Pay More, Get Less. Spending on durable goods after inflation down 10% from historic spike. But services surged, pointing to next source of inflation.

By Wolf Richter for WOLF STREET.

The fly in the ointment of the most monstrously overstimulated economy ever is, it turns out, duh, inflation which is now eating into what Americans earn, and what they spend, though they’re making heroic efforts to spend.

Before inflation, personal income from all sources rose by 2.7% in July compared to a year ago, and by 1.1% for the month, to a seasonally adjusted annual rate of $17.8 trillion, according to the Bureau of Economic Analysis on Friday. This includes income from wages, stimulus payments, transfer payments (unemployment compensation, Social Security benefits, etc.), and income from other sources such as interest, dividends, and rental income.

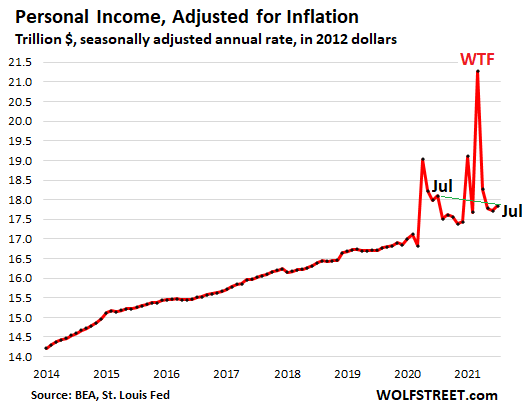

After inflation, “real” personal income fell by 1.4% from a year ago, despite the 0.7% increase in July from June. The three spikes in the chart are a result of the three waves of stimulus payments on top of all the other layers of money that were handed out and triggered some of the biggest distortions in consumer spending ever:

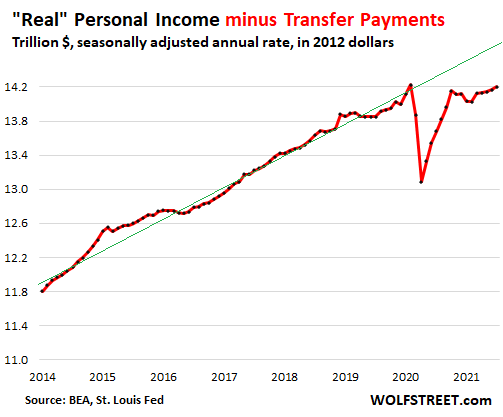

Without transfer payments, inflation-adjusted personal income rose 3.8% year-over-year. This is income from labor, interest, dividends, rental property, etc. – but without stimulus payments, unemployment payments, and other transfer payments from the government. It’s a function of the larger number of people who are working, higher wages, and higher incomes from rental properties, dividends, interest, etc., and adjusted for the effects of inflation.

But it has hardly improved at all since last October and is still below the peak in February 2020 because inflation has been eating it up. The green line represents the pre-pandemic trend:

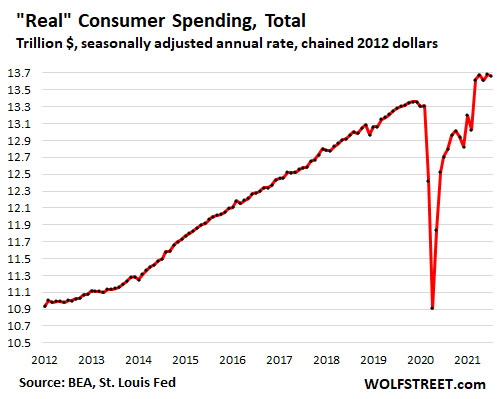

Before inflation, consumer spending rose 0.3% for the month to a seasonally adjusted annual rate of $15.8 trillion.

After inflation, consumer spending fell 0.1% in July, and was back at March level, as people spent heroically, but inflation ate all the growth plus some. “Real” consumer spending hasn’t really moved since the stimulus powered spike in March. But these are still huge amounts that consumers spent, as they’re still flush with all the free money they got from the myriad of stimulus efforts by the government and the Fed:

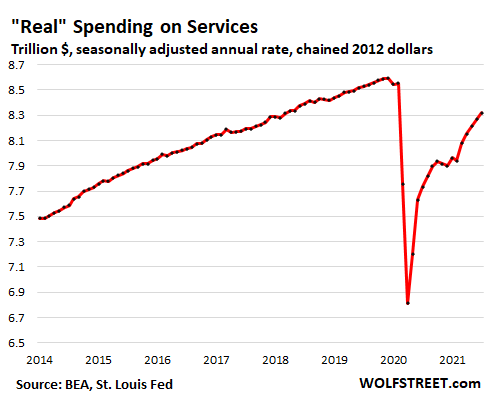

Spending continued to shift to services. “Real” spending on services rose 0.6% in July from June and was up 7.6% year-over-year. But it remains 3.1% below pre-pandemic levels. Services accounted for 60% of total spending in July. Before the pandemic, it accounted for about 65% of total spending. But last year, consumers shifted their spending patterns from services to goods, and that shift is now reversing:

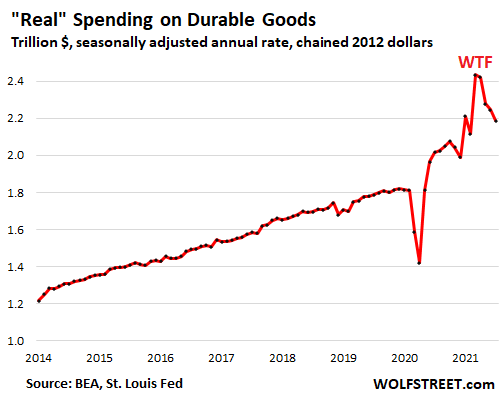

“Real” spending on durable goods fell another 2.6% in July, the fourth month in a row of declines, and fell below the level in January, after the stimulus-fueled binge in March and April. Since the peak in March, it has dropped nearly 10%.

But consumers are still spending heroic amounts of money on durable goods, compared to pre-pandemic times, though they’re struggling with shortages of all kinds and surging prices, and some consumers are starting to lose their appetite for these prices, such as for used vehicles, and have decided to wait it out:

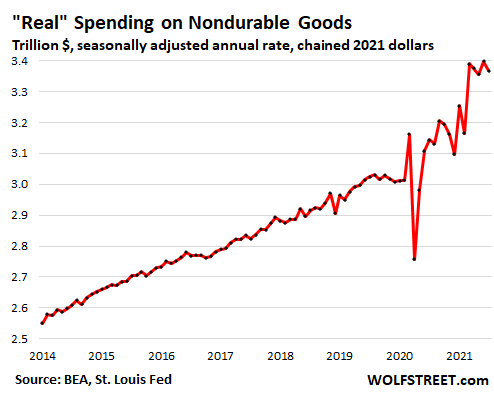

“Real” spending on nondurable goods fell 0.9% in July from June, and is now below the March level, but these are still huge amounts consumers are spending.

