With inflation hotter than it expected, the Fed is trying to slow the pace at which it’s falling further behind.

By Wolf Richter for WOLF STREET.

There were some delicate morsels in the Fed’s monetary policy announcement today, none of them a surprise, but the nuances were perhaps such that some folks’ hopes got a little jostled, with the 10-year Treasury yield jumping 10 basis points in a matter of minutes and the Dow falling 265 points.

Projected rate hikes move closer.

The Fed’s projection per its “dot plot” pulled the first two interest-rate hikes into 2023, up from no rate hike in 2023. The “dot plot,” which represents the median of the FOMC members’ projections for future interest rate levels, is “to be taken with a big grain of salt,” Chair Powell said during the press conference.

This was perhaps a nod to the prior dot plot in March that had noted zero rate hikes in 2023 and now has already been obviated by events – these events being red-hot inflation. The dot plot is “not a great forecaster of rates,” he said.

Two upward “technical adjustments” to administrative interest rates.

The Fed’s monetary policy committee announced today that it raised two administrative interest rates “in order to keep the federal funds rate well within the target range and to support smooth functioning in money markets.”

It raised the interest it pays the banks on required and excess reserves, the IOER, to 0.15% (from 0.1%). And it raised the offering rate for overnight reverse repos (RRP) to 0.05% (from 0.0%).

I expected that the Fed would undertake these “technical adjustments,” as the Fed has been struggling mightily with its overnight reverse repo operations, now totaling over $500 billion, to drain the tsunami of cash sloshing through the banking system that is causing all kinds of issues.

The goal of those rate hikes is to put a floor under money market rates and to keep the federal funds rate in the middle of the Fed’s target range (0.0% – 0.25%). The Effective Federal Funds Rate has been at 0.06% recently, with a good portion of trades at or below 0.04%; the Fed would like it to be around 0.12%.

Inflation red-hotter than expected.

“If we saw signs that the path of inflation or longer-term inflation expectations were moving materially and persistently beyond levels consistent with our goal, we would be prepared to adjust the stance of monetary policy,” Powell said in the press conference.

“We would be prepared to adjust the stance of monetary policy” was maybe a nuance too much for some folks. So lets see just how far the Fed is behind the curve.

The Fed ratcheted up its inflation expectations as measured by core PCE to 3.0% for 2021, up from 2.2% at the March meeting. For 2022 and 2023, it projects core PCE inflation to decline back to 2.1% and 2.2% respectively, just above its target range, with everyone still believing that the current increases above 2% are “temporary” and will unwind.

The last actual core PCE inflation rate – this was for April – was already higher than all of these projected rates, at 3.1% year-over-year, with the three-month annualized core PCE inflation jumping by 4.9%. This is the Fed’s preferred measurement of inflation. Inflation as measured by CPI came in much hotter in May.

Here are a few nuggets of what Powell said about inflation at the press conference:

- “Inflation has increased notably in recent months.”

- “Inflation has come in above expectations over the past few months.”

- “The expectation is that high inflation readings will start to abate.”

- “We don’t in anyway dismiss the chance that it goes on longer than expected, and the risk could be that inflation expectations” rise above our goal. “When we see that, we would not hesitate to use our tools.”

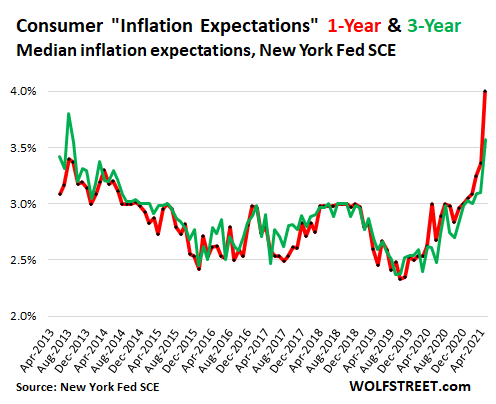

Alas, inflation expectations jumped to 4.0% for the 12-month outlook and to 3.6% for the three-year outlook, according to the New York Fed:

So the Fed should be getting nervous. And he said:

- “There is so much uncertainty,” and “we need to see how it develops over the coming months.”

- “Yes, there is a risk inflation will be higher than we thought. If we see inflation move above our goal persistently enough, we would be prepared to use our tools to deal with that.”

The Fed “had a discussion today” about tapering.

“The near-term discussion is the path of asset purchases,” not raising interest rates, Powell said, based on the doctrine that ending the asset purchases would precede rate hikes, same as last time. Here are some of Powell’s other nuggets on tapering:

- The Committee “had a discussion today” about tapering, and it will have discussions at “future meetings.”

- “We will provide advance notice” … “to give people a chance to adjust their expectation.”

- “Tapering will be “orderly, methodical, and transparent.”

The Fed is officially no longer talking about talking about tapering. It’s talking about how and when to taper.

All this boils down to this: The Fed is so far behind the curve, it’s no longer funny. But it is now trying to slow down the pace at which it is falling further behind.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

No it ain’t funny

But I’ll take your money

With my dope inflation

All across the nation!

I’m creatin’ paper

Ain’t gonna taper

How ya like me now?

The name’s J-Pow!!!

Well versed Sir !!

It’s a real scary time due to many other factors .. complicated is not word enough.

I got a big tool

In my possession

Usin’ it fo’

Financial repression!

Like my drawers

I keep interest rates low

Down wit’ the rich

So f*** the po’!!!

wordsmith at work here….give it up for J-Pow!!

10/10

Their jaw bone may have false teeth but it sure chewed up gold.

“If we saw signs that the path of inflation or longer-term inflation expectations were moving materially and persistently beyond levels consistent with our goal, we would be prepared to adjust the stance of monetary policy,” Powell said”

Do these people shop at grocery stores? Buy used cars? Even fill their own gas ranks? Do they live in the real world? Or only in the world of ‘gamed” data?

Sorry, handle should read MiTurn, not my cousin Mu…

Or go to the lumber yard or run a business…ever run a business….answer to your question is NO.

And …. ever worked and tried to save their way to some financial stability? They have STOLEN the ability of people to SAVE…for if you do…if you are “inactive” and Save, you will be punished by central bankers.

As far as I’am concerned it is all about the infrastructure bill.

If we get the democratic bill passed in July with 1.7 trillion dollars or more included…….the fed may have a meeting that shocks the markets…..particularly if tax increases are avoided…..but this time no back tracking…..the market could be down 30 percent or more in a year……only because it is so over priced. Interest rate upward movements might still be in the future but taper may occur relatively quickly.

If a compromise bill passes (assuming it is about a trillion dollars short and contains a few tax increases) the fed tapers over the next year and prepares for interest increases in later 2022 if needed.

