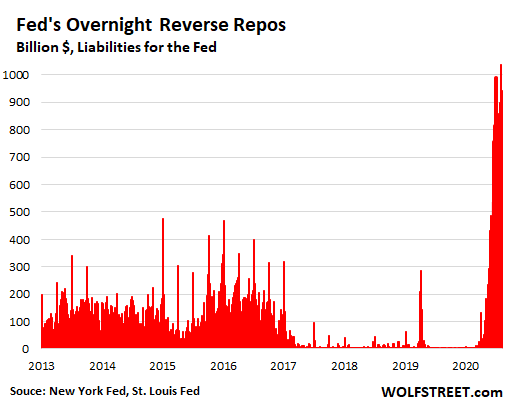

And as the Fed pumps out cash via QE on one side, it mops up $1 trillion in cash via reverse repos on the other.

By Wolf Richter for WOLF STREET.

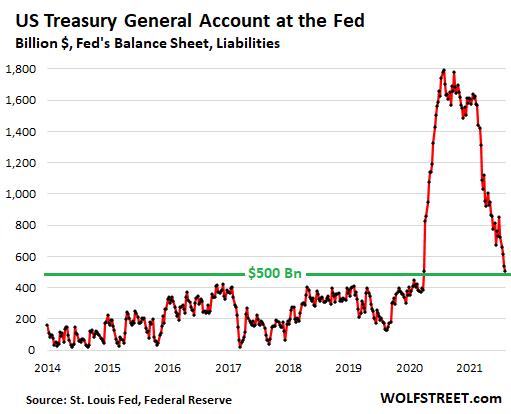

The $1.1-trillion tsunami of liquidity that has washed over the land starting in February through the drawdown of Treasury General Account (TGA) has just about run its course and is now petering out.

As of the Fed’s balance sheet for the period ended August 4, the TGA – the government’s checking account at the Federal Reserve Bank of New York – fell by another $31 billion from the prior week, and by $219 billion for the four-week period, to $506 billion.

The Yellen Treasury announced in January that it would draw down this account from $1.6 trillion at the time to $500 billion by this summer. And we’ve arrived:

To accomplish this drawdown, the Treasury, which is spending money hand over fist, raised less money in new debt, particularly in short-term Treasury bills, and made up the funding shortfall by drawing down its checking account, the TGA.

This drawdown has caused $1.1 trillion in cash to flow from the TGA into the economy and thereby into the financial system between February 2021 and now.

The situation originated in the spring 2020, when the Treasury Department issued $3 trillion in new debt to pay for the stimulus and bailout programs, and when the Fed bought $3 trillion in securities to monetize this new debt so that the market didn’t have to absorb it.

However, the government didn’t spend the $3 trillion it had raised, and the unspent amounts remained in the TGA, peaked at $1.8 trillion in July 2020, and by the end of the year was still at $1.6 trillion.

The purposeful drawdown of the TGA ends when the account reaches $500 billion, which is about now. Going forward, the account balance will fluctuate, as checking accounts do, but it should largely remain around $500 billion.

The $1.1 trillion tsunami of liquidity made its way from the TGA and the Fed’s books (where the TGA is a liability) into the financial system and caused all kinds of issues in the money markets where interest rates began to drop below 0% as all this cash was trying to find a place to go. Even 30-day Treasury bills were trading at 0% or below 0% by early June.

This is when the Fed started mopping up extra cash via its overnight “reverse repos” (RRP). At first, the Fed’s offering rate for overnight RRPs was 0% interest. On June 16, it raised the interest it is paying by five basis points to 0.05% (annualized rate). This triggered a flood of cash, mostly by money market funds, to be handed to the Fed via RRPs, and these RRPs have now been at around $1 trillion for over a month.

On Friday, the Fed sold $952 billion in overnight – well, through Monday morning – reverse repos to 68 counterparties. These counterparties have mostly been money market funds. In other words, they handed the Fed $952 billion in cash and obtained securities from the Fed for that amount, to earn an annual rate of 0.05% interest on that $952 billion.

Those reverse repos will mature and unwind Monday morning, and there will be new repos in a different amount that will unwind on Tuesday.

Reverse repos do the opposite of QE: They absorb cash as the Fed sells Treasury securities for cash, and removes that cash from the financial system. With RRPs fluctuating at around $1 trillion, the Fed has undone over eight months of QE, at $120 billion per month.

Another way of looking at the effects of the RRPs is that they have removed the $1 trillion in liquidity from the financial markets that the drawdown of the TGA has pumped into the financial markets.

Either way of looking at it, the RRPs have been a giant sucking sound of cash. One of the effects, with the offering rate of 0.05%, is that short-term interest rates have risen from 0% or below 0% in early June to around 0.05% now, including 30-day Treasury bills and the Secured Overnight Financing Rate (SOFR, the newfangled Libor replacement).

For money market funds, banks, and other financial institutions that handed the Fed this $1 trillion via RRPs, the 0.05% interest that the Fed pays them amounts to an interest income of $1.4 million per 24-hour period. Over the weekend, all together, they made about $4 million in interest income on the $952 billion in RRPs. If they do this for a whole year, it would amount to $500 million in risk-free interest income.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Overnight” keeps sticking in my craw…

Over night…over and over again….does not seem like a policy.

And .05%…

The prime rate was bouncing around at .5% each week (10 X’s .05) back in the early 80s….and at much much much higher levels.

This is hair splitting…. and why again is the Fed QEing and buying MBSs?

Where is the intellectual inquiry in the financial community? I think I know….

THEY are afraid to ask the question…because it might reveal the game.

Well Put historicus perhaps they have a get out of jail free card ?

A get out of jail card means there is the actual possibility of a high level executive banker going to jail.

Which really hasn’t happened in quantity and quality since the S&L scandal of the 1980s.

> Where is the intellectual inquiry in the financial community?

It’s out there, by very few (like Jeffery Snider at Alhambra Partners) and often they dig into the most estoric parts of the monetary system that those few actually try and pay attention to, but its there… but such is probably not likely to be a topic of any wolfstreet post :P

Came to say the same thing. It goes out and back in and back out and back in….

So what is the whole point of this exercise. Seems like a clerical step to play hot potatoe

To the Fed, cash is money and a treasury bill, note bond is money that pays interest. They are basically manipulating the value of cash and all interest bearing money from cash to 30 years. Makes investing very tough as it affects the value of everything. Stocks are way over valued except at current manipulated value of money.

Double the transactions, double the profit.

I am in your boat ND. It seems like a mafia skim operation . The Money Market has been, functionally, nationalized by the Fed to keep it squirting out its rapidly de-based fiat so MSM can not run around with their hair on fire yelling ” OMG We Busted The Buck”. Optics become most important at the start of the harvest.The dumb electorate whom do know the difference between money and currency and still,believes in the Fed as they would a King or the church in past history. They will be harvested as they always have been. It is their fate.

ND

There’s no rocket science here.

When the Fed buys anything at all, even toilet rolls, they are putting cash into the economy. (they are the only people who can actually print cash).

When the Fed sells anything at all they are taking cash out of the economy. The time scale is of no consequence, it is the action at the time that counts.

They don’t want people to know what they are doing, that is why they shroud it in complexity so that media pundits can BS for hours on what reading the bones all means.

The Govt knows it’s put far too much cash into the economy and they are trying desperately to get it out without losing face on all the promises they made about tapering and all that other BS.

