Home-price explosion pumps up mortgage debt.

By Wolf Richter for WOLF STREET.

American debt slaves could only be knuckled under briefly – that much is clear now. They’re tough. And now they’re once again taking on more debt, particularly credit card debt, the most expensive debt on which banks make huge profits with obscene interest rates of 15% or 20% or 25% or more in a near-0% world. And the Fed has taken notice.

When the New York Fed released its Household Debt and Credit Report today for the third quarter, it topped it off with an article in praise of the once again rising credit card debts. Given that the New York Fed is owned by the banks in its district, including the biggest credit card issuers, it was proud of the American debt slaves that are once again charging up their credit cards.

Credit card balances & delinquencies.

Americans shook up the banking system and the Fed during the pandemic when they started paying down their credit cards. Following the Financial Crisis, credit card balances also fell, and for four exasperating years, but not because consumers paid them off, but because they defaulted on their debts and bank wrote off the balances.

During the pandemic, consumers, flush with stimulus cash, had actually paid down their credit cards. But that phase is now over.

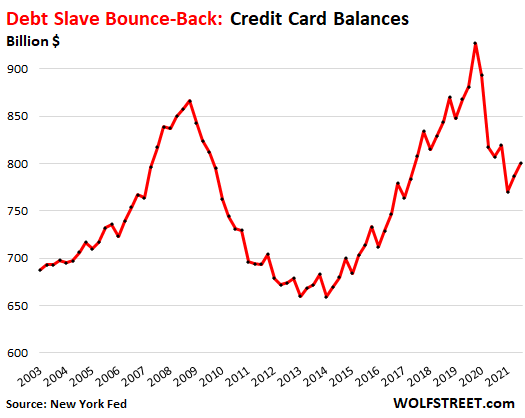

Credit card balances in Q3 rose 1.7% from the prior quarter, to $800 billion, the second quarter in a row of increases, and the first back-to-back increases since 2019. OK, so not a huge massive bounce-back, but a bounce-back nevertheless:

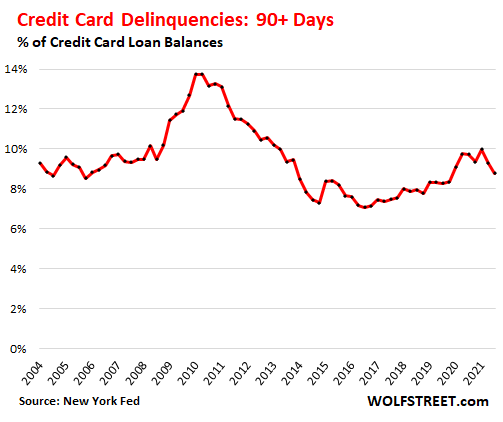

Seriously delinquent credit card balances – 90-plus days past due – fell to 8.8% of total balances, the second quarter of declines, as many consumers got caught up thanks to the flood of stimulus money that came in various forms, and included moneys-not-paid for rent and mortgages and student loans under various forbearance programs, eviction bans, and foreclosure moratoriums. All this took pressure off, and some folks got caught up with their credit cards:

Auto loans & delinquencies.

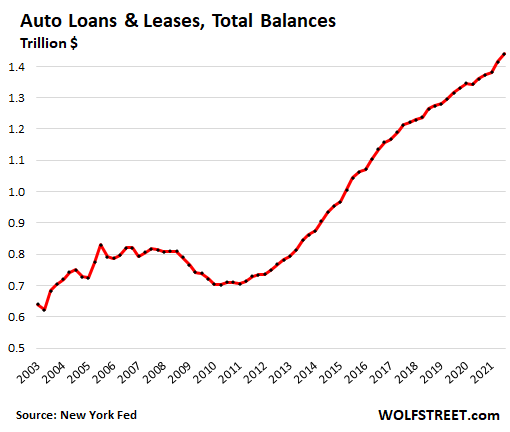

Fired up by mind-boggling price spikes of used vehicles and a massive increase of average transaction prices of new vehicles that shifted upscale and sold for over sticker, consumers borrowed a lot more to purchase a lot fewer purchases, as sales swooned due to the shortages of vehicles. The balance of auto loans and leases rose by 1.8% in Q3 from Q2, and by 5.8% year-over-year, to $1.44 trillion:

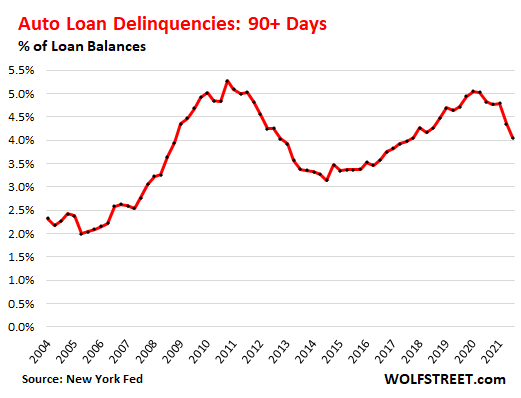

Flush with cash, many consumers got caught up with their auto loans, and serious delinquencies dropped to 4.05% of total auto loan balances, the lowest since 2017.

Student loans, dropping enrollment, and the miracle of forbearance.

So, student enrollment in higher education has experienced a sharp decline during the pandemic, after having already declined steadily since 2010, according to data from the National Student Clearinghouse Research Center, which tracks student enrollment. This includes a 3.2% decline in undergraduate enrollment this fall semester, following a 3.4% decline last year.

