Producer prices that are input prices for consumer-facing industries are red-hot. But further up the production chain, prices are white-hot.

By Wolf Richter for WOLF STREET.

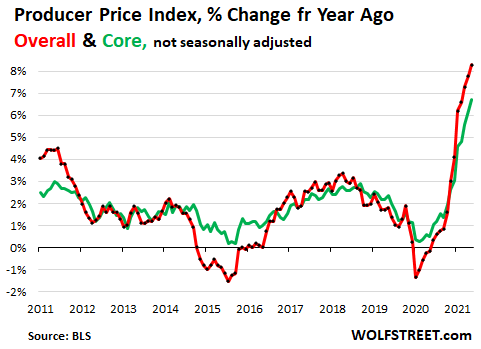

We’re going to go step by step so you don’t get dizzy right away. The Producer Price Index for Final Demand – these are input prices for consumer-facing industries and are the next step up in the pipeline for consumer prices – jumped by 0.7% in August from July. This pushed the year-over-year increase of the PPI Final Demand to 8.3%, the biggest year-over-year jump in the data going back to 2010.

Prices for goods jumped by 1.0% month-over-month, including food up 2.9% (35% annualized), with meats up 8.5% (102% annualized), while energy rose 0.4%.

Prices for services jumped by 0.7% month-over-month, including a 2.8% spike in transportation and warehousing costs (34% annualized), reflecting port congestion, spiking container freight rates, backlogs, and general chaos in peak shipping season before the holidays.

The core PPI, which excludes the volatile food and energy segments – though food and energy make up a big part of spending for consumers whose income is on the lower portion of the income scale – rose 6.7% year-over-year according to the Bureau of Labor Statistics today.

If businesses are able to pass on those price increases – which they have been easily able to do this year because the whole inflationary mindset has changed – then they will end up in consumer price inflation, at which point consumers will encounter them.

While some prices that previously spiked have now been declining for a month or two, other prices that had risen more moderately in prior months, or had declined, are now jumping. The overall indices average out this game of Whac-A-Mole.

Further up the pipeline: Intermediate Demand.

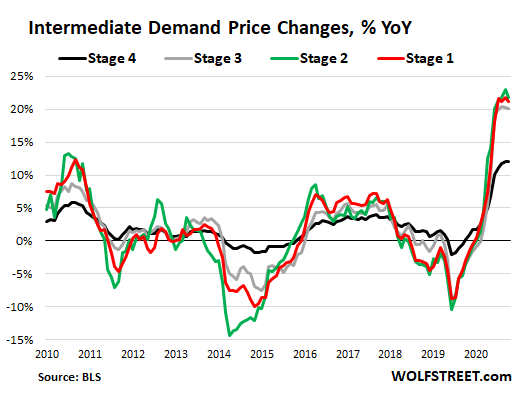

Intermediate Demand comes in four stages by production flow, ranging from Stage 1 industries that are some distance up the production flow and create in puts for State 2 industries, to Stage 4 industries that primarily create the inputs for Final Demand industries, which create the inputs for consumer-facing industries.

Across all four stages of the production flow, inflation pressures were high, and these pressures will likely be passed on to final demand industries, and from there to consumers. We’re going backwards up the pricing pipeline of the production flow.

Intermediate Demand, Stage 4: +0.8% in August, with goods +0.9% and services +0.7%. Year-over-year: +12.1%, the biggest jump in the data going back to 2010. These industries create inputs for consumer-facing industries.

Increases in prices for meats; machinery and equipment parts and supplies wholesaling; metals, minerals, and ores wholesaling; structural, architectural, and pre-engineered metal products; steel mill products; and nonresidential real estate services outweighed…

Declines in prices for securities brokerage, dealing, investment advice, and related services; softwood lumber; and hardware, building materials, and supplies retailing.

Intermediate Demand, Stage 3: +1.0% in August, with goods +1.9% and services +0.0%. Year-over-year: +20.2%.

Increases in prices for steel mill products; slaughter poultry; metals, minerals, and ores wholesaling; industrial chemicals; corn; and slaughter steers and heifers outweighed…

Decreases in prices for television advertising time sales, raw milk, and softwood lumber.

Intermediate Demand, Stage 2: +0.4% in August, with goods +0.5% and services +0.3%. Year-over-year: +21.8%.

Increases in prices for gas fuels; industrial chemicals; steel mill products; machinery and equipment parts and supplies wholesaling; transportation of passengers (partial); and oilseeds outweighed

Decreases in prices for crude petroleum, television advertising time sales, and softwood lumber.

Intermediate Demand, Stage 1: +0.9%, with goods +1.3% and services +0.5%. Year-over-year: +21.1%, matching July.

Increases in prices for industrial chemicals; steel mill products; metals, minerals, and ores wholesaling; transportation of passengers (partial); building materials, paint, and hardware wholesaling; and structural, architectural, and pre-engineered metal products outweighed…

Decreases in prices for hardware, building materials, and supplies retailing; securities brokerage, dealing, investment advice, and related services; and diesel fuel.

The 4 stages of Intermediate Demand production flow in one chart.

Prices in the three production stages that are the furthest up the pipeline (Stages 1-3, red, green, gray) have all jumped by over 20% year-over-year. Prices at production stage 4 (black), up 12.1% year-over-year, are inputs for final demand prices, which are inputs for consumer prices.

Final demand prices are what consumer prices will encounter pretty soon in their consumer prices. Stage 4 intermediate demand prices will follow. And prices in productions stages 1-3 are further behind, but they’re true whoppers, and they will provide massive pressures on consumer prices for months to come:

These are the kinds of price increases that are now coming down the pipeline toward the consumer. With the current inflationary mindset – radically changed from the mindset in prior years – consumers, flush with free money, have been accepting higher prices, and companies are confident that they can pass on higher prices. And there is a good chance in this inflationary mindset that industries further up the production pipeline will be able to pass these price increases down the line all the way to the consumer, and that the consumer will pay them.

“We need lower consumer demand to give supply chains time to catch up… recover efficiency… and break this vicious circle”: CEO of Maersk’s APM Terminals, one of the largest container port operators. Read… The Everything Shortage & Price Hikes Plastered All Over Fed’s “Beige Book”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

And remember:

You serfs will make due with 0.0001% interest on your savings

And a 1.5% raise.

Because….transitory.

“Up the Price Pipeline, Inflation Rages at 20%”

Look at the bright side: once cash is trash we’ll all be more equal. Everybody gets a prize. Keynesian heaven, digging holes and filling them up. Our betters fly to Davos to kvetch over populism and global warming, hopefully wearing their masks as they dine. Bernanke, Yellen, and Powell, they saved us all.

Exactly

spoke with main plumbing supply house owner this morning

he’s had 5(count them 5) price increases this year on WATER HEATERS

now coming in at just under $600 each(not installed)

last week(pre-sept) he was advised to put in his PVC order since they were increasing price on sept 7

got their order in on sept 5 – when got confirmation he said it wasn’t same price as aug

supplier said they had price increase on sept 1 and another coming sept 7

another supplier said if you don’t pre-pay at time of order then you will pay price at time of delivery

30-50% increases across board

sure glad it’s transitory

“if you don’t pre-pay at time of order then you will pay price at time of delivery”

Now that’s classic hyperinflation SOP.

Million + $$ ”quotes”, ( each, ) for rebar, red iron, and fuel for large construction projects were good for 24 hours in 2004-6,,, and would almost always go UP if not accepted so this is typical of THE BUBBLICIOUS times so far this century, eh?

Turned right around by early 2008, when similar bids were going DOWN daily if not hourly for same size projects materials.

Just one more indication of the coming crash IMHO…

Lumber crashed first. I wonder what is next? I imagine some things will crash, before alot crashes at once. Some things will stay high indefinitely.

Anybody got any guesses?

By the time aluminum crashes, lumber will be spiking again :-]

@ Thomas Roberts

WOOD – etf for lumbar is now at $89.92 ( 62.31 – 98.98

52 week range)

Where is that ‘crash’ now?

If EV vehicles are the future, watch out for Copper- demand recovering slowly!

We will see about lumber, alot of crazy things have happened for last 18 months.

