A burning question in these crazy times.

By Wolf Richter for WOLF STREET.

The US gross national debt outstanding has ballooned by over $5 trillion since early March 2020, to $28.4 trillion, where it has been stuck since August 1 when the debt-ceiling farce recommenced.

The burning question is who the heck bought these Treasury securities and who is holding them, given that everyone who is buying any of them now is getting crushed by historically steep negative “real” yields, with CPI inflation outrunning even the 30-year Treasury yield by 3.5 percentage points.

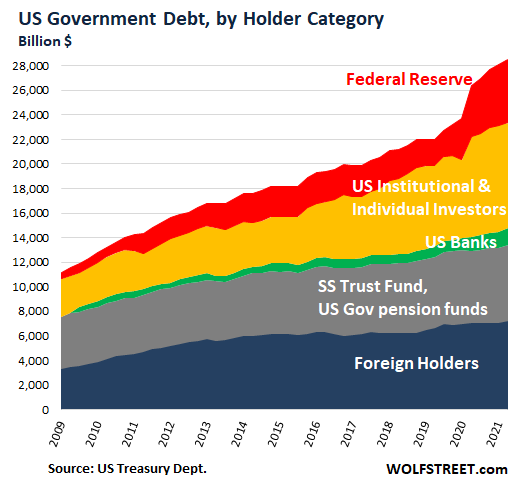

The Treasury Department released its Treasury International Capital data this afternoon. It tracks foreign holdings of Treasury securities by country through June. Now we can piece the holdings together, along with: the Fed’s holdings (per its weekly balance sheet); the banks’ holdings (per the Fed’s bank data); the holdings by US government entities, such as government pension funds (per the Treasury Department’s data); and holdings by other US entities, such as mutual funds and pensions funds (per data from SIFMA). And it’s quite a show.

Huge but fading importance of foreign creditors of the US.

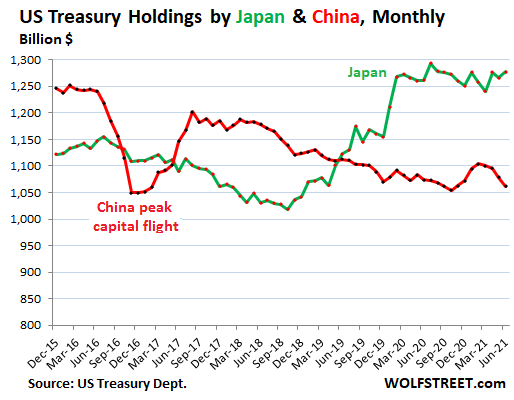

Japan is the largest foreign creditor of the US. Since March 2020, its holdings have ticked up by less than $5 billion, to $1.28 trillion at the end of June, zigzagging up and down without going anywhere.

China is the second-largest foreign creditor of the US. In June, its holdings fell by $16 billion from the prior month to $1.06 trillion bouncing into the multi-year low of $1.05 trillion achieved during peak capital flight in December 2016. Since March 2020, China’s holdings fell by $21 billion:

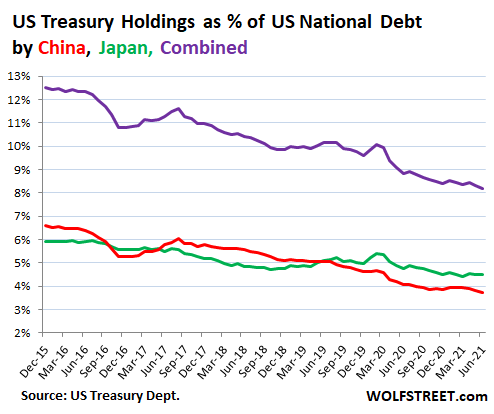

But their importance as creditors to the US – once a huge concern because what are we going to do if they start dumping this paper? – has been fading for years because their holdings have been roughly stable, even as the US debt has exploded, and their share of the total US debt has been declining for years. In June, their combined share (purple line) fell to a new multi-year low of 8.2%, with China’s share falling to just 3.7% (red line):

The 10 biggest foreign holders after Japan & China are mostly tax havens and financial centers, some of them tiny countries. The exceptions are Brazil and India. At some of them, US corporations have established corporate entities where some of their Treasury holdings are registered, such as Apple’s holdings in Ireland.

- UK (“City of London” financial center): $453 billion

- Ireland: $323 billion

- Luxembourg: $302 billion

- Switzerland: $270 billion

- Brazil: $249 billion

- Cayman Islands: $244 billion

- Taiwan: $239 billion

- Belgium: $228 billion

- India: $220 billion

- Hong Kong: $219 billion

Germany and Mexico, the countries, along with China and Japan, with which the US has the biggest trade deficits, are way down the list.

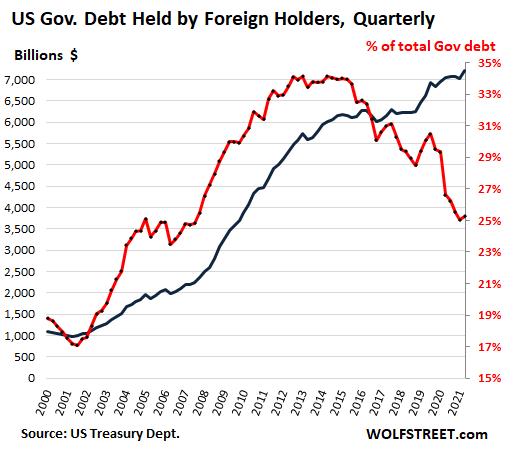

Foreign holders in total – foreign central banks and government entities, foreign institutional investors and corporate entities, banks, and individuals – increased their holdings in June by $174 billion from the prior quarter, and by $253 billion since March 2020, to a record $7.2 trillion (blue line, left scale). But this accounted for only 25.2% of the incredibly spiking US National Debt (red line, right scale), the second lowest end-of-quarter percentage since 2007:

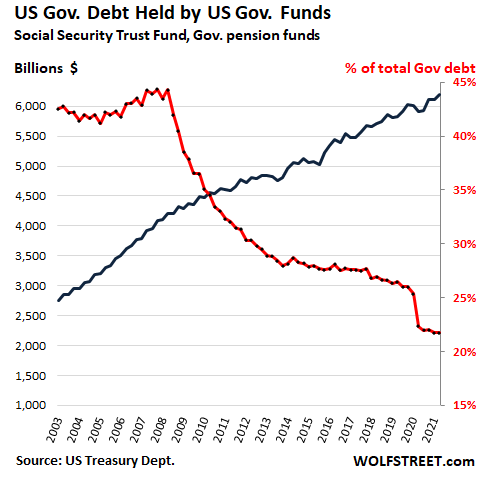

US government holdings rise to record, share drops to multi-decade low.

US government pension funds for military personnel and federal civilian employees, the US Social Security Trust Fund, and other federal government funds increased their holdings by $90 billion during the second quarter, and by $188 billion since March 2020, to $6.2 trillion (blue line, left scale).

But the Incredibly Spiking US National Debt totally outran those paltry increases, and the share of US government funds fell to a multi-decade low of 21.7%, down from a share of 45% in 2008 (red line, right scale):

Federal Reserve very busy.

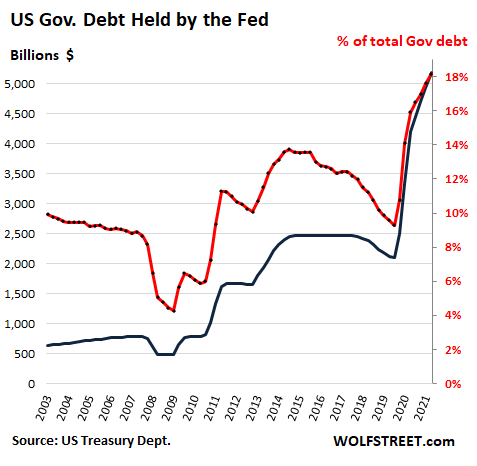

The Fed increased its holdings of Treasury securities by $241 billion in Q2 and by $2.6 trillion since March 2020, more than doubling its holdings in 16 months (blue line, left scale), which brought its holdings in Q2 to a record of 18.2% of the Incredibly Spiking US National Debt (red line, right scale):

US Banks gorge on Treasuries.

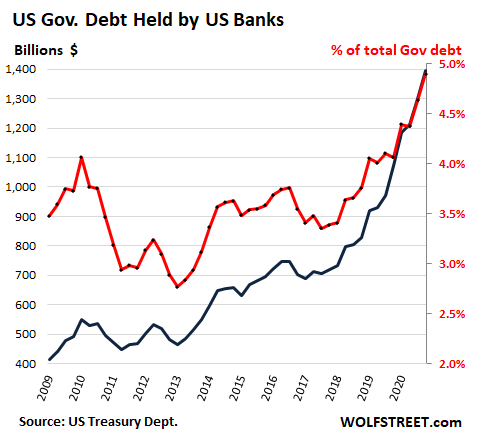

US commercial banks increased their holdings of Treasury securities by $96 billion in Q2 and by $424 billion since March 2020, to a record $1.4 trillion, according to Federal Reserve data on bank balance sheets. They now hold 4.9% of the Incredibly Spiking US National Debt:

Other US institutional and individual investors.

