In the stock market, rising leverage fuels buying pressure; declining leverage fuels selling pressure.

By Wolf Richter for WOLF STREET.

Margin debt as reported by FINRA, based on data submitted by its member brokers about their clients’ margin loans, is the only measure of market leverage that we have. FINRA reports it monthly. There are many other forms of market leverage – including those that felled Archegos and saddled banks with huge losses – but those forms of leverage are not tracked on a market-wide basis. Margin debt is a stand-in to indicate broader trends.

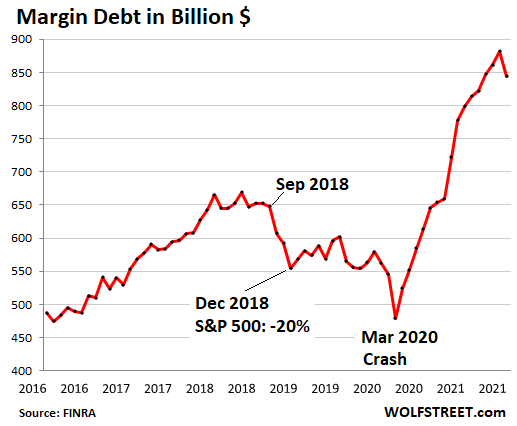

Margin debt fell by $38 billion in July, from the historic high in June, the first drop since March 2020, according to FINRA today. For the 15 months through June, stock market leverage overall had been on a mind-boggling rampage, with margin debt alone soaring by 84%. This surge in leverage fueled buying pressure funded with borrowed money. And in July, after those 15 months, margin debt dropped:

Markets piling on leverage is the expected result of the Fed’s policies of interest rate repression and asset purchases, which is inflating asset prices, as investors back up the truck and load up and borrow on margin to load up further, which drives prices up further.

Leverage creates buying pressure and drives up prices – and thereby increases collateral values in brokerage accounts that then can be leveraged up further to drive up prices further. It’s the great accelerator on the way up.

It also drives up risks – as Archegos and its prime brokers figured out when it blew up. When nervous investors deleverage, they sell assets and use the proceeds to pay down their margin debt. Longer periods of dropping margin debt are associated with big stock market sell-offs.

July was just the first drop in margin debt after a 15-month spike – and maybe it was just a go-on-vacation summer lull, or maybe it was the first step of a persistent decline.

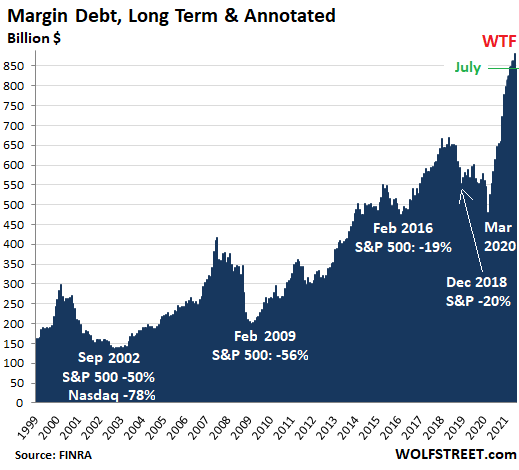

As with any dollar-denominated chart that spans two decades, it’s not the absolute level that is important because the purchasing power of the dollar has declined.

What’s important are the systematic moves: The big jumps in margin debt spanning many months that are associated with big rallies in the stock market; and the big multi-months drops in margin debt that are associated with big drops or crashes in the stock market. Margin debt and stock market levels are linked because rising leverage fuels buying pressure, and declining leverage does the opposite and fuels selling pressure.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So even though nominally margin debt has gone up by a lot, when accounting for the increase in money supply / decline in purchase power and the ratio between margin debt and the assets they purchase, that margin debt is at least in ratio terms perhaps consistent with prior recent years?

Depends on how you wish to normalize, but as a percent of GDP, it has never been higher.

It’s another indicator of the unprecedented historic mania. There is no way to rationalize that away.

FINRA reported margin debt yes.

But you could argue unreported volumes may be much higher this time round.

Another way to think about it is people are using a record amount of debt to buy companies with a record amount of debt in a country with a record amount of debt backed up by a central bank with a record amount of debt assets on its books.