Wolf, is the reverse repo really decreasing liquidity? Seems like a overnight storage of cash by the fed collateralized by the fed with bonds is nearly as liquid as cash. It’s basically another central researve account but it has a 24 hour hold. The bonds they are buying adds liquidity but I don’t think the repo market really removes any liquidity it’s just a place to store cash that is not qualified for the rate given to researves accounts.

As long as the balance of RRPs exist, it drains cash by that amount. But this balance can unwind when market conditions change, and then the liquidity goes back into the market.

Didn’t the authorize only $500B nightly, recently? How are they still polling in $1,000B?

I think you’re referring to the Standing Repo Facility, which does regular repos, not reverse repos. And regular repos are at zero now.

I think it is wrong to say that the Fed „SELLS“ Treasuries in RRP transactions. Repos are collateralised lending operations and consist of both lending and borrowing i.e. bid and offer. Neither is a money printing or money destroying operation as it would be if the Fee were to respectively BUY or SELL treasuries or bills. When the Fed LENDS money via Repo Operations (RPs) , it does so by taking treasuries from dealers (bidding for them at the Repo Rate the Fed sets and dealers are effectively obliged to offer) as collateral for short term cash borrowing (temporary cash injection into the market for the duration of the Repo, ususally a few days, sometimes, in more aggressive System management a few months) and when the Fed borrows money, wants to drain liquidity from the system) it dies so by with RRPs by offering treasuries or bills as collateral for a loan to the dealers).

It is important to understand that RP operations are temporary system liquidity management tools by the Fed and not money printing Operations. QE was money printing: the Fed BOUGHT treasuries and crates reserves for banks. That is money printing. Had they not wanted to print money but wanted to just provide temporary liquidity the Fed would have engaged in Repo operations i.e. BORROWED and not bought those treasuries and issued a loan instead of creating reserves. In turn if they Fed meant to remove them money it had printed and tighten money supply permanently it would have to BUY treasuries from banks against eliminating the reserve assets of these banks. Instead it only dies short term reverse Repos, which does not reduce the money the Fed has printed!

By doing just RRPs the risk of Inflation from the money the Fed has printed is not reduced one iota. They liquidity trap in form of HUGE excess reserves still sits unchanged on the Fed balance sheet as a liability in the form of reserve assets owned by banks. By doing RRPs Feb Fed is managing excess liquidity but not reducing Money Supply amd thus not removing at all the money it had printed and thus its potential for inflation. This is why they market is sanguine about them huge RRPs. If the Fed were unseats to PURCHASE those securities rather than borrow them through RRPs then all he’ll would break loose as the market would correctly read that as monetary TIGHTENING. Watch for that and more importantly watch what happens to the reserve balances held by banks at the Fed (the printed money) i.e. if the banks start drawing them down (meaning their lending increases). Watch the loan/deposit ratio go up from historically insane lows and with it watch M2 velocity

There was a mistake towards the end of my previous comment. The sentence there should read:

This is why they market is sanguine about them the huge RRPs. If the Fed were instead to SELL those securities rather than lend them temporarily through RRPs then all he’ll would break loose as the market would correctly read that as permanent monetary TIGHTENING.

There was a mistake towards the end of my previous comment. The sentence there should read:

This is why they market is sanguine about them the huge RRPs. If the Fed were instead to SELL those securities rather than lend them temporarily through RRPs then all he’ll would break loose as the market would correctly read that as permanent monetary TIGHTENING.

Apologies for that

Its called a “Repo Roll.” Common amongst Wall Street. But why is The Fed buying MBS? The Fed would say “Why not?”

The Fed is buying MBS to control and maintain mortgage rates.

“The Fed is buying MBS to control and maintain mortgage rates.’

I think that is manifest.

The question is why at these levels, 2% below inflation which is a rarity if not a unique condition, and with the housing market at all time highs?

I am not sure why, but J Powell said government backed mortgage backed securities are very similar to treasuries. Lowering the rate on one will lower the rate on the other by nearly an identical amount. Buying both is a way to try to lower rates for mortgages and probably other long term debt as everything is a spread off of treasuries.

I know you have no trust in politician, but you got to trust your eyes and your computer #1 in your brain.

Virus- Is doing what biology’s positive feedback loop does, it’s going to keep going until it can’t. Think end of dark ages Europe that gave birth to the renaissance . 1/3-2/3 of people killed by bubonic plague which was on a positive feedback loop of unsanitary conditions-rats-fleas-pathogens-humans dead. At any point use of human brain could logically try to solve/mitigate problem but did not occur because of social dogma.

Politicians – Who’s trying to do what?. What do you see every day?. Who is pushing for fascism aka competitive authoritarianism?. Why?. How does they benefit or not benefit vs a truly open democratic society? Who do you think is going to do better in 30 yrs vs the Chinese Commies? A authoritarian corporate state or a open democracy? Who did better against the last Commie dictatorship? Why?

The financial institutions will be playing with fire if there is a second Trump administration starting in 2024. He’s already talked about renegotiating the debt instruments and paying pennies to the dollar. After all, if he could do it (he thinks) with his Atlantic City casinos, why can’t a sovereign state like the U.S. of A do the same . . . .?

Catmax

“He’s already talked about renegotiating the debt instruments and paying pennies to the dollar.”

Could you point to a source ? That’s a rather remarkable claim.

It is quiz time everybody!

A gambling addict, a drug addict and the current financial system have what in common.

A. Excuses.

B. Ways to finance more poor behavior.

C. No real prospects.

D. Limited time until it ends.

E. All of the above.

Alpha – It is going to be different this time!

Beta – I am unique

Doing the same thing over and over…

It will be written, cutting rates is ONLY stimualtive in the short term. Protracted, it is dangerous as it promotes over leveraging, irresponsible debt creation, desperation investing, yield chasing, et al..

Former Fed Gov Fisher said the Fed FORCED investors to take more risk.

Where and when did the Fed become the intentional forcer, the coercer of the participants? Force.

Altering the markets for the market’s sake.

It’s a small club…

And you (and me) ain’t in it.

“Over the weekend, all together, they made about $4 million in interest income on the $952 billion in RRPs. If they do this for a whole year, it would amount to $500 million in risk-free interest income.”

2,

The way I understand it, that risk free arbitrage that the Fed has created for banks is central to the Fed’s (mostly theoretical, macro untested) ability to really withdraw liquidity/undo QE from the monetary system.

More or less, that riskless return is intended to keep banks from making the absolutely riskiest/crappiest loans (including to the US Treasury?) at the margin, by providing a way for otherwise idle bank funds to earn a comparatively tiny return (but risklessly!) from the Fed’s bottomless bag of funny fiat.

Banks don’t need or want Reverse Repurchase Agreements at .05%, when they can earn .15% on their reserve account balance.

Good to know.

Then why the two similar programs? How do the players/objectives differ?

What I know I’ve learned via the internet. But as Wolf points out money markets don’t have direct access, if any access at all to becoming bank reserves.

Reserve account…

required or excess reserves? Or both?

What rate on excess reserves?

The reserve requirement is now zero, so excess reserves are anything over zero. The .15%, as I understand, is paid on the entire reserve account.

Reserve accounts are very tricky, to me. The experts (Jeff Snider, Brent Johnson, Steve Van Metre, etc.) make reference to them, but seem to go out their way to not define them or their composition.

Wolf is the only one that I have seen who answers direct questions about them.

CB,

Banks are still required to hold (smallish but real) reserve capital against possible future loan losses.

The “excess reserves” that the Fed will pay the 15 bps on, is the amount *in excess of* the capital requirement for that particular bank’s level/composition of lending.

The Big 4 TBTF banks have astronomical amounts of excess reserves that could serve as the foundation for trillions in new loans…but those prospective loans are hideously crappy risks.

