Why is the Fed so far behind the curve? Other central banks are now making room for “persistent” inflation.

By Wolf Richter for WOLF STREET.

Today, the world saw announcements by two central banks about reducing or ending asset purchases: By the Bank of Canada, its third reduction, and by the Bank of New Zealand which will stop them cold turkey in 10 days – following a slew of similar announcements by other central banks, while the Fed is still fiddling as inflation burns.

The Bank of Canada announced that it would reduce its purchases of Government of Canada bonds to C$2 billion a week, from C$3 billion a week, the third reduction of the same magnitude. It cited inflation, which rose 3.6% year-over-year, a pale imitation of the US CPI jump of 5.4%.

The rhetoric of “transitory” inflation is still there, but room for doubt is being opened up: “The factors pushing up inflation are transitory, but their persistence and magnitude are uncertain,” the statement said.

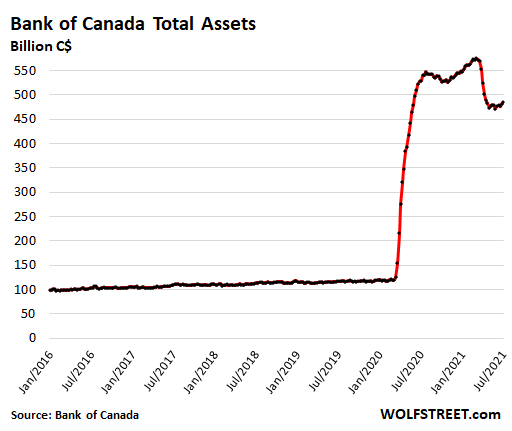

The first taper announcement came in October last year, when the Bank of Canada said it would reduce its purchases of Government of Canada (GoC) bonds from C$5 billion a week to C$4 billion a week. At the time, it also ended buying mortgage-backed securities. In March 2021, it started unwinding its liquidity facilities, including repos, citing “moral hazard” as reason.

The second taper announcement came in April, when it reduced its purchases of GoC bonds to C$3 billion, citing “signs of extrapolative expectations and speculative behavior” in the housing market.

Unwinding the liquidity facilities caused a sharp drop in the total assets at the Bank of Canada, from C$575 billion in March, to C$484 billion as of the latest reporting week through July 7, even as the purchases of GoC bonds continued at a much slower pace. GoC bonds now account for C$400 billion of the total.

Until the next taper announcement, GoC bond purchases will continue at a pace of C$2 billion a week. This pace is down by 60% from the pace that prevailed until October. Some of the remaining liquidity facilities might continue to unwind:

Reserve Bank of New Zealand stops cold turkey: “least regrets policy”

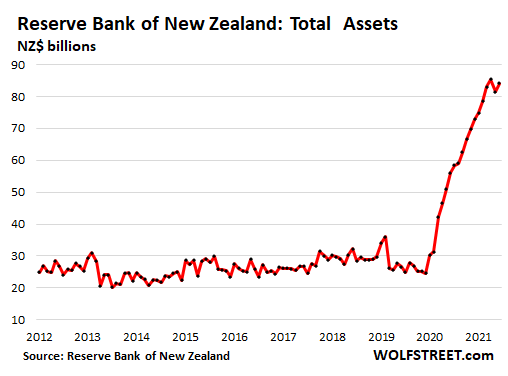

With the government, which has come under pressure from the biggest housing bubble in the world, breathing down its neck, the Reserve Bank of New Zealand announced today that it would stop its asset purchases on July 23, citing “unsustainable” house price increases as reason. No tapering needed.

The statement said that in addition to “near-term spikes in headline CPI inflation,” driven by “one-off” or “temporary” events, it expects “more persistent consumer price inflation pressure” to build over time “due to rising domestic capacity pressures and growing labour shortages.”

The magnificent housing bubble is now showing up explicitly in the statement as reason for ending QE: “The Committee agreed [with the government] that the recent rate of growth in house prices remains unsustainable.”

It said that some of the factors leading to the unsustainable house price increases have already eased: “more constrained investor demand,” more construction, and “changes to housing tax policies.”

And “any future increases in mortgage rates will further dampen house price growth,” it said. So those higher mortgage rates are coming.

Hence the “least regrets” policy: “The Committee agreed that a ‘least regrets’ policy now implied that the significant level of monetary support in place since mid-2020 could be reduced sooner, so as to minimise the risk of not meeting its mandate.”

Compared to the giants, New Zealand is small, and the Reserve Bank has a small balance sheet, but its QE program was massive, ballooning its total assets by 230% between December 2019 and June 2021, to NZ$84 billion.

Other central banks already started tapering their asset purchases.

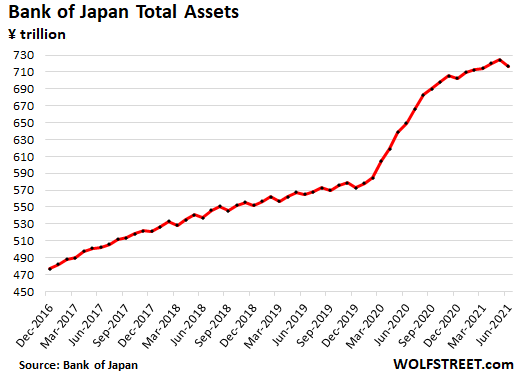

The Bank of Japan, one of the biggies, has been tapering its asset purchases for months. By June, its total assets, after months of slowing growth, fell by ¥7.7 trillion ($70 billion) from May, to a still gargantuan ¥717 trillion ($6.5 trillion):

The Reserve Bank of Australia announced on July 6 that it would reduce its weekly purchases of government bonds by A$1 billion a week, to A$4 billion a week.