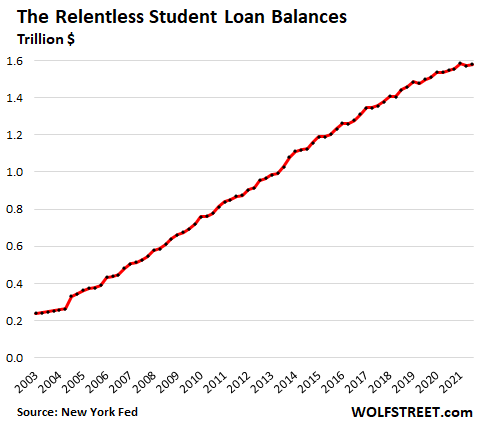

And yet… student loan balances in Q3 remained at the record of $1.58 trillion, up 2.2% year-over-year, as forbearance for government-backed student loans has been extended to January 2022, and the interest on student loans has been cut to 0%, and practically no one is making payments:

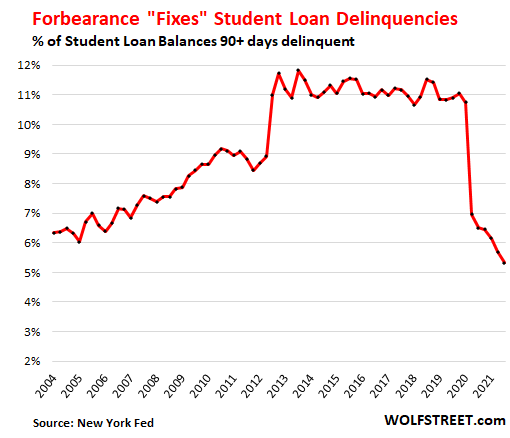

Loans that are in forbearance are not considered delinquent, no matter what the payment status, and this forbearance produced a miracle of curing serious delinquencies, though practically no one made any payments.

Serious delinquencies dropped for the seventh quarter in a row, to a record low of 5.3% of outstanding balances, down from the 11%-to-12% range before the pandemic. Forbearance swept everything under the rug, but now there’s a huge mess under the rug:

“Other” consumer debt balances.

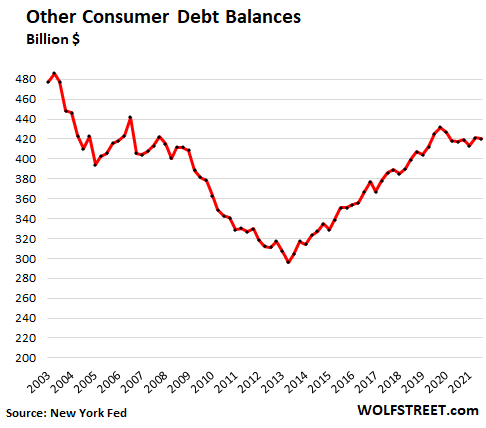

The balances of personal loans and lines of credit from banks, shadow banks, peer-to-peer lenders, and payday lenders, after falling early in the pandemic, has remained roughly flat for the sixth quarter in a row, at $420 billion:

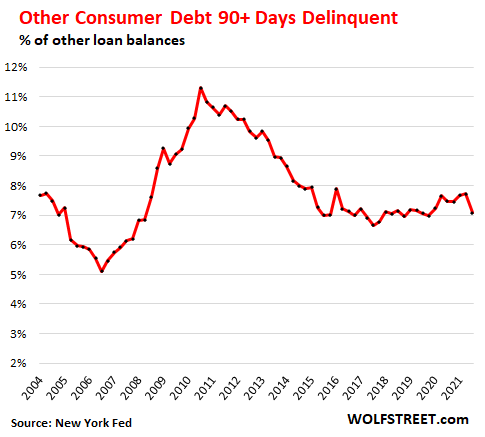

Serious delinquencies in Q3 fell to 7.1% of total balances, in line with pre-pandemic levels:

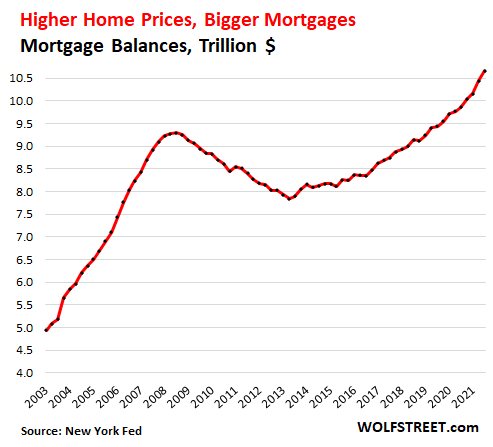

Home-price explosion pumps up mortgages.