In theory, the Fed can use that bps payout to calibrate banks’ willingness to “further lend on” QE engorged capital/deposits at the margin, to the crappiest, riskiest loans…a riskless 15 bps looks better than excess reserves being “loaned on” to a debtor who can barely fog a mirror.

Cas127,

It seems you mixed up the terms “reserves” and “capital,” and now much of what you said is wrong. There are no “reserves” on a bank’s books. Reserves is a term that is used to describe cash that banks have put on deposit at the Fed. Reserves are a liability on the Fed’s books that is called “reserves” on the Fed’s books. On the banks books, this cash on deposit at the Fed is an asset called “cash” or “cash equivalent” or similar.

Capital = equity capital or called regulatory capital for banks. “Capital” in the simplest sense = assets minus liabilities. It’s what you have left over after you pay all your debts.

I’ll just address your first point. I don’t have time for the rest.

“Banks are still required to hold (smallish but real) reserve capital against possible future loan losses.”

No. Reserves have nothing to do with loan losses. Loan losses eat up equity “capital” not reserves. That’s why there are regulatory capital requirements. Loans that the bank issues are assets to the bank. When loans go bad, the assets shrink and eat up capital. If too many loans go bad, there is no capital left, and the bank gets shut down (“resolved”).

The capital requirements have NOT been removed during the pandemic, they remain in place. Only the reserve requirements were lifted. Two totally different concepts.

Well if we think about it for a moment , the government is giving them .5% interest on the repo ,but the inflation rate is close to 6% , so basically the government is giving them back dollars that have depreciated in value , ergo the government is making money lol

Banks are not paying the inflation tax, the money is not theirs, it belongs to bank customers who pay 100% of the inflation tax being levied by the Fed on savings.

The banks are skimming Fed interest income on other people’s money.

This is just one tiny problem in a vast sewer of monetary mismanagement. The Fed has simply made the cost of capital too lower for wealthy investors. Currency collapse is the only option left for the system.

Mylady…

right you are.

There was a guy on one of these sites who always used to say the same thing: housing will tank soon. This isn’t about housing but that came to mind as I’m always saying this won’t end well. What they’re doing is beyond comprehension and there’s no denying it’s fuel for the inner conspiracy-theorist in everyone that this has to be by design. I don’t know any of you but I can be virtually certain that neither Wolf nor any one of us commenters would ever do what the Fed is doing. It begs the question, why are they doing this?

I hope I treaded lightly enough on this one. It’s been a while since I’ve been moderated.

A good question as, obviously, it is being done on purpose by very smart people.

Most likely:

1. To keep those in power who they want in power

2. To keep the plates spinning as long as possible to keep the good times going for those in the club

Wait…you can get out of moderation? I think I have been in it for years.

2banana said: “it is being done on purpose by very smart people.”

_______________________________________

It is being controlled by very devious, self interested, cunning people, and is being implemented by very corrupt, morally bankrupt, bought off people.

I disagree, I think they are ignorant idiots.

Occums razor – the simple and most obvious answer is most often the true answer.

Do you really believe that Fed officials are the noble geniuses they believe themselves to be?

They have made themselves wealthy beyond their wildest imaginations. Every time Jerome Weimar Boy Powell dials up some QE, his net worth magically grows. Gee, I wonder what he’s financially incentivized to do?

Is it wise? To give wealthy, corrupt, and entitled people a great, but limited range of powers and expect them to use it wisely. Would they use those powers, just because they could?

They are definitively not noble. They are also not geniuses. They have at least enough intelligence to wield their powers, to enrich themselves, knowingly at the expense of the actual economy.

It’s unclear if, even if they wanted to, would they know how to use their powers, to help actually grow the economy in a sustainable way? Looking at the current failed crop of CEO’s leading most large corporations in America; I would say, “the ivy league” doesn’t teach such things. They only teach, how to make it to the top and enrich yourselves and how to get away with it and why you should do that.

#ReplacePowellWithAI

“They are definitively not noble. ”

Agreed. They have no idea the damage to the real world, the working, earning and saving people of this nation inflation brings.

They have no idea, and dont want one.

BTW, they exist to “fight inflation” with their stable prices mandate…..

but boldly push for inflation. THIS IS AN OUTRAGE….but not a peep from Congress….who loves the free money.

They are closer to evil than noble.

Not an expert by any means but doesn’t this have to do with Velocity of money flowing through our financial system?

There are surely unintended consequences around what may be needed to create and sustain velocity when it weakens.

Wasn’t the super-scary thing in 07-08 that these money gears almost seized up?

Secretary of Treasury Paulson at the time has written about this.

Like to hear Wolf on this, thanks!

Velocity of money involves a calculation that puts the money supply in the denominator.

The Fed, remarkably, exploded M2 last year……and that sharply reduced the velocity. The system is more clogged than ever by a money supply sharply expanded by an unelected committee who, IMO, was never intended to have such control over long term conditions. The Fed was charged with assuaging banking liquidity issues, not the MACRO central planning that they seemed to have taken upon themselves, a plan that apparently involves water running up hill and plates spinning.

I agree. The Fed is not the right institution to run commerce or the economy. Congress does that. Unfortunately the population has no clue how the government funds its spending, so they elect people who don’t know either.

@ MJ – “Secretary of Treasury Paulson”

__________________________________

listen to that bended knee joke at your peril …………

It was Jim Taylor

“housing to tank hard”

Here too? I used to read him saying that on another blog.

It was Robert Beckman in his book; The Downwave, Surviving the Second Great Depression . . . that set that “housing to tank hard” debate into motion in 1983 where he set out an argument for house prices to revert to 1939 prices. To quote:

“We are moving into a period where the world as we know it will be turned upside down.

All the things we associate with the right course of action during the past 30 years will suddenly become the wrong course of action.

All of the things we were told were wrong things to do will become the right things to do.

We are now moving into the Downwave.”

So 38 years later than he predicted; surely his Downwave has at last arrived.

Who would lend money for 30yrs at 2% below the current inflation rate?

Only the Federal Reserve….and the question, as you state is WHY?

And who is advising the Fed on all this? The unprecedented “partnership” of the Fed and an “outside” entity.

It may be innocent, but it doesnt look that way to me, IMO.

Someone might when it isn’t theirs, not just the FRB.

People behave very differently when they are placing someone else’s money at risk, like fund managers, hedge funds and private equity. There is herd mentality in effect but at least some of them must know they are participating in the greatest asset mania in the history of civilization, yet they do it anyway.

historicus,

No outside party is “advising” the Fed on its purchases of Treasury securities. The Fed does this on its own just fine, and always has.

Fed has 700 PhD economists on their payroll!

30yr refers to 30yr mortgages, I should have made that clear.

I think the worry here is that the Fed may be part of the inside, not the outside. Why would they be doing this? None of us can predict exactly what will happen, but we all know it won’t be pretty. Several of the folks here remember the 70’s and what it took in the 80’s to stop inflation etc. this is way worse. CPI is a bunch of made up numbers. Inflation has to be 50% or higher. Something as ordinary as carne asada meat is running over 200% higher. Rents are up 15% minimum, gas up, construction materials at least 25% across the board. The anecdotal evidence is in our faces. Wage growth is on the horizon as they’re all experiencing this too, and it’ll be needed for employee retention in certain industries. New cars are going at or above list, used cars are out control, just try finding a decent used truck. There’s nothing transitory about this at all. Money’s being flooded into society, interest rates are insanely low, etc. We see it, so they must and just don’t care? There’s more to this than meets the eye.