The Bank of England announced in May that it would reduce its bond purchases from £4.4 billion a week to £3.4 billion a week.

The Riksbank of Sweden announced in late April that it is sticking to its plan to end QE entirely by late this year.

So why is the Fed so far behind the curve, rather than leading, with inflation having surged in recent months at the red-hottest pace since 1982? Why is it still buying mortgage-backed securities, given the biggest housing bubble since this data was tracked? The convoluted rationalizations and denials coming out of the Fed trigger nothing but bewildered head-scratching.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

You can lead the Fed to inflation but you can’t make them see inflation!

They’re outright denying inflation. The numbers are there, the dual mandate is not being met, the jobs aren’t following, and yet it’s foot on the gas for as long as it takes. Almost as if it’s a single mandate.

“the jobs aren’t following”

Golly, destroyed interest rates have only failed to maximize employment for 20 years!!

How fast do you think a government can respond?!…

The best and the brightest are doing their bestest and brightest…est.

Today’s economic midgets missed the course in the Trade-off between Capital and Labor.

By reducing the cost of Capital hugely below the market price – near zero cost of capital – then Labor is replaced by capital – computers, robots, etc…

No greater theft has ever been seen. “Free Trade” equals outsourcing American jobs to China, and lower than market interest rates means the rest of the American Working Class gets knee capped.

There are help wanted signs all over the place. Almost every restaurant or hotel I have been to will tell me they are understaffed.

I am seeing sign on bonus everywhere too. Even for fast food joints.

Maybe the statement should be “wages” are not keeping up?

The single mandate is NOT jobs, it is propping up asset bubbles for the rich.

But over the past 4-5 months, the Fed has been adding both purchases of bonds PLUS starving the supply of Treasuries by using the balance at the Treasury to pay for the deficit spending. But in about the next couple weeks, if not already, that is over and the Fed needs to start floating $300 billion of Treasuries more than in the past couple months. That alone is going to lead to higher interest rates.

The stimulus, both fiscal and monetary, has been like nothing ever done.

But as the old saying goes, dont let a good crisis go to waste.

Blsackrock’s Fink has wormed his way into the Bank of Canada, a crown corporation. Blackrock is being paid to pick and choose which corporate bonds to buy. If you know Blackrock’s ETF and retirement funds biz this is beyond corrupt. Yes, letting the proverbial fox into the henhouse!

“The single mandate is NOT jobs, it is propping up asset bubbles for the rich.”

Exactly. The Fed’s only mandate is to keep the money pump pumping for the creditor/asset-holding class. The creditor/asset holding class’s inflationary gains come at the expense of the 90% of Americans who make up the debtor class.

When will we have a heavy hitter reporter ask Powell to name a date on which he will no longer claim that this inflation is transitory. Imagine Wall Street’s anxiety level as that date looms closer.

Lawrence Smith. What an ignorant post. I’m embarrassed for you.

Mr. Smith,

Couldn’t agree with you more. Commenter “RES” is some kind of Kommiefornia dingbat. I am embarrassed at his obvious MSM brainwashing. Defending the FED?!? Give me a break.

Greg

“Blsackrock’s Fink has wormed his way into the Bank of Canada, a crown corporation. Blackrock is being paid to pick and choose which corporate bonds to buy. If you know Blackrock’s ETF and retirement funds biz this is beyond corrupt. Yes, letting the proverbial fox into the henhouse!”

Can not the same be said of that outfit and the Fed?

I suggest everyone watch the PBS Frontline “Power of the Fed” episode that aired yesterday. Kashkari the Klown couldn’t even muster a non-emotional and coherent response to very gentle and obvious questions about the Fed’s role in promoting wealth inequality and inflation. Add in today’s Congressional farce and you know all you need to know about the Fed’s gameplan: Money printing now, money printing forever.

I’m reminded of George Carlin’s line: It’s a big club, and you ain’t in it. The Fed works for the club, not for you.

The Fed *is* the club…used to beat the saving middle class to death.

Till we’re all peasants then sweet revenge

Yeah, but Amazon is all out of pitchforks and torches, as they’re made in China now and stuck somewhere on a container ship in the Pacific.

End. The. Fed. Now!

There’s a way out, you know. You’re just too stubborn to see it. Convert your dollars to bitcoin. The supply of those can’t be tampered with and you can easily take custody yourself.

Bitcoin is down 50% against the dollar. Not very encouraging. But go ahead. YOLO.

Government can confiscate ask russia

Go home and sleep it off.

“The supply of those can’t be tampered with”

I beg to differ. The supply of bitcoin is controlled by software, which is written by people, which means it can be tampered with. Who controls the software? Who sets the “proof of effort” threshold for mining? Who decides how many variants of bitcoin there will be in the future, all competing with one another?

I watched it last night. Not a word was said in the video about the screwing they have given retirees and others on fixed incomes from their ZIRP and inflation. We are all “cattle” in their minds and they will use tear gas and force if needed.