As for copper, while EV’S do use alot more of it, cars only make up a small percentage of copper usage, the number I found is that if 100% of passenger cars sold were electric, total copper consumption would go up by 22% in America. It will take awhile for all cars sold to be electric, so for next few years, it wouldn’t be enough to substantially increase demand or price. By then the amount of copper needed in EV cars might decrease or there could be reductions in other copper usage areas.

@Thomas: Don’t forget all the electric grid upgrades that will be required if people shift entirely to EVs.

The overall grid is NOT currently capable of supporting an “all energy is electric” economy. Just ask Louisiana (hurricane), Texas (Big Freeze), California (wildfires), New York (flooded)…

If you want to FRACK something up get a Yank to do it. My understanding was that your greatest President Roosevelt was a Keynesian, he actually paid people to built stuff which is your greatest infrastructure build in your history.

What you yanks pass for Keynesian now is give money to the banks to hand out to the 0.01% to invest in already built infrastructure to inflate price through company buy backs etc to make themselves richer, with M2 money at zero.

OR start a war somewhere and hand all your money over to the industrial war complex, didn’t one of your president warn you guys about that?

Yup. That’s the truth. Give money to the banks (owned by the oligarchs) who turn around and inflate the prices of their assets (stocks, bonds, property), without proportional increases in wages for the serfs, until commerce has a heart attack and inventories balloon and prices collapse. Then that old socialism is required to save the oligarchs.

Yeah, we be lookin’ for ‘nother war soon so we can fire up the war machinery plants. Promotes higher employment too! You guys need a bigger army. s/

More war makes the USA go around

Aussie Mark–“start a war somewhere and hand all your money over to the industrial war complex, didn’t one of your president warn you guys about that?”

Actually a couple of presidents warned about that.

Truman and Washington.

From Washington’s Farewell Address:

“… let those engagements be observed in their genuine sense. But, in my opinion, it is unnecessary and would be unwise to extend them.

Taking care always to keep ourselves by suitable establishments on a respectable defensive posture, we may safely trust to temporary alliances for extraordinary emergencies.

Harmony, liberal intercourse with all nations, are recommended by policy, humanity, and interest. But even our commercial policy should hold an equal and impartial hand; neither seeking nor granting exclusive favors or preferences…”

Aussie Mark- it was Eisenhower and Washington…

@AM

Just watched my favourite journalist Murad Gadniev (RT hatchet man) reporting live with flack jacket, no helmet as usual, from amongst the Taliban footsoldiers celebrating the ‘liberation’ of their country. (deliberately picked on the same day as 9/11 anniversary).

He gobsmacked me (again) by reporting that US had spent more than the whole of the post war Marshall plan which totally rebuilt western Europe.

He says there is nothing there, no power stations , no waterworks, no infrastructure, nothing, other than abandoned military bases.

I don’t suppose any jail-time will be on the cards, makes Catch 22 look like non-fiction to me. Unless Murad is fiction of course, fake news.

I’ve been saying on here for months and months, when everything else fails, they take you to war…. It seems others have the same view….. Shame if you have boys around the late teens, they do like to send them off to war…..

the one silverlining of inflation is that we likely will not see that much house market crash and stock market crash in nominal currency value.

if house prices go up 15%, with inflation it is still 5% down.

Just wonder when they will start talking that the $15 minimum wage is not enough.

M,

$15 an hour is an appeasement… not a true discovery wage…

It only became a social meme recently and does not have a basis in fact for substance…

Most people above that level are paid for responsibility or competition for the task…

There is no silver lining for inflation because a) you really don’t know what it actually is and can adjust for it and b) you are always behind it…

For example, try asking for a 30% raise based on inflation for the next 6 years and try to justify it… you really can’t, even though you know it’s going to be there…

Can’t you explain to the boss that the raise is just transitory?

Maybe they will grant the wish next year. This year the reason for no raises will be all this damn inflation eating up operational costs. Maybe next year Joe

Wonk Wonk Wonk plays via trumpet

You may want to search for shadowstats “alternate inflation chart” which has inflation as measured in the 1980s running for years at slightly just below 10%, so all of our wages, savings, social security payments, pension payments, and cash have been slowly stolen by the banksters’ “Federal” Reserve as it lends its banksters TRILLIONS at 2.5% a year or less, to lend to you and me on our credit cards at 25% a year or more. Thus, I very much doubt that even a $20 per hour wage would be enough to keep average US wages at the purchasing power level that they were ten or fifteen years ago.

Technological advances and mass production have made TVs, computers, food, etc., grow so cheap that our buying power is deceptively increased or at least kept the same. If the “Fed” thieving had never occurred, we could probably all buy ten TVs or computers with one day’s wages by now, because TRILLIONS in earnings have been stolen by the banksters and their cronies. Read “What You Need to Know About Goldman Sachs Fraud,” for example, in fraud.laws.

QUOTE FROM THAT ARTICLE:

Goldman Sachs Fraud Resolution:

On July 15, 2010 Goldman Sachs agreed to pay $550 million–$300 million went to the United States government and $250 million went to the investors who lost monies—in a settlement with the SEC. Additionally, the company regarded to change its mortgage investment business practice, including the way it created and designed marketing materials.

END OF QUOTE

Like the persons defrauded by B. Madoff, those defrauded by that company would probably now be billionaires if they had instead invested in AMD or Amazon or other stocks. Thus, the fraudsters of the banksters have netted huge profits that have effectively been cut out of all Americans’ net worth, because the punishment that they have suffered from the politicians and “prosecutors” that they have later hired or pre-hired has usually been a slap on the wrist for MASSIVE FRAUDS FOR YEARS. Read “Eric Holder, Wall Street Double Agent, Comes in From the Cold” in Rollling Stone.

Moreover, keep in mind that many of the inputs into US products are currently coming from China, which has increased production costs, e.g., because of the fight that it picked trying to shut up Australian politicians calls for an independent investigation of the pandemic. Thus, inflation will keep on rising for years and a $15 an hour wage is NOT a living wage already in huge portions of or most of the USA, e.g., like NY or Southern California in which average rents for a modest house are about that most people get paid a month net of taxes.

It is the banksters’ thieving, so that one bankster leader, for example became a billionaire after his bank (which was “converted” into a bank so that their “Fed” could bail it out), that causes so many Americans to want to recoup the stolen funds by raising the tax rates of the ultra rich banksters and their billionaire cronies.

Stocks have their highest valuations in sweet spot of 1% – 3% inflation. Never been high valuations at high inflation.

And the CPI says that 1/3 of the lie is rents… not actual rents, but “owners’s equivalent rents”… which are up 2.3% year over year as of July, according to the BLS.

The markets are giving mixed signals.

The smart market, the treasury market is saying there isn’t going to be sustained inflation.

I just bought gold mining shares first time in my lifetime. They are priced for gold price to be lower, not higher.

Stock market the dumb, manic market is not priced for inflation either.

It will be interesting to see of consumers have the money to pay for all these price increases… if not the we will have disinflation

with shortages I doubt it

to much 1% buying every asset out there

I think the smart market has been overwhelmed by the fed and central banks. The big institutions, pensions, insurance companies etc, use allocation models and about the only thing they can do is try to hedge their positions in fixed income, and go up and down the yield curve slightly.

Throw on top of that the impact of indexed funds, both fixed income and equities, which is the dumbest money, we get no real price signals of what the market is thinking until there is absolute panic and the Algos go wild dumping assets.

Hedge funds can now scrape the internet to determine sentiment in real time. They are sitting closest to the theater door hoping to beat retail investor out.

The Treasury market hasn’t been “smart” in years. It has been cowed by trillions of QE. The bond market was totally blind to this bout of inflation, didn’t see it coming, still hasn’t seen it. All it’s doing is what the Fed is doing, buy, buy, buy.

until market decides to raise interest rates despite fed

THAT”S WHEN SHTF

until then it is up up and away for 1%

other 99% soon to become paupers

Wolf,

Treasury market gives a long term expectation of inflation. You wrote an article comparing it to conteporaneous inflation and growth, and showed that Treasuries always lagged. Even if one compares it to 10 year forward realized nominal growth, 10 year treasury yield .. the correct comparison in my view.. it would still appear a poor predictor.

