Buy High, Don’t Buy Low. Prices are sky-high and but companies are buying them back like never before.

By Wolf Richter for WOLF STREET.

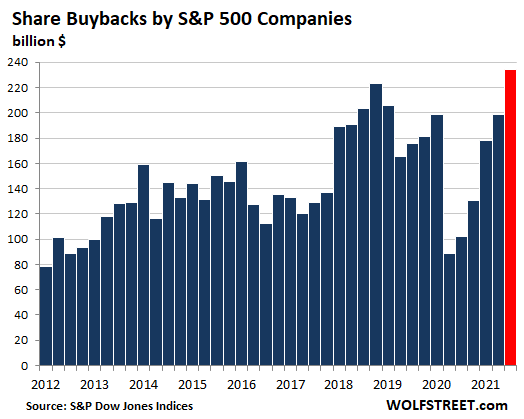

Combined, but heavily concentrated at the top, the companies in the S&P 500 Index bought back a record of $234.5 billion of their own shares in Q3 2021, according to preliminary estimates by S&P Dow Jones Indices, blowing by the previous record of $223 billion in Q4 2018. And there’s more coming, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, cited by the Wall Street Journal: Buybacks in Q4 would set a new record of $236 billion, he said.

This comes on the heels of a proposed tax of 1% on share buybacks in the “Build Back Better” bill that passed the House on November 19 and is now hung up in the Senate, where the tax hasn’t generated the storm of opposition that other measures in the bill have.

Buy high. Don’t buy low.

These buybacks come after share prices have surged in a historic manner, following a historically reckless money-printing binge by the Fed and other central banks, and by historically reckless interest rate repression in face of red-hot and worsening inflation.

But note how buybacks collapsed to $89 billion in Q2 2020 and to $102 billion in Q3 2020, after share prices had plunged. This was based on the corporate strategy of buying high to drive up share prices even further when they’re already high, and not buying when share prices are low.

When prices are high, this is also when insiders are dumping their shares, as they’re now doing, and it’s that much more important for companies to buy back those shares that insiders are dumping.

How much difference would 1% in taxes make?

Microsoft announced in September that its board approved another round of $60 billion in share buybacks. A 1% tax on it would cost Microsoft $600 million – not huge for a company the size of Microsoft. But not negligible either.

But if the company can get the buybacks done before the tax becomes effective, if it becomes effective, it would save $600 million while re-absorbing the shares that its executives are dumping hand-over-fist.

And those buybacks work wonderfully when executives themselves are dumping like there’s no tomorrow: For example on the Wednesday before Thanksgiving, Microsoft CEO Satya Nadella dumped over 50% of his Microsoft stock in numerous trades in just one day. But the stock barely budged because Microsoft itself was busy buying back shares, and by Friday December 10, shares closed near the pre-dump high.

What does it mean when executives are dumping their shares while the company is buying them back, after a huge parabolic run-up in share prices, fueled by the greatest money-printing binge ever and by interest rate repression, which are now heading into trouble under the withering bout of inflation that those monetary policies have fueled? That was a rhetorical question.

Since the beginning of 2012, the S&P 500 companies have bought back nearly $5.68 trillion of their own shares. A 1% tax would amount to $56.8 billion in additional costs to them.

Over the past four quarters, S&P 500 companies bought back $742 billion of their own shares. A 1% tax would amount to $7.2 billion in additional costs. Not huge. But much of it would be concentrated on the 20 companies that are buying back the largest amount in shares.

New entries into the buyback hall of fame.

Hertz Global Holdings – which emerged from bankruptcy this year and then held an IPO to give the Private Equity firms that had bought it out of bankruptcy a way to unload their stakes – announced in November that it would buy back up $2 billion of its shares, even as the PE firms are unloading their stakes.

This announcement followed other announcements designed to manipulate up its share price so that these stakeholders could make more money when they dump their shares.

The flashiest trick was the announcement on October 25, when Hertz said that it had made a deal with Tesla to buy 100,000 Teslas, that caused its shares to jump over 10%. At the time, I called the announcement a “Propaganda Coup for Hertz’s ‘Selling Shareholders’ & for Tesla.” A week later, Musk tweeted that there was no deal, as “no contract has been signed yet.”

Hertz will do anything to manipulate up its share price to allow the “selling shareholders,” as the group of PE firms are called, to maximize their profits as they’re dumping their shares. And share prices have sagged despite these shenanigans, but would have sagged a lot more without them, from the post-Tesla announcement closing high of $35 a share to $24.92 on Friday.

Another new entry into the mega-share buyback clique is Dell, which announced in September that it would buy back $5 billion of its own shares.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

why not do buybacks? they can do so with money borrowed for free, and if things fall apart, they can get a taxpayer bailout! win win, for everyone except the taxpayer.

Exactly, just look at Boeing.

1% tax – woohoo

got them shaking in boots

So much for the vaunted ‘job creators’.

They’d have you believe suppliers are the only job creators, but consumers are job creators as well. You can’t have supply without demand, and vice versa. Business propaganda over the past 30 years hasn’t done us any favors.

Yeah, that’s really the guts of the whole thing, Apple, plus turning people into “consumers” of whatever shit they invent, and then selling it to them. Plus looking down on those who can’t consume, or consume as much.

If they can’t consume at all, they have COMPLETELY failed as human beings and should be treated as scum.

And of course, viewing it all as a short term game, trashing the planet as we go.

Growth for growth’s sake is the ideology of a cancer cell.

We have come a long long way since the “corporation” was invented, but probably won’t last much longer.

NBay, that is rather gloomy!!

The good news…… if we destroy ourselves planet earth will live on. Probably be healthier too. I saw a special on how nature made a great comeback with the pandemic lockdown, it was amazing actually.

Our hubris as a species is bewildering

Yeah, Dave…I’m was usually screaming for downsizing, and a MASSIVE green new industry, conservation, a constitutional maximum individual wealth, and such.

But it seems nobody wants to give an inch…even if they are in a position to give a hundred miles…some even thousands. Mainly boomers, which makes me REALLY ashamed to be one.

BTW, the single celled set, which were here at least 3 billion years before ANY multi-cell critters (we are only 1/2B or so) are still the ABSOLUTE “winners” in the life game….measured by numbers and also in biomass….far and away.

Humans, and even vertebrates, are evolutionary “curiosities”……types seem to come and go….hardly worth the special attention of all these cosmic deities we have invented.

We are totally on our own when it comes to surviving as a species, and doing a piss-poor job of it. We came from chimps 6-7 M years ago who gradually developed bipedalism and large brains to specialize in social cooperation and especially rock throwing…delivering pain and physical damage at a distance was our specialty…all other animals had developed to deliver it during actual contact. Big advantage…and of course the step was made from the best throwing rocks to hand axes and we were off and running (in geo time).

