now and the 70s

In the 70’s you had a Fed that FOUGHT inflation

Now, we have a Fed that PROMOTES inflation

It’s that simple

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates. — 12 U.S. Code § 225a

There are three mandates.

moderate long-term interest rates — what ever they like is moderate.

Dont forget the most important mandate, which is the most important demonstrated by their editing out, their omission.

The Fed has edited OUT the THIRD MANDATE of the Federal Reserve Act…..they have removed from their web site any mention of this directive from the Act !!!

The language that is in the Federal Reserve Act making clear that the Fed is bound to “Moderate long term interest rates” can be found here

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.

[12 USC 225a. As added by act of November 16, 1977 (91 Stat. 1387) and amended by acts of October 27, 1978 (92 Stat. 1897); Aug. 23, 1988 (102 Stat. 1375); and Dec. 27, 2000 (114 Stat. 3028).]

Federal Reserve Board – Section 2A. Monetary policy objectives

HOWEVER, in the most recent REWRITE of “The Fed Explained”, a document prepared by the Fed in Aug of this 2021

THERE IS NO MENTION OF THE FED BEING MANDATED TO “Moderate Long Term Interest Rates”!!!!!

They have edited it out!!! They have disregarded a key portion of the Federal Reserve Act.

That third mandate is unmentioned, and completely disregarded by this Fed, and their omission is proof as is their pegging long term interest rates at record IMMODERATELY low levels.

You cant find any reference to their directive to promote “moderate long term interest rates” anywhere on their web site. The game of “dual mandate” (employment and stable prices) is their trimmed down version. The Fed is writing their own powers and obligations.

Moderate long rates would prevent the flattening of the yield curve, keep a balance between lender and borrower, prevent crippling creation of long term debt that burdens future generations to fluff the present.

The Frds mandate is full employment and price stability NOT 2% inflation. 2% inflation destroys 50% of a dollars purchasing power every 35 years. They’ve been touting the 2% number so long that everyone has forgotten that price stability is really ZERO percent inflation.

“I thought FED’s mandate is to achieve full employment and keep inflation under 2%.”

Which is simply not possible when using using simplistic garbage economic theory to centrally plan (that always works well, huh) the nation’s (and, effectively, the world’s) economy with key input data (like actual inflation) manipulated for political reasons plugged into the garbage models created from that simplistic garbage economic theory.

CORRECTO MUNDO W:::

IMHO, very good summary of the deep fundamentals of which NO ONE in the paid political puppet class will ever utter a single word!!

SO, again IMHO, sooner and later, the political puppets will sooner and later be replaced by those willing and able to put up with the abuse,,,

and keep/focus as/on #1, their actual voters of WE the PEONS,,, first in mind,,,

After that,,, we can have still have some hopium that their other more extensive obligations for our USA Senators,,, and, even possibly our POTUS will become more to their liking than the obvious millions and billions from the oligarchy…

WE can hope, eh???

The Fed could halt inflation quickly by telling banks to tighten credit, by raising margin requirements, by cutting off QE cold turkey, and by raising Fed fund interest rates a mere 0.25%. Instead, the FHFA just raised annual conforming loan limits by 18%. Government is not trying to stop inflation. They are pedal to the metal trying to keep it alive.

“Government is not trying to stop inflation. They are pedal to the metal trying to keep it alive.”

Why? What is the end goal? Inflation really is a political B. So why not address this sooner rather than later?

The Federal Reserve does not have the authority to tell banks to tighten credit requirements. Banks set their own credit standards. Banking supervision can criticize lending practices after the fact but won’t get the result you infer.

The Fed ABSOLUTELY has a set of “macroprudential” regulation tools / capabilities, and does set standards for the banks in any number of areas, including reserve requirements, interest on “excess” reserves, and much more.

The Fed doesn’t have to tell the banks to “tighten credit requirements”, it just has to tell the banks that they cannot add to their balance sheets and the tightening is the immediate side effect.

BTW, the Fed was deeply complicit in the 2006-2009 credit crash precisely because it failed to use any of those tools in a “prudential” fashion.

Don’t expect it to do any better here. The incentives are all wrong. But it COULD do something if it wanted to.

I think it can be said with certainty that people are buying now to avoid further price increases later.

I thought the exact thing when buying a new battery for my car. It cost nearly $250 and was difficult to find due to supply problems. My instinct was to buy now while it was available, and before the price goes up. Humans seem to be hardwired to react his way, must be our hunter/gather instincts for when food and supplies are hard to find.

Sam,s club half price

True, but you can train yourself out of the lemming reaction.

It all reverts to the norm. Unless there is foul play to manipulate it off balance for benefit to a few. Then you have to follow the money, Figure out who and why. and then develop a counter strategy to shadow and profit, wait it out, or ignore it and become part of the friction.

joe2

‘Unless there is foul play to manipulate it off balance for benefit to a few’

LOL!

What do you think happening since fall of 2018? Mkt remain disconnected from the economy on the ground.