Where is the smartness then?

Treasury market expectations are long term trend expectations derived largely by extrapolating historical trend (more of the same) and ignoring intermediate fluctuations in growth/inflation (“that is the so called smart part”).

To be smart in the sense of the comparison you present in your previous article, Treasury market participants would need a crystal ball to see next 10 years, or the prevailing long term growth trend needs to be precisely followed in the subsequent 10 years.

To be revising 10 year inflation expectation based on this year’s inflation, Treasury market would need to consider all the intermediate noise like non-smart equities. And for all we know, bonds may still be trying to do it. It could well be that inflation rages at 10 percent for 2 years (this year and next), followed by a crash and deflation leading to a 10 year realization of around 1.5-2 percent nominal growth, not too far from current 10 year yield. It is impossible to know ex-ante. Ex-post one needs a comparison, is there a better forecaster of next 10 years avaiable which outperforms bonds, in which case it should be a goldmine predicting trends in interest rates over long term, something notoriously hard to achieve.

At least yield curve inversions predicting recessions gives some cdredibility to near term forecasting avility of bond market participants

Investors hate higher taxes and complain when taxes are even under consideration to be raised.

Yet they are voluntary buyers of 7 and 10 year bonds , where inflation is an obvious tax and guarantees a negative real return. And every rational participant realizes that the inflation numbers promulgated by the FEDS is not realistic and only guarantees inflation numbers that are to be put it simply ,LIES

And because of this silly bidding up of bond prices , equity and real estate prices have been bid up to stratospheric levels.

The Fed serves whom, exactly?

“and to promote stable prices…”

Punishing savers and earners….with the lame excuse of keeping rates low to “promote maximum employment…..” while there are RECORD JOB OPENINGS.

So, the Fed pretends to help those who choose to be idle, yet they punish the working and earning and saving families of the country.

Its kinda like making everyone get an injection, except illegal aliens.

Pull back the money supply Jerome…the MMT thing isnt working

You already know who the The Fed serves . The MIC/ Security Complex which by extension was Congress’s bitch. The Security Complex has turned the tables on Congress. Congress is now their bitch. The SS has a “perishable dossier” on every Congress person that J. Edgar could only fantasize about while in his sexiest fish net evening wear. As the brilliant and honorable Senator Schumer from NY stated. ” The security services has six ways come Sunday to get you”. One well placed strategic leak to the Security State MSM outlet and careers and elections are terminated . Their Beast is now lording over them. The Beast does allow them to grab all the cash they can for their obedience . And grab they do.

Until they can’t.

Then comes the game of chicken of who blinks first.

With corporations stuck with massive inventory costs, especially dangerous with items that go obsolete fairly quickly (electronics, seasonal, toys, clothing, etc.)

And let’s face it, except for some small exceptions, consumers really don’t need anything.

Hamburger Helper came out in the inflation racked 1970s….to stretch cheap ground beef.

“And there is a good chance in this inflationary mindset that industries further up the production pipeline will be able to pass these price increases down the line all the way to the consumer, and that the consumer will pay them.:

“Hamburger Helper came out in the inflation racked 1970s”

But “Housing Helper” (more units permitted, with greater density) might be a lot slower in coming because first-there, vested interests control/abuse the permitting process, wrapping their self-interest (limiting supply spikes existing home prices) in the flag of “quality of life” hokum.

Good point c10:

Zoning changes already approved in Berkeley to allow 4 units on some lots in what has been single family residential zoned areas…

Not sure if that will include the really high rent areas, but apparently movements that way are happening in many places.

VVNV: Friends I know who live in Huntington Beach are fighting the same issue (increased density)… so I would say it is infecting the high rent areas.

There is a lot they could do to ease the burden to allow more residential development, but homeowners, NIMBY – are the biggest barrier

A home is people’s largest or second largest asset usually. You got to expect them to fight for protecting their investment.

High density housing has become all the rage in Boise, Idaho, and absolutely ruining the neighborhoods and quality of life here. Snapped up by Californians and others fleeing their “diverse, collective living” paradises and who actually don’t mind that homes are squeezed together and aligned so that your neighbors can see into your back yards, living rooms and bathrooms. Rows and rows of future slum cheap apartment buildings being constructed primarily for young families and service industry workers and overflowing as soon as they’re built, but with rents still climbing into the stratosphere. Literal war has been declared on farmland, large lots and anything smacking of rural lifestyle everywhere in this valley, under the rubric that “smart development” brings everyone a better way of life and can squeeze millions of people into a semi-arid land area reasonably capable of supporting a few hundred thousand with a comfortable base of local agriculture and breathing room for major concentrations of wildlife that depended upon this area for critical winter subsistence. But, hey, seems like nobody except the “old timers” minds the crowding, pollution, degredation of the local environment, rising crime, “diversity”, loss of traditional ways of life, rising housing costs and property taxes, increasing regulation of social activities and outdoor recreation, advancing drought and growing reliance on distant farming for food security because, you know, “economic growth” and all that.

JC123,

I understand what you’re saying. And parts of it I can agree with. But your condemnation of “diversity” puts you out on the thin end of a limb here. I understand too what this code word stands for. I’ve been happily married to a woman of color for 20+ years. Our household celebrates diversity. This is my living room your talking in. If you’re complaining because not everyone around you is white, well then, complain about it somewhere else, not in my living room.

“diversity” A soon as you said it like that all I could think of was my coworkers that talk of people that dont look like them.

California has the most amazing combination of natural resources and climate of anywhere in the world . But it also has far, far too many people and cars and some of the stupidest laws and politicians in the country .

JC123 put “diverse” in quotes. I take that as partial sarcasm. Somehow the elite coastal “diversity” types frequently fail to include the rural-state folks in their “inclusion” processes.

Instead, the migrating coastal elites, “wealthy” with Cantillon-effect-inflated assets, are pricing the rural-state natives out of their own hometowns, while destroying much of the local culture.

Consider the demeaning phrases applied to the rural productive workforce’s home territory: “flyover country”, “redneck states”, “cultural wasteland” (saw that here)… one could go on and on.

One can argue against the faux “diversity” and still support genuine diversity.

“I’ve been happily married to a woman of color for 20+ years. ”

Is that what a Japanese woman is now called in the USA: “a woman of color”?

I would think she would want to be called JAPANESE. At least most people here in Japan call themselves JAPANESE and not “PEOPLE/PERSON/MAN/WOMAN OF COLOR”

Or have things gone so far down the tubes in the USA that this is the kind of bs that is now taken as common sense?

No wonder the USA is is the mess it is with this woke bs permeating the entire country. What a stinking crock of cow manure the USA has become.

If someone called me a “man of color'” I’d probably call them an idiot to be polite.

I’m not, I’m Japanese.

Mistuhiro,

Yes and yes and yes. Yes, she doesn’t see herself as “woman of color” but as Japanese. Yes, that is the official term now used in the US media to group together all non-white woman in the US, including east Asians, such as women of Japanese, Chinese, and Korean descent. And yes, common sense has gone down the tubes.

But note that in the US, “woman of color” is a description in the racial context (in this case, the comment I replied to lambasted “diversity” which means “racial diversity,” so it was a discussion in the racial context), not in the context of national origin. Those are two distinct concepts in the US.

Just going to add in here my lack of regard for the term,,, as mentioned by others:

Now, finally, after going to Redwood after a couple of years in holy wood looking for that heart of gold,, found exactly that with a person with far darker skin who actually has that heart of gold,,, and I am definitely accepting and enjoying ”being old.”

IMHO, shame is all of those who cannot or will not STOP with all the various and sundry and extensive ”race baiting” started in the 1930s to put WE the PEONS in our place as subservient to the ”angels” of the pure and holy folks in Germany,,, until they met Jesse Owens,,, one of the really and truly GREAT AMERICANS of that era…

Well, there are too many people and not enough houses. We have some economic means to balance this, one of which is relaxing zoning and incentivizing development of lower cost homes and penalizing overdevelopment of high cost… some potential dangerous pitfalls there, but there is reason in it. Prohibit housing purchases for purposes of investment only and penalize home ownership in excess of three or so.