Too hard to be a cheerleader among mostly bitchy old wealthy farts, or wealthy and wannabe wealthier types…it’s a sick game with no boundaries.

Side note;

When corporations with all their legal protections for the major players were first invented, one could ONLY sell his stock back to the corporation.

Turning them into poker chips (and all the gambling laws/games that followed) REALLY opened a can of worms.

Taxpayers are tired of this nonsense our kids know there,s no future for them

Are they tired of it? Never underestimate the stupidity of the American public.

Yes, we are. Thus the low birthrates.

There are those who want the lazy way to make money. Off of others.

So, they buy “stock” in a company and expect the owners and managers to make money for them.

Really?

Why should they?

I remember reading about Henry Ford when he shut down the first company he was involved in. He hated others making money off of him. So he stopped, let the company fail, and started the company we know today.

He went home to his wife and said (to the effect): “It is all ours now”.

Henry Ford first worked at the Cadillac Automobile Company (after working for Thomas Edison of course).

They still build Cadillacs today!

that’s why “outsiders” like trump, aoc, bernie, and so forth have gotten traction. people are tired of the “establishment” which isn’t working for them.

for what it’s worth, i don’t think the above people are the answers. they’re just a symptom of people being fed up.

“i don’t think the above people are the answers”

Trump didn’t do a fraction of what he could have and what little he did was in a large part obstructed by the actual government which is the vast, unelected administrative state and lobbyists.

At least he temporarily reduced the influx of future wards of the state although he could have eliminated that entirely and caused a mass emigration of those who entered illegally without a silly wall simply by a simple change to one paragraph intentionally set out from the rest of the text in “8 U.S. Code § 1324a – Unlawful employment of aliens,” set out, I assume, for emphasis so that potential employers wouldn’t miss noticing their “avoid jail” excuse for the unlawful hiring of aliens.

See if you can find the loophole as I did. NOTE that the POTUS is not only the sole person to be explicitly designated within the code to make certain that the code is effective, but also the one designated to make changes if it isn’t.

Of course, if he’d done that, the US would have lost a very large portion of its hardest working, underpaid manual labor force whose income supplements and medical care are paid for by taxpayers and not their employers.

You are not wrong, but left out the first outsider elected, which was Obama. And we are still fed up.

I’m curious what makes Obama the “first outsider”?

And I’m beginning to think you will always be “fed up” until you are making and spending whatever it was you used to “make and spend”…or maybe even more.

Taxpayers are:

1) Insignificant in comparsion to the FIRE economy,

2) Mostly dum-dums, who will always act against their own interests,

3) Totally useless in terms of getting nice things for an ambitious politician.

Politicians know this and prioritise who they represent!

My view is all this manipulation is completely illegal. It is the same as those who used to buy control over a commodity industry in order to pump up prices. Reminds me of the old ‘cornering the market,’ which was ruled illegal.

Holy Sh%t. Mohammed El Erian just said: Calling inflation ‘transitory’ was ‘worst call in Fed’s history’

He recommends doubling rate of taper and 3 hikes in 22. Says Fed has to ‘regain control.’

No doubt Powell already knew that Goldman is predicting 3 in 22 but that ‘worst in history’ has got to sting. So money may not be free much longer and maybe El just pushed the first hike forward a month.

El Erian can be funny. First saw / heard of him being interviewed on Canada’s BNN biz show a few years back. He was either # 1 or 2 at Pimco, world’s biggest bond outfit. They got into the bonds of Canadian provinces and El says: ‘we like some more than others’

Oh? says host, ‘which ones don’t you like?’

El flashes a big smile: ‘If I told you that you could come here and run the money and I would be out of a job’

Which is smooth way of not saying that some would be POS without the presumption of a Federal guarantee that does not legally exist. In the last provincial election the head of Newfoundland’s opposition said he would threaten bankruptcy unless the Feds coughed up more $.

I was there in the 1970’s. The FED had options.

We had “real” interest rates that could be decreased or increased.

We did not have the horrific level of National Debt

We did not have the horrific level of Consumer Debt.

Therefore, to me, the FED is trapped. Check Mate.

If they raise rates, how are they to fund the 30 Trillion Debt?

Value of houses will go down.

All adjustable rates will eventually go up, etc.

The Stock Market will go down, and thus the value and condition of every Pension with Stock “investments ” will suffer. Hello, California.

So, they can’t do that. They can’t do anything. Raise rates and crash the market. Don’t raise rates and crash the dollar (unless all other paper printers do worse on the relative scale).

If they stop buying the junk bonds, who will?

Everything “man made” is in trouble, so it is back to nature. The reason this is on my mind is last week I came into a pleasingly large some of money (Fed notes), and I am not sure what to do with it.

Pay off my real estate or let inflation pay it off?

Pay off my real estate to protect myself and family from a Depression, which will impact my future earnings.

Buy Gold, and worry about confiscation?

Buy Silver and worry about the constant paper-Silver price manipulations?

I really am at a loss. It is easy to speculate and take, and give, advice, until you actually are risking YOUR money in YOUR account. Then it gets real.

What to do? (The amount is over $1 Million, but that is all I will say. A family member passed away……….and NOT from Covid.)

It’s awful because the result of all this Fed cheating instead of addressing the underlying problems has led to where we are now in that there is no way to confidently invest and plan with any degree of safety. Our choices are risk it all in stocks or risk it all in cash while making nothing and potentially losing from inflation.

As I see it the only thing to do is to diversify as basic as it sounds … it’s just that this isn’t the good solution it’s usually made out to be, it’s just the only way available. 25% in cash, solid or value stocks (I like NOBL), real estate/Reits, gold … nothing ingenious here it’s just that everything pretty much has “all or nothing” type risk it seems and hopefully if things fall apart then one of those things might do well enough to make up for a sizeable portion of the rest. That “all weather” portfolio Dalio came up with comes to mind although I don’t think bonds are worth owning.

Is this some kind of a set-up? Count this fish out.

You said it yourself. Back to nature. Pay off your real estate. Land is the safest place in a storm. It’s no longeŕ a question of return, but of survival.

My impression is El Erian will say anything to stay on tv.

Everyone likes attention but El M is not as needy as El T. Reporters chase some people, others are chased by reporters.

Been an NY joke for 40 years.

Typo: others chase reporters.

Kinda works either way.

Buybacks should be illegal! It serves to fatten CEO pay from inflating stock prices which determines CEO reward payout from stock performances! Does absolutely nothing in building new factories and better pay for employees!

This America, not China. If you don’t like how a company is using its cash, sell the stock. While “woke capitalism” is in vogue today, I still believe the primary goal for a company is to increase shareholder value. Obviously, if you don’t pay employees well or don’t deploy capital responsibly, your share price will suffer.

