Some disruptions are “transitory,” but the spiral that the mix of ongoing over-stimulation has set off is anything but “transitory.”

By Wolf Richter for WOLF STREET.

There is already enough shipping chaos, logjams, container port congestion, rail terminal congestion, container shortages, delays of all kinds, along with various shortages, including the semiconductor shortage that has wreaked havoc in the auto industry and consumer electronics, amid surging consumer prices and exploding transportation costs across the spectrum as an overstimulated economy is grappling with a supply chain nightmare.

And now China has suspended operations at the newly built Meishan container terminal at Ningbo-Zhoushan port, China’s second busiest port after Shanghai. The mega-terminal accounts for about 25% of the port’s traffic.

After a worker at the Meishan terminal had tested positive for Covid, Chinese authorities suspended all inbound and outbound container services at the terminal on Wednesday until further notice due to a “system disruption,” according to a statement from the port, cited by Bloomberg.

Other container traffic at the Ningbo-Zhoushan port will likely also slow as the port will now only accept containers within two days of a ship’s estimated arrival time, according to a statement from container carrier CMA CGM, cited by Bloomberg.

This shutdown comes as peak shipping season approaches when retailers in the US and elsewhere attempt to line up merchandise – much of it imported from Asia – for the holiday selling season.

This is the second major port disruption in three months in China. In late May, Yantian International Container Terminals in Shenzhen stopped accepting containers due to a Covid infection among port workers. The port then operated at 30% capacity for about a month.

Container ships balled up off Shenzhen and Hong Kong, waiting to pick up containers bound for North America, Europe, and other parts of the world, causing all kinds of disruptions in China’s factories and supply chain headaches overseas. Even when the port resumed normal operations, it took weeks to work through the backlog and stacked containers.

These types of supply-chain disruptions and transportation nightmares have been piling up from all directions and are bound to drive up end-user prices further.

In the US, where consumer price inflation is now surging at the hottest rate in years, input prices for companies have exploded, which will further transfer into consumer prices down the road.

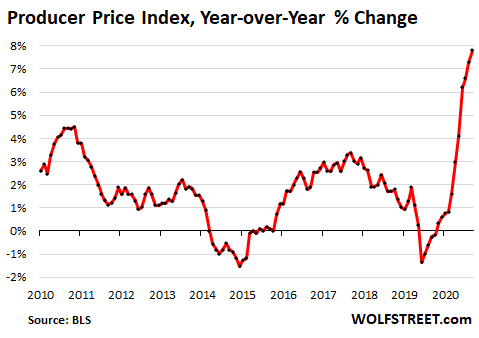

The Producer Price Index for final demand, which is an indication of input price pressures that companies face, and that they’re trying to pass on to their customers, spiked by 1.0% in July from June and by 7.8% year-over-year, according to the Bureau of Labor Statistics today, by far the highest rate in the data going back to 2010:

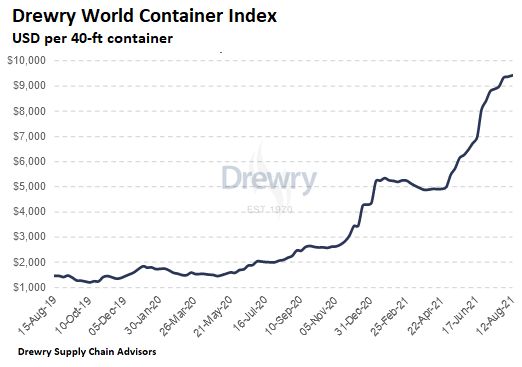

And the ocean freight rates charged to ship containers across the world have exploded. Drewry’s composite World Container Index in the latest week, reported today, rose to $9,421 per 40-foot container, up by 358% year-over-year (chart via Drewry):

Specifically, rates to ship a 40-foot container in the week through August 12 from Shanghai to:

- To Los Angeles: $10,322 (+241% year-over-year)

- To New York: $13,505 (+285% year-over-year)

- To Rotterdam: $13,653 (+636% year-over-year).

These are astounding freight rates – to be passed on to consumer just for the holiday season. Makes you wonder if the big container carriers aren’t engaging in some classic price gouging. Why? Because they can. That’s what inflation is all about: Companies get away with raising their prices whatever the reasons may be. And those higher prices become costs for the next company, and they get passed on further.

The other way it’s less costly, but also a lot costlier than it was a year ago. For example, from Los Angeles to Shanghai: $1,461 per 40-ft container (+182% year-over-year).

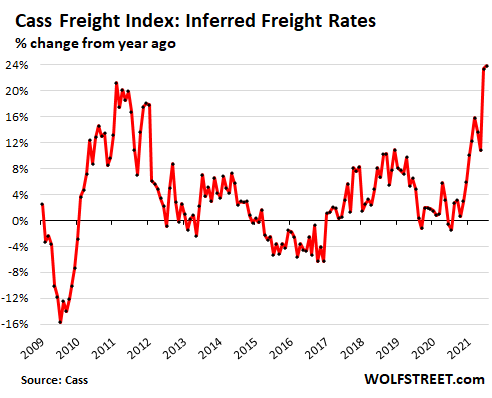

Shipping costs within the US have also soared. The Index of Inferred Freight Rates by the Cass Freight Index, which covers all modes of transportation soared by 23.8% ear-over-year, the biggest jump in the index going back to 2009, showing “broad and material increases in freight rates across modes,” according to Cass. Within the index, truckload accounts for over half of the dollar volume, followed by rail, LTL (less than truckload), parcel, etc.