Of course, there is a more diabolical solution on the other end… we’ve essentially self selected our population based on critical thinking capacity with the vaccine… we could simply introduce covid to everyone, now, all at once, and shut down covid admissions to hospitals for a few months. But somehow I rather doubt this falls into your implied “diversity” criteria, quote unquote, moral turpitude aside.

We all, all of us, have a common enemy, and it is those at the top playing us for fools. They’d rather you focus on such “diversity matters” as they fleece your pockets, screw your wife and steal your children’s future.

JC/Wolf-i actually hear what you’re both saying, and Craig has hit the core problem. JC-you’re upset about people leaving a BIG (population, particularly) state that once (and in many areas still is) as lovely as Idaho (i lived in Newman Lake on the WA/ID border for most of the ’90’s). What you (hopefully) don’t seem to realize is that ANY ‘nice place’ that doesn’t foresee and effectively manage its growth will have BIG problems when the inevitable immigration occurs, especially when a lot of that growth is generated by people and developers who find a relative lack of responsible ‘growth’ management in a region (and ID could be a poster child for this, certainly CA has been the same in the past and the necessity of playing catch-up is not the best strategy), irresistible. Having said that, i have also witnessed the ugliness Wolf alludes to in the Panhandle during my time in the neighborhood (sadly, it’s in every state). As humans, we are at once magnificent and miserable.

As Saltcreep has so elegantly stated here, the seemingly permanent disconnect the U.S. (nay, the word) maintains between human economic/population and planetary resource equities are generating crises in more and more ‘nice’ areas (from emigration from previously ‘nice’ or not-so-nice ones-not forgetting ‘nice’ is always relative) unless your personal metaphysics soothe your temper about it, one might carry a few concerns about a concurrent lack of growth in planetary resources necessary for long-term human existence.

Time to clean, lube and reacquaint yourself with those adaptation tools located in your DNA.

may we all find a better day.

Remember, it’s all because of those greedy corporation and nothing to do with the Fed or the trillions the government been sending to China via stimulus into the supply chain. Heck, look at groceries, half of recent increases in food prices stem from beef, pork and poultry… it’s all about those greedy for profit food companies. Sustenance is a human right, just like medical car, air, water, iPhones, flatscreen TV, Peletons, etc, all human rights, fundamental and inalienable.

And don’t worry, by the time this decade is done, Hamburger Helpers will be a luxury items, I think we all know that it is scientifically proven that earthworms are fantastic superfoods, good for your bodies, and heck, can even be made to look like hamburger patties, already proven with impossible burger, and beyond meat.

Get ready for the awesomest future ever.

There has been real progress in making vegetable based fake meats, that do taste real and have the necessary vitamins added into them. That are healthy.

I’m not talking about burger king garbage. Or those terrible goo substitutes.

Good fake Chicken has made the most progress and may be available soon locally.

In the event of total Armageddon. While hard to find, politicians are a safe and healthy food supply.

actually, I’ve had soy based version of faux meat as far back as a decade ago, they tasted pretty good, the problem is that you couldn’t have industrial scale.

Ground Beef: Ingredients – Ground beef.

Whole Foods Market Plant-Based Burgers:

Ingredients: Water, Soy Protein Concentrate, Expeller Pressed Canola Oil, Onions, Textured Soy Protein Concentrate, Soy Protein Isolate, Natural Flavors (Contains Wheat), Cellulose Gum, Onion Powder, Mushroom Seasoning (Mushroom Powder, Salt, Dehydrated Onion, Torula Yeast, Sugar, Spices), Yeast Extract (Yeast Extract, Salt), Caramel Color, Sea Salt, Tamari Soy Sauce (Water, Soybeans, Salt, Alcohol), Carrageenan, Garlic Powder, Organic Cane Sugar, Ground Black Pepper, Ground Mustard Seed.

Current meat substitutes are goo based, but future ones don’t have to be.

You are also implying that most meat in America is pure. For numerous “meats” sold at stores and restaurants, only 30% of it is actual meat; the rest is a disgusting concoction of ingredients that make saw dust look appetizing. Additionally, the meat itself (before filler) in America, has had things done to it, that comprises both safety and taste (hormones, antibiotics, forced corn feeding, and much much more). There are numerous nightmare ingredients to most “meat” in America.

Compared to that, a vegetable based substitute, if they can make it taste right, holds alot of appeal. If they can make it right, would probably be cheaper, healthier, thicker on average, more sustainable, and many other things.

We’ll just have to wait and see.

MCH,

Alot of new trial and error attempts in pipeline, will just have to wait and see, if any are good enough. That can also be made at scale.

Back in the 1970’s grocery stores sold soyburger. It was a mix of about 50/50 ground beef and ground up soybeans.

It wasn’t bad. It made a decent, high fiber hamburger.

But as soon as the price went back down, the stores discontinued it.

I wonder how much of the food price issue is related to food-produce supply chains that do run through China, even if the raw materials are sourced elsewhere.

Food products should have every country of origin, trans-shipment and processing marked on the labeling. We’ll be astonished.

Good point WS,,, and just have to add:

Went to my usual grocery market yesterday,,, and

PAID EXACTLY THE SAME for:

Eggs, yoghurt, cheese, lime juice (for the margaritas), orange juice, and coffee as for the last two years since I ”retired” and had not much else to do, and not the same net net net income…

Not sure where the ”meme” of higher prices for food is coming from, but definitely not seeing it in the foods we buy on a regular basis…

Certainly that basis is based on the very best foods we can find at any store,,, because, mainly, as a partially farm raised person, I KNOW what ”real” food tastes like, and totally reject all the various and sundry and extensive efforts to make foods taste like paste or cardboard.

Rather starve than put up with the ”stuff” parading as food with no taste, and absolutely none of the texture or other components of real food stuffs, from the beef to the garlics,,,

VintageVNvet,

We just noticed that the carton of OJ at Trader Joe’s shrank from 64 oz to 52 oz — but the price remained exactly the same. So now we’re paying over 20% more per oz than last time we went there. Shrinkflation.

It was pretty slick, the way they did that. Safeway chose to keep the same height but make cartons narrower (started years ago) which was easier to notice. But it went in smaller increments over the years. Trader Joe’s kept the same width of the carton but reduced the height. So the cartons are now stubby.

So check your OJ container for quantity and see if the quantity changed.

The Trader Joe’s OJ shrinkflation happened a while ago, pre-COVID.

Simply Orange, Tropicana and then Florida’s Natural downsized from 59 to 52 oz in 2018. Trader Joe’s held out at 64 ounces until 2019 and then went to 52.

Mouseprint dot org appears to be a good source of info on shrinkflation and other consumer-misleading product shenanigans.

Oops. Just looked at our receipts. Correct. My wife goes to TJ and Nijia. I go to Safeway and Costco. So I missed the OJ shrinkflation at TJ when it happened.

A lot of consumers don’t need anything, but if you raise a family they need a whole lot.

Plus government is constantly trying to stoke demand by making something a right. People always spend other people’s money freely.

My parents always taught me growing up that if you don’t work for it, you don’t take care of it.

We need a national full employment policy. Anyone who cannot get a job gets hired by government. A lot better than simply giving out the ‘dole.’

and the Fed conveniently watches the PCE index which is chain weighted and allows for items that rise “too much” in price to be substituted out…

talk about a biased index!

So like the line in the movie “Vacation”….”hamburger helper is pretty good all by itself”

Stagflation is a hard one to get through. Can’t hide in bonds, stocks tank, cash gets eaten up sitting in bank accounts, even real estate takes a hit. Three and a half more years folks. Good luck.

Once you have ran up the credit card the fun comes to an end and you have to slog through life with the debt hangover.

As much as they say debt doesn’t matter and it’s different for the government, that’s not true. They are just able to play games with fiat to be dishonest with the cost of the debt. Savers and most wage earners have been paying price for more than a decade. Consumers are paying price now and probably stock holders will follow shortly. Too much consumption and not enough production in USA will have its flesh to extract.

So they say “debt” is an asset…and “debt” creates money…

how come the credit card companies dont see it that way?

cause their vig is 20%+

and they get 3% transaction fees

and visa/MC don’t have any problems with debt

it’s the banksters issuing said cc

The credit card companies DO see it that way. Whenever you owe anyone, your debt IS their asset. Your promise to pay is now their future income.