Nondurable goods are mostly food, drinks, other household goods of the type sold in supermarkets – among the big winners of the shift to working from home – and gasoline. And people are driving for vacation (buying gasoline) instead of flying (buying a service), and gasoline consumption over the 4th of July week hit a record high, amid surging gasoline prices:

The continued sharp increase in spending on services, after they’d gotten hammered last year, points at the next source of inflation pressures. Services dominate consumer spending, unlike durable goods such as used vehicles, sofas, or electronics, and they weigh much more in the inflation indices, and as prices of services begin to rise, they will impact overall inflation and core inflation measures much more than durable goods.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Fed has destroyed price discovery. Many value stocks languish while unicorns like guru Jack Dorsey’s Square have P/E’s over 300. Many people say the P/E metric doesn’t even matter anymore. Then there’s these NFT’s trading for $Millions. I wonder if anyone has made an NFT of a tulip image yet? Why not?

More price discovery in stablecoin yielding dog$h1t token synthetic interest rate swaps than there is in deep-junk-rated-on inclusion S&P 500 companies.

Jerome et al cant shut it down the former until they stop enabling the later… its all connected…

And we all know they aren’t gonna stop the party willingly, so risk and leverage will build up in the junkiest parts of the system just waiting to take dump on everyone who thought “central” banks could save em… lol

we’ve stopped spending

have enough stuff – don’t go out to eat(to expensive)

making chicken breasts on grill today

NOTHING OF VALUE ANYMORE

Guess what it is.

2 medium carrots diced

10 cloves garlic peeled

2 cubes Massel chicken stock cubes

300 ml sour cream

Place carrots , garlic, stock cubes, in a pot with just enough water to barely cover & cook to tender .. blitz .. add sour cream & cook to hot.

Add to cooked pasta .. taste before adding cheese as it has a distinct cheesy taste already.

Why not you?

Build it. They will pay.

Hey,

Why make it, just say it exists in an empty room….

TimTim wrote…..”Why make it, just say it exists in an empty room….”

Indeed. Why not? It works for Foxconn here in Wisconsin.

Some people call it a boondoggle. But I think it is more like a Potemkin Village (if anyone here knows enuf history to know what that was about).

The former President and former Governor called it “the 8th Wonder of the World”. As if Corporate Welfare can be called a “Wonder” anymore.

But a real honest to goodness Potemkin Village would a real tourist attraction. At least Wisconsin will have that.

This reminds me of the saying that central banks can change how things look but not how things are. The unfairness of it all is they do it by being Robin Hood and stealing from savers and giving it to debtors.

“This reminds me of the saying that central banks can change how things look but not how things are.”

Nice.

Except I would say that that the Mother of Delusions can most certainly make things worse, by creating false impressions upon which very bad decisions are made.

Black Tulips…..those are worth most…

Or maybe the red pimpernel will become the most sought after..?

No,

Surely the Scarlett Pimpernel….

This was a BLM snark, right?

When the poop hits the fan, stocks that are currently reasonably valued with strong balance sheets will be the only stocks to ride it out imho. A lot of stocks are just vehicles for gambling right now.

Agreed, but people shouldn’t confuse “ride it out” with “invincible.”

For example, take a company like Apple or MSFT. They have plenty of cash and can easily ride out any problem. But that doesn’t mean they won’t have a massive drop in earnings and revenue. They are heavily supported by the credit bubble, which, when it bursts, will drastically reduce the amount of money to be spent on them. So they’re not immune either.

I agree 100%. PE ratio down 50% X earnings down 50% = down 75%. That’s definitely a possibility even for a blue chip.

True…but compared to debt hoarding companies, they should still come out on top, and investors (should) see that and support it…no ??

Well, yes, but support it at what costs? I’d rather have MSFT with a P/E of 40 than CMG with a P/E of 90 or TSLA with a P/E of 1,000, but I wouldn’t buy any of them at current prices.

We don’t have to sit on something forever, though, RNYer, regardless of what is happening around us.

But those creepy big tech names do tend to do pretty well when inflation is apparent. MSFT e.g. both can raise and recently have raised their prices. And they currently have an added potential catalyst for a short term boost coming along this autumn called Windows 11. (And also, although not of any statistical relevance, the clients of my own little company appear to broadly be extremely satisfied with Azure).

So it’s currently in my portfolio, but, like all those monstrous abominations of huge scale enterprise, I can’t stand the company from a more personal or idealistic perspective…

Most of those stocks are overvalued too though, the issue is that right now, America is an anti competitive environment, which drives up corporate profits.

As far as the tech companies are concerned, I don’t see most of them making nearly as much in 10 years as I expect consumer electronics spending to crash. There are many reasons for this.

The biggest one though, is that the main way electronics are made faster is to shrink the transistors, right now in as little as 5 years-ish the smallest possible size of transistors will be reached, meaning no more yearly speed increases. That also means there will be no more yearly increases in power consumption, shrinking the size of the device itself and much more.

Everyone is already switching to ARM processers, which will be 1 time speed boost. The Intel architecture has many legacy design shortcomings dating back to the 70s and while ARM is nothing special, it’s modern.

The only big thing for consumer processors after that, is the stacked processor, basically it’s a 3ish layer chip that combines most processing components into a single piece, this increases speed and likely will reduce rare earth metals needed, though, I still wonder if heat will be a problem. This is likely a 1 time thing though. This might not be far off and may be within 10 years.

A couple hypothetical major increases are left, that would mostly be 1 time things like using superconductors. But, it’s unclear if it’s possible.

There are alternative processor types involving quantum mechanics and light, however, these won’t replace conventional processors and will be mainly in specialized computers and server farms. The light processor will be available in some consumer computers; It’s mainly thought to be good for some things like AI.

Actually, I’d guess that they don’t have hardly any actual cash. Cash is currency in circulation and bank reserves at the FRB.

What they almost certainly almost exclusively have is some other entity’s debt. All of it is subject to potential default.

Pretty much everyone believes a systemic default can’t happen but even if it doesn’t, inflation will destroy much or most of it.

The difference matters because that’s what happened in 2008. A lot of companies supposedly had “cash” on their balance sheets which they couldn’t access when the credit markets froze. That’s how supposedly “AAA” credits can go bankrupt overnight.

The secret will be the price to book ratio, which is very difficult to gauge in tech companies. Often the employees are their best asset. IBM has a new program to hire and train people who don’t have college degrees. If you have a large workforce trained by you, they might be more loyal in a downturn. Many intangibles.

