Getting ready for the holiday selling season.

By Wolf Richter for WOLF STREET.

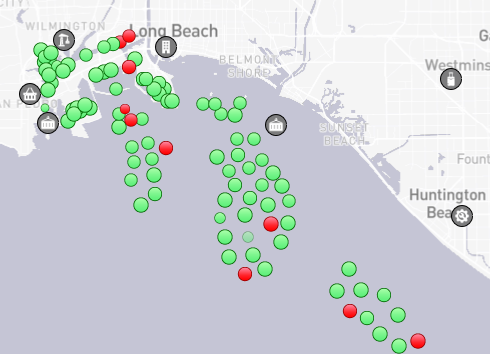

There are currently 56 cargo ships anchored in front of the ports of Los Angeles and Long Beach. This includes a record of 44 container ships, bypassing the infamous record of 40 set in February 2021. This is the run-up to the holiday selling season in the US, when retailers are desperately trying to stock up their inventories, which from many categories, including apparel, have already been running low. Green dots are cargo ships, red dots are tankers (image via Maritime Traffic):

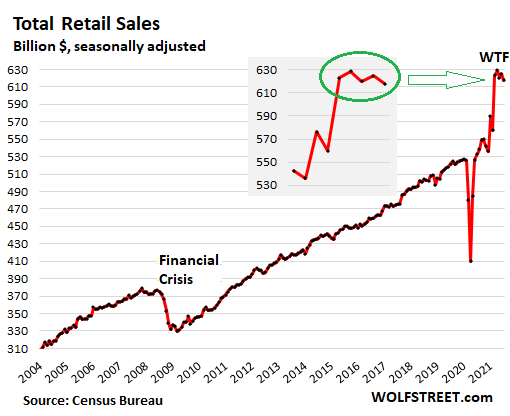

Americans, flush with the $5 trillion that the government borrowed and threw at them over the past 18 months, and the $4 trillion that the Fed printed and threw at the financial markets, are spending money hand-over-fist on goods, setting off a historic spending spike.

Since production of many consumer goods has been offshored by Corporate America, from Apple to Zappos, to cheap-labor countries, this stuff has to be imported.

There have now been some indications that consumer demand for goods might be backing off just a tad from the historic spike. But this could be due to a combo of factors, including retailers running out of stock on some items. Numerous retailers have complained about this, including apparel retailers such as Nordstrom.

Despite an apparent loss of upward momentum over the past few months, sales remained at mind-bendingly high levels:

Now is peak shipping season in the run-up to holiday selling season, and ports are congested, rail yards are bogged down with containers, shippers are complaining about a driver shortage in the trucking industry, warehouses are full, everyone is complaining about labor shortages, and containers get stuck and tangled up and rerouted.

Each container that sits on a ship that is at anchor waiting for a berth, or that is stuck in a rail yard or port somewhere, is a container that another shipper with merchandise ready to ship cannot get their hands on. And there has been a mad scramble underway to just get empty containers.

The port congestion in Asia isn’t helping. On August 11, China suspended operations at the newly built container terminal at Ningbo-Zhoushan port, China’s second busiest port after Shanghai, and instantly, everything got a lot worse. Container carriers rerouted vessels and told customers of long delays, as other ports couldn’t handle the additional vessels either.

The container terminal at Ningbo resumed operations three days ago. But the backlog of containers at the port, on vessels, with China’s trucking companies and railways, and the chaos it caused in the shipping world, will continue to disrupt the flow of containers and merchandise possibly for weeks.

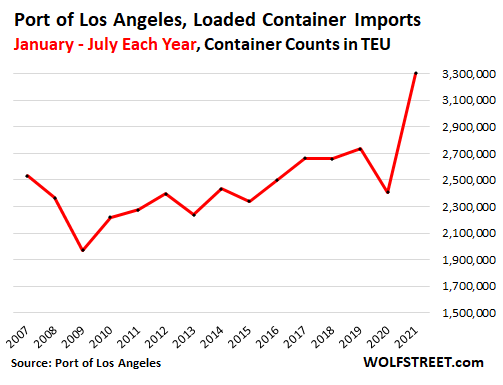

At the Port of Los Angeles, loaded container imports for the first seven months through July this year soared by 20% from the same period in the record year 2019, to 3.3 million TEU (Twenty-foot Equivalent Units, a standard measure in the industry):

The average rate to ship a 40-foot container from Shanghai to Los Angeles rose to a record of $11,362 in the week through August 26, over five times the typical rate before the pandemic of around $2,000, according to data from Drewry Supply Chain Advisors.