But unless they own the printing press, they had to forego something in order to save the money they lent to you. You’re paying them extra (as interest) for the privilege of having your cake now, whereas they chose to eat less for a while in order to have more in the future. At least, that was the classic “loanable funds” save-to-lend theory.

Nowadays, it’s not so clear that it works like that, and credit cards charge interest rates to used to be illegal, to those who get caught short, while sharing those usurious revenues by offering rebates to those who pay every month. Everyone with a rebate card is quietly suctioning wealth from those who aren’t as responsible. A peculiar form of financial cannibalism…

From what I’ve read after the midterm elections things may go to heck fairly quick how does this double digit inflation play into that?

publicans bad, dimwits worse

take your poison

This won’t wait until midterms.

Sorry.

obviously didn’t have to go through carter years

it’ll keep churning with Biden and nancy pouring on more fuel to fire

then they’ll try to put out fire and take credit for it

but I don’t think they can put this fire out

difference between 70’s super inflation and today

we are WEIMAR GERMANY now – ie LOADED TO GILS WITH DEBT we can’t pay

Dr Havenstein in 1923 was asked why he did what he did in destroying the German currency by massive money printing. He said it was either that or have massive civil unrest and violence. He hoped the economy would grow out of it, and the debts would be repaid by devaluation. Are things any different today in the USA?

As long as the nation doesn’t get handed over to another cabal of conspiracists, politically things ought worsen much further. Economically….well that’s a different story.

We have an awful lot of systemic risk and moral hazard to unwind as the overstretched markets return to and probably significantly overshoot their historical nominal levels. In summary consider the next 10 years or so a lost decade. Like the roaring 20’s things will likely end the same way.

I think it’s going to be different. As the economy gets worse politics get even more ugly.

I think Harry Truman might have been the last politician that wanted buck to stop at his desk.

os-don’t think he wanted ‘the buck’, but had the maturity/manhood/ownage to know it HAD to stop with the administrator occupying that ‘great resolute desk’ for the sake of future America…(though his, and everyone’s mileage always has, and likely always will, vary…).

may we all find a better day.

Stagflation sucks.

Djreef,

“Stagflation” means inflation plus declining GDP, meaning GDP growth with a minus-sign in front, or zero growth.

But GDP is still growing (with a plus-sign in front) at a massive unsustainable rate, and it’s going to grow just a little more slowly. So far, there is no sign of declining GDP (with a minus-sign in front).

Goldman Sachs lowered its GDP growth forecast for 2021 to 5.7% from 6.2%. Normally, we’re happy to get 2.0% GDP growth for the year. A 5.7% or even 5.0% or 4% or even 3% GDP growth would be HUGE for the US economy.

The last time the US reached 3% GDP growth for a full year was in 2005.

The 70s misery index was the unemployment rate + inflation rate.

Do you know how to improve unemployment rate?

Mandate that employers fire half the employees due to OSHA violation*.

* OSHA violation = not vaccinated

Nacho Bigly Libre,

It doesn’t work that way. In OSHA violations, the employer (not employee) gets fined because the employer violated the OSHA rules, which are supposed to provide a safe work environment for the employee. OSHA oversees employers not employees.

Keep splitting hair.

actually wolf – john mauldin had great article this weekend on stagflation

it’s HIGH INFLATION(ie devalation of fiat $dollar) with growing GDP

but when you NET THINGS OUT – GDP Growth minus ‘inflation'(ie using more $$ to buy same amount) you get NEGATIVE growth

of course it also means WAGES continue to FALL BEHIND massive $dollar devaluation(I refuse to call it inflation-fake govt word)

give it time, Mr. Richter, we’ll get there, we must have patience. Rome wasn’t sacked in a day, we need to keep working at it to get to that point.

Nominal GDP (unadjusted for inflation) is one thing, real GDP (net of inflation) is quite another.

That is one major reason why the G expends so much energy trying to convince the public that a lot of inflation really ain’t inflation (this ain’t your Pa’s F150, and his college didn’t have rock climbing walls…)

But, in the end, nobody’s life is really improving just because the G prints enough lucre to add a zero to prices…in fact, quite the contrary.

But the G loves ’em some nominal GDP, since they can goose it up merely by printing cash (which they want to do anyway, as a mechanism for control). So the G can claim that the economy is booming, even as savers get dispossessed.

Just to clarify, the GDP numbers I quoted were real GDP, annual.

REAL gdp as in using DEVALUED $dollar to buy LESS

seeing 30-50% price increases across the board

plumber – 5 price increases so far this year with another coming

paint, wire, steel, things used to build stuff we need

love the used vehicle market going up 35%

just means buying less with devalued fiat $dollar

I’m just not impressed by a high GDP growth number. The government borrowed and printed money and handed it out to be spent. How could you not have growth under those conditions?

A: Japan? The sparked the saver generations.

Agree with your thought about printing and thin air creation of trillions of dollars on a scale that is like a moon shot but for an economy. They (world gov’t) really have goosed the entire system by raising the bar to a level never seen before

Exactly I don’t have the faith that Wolf does in the numbers we are handed by our caring government.

Like the 1%-2% inflation we were expected to believe.

And the 4% unemployment we are still expected to believe.

This is the type of stuff that made Soviet Pravda famous ……

And as the GDP is deflated, a fake inflation rate (real inflation is much higher than stated) creates a massively fake GDP.

The real GDP is much lower than stated.

And the clown in power…

5.7% seems like a roaring number until you consider that we contracted 3% last year. When you subtract 2020 from 2021 you get 2.7, or 1.35 average over the two years, which is slower than the average growth rate over the last decade. We spent all this money just to achieve that.

if YOU DON’T MASSIVELY devalue $dollar then how are you going to pay these HIGH PRICED PENSIONS

got to make paupers out of 90% retirees 1st

Wolf – without going into detail, the govt has added so much fluff to GDP via the “financialization of the economy”, “social media GDP”, “patent GDP”, and the huge sums of free printed money that somehow count as GDP due to monetary magic (even the broken window fallacy counts as “Hurricane GDP”, “Wildfire GDP”, etc)… So even a 1% GDP print is almost like negative GDP from 20-30 years ago when the economy followed “Mark to Market” versus “Mark to Fantasy”. Has capitalism not mutated over the past 30 years from a means to an end to an end to mean(ing)??? We most likely already dove head first into stagflation at this point, but who knows how deep we go until we hit bottom as the Fed has created a global dark pool of insane excess that blinds us all to the current and future financial and resource based “base realities”.

Honestly do you trust the current GDP calculations?

Perhaps humans would be better served with GNH (Gross National Happiness) or some other experimental form of “Group Societal Success” (GSS?) that does not tend to enrich the top1% at the expense of the bottom 99%ers.

“GDP” is kind of a joke as a measure of national wellbeing. Is GDP, in basic concept, not just “Number of Workers” times “Productivity”, which means one could substitute “Number of Robots” times “Robot efficiency”, and perhaps then achieve 100% GDP per year (SP 500 @ 1,000,000,000,000!), yet doe that ensure that the bottom 99% of carbon based humans are actually better off, when the top 1% own all the robots???

Craddle…GDP…Grave…¯\_(ツ)_/¯

And how much of GDP is government spending…spending of money that is deficit spending from sources like QE?

21 Trillion in new national debt in just 12 years…..and ready to click up big…

Wolf,

It’s been decades since I studied economics in college, but I don’t recall “stagflation” being a real term in economic theory at that time. It was a term coined in the press. In any event, your definition seems to describe depression combined with inflation rather than what I remember from those years — economic growth that is slower than the population growth combined with inflation. That situation put the federal government between a rock and a hard place. If the government tried to increase the growth of GDP, it simultaneously increased inflation. If the government tried to reduce inflation, it simultaneously reduced the growth of GDP. We know which option Paul Volcker chose.

@C

There is no rocket science here.

Gdp =V*P where V is total physical volume of goods produced ie cars + haircuts + roofs +++. Often referred to as the ‘supply side’

You can’t add these together unless you use the money value of each good which is averaged out as P.

When P goes up it’s inflation, when P goes down it’s deflation. In that equation it is perfectly possible for V to go down (less goods) and P to go up (inflation) together, hence the term stagflation.