This would be a valid argument except for the whole bailouts thing.

And the whole CEO-board-cronies mutual-back-scratching thing.

And the whole meme-bubble-stock profitless-unicorns thing.

And the whole history of very profitable companies NOT paying employees well.

At a deeper level, the CEOs should be getting rewarded not for short-term share-price performance but for long-term performance.

The pay-with-options / balance-with-buybacks system is too focused on the short term and too vulnerable to corrupt manipulation.

The companies that got bailed out in 2009…

many paid out big compensations to their executives, leaving little and less for a buffer for bad times to come. They came.

There should be clawbacks for companies that drain their ‘rainy day’ fund to pay out big money to executives, then blow up.

Maybe outfits that are big swingers keep the bonuses in escrow for 3 years before dispensed to the executives. And if the company blows up before the 3 years, that escrow account empties out first.

Stop investing in US companies, problem solved. In fact stop investing in US assets altogether, a rampant culture of corruption has taken root and you are a convenient income stream and tax donkey.

If you are stuck playing a rigged game, stand up from the table and walk away. Stop participating. Stop being used.

And the protections accorded using the bankruptcy system. Start sending CEOs of bankrupt companies to penal colonies until their debts are cleared and see how quickly things change. Funny how I think China would do this most pure capitalist thing well before the US would.

Timothy,

How does your solution work when the investor buys a stock fund that tracks the S&P 500?

It doesn’t….

Unless you have a lot of time to research the fund/index you own or want to invest in and determine the stocks that go against your grain…

Most people will not put their money where their mouth is…

As long as your fund/index is making you money, generally most people don’t give damn about the machinations involved…

If Hertz, for example, will rent you a car for $100 less than anybody else, do you not rent from them because of stock manipulation… you don’t have to answer that…

Share buybacks are classic Crony Capitalism at work. The executives get free shares as part of their package, and sell them back to their own company at current price. Which is manipulated up in a variety of ways. Fake news announcements is an obvious one, but my personal favourite is to pay a commission to a fund manager to put other peoples’ money into my company shares at an agreed price. By the time it all gets unravelled, and blame is to be apportioned, the commission sallesman is long gone. Think Uber.

your argument might have merit if we actually let people/companies suffer the consequences of their bad decisions. but we don’t, so it doesn’t.

I don’t appreciate the woke reference. Mostly because I don’t know what that means other than a fox news tabloid. But investing is ideal when investors can do so based on anticipated cash flow and ROI. The notion of investing is polluted by the manipulation of buybacks and insiders. Made worse by a fed that enables such strategies. All of this leads to unsustainable valuation. Mostly I am dissappointed that so much wealth is created by the folks with money and lawyers, taking equity out of great companies. I worked for a great company bought by PE. They levered us to 120% and kept the proceeds. Our “mortgage went up 5x’s. Not so great for savers, employees or community. Great for the PE crowd. And we thought the corporate tax rate expense was a hindrance- silly us.

Timothy,

In order for that to happen you need “well regulated” capitalism.

What we have today is “regulatory capture” capitalism.

Regulatory capture=the ones with power and money write the laws to govern themselves and they are never altruistic laws

We are at closer to the latter than the former. Revolutions/political movements often happen in the later stages of a decaying political system.

Prove your assertion. Give some citations. Enough BS.

I know, in the old un-socialist USA this would never happen.

Until 1982 companies couldn’t buy back stock without being charged with manipulation.

So in the good old 1950’s companies couldn’t buy back stock and the top tax bracket was WAY higher than it is today, but you better not have any socialist sympathies or you’ll get hauled in front of Congress, or at least fired from your job. Yep, sounds like exactly like the Capitalist paradise all the Libretardians love to blather on about.

“Obviously if you don’t pay employees well”. LOL. Ever heard of a company called WalMart? You know, the one that pays so well that associates commonly are on public assistance?

“Don’t deploy capital responsibly”. Like by buying back stock at all time highs? Did you read what Wolf wrote above? Have you read any of the research for the last 20 years that shows that companies typically pay terrible prices for their stock?

Nah you just come here to type BS in a text box.

Who needs Netflix? Your comments are pure comedy gold. It’s like Dumb & Dumber, except you went straight to Dumberest.

Except they’re not increasing shareholder value by buying when stock prices are high and ceasing to do so when low. It’s basically a slush fund to goose the stock price for managers who hold stock and options.

The problem with this theory / argument / idea is that you are saying it as if we had the capitalist America you dream of … we don’t. The idea of this free market American capitalism where greed is good and efficient and the market knows best is just utter bs.

There would be a reasonable argument for it if we had that but again we don’t, all our laws have been slowly tilted so far in favor of the rich and corporate interests that there is nothing left in that idea. It’s basically the same with the right leaning ideas on the economy is most respects. We don’t have that system and haven’t for a while now … the people get the worst parts and the corporations get all the benefits while all their mistakes and results of their risks and irresponsibility are put on us when they manifest.

I’m glad you liked your first intro books on business and capitalism but keep digging and learning because they are mostly irrelevant, just like your 8th grade history book was.

Another alternative is taxing stock buybacks as dividends.

I don’t remember when the law changed, but share buy backs use to illegal.

In 1982, there was legislation that stated that stock buybacks would not be considered stock price manipulation.

Whoch is funny because I’m sure these CEOs do see it as stock price manipulation.

@D

Yup!

I think it was Clinton and Blair but I can’t remember.

That’s how they escape their crimes. We should write it all down and hold them personally to account/

Reagan.

Apple is correct,,,, it was ronny ray gun who was the POTUS following orders from the oligarchy/owners of the world to stop the increasing equality of the working folks/minorities of USA who had received ”enough already” rewards for their work in WW2 to save the ass(ets)es of those same owners/oligarchs…

It was the clintonistas POTUSes people who followed similar orders and completed screwing WE the PEONS while enriching ”they selves” with gazillions of dollars of ”campaign donations” and ”speaking fees” and similar, same as ray gun and all the others since.

While a lot of us have some serious issues with Carter, so far, he was the last that at least tried to work for the benefit of the common folks and not just himself and his cronies…

Again, classic Crony Capitalism.

They were illegal until 1982, when rule 10b-18 rescinded it. It was legislation created in the ’30s and was considered stock price manipulation.

But the buyback thing really got rolling when huge low-price options were granted to executives, sometimes even backdated; the option holders cashed out and the shares would be mopped back by the company to mitigate dilution. Funny thing is after years of doing this the share count is usually much higher than when they started.

Sort of like looting the treasury but not writing a check to do it.

They always say it’s about ‘returning value to shareholders’, but very often the companies don’t pay dividends and never will.