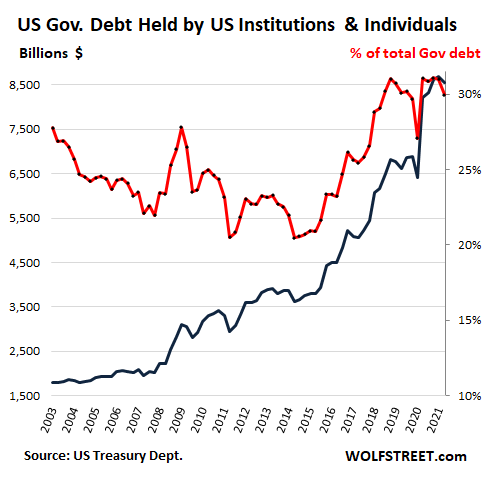

These include mutual funds, US pension funds, money market funds, ETFs, US insurance companies, other US entities, and US-based individuals. We’re going to get to the biggest of these subgroups in a moment, based on SIFMA data through Q1. But here is their overall trend through June.

These US entities reduced their holdings in Q2 by $152 billion to $8.55 trillion (blue line, left scale), which reduced their share of the total US national debt to 30.0% (red line, right scale). Since March 2020, these holdings were up by $2.13 trillion:

Within this group of other US institutional and individual investors…

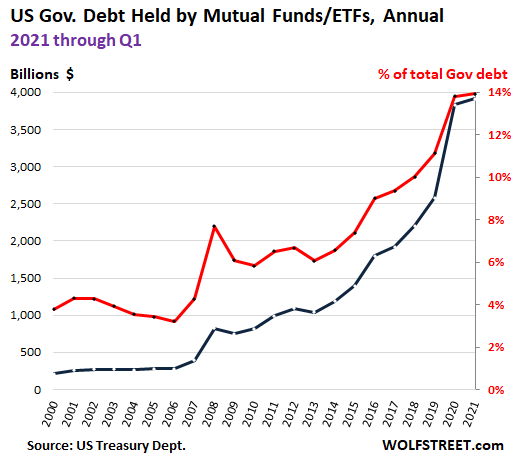

US Mutual Funds, Money Market Funds, & ETFs, from March 2020 through Q1 2021, increased their holdings of US Treasuries by $1.26 trillion, to a record of $3.9 trillion, according to the latest data available from SIFMA (Securities Industry and Financial Markets Association). This brought their share of the US National Debt to a record 13.9% at the end of Q1 (red line, right scale).

Note the massive jump in 2020, largely due to the increase in holdings by money-market funds. SIFMA has not yet released Q2 data, but it likely jumped in line with the situation we have been encountering starting in April with the Fed’s massive liquidity-mop-up operation via Overnight Reverse Repos (chart shows annual data; 2021 = Q1 level):

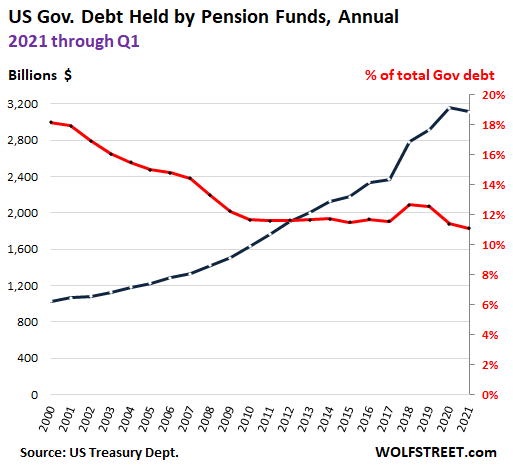

US Pension Funds trimmed their holdings in Q1 from the peak in Q4 2020, to $3.1 trillion, according to SIFMA. Over the years, they have steadily increased their holdings, but less fast than the US National Debt has surged, and their share of the total debt reached a multi-decade low of 11% in Q1, down from 18% in 2000:

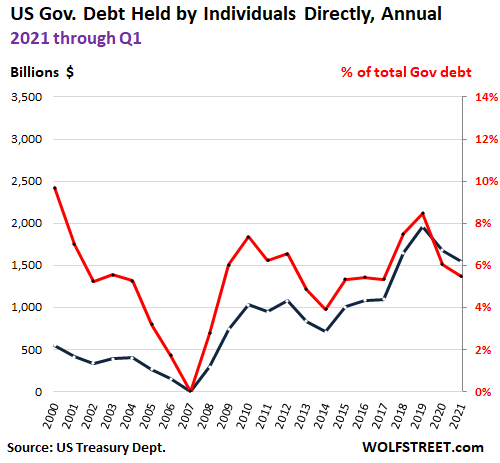

Individual investors are a fickle bunch. They have been unloading their direct holdings of US Treasuries in 2020 and 2021 through Q1, to $1.54 trillion, down by $400 billion from the peak in Q4 2019, according to SIFMA (blue line, left scale).

Note, amusingly, the plunge in holdings to essentially zero from 2000 through the peak real estate frenzy in 2007. After the real-estate collapse, American fell in love with Treasuries again, though the yields were piss-poor. Their share in Q1 amounted to 5.5% of the monstrous US debt:

Insurance companies held $388 billion in Treasury securities in Q1, according to SIFMA. They’ve also been unloading Treasuries from the peak in Q3 2020 and their holdings are down a tad from Q1 2020.

The Monstrous US National Debt and who holds it, in summary:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Powell refers to the Fed buying govt paper as “asset purchases” rather than “monetizing the debt”

The inability of the US to pull out of Afghanistan should be a stark reminder to the Fed……. the deeper you get in, the more difficult the extraction. And, you better have an exit strategy. I wonder if that thought passed through J Powell as he watched the attempted exit from Kabul airport.

So far, the exit from Afghanistan seems remarkably calm. The entire government crashed in the space of a month. Total regime change.

And there are a few lines at the airport. Not unlike the lines you’d see on a busy day at our TSA checkpoints.

As is so often the case, the media was hoping for some click-bait, and doesn’t have a lot to work with.

========= Separately, and on-topic:

Who owns all that debt? We do. Foreigners are slowly pulling chips off the table.

We own this one, folks. Take your wages and profits and either bet it on the stock market – hope the frenzy continues – or plow it into UST, buy this debt, denominated in dollars which are depreciating.

Then the proceeds from the debt sales can be momentarily recycled into the economy for a few more turns, and the proceeds (wages and profits) can be used to … buy stocks and more USTs.

But, we did exit Afghanistan. Yay!

There is an economic side of that, Wolf: one less major leakage. One more chance to re-direct all that money into wealth-building activity here in the U.S.

“So far, the exit from Afghanistan seems remarkably calm. ”

Are you an idiot?

Boots on the ground trying to salvage as much as possible of the Biden disaster.

“A startling photo has emerged of hundreds of Afghans crammed into a U.S. military C-17 that took off from Kabul amid the chaos and landed in Qatar, suggesting that the military was forced to make decisions to take off with refugees aboard, in the wake of a complete lack of any contingency from the hapless Biden administration.”

JUST IN: “The Crew made the decision to go” — Inside RCH 871, which saved 640 from the Taliban …

#BREAKING: #Taliban has started public executions. Two indviduals were executed in Cricket stadium of #Kandahar today.

joe2,

A Republican – the Bush White House – started this friggin war and in the six years it was at it, didn’t pull out because Afghanistan would have done exactly what it is doing now, and so Bush handed this fiasco off to the next guy.

Everyone knew for the past 20 years that as soon as the US pulls out of Afghanistan, the government would collapse and the Taliban would take over. The Afghan government and military were nothing but a cesspool of corruption, and everyone knew it.

Bush started it and then chickened out and refused to end it because he couldn’t take the heat.

Bush then handed the fiasco to Obama who tried to pull out but failed because the government would have collapsed, and so he did the “Surge” and handed the fiasco to Trump who got ready to pull out but then didn’t.

All of them chickened out because they couldn’t take the heat.

Trump handed the fiasco to Biden, who FINALLY pulled the US out of this war that was started by a Republican, that cost US taxpayers at least $2.2 trillion, and killed at least 5,000 American military personnel and contractors.

It was Biden who finally had the gumption to put an end to this fiasco that was started by a Republican. The US should have never ever been in Afghanistan. This was a civil war. It’s their country, let them figure out how to run it.

The outcome – a total and rapid government collapse – is exactly what it would have been all along, and everyone knew it. And it has been predicted many times. And that’s why Bush, Obama, and Trump had chickened out, these weaklings.

As one who was involved in the VN war at the early stages as a typical young and ignorant ”warrior”,,, and then learning SO much more than was available to any of WE the Peons at the start of that war,,, I agree, totally, with Wolf:

USA MUST LEARN ASAP that unless WE the Peons and each and every one of our elected and appointed leaders decide to go ”full on NAZI”,, WE should never ever get involved in the civil wars of any other nation/country/ etc., etc.