When the mkts tanked almost 35%, Mr Powell sprikled 4 Trillions right away and now over the pre endemic record. Price discovery is NOT allowed! If this not foul play or manipulation, then what is?

Inflation number under counted to someone’s advantage, NOT to the man on the street! Just the CPI portion renter’s equivalent inflation is almost 26% ( per Mish Shedlock)

What do you think happening since fall of

20182008.FIFY.

The lawless “Calvinball” make-it-up-as-we-go make-sure-we-win policies began in 2008.

Historically, financial crooks went to jail and failed companies went bankrupt. The S&L crooks went to jail. The dot-com bubble stocks went BK. The Enron crooks and Bernie Madoff went to jail. Lehman Brothers went BK.

But since Lehman went BK in 2008, though, no one has been punished, moral hazard reigns supreme, and behavior that used to be considered criminal is now considered normal.

@Wisdon Seeker: “Historically, financial crooks went to jail and failed companies went bankrupt.”

Nope. Read:

“The Gods of Money” (Engdhal)

or

“Super Imperialism. The Economic Strategy of American Empire. (Hudson)

Wisdom-still not convinced that Kenny-boy isn’t lounging on a beach somewhere sporting a carefully-reconstructed physical countenance and paper history…

may we all find a better day.

$250?! I just bought an Interstate Mega-Tron II for $130.

Tom suspects “I think it can be said with certainty that people are buying now to avoid further price increases later.” They are more likely to regret not waiting for a more normal economy.

I certainly have. I have all the materials I need for my renovations already purchased and stored. I got them all before prices rose. Furthermore, my property is unlikely to need any serious work for the next 30 years. And I’ve cut my energy bills by 20%, with another 20% saving when reno’s are complete. I see quite a lot of people around me doing the same thing.

And another thing, from relatives who are experts in interior decor, is that nobody even knows what “this year’s style” or “this year’s colors” are. What this means is that when demand starts to drop, it could seriously crash.

> nobody even knows what “this year’s style” or “this year’s colors” are. What this means is that when demand starts to drop, it could seriously crash.

Isn’t that a sign of Americans finally developing a sense of good taste? You don’t see Italians changing design colors of their homes every year. They have a classic taste instead.

Pantone just released their 2022 “color of the year”. If you care, it’s “Very Peri” (a Periwinkle Blue). The press release announcing its selection is a word salad of magnificent proportion.

I do agree that style is better than fashion (says the man with a 20 year old YSL raincoat), and it could be a sign of same, but I think it’s more likely due to people having bigger priorities, nevermind the lack of supply.

Tom

And that is where the bottlenecks originate, IMO.

Every purchasing agent sensed the inflation coming, and called their suppliers and said, “Get me all you can at that price.” For to have inventory in an inflationary period is everything.

THIS caused the bottlenecks.

The Fed and the administration would suggest otherwise……they don’t want the blame….but THEY are to blame.

Kellogg has the solution.

Kellogg’s reaction mirroring Reagan’s response with striking ATC (’81)

Rarely noted today (even in case study’s) – theintercept.com/2021/08/06/middle-class-reagan-patco-strike/

That action very well might have nipped in bud the possibility of special interest groups taking hostage critical services. It removed a big Alinsky weapon from hurting general public.

If Kellogg shuts down, there are alternatives. Not for ATC.

Seems hostage-liberator-in-chief liberated more than just hostages in Iran.

From the article sam cites:

“Reagan fired 11,345 striking air traffic controllers and barred them from ever working again for the federal government. … The careers of most of the individual strikers were similarly dead. … PATCO was dominated by Vietnam War-era veterans who’d learned air traffic control in the military and were one of a vanishingly small number of unions to endorse Reagan in 1980 … It’s easy to imagine strikers expressing the same sentiments as a Trump voter who famously lamented, “I thought he was going to do good things. He’s not hurting the people he needs to be hurting.”

Yes, big unions in relatively high paid critical services trades tend to be extremely selfish. They can’t be given blackmail control. However, ATC work is extremely stressful and should be compensated as such.

Looks like Reagan didn’t have good negotiating skills at that point. Barring the workers from ever working again seems vindictive, some kind of revenge mentality. It’s very possible that Reagan had onset Alzheirmer’s at that point (he was diagnosed 5 years after he left the presidency).

What you quoted is the narrative; one side of the story written in a tearjerker manner.

If you are curious about the larger picture, you can watch the press conference on YouTube titled “President Reagan’s Remarks on the Air Traffic Controllers Strike in Rose Garden, August 3, 1981”.

@Nacho Bigly Libre

What I quoted was facts, not narrative.

I have no need to watch Reagan practicing his second rate acting skills. I lived through that era and paid attention to what was going on in the “big picture.”

You seem to be adamant on being a drifter and not seek the truth.

Let me list down the facts for you and those who get triggered by him:

– ATC union had agreed to the terms and then reneged.

– ATC union wanted a far higher package, which they themselves didn’t believe was possible or practical.