No bill…..more talk about tapering some day.

Why is the infrastructure bill related to the policy on interest rates at all? Can you explain more?

The gov borrowing and spending injects money into the system which is inflationary. If the gov raised enough taxes to pay for this or any program it would be balance out and not be inflationary The early 70’s inflation that eventually pushed the US off the gold standard was caused by spending on the war in Vietnam while not raising taxes.

I could be off base here, but it seems like it’s only inflationary when the money is given to people who are likely to actually spend it (e.g. the working class). Contrast this with 40 years of tax breaks and miscellaneous subsidies (welfare handouts) to wealthy corporations and the elites who generally won’t reinvest any of it back into the US economy but rather will offshore that money into Caribbean tax havens so it can be passed on to future generations of elites.

Mak: Gov funded infrastructure can only be built by union labor, so a lot will end up in workers’ pockets. It will be important however to watch out for corporate profiteering and organized crime ‘skim’. The two may work together.

After Prohibition ended, but before drugs became mainstream, the biggest source of mafia income was via control of unions. (This statement is not anti-union ) Example: in the 80s Canadian outfit Cadillac Fairview was hauled into a NY court to explain its ‘ghost employees’, union members on the payroll who never showed up. Its defense: ‘that’s what we have to do here to get our project built’.

Concrete, without which nothing is built has been a frequent target. Montreal, Canada, was notorious for every sidewalk paying a 10 % ‘commission.’

Was it not de Gaulle who broke the US bank when he used to once a year exchange French dollarreserves into gold ? If the US had not left the goldstandard what would have happened with US gold reserves ? At the even the obient Brits did exchange their dollars for gold …

It was the French, always suspicious of paper money who decided there were a lot of extra dollars being printed. So they began acting on the Bretton Woods agreement, presenting dollars and demanding gold .

The US moved off the gold standard in 1971. This triggered capital to move away from the dollar and devalued the dollar against everything else. This is incredibly inflationary.

You are all STILL missing the “prime cause”. A war that cost maybe 2/3 of WW2, in today’s dollars, and completely unpaid for through lack of taxing. And all that factory building/updating cap-ex just blown to hell…….set us back plenty good.

WW2, BTW, was just about paid off.

It kicked off Reagan’s massive “deficit spending” and labor wage crushing…..we are all right now still wondering/opining on how long that triggering move of his (actually, he was just a puppet who was manipulated by the usual suspects) can go on, yes? And the senile “B” actor got his long awaited epic role to play.

Bay Area, as I understand it the bill spreads the spending over the next 8 years….I assume based on past bills that it will be front loaded and targeted at the years prior to the next presidential election.

So about 300 billion hits the economy each year for the next 3 years.

At a time the economy will just be starting to feel some of the government spending legislated earlier this year.

With a 1.5% GDP fix of sugar money on top of my own estimate of 1.0% in earlier fixes…..we will be at full employment in no time. Cash flowing to the working class and construction firms, the elderly and all the other targeted classes in the bill…..who will increase the velocity significantly. This is no collection of conservative banks holding cash. Our demographics turning positive for the first time in 15 years is a contributing factor.

Since inflation is already rolling….adding all this additional cash to the economy on top of parts and commodity shortages and you’ve got the conditions for an inflation that even the dufus in the Eccles building cannot ignore. He’ll have to hit the brakes hard or go down in history as the dunce that lost it. Running around fighting deflation while inflation kicks him in the nuts. Just the opposite of 1929. With inflation embedded the danger becomes that central banks drop the dollar as a reserve (with our 800 billion deficit in the current account opening the door) and the dollar takes a dive in spite of higher rates. Inflation goes wild and fed rams a 3% increase in within a day. Causing the 29 scenario.

Bottom line….avoid all this and rise the rates to inflation level…soon. Unfortunately our fed chair is a political man….and not a patriot. Right now the 82nd airborne will defend him and his type….if the inflation gets out of control….see Germany 1932.

‘Our demographics turning positive for the first time in 15 years is a contributing factor.’

That IS news. Not saying yr wrong just not sure what you mean. If yr birth rate is enough to sustain population you are pretty much alone in G 7. Canada is about half of rate needed (2,2 per thou) at 1.2. There is no alternative to immigration at that rate. Also in Canada there is now one retiree for every three workers, down from one in seven when pension system began.

nick kelly,

“There is no alternative to immigration at that rate.”

Japan has had a declining population for years, and on a per-capita basis — which is what counts for people — is doing great. Life for individuals has improved a lot. In these immensely crowded cities, no one other than politicians needs more people. Japan is uniquely positioned to benefit from automation. Unemployment is minuscule. Immigration is minuscule. Sure, some of the fake promises that lying politicians have made come home to roost, but at least they’re being exposed now rather than shuffled to the next generation.

Good call up and down Stoney, though Fed is a committee and Treasury Sec pulls the strings despite the real stripes on that Fed cat. If the Fed raises rates and the bill falls short, where are they? Tough spot, they don’t control fiscal spending.

WR: He mentioned ‘Japanification’ not me. I’m constantly telling folks here not to worry about Japan. The only country I named was Canada, largely a resource extraction economy with I believe the lowest population density in the world, and not in as favorable a position re: automation.

To my question: which US demographic factor has turned positive in what respect?

nick kelly,

I know you didn’t mention Japan. I mentioned Japan as an example of how mass-immigration is not necessary, and of how a slowly declining population in a crowded country is beneficial for the individuals in that country.

This was in response to your statement: “There is no alternative to immigration at that rate.” I should have made that clearer. Apologies.

A Japan-like future may be good for humans but it’s awful for capital. If you wish for Japan then I hope you’re already rich because nobody is getting rich in Japan, they’re either barely keeping up with inflation or losing wealth.

And we all know America in 2021 is ruled by billionaire capital. So immigration will continue because republican Koch Industries and liberal Google both need immigrants more than US citizens.

Nick,

Demographics are about spending……yes we are replacing ourselves but there are waves that are much larger than the average of population…..the mirror generation also known as millennials have finally arrived at the point where they are making greater sums of money, getting the Vice Presidents pay, are forming families and buying homes…..this generation is the largest in US history……..expenditures increase during your lifetime to about age 48. The oldest Millennials are still in their 30’s…..but moving up. The peak boomers have now largely retired or approaching it quickly and their spending will be declining but at a much slower rate as they fade off to their graves. The immigration wave has filled quite a bit of the hole between the two big waves. Bottom line is that the boomer decline in spending from roughly age 48 to retirement has now been largely absorbed by our economy. The millennials are going to be spending more and more each year from now until their average age approaches 48.

