Massive price increases now building up in the pipeline.

By Wolf Richter for WOLF STREET.

A lot of price increases at various stages of production are coming down the pipeline that haven’t flown into consumer prices yet. These are input costs for industries that will try to pass them on to the next company in line, which will try to pass them on until the consumer gets to eat them. We’ll go up that pipeline in a moment.

At the front of the pipeline: Producer Price Index for Final Demand.

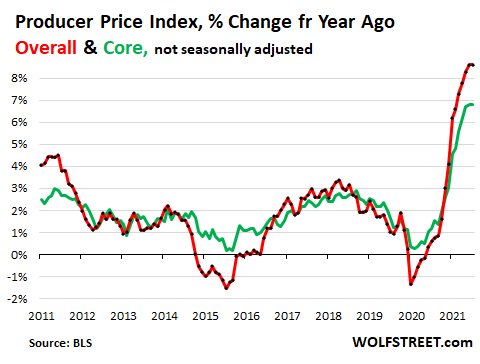

The PPI Final Demand covers the input prices for consumer-facing industries whose prices then enter into the Consumer Price Index. The PPI Final Demand jumped by 0.6% in October from September and pushed the year-over-year increase to 8.6%, same as in September, the biggest such jumps in the data going back to 2010 (red line).

The Core PPI Final Demand, without food and energy rose by 0.5% for the month and by 6.8% from a year ago, same as in September, the highest readings in the data, according to the Bureau of Labor Statistics today (green line).

Time of the year for “hedonic quality adjustments” to kick in:

The price index of new vehicles fell in October from September because the new 2022 models were entered into the index with “hedonic quality adjustments” as they always are at this time of year. The wholesale value of the hedonic quality adjustments for the PPI amounted to $86.84 per car and to $186.22 per light truck, according to the BLS. These hedonic quality adjustments are going to reduce CPI for new vehicles.

These quality improvements include changes in the infotainment systems, power trains, and standard and optional equipment packages.

In other words, the once-a-year price increases of the new model-year vehicles were reduced by those amounts, which is why we have the amazing WOLF STREET F-150 and Camry price index, which shows actual prices versus the CPI for new vehicles going back 30 years.

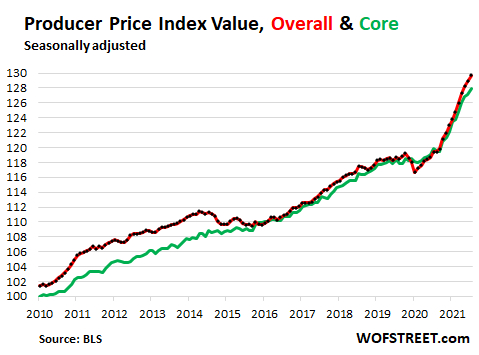

In terms of the PPI, tor year-over-year comparisons, there is always the “base effect,” meaning that the level of the index last year impacts that year-over-year percent readings. And there is always the cumulative nature of inflation. The chart below shows the PPI and Core PPI as index values, which avoids the base effects and shows the cumulative nature of inflation. Note how the curve has steepened over the past 12 months:

Some prices that had previously spiked ticked down in October, while other prices that had risen more moderately in prior months, or had declined, jumped. The inflation game of Whac-A-Mole. The overall indices average out.

Up the pipeline: PPI Intermediate Demand.

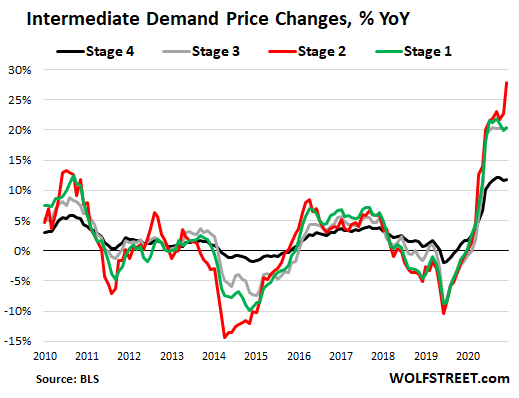

Intermediate Demand is categorized in four stages by production flow: From Stage 1 industries that are some distance up the production flow and create inputs for State 2 industries, to Stage 3 industries and to Stage 4 industries, which primarily create the inputs for Final Demand industries (see PPI Final Demand above), which create the inputs for consumer-facing industries (tracked by the CPI).

Going backwards up the pricing pipeline of the production flow.