The Fed has destroyed price discovery in that in which prices are denominated.

Money and the cost of money.

What would interest rates be without the Fed’s constant intervention…spinning plates and holding the beach ball under water?

What is money worth when sitting it a bank….it hurts the owner?

This Fed is rogue, and has abandoned all the agreements, instructions, mandates that allow their existence and special powers. Congress enjoys the cheap money for their vote buying schemes.

And this is the GREAT FLAW in the system.

Spot on. All valuations are pegged to the cost of money, which has been completely obfuscated.

“Many people say the P/E metric doesn’t even matter anymore.”

Sounds like the Cathie Wood ARK school of investing. When this woman gets completely wiped out, we’ll know we’re on our way back to sanity.

It will be a start.

The P/E is abut the worst metric to use.

First, it’s often measured using forward earnings which hasn’t even happened yet.

Second, earnings aren’t even real money. You can’t spend it. Earnings go into dividends and cash flow. Dividend yield has only been worse once in US market history, at the dot.com peak and just barely. It’s “competitive” for “yield” with mostly gutter quality debt instruments but that’s only because bonds have never been more overpriced than now either.

No one cares about balance sheet health, except when a company is about to go bankrupt because it can’t access the credit markets. Corporate balance sheets have been gutted through stock buybacks. There has been a lot less reinvestment into the business since 2008 versus previously.

Earnings are also hugely inflated due to the fake economy and the loosest aggregate credit conditions ever. Most “growth” since 2008 is directly correlated to increased federal deficits. Artificially low interest rates have lowered interest expense and made it cheap to gut balance sheets through stock buybacks. It’s also made it easier for customers to buy things they actually could not otherwise afford, either through borrowing or because their job and pay is inflated by the fake economy.

For those participating, make sure you have a chair reserved when the music stops. It isn’t “different this time” and there isn’t something for nothing in life either. Most of this fake wealth is destined to disappear where it came from. I believe it will start with an asset crash followed by worse inflation than now.

I think you are correct in terms of re-establishing ‘real’ price discovery. But what if we get deflation? What does that look like?

Right, and that’s why it’s ridiculous when people say that bigtech are immune and “money printers.” Without the fake economy, who would be buying all of the subscriptions to Microsoft’s software? Without the fake economy (and jobs propped up by it) and without cheap credit, who would be buying all of the iPhones?

The massive debt bomb will take down everyone. Some worse than others, but no one will come out unscathed.

We are now in Tulip mania territory if that is what you imply. Reading the analysts, e.g.., one who was talking about Tesla going to $780, when it would take over three hundred years for it to have earnings enough for it to match that sum at its current earnings, the price-earnings ratios have been thrown out. We are in fantasy land now like the real estate brokers that ignored the fact that not enough Americans remained in 2008 qualified to buy the many mini-mansions that so many had purchased once their mini-mansions’ prices went sky high, so the rises in those prices could not continue indefinitely.

As Jeremy Grantham has pointed out, the present value of the earnings stream is what we are purchasing when we buy an investment. Thus, those who ignore the price-earnings ratios and other substitutes for that computation will face the consequences when the “Federal” Reserve banksters run out of space to manipulate the markets: it is just a matter of time, like the law of gravity will eventually cause a shell to go down.

PEGs don’t matter.

Only quantitative sleazing matters.

The valuations are complete dung. Tesla is the poster child.

Michael Burry is the only prognosticator worth listening to and he is picking up shorts on almost everything.

It’s hard to admit, but for a lot of people this was the most profitable crisis of all times. Those people who benefited want the next crisis to come quickly. Best times ever. /sarc

On a personal note and off-topic:

I find it shameful that more and more channels get banned from platforms like YouTube by the corporate censors who only allow ‘approved’ propaganda.

I hope we can enjoy WolfStreet for a long time to come, without those propaganda pushers directing the narrative.

I agree. History teaches us that there are always smart people who can see the truth before the general population and it will be good if those voices are allowed into the general market place.

Seems like government and corporate media are sleeping together now. Not good.

I’m afraid it’s only a matter of time before Wolf get blocked too. He’s too honest and a straight shooter. He discusses facts. Facts are dangerous!

I can get thrown off Twitter and YouTube, and that wouldn’t be a huge problem for the site, and my email service can cancel my account (Wolf Street Updates), which would be a bigger problem since lots of people rely on it. And search engines could make the site disappear, and that would be a BIG problem.

But this site itself is harder to shut down. It runs on its own dedicated server in a data center. I can migrate the site to another server at another data center. If I have to, I can set up a server at home and run the site from here, with all the problems that entails. So it’s much tougher to shut this down.

However, I can get sued by deep pockets, and just the expense of the fighting the lawsuit, however frivolous, could shut down the site.

We got your back Wolf

If you have to switch your email accounts or have a backup account, I’d check on ProtonMail.

Thomas Roberts,

No, I’m not talking about my personal email accounts. I’m talking about the email service provider I pay to send out hundreds of thousands of emails per week to regular readers who signed up for the Wolf Street email updates. You can sign up at the bottom of each article. Here is the link:

https://wolfstreet.com/sign-up-here-for-wolf-street-email-updates/

If I sent out these hundreds of thousands of emails every week with my personal email accounts, all those updates plus all my other emails would be instantly marked “spam” and practically no one would read them.

May I ask what data center you use? I’ve been investing in data center REITs. Won’t be offended if you decline but it would be useful investing info.

Sued by deep pockets? If you’re incorporated (which I’m sure you are) walk away and start up under a new corporation. Let the plaintiffs break their teeth on collecting from a company with no assets.

I’m sure you have good lawyers. They should have you structured to protect you from creditor attacks, just like the evil SPG. ;-)

Don’t hesitate to use the same defenses that the dirtballs use. They exploit them but you can use them for their (alleged) intended purpose under the law.

Hopefully wolfstreet.com is trademarked and owned by a separate entity, preferably in someplace like NM that won’t give any info out on who owns a LP.

Or register in Texas (your old stomping grounds) where creditors don’t have a snowball’s chance in hell. Email me if you want a good asset protection guy in Houston.

Michael Gorback,

In terms of the data center, ask me for the name by email. You will not be able to invest in the company where my server is. They might own the buildings (there are at least two buildings involved because of the on-site backup which is in a different building on the same campus (there is also an off-site backup with a different company). Or they might lease the buildings, possibly from a REIT, I don’t know.

Some data centers are huge. Others are just a floor, or part of a floor, in an office building.

I just switched this week, migrating my site over to a new server at a new data center with a different hosting company (they physically install and manage the server and deal with other server issues).

If this stuff is interesting to people, I might actually write an article about migrating the site to a different location, what it took, and why I did, likely without naming names.