What would be great for consumers would be the very opposite, ie falling P and rising V but who in Govt cares about consumers when you have Facebook HQ in your constituency?

While I’m on this I should say V=E*p where E is employment and small p is productivity ie output per head which is the most important number for national prosperity but nobody in the west seems to care about it anymore.

I moved to Puerto Rico in April. Back in April, it was impossible to visit Sam’s or Walmart and not see someone wheeling a new big screen TV out of the store. Remember, that was around the time of the shimmy checks.

This week, we went to Sam’s and the store traffic was down 80% from what we’ve seen all summer. Remember, this is when the Federal Unemployment benefits expired.

GDP growth in 2021 is the Fed and government handout programs, along with millions of renters having all that extra cash burning a hole in their pockets. The economy is in free fall, in my opinion.

Let’s hope the wage pressure continues and wages continue increasing.

There is no stagflation now. Inflation started when money was injected into the customer base. This ends now and consumption will end as soon as this money is spent. Without wage increases, we will see stagflation since price pressure will continue.

Stagflation is worse than inflation or deflation. I saw it when I was a child and it hunted me all my life.

The U6 is under 9%.. unemployment really isn’t that bad considering what the economy has gone through.

https://fred.stlouisfed.org/series/u6rate

So yes there will be a demand for workers and wage inflation.

When a stockbroker or fund charges a commission for selling shares of bubble stock, that is counted toward GDP. All they have really done is move money from one pocket to another. How much of the current GDP is pumped up by the financialization of everything?

Consider than up to 2010 fed debt to GDP ran about 65%, by 2019 it was at 100% and now 155%.

Simply on a vector that it takes more and mor debt to produce a dollar of GDP, headed to the stars.

Now also factor in all the negative demographic factors that are headwinds. Future doesn’t look very promising.

Negative demographics can be nullified by massive immigration which is what government is doing and it helps also wage suppression

GDP growth year over year or since ’19?

Anything will seem massive compared to last year. But the core issue is that GDP is including financial companies and existing home sales, neither of which are really growth. They are just money being shifted around.

GDP is a manipulated metric, just as badly as CPI. Real GDP should only be pegged to actual goods and services. Inputting monetary values into a quant is not work.

Selling an existing home reflects no real work or goods. Why are these and maybe even used car sales considered part of GDP? It’s just all a scam to distract from the joke of “service economies.”

The disease based years make the GDP increase semi coming out of those years meaningless in comparison.

All the auto mfgs shut down production again because of chips. End of year sales should be interesting…

@R

UK Vauxhall was hinting at ’23 before chips resolved.

Next stage in this predictable process : start blaming greedy corporations and businessmen for increasing prices.

We never learn and deserve whats coming.

U.S. PPI rose 8.3% in August.

China PPI rose 9.5% in August.

In Malaysia they closed a chip assembly plant after three people died of COVID.

We need chips for vehicle assembly and repair.

Hulu will increase prices by $1. Food prices up. Gas prices up. Uber/Lyft prices up. Rent up. Car price up, etc.

Is there anything that is going down in prices? This is a serious question. For example, are TV prices going down like most tech? Phone? I have this theory that in the past, services or goods that are essential and can’t be outsource are going up in prices but is offset by prices of goods that we don’t need and that can be outsourced (i.e., see TV prices, toys). This offsetting of prices made inflation look tame. However, this is not the case right now due to supply chain problems caused by the massive money printing.

Honest answers. Phone call charges. News. Stock trades. Shipping charges.

That was all I could muster

According to my Vietnamese wife who lived through serious inflation in her country, prices are not going up, money is getting cheaper.

Only when the average joe is on his knees by prices so high he can not eat will the poor dumb shit figure out that it is Congress and its bitch the Fed that has de-based his currency and his life. Joe needs to be hit in the head multiple times with a shovel untill he finally figures out who has been at the other end.Suffering ain’t even started yet. These are realitive boom times. Joe ain’t learned Jack yet.

Joe will likely suggest “inflation compensation checks” be issued…

You might have it somewhat backwards. The private Fed works for the financial elite. As does congress. Anyone who bucks the system doesn’t make it into office. All this social spending is part of Bread and Circus as the Fed grows its holdings.

The Republican Party works for the top 1%.

The Democratic Party works for the top 10%.

That lever in the voting booth serves the same function as the steering wheel on a child’s car carrier seat.

As somebody in that top 10%, I fail to see how the Dems work for me.

IMO they altogether are the Uniparty and do the bidding of those who fund them, i.e., the 1%.

Really this is the perfect sponsor image.

I’ll dig out my WIN button!

Wiki:

Whip Inflation Now (WIN) was a 1974 attempt to spur a grassroots movement to combat inflation in the US, by encouraging personal savings and disciplined spending habits in combination with public measures, urged by U.S. President Gerald Ford. The campaign was later described as “one of the biggest government public relations blunders ever”

Heh. Yeah; the alternative was LOSE: “Let’s Organize a Sane Economy,” which never got tried. Even yet.

I bought a handful of these buttons for an amazingly low price of 11 dollars! An instant hit at parties composed of financially literate….other than those people are clueless to the insanity of these financial Times. “If you are not outraged by the actions of the financial authorities, you must be financially illiterate” .

“…..by encouraging personal savings and disciplined spending habits in combination with public measures,….”

Boy oh boy, are those suggestions gone forever.

Saving? And lose 5% a year…..

Question….if money is an asset, and I use (spend) that money at a loss, can I write off the inflation loss?

And with our crony “conservative” governments the FED will shower the rich with more and more money to make up for the inflation. But you, the middle class? You get nothing except being told to pull yourself up by your bootstraps, get a 2nd job, and hustle more.

Hmmmm.

A single party controls the house, senate and White House.

And they are about as far away from “conservative” as you can get.

FYI. A conservative is traditionally defined as someone who wants the Federal Government to live within its tax means and to follow the US Constitution as written.

They might be defined that way but they don’t implement it. They spend at least as much as the opposition when given control.

yep…. those guys are called CINO… I’m sure you know what that means. I think the last conservative they had was Ron Paul… and he was more libertarian. (not sure why he is that… doesn’t look like he ventured into the library much…. :P)

Also called RINO.

I used to consider Ron Paul a nut case decades ago. Always whining about the Fed and fiat money.

He was a visionary and definitely libertarian.

Also:

A constitutionalist.

Vocal critic of the federal government’s fiscal policies and the Fed.

Believes in sound money and a balanced budget.

Opposes the military–industrial complex, the war on drugs, and the war on terror.

Opposes mass surveillance (PATRIOT Act and the NSA).

Opposes interventionalism.

Libertarian or conservative? Elements of both. Ran for president 3 times but with that belief system he was never going to get elected president.

You know, I think when a guy like that comes along, the establishment just wants to crush him. I agree with you that a decade ago, I looked at him the same way. But turns out I was the nutjob in the insane asylum, and he was the rational one. His son will get there some day.

The crazy thing is that it took the current and the previous administration to actually get a handle on how nutty we are as a country and as a system. The returned to grown ups in the room was anything but…

It’s times like this when one starts lending credence to the ideas around cryptocurrency. Something relative stable and finite with value that doesn’t erode steadily due to nutty government control.

Sadly, the destruction of the gold standard and the ensuing rise of print-and-spend politics has led to an infestation of both RINOs and DINO’s in DC.

In the 1980s the Republicans complained about “tax-and-spend” Democrats.

Now they don’t even complain much about “print-and-spend”, as long as they get their cut.

If the Democrats actually solved any of the problems they claimed our money was solving, they might have a better case, but too often it’s just waste, as Wolf has repeatedly shown.

When you print-and-spend and then waste the funds, stagflation is inevitable because too little of the printed money is going to productive use.

2b-with ‘deficits don’t matter’ and tax cuts during a virtual wartime, your point applies to the putative ‘conservative’ party as well…

Intellectual rigor deficits being run concurrently.

may we all find a better day.

I really don’t think we’ve seen one of those in our life time. There is always a reason to over spend. War on Poverty, war on drugs, war on terror.. always an excuse to give tax breaks to those who don’t need them and up the spending.