Intermediate Demand, Stage 4, the input cost for final demand: +0.7% in October from September, with goods +1.2% and services +0.1% month-over-month. Year-over-year +11.8%. These industries create inputs for consumer-facing industries (black line in the chart below).

Intermediate Demand, Stage 3: +0.9% in October from September, with goods +1.1% and services +0.6%. Year-over-year +20.2% (gray line).

Intermediate Demand, Stage 2: exploded by 4.7% in October from September, with goods spiking by 9.8% month-over-month and services ticking up 0.1%. Year-over-year +27.8%, the highest in the data (red line).

Intermediate Demand, Stage 1, furthest up the pipeline: +1.0% for the month, with goods +2.1% and services -0.2%. Year-over-year: +20.4% (green line).

In the three production stages furthest up the pipeline – Stages 1-3, red, green, gray – prices have all jumped between 20% and 28% year-over-year. These are massive price increases now building up in the pipeline; and they will flow to some extent and in some form into future consumer prices.

With the new inflationary mindset among consumers who are now willing, and with vehicles even eager, to pay whatever, and with surging wages across all industries and continued massive monetary and fiscal stimulus, I don’t see a whole lot of hurdles for this inflation to get passed on to the consumer.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Well this is all transitory so I don’t see what the issue is.

“This inflation is transitory, like the Roman Empire”.

J Powell, apocriphal.

Powell is terrible, but can you imagine Brainard?

“You get a lambo! And you! And you get a lambo!”

Hi Wolf, why are bond yields still so low. Either too much liquidity or a fast-coming recession ?

Because there’s still 120 billion of QE going on every month.

If bond yields went up fastly in parallel, higher pressure would be on the bond interest payment from Treasury dept in long term.

Gary. I doubt the Treasury worries very much about making interest payments on the Federal debt. All they have to do is print up another bond, and the Federal Reserve buys it if nobody else wants one.

redirect that monthly QE to interest payments…

Hey, the money ends up in the economy, right? Just the same, except the govt doesnt get to decide how its spent…..the lender, the security holder does.

And why is that a bad thing?

Why? Because the FED is cheating humanity, that’s why.

Funny how Dems always want to blame the FED for malfunctioning Dem policies.

Don’t tie up your thinking with that phony blue red battle Jim. It’s a distraction from the real issues.

Look, look, over here, it’s the ‘wicked’ Dems.

Don’t look over there at the plutocrats and the M.I.C., there is nothing to see.

“ . . . economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. https://www.cambridge.org/core/services/aop-cambridge-core/content/view/S1537592714001595

SJ

I thought you were just a standard RE troll?

What set this new weirdity off?

Looks like a good link James. Thanks. Will read later.

That is the question to which no one has an answer.

Lacy Hunt seems to make dome sense but then inflation is also raging currently with no end in sight.

And his explanation of the velocity of money seems lacking.

I haven’t seen anyone make sense of low bond yields so far.

I don’t think we really understand what is going on, but in hindsight things will make sense. We can all say, how didnt we see it coming.

My own thinking is that the economy is circling the drain.

I think current money system is coming to an end in the near future. Imbalances are huge. US trade deficit is huge and penalizing savers so people can party on Tesla and crypto coins can’t last much longer.

“I haven’t seen anyone make sense of low bond yields so far.”

Well, let’s see what things are really worth when, and if , the Fed takes their thumb…make that a foot……off the scales.

MMT? Is that the game. Inflation is to be met with higher taxes to smooth out the price increases? As the govt becomes more enriched and empties out the private sector?

No…it is more similar to OMT (Orwellian Monetary Theory)

• Debt is good.

• Lender is slave to the borrower.

• Saving is Punished.

• “Stable” now means increasing (prices) at a stable rate of increase. (2nd Fed mandate)

• Extremely low interest rates are moderate, even though at immoderate record lows. (3rd mandate)

• The future funds the present. (It is no longer incumbent on each generation to pay their debts.)

• Free market economy is arranged by unbridled unelected power. (central bankers)

• Democracy is ruled by these monetary dictators.

• Ignorance is strength.

• Inflation is GOOD!

• Freedom is slavery.

• We can not raise rates because there is too much debt, so we must allow the current condition of zero cost debt creation to continue.

• Tax unrealized gains

• Rates must stay low to solve the employment situation, even though there are record job openings

• Trade deficits don’t matter, even if we must import critical items to the survival of the natio

The best explanation for current bond yields is psychology.