The 2 largest single demographic factors in Canada are: the shrinking number of workers paying in compared to retirees taking out, and, the spiraling cost of health care for those over 65, which goes parabolic over 75. The number of retirees won’t be different in the US. but with the first world’s most expensive medical, the second will be worse. The number of people hitting this ‘magic’ 48 doesn’t affect either.

The Infrastructure Bill has everything but infrastructure in it. Like the last tidal wave of ‘stimulus’ the Nigerian princes and certain destroyed cities in the States are licking their chops waiting for the helicopters to start dropping.

Anyway, this repo and reverse repo business is looking and acting like the old-fashioned open market operations at Weimar Republic warp speed.

The other day I was talking to a guy who is a mortgage broker. He was telling me about all the hoops people jump through to shave a 10th of a % off their mortgage interest rate. I asked him what would happen if mortgage rates went up 2%. He said that would be the apocalypse and he would be out of a job.

As a guy who’s watched his local housing market go from $400k to $670k median, all I can say is RAISE THE RATES!! Low rates encouraging investors to swoop up all the houses, raising prices, creating mucho homelessness. My wife and I make what I would consider really good money, have great credit and money in the bank for a down payment, but prices are just too high. As a former 2005 buyer – we aren’t going down that road again. RAISE THE RATES!!

Well. Uncle POWELL, doesn’t care about YOU. The Rich people don’t care about honest people working hard and saving money to put a roof over their heads. The SHOT callers don’t see you, you are invisible to them.

All investors and Hedges buying houses is the most heinous crime on the working American people.

I own a little home, but it sucks some of my family and friends can’t.

I always advice against over-leverage. It’s not worth it.

With all printing and FED and Govs free stimmies I learned to always follow the money. The Banks and Top Companies are now HUGE to Fail… so they’ll always win. Thus, I had 100K in the bank to buy a bigger house because I had another baby, but I decided against it. My kid will have to double up. I am going minimalist.

I dropped the 100K on VTSAX, and I add all my extra money there. screw the Bonds, CD, savings accounts and having cash on hand. I see the biggest risk being inflation by holding cash, with the paltry rates.

I’d rather risk a 50% drop from the market, because it will eventually recover to new highs. If it does not recover, then we have bigger problems than money won’t matter really.

I just stay debt-free and low consumption. If market drops, and I’m out of job and savings the government will give me food, and stimmies and even If didn’t have a house, we know we can okupa a rental with government permission rent free. it’s all good.

If you SAVE, you will be punished by the Fed.

The history of this nation is that you could save your way to financial stability…..the Fed trains you to borrow and leverage at rates below inflation.

It is INSANE. It is also unfair, abnormal, and reckless.

Same sentiment here and just like someone else already said. Weimar Powell doesn’t give a 2 craps about people like you and I. Also, state and Federal government also don’t give a crap about affordability since less home value = less tax revenue.

Exactly I’m positioned pretty well atm with a well paying union job in which I have seniority over 4 guys below me and open job spots nobody will fill. And not to brag or anything but I’m the hardest and fastest worker at my division and also one of the best drivers we have and get sent out to cover the hardest/most dangerous routes. Very unlikely I’ll lose my job and so I’m pretty well set for the future.

I’d be hunting down a house right now but all I see is turd sandwiches for housing being passed off for 4-5x the price they sold at in 2013-2014. The market has nothing new being listed other than crummy apartments so the only things cropping up are the

normally unmovable survivalist shacks up in the hills or the RV shelter converted to a “tiny home.” All for prices of hundreds of thousands. You’d have to be the biggest idiot on the planet to spend 300-400k on an 800sqft off the grid shed in the middle of nowhere that is 10 miles away from the nearest power pole.

I eagerly await the collapse of the real estate market. You’ve got to be the world’s biggest fool to get in right now so I don’t have much sympathies for those that do. I just hope it comes and ole uncle Sam or Mr. Powell doesn’t have some magics that props it up for years and years to come.

TG: I told my son several years ago who has a union position in the oil patch, “Be indispensable, not and never a brown noser, but the guy no one can imagine not being on the job. Plus, get along with people”.

It works.

Each minuscule interest rate hike of 10 basis point causes stock markets to lose 1%-2% of their so called “value.” Imagine how much these FED criminals have taken from the poor and the middle class to enrich their billionaire buddies. Any wonder that billionaires are becoming trillionaires? Imagine how much this criminal, financial terrorist organization has taken from all of us.

Dan

Indeed.

Removing the ability to SAVE one’s way into financial stability with FAIR returns on fixed income…THAT is the great tragedy of this new breed of Fed people.

They really dont understand that to punish people for a NON ACTION such as holding money, while they promote an inflation and a decline in the value of that saved money, is a terribly destruction policy.

Fed Funds zero as inflation is circa 5%? Never happened before….and why now? That is prearranged theft IMO….by a Fed that is supposed to FIGHT inflation. They promote it and when it runs too hot, do virtually nothing.

Wolf,

Thanks again for the breakdown.

Yeah – two rate hike by 2023.

Assuming no “emergencies” between now and then. And that even a slight bump won’t send all these bubbles a’popping.

It ain’t going to happen.

“The Fed is officially no longer talking about talking about tapering. It’s talking about how and when to taper.”

At the current pace of things, those projected rate hikes will get pulled closer, just like they did today.

But before the Fed hikes the rates, it will end the asset purchases. Those rate hikes won’t begin until after the asset purchases end. That’s how they did it last time, that how they will it this time.

Wolf. With all due respect, they are so far behind the curve that it’s laughable. And “…those projected rate hikes will get pulled closer, just like they did today…” is a bit generous to put it mildly. Remember at first when they said “no rate hikes until at least 2022?” They are moving the goal posts back and forth so much that they have zero credibility. These guys are a bunch of idiots.

One year ago this month:

“The response: officials see the key overnight interest rate, or federal funds rate, remaining near zero through at least 2022. The decision to leave that rate unchanged on Wednesday was unanimous.”

See the sham? I sure do. Yesterday’s news was NO NEWS and NOT HAWKISH.

Wolf,

Agreed. Inflation appears to be just getting warmed up. Fed is OBE.

Taper announcement by Sep. Rate hikes by Christmas.

No one asked Powell why they were still buying MBS when the housing market is already overheated. Is this some backdoor way to keep the 10 year Treasury rate suppressed? We all know that once this Treasury rate rate jumps up to say over 2% refinances will dry up and using the house as an ATM machine will cease. Remember Alan Greenspan in the early 2003/2004 salivating over the use of house equity as an ATM to keep consumer spending up. We know how that ended.

If we can only trust what the FED is telling us…I would be stil clinging on to what vulture look-alike mofo Greenspan told us before 08 there’s no bubble in the housing market and all is well..