The average rate of shipping a 40-foot container from Shanghai to New York jumped to $14,136 per 40-foot container during the week.

Drewry’s composite index or world container rates jumped to a new record of $9,818 per 40-foot container. The index had been running well below $2,000 before the pandemic.

Rates for shipping containers in the other direction have also soared, but from much lower levels: From Los Angeles to Shanghai, the average rate jumped by 170% year-over-year to $1,398 per 40-foot container, according to Drewry.

When you talk to people have to get containers shipped to the US or from the US to Asia, you hear a litany of stories about “containers from hell,” that got hung up somewhere, then were rerouted, then got hung up somewhere else, and finally arrived way behind schedule, and after endless hours of trying to sort it all out.

And they’re complaining about sky-high rates that exceed Drewry’s averages here by big margins. There are complaints that the container carriers, after running through very rough waters in 2015 and 2016, consolidated too much, and now the few remaining major carriers are just doing whatever they want and charging whatever they want, and are getting away with it, to the endless frustration of shippers. And those shippers then have to figure out a way to pass on the extra costs to their customers. And that’s happening too.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Christmas is coming and retailers need to stock up now. That explains the clogged shipping channels.

The helecopters spewing free money might just fly away.

What then?

Welcome to the new America – much like every socialist country in the world, there is no inventory to buy, even if you have the cash.

But the bill is coming due for this big party, and it isnt going to take long. Retail sales will only remain strong for another two quarters, as all the stimulus and unemployment and PPP money is being spent down. Of course, as long as stock prices and real estate are so high, there will still be a group of people who are spending like they are newly rich.

But then the asset bubbles will begin to pop.

The catalyst for all of this is that as soon as the debt ceiling is lifted, we will have a situation where the Treasury needs to start printing and selling debt. And foreign governments are not buyers any longer. The Fed cant continue buying, or create more inflation, so guess what happens? Interest rates must rise to the point that investors will absorb the debt. But higher rates will do two things to the stock market. First, it increases the discount rate, which means that every calculation of stock price valuation is reduced. The high tech growth companies get hit the hardest. The other impact of selling alot of debt will be that it competes for capital with the stock market. So as $400 billion per month is added to the bond market, money will be sucked out of the equity markets.

Assuming the debt ceiling is raised in October, it might take 2-3 months of selling an extra $400 billion per month of debt to really start to flood the markets. At that point, rates take off, and while rising interest rates are an incentive for investors to buy debt, falling bond prices will start to hit the principle value of all that existing debt. And the amount of fresh capital that will want to buy debt at these low interest rates will be tiny, compared to the massive wall of selling from investors trying to liquidate bonds whose market values are falling every day.

Debt is a market, just like the stock market. But we have been in a debt bubble for so long, that we dont even realize how out of whack the debt bubble is.

There are two things that have kept this debt bubble growing. First, is all the printing of money. The growth in central bank balances was made possible because the internet created price discovery and made it impossible for retailers/manufacturers to raise prices simply based on their distribution footprint. Second is that investors in debt have profited from the gain in the market value of debt as rates dropped. So even if investors were earning little or no interest, they earned appreciation in the value of the bonds, so bond ETFs kept running higher. This cycle of central bank intervention and investors piling more money into bonds for the capital appreciation kept pushing yields lower, to the point where there are negative rate bonds in many countries and negative real interest rates on most debt in a majority of countries in the world.

When the debt bubble bursts, it could set off a much worse economic collapse than any before.

‘But then the asset bubbles will begin to pop’

How long have you been waiting for this to happen!?

Now Fed has PERMANENT ‘Standing Repo Facility’ to buy ‘whatever they need to buy’ to keep the mkt up, up and away. They can talk and may even do some QE taper but repo activity in the rear door, in case of Mkt tantrum!

Last year they cprp bonds and some junk bonds ETfs. When crisis hits probably they will buy DIA, SPY and QQQ

Fed’s insanity has no limits!

No, it’s not different this time. There is a day or reckoning in store ahead.

With printing money the FED can create inflation. If foreigners do not buy the debt, locals will.

Those dollars sendt abroad will return and devaluate the US dollar. Imports will rise in price and there will be inflation. Assets will still be considered a hedge against inflation and the bubble will expand.

There is a catch, though. It is prohibitively expensive to produce anything in the US, even with import duties in place. It is prohibitively expensive to build anything in the US. And, ultimately, it is prohibitively expensive simply to live in the US.

You left out psychology. It’s the actual explanation why the bond market hasn’t thrown up. It’s the reason why this didn’t “work” in the past, like in the 70’s the last time the Fed tried to monetize the debt on a large scale.