Mortgage debt jumped 2.2% in Q3 from Q2, and by 8.2% year-over-year, the biggest year-over-year jump since Q1 2008, amid exploding home prices and a surge of cash-out refis:

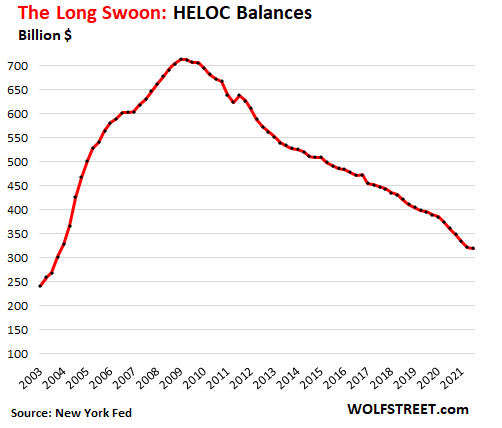

But home equity lines of credit (HELOC) balances continued their long decline, down to $320 billion, the lowest since 2004, as they have fallen out of favor, with cash-out refis being the easy alternative to using the home as a leveraged ATM. HELOC balances are down by 55% from the peak in 2009:

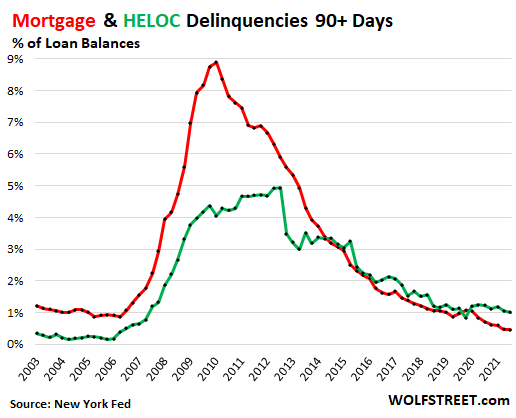

Foreclosure moratoriums and forbearance swept delinquencies officially under the rug since a mortgage is not considered delinquent when it is in forbearance. And exploding home prices see to it that distressed borrowers that cannot make the payments of even a modified mortgage to exit forbearance can sell the home, pay off the mortgage, pay the costs, and maybe have some cash left over, and thereby exit forbearance and fix the arrearage.

So, seriously delinquent mortgage balances dropped to 0.46% of total balances, the lowest in the data going back to 2003. Seriously delinquent HELOC balances dropped to 1.0% of the outstanding balances:

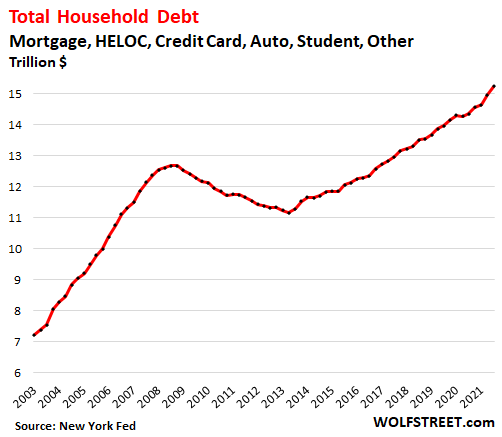

Total household debt – mortgages, HELOCs, credit cards, auto loans, student loans, and other debt – jumped by 1.9% in the quarter and by 6.2% year-over-year, the biggest jump since Q2 2008, to a new record of $15.2 trillion, as the hardy American debt slaves are bound and determined to do a good job loading up on debt:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Unreal. The lessons of the past go unlearned.

People are stupid, what did you expect?

With low rates extending into 2022 and the current low levels of delinquencies there appears to be more room for household debt to expand.

My thought exactly. last chart of 90+ days delinquencies is perfectly lined up with last bubble. Jumbo loan amounts going up for a higher round of RE prices. Looks like this fiasco has at minimum 6 months more life in it. My personal guess is 1.5 years of going up.

Yes, but from my experience, greed in America seems to be more pronounced than other western industrialized democracies.

And if introduced, the “Austrian” model of economics will just exacerbate the cultural/social/political problems with in the United States.

Most Americans are learning. Just the paying off of their credit cards with their puny earnings instead of getting nice 70″ tvs, etc., shows that we are now all learning. As with the second world war, it took a lot, but eventually Americans reacted with justified rage.

Woe to the crooked banksters and Wall Streeters in coming years. Like a flock of vultures (which birds are not parasitic like those persons, and I do not mean to defame) they will have to fly off to other countries if Americans stop the banksters’ “Federal” Reserve from giving then TRILLIONs of dollars in free money, and they cannot cheat Americans as much.

I hope that they go to China and straight into the CCP’s organ banks. The CCP does not tolerate other parasites even though it has pretended to allow some into the Chinese financial market: it wants to be the only parasite feeding off of the Chinese people.

It just needs the Wall Street and bankster parasites to keep pushing dumb Americans to invest and thereafter lose their savings in CCP companies, so it is granting those bankster and Wall Street parasites temporary privileges that it can revoke later in a day when it does not need them anymore. This is similar to when the banksters and Wall Streeters used fake credit ratings and lies to induce (or reportedly bribe) US pension administrators and other Americans to invest in subprime securities.

Now they are using their lying powers to push garbage CCP, PONZI companies’ stocks and bonds to gullible Americans.

By the way, beware of “investing” in mainland, Chinese companies, which are almost all PONZI schemes or like Alibaba will get destroyed or taken over or forced to turn over their assets to the CCP. I love some commentators with CCP-crony entities that are now claiming that those companies are “buying opportunities” because their stocks and bonds are now worth so little after foreign investors lost dozens and dozens of BILLIONs of dollars due to the recent CCP’s actions and due to the increasing number of implosions of the hundreds of CCP’s PONZI, real estate developers.

I guess that by their twisted “logic,” the Titanic, as it lies in the bottom of the sea, is also a buying opportunity now, because whoever owns it now would sell it to you for much, much less than the price of a new, cruise liner. LOL

So, when a home is foreclosed and the auctioneer shows up on the courthouse steps and local men start showing off their deer rifles nearby, is that a Marie Antoinette moment? Or, do they need to actually use them?

Advertising WORKS, otherwise they wouldn’t do it.