Historicus: “Who would lend money for 30yrs at 2% below the current inflation rate?”

If I am not mistaken, it means more money was created than anyone knows what to do with.

This situation will likely persist until something happens to change it.

Congress may have noticed. Now they want to spend new stimulus money on something productive, like employing people to repair roads, improve water utilities and sewage systems.

Five states–Arizona, Idaho, Iowa, Montana, and Ohio plan to give income tax breaks, (guess which group will get most of that), which sort of defeats the whole point of the stimulus to begin with. Or does it? ? ?

The Fed buys $40 Billion and more a month of MBSs…..well below inflation….putting more and more money into the system at rates well below inflation.

” why are they doing this?”

_________________________________________

Big Picture: – They are suppressing interest rates and giving cheap money to insiders.

I wish I was a Bank.

I could get free money from the Fed (because, apparently they printed too much), hold it for a while, then give it back to the Fed and get paid 0.05% interest on the free money I gave back. And that interest income produces no wealth in the economy.

Yeah, and then you can lend it out to credit card borrowers at like 10-30% interest. Nothing to see here.

Ha ha ha ha yes this has been called a bank for about 3000 years or maybe more but our Anthony only settles for 0.05%, he would be an honest banker never seen before.

In France when they first tried fiat currency and the Mississippi company went bust, if you wanted to insult someone you called him “a banker”.

Curious that Fed policy intended to help “main street” offered no relief to the high charges on borrowed money by the residents of “main street”. Only the big boys got to borrow cheaply.

End the Fed.

My friend inherited shares in a very small bank. Only one or two branches. It’s a terrible business. Big banks might be a good business, I don’t know. You can buy shares in them if you think it’s a money maker.

The way I see it, the Fed is acting as a pawnbroker providing overnight loans for the high rollers in the large bank trading departments who are treading derivatives when they provide money (for normal repos) and treasury securities (the collateral) for reverse repos. Unlike a pawnbroker in Las Vegas, however, they pay the entity they are dealing with a little interest for the privilege of conducting business with them. Very strange business model.

Wolf, it’s ok. Robinhood, and the rest of the gang, already went IPO. For $Billions. Scratch that. Tens of $Billions. All is well now.

How to know top of Market when ipo,s go nuts watch out spac,s make chamathta 20% games rigged we lose pensions 401k house great reset right in front of your eyes simple really

Enlightening article. Nothing like it anywhere.

With the Kappa, Lambda, Omega, and Upsilon variants waiting in the wings, it will be awhile before the opportunity, I mean crisis, is over.

It seems the Fed is supplying the financial system with money-good collateral, even if only overnight, unless it repeats this exercise regularly, in which case there will be money-good collateral available until the Fed stops the exercise or slows it down considerably.

I think these are technical issues with the Fed being at zero bound. It would seem like it would have been better to stop at Fed funds rate of 0.5% instead of going to just above zero.

Zero bound kills money market fund business and Fed had to mop it up or they were going to break the buck.

Past vaccination performance is no guarantee of future results.

Media already talking about a sub strain Delta-Plus which evades current vaccine. And substantial fraction of new cases are among vaccinated populations.

Outcomes hopefully less severe but basically evolution is finding a way … and we need to be mentally flexible and ready to adapt. Yet this is not a characteristic of either party IMHO…

So true – check out Ba rac k Hu ss ei n O ba ma birthday party pics from tonight. Sick!

Climate czar took his own fkng plane! W T F !

Why buy a house that sits on water’s edge when CLIMATE CHANGE is gonna put it asunder? W T F !

TenGallonHat- obviously these people don’t believe their own BS either.

The “liqidity”- I am not a bond or money market expert. What I have read from the experts is that this is mostly aimed at “confidence/sentiment”, i.e. that the money actually isn’t meant to do anything most of the time except as a signal.

We’re being robbed.

Brian…

Why hasnt the country awoken to the fact that everyone just got a 5% pay cut on current earnings and any saved earinings?

The promoted inflation by the Fed, who refuses to lift a finger to tamp it down, is a scourge and TAX on the citizens…..only Congress may tax, not an unelected body of central bankers. (Congressmen must answer to voters)

How can a Fed Chairman, charged with “stable prices”, stand before a group of “financial journalists” and say he is promoting inflation, and not a word or a “hey, wait a minute”?

Don’t worry, Powell’s tune will change as we get closer to the 2022 midterm elections. One party will continue to relentlessly pin inflation on the other party, and he’ll end up doing a 180, just like he did with T in ’18-’19. Anyone who believes the Fed is immune to political pressure is naive.

Wage earners got a pay cut. They create wealth.

Rentiers got free money. They appropriate wealth.

More people will become rentiers, decreasing growth, necessitating even lower rates.

Which then rewards rentiers, back to step 1.

This is the dynamic.

Why don’t you sell your labor in a country with no invested capital and see what your wage would be?

“We’re being robbed.”

News from 1970.

We have already been robbed.

The economy had been effectively asset-stripped by 2007, the very profitable products of this asset-stripping of America and its middle-class fueling a series of market bubbles driven by this transfer of wealth, (“transfers” in both who holds it, as well as how wealth is created in this empir…er, country), finally leading up to the market meltdown of 2007.

After 2007 this system maintaining the monopolization of power and wealth has been fueled by financializing/arbitraging debt, rather than financializing the profits of arbitraging the asset-stripping of America.

So technically, we have already been robbed, and now we are being enslaved by debt obligations to exactly the same people who robbed us, to maintain the economic-social-political corruptions that already robbed us…

AlexW…

yep….those who created the mess in 2007 end up the winners. (Dimon, et al)

Those in power decided that the Fed would change to be a new entity, ignoring mandates and pumping and plunge protect from that time forward. And Congress will not mention a word of caution or objection as the free money will be “candy” to the children in Congress….and politically, who could object to the free money?

You are only being robbed if you are trying to save for your future.

Don’t try to save.

Spend everything you make, borrow money more, take the free stuff the government hands out and let the government pay for your future. Follow this prescription and you will be fine.

It’s all good until the government stops giving out the “free stuff”. And I am pretty sure that will happen (eventually) when the gov has no need for your vote anymore.

they will always need our votes! we live in a democracy!!! ?

Few things stand out:

1) the name “treasury securities”. What’s so secure about those? Because …

2) “treasury securities are a liability on the FED’s balance sheet”.

Essentially the FED is paying 0,05% to get these ‘secure’ liabilities of it’s balance sheet. Where comes the 0,05% from? Does the FED ‘print’ that too?

This whole RRP thing is swapping a FED IOU for a treasury IOU and vice versa. Is the FED not willing to hold the treasuries, or is it the market not willing to hold cash? Or both. It looks like both parties are not sure about the one or the other? Hence the daily swap. Which is the bag and who is holding it? I don’t get it.

The majority of “wealth” in the financial system is just someone’s else debt, including the “money” we all have “on deposit” in banks.

Stocks are also a liability, a perpetual one. It may represent a claim on something of real value and a cash flow stream (dividends) but for over 20 years, at ridiculously inflated “value”.

Dividends on S&P are a good example. Current yield is 1.2%. That is all that can be paid out because the rest of earnings must be invested to try to grow, including growing dividend payout. So that is your long term income stream that may grow at 4%- 6%. The nominal SP500 index may boom and bust but your income stream is very low. The dividend payout and dividend growth rate is the real long term value. The current 4400 is the speculative value that might be 6000 or 600 next year at this time.

Old School

” the rest of earnings must be invested to try to grow,”

dont forget stock buy backs.