Time and enough to bring ALL our actual ”troops” HOME,,,

And put them ALL to work on ALL of the domestic challenges currently in front of USA.

Thanks again Wolf for your ongoing common sense and clear understanding and especially reporting ”things” AS they really and truly ARE!

Wolf,

Please feel free to edit or delete my post above, as I am quite aware of my absolute hate for and and every ” war ” very very possibly clouding my judgement and my commentary…

Thanks again,

The initial war was fully bi-partisan. It is easy to blame Bush because he didn’t pull out in his second term but the democrats were just as fully invested initially, led primarily by Hillary Clinton.

The only president who didn’t add to the mess was Trump. True, he didn’t pull out but the Middle East saw more peace while he was present than in my lifetime, particularly with Israel.

Russell,

Yes, the fact that warmongering is bipartisan in the US is a big part of the problem.

Based upon the public opinion poll approval ratings and applause by the media at the time for Poppy and Dubya & Co. there is a vast majority in the U.S. who can take credit for The Middle East Thirty Years Wars, too.

Sorry, Joe, not buying it.

Given the speed of the collapse, and the sheer number of contractors, retainers, spies, baksheesh-recipients and other leeches on the U.S. body politic, the exit’s been remarkably calm.

The former president escaped with a helicopter full of cash. Had to leave some on the runway, he had so much of it.

That was his priority: cash. Not his people, his cash. Just to be clear about where the installed gov’ts values were.

Regarding executions….can you imagine how these people view the enablers of this (latest) 20-year occupation?

The fact that it’s not been thousands is a testament to the Taliban’s forbearance. They have to be absolutely livid.

Since your post is so clearly Red .vs. Blue team hyperbole, allow me to point out, as so many have already, that Biden just finished off what Trump wanted to do.

In both cases, right decision. One thing they both got right.

Someday we’ll get beyond the Red .vs. Blue theater.

One more thing, Joe.

How did calling me an idiot advance your cause?

Calling people names indicates to all observers that you’re not totally in control of your emotions, and you have trouble formulating your case.

Why else would you resort to bombast when well-articulated logic and good manners are so much more effective?

Biden may not have gotten us into this mess, but badly botched the withdrawal. I agree with those who frame this as a solidly bipartisan disaster. When it comes to the really big stuff, we effectively have one party, two PR firms.

‘Given the speed of the collapse, and the sheer number of contractors, retainers, spies, baksheesh-recipients and other leeches on the U.S. body politic, the exit’s been remarkably calm.’

You are kidding? How about we give this a few days.

Do you think the fate of little girls will change?

Wolf,

“Afghan government and military were nothing but a cesspool of corruption, and everyone knew it.”

After 20 years of moral cowardice and monetary corruption, you could just as easily substitute “”US” for “Afghanistan” in your sentence above.

You explicitly say as much for the top level political leadership of the US.

I agree.

But you don’t go as far as to condemn the tens of thousands of US government and military bureaucrats who…having highly detailed information (or equally troublesome, completely absent or facially farcical information) took their undeserved pay, year after year…for over 7000 days, and never once attempted to expose the habitual lies and congenital incompetence.

When people mention a rotted out “political class” those are the worthies we mean.

wolf/vvnv-the promises of the Enlightenment were, and are, only secured by a willingness of a people to wager their ‘…lives, fortunes, and sacred honor…’ to that end. Given the everpresent darker side of our species’ nature, the struggle will be ongoing.

To those now shocked at the conditions in Afghanistan, y’all haven’t learned a damned thing, or reconsidered our own arrogant betrayal of our founding principles from our experience in SE Asia over fifty years ago…

gawds forgive us, and may we all find a better day.

Wolf,

While, I mostly agree with your statement, you gave the current president too much credit. Because of the pandemic and the upcoming 20th anniversary of 2001; people care alot less about the middle east. It was far easier to pull out, because of that. We also have to take into consideration, the new colld war that the CCP has started. Before he got in, the current president was much more subservient towards China, but has changed course, since he got in. This is probably, because the US military and Intelliigence agencies were pressuring him.

Pulling out, will allow resources to be directed elsewhere; previously there wasn’t a need to redirect resources, but the CCP is now threatening Taiwan, Japan, South Korea, and pretty much the rest of the world. It’s also important to note that over time, the Pakistani military has been increasingly giving overt support to the tallies and that has been making the situation increasingly dangerous. Pakistan is of course the CCP’s only real military ally; and all US officials have been too cowardly to confront Pakistan or Saudi Arabia (who was early on, a major supporter of the tallies, and the main responsible party for 2001). Failure of any president to confront these countries has made the situation impossible to win, without going to lengths America isn’t willing to go. The situation has been devolving for years, because of the Pakistanis and others support, the US would have been forced to increase troops to maintain the status quo as it was. That given everything else going on, made pulling out much easier. Most current news about the military and world threats, now focuses on Russia and China.

But, Esper told CNN’s Christiane Amanpour, “my concern was that President Trump, by continuing to want to withdraw American forces out of Afghanistan, undermined the agreement, which is why in the fall when he was calling for a return of US forces by Christmas, I objected and formally wrote a letter to him, a memo based on recommendations from the military chain of command and my senior civilian leadership that we not go further — that we not reduce below 4,500 troops unless and until conditions were met by the Taliban.”

Esper was the Sec Defense, meaning Trump ignored his highest military advisor for the patently obvious political motive of saying he got the boys back for Christmas, AND just before the election. Maybe he thought he might also get the Nobel Peace Prize. having missed it for ‘solving’ North Korea.

Reply to reply from Wolf

Wolf you are doing the same thing Biden did in his speech Monday – divert the discussion from HOW the evacuation was done to WHEN the evacuation was done. Two separate things.

First, I don’t think anyone would disagree that Bush, Obama, and Trump all failed to appropriately address the situation in Afghanistan. It’s a fundamental consequence of civilian control of the military – for both good and bad. The military sets objectives, executes plans, and gets the hell out as fast as possible so they don’t get shot. Politicians and businessmen think of political advantages and profits and don’t understand real near-term and long-term risks. And usually don’t care about short-term risks to others or long-term risks even to themselves. So that got us in and kept us there. Pride, hubris, and greed.

Second, once the decision to withdraw was made for whatever reason – and it obviously was the correct reason – adequate plans are required to protect the US personnel and coalition personnel who have put themselves at risk based on US government promises. Trust is the fundamental basis for government. Without that you don’t have a civilization. I have seen plans and worked on plans and been the subject of such plans. I know there are always external factors that cannot be anticipated. But one can tell when a good faith effort has been made to keep faith with promises made. And that is adequate. Biden did not do that.

The lack of planning for the evacuation betrayed that basic trust. I don’t trust the US government to get me out of a jam overseas that they created. It’s just a fact of life now. It has not always been that way. And any future coalition partners will remember this break in trust. I can see a lot of rethinking coming in reassessing ties between US and China. Frankly I think they are on a par now. I think thre US lost an obvious advantage in perceived moral high ground.

Back to the issue of leaving Afghanistan. The politicians seemed to compare Afghanistan with Germany or Korea or Japan where US troops settled in for the long term. But they were blind to the differences and operated on what they desired and thought should have been. Not reality. There lies the real blame. Germany and South Korea shared a common goal with the US in joining against a perceived foreign aggressor. There was no such common ground in Afghanistan. The US government is full of meddlers. Meddlers in foreign countries. Meddlers in internal US culture, society, economics, privacy rights, and freedoms. Meddlers that want to tell everyone what to do and what to think. That is the real issue to be addressed.

the State Department sent the following message via text alert to every American in the country [Afghanistan] yesterday. The alert begins by advising the remaining AmCits that the US military and State Department “cannot guarantee your safety”, while directing them to the proper channels for any bureaucratic paperwork that still needs to be completed before they can leave.

Ha Ha! Complete your paperwork. Back in the day, the Marines would have been sent in to shoot the sh*t out of anyone harassing “AmCits”.

So they have cell phone numbers. Then they have locations. And they do nothing.

Lo how the mighty have fallen.

The war was handled badly, and with plenty of blame to go around, especially in light of the Vietnam experience. It’s practically the same problem as Vietnam.

Remember that 90% of the public wanted to go into Afghanistan to degrade the ability to train and project terrorism outside that country. I believe it was a just and reasonable thing to do at that time. Time and circumstances can change.

After a few (3-4) years, it was clear that the mission had basically been accomplished, except for finding a few of the leaders, OBL, for example. That should have been the time to declare victory, regular military leave, and continue hunting the leaders with special forces/intelligence.

Instead, the usual suspects (military industrial complex- neocons, in both parties) kept the war going- for another 15 years.

As I said, plenty of blame, but the current administration can’t be let off the hook for what has happened. Anybody who has spent time in that part of the world (I have) knows how these things have to be done, and it’s not like this was done. This specific responsibility is on the current administration.