It sure isn’t because credit quality is better than ever. In the aggregate, it’s close to or at the lowest, ever.

Governments have never been more overcommitted, except in time of major war. Corporate balance sheets, worst since at least the Great Depression. Consumers better than pre-GFC in the aggregate but then, don’t know how this applies to those who owe most of the debt. What I am confident oi though is just like pre-GFC, many “prime” credit risks with high FICO scores are actually broke or near it.

Concurrently, all major asset classes are the most overvalued in history, inflating supposed collateral where it even applies.

The answer for this is widely known. Interest rates are based on supply and demand in the bond market. Right now we have demand that is artificially high by a huge margin because of Fed bond buying. Take that away and rates would be much higher.

Exactly, and the only question now is will the FED be forced to accelerated their tappering & raising interest rates. Can’t wait to see what mortgage rates are by this time next year.

You’re right.

But we arent suppose to notice.

Neoliberal central bankers all follow the same playbook: To increase “growth”, lower interest rates is needed, even negative, even if it renders the main asset of the 99% – housing – complete unaffordable in every developed country.

There’s a very interesting project happening in China right now. We all know that the CPC is actively deflating its housing market; but to offset the loss of growth from real estate investment, it’s simultaneously inflating its Fourth Industrial Revolution sector, betting on huge long-term productivity gains from robotics, AI, etc

Rowan: the more interesting question as to China is, are CCP factions now blowing each other up as rumor claims like Mafia factions assassinated each other in the 1920s to 1930s? Ten blasts were reported then suppressed from media by them reportedly!

China is replacing the housing market with military expansion.

I give you Adolf’s spawn Emperor Xi.

Because the FED is artificially depressing them (indefinitely it seems).

FED won’t do anything to hike rates. Also even if mortgage rates goes up to 6-7%, I don’t see any housing price crash. I don’t see mortgage rate going to 6 % which means 10Y yield is 4.5% . Today it is at 1.6%~

It’d take 10% or more mortgage rate for prices to cater.

Hike in rates would crash stock market for sure

Jon

You are dreaming.

Watch the movie “the big short” and tell me again about 6-7% mortgage rates won’t implode the real estate market …which is a collateral domino in the entire scheme of things.

You will be able to stand on a street corner and hear the keys being tossed in the mail boxes.

Historicus,

No kidding. The idea that marginal home buyers (the ones who ultimately determine prices) can afford the monthly expense @ 6% at current prices is a pipe dream.

This doesn’t even consider increasing property taxes from the recent appreciation.

Replying to historicus:

My friend lives in a pretty expensive area in Bar Area.

The house beside his was sold for 3 million USD I guess. 4 families moved in. The garage was convered to a dwelling unit , 1 small Dwelling Unit in backyard and 2 families in the 4 bedroom home.

If the rates go up, people would be living like this like in 3rd world country. California is already turning into like this

Bond yields have been coming down since 10/21. China debt is imploding, driving entities into the safety of US treasuries.

Long DJP.

Long DXY. Short DJP.

The people don’t have the money to support these prices, so we’re headed for Klaus Schwab’s utopia: “You will own nothing in 10 years, and you’ll be happy about it.”

Producers better brace for fewer sales, this sucker’s going down.

Not if you are hungry…

I buy in FPGA boards which I use in gadgets that I sell online. For the last 2 years they have been priced at £118 or thereabouts. They are now £156 – £170 . Other components that I use are upto 70% more expensive. It has made my little sideline business unviable as people aren’t willing to pay the increased prices I would need to cover my costs.

Tired, I know, but still worth stating:

“When something cannot go on forever it will stop.” Herbert Stein

But when?

The day after grandma sells her CD for some crypto.

LOL!!!

We need a new bigfoot sighting, UFO or asteroid approaching earth to divert our attentions. No….don’t look here, look over there!!!!

China invades Taiwan, my guess. AND it will happen while Joe is still President.

Where is JPOW

Time for JPOW WOW

LOL

JPOW

Please quantify what “transitory” means

weeks? months?

when do we hit the point you ADMIT you were wrong? We all see you are wrong already. But that’s the game, isnt it? You go away to wealth and speaking engagments (paybacks). Maybe you write a book that sells hundreds of thousands, but is only printed in limited numbers. The old game.

I used to keep up with luxury fashion trends, but have cut back watching because of the insane prices on items. I wasn’t buying much as it was, but now everything is the price of a down payment on a house, ridiculous isn’t a harsh enough comment. There really isn’t enough value in most of these items to warrant interest in them. The lowest end is still cheap, but too cheap to be of much use, so doesn’t warrant considering as well.