Don’t think rates are going to rise much.

When I sold short, I had to borrow from my broker.

That created margin debt. That was years ago.

Now we have EFTs to go short.

There is no way to go higher. PEG ratios are demented. Time to pump something else.

Oh is that crypto spiking again?

The Fed subsidizes demand for risk assets, investors obtain obscene amounts of margin debt, risk asset costs spike…

This mechanic seems to be what govt does best…spiking the monetary and fiscal punch bowl via “Subsidizing Anything that can buy a vote”…

For example:

Govt subsidizes demand for college loans, college costs spike…

Govt are planning to subsidize demand for child care, child care costs will spike…

Govt subsidizes demand for housing, housing costs spike…

Govt subsidizes demand for unemployment, unemployment costs spike…

Govt subsidizes demand for “Product/Service Whatever”, magically “Product/Service Whatever” costs spike…

The “Something for nothing” Govt subsidizing mania is now our new normal. We are experiencing a mutated form of parasitic Govt and capitalism that pushes us daily toward the point of no return. Whether this new form of Govt and capitalism is heaven or hell…TBD…

About two years ago I used to get about $1400 interest income, now I get about $100 and my neighbor gets about $1000 for having three young children. There is $300 per month missing but I guess that is the government administration fee.

Decades ago I got $200/mo interest income. In a good month $300/mo. In 2020 my IRA was much larger. In January 2020 my Interest income was $100. By August 2020 it had shrunk, I kid you not, to $1. I stopped looking at it.

When your own government is doing more damage to you than anyone else the smell of revolution is in the air.

How long until the Fraud Reserve moves the goal posts on unemployment and/or “price stability” to drag their feet on normalizing policy?

Several Fraud Reserve officials have suggested raising the long-term inflation target from 2% to 3% to “reduce unemployment for marginalized groups.”

Fraud Reserve. That’s good for a thousand points. And even with the 25% increase in food stamps, Dick and Jane or Julio and Carmelita will still have to use both sides of the toilet paper during a wipe.

Jackson here’s a better question, how much money printing will it take to make the stock market and houses go “up” 5% per day? And how many weeks away is that?

Does anyone know if it’s possible to obtain raw data the BLS & BEA use to calculate their inflation numbers, from the original prices they collect (item, price, retailer/location) to the quality adjustments & other calculations, to the final numbers?

If they don’t make this data available, is it possible to file a FOIA request for it?

Right there,straight from the horse’s mouth:

https://www.federalreserve.gov/feeds/feeds.htm

Our Dear Fed bends over backwards to accomodate various data format tastes & preferences: xls,csv,json…

Plug this datafeed into Matlab Financial Toolbox…

Then return the courtesy and tell us ignorant yokels when oh when this thing collapses and goes belly up down the sh…t creek.

I second that, and doing a FOIA would be a good idea.

And yet the markets are un-fazed. Went to go check the markets based on this and was like. Ho hum normal day just starting at ATH.

Seriously how bizarre are the early 2020s going to look in the history books?

And the money flows. Amazing. If this market crashes it crashes UP. Soros dumped shares he bought which were held by Archegos after their collapse. Just an arbitrage trade probably. Buying the dip is so mighty I don’t need to say it, I just point to my lips.

The years since the repeal of the Glass Steagal Act must be remembered by historians as the years of the most massive CORRUPTION and stealing by banksters and Wall Street. As you all get poorer, remember that you got ripped off by the banksters. They have deceitful, apologetic propaganda out now, e.g., the Frontline documentary (now in version 2 which is almost identical to the Council of (the trillionaires’) foreign relations propaganda piece.

I particularly like the “ethics of wall street comment.” Ethics of Wall Street? What ethics? That is like talking about the bat wings of your German Shepherd or of a Blue Whale. The Wall Streeters and banksters do not have any, except “let us steal more and more and more…”

Currently, remember that the $2.5 TRILLION that has been created by the “Federal” Reserve to buy the mortgage-backed securities (”MBS”), which are guaranteed by Ginny Mae, Fannie Mae, and Freddie Mack, which will likely have massive defaults due to the non-payment of rents and mortages, will have to be paid and effectively bailed out by US taxpayers. They are like the American Taliban: everyone is afraid to criticize them or say anything since they took over organized crime years ago.