Inflation isn’t a cause but a result and it’s also predominantly psychological. It’s not a mechanical process as human beings aren’t robots. Central banks can “print” as much as they want but if the “money” just sits there, it won’t cause price inflation in goods and services.

The credit mania is the ultimate mania, supporting both the stock market and real estate bubbles. It will end when sentiment changes and central banks won’t be able to do anything about it when confidence sufficiently erodes.

The question is why will sentiment fade, and when?

Seems to me there is an easy solution to the shipping “crisis”.

Instead of buying plastic imported junk, why not just stick a $20, $50 or $100 bill in a card, and exchange them amongst ourselves ? ?

That eliminates the guesswork of buying something for someone who is 50, 60 or 70 years younger than us. ……and the banknotes are still made here in the USA.

$pend!!! $pend!!! $pend!!!

You should pay more because there are disruptions in the pipelines!!!!

Buy now before it costs more later!!!!!

Hurrryy up!!!!!!!

Gotta get me another term baby!!!!!!!

Hahahahahahahahahaha!!!!!!!!!!

Nonsense…give GiftCoin, it will go up infinitely in value so they’ll never buy anything with it!

LOL!!!

So…is the backlog, chaos and bottleneck of this port congestion due to a certain and simple phenomena?

No further demand for what is on the container ships?

Hot potato in the port?

This musical chairs financial game is gonna end…it is just when?

“The average rate of shipping a 40-foot container from Shanghai to New York jumped to $14,136 per 40-foot container during the week.”

Forgive my ignorance, but is this massive jump in the cost of shipping considered inflationary, as the cost has to be passed on? And, even though, it might be transitory?

Thanks in advance.

Yes, we’ve been paying for those costs without demur. They’re getting passed on just fine. Maybe with a little lag since it takes a while for the socks in the container to be charged to my credit card.

Perhaps it’s time to get the holiday shopping started… So that we ensure that we don’t get hit with all the extra shipping costs come December.

It’s also sensible too, cause if transitory (transient) inflation continues, our dollars are gonna be worth just a bit less come December.

and that is the classic economic reason for inflation. Buy now because it will be more expensive next year… lol

It is…. But what else can people think as economic warfare is being waged at all levels. COVID sure is a convenient excuse to screw up the supply chain which has a secondary effect of messing up ones economy. Not that the US economy needed such help to get messed up.

Or just F Holiday shopping altogether. Our families did away with gift giving years ago (the kids get some things, but that’s it) and we’ve never been happier. Just get together and drink.

@MCH – the goods arriving in the ports now are the ones that will be in the stores for the holiday shipping season. The retailers ordered the goods months ago.

Christmas is not a just-in-time delivery.

P.S. To avoid shipping costs and supply hassles altogether, one could of course identify and give locally-produced goods as gifts… would be a boon to our domestic producers as well as the recipients.

@Wisdom Seeker

But how much do you want to bet that the prices are going to get jacked up, and all the excuses around supply chain, higher transport costs, etc are going to be used.

MCH, point taken! Shipping surcharges can always be added post-facto!

‘It is…. But what else can people think as economic warfare is being waged at all levels. COVID sure is a convenient excuse to screw up the supply chain which has a secondary effect of messing up ones economy’

I usually stay out of these conspiracy fests but this one is too weird. Who benefits from a clogged supply chain? The exporter? Everyone else seems to think it would help the US economy to limit imports. The only one who conceivably benefits would be a domestic supplier. So is that what you’re saying?

How about we check in with logic: First, Occam’s Razor: the hypothesis with the least assumptions is usually best.

Second related, ancient advice: From Hippocrates on diagnosis of illness: ‘when you hear the sound of hooves do not think of zebras.’

Conclusion: The most likely reason for clogged supply chains is that Americans ordered more than usual, fueled by boredom and ‘the most overstimulated economy ever’.

Wolf:

How many pair of socks, apparel, sandals, shoes +++ do we need each year? Want is being percerived as need!?

There is no way ‘Green Economy’ even make a dent in this country or in the west, until our consumption economy is slowly turned into ‘sustainable/recycle’ economy. I am not holding my breath.

I never have enough socks, often because they don’t match.

I heard about Russian de-addiction camps for alcoholics. The doctors will give excessive amounts of vodka to the alcoholic that even he cannot handle and realizes the toxicity of alcohol and give up drinking altogether. May be we are in a financially Russian de-addiction center. Give people too much money to buy too much stuff. They will buy so many things for a while. How much anyone would handle? People will give up at some point of time and turn to be minimalists.