These pressures in the supply chain and transportation systems that make supply chains work didn’t come out of nowhere. They came from a hyper stimulated economy, to a large extent in the US, where the government and the Fed threw many trillions of dollars in all directions that then needed a place to go. And some of it ended up getting spent on goods that are mostly manufactured overseas.

This mix contributed to the beginning of an inflation spiral. While some of the issues will eventually be resolved, these higher prices have led to higher wages that are now further pushing up prices, and companies are raising prices to deal with higher wages and higher input costs, and there are all kinds of signs that the whole cycle is anything but “transitory,” especially with the massive fiscal and monetary stimulus still raging – under these conditions!

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It’s unbelievable that we are going to relive the 70s again.

Do we ever learn?

Only thing missing would be the evacuation of a US embassy after a defeat in a forever war….

never mind

We’ll need the Canadians to save our butts once again.

…said nobody ever?

The federal Liberals are throttling oil and gas production as best they can.

No relief in energy prices from Canada.

where’s Paulo when we need him?

The “Canadian Caper” was the joint covert rescue by the Canadian government and the CIA of six American diplomats who had evaded capture during the seizure of the United States embassy in Tehran, Iran, on November 4, 1979, after the Iranian Revolution, when Islamist students took most of the American embassy personnel hostage, demanding the return of the US-backed Shah for trial.

After the diplomats had been sheltered by the British mission and Canadian diplomatic personnel, the Canadian and United States governments worked on a strategy to gain their escape through subterfuge and use of Canadian passports.

It’s obvious people here don’t know history.

@MonkeyBusiness

Or they know only the Hollywood version (Argo, 2012), ignorant of what really happened

@intosh. Absolutely. The fact of the matter is, the CIA’s involvement was very minimal. The Canadians came up with the whole idea.

No, we need Canadians to stay our od our nation and deal with their own problems.

BH

Don’t tell the MSM but you’re getting oil from Russia!

Thanks for explaining that “history test”, MB.

I’m not ashamed of what I don’t know ONE FN BIT, and NOBODY should be, ever. I like people who never stop learning.

Since it’s just an historical tidbit with no value to my present world view (situational awareness) I won’t even bother to verify or likely remember it. Burma Shave.

Thanks for mentioning the Hollywood version, intosh. It’s likely where MB found out about it and then looked it up. “Man on Fire” and “Black Hawk Down” are two of my favorites, but I never bothered to look up what they are based on, and don’t recall what was in the news.

The marketing/advertising/PR people call it, “capturing your imagination”, or used to. Probably has different term now.

the evacuation from the forever war will occur any day now in Afghanistan.

china is waiting though they don’t need taliban since the belt and road go thru friendly pakistan

To Joe Saba and Marcosa,

Both of you are right. I am amazed that we never just decided to take our lumps and hold peaceful, democratic elections to elect an independent, more popular government, even if they resulted in a radical’s victory.

That would be better than the current crooks remaining in power by their nails just to steal more, like US banksters. Reportedly, much of the aid that we have given has been stolen by corrupt, Afghan politicians.

However, the CCP may not get exactly what it thinks that it is getting. The Taliban is not made up of reasonable people.

Afghanistan has a lot of power holders, who will become warlords, particularly if we arm them now. With luck (US luck), Chinese investments will be pummeled and China will suffer its own Vietnam war.

The Afghan government is corrupt but the people will not like to bow down to the Chinese government, any more than most have liked the current government, which they see as foreign-US dominated.

K-we so soon forgot the wages of our own national hubris harvested in Southeast Asia. You’re spot-on about the PRC and Afghan warlords (and i seem to recall an earlier U.S.-arming of the the warlords when the Soviets decided to take a turn at bat…).

The PRC’s treatment of their own Muslim minorities will possibly make future ‘Belt & Road’ relations with the Middle East into ‘interesting times’ going forward…

K-

Barry Goldwater said Christians are NOT “reasonable” people.

I tried to post his full comment , but Wolf deleted it.

Hope you aren’t one of those people who want a FN holy war, like a 2016 campaign strategist who unfortunately was really good at splitting this country on STUPID issues.

I have deleted no such comment. If you succeeded in posting it, it’s still there.

M

RT:- ” we came, we saw, we lost.”

True, but it was deleted because it was connected to some hack website. I didn’t know that, I just wanted the quote. I’m going to try another because I believe his observation to be true, even though I didn’t like most of his other notions, or my uncle’s.

It’s a huge part of what many here realize to be the needless political splitting of this country based on stupid “issues”, while ignoring the real problems.

https://images.search.yahoo.com/search/images;_ylt=Awr9H6kLuhphZUUAoAZXNyoA;_ylu=Y29sbwNncTEEcG9zAzEEdnRpZAMEc2VjA3Nj?p=barry+goldwater+christian+quote&fr=yfp-t-s#id=2&iurl=http%3A%2F%2F3.bp.blogspot.com%2F-zx8N6z7EPq0%2FVlRxOR9BxwI%2FAAAAAAAD338%2FA-CKpBUOAfw%2Fs1600%2F12243472_1216135381736130_7563452214298865053_n.jpg&action=clic

He had other many other things to say on the subject, but this

seems the best one.

Ha-Ha….in my computer ignorance I posted a bunch of them, good! But “mark my words” was a most obviously true prediction. People who stormed the capital were also waving Jesus flags.

Making a good stable puppet state “In Our Image” hasn’t been done yet, that I know of. But it might make for good TV and lots of AD $$$$$$$$$$$$$$$$$$$$s….the “bright” side for too many. My deceased uncles bunch has already cashed in.