To Tom P:

Check time lag between Nazi take over in 1933 and first roundups. Initial ‘baby steps’ applied to so few that many thought they could live with it and missed chance to escape. ‘Merely’ banned membership in many professions.

Top nuclear physicists though who usually needed connect with university or gov funding pretty much left including Einstein. One had just been taken on by a rad guy named Geiger, only to be told the position was no longer available.

The Taliban can hardly believe their luck and are on their best behavior. which is already iffy because it is not a centralized command outfit and local members may act alone.

As everyone else is saying: actions speak louder than words, meaning ‘let’s see’.

I disagree with Wolf completely on his statement that Bush, Obama and Trump “chickened-out” of an exit from Afghanistan. That country is a key lynchpin of the region as far as the Taliban and radical Islam. Keeping a minimal presence there to keep the Taliban from taking over was the smart thing to do. The real key to the middle east is to just keep them focused on their local rivalries and wars until the value of oil approaches zero and then the region will just become like Africa, a non-entity on the geopolitical stage. So put it on ice for ten years and the stakes get much lower.

What I cant understand about liberals is how they love human rights for women and LGBTQ and minorities in the United States, but dont seem to think that the Taliban, which represses those same human rights in a rabid way, is a problem. That goes the same for the liberal approach to Iran and Muslim countries in general.

Trump’s foreign policy was actually pretty decent, not great, but decent. He identified that China is the existential threat to the US, but came out with a tariff policy that only pushed factories out of China to Vietnam/etc , but not back to the US. His policy in the middle east of supporting the most moderate elements of the Saudis and leveraging them against Iran (the #1 destabilizing force in the region) was generally the right strategy. His attempts to get muslim regimes in the middle east to sign agreements with Israel should have earned him the Nobel Prize (compared with Obama’s Nobel Prize for doing absolutely nothing).

And the real travesty of the Bush presidency was not his entry into Afghanistan, it was the push into Iraq instead of focusing all efforts on Afghanistan. Iraq was an enemy of Iran and kept Iran busy in local conflicts, instead of funding terrorism in the rest of the world.

The problem with the Republican/Democrat party divide is that Republicans seem to never be able to admit that a R has ever made a mistake and the same for Democrats.

Although we have not yet seen his whole presidency, it is my guess that Biden will end up as one of the worst Democratic presidents in history.

If we look back at history in hindsight, we can see that several past Presidents that are loved by their party faithful actually did the most harm. President Clinton made changes to the financial world that led to the real estate collapse of 2007 and also to the entry of the Chinese into world trade. Both of those are defining “achievements” that make him among the most destructive presidents after he left office. President Reagan started the whole deficit spending binge and also fired Volcker, the last great Fed Reserve chairman. So in my opinion, the most loved Presidents by their partisans were the absolute worst presidents.

Obama gave us the travesty of Obamacare.

Bush the never-ending war with Iraq/Afghanistan.

Trump’s personality divided the nation even further, although, to some extent, the actual dividers of the nation are the liberal media which stopped being journalists so they could try to undermine a sitting president – damn that notion of truth or journalistic integrity in the process.

I just get really frustrated by partisans who can never see the problems their side causes.

gametv,

There was never a need to invade Afghanistan in the first place. The tallies were not necessarily our enemy. They were the enemy of our enemy, that we trained. The tallies are very tribal and their influence doesn’t extend very far past Afghanistan. They have no major objectives past Afghanistan. They have never mentioned any desire to build missles, submarines, or anything of any major threat. And they definitely don’t have the capability, anyways. Iran, wouldn’t have let them pass westward. Nowhere around them, is there any country to weak to stop them from getting in. After 911, the tallies offered to hand over bin Laden, if America didn’t invade and later that we stop bombing them, the only condition was that first, we would have to provide evidence in a courtroom in Afghanistan of bin Laden’s guilt, if found guilty, they would hand him over. This might seem ridiculous, but they were legitimately, not 100% sure he was responsible for 911. Bush, never went down that path. A leaked memo years later, revealed the only reason Afghanistan was ever invaded, was to give an excuse to invade Iraq.

Nothing positive has ever developed from either invasion.

The tallies have some influence inside Pakistan, but the Pakistani military is their major current supporter, who is also who probably lets them into Pakistan. I have never seen either party, ever mention getting tough on Pakistan. Pakistan was also where bin Laden was being hidden. By…

The Pakistani military.

The only actual military ally of the CCP???

Also, the Pakistani military.

The early on supporters of the tallies during our war with Afghanistan, Saudi Arabia. Who cultivated, funded, and gave logistical support to Al-Qaeda. America never punished Saudi Arabia.

The only actual counterbalance to all these groups???

Iran, the only major country in the middle east, besides Iraq, American leaders are brave enough to confront and punish.

None of the countries in the middle east are America’s allies. We could have just done the ridiculous trial in Afghanistan, dealt with bin Laden. The Pakistani military would have never taken control of the tallies. We could have demanded and forced the Saudis to hand over everyone responsible for 911 and dealt with them and been done with it.

As far as oil goes, there’s alot of oil sources in the world. Venezuela has more than Saudi Arabia and it’s alot closer. Dealing with them, would be alot easier than the middle east. For a fraction of the price of the middle east wars, we could have made America more energy efficient and just need less oil forever.

Wolf, wasn’t the agreement to pull out signed under the Trump administration in 2019?

Trump did negotiate a deal, but I don’t remember the details. I do remember that there were a lot of ifs, whens, and buts in the deal.

“There is an economic side of that, Wolf: one less major leakage. One more chance to re-direct all that money into wealth-building activity here in the U.S.”

I don’t think so. We always seem to find ourselves in this predicament.

This reminds me of when the U.S. pulled out of South Vietnam in 1975. I’m just an average guy of average intelligence but I find it mind boggling that we keep finding ourselves in this situation.

It is not really mind boggling. It is a well known and reliable mechanism for directing federal monies into defense industries, and subsequently campaign contributions.

Harvey – yes, there’s sure be another boondoggle, there’s just so much money to be made.

What’s different, and maybe significantly different, is that the American public is much more aware that they’ve been lied to and fleeced.

Each time it happens, there’s more friction.

The U.S. public was unfazed by the “imminent doom” propaganda from MSM re: pullout. Didn’t move the needle.

To all commenting on this excellent thread, hosted by The Master of Ceremonies of the American Economy; Remember, money sent overseas for base rents etc comes back as income to those selling property in the U.S. and as campaign contributions via U.S. cut outs.

Why isn’t George Bush in federal prison for treason? No agent of the enemy could have done more damage to our nation than did he.

Foreigners aren’t pulling any chips off anything.

They’re just not buying anywhere near as much as the US debt is increasing.

Even the overall net foreign increase – not clear to me that it is actually non-US people/orgs doing it as opposed to offshore insurance companies and hedge funds.

You disagreed with my point, then made my case for me. Thx.

TP

I shouldn’t be in this private grief, but best story I heard (RT as usual).

The ex-president did a bunk in a limo packed full of suitcases of dollars, but once he was on the helicopter with the loot, the baggage exceeded the weight limit and two bags of cash were dumped on the pad for some lucky staff to pick up.

Don’t know where the copter went but it couldn’t reach the Hamptons without re-fuelling. I also don’t know if the dollars were fresh printed from the Fed.

He’s at the UAE and his luggage only included necessary changes of clothing he says.

Yeah right!

But the MSM will buy it for their narrative.

Is irony a UK thing?

Doesn’t anybody get a tinge of it when they hear western MSM constantly denigrate China for the reported bad treatment of Muslims to ‘adjust’ their behaviour, while, at the same time, feeling entirely justified and cheer-leading a campaign to bomb, drone and kill a whole country for 20yrs because the West didn’t like the way the Taliban ran their ancient society?

BL wasn’t even there.

Russia and China and others are fully aware of the irony I think.

Amen. Getting out of no-win situations is something that puts the US in a better position. It is just sad that we did not do this years ago.

As the decreasing foreign purchases of US treasuries show, the US has been painted into a corner by the banksters’s massive thieving and control of the government through their “Federal” Reserve.

While there were desperate, Afghan people due to the exit, and the US should grant those who helped us asylum, Afghanistan was a non-win situation: the best evidence is that a huge, Afghan army abandoned its weapons or or surrendered rapidly.

Too many now foolishly forget how US casualties were rising dramatically in 2019 and would have spiked if the US-Taliban agreement signed by Trump had been broken by the Biden administration. There might even be a positive: if the CCP continues its genocides against Muslims, the fanatical Taliban may eventually start supporting an insurgency in China.

The CCP knows this and is trying to cozy up to the Taliban. It will be like that lady trying to feed an alligator recently, except no one will be there to pull the CCP’s hand out of the Taliban alligator’s mouth. LOL

After everything going on, there won’t be many Musliims left in China, so the CCP doesn’t have to worry about internal Musliim uprisings. It’s important to note, that countries like the Soviiet union and america, could have beaten the tallies, but weren’t willing to be brutal enough. The CCP is.

