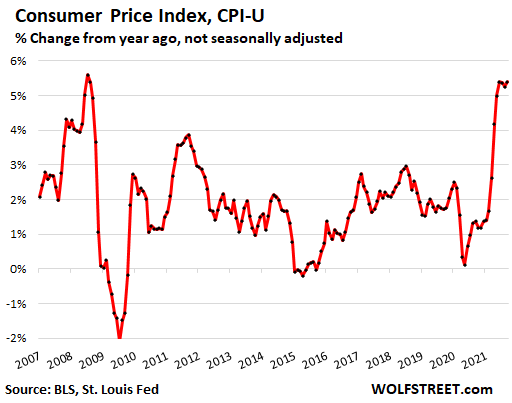

CPI inflation highest since 2008 and 1991.

By Wolf Richter for WOLF STREET.

The Consumer Price Index (CPI) jumped 0.4% in September from August. The relentless series of jumps started in January when this “transitory” inflation took off. But now, “transitory is a dirty word,” as Atlanta Fed President Raphael Bostic phrased it so elegantly, because the underlying dynamics have made it persistent: as some prices back off, others are surging.

On an annual basis, CPI jumped by 5.4%, matching the June high this year, and both are the highest since July and August 2008 (5.6% and 5.4%), and all four are the highest since early 1991, according to data released by the Bureau of Labor Statistics today.

The increase was driven by numerous factors including food and rents and gasoline and utilities and new vehicles.

Food and energy can move sharply and erratically, often following prices of commodities. With food and energy removed, the “core CPI” rose by 0.2% for the month and by 4.0% year-over-year.

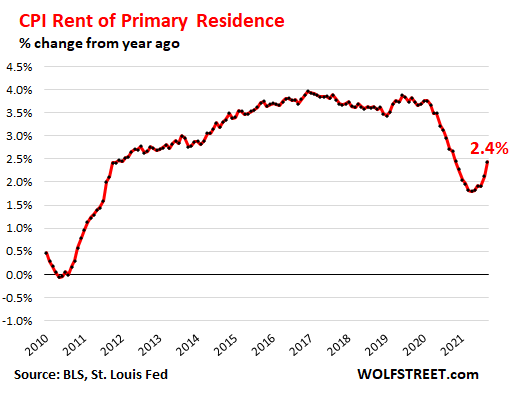

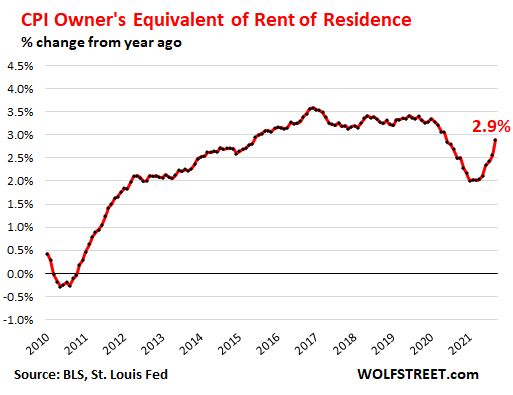

Rent is the biggie in CPI. Its two versions are the largest items in the CPI basket of goods and services, and determine nearly one-third of CPI. These rent factors had plunged, and had kept CPI from surging even higher in the spring and summer. But they made a U-turn a few months ago and are now rising but are still holding down CPI. This is going to be the driver of CPI going forward – as market rents are surging in many cities by 10% year-over-year, and in some places over 20%. CPI is now making tentative steps to catch up.

This is the inflation game of Whac-A-Mole, as price increases spiral through the economy from category to category.

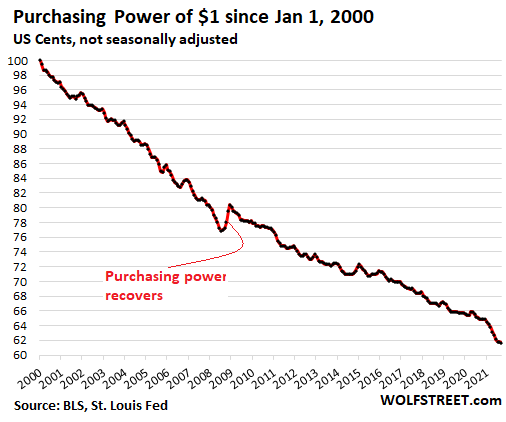

The overall CPI attempts to measure the loss of the purchasing power of the consumer dollar. In September, the purchasing power dropped another 0.3%. On this 20-year chart, you can see the sharp drop-off over the first nine months this year (-4.9%). Since 2000, the purchasing power of $1 has dropped by 38 cents:

CPI understates housing costs, but the CPI for them are taking off.

“Rent of primary residence,” which weighs 7.6% in the overall CPI, jumped 0.5% for the month, which brought the year-over-year rise to 2.4%. Before the pandemic, the rent index ran between 3.5% and 4% year-over-year. During the pandemic, it plunged and prevented overall CPI from surging even more. But that phase is now over as surging market rents are gradually getting picked up by the CPI for rent:

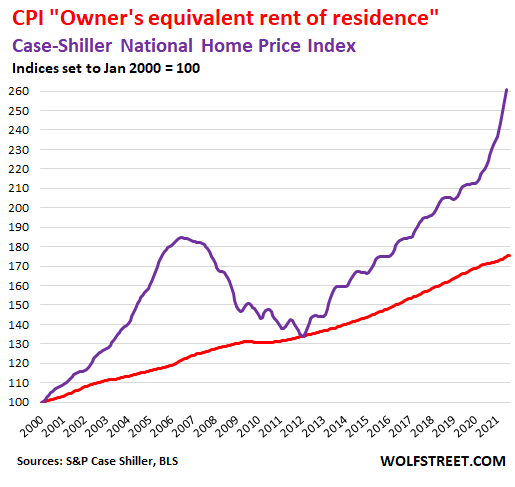

“Owner’s equivalent rent of residences” – which tracks the costs of homeownership and weighs 23.6% in the overall CPI – doesn’t track actual home-price inflation, but is based on surveys that ask what homeowners think their home might rent for and is therefore a measure of rent as seen by the homeowner.

This measure also U-turned and is taking off. In September, it rose 0.4% for the month, the fastest monthly increase since 2006! This brought the year-over-year gain to 2.9%.

So two things:

- The 2.9% rise is still holding down overall CPI (5.4%).

- The 2.9% gain is still ludicrously small compared to the record crazy price explosion in the housing market.

As the index for “Owner’s equivalent of rent” just started budging (red line below), the Case-Shiller Home Price Index, which tracks actual price changes of the same house and is therefore a measure of house price inflation, spiked by 19.7% year-over year, the most in the data going back to 1987 (purple line). Both indexes are set to 100 for January 2000:

Food costs (weighing 13.9% in the overall CPI), jumped 0.9% for the month and 4.6% year-over-year. The CPI for meats spiked by 3.3% for the month and by 12.6% year-over-year, with beef spiking by 4.8% for the month and by 17.6% year-over-year, which is surprising only in that it hasn’t spiked a whole lot more, given reality at the grocery store.

Energy costs (weighing 7.3% in the overall CPI) spiked by 1.3% for the month and by 24.8% year-over-year. Within the category:

- Gasoline +1.2% for the month, +42.1% year-over-year

- Utility natural gas to the home: +2.7% for the month, +20.6% year-over-year

- Electricity service: +0.8% for the month, +5.2% year-over-year.

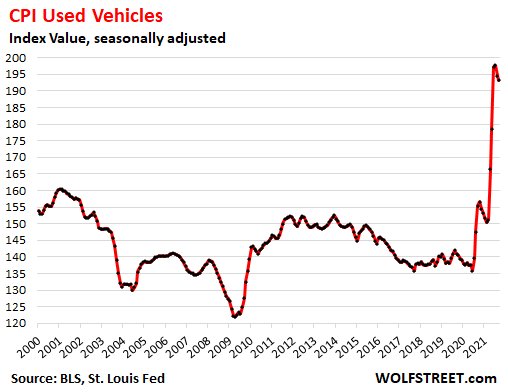

The CPI for used cars and trucks fell by 0.7% for the month, the second decline from the ridiculous spike, but was still up by 24.4% year-over-year. This is based on retail prices at dealers.

But wholesale prices, after dropping for three months in a row, spiked to a new crazy record in September and are set to rise further in October. Wholesale prices lead retail prices by a month or two, so the used vehicle CPI may U-turn in a month or two, just like wholesale prices did with a vengeance in September.