– ATC members had signed and taken oath not to strike, else get fired.

– President clarified all that and gave a 48 hour notice. Only then fired the violaters.

And the big picture? You mean the spectacular reversal of American dull fortunes and start of decades long prosperity?

@Nacho Bigly Libre

“decade of long prosperity” for who?

I’m not triggered by Reagan. Reaganomics destroyed the middle class. This is a fact. Check out how the middle class has done since Reagan. Trickle down is a joke. If you look at a chart of the income growth since Reagan, poor and middle class income grown has tanked, while the top 1% has skyrocketed.

Also: “Wealth Gap in US Between Blacks and Whites Tripled Since Reagan”

If you want to become educated on FACTS related America’s history of violently crushing unions, watch the documentary “Plutocracy” (Metanoia Films). Otherwise, enjoy your echo chamber.

I have no empathy for ATC, Teamsters, etc. But it’s obvious that breaking the backs of unions, an American oligarch tradition promoted in the Reagan era, has not benefitted anyone but the filthy rich.

You mentioned you have no desire to watch that short video – so I assumed that you get triggered by him. I know some who do.

“Trickle down” was not his theory or any theory – that’s a lie; a politically charged term, not an economic term. But still gets repeated to-date in the echo chamber. Feel free to live there, just don’t claim that’s the truth.

Can you explain what you mean by middle class was destroyed? What metric are you using here? What objective data are you citing? Does your ‘since Reagan’ include 2021? Middle class was destroyed by NAFTA and a nonstop outsourcing of manufacturing capability in the 21st century.

“Income inequality” exists everywhere – it’s far worse it Communist and socialist nations, but hardly gets highlighted.

People or households who are in the 1% (or 10%) keeps changing with age and income mobility, that’s a whole big tangential topic.

Nacho: “Can you explain what you mean by middle class was destroyed? What metric are you using here?”

Obviously, I referred to a graph showing a metric comparing tanking increases of poor/middle class income compared with skyrocketing 99.9 percentile income. It’s not hard to do a web search on that (“middle class since Reagan”) Too lazy to find it?

Reagan’s policies: economic growth would occur when marginal tax rates were low enough to cause investment, which would then lead to higher employment and wages. Critics labeled this “trickle-down economics” (tax policies that benefit the wealthy will supposedly “trickle-down” to the poor).

Reagan’s trickle-down economic policies included

* freezing the minimum wage at $3.35 an hour

* slashing federal assistance to local governments by 60%

* cutting public housing and Section 8 rent subsidies in half

* axing antipoverty Community Devel Block Grant program

* Reagan’s 1981 cut in the top tax rate on unearned income, reducing max capital gains rate to 20 percent; later set tax rates on capital gains at the same level as the rates on ordinary income like salaries and wages (both topping out at 28 percent)

* raising taxes eleven times throughout his presidency, all in the name of fiscal responsibility.

But most of all, the filthy rich kept their money, stashing it overseas. And the industrial oligarchs moved their companies overseas. You can easily find metrics on that too.

“Reagan fired 11,345 striking air traffic controllers….”

To me, that was the moment everything changed in labor. Our small union was crushed systematically afterward. Every company in the states seized the moment and we can see the results to this day the downward projectory of labor compensation and benefits through the years.

Why did you delete my response?

Because you got into an endless tit-for-tat argument, and this argument is OVER. I let it drag on far too long.

As a senior commenter, I have to update the kellogg situation. As the company decided to hire scabs, their recruitment website is down. Reddit apes (not the wallstreet bet guys) wrote a bot that brought the job application site down. Even NPR wrote an article on the situation.

Ford workers versus police situation comes to my mind.

Every Union in the country is considering striking…and come 2022, it will be a common news item.

Bits vs Bullets……nice……thanks for the info.

They should call this malware “Woody”.

I’ve had enough of our 40 year New Gilded Age.

Boycott Kellogg’s.

Totally agree

We’ve been boycotting them since our kids grew up….. about 25 years. Rice Krispy treats don’t have much of a place on our menu.

A hallmark of banana republics is rampant inflation.

But that probably wouldn’t properly obfuscate the issue of who’s to blame.

If you are on social security or getting close to being on it, look up Rep. Larson’s proposal to revamp it. It includes a change in the index to cpi-e and other adjustments.

Petunia,

CPI-E rose only 6.2% in November, compared to CPI-W 7.6% (CPI-W is used for COLAs). Read my article about CPI-E. I wrote it in response to Larson’s proposal. I compare CPI-E to CPI-W. It’s not a cure-all. People need to know what’s going on:

https://wolfstreet.com/2021/12/06/social-security-reform-what-if-cola-calculations-shift-from-cpi-w-to-cpi-e/

I don’t expect the index change to be great for beneficiaries, but I brought it up because it pertains to your article. There are other provisions in the bill I am more interested in, liking rising the minimum benefit and survivor benefits.

Plus I want to point out the potential changes to anybody retired or on the brink of it. People can decide to support it or not. I’m supporting it so far.