Dead on!

Theft pure and simple

I watched the Frontline episode.

It was not hard-hitting investigative journalism by any stretch. Powell refused to be interviewed for the show but Kashkari’s interview (in separate short clips) lasted quite a few minutes.

Kashkari’s arrogance really came across as he deflected interviewer questions about Fed’s role in our financial mess and wealth inequality. That weasel would rather blame be placed elsewhere, but never with the real culprit– the Fed.

The episode only had a few brief words about the current raging housing mania and bubble but was rather constantly hammering about the stock market bull market and its benefits to wealthy class.

I viewed some of Jay Powell’s hearing before House Financial Services Committee today.

He is a man of steel– not Superman of comics– but to me he comes across as an emotionless android always repeating the same mantras about how Fed will be accommodative (easy money) until apparently their self-appointed fantasy nirvana employment goals are reached and that Fed remains introspective and thoughtful about tapering.

It was fun to watch these Congress critters literally groveling before their Fed master, and so many were tossing limp softball questions to him.

I guess no one told these political hacks that Congress is (in theory) the master of the Fed and is supposed to be in charge.

Why would Congress do anything. Just take a look at the Speaker of the House’s trading record. George Soros himself might blush.

They are all in it together.

“There is an infinite amount of cash in the Federal Reserve. We will do whatever we need to do to make sure there’s enough cash in the banking system.”

– Kashkari (president, Minneapolis Fed)

With protectors like this who needs enemies to destroy the country?

People are conditioned to think we need the Federal reserve system. We don’t.

You don’t expect anyone in Congress to make a decision, do you?

Trickle down for the plebs, tsunami up for the patricians.

As I said the other day… it is good to be a Director for the Bank of Canada. You can tighten up as much as you need to for the benefit of Canada confident in the fact that the Colossus to the South is still spending wildly.

The management of the Canadian “economy” is an absolute disaster. Home prices are far in excess of USA averages. USD is the reserve currency, CAD rates are controlled by Fed rates yet private debt in Canada requires low rates *until the sun dies*.

Canada is a safe haven economy, very little in common with the US these days.

> Canada is a safe haven

Okay good luck with that.

How is a country with 35mm inhabitants, with *insane* house prices, most of GDP is real estate, requires ever increasing immigration and massive corruption a “safe haven”?

Canada “works” while rates are at zero. After that they will have to either inflate hugely vs USD or pull the rug from under the entire “economy” (real estate).

Canada’s exports to the US equal its imports. You can’t export real estate. How many Americans know Canada is the largest exporter of steel to US? Most know it’s a huge exporter of power to US east coast.

But maybe biggest asset is political stability combined with a sane science- driven Covid response. How long until a state secedes? Coming soon: bans by vaccinated states on entry from anti-vax states.

Did I mention the nights don’t echo with gun fire? Several US cities have installed mikes to help locate gunfire.

And no, you can’t pack heat because you imagine you are Bond or in a Western movie. Maybe that’s related to the absence of gunfire?

Nick – it’s not valid to infer Canada is doing well by comparing it to the USA.

The USA is an absolute mess. I’m in Canada and have zero desire to go there. I’d consider going to hike near the border, but I don’t want to encounter the fascists patrolling the border again.

Yeah, all of us who carry guns do so because we think we’re James Bond or Wyatt Earp.

/sarc

The fact that a 5% Ten Year Bond would lead to a complete Systemic Implosion tells one all one needs to know. Meanwhile, Ride This bubble!

When the 10 yr went above 3% in 2018, the stock mkt fell 20% in three months.

The brain trust at the Fed has spent 20 yrs herding the US economy into a kill box.

People always say that this 20% drop “proves” that the economy can’t handle higher rates, but no one has ever said just WHY. If the market was 25% overvalued, then a 20% drop makes sense. Every new height created by the bubble becomes the new “floor” beneath which any drop is a catastrophe.

Absolutely! I think this is one of the most overlooked concepts in discussing all this stuff. Everyone always talks about the market level as if it’s “supposed” to be where it is. Well guess what? We know we are manipulating the market higher with QE and low rates so the Fed’s idea that they can stop or do the opposite of this and somehow the price level will just stay there is simply moronic!

I can’t stand how this works with earnings… every year they project 10% growth … so stocks go up as if it’s going to be 10% …then they come in at 1% but stocks dont’ go down because they say “oh well, it didn’t but it will next quarter” … but the market never comes down. After a few years of this the market is up to where earnings should have grown 50-100% and they have hardly increased…..but stocks stay afloat and if they drop then the Fed has to spend all our money to save them!?!? ARRRGGHHGHGHGH!!!

” the stock mkt fell 20% in three months.”

maybe the stock market was too high? Anyone think of that?

maybe that flushed and corrected the imbalances and the market gained health rather that promoted excesses..

Exactly. It’s like assuming that every time a person loses weight, he’s become too skinny. There’s never any consideration that he may have been too fat to begin with.

The conspiracy theorist in me thinks it’s because ending the purchase of MBS and backing off QE will tank the stock market as well as burst the massive real estate bubble and the puppet masters still have plenty of both to unload at these lofty prices onto the unsuspecting masses of retail investors before that happens. Got to keep the interest rates low and stocks running up in order to find buyers.