The big problem for the bigger Musliim world is that politicians across the world, are watching the Musliim countries, cozy upto the CCP even after everything it’s done to it’s own Musliims, and they will react to that. Right now, France is watching the head Turkey in particular, who is cozing up to the CCP, despite Xinjiang; the head Turkey threatens Europe and France in particular, all the time. There will be a reckoning from all this cozing up and it will likely result in the western world increasingly, decoupling itself from the Musliim world. Without the west, those countries will implode on themselves.

China isn’t as rich as it claims and if a few strategic industries were pulled from China, the west could apply great leverage to the CCP. China is not even remotely strong enough, to support entire regions of the world. It’s rich enough to buy up corrupt politicians, but not enough to develop a bunch of countries. The CCP depends on the west integrating countries into the global supply chain and then it tries to exert leverage from the PLA and the China market dream, to control these counties. In reality, China can’t back up all these “promises”.

Also, it’s important to note that the pandemic has cost every country in the world, more than the CCP has ever put in them through the Belt and Road.

Right now, China is trying to win over Musliim countries so that they overlook Xinjiang and so China can build up its military through Pakistan and build links to Irran. Right now, China’s navy has to pass all it’s ships past foreign islands, who can detect these ships, a naval base on Pakistan’s coast, would allow PLA submarines to move through world, more undetected. Taking over Taiwan is very important for the PLA as well, in order to get submarines, undetected throughout world.

VERY good summary RH AND TR; thank you both.

Please keep on here, sharing your insights with the rest of us fans ( abbreviation of fanatics for those not familiar) of WOLFSTREET.com

Meanwhile, for those of us former ”warrior” types who see this as just one more shame full episode, similar to the ones we had to put out of our brains while seeking personal ”forgiveness” in decades past,,,

WE the Peons can only hope for ”peace in our time” as some obviously/usually lying politician said long ago…

But,,, with the advent of the internet to all corners of humanity, increasing the availability of information, WE can hope some more, eh

Dear Thomas Roberts,

While well-armed, I think that you will see that the PLA is a tofu tiger, like the mainland Chinese tofu constructions: very corrupt. I suspect that the reason why the PLAN cancelled its planned carriers is the poor quality of the existing ones.

As the corrupt, Afghan army just proved, it takes more than great weapons to fight and win a war. Read about the Soviet Union and its tactics in Afghanistan. They also developed bioweapons and probably used all that they had during their Afghan war. Read David Hoffman’s “The Dead Hand” book.

I suspect that the CCP may have the same problems: it is a desolate country outside of the cities. Large parts of Western China are similar.

The USA might have decided to secretly help them, like the Taliban were helped against the Soviets. Giving the CCP a hot foot burn as the Soviets received might be the best way to preserve lasting world peace.

RH,

I am aware that the CCP army is weak. Defeating the tallies isn’t hard at all. The question is how brutal are you willing to be?

If America wanted to simply wipe out the whole country, that would be easy. If America wanted to defeat the tallies by being brutal, also easy.

For instance, America could have built up a genetic database of the country, then anytime a tally was caught or went booom. We could have done a DNA test, sometimes on the chunks left, and investigated their family and friends. Anyone in their family or friends who encouraged them, would have been dealt with. Doing this, would have made us win. We could have also done many far worse things, to win. America wasn’t brutal enough. The CCP, does things, far far worse than this to innocent people.

I’m not saying that we should have done any of above.

The only proper way to deal with groups like the CCP and the tallies, is to slowly cut them off from the rest of the world and apply leverage. This is something that needs to be dramatically improved upon, but is one of the only effective strategies to deal with these kinds of groups. Perfecting the ability to crack these groups from the inside, is another major need.

VintageVNvet,

Thanks.

To clarify,

Most Musllims in China, aren’t in Xinjiang. However, Xi has been cracking down on all religions in China, so that everyone will worship him instead.

Reply to reply of Tom Pfotzer

I called you an idiot because you called the chaos in Afghanistan “remarkably calm”. I stand by it based on the videos I have seen. I have been in evac exercises that you could call calm, but a real evac is never calm unless planned and executed over months, sometimes years. And executed well in advance of actual hostilities as part of a comprehensive Crisis Action Standard Operating Procedure. Do you have any idea what it takes to plan an operation involving thousands of people, ground transportation, aircraft, air control, security, even friggin bottles of water?

It is not so funny when you are in the scrum, unarmed surrounded by armed men, and God forbid with your wife and children.

There was no plan. There was 20 years to plan as everyone keeps pointing out. And Biden set the date so it was not a surprise invasion like in some situations. All he had to do was count weeks backward to schedule an orderly operation. Lists of evacuees? Addresses? Residence maps? Cell phone numbers? Transportation allocation and scheduling? Planning orders, Warning orders, Execute orders? Nothing. Hell, I get flood warning notices on my phone all the time. That’s pure incompetence. No excuse. No one can plan for everything, but to not plan anything? And the standard “No one could have seen this coming” excuse. Pathetic. For God’s sake we fought a war for 20 years and Biden could not expect a war? But the K9s were evacuated smoothly.

I don’t think Biden cares. I don’t think the State Department cares. I’ve lived. worked, and traveled overseas. I never rely on the State Department with their little STEP notices, like the one warning not to travel to Europe. Hilarious. I used to carry a sat phone and register with the embassies when I traveled, but stopped when it became clear nothing would be done.

So this is not just a Biden thing. But the evacuation of Afghanistan is all his thing as the Commander in Chief commanding what should have been an orderly, phased and planned withdrawal.

I hope I make myself clear.

Joe2- correct. Most people have never been in a situation where “real” personal safety is at stake, even in a factory, construction site, as examples, let alone in a military or security situation.

The Biden administration is responsible for the improper implementation of this action. It’s easy to sit in a chair and make a decision to withdraw- that gets no positive credit. Only proper implementation gets credit.

I am not sure where the line is between caring and cognition is with the current occupant of the white house.

10-4 j2,,, and thank you for your clarity!!!

Does absolutely NOT mean anyone on either side of the ”aisles” will pay any more attention than usual, unfortunately…

But, as an old guy with an always positive and upbeat attitude, including phrasing or at least encouraging the idea of ”atta dude” WE can hope some of our rulers/owners/masters at least start to get a clue…

Trump’s administration made an agreement already with the Taliban and released their most active members. See “Taliban prisoner release: Afghan government begins setting free last 400” in BBC. Nevertheless, President Biden correctly recognized that it was either US soldiers dying and getting crippled forever in Afghanistan or a pullout, which was planned announced months ago after it was delayed for months.

There was no need for such a rushed departure of Afghans, if the superbly armed 300,000 man, Afghan army had just been willing to delay their mass surrenders to the 75,000 man Taliban, which was armed only with machine guns, mortars, rocket launched grenades, and similar, light weapons for a month. This was a failure by cowardly, corrupt, incompetent, Afghan leaders and army, not by President Biden.

Watch Crux’s youtube program about Afghanistan’s “ghost” soldiers, which is about how people signed up as fake soldiers to collect salaries who were never actually soldiers. Search “corruption” and “Afghan government,” which is kind of redundant, since saying Afghan government is like saying corrupt government.

That Afghan government was as if US banksters had actually been elected to the government, instead of just having bribed our politicians, who know that there are some limits to the thieving and corruption that Americans will tolerate. Good riddance!

This inevitable pullout was talked about and planned for years now, as Wolf pointed out in the comments. Twenty years of trying were not enough and fifty would not have been enough but would have resulted in thousands more American soldiers dead or crippled. Right now, there is just political posturing for political gain.

Wolf.I would just say that foreigners dont recieve the real yield only the nominal yield.its only applicatable for domestic investors in the US.I am not sure the shift matters or is actuallly strange.Does it matter who owns the bonds in reality?Unless there is soveerign crisis.Only foreign investors can create a doemstic bond crisis.

To the USA foreign countries own less of the US debt. Positive for the USA as they can not dump their holdings to devaluate the US dollar.

But, with the debt and then US dollars returning to or staying in the USA the monetary inflation translates to assets and price inflation. Which is pretty much the same as a devaluation against other currencies.

Sams

We own our own debt…..its a Peter and Paul thing

We must print so we may buy our own debt.

We must print so we can buy our own debt at prices no one else will

We live in a pretend monetary world, an illusion create by alchemists and magicians

except Peter is the elite and Paul is the 95% of the rest. Peter gets rich and puts the burden on Paul.. Good gig if you are one of the elite.

Sams, foreigners hold billions if not trillions of Dollars of other U.S. assets such as China owning a portion of California real estate, U.S. stocks and corporate bonds, actual U.S. corporations and some assets I can’t come up with this early in the morning. These can be sold in exchange for their local currencies after receiving Rotting Dollars for them in a sale transaction.