Boy if that is ‘control’ I really don’t want to see ‘out of control.’ Biden is making a good faith effort to keep us from descending into Depression. The monetary control system is collapsing. The fiscal tools are being dusted off and hauled out. Still, Presidents have a really hard time of figuring out how to stop feeding the oligarchs at every one else’s expense. Raise taxes on the oligarchs. Raise wages and eliminate FICA. Hire everyone who cannot find a job. Put them to work improving public assets. Beats the dole.

“A single party controls the house, senate and White House”

Republicans + Conservative Democrats

>

Liberal Democrats

The permanent majority.

“There is only one party, the Property Party, and it has two heads, Republican and Democrat” – Gore Vidal, 1970s. Still true.

The only thing that can defeat the Property Party is a populist uprising, but the Property Party owns the printing presses and the populists are ever-divided by social wedge issues.

Let’s face it… like a weak reed the Fed bends where the political wind blows, economics or fiscal justice are secondary issues for them.

They wanted to pump up the liquidity for the Democrat Administration but they have let the situation slip away from themselves. They are now going to have to start hitting the brakes harder because of that bias (unlikely) or they are going to barely taper (which I believe is likely) which means more Inflation Tax, especially for the poor.

The Fed was nearly as bad under Trump.

Remember, Trump invited NEGATIVE interest rates.

And like a psychiatric patient, we can see that Trump hates interest rates (always a leverager) and hates the Fed (put him out of business in 1981),

To his credit, Powell actually got rates back to “normal” in 2018 when Fed Funds rose to meet the then 2% inflation. The markets didnt like it, and Trump jawboned him into a new course.

Someone threw their arm around Powell and said “this is how its going to be”, and he hasnt been the same since.

I think the Fed mostly wants to grow its assets these days, done by buying mortgages and treasuries with conjured fiat.

The poor don’t have any money to ‘inflate’ away.

They have wages that get inflated away though. Inflation is one reason why the poor remain poor.

The poor also owe most of the net debt, which potentially could be inflated away, but … in stagflation earnings don’t keep up with rising costs … so inflation will put them more in debt, not less.

Arguably the bottom 90% have been in stagflation for about 20 years. Income stagnation is well documented. Living expenses not as well tracked by CPI, but clearly have been rising steadily as corporations extracted higher “profit margins” at the expense of both workers and consumers.

Why isn’t this slowing the housing market? So many homes on the market are in need of repairs, addressing deferred maintenance, and renovations, and yet buyers are still not put off? I have been.

I’m now seeing builders from out of state. Like 07, the out of town contractors showed up @ peak frenzy.

Expect the same to happen, but the new jobs keep piling up.

Maybe they are all preppers. I’m rural, and in flyover. Home schooling,

or coop has exploded. That and living off the land.

Foxes & yotes are starting to have obesity issues with all the “free range” KFC running around.

Oh well, no debt this time around like 08. Just me and the Mrs.

Guns, ammo, fishing poles, and garden. Need to update the still.

Fear Of Missing Out (buyers). Still going on around here…..houses last one day on the market.

There’s a development out here that has simply shut down construction (Shea, Toll Brothers) other than infill lots. Even the pre-sales are shut down, with no firm delivery dates. They have put in infrastructure (water, sewer, underground utilities) and laid out roads – but not paved them. In talking to a manager at the on premises restaurant, he indicated that they will not start to build again until all the materials are purchased and stockpiled. The list of things they can’t get has grown and the wild price gyrations make it difficult to predict appropriate pricing structures.

Still no shortage of people willing to plunk down $1M plus for a semi custom tract whack on a postage stamp lot.

We have been looking at 55 communities in sc, ga, fl. Build out time for a new house from signing is being quoted as 1 year, with a built in expected inflation factor to be determined at competition. Meaning no fixed price, so just be ready to bend over. No thanks.

Side note if pool is desired, what in 2017, 2018 cost 45 to 55k is now quoted at 75 to 100.

I have friends who have money, good jobs, and good credit and cannot find a house to buy. Sure…they can find a house in a low income neighborhood but they do not want to live there so they will continue to rent and hope that housing drops or more houses come onto the market.

During HB1 there were so many spec houses being built with no buyers in sight or speculators were buying houses with intent to flip immediately, we had too much inventory. There was FOMO back then too. I had a friend who decided to get into the home builder market in the mid 2000s. I remember him building 3 or 4 homes but too late in the game and went bankrupt as he could not find any buyers in 2007 and 2008.

In Cleveland there is a construction boom as of late. In the suburbs I have seen hundreds of new homes under construction. recently. With the metro area population steadily declining I can not understand who the buyer for these houses will be. Most of them seem to be $300k-600k houses. Not to mention government housing construction has gone through the roof. Sherwin Williams is constructing a new headquarters to the tune of $600 million. There are also a lot of apartment buildings being built in the city. One example is the Intro Cleveland apartment complex, one of the largest wooden apartment building in the US.

“Studios will start at $1,450, one-bedrooms will start at $1,750, and two-bedroom units will start at $2,600. Ten penthouse units could cost considerably more.”

I make alright money but can not justify 1,750 for a one bedroom apartment in Cleveland. These prices seem ridiculous, especially since the area it is being built in is a B grade neighborhood. I think soon buyers will have sticker price shock and possibly hold off on purchasing. Everyone I know who hasn’t already purchased is planning to wait it out a year or two. I hope it works out for them but with interest rates so low they might just keep this charade going.

It’s the low interest rates that keeps it going. Article today stated the lack of listings where I live continues to push housing prices higher and higher. The good thing is we now have more people working than before the pandemic for the last 3 months in a row. This situation is adding to the higher house prices, plus vacationers planning to remain here.

I wouldn’t buy now, either. Unfortunately, I gave that same advice 5 years ago to my friends daughter. Rentals are suffering the same price pressures despite lots of new construction and available units.

Lower interest rates (this low anyway) doesn’t really benefit actual home buyers, it benefits large scale investors who probably get much closer to 1.5% than the average *home* buyer can. Plus, with increased prices come increased taxes, plus the home repairs- even at sane prices for lumber. Most home buyers I think can not do their own major repairs or finished carpentry.

If a home buyer can get a loan at 3.25% and an international corporation can get one at 1.5% then the loan cost doubles for the average home owner as well. Not to mention corporations probably pay less percentage on fees as well.

“Plus, with increased prices come increased taxes, plus the home repairs- even at sane prices for lumber.” Newly assessed, higher prices, cause the property tax rate to adjust. In my city, the property tax rate is going from $24 per k, down to $17.5 per k. Governments are not in the business of making a profit.

Real estate is the most ILLIQUID of markets.

A click up in rates and you will see inventory galore and a buyer pull back.

Greater fools, scammy REITs, and foreign money laundering.

I have heard of money laundering pushing up Canada’s house prices. I have yet to figure out what type of crime they are getting the money from.

Reportedly a lot of it is bribe money etc from China. Plus a Nigerian Prince or 2 that has scammed his countries treasury. Plus any international organized crime- like credit card fraud, drugs, arms dealers etc.

I don’t know about Canada. but it is much more difficult for US citizens to do this as money needs to be accounted for. Foreign money does not.

They had a pilot program in Miami and NYC and a few other places where they demanded foreign money be accounted for- where they got it. Luxury condo sales suddenly went down I think 30% IIRC. I don’t rember the other stats.

Probably people trying to move money out of China and the money might not be the proceeds from criminal activity. Oh wait. China. Yeah, criminal activity.

They’re pretty clever. One scam takes place in the US because of all the litigation we have.

They buy or start a company here. Something bad happens and the company gets sued. The plaintiff is in cahoots with the owner or a front for the owner, so they have a huge settlement and the money is now in the US under a different name.

1. Chinese factory owner invests the required amount in Canada to qualify for a Canadian immigrant visa.

2. Wife and kids move to Canada and kids are enrolled in local schools and join provincial government health plan.

3. Husband continues to run his business in China, visiting the family several times a year.

4. Little or no income tax is paid in Canada.

5. Little or no follow up by Canadian tax authorities questioning how the family can afford their $1million+ Canadian home.

My guess is that the Chinese family is committing tax evasion and that Canadian tax authorities are looking the other way.