What’s “unbelievable” about it is how stupid Jerome Powell and Co., and CONgress are. They overreacted in grotesque fashion and just printed like there was no tomorrow. These are the distortions you get from such myopic, reckless behaviors.

This is much different than the 70s

The Federal Reserve then FOUGHT inflation…they were AGAINST inflation…

This Fed PROMOTES inflation and doesnt lift a finger to tamp it down.

THAT IS A BIG DIFFERENCE.

It seems like to me the Fed has two problems:

1. The real US economy without government transfer payments is very weak.

2. Asset prices are in a bubble.

Therefore they continue to print thinking they are helping #1, but are making #2 worse.

When #2 bursts it will collapse #1.

The correct way would be to tax/regulate the asset bubbles and transfer directly/indirectly to the low wealth stratus. Just printing money and distributing to the bottom rung exacerbates the problem, because our entire political economy is structured to funnel ALL money upwards.

Ideologies are bad; policies need to be calibrated the facts. Wealth inequality is THE economic problem globally. China recognized it and recently instituted a bunch of regulations to tackle it from both sides.

“Ideologies are bad; policies need to be calibrated the facts. Wealth inequality is THE economic problem globally. China recognized it and recently instituted a bunch of regulations to tackle it from both sides.”

Wisdom right there. Too bad a large portions of Americans are stubbornly married to ideologies.

For every action there is an equal and opposite REACTION..

the reactions to this rogue Fed policy are piling up…..big time.

@historicus

This is also very true. Some call it the boomerang effect. The boomerang may come back only in 20 years but it will come back, e.g. terrorism, migrant crisis, dependance on China, climate change, etc.

WOW, so many CCP trolls commenting here on the virtues of Socialism, and poo pooing Capitalism (that is the engine of the CCP explosion of wealth.) Good back to harvesting organs from the 1,000,000 Muslims you hold in prison.

Just ask the Canadian Maple Syrup makers who owns all of their syrup after they tap a tree (Socialist government sized ownership much like Hugo did with all big business in Venezuela. )

I kinda liked what the CCP trolls had to say in this little thread. I should send Pilot Dave my own copy of the Little Red Book, but I’d be totally confused, maybe even non-functional, without it.

Maybe someone else here can spare one for him?

i think that it is exactly the situation

I would take reliving the 70’s anytime over the mess we are in now.

Yes, we will re-live the 70’s.

Only this time your bank/money market account will pay 0.1% interest – not 11%.

Enjoy.

Second that excellent point!

Although some poor bastards would still be in Vietnam.

And maybe we’d listen to Carter this time, and also have vehicles totally designed for 55mph.

This will be worse than the 70s. Bidenflation will make Jimmy Carter’s Stagflation look like a walk in the park.

Rat? I smell a whole nest of rats. The whole situation is appalling. One COVID case and you shut down a port? Stupid but certainly intentional….

intentional? Yes. Because China gets the concept of an exponential function and the US clearly does not. That is also why China managed to get Covid under control in only a few months and the US did not. Do you also when a curtain in your house catches fire say, oh it is only one curtain, no need to extinguish it as the water might damage the carpet? Let’s wait till the entire house is engulfed in flames before we do anything?

I was thinking the same thing. Since when does the Chinese government, which controls everything, give a rat’s ass about one or two dock workers? There are, I am quite sure, millions more to replace that person on a moment’s notice.

This is all controlled demolition of world economies.

It’s not the 1 or 2 dock workers they’re worried about. They have to prevent the loss of reputation and loss of control that would ensue if they let COVID take root again and make millions sick (as in Wuhan). The riots and chaos that we’ve tolerated in the West are anathema in most Asian cultures, so this “zero COVID” policy has fair support there.

COVID’s not going away, so this is going to be a very interesting test/competition between the two styles of civilization for the next few years…

Sounds like a “stealth embargo” to me.

When will the bank give me 14% on a CD?

M

I said a while back that China and Russia had got tired trying to be ‘friends’ with the West and were now going their own way and there was nothing we could do about it.

Non-MSM media is now reporting that the new 5yr plan which started after the CCP 100th anniversary is focused towards making China self-reliant on all vulnerabilities ie to the $, to tech, to sanctions etc. They are not stupid and their 5yr plans mean business. Your chestbeaters deliberately did this, and recruited UK, EU, Japan, NZ, Aus, Canada and all the usual suspects. S. Korea interestingly is hedging it’s bets (huge ties to China).

Personally I am going to miss all my cheap tech stuff, don’t see me fancying any Western substitutes even if they could match the prices which they can’t

The Vietnam War caused most all that 70’s “bookkeeping mess”. And I am NOT going to “speak” in Econ just to try to prove it,

other than Cap-ex blown or blown to hell…..IS Cap-ex blown or blown to hell! Also Jap junk was no longer Jap junk….they got VERY good at things we SHOULD have used our Cap-ex for. Marketing and sales Depts ruled here, still FN does.

The Fed just tries to plug holes in a basically sick, maybe even evil, system

Only took you 40-50 years to smell that “rat”….maybe ya got Covid way back then?

But Jim “Bear Stearns is fine” Cramer said you all eat crow! Give JPOW the benefit of the doubt!! All you rich folks stop being cheap and raise wages NOW! Apparently, you want deflation to protect your net worth and have been wrong for ages.

Search for the video on CNBC yesterday.

Cramer sounds scared. I wonder why.

He was probably on some kind of drug.

Cramer’s program is literally for children.

Who takes advice from a man who plays different sounds when he says up/down?

If the USA had a decent education system and a culture that includes regular reading it would be _impossible_ for his program to find an audience. Cramer is the symptom.