Michael Brush wrote articles about this many years ago before it became a really big thing, as have a few other writers.

All these problems can be laid at the doorstep of the Fed. They decided to goose financial engineering by Zirp and QE. Corporations and Wall Street ran with it and now it’s a game of chicken to see who blocks.

In a blow off top smartest thing to do is buy your shares if you know Fed is going to blow up asset prices by 50%. Stock price is currency til it’s not.

Yes, the Fed is what make the share buybacks possible with the cheap monetary policy, remove the accommodation and then I’m fine with the business doing whatever it wants.

This share buy back concept mystifies me. I don’t consider myself a sucessful business person (insofar as I exited all of them when there was no future gain to be had). However, each business produced a lump of spare cash that I was more than happy to throw at something innovative and adventurous. My partners didn’t see it that way so we never ventured into “the unknown”. That’s the place where the future resides. Using that cash to buy back shares is surely a misuse of capital? Buying back shares only defends previous innovation – it doesn’t invite future progress. Where I have the option I always vote against share buybacks in companies I own shares in. Can someone point out where I am going wrong?

While getting my MBA there was a lecture where a Finance professor made the point that buybacks happen when corporate leaders cannot find anything in the market worth paying for. She described it as a “lack of imagination” on the corporate leadership’s part. Granted this was in the Internet Boom Era when every stock on every exchange was overpriced… but still I think she had a point.

Buybacks happen because top corporate executives are compensated in stock/stock options.

Money is made with financial engineering, not business capex. Some years back Alcoa beat earnings by a lot. They shut down their main plant and sold the electricity they had forward contracted for a huge profit. That was a happy accident, now all companies excede to that method. Companies like Microstrategies have moved all their market cap into bitcoin.

Share buybacks are mostly insiders looting the company. The only good reason to buy back shares is to resell to employees or allocate to employees as profit sharing. Otherwise, it’s insider looting.

I don’t want to defend the practice (it should be outlawed) but, as Buffet might put it, if the company sees the price of the stock so undervalued that it’s actually a good use of their money, then a buyback makes “investor” sense. But I think Timothy McLean and Sit23 are chiming in on the fantasy that corporate management is working in the interest of their “shareholders” or that there are different kinds of capitalism: “woke” or “crony”. It’s Capitalism! Add an adjective and you can probably buffalo the knuckleheads. But it’s inevitable that financial engineering will take the place of productivity. It’s inevitable that Congress gets bought-off. “Crony” capitalism is nothing other than “lack of regulation” by the “crony” government. Capitalists needs restraints. For Americans, that isn’t happening – our legislators have been bought off through campaign financing. The corporate oligarchies have installed their own “regulators”. They will make you BELIEVE they don’t want immigrants taking our jobs, or need walls, or want “free markets” or want “pro-choice” or are “anti-abortion”, and on and on. But it’s only about the money. They have no morals and don’t want any morality to interfere with making money. So, I wish the free marketers, or Libertarians, or “shareholder valuers” would wake up, not woke up, and smell the coffee. It’s childish BS and McLean and Sit23 shouldn’t be shills for the “good capitalism”. The tooth fairly will not fix this. Our only hope would be genuine campaign finance reform.

I left out “level playing fields.” Isn’t that a hoot?

Average person should be able to earn reasonable return on savings and not have to try to make money in the casino. Average holding period is days which means market has become its own tail wagging the dog of capital investment.

In the information age sites like guru focus give you all the needed fundamental data needed to do fundamental investment including whether share count is rising or falling. In the long run fundamentals may matter, but government is in pretty deep on most businesses such as GM and Boeing and Pfizer and JP Morgan….

Agree completely. We go back and forth with all this nonsense but the only real way to address anything is to have representative government again … and that means no more lobbying and money in politics .. and term limits. If politicians had to work for the interest of the people things would more or less work in our favor …but that couldn’t be further from the truth. The only thing we have now is a show as a disguise for the bought off corporate interests.

If a company returns the surplus money earned back to the shareholder as ordinary dividend, it gets taxed at income rate which is higher than capital gains tax

If the company keeps the surplus just in treasury, it won’t give any interesting yield.

But if it supports the stock with buybacks stock ,may rise or prevent from falling when someone, insider, outsider, whoever sells.

The stock it buys back can also given as 4 year maturity stock-incentives to employees (most go to the top but not all) so it will improve employee retention which is good for continuity.

It is all the consequence of the double taxation of profit (corp income and div tax) and high tax rates.

If I am allowed to work hard and get a dollar, that is great. If I can work not so hard, cheat legally, thanks to Ronnie, and get a dollar twenty, which one am i going to do? One assumption. I have no morals or conscience.

Large corporates these days clearly need a CSO (chief shananigans officer) if they expect to survive and grow under these conditions.

Another good writeup Wolf Richter. Facts are good for the soul.

By 2024, after team blue gets completely wiped out in the 2022 and 2024 elections due to out of control inflation ( blamed on govt typically), many of the team blue laws will be voided and reset as the political pendulum swings wildly back and fourth every 4 years, as has been the case. Having 4 year Presidents used to be super rare, and now is going to be very common. Typical behavior of previous Empires on the decline from peak prosperity…

The political class is clueless on the history of inflation how it affects election outcomes, as this could have been predicted 12-18 months ago…

Per ABC:

More than two-thirds of Americans (69%) disapprove of how the President is handling inflation (only 28% approve) while more than half (57%) disapprove of his handling of the economic recovery.

What right in the Bill of Rights did Texas eliminate? Let’s see a citation for that absurd assertion.

John,

I’d like to see the source of that comment as well.

LMFAO! You Q guys are something else.

Keeping voters distracted with nonsense, like supposed rigged voting machines, provides the all clear politicians of all stripes need to run multi-trillion dollar deficits.

It’s amazing how easily people are distracted by nonsense during an existential crisis. Like a cat distracted by a dangling string as he’s about to be consumed by a pit bull.

True that.

Unless you’re a scumbag insider you make your money when you buy, not when you sell. These guys can run the price up with buybacks and sell into it while you’re completely unaware.

Once you’ve figured this out your investing will improve dramatically. It’s a cliche, but buy low, sell high.

Suppose you bought 20 stocks in the late 90s, allocating $1,000 each. 19 went to zero, but one was AMZN and you had the conviction to hold it despite dramatic drawdowns. Your $20,000 would have lost $19,000 but gained about $370000 based on an approximate initial investment of $1,000 (100 shares @ $10) in Amazon.

There is, of course, the process of picking the stocks but look for a good business model, good management, and a future for the product. If you can’t hit 1/20, time for a robo investor.