Take what these people tell you with a giant block of salt. They message or forecast is either a bad joke due to incompetence or just a cover for them to enrich the elites more, which in terms secure his term longer. I tend to think latter is the case..

two hikes…? what increments?

With 5% inflation …what do two 1/4 pt hikes do? Zip.

For those who werent around in the 70s, banks would raise there prime rates 1/2 pt at a crack on Friday afternoon….and the Fed would FOLLOW.

That shows you how much power the Fed has accrued in those 45 years.

I was around in the early 80’s when the run up began and the banks weren’t leading the Volker Fed they were following it, almost as shell shocked as their customers looking for a mortgage. And the Fed rate more than once jumped a whole one percent at one time.

Back then weren’t government insured loans capped at 10% max interest rate? So there was a credit crunch as financing dried up.

Powell: Tapering will be “orderly, methodical, and transparent

Unwinding of Ponzi schemes is never orderly, methodical, and transparent.

Try quick and brutal, you will be closer to the truth.

I’m not sure the Fed even needs to start raising rates to prick this thing, they only need telegraph that they are. If this is a bubble – and it is – then it should pop NOT when rates start going up, but when they stop going down. I think that’s especially true with mortgage rates.

The stock market doesn’t even matter insofar as rates are concerned. They are forced to raise rates because they have caused a massive inflation inferno and have no other way of fighting it. Hyperinflation would cause a complete economic collapse.

I predict about 30 to 40% of the mortgages originated this year and last will be underwater once this bubble pops.

The dollar getting stronger will help get commodities down. As the 12 steppers know, the first step is to admit you have a problem. Was that today?

Step One – Admit you are powerless…

The Fed reminds me of my father, a slide-rule era engineer, who by the time he retired had acquired an alcohol habit of sipping at least a fifth of gin daily. As the years passed he had described many methods, backed up by graphs of data on how he was “tapering” down on drinking.

The basic lesson being that an addict can taper in one way, but at the same time untaper in other ways. Like dealing with addiction, there are real and fake ways of getting out of debt.

Excellent analogy — well stated.

(Sorry about your dad…)

Admitting you have a problem? Really? We live in a culture of cognitive dissidence, where reality is denied at every opportunity.

Even here, you can read comments where people are assuming the Fed is acting to make things better for the average person, despite the overwhelming evidence that everything they do has the complete opposite effect.

The fact is, America is being looted like a drug store in the middle of a “peaceful protest”. The Fed and the Government are not trying to make your life better, they are trying to steal everything you have, or ever will have, far into the future… And they are succeeding.

QQ – What tools is he referring to when he says if inflation goes hotter than expected? Is that more QE in the form of more MBS purchases. Or perhaps an unknown tool that is yet to be revealed. I thought they had shown most of their tricks

The Fed has two “tools.” Selling bonds (taking money out of circulation) and buying them, which prints money. That’s it. No matter what else they claim, or what fancy acronyms they attach to these “tools,” that’s all they have.

The markets need to get prepared for a reality that Powell isn’t ready to share with them yet. There will be nothing “orderly, methodical, and transparent” about what comes next.

The last “taper” was announced seven months before it was implemented. The Fed doesn’t have seven months to spare this time… that would be February of 2022.

The last taper went on for TWO YEARS… the Fed doesn’t have two years to spare this time… and especially not seven months and two years. Feb 2024 would be in the middle of a presidential election year when not even Paul Volcker could make interest rate hikes stick.

The last taper got rid of seven hundred billion dollars of assets from their balance sheet in two years. Now they have FIVE trillion dollars of assets they need to dispose of… and less time to do it in. Even to whittle the balance sheet down by the same 17% as 2017 to 2019 means getting rid of 1.25 trillion in assets.

And all of this is without even addressing interest rates… or fiscal stimulus. As Wolf says, the Fed is just trying to slow the pace at which they are falling behind. When they actually start the process to “fix” the economy… catching up is going to be a VERY bumpy ride.

The planners can pull forward demand with fake rates and QE and spending bills, but COVID still happened. No amount of paper is going to bandage up that flesh wound to the bottom 70%. Of course, the wound really happened when they killed manufacturing by letting Walmart and Amazon move everything over seas and undercut the American job market in the name of low prices. Nooone cares if they’re getting slave labor trinkets as long as they’re cheap. Saying it’ll take too long to taper or looking for the Japanification of Amrica is the same as saying this time it’s different. I’ve got a feeling this time it’s more of the same, ride the waves and hope you make it out alive.

Manufacturing is the key, I agree. The globalists saw no danger in our loss of self sufficiency. China laughed.

The markets biggest fear should be a geo political event….

5% inflation and the Fed doesnt lift a finger…..that is dereliction of Powell’s duty of “stable prices”.

And to leave rates near zero as they do nothing regarding inflation can only be termed pre arranged THEFT…to keep the markets up.

This kind of action by the Fed is very similar to what the finance ministers did in Weimer Germany in 1920/1921 before inflation really got out of control. They kept everyone in the dark about what they were doing so no one knew ahead of time that they were being scammed. That’s how they got away with wiping out the middle class and the pensions and savings of everyday German citizens. There was no mass communications or Internet to inform people of what was going on.

I read yesterday? that a Dollarama is within 5 miles of 40% of Americans. There is a reason for that.

In a nearby small city where I live, there are more Dollar type stores than 7/11s. We used to have have the junk chains Zellers and K-Mart, now just Walmart and Dollar stores. This is in BC and a relatively well off area. Grocery stores are another issue, entirely. There are two low enders, Walmart and Superstore (Loblaws), but their prices are still very high. Every other grocery store is trendy expensive. I stopped at one of the trendy stores last week and both my wife and I noticed there were….shall we say? limited ethnic representation in the aisles?

And Walmart often does not list prices by pound or kilogram. They simply have 5-10-15 dollar size packages. People must just say, “That looks like a good deal”.

It reflects a Politico article I read today. Worker’s wages with high school or less are down 15% in real wages over he last few decades, while the wages of well educated workers have grown as ‘they’ haven’t yet figured out how to automate or transfer their jobs. Yet.

Paulo – I’ve been traveling non stop in the US, west of the Rockies, for the past 2 months and your comment pretty much sums up what I’ve seen and experienced.

Poverty is rising in America at an alarming rate, but the facts about that are being suppressed. While everyone sees the homeless camps in large cities, there is another large group of Americans being priced out of permanent residence and into vehicles because they cannot afford rent.

In 2008 recession, around 10 million people were evicted from their homes and had to find alternative shelter. Over the next few years, I would expect we will see a similar situation.

The policies of the Fed and the Government are creating this situation, as constant inflation and wage suppression continually erode living standards. The bottom tier of the workforce is where the vast majority of the damage is done.