Rather than saying “people are stupid” (which is rather a stupid thing to say), the question is more like ads work on who and why? Forcing people into “hedonistic cars” is another big source of corporate cash and debt slavery.

Also, letting public schools go to hell, and making higher education more expensive comes to mind.

Then you have lots of sponsored content like “Duck Dynasty” where more educated people are condemned, and stupidity is praised.

All a good human needs to know is how to hunt ducks, use his big four wheel truck, and say his prayers with the whole family, thankful for a another glorious productive and fun filled day.

I ate greasy wild duck once in Medford. Yuck! My almost brother in law finally admitted it was just a way to hang with the guys for a while.

He also found me a 400 Kaw with a bald rear tire so I could go dirt biking with the guys. Was a real challenge, even though I was a damn good dirt rider then, because those guys like to ride in hilly slop with lots of trees.

Back then you could drink beer driving thru downtown….you just could’t be “drunk”. Mid to late 70’s.

The really incredible part is that folly has been forgotten so fast. Bubble bust #1 started in 2008 and the consequences could be felt though 2017 (by some measures)…this is hardly beyond the memory of Man.

More likely it is less “forgetting” or “never learning” than it is pathological incentives built into the system that DC created and presides over.

“DC” can’t create or preside over most ANYTHING that the corps, PE, and plain old big money do NOT like.

Quit cussing our effort at Democracy or you will likely get something you REALLY don’t like…..we all just dodged a bullet to the head.

If inflation is raging, as long as the rates are fixed, loading up on debt may be the smart thing to do.

Buying a house the buyer can actually afford with a long term currently low rate fixed rate mortgage, yes. Everyone needs to live somewhere but just make sure it’s in a location you actually want.

There are many areas in today’s “good times” which are actually in long term structural decline which will become obvious once today’s fake economy and financial conditions finally end. Look at price trends since housing bubble 1 for a sneak preview. Some of these areas have exploded from a very low base in housing bubble 2 (the one we are in now) but it isn’t because the place is actually desirable.

I have the sneaking suspicion that more often than not, buyers are using today’s low rates to “stretch” on a house they actually cannot afford, outside of today’s fake “good times”.

As Buffet said, when the tide recedes, we’re going to find out whose been swimming naked. Problem is in today’s world, the naked swimmers are going to try to get someone else to make good on their losses. Many on this site will agree with this sentiment. I see it now.

which areas are you talking about?

Not looking forward to seeing Buffet naked.

Certainly not revolving debt, such as credit card debt, that costs 15% or 25% APY. But a case can be made for 30-year fixed rate debt, such as mortgages.

unless of course, you think all debt will be forgiven.

“many consumers got caught up thanks to the flood of stimulus money that came in various forms, and included moneys-not-paid for rent and mortgages and student loans under various forbearance programs, eviction bans, and foreclosure moratoriums.”

Agreed. So, now most of that’s ended and we’re waiting for consumers to spend through their $4.4T in mortgage refi’s over the last 12 months.

Looks like the later half of 2022 could get a little ugly for consumers, especially all those great resignation folks that willfully chose to not re-enter the labor market.

See my comment immediately above Anton’s, vis a vis pathological incentives.

A long term economy is not built upon the gaming of financial structures that overlay the creation of real assets.

It is built upon real assets.

Once the financial structures are gamed to the point that they work in opposition to the creation of real assets (Fed and re-fed inflation undercuts the creation of real assets in the long term because it destroys the reliability of the medium of exchange) then the financial structures cease to be tools and become curses.

After I paid off my mortgage at age 35 I never even considered taking another loan.

And Volvo, just to add:

After paying off your mortgage you won’t need to take on another loan. Surprise surprise. Paying off a mortgage opens the doors to everything, including early retirement.

As for credit cards we seldom ever use them in our family. People say that attitude is crazy because of air miles, 2% cash backs…whatever, but decades ago I watched people get in trouble with credit and simply got rid of the possibility. Sure, online purchases require them, but even that hassle/event reduces the urge to use them. Another strategy is to lower the credit limit. Every year mine kept going up and up and it took quite a few phone calls to get it limited to $10K. I thought if we were out of town and faced an emergency that amount would be enough.

I remember having the ‘discussion’ with my brother in law. He is 13 years older than I am . He kept saying his accountant advised him against paying off his mortgage for tax purposes. (He lives in the States). All I know is he retired at 72 and did at 57, plus he earned at least 2X my salary. They took out a lot of loans along the way.

Only very rarely is there a case to pay off a mortgage early.

You’re taking money today at today’s value and throwing it at a fixed debt unless it’s an ARM. The fed and .gov want the currency to inflate and it always has. The payments you make on a mortgage in the future will be inevitably cheaper than the payments today.

Plus that extra money you spend today could have been invested and will make you money whereas a paid mortgage is just a feel good sensation for you.

Now the credit card thing is also a bit foolish but I can see the issue with most people regarding the discipline. I funnel every single last expense I can through my 2% back credit card. I pay it off in full every Friday like a religion. Even if I were to somehow forget, CC’s are done on a monthly basis. As long as I don’t forget 4 times in a row, I’m good.

People spend a whole lotta money. If I can skim 2% off some mega bank for every dollar I spend, that ends up being like a 1-1.5% tax cut the way I look at it.

Of course the best way to be financially stable is to reject materialism and consumerist behavior to a reasonable level and save/invest. You can’t rewards card and coupon your way to wealth.