More and more, events/actions .. just like the kind that our host showcases above, has my brain having reoccurring vignettes of the space tug NOSTROMO – of Alien film fame, chugging along relentlessly with its cargo .. and what’s left of the crew, whilst MOTHER warns to escape within minimum safe distance, before the destruct sequence countdown reaches T-Minus ZERO!

For most of the public, they’re being guided towards economic destitution, with nary a shuttle craft to be had. Instead, at the very least, they face nefariously acidic high-worth creatures, enticing the naive plebs into pulling their ‘fingers’ ,while their faces get chewed off!

Everybody keeps buying stocks, knowing that they can sell them to somebody else for a higher price. At some point, the Greater Fool Theory runs out of fools.

Pension funds

People I know have quit contributing to 401 buying crypto with money

Borrowing money and buying nearly anything has been the profitable thing to do for a long time. Saving fiat in the banking system has been a terrible disaster. Makes sense, since Fed can poof out dollars faster than you can save them. Why work when Fed can print your past labor out of existence?

Fed is probably going to find out they messed up as they have mixed up the hand with the carrot and hand with the stick. At minus 6%, money might really start fleeing to who knows where

The Fed has removed the time value of money, and since we pay money for labor, thus the time value of actual labor…so unless you are part of the top 10% with lots of income producing assets to compensate for labor being worth less each and every day, you could easily fall way behind with 10% inflation per year. And the Fed has really, really, really punished those who rent instead of own homes via ZIRP and QE madness…a fiscal class 5 tornado that will be circling the globe for many, many years doing untold damage to those who can least afford the Fed monetary self-inflicted chaos…

So why do I say 10% versus the published 6.8% inflation number, well even Bloomberg prints the truth now that rents, if accounted correctly, would drive the inflation number to at least 10.1%.

Per Bloomberg:

The hedge fund manager Bill Ackman garnered a lot of attention pointing out that large owners of rental properties are citing a 17% increase in rents over the year. Inputting this in place of the official figure would take the headline rate of inflation up to 10.1%. It’s fair to expect rents to put upward pressure on inflation for a while.

‘What does it mean when executives are dumping their shares while the company is buying them back?”

Where is the company getting the money to fund the buys? Is it leverage? In that case it seems the company merely creates a shell game to enrich the “executives”, place the entity in an overleveraged position until the day of reckoning and finally bankruptcy. Obviously true in the case where these firms have never even made a profit.

And if they are profitable, where is the reinvestment?

If, at the top level of the corporate hierarchy, the subliminal conspiracy is to suck enough blood money from the economy while at the same time providing products and services of diminishing quality then we are near the end game of this sick mindset.

From this perspective, it’s important to consider the last 10 years as merely an expansion of credit. And then conclude that this is how credit cycles work. And if it is a cycle then there must be a return back to square one plus inflation. When credit dries up economies deflate and that has a cascading effect (not hard to imagine where it goes from there).

How is it different this time? The top of the food chain has an enormous bounty. You’re getting “used to this lifestyle”. Sucker.

Legal fraud people are waking up to this manipulation =mass stealing going on game over foe capitalism

I hadn’t heard about the 1% tax on buybacks. I am certainly not a Democrat but I have to admit that it is a good idea. A lot of buybacks are done because it is a tax-friendly way of rewarding shareholders (as compared to increasing taxable dividends). I am not sure if 1% is the right number but it is certainly as good a place as any to start.

Buy backs should be 3-5% miniscule amount won’t stop anything

@SG

All taxes take money from citizens to the benefit of the ‘State’. If you believe the ‘State’ spends your money ‘better’ than you do, good luck with that.

They’ve already covered ‘capital gains’ with capital gains tax so this is clearly a self righteous surcharge to punish the ‘evil’ investors playing the market.

Who are the ‘bad’ people here?

Just askin’

The “state” in this country has provided you such things as

Roads, bridges, an interstate highway system, airports.

Satellites in the sky so you can have cell phones, an internet & every other modern convenience you enjoy through a “connected world”

Interconnected utility power grids that provide you with electricity and water. This includes dams & man made waterways,

Maintain a system of laws and regulations to protect you and allow society to act in a civilized manner. Provide you with a police dept. & a fire dept. Make sure you have food that is safe to eat.

The greatest military force in world history

Really you could on and on but what’s the point? Everything you take for granted. None of these provided by the “private sector”. And when these do become privatized it’s gonna cost you. Big time

To the extent that government has failed or deteriorated in any endeavors look no further than decreased tax rates, the private sector’s successful attempts to infiltrate government with their own who, once they get the right legislation enacted, slip back into the private sector to enjoy the fruit of their labor. The “controlled demolition” of the very same offices of government oversight that are designed to police white collar criminal activity. A defunded SEC, IRS & on and on.

As for the private sector, this article presents a great example of the significant waste found throughout the private sector which has grown so corrupt and greedy for “money” that the “product” is the last thing they are worried about.

@MarkinSF

Thanks. Excellent and eloquent reminder.

Let’s give it all to the government since they do such a good job.

@SF

So you really do think the State spends your money better than you do. I won’t counter list all the instances of money squandered because I know I can’t win and there is no early prospect that the State will stop mushrooming any time soon.

You’ve obviously never waited for a telephone in the good old days when the State allocated you one when they got round to it.

How about a 25% tax instead of 1%?

Amen. Or just go back and outlaw them altogether

So much stuff in the BBB none of us know it all.

Just by reading this website you know more about the BBB legislation then any member of Congress. Lobbyists write the laws and lobbyists tell members of congress how to vote, they don’t represent you, they serve corruption.

What did Nancy do to earn her $200,000,000? She sold her soul to the devil.

Where’d McConnell get $200,000,000?

When companies buy back billions of their own shares, in many ways they are saying “We are ripping my customers off so badly, we don’t know what to do with all the excess cash”.

American Capitalism is sick, and we all know it but have no leaders willing to tackle the greed at the corporate level, because the system allows the corporate barons to legally bribe the political class into allowing crony capitalism. Until the “Bribe-A-Politician” lobby system is dismantled, this will uncontested. We are living through the “Corporate States of America” era…

@Yort

The old revolving door – DC and Wall Street. Were Team Trump people really so much different or better (or worse) than Team Biden? The rather miniscule real difference between Ds and Rs is greatly exaggerated by both Ds and Rs. When Beto ran against Cruz in the nationally much talked about 2018 competition, there was lots of fury and fight on both sides. But my belief is that neither one is a friend of any voter. They are friends of system interests and lobbies. But if you live in Texas, have guns and like your guns, you would have to have voted Cruz.

So you see those sort of differences. Like whether you think a Covid vaccine mandate is good, OK, or bad. So there can be a difference there. But only if the pol actually sticks by what he or she said during the campaign.

Cruz fled to Cancun while his fellow Texans froze to death, that is the difference between the two.