So there is still plenty of foreign ownership of U.S. assets to put a hurt on the international value of the Greenback. Remember there are a ton of Dollars floating about the world since we have lived way beyond our means since WWII, and are now have the largest trade deficit in history as well as being the largest debtor nation on the planet.

An ocean of Dollars chasing too few goods Stateside as well; little is to prevent Americans from opening Swiss Franc money market or Canadian Dollar money market accounts overseas or through a Stateside intermediary. Welcome to the Powell Inflation Explosion! P.I.E. or pie. But this is not a dessert you want to end your day with.

“Nothing to worry about until the Social Security payments are worthless.”

Along with a small pension, SS is my bread and butter. Nothing to worry about…thanks for the reassurance Andy, I was a bit nervous.

:)

SS will be OK as the Gov can keep raising the percentage they collect from employers and workers. Plus, no politician wants to be the bad guy who cuts it off (I hope). It’s a Big part of what pays our living and health expenses too.

Right, but raising that percentage will either cause a reduction in standard of living to the payee, or salary increases that will fuel inflation.

As they say, there’s no free lunch.

There is no law, regulation, or statute prohibiting the Federal government from funding Social Security with another source, such as redirecting corporate welfare masquerading as the “ defense “ budget, for instance. How about making tax cheating billionaires pay as much tax as normal people ? Spare me the BS about how their paying so little in taxes is legal. How about a wealth tax ?

Wolf, you do great work. You analyses are always of the highest caliber. And, honestly, I read Wolf Street in order to learn and better understand.

Bravo and thanks!

Yeah, Good job WR and WS commenters, minus the angry ones like fire all the SS employees, etc. I get it that people are mad and afraid, but it is directed at the wrong parties.

I also want to add a shout out to those who are on SS. They paid into it their entire life and planned accordingly. To float threats about their literal survival due to created debt they had no part in making, is just plain wrong.

I was surprised at ‘tax havens’ and respective companies buying up the debt. On one hand these bastards fail to support the Country that nurtured them and ensures their continued survival, then they take that extra scoop with buying said debt for a future stable return. Profiteers by any other name while seniors watch their savings decline and young folks struggle to find housing and pay for the basics. This is the definition of insider corruption, imho.

Today’s American seniors helped put Bush 43 into the Oval Office. Some were undoubtedly motivated by his promise of tax cuts, others by his support of the culture wars. What we got were very expensive wars in Iraq and Afghanistan. There is more than a little bit of truth in the old adage “we get the government we deserve”.

Some of us seniors voted for Gore. Please, let’s agree to quit claiming that all members of any group are responsible for our problems.

To Confused: I voted for Al Gore as well. Al Gore in fact won a majority of individual votes (by about 500,000) but lost in the electoral college. Republican justices on the US Supreme Court put their thumbs on the scales of justice in favor of Bush in Bush vs. Gore. Justice may be blind in those allegorical pictures but that is not really true in real life. However, the system we have is not likely to change for a very long time. Of course not all of today’s seniors voted for Bush. But enough of them did two decades ago and we are living with the results.

So what would Gore have done if he were elected? You don’t have to answer this question.

To Anthony A: My guess is that Gore would not have gotten the US involved in a war with Iraq and that any attack on Afghanistan would have been very limited. When Bill Clinton/Al Gore left office in January 2001, the federal budget was running a surplus and the national debt was slated to be paid off around 2010.

With all due respect, those who “paid into Social Security” are drawing far more out than they contributed. That’s why it’s a ponzi scheme. And it’s been obvious that we collectively can’t afford our standard of living for decades now, but rather than come to that realization and address the problem, the people who were in charge, from the Greatest Generation to the Silent Generation to the Boomers, just ran up debt. To say they had nothing to with making it is disingenuous.

RNY

No….you are confusing SS with the stock market.

The stock and bond market pays out FAR more than the investor puts in. Yet you are fine with that but SS is a ponzi scheme?

Isn’t the stock and bond market a ponzi scheme?

And isn’t real estate investing a ponzi scheme?

I would say overwhelmingly INVESTING is a ponzi scheme.

SS is more like an annuity.

RNY, us old guys like me that put into SS over 50 YEARS did not have a choice to not put in. It was mandatory.

I would have gladly put that money into an investment vehicle in the 1960’s when I started to have the government pull money from my earnings. I am pretty sure I would have a lot more than a small monthly check from them now.

OutsideTheBox, in its current form, yes, the stock market IS a Ponzi scheme, as everyone knows earnings will never grow into valuations. It’s purely about multiple expansion, which is not sustainable.

But Social Security is indeed a Ponzi, because the amount put into the “trust fund” are never enough without raising the FICA limit or the tax percentage.

Not according to one of my junior high school best buds rnyr…

When I told him I was not going to take my SS,,, he told me that with ANY other system, I would not only get a ton more than SS,,, but would also have enough for my better half to get WAAAY more.

In spite of the challenges of being my friend for 60+ years, he was an auto didact who hated HS and would not go to any college,,, etc.

And made his mark as a mortgage broker, always trying NOT to contribute anymore than he could to SS because it was SO LOW returns compared to his other ”investments.”

And, following through on his philosophy, he now lives outside USA for ”social reasons” , apparently in a level of luxury way beyond WE the domestic retired Peons trying to live only on our SS and keep our capital intact and untouched, ready, willing, and able to ”invest.”

Those “who are in charge”… are mostly of a ‘class’ rather than a given generation, so lumping all coal types in one hopper .. calling it all the same, don’t cut it. Imo, that’s just buying into the devilgarch’s handywork – namely .. Distraction/Obsfucation.

OutsideTheBox,

The stock market only pays out more, until enough people pull out. At that point, it crashes. It has gone up hugely, because the market price and total value of a stock is decided entirely by the last transaction for said stock. It’s benefited hugely from decades of more people putting in, than taking out, because it was being saved for retirement; and the demographics worked out that way.

Most people seem to think the stock market is some kind of magic money machine, it isn’t. Eventually, it will have lackluster and even negative yields for years and years. It will go up sometimes and down sometimes, but it won’t magically allow, entire generations to put away a little money and pull out a small fortune. That money has to come from somewhere.

The stock market has real value, but far less than the current valuation. Whenever someone wants to cash out, someone has to be willing and able to buy your shares for that price, or the price drops.

Paulo, if people are mad and afraid what is the correct strategy to deal with them?

Nukes and F-15s?? .. I mean, Joe after all stated as much less than a moon ago, am I right? ……

Do these securities need to be bought by someone in order to be shorted (puts, short ETFs) by someone else?

I think Hussman has the right idea. All major financial assets are in a bubble. Government bonds look like a stupid purchase, but probably no more stupid than purchasing any other broad asset class. All asset classes inflated by ZIRP. Maybe there is some off the beaten path something of value, but buying any major asset class now for a long term hold is going to be a poor return.

That is the problem.

For decades, people have been putting in more than has been taken out on every asset class.

Government bonds, would be among the safest places, and would at least have a predictable return. While, stocks could for awhile, have a substantial negative return. Possibly, there could be another large stock market bubble in America, if enough foreigners bought in, but this is difficult to predict.

Some housing markets will be a boon, but which?

Precious metals are a possibility, but even those can be devalued in future, by Laboratories synthetically creating them, which is already being done, but is currently more expensive than simply buying existing metals.

For Americans with less than the FDIC insured amount, the best option for awhile, could be a savings account. For those in many other countries though, they might not have access to issued savings accounts and they have to stick their money somewhere.

There is a glut of savings in the world and logically, if there is little savings the return should be high; as more and more savings are amassed, yields should keep dropping, until it turns negative. It makes perfect sense that bonds from more developed countries turn negative, eventually. It could go back and forth as people save less though. A reworked Social security scheme is the only realistic retirement option for those in the future. Done correctly, this could work out very well.

Channeling a Greenspam quote to CONgress from 20+ years ago.

Wow, the Cayman Islands with a population of 71,100 and a GDP of only $5.94 billion sure has a lot of money. Snark…

Perhaps they are a saving culture like Japan or China.

Cruise ship visit income? LOL

The banks/MM funds is probably RRPO. Cash for Treasuries. They want to make that permanent. Interesting to see what sort of hit expenditures takes now that the forever wars are over. Then the tax cuts kick in. In the 70’s, our inflation analog, they didn’t have the wherewithal to expand the deficit (yet). Nixon put us on the “fiat” standard, which set the stage for Reaganomics. This cycle (postwar economic malaise, sorry JC) will go smoother. They do need to either let some old debt roll off, or cancel out some of their borrowings. Too much derivative play, over insured investors. Mainly interest rates need to remain attractive to foreign bond buyers and they are. Japan is the biggest carry trade in the universe, just no idea how it works. Maybe SDR will relieve some of the forex pressure, or bitcoin. What happens when the world values everything and everybody the same?

Ambrose Bierce,

What happens when the world is nearly flat? Everything will converge to the lowest point.

One thing about a big problem, it puts little ones in perspective.

Maybe now we won’t hear the line: ‘but what if China drops the A-bomb and unloads its US debt.’