This chart shows the index value (not year-over-year percent change), which essentially hadn’t increased in the prior two decades despite large price increases, thanks to the massive “hedonic quality adjustments” (explanation below). It took this crazy price spike to break the grip “hedonic quality adjustments” had on the index:

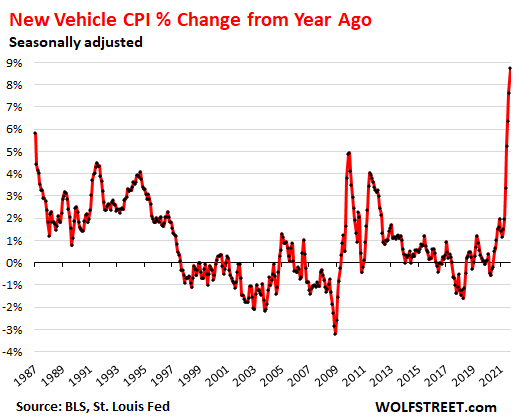

The CPI for new cars and trucks spiked by 1.3% for the month and by 8.8% year-over-year, the most since 1980 during the massive bout of inflation at the time.

Inflation Whac-A-Mole: Just as the used vehicle CPI ticks down, the new vehicle CPI spikes. This is how inflation spirals through the economy, from category to category. This chart shows the year-over-year change:

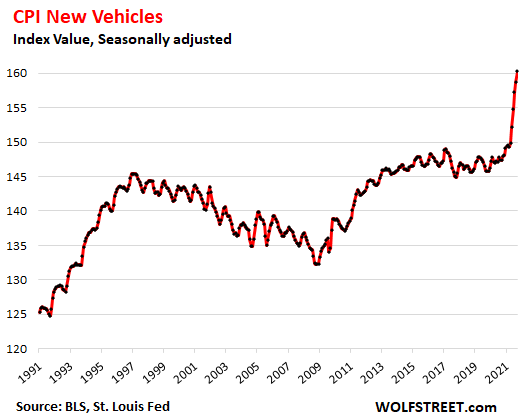

And the chart below shows the index itself (not year-over-year change) for new cars and trucks. As everyone knows, prices of new vehicles surge year after year. But aggressive application of “hedonic quality adjustments” have held down the CPI for new cars and trucks, with the index level in 2019 not far higher than in 1996. But even those aggressive hedonic quality adjustments were no match for the price spike this year:

What are “hedonic quality adjustments?” CPI attempts to measure the loss of the purchasing power of the dollar with regards to the same item over time. When the price increases because the product gets better, the portion of the price increase related to the improvement of the product isn’t considered loss of purchasing power. And this makes sense: Pay more for a better product.

In terms of cars and trucks, these improvements have been dramatic, for example, the move over the years from a three-speed automatic transmission to a 10-speed electronically controlled transmission today.

In the end, inflation indexes are political devices, decided by politics, for political purposes – underplaying the actual loss of purchasing power of the dollar and the purchasing power of people’s earnings. Even if the understatements are fairly small each year, they massively compound over the decades. Every government over the past decades adhered to this strategy religiously.

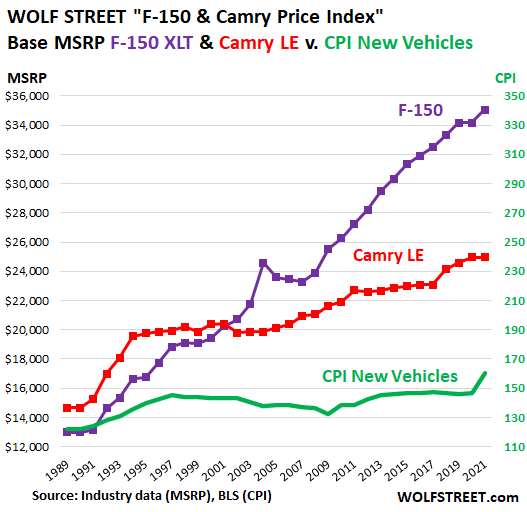

My F-150 and Camry Price Index illustrates how prices have soared, even as the CPI for new cars and trucks (green line) remained nearly flat until the current spike.

For retirees, 2021 was a nasty year: Red hot inflation and a stingy COLA. In 2022, they might fall behind more slowly. Read… Social Security COLA for 2022 Biggest since 1982, But Still Won’t Cover Actual Cost of Living Increases for Many Retirees

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Cuba here we come!

Not to worry, they just raised Sociial Security by highest amount in 40 years.

Couldn’t tell if that meant to be sarcastic.

Average monthly soc sec payout is $1437. So a grand increase of about $70 a month!! Oh all the things one can buy for $70.

Hold off on that boat ride to Cuba.

My comment did not mean I planned to move to Cuba, it meant that our current situation is starting to resemble Cuba in the early

60’s with collapsing currency values and a supply chain that forces us to fix up old cars from the previoius decade to stay on the road.

Bidenflation? He’s going to lose the senior vote if a massive increase isn’t forthcoming pronto.

Maybe we’ll see a Bidenpression before 2024?

You are right Seneca. Sorry, my sarcasm detection meter is just broken.

Chinese made junk will be cheaper again though.

Freight rates are starting to drop on some of the world’s most popular shipping routes, new data has found.

According to the South China Morning Post, the spot rate for shipping a 40-foot container from China to Los Angeles has dropped by 51% from $17,500 last month to $8,500.

during chinese port shutdown when nothing was moving

now open and back to even higher rates

I do expect many xmas sales during easter

The really bad news is, I’m ok waiting for the Xmas in July sales.

we have grandson(2) – other than that we tend to

GO TO CHURCH, eat lavishly and talk about year gone by

Is church where you learn to brag about raising rents on your tenants?

Asking for a friend.

I think the US and western Europe could probably do with a dose of reality on not having everything around Christmas. Most of the rest of the world isn’t like that.

The problem with consumer centric model is that if it starts to fall apart, then you really have nothing afterwards. Oh, but I forgot, there is always the service industry that was bandied about in the early 2010s as the best solution to crappy manufacturing jobs. Look at the great service export, a component of which as Wolf so kindly pointed out was US hotels and restaurants serving tourists. Congratulations to the baristas at Starbucks, now you are part of the export helping to offset the trade imbalance.

Thank heavens for financial saviors like Affirm, who can help put your Target and Amazon purchases on an installment plan. Hey, that toaster for $50 (with WiFi) looks great, let’s buy it and put it on a 5 months installment plan paying $11 a month.

Great, so we will be buying more Chinese junk, enabling our Benedict Arnold banksters and Wall Streeters to get more foreign income that they do not pay US income taxes upon by keeping it in foreign tax shelters, and thereby, indirectly enabling the PLA to arm to later invade Taiwan, Japan, India, South Korea, the Philippines, Australia, etc. War can be good economically, I suppose, for weapons manufacturers.

Oh shut it already. The only country that will be starting WWIII is old Uncle Sam, biggest threat to world peace.

Yep … Guns-R-Us

Maybe SO, Maybe NO MB:

Happen to be reading ”The Rise and Fall of the British Empire” 1998 edition by James,,, and while it is very very ”indicative” of our current times, it is also a very very clear indication of the actions of many other players playing their parts;;;

That those very same players continue to do their best these days should be very very clear to anyone who wants to ”predict the future.”

I do not, so will continue to hope and pray that at least WE, in this case WE the HMN species are getting at least ”close” to a point where WE can act to prevent anymore ”WAR” in any and every form…

Having been to the local brokers branch of the SM in the late 1940s and subsequently, I have great hope that the incredible increase in flow of information to WE the PEONS will also increase the awareness of the continuing corruption of the various and sundry oligarchies,,, though willing to admit the corruption of those and their paid political puppets has not been reduced much, if any, in the last 1000 years or so, in spite of their propaganda.

When I was in the brass and copper business (Anaconda – manufacturing), our BEST profit years were during wars. We sold brass stock for bullets, shells, and buttons. Now that those plants are GONE, where will our ground troops get their bullets? China?

Oh, I forgot, we don’t need ground troops anymore with drone bombs, and all that other flying stuff.

The threat of war is coming from the US, no other nation.

That is no longer true and was not true for decades. The Germans were actually angry we pulled our troops out of Germany to protect Poland first.

We are an aging nation, frankly, weakened more each year, whose blood is being sucked out by parasites like banksters and Wall Streeters, and our invading days are over. We are strong still but just pulled out of Afghanistan because we did not want to lose more American kids in more futile battles

Only serious threat of war right now is ML China’s threat to Taiwan. I think a clash of arms there is possible, given that Xi’s stance has painted him into a corner, and China’s ‘build build build’ has finally run aground, creating the need for a distraction.

I think it would be an idea for both sides to agree on rules of engagement. Rule 1: no nukes.