In terms of getting sued: yes, WOLF STREET CORP is a C-corporation in part for that reason. But the issue in MiTurn’s comment – “it’s only a matter of time before Wolf gets blocked too” – was that the site might get “blocked.” They can sue the corporation, and might prevail, and then the site shuts down. Shutting down the site was the issue raised in the comment. This happened to lots of bloggers.

Sure, I can start all over again, with a different website name, etc. But that’s a long tough slog I’d like to avoid.

CRV

It’s NOT censoring.

It’s editing.

All the good commentary is migrating to other platforms. Even some of my favorite fashionistas are moving on.

Yep. People are leaving YouTube en masse. Bitchute is exploding.

The shape of the Real Personal Income Minus Transfer Payments graph should scare anyone who looks at it, especially those individuals who claim that the robust economic activity we are currently witnessing is a durable phenomenon.

Obviously government cannot continue to maintain annual deficits in the range of ~15% of the economy in perpetuity – at least not without some major things breaking down spectacularly at some point.

I’ve been saying that for months now. All of the rosy “earnings” reports at the big public companies were to be expected. How can you not make tons of money when your competitors are forced out of business and trillions in helicopter money is dumped into the hands of your customers to spend?

The idiot financial analysts are so delusional they actually think our economy has “rebounded” and is “booming.” No, it’s all appearances. Any economy can appear to be booming if the government can borrow trillions and hand it out. But deep down, everyone knows we can’t do that every year.

But these earnings are likely peak earnings, unless the government is going to borrow $3 or $4 trillion extra each year to dump into the economy. The argument for helicopter money is always that it’ll ultimately lead to organic growth which will sustain itself. I’ve seen little evidence that is ever the case.

RightNYer –

I would amend your statement to:

“But deep down, [the small percentage of people who have a clue about what the Fed does, and what debt crises are] know we can’t do that every year.

Haha, right. If the 2020 level of printing continued in perpetuity, the dollar would be destroyed. The Fed knows it.

The government can’t afford…..but they engage in the activity without restraint.

Very similar to college tuition debt…..the person cant afford it, takes it on anyway, doesnt plan on repaying, and hopes for some forgiveness.

The SPORT of the 21st century.

When housing stops this price idiocy, keys will be in the mailbox….again.

The college students are in a different position, their parents got college very cheap, and they are worried if they don’t go, they will get hit with degree inflation. Basically, for the rest of their life, they could lose job positions and promotions, to someone who has an equivalent or better degree. This is no excuse for dumb degrees though. It’s impossible for them to know, whether it will have been worth it or not, until much later.

Back at college, I knew people who were middle-aged, they didn’t have a degree, missed out on major promotions (for not having a degree, when others being considered, did), and got laid off during the 2008 recession. Not having a degree, didn’t effect them for 20+ years and now, they were screwed, and had to mostly restart.

Degree inflation is real thing.

Compared to all other developed countries, American College students, pay vastly more.

For some reason, my adopted grandson’s public school is sending out food stamp cards to ALL students. I never applied, never asked for assistance, don’t need it. But the cards are going out to all families no matter their income. There is $800 on this card.

Talk about another cause to boost inflation on food. The government money is falling from the sky.

Of course we can afford it.

We’re pulling out of Afganistan.

All that formerly wasted money is now being spent on actual U.S. citizens.

See…..we’re not actually spending more.

LOL.

First, the way that clusterfuck of a withdrawal is being handled it’s eating funds at an enormous rate.

Second, those refugees are going to cost more than staying ever would.

Third, the Taliban, ISIS, and any other Islamic extremism isn’t going away any more than it has over the past 1,000 years, and protecting the current standard of living isn’t getting cheaper.

Last, expect heroin to increase in availability and at a lower cost.

“Islamic extremism isn’t going away any more than it has over the past 1,000 years,…”

You mean the past 3,000 years, right?

Finally. We get some price discovery in heroin.

Anthony, FYI, Islam has not existed for 3000 years. the birth of Islam as a religion is usually placed at @ 600 ad (or ce to be politically correct). Islam was not an extremist religion when it started either, being exceptionally tolerant of Jews (Mohammad’s wife was Jewish) and Christians. Unbeliever was one who didn’t believe in God, not someone of another religion.

3,000 years ago Egypt was the major religious power in the Mid-East, and the Greeks were just starting to spread out having subdued the Myceneans. The Bronze Age was just ending.

It might help if you read a little history.

I think Afghanistan was a massive waste. But it was $2 trillion over 20 years, or $100 billion a year. $100 billion a year doesn’t even cover 1/4th of the “stimulus” payments that went out in March and April, and that’s only the direct “checks,” not the rest that ultimately filters into consumers’ hands.

In 2021, Social Security is expected to pay out $1.2 trillion in benefits, while Medicare is another $700 billion or so. Again, all in one year.

I’m just pointing this out to show how unsustainable our government spending is. EVERYTHING needs to be reduced, including the entitlements, other welfare spending, AND the military.

But the left’s fantasy that we can easily have white unicorns for everyone if we just increased taxes on the “rich” (an ever moving target) and reduced military spending is just that, a fantasy.

RightNYer,

“In 2021, Social Security is expected to pay out $1.2 trillion in benefits, while Medicare is another $700 billion or so. Again, all in one year.”

Yes, but they will also take in about that much money. It’s dishonest to only mention the outflow side of SS and not mention the inflow side of SS.

SS needs to be separated out from the budget and become its own stand-alone funds, so that Americans can see that SS has been cash-flow positive for over two decades based on SS contributions by employers and beneficiaries, and has accumulated nearly $3 trillion in capital over the period. This capital is now invested in Treasury securities.

The war in Afghanistan never produced any revenues for the government. It’s just a money pit that ate up $2.3 trillion and lots of lives.

Sure, but, if we’re going to consider FICA payments as separate from general government revenues, then people need to stop using as a response to the argument that the bottom 50% pays no income taxes, “But they do pay social security and Medicare.”

They can’t have it both ways. That money is basically all the lower 50% can afford to pay in. So if instead of collecting 5,000 from such a person, you collected $2,500 in FICA and $2,500 in federal income tax, then SS would no longer be solvent on its own books.

To say that Social Security is invested in Treasury securities is also to say that it is entirely undiversified and dependent on the full faith and credit of the United States government. On any other site, I’d have to explain what I mean by that (not here). There is no way that Social Security can guarantee financial safety to US citizens going forward if its receipts are drawn from the cashflow of the US government, is there?

Laurence Hunt,

The US government can and will always print itself out of trouble. That’s a guarantee. So the risk of the US defaulting on its debt is essentially nil.

The problems occur with the currency, namely inflation, which cuts the purchasing power of the dollar, and we’re already seeing this. And that’s kind of a sneaking default.