From policymaker’s view there is no debt problem as long as:

1. Inflation runs at a steady 3-5% annual rate

2. Savers don’t object to negative annual real returns of 3-5%

3. The USD remains a credible store of value — relative to precious metals, cryptos, real estate, stocks, etc.

As long as # 2 remains in place, # 3 is a safe bet.

Google the phrase “liquidity trap” and you see a number of articles. A few months ago there was a rush to get out of cash. Policymakers must know they kept QE too long and rates too low . They can bump the FFR without putting more pressure on cash equivalents. Cash equivalents have ticked up a notch but no where near 2016 levels. If cash levels rise, then gold should shine.

I read an article yesterday about Palantir buying $50MM in gold. I found it interesting because do not recall hearing about any company (especially a tech company) ever buying physical gold. I wonder if they have a model predicting the need for it.

Just watched a video this morning of shopping in high end shops in Africa. All the goods were luxury brands or other high end goods and all were priced/selling in USD only. No local currency accepted or crypto either.

As a corollary, saw the mid priced fashion chain stores in Spain, offering incredible discounts on end of season goods. All priced in euros and the discounts were all over 50%+ off.

Russia used to have $ stores as well before the collapse of the Soviet Union in 1991.

It still has ‘dollar stores’, e.g., all the swank joints in Moscow, meaning the price is in US$ or euros but you can only pay in rubles that can only be legally exchanged at a poor rate. It is illegal to pay in dollars.

The policy makers have a political problem with housing cost continuing to inflate. I think running major economic policies out of DC is like trying to drive a car fast in reverse. It doesn’t work so well.

The Fed’s model can’t work in a free society because behavior of 330 million people is impossible to predict and people’s reactions to Fed policy undermines what the Fed is trying to do. If you believe Talib centralizing risk control undermines risk management.

5% yearly inflation make all prices double in 15 years. Not quite fast enough that everyone notices the doubling, but people will be aware of the price rice. People then may adapt. Morale or not, carrying a lot of debt is then rational if the interest rate is low. Then there is the old adage, with the debt large enough it is the bank that have a problem.

Then, what if enough and large countries outside the USA find that they do not want a 3 to 5% yearly inflation? And chose to remedy it by devaluating the US dollar by 1 to 3% yearly to have a 2% inflation and export the inflation to the USA?

And no, US industries will not be that much competitive with a debased currency as raw materials and commodities will be more expensive. Also the value of income from royalties on IP rights will decrease as these are in US dollars.

#3 may then be for US residents only, fuelling the devaluation of US dollars

Relax peeps, a trillion is just a lot of billions with an extra zero, er keystroke on the qwerty.

The gig seems awfully similar to the prelude of WW1 with interlocking alliances coming to each other’s financial aid.

Rambo’s holdings of U.S. national debt (not shown on chart) ticked up a few basis points.

He’s a sly buyer?

The FED drew the first blood.

I’m trying to abstain from suspension of disbelief…

good ones folks,,, suggesting only and once again the margins of clever of the commentariat on the Wolf Streets!!!

So what is the reason behind these shifts in UST asset ownership mix?

The major shift seems to be Fed ownership of UST has jumped from under 5% in 2009 to 18% currently.

I would guess that the reason for this increase in Fed ownership is so that the yield will not nose dive into negativity. I’m not knowledgeable enough to assess the drastic results which would ensue.

But I do wonder actually what it means that the Fed own 18% of UST debt. Who is it that actually owns that debt? Or is it kind of an abstract owner?

The primary dealers, the banks, are forced to buy the treasuries from the govt. Since the banks can’t trade for their own accounts, they can only sell to clients. The fed is buying/monetizing the excess supply to keep the banks liquid.

Technically, the banks still own the treasuries, since it’s their clearing agent(fed) exchanging the banks reserve cash for the treasuries. The fun really starts if one of the major banks has a liquidity crisis and the fed can’t cover it. Then the fed will have to dump the treasuries/securities for whatever they can get, to provide liquidity to their member bank.

P,

As one who got OUT of the SM in the1980s era because I had come to realize I had never made a profit except when recipient of ”insider” knowledge passed to me through old friends and relatives from their long term friends, etc., etc..,,,

I really want you to write a book or two,,, and if possible, get Wolf to at least read and comment, if not edit,, ETC.

Thank you,,, and please LMK asap, if you do so.

VVN,

Thanks for the vote of confidence. Over the years, I thought I was wasting perfectly good brain cells knowing all this garbage.

Petunia, would you please kindly elaborate on how / why primary dealer banks are “forced” to purchase UST?

The 5 to 18% increase in Fed ownership of UST I understand, but the participation of banks at these low yields, THAT part I did not understand at all…

Was under the impression that the Fed buys from the PDs and hence this is where the banks end up with excess reserves, the Fed has a shopping problem. The PDs are “required to submit meaningful bids.” Since the Fed never puts up actual collateral, yes the PDs own the product. This is the part that seems obvious about RRPO, the Fed adds Treasuries to its balance sheet and then the banks swap excess reserves for treasuries. Summers says this shortens the Feds average maturity so when they swap the paper on their balance sheet they end up holding shorter term maturities? Technically the PDs want to sell all their product but if they don’t that would create the problem you mention?

PG,

The primary dealers are essentially the member banks who own the fed. The faustian deal is that they are the only ones allowed to buy US treasuries, guaranteeing them a stream of income with no competetion. This is great in a normal market with excess demand, but a problem when not enough bank clients want the treasuries. Before Dodd Frank the banks could hold the excess treasuries in their own accounts and trade or repo them, now they can’t.

The fed can force or coerce the member banks to do anything they want. The fed banks operate under a bank charter, a license, and the fed can cancel those charters pretty easily. They can force the banks to participate in the treasury auctions, operate a minimum number of hours or branches. Keep rates within an operating range, etc. Basically, if a bank goes rogue, it goes bust.

Individuals can buy Treasuries by submitting a non-competitve tender before a Treasury auction cut off time at their nearest Federal Reserve branch. I actually bought some 10-year notes this way in 1988 when they were yielding 8%. But it can be messy trying to sell the Treasuries before maturity date. I don’t know what privileges primary dealers enjoy at the Fed but the dealers are expected to participate in all of the Treasury auctions.

Like a Giant Ecclesfly .. sopping up saccharin sweet liquid reserves .. to then deposit as flyspecks unto the Banksters notations .. who then sell all that dirty, sticky paper on to the unsuspecting retail mokes.. Got It! Ewww.

Petunia:

“The fed is buying/monetizing the excess supply to keep the banks liquid. Technically, the banks still own the treasuries, since it’s their clearing agent(fed) exchanging the banks reserve cash for the treasuries.”

There is a lot packed into that statement! An official description (federalreserve.gov) states:

“The Federal Reserve purchases Treasury securities held by the public through a competitive bidding process. The Federal Reserve does not purchase new Treasury securities directly from the U.S. Treasury, and Federal Reserve purchases of Treasury securities from the public are not a means of financing the federal deficit.”

I know this information might be outdated, or government BS. Below, Ambrose stated: “The PDs are “required to submit meaningful bids.”

Does that mean the PDs (which are considered “the public”) are required (by the Fed) to purchase Treasuries? If so, it is not really the public that is purchasing the Treasures. It is a Fed requirement of it’s member banks.

drift,

The fed statement is misleading. The public they refer to is not you and me, it is the public market which consists almost entirely of their member banks/Primary Dealers. They do have a department that bids on the open market for the bonds. This makes it look like an arms length transaction.

The answer to your question about what the PDs initially bid for the treasury bonds is, the PDs are fully aware in advance of the acceptable rate spread the treasury expects to pay. This has always been the case, but in recent years the spread is much tighter.

Your question to WS about how is debt the foundation of money can be explained by taking a dollar out of your pocket and reading it. It is a federal reserve “note” which is a bond, a debt instrument, exchanged for the debt of the treasury and whatever else the fed now holds on their balance sheet. That is the foundation of our money.

Petunia: [A dollar] “…is a federal reserve “note” which is a bond, a debt instrument, exchanged for the debt of the treasury and whatever else the fed now holds on their balance sheet. That is the foundation of our money.”

When the gold standard ended, “Federal Reserve notes themselves became the sole circulating legal tender (along with small base-metal coins), redeemable only for other Federal Reserve notes and not for physical dollars.”

It seems like circular thinking to say the federal reserve note is a “debt instrument,: since one cannot get concrete assets from it, only some kind of theoretical exchange for other debt instruments.

When Federal reserve notes (dollar bills) legally defined as no longer backed by hard assets, they became “backed solely by the government’s declaration that such paper money was legal tender in the United States.”

So for me, the “foundation of our money” (paper money people use) is the government declaration that it is legal tender.

@drifter:

Not this: “increase in Fed ownership is so that the yield will not nose dive into negativity” … But the opposite.

Fed is putting its thumb on the scale to keep interest rates extremely low. Had the Treasury tried to issue so many trillions of bonds to pay for Gov’t expenses, without the Fed helping out, the supply of new Treasury bonds would push yields higher.