It’s not a conspiracy theory but any stretch of imagination. If the FED ends all MBS, stop QE and raise interest rate by 1 to 2%, you’ll probably see a bigger crash than what happened in March. This is almost a given at this point.

The longer the Fed engages in its complicated financial engineering efforts to keep multiple asset bubbles (stocks, bonds, and housing primarily) levitating simultaneously, then the greater the collapse when it all stops, since logic tells us that it is not a perpetual motion machine.

The end will be a show for the ages, and be written about for as long as histories are written.

Maybe prices are too high…

maybe the “fluff” needs to be drawn off these markets…excesses have been pent up…..

If the stockmarket drops 50%, it is still overvalued by historical standards. At some point things just have to normalise. That includes defaulting on all the debt that can never be repaid. This is the nature of asset bubbles. The longer you wait dealing with it, the worse the damage will be. Better bring it on now.

maybe stocks shouldnt be this high?

40 times earnings ludicrous

Waste Management, Inc. is a well run company that’s in the garbage collection & disposal business. They pay a forward dividend yield of 1.6%.

Their PE Ratio is 40.

Heard the tech stocks are right back where they were at the tech bubble at something over 7 times sales. Didn’t work out good the last time.

This is what I keep telling people. Despite inflation, get in cash. CAPE ratios are demented. The Fed has mastered the ability to hide inflation in CAPE ratios and the real world value of currency is being dismantled, devaluing the work used to generate what isn’t printed.

It’s straight up currency manipulation.

“The convoluted rationalizations and denials coming out of the Fed trigger nothing but bewildered head-scratching.”

Wolf, I’d love to hear your pet theory. You’d know better than any of us posting.

Powell is a spineless jellyfish backed by a group of reckless Progressives at the Federal Reserve. This will end in serious pain for the working family

The Republicans were applauding this piece of garbage today too.

Totally agree, all fools

I don’t think they are fools!

Republicans? Are there any of those left?

The current group of “Republican” politicians should be put out to sea on a small dinghy. Not a single true fiscally conservative one among them.

Good people dont succeed in politics anymore.

At the local level they do. My next door neighbor is one of them.

What? Republicans are trying to rein in the spending of wild eyed leftists in Congress like Schumer. Why would you blame Republicans for what Powel and the Fed are doing?

Yeah, they always try to rein in spending when they’re in the minority. When they’re in the majority, not so much.

Ed C. Why didn’t they do anything to rein in spending by the wild eyed wingnuts during the catastrophic previous four years?

Sound financial principles doesn’t include repeatedly slashing revenues. After doing this, it’s a bit crazy to then blame liberals for excessive spending.

That would be like cutting my hours and taking a lower paying job and then yelling at my wife for spending too much on necessities.

If and when politicians rein in spending , the economy will slow dramatically and those who cut will be toast politically. The majority of Americans won’t accept any kind of austerity. I support tax increases and spending cuts but obviously that’s not going to happen.

JP knows that if (when) he raises rates in the EUA it will provoque a turmoil in foreign countries with USD debt…if people are already tired from covid, those countries only need a little spark.

If they are Progressives at the Federal Reserve, they are doing a horrible job. Wealth concentration has expanded dramatically. Job mobility is rock bottom. And opportunities for starting a successful business and competing with the top .1% are nil. Perhaps you could open a smoothy shop or delivery company and squeeze out a subsistence level income, but make sure you plan for the cost of covering Peter Thiel’s taxes.

Oh yeah, and you have to use Amazon Web Servicer for hosting your website and Facebook and Google for advertising, and have to pay whatever they charge, as there’s no real competition.

Progressives at the Federal Reserve? I would love to know your definition of this word progressives means…miss the mark there so much I don’t even know where to begin..

Brains melted by years of partisan cable news programming only see the world in two colors. When something happens that they don’t like, it must have been the “other side.”

Yep

Powell is a republican appointee and a lifelong republican. As are most of the Governors. FYI.

The Fed is in a silo and legally has a mandate. It’s why everyone who gets in the position of central banker is a continuation of the last one.

Look at any country in trouble, the central banker is going to do whatever it takes to fund what the government needs, even if general population is paying a million currency units for a loaf of bread.

The Fed people are just politicians…just listen to them…

the real powers are in the shadows..

a poster here mention a certain outfit in the “tent” of the Canadian central bank……and they are in the Fed “tent” as well.

Agree with you about the Fed Folks just being more of the paid political puppets of the real powers his story!

However,,, IMHO after watching the SM and RE mkts off and on for the last 60+ years,,, SO are the folks at the various hedgie and PE firms.

All of them doing the bidding and buying and selling of the real powers who are not in the shadows because they live in the best of their houses of the moment,,, typically owning at least six, and many with a dozen, around the world, high and low latitudes, etc., etc.

Their weather is always perfect, or almost,,, they have others to do all the maintenance and prep and cooking and cleaning,,, ALL very very carefully screened from any public view or analysis.

A friend used to work for one of the oldest oligarch family of USA, whose original ”patriarch” had started, as they all have, as a warrior of the old school,,, willing and able and actually doing ”anything it takes” to achieve oligarchic status…

Said friend used to tell me tales of some of the extremes of the 5th generation of that family,,, none of which were ever reported in any media,,, ever…

The Fed already started talking about talking about tightening financial conditions. Let’s not expect too much from them.