Yes. Thanks. And every little thing helps, and switching COLAs to CPI-E might help over the decades by a tiny bit. But there are times when it’s really bad for retirees. I’m not opposed to CPI-E COLAs. But it’s not as clear-cut an improvement as it’s being pitched.

“I don’t expect the index change to be great for beneficiaries”

Boskin Commission (1995)

“Its final report, titled “Toward A More Accurate Measure Of The Cost Of Living” and issued on December 4, 1996, concluded that the CPI overstated inflation by about 1.1 percentage points per year in 1996 and about 1.3 percentage points prior to 1996.

The report was important because inflation, as calculated by the Bureau of Labor Statistics, is used to index the annual payment increases in Social Security and other retirement and compensation programs. This implied that the federal budget had increased by more than it should have, and that projections of future budget deficits were too large. The original report calculated that the overstatement of inflation would add $148 billion to the deficit and $691 billion to the national debt by 2006.”

It was a 50/50 chance that they’d find that the CPI figure was too low. But, MIRACULOUSLY, they “found” exactly what they wanted, that it was too high.

In “accurately” measuring what is impossible to measure accurately, and which has a strong political incentive to NOT measure accurately because of the need to slowly inflate away promised benefits which cannot be economically maintained, one can come up with anything.

It’s ALL a big farce and always has been.

I was waiting for this report and sent it off to my friends and family. Thanks Wolf!

WE REQUEST YOU COVER THE ADMINISTRATION IN A MORE POSITIVE LIGHT.

we have the strongest economy, perhaps I have ever seen

The fact that we only have one kind of inflation, though, is tremendous news

I trust in science, the science of our great ph//arma companies, and they haven’t let us down at all. They won’t in the future, not in their DNA

lmao

I laugh out loud every time I read your name.

Ha Ha! Good one. Black humor will save the human race. Or not.

FYI I failed to attribute the italicized quotes to Jim C from MSDNC (I read his words, didn’t watch), in case anyone didn’t catch that.

It sounds very Orwellian…!

I would be afraid to be caught quoting Jimmy the Con also.

Unbelievable how he is still on – “Bear Stearns is [still[ fine.”

I did once have a friend who watched him. He liked the horn honking and bells and whistles and sirens. But I think he just missed the circus clown from when he was a kid.

Inflation has been happening for several years….

We new it would spike as factories/companies started coming back to the US, and honestly, we were willing to except it for the greater good…. My job materials would see spikes every time a Tariff was put in place (last administration)… we anticipated it and absorbed the cost. IMHO, it was somewhat controlled and manageable…

This is different…..

Glad too say I’m hanging it up, but the next generation of contractors/businesses owners are gonna have a hard time staying ahead of this madness…

‘Hottest U.S. inflation rate in almost 40 years brings sigh of relief in some corners of financial markets’

quote from popular finance site.

That is some tortured, beaten, quartered and drawn logic behind that headline.

I saw that headline too and went Hmmm

Manufacturing has to come back to our shores but we can’t compete on a global economy when third world countries pay poverty wages and no benefits seems simple break system start over ,peons will work at same rate or starve happened before history repeats

ron:

Just not going to happen. A big explosive arrow was shot into America’s economy when NAFTA and “globalization” were embraced (thru so much propaganda).

“American labor must be crushed to a world level playing field for American businesses can again compete in world (labor) markets”.

That was objective of the Reagan incoming admin. and we are living with the results.

I saw all this coming way back in the 1970’s and 80’s. What we were (and are still doing) doing to smaller vulnerable countries economically, politically and militarily thru so many “off the books” endeavors would someday have to come back and bite America in the A##. And it has.

We are in a totally new world for the “commons” which includes the declining middle class here which was fought and bled for by organized labor.

Adam Smith appropriately stated (which is never quoted) that, (Paraphrasing) “Can’t allow free market capitalism to be dominant or it will crush all of society”.

It’s happening whether anyone sees it or not.

Well said….there are many other negative things about that senile B actor’s puppet masters and their agendas you left out, but he was picked to begin a really really nasty program for this country, and it was DONE.

Sierra/NBay +1. (Reaganistas the resurgent reactionaries aiming for a return to the Gilded Age by reversing and extirpating economic/labor changes beginning with the Trust-Busters and extending through the New Deal/post-WW2 eras).

Perfection is never achievable, but improvement always is…

may we all find a better day.

doug

They try to see ‘silver’ linning in every negative or bearish news on the mkts. Guess that’s their defined job by their masters! Reality matters little.

But hey, when the U.S. can out-do Mexico’s inflation rate, it’s a sigh of relief that it’s ok to go buy another $90k pick-up.

the good thing about all of this is it basically lays waste to the argument that we can print with impunity because we’re the reserve currency. now, it’s very clear that we’re not immune to the forces that have been with us since the beginning of time. if there is a new crisis, it won’t be as easy, politically to just do more qe, as people are saying will happen, as its effects are plain for everyone to see.