Xi will refuse. The CCP likes to wonder aloud: ‘will the West risk nuclear war over Taiwan?’ This is a bluff, to which the answer is ‘will the CCP?’

It is patently clear that US and allied forces could slaughter any invasion attempt over the 70 miles of ocean. The US subs could take care of the larger ships alone. I think the CCP and Xi are smart enough to realize this. But as any student of WWI knows, you can try to bluff a pot and then get called.

Since abandoning Maoism the hard- working Chinese people have accomplished much. It would be a shame to see it all lost so Xi can try to turn the clock back to become some kind of Mao, complete with book of ‘Xi Thought’

Neither Hong Kong or Taiwan want the CCP. HK was lied to and had no choice. Taiwan is not going that route.

We are a carbon copy of the Austrian Hungarian empire. We start wars to cover up the bankruptcy of our own republic. Our fate will be the same.

@Monkey business, while I would agree that the US did start wars unjustly like the Mexican America war, about which Grant expressed shame or the Spanish American war to take territory, we are no longer the aggressors as to China. It is the CCP that invaded Tibet, Mongolia, Korea after the NK tried to invade SK and failed, tried to invade parts or the old Soviet Union and later Vietnam and failed, and now tries to steal from India, all the South China Sea neighboring countries, Japan, etc., by salami slicing away territory.

The CCP, not the USA, is developing weapons like more bioweapons in its many labs to invade others after Canadian scientists shipped Ebola, etc., to its labs in 2019.

Search online for China and border conflicts and you will see that the CCP has no less than 18 border conflicts with different neighbors that lead it to regular wars or armed conflicts. For example, it claims all of Mongolia, because the Mongols invaded it and formed an empire with Mongolia and China in it. It also claims all other territories that ever were in that Mongol Empire!

By that avaricious, crazy “logic,” I guess that the USA can also claim Canada, Scotland, Wales, New Zealand, and Australia, because it was once in the British Empire and so were they. LOL.

The CCP just sent me a message. They’ll leave Tibet, once we’ve returned this country to the Indians.

What you think history started 400 years ago?

And don’t forget Iraq.

@Monkey Business,

First of all, it is not “Indians” because that was a term that Native Americans find offensive, since they were never from India or related to people from there. Europeans called them that erroneously. They got wiped out by measles, etc.

Second, if you truly want to go back farther, China was a group of many countries conquered by the first emperor of China. Xinjiang was only joined to China by the Qing dynasty in the 18th Century. Indeed, the former, Sung empire (conquered and rejoined to Northern China by the Mongols) was a very different empire, with a different language, and remained distinct for years. The Manchu territories were only joined to China in the 16th Century when the Manchus conquered China.

I could go on and on and on. Thus, China would have to agree to be broken into dozens of pieces for the trade to be even close to equivalent.

There were also many tribes that were independent even in those countries. Tibet, and those other countries, were relatively recent conquests to the CCP’s evil empire. Justifying those conquests and the CCP’s dreams of conquering Taiwan, Japan, the Philippines, Vietnam, Korea, etc., by comparing them to the conquest of the Americas is ludicrous.

This was simply Golden Week shutdowns. Temporary.

My wife and I are early 40’s, great income(2019 standards), nearing the height of our careers. We drive older paid off cars. We don’t have cable. We rarely eat out. We’ve been saving for a down payment on a house that continues to get further away from reality while it should be getting closer. Higher rent, health care premiums, medical claims…cost of living.

A married couple with full time professional positions and we are failing financially.

SOL, time to get second jobs! /s

“Saving Money” in the traditional sense has been a losing proposition for the past 12 years.

An investment in basic Treasury Bills (money-market, Treasury Direct, whatever) has lost 20% against CPI inflation over the past 12 years, and is in the process of losing a lot more.

This is not an accident, but a federal policy choice.

No wonder supply chains are maxed out – no one wants to hold fiat currency depreciating against real-world assets at >5%/year!

Completely agree, and indeed I did quit work and conventional saving 13 years ago. I have been ‘investing’ in property, supplies, skills, and tools ever since.

Maybe not. I felt the same way at your age. It’s a tough time especially if you have kids. I was dumping 15% into 401K plus dropping max in a Roth and 6.6% taken out for soc sec. Didn’t leave that much after paying bills.

Now I have a decent income from when I grunted it out and I am too old to slug it out in the day to day grind anymore.

I heard of these things called retirement plans/401k

sounds like nice idea

The 401K concept is good but the implementation is piss-poor.

401K plans deny investors a fundamental economic right – the ability to express preferences for particular parts of the economy. Instead, one gets to choose between a few stock funds, a few bond funds, a few target-retirement date funds and that’s about it.

This means that all 401K investors are subsidizing the economic abuses of the giant monopolies, subsidizing the profligacy of Congress (treasury bonds), subsidizing a large part of what’s broken in the current system. And now their financial interests are misaligned with keeping the broken system going – rather than fixing it. Perverse incentives create perverse outcomes.

Don’t get me started on how this corrupts corporate governance – shareholders should be able to vote for boards, but instead a handful of large mutual fund organizations now rule the board system, which is as crony-corrupt as it can get.

By rendering savers unable to express their economic and political preferences with their wallets – and giving them no incentive or ability to oversee the companies they collectively own – the 401K plan has destroyed a large part of the capital-allocation system that made the US such a strong nation. And it’s created the perverse situation where too many people benefit financially from keeping a broken system intact, precluding necessary reforms.

The 401K, in short, is a tool by which the 0.1% exploit the top 20-30% and keep a broken and corrupt system intact, while making the masses think they’re getting a good deal “because tax benefits”.

Great comment Wisdom Seeker. I totally agree. I’ve had a small amount in a TIAA-CREF account for about 20 years. I don’t like their bundled choices.

During pandemic they informed me I would probably be losing money if I didn’t invest in one of the stock or bond bundled options (because of fees on low interest money market options).

For me, the whole thing is a big WTF.

It took me awhile after thinking the menu options in 401Ks were the only choices until someone introduced me to the self-directed IRA (I have 2 + a Self-Directed ROTH for VC investments). I can’t necessarily say I outperformed my 401Ks of old (due to company matches), but having my hands 100% on the controls and bleeding NOTHING to fees and fund MGR pockets has been satisfying.

Wisdom,

Read where Blackrock, Vanguard, and State Street own majority shares in 88% of the S&P 500…

Harvard business paper…

Therein is your issues…

Actually for WS:

Agree, like totally dude or dudette, with most of your comment, but not all.

When confronted with the choices you mention, I asked if I could just put my money and the matching contribution from the company in 2007/8 into a savings account,,, and did so…

After that week, owner/boss gave me the OK to once again be a 1099 contractor with cash per hour equal to and including all their required and offered contributions…

As usual, worked out better for me as an ”independent contractor.”

‘So the government and big corporations got together and created something to help the working American. The 401k’.

Lol. I’ve been 100% allocated in a S&P fund, yet only gained 7%.

I assume the other 14% of profits were allocated to Transamerica.

Throw in it’s a 401 Roth which I’ve been taxed, and add the liabilities and future withdrawal headaches … it’s a deal with the devil.

I’m putting exactly 15% in my 401k. I also have aggressive 3x roundups roundups in my Acorns account.

I think the 401K worked well for me as it allowed me to defer taxes at about a 30% rate and pull the money out in retirement at about 15%. Plus the tax deferred compounding.

Each 401K is different. Government incentivizes company to match sort of like they subsidize mortgage rates.

Once you get to retirement it’s great to have assets in different tax buckets so you can respond to changes in the tax code.

401k(s) got created in the late 70s. In my opinion just in time to help facilitate the boomers move into the investment world. I remember the propaganda well. We would all retire multimillionaires!

At the companies I worked at you could invest your 401k balance (in 25% chunks) into either a bond fund or a stock fund or a short term treasury bill fund. That is it.

The real exciting feature was company matching funds. The company matched 100% the first $1k and 50% the next $2k. An automatic, guaranteed 67% gain on $3k for the first year. I didn’t see much use in going past that $3k/year.

SOL,

NO MO FOMO…

Don’t chase… zero in on what you want ( multiple acceptable scenarios) and wait for it to come to you…

I’ve said before… sometimes the best thing to do is nothing…

You might end up being very thankful…

I quit my full time professional job age 45 and have since been working part time (occasionally). I have bought an old, run down rural place and have been reno-ing it. It is practically full time work, and you do have to have or acquire the skills, but allowing for taxes, etc, I will end up with a better property that if I had stayed in full time work. That’s true whether I had saved for a new place or paid a contractor to reno a place.