I regret living in a world that can support his garbage.

“If the USA had a decent education system…”

That is the source of our modern day problems.

Americans should take a step back from hyper consumption until prices settle out.

Jim Cramer went to Harvard, he claims to have put himself through college playing the horses and he roomed with Andy Beyer. He sold Rockport shoes. His website at debut was a killer app for regular investors. He had the best people. His own hedge fund was a flop, and he was accused of using Maria Bartiroma, CNBC to daytrade Mister Softy. She turned out to be thee biggest TV shill ever, was once the most respected financial newsperson. The 90s were a lot different. It was day when hedge funds ruled. Daytraders all eventually got eaten by the manipulation in the market by the fund mentality. It was the beginning of the end for technical analysis.

Jim Cramer reminds me of Soupy Sales, only Soupy was in it for laughs…

Don’t forget he’s yet another GS Alumni…..the best Econ pirate “finishing school” I know of.

“If the USA had a decent education system”

But it’s much harder to control and take advantage of truly educated people who are not busy with mindless consumption.

Jim Cramer’s main competition for viewership is Sesame Street level understanding where they learn numbers and letters. It’s where the amateur feels most comfortable.

I said it 20 years ago when I could see it in high school … we have fallen behind in education so much that eventually we would have a huge problem with a large portion of the population being morons. Incredibly, the best information dispersion invention in all of human history just acted like gasoline on the stupid because we let it get directed by advertising dollars. Now the dumbest ideas get as much or more recognition when they used to just be some town idiot with one or two other idiots that liked them….now they have 5M followers.

Citizen-may i recommend an excellent short sf story from the ’50’s by C.M.Kornbluth entitled: “The Marching Morons”?

(Are ‘inflection points’ nothing more than human life imitating its art?).

may we all find a better day.

I concur wholeheartedly.

Freedom’s just another word for nothing left to lose.

Re “If the USA had a decent education system”

Or a culture of individualism in which people didn’t assume that “the system” was sufficient in any way, and educated themselves…

As “the system” keeps failing, we will all be getting our own education.

WS-one might posit that we’ve had a ‘culture of individualism’ since WWII that has grown inimical to a general societal cooperation ‘system’ required of any great civilization.

Be careful what you wish for…

may we all find a better day.

“you want deflation to protect your net worth”

First, there never has been “deflation” with the exception of the Great Depression. File deflation with Big Foot and the Loch Ness monster.

Secondly, anyone who is for higher wages should be OUTRAGED that the Fed promotes inflation and has delivered 5%…..which gives a cut to all the earners and savers in this nation on the value of what they have saved and earned. Where is your outrage?

China wants to export high value merchandise. I think there are plenty of poor Americans ready to take those jobs. If not we open the borders. The Marshallian K indicator is crash flashing, below zero, which is GDP vs M2, which on the face of it is ridiculous. Chinese ports shutting down? Covid surge? Tight labor market? GDP is way oversold and liquidity, or seedcorn is being given away? The Fed absorbs excess cash through RRP? Who comes up with this stuff? This time next year we will be in recession and if the market is down 20% that is the reason. Of course the GDP numbers are getting a lift from supply chain inflation.

@Ambrose Bierce

You’re falling into the trap of thinking manufacturing jobs are for the unskilled.

We may have plenty of poor Americans willing to take the jobs, but they are insufficiently-skilled.

Wants do not imply means.

One of Boeing’s biggest problems in the early 2000’s was trying to find guys with the basic skill set to set up CNC machines. They would call them machinists and the union let them in. But they couldn’t get jobs at smaller shops because even after a couple years at Boeing they still didn’t have the skill set to make things. My boss at the time would just throw resumes with Boeing on them in the trash.

When I was learning how to run lathes and mills in the 90’s in Southern CA there was a really good set of courses at Pasadena City College. I’d be one of the very few who could speak or read English fluently. And those guys were working and learning, and buying every manual machine they could lay hands on to take home so they could set up their own business.

That was 30+ years ago. I mention this type of stuff to my nephews and their friends (who don’t have the grades or inclination to get into a good university) and the standard response is, “that sounds like hard work”. They’re all going to have a really hard time when reality hits them in the face and the folks kick them out of the house.

Yeah, hard work sucks, that’s for boomers and GenXer losers. Not the brilliant and utterly talented millennials and their supporting cast, Gen Z.

Speaking of China’s shipping problem, it is a very nice subtle way of reminding people who is in charge. Oh, your company needs some critical components for machine tools? Sorry, the COVID has shut down the ports for a little while, and we are prioritizing based on a first come first serve as well as a need base. Will get to your cargo as soon as possible.

By the way, rates have tripled because COVID and we need to keep our citizens safe.

Very easy to train people every job I had included training learn or be replaced simple

Except it’s often not that simple. Replacing someone and start over that training routine cost time and resources, and slows your business.

Industry is willing to train but not to teach the 3 R’s. High school grads are often functionally illiterate.

The just in time principle on all goods and trimming of all stocks to the bare minimum may be part of the reason for the price hikes. Another is trimming of production capacity to the point where there is no excess or slack.

This pay small dividends in normal times, with disruptions in the supply chain where shortages can by managed by price hikes it pays big dividends.

It look like industry have learnt to go for maximum profit on minimum produced instead of maximizing profit by maximum volume.

@Sams,

I remember the horror in the early days of the pandemic when people were shouting “why diid we micro-optimize everything for profit at the cost of resilience?”

and all I could do was shrug and tell them:

“because nobody has yet figured out how to nano-optimize everything for even greater profit”.