True Wisdom

Totally. They do it via IV. They odds of survival greater exceed that of Russian roulette.

As crazy as that is, it just might be tried in Russia. Alcoholics drink themselves unconscious all the time. Especially in Russia, where beer is considered koolaid they drink to death all the time. Alcoholics know it’s toxic. Not caring about self- destruction is part of it.

Now what does work along these lines is Anabuse. The first drink makes the patient violently ill. Know someone well who was put on it after third rehab. Been dry now for years.

BTW: potato vodka is dirt cheap to make. This might be behind the Russian ‘cure’.

I have been a minimalist for a couple decades. Anything new comes into the house two things leave. I get the warm and fuzzies selling stuff on Craigslist. Why buy new? I can get great pre owned stuff all the time Especially furniture. All wood. Pretty much everyone I know is in the same mindset. Downsizing and reuse , recycle

And best of all , zero debt. I guess un American.

What’s noteworthy is the amount of Ikea compressed sawdust crap that people are listing for sale, week after week. Why would anyone buy that and then expect someone to pay for it used, or even take it for free?

Hilarious when people use the made up B.S. name for it, “Malm bed for sale!” the exclamation point is always a giveaway to their delusions. Better yet when they proclaim, “Paid X thousands for it!” which just shows what suckers they are.

However, good American make stuff is constantly being given away. Better to grab it and store it if you have space, than let it go into a dumpster.

Fully agree!

Just bought from Craigslist a 1948 solid oak

Library chair in perfect condition for $45

delivered at home here in The Midwest (WI)

In our home no ” compressed IKEA sawdust crap “!

I build furniture and have done so for decades. You guys are lucky to have this access to old stuff.

Most Ikea products that I see are pine…solid pine put together with metal fasteners. But maybe it has changed or is different in the States.

The crap you folks reference usually comes from the Phillipines, especially dept store ‘solid oak’ dining room furniture which means particle board with an oak veneer. My best friend used to own an oak furniture store and sold mid to high end products. His competition was always from the Phillipines and customers tried to haggle him down with dept store examples.

You guys are bang on buying the old stuff. You can strip it and re-stain or simply restore it. The best buy (imho) are chairs, as they are the hardest to build (glue up) and have the most parts.

The US has a great furniture tradition and if you live back east you are lucky by being close to the action. West coast not so much having filled up after the ’50s and during the dept store surge.

“ However, good American make stuff is constantly being given away. Better to grab it and store it if you have space, than let it go into a dumpster“

Not necessarily American…

Picked up a damn nice Natuzzi leather chair and foot rest… retail $4k… store sale price 2k… individual purchase store demo $1200… I paid $200…

Looks real good in my house…

OSB should also be out of the building code at least for roof sheathing. It is a step up from particle board, which can be cast into molds, but way below good old genuine plywood and WAY below planks. (shiplap for roofs )

BTW: some may think I’m joking about good old plywood, but it has gone downhill a lot. You can go to marine at double. But even exterior ply has many times the life of OSB.

Two anecdotes: After leaving a roof leak with pans catching leaks, I broke down and got it redone. It was built in 1948 and had ship lap planks for sheathing. After a year of leaks there was so little damage to sheathing there was no charge for repairs to it.

Next: being a slob ( see above) I once used a piece of plywood as a cutting board and put it in the DW once a week for months.

Do not do this with OSB.

PS: around here if the roof is OSB it’s WCB regs it has to be replaced at reroof. Not safe to walk on.

Same here. Practically all of my furniture is “vintage” made of solid wood. Most of what I have is about the same price or less than new, which is mostly junk.

My daughters are passing down baby clothes used twice then giving to there friends to be used again we really have to much junk

True that gambling one:

Not wanting to bet, or gamble unless and until it looks like a ”sure thing”,,, WE have been on the sidelines from the SM, (stocks market) since the 1980s when we realized the massive profits we had made in that market were mostly due to what is now called, ”insider information.”

Since then, only in RE and have made similar returns, in spite of, or because of the well known lack of ”liquidity” of that market…

Now deep into the final retirement, after more than a couple ”retirements” where it was SO boring that we had to get back to work for not only the money,,, but to overcome the boredom…

And, to be clear and hopefully helpful to the younger folks, especially the so called ”boomers”,,, be sure to have a long list of ”things to do” before you retire… most of my old and older friends died quickly when they just tried to do the,, ”only going fishing,, or golfing,,, or some such.”’+

Plenty of work, some with no personal pay,,, some with moderated or low pay,,, but many with tons and tons of personal satisfaction that more than compensates in clearly helping young folks, as was the case in my youth, for damn sure, when so many old and older folks helped me and many other youngsters willing to work.