As a fake woke person and confirmed moron I must object to the use of the word “bitch”.

/s Alexandria Ocasio-Cortez

AOC is not a fake woke person, she is the real thing.

Correctamondo maximus.

+1

+1, she is one of a kind

Yogi Berra might say that they are all fake, even the authentic ones.

WS…hafta admit, your comment slipped by me the first time…..yeah…+1000

+1000

Yeah. It’s all her fault. lol

Ok, Ok…..so I get how “woke” is used.

So my question is what is a “phony rugged individual” called?

And don’t say their aren’t any.

Usually called ”victim” of something similar nby.

They are the ones the coasties rescue regularly, even in the bay(s),,, and the forest service folks rescue regularly,,, and the ones that end up in hospital regularly, etc., etc.

In the field doing the actual hands on manual labor, skilled and otherwise, they are usually called, ”quitter(s)” after a day or less on the job when they realize construction field work is just not the same ”work” as sitting in the AC at a computer terminal.

Will always remember 60 folks showing up at a job site by 0800 in ’81, after one ad in the SF Chron; 12 were left by noon!

“So my question is what is a “phony rugged individual” called?”

Poseur

She is neither fake woke nor a moron, and she may become a big nightmare. At least she didn’t work for the FED —– that’s one positive thing.

You once mentioned Proteomics as the “future”. I assume you meant for investors……so here’s another -omics for you and sunny and any other investor-docs here at this website….I say it’s more all inclusive, IMHO, kinda like a pre-ETF for “drug discovery” pipelines.

I think this cranking out of “magic bullets” stuff is way out of hand, even physically damaging to many. But it is easy to get richer on, if that’s your bag.

file:///Users/network/Desktop/Clear%20stuff%20%20quotes,for%20writing/GRANTONOMICS%20Website%20copy%202.webarchive

You can find it if you want….blue brings moderation.

In 1981 U.S. inflation was 10%, the unemployment rate was 8.5%. In 1982 the unemployment rate was 10%. People searched dumpsters for food.

After Evergrande, China printed money. Chinese fresh vegetable prices surged 30% over the past 12 months.

China will not bail out many property developers ,in default bond holders take a bath worldwide problem there go our pensions there lying it’s systemic

Exactly. I’ve been pounding the table on this for months. Nobody wants to hear it until it’s too late.

The World’s Climate is changing. It is getting Colder and the Chinese State has 3,000 years of history of this cycle.

Prices for food are going to go up dramatically, as more and more countries ban export of food. Inflation is just an additional factor, but you can’t inflate food when Meridional Jet Stream Artic blasts extend down to the growing regions.

Pay attention to this Climate Change.

Nah, not scared.

I live through climate change every season.

Poseur

Why whatever are you talking about Wolf? I just saw a report on CNN detailing for almost four minutes how hunky-dory everything is with the economy. The CNN newsreader even prefaced the report by saying how much she loves bringing out these “good news stories on the economy.”

The title (which I cannot make up): “From gas prices to supply chains: Signs of improvement for the US economy”

Looks like the Security Complex /Mic MSM is following marching orders given to them from the White House. The orders were simple just like in the old dead USSR. Do not speak bad comrade about our heroic leaders. All is well. All that is missing now is for the Powell speech about his Tool Kit then it’s nappy time. Inflation does not matter to Mrs Magoo or Jerome or the Connected. Inflation is the problem of the scurrying little piss ants.

I have an ABC I have and XYZ I have a PDQ I have a GBH

that’s propaganda even goebbels would be proud of

Was that reporter’s name Stupid Morone? I’ve read her articles before and I just love them for their humor.

Very good,

As we deplete world resources ,scarcity creates greater demand,plus China gamed the system buying up copper iron ore and many other commodities while we argue over nonsense politicians looks like a failed republic

It is the job of Congress to provide the US Gov’t financial guidance, and they won’t do anything more than try to pass a higher debt ceiling. Forcing the Gov’t (and consumers) to live within a balanced budget is something nobody has even suggested in over 20 years. Trying to force the Gov’t do so would cause the greatest social unrest ever, even worse than the 1860’s.

They have to keep printing money. This country depends on entitlements and subsidies to keep running. Bread and circuses…

20 years you say? Would that perhaps have been because of a certain president launching certain wars without any certain way to pay for it, just a mandate that the domestic population shouldn’t have to feel any negative impact from these conflicts?

That war that saw the U.S. government load up on debt to pay out to a bevy of private contractors could reap the benefits, contractors whom were COMPLETELY unrelated parties and had no connections to policy makers?

Didn’t a certain Presidential candidate as an owner and investor of a certain Private Equity firm do the same thing? Got rich by buying up public companies, loading them with debt, and reaping the gains?

So basically you’re saying that when the Congress doesn’t do it’s job it’s okay for them to continue not doing their job? And we should point the finger at the President? Because, for the large majority of the time this countries been in existence the President has not been of the same party as the Congressional majority.

OK. Let’s go with that. This is all Joe Biden’s fault.