Also, when the Fed owns 18% of the national debt, the interest on that debt is remitted (less expenses) back to Treasury. So it’s not really debt, it’s the foundation of the national money supply.

Probably what he meant, the Fed opened RRPO to keep short term rates from going to zero and busting the NAV on the MM funds. The Fed has conflicting dual mandate goals. They are attempting to flat line the yield curve, that isn’t where banks make their money any longer. There could be liquidity trap forming, while consumers are being priced out and the Fed is pumping liquidity through QE. The market is an index of misallocation.

@Wisdom Seeker

Agreed. But at what point will the Fed need to stop buying… 30%, 50%, 90%? Looks like most of the normal buyers are coming to their senses and trying to get non-negative real yield elsewhere. Seems likely the U.S. will at some time control supply and demand (Fed). What’s the point of this market?

WS:

Okay, thanks for the correction. Initially, the Fed is flat-lining rates. However, it seems like once the Fed “owns” a large portion of outstanding Treasury bonds, they would not want the yields to go negative.

“Also, when the Fed owns 18% of the national debt, the interest on that debt is remitted (less expenses) back to Treasury. So *it’s not really debt*, it’s the foundation of the national money supply.”

Due to my lack of knowledge about macroeconomics and money supply, I can’t understand how debt is not really debt, but is really the foundation of the national money supply.

@DrifterProf:

How Federal Reserve holdings = foundation of national money supply:

1) When the Federal Government “borrows” $1, or $1T via Treasury Bonds, and spends that money into the economy, they they trade bonds to someone with existing money. There’s no new money created at this point. And you’re right – the Fed Gov owes on the debt here.

2) But Next, the Federal Reserve “purchases” those $1T in Treasury Bonds from the bankers, using newly created credit, which is their great power. Notice that the people who bought the bonds get their cash back … but the government still has the cash they borrowed. That cash gets spent and becomes part of the nation’s money supply.

3) BUT notice: the Federal Reserve pays any interest on those Treasury Bonds back to the Federal Government (less a few minor expenses). So these Federal Government bonds held by the Federal Reserve (and just the ones held by the Federal Reserve) are special. Unlike the rest of the national debt, they’re interest-free to the government – no burden on the taxpayers.

That’s why the Federal Reserve’s Treasury holdings are “national money supply” and “not really national debt”.

Wolf has pointed out, though, that when the newly-created money doesn’t result in increased production or other benefits, all it really does is make everyone’s existing dollars less valuable (inflation). That’s the hidden inflation tax.

WS:

1. This statement is a bit confusing: “Notice that the people who bought the bonds get their cash back … but the government still has the cash they borrowed. That cash gets spent and becomes part of the nation’s money supply.”

Does it mean: “…but the government still has the case [it] borrowed.”?

(seems “they” can’t be the “people,” which Petunia indicates are mainly the Fed member banks, who bought, not borrowed).

2. Your original statement about Fed purchase of Treasury debt: “So it’s not really debt, it’s the foundation of the national money supply.”

This does not make logical sense. The history of the Fed balance sheet (from 1917) shows that before Fed started adding Treasury debt to the balance sheet, there was a money supply. Not Treasury debt on the balance sheet does not mean no money supply (i.e., where money supply is currency, etc.). It seems like a better description would be that Fed treasury debt is a fundamental way for the Fed to manipulate the money supply.

>”So it’s not really debt, it’s the foundation of the national money supply”

This non-debt is what the government uses to buy and eat the nation’s seed corn. Oh, look, it’s harvest time and the only vegetation we see is growing… in China.

Wolf , every time I read your article I feel like I attended an MBA class with so many commentators that add flavor to the well articulated writings. Thanks

Just a related note, because I always worry that the structure of the commenting system here is always in danger.

I firmly believe that Wolf’s current commenting system (open, allowing essentially anonymous comments…instead of closed, requiring Facebook, etc. ID) plays a key role in the generally higher quality, better informed opinions shared here.

More or less, my guess is that a fair number of pro/semi pro investors/corp fin types read the blog and occasionally comment.

But…they can only do so with de facto anonymous commenting…because corporate managements *hate* controversy that can be traced back to them via employees (blog comments don’t increase revenues but they do piss off some customers and expose organizational/business model BS they don’t want discussed period).

So, without anonymous comments, WS would likely lose some/most of the best positioned/informed commenters.

Congress is the spender of last resort and the Fed is the lender AND buyer of last resort.

“Congress is the spender of last resort.”

Yep, thank god for the Keynesian dawn made possible by flushing $1 to $2 trillion down the Afghan/DC sh*thole.

I can make a good argument that Vietnam demonstrated that we could not pay for the ambitions of the Military Industrial Complex and their enablers in Congress using Sound Money . Sound Money had to go. And it did. The electorate let them gives us the Debt Note we now call the dollar and endless bipartisan “conflicts ” ( Not War) that has enriched a lot of people since the electorate let them get rid of Sound Money. Sound Money would have forced the electorate to pay for the “conflicts” which would be immediately painful. The Fiat Debt Dollar anethesiszed the electorate’s brain and induced a euphoria that made us feel we could have it all. Profiteering from endless ” conflicts” plus a Big House, Big Car, Big Food. The electorate and its fiat dollar anethesized brain owns Afgahanastan . Senator Biden was just a salesman , looking for a chump. And did he ever hit pay dirt. The American Electorate.

An even better case can be made for the massive expansion of the welfare state that accompanied the Vietnam War is the end of sound money in the US. Wars always end but entitlements multiply like rabbits.

Well, the USA may get rid of the welfare state and become a country with sound politics again. Maybe a little fragmented and looking a lot like Afghanistan today. State welfare is no good;)

Well said. Remembering President Dwight Eisenhower warning ⚠️⚠️

My opinion of Wolf changed today after he literally tripped over himself to rush to the aid of Biden and defend the horribly botched Afghanistan pull-out. Wolf, are you trying to build a financial based website, or branch out into personal political virtue signaling? You lost a lot of support today, and remember, when you choose to make it political, you also choose to lose about 50% of your viewership. Biden is the worst President in the history of USA, he hates America, as do those that support him.

Jon Miller,

Hahahaha, that’s funny. I spent five years (1+4) trying to control the comments from the Trump haters in this comment section, and there were a lot of them and I pissed a lot of commenters off, and ran a lot of them off. Now I’m going to spend five years (1+4) trying to control the comments of the Biden haters in this comment section, and there are a lot of them, and I’m pissing a lot of them off. But that’s what you get when you run a comment section. There is nothing new.

I have hated the war in Afghanistan for 20 years. It was totally useless, wasted a lot of lives, and lots of young Americans returned permanently damaged by serving in that war, which was someone else’s civil war, and we wasted a huge amount of money doing it, and dealing with the aftermath. Bush got us into it then effing failed to get us out of it, then Obama and Trump effing failed to get us out of it, and now Biden is getting us out of it. Sure, it’s a huge horrible mess, as everyone has predicted for 20 years that it would be, which is why the three guys before Biden chickened out. But at least Biden is getting us out of this fiasco. And I’m thankful that he’s doing it and that he is taking the heat over it.

You should be lambasting Trump, Obama, and Bush for having failed to get us out of it. And then you can lambaste Biden for HOW he is getting us out of it, but giving him credit for getting us out of it.

???

Bye.

Do a ranking since QE began of the purchasers of U.S. debt by the amount of “coercive power” the Treasury has over the buyers. I think you’ll find that foreigners (least) are at the bottom, and the Fed and U.S. banks (most) are at the top. Does not bode well for the dollar as the world’s reserve currency. Also, as the debt rises, foreigners don’t have to actually sell large numbers of dollars for their total “interest” to shrink dramatically. Classic dilution.

ya’ll can talk in circles about the Middle East till the cows comes home. nothing will resolve til you recognize we ARE Rome, and are following in its footsteps, step by step.

Most of these “entities” like the city of London or the Cayman islands are just a front for the Federal Reserve.

It’s just monetization of debt.

This disaster administration is pushing us to massive inflation.

First they hide it, then deny it, then say it’s temporary, then it’s there for all to already see.

Disaster.

Far greater than the Afghanistan debacle.

$323 Billion debt bought by “Ireland” is instead debt bought by an entity domiciled in Ireland.

National Treasury Management Agency (NTMA) is the statutory body which manages Ireland’s sovereign debt. This agency sells Irish state debt, but it also buys the debt of other sovereign nations. NTMA did not buy $323 billion of US debt.

The likely buyer $323 billion debt is an entity registered in the Irish Financial Services Centre (IFSC) in Dublin city.

IFSC is effectively a self governing location where the rule of our nation is arbitrarily applied. The location is heavily stocked with brass plate entities who use Ireland as a location to claim domicile status but who have no operational presence in our country. Effectively many of these entities are shadows – they’re there but not there, simultaneously.

It would not surprise me if the Fed itself has an entity in the IFSC “buying” this debt.