When I went to Asia in the 1990’s the one thing that I found to be the biggest contrast from America was the disparity between rich and poor. There were beautiful mansions, and plywood shacks, and really nothing in between. Rich and very poor, and no middle class to speak of. Looking at what is happening in America today, I am afraid we are trending in that direction.

CA is the epitome of third -world-ization of USA. Lots of rich people and lots of poor. Middle class is shafted and are running away

It’s pretty obvious these guys don’t buy their own groceries.

The “expectation” is that higher inflation will abate? Seriously? The Fed is a tool, and it’s being used. It’s bankrupting the middle class and turning millennials and their offspring into debt slaves.

Boomers are going to hold jobs until they die now that their retirement is destroyed.

That’s a heck of a future, no jobs, no way to earn wealth without gambling on a rigged system, and the only people with a rising standard of living are the poor and the 1%.

And the retired old guys are pricing cat food since we can’t make a dime on our savings that is losing it’s purchasing power.

All my 1 year CDs are now maturing. The new interest rate to roll them over is .37%. And that’s before taxes. I may just not roll them over and just cash them in. WTF am I suppose to do with that .37% interest?

SC

Mine in UK went to zero at Christmas so I cashed them in and took a punt on a Russian managed fund yielding 5% on the basis it couldn’t be any worse. I’m getting the divis and I’m up about 10%+ on capital. They are getting out of the dollar and they’ve got a ‘proper’ central banker. Target 4% actual 6%, we’ll have to put rates up 6.5% done already. Oil is climbing again and you guys are arguing over ESG and smoke.

Not a recommendation but just saying zero % is not hard to beat, and Russia is about as far away from everything in the West as you can get. Ask Jim Rodgers.

Don’t tell me to go live in Russia, it’s too cold at my age and I’m happy where I am.

Did you see Vlad’s car and plane at Geneva? Just askin’

A: ‘they’re getting out of the dollar’

Right, Russia has announced its getting its cash reserves out of the dollar. They are going into the euro. No one considers rubles as reserves. They also announce something about gold every week, hoping to bolster the ruble. Germany has about 4 times as much.

There have been some pretty ‘world wise’ cos and people bail on Russia. I think BP is one after a Russian partner at meeting showed up with a gun. Few years back, a Canadian outfit partnered with locals and took over a Moscow bar/ restaurant, that was failing. Year later, it’s thriving, doing stuff like customer service. One day, partner shows up with muscle, changes locks, Canucks out. Courts, cops, not interested. At all.

But! The locals are connected but so are the Canucks. PM Harper takes it up with Putin. Putin tells Russian ‘partners’ ‘settle with Canadians or go to jail.’

Does your outfit have a ‘roof’ the translation of the Russian word for political cover, without which any success can be stolen?

NK

By getting out of the dollar I meant they are doing vastly more trade with their partners in currencies other than the dollar. On the point about reserves they maybe switched to Euros to help to persuade Merkel to stand by Nordstream 2 and not give in to US bullying?

KGC,

Your sentiments reflect my own. The people running the Fed do not live regular lives and are out of touch with reality.

I appreciate your comment about how the current market is so broken that there’s “no way to earn wealth without gambling on a rigged system…” Reminds me of an anecdote from the late 1920s when a fellow (I can’t recall who) realized that the whole system was in serious straits when shoeshine boys were playing the market and giving stock purchase advice to customers.

Supposedly that was Joseph Kennedy, but who knows?

Country truly lacks strong leadership at Fed level. Well I guess any Fed leader who does not support money printing , will not get appointed. The current Fed leaders know about the asset bubbles, inflation and the theft from savers to debtors but can’t admit it and will play pretend and extend… I bet by 2023 if there is a 10% crash to market they will be reversing course in a heartbeat..

Seems Like 1 President wants to make money, another wants to impress’

Then their is the Fed Chair . So ? who are we anyway ? Visitors watching the show but not for Free . We must pay for Free now then Pay some more .

Free is the New Money but for who that’s the reality the End game.

What?

November 2022 +/- 4 months. That is when the S will HTF

The Fed talk about tapering and higher interest rates ==> before stock markets correction.

It is probably already over. The rising inflation may cause the downturn because people have decided not to pay the price increases. Falling interest rates and lumber prices may be saying it is already over and we are in the next leg of the downturn.

Items other than wood are still hard to come by without paying markups beyond MSRP. Looking at you PS5!

Sony has left the door open for the supply to increase in 2022, but it’s best to assume that the PlayStation 5 won’t be readily available to pick up from stores until 2023

This is what happens when you give a bunch of freebies to people who never had a pot to piss in.

Just a bunch of hot air. A year from now, rates will not be very far from where they are now and house prices will be higher, but the price growth will be much slower.

I heard nothing today that makes me think housing will become any more affordable anytime soon. No end in sight.

Wage increase and no real action from fed will keep price high for a long time.

Having lived through this in the 70’s, shortages and inflation cycles from one consumable to the next. Lumber inflated wildly, and is now starting to come down, although I doubt it will go back to pre-covid cost. Soon, another consumable will have a shortage and its price will be inflated. This pattern will cycle from one consumable to the next, and each time never going back to it’s pre-inflated level. Basically, each industry gets their turn at your backside…

Does propaganda not equal policy and the proscribed narrative not override the described reality? Am I misssing something here because the words don’t match the deeds.

Raising rates is only one way to drain liquidity. You can use other methods to drain liquidity through reverse repo and increased rates on reserves.

Neither of these are as powerful as rate hikes but they’re less visible to the MSM (how many reporters on CNN are going to discuss the impact of increased reserve rates?) and not understood by the public.

IMHO the Fed is temporizing to see if price inflation settles down and these weak stopgap measures are their way of tapping on the brakes.

However, there are nonbank lenders in abundance that are not bound up in this system and capable of providing liquidity.

I concur. Fed said “we’re aware of inflation issue, and we’re prepared to intervene if things don’t settle down”.

The Fed can reduce the money supply easily by stopping the purchase of mortgages, gov’t bonds, etc. They can raise reserve requirements for banks. They can raise interest rates. All those techniques serve to reduce the money supply. They can do that fast or slow, and it’s just a few clicks of the mouse to get it done.

The question is about “effects”. When any – let alone all – of the foregoing reductions in money supply are implemented, it has _effects_. Those effects include:

1. Reductions in entitlement/transfer payments of all sorts, and 50% of all U.S. households get transfer payments of one sort or another.

2. Homebuilding slows, car-buying slows. Those are two of the biggest drivers of U.S. econ activity.

Easy money keeps businesses going; it is an attempt to compensate for the fact that households can’t afford to buy; they have to be given _assistance_ to buy.