I also use my 2% card on everything that will take a CC without an upfront fee. I pay the card off each month as it’s on auto pay. I make about $1,000 – $1500 per year from the 2% rebate and that covers Christmas for the dear wife.

Someone who pays off their mortgage early has a completely different mindset about money than someone like you. Neither one of you are wrong. Each of you are simply putting your money towards what you value most: security vs asset accumulation. There’s right or wrong answer here.

It’s different in Canada as money earned from rent is deemed “earned income” which pushes up how much money you can put into a registered retirement saving plan. So having no mortgage/mortgages means you can put a lot more money into a registered retirement saving plan. If I remember I think Bob Rae brought this in back in the early 1990’s.

That’s the key – one must have the discipline to invest what you don’t put against the mortgage, many do not, “Plus that extra money you spend today could have been invested”. Some advice that I believe has some merit – best to have a mortgage paid off completely (freeing up cash flow) or “mortgaged to the hilt” (invest more or walk-away in a huge downturn) but your worse off in between.

Excellent comment Jay. You descended from Henry Clay?

You can prepay and use your credit card like a debit card, but with less risk.

Credit expansion responds to interest rates because there is a debtor and creditor. Fed money, QE, doesn’t have a debtor, as far as the banks are concerned its credit money from outside their internal balanced system, its the same as original base money. So if the Fed were to raise rates then they would have to pay rates on these additional bank reserves, to the banks. This is an increase in the quantity of money. How would the Fed escape public approbrium doing this?

So my conclusion is that tapering to zero MUST be first if the Fed is to do anything (imo it won’t) because at least tapering would work to combat inflation.

Any flaws in this reasoning?

Interest rate paid on reserves banks have to hold at the central bank is decided by the central bank. If the central bank does see it fit, they could set this interest rate negative to tax the banks and deflate the amount of money. In other word, credit deflation.

They may have to get the legislators with them to raise the size of the reserves the banks have to hold, but even that is “possible”. In the USA it will not happen as the banks own the FED and the banks would be squeezed hard by such a move.

Thanks very good point. But wouldn’t the banks be able to just lend those reserves out themselves at a (slightly less) negative rate repayable in a year?

Also wouldn’t that be equivalent to taxation by the Fed? Because the fungible trail of money from QE treasury purchases first goes through government spending and thereby becomes a real economy asset.

i.e. these reserves aren’t any longer some artifact of the Fed, they are in truth changed into some person’s cash. The Fed doesn’t own them and these losses would have to be expressed by the bank.

How would the fed effectively signalling a deposit tax control inflation?

I do agree it would be deflationary though and it didn’t occur to me, but I think maybe they can’t do that either which is why QE has been used to set negative real rates (as opposed to the nominal negative interest rate on reserves mentioned).

The banks are required to hold a certain amount of reserves at the central bank. That is one of the fundaments of fractional reserve banking. So the banks are not able to put this money somewhere else.

It would act like a tax like inflation is and shift values around, but it is not a tax. Neither do the bank loose on it, it will be an operational expense like any other interest paid.

If they can do, well, the question do they have the will and the power to do it?

“Also wouldn’t that be equivalent to taxation by the Fed?”

What do you think 6% inflation and zero interest rates…both promoted by the Fed is?

Banks are currently, I believe, paid not only on the required reserves but also the excess reserves.

All these complications that come with higher rates IS WHY debt creation is dangerous. Did no one really see what was going to happen?

Now we get the “rates can’t go up because the debt service would be too much.” So, that argument is basically saying rates must stay ultra low, and way below inflation which promotes debt creation, which feeds the problem.

Thus, the CAUSE is the SOLUTION based on that illogical stance.

Debt creation is dangerous and comes with a responsibility…..and what happened to “it is incumbent on each generation to pay their own debts”?

What has been going on is nothing but a pulling forward of future wealth to fluff the present.

Who HIJACKED the Fed?

I look at the Fed as a kind of “Super-Lobbyist” for the banking corps/organizations.

But then banking always seemed to have special powers over things ever since the Medici (or whoever) first made it into a “trade”……and it still beats carpentry or even doctoring. Preaching I’m still not so sure about…..

1) Total household debt equal to bank’s total assets. In real terms it’s about the same as 2008 level.

2) Out of that, $1.6T student loans are zombie loans, a large number of c/c loans are zombie loans – paying down debt in turtle pace, at zero rates, producing no profit from interest, with shredded c/c cards. c/c interest rates must be high, because the risk is very high.

3) In real terms, WTI is about half from a decade ago, suppress by an inflation of taxes at the pump.

4) CA is robbing drivers, telling them bs about the climate change and the sun.

5) Chip shortages. If used cars are so profitable dealers should have thousands of them, but the parking lots are half empty.

6) If JP raise rates he will destroy real estate. His replacement

will, “normalizing” rates, at slower pace, to fight inflation, before it’s too late, because of Long Beach clogging.

Wolf,

Debt increase roughly matching overall inflation but further price inflation (highlighted in your last post) unlikely to be matched by taking on enough debt to match? Squeeze on living standards ahead!

high gas prices and ridiculous registration fees. My 2009 truck costs $360 to register. We get to pay more for everything because fuel is used to deliver

$360 is nothing. Try $1,500 in some places.

We are pretty lucky here in Texas with auto registration about $75 for any vehicle. No value tax assessed on vehicles.

What is Long Beach clogging?

The Port of Long Beach and the shipping container backup.

Haha, That one got me too. I was thinking I had mastered “ME Speak” finally and had successfully deciphered all the acronyms in the post until the end.

Occupation: Consumer.