Related: just saw a bit on CNN that stocks of Chinese cos traded in US are not actually a claim on the co. Chinese companies by Chinese law can only be owned by Chinese. But they want to raise US$ in US, Solution: a middle company usually based in Cayman Islands.

In the case of Didi ride sharing co, the US investor may like the idea but to participate he will buy shares in Didi Global which is not the parent but has contracts with it.

The prospectus warns this arrangement could be open to review by the PRC but who reads a prospectus.

CRV,

1. Repos and reverse repos are “repurchase agreements,” meaning an agreement between the parties to repurchase the security after the term (for these overnight reverse repos, the term ends the morning of the next business day). So the Fed isn’t getting these Treasury securities off its balance sheet.

2. No, the Treasury securities are NOT a liability on the Fed’s balance sheet. The “reverse repos” are a liability.

3. There is massive demand for these Treasury securities in the market which is sitting on too much cash that cannot earn anything.

The treasury securities are an asset (created by Congress) to the Fed and a liability to the US Treasury/government.

“There is massive demand for these Treasury securities in the market which is sitting on too much cash that cannot earn anything.”

FDIC stats illustrate just how massive essentially unloaned balances are at the TBTF Big Four (mostly a function of their disproportionate size).

For those four in particular, the Fed’s “tool” to “control” QE effects operates as an enormous risk free money machine.

It can also be seen as a mechanism for the Fed’s Big 4 stealth recapitalization/offset for new and historical loan losses.

These heads banks win/tails banks win games are one reason why the Feds have made starting a new bank tremendously difficult (look at de novo numbers over the yrs)

There is too much money in:

stocks

treasuries

corporate bonds

Junk bonds

housing

money market funds

Gee. Wonder why that is?

Wolf….

Would you agree that the Fed (Powell) put too much liquidity out there and refuses to make the hard decision to actually take it back, thus the RRP overnight game?

Seems like it. To me, he put too much liquidity out there the first day the Fed started QE.

Wolf,

When it comes to QE (used to paper over the increasing consequences of DC’s decades of policy/operational f-ups), the Fed’s policy bias seems clearly slanted to be one of shock-and-awe…better to go too big than too small.

Not saying it is right…just that for 20 yrs the Fed has seemingly stopped caring too much about inducing printed paper inflation.

(In point of fact, by loudly making “deflation” – known as cost savings among normal humanity – into a monster, the Fed has *advocated* inflation…so long as it “only” erases any benefit to US consumers of the China price…).

It is about getting some return, however low (.05%), on money market funds.

My take:

1. QE is to keep interest rates low – higher rates would trash government’s deficits, the economy and the housing market.

2. RRP is to mop up excess cash in the market to prevent inflation appearing in CPI/PCE figs – once inflation appears, there will be upward pressure on interest rates – see point 1.

3. How long can the Fed keep the charade/house of cards going? Each iteration takes us closer to breaking point.

4. Ultimately the market sets interest rates, not the Fed. Eventually the Fed will fail – financial collapse, shortages, hyperinflation and widespread poverty?

Andy said: “4. Ultimately the market sets interest rates,”

__________________________________________

The “market” is distorted, at best – The FED gets to digitize money at the click of a button.

The FED controls interest rates, There are no bond vigilanties.

We have been flooded with dollars. The FED is doing Reverse Repos to keep interest rates elevated (What a joke) to .05% for money market funds.

cb

“The FED controls interest rates, There are no bond vigilanties.”

In the late 70s and the early 80s, the Fed actually followed the market…with rate moves, on occasion. The banks raising the prime, usually on a Friday was key. All eyes were on the money supply.

1/2 pt moves were not uncommon. Now .05% is a hand wringing event.

The Fed has accrued much more power, with each emergency. And the digitizing, the digital minting, has given the Fed even more powers.

I am afraid bond vigilanties have lost their power. This is no longer a free market. The Fed ignores two of their THREE mandates, and people just shrugged their shoulders. Remarkable.

It is pathetic. They are ruinous thieves in plain daylight. But some, Wall Street, Bankers, Large asset holders, Politicians, etc. benefit and shower the FED scumbags with accolades.

Andy

” higher rates would trash government’s deficits, ”

and the artificial low rates allowed this dangerous condition.

The real cost of borrowing would have kept deficits down and things in balance. The imbalance is purely a result of the Fed with their thumb on the interest rate scales ….and it is damaging.

It will be written that low rates can stimulate in the short term, but protracted they beget irresponsible debt creation, over leveraging, desperation investing, and yield chasing.

Former Fed Governor Fisher admitted they FORCED investors (the people of this country) to take more risk. (“The Power of the Federal Reserve”, PBS documentary can be found on the PBS website)

Is it the charge of the Fed to “Force” the people to a mode of conduct?

Is it right for the Fed to steal from the people via a promoted inflation?

More salient, for me, in that PBS documentary (“The Power of the Federal Reserve”) was another Fed guy justifying the obscene expansion of the wealth gap as a by-product of the Fed trying to increase employment.

He said leaders of lower class areas were begging the Fed to do something to increase employment. So THAT was the reason the polarization between rich and poor increased. Shocked, they were, and surprised that this surprise windfall for the filthy richest classes occurred. I guess they didn’t notice it happening over the decades. Or they thought the wealth would “trickle down.”

Something doesn’t seem right about making the major issue to be that investors were “forced” to take more risk. Many hard-working people live paycheck to paycheck. They have nothing to invest. If you think about it, investors are not forced to do anything.

Adam Smith would not approve of this, I think. He favored taxing the wealthy not in proportion, but more than proportion. And he didn’t like huge profits. He said huge profits were common in nations going into ruin. So far, so good.

Chris Herbert:

+1000

Chris H.-there’s his pesky ‘…well-regulated markets…’ position, again…

may we all find a better day.

drifterprof

“Something doesn’t seem right about making the major issue to be that investors were “forced” to take more risk.”

That leaped out at me. Former Fed Gov Fisher said the Fed FORCED investors to take more risk….Is that their place?

This ruse of keeping rates low to promote employment, while ignoring “stable prices” and actually promoting inflation must end.

Powell said the unemployment today, with RECORD JOB OPENINGS, is due to COVID fears, child care issues, looking for better jobs, and generous Fed payouts (he forgot to mention the cheap money as provided by the Fed).

But these FOUR reasons for the unemployment have nothing to do with interest rates, but he points to keeping rates zero to solve the employment condition. This is DISHONESTY.

?

@ Historicus – Great commentary. Your contributions are clarifying and much appreciated.

Just like the soldier on D Day you are expendable as an investor for the common good of DC surviving.

However, the people who own the Fed banks are not expendable investors.

And rates drop as permabears growl.

Dont fight the FED is the best advice ever given. Doesnt matter how or why what they do.

If you fight them you will be on the losing side for years, even decades

There is some truth in it, but when people panic Fed is pretty much helpless til the panic is over. Used to be they would cut rates as the stock market kept falling. Now they tend to fire the bazooka on day one. Market asset prices still about 20 times bigger than Fed.

Libdis…

“Dont fight the Fed.” Ok. You must go with the Fed…but you will be the last to know where they decide to go. Kinda like a kids game called “crack the whip.”…and you are at the end of the line.

It is not a level playing field….have you noticed?

If the debt ceiling isn’t raised, is Yellen going to be forced to draw the TGA down to zero? Is that even possible?

Yep, but the theater will be over before then. Congress used to have to approve any new debt issuance on an individual level. It later got grouped into approving an amount of debt. Later they just suspended debt ceiling. It’s getting to be a banana republic farce or a professional wrestling match for us peons.