Great advice! As an early boomer/RVN vet , I am still working about 2/3 time on some of the most useful work I have ever done and slowly working through many way overdue house and second home projects/repairs/renovations that I can’t imagine when I might have any “free time”. It feels great to actually get some of these projects done and on to the next on the list..

Bet- You are also benefitting the planet.

I really need to cut up my wife’s credit card.

Wow! Us too, though we’ve always kind of been this way. So much so, that we have no house, now.

Pay lazy, stupid Americans to sit on the couch, get high and buy sh!t, and they will – and this is the end result. The Make China Great Again plan by .gov and the FED was a smashing success. Now we have a bunch of containers of future plastic landfill garbage anchored offshore. Oh, joy…

MCGA just doesn’t sound very good.

Long ago when MAGA first came out, there was a few options we were having fun with.

MAGA: Make Australia Great Again, Make Argentina Great Again

MEGA: Make EU Great Again, Make England Great Again

MIGA: Make India Great Again, Make Italy Great Again

MOGA: couldn’t come up with anything… Oregon isn’t a country… heh heh

MUGA: None of the countries we could think of come close, and let’s face it, MAGA sounds better than MUGA when it comes to the USA.

But MCGA just doesn’t sound right as an acronym, there is also no vowels with PRC… so there is not an easy acronym that makes a slogan, Make blah blah Great Again work with China

MAMSA – “Make American-Made Stuff Again”

That might be a road to prosperity…

The big problem is the high cost of manufacturing in America. The products would be so expensive that nobody would buy them. The horse is out of the barn.

LOVE it mit:

Good one going forward for damn sure!!!

Thank you.

No, you need a catchy acronym, MAMSA isn’t catchy.

You have to have relatable names like BAT or FANNG or MAGA, something that doesn’t take more than a split second to adjust too.

Heck, it occurred to me you could add Huawei to the trio of Tencent, Alibaba, and Baidu, if it was on the stock market by calling it BATH. As in when you invest in this set of stock, you accounts take a bath eventually… heheh, too bad Huawei isn’t public.

Make Alexandria Go Away

Trump was right about the big problem of exporting all our manufacturing to China, but his method of addressing this problem – higher tariffs – only served to move production of the lowest value add goods to other foreign countries.

The US economy is being held up by the high tech areas. Can you imagine how great our economy would be for workers if 1) we forced companies to move production back to the US 2) we eliminated the flood of cheap labor that comes into the country illegally across the border? All that high-tech growth plus a robust manufacturing economy would make the US dominant across the globe.

The democratic party/liberal economic policy is a complete lie. Democrats are more responsible for economic policies that increase wealth inequality than Republicans because every government policy that distorts free markets or spends more borrowed money chips away at the link between work and rewards. The ultimate goal of the democratic party is to have a population that is dependent upon government programs for their livelihood. That means total control by the state.

The current focus of democrats on monopolistic big business and government control is really the closest thing to fascism that this country has yet seen.

Our country either needs to send the current politicians packing, or they will destroy what remains of this country.

Absolutely. The blue states have the worst GINI coefficients.

So the neoliberal neocons which dominate the Republican party get a free pass even though they’ve been in charge of our government for at least half of my adult life. Spare us your partisan nonsense.

The only effective thing the GOP has done is convince their voters that they are not responsible for any of the country’s problems even when they are in charge. Blame the democrats, the liberals, the educated, the Hollywood elites, the Chinese, the Mexicans, the Blacks, the Muslims. Blame anyone but us, our donors or yourselves.

Remember Gingrich and the Contract With America. Remember how quickly the subject of term limits was forgotten once they were in office? Care to remind me of all the balanced budgets they produced when they had a Republican President and Congress? Remember when candidate Trump said the stock market was a Fed created bubble, and then once elected publicly bullied Powell about continuing QE?

Wolf, you say you don’t want your comment section to be political and I agree with that policy, but I regularly find partisan bs as found in gametv’s post is a regular feature of this section. Are you blind to it because you agree with it? I fully expect that my post will be deleted as his should have been.

Rumpled Bemused,

concerning your last paragraph: I HATE making those kinds of decision. I HATE having to agonize over comments to see whether they’re too political or not. It just wastes my time. I try to tamp down on the partisan screaming and I don’t allow derogatory terms for presidents and other major politicians. I wish people would keep clear of the invisible line in the sand on their own.