Inflation is really making people think about what is worth buying. Either it makes the high end item not worth the price or it makes the cheap item so poor in quality, it isn’t worth buying. Inflation is discouraging spending in general and that’s why there is no velocity in the money supply.

My friend bought a LV bag for $7K 4 months back after a wait of 4 months.

Now that bag has increased in price by 20%. Same wait time for Rolex

People are buying luxury items like crazy.

If someone has to cutback on buying luxury items then I think they should not buy luxury items in the first pace.

Inflation does not really hit rich people.

Unless the LV bag had real gold or silver hardware, or other real jewels, it isn’t worth the $7K. I can buy a bag on sale for less than $500 that would rival the quality of LV.

Most of these items are now used as a way to get around capital controls. You can wear 500K on your wrist and move it anywhere you go.

I like buying high quality outerwear. A coat or jacket can run $850 to $1,000. That being said, I end up selling a lot of used clothing because for whatever reason I didn’t really like it or wear it as much as I had anticipated. After all these years, I can never know how much I will wear a piece I buy. Some become favorites for reasons I myself don’t even understand.

I shop at thrift stores. Way cheaper.

I buy fabrics and have my best clothes custom made in South America.

Exactly. Picked up a pair of never worn Lands End leather loafers for $20 at Goodwill last Friday. Crazy what peole buy and never use.

Puuuleease, shut up about thrift store finds. Too damn many shopping mall expatriates getting in my fishing pond these days. Curse that Antiques Roadshow and the cabriolet they rode in on! BTW..a sense of flashion isn’t the quivalent of having true style…taste is aquired, not purchased. Now drill ye tarriers, drill!!

Nah, it was too good to last. They are being picked over so hard that there is next to nothing decent to find in there any more.

Well this is a problem. Let see how Powell spins it and how Congress keeps ignoring it. Climate change does not have a lobby in Congress. Perfect thing to run against. Inflation that was caused by the un-organized electorate wanting everything tax free with no pain got very little compared to the highly organized that own Congress. You know the short list. Wall Street,MIC/Security State, Big Pharma blah, blah, blah, Pelosi et al jetted away after the infrastructure vote to Glasgow for a hopeful face to face photo op with Greta the Wretched while spewing enough Carbon for a small town for a year. The perfect venue is in Glasgow for her to point her surly finger at you and me for wanting to stay warm and eat and maybe not drop dead from having to stay in the work force past our use by date. Can’t wait to see how much of this 20% That Wolf wrote about ends up downstream and how Congress and Jerome runs from it.

Engineering wise I would say the simple quick estimate for your carbon foot print is how many lbs of stuff you have including weight of cars, house, boats, concrete drives and how many miles you travel.

Our rulers will be the ones telling grandpa he has got to get rid of his oil furnace to heat his 800 sq ft house while they have seven houses and travel 100,000 miles per year. We are getting close to the let them eat cake moment.

Yeah, but it won’t be a piece if Queen Victoria’s wedding cake. Try the stale Entemann’s at the end of the aisle…in the day old store.

“We are getting close to the Let Them Eat Cake moment.”

No. You are in it right now. Capricious, erratic Dictates, doubling down on stupid power.

The 10 year US bond yield is 1.43% today. It is the US Federal Reserve that is still buying bonds, QE so it will help saved $1 trillion+ interest on the US 29 trillion national debt. Inflation is what they want, thieves.

It is. Dropping rates are the work of JP and his tireless band of day traders over paying for Treasurys at the Fed.

Donnie

Thieves they are…

Inflation north of 5%….and Fed Funds (savings interest) still near zero.

Never EVER happened before. Emergency measures? Record real estate and stock prices.

I would like J POW to answer this..

“Did your parents ever save money to buy something?”

Because now, people are PUNISHED by your policies, for saving.

Wolf

Thanks for the accumulation and compounding charts

This is key

especially when Yellen and Powell speak of inflation backing off…

but they never mention the permanent TACKING ON of the current inflation…

the chart is always “Low left to Upper right”

The People will learn, and hopefully the media will report on the RAPE of the citizens going on due to CURIOUSLY directed monetary policy. I suspect one thing ….

Look, supply chains got rattled, taking a while for supply to spin up.

When it does prices come down.

In the meantime, Do not be the rube who overpays unless you want to or have to.