If the debt ceiling isn’t raised, and the US defaults, the dear Members of Congress will take a HUGE personal loss on their stock and bond holdings as the markets come apart. That is why the debt ceiling will be raised — and why it has always been raised.

Unless they all say “Aw hell with it…the gig is up.”…and short the market.

That would be interesting ;-]

And if anyone can front run the market, it’s the Congress, far more than any hedge fund or megabanks.

Cause, you know what, Congress makes the rules, Congress gets the gold. what would be cool is if the family and associates of every congressional member has their trading accounts in broad view of the entire world.

The DEBT ceiling has been raised more than 44 times in the past decades but both parties will put ‘smoke & mirror show’ with their crocadile tears!

MCh

“And if anyone can front run the market, it’s the Congress, far more than any hedge fund or megabanks.”

Keep and eye on Nancy Pelosi’s husband….watch to see if he buys S&P puts…

Wolf / Great article. Your the man ! Tks. / : )

There is massive civil disobedience going on now around here that I noticed the other day. My County, Montgomery County has the highest vaccination rate in the country. 99% of the vulnerable population is vaccinated. There is no spike in hospitalizations and practically zero Covid deaths. Yet these clowns that run our county government want to force everyone to wear masks to protect the unvaccinated, who are mostly the 20 to 40 year olds. I am one of those who don;t give s$it about the unvaccinated. People are starting to ignore the government’s mandates and telling them to take a hike.

Wolf,

It looks like Congress has roughly 4 months to raise the debt ceiling. No way they won’t raise it. Perhaps that is why the infrastructure bill has been pending for so long.

I’m in the camp that this is a deflationary move, but I don’t think it is deflationary enough. One question I have for you is, how can you have excess reserves when the reserve ratio has been slashed to zero? It seems the repo market behaves more like a sweep account and if that is the case, couldn’t banks still use those deposits at the FED to expand credit when returned?

If you look at Deposits, All Commercial Bankstal reserves, and Total Reserves of Depository Institutions, they still are up by a huge amount. It looks like banks are lending again seen in Loans and Leases in Bank Credit, also gross output has been increasing. The yield curve hasn’t inverted, so this might ride a little longer.

Does a debt ceiling even matter anymore?

The Fed will cover all in the next QE.

Even so, Congress still has to authorize borrowings, whether the bonds are “purchased” by the Fed or purchased by actual investors.

Article in this past weeks WSJ about banks have large amount of untapped loan capacity. Went onto say they thought the loans would be tapped forcapex, AI and other productivity enhancements. Banks have too much money, reverse reposallow them to make a bit of interest.

Wolf would know better than me but thereverse repos may

be a test run to see how markets respond to some capitalemoved from the system tohelp them better navigate the taper since there is worry the taper will crash things.

Not sure how all the plumbing works sothe reverse repos may not flow through or impact the system in the same way the taper would.

“Over the weekend, all together, they made about $4 million in interest income on the $952 billion in RRPs. If they do this for a whole year, it would amount to $500 million in risk-free interest income.”

Hi Wolf, any idea what level of inflation an amount like $500 million could add to the CPI?

Or, isn’t there a risk the Fed may have to cease QE if the inflation risk becomes too great. Can the Treasury then fund it’s spending programs in another way that is not inflationary?

We’re in an era of financial repression. No one investing in investment grade bonds and even in many junk bonds is making a positive “real” rate of return. All those yields, except of the riskiest junk bonds, are below the rate of inflation.

I think the Fed has created a potential situation of wealth destruction on all levels…it wont matter what room of the house on fire you are in..

Negative real rates

Sinking stock market returns

Central Bankers have painted themselves into a corner, and will likely ask for more paint.

They need a physics lesson.

“For every action, there is an equal and opposite reaction.” The reactions cometh.

Historicus:

“They need physics lesson”

Castor Oil!!

My 1 year CDs’ at the credit union are about to be rolled over. Interest will go from 1.3% to .37%. I’m getting taken to the cleaners, and there ain’t nothin I can do abut it.

1) The DOW log : If u draw a line from 1929 to 2000 u reach Aug 2021.

2) The DOW nerve system : dot #1 above 2003, dot #2 above 2010 and #3, a future dot, on the right of Mar 2020….

3) The 100 years Dow : We might get an A-B-C correction like 1936/42.

4) Plenty of open spaces above 1942 nadir and the early 1980’s.

I been drawing those lines for years. Mind blowing

I would argue the January 1966 top is in that same line, but it is the last one under a gold/semi-gold standard, afterwhich inflation too off for a while.

I would also argue that 2000-2010 was the ABC correction similar to 1936-1942, just a bit longer.

Yancy Ward:

WW2 solved that problem!!

Pick One Please

Monopoly

The term monopoly is often used to describe an entity that has total or near-total control of a market

Democracy:

a system of government by the whole population or all the eligible members of a state, typically through ” elected representatives.”

Mendocino

We are controlled by an unelected body of central bankers who apparently report to no one. They lay an inflation tax upon us though they are instructed to exactly the opposite, “stable prices”. Only Congress has the power to tax, and that power may not be delegated. Thus we have..

Taxation without Representation….ring a bell?

The Fed has also stolen the power to mint….and per the same article in the Constitution that gives Congress the power to tax, also is given to Congress the power to mint. This power also may not be delegated.

The rules are there….no one follows them.

From the trading rooms, WTF : we know it’s a bubble, we know it might

deflate tomorrow, but we don’t care, because we have SL (stop losses).

LOL. I can’t wait until people’s stop losses are blown through and there are no buyers.

I think 2020 was a hard lesson for a lot of newbie investors: never, never set a stop loss. The market will slice through your stop loss, the wash sale rule will keep you out for 30 days and the Fed will intervene and save the day by pushing markets to all time highs, leaving you and your new handfuls of cash high and dry and worthless.

Stop loss? Don’t do it. If you put a stop loss in place you are fighting the Fed. If your fight the Fed you are broke. IMHO only – not investment advice (don’t want to get sued for giving investment advice)

MyLady

There are 33 year old stock brokers who have never seen interest rates over 2%, nor a bear market.

Hussman had interesting chart showing 1941 was the best time to buy stocks on a 12 year basis with annual return of 20% and today being worst time with anticipated return at minus 7% annual return. Hope I am alive then to see if he knows his stuff.

There is no such thing as “cash on the sidelines”. When you sell your stock to get cash for yourself, somebody else buys it. The amount of cash in the market remains the same.

Generally agreed the Fed can taper now without consequences. They can also bump the prime rate if they like. The question is, if the Fed doesn’t have control of this market, who does? One catalyst for 2008 was private money creation (which got out of hand) but with corporate bonds at historical lows, has the Fed lost control of the money supply? The seminal question is how does leveraging work in this market. How will the free market deploy capital? When Druckenmiller went all in on China, was that a signal that he thought their draconian command economy was more than a bit safer than the wild west of Wall St finance? The Fed raises the monetary base by multiples over a decade, and then they walks away? QE is hyperpumping the system but relinquishing control? Back to the 70s and price controls.

Ambrose

“They can also bump the prime rate if they like. ”

I dont think the Fed controls the Prime Rate directly

@ Wolf –

Interest on Reserve Balances is now .15%. It seems the large Money Market players could establish a banking relationship and exceed the .05% repo rate. If the bank and the money market players spit the difference, then the bank would earn .05% just for putting the money in a reserve account and the money market player would earn .1%.

It makes no sense to me. You could a whole primer on the different interest rates (Fed funds, Repo, Interest on Reserves Balances, etc.) and their inter-relationships.