Since college debt was mentioned….

Why is the cost of college so high?

Video lectures, then teaching assistants running classrooms.

Where is the cost? Static courses such as math, physics, chemistry, history, language…..why more expensive?

*These very rich schools should co sign the loans taken for their own tuition charges. They must have a skin in the game.

*The Dept of Education, which had a budget of 0 in 1978 now has a budget of over $63 Billion a year. The chart of that budget and increases matches the trajectory of tuition.

*For math simplicity, what if each state was allowed “to keep” one billion a year for education within the state to be spent as they see fit? Leaving, $13 billion for some bureaucracy in Washington DC?

The first thing Obama did when he took office was to federalize student loans. Now why would that be at the top of his list?

The biggest contributing factor to increasing higher “education” costs is the student loan program.

Think of it this way. How is it possible for any industry to perpetually price its product above their customers ability to pay?

The answer is that it isn’t, unless someone else is making up the difference. It’s the same reason behind the inflated cost of medical care and housing and now there are calls to do the same thing for child care. Watch the cost explode upward if it happens. Every time this “solution” is used, it creates the need for more “solutions”.

Fact: The very first thing Obama did when elected was to federalize student loans. Now, why would that be at the top of his list?

Fact: The Department of Education budget went from ZERO in 1978 to $63 Billion a year.

Fact: The trajectory of college tuition and the trajectory of the budget of the Dept of Ed are in lockstep.

Imagine…. if the States could, for math simplicity, keep ONE BILLION DOLLARS A YEAR to spend on schooling in their State. That would still leave 13 Billion for some Dept of Ed in Washington DC to do whatever they do.

Imagine …. If the schools themselves cosigned the very loan for the tuition they charge. The want to continually raise tuition might subside. The interest in the student getting a degree that would enable him to repay the loan would increase. There is no interest now.

Imagine…The schools, which are big business, were required to act as such. You wish to buy a Ford with a loan, you deal with Ford Credit Dept. You want to borrow money to attend XYZ University, you deal with XYZ University. No government involved…and maybe that’s what they are afraid of.

And ask, “Why is tuition so expensive?” Lecture halls, Teaching assistants getting paid nearly nothing. Many subjects STATIC, ie Math, Language, History, Arts, Accounting, Physics, etc…

Canned video lectures anyone?

Why so much more to deliver now than 20 years ago?

Fact: The Department of Education did not exist as an independent cabinet administration in 1978. It was part of the then-Department of Health, Education, and Welfare. It was spun off as a separate cabinet department in 1981 while the Department of Health, Education, and Welfare was renamed the Department of Health and Human Services.

There was legitimate jump in tuition rates some 20 years ago when fed/states significantly cut university support. But that does not explain the continual rise in tuition.

The elite universities have not incentive to cut tuition. In fact, if one is lower then other elites, they look “cheap” thus chance losing exclusivity, so the raise tuition in lockstep (somewhat similar to CEO salaries).

There is also the game of having a high tuition rate (that only foreign students and students who are low-performing-but-have-rich-parents pay). Many excellent students pay far less than the posted amount.

Finally desperation of the middle class, willing to pay any price to stay in the middle class (the same group that price up homes in good school districts).

Fact:

As of 1979, the Office of Education had 3,000 employees and an annual budget of $12 billion

Dept of Education elevated to cabinet-level status in 1979

It was NOT spun off in 1981, but in 79

I was off by a few months ,but my point still stands and sorry to touch a nerve.

“So, student enrollment in higher education has… declined steadily since 2010”

With some specific exceptions, a college degree is only a guarantee for a lifetime of onerous debt load and with little if any inreased opportunity for better emploment.

The idea that everyone needs a university degree is both misguided and an avenue to debt-slavery. Money to be made on the backs of fools.

I know a woman who has a master’s degree and can’t find a meaningful job. The offers she’s getting are in the $30,000 starting pay range. I think it’s because she’s in her early 50s now and nobody wants old people.

Doesn’t sound she’s got the MSc in engineering or medical sciences or physics or suchlike.

Students prepare to Work past 75 to pay of your ongoing Debt. Do not count on your inheritance, your Parents are in the same Boat. Your Money Masters will tell you how to live your life.

Can someone give me an explainer?

Why are Credit Card delinquencies going down while credit card balances are going up?

We have (2) main demographics in the US, and they’re somewhat equal in population. Millenial and Baby Boomers.

My stab at is that you’re seeing one demographic use their ‘helicopter money’ payoff and prepare for retirement, while the other is using the card.

With a 62% labor participation rate, eviction moratorium lifted, somebody is having to use credit cards to live.

And neither group has had to feel the pain…

Yet…

A lot of consumers are flush from the many stimulus programs and from the don’t-need-to-pay-for-housing programs.

So, it looks like bad news, since the stimulus was temporary. Plus, inflation. I guess a warning sign would be a jump in delinquencies.

Thats kind of like ignoring the debit side of the ledger. It’s the new “mark to make believe” on steroids.

My ex-wife did that when she decided to leave me in 1992.

She forgot that we had a $600,000 mortgage on a house worth maybe $700,000 at the time. Tough sledding for her after that, even though with the California divorce, she made bad choices going forward. She did manage to die with about $70,000 in CC debt though. Stuck ‘um!

If they’re “flush,” then why are they using credit cards? Not making sense.

They used their flushness to pay down their credit card balances and catch up with their payments. It doesn’t mean that they have cash in the bank.