BigAl-with your permission, i’ll start using that one. Kudos!

may we all find a better day.

How high will the Drewry index go? Will the chart look like lumber?

Can wage cost pressure continue over a non “transitory” period with organized labor so gutted and remote foreign labor so plentiful? Granthams GMO just released a white paper saying it can’t and thus pace of inflation will slow (understanding the purchasing power is permanently gone, but thinking more about medium term int rates). That seems to be the dif between opportunistic inflation (aggressive pricing) and the uncontrollable if labor costs keep increasing.

The conspiracy theorist in me says the US is waging biological warfare against China. This time around it tried to use containers to contaminate the Chinese. China responded by shutting down ports. Once again, the US shoots itself in the foot.

The “conspiracy theorist” in you is an idiot.

Crackpipe again, huh?

I read an article on Freightwaves the other day that said actual volume of shipped goods is only up a tiny amount (2%) over 2019, and theoretical shipping capacity has actually increased since then. They blame these delays and higher shipping costs on congestion at the ports, inefficiency and productivity problems, and imbalances between full and empty containers. I wish I could bumble around mess things up yet get paid higher prices to makeup for it.

A big problem is that the major shipping companies moved to mega cargo ships (20K TEUs), but a lot of ports in the US aren’t deep enough to accommodate them. The carriers don’t want to run the smaller ships, so they jack up the rates.

The US needs to build a bunch of ports from scratch, in deeper channels, with full automation, but with everything else, there are just too many entrenched interests that would be hurt.

Rowen..

I also heard they just are not stacking those containers for trans ocean voyage as high as they were after that big container dump a few months ago. True?

‘…don’t raise the bridge, lower the river…’.

may we all find a better day.

When you print and spend $4 trillion, it’s got to be produced and shipped by somebody. Think about Powell effortlessly buying $120 billion in assets, then think about a Chinese production worker killing themselves to make $4/ hour to get the 1000 pieces per day out the door.

Think about Powell effortlessly printing his net worth higher while the plebs toil away and lose it all to inflation.

Maybe it wasn’t such a good idea to offshore your manufacturing base for a quick buck profit, for the few?

How long will these freight prices need to persist in order for production to return back to the US?

The ivory towers who softened the ground for it to happen, have never thought about it. Figurately speaking, that ship has sailed.

Printing dollars is so much more fun.

The few chip fabs currently under construction, will have to find customers outside of defense and auto industry, or ship to Asia. However, hardly by the container.

Great point. We can make the chips here but the product they are going to in the middle is far far away. Yes they need them in the automobile. But first they have to be put into the assembly that will form the MCU (micro control unit). So we build them in the USA in some future then need to ship them via cargo ship (bottle neck and expensive) to a foreign land to have them put into an assembly that has to then be shipped back to the US to have them installed into the vehicle. Brilliant

Nathan, small high-value items typically don’t go by container ship. Some of the chips are cheap, but normalized by freight volume, they are still expensive.

ND

“We can make the chips here”

IBM recently boasted they were about to reduce current 10nm to 6nm tech. (smaller is better and faster)

Only for TSMC to announce a couple of weeks later they were going to 4nm.

I don’t know if IBM even make chips in USA.

People in Argentina find foreign goods expensive but manufacturing didn’t ramp up there. Why? I suspect it’s that they are not competent enough. Could be the same for the US of A?

Silly. It has nothing to do with competence in the US, and everything to do with fraud, greed and corporate influence on politicians. CONgress is bought and paid for.

I think conspiracy is very popular because if you can just wrestle control from “them” then you are back in business.

Systemic decay is a less popular diagnosis for similar symptoms as the road back to health is far, far longer.

People want to believe in the easier fix.

Also if it is just corruption, is that simply American culture? One minute singing the national anthem the next accepting bribes that harm their neighbors but reward their own narrow self interest? Changing culture takes generations.

Greed I would say mainly. Why go through the effort of setting up production(risky). You can just place an order from a Chinese manufacturer. Not saying it’s right, but the easy way

I don’t think that’s the problem. Western Europe and the U.S. both seem to have a problem involving two diametrically opposed movements. Which is best shown by the begging of OPEC+ to ramp production despite the fact that the U.S. has plenty of oil reserves.

You can’t make society green overnight without major tradeoffs of quality of life. Somebody has to still do the dirty work. Out of sight out of mind as you buy that cheap squeaky toy for your dog made out of petroleum based plastics. The hypocrisy of it all is insane to me.

@georgist,

Well, as of 2018, manufactuing made up 12.8% of Argentina’s GDP vs. about 11.5% of the USA’s GDP.

The figure for China is about 28-29%.

Argentina, at the beginning of the 20 th century the most prosperous in the world, has been out of touch with reality since before Peron.

So retail better wake up and quit buying going to be a consumer revelation when prices get to high inventories at bottom fishing prices can,t wait

‘This is the second major port disruption in three months in China. In late May, Yantian International Container Terminals in Shenzhen stopped accepting containers due to a Covid infection among port workers.’

And the first was also due to Covid.

This is a site about economics. About two weeks ago I commented that the largest economic factor is the resurgence of Covid and the much more contagious delta variant. I said this would be apparent in about 30 days, by now possibly dawning on the person who replied that I must believe the MSM. To which I replied, ‘ya, kind of’

Not at first, but by the time the 30th Ph.D weighs in and the 40 th ER respiratory tech does and the largest hospital in one of several states tells its small outlying hospitals it has no room, well,,, ya, I lean toward belief that this is a big deal.