Cruz also left his dog Snowflake behind to freeze.

The leader of team Biden hasn’t been twice sued successfully for fraud. Much more to come.

The endgame of all this is taking the company private. Private equity will rule, and NYSE rules are no longer the prerequisite to raising cash. To put an asterisk on that each time the government attempts to regulate Wall St (like now) the private equity boys get a new client. At the end of the day they buy what’s left of the float, at a premium to market, and the shorts pay the price. Government debt supporting these companies, creates a fiat liability. Stock speculators make a fortune in their worthless script, end up broker, go to work in an Amazon fulfillment center and are paid in bitcoin. Workers revolt and seize the means of production and Marx is finally proven right.

PE only make their money when they sell off the pieces or repackage into an IPO.

Buying a company and actually owning it…is rather boring.

@AB

Very tempted to agree with you, but I can’t decide to go with PE because valuations are based on ‘assessments’ and not actual market sale prices. I’m out on that score.

I think fundamentals are fundamental and all the BS built on top is precisely that, BS.

AB,

The PE crowd doesn’t even have to play with their own money, right?… they take OPM, buy a company, take it private, load it up with debt, get a football person to make a commercial, relist the company in an IPO, sell all their private shares to pensions and index funds and buy a new jet and a Dressage horse…

Do I have that about right?

You forgot to mention the PE scumbags taking special dividends along the way to finally BK’ing the company.

Based on the discussion with the high command, I want to say this.

1. Wolf took a day rest and everyone behaved like kids in middle school when the teacher is gone outside.

2. 500 comments in the last thread. Each single comment became like a thread and then a baby thread with siblings from the main point.

3. Here after only 300 comments total. Take it or leave it. If you have extra comments post the next day in another thread. You all not reading the post anyways.

4. Every commenter can have only two comments including replies

5. Comments must be relevant and direct response to No more trickle down economics, which prez messed up better, middle class is gone and vague comments about the bond market totally unrelated to the post.

6. If a person is relentlessly commenting back and forth. Just leave it. This is not a drunken bar or who should have the last word.

7. The obvious loss is the points from important commenters like me.

Seem pretty proud of yourself

CP

Have to agree. I did not get to the last article for awhile and then saw 500 posts. Most ended up in the same rabbit holes so I quit trying to edgemecate myself.

As to THIS article, as with many High Finance subjects I don’t understand, I find it illogical that companies buy back stock when prices are high. If Execs dump, knowing the company is gonna buy what they dump (and I have no idea where the company gets the capital), then it seems impossibly rigged and equivalent to insider trading.

I remain thoroughly befuddled. It cannot be that directly “cause and effect.”

Think of the executives who cash out as the company itself. The company leverages up. takes those funds and buys the stock from the said executives (i.e. hand over the loan proceeds to themselves) then just fold up when the credit cycle hits zero leaving the debt holders in the dust.

beardawg – it’s not a direct cause-effect but skewed incentives leading to the same outcome.

In recessions, when share prices are low and share buybacks might make the most sense from a “fiduciary responsibility to shareholders” perspective, company profits are squeezed, cash is tight, and there are also far more opportunities to spend on growth as the economy recovers. So companies are less likely to buyback shares when they’re cheap.

Conversely, when the economy is running hot, companies have maximum profits (and maximum ability to borrow) but few opportunities to invest in growth at reasonable prices. Sadly, while this is the phase when companies are most able to buy back shares, it is also when the share prices are highest.

What’s criminal is the insiders who know that profit prospects are dimming, and go out and sell their own shares while pushing for and/or authorizing share buybacks.

I can think of several much better ways to manage buybacks rather than “1% tax”:

1) Companies may not buy back shares within 20% of the 52-week high price.

2) Companies may not buy back shares within 90 days of any insider stock sales.

3) Companies may not buy back shares if any compensation to employees, executives or board compensation in the past year included shares, options or other equity derivatives.

4) Companies may not buy back shares at all.

But aren’t we assuming that the c-suite actually has the companies best interest at heart…

I would venture that in todays management world, what the company actually is, is secondary to the amount of “value” in the company’s stock management can extract…

Regardless of what the company is or does…

CP, regards to #4 you posted…..what will happen to Historicus? It’s not fair limiting the number of posts a person can have (remember, everything these days is about being FAIR).

Just to clarify that….Point 5: Comments must be relevant and of a direct response to the topic at hand. (Note the period) Thence, the “No more yada yada etcetera, etcetera, etcetera…”.

And please don’t assume everyone is not reading the post..an elitist attitude is as much a pile of it as what comes from those with blind agendas. (When the spitballs clinging to the roof hit 413, I bailed out of the classroom and played hooky. Knew the ceiling might come crashing down. Extra credit from Print Shop ain’t worth the broken neck.)

A legend in your own mind.

The obvious loss is the points from important commenters like me. Voting for your self? My fav is augusts, historicus and solcal.

I think he is making a joke. Generally I agree with him.

Brilliant! Might be a bit subtle for some of us! Myself and 43 other commenters actually have 612 different points to make on your comment, especially number 7.

CB:

Correction to #7:

7. The obvious loss from implementing the above rules would be having to read a predominance of mundane self-absorbed comments of boring hacks like Cobalt Programmer.

Loss too of my monthly donation.

After a 50% crash in the market, will stockholders complain about buying shares at such high multiples? CEO will probably be out with a golden parachute by then.

This is still a “banking problem”. Addicts rely on enablers to support their illness. Time has come for another bank holiday FDR style. Shut ’em down and only re-open under a harsh new set of standards. Wipe out everything that is fake and derived from fakery extensions. Economy tanks and shrinks back to reality…tough sh*t. Protect the money. Put down the mob. Try the treasonous. Re-build anew. Get on with it or suffer the long game consequences. “China in charge” is not a 1980’s television sitcom.

I get a kick of the anal- yst on cable and you tube that conjure up a genius plan of a tortured Rube Goldberg process of why these CEO’s are selling. Six Pack Joe that’s busy sucking out a septic tank in a honey wagon will tell you in between drags on a cigarette while jostling the 4 in ribbed vacuum lift hose in the corner of the septic to get the thick “good stuff” with his un-washed hands what the deal is. Take the money and run because this bitch is going down.

So, PE firms are exiting a crashed car rental firm that’s just got out of a hokey body shop…

Insider’s are selling the shares they inflated with debt. Debt that they’ll leave the other investors to watch affect their share performance later.

Maybe something is not all as healthy with those companies. Maybe underlying performance is, like a fading pulse.

Now what’s that song again ……

‘Blinded by the light…’

There is a clear conflict of interest of allowing stock buybacks and C Suite getting compensated by how well the stock performs. This similar to scalping and front-running. Made legal 1984 IIRR.