It simply does not pay to work for anyone but yourself for many people these days, given the big IF about having the skills.

A lot of couples, including ones in their twenties, have also worked this out. Almost all the run down places around here have been bought up. Even for younger couples, this can be done if one partner is able to remain in work and a practical partner works on the property. Nearly half the couples I’ve met have the female doing most of the renovation.

There is also the benefit of swapping skills with the others around you. I’ve just helped a new neighbor with his roof and given insulation advice. Turns out he’s a drywall seamer and will return the favor when I finish the kitchen reno next year.

Grow some of your own food and stay healthy, the work keeps you fit, and of course if you don’t eat out much or have cable then the rural location will not be a problem in those respects either.

I did that 10 years ago – was paying contractors while I worked

few months of no income to me and 100% to them

I quit and went to work for myself

now I’ve EARNED all sweat equity

and keep on raising rents 10% annually(until its even more)

@T

I retired at 53 and bought a run down holiday home, which I did up at leisure over 10yrs. When I sold it, I worked out over the 10yrs a/t, I made almost as much as I would have done staying at work.

Ridiculous World!

Ridiculous indeed.

If you made $500k on the sale, at least here in California that will be tax free, whereas if you made that amount in wages , you would pay $250k in taxes.

Working is a losing proposition, no wonder no one wants to work.

Read Thomas Mann, first thing inflation inflicts on the fabric of society, is demoralization.

We are there.

>It simply does not pay to work for anyone but yourself for many people these days…

I couldn’t agree more. Maybe even for the vast majority of people, it simply doesn’t make sense.

Two cars, living large.

There’s a housing and real estate crash coming. That’s when you get a return on your savings. I’ll be buying another 10 acres. Not worried at all. I know it’s coming.

I think so to, but you never know Fed policy. Stocks and housing are things the Fed can add a zero to as Gunlach says.. They almost have done that with SP500 with low at 666. It’s conceivable that they could pump it to 6660, before they stop. My first home was $48,000. We are not that far from $480,000 starter homes where I live.

Sure, they can destroy the currency. But what good’s that going to do them? None. They’d be running for their lives. In reality, they cannot continue to pump up real estate. It’s over. Accept it.

Well, I’m retired and working more hours than when I was employed by the US government. Need to keep working to pay the bills. Stop whining and get a second job.

This will only get worse once shelter prices are included properly. Even the white house acknowledges that shelter is lagging and will add “several basis points”

Last time I checked Zillow vs Shelter CPI it was ~0.3% difference/year. Something is very wrong based on the recent divergence.

Other people have mentioned the delay in sampling. I’d expect further upward pressure on CPI as measuring “catches up” with reality.

Look at my article, 5th chart from the top, Case Shiller Index v. CPI for homeownership (“Owner’s equivalent of rent).

Right, but economists would say that a home price index isn’t correlated to rent index because of the investment component. Prices outpacing rent could show low yeild.

However zillow’s Rent index was highly correlated to shelter CPI (until lately). Rent index proportional to rent index, apples to apples.

You still didn’t read my article: The homeowner component IS A RENT INDEX, it is based on what homeowners think their home would RENT for. The CPI for home-ownership is highly correlated to the CPI for rent. I posted both charts. Look at them.

Engel-esque transtion of FromKS:

1) Not talking about OER here.

2) Even the basic rental shelter CPI is too low.

3) The Zillow Observed Rent Index (ZORI) measures same thing.

4) ZORI usually agrees with Shelter CPI.

5) ZORI is currently showing much higher increase than Shelter CPI. (US ZORI is up 7.4% YOY as of the August 2021 data.)

6) When Shelter CPI catches up to reality, it will goose future CPI inflation readings.

7) White House acknowledges this deficiency.

Bonus:

8) Retirees are being screwed because the deficient rental CPI led to lower Social Security COLA.

Wisdom Seeker Prediction:

9) Next revision of Social Security might eliminate use of CPI-with-OER altogether and then discriminate based on home-ownership: COLA based on CPI ex-shelter for homeowners, vs. COLA based on CPI with just rent but no OER for renters.

Rents are available on the Multiple listing services. No need to guess. We get them routinely and put them in our reports.

I believe the Case Shiller index on home price appreciation is a much more accurate reading on inflation than the rent equivalent survey index. I see this every day. Properties that are in a good location, in good condition, and have a good floor plan have gone up 18 to 20% here all over the close in suburbs of DC. Same with properties right in the good areas of the DC Swamp. We did one the other day, a two story condo that was over 1 million vs 800K a year ago. I sold in a day on the market. Noticed the main stream corrupt media and J Powel have taken the word “transitory” out of their speeches when referring to inflation. It was a lie then and a lie now. These people are liars and you can’t believe a word they say.

The problem with the rent “equivalent” is that no one has any freaking idea. Most people don’t rent single family houses. People rent apartments and buy houses. That’s not to say you can’t find single family houses for rent, but they have not been common anywhere I have lived. So when people are asked “How much would your house rent for,” they’re literally pulling a number out of their rears. They have no clue, as they’ve never even thought about renting it out, so they haven’t done any research on comparables or anything else.

Two major problems with Case-Shiller Home Price Index:

1) Doesn’t cover a large chunk of the country.

2) Case-Shiller measures sale prices. But those are not “consumer” prices, so that’s not properly part of CPI. Sale prices depend both on inflation and interest rates (monthly mortgage payments), not just inflation. So once someone has “bought” a house, the mortgage payments are typically fixed (no further inflation for the homeowner, even if new buyers are priced out of the market).

That being said, OER is totally wrong since it’s a bad measurement of a nonexistent benefit. Owners aren’t simply landlords who pay themselves imaginary rent! They’re in a fundamentally different economic position than either renters OR landlords, with different inflation pressures since they aren’t participating in a rental market.

We’ve all but given up trying to find a house until next year. Prices here in TX have just gotten stupid.

They will continue to skyrocket as Californians move in. Eventually there will be an equilibrium in prices between the two states and we can move to California. Texas is a Third World shit hole. In fact most Third World countries look better by comparison.

This is why I stopped going to work at 50 in 2019. I sold 3 of my rental properties and live off my 10 year IRA CD’s and 10 year cash CD’s. The 3.35% to 3.6% yields, 15 CD’s in total,10 year terms.. The annual interest is more than enough for me to live off and build up savings, cash. These properties were bought back in the early 90’s, cheap as I sold them for 6 times.

I am not paying social security anymore and many work related expenses like extra gas, car repairs, work clothes which is saving me at least $12,000 a year. I am debt free with all my 3 properties which were total $350,000 at the time but have I kept 1 modest property I live in which has no debts, no mortgage either.

Looks like just missed the big mess of corona virus, pandemic and after taxes, living expenses still have $55,000 left over in cash and when real estate prices come down will make my move or use it for some other investments that look at a discount.

You will be punished.

Sincerely,

Jerome Pow!!!!

After reading this, I feel so much better knowing that our SS checks will be increasing 5.9% next year for my wife and I (at ages in late 70’s). Although this is a blessing, only one of us will have to find a job next year!

On the ground report from Holden Beach, NC. Rented beach house for a week. Small one on canal for about $1000 after sales and hotel type tax.

Market value of this 30 year old 1500 sq ft home is around $550,000. Appears from rental spreadsheet that rental income is $50,000 per year, but rental company gets a big take to handle everything. I guess they might net out $20,000 annually. But recent price increases have have probably bumped value of house up by $100,000 this past year alone so it’s been a good return for owner.

A lot of building here and a tremendous amount of improvements being done by all types of building trades. It has the feel of a boom top.

Is that $1000 for a week or $1000 per night. In my area, they have Airbnb places going for $1000/night if they can sleep four people or more.

It’s $1000 / week because it’s off season. About $2000 during peak. It’s only 3BR. It’s got a nice canal view of all the parked boats. It’s a five minute stroll to beach.

Second row 4 bedroom was $2000. No ocean front available because I booked last minute.

It’s competitive market as it’s all residential housing rentals. Probably 500 or 1000 for rent. No hotels. A few duplexes. No high rise. Very nice feel if you like non commercial. Just house and ocean recreation such as fishing and boating.

How many people can afford $1,000 per week for shelter? VERY FEW. Most people can’t even afford a $400 emergency. These expensive Airbnbs aren’t making any money, they’re all relying upon price appreciation. Once that goes into reverse, watch all these places magically show up on the MLS.

Yep. I have been researching market while down here. Saw one dumped due to covid for around $250,000 Jan 2020 and just sold for about $650,000.

You are right. People buy them expecting rental income to carry it and when covid locked things down they panic sold.