Speaking of beliefs, one of the non-vaccinated in the ICU who was interviewed between breaths, said he HAD believed he had the blood type that made him immune. WTF? What branch of which snake handling cult spawned that bit of crazy? One thing is for sure: it wasn’t the MSM.

I agree delta is a game changer.

Track and trace is infinitely harder when the track moves from “did you converse with” to “did you use the same corridor with a 4 hour period”.

> I agree delta is a game changer. Track and trace is infinitely harder when the track moves from “did you converse with” to “did you use the same corridor with a 4 hour period”.

Indeed, what will the economic picture look like when k-12 is moved to online learning due to COVID yet again?

@Nick Kelly,

You think your ICU story is remarkable? Give it a couple weeks when “grey alerts” are occurring in hospitals all over the USA as the un-vaccinated start pulling guns on hospital workers, demanding that they kick out the current occupants of hospital beds to treat their own covid-infected relatives.

As for China…

If China truly wants out of their “zero covid strategy” – the CPC is going to have to frame it as “we chose to do this” instead of “covid got too infectious for us to control, so we capitulated to it”.

I don’t think they are there yet.

Wow. It’s time for you to get some sleep and re-think life. Your imagination is getting the best of you.

Wait got the Ebola strain out of Africa you ain’t, sen nothing yet

Yes NK, where I am reading the MSM, admittedly not much these days compared to 50 years ago when I read the NYT Sunday edition ( in the SF Bay area ) at least once a month cover to cover for the laughs and giggles, and the ads, it had been mentioned several times; however, as always, taken out of context it did sound possible that one or more blood types had decreased ”odds” of catching covid.

Some folks, part of the very deliberately dumbed down part of the USA public, clearly do not have any clue about context, or, for that matter, ”reading between the lines” as was taught at least at the very best high schools and colleges in the past.

Surely, there was a large segment of memorizing whatever ”facts” the schools of all kinds considered important, but, again at least at the best schools, learning to think was THE most important part of every basic undergraduate course.

VVNV-i recalll senior Geography seminar my final year (1980, CalState system), taught by the head of the Dept.-an older, unpopular (he was VERY tough academically, fighting the losing battle against ongoing grade inflation), but grudgingly respected, prof.

Question: “…now, after your time here,what have you come to learn?”

Responses: many, each citing the student’s particular slice of Geography-physical, social, atmospheric, etc., mostly in terms of acquiring the necessary qualifications for future employment (i know, if you were a major, those responses were a bit ironic…).

Doc F. (with a weary look and tone) “…and i thought you were here to learn how to objectively and effectively think for yourselves as you go forward in life. If you came only to get your ticket punched, you’ll have problems if the train you boarded sidetracks, or gawd forbid, derails…”.

No one aced senior seminar that year.

may we all find a better day.

NK

The Covid story has a long, long way to run before ‘all’ the dust settles.

I reckon it’s best to stay out of it altogether meantime.

It might be good to come back to it in a couple of years when we know what all the damage is from all sources.

Good excuse to throw away my Christmas shopping list. I’d give out lumps of coal but the Chinese are burning all of that up too.

They are preparing us for the next manipulation, it seems it will be toys, and coffee. Buy it all up before it’s too late.

Boomer. I am thinking instead of presents this year, we should all just exchange $20 bills back and forth.

Take China out of Christmas altogether.

I just heard that the shipping rates for containers going to the US are so high relative to the rates for containers going out, that they don’t want to wait for the outgoing container to be filled as they can get a faster turn around by just shipping back an empty container, i.e. it is not worth the wait to fill the empty container. This is a result of the goods coming to the US are of much higher value then the outgoing good (mostly agricultural products). The demand for our ag products is not such that we can command an inflated shipping price.

Maybe some containers can be filled with stimulus checks and government procurements, to streamline the process.

The arriving goods will by marked up, and add to the GDP to great satisfaction of the bean counters.

I thought most Ag products go by bulk in the hold. I know our wheat and grains do.

They finally quit taking Cdn plastic recycling; all recycling from everywhere. People here have this wonderful illusion that if we don’t melt/burn/make plastic in Canada we can pat ourselves on the back about lowering pollution levels. We tend to forget we live in an aquarium.

Might be one reason for empty containers, they don’t take our junk.

Paulo,

In terms of $ value, the vast majority of US exports are NOT ag products.

In 2020, the top categories:

Machinery, nuclear reactors, boilers: $182.59B

Electrical, electronic equipment: $162.88B

Mineral fuels, oils, distillation products: $155.09B

Vehicles other than railway, tramway: $105.16B

Optical, photo, technical, medical apparatus: $83.40B

Aircraft, spacecraft: $80.94B

Plastics: $60.22B

Pearls, precious stones, metals, coins: $58.81B

Pharmaceutical products: $53.94B

And only then come the first categories of ag commodities.

holy glowing smoking balls, the US still export nuclear reactors?

CRAZY.

Amazing medical equipment isn’t higher on that list there. But I would be very curious to see what the comparable Chinese exports on each of those categories are.

Wow. The list is quite surprising.

I used to see lots of adds for container rentals for work site storage, etc. No more. Now every jobber seems to have big aluminum trailers and Atco site offices/trailers.

I used to do lots of welding and fab work and it would be very very expensive to build containers. I assume robots weld them up in jigs. They would still be pricey. Used I see they are listed at $5K US…used once.

“Used once” means they are “one-way” containers. Cheaper and minimal steel, cheaper and minimal plywood floor. $5K is an awful lot to pay, but a lot of it is probably because they found they make more money just renting them out, as they look newer and nicer and don’t have toxic floors.