But in terms of SS, it is adjusted for inflation via the CPI-W, which rose 6.0% in July. The adjustment for next year is determined by the average CPI-W increase in July, Aug, and Sept. So it looks like to me that the SS adjustment for 2022 is somewhere in the high 5% area. If we get two more months of barn-burner inflation, it could be above 6%.

https://wolfstreet.com/2021/08/11/social-security-cola-for-2022-could-be-highest-since-2009-or-even-1982-but-wont-cover-actual-cost-increases-for-many-retirees/

That $2.2 trillion could have housed and helped every homeless person in this country and that’s just what they spent in Afghanistan. Our leaders are intent on sowing destruction and division.

They don’t care about you or your health. What amazes me about the pandemic is no one anywhere in the US is clamoring for universal health care. Mandatory injections but no free basic health care.

The disconnect is otherworldly. I mean, what better time to rebuild the corrupt medical services industry and get the insurance companies out of the hospitals than now?

Crickets.

The War in Afghanistan was a boom for Defense Contractors and nothing else. They all have blood on their hands for enabling this illegal Nation building exercise. The politicians and architects of this misbegotten adventure should be tried as war criminals.

RNY

Why not follow Wolf’s example and argue your points with actual facts and data ? Wolf made an excellent eviseration of your Social Security rant.

You post consists mainly of hand wringing.

I have seen other posts where you establish your animosity towards Social Security & Medicare.

So let’s assume you get your heart’s desire and both programs vaporize. You are left with millions of elderly folks that are impoverished. Now what ?

The private sector low these many years have proven unable & unwilling to solve old age, sickness and demise issues.

I am beginning to think you solution is akin to Soylent Green.

Outside the Box,

I agree to some degree with RNY. Social Security is a pay as you go system. Like nearly everything the Fed government does that kind of pension system would not be allowed in the private sector.

I remember reading one of Warren Buffet’s first shareholder letters and he basically said any CEO that offers an inflation indexed pension payout is a fool because there is no way you prefund an unlimited commitment.

Outsidethebox, I did respond with data. I don’t see any value in breaking out Social Security/Medicare expenditures/revenues from general revenues. The federal government takes in a certain amount and pays out a certain amount, in both cases, including Social Security/Medicare.

I don’t desire for the elderly to suffer, but I also don’t want them to benefit from unsustainable programs that then collapse in twenty years. We collectively have to reduce spending, and that means EVERYONE takes a haircut, not just those unlucky enough to be at the bottom of the ponzi scheme.

Wolf,

I think we’re kind of saying the same thing. That is, the cost of living adjustment won’t match the real rise in inflation. But there’s more. The bond market could go on strike and force up long rates. Or do you think that the Fed will monetize the debt indefinitely?

Fifty cents on the dollar in the underground economy…

Cash, opioids, stolen property, weed… all valid currency…

They take food and energy out of the inflation calculations..so ..??/s

Vote buying with gifted money made cheap by Powell and his ilk.

I hadn’t heard that, but I know that a lot of school systems just provide everybody a free lunch now.

Still remember having lunch with my son at school and being introduced to welfare state where a child got a free lunch and then went over bought ice cream. It made me feel f’d over cause I never gave my child money for ice cream.

The states are sitting on a mountain of cash which is only 10% dispersed. Yesterdays bridge to nowhere is today’s golden arches.

Supply chain issues are now returning to the local supermarkets, leading to price increases. I recently had a discussion with the manager of my local supermarket over the shortages and he stated that 50% of the items they routinely order are in short supply or non-existent. In addition, the quality of the food has gone south. Its almost impossible to get fish that is unfrozen. The prices are starting to go up on almost everything. There are few discounted items. If you want junk food there is plenty of that.

Common add for unfrozen fish…..at least where I live is, Thawed for your convenience.

My favourite is fresh caught Alaska _________. Okay, at least fresh when they caught it a few thousand miles way and held in slush until they got a load to move it all to the processor.

My question is about services. Everything but goods? The definition says

According to BusinessDictionary.com, services are: “Intangible products such as accounting, banking, cleaning, consultancy, education, insurance, expertise, medical treatment, or transportation.”

So if I follow the article correctly people are simply spending more money on things that needed to get done, maybe before Delta hit hard but had been put off for the last 18 months. Seems reasonable enough. Those offering the services are charging more because their costs have gone up too and they can do so.

P, re fresh fish:

As someone who usually caught their own fish, then cooked and ate it within an hour or so of it being ”out of the water”… and could not eat fish for 20 years or so after leaving ”home.”

I can add only that my life long preference after being there helping, is for the Bahamian model at all the fish market docks in Nassau in the early 1960s:

”Fresh fish” are only those swimming in the hold of the fishing sloops.

Everything else is not only OLD, but not worth a shilling,,, etc…

I think we are in for a long slog as Israel has found getting nearly everybody vaccinated wasn’t a silver bullet and booster shots need to be at about 5 months as Pfizer effectiveness has fallen to 39% with delta.

Going to be a lot of economic and social turmoil ahead I think. Plus asset markets are priced for goldilocks and she isn’t showing up.

Old School,

Yes, this is going to be a slog. And we’re going to live with this virus, like so many others.

But getting a booster shot is no biggie. With other vaccines, I’ve gotten booster shots. This one is similar. It takes a few minutes and is free. Getting a booster shot isn’t going to hamper the economy at all — on the contrary, since they make people and businesses feel safer and more comfortable with their day-to-day activities.

The shots aren’t “free”. I read that the government pays the drug companies $2100/dose. How much is that going to tack onto our debt? Plus we’re donating vaccines all over the planet!

Onion patch. I think the price is in the $20.00 – $35.00 range for Pfizer and Moderna. That doesn’t include the cost to store and administer. Call it $100 would bey guess. Might pencil out to $60 billion per year for two doses to cover US. Jay prints that in two weeks.

You have REPEATEDLY told this story. REPEATEDLY! Supply chains are just fine here in BFE. If I read this story again, I’m going to research just how many times you’ve said it.

Just like I’m substituting at the grocery store, I’m also substituting in the services. Still spending on beauty services, hair, nails, etc., but going to less fancy places. Now I can afford some extra services occasionally.

I see the trading down effect in dining as well. All the less fancy places are packed on the weekends. I think the WFH crowd has to get out of the house by the weekend.

I’m seeing restaurants that were packed in April and May (right after vaccinations were widespread) are back to more normal crowds, just like I suspected. When you haven’t been to a restaurant in over a year, you’re going to want to go a lot initially, but the novelty wears off after a while.

RNY, restaurants are packed around here EVERY NIGHT! We are on the north side of Houston, TX and I have never seen these places jam packed on Sunday and Monday nights, ever…..after 30 years here. It’s crazy. On the weekends figure a 1.0 to 1.5 hour WAIT to get a table….at every big restaurant in the area.