Property tax rates are very low in Vancouver (about 0.3% of market value) and almost as low in Toronto (about 0.6% of market value).

Most of the money are from corrupt means bribery tax evasion etc

Most of the powerful people in developing or 3rd world countries have their ill gotten wealth in western countries

Probably CCP corruption from what I heard, and it is ALL corruption all the time in the CCP from what I have heard. That is why they are banning any way to ship money out of China like the digital coins, etc.

To those who have now decided to follow the steps of certain financial “geniuses” and invest in “mainland Chinese companies,” e.g., of a well-known female financial advisor who could not see or find a financial bubble (or her own rear end) with a compass, map, GPS, GPS enabled tablet, and a sherpa guide.

Before you do so, you may want to consider that what you can actually invest into are not those companies but their “variable interest entities” because the CCP does not want foreigners to actually own and thereby have rights to inspect the books of their CCP-Ponzi-schemes-companies.

Thus, at best, your “investment” in mainland Chinese companies (reportedly even those listed in US exchanges) amounts to a right to receive some funds from Chinese companies in YUANs, which the CCP can laugh at or repay after they have utterly devalued their currency. Why would they do that, you ask?

Well, that question shows that you have not done your homework. As reported in Real Vision Finance interviews and other sources, the CCP has had huge trouble keeping mainland Chinese capital in China. Imagine that you are Jack Ma or someone like him, you could decide to keep all of your money in China and you could also decide to put your most sensitive appendage into a nest of killer bees.

However, wiser, mainland, Chinese persons will probably say to US or EU companies for each shipment of thousands of widgets, pay me $1 million under the table and pay me the rest in the normal way. After all, if you have ever ordered anything from China, you know that they already are happy to do fake invoices: e.g., claiming that the $1000 computer that you purchased on their website actually cost you $50, to evade U.S. import tariffs.

Thus, mainland, Chinese capital available for the CCP to steal has been hard to reach. That is why the vice-dictator of China recently went full Krushchev and banged his boot (well actually, probably his $10,000, hand-made, pre-stressed, extra cushioned, Louis Vuiton, beatiful, shiny, Richeleu, lace ups with beautiful Blake stitching) on tables to demand that Chinese teachers PAY BACK their meager BONUSES, because the CCP is out of dough.

They also told the local CCP thieving gangsters-CCP-officials that all profits from the sale of local land are to go henceforth to central gangster headquarters in Beijing. (What will those those sad, local, gangsters-CCP-officials do now for income for their yachts, prostitutes, etc.? I imagine that they will start some socially beneficial, new tactic like killing more people to sell more of their organs to foreigners or creating more fentanyl to ship to US mass-murdering-drug pushers-pharma-companies.)

Similarly, the CCP just canceled their next aircraft carrier reportedly and their precious reserves of metals and oil (which they would need if they wanted to invade their neighbors, because the US, Indian, UK, and other navies could be expected to blockade shipping to China once they did that) are being sold. Think about that: there is nothing their fat, liposuctioned-nearly-to-death leader, who has been called Pee Pee de Pooh, wants more than to invade his neighbors and steal their stuff.

What (other than financial desperation) could force Pee Pee de Pooh to sell his most precious, neighbor-stealing-tools, when he has long-cherished dreams of stealing many things from each and all of his neighbors, like their islands, assets, lives, organs, and funds? Well, the CCP’s Ponzi schemes may have just sprung leaks: Evergrande Real Estate group’s likely insolvency, with other Chinese companies similar insolvencies, like Fantasia Holdings’ financial fantasies.

Even the bankster allies of Pee Pee de Pooh have now been reluctant to lend more to him, albeit they are happy to keep his ponzi schemes-companies listed on their stock indexes and to claim that things are going on swimmingly in mainland China. After all, the Wall Streeters and banksters need to get their cuts of the funds being stolen from gullible investors by Pee Pee de Pooh’s ponzi schemes-companies: if they did not have such frauds and their “Federal” bankster Reserve cartel, how else would they be able to steal Americans’ and Europeans’ wealth?

Housing is like a titanic

It takes lot of time to change direction

Unless that direction is down. After splitting it only took 5 to 10 minutes for the Titanic hull to be resting on the sea floor.

USArgentina?!!

So if Mr. Richer is Not the main contributor to our rabid inflation “ by the large orders for shoes and beer mugs 😉”?!

Who is to blame for this runaway hikes exactly?

Before you start your answers folks, let me tell you this little story about farmers warning to the government in Western Australia “ a large grains production hub “, the story goes like this,

The government of Western Australian State has kept that corner of the country largely locked up from the rest of Australia for the past 18 months! They have like 5 Covid cases??!!!🤣🤣🤣

Now the West Australian farmers are warning that they have to employ 80 years old and primary school kids!!! To operate their grain harvesters if nothing is done by the stupid government to open up theirs borders and allow the workforce to travel.

You get it yet?

They want us to starve and be done with quick smart! That’s one of the byproducts of grinding everything to s halt.

Supply chains that the business established and operated “ by the guidance and legislations passed throughout the last 3-5 decades “ have been taken out by a virus!!!

What will it take for us in the “ democratic “ countries to have a F$&$)ING revolution?

Maybe an Argentine style “inflación”?

4 TRILLION dollars of wasted and misplaced Funds wasn’t enough apparently! 🤣🤣🤣

>What will it take for us in the “ democratic “ countries to have a F$&$)ING revolution?

It generally has taken 51-53% of the population at starvation levels for more than 2-3 days to start a proper revolt.

We will be feasting on the fruits from the believed notion of “little need of accountability”. We can ignore knowing there is never free money all we want however the free money thinkers one day will be forced to gaze into a mirror and admit they were never the fairest in the land, and now it’s time to pay. Don

Interesting about nonresidential estate services. I wonder what’s driving it? Builders looking for new sites? People looking for a bug-out place? I get spam for new developments in the Texas Hill Country but they’re mostly large ranches being chopped up into 10 acre parcels.

I recently bought 20 acres in the middle of almost nowhere. While I was searching I came across a listing that was predominantly wooded but already had a cabin on it. It was a really nice setting but way above my price point.

However, when adjusted for the cost of clearing a home site, running in water and electricity, a septic system, and building a house [with unavailable materials], it looked like a bargain. And one of the few properties where if there was a house it wasn’t a double-wide.

It was listed a week ago. I saw it Sunday and started to prepare my haggle strategy. Monday morning my real estate agent told me they had 5 showings scheduled just for that day.

Strategy changed dramatically. I immediately put in a bid for full asking price, cash. I was gambling that some people might try to haggle the price 10% or would offer full ask but had to finance. My bid would be the most attractive unless someone bid over the ask. Two other parties entered bids right away.

If I were the seller I would have pulled the listing and then re-listed it much higher. I think somehow the seller was under some sort of time pressure though.

Two days later they accepted my offer. Did I get caught up in the inflation in raw land? Probably, but I’d like to think I was near the front of the line. A property has to be price-inflated by 10% on its way to 30%.

I have a friend who is constantly buying land in Oklahoma. He has millions of dollars in it. He’s been getting cold calls from real estate brokers asking if he wants to sell.

Months ago I read that Jeff Gundlach wanted to buy a ranch but couldn’t find one. Brokers weren’t returning his calls. I wasn’t too concerned. Probably just another billionaire looking for 50,000 acres. Now it’s trickled down to the little people.

I’ve been debt-free for 15 years but with inflation running hot and mortgages low I was going to leverage the purchase but circumstances didn’t allow for it.

Might run that play again but this time without pressure so I can finance it.

“nonresidential estate services” should be “nonresidential real estate services”

Was it a homesite? Did you buy it as a second home?

I was looking for hunting land. I knew that at some point I’d need some amenities like shelter, electricity, and water. Lest you conclude that I can’t “rough it” the current lease is a one-room shack with three sets of bunk beds and no electricity or water. We haul in our water and run generators for electricity. We use an outhouse. It’s hard to enjoy the peaceful woods with a generator running but this Texas and you need AC.

So I was looking for raw land where I could run electricity and either tap municipal water or drill a well. Wells can cost $15,000-$25,000. You can forget sewer. You’re going to put in a septic system.