Nope.

Not this situation.

The Fed pumped money supply 30%.

Supply? Bottlenecks?

Those are created by businesses reaching for inventory….

for fear of inflation..

for to have inventory in an inflation is to be in the drivers seat

The first question is, will supply chains spin up?

Or do manufacturers consider the demand transitory with a high risk of loosing money if they invest in more capacity? Many may also look at their margins and decide they take the larger margins as long as they last and not risk excess capacity in the future.

The second question, is there a constraint that is not easy to bypass?

That is, is some input to the product chain no longer available cheap?

That was a lot of numbers.

You had me at hello

Most Americans have never seen how economies in less “developed” countries work. Trash piles of perfectly good things in front of houses don’t exist. Why? Because replacement is either too expensive or impossible. Americans value quantity over quality in every aspect of life.

What is happening now is actually the best thing possible for both our planet and our ethics. Instead of throwing away an “outdated” piece of furniture or appliance or BBQ pit or clothing, or “renovating” a 10 year old solid wood kitchen with particle board garbage, god forbid … we’ll start REPAIRING them.

Instead of buying more crap from China, Mexico & Vietnam, we’ll start buying higher quality (yes more expensive) American made products. We’ll just buy less. Instead of trading “UP” to the latest car or truck every 2 years or having 4 vehicles we can’t afford sitting in the driveway, we’ll fix our “OLD” ones and take better care of them in the first place so they last a lot longer.

We’re entering a new era with new paradigms where LESS is better and MORE third world junk to fill our overflowing land fills is UNCOOL.

Spending time with our families and friends will take precedence over working ourselves into burnout so we can buy more garbage will be very early 21st century

Have you ever walked into a house with three kids and notice there are 278 toys per child (some even unwrapped) but their parents are literally exhausted from working 2 jobs each to buy more, more, more?

Yes, this means we’ll have a BIG ugly recession! THAT’S WHY INTEREST RATES ARE LOW!!!

Hear, hear!

Most Americans can’t afford to pay for repairs on consumer (durable) goods. Labor rates are far too expensive for all but a low fraction of the population.

It will have to be DIY.

Good message, buy more plastic stimulus for the children so that no matter how much you buy, they still want more, bingo, drug/toy addiction. The sadistic solution, gas !0 dollars a gallon, nobody will drive, so buy electric cars, no electricity. Stay home, drink more, then die. Not a pretty picture society is painting for us all.

Nobody knows where we are heading. To assume U.S. manufacturing will pop off when the regulations and restrictions for either cultural or environmental reasons hamper nearly every turn. Just hiring people is brutally difficult now.

Nobody will want a plant making flat screens near them. This country is full of hypocrisy. Out of sight out of mind. 15 an hour minimum wage but rampant importation of below poverty line slave labor done “under the radar.”

“More equality” say the rich city dwellers who want for nothing.

What insanity to think that anybody has a clue what this stew of chaos will cook into.

DXY is still obscenely strong though. So what the hell?

Oh and let’s not forget: the CDC says we should avoid crowds and that there is still a pandemic. But every NFL and NBA and NHL stadium is filled. I mean we are in bizarro world.

Now I wager my guess: Fed starts taper, Brainard gets appointed as head, Congress gets turned over red, and the stew’s recipe gets even more chaotic and weird.

I can’t wait to see what happens when Chinese real estate bonds start defaulting and the CCP starts really showing its hand that it doesn’t care about the global economy at all because it makes everything and why should it? You think magically after U.S. investors get crushed because Chinese real estate bonds kill Blackrock which works lockstep with the fed there will be appetite for massive investment into U.S. manufacturing where everything is obscenely expensive and there is no market where anybody can afford any thing made or will Brainard just start printing subsidies directly to manufacturers?

Or perhaps it all just collapses and we should have an actual free market and the SEC should bring antitrust suits to these insanely powerful mega conglomerates like Google, Amazon, Facebook, and Microsoft and actually facilitate a Free Market?

Roger That! – China has already started to default on dollar debt. Evergrande is 2% of Chinese GDP before counting the other 18% that constitutes the rest of the crumbling real estate sector. There will be contagion in the west but it may not be terrible, because China did us the favor of limiting western involvement in Chinese banking. Otherwise the predators would have been all in.

As far as tech goes, Google, Amazon, and FB are on the ropes as far as I’m concerned. If I had money I would be a long term short.