Either MORE hundreds of BILLIONS will be given to Ginny Mae, Fannie Mae, and Freddie Mack, to bail them out of their losses from guarantees of the uncollectible MBS. OR the banksters’ privately owned but deceitfully named “Federal Reserve” will take the losses and shield Ginny Mae, Fannie Mae, and Freddie Mack, by just printing dollars to create even MORE INFLATION. Either way, most Americans will have to pay, NOT the corrupt gang of banksters or Wall Streeters.

And yet there is a thread in American culture that celebrates the financial rapists on Wall Street.

Mom and apple pie sit in the background, while “The Wolf Of Wolf Street” movie gets all the foreground bells and whistles.

What generates such celebration? I think people realize that in a sense having a normal 9-to-5 job with a boss involves the bowing of the head and abandonment of free will to a kind of machine that EATS labor.

The legal bandit who is clever enough to cheat the system, whether the hacker who steals millions, or the hedge fund manager who escapes punishment for his ill decisions, and gets to keep his money, is applauded.

It’s also a celebration of having the balls to do it.

Most people would never dare challenge the monolithic face of the System. Why? For fear of the monolith toppling on them and crushing them to smithereens.

Yeah, there’s a kind of celebration of Wall Street cheaters mingled in with the negative emotions of hatred and jealousy. Remember though you always want to be the thing you’re jealous of. That’s just life.

People hate being robbed by rentiers.

The “you’re jealous” argument is super weak.

I think people hate being robbed by anyone. The list is far longer than “rentiers”.

Robert Rubin and Clinton ended glass steagal

cha ching

But it started with Reagan

A very good indicator of the animal spirits running amuck in the U.S. stock market. Shows perma-bull American investors are starting to get a little weak in the knees just based on market appreciation alone since the March, 2020 lows when a rabid bat flew into the trading pits on Wall Street.

But even more telling for these casino-style gamblers, is the current loss of momentum in the major stock indices of late. Any market that cannot continue to go up on increasing volume, also lacking, is going to succumb to Newton’s Law of Gravity.

Now one month’s worth of Margin Debt pullback does not a trend make, but it is a warning shot across the bow of today’s Never Seen a Nasty Bear Market investor. However, it is just another sign of investors starting to edge closer and closer to the exits. When the Theater of Humongous Risk on Wall & Broad finally catches fire with a waterfall collapse accredited to mice being discovered that carry the Gamma variant of Covid, the exits are going to be so clogged they will look like the airport in Kabul today.

Be prepared for not being able to access your broker by phone and not being able to get online to trade your brokerage account. Schwab has had many days in the last two months where I could not even sign on for hours. That kind of delay can be very costly in a waterfall price decline in stocks.

But I have 60% of my very modest brokerage accounts already earning 0% in cash (thanks, Jay!), and the rest very bearishly/defensively positioned. I know from 1987, 1998, 2001, 2008, etc. to always be early to leave a party where the guests are so drunk that they will be lucky to find the bathroom doors, much less the exit door.

Principal preservation is a key ingredient to successful investing. Think of what Will Rogers said of investing money.

In 1987, you could have done pretty well by investing in non-callable zero coupon bonds. A protracted period of high inflation will slash the buying power of your cash.

Paid for 2 kids college with those babies!!!

I can’t comment much on interest rates, fed, debts … But if I can contribute something that is very worrying for me, aluminum increased 65% since 2019 (prepandemic where commodities dropped in price in an incredible way), in the case of copper it increased by 70% and in the case of steel by 75% . Think about how many things these three elements use, for example an EV, a wind turbine, a common factory, trains, airplanes, ships, etc, etc … I think WTF happens with this? I would like to know what you think and I would like to have a note from Wolf who should have more access to information than me.

Everything gets a whole lot more expensive.

I think China had fun making steel and made too much and so world put tariffs on it. I think China hoarded copper and aluminum a while back.

Everything is screwed up right now with somewhat fake economy. For example GM and Ford committed to going all out on EV, but they have basically gotten out of car business and make fuel hungry trucks and SUVs for next quarter’s earnings. I don’t see them being successful unless a big tax payer credit comes with each vehicle. Reality and Utopia going to collide as money gets worthless.