Dream world. Go to Walmart and you’ll see 90 % of Chinese imports.

None of it has any appeal to US producers. About 40 % of Chinese imports are two categories: Apparel inclu footwear and consumer electronics. Ex niches, neither has existed in the US for decades. Last US TV Zenith 1995. The US was out before China was in. Taken out by Japan.

In all that blather, T did hit on one idea: a tariff on German cars, where the trade imbalance is near total. It is not feasible to have apparel made in US, without tripling price. But it is feasible to tariff German imported cars by 25%. There actually is a domestic US industry, so you have something to protect.

Problem: ‘Germany bad’ does not sell at the ballot box.

I have no doubt that the “Federal” Reserve’s banksters sold themselves to China’s CCP and help them by holding off US retaliation for the CCP’s misconduct, such as in the recent intelligence report. After all, if any other country did the outrageous abuses regularly used by the CCP since Tienamen, such as organ harvesting from political prisoners, trade with them would be strongly banned and there would be cries of outrage.

However, you will see more and more persons avoiding China and its products as time goes buy and not just because they no longer have the lowest labor costs among trained workers. The CCP is unstable and has made investment and trade there too risky. I imagine ARM and Softbank could tell you all about this as their IP is taken by a joint venture’ CEO, probably linked to the CCP, acting against and despite the vote of his own directors to remove him!

The way the economy is going in the US we should have a pandemic more often!

Many OECD economies are facing similar booms for somewhat similar reasons. But like in many thing the US seems to have good bigger than most.

At the very beginnings of the pandemic if you had asked what country would be handing out the most cash and generous welfare most people would not have thought it would be USA.

That’s what I said last year too. Who knew pandemics are the way to economic prosperity?

If only there’s a new virus now, Powell will print 9 more trillion and we’ll all be rich. MMT will come to fruition and everyone will be happy!!!

I see it as an acceleration of our fake prosperity.

Don’t disagree at all S,,

Very interested to hear what you suggest going forward??

Thank you.

Mark…

Handing out cash to make the “economy” better?

Actually its handing out cash to quiet the masses as the 1%ers make big money in housing and stocks.

Heres the $500 for doing nothing, Mr. low income man, isnt that wonderful? Now be quiet, and vote Democrat…..

While we use your predicament to justify interest rates 5% below inflation and thus propel a rip roaring stock market where we make Millions.

Plus the SNAP cards often used by workers as their employers pay so crappy. Legalised pot , cheap electronics, smart phones to keep people dumb and busy. Shhhh, don’t wake them up.

‘They’ even pay some farmers to grow food, and pay some not to grow food. hmmmmm most farmers vote Republican.

Maybe there is a cycle building. Pandemic forces people to cook and eat at home. Prices and pandemic pushes alcohol consumption into living rooms. Now, goods shortages equals reduced consumption. All good. Will this Christmas will focus on family and fellowship instead of buying stuff?

H,

Once you realize you have the opportunists at the the top 30% and opportunists at the bottom 30% , the reality and plight of the middle 40% becomes increasingly apparent…

The middle 40% don’t make enough for the opportunities of the top… and make too much for the opportunities of the bottom…

That middle 40 is also hammered with psychology by the advertisements that if you do certain things, buy certain items, that you too can be successful and have a wonderful life…

It will be interesting to see if the Xmas buying is gangbusters by this group if all the China products are delayed or reduced…

That might not be a bad thing…

And that middle 40% is also the group with some meager savings to be inflated away. And is disproportionately the white working class, which the elites in both parties disdain.

You are joking? The USA’s economy was living on borrowed time in 2019 due to widespread gambling and over-leverage until the pandemic basically caused the banksters to be openly bailed out while sinking their suckers’ real estate gambles.

Now, what happens when tapering begins or inflation takes off more, since the stimulus cannot continue due to pre-existing US liabilities of over $200 TRILLION as baby boomers age out of the workforce? We raise taxes or face the music.

China and Vietnam are locked down due to the virus. It is spreading in India.

There is a shortage of shipping containers, ships and port capacity.

A major Asian port reported shipping volumes are over 7% higher than prepandemic levels. Ships and containers can not be built overnight.

Here in Thailand, it’s been fun to revisit my early pre-Prime Amazon behavior pattern of buying a lot of stuff online. Here, it has been from one of the dominant S.E. Asian versions of Amazon – Lazada. A major reason is that, like in U.S., the big-box stores here often make me feel roped in – a captive consumer who must settle for what they determine will be available in stock. Lazada, like Amazon was, is often cheaper and has a much wider range of brands and options, with verified buyer reviews.