All 5 of mine, stacked 2-2-1 with the paired ones cut so as to be one big room (less 2-4 ft each end) are Korten steel, expensive plywood treated to Australian standards, and said to usually last avg 17 years, unless dropped or speared with fork lift, etc. Mine all have some rust, some small dents, couple patches, but all have good doors and were still only $2-2.5K at the junkyard of the guy with the Customs License needed to buy them. (Paid him cash, though, and no paperwork, plus we had a lot of mutual friends) and I bought a lot of other stuff from him, rebar, angle iron, flat iron, plates, t-posts, used ladders, shelves, work benches, water tank, etc. All 2013.

That direction difference Shanghai-LA says it all, to me, but the “to China” breakdown was interesting. Thanks. I figured they all must have had “my pillows” and sea urchin gonads, or were just empty.

Frank,

Yes, they have been doing this since last year, and it violates US law, and there is an investigation by the Federal Maritime Commission going on because US exporters are having trouble getting containers to export their goods. I covered this last December, and it’s still going on…

https://wolfstreet.com/2020/12/20/breath-taking-spike-in-china-us-container-freight-rates-triggers-mad-possibly-illegal-scramble-for-empties-us-farmers-twist-in-the-wind/

Wolf,

What comes of these findings? No doubt there are violations. What legal measures can be taken? It just seems more and more there is a tolerance for this because it draws out and nothing really happens.

Yes, I wouldn’t even expect a slap on the wrist. But it does put violators on notice that they’re being looked at, and maybe they’ll change their behavior somewhat.

1) Cass is up, but IYT (transportation ETF) is down.

2) IYT top 5 : UNP, UPS, CSX, NSC & FDX.

3) IYT weekly log support line : Dec 24 2018 low to Aug 19 2019 close.

4) IYT might test a Lazer : May 15 2017 low to June 25 2018 close // parallel from July 10 2017.

5) China export inflation and shortages.

Worth noting that inflation is cropping up seemingly-everywhere. No joke- search for headlines for South Korea, Australia, etc. in addition to the USA.

And it’s present in China, too. I’d encourage anybody doubting this to start searching for articles on factory floor inflation, or simply examining a graph of the price of Chinese rebar (steel-reinforced concrete produced in China).

Much of this has to do with surges in commodity prices. China has been actually trying to curb exports in its steel industry by implementing “export tariffs” (yup, you read that correct – they are *FINING* steel companies are attempting to export their product).

Thus far – it’s met with very limited success. And keep in mind that the steel industry in China is a huge user of coal – which is in short supply.

It will be fascinating to watch this because the CPC believes it can control everything internally – but they have curiously been able to prevent their own steel companies from producing too much – thereby causing commodity price inflation surges.

BA

RT Boom Bust showed a graph for Chinese Input Prices, I think from memory (lousy) up about 8%.

That’s before all W’s transport and US add-ons.

There’s lots of TEU’s in the USA, and i’m not up on market values, but they used to fetch $2-3k.

Why wouldn’t these be sold back into the shipping market if rates are so very high?

I wish there were “lots” of containers available. There isn’t. Two years ago I could walk pier 7 at Port of Tacoma and count 2-3000 containers awaiting movement. Today there’s maybe 100.

I spend my days trying to move cargo across the oceans. It’s been insane. Singapore’s jacked up, let’s divert the load to Korea. But the ship was loaded so all those Singapore containers would be offloaded before the vessel went to Korea, so now they have to figure out how and where they’re going to get the cargo that’s stacked below the Singapore load off, and where to find room for the stuff that was supposed to fill that space that’s now sitting on the dock in Singapore for Korea, Japan, Okinawa, and the Philippines. Those ships don’t just go to one port, they usually hit 10-20 on a round trip. Loading them is incredibly complicated due to a dozen different factors of which balancing the ship is only one.

Then you factor in labor, and realize just how bad it’s getting. We had 850 vehicles that needed to get loaded on a train last month. These are big trucks. About 10% of the labor needed to chain them down showed up. So this very important job, on which a lot of other moves were going to depend, is going to be about a month late in clearing the port, because the railroad can’t afford to leave the cars idle until the labor shows up.

The world is still cleaning up from the Evergreen blockage, although it’s been totally forgotten by almost anybody who’s not in the industry. Cargo’s destined for the Med went to Europe, so instead of dropping 700 containers in Naples, they got offloaded in Antwerp two weeks late and need to be trucked 800 miles to Italy when they can find the trucks. which causes congestion in Antwerp, so it slows down the next couple ships, which backs up those even further behind. And that’s one small example.

Everyone looks at hard line items, but places like Fiji, Tahiti, Okinawa, etc, are having trouble with stuff like milk, or cheese, or cooking oil; things people start going hungry without. You can live without a new car, but kids need milk. And refer containers are never excess, and they just can’t be moved by any old trucker either. The effort it takes to move fresh vegetables to Hawaii, or salmon to Plovdiv, or even flour to Niger is extensive. And it’s getting more expensive.

Nice report from the trenches.

And there’s no ‘disruptive’ software to manage all this, is there?

Just ordinary humans, gnawing through the mangrove forest as best they can.

I think the traveling salesman software was disruptive a long time ago, now it is just a basic tool for logistics.

Geez. Someone needs to put some of those “nifty” Google supercomputers to work to solve this problem, Thanks for sharing.