Might need to retire that old trope. The 2022 Ford Maverick hybrid truck gets 40mpg for only $20k.

Is that $20K Ford Maverick anything like the $35K Tesla Model 3 (that had an average selling price of $59,300? As in – they won’t make any base trim models?

Betcha dollars to donuts that the $20K Maverick is what’s known as a loss leader…. they build one per dealer (so they don’t get smacked by the Feds for bait and switch) and then they become NLA. The automobile manufacturer that I worked for built products in lots of 50. If they didn’t get 50 orders for a white “blah-blah” in trim level “el-strippo”, the order recycled until 50 orders were accumulated – all needing to be white with the same interior. Dealers won’t want the stripped units (no profit), so they don’t order them. Guess what never gets built?

Light duty fuel average was 25.7 mpg. That’s not counting 3/4 and 1 ton pick ups. If they get exempted from EV standards going to be a lot of 3/4 luxery pick ups sold after 2030 unless fuel goes up.

Tariffs on Canadian and European products as well. Just saying.

The economy is more than just a little fake.

Try “normalizing” the FRB balance sheet back to the pre-2008 trendline and federal deficits to pre-2009 % of GDP and watch the economy crash.

It’s all smoke and mirrors.

Did they finally close out the Archegos leverage? 38 billion…kind of in the neighborhood….

That leverage was NEVER part of the “margin debt” reported here. Archegos leverage was an entirely different thing. As I mentioned, there are many different types of stock market leverage, and only a portion is picked up by margin loans.

Thanks Wolf.

So that’s really just the visible Traditional Retail and YOLO leveraged stimmy team beginning to dry up? Ouch.

Any indications this is happening in the invisible leverage pools as well?

Incidentally how have the folks in the banking pool dealt with the fiscal holes from that “family firm” implosion? Must be some ugly accounting.

Looks like a rather well known vulture just closed out some significant Archegos positions after catching the knife looking for a distressed asset play….but if they were short those positions prior to the incident they have done quite well.

It seems momentum is waning in the stock market. I will one day in the future own utilities again. I got bounced out on DUK covered calls on Jan 2020 contracts. With dividends and call sells I did about 15% . Can’t own DuK at 28x. 12x, maybe. I got that $78 locked in my un-sophisticated trading brain pan. I am short again in the QQQ and will see if we are going to have a blow off top then the go in crapper,or go to 18k in the Nas-nasty and 40+k in the Dow. If that happens I will be licking new wounds and the old wounds for stepping in front of the Fed free money bus twice. What the hell, I am long in the tooth and I have had my good luck already and deserve nothing else. If I hit it I am going to use the money to fund Dog Rescue programs locally. We need Dogs and Dogs need us. They make us smile. If I am still above ground the Wolf Street Empire could get a slice . Wolf sticks to his data and does not spray you with BS. His commenters do the BS and I love to read it. I can do it too.

I follow DUK as I am NC resident. $107 and 3.7% yield is not a good buy price imo and shows how inflated markets are. Population is growing and friendly oversight in their service area is the only pluses I see.

Dr. Doom,

I didn’t short but five years in short term government treasuries is getting painful as repression gets worse.

Keeping it simple. Price to sales of SP500 at around 3.5 is too high.

Old School. I am a tar heel also. WNC. This is an illogical market. That said there is still a good chance to get ran over by the Fed free money bus on a short. Shorting makes me feel like I need to take a bath.

Have some good memories from teenage years camping on top of a mountain between Bat Cave and Black Mountain. WNC is special place.

This is out of their control, they can end QE raise interest rates 100 BPS and run naked through the halls of Congress, it don’t matter.

How about 1000 basis points, and they can keep their blinders on!

1000 bps, and we’ll be seeing Nasdaq 2000. Got to wait till the elites are safely in New Zealand before that happens.

We have forgotten how to govern. Gave all the levers to capitalists. Everything’s good in the neighborhood. Mo money money money.