Those just a few of the effects, and the Fed wants badly to avoid those effects.

So we expect too much from the Fed.

The problem of middle-class wage reduction can’t be addressed via monetary policy. It could be addressed via national industrial policy, and it could be addressed via household-level investment decisions.

Those are tough issues. They “cost” real change at the individual and societal levels. How good at adapting ourselves are we?

So when you object to inflation, and rate repression, and wild expansion of the money supply – and you should – don’t forget to explain to yourself what your proposed alternative is.

Our economy, as many have stated – is addicted to easy money. It’s addicted to easy money because the middle class can’t earn enough to buy what’s produced. The 99% can’t sustain it’s own buying.

If the easy money stops, the shuttered-business phenomenon we saw from Covid is going to happen again. That was a fairly decent example of what happens when demand stops. No transfer payments, no demand.

What would have happened to demand without the stims?

Tom Pfotzer- yes, the workers’ ability to earn a living wage has been hammered by globalization of labor and capital.

In normal times (past few decades) ~50% of households receive government assistance in the US. I do not know what that percentage is with the stimmies, but I am betting closer to 75%.

So, the plan to make everybody dependent on the government and get votes for more government is working. I don’t know if there is a way to reverse the trend.

Note that less economic progress correlates with more social/government support. However, it’s like smoking. You don’t get the bad cancer the first day. It happens many years later.

Look for less medical, electronic and other new products in the future; a lower standard of living than would otherwise happen.

If the developed world wants to have a “real” economy again, it needs to stop (“globalizing”) rewarding places that have lower costs due to less worker, environmental and other protections/costs.

That’s what globalization amounts to in reality. (Note- I have worked outside the US and seen it first hand).

wkevinw – yes to all. And it’s not just globalization that’s hammering the value of labor. It’s automation.

Automation’s job is to wring the labor component out of the production equation. And it works – relentlessly.

This is why the so-called “advanced” economies all have to do so much transfer-paymenting. They’ve automated all their workers out of a job.

Transportation, energy, mining, manufacturing, agriculture … they used to offer a lot of decent-paying jobs. Not now – and these are _domestic_ industries. Not globalized, and yet labor’s been virtually wrung out of them.

If your household can’t sell labor at a price high enough to make ends meet, what’s Plan B?

Well, for the past few decades (since about 1990), Plan B was “issue credit, and when they can’t handle any more credit, degrade the money supply”.

We are nearing the end of Plan B.

I would like to get source for your claim that “~50% of households receive government assistance “.

Tom Pfotzer- on Automation. There have actually been some serious academic studies that concluded that automation has not been a significant source of job loss compared to off-shoring. It depends on whether you believe them or not, but I tend to.

Automation can create value; CREATE value- not just shift to another geography. That value: free time, low cost can be used to redirect activities/labor to other jobs – in the long run. In the short run, jobs are certainly lost.

yxd: do a google search on “percent americans government benefits”. Plenty of sources. And those sources don’t include the recent stimmies.

And that 50% I quoted doesn’t include gov’t employment, nor Defense-related contractor employment, nor health care employment funded by gov’t expenditure.

Transfer payments are massive.

=======

wkevinv: Automation yields great benefits if you own the automation. The 99% doesn’t own the automation.

If you sell labor, and there’s fewer jobs available for your skill-set because of automation, your household income will drop.

That’s why there’s no pricing power for labor – too many people for too few (good) jobs. You don’t dare strike.

That’s one big reason inflation has been so low over the past few decades, in spite of all the money creation. Wages are static (actually falling in real terms).

The proposed alternative is a free market monetary approach, but also good governmental regulatory policy to protect jobs. Life is full of cycles, bad things happen, the Fed cannot provide a mirage that there is no trouble in the world, or that recessions are not natural. Automation is fine, it’s less destructive than people realize. One of the big problems is many of the largest automation companies (at least in the automotive industry) are not based in the US. Prior admin was not wrong to favor a more isolationist policy approach to protect jobs, but they also wanted unlimited “trickle down” stimmy at the same time to protect their very rich selves.

When dumb-ass bureaucrats who persistently failed at everything they did in the past start making a fuss about thinking about considering to simulate the appearance of action possibly sometime in the distant future with no clue whatsoever what the consequences might be and the markets go crazy about it you know the end is near.

Got gold ?

In other news, alcoholics plan to stop drinking in two years.

Or is it “alcoholics plan to start talking about stopping drinking in two years”.

If I have 2,000 to 8,000 USD because I’ve been pump primed by the Fed which I intend to spend, then I’m not going to change my spending plans because the Fed changes the rate to 3%, because I wouldn’t care because it doesn’t make any difference to the amount of money I have. I also won’t care at 5% and will continue not caring because -you cannot generate a meaningful return on a small amount of money-.

The Fed is used to dealing with the financial markets who appreciate minute changes in rates because of the billions under management and if they imagine they are going to be able to change the average consumer’s behaviour in the same way, then they are, imo, very wrong.

Maybe they can cause a crash in valuations but they will not be able to stop consumer inflation and thats the issue, not -when-.

Kudos to you, Wolf, for accurately predicting in advance the reverse repo interest rate payment to stabilize the overnight rate in its target range.

While this was done to keep interest rates from going negative, in effect it shows that rates really are a bit negative it’s just the fed subsidizing things to keep them advertised above zero.

They just cannot raise rates. Not with 30 trillions of debt. Impossible.

Unless you want a US default.

Won’t happen. Words. No action.

The Fed is trapped. And we know it.

It’s the sad reality of bankrupt nations.

And the joyous reality of those who planned it by loading up on mortgages at fixed rates.

Nah. The US can always borrow a little more to pay interest. That’s no biggie, amid the huge borrowing that has been going on for years.

In addition, a lot of the debt will mature way in the future — some of this is 30-year debt — and the interest rate on that debt will remain fixed until it matures.

You don’t understand exponential math.

richer,

You don’t understand sovereign debt: a country (government) that issues its own currency cannot go bankrupt and will not default on its debt issued in its own currency because it can always print more.

But it can destroy its own currency via inflation. And that’s what this is about.

That’s what they said back in Weimar, too.

And i guess Simbabwe.

Bring in the wheelbarrows. We can always print more.

To quote a former champion printer: Yes we can.

And look: interest rates are going down, so there’s no inflation.

Yeah, right.

Taper talk is all about wage inflation. The proles HAVE to be satisfied with low wages and need a scare.

Inevitably, whenever they finally realize they have a problem, they’re too late to fix it.

That, sir, is an axiom of history!