A rate increase will come when Angie Dickinson gives Junior the go-ahead. (a Soprano’s reference).

The Fed has expanded M1 and M2 by approximately 80% over pre pandemic levels. This was not an accident, it was very deliberate. Let’s not forget that govies pay principal at maturity, and let’s admit that the Fed is planning to repay principal with dollars that are worth less than 50 cents on today’s dollar. Neither party will ever raise taxes on the ultra wealthy and the mega corps, so this is their only solution. Conclusion: Inflation is not temporary and the Fed knows it. The only remaining question becomes – what excuses will Yellen and Powell make up to hide their involvement in reducing the standard of living for the bottom 60% of Americans?

Do they really need an excuse when the culture of individualism ensures the working class will not bad together to reject being exploited?

Weakest working class in the history of time.

I guess we’re the only country on the planet without inflation.

Wolf,

Always love your comments. Please note, however, that Canada’s pale imitation” of US CPI inflation owes, in large part, to the fact that Used Cars and Truck prices are “not a thing” in Canada’s CPI. That is, they are not tracked and have zero weight in the CPI. But you can be sure that used vehicle prices are rising in Canada, just the same as in the US. In fact, Desrosier Automotive Consultants report that exports of Used Vehicles from Canada to the US have surged as prices have spiked.

Here’s a comparison of the vehicle price component of the two CPI’s: US new and used vehicles up 20.6% y/y in June vs Canada new vehicles up 5.0% in May. June data coming on July 28.

Please email me if you want a chart and spreadsheet showing the comparison.

Ted Carmichael

Nice comment Ted.

The Fed has been backing itself towards a corner for the last fifteen years or so and is now getting right into it. What options does it have to fight inflation? Unwind the QE and raise rates? Say it is temporary (which could be right)? Just let it happen? My guess is that monetary policy has run its course as the primary influencer of markets and economic activity, the fiscal side is about to take over as the main driver and the Fed will take a back seat. There may be no choice in this with the challenges of maintaining infrastructure, fighting climate change and remaining competitive with China, all of which will require massive spending, both government and private sector, and will increase the demand for labor. Wages will go up, taxes will go up, rates will go up, cap rates will fall, markets will come down.

Not true. Canada and like countries are just always ahead of the curve. Used and new prices of cars coming down in Canada. Housing prices are settling and multiple bids going down. Canada is just smarter than the usa per capita. A fact

Good comment.

My question is focused on the personal level.

What is stopping individuals from controlling their debts? Sure, the occasional auto buyer absolutely needs to buy wheels right now, but I have yet to meet anyone who cannot defer or substitute.

Why do people need to buy overpriced homes full of bling? (Answer. They don’t.)

Why is it an issue that restaurant prices are skyrocketing? Pssst, it isn’t because people actually don’t need to eat at restaurants.

This isn’t a facile comment. (def ……especially of a theory or argument appearing neat and comprehensive only by ignoring the true complexities of an issue; superficial.) I lived through rampant inflation in the 70s…with a young family, as the sole breadwinner, who lost their job, and had a mortgage to pay. We cut back on everything, but never missed a mortgage payment. A restaurant meal was maybe for a birthday and maybe not even for that, otherwise we ate at home. I made wine, brewed beer, and we still lived very well and ate good wholesome food. They were good years. Vacations were local outings. Most good things in life are free. I even built a still and made over-proof rum. We had great parties that cost zip. We had a lot of fun, to be honest.

Build a spreadsheet and make a budget. Discover the difference between needs and wants. Have a list before entering a store and stick to it. Build the grocery list with what is on sale.

Yes there is rising inflation. So? You cut back. When enough people do this the situation is self correcting. I don’t like today’s inflation numbers, nor do I like 0% interest rates. Yet it has absolutely no effect on my home and family because we don’t have debt. In fact I carry a healthy savings balance which I add to every month. Always have, always will. I’ve been doing it for 50 years.

The Govt will do what it is going to do. In the 60s and 70s the US govt borrowed zillions to pay for the war. Still doing it. Nothing has changed. People can only control issues in their own realm of influence. Live within, or below your means. Vote. Rinse and repeat. Vote for a serious thinking political party that has policies beyond grievances. Both sides.

Can any of us influence the this FED, or any reserve bank? Nope. You can only control you own actions (expenses) and vote politicians out as need be.

regards

I am like you Paulo. Got it honestly from my parents. Some people don’t know how.

When I was designing products I had access to all manufacturing costs in two different companies. It wires you to think always about cost and efficiency.

My friend’s know that I have a problem overpaying for anything.

Paulo lectures the peasants from his forest castle.

The forest castle I built myself, with my own hands, after work and on weekends. I enjoyed every minute of it, stayed in shape, and now reap the benefits. Still building.

Beats golfing. :-)

My Dad, Great Depression kid in MN, grew up in a small bungalow with 4 other siblings. They had one bathroom and were pleased enough with their lives and lifestyles. My mom grew up poor in New Brunswick…had one dress and a pair of gumboots. I get a little tired of people whining when they pack around $600 phones that plug into their bought on time cars. Just saying.

I agree with Paulo and we typically work the same way.