Just saw a beachfront tear down of old structure today. It’s a double lot worth about $1 million in today’s market. They plan to live in one and rent the other. Sounds like the top. I wouldn’t be surprised if they loose it all unless they have deep pockets.

I am retired now, 60, I never owned real estate but I was successful for 36 years as a small business lawyer. I did everything possible maxing out my IRA, CD’s, health savings plan, cash accounts with my investment brokerage account. My total inflow, income is $6,000 month and my total outflow is $3,300 a month. This is everything from taxes to rent to food etc.

The only dilemma I have now is the extra $2,700 a month for the last 18 months is siting in savings making really nothing but I am glad I have $49,000 in liquid cash and it keeps building every month.

Good for you Bill! Living on $3,300 per month is amazing. You must not have a wife at home (LOL).

Curious as to what you are doing for health insurance seeing you are too young for Medicare. I understand that ACA plans are quite expensive for someone your age.

I’m nearing Medicare age. Private insurance 2013 was $500 per month, without dental. ACA took it to $100 per month with dental. Then this year it became $1 per month. Maybe it relates to, I’m religiously healthy and never sick. I haven’t seen the inside of a clinic for around 10 years outside of vaccines/flu shots.

Bought a spacious condo in my later 30s, in early-mid 1990s, $90k. Yes, jettisoned the wife. It is now worth $400k and almost paid. I assume inflation could produce similar results over multi-decades going forward. The first thing I think to adopt is a big time-horizon. I patiently paid bills, saved and didn’t get foolish leading to 2008. never lost a minute of sleep or any assets.

It depends so much on where you live and how you live. I live of my early retirement social security. About $1700 per month and try not to touch my retirement funds. My to the bones cost is about $1000 per month. I can be sloppy with money and still come in at $1700. Got to have cheap hobbies though.

Cheap hobby you say… no hobby cheaper over the long term than playing an instrument. Already own my grand piano. Could spend thousands of hours playing it over many years with only minimal annual maintenance costs.

Affix a scale model railroad to the top of that piano and you’ll have two cheap hobbies in one space. So what if you wreck the surface, you can’t take it with you, but it will provide a future job for someone who refurbishes those planes.

Interested in all your comments about retirement. It all depends so much on where you live as to what your options are and what decisions are best.

As per Truckman I did the sweat equity thing my whole life while still working. TM, I was very pleased to read you bought your property as you had been mentioning the search for some time.

We bought the house….ooops shack in the boonies about 20 years ago. Sold the house in town and used the extra cash to buy more adjacent property. Mentioned this before, but my town buddies used to hum the ‘Deliverance’ theme song (dueling banjos) when I met them for a beer after work. Fast forward to now, young people are moving here for affordability and all I hear is “how did you ever get this place”? Answer, “I built it”. The shack became a vaulted fir and yellow cedar gem on a river full of salmon….and we don’t flood. Sea level can rise another15′ and we won’t flood, one of 4 riverfront places in our valley that can say that. We winch our dock out every fall at high tides before the deluge hits and the river rises.

We live very well on $2,000 per month and save an additional $3K per month. Universal health coverage here so no medical costs beyond a $300/month private plan that covers my wifes insulin and insulin pump and supplies (type 1 diabetic for 50+ years and in excellent health). People on WS slam savings but saving cash is a wonderful habit. Maybe there are better investments than savings and sweat equity but I retired at 57 and my wife at 53 so what we did worked for us. It would NOT have worked at all if we lived somewhere else. I would have been lucky to have ever afforded a home in a Vancouver suburb…ever. Bay Area? Not a chance. My hat is off to all that have thrived in such locations….even survived there.

Our challenges? Well, we always keep an eye out for bears raiding the freezers at night and this time of year we lock our garbage cans up in my shop. Two years ago we walked smack dab into a grizzly that supposedly doesn’t live here. My latest project is making sure those damn beavers don’t rebuild and flood our fields. Cougars have killed my sheep so I had to nix the lamb chops and a deal with 2 cougars over the years….now the fields have visiting elk (protected). On my morning walk I have to wait for a herd of elk to let me through on the main road….because they will stomp my dog. It might not be Chicago or full of gun packing nutjobs, but we have to be careful out walking in the morning or evening.

An hour away a good friend of mine lives in a condo….go figure :-)

Paulo

Don’t worry about sea rise of 15 feet. As there is a climate booze up in Scotland.. I had a look at the tide gauge for Aberdeen Scotland and it came in at just under one millimeter a year for the last 120 years…which is 4.75 inches…. About the same rise rate since the end of the last ice age ho ho ho

What I find puzzling is how/why interest rates on bonds react to the news by falling. You would think that a higher rate of inflation would cause interest rates on bonds to surge, after all who wants to get less return that are being washed out by higher interest rates. So what is going on?

It is the US Federal Reserve buying up more bonds behind the scenes to keep interest rates on bonds, bond yields lower for longer.

Darryl,

The Fed is buying nothing behind the scenes. That would destroy the Fed’s purpose. The purpose is to whip the market into frenzy, and so the Fed hypes and buys in full public splendor and display: $120 billion a month in bonds ($80 billion in Treasury securities and $40 billion in MBS), on autopilot, until November, when this will be reduced.

If it isn’t reduced by November what would the head honcho at WS think of that?

Not true.

The Fed buys a lot thru swaps with other central banks and financial centers.

Historically the “Carribean” ones are the Fed in hiding.

Always was.

The Fed is just owned by big banks in turned owned by big people who own these entities.

A circle jerk for wealth. While the People get the inflation.

steve,

Almost everything you say is fabricated BS — “fiction.” You can check the swaps on the Fed’s balance sheet, where they’re listed, if you care to take a look. But you probably don’t even know what the Fed’s balance sheet is or where to find it. It’s much more fun to abused my site spread BS.

“The Fed is just owned by big banks in turned owned by big people who own these entities.”

That’s BS too. The Fed is a hybrid institution, with the Board of Governors being a US government agency (Powell and its other employees are employees of the federal government). The 12 regional Federal Reserve Banks are owned by the financial institutions in their districts, and these financial institutions (JPMorgan, Wells Fargo, etc.) are publicly owned and not “owned by big people.”

The Fed is bad enough as it is; there is no reason to make up BS and spread it.

There is so much leveraged wall Street and hedge fund gambling going on with bonds. Sometimes the market gets bets wrong so to speak and has to close out loosing positions causing strange moves.

Plus sometimes there are like second and third order affects. I think QE was like that. Interest rates moved opposite to what you would expect because of unintended consequences.

Ugh. Meant to say higher inflation. Not interest rates.

There will be higher interest rates when the Fed removes the price controls from Treasurys.

That is conventional wisdom, but I don’t know if that is true. Some theories we are debt saturated and rates are never going to rise.

SF has brought back cash for clunkers? If you a buy an electric or hydrogen car, you get between 5500 and 9000, on any trade in older than 2005? No wonder there is inflation in used cars.

ALL Federal, State, and Local incentives combined, except Tesla and GM, I assume. Tesla an GM already outran the federal rebate. There is no $5k to $9K incentive by San Francisco alone.

Where is Bernanke, the genius QE Architect, hiding these days. We used to see his face everywhere post immediate retirement and big pay Speeches ?

He may have less to say to the peons these days, but I am sure he is still holding invited speeches for well paying customers. To get your free blue pill, you may have to turn to Paul Krugman, who in a recent article says that we don’t really see a lot of inflation if we exclude all the prices which are rising.

Lol

Used to be a saying about avoiding the appearance of evil or the appearance of conflict of interest. If someone wants the prestige of being Fed chair they should never take a dollar from Wall Street before or after being chairman.

He had a face cosmetic surgery, so he is around but not recognizable. If his genius idea goes pop, he will need it. Might be the best investment of his lifetime.

For sure

Next thing you know they will will have owners equivalent car rentals; how much do you think you could rent your car out for? Those pesky used cars are driving up the fake inflation metrics too much.

This is an excellent idea if we extend it to further sectors: ‘Owners equivalent Food Price’. How much do you think your can of tuna will sell for if you offer it in a yard sale.

Wherever he is, I’m sure it’s a courageous location, with courageous food,, courageous nightlife, and courageous automobiles.

The local Honda dealership (Houston) had maybe 40 cars for sale total on the lot this morning, including the used ones. Unreal.

Like Yogi said, “no one is buying Honda’s because their lots are always empty”…..

The three local Ford dealerships are special order only. I wonder how much of the demand for the EV F150 would disappear if an ICE F150 were available. Have they moved the Spring 2022 availability, cuz there’s no way in hell that’s accurate anymore.

The EV F-150 is special order only as well, and likely with much longer wait-times than the ICE F-150.