Agreed. All efforts will be made to maintain the status quo until it simply can’t be maintained. It will correct itself. Ouch!

wow thanks Wolf for this discussion, I for one would not like to be at the helm considering and pondering about the actions to take, this is a very unusual set of circumstances, will probably not occur again in my lifetime. The present economic models do not provide adequately for the extremes that we are currently seeing in the US and across the globe. So grateful to Wolf to give us the ins and outs of what is going on.

Inflation yup lets hope its a supply side issue for now, this can be easily resolved through the increased availability of labour production and raw materials. Noted that there are lots of bottle necks here particularly the availability of workers, shipping transport , and lack of semi-conductors for cars – mmm the list goes on . Roll out the vaccines will resolve some of this, then see where to .

I trust the people at the helm, do not want there job no doubt there experience from past events and what is happening now are vastly different. Lets be grateful for there good work, and sure they may well deviate from the path however for me I am adopting a frugal attitude – dont spend or contribute to inflation, tighten my belt , dont complain, learn and grow from this experience.

Cheers and once again Wolf thanks for your thoughts and analysis. Very useful.

Just playing Devil’s advocate.

If you had a slave, isn’t that the attitude you’d want him to have? Walk the line, don’t complain. Eat crow with a smile, while the elite eat their cake, on the back of your labor.

The wealth and income gaps today are truly astounding. CEO pay, shareholder compensation, influence of money, are all making new highs, while young folks are being priced out of life. It’s time to speak up, no?

The longer the Fed waits to reduce the threat of prolonged inflation, the more severe the recession will need to be to finally get the job done…same as in 81-82. Of course, they’ll all be stepping back at that point claiming there’s no way humanly possible they could have anticipated how sticky inflation would ultimately become. That despite the myriad of signals all around us, if only one bothers to open one’s eyes and ears.

The problem is that we have already seen the effects past stimulus has had on inflation, and now we are looking at the child credit stimulus that is going to be rolled out soon.

So we know now that more inflation is already built in to the future due to the new stimulus.

Jobless claims are up. The biggest negative component : nurses

and vaccine centers employees.

When the Fed does a “technical adjustment”, it is never a “technical problem”, but rather a FUNDAMENTAL problem.

There are no small matters

1) US continuing claims are in trading range for one year, since June 2020.

2) The chart indicate that continuing claims might jump > the upper

boundaries and explode in the next few weeks.

3) There are more nurses and administrators in vaccine centers than

customers. Doctors check in cubicles are empty.

4) Hospital shed workers who refuse to be vaccinated in order to cut

cost and OH, under the banner of safety, because their lucrative outpatient sectors are not coming back to their full potential.

5) Nurses salaries are equal or higher than part time job doctors. Med school students, for free.

6) The pandemic eliminated additional 500,000 “prime age customers” between 65y and 95y. That’s hospital’s nightmare.

Point 6) is a big one. It also reduces the burden on the SS & Medicare systems, for which the Treasury is likely grateful…even if they won’t openly admit it.

I have become so cynical about this system that I plan to marry some 20 year old sweetie pie near my deathbed so that she can get my SS benefits for 60+ years.

I think you have to be married for x amount of time. Maybe a year or 2 for that to kick in. Seems like you’re not the first to have that idea.

“Hospital shed workers who refuse to be vaccinated in order to cut cost and OH, under the banner of safety, because their lucrative outpatient sectors are not coming back to their full potential.”

Utter bullshit. During the pandemic when hospitals were allowed to resume elective surgeries they were constrained by the fact that so many nurses and scrub techs were out with covid that the remaining staff worked brutal hours.

Every hospital I ever worked at required flu vaccination annually as well as a negative TB test. One system required blood work for hepatitis and HIV as well as up to date vaccination such as tetanus and DPT. I still have a copy of my varicella, rubella, mumps, rubella, and Hep B titers from 2015 stored on Dropbox. I have no idea why.

It’s for safety, not money. The Methodist system in Houston vaccinated 25,000 employees and placed 178 on suspension, to be fired if not vaccinated by June 22.

Quite a savings firing 0.7% of your staff. Besides Texas is an “at will” state. You can be fired without cause.

Theres no conspiracy. As Freud said, Sometimes a cigar is just a cigar.

Thank you!

Except there is one huge difference. The vaccines you were required to take were FDA approved, and not “experimental”.

When you attempt to force someone to take a experimental drug or vaccine, you are violating their human rights and legally attempting to make them part of a medical experiment without their willful consent. That is in violation of the Geneva Convention of 1948, and in fact makes you subject to prosecution under international law.

My guess is that the hospital will find themselves paying some very big settlements in the not too distant future…

It should be noted that Fed is as of yesterday announced they will be paying interest on ALL reserves, both *required* reserves and *excess* reserves.

We may therefore dispense with the IOER acronym and say just IOR.

NARmageddon,

This is not new. The Fed has paid interest on required reserves and on excess reserves since 2008.

Also, as of 2020, when the Fed did away with the minimum “reserve requirement,” there are no more “required reserves.” And they’re all now “excess reserves,” and the whole distinction is just a leftover.

Every time the Fed makes public statements, it further damages its own credibility. Talking about inflation in the 2.5% to 3% range is so far from reality you have to assume everything they say is a blatant lie.

One of the heavyweights asked about yield curve and Powell pushed the term aside, as if to say, we are already buying a ton of stuff, so what if we buy different maturities? Answer: QE is replaced by YCC. The dollar is getting a pop here, and yields are down at the long end. Gold down bigly. The buck is driving this action look for more. And there would be inflation in imports. Time to go bargain hunting at the Ten Dollar Store.

Following this for years I’ve given up on expecting drastic anything. I think the inflation will be hot for a bit but then cool down because the truth is that like Japan, QE is deflationary and that is what is really going on in the background so they will only get enough inflation to have to talk about it for a while.

They know they can’t raise rates though. If they even try to the only thing that will happen is the market will fall 30% in a month and they will come back in with emergency measures bigger than before.

It’s pretty crazy to think what would happen if inflation really kept going because if it really was like 10-20% where the public demanded it fixed and rates really were raised more than even just 3% ….the market would probably fall like 80%. It’s basically unthinkable but I don’t think it will be that extreme because we will just get a mini taper, a mini tantrum and then the same fix which will just keep the march of asset inflation going with low rates.

Japan is very different from the United States. Japanese people don’t consume like crazy i.e. they tend to be more conservative with money.

They walk around with hundreds of dollars in their pockets.

Folks here don’t have hundreds in their bank to pull out. It’s all plastic.

We’re horrible at money. It’s sad.

“They walk around with hundreds of dollars in their pockets.”

LOL. That’s not because they have a ton of money. Japan is still mostly a cash only country. When it comes to “fintech”, they might as well be living in the 1980s. I think Paul Volcker would feel right at home there in this aspect.