We’ve dealt with the RE market in the last year and it’s been mind blowing, head scratching and logic defying irrational. I’ve done and seen a lot of RE over the years including dealing with some strange book worthy situations, however, even I have never seen anything remotely like what’s been going on. It’s been truly insane, bizarre and irrational.

As for purchasing RE right now and to add some perspective. Before all of this hit the fan, we were in transition. When we got to our present “temporary” location, I said to myself “Okay, this is going to be tough but it’s only temporary.” It has gotten increasingly difficult and things are failing after a couple of years. Not surprising as temporary set ups only work temporarily. For example, my day started by unexpectedly digging a grave for one of my best livestock. It happened because the set up is “temporary” and I’m losing the battle. A daily problem solving puzzle, exasperation and worry. Now this afternoon, I’m sitting outside with my dog because predators have decided to show up so more stock is at risk. Can I get more stock? Yes but at ever escalating cost and it plain s**ks to dig graves. Without the temporary, it wouldn’t be an issue. Without knowing how much longer “temporary” is, it doesn’t make sense to put in the systems w/associated expenses especially at the current lumber and metal prices. We have been waiting for various issues to resolve, particularly the RE mania. If life had played out anywhere close to plan, we would be back to where Paulo is. Instead, it’s daily struggles, challenges, deferrals and failures. So at what cost (financial, emotion, physical, logistic, failures & deferrals) does it stop making sense to wait regardless of the RE markets bubble. As it is and despite selling a place last December, we can not make a lateral move anymore. This is why we may not continue to wait for a correction or crash that may or may not happen anytime in the near future. Others will have equally valid reasons for no longer waiting. So it isn’t all about a lack of discipline or greed.

As far as CDA tapering faster, we still have far larger idiot debt levels and a far more massive RE bubble than the US. The CDN Feds have still committed to keeping interest rates low to support the idiot overvalued RE market causing even larger mass affordability issues with no regard for the citizens they represent. I would argue that the CDN feds response isn’t any better, their just being very CDN about it so it looks nicer.

CREA is suppose to be releasing an update today. Undoubtly it will be full of their usual excessive optimism and over generalization but at least it’s data. Something to watch for.

Maybe there is a smaller fraction of individuals on Canada wanting to transition from using public transportation to driving themselves in a (used) car given covid risks of an unventilated bus or subway? New York used to be full of Largely car-less subway users.

I don’t think the pandemic trauma is all the fed’s fault

No, I think it has more to do with Canadian geography and public transportation and therefore, Canadians didn’t need to make that adjustment. Outside the centre of major cities and certain transit lines, 1 or more cars is a necessity. If anyone tells you otherwise, you know they live deep within a city.

“GoC bond purchases will continue at a pace of C$2 billion a week.”

To bring it into context, that’s over C$ 8B a month. Canada is about one tenth of the US (population/economy), so that’s equivalent to about C$ 80B a month. Some tapering.

Maximus Minimus,

“Tapering” asset purchases means “buying less.” That C$2 billion a week is down from C$5 billion a week. So to use your 10x math, C$5 billion a week corresponds to C$200 billion a month for US size. And that’s now down to C$80 billion a month. The next cut will bring it to C$40 a month. The fifth cut will bring it to 0 a month.

But yes, Canada’s QE was gigantic. The BoC now holds over 40% of the GoC bonds.

But that tapering cut purchases by 60%. If the Fed did that, it would have cut its purchases from $120 billion a month to $48 billion by now. The Fed won’t get there until more than a year from now!

WOLF

and comparatively speaking, Japan Fed at $6.5T to US $8T(ish) makes Japan’s Fed assets maybe 10X USA on a per capita comparison?

The US economy is about 4x Japan. So Japan would be $13Tn to US $8Tn.

Weimar Powell and his antics reminds me of a fat man trying to go on a diet. Seems to be have an excuse at every turn why we can’t even start thinking about thinking, let alone doing to raise interest rates or stop MBS purchase while the market continues to go parabolic. Way above our lame core CPI, oh it’s transitory. Probably just better off if he just be honest and come out and say, nope don’t feel like stopping QE or raise interest rate cause I got the market’s back, at least then he doesn’t need to worry about market bouncing up and down based on his read between the lines message.

Today is my birthday so I will start my diet tomorrow. This is my first time at this buffet so let me start my diet tomorrow. My friend’s birthday dinner is today so let me start my diet tomorrow.

They know the economy is very weak. QE is a substitute for negative rates since they are at the zero bound. They are suppressing longer term rates to reduce debt service costs and spur activity.

Powell is like the boy who cried wolf. Soon people will just ignore him and prepare for hyperinflation. Most will end up penniless and destitute.

The Fed is a classic case of “groupthink”.

My guess is that they will continue on the road to the hyperinflationary default on the trillions of debt.

At this point, they have no choice.

b

“groupthink” will be their excuse when the market starts causing severe problems.

How will they default on the debt? Just select not to pay China, the US taxpayers or some other group? Curious to how this would unfold in one meta-verse

They have a lot of tricks up their sleeve yet such as inflation at 10% saying it’s 5% and paying 0%.

Academics….like Yellen

“The theories we chose were wrong.”

But we werent for choosing them….

In the real world…You’re fired.

There is an old old saying permabears always seem to ignore. I don’t get why they do:

Don’t fight the FED.

It’s not over until it’s over and worrying about it being over month after month, year after year, in many cases decade after decade, leaves an awful lot of profit on the table…….