Do you think Ford has built out sufficient supply chain for the batteries here.

I think this is still their first big foray into EV, unlike GM. I would love to see the a full BOM for a Tesla, a Bolt, and an EVF-150; it would probably tell you a lot about the supply chain as well as where the big weaknesses are.

Darn it, where is wikileaks when you want real juicy information like this.

If you believe the government’s inflation figures you’re dreaming. They are totally bogus. Inflation is close to 20%. Unemployment is really not much below that. Only 61% of the eligible workers are employed. Add the two and you get the Misery index. Its’40%. Jimmy Carter’s misery index has been blown out of the water and then some.

I think inflation is a minimum 20%. It’s outrageously high. But Weimar Boy just dialed up another $120 BILLION in QE this month.

Are you ignoring the hedonic improvements? I mean, the oatmeal shrank 30% but I’m sure it’s better oatmeal.

When you need to pay every $520,000 invested in your company the same returns as a full time employee in perpetuity ($31.2k for $15 an hour FT wage = 6% returns on $520k) something has got to give when both labor and capital are both demanding and getting more.

…what gives is the value of the dollars they get paid in.

Yes, but inflation is caused much more by the trillions of dollars that the banksters “Fed’ printed via their scheme of addicting our politicians to spending without tax increases and even enabling 2017 tax cuts by just creating more dollars.

US capital flows to other countries also weaken the dollar. I love those desperate to keep Americans’ capital flowing to China’s CCP crooks. Read Elly Chen of Morgan in cnbc, “Morgan Stanley upgrades China Property to “Attractive” despite default fears.”

Chen must be dyslexic or maybe, failed to read the latest reports. After reading that article, I suspect the owners of the Titanic are now planning to see if they can also sell it to the gullible with banksters’ help. LOL

Jerome Powell: “Inflation is not a problem for this time as near as I can figure. Right now, M2 [money supply] does not really have important implications. It is something we have to unlearn.”

Powell: “There was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time” Powell refers to M2.

Powell doesn’t know money from mud pie. Nothing’s changed in over 100 years. And we knew this already:

In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7 year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal”

its 2nd proposal: “Requirements against debits to deposits”

https://fraser.stlouisfed.org/files/docs/meltzer/bogsub020538.pdf

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

We will see who is right. Steve Hanke basically said the Fed blew up M2 by 22% instead of what they should have which was about 6%. That leaves 16% excess inflation spread over some unknown time period. He said it inflation was going to be between 6% and 9% by year end when liar Powell talked like we would be slightly above 2%. I say Powell knew it was going to be 6% plus but couldn’t spook the markets.

Every one of these clowns should be fired – arrested – from the central bank all the way down to every member of CONgress. They destroyed the country.

As the Fed has shirked their duties, so have the Congressmen.

The Fed is “independent”? The federal govt IS DEPENDENT on the Fed.

Depth Charge

Agreed,

But, I think you need to add in all the current occupants of the Executive branch.

When they realized they could inflate the money supply and inflate assets without inflating the cost of money. Interesting the Fed hates LIBOR,, which is an honest calculation of the cost of money, and replaced it with SOFR with is a joke. Now instead of a bunch of (commercial) bankers setting rates, according to need, Fed bureaucrat bankers (across the pond) set rates, using a unicorn measurement system. Today’s Wall St rally should make the Fed proud. Bank earnings and lending improved (Citi and JP, not Wells Fargo – which is a mortgage bank) Then they could focus on the low jobless claim numbers, while workers are leaving the workforce, (but never mind) and one headline brought up the notion of a recession, which means what? A slow down in business? Nah, it means QE will keep rolling on and short rates will never move higher and stocks We keep buying stocks and retiring them out the back door, in order to increase the size of our market cap. Everyone knows the Fed pumps the stock market, and who are they stealing the money from. They can print investment cash which is not main street inflationary, as long as China will cost cut US manufacturing and those poor slobs in China can’t ask for a raise, (or maybe they can?)

Not so sure LIBOR is an honest calculation of the cost of money. Collusion between banks (look at Barclays, Chase, pretty much any of the 16 banks used to calculate it) going as far back as possibly 2003 has caused billions of dollars in fraudulent transactions/bets. Not to say SOFR is better but LIBOR has its own problems.

Libor is a free market system with instances of manipulation. The Fed is a corrupt system.

Does any zip codes and sample size or other meta data attached to this ” owners equivalent rents”. If someone answers that their home is not for rent is it thrown out or thrown in as a 0. I think it is more than just suspect.

Greenspan said the same thing: As early as 1996 in his infamous “irrational exuberance” speech, the “maestro” admitted that the very concept of money had gotten away from central banking a long time ago.

“Unfortunately, money supply trends veered off path several years ago as a useful summary of the overall economy. Thus, to keep the Congress informed on what we are doing, we have been required to explain the full complexity of the substance of our deliberations, and how we see economic relationships and evolving trends.”

“There are some indications that the money demand relationships to interest rates and income may be coming back on track. It is too soon to tell, and in any event we cannot in the future expect to rely a great deal on money supply in making monetary policy. Still, if money growth is better behaved, it would be helpful in the conduct of policy and in our communications with the Congress and the public.”

Both Chairman are wrong. There’s a near perfect correlation between money flows and inflation. Inflation spikes in Jan. 2022.

I fear our leadership thinks inflation is the solution. Ten years of real 10% inflation reduces our current debt from 30 trillion to 10 trillion (effective) and our GDP to 78 trillion (nominal). See how that works.

Of course, if we keep running a 10+% deficit every year our nominal debt will be close to 80 trillion too. Not really gaining any ground.

Yesterday’s burger cost $24 before tip. It will be $62 in 10 years at this rate. Guess I’ll have to substitute.

Yeah, therein lies the problem. Politicians use low rates as an excuse to borrow and spend more, and then we’re told that rates can’t be allowed to go up because of the debt, so rates are kept low, encouraging even more debt. Wash, rinse, repeat.

RightNYer…

Yep, that’s the mantra indeed.

How about they take that QE and instead of buying federal debt, use it for debt service at a fair rate? Those interest payments would go into the economy…..a good thing….but wait. Then the govt wouldnt control that money would they….the lenders to the govt would.

And that is the MMT gimmick. Creation of debt is good as long as the government controls the money created. If the money created goes to debt service, the govt is left out.

Yes. The Fed affects of easy money is really starting to have consequences in people’s behavior which hurts real world economy. People gambling. People quitting working. People buying a second home for asset appreciation. Not good.

Exactly. We only are getting away with it in the short term because the rest of the world is still willing to give us their goods and services for our printed dollars. But that’s declining, and our runway is not unlimited.

Seems like real estate is our version of the late 1920’s call loans. To my utter amazement I got a call today offering to buy a property from me that I haven’t actually closed on yet (and may not close on). I was almost curious enough to follow up just to find out what the angle was.

Movie in SoCal with food (1 adult 1 child) – $70

“I fear our leadership thinks inflation is the solution. ”

The Federal govt wants their debt serviced with cheaper dollars, a given.

But the Fed is supposed to promote stable prices…and moderate (not extreme up or down) long term interest rates. They do NOT! They shirk their duties, and in so doing, serve on group (stock and real estate investors) and punish earners, workers and savers.

Tell me I’m wrong.

See: “History and forms. Irving Fisher (1925) was the first to use and discuss the concept of a distributed lag. In a later paper (1937, p. 323), he stated that the basic problem in applying the theory of distributed lags “is to find the ’best’ distribution of lag, by which is meant the distribution such that … the total combined effect [of the lagged values of the variables taken with a distributed lag has] … the highest possible correlation with the actual statistical series … with which we wish to compare it.” Thus, we wish to find the distribution of lag that maximizes the explanation of “effect” by “cause” in a statistical sense”.

And “The Lag from Monetary Policy Actions to Inflation: Friedman Revisited” 2002

“We reaffirm Friedman’s result that it takes over a year before monetary policy actions have their peak effect on inflation… Similarly, advances in information processing and in financial market sophistication do not appear to have substantially shortened the lag”

“At the Dec. 27–29, 1971, American Economic Association meetings, Milton Friedman (1972) presented a revision of his prior work on the lag in effect of monetary policy (e.g. Friedman 1961). His new conclusion was that ‘monetary changes take much longer to affect prices than to affect output’; estimates of the money growth/CPI inflation relationship gave ‘the highest correlation… [with] money leading twenty months for M1, and twenty-three months for M2’ (p. 15)”

The distributed lag effects of monetary flows have been mathematical constants for > 100 years (contrary to Nobel Laureates Milton Friedman’s and Anna J. Schwartz’s: “A Monetary History of the United States, 1867–1960).