Those are two entirely different things. Banks put their extra cash on deposit at the Fed where they become “reserves.” A money market fund – even one managed by a bank – cannot do that. Money market funds invest in short-term securities and do not have Fed backing (unlike banks).

However, there is a connection because banks, which are drowning in cash, which is causing them regulatory issues, have been telling their big clients to take their cash elsewhere. And so bank clients have been moving some cash from banks to money market funds, and now money market funds are drowning in cash. And when the MM funds tried to invest in short-term securities, the yield of those securities turned negative, causing fears that money market funds would “break the buck.” So one of the reasons for this RRP thing is to bring up yields to where they’re positive, and this worked.

I know these questions might be irritatingly stupid:

1. Why does drowning in cash cause the banks regulatory issues that make them want to get rid of client’s cash?

2. When the Fed swaps the securities in a RRP, and then gets them back … it seems like they maintain and would eventually collect some kind of yield from the securities? If so, then the interest they are paying the RRP buyer seems like it could be considered a cut in positive balance sheet yield of the securities, not a negative balance sheet factor. Like, they are just taking a cut in their bloated balance sheet securities that they can’t get rid of anyway, with the benefit of not letting rates go haywire below zero.

excellent questions

@ Wolf –

Why can’t a money market fund loan/deposit to the bank at .075%? The money market fund would earn a ,025% premium over the FED reverse repo offering and the bank would earn ,075%, just by moving the dollars to reserves.

Because the loan/deposit to the bank is only insured to $250,000?

It all rolls back to too much money creation and interest rate suppression. No?

and also the reason why Lehman went down the toilet… But it’s different this time-the Fed is there.

Yep. When the loan can’t be paid it’s not a good asset any more.

I always wondered who was going to pay for covid hit to the economy and said it would be determined by politicians. We know part of the answer is mom and pop savers and mom and p landlords. Mom and pop savers and landlords can be fleeced in DC because they don’t have much representation there.

@ Wolf –

I would contend that no money has been removed from the financial system. Repo’s are part of the financial system, and the money is simply moving to where the interest rate is higher on an overnight basis (Though I cant figure why that money would not find its way into bank reserves, with the current interest rate on reserve balances being .15%). In fact by the FED paying $500 million per year in interest to money markets, the FED is expanding the money supply.

At the rate they are increasing the money supply the interest they pay is inconsequential. Real rates are severely negative. That money is earmarked for spending, its taxpayer money. What’s its doing in private bank reserves is a question for securities and fraud division. The Fed gets away with this because taxpayers don’t own the money either, its a liability, nonetheless a taxpayer liability. Despite Powells denials the collateral on that debt is highly leveraged to the stock market. Prior to 2008 the laws of disbursement put all funds in a brokerage as equal. So if JP goes bust your MM account gets in line with all the other losers, and no priority. Then these brokers started setting up private banks which were fire walled from the system. The one thing that has changed is that no one thinks a complete washout is possible. Sure the FDIC can print money, and hyperinflation. These bank reserves as a result of QE are not real. The Fed didn’t use collateral to buy those treasuries, so bank reserves are pixie dust. Basically your sweat money in an MM account has been leveraged ten times, you are getting zero for your trouble with a guarantee of hyper inflated cash if the fund breaks NAV. In a deflationary scenario a zero interest bond makes more sense because its leverage the other way.

“The Fed gets away with this because taxpayers don’t own the money either, its a liability, nonetheless a taxpayer liability.”

____________________________

How is existing money a liability. Money is only a liability if it is owed. Money owned is an asset.

Government pays their debts with this money, including selling their bonds, in order to circulate more of the currency. They own the money and their business is currently trillions in debt. The fact they give you money implies that money is a liability which will have to paid back at some time in some way. I would expect a national service program and a confiscation of assets. They don’t want to collect taxes paid in their upside down currency, for the above reasons. One solution is crypto which does not constitute a government liability but has no economy of scale. Government has a monopoly on money :)

As the calls from both sides of the aisle grow to taper, the Fed will have to manufacture a sell-off to retain cover for printing. Remember that short volatility position?

Powell would rather cause a market dump that can’t be pinned on him than taper and result in the same to get the blame. My money’s on this playing out end of year as final CPI numbers roll in.

Last interview I heard by Marc Faber was the best ever. He said we have to be humble enough to say we don’t know exactly when and how it’s going to end, but history teaches money printing always ends badly. No exceptions.

I wonder if this fed action may cause a little hiccup in the market? maybe 6-7%. Maybe the fed would like that. Blow the head off the beer.

1) SPX PE plunged In Mar 2021. The current yield is 2.85%. The real yield : NR.

2) When the real yield is zero or below, investors don’t care about dividends.

You lose money by keeping it. You lose money by holding a stock that compound negative yield for years.

3) When yield is zero or NR investors go for growth stocks, like AAPL,

GOOGL, AMZN or software co. The price increase is self fulfilling.

4) Self sustained growth, growth sectors that reboot themselves, even if prices are detached from earnings and dividends, – prices will go up independently, – because higher prices raise market cap ==> and that’s sexy. Until it flop.

5) IF JP raise rates, growth stocks 20 years bull run will be over, including software. Prices will revert to the mean and attract value value investors.

So I have a theory that the Fed is in a pickle and is lying about what is just now happening.

I think that over the coming months, it will get harder and harder for the Fed to finance the deficit spending with sale of new notes, bills and bonds at these low interest rates, so interest rates will spike higher. And they will also be forced to cancel the $100 billion in monthly purchases because inflation will remain persistent.

So the lie is that the Fed will make lots of statements that claim this is all intentional and that they are allowing interest rates to rise because the economy is repaired, when the real truth is that they are in a pickle between persistent inflation (which will prevent more QE) and higher yields due to supply/demand in the debt markets.

What will impact all of this is whether Europe and Japan begin to raise interest rates also, because demand for US Treasuries is increased if rates in Japan and Europe continue to be negative interest rates, but that demand will dry up if European bonds and Japanese bonds start to show higher (positive) yields.

I guess my point is that I think that at some point, as the 30 year bond bull market begins to break down through uptrending support lines, the traders will flip into selling mode and that will cause massive upward pressure on yields. And the Fed and central bankers might be trapped because they cant keep going with QE when inflation is picking up.

So why have investors been so willing to buy bonds that yield either near zero interest or negative interest? Because they looked at capital appreciation offsetting the lost interest income. But bond yields start to rise and keep pushing higher, the capital losses on bonds makes them a bad investment, which means more selling and higher yields. The selling doesnt stop until the interest rates are sufficient to actually entice investors to buy bonds for the interest paid.

I guess I see potential of a major collapse here. These insane central bankers created a Ponzi scheme and when it reverses, just like every other market reversal, the downside for bonds is immense.

So what is the difference between the Fed allowing interest rates to rise and interest rates rising despite the best efforts of central bankers to repress them? Control, or lack of control. If you are an investor in bonds, you have been betting that the Fed and other central bankers have absolute control on their interest rates. What if they dont? What if they effectively lose control? That makes for a very scary situation when debt is so high. A debt bubble out of control. That makes for an economic collapse.

Maybe none of this happens. But I think that this debt bomb is a lighted fuse ready to go off and the people at the helm are so dishonest with themselves about what is happening, that they dont intend to admit the truth. They have created the ultimate bubble, a toxic mess of a situation.

One other point to support my thesis. At the beginning of 2021 interest rates were rising rapidly until the Treasury started to use that surplus balance to pay for the deficit spending. That starved the markets of supply and allowed interest rates to drop.