Margin debt tends to peak several months before the S&P 500 peaks at the end of a bull market. However, it is not unusual for margin debt to go lower for a few weeks during a bull market and then recover. Right now we have the biggest margin debt drop in 15 months. Volume is low, and we are heading into a seasonally weak period of Sept/Oct. Delta Covid will peak in the US in Oct and cases will drop fast just like they did in the UK. We also have morons running the country and it is starting to bite. Smart money is being cautious, hence the drop in margin debt and low volume.. I have trimmed my small cap index fund holdings by 50%, and will trim this to 0% shortly. I’m staying long with the energy index as we are now guaranteed an oil supply problem (thank you Joe). I may shift some of my S&P 500 index holding, which is now massive, into a balanced fund soon, and then lean back in during the Sep/Oct low, if we get one. I think we will end the year higher on the S&P 500, but next year I see problems with the Fed and a totally incompetent president.

Great charts showing the market is being driven by speculative mania. The Fed should try to temper the irrational exuberance by at least saying they’re monitoring the surge in asset prices. Unfortunately they’re too focussed on short term outcomes and don’t have the courage to do what’s best for everyone over the longer term.

Curb the irrational exhuberance?

They promote it.

They punish savers so whats left to do with money?

Former Fed Gov Fisher said in the PBS “The Power of the Fed” that they intentionally dropped rates out the yield curve to force investors to take more risk. Forced. Did I say Forced?

And where is the notion of forcing investors to take more risk mentioned in the federal reserve act?

Millenials getting killed by FOMO:

How Millennial Investors Lost Millions on Bill Ackman’s SPAC

Look for the article over at the Institutional Investors website.

People in general have been sucked into risk. Not saying it’s going to happen but you better be able to survive earnings getting cut in half and a PE of 6 which gives you SP500 at about 500. That would be putting in a true bottom.

Only Google and Facebook will survive and thrive. How do I know? Because Michael Burry is betting big on those two names. He’s short Cathy Woods’ ARK while holding a very sizable option position on both GOOG and FB. He’s also short Treasury through options, so he’s guessing inflation will be not be “temporary”.

Dr. Burry seems smart enough. Short treasuries has taken a lot of people out but he probably has good risk management if it goes against him.

Stock and bond markets were meant to be owned, but everything just a trading vehicle now the Fed has made money free.

Bill Ackman should be Jailed for front running this scam and using Twitter to push it. But…no one goes to jail at the top.

Buyer beware is still good advice.

Actually to be fair, Bill said through Twitter not to speculate with short dated options when it came to his SPAC. But many people didn’t hear his warnings. FOMO, YOLO, mass psychosis, you name it.

I eagerly await announcement of the new Fed program MOAR — the Margin Obligation Augmentation Racket. It will increase the employment rate of marginalized debt communities. Onwards and upwards!

Once upon a time, margin interest rates were close to the Fed funds rate. But that has not been the case since the Great Recession when the Fed adopted a near zero interest rate policy at the short end. Retail brokerage firms did not follow suit with much lower margin interest rates. I suspect that margin debt is a major source of profits for the retail firms. For small amounts of margin debt, one larger discount broker charges 9.50%. Ouch.

To be fair, margin interest rates should be high when the collateral’s value is in bubble territory.

AMC should fold theatres and become a SPAC. Just think of the biz loss it could claim. Could it become a SPAC while selling the biz to someone needing a write- off? Over my pay scale ( 0)

Maybe they could change the name and the ‘C’ could stand for crypto. Worked for awhile in dotcom bubble. How about ‘Awesome Mined Crypto’. Should be good for a few points.

Recently MacroVoices Podcast had Lakshman Achuthan of ERCI on. He noted slowing growth indicators pretty much everywhere.

Just something to keep in mind

That was a well done podcast and the text and charts can be easily downloaded. He indicates the U.S. and the global entities are heading into an economic pullback.

Of course it’s slowing. The “base effect” now includes the effects of trillions of unnecessary stimulus, stimulus which was deployed in quite possibly the least productive way possible (people buying durable goods made in China).

You can’t borrow money to create real growth. You can create temporary economic activity, but that disappears the moment the money spigot is turned off. To get actual growth, you have to incentivize and possibly fund productive activities.

None of the stimulus bills did that, so here we are.

From the data I have seen you get the best real economic recovery for the government to do nothing. Individuals figure out how to put food on the table and pay the rent if they have to. Safety net should be for people can’t, not for people who won’t.

Now we have EFTs to go short.