Economists are running the economic engine in reverse. Inflation is the most destructive force capitalism encounters. Inflation is running faster than incomes.

The prognosis is dire. We have self-destructive capitalism. Only depositors can activate monetary savings. The banks, from a system’s perspective, pay for their earning assets with new money. So, 15 trillion in bank-held savings are frozen. That destroys velocity. That’s the cause of Alvin Hansen’s secular stagnation.

Yes, and the $250K FDIC’s guaranteed “protection” of depositor’s account have only made matters worse.

And stagflation is here

Greenspan credited two primary reasons inflation wasn’t a problem, despite very low interest rates. First was that globalization lowered the prices of consumer goods, and the second was that labor insecurity prevented workers from asking for higher wages…

This is gonna be a wild ride.

I would like to know if hedonic quality adjustments also apply when the quality deteriorates. A good example is the cost of air travel. It has gone down, but leg room is much worse, you don’t get free snacks etc. Or do they only use hedonic adjustments to dampen the CPI?

To anyone that’s interested, it seems like hedonic adjustments only ever dampen the CPI. Apparently everything only ever gets better and the phrase “they don’t make them like they used to” doesn’t apply anymore.

Suppose an item goes up 10% because of improvements . The CPI of s not effected.

But what happens if you do not want those improvements and there are no alternative . Isn’t that inflationary

Yes, this is why inflation and cost of living are not the same. Your cost of living goes up because you can only buy the higher-quality and more costly item, but inflation might be flat because the costs of the quality improvements matched the price increase.

Wolf

Some of these so called improvement are unwanted. They just bundle them to justify raising the prices. The consumers have to pay for something they don’t need and don;t want. I don’t buy this hedonic adjustment crap.

Where do they find the people who provide the “what the house MIGHT rent for” data? Is there anyone in the USA who hasn’t seen what real estate and rents have been doing for almost a decade? They can’t only be poling individuals in sub $50,000 houses in the middle of nowhere who never read or use the internet. Are they?

I have no idea what the rent would be on my house. The whole OER BS is like playing The Price Is Right.

Erin Burnett was on it tonight—and why are domestically produced items like detergent or bacon more expensive? Ripoff factor? The pandemic has shown to bring out the worst of us and the devil really does overplay his hand.

GREED is everywhere right now. There’s never been a better time to hunker down and STOP SHOPPING. Buy ONLY what you need. Play a game of seeing how long you can go without spending a single dollar. STARVE THE BEAST.

While the preppers and hoarders starve you in the future?

Hysterical much?

Depth Charge no one is more hysterical than you and your impractical bizarre world view. No recollection of toilet paper or ammo shortages.

I’m laughing at you.

LM….

How about shipping and labor costs? Did Erin think of that? She is such a deep thinker. Why would you watch?

So why are shipping and labor costs up? Well, Erin, shipping uses energy.

And labor is demanding more pay because of the Fed promoted inflation.

Ask Erin this…..”So if you are a purchasing agent and you know prices will be higher next month and the month after, what do you tell your supplier?” Answer: Give me all you got at that price.

This is why inflation is a bad thing. Did Erin ever object to the Fed promoting inflation?

Feed costs for bacon going up. Detergent probably going up because of energy cost and plastics.

“Utility natural gas to the home: +2.7% for the month, +20.6% year-over-year”

“Electricity service: +0.8% for the month, +5.2% year-over-year.”

IMO these are the big ones over the next 10 years.

I watched the St Peterburg Energy Conference live for 2.5 hrs today. Fantastic! Vlad did a direct Q/A. Totally on top of his brief! Chairmen of Total, BP, Exxon/Mobil, Mercedes Benz all spoke with their views of the future.

I had been really worried about all that green MSM nonsense but these guys are all feet on the ground engineers so parts of the world are going to be OK after all.

Merc hopes for their first ground up EV for 2025 and they think EV will be ‘appropriate’ for their up-market luxury brand, but even then they are expecting appropriate Govt ‘commitment’???

On the home front your Lng guys have dumped Europe and maybe you and are selling spot market to China who are paying whatever it takes.

Vlad won’t deal spot, he wants long-term contracts, smart guy, he’s looking after my Gazprom divis.

Vlad should be on top of it. He’s an owner.

Peskov to Putin, “Boss, Europe’s running out of gas!”

Putin to Peskov, “Am I the ONLY suspect?”

Speaking as an American it’s nice to know that our military is protecting Europe from their chosen natural gas supplier. Foreign policy 2021!

Oops, Not St Petersburg, it was Moscow, I mis-recognised my buildings.

Rate of change charts do not tell the story…

for inflation is cumulative and compounding in reality…

a flat line of increases, say in the Fed’s illegal goal of 2% would be a horizonal line, suggesting nothing. But it would in reality be a 22% decline in the dollar in ten years.

What does 5% inflation bring in ten years? Its a 62% decline in the dollar.

historicus,

“Rate of change charts do not tell the story… for inflation is cumulative and compounding in reality…”

Agreed. That’s why there are 4 charts in the article above that are index values or USD, not rate-of-change (there are only 3 rate-of-change charts in the article). These are the four charts just for you:

– Second chart: decline in the purchasing power of the dollar, from $1 in 2000 to $0.62 now (in USD).

– Fifth chart: Case-Shiller v. CPI Owner’s equivalent, both indexes not rate of change

– Sixth chart: used vehicle CPI as index value

– Final chart: my F-150 & Camry price index (in USD left axis) with new vehicle CPI as index (right axis).

Happy?

Wolf…it wasnt a shot at you. It was a caution to those who will likely see those rate of change charts, elsewhere. Your other charts do tell the entire tale. Most web sites and publications just show the rate of change which hides and mitigates the damage, and I wanted to point out the game others play.

It was nevertheless a good point and a good discussion about why I use both types of charts: %-change and index/USD charts. I’m glad you brought it up. I think about this stuff a lot.

One question arises when reading, how do USA numbers compare to EU, Japan, Australia and others? If exchange ratios are stable, but inflation higher in the USA there is a strange devaluation going on.

Thanks historicus and wolf… excellent point…helps me understand the long term pernicious effects of inflation better

Apart from the financial wisdom gathered from the authors of the blogs and comments, I put myself in the shoes of little people and think as follows.

1. What is the importance of port congestion in the west coast? Containers are not available for the mid west railways. So what?

2. I read the news. Federal reserve chief talks about something like tapering? It doesn’t matter. I voted for the new president.

3. Luckily I do not have stock positions or savings or even assets. This will not affect me right?

4. My landlord agreed for the same rent. Glad I don’t have to change homes and schools for my children.

5. The supermarket nearby me is sending me coupons. I am choosing the clearance meat, fruits on discount. Nothing bad as soon everything is cooked this weekend.

6. I cannot go to restaurants as I used to. No one during this times. I am OK with it.

7. What is this energy crises? Gas got a dollar more. Does it mean anything more below it?

—Yours Sincerely

(Censored) Programmer.

A good market economy serves all price level. A poor person needs a place he can go and buy bulk rice and beans and other cheap staples. They need to be able to put a roof over their head even if it’s not up to the latest code. He needs to be able to hustle up some income even if its doing work for cash off the IRS books.

The cure for high prices is high prices, whilst I don’t dispute the decline in US Dollar purchasing power, over a short term exorbitant prices will come to an end as almost no one can pay them.

Additionally most firms cannot pass the whole of the supply side increase in price on and thus profit margins fall, so in turn suppliers are pressured

Been happening all summer. I told my equipment dealer I couldn’t buy that new piece we had talked about. They lost a sale, as did the manufacturer. This is not even remotely sustainable.

Beating up on J Powell is getting old. What about that school mom. Yellon. She’s the worst Treasury secretary in US History, appointed by Biden.

1. She encourages spying on your bank and promotes these gigantic Federal Deficits.

2. Powell then prints the money to finance the massive deficits that Yellon promoted.

3. Biden then pays people not to work so we don’t the goods nor the infrastructure to get them to the consumer.

So we have inflation out of control thanks to all three of these morons. Next, look for wage price controls.

Powell is not the only one screwing things up. There are a lot of actors on this stage.

….and this is why the Fed should never ever promote inflation….at any level.

In fact, they are actually charged with stable prices……imagine that.

Since August 2008, huh? Right on the precipice of a deflationary crash. Oil prices had peaked at $147 a barrel just the month before.

And yet the Fed justifies its pursuit of inflation on the basis of a slippery slope theory of deflation. We might slip into deflation if inflation slides too low.