I just think they temporarily moved the market lower with that 1 trillion injection and now, with inflation raging, they will be trapped in a really bad place to try to keep rates down. Do they announce an increase in QE now? No way.

The rooster has come how to roost.

gametv,

Thanks for your input. You raised some good points.

Most of all, thank you for your use of paragraphs; they are a tremendous aid to comprehension. Many here do not seem to grasp that concept.

The SEC should be closely monitoring the put buying of every member of Congress and the Fed. That will give some clue as to who among them think this house of cards is being shaken just a bit too much.

Sec what a joke no power corruption

Fed will go to digital dollar total control all fixed by corporations and imf world bank

Treasury prints and the FED buys a vast quantity of the financial instruments. Same in other countries. I loved that Wolf published the article recently about the Russia rate increases. My summary would be they are doing leap increases rather than .25% and the results are they are struggling with inflations.

My thesis is that the global economy is using this COVID/QE as cover for price explosions that have been waiting to be priced in. These companies from raw materials to labor to transport and beyond are all extracting their fair share. Interest rates be damned. Using this to say that is why we had to raise rates 15-50%

gametv said: “it will get harder and harder for the Fed to finance the deficit spending with sale of new notes, bills and bonds at these low interest rates, so interest rates will spike higher.”

—————————————-

The FED (Federal Reserve) does not finance the deficit spending with the sale of new notes, bills and bonds. The Treasury finances the deficit spending with the sale of mew notes, bills and bonds. The FED may provide financing to the Treasury by directly or indirectly buying new notes, bills and bonds. There is no limit to FED’s ability to buy these treasuries.

Japan has no problem with financing, why would the US Gov? They (TPTB and the Globalist Kleptocrats that control the banking cartel & US Gov)… It will just continue being absolutely brutal for anyone not at the top of the pyramid — stagflation with a continued decline in living standards caused by a LACK of Sound Money, a LACK of Free Markets, and a LACK of the Rule of Law…

” Fed is in a pickle and is lying about what is just now happening.”

The Fed has painted themselves into a corner, and the solution will likely be MORE PAINT.

I picture Powell up on a ladder with some spackling and caulk trying to cover the growing cracks before painting again.

Maybe he should check the foundation.

I think Powell has run out of rungs on the ladder

So you believe that the Fed is going to actually announce that it is INCREASING the purchase of bonds?

The two ways the Fed and Treasury can control interest rates are 1) for the Treasury to use primarily or only short term bills and notes to control the interest rate curve (basically starve the long term market of issuance) and 2) to have the Fed buy up more of the long term bonds.

I just dont see how the Fed is going to be able to announce that it is increasing QE with this raging inflation. It would show that they really dont care about destroying the purchasing power of working class people.

Coming soon to a transaction near you!

“Your credit is NO GOOD”.

Thanks for this post, Wolf. If I’m understanding effects of this correctly, the TGA reduction increased cash liquidity in the financial system by a commensurate amount. However, this net increase in liquidity has been almost completely neutralized by the Fed’s reverse repo program which has essentially pulled most of that cash back out of the financial system and locked it up on the Fed’s balance sheet. There it can be used or released back into the financial system by the Fed at their discretion. I find the continuation of the Fed’s ongoing $120 billion per month Quantitative Easing program particularly puzzling against this backdrop, but surely must be missing something potentially significant.

Gold just flash crashed. Don’t know if that means the dollar will be spiking soon. About time, I’d say.

I want to see if it was a hedge fund trapped. When you are trapped you sell what you can, not what you want to. Also gold dropped end of last week. Someone might have been leveraged up and had to exit.

Hedge funds run all kind of pair trades. We should make long term cap gains tax lower and jack up tax on speculation.

Old School..

right you are. Being hurt in another trade may make them dump another unrelated position.

Or, maybe there was a “fat finger” or the trader had a fight with his wife.

You’ve been outed as a ZH reader!! Tut tut. (kidding)

Or I could be watching goldprice.org ;)

Notice that Gold crashed while Bitcoin spiked. My thought is that this is a battle between Gold and Bitcoin as the “store of value” when we run the printing presses.

Gold doesn’t have Tether backing it ;)

Backed by nature. 100%

And no, I am not a gold bug.

1) After 20Y of bleeding us, the Taliban metastasized in Afghanistan and forced us to flee, before we have Saigon.

2) China don’t want a war with us. All they want is to bleed us internally and externally, until we flee, before falling on our knees.

3)

A $500 million in risk-free interest income is actually a $4 billion dollar loss in real terms.

Better than a $4.5 billion loss in real terms. And better than a $5 billion loss in real terms because the MM funds were facing negative yields on short-term paper.

There is an ongoing idea from a number of commenters that the solution to an overly easy Fed is to take control from appointed members and give to elected members, i.e., Congress.

This is bonkers. Do you honestly believe that the 1980’s Volcker crackdown on inflation that took the Fed rate to over 20% could POSSIBLY have happened under a bunch of politicians? All they care about is poll numbers.

If you want a central bank that just does its job, look to Germany’s Bundesbank. It is constitutionally independent, not just by precedent.

A politician is not supposed to contact it. (it may be illegal but I’m not sure)

During the pre- euro days, German industry was reported to be on the verge of despair over the high D-mark but the Bundesbank seemed not to listen. It no doubt did listen and industry survived. But then and now, it doesn’t come running every time the stock market hiccups.

Back to the pseudo-independence of the Fed, which is always given lip service by an incoming Pres as he accepts the office.

In the past, Presidents have ‘put the arm’ on the Fed Chair about rates in private.

Not the latest buffoon who publicly, repeatedly, trashed Powell at the smallest baby- steps towards normalizing. (This would have created outrage in the English- speaking parliamentary democracies, where the PM is just a politician, not the ’embodiment of the nation’ etc.

The attitude of that incumbent to budgets, as expressed to then Economic Advisor Gary Cohn: ‘Just print the money.’

There is no solution. private money is the simplest and most elegant solution to all this

There once was all kinds of private money, in the US and elsewhere.

The scrip given as wages by company towns, spendable only at the company store is type of currency ( now illegal) Joseph Smith issued all kinds of scrip and had to leave town, fast. There is still a group in the UK trying to pursue Mississippi for its paper.

All developed countries have a central bank, there to stop private bank failures, events which precede central banks by at least 2000 years. (Ancient Rome had a bank panic, with losses)

People fond of private banking may look to the Depression where 10,000 US banks went under, many with the loss of deposits.

But the central bank has to BE a bank not a slush fund for gov.

A fairly non-partisan group in the UK (Lords) is starting to ask why the BOE’s debits are exactly what the gov asked for.

That’s why I suggested the other day that the President of the United States and the Chairman of the Fed should be the same person. Stop the Kabuki already.

You can stop hiding the disaster or try to fix it.

Or combine the offices of Fed Chair, POTUS, AG and Chief Justice of the Supreme Court.

There was lots of Kabuki between the last POTUS and his AG.

This is a morbid thought but I think Covid 19 delta variants + other variants in the pipe line, are acting EQUALIZERS against Fed’s insanity!

There is asymmetric information polluted with wishful thinking of PMC who think covid is a past history. CDC is unreliable. Those who can discern the real underneath forces have an edge, IMHO) This is similar to signs of housing bust which startedapearing in blog articles in late 2005-’06 (GFC). Never lost a penny. There afte, is different story. Reversion to mean is coming on way or the other!

(been in the mkt since ’82)

CHANCE favors the one who is prepared!

They are in a big hurry to suck it out, cause they’re going to have to dump it back in!