Covid is spiking on our county and no one seem to give a hoot. The hospitals are full of patients that refused to get the vaccine. The restaurants don’t even require masks, but the servers wear them.

Spiking here too. I see they are researching people who don’t seem to get covid. There are couples that sleep together and one gets covid and one does not. It happened toy neighbor confirmed thru testing.

RightNYer,

Yes a slowdown was expected after the initial burst. But I’m not seeing any slowdown in San Francisco. Lots of tourists (mostly US tourists since the masses of Asian tourists are mostly absent). Our favorite restaurants now have indoor AND outdoor seating, which gives them much greater capacity, and they’re still hard to get into.

This is just anecdotal, and just in my bailiwick. But nationally, the July retail sales numbers for restaurants set a new record, and I expect August to be on trend. Americans are just spending money hand over fist.

But as you said, those sales numbers include the fact that restaurants are substantially more expensive now. So some of that is not growth, but inflation.

And to your and Anthony’s point, I haven’t been to a very urban area in a while, so the slowdown I’m seeing is in the suburbs.

I’m just wondering where the money is going to come from when the stimmies wear off.

All I see around here in silly PDX is picnic benches in parking spaces. Picnic benches here, there everywhere. People eating 2 feet from passing cars. That’s not a palatable experience for me. I’m surprised there hasn’t been some car carnage.

Besides, an old injury makes it very uncomfortable for me to sit on a picnic bench for more than ten minutes. I’m boycotting my old haunts for the duration of this global freak out. I can cook and make two weeks of good food staples in about three hours to put in the freezer.

I ate out every day for 15 years. Grocery prices could double and I’m still saving bigly.

8-10% nominal inflation.

Savings accounts pay 0.001%

Raises will be about 2.5%

Guess who gets the short end?

What’s the American Dream now?

Break even, rent, and if you have left over throw it at the stock market?

No more work, earn, save, THEN invest in house etc.

The Fed intentionally punishes SAVERS with this interest rate environment of 5% and more inflation…and zero interest rates.

The excuse is unemployment…..WITH RECORD JOB OPENINGS!!!

and the blind eye to INFLATION which hurts far more people and to a greater degree.

If you are unemployed now, you arent looking for work….

BUT, if you are working, you are getting monthly pay cuts from the inflation.

So the Federal govt is taking care of those who wont work with over the top “stimulus” payments…as the Fed punishes those who WORK!!!

This is the Fed.

Investment turned to mostly the stock market years ago. No one wants to run a business or manufacture anything. It’s bled down to the working class. Find a way to sit on our butt and make money.

If a person would have sold his restaurant ( or almost any business) in March of 2020 and put the proceeds in the stock market….then went to sleep for 18 months….he’s be way ahead.

We are close to the moment when people are going to say…”why bother to work”

“Honey, how much higher is the stock market this morning?” is the mode we are in now

Right. The stock market IS the economy.

Which is why you need to get into assets ASAP if you have not already. Most of the free $$$ has been used to inflate assets and the bottom 50, 60, 70% will receive “gifts” in the future to consume and continue to sustain asset holder cash flow / wealth.

It’s gonna take years for that rat to get through the belly of the snake. Best to be the snake feasting slow and steady. ;-)

Yes, thank the Fed. It’s a fake illusion brought on by Zirp. Very long term stock returns about 6% above inflation in most developed countries. When you you make stock market a gambling casino by Zirp it’s all going to end badly.

Beardawg, I’ve been buying gold and silver.

But at our pace, I don’t consider public equities to be “assets.” They’ll collapse when this house of cards does.

If the Fed keeps that up they are going to create a boom in the gold mining business.

As the auditioning Gartman replacement wannabe, my investment track record speaks for itself. I also have been buying stuff as a protection against inflation. However I find no one wants to buy an old package that has 16 oz that costs 20% more than a new package that has 8 oz. Bummer. Can’t even spend a $20 Eagle like a Jackson. I blame US education.

“they’re making heroic efforts to spend”

We bought silver. I’m feeling heroic!

I bought a new tooth implant stud (surgically installed) and soon will buy the actual tooth to be screwed in place.

Last week I bought a new water heater and the labor to install it in our attic.

I’m also getting 0.001% interest on my savings. I’m not feeling too heroic at the moment.

.01% with 5% or more inflation…

both brought to us by decisions by the Fed…an unelected body

You could have bought TIP or Ibonds. That ship has sailed sort of, the ETF yield is sub 2%. You buy TIPs when inflation expectations are low. Last week the 30yr TIP auction was zero yield at 120 basis points. Not very long ago 20 points was discounted and there was a fixed yield, however slight. Expectations are always inflated one or the other.

Anthony A.

Your savings being depleted is the way they are keep this charade going. Simple as that. You have no voice. Enjoy

Anthony A.

Isn’t the tooth glued in not screwed in.

The new tooth has a hole step drilled through it lengthwise where a small screw is placed and then threaded into the “insert” in my jaw bone that was surgically implanted into the grafted bone which filled the void where the old tooth was removed. (I had a dead tooth removed)

How it’s done by the dentist after the bone graft had hardened is as follows:

The dentist places the new tooth in the open slot between the surrounding teeth and screws the small screw into the threaded hole in the implanted stud and tightens it against the “step” in the tooth. Then he fills the top of the hole in the tooth covering the screw head with a filling material. Walla! new tooth!

Forgot to add….after Walla!

$6,000 has left my savings account!

Your no alone. Went through the same thing myself. Now I’ve got another one on the other side. My tax rebates and stimmie checks were gone before I even got them. My 1st implant is working great. Worth every penny of the $8,000 including the cost of two extractions and bone grafts.

I have two – both done quite a while ago. Amazing dentist who does these. Both eventually failed, but he replaces them for free. The second replacement will be done in about two weeks.

Joe100,

How long did it take before they failed?

joe 100?

That alone proves there is wild inflation.

Count your lucky stars every day Anthony and imagine what your expectations would of been 100 years ago.

Lucky stars for sure..

1. I would have not made it this far (77 + years old)

2. If i did, I would have no teeth left and no dental bills!

3. I would be living on oatmeal!

According to a June 2021 apartmentguide(dot)com report, U.S. rents for 1 and 2 bedroom apartments rose nearly 5% YOY.

In areas where there is job creation, the need for more housing is greater.

David Hall,

They’re talking about “asking rents,” not “effective rents.” Asking rents exclude current rents, including in rent-controlled locations. In many of the biggest rental markets, asking rents are actually below where they were a year ago. But in many smaller markets, rents have shot higher. So it’s really hard to come up with a good national number. I don’t know what the answer is, but I doubt that effective rents increased 5% nationwide, given the large rent declines in the big cities.