Let’s also note that WWI, WWII, The Korean War, and Vietnam were wars the USA got involved in where a single party (the Democrats) had the Presidency and majorities in the Congress and Senate. In fact you have to go all the way back to the Civil War to find a Republican supermajority at the start of a conflict, and in that case it’s because the Dems all committed treason and went South. And every war has loaded the country up (all the countries) with debt, and made contractors got rich.

A war about every 10 years keeps things ginning… no matter who is the majority….

At least since the late 1800s….

A war every 10 years or so keeps a ”blooded cadre” operating military forces; this was very clear policy after USA was caught almost completely unprepared for WW1 and WW2.

Explained to me in early ’70s by former WW2 US Army Medical Officer who was still friends with folks who had stayed in and become top generals, etc.

Don’t think that policy has changed at all since.

“,,,the domestic population shouldn’t have to feel any negative impact from these conflicts?” — The elephant in the room!

GWB “Go shopping or the trrist win.” OBL must be laughing his butt off – David to the US Goliath…

To quote Bender Bending Rodriguez – “well, we’re boned!”

What’s truly astounding is how bonds reacted to today’s CPI release: prices up, yields down.

Could it be the bond market is looking beyond current inflation and is already pricing in a deflationary asset price collapse on the horizon?

Why should one own junk bonds with a current negative after-inflation yield of 3 to 4 percent and the potential of much much bigger negative returns in a meltdown when purchasing T-bills gives you an assured negative after-inflation return of 5 to 7 percent?

Bond mutual fund performance is relative. For years the junk- and high-grade bond owners have outperformed the T-bill owners, but with stock indices (by some metrics) higher than they were in 1999 and 1929 for how much longer?

There are no problems I can see . . . as long as the USD doesn’t collapse (more than it already has vs cryptos).

For the bond market to react to inflation, the Fed would have to not only stop buying bonds (it’s still adding $105 billion a month), but also allow maturing bonds to roll off its balance sheet without replacement. That would free up the bond market to react over time.

Our money is bailing out china

The Fed isn’t buying junk and corporate bonds.

Why are people holding corporate bonds yielding 1% when inflation is 7% ?

because every other bond is judged against treasury bills, a “safe” investment. the spread is considered a premium over treasury. if the fed suppresses treasury bills by buying them, the spread can remain the same while the overall rates drop.

Wolf,

The inflation number was hot – but given the rapid drop in yields in the minutes after the report – it was clear that while the number was higher than expected….it did not beat expectations as much as some had expected.

Also note that the news today concerning Omicron is not as uniformly good as it was earlier in the week. That would tend to keep yields in check, also.

There’s also the fact that other central banks around the world are also printing like crazy, driving their yields down. All the European & Japanese investors getting 0% on their government bonds move their money to US treasuries.

The Bank of Japan has stopped printing a few months ago.

https://wolfstreet.com/2021/11/03/monstrous-money-printer-bank-of-japan-stopped-printing-money-started-unloading-government-securities/

The ECB will let its massive pandemic bond buying program expire early next year, as scheduled. That said, the ECB is the dovish-est central bank out there.

minor edit Wolf –

….. the FED would have to stop creating money to buy bonds

That’s exactly what’s happening. The bond guys expect the Fed to trash the markets and send us into recession – just like they always do.

A recession is about the only thing that will cure this type of massive inflation.

The wealth “created” is not backed by real wealth creation. It needs to recede. Asset prices falling will hurt the mega rich and help the bottom 25%.

Stopping the money creation is about the only thing that will cure this type of inflation ,,,,,,,,,,,,,,,,,,,,,,,,,, eventually. It will take a long time, with recession along the way.

Mr. Richter:

+1000

Help defeat inflation, hold a massive garage sale, or just give away stuff you’ll never use, to reduce retail sales.

Watched a Jim Rogers interview. He said when he was on Wall Street you got out of the markets on the third Fed interest rate hike. Will be interesting if that works this time.

Can we all agree that the reason why the FED continues to keep rates near zero is to keep the treasury’s borrowing costs low? With the annual deficits we’re expecting over the next 10 years, does anyone expect the FED to let rates move more than 1-2% higher? They can’t. We don’t payoff debt. We just roll it over. And if we start rolling over trillions of dollars in debt at 4-5% borrowing costs, we’re sunk.

So what you’re saying is that they are going to let inflation destroy the country. Got it.

Hyperinflation will destroy the country and the rest of the world since the U.S. dollar is the world’s reserve currency. Until something supplants the U.S. dollar as the world’s reserve currency hyperinflation will run rampant everywhere worldwide.

@The Real Tony

It won’t run wild in China. Aside from dollar denominated bonds – which it’s own financial institutions largely don’t touch – they have no exposure to the dollar. Ditto Russia. Ditto Iran. You get the picture.

China can still produce stuff. Even if savings are wiped out by a currency event – they can recover. Enviable.

And the vacuum created by the dollars collapse will be nicely filled by the Yuan.