Now, people might be thinking, how can it be safe for anyone to be walking around with hundreds of dollars in cash? Well the thing is 99.99% of Japanese are extremely honest. You can leave laptops, valuable goods, etc lying around in the busiest Starbucks at Shibuya Tokyo, and you’ll still find them where you left them or at the nearest Lost and Found. There are too many testimonies out there about the honesty of the Japanese people. Sure they might “borrow” your 3 dollars umbrella from time to time, but when it comes to valuable goods? Nah.

That’s why I always laugh when people compare Japan and America. Say both countries collapse today, America will be a warzone. Japan? Not so much. But USA, USA, ROFL.

Monkey, yes. After the earthquake back in 2011 that triggered the massive tsunami, I remember seeing pictures of Japanese people waiting in line in an orderly fashion for water and other emergency supplies. Contrast that to your standard Black Friday sale at Walmart.

Because most people can’t figure out wants and needs I always wait one week most times don’t purchase as it is a want American s buy to much junk

When I visited Japan I was impressed by the way the Japanese used rooms for more than one purpose. A bedroom at night was an office in the daytime. Space was always at a premium and they seemed to make the best use of it. They always seemed to be well structured and organized and loyal to their bosses and had good work ethics.

Japanese spent they don’t have in the late 1980’s, because the

momo trade was better than wages.

Two months from now, after a “market event”, the Fed will say “rates will not go up till 2025 at the earliest”.

Same old Fed.

I disagree, the Fed represents the banks, and the banks fear inflation much more than they fear higher interest rates. The last thing the banks want is to have loans repaid in dollars that are worth far less than what they loaned. Especially when they are making those loans at low rates to begin with…

If we are having 10% inflation, the money being paid at the end of a 7 year car loan is worth only a fraction of the money they initially loaned. It is pretty hard to make real profit like that….

Ha…Jedi Weimar Powell…if Oxford needs a picture next to definition of Jawbone/Gaslighting expert, they should use his picture along with Greenspan/Yellen/Helicopter Ben.

These clowns use the same playbook, it’s like that psycho ex that will say and tell you everything you want to hear just so you won’t leave. Just watch, if the market start heading down until the next FOMC, back to not thinking about thinking again stance and oh our new inflation target now is 5%…

Wut? We’ll be Venezuela by 2023 at this rate. No pun intended.

They think inflation is going to go down to “2%” by itself?

History’s not going to remember these people well.

“There is so much uncertainty,” and “we need to see how it develops over the coming months.”

Quite a funny statement….been saying this since two predecessors ago..I guess “uncertinty” is the password for QE infinity and ZIRP. Looking forward to them saying this for the next 100 yrs..

“There is so much uncertainty,” and “we need to see how it develops over the coming months.”

Let me translate:

“We have no clue what is going on in the economy. We will sit on our asses and see what the charts point to before we make up more excuses”.

The Fed is now beginning to be seen for what it is. Those who believe the Fed is omnipotent and the master of the Financial world are about to have their reality shattered, as they see the economy first spiral into double digit inflation, and then a major recession, and the Fed be powerless to stop either. The fantasy that the Fed is “in control” is about to be proven to be unfounded faith.

Seems to me that when a government’s central bank enacts policies that serve to transfer the savings of elderly retirees to Wall Street and other speculators through financial repression of the former, in order to maintain a debt-based monetary system that is in large part based on highly-leveraged speculative finance, that monetary system is categorically broken.

So how can we fix a broken debt-based monetary system?…

I recall reading an article by Hellasious on his suddendebt blog as the GFC was unfolding many years ago in which he proposed the following:

1. Straight debt cancellation for a portion of debt, particularly for the “bottom” 80% of the population.

2. Anchor the dollar and money supply to the real Green/Sustainable economy.

3. Focus government action on income creation, instead of asset/credit/debt protection.

Just a thought and there’s much to consider here, including fairness, transition and global reserve currency issues.

What is incredible is that these guys (Federal Reserve) have zero accountability and incentive to get it right.

If they are wrong, millions of people will suffer due to their bad decisions.

How would they know 2023 is going to be the right time to increase rates? They don’t and they don’t care. It is a parlor game for them.

The Fed minutes had a fine print uncertainty section. It mentioned allowing interest rates in negative territory. A conflicting raise rates yet have a negative rate in the tool box narrative.

In previous Fed memos “cut and paste”. Almost word for word when raising or lowering rates over the last ten years.

$700 billion in reverse repo’s Thursday.

Previous emergency rate hikes just come out of the blue. The previous minutes never forewarn of the agenda. Is this “bed side manner” like a Doctor? Don’t freak or stress the patient out?

I also noticed a Wolfstreet graph link on Peter Schiff’s blog today.

Great research as always Wolf!

Stay vigilant.

UK is bad enough, but I never cease to be amazed by the amount of PR BS your officials (Covid & economy) need to do, to try and ‘blindside’ all your relentless MSM talking heads, and it works, dots for God sakes!

Nobody has mentioned Yellen at the Treasury, where all the big levers are pulled. She was yacking about how higher rates might not be a bad thing. There is nothing to say the Treasury needs to go anywhere near the Fed to raise money, she could go straight to the market to raise cash and all those banks, having to do reverse repos every night, might be dead happy to buy new bonds and keep them, especially after all that QE let them dump their useless junk. The RR’s could be bait on a hook to see what’s biting. She would only have to go to the Fed if she had to discount her debt too much to sell it. Then Powell would be keeping all his promises about not tapering and any rate rise would not be his fault, he could blame it all on Yellen and the Govt who might be happy to give the impression they were screwing the billionaires at last.

It’s a terrific game and I can’t take my eyes off it.

“a country (government) that issues its own currency cannot go bankrupt and will not default on its debt issued in its own currency because it can always print more.”

“But it can destroy its own currency via inflation. And that’s what this is about.”

I’ve often wondered about this common piece of economic sophistry, so beloved by MMT.

If your currency goes to zero, you’re functionally bankrupt. You can’t pay a creditor with zeroes. You can’t print zeroes. By definition zero is nothing. You can only avoid bankruptcy if the lender accepts no payment as payment.

If you have any brains at all never go near zeroes or infinities. Weird stuff happens. ;-)

I’ve been reading about infinities. Note the plural. There are different sizes of infinities and some infinities contain other infinities. The amount of numbers is infinite. A subset of all numbers are odd numbers, which are also infinite. Same for even numbers, irrational numbers, etc. I need a drink. Maybe an infinite number of drinks.

MG

What’s worse is that space is also infinite.

Basel III has kicked in. Gold price has to be suppressed to help the Banks.