Hahahahahahaha!!!! I am tricking everyone!!!! I am doing this to create permanent oppressive inflation and minimize the relative size of U.S. national debt to cover for the irresponsible spending of Congress!!!! And then I go before Congress so they can approve of how I am covering for their irresponsible behavior!!!! It’s hilarious! Hahahahahahahaha!!!!! I am better than Saturday Night Live!!!!! Hahahahahaha!!!!!!

You are telling the truth, the whole truth and nothing but the truth.

Not to worry. The Fed is aggressively starting to talk about talking about thinking about maybe possibly tapering by 50cents in 2030.

The Fed: taking the punch bowl away after the cool kids have drunk it dry and left for the after-party.

Too much! That’s risky! Hahahahahahahaa!!!

The Fed is ahead of the curve. Assets owned by the Fed did a bit less than double during the pandemic.

In NZ they increased from 25B to 85B (3.4X). In Canada they went from 125B to 475B ( 3.8X). The Fed went from 4.158B to 8.091B (1.98X).

It is actually the case that NZ and Canada’s central banks bought proportionately more assets in their countries than the Fed did in the US.

Now that Biden is in office we will see the results of all this QE elsewhere which is even worse than what has happened in the US. The DXY is likely to strengthen for the next 4-8 years and this also means US currency as a share of the world reserve is likely to increase. While the worst inflation will occur in the developing world re: food prices, and we are now seeing this manifest in increasing civil unrest in certain areas like what happened after the QE initiation and recession in 2007-2008, asset inflation is likely to continue worse than the US in the other major developed countries with Central Banks, with the possible exception of Japan.

BBR, best comment of the thread. As usual, Americans are myopic; the real story is what’s happening elsewhere. Ie. South Africa, Lebanon, Brazil….

America is still an empire, the dollar rules the world.

“double during the pandemic”

by their own hand. Their policies played right to their portfolio.

When you are in complete control, how is it you are “ahead of the curve” when “you are the curve”?

How will their portfolio do if someone walked in and said…”no more QE, no more MBS purchases”? oops

The DXY index will fall off a cliff. Next year it will fall below the 74 level and head down to the 50 level and then keep on falling every year. I haven’t a clue where you base your theory of the DXY index rising on?t

PS while the ECB has increased assets by 1.68X and Japan 1.24X, the ECB’s accumulation of assets continues at a very rapid pace while the Fed’s has waned considerably. Seeing as NZ and Canada will end up doing at least 4-5X the Fed is probably not halfway done and the ECB is likely to accelerate dramatically and eventually match or exceed the Fed in assets if the post-2008 responses of each respective Central Bank are any guide.

The biggest winner in terms of % reserve change is probably going to be JPY but in actual % of reserve growth I believe it will be USD. It shrank from 65% of reserves at Obama’s peak to 59% by Q4 2020. The same devaluation occurred more precipitously under Bush. But with actual printing as of late it is very possible the Dollar ends up rising to 62-63% of global reserves within a year or two and retrenches further to 65-70% if Biden is re-elected.

It seems the EU is the latest to the party in terms of printing and I think they are going to hit the gas pedal with vigor through 2022 resulting in a fairly rapid depreciation of EUR to USD.

BBR

New face on Wolf Street ? I like your reasoning. Love to hear more from you !!

American financial experts agree, free money is still the best kind.

If they don’t enact a new debt ceiling law in a couple of weeks, there won’t be any treasury debt issuance going up against QE. All the other FOMC presidents have let QE run during these lapses in supply.

The U.S. Fed has created the biggest financial bubble in the history of the world, and the patients are so addicted to the constant flow of basically free money, that the Fed fears, with good reason, the inevitable Withdrawal Pains upon reduction of I.V. flow. They can fiddle and dawdle and double-speak until the Reset Turkey comes home to roost, but the fall back to reality becomes more damaging to all concerned THE HIGHER THE MOUNTAIN OF NON-PRODUCTIVE DEBT GROWS BY THE DAY. Avalanches aren’t a biggie from foothills, but are very fatal from high mountain peaks.

The marketplace is going to force the Feds hand, kicking and screaming to the Alter of Panicked Tightening. The reduction in asset purchases are a no-brainer for tapering, but the big surprise to the rest of the Central Banking World will be the necessity to bump interest rates up to prevent a currency crisis in the U.S. Dollar. Defending one’s currency to prevent a literal Run on the U.S. banking system and financial markets with U.S. securities sold to avoid immediate currency devaluation by foreign holders is a sad repeat of history for a country spending at every level WELL BEYOND ITS MEANS.

The Shenanigans in Washington, with one-party ramrodding of massive, additional Federal Spending at over 10% of National Debt Extant for a fundamentally Bankrupt Country, is a Black Swan that may very well start the economic and financial system avalanches leading to an inevitable CRASH.

When a Central Bank such as the Fed walks on a tightrope high in the air over a windy canyon, a mere pigeon burp can cause the daredevils to go airborne into the ABYSS. There is no net big enough to prevent this event from being fatal to the future wellbeing of the citizens of the United States. And the world by association.

Who is this David Young guy?????? I have everything under control! If you believe him, I’ve got a house in San Francisco to sell you!!! Hahahahahahahaha!!!!!