Real long term economic growth in US is about 2%. You can’t live under the illusion of assets growing a lot faster than real economy for only so long.

We’re sunk already.

@J

“Can we all agree that the reason why the FED continues to keep rates near zero is to keep the treasury’s borrowing costs low?”

Partially, yes, but another, maybe bigger, factor is the value of balance sheet collateral for banks and corporates. If interest rates go up paper values go down, that means liabilities might exceed assets which is the ‘polite’ definition of stuffed.

The EU would glow white hot with all the melting ‘collateral ???’ if that happened.

Good point Auldyin.

Higher interest rates are a double edged sword in regards to the USA national debt, European Union debt, and Fortune 500 Corporate debt.

I keep my eye on the 3 Year Treasury Yield for the above reasons. Today’s close on 3 Year = 0.98%.

Jay

” They can’t.”

They must.

The fake low rates allow the rampant creation of debt, even promote and subsidize the creation of debt.

To allow it to continue will…….follow me here……..perpetuate more of same.

The CAUSE can not be the SOLUTION.

The solution must be higher rates to put a REAL cost to debt creation.

Historicus:

Either we return to some good economic basics that return to “market to market” values, or resort to the “means” of historical economic behaviour we are finished as a nation.

The whole American economy is now based on false premises that anti historical. The FED and the political economic system here has painted itself into a corner since the 2008 crash and what they used as tools to support the failures.

This will continue until it can’t.

Why do you think that both sides sink so much money into the military?

China and Russia are testing fractured America’s resolve.A weak President and a dis functional split Congress make moves ripe for opportunity.How is it they say?

Don’t let a disaster go to waste.

Plenty more inflation coming.

I am prepping our annual price change for 2022. It’s going to be a whopper. Our company has not fully kept pace with all the cost increases in 2021, and we have no choice but to raise prices again for 2022 after five increases in 2021. From chats with others in the industry, it won’t jus be us.

So if the social security COLA goes up by 10%, does that mean it is retroactively bankrupt?

Asking for an old friend who may have to retroactively die.

Speaking of which, just to be totally dark:

are the excess deaths from Covid going to affect Social security’s long term solvency? I always assumed it would be bankrupt in 25ish years even if i do make it to 65

Shells,

There are two opposing factors for SS: excess deaths of retirees and near-retirees reduce benefit payments, so that would help SS; but millions of people still not working lower the contributions, and that’s hurting the inflow. It’s the second that is the much bigger factor.

https://wolfstreet.com/2021/11/11/status-of-social-security-and-the-trust-fund-fiscal-2021-beware-of-vicious-dog/

Omega Variant

So what is Weimar Boy Powell doing about it? He’s PRINTING “OUT THE WAZOO” (thanks, Wolf). This out-of-control megalomaniac is destroying the country in real time. Has anybody thought to publicly ask this destroyer of human beings wtf he is doing?

“Chairman Powell – we have the highest inflation reading in 40 years, and yet you’re still printing. Why are you doing that?”

CRICKETS.

Because I love America!! I am ushering in a great era of prosperity!!!! Every year gdp will be higher than the year before!!!! You will have more dollars in your pockets!!!! There will be more and more zeros at the end of your account balance!!!! We are all getting richer!!!!

Peter Schiff was on the local radio here and said some things I agree with 100%. J Powell will not be able to tighten to the degree that he wants to in order to tame the inflation monster. The current Biden administration, who didn’t really want to re-appoint Powell is getting ready to appoint “Woke” Federal reserve governors to the vacant posts on the Fed. Their priority will not be price stability nor control of the money supply. Their priority will be to mitigate climate change, and promote social justice and diversity. They will continue to monetize the gigantic federal deficits that are backed into the cake already and the new bigger ones that will result if the BBB bill passes. Inflation which is now 15% to 20% right now if you used the same way to calculate the CPI as was done in 1981 will accelerate to 20 to 25% in the next year.

Fed to announce new Mission Statement

“It is the Federal Reserve’s actions, as a central bank, to achieve these goals specified by Congress: promote unemployment by providing cheap money to the federal government to dole out and encourage idleness, promote inflation, punish savers and holders of dollars, and promote record low long term interest rates so as to facilitate the pulling of wealth forward from the future generations of the United States””

Fed’s mission statement contd

Add ” keep the low interest rates on 10year bonds at 13% below the real rate of inflation” to promote cash out refinances and using the house as an ATM machine just like Greenspan did in 2003/2004. If the housing becomes unaffordable then we will loosen lending requirements and encourage people with bad credit to enter the housing market as “everyone should own a home” as George Bush once said just before the housing crash. If the banks lose money on these mortgages then the Fed is standing ready to bail out all the lenders who made these loans, and assure that their CEOS’ can retire with a golden parachute. The hell with the now homeowners who get wiped out. They were just lemmings who made a bad investment.