Congress passed law that created this mess as high salaries can not be deducted, so companies switched to stock options which led to stock buybacks.

Buffet tries to do the right thing by giving no stock options and paying cash salaries tied to business performance and not stock price.

If you read Buffet’s shareholder letters there aren’t any large things out there to buy because of price, he has enough cash to pay off all corporate debt, and if you pay a dividend it is not as tax efficient for shareholders so you might as well buy back stock if you have stable business and buying back stock meets your hurdle rate for investment.

I’ve been a long long term investor in one of the very oldest funds in the world (150yrs). I do it for history!

They have just decided to issue some debt, 2037 @ 2.06%, 2056 @ 1.96%,2061 @ 1.87%.

Only question, why wouldn’t you?

Incidentally they have been buying back shares quite aggressively with a big discount to NAV due to Cov fear.

Am I lovin’ it?

Pride comes before a fall, so no comment.

“ I’ve been a long long term investor in one of the very oldest funds in the world (150yrs). I do it for history“

Newcastle Ladies of the Evening Retirement Fund …

Just asking’ :)

Nah…probably the Abe Lincoln go fund my funeral ETF.

@COWG

Funny, but nothing so exotic, worst luck.

F&C formed for US and Canadian railways way back. Now has something like 500 co’s all over the world. Price is a bit like a World index. Divi has increased every year for 50yrs. It’s an institution.

If I could borrow £50mn to 2061 at 1.87% I’d be sorted. Pay the interest out of capital until I ‘went’.

The collateral is the problem.

Without buybacks shareholders would be better off. And money losing companies should not be allowed to IPO, if you ask me.

Options should be outlawed.

All they do is create a separation between what is good for the shareholders and what is good for the management. Just the opposite of what they are supposed to do. Management spends its time coming up with schemes to increase share price instead of improving the corporate products, markets, balance sheet or income statement.

We should offshore all executive positions…….LOL.

]

Another story of how the Rich operate with nothing for the Normal citizens the savers Etc no one cares about them as they have no power no control no working representation . Really it’s about the total lack of Law Enforcement allowing all of this .

After all this time nothing from Law Enforcement and it’s been so long now it’s boring to read about with zero end in sight . No one with a court date , no handcuffs just tails of the rich getting richer.

At least China is going after top executives

If you are not a lawyer it takes a while to learn we are in a country of free speech, but speech can be b.s. and what is important is what is in legal contracts and legal filings like with the S.E.C.

If you are a really serious investor you are reading the S.E.C. filings and not listening to all the b.s. floating around. If you don’t like companies financial dealings with shares such as buybacks and options, don’t buy the stock. Do we need Congress fixing a problem by creating another problem?

1) For entertainment purposes only. Borrow at low interest rates several $100M for buyback, lift market cap by the billions, absorb shares supply, and pay less in dividends.

2) On Nov 22 Satya Nadela sold 840K shares for $285M, while MSFT plan to buyback $60B. Plan.

3) MSFT Nov 22 fractal zone high was 350. Last Fri MSFT closed at 343.

4) MSFT backbone : Nov 5 high/ 10 low.

5) Buying Climax : Nov 22 hi// AR on Dec 3 low.

6) If Dec 3 low will be violated, there are several options for the next low.

7) Ilan is another 10% without asking permission from his adoring fans..

Do/did MS issue bonds to fund buy backs?

Or do they really have millions of $ cash building up?

Either way I have no issues with it. As someone else noted, you have a choice as an investor.

I think a big issue I’ve notedin articles here and elsewhere, is people buying index tracking and other such products to minimise risk… but it’s essentially enabling this kind of buy-back behaviour to go well rewarded because these companies are large within the index, and they’re not bought specifically but just because they’re in an index.

This behaviour is also said to be creating systemic risks because of the homogenous behaviour of most investors.

I’ve gone 50pc cash in my pension and kid’s investments.

What’s left isn’t in index funds either… quite a narrow selection of value stocks, and under-valued stocks (mainly since Feb 2020).

The trouble is that nowadays most people really DON’T have choices as an investor.

Most US investors are 401K plan participants who are given 5-10 options, all of which are mutual funds or equivalent. There’s no option to choose individual stocks, or to avoid individual stocks; similarly for bonds. You’re basically chained to the vampire squid and forced to subsidize all the evil therein.

For that matter, there’s also a large number of people with pensions and no say in how that is invested or run.

I was in with bigger funds, thankfully the UK has SIPP, self invested pension plan, so I jumped across to self investment and can pick and choose.

It’s hard though to get a good spread.

It’s be very useful to be able to provide booleans on funds to essentially buy X, but remove Y and Z.

That way people could more easily ‘vote with their feet’ and stop having their pensions ultimately funding corporates that are doing things you see as unethical.

Self directed Ira read learn ,secret to buffet,s sucess

Self Directed IRAs.

Yes, some people do that, but not most. And you generally can’t do a self-directed IRA with your current employment-based 401K without quitting.

This is why the claim that “investors vote with their wallets” is wrong.

A tiny handful of investors do the extra work. Most just take the default vanilla options and thereby enable all the shenanigans.

Wonder how many of these companies will soon be clamoring for layoffs or other cost cutting measures for their workforce?

w.c.l.-if the previous/current unemployment figures are to be believed (dubious, at best), they’re still below the WSJ’s editorially ‘preferred’ level of years past…

may we all find a better day.

1) MSFT daily : Nov 22 fractal zone is the space between Nov 22 open and

Nov 22 high. Draw two parallel horizontal lines between the open and the high and u get a horizontal fractal zone.

2) AAPL weekly log : draw a support line between Sept 21 2020 low and Mar 8 2021 low. It’s very simple.

3) Draw a parallel line from Aug 31 2020 high.

4) Draw a second parallel line from Aug 31 open.

5) The space between them is a diagonal fractal zone.

6) Draw a third parallel line from Jan 25 2021 high for a potential resistance.

7) If AAPL rise to the middle of the fractal zone, to 183 ==>

$3T : 16.427B common shares outstanding = $182.62. AAPL will become the first $3T co in history.

This article is proof that the stock market is nothing but a rigged casino. I will have nothing to do with it.

Fed had reinforced all the gambling. It’s obvious that the Fed wants to run a highly leveraged financial system. Seems stupid to me.

US had the big 75% devaluation of the dollar under FDR and then the other soft default as we went to totally to fiat system under Nixon. Letting China into WTI was last giant financial system change. Something big most likely will happen by 2030 I think as numbers are getting too big and real rates getting too negative.