Wolf – are the credit card balances of those who pay off their CC monthly included in the CC dept figures? I know of many folks like myself who purposefully charge everything possible to cc’s for cash back/bonus points but pay them off monthly. This is potential a huge amount of cash and may distort the results.

CC are now used like debit cards for the rebate programs. But those are mostly paid off every month and never become delinquent. This still increases the volume of credit outstanding at the moment of measurement, and widens the spread between credit outstanding and delinquencies.

Are SNAP cards considered credit cards when used?

Debit cards given out in govt programs considered credit cards when used?

Anyone know?

They are debit cards.

I pay off my CC ‘debt’ every month, and have done so for decades (rebates+convenience). My usual balance was $3K give-or-take, and my credit scores were all 800 or higher. For a few months now, I’ve been paying my mother’s rent for memory care–about $7K/month–on that CC so my monthly balance hovers near $10K at EOM, but I still pay off every penny. My credit score has dropped as much as 50 points, because I don’t have ‘any recent revolving debt payments,’ and my average balance is higher. So, you’re punished if you’re not a debt slave. If you complain about the excesses and (lack of) accountability of the Fed, you should add a dig at FICO, a secretive, for-profit private company that holds inordinate power over citizens’ financial lives, with no oversight or accountability.

ps. I interviewed at FICO HQ once; it felt like I might as well be at CIA HQ.

When I got divorced my credit score dropped. It turns out that you can make timely payments for 20 years but if you divorce and change credit cards your FICO resets.

So suddenly, in my 60s, I had a FICO below 700 because I had a “short” credit history with my new cards.

I also didn’t have enough credit cards, another by-product of my divorce. Apparently they want to see a lot of credit action

I asked them if they would like to know my net worth but apparently net worth and credit worthiness are completely unrelated.

“I asked them if they would like to know my net worth but apparently net worth and credit worthiness are completely unrelated.”

Ability to pay means nothing anymore. I don’t even have a credit card but I decided to apply for one a few years ago with my same bank who I have a checking account and savings account with. My savings account had over $100,000 in it. I was declined because my credit score didn’t show any debt and was below 700 as well.

1) In the early 1990’s HIAS org offered 1M Russian refugees discount

mortgage rates to settle in.

2) In the early 2000’s black communities org offered tenth of millions inner city poor discount mortgage rates to settle in.

3) In the early 2020’s US gov offer the whole world discount rates and

subsidies to settle in.

Well, if we all max out our credit cards and then piss on the banks, we will see what happens. Betcha the Fed goes crazy and re-capitalizes the too-big-to-fail banks. But the government will insist on punishment.

Biden will probably pass an Exec Order to allow banks to do civil forfeiture. And after it is found unconstitutional he will insist people follow it anyway rather than Supreme Court law as he has done for his Covid proclamations on rent waivers and private corporation employee practices.

It’s going to come to a head regardless. But under whose terms?

Our own federal government and currency have become predatory.

Nothing a 6.2% CPI can’t fix.

Excellent read. Great charts there.

The charts show we live in the Debt Age.

Debt is cheap and virtually unlimited.

Debt is the new savings.

Credit is the new currency. Credit buys what cash can’t buy.

Especially when you live your life in 2 week increments….

Can you imagine the debt carnage if people only got paid once a month…

Screw up and it’s a long 30 days until the next paycheck…

Me and my wife’s job pays us only once a month on the 25th. Its annoying at first but autopay a few days after the paycheck hits makes it a nonissue.

‘Debt’ has always been the creditor’s savings. Been that way for over 6,000 years.

Like I mentioned a few days back, Millennials are the biggest debt junkies we’ve ever seen, by FAR. Ironic how, during the GFC, we were told they were a whole new generation who eschewed debt.

Some things are still fairly cheap, like electronics. I just bought a new laptop (replacing one from 2013) and a new TV (replacing one from 2009). Both the newer, better devices cost about half of what I paid for the previous ones.

yeah, that’s the government’s argument. who cares if housing, health care, education, skilled services, and taxes are going up, as long as you can buy cheap flat screen TVs and computers from Asia?

I think by and large, over the last 20 years, it’s really in services that you see the most inflation, rather than in goods.

not all housing and autos are services yet

Food is also not a service yet.

Food is not a service, but it’s becoming a luxury item.

That’s weird because I need a new laptop and the prices are WAY higher than my last one from 2012 if I want the good components this current one has.

Laptops have definitely gone down in price for me. I bought a Dell in 2006 for $1400. Then I bought a Dell in 2013 for $700. Now I bought an HP in 2021 for $330.

And I got it on a Black Friday special. But even the “regular” price of $520 would’ve been less than I paid in 2013.

You can’t eat or refuel your car on laptops and TVs.

If this is the way the government runs its finances, people must be wondering – “why pay taxes?”

Your tax money goes to fund bailouts of speculators, who intentionally take advantage of government.

There is serious moral hazards in play today that threaten to tear apart the nation.

If all people do always act as rational capitalist, the end of society follow quickly.

There will then be no morale, only the bottom line counts.

Maximum profit the goal, any means available to accomplish.

Mortgage loan balances will take another step up starting in January. That is when the mortgage loan limits for a conforming (FHA, etc) will be raised in most places. These limits are location dependent. In our area they are currently around$ 540,000 but will be going up to $640,000 in January. I figured this was coming because home prices were overrunning mortgage limits. So I expect home prices to continue going up to gobble up this additional borrowing capacity. My son is having a home built and has the end price locked in. He is happy that the window and door shortage will push his closing in to January so he may be able to take advantage of the new limits and put a lot less down, which he can used to buy the air conditioner and appliances that got taken out of the build contract due to supply chain issues.