Meanwhile, there are thousands of overpriced, empty Airbnb rentals across every market with no hope of a tenant.

I would guess that the majority of these Airbnb units/room/houses/flats/converted garages/etc had no tenants before Airbnb became a reality. People stayed in hotels.

Actually no, most were occupied by owners or renters. Now they sit idle, with millions of homeless people on the sidewalk in tents – Bidenvilles.

I read that AirBnBoomer offered to host the Afghani refugees our military created.

In my area for the past 10 years, millineals who grew up in the suburbs and had to drive everywhere with their parents to go to soccer practice, out eating, etc. where all moving downtown and renting and liked how everything is in walking distance. Rents skyrocketed downtown while the suburbs languished. problem now is the urban school are terrible and the millies are getting married and having kids and moving to the suburbs and good school dristics.

Not many homes where built as all the new housing units where downtown office buildings being turned into lofts. Anything that was built were luxury apartment buildings. I attended several NIMBY subdivision meetings trying to fight the buildings of big apartments complexes.

Now the millies looking for suburban life is finding out there are not many homes and they are completing with wall street investors for the good homes in good subdivisions. there are still some good home deals in the drug and crime infested neighborhoods but for some reason they are not willing to move there.

If you are a landlord renting a home in a good school district you know you will have wall street on you side in keeping your home value high. lol

They might offer the first month as free rent in exchange for a lease agreement. They did that last year too, except in areas where rental vacancies are low. Rent control is foreign to my area. San Francisco has seen falling rents, other areas are seeing vacancies dropping and rents rising. Some WFH NYC refugees have been returning to the city. There are numerous reports of rents rising there.

Should be signed David Hall not David Halk – typo.

I’ve been thinking about the social security cola and expect it to be manipulated down in spite of the upward inflation trend.

My thinking is that since only the third quarter determines the “inflation” rate for the social security cola, if all spending by seniors was concentrated into this quarter, they could move the needle up in their own favor. If seniors were to act in concert and make their major purchases during this third quarter, this spending should push up the social security cola numbers.

Obviously, this would only be spending for big discretionary items, but it might insure an extra push up in their colas, if they all decided to only buy cars, furniture, expensive medical and dental services, or do early holiday shopping only in the third quarter.

Since all the markets are manipulated anyway, why shouldn’t they manipulate the number that affects them the most.

Petunia, I am “doing my part” by spending $6,000 additional dollars for a tooth implant this month and the balance in September!

I’ll see if I can get my wife to buy all the Christmas junk in September. I’m sure she won’t spend any more come December…..(wink)

I thought about this strategy when I first heard the cola might be large this year, back in the spring. Your comment about your dental expenses and home repairs prompted me to divulge it. Let’s see if it picks up steam by next year.

The ruse was planned to get you to buy your Christmas presents early, due to inflation and supply constraints, virus and terror threats. You can tell how much BS is built into their boilerplate by how hard the market goes up. Yesterday almost a percent.

I was in a Cracker Barrel restaurant this week and the “trinket” shopping area was chock full of Christmas stuff for sale. The lady at the register said the Christmas inventory was put out three weeks ago. I looked at a few items and they are all made in China.

Wolf, I know you’re not a precious metal investor, at least not primarily. I started investing in gold and silver miners in 2003, for all the reasons you outline in your articles. Gold has outperformed the $SPX since 2001, by 2x, which is pretty stunning under the circumstances. My portfolio has also done well, without the risk of buying Microsoft at 130x 2018 earnings.

What asset class could possibly do better going forward, given the facts that you lay out daily?

It seems as if cryptocurrency has everything beat by a country mile in terms of performance, not that the invisibles existed in 2003.

You’re cherry-picking a time span. Compared to 10 years ago gold hasn’t moved much, with some times inbetween that it has declined substantially.

In the 20 years you mention essentially all of the appreciation in gold price took place between ‘03 and ‘11. Since then it’s basically been range-bound.

Congratulations. The only thing I would say is future is unknown so don’t rely on one single asset class. Gold like SP500 needs to be able to be held for 20 years if there is a down in market if you are going to need the money to live on.

Laurence Hunt,

I have some silver from some time ago, but I have no big hopes at this price. It had a huge run-up (thank you), and I don’t see the logic for it to rise further. If it were paper silver, I would sell. But it’s physical, and it’s too much hassle and costly to sell, so it just stays where it is. Not even the Robinhood/Reddit crowd could get it to budge.

I have no gold, but I put it in the same ballpark as silver. It had a huge run-up, far exceeding years of inflation, so I don’t know why it should rise further at the moment. But of course, it could.

What asset class could do better over the longer term? That’s a very tough question. And I don’t have an answer.

If you have your own business/farm, it’s not considered an asset class, but you have some control, and you know what you’re doing, and if you can navigate those times, it could be a very good investment.

It’s very easy to sell silver and gold coins.

There was a time in my life where I kept anything not needed for a checking or investment account in coins. I did it because BofA pissed me off telling me to take off my hat and sunglasses and be fingerprinted to cash a Cashier’s Check! (I never banked with them)

My timing was lucky enough that I had maybe 50% gain on average on those savings because I steadily sold into a long price rise. I went in big with gold at $900. Anyway, it was much more pleasurable to deal with Mike at the coin shop. He didn’t care about my hat, my sunglasses, or my ID. Always, had cash on the spot. Talked about cars.

Up to $10k before he had to report, like a bank, but he warned me beforehand. He could have easily handled a $30k exchange on any day.

Banks often will tell you to come back tomorrow if you need to withdraw a lot of cash. Happened to me twice buying old cars. They also have to file suspicious activity reports on accounts that move a lot of cash or if a teller smells something funny, like weed. Banks won’t tell you they are doing this.

It’s very easy to bank in coin. You only have to be clever enough to find a coin broker a good hiding place.

… a coin broker AND a good hiding place.

The buy-sell spreads on physical silver are awful. Gold is also higher than I ever recall, though much lower.

On a “value” basis, gold is expensive, not cheap. Compare what it can buy over time and it’s evident. The rationale for holding it is psychological. It shot up from the October 2008 low to YE 2011 in anticipation of much higher inflation.

Silver is much cheaper relatively but it’s lost its monetary role to most people. That’s my explanation for the wider gold-silver spread since 1980, not any supposed manipulation. No one except for coin collectors and “metal bugs” cares about it.

You are correct.

Coin brokers offer the spot price. Anyone serious must figure in the transaction cost as well as the premium available to sellers at retail.

Coins can be sold on Ebay above spot in rolls with very little effort too if that is your thing.