The facts say otherwise. It’s inflation that provides the fertile ground for deflation. That which has not first been inflated cannot deflate.

Once you have the system built on asset appreciation and leverage, deflation is a killer. Think about the housing market with a 3% mortgage and a 3% tax, insurance and maintenance. How many years could market take a 5% price drop before it all implodes?

Two old horsetrader types sitting at the bar:

-Bill offers, “Ya know Tom, sometimes I can’t help but think about those long gone folks with meager savings that I sold things to at a great profit, and I’m just bothered to hell about the prices I got out of ’em.”

-Tom replies, “Why’s that Bill? You were always a fair dealer.”

-Bill kicks back, “Well they obviously can’t use it where they’re at now, so I should have held out for more!”

I believe this energy crisis will continue to escalate and eventually bankrupt a lot of insolvent companies with bad loans which will cause a ripple effect of defaulting private junk bonds globally. Since a lot of foreign debts are denominated in USD, the shortage of USD will further increase (milkshake theory). Right?

Perhaps, the dollar purchasing power is diminishing inside US but for people outside US, holding USD cash or asset denominated in USD would be a better move. Also when the public confidence on their own government is disappearing, people will dump their own domestic currency for USD. Foreign banks will seize on any USD savings, like in Africa and Lebanon.

Eventually, all currencies will fall against the USD. Like Daniel Lacalle said, all central banks behave like the Fed but they don’t have the power of Fed. That’s a very bad consequence to pay.

Please comment.

Maybe the USD is one of the cleanest dirty shirts out there?

All fiat currencies are “dirty” shirts. No one wants to hold any of them as a store of value anymore except as a temporary stepping stone to buy stuff. That’s why inflation is out of control worldwide.

Well, maybe not all currencies will fall against the US dollar. There is the question about trade deficit. In the end those with a trade deficit may see the currency devaluated.

Then, there is a question about what countries hold scarce energy and raw materials.

Last, the USA have engineered social unrest around the world now and then. At the moment it look like some could do it at home, by purpose or by accident.

Still no rate hikes…..the do nothing Fed is letting the patient “bleed out”…

Record spread between Fed Funds and CPI rate of increase.

Dare I say? Dare anyone ask the Fed ” WTF is going on here?”

We know the sequence – it has been announced:

1. End QE by mid-2002 — to let long-term yields drift higher; If you hike short-term rates while long-term yields are pushed down by QE, you’ll get an inverted yield curve.

2. Either start balance sheet runoff at that time (to let long-term yields rise further); or hike rates (to bring up short-term rates), or both.

Wolf – the FED is so far behind the curve it’s laughable. If they were actually one bit concerned about inflation, they would have immediately stopped their QE, and announced emergency rate hikes, kind of like the emergency rate cuts. Instead, they are QEing into mid next year. C’mon, man, what a joke…..

“the FED is so far behind the curve it’s laughable.”

Totally agree.

You keep telling that nonsense.

With 600 trillion in derivatives (that we know of), all correlated to interest rates and depending on endless streams of liquidity, the FED will never “taper” or raise rates, because they can’t. That’s just a mathematical necessity.

End of story.

🤣🤣🤣😍

Even if they do taper they are still rolling over paper on their balance sheet and might actually be adding more than they are removing – by implication. It just means that instead of crazy ass bond buying its just crazy bond buying.

I can see people here are divided in two camps over if FED would taper/hike or not.

My take is: FED won’t do any meaningful tapering/hike rate.

The actual inflation on the ground is 20%. FED rates are close to zero. If they hike to 2%, it still amounts to nothing.

FED would do their lip service by tapering/hiking but not in a meaningful way

Since we can’t have real price discovery, it will be interesting to see where the whiplash comes in. I think autos could be the first place. I drive by a large Jeep/Ford/Lincoln dealer every day and was surprised by the amount of new cars that came in yesterday. Maybe 30-40 in one day. They finally had a new Bronco (the real one) I could look at. Cool truck but I’m not paying $58k for a vehicle with an MSRP of $38k. A lot of stuff is backed up in ports but you can fit a lot of chips into a 747. There is supposedly a large pile of built units waiting for them.

Yesterday morning early I was walking past a Whole Food in my Manhattan hood.

Now U never know the price of things. Never did.

I decided to go in to buy fruits for my friend.

Apples: 4 of them, already bagged and left by someone. I’m lazy I took them. $10.

WTF.

Bought really nice sweet crisp Ambrosias here on Van Isle 1.00 C per lb. That was a bit unusual, most places 1.30- 1.50

Pretty sure the trees were on VI but not sure. The Ambrosia is sort of new and orchards nearby are older types. Don’t know if you can graft new type on older roots like with grapes.

BTW: its amazing how well apples keep in fridge. Not in fridge, start to lose crisp, and mushy after 10 days. In fridge crisp for 2 months.

Lessons for your kids and grandkids:

1) Some people have more money than brains,

therefore

2) Sellers look for ways to get people to pay extra for the same thing,

and so

3) You don’t have to pay far more than you’d expect just because someone asks for it.

$2.50 for an apple is ridiculous … even if it’s a huge Honeycrisp or one of the other premium flavors… except maybe in a place like Manhattan, Berkeley, Aspen or Martha’s Vineyard, where the social contract implicitly requires trading in your sanity to live there.

My friend who is on unemployment for last 18 months shops in Bristol Farms where a simple mango cost $5 plus. In Aldis, it cost $.29.

I can easily afford $5 mango but on principle I refused to buy from these hyped up expensive places.

But for general populace, their buying behavior are driven by hyped up via popular media/social media.

“In the end, inflation indexes are political devices, decided by politics, for political purposes – underplaying the actual loss of purchasing power of the dollar and the purchasing power of people’s earnings.”

And as described in the book “Greenspan’s Bubbles,” that data manipulated for political reasons is then plugged into simplistic garbage models to run the world via the price of money and a few other crude levers. What could possibly go wrong…

Housing is the main problem. Land is the main cost of housing.

Profiting from location value is rentier activity.

This site does not distinguish rentier activity from other activity, unlike Adam Smith or Keynes.

Therefore you cannot begin to think of a solution.

Good to see you again!

Sadly land is not actually the main cost of housing, at least not in most places in the USA.

I would argue that the main cost of housing is actually bureaucracy.

Bureaucracy drives up the cost of new construction.

Bureaucracy is also what’s mainly funded by property taxes (the main cost of housing after construction).

very true!

g,

Housing is NOT a problem…

Plenty of em’…

Rentier income has been around since like forever…

Almost every major city in the world was built on major waterways in their beginnings due to rentier activity developing the ports and necessary infrastructure for water commerce…

You really can’t have one without the other…

If you build it, they will come…

Well, rentiers extracting profit from, or should we say tax, the economy as whole just stuffing the dividends and piling up money may be the problem. What differ is that the big rentiers are not landowners today. They run the monetary system.

How much higher can inflation on food and energy rise before people start missing payments on their overpriced homes they just purchased?

Can the banks use their excess liquidity, that is visible in the reverse repos, to keep themselves liquid while foreclosing on homeowners?

Charts notwithstanding, my conversations with realtors has revealed that whereS there might have been 20 or more people looking at houses there are now maybe 4 or 5.

In addition, I learned from the title company that the area where I just bought my second home is a hive of large ranches bring subdivided into 1-3 acre lots. I get at least one email about these developments every week.

The charts are lagging the behavior.

The Case Shiller index versus CPI owners equivalent rent chart and the CPI New vehicles versus Camry and F150 price chart are two of the best charts I’ve seen in about 45 years of reading about finance and economics.

Partially off topic but a potential ‘hugy’ re energy.

A giant wind turbine collapsed in Germany, fortunately, miles out, so no one was injured.

My old engineering institution will be all over this bigtime because it looks like a fracture near the top of the tower.

I’m retired 25yrs and looking at these towers, I’m saying to myself, isn’t it wonderful how things have come on and the columns are so slender and tall with all that massive rotating superstructure up top.

I did wonder why they all used 3 blades and not 2 or 4, 2 or 4 would give a balanced wind loading with only gust changes in column stress and hence easier fatigue calcs. But looking at 3 blades I’m thinking, I’m glad I’m not the poor sod who has to do the fatigue calcs on that! With 3 blades you get 2 to 1 on each side on every rev, putting a horrible reversing torque into the column on top of bending moments due to wind which also fluctuates due to gust. The traditional response to that much hypothetical was to multiply everything by 2, but as I said the columns are beautifully slim and tall. Don’t suppose it matters if they disappear into the sea but there could be big insurance and inspection costs coming to a wind farm near you. How many of these things are there? It was a German one that popped!

It never rains but it pours.