Supply Chain optimization software is available that runs very well on standard business grade computers and so, is fairly ubiquitous. Commonly, this software uses linear programming where you define the parameters you want to optimize and then solve for the optimization goals you set. For example, your optimization goals may be to minimize cost and maximize the fastest delivery times. A common term to describe this setup is a “Model”. You build a Model of your supply chain and the optimization goals you have defined. If you have a highly optimized supply chain, it seems to me a massive disruption, like Covid, just in the shipping area alone, could blow up your cost structure, depending on your margins and thus, crush earnings. This is even a bigger no-no in today’s hyper-stockholder value world. IMO companies are expert at “fudging” earnings over a few periods to avoid this problem. But with a longer term disruption like Covid that might not be possible to sustain. An obvious solution would be to jack up prices to a level that would hopefully prevent an earnings drop. Read into the implications of my speculation whatever you like. There is a real economy outside there beside what the Fed does.

KGC-thanks for the spearpoint dispatch. Widespread binary-thinking (digital bleeding into human) tools appearing to have inimical long-term effects on the realization of complex (thus fragile) system-management missions…

may we all find a better day.

Its best to stay up to date with Fed Speak. Transitory is soooo….. last month. It’s now about the fact a steady rate of increasing inflation is the target. Steady as you go in the crapper is good. Accelerating into the crapper Bad.

Now that the west has outsourced manufacturing to China and the CCP have started to take control of Chinese companies recently.

China can increase prices of their products and the west can do nothing about it but suffer from inflation.

@Cashboy

CCP has always exerted a fairly-heavy hand over corporate activity. Remember that state-owned-enterprises are the largest employers in the industrial sector.

It’s not fully-true that the west can do nothing but suffer inflation.

Quite a lot of lower-value/high-labor manufacturing (e.g. shoes) has been moving out of China for a decade. This is light industry, though, so it’s relatively-easy to move.

But moving around supply chains for heavier industrial work is a big project. And there isn’t excess industrial capacity in other countries to replace China in the near-term.

China seems to be doubling-down on a “zero covid” strategy involving lots of intervensions, such as these. They may abandon that if they are utlimately-successful producing a more effective vaccine that would enable them to achieve true herd immunity.

But these sorts of disruptions – if repeated – do move the needle in terms of corporations moving at least some capacity out of China. Whether or not the USA is poised to recapture any of that is another discussion…

My point is that China cannot *indefinitely* perform these sorts of interventions that lead to such disruptions before transnationals, as well as smaller companies that perform contract manufacturing in China, start to spread their manufacturing operations outside of China.

MAYBE one day the greedy U.S. corporations AND stockholders will WAKE UP and start pulling out of Communist China and the American people stop buying their cheap sh*T! That goes for EVERY country that deals with the Commies.

@Liberty ONE

Dream on.

I recently concluded a contracting project for my ex-employer.

It involved offshoring their few remaining software developers to Peru – a country that just elected a Marxist-Leninist president.

Did I mention the CEO used to be a fellow for the “Heritage Foundation”?

BigAl-should we be surprised by this time? (After all, big money has big ‘heritage’, and a deathless belief in its ability to ‘subvert the dominant paradigm’ wherever it goes…).

may we all find a better day.

Why are these increases in shipping costs treated as “transitory” bottlenecks…

It looks like shipping prices are rising and will continue to do so…

So for Powell to blame this on bottlenecks, etc. is disingenuous ….kinda like his “stable prices” dodge.

@historicus

Much of the increase in shipping costs is due to demand increases that are not global in nature; the USA has super-charged consumption with stimmies and what one might consider to be “ill-begotten asset price inflation”.

As I have pointed out above, the inflationary pressures resulting from that are not limited to the USA, however. They are even being felt in China.

To this day I can see no one is catching a clue as to how much mark-up is on our darling retailers’ shelves. Container shipping cost is going exponential and still, our retail corporations are clamoring for more instead of the option of gearing up in the states.

Besides some electronics for promotion, most of the (lipstick on a pig) goods flowing in on container is marked up 500 to 1000%+ on your friendly (“Low price Leader”) shelves.

Instead of promoting human rights in mostly Asian countries, corporate America has represented us all in further enslaving poor people, including children, to work endless hours in hellish conditions.

@Brant Lee

Retail corporations generally don’t manufacture anything. Doubtless they are terrified about what this means for the holiday shopping season, though.

Despite what magical-thinking free-market fundamentalists would have you believe – factories are not magical widgets where one flips on a switch and watches finished goods issue forth a moment later.

‘Gearing up in the states’ would require a whole change of mindset, investment, etc. – which cannot be done on a compressed timeframe.

The best policy right now would be to simply cool demand a bit (i.e. no more stimmies)

The INTENTIONAL destruction of America (on many fronts) is at hand. Prepare accordingly.

Gosh, I sure hope my dog’s Halloween costume isn’t stuck in the Meishan terminal somewhere. He’ll be so-o-o upset if he doesn’t get to dress as Brittany Spears this year. I may have to take him to Home Depot to pick out some new carpet to stain to compensate…

$10322/$1641 = ~ 7.

Ratio of cost of a 40 ft container coming from Shanghai to LA, as opposed to one going from LA to Shanghai.

That about sums up the relational values of US>>CHN trade and the importance that the CCP will attach to US demands of being treated as VIP partner in their trade relations.

Chicago’s infamous RR strangle hold. Most railroad buffs know Chicago is premier railroad capital of America because of the Great Lakes and handles half of all freight traffic in America.

Always had major traffic jam in southwest burbs rail yards because public Metra operates the commuter trains so they shut down all freight trains during day times.

SW Chicago freight yards got several rail new overpass that multi quad government paid for!

Nope we had the infamous Chicago strangle hold because the modified railyards were not equipped for intermodal like Port of Long Beach.