In my case I lucked out and got the timing right for once. Annualized, my gains in that time frame leave me very happy with my banking experience with Mike the coin broker while my gardening profession was illegal.

If it wasn’t for BTC mokes using the same hyperinflation/debasement rational previously reserved for buying gold, and siphoning off all the potential metals buyers. I think gold would be over $10k easy.

I wonder if that wasn’t the plan all along. Distract people from buying the hardest of hard assets. Who knows?

Exactly!

When I first started buying PM it was after 9/11 and the Patriot Act. I didn’t know about KYC laws. I withdrew $50,000 in cash and bought bullion.

Then the bank called me in for a KYC form. WTF? When I filled out the form there was a question about what I did with the money. This is like the 4473 form for buying a gun. Are you a felon? Are you in the country illegally? Are you buying this gun for someone else?

What criminal answers those questions honestly?

What are we compared to Wells Fargo and HSBC or Eric Holder’s Fast and Furious? You can count the number of people who went to jail for those actions on the fingers of one foot.

Anyway, when I went to the dealer to tell him about the KYC form he looked at me and said, “Who are you?”.

There is also no spread on bartering.

Otishertz,

I did a real estate deal with a friend and transferred funds from Vanguard to my credit union. I got a $91,500 cashiers check made out to my deal partner no problem. Once I got home I got two calls from the credit union grilling me about what I am doing with the money and how well did I know the person I was writing the check to. Kind of infuriating actually.

Eighteen months later the deal partner writes me a check back for $91,500 and she gets the same treatment at her bank. I assume it’s regulator pressure on banks about knowing customer. Plus both credit union and bank put a several day hold on cashiers check because it’s over $50,000.

The entire financial system is a walled garden.

Use cash, starve the banks. Take back your privacy.

I remember privacy. Privacy felt good.

A purely hypothetical discourse on PM.

Anyone who thinks the spreads are an impediment doesn’t understand how to trade physical PM.

You buy at a 3% premium and sell at a 3% discount. Sounds terrible right? And with a paper trail if you buy and sell on Kitco or Goldmoney you’re also going to pay 28% on gains (taxed as a collectible) because there’s a record of your cost basis and sales price.

But trading in cash with a private individual or at a local store, all you’re going to take is the hit on the spread, not the 28% tax hit on Kitco plus the spread.

Local gold traders are happy to trade in cash. There are PM traders at gun shows. No records.

When have you been able to pay capital gains tax of 6% on your stocks? And it’s not always 6% for a round trip. The spreads vary over time. But let’s say you bought an ounce of gold at $800 in 2008 or so. You took a hit of 3%, or $24.

You sell at $1800 with a 3% discount, or $54. Total loss on the spread is $78 vs a $1000 gain.

If you have a paper trail your tax will be 28% of $1800-800 = $280 plus the spread.

At the gun show your hit is $78. Tax evasion? Go complain to Donald Trump and Hunter Biden.

If you have 1,000 Silver Eagles you’ll get a hernia trying to carry $30,000. $30,000 in gold is one pound. 4 oz of silver gets you a tank of gas for your SUV. 4 oz of gold gets you passage on a Panamanian flagged freighter to Chile and it fits in your watch pocket. Best to have both.

Bitcoin is the PM wannabe. Do you think the IRS is going to dig up your back yard looking for your 4 oz of gold or rip out your walls for the fake electrical outlet with your cash proceeds from the sale? How about the funeral urn labeled “Mom”?

They’re going to be too busy chasing your crypto.

Not that I’m cynical. Just don’t do your gold trades with Jon Corzine or in China.

False drain pipes …

Don’t tell anyone.

OK Wolf. The short case for gold and silver as monetary metals is that their market price is driven by the quality of money. They are more correlated to real interest rates than inflation. But if the money truly goes bad, then the precious metal prices fall under the law of supply and demand. Due to scarcity, then you can see the kind of massive run-up that occurred in the 70s. That is what I expect to occur when the Fed policies stop working, and you’ve probably thought about that more than I have!

A quick reply now. I’ll add more later. As usual, WolfStreet is THE place to have a respectful, informed discussion. I’m a secular trend investor. 2001 is not arbitrary. It’s when the trend in the gold price vs. other assets reversed. In Canada, the gold price has risen every year since 2001, except 2013 and, so far, 2021. The gold price rises more than inflation because inflation is only a secondary driver. Going forward, secular trends tend to last decades. Will the crypto trend last decades? There is no history to confirm or deny. Gold’s value is rooted in millennia of history. The trend in gold will last until money gets good again.

I used all the free money ($3200) given to me from the government, on video games, fast food and booze with screw tops…

… the rest I just wasted

If you are middle class you probably should have realized the government just stole $3200 from your future and do something to increase you net worth by that amount such as paying off debt or building your emergency fund to at least 6 months.

I got $3,200 but the things I wanted to buy increased by over $20,000 – a massive net loss.

No hookers and blow?

Inflation in nondurables is much higher. Durables have been consistently a drag on inflation. China is trying to move away from low end export merchandise, if container fees keep rising they will price them out of the market. What does this do to Walmart and the dollar stores? If inflation is going to be persistent that would be one cause. Higher shipping costs have been a drag on bulk containers, will China buy our AG as they promised in the trade deal? It was a phony deal anyway. I know where you can get a 5 pass PU hybrid for under 20K msrp but a six pack is almost ten dollars.

It’s a bit disingenuous when you don’t include the $1,495 shipping charge with that “under 20k” line—it’s $21,490.

And I’ve asked before—are dealers willing to order this base model?

I was looking at pricing out a new scooter and they have a new additional freight fee due to expense of getting them shipped from China.

Which i predicted would happen when the first stimulus was passed. I said it would be ate up in inflation. Check the post and you will see i predicted it. Any idiot could see what was gonna happen. Fiat currency is a fools game. A ponzi scheme. In order for fiat to survive it needs a constant influx of new funds. Thats the definition of a ponzi scheme. Stop the influx and the dominoes will come crashing down.

Artificial Intelligence is software that writes itself, it writes its own updates, it renews itself, it writes itself at speeds that we can hardly comprehend & people who write it know that you can’t take it apart again, to figure out what it’s done, it writes independently, autonomously, it develops it’s own way of thinking.

People ask .. “When is artificial Intelligence going to be smarter than us?”👀

The people you see in the stock markets are extras in a movie, they are not doing the big moving, the big moving is being done by high frequency computers.

They move so fast, they make, in milliseconds, billion-dollar business, we are helpless in their shadow.

I was listening to music on Youtube, sometimes I like to listen to songs over & over again, I went to have a shower, when I came back, on the screen was – 1hour Love is a Losing Game – Amy Winehouse.

I have a friend who gets me.😊

What exactly does Janet Yellen do ??