A lot of the stuff is shipped by truck directly from China, or sometimes South Korea (through China). No problem with import fees so far, like happens ordering online from America. Some of the stuff is pretty good quality, for a competitive price, maybe because it eliminates the American middle-man (corporation). Shipping is cheap, with all kinds of small-business contractor delivery from motorcycles to big vans.

I’m a minimalist and tend to buy tools, household items, etc., that have some practical use in making living easier, DIY, or more moderately pleasant. Although, I do indulge in a few non-expensive things like a mini JBL Bluetooth speaker, which was about a third of what it cost on Amazon. There are some items that are knock-offs, but sometimes they are roughly the same quality as the branded versions, shipped from China or somewhere else as “no-brand.”

;-)

All of this is really amazing considering how much bigger container ships are now. The size of these ships means that smaller ports cannot accept them… which causes even further delays at the ports of Los Angeles and Long Beach.

The runup in prices for containers means that the number of ships scrapped last year was 87 (of which 55 were in the first half of the year) for a TEU of 119,000… compared to 100 ships scrapped in 2019 (195,500 TEU). By comparison, ships sent to the breakers in 2016 and 2017 represented 655,000 TEU and 417,000 TEU respectively.

In short… the shipping industry made too big of a bet on BIG container ships because of their fuel efficiency… but right now couldn’t care less about fuel costs. ANY size container ship has value.

Our dependencies are becoming manifest.

light bulbs and spark plugs first…..then F22 parts….

Not to be picky but: “In a fiat monetary system (for example, US or Australia) with an on-going external deficit, if you desire the domestic private sector to reduce its overall debt levels without employment losses, then you have to support the national government increasing the fiscal deficit beyond the size of the external deficit in line with the private de-leveraging process.” Context is helpful.

CJH,

What glorious BS. Just because some economies are doing this doesn’t mean you “have to” do it that way. Sticking to reality is helpful.

CJH

It is incumbent on each generation to pay its own debts.

What is going on now is a pulling forward of wealth from the future to fluff the present.

The younger people should be outraged at the “financial environment” being left to them, rather than being fully concerned about the ecological environment.

The irresponsible debt creation going on now would not be possible if the Fed was held to the mandate they REFUSE to discuss.

Third mandate…..

“promote moderate long term interest rates”…which prevents the game currently being played by the Fed….dropping long rates to 4000 yr lows to enable massive TRILLION dollar deficits to be created…burdening future and current generations.

If long rates were “moderate”, ie NOT EXTREME (high or low), a balance between lender and borrower would be maintained, and a genuine COST to the debt creation established, curtailing the supply.

Now we get the constant references to the “dual mandate” which carves out this VERY IMPORTANT third mandate.

I didn’t read his post to mean that anyone had to it that way; rather that a way to stave off pain that would come from private deleveraging is to shift all of the debt to the government’s balance sheet.

Which is basically what happened over the past year and a half.

It’s just nonsensical. A profitable growing company can very easily reduce its debt, and continue growing and hiring, and many of them do. Unprofitable companies, such as startups can be funded with equity, not debt, and that is the case normally, and they grow and hire without debt. A household can reduce its debts, as its spending rises as the workers in the households become more productive, experienced, and earn more, and households do this all the time. Many households have zero debt, and their spending grows. About a third of homeowners own their home free and clear. Instead of spending money on mortgage payments and interest, they’re spending money in the real economy.

These kinds of global statements based on some hoary theories are exactly what gives economics such a terrible name.

Glad I don’t have kids but if I did I could tell them all the elves got covid and couldn’t make toys anymore and Santa being diabetic died of the delta variant so Christmas isn’t happening lol. Let me don my green fur and stick a tree branch on the top of my dog’s head. Bah humbug.

TG,

If you were to advertise, you might be really busy for a couple of days !

“now the few remaining major carriers are just doing whatever they want and charging whatever they want, and are getting away with it, to the endless frustration of shippers”

If capitalism is still alive, this means there is an opportunity for some one to ship things faster for less.

I wonder what retailers will do with overpriced inventories when consumers don’t show up all things end badly wit h this nonsense COVID has made people don’t need more stuff

Funny, when I think retailers these days, just about 5 come to mind. I suppose this container issue will weed out the small-timers for good, the giants will find the upper hand.

Strange how the pandemic just keeps working in favor of the richest rich.

Sean..

If there is free access to ports..

Guessing there are some hoops to jump through, payoffs, politics over in China….