“everyone should own a home” as George Bush once said

————————————–

what he meant was that everyone should take out a large loan …

to buy a home ….. push up demand for and prices of the homes ….. and become debt slaves ………. with funny money created under the auspices of the FED to the benefit of funny money lenders who create dollars to loan ……….

and climate stuff and that

That scumbag J Powell never cared about taming inflation. His priority was never price stability nor controlling money supply in any way other to massively increase it. The proof is in the pudding. Don’t ignore the obvious.

Democrats spent the past year screaming that inflation was transitory, caused by supply chain disruptions that would soon resolve, and most importantly, fearmongering over inflation was a Republican talking point to derail their spending agenda.

Many Democrats continue to parrot these talking points today. It’s why the party is now stuck between a rock & a hard place: they either do a U-turn on inflation being a serious problem, lowering their credibility, or they double down on their talking points while sounding increasingly out of touch to ordinary Americans.

Um, Powell was the first to say that inflation was transitory and he’s a Republican.

Nice try, though.

Except Jen P, with majors in English and Sociology, mouthpiece and press secretary for the administration, ran with bozo claims.

Read her Orwellian double-speak claims on inflation.

Also:

‘False’: Jen Psaki Gets Fact Checked Over Inflation Claim

so did yellen. powell isn’t a republican. he’s not a politician at all. he’s just an idiot.

JW – Powell wasn’t appointed because of his political affiliation and willingness to abide? Got it…

JP is set up as the fall guy if anything blows up. Plain and simple.

I heard Steve Mnucian hand picked J Powell for Fed chief, Mnucian use to work for George Soros. Why the hell didn’t Trump check out this connection before he appointed him?? This has to be the worst appointment ever made by any President in the history of the United States.

Republicans are the same as Democrats. Only the sales pitch is different. Wake up.

It’s like arguing over Coke v Pepsi, when what we really need is a stiff drink.

Cheers.

Actually, people will probably go to Smirnoff vs. Grey Goose or some bollocks just to have a conflict over.

Bobber, arguing with yourself?

bobber:

Castor Oil!

Things would have been same of we have a Republican President !

Wolf, do you not think the FED knows exactly what is going on and proceeding with their own agenda?

It’s incomprehensible that people would reach the pinnacle of power in this cutthroat field and not be completely cognicent of the actual ramifications of their actions.

dishonest,

This massive bout of inflation caught even me by surprise. But in early 2021, I already knew something big was coming because I was seeing the action in new and used vehicles — remember, the ultimate discretionary purchase. People and dealers were paying crazy prices. That was new.

But the Fed doesn’t pay attention to what is happening at auto auctions and dealer lots. They didn’t see the shift in the inflationary mindsets.

And also, they had deluded themselves into thinking that QE and 0% would never create inflation because over the past 13 years in the US and the EU and over the past 20+ years in Japan, they hadn’t created inflation. This gave them a false sense of security that is now getting rattled. This is a paradigm shift.

The Fed is staffed with group-think economists. If you’re not a group-think economist, you don’t get a job at the Fed. There were plenty of economists that warned about this, but they’re not working at the Fed.

dishonest

They were too busy getting rich by trading in their own investment accounts, using the inside information that they were aware of to pay any attention to what was going on with inflation and the ramifications of their flawed policies. History will not look kindly on this group of misfits that have wrecked the financial integrity of this country for many years to come.

Two Economists on opposite sides of the aisle told anyone who would listen that the Fed was doing too much. Larry Summer’s said it was basic arithmetic and Steve Hanke predicted the year end inflation rate.

My guess is the Fed knows what they are doing. It’s not an accident.

Who hijacked the Fed?

I have an idea…….

Finding a new reality or new development emerging from sets of data is often surprising because it consists of something you couldnt have predicted when you started looking at the data.

As they say, the truth is stranger than fiction.

“over the past 13 years in the US and the EU and over the past 20+ years in Japan, they hadn’t created inflation.”

The two big reasons, as explained by Greenspan himself, were worker insecurity and China acting as the great disinflator. As we’re seeing now, both of these disinflationary forces are being unwound globally.

The only way inflation would be manageable in this environment would be massive state investment into increasing supply. For some reason, FedGov is happy to drop hundreds of billions into semiconductor development, but not affordable housing or increasing food stock.

Wolf said: “And also, they had deluded themselves into thinking that QE and 0% would never create inflation because over the past 13 years in the US and the EU and over the past 20+ years in Japan, they hadn’t created inflation.”

——————————————

There has been an expanding money supply (inflation 1) and rising prices (inflation 2) for many, many years.

The only delusion is the one we buy into via buying into and expanding propaganda. The FED’s scumbag moves have been obvious.

I don’t believe that there has been no inflation in the last 13 years for the last 13 years.

The cost of almost all necessities have gone up quite a lot for last 13 years but not properly registered in manipulated government inflation metrics.

It reminds me of the monkey trying to put the cork back in the elephant’s behind. Forgot to mention that the elephant had diarrhea…. The circus must go on.

The Federal Reserve is STILL printing $105 billion per month to buy treasuries and MBS.