The only difference between the US and other third world countries is the size of the house and the amount of junk in it, LOL.

But really, the huge amount of central and South American immigration brought the third world conditions to here.

That has to change.

Americans might need to think about learning some skills. I do my own vehicle maintenance on my 2006 truck and my wife’s 2013 SUV. Grow a pair already. Take some time to LEARN and be self sufficient instead of spending $200 for an oil change do it $70. A fool and his money…..

A couple of recent studies suggest US general inflation for the end-consumer is (mostly) coming from just a handful of sectors, such as car rentals, used cars, and gasoline. Cars are lacking chips (due to Covid factory closures), while gasoline can get relief from OPEC.

Most US GDP sectors (~80%) are not inflating. Some, like sports events, are deflating.

Overall, it suggests the alarming up-spike in prices today will be temporary, and fall back when chip and oil supply recover in 2022.

You missed the big important part in the article. Car and truck prices in the PPI FELL in October thanks to hedonic quality adjustments. They didn’t drive this spike.

These year-over-year price increases are across the board, and across stages of production.

R2D2, i agree in general but “some relief from OPEC” is Jimmy Carter II and a loser.

” Covid factory closures”

Where?

Google “TSMC Covid Taiwan”

Haha, right. Read the article prior to this one! It has the following stats:

Rent: +10.0% (new record)

Food prices: +9.1% (new record)

Gasoline prices: +9.4%

The necessities of life are going up massively and only some of the discretionary stuff is falling in price.

R2D2,

Rising insurance cost is also sucking up a lot of consumer income, health, car, and home especially.

The common thread here is that The Fed has screwed up a reasonable existence. Where is Paul Volcker?

Notice in the PPI chart provided…

the Yellen era of “fear of deflation”……

see any deflation?

What a ruse, misdirection play by the Fed….

“Stable prices” would be a horizontal line on the chart…..

not even close..

Oh to have all those inflation protected pensions these purveyors of inflation have, our governmental servants.

Keep your eye on the ball. Trade balance of payments is the expression of inflation since US doesn’t produce anything anymore. Watcha gonna buy wid dat money?

China is very excited to accept all the Biden infrastructure bill money to supply the infrastructure and green energy stuff that can be purchased using waivers to the Buy American farce. I doubt they will buy Treasuries with that loot.

Stop American oil production and beg the Saudis and Russians to pump more oil? Kill coal production in the US and endanger US electrical capacity while China builds more coal power plants to support the manufacturing to supply stuff to the US at high prices?

Watch fuel. This disaster of an Energy Policy is underlying this whole inflationary tsunami. Look for massive upward push on goods and services as fuel gets further hammered by more US pipe line shutdowns and production bans instituted by the the Regime. Their Director of US Energy, after “blowing away” Michigan’s economy as Governor, now claims that OPEC is the controlling power over US fuel costs. 12 months ago we were energy independent and selling into the global markets. Now that the Regime has cut off US production at the knees, they complain that they can’t do a thing about it and blame OPEC.

This is akin to economic suicide. Destruction from within our own government.

Some random article I read claimed EROEI was around 5 now. If so, not good at all. And now they want to shut a pipeline that that handles roughly 3% of US oil consumption needs.

We’re flailing about aimlessly. Or maybe a more accurate metaphor would be swimming further away from shore with our last bit of strength.

GB,

Partisan BS.

The creep of Peak Oil is what is rearing it’s head again. the Obama all-in-on-fracking that juiced the American energy markets has now faded.

Injecting water deep into near exhausted wells to pull out the last twenty percent is not a long term solution, just a cheap political slogan fired by unlimited debt. Those West Texas oil pigs have been some of the biggest debt consumers in the history of finance. (See previous Wolf articles)

We haven’t been energy independent since the 60’s when the Pentagon (the biggest end user of fossil fuels ever) decided to bomb the shit of Indochina for a decade. There went all of our cheap oil.

Everything since has been predicted by Peak Oil. Spasms in price, investment, hunting for ever pricier more distant reserves. Meanwhile the worlds population doubled.

Look no farther than to Afghanistan to show the collapse of our energy systems. The empires provinces suffer first. Harvest failed in drought. population doubled… Starvation looms

WOLF

Unique breakdown of upcoming inflationary factors- where do you find this stuff?? Fascinating!!

I consume so little other than dining out, so inflation beyond food is off my radar. The political ramifications of these numbers coming to fruition is gonna be interesting indeed. Fingers-a-waggin’ everywhere.