Agree totally SC:

When my first stock market (SM) mentor, a guy who had ”retired” to FL ( in his late 30s in the early 50s ) made the call to get out of the SM in the early 1980s because in his very very knowledgeable opinion it had become legalized gambling, I did the same and focused on real estate…

Even though he had the ticker running on his TV by then, after years of going to the broker to see his trades happen, etc., he would point out some of the early manipulation and insider trading trends that have now become legendary to the clear detriment of retail investors.

Have been hoping to learn enough to feel safe to get back into the SM, but not looking very likely at this time.

Maybe some bonds if the interest rates ever come back to reality??

My parents took all my money that I earned delivering newspapers and put into the stock market, just before the 1962 crash when Kennedy has some dispute with the steel industry. It was General Mills stock, a safe investment. It dropped 30% overnight. Never went back in again.

Buy backs with excess earnings may be good as it decreases the number of stocks available for trading and may cause the value of company stock to rise. It is the opposite of issuing new shares to fund management raises.

Due to insider trading laws, corporate officers are not allowed to trade at certain times. If they want to sell part of their stakes they might set up an automatic sale plan. As they get older they may want to cash out before retirement.

Let’s see:

The Fed is on the white horse

The Senate is on the red horse

PE is on the black horse

And CEOs are on the pale horse

There we have it. All four horsemen. Stock market apocalypse imminent.

The USA is a rigged system for the wealthy. And when it all blows up again, CONgress will be sure to work hard to “fix” it again, so that the wealthy don’t lose but the taxpayer does.

Where do the board of directors Stock Options kick in?

Jim, you sit on Bill’s board.

Bill, you sit on Ira’s board.

Ira, you sit on Bruce’s board

Bruce you sit on Jim’s board. A corporate “daisy chain”.

Ok now …. vote everyone big money.

Called Ivy League club

Eventually, things become sooo untenable that the pluribus coalesce into unum out of sheer desperation, to push those boards downward, snapping Bill’s .. Ira’s … and Jim’s necks with daisy chains fashioned outta hemp!

Non-financial US companies hold almost 4 trillion in cash, for various reasons. IF they are returning the cash in share buybacks, that means they aren’t using for capex and that money is going to people who are likely to spend that money.

Its not borrowed money its cash being unleashed for personal consumption so I would think its inflationary, and the more inflation there is, the more calls there will be to get the money out and returned to shareholders.

WR,

Where are the insider stock sale proceeds flowing into?

Is Satya buying BTC? :)

How much BTC do you think the government owns?

Treasuries?

Are you kidding? 90% of stocks are owned by the top 10%, who are NOT spending incremental passive earnings. They are investing it in more passive assets, maybe even the home you rent.

I think the top 1% own most of the stocks. Probably over 70% now. The top 2% to 10% probably only owns 20% of that 90%

Stock buybacks benefit executives the most even over stock holders.

Many Hedge Fund manager earn over $1 billion a year. Just think what their 2nd and 3rd in command make. Warren Buffet’s two main managers make over $500 million a year and he said they could make more elsewhere.

Just think of all the jobs hedge funds create……..almost none yet they are the highest compensated workers in the world. This is messed up.

I would like to see you put up the facts on Buffet’s managers. The last I saw was his insurance manager earned $21 million. I am pretty sure Buffet’s insurance operations are the most profitable in the world so $21 million is probably about right payment.

His other manager runs the most real capital in the US so again if he makes $20 million that is probably fair price.

If I am not mistaken Al Roeker made about $6 million giving the weather on TV. Football coaches and athletes can be in the $10 million range for playing games.

I am speaking about his two top internal Hedge Fund Mangers that manage all their portfolios. He stated this in an interview I saw him give a few years ago so I do not have the facts on paper.

Ru82

Don’t think his two investment managers are very highly paid as he said they could make more some where else. From what I remember they make $1 million each in salary, plus an incentive bonus if they beat the sp500 on a 3 year basis. I think they were not beating sp500 as of last meeting because they are value managers.

Hedge fund managers can make too much money. Mostly they take excessive risk that cannot endure 1 in a hundred year events and hope to make it rich before the dance stops

Glad to know Buy Back Better is doing very well!!!

Very good easily readable and informative article. Valuable to me personally to learn about the connection between buybacks and execs cashing in on stock options.

Sad that somehow, great majority of people won’t be informed or care about it.

No pity for anyone in collusion (that includes Pensions/IRAs/401Ks) with stock market represented corporations. Just to see the 10yr above 2% would be a beginning.

Watched a fund manager from Austria who seemed very good. Me said in Europe he was not allowed to buy gold bullion as an investment, but could buy Greek debt using leverage if he wanted. That is how government can direct money flows and try to keep system afloat.

The soon-to-be-former middle class has been drawn in as suckers in this current phase of zero-sum casino game. This, to pave the golden driveways of the nobles.

Yes. I am a little worried about that. As inflation drives real rates highly negative it drives people out of where they wanted to keep their investments into riskier things trying to protect themselves.

Old school

Yep, some dude was on CNBC this morning parroting the same thing you just said. He told the viewers that unless you were willing to lose 6.8% to inflation, you had no other choice but to jump into the stock market and buy stocks, even if they were overvalued. He said that’s what he was doing with his clients money. He’s into tech, big time.

NASDAQ starting to pump around the track again like a sleek powerful Triple Crown winning racehorse (those anabolic testosterone boosters cam do wonders).

1) NDX peak is not too far above. Sarya preempted the peak, probably buying US treasuries.

2) There are $4T in corp cash, just in case a new variant of OmiXi, a deadier

variant, will lead to a new closure, or harsh restrictions, while waiting for Dr Faust new vaccine, for Dr Faust to save us.

3) The $4T cash will not be spent on RE, BCT, Peloton, or NDX. It’s ammo during deflation. US corp CEO herd, imitate Warren Buffett.

4) If crude oil futures rise to a lower high, under 85, it will form a H&S. Targets :

mid 40’s, to between Oct 20 2004 high and Dec 2004 low trading range.

Back a few years ago Radio Shack started buying back their own stock. They kept doing it to prop up the declining value of the stock. It didn’t work. The stock went to zero. Totally worthless. What a great use of the company’s capital. Same will happen to a lot of these companies that are doing this now.

“A 1% tax on it would cost Microsoft $600 million – not huge for a company the size of Microsoft. But not negligible either.”

$600 million is six new G700s, the crews, maintenance and support to staff them, and lots of Jet-A.

You gotta look at things from the C-suite’s perspective.

“it’s that much more important for companies to buy back those shares that insiders are dumping”

Modern business 101 – What is it your company makes? I forget and it doesn’t matter anyway. But I think our main product is creating narratives that convince people to loan us money that we give to ourselves.

Wolf,

I believe the corporate buyback window closed last Friday for the balance of the year.

No real pushback on the proposed tax because most everyone knows the bill is unlikely to be passed, at least as currently constructed.