A recent Bloomberg headline reads “Yellen says Fed Wouldn’t Allow a Repeat of 70’s-Level Inflation.” Which indicates to me that the Secretary doesn’t know how inflation works…

We’ve already blown past that. She’s a jawboning LIAR.

Why is it that all those not concerned with inflation are either

Fully invested in stocks

Fully invested in real estate

The beneficiary of inflation protected pensions (Janet Yellen has at least 3….U of C, Fed, Treasury)

Because they hop onto the computer every morning and get a massive dopamine rush from their skyrocketing “values.”

Student loans in hindsight are turning out to be a stealthy wealth transfer, a stealthy jobs program (I am a college teacher and I suppose, beneficiary of a pass-through). This is similar to — let’s see — military spending, aid to families, forbearances of all sorts …. It is stealthy socialism, in a country that dare not speak that name, but bobs along on the benefits and bailouts across all demographics.

I do not back the student loan bailouts (under whatever name), or free community college. It is because of moral hazard — no skin in the game is filling my classrooms with people with no commitment. The incentives are eroded because Uncle will always bail us out. (And it has bloated tuition prices, weakening the character and bodies of school staff people.) I am proud to teach at a very low-cost college, and to preach sound personal finance. I had a modest student loan and I paid it off.

The other pass-through I see here is to credit card issuers. Funny thing, 2008 was a harsh wake-up call and I didn’t use any new credit for years. But this crazy world of memes and NFTs shows a young population numbed to any consequences. That’s an indicator: it’s about time for a new wave of consequences to arrive. And those rickety structures can collapse faster than ever before– at digital speed.

Perhaps free community college would offer net societal savings as the credits could transfer to 4-year schools. It would also help universities reinstate high academic standards instead of teaching remedial crap that should have been learned in high school. Finally, it could give older folks a chance to reskill, if the program extends to them.

I haven’t decided on a position on it myself, these are just a few initial thoughts.

I totally agree with you about a buy in when going to college. I worked in community mental health for years and there was no buy in. In fact, the organization would give lots of freebies like gift cards and wouldn’t penalize for not showing up to appts. The result was a lot of waste and enabling of poor behavior.

I now work for myself and got out of the non profit because I was sick and tired of freeloaders.

At this stage of Debt Note Currency (Fiat) aka the dollar the euro and the economies that depend on it there is no down side on debt due to default. So it does not matter now. They are going to load the Credit Cards up then walk away. They fully believe the Government will bail them out as the Gov’t has before. They do not know or care that the Gov’t is bailing them out with wealth from their future and their children’s children’s future after getting a big cut for a selected few that control Gov’t . They believe the Stock Markets cannot go down. Forbearance to infinity is on the way. Work Ethic is a colonial imperialIstic construct. The American Consumers job and fate is to consume like bacteria in a Petri dish. They are not aware and do not concern themselves that their nutrient and waste systems in the Dish are finite. They gonna’ bop till they drop.

Powell……..inflation raging all over the US………well……maybe ……maybe ……..we could consider………just consider………thinking about……..tapering a little…….but we could take it back……..because we don’t want anyone to hurt……..while US families are being destroyed.

Where in the hell is Patton! What a weasel……

The masses are getting destroyed and Powell is worried about the stock market suffering even the slightest boo-boo.

Fred

“The Fed is keeping a very close eye on this runaway inflation.”

J Pow

“Are you better off than you were four years ago?”

(RR,Oct 1980)

“The mechanics of a bubble is you have maximum borrowing, maximum enthusiasm. And then the following day, you’re still enthusiastic but not quite as enthusiastic as yesterday.

A week later, you’re not quite as enthusiastic as last week and last month. And gradually, the enthusiasm level drops off a bit, you have no more money to borrow, you’re fully borrowed, and the buying pressure gradually slows down. And that’s it.”

(Jeremy Grantham,old school investor,Nov 2021)

The $1M question is:

Are you more enthusiastic with every passing day ? Are you overflowing with joy and start doing cartwheels after yet another daily stock market ATH ?

Emphatically,I am not.

Kinda like the description of going bankrupt in The Sun Also Rises by Hemingway. Euphoria slows at first then it just descends into depression all of sudden.

Fortune is of sluggish Growth, but Ruin is rapid (Lucius Anneus Seneca, Letters to Lucilius, 91–63)

Dem damn Roman wet blankets and joy killers 😀

Every year I am better off than the last. My worst was During Trumps time getting rid of itemized deduction where I could not qualify and getting rid of salt and most of my mortgage deductions. Best was just now due to free giveaways.

I guess they just bought your vote.

Isn’t all of this debt overhang ultimately deflationary? How does this square with the current inflation narrative?

The Government requires us to use money for taxes, fines, fees, licenses, and for settling private contracts (legal tender laws). Anyone refusing to use the money is soon homeless or imprisoned, because there is no other way to pay income tax and property tax.

But the government doesn’t create any of the money; only private banks create money when they issue loans. Banks charge interest for loaning something they never had to begin with, and we are FORCED to borrow from them!

When banks create money, they only create the principal but not the additional interest that is due. This means it is 100% impossible for everyone to repay their debts. Everyone is forced deeper and deeper into debt: people, businesses, and governments.

This puts all of humanity into involuntary servitude to private banksters.

Please stop attacking the victims and accusing them of being irresponsible.