I believe entrepreneurs can work with “Yes, if”

I’m actually surprised the car carriers RO- RO (roll on – roll off) or DO-DO ( drive on – drive off ) haven’t created a smaller container on wheels to suck up some of the shipping money…

Access to many, many ports that would not need the monster gantry cranes…

I would question if the tie downs for the vehicles inside the ship would hold a much heavier container fast during heavy seas. One container coming loose inside a car carrier would crush the entire shipment of cars. I’ve seen what happens when one car comes loose…..

The Baltic Dry is higher than any time since GFC, though way off the crisis highs. This might be profoundly deflationary, after commodity sellers are forced to sit on inventory. You really can’t like what is going on in China. They have the vaccine and the power to mandate. So why are they locking down the ports? They are also hammering at the tech companies, their homegrown form of anti-trust. And RE speculators. A lot of money is going to leave China through the backdoor, where it goes is anyone’s guess.

Hi, Wolf, I think that the little green button to the right and the bottom of the page, has disappeared.

The one that takes you to the top of the page.

I liked that feature of your site. No doubt other people did as well. Get your IT people to earn their wages and fix this.

Otherwise, don’t start me on repercussions!! :)

Yes, I took it off temporarily. I’m experimenting with some things, and it interfered. It’ll be back. The functionality is still there, it’s just a click away. So hang in there.

Glad to know at least one person was using it :-]

I was using it and noticed it was gone. I thought it was my browser that was goofy.

I can’t stand that button ! It lines up with the “close” button of the Ads on the bottom. Can’t get rid of the Ad without going to the top of the article. One vote for LEAVE IT OFF !!

This seems like a good Christmas to pass on the high volumes of imported junk and focus your gift giving on a few quality U.S. made items. Yes they are more expensive but you didn’t really need a pile 6 feet high under the tree. A nice Case or Gerber pocket knife for Johnny, A lodge or Finex Cast Iron Pan for Mom, some Filson for uncle Harry and a nice Leopold scope for dad and you are done. We need to give up our addiction to heaps of cheaply made swag and settle for a lot less of something that lasts. I was just using the Osterizer blender my wife purchased at the state fair in 1983 and has been used regularly since. Sure it cost $125 in 1983 dollars but that is certainly cheaper than the 12 junky imported ones I would have gone through in the same 38 years. No one needs all this cheap junk. We have filled our storage units and attics with it for the last 40 years and the gig is up, the party is over, the punchbowl has been taken away.

I can imagine that the first use of a cast iron pan, if gifted to someone’s wife or mother instead of something they actually wanted, would not be for cooking…

My mother-in-law once received a deep-fat fryer for Christmas from her husband, and we all certainly know not to make that mistake again!

I got my wife one last Christmas however, knowing full well that she actually wanted one, and she was delighted, despite my M-I-L’s disgust and incomprehension. Made me enjoy it even more, haha.

Well, look on the bright side …

There will be less useless plastic junk to eventually swirl into the Great East Pacific Gyre.

That’s one down for Mother Gaia .. Yay!

😄

My old man once told me that the greatest problem facing this country was the new generation that came out of the 60’s, and which I was a part of was not well versed in ballroom dancing.

Your father was right!

What I hear from some people working in logistics is that logistics centers keep getting hacked and of course there is a trade war on with China, and China is pretty good at waging it. Some trivial “zero cent item”, like screws, fasteners, glue, suddenly gets stuck in China’s for weeks causing 99% ready engine controllers and PLC’s to pile up at “our” end. Then next month it is something different that gets stuck.

The hacking of logistics centres never makes the news, so it must be serious.

” From Shanghai to Los Angeles rose to a record of $11,362.” “From Los Angeles to Shanghai, the rate jumped to $1,398 per 40-foot container.”

I make that an 8x difference. Who pays, sender or receiver? Is this a microcosm of the US/Asia trade and inflation dynamic? Can it really be 8x?

Side issue, I wonder how overland rail is doing, as price was their greatest impediment visavis shipping. Relevant to Europe not USA.

What a wonderful example of a context-less data-drivel graphic!

How long are ships waiting at anchor off those ports?

How many ships are unloaded/loaded each day?

How many ships are historically anchored there?

Etc.

As mentioned in the article, the previous high was 40, so this is certainly more than have ever been there before.

Massive delays/backlogs in vinyl music production. An order I had made now estimated to be delivered March 22! Not only all this mess but a major vinyl pressing factory had burnt to the ground in February 2020. A perfect storm! We can live without vinyl LPs but we really can’t (most of us here) live without tires. If that is where this is going, that’s pretty scary…