This consternation over inflation is going to get awful tedious if the Fed’s term “transitory” ends up being measured in years instead of just a few weeks or months…which seems highly probable at this point. That’s likely what they’re counting on.

You’d think the way people are wringing their hands over the way a few unelected bureaucrats control the world’s economic fate, we might as well be in the Soviet with Chairman Joe in the big seat.

But god forbid, we compare inflation rates across these countries over the last 20 years, see the US has been consistently lagging their targets, and now have room to catch up, even if this year is the outlier.

God forbid we see those other countries have stayed closer to their targets and don’t feel the need to push the numbers up.

God forbid we take into account the social safety net policies those countries have that could direct where the money was sent.

God forbid we have an inflationary policy that doesn’t benefit creditors over debtors.

Let’s just keep wringing our hands.

A co-worker just closed on one this week in Pebble Beach, CA for $25mn. He represented both the buyer and the seller. He has closed on about half a billion so far this year. Some fat cats are sellin’ and some are buyin’. I wonder why on both counts.

“So why is the Fed so far behind the curve, rather than leading, with inflation having surged in recent months….”

The Fed, in poo-pooing the inflation issue, is camouflaging their real intent: a steady, surreptitious default through inflation on the debt the Treasury is issuing. There is no other way to plausibly deal with the accumulation of government debt with Congress adding trillions each fiscal year. Outright default would be way too disruptive. Increasing taxes sufficiently to cover the level of current spending would cause a revolt. By promoting inflation, the Fed can divert attention away from the government, Congress and themselves and shift the blame onto businesses greedy to raise prices and onto labor for demanding wages to make up for the declining value of the currency. They are trying to get a head start before the public figures out their ruse.

The Fed is only one player in what is obviously a global game.

QE is an economic virus that has gone round the World like Covid. Where did it start? Did it escape from a ‘think tank’ in Washington, or did it mutate from Gnomes in Zurich? Is there a paper trail of blame?

The parallels are amazing does it indicate that these ‘Global’ narratives and imperatives could be very bad for all of us at national and street level.

Even changing your Govt doesn’t change the global dictats.

Is there any country not using the QE ‘vaccination’ ??

I don’t know but I would wonder about China, Russia & Co.

World bank runs things Russia China not reserve currency

“QE is an economic virus”

Yes, and it originated in the Japanese Central Bank and was transported to the US in 2019 and perfected by the Fed under the ‘Depression Expert’ Ben Bernanke!

Oops 2019, should be read as 2009!

KPL

and QE “will be temporary” Bernanke 2009 July WSJ…

and rates will “normalize” when unemployment (then over 8%) dips below 6.5%……

well, unemployment went to 3.5%….and the Dow went from 10K at that point to well over 30K….and QE got larger and larger…

The Fed and the FBI have a lot in common.

The party was so fun in Japan, the whole world had to join in. QE it’s what the cool countries do.

I look at it realistically. If my life savings are inflated away, I will have the freedom of nothing left to lose. That would be liberating in itself, but think of all the possibilities in life…

“Inflated away” is not really a given for us… higher prices can mean we buy less and do what real conservatives have been doing for hundreds of years, which means we actually conserve things.

As for protecting ones savings, this may very well be accomplished by how we mix them up. For example: 1 cup of well bought investment real estate, 3 tablespoons of Equities (dividends are a plus), 1/3 cup of cash reserves and 1 tablespoon of precious metals may make for a tasty recipe… Remember, shaken, not stirred.

> Blackstone has agreed to buy a $5.1bn portfolio of rent-controlled apartments geared towards low-income families in its second big bet on the US housing market in less than a month.

georgist

This may be a smart play. After eviction moratoriums end and inflation takes hold, lower end renters will be squeezed. Politicians can appease the renters AND the landlords with massive rent subsidies, and the Blackrocks of the world will set the rent prices.

Everyone wins. Hopefully the Mom n Pop landlords will ride that wave to climb out of their properties having been effectively seized.

During a recent interview, Blackstone’s Jon Gray said they are betting on a housing shortage continuing in the United States. As homes become more unaffordable for larger numbers of Americans, these Americans will look to moderate and low income apartments. And then Blackstone will enjoy the “tail winds” they always look for in their real estate ventures. So even in these times of doom and gloom and “run away inflation”, professional and visionaries like Jon Gray are finding ways to make money on a large scale. This means we can do it on a small scale. But we most remember this: During the same interview, Gray said the real estate investments that get into trouble are usually due to over leveraging. With real estate investments, one needs cash reserves to make it work and to get past the rough spots. Do not forget that wise piece of advice.

” And then Blackstone will enjoy the “tail winds” they always look for in their real estate ventures. So even in these times of doom and gloom and “run away inflation”, professional and visionaries like Jon Gray are finding ways to make money on a large scale. ”

and Who is partnered up with the Fed for “advisory purposes” for the first time in history? Starts with Black…..ends with Rock.

30yr mortgages below 3% with inflation over 5%. Never happened before.

30yr mortgages below 3% when in 1999 and 2006 with less inflation, the rate was 6%.

Why? What changed? Who is in control of the Fed? Fair questions.

“Visionary”

“make money”

One thing this site lacks is a basic differentiation that Adam Smith regularly made: wealth creation versus rentier activity.

Buying up land and then demanding money for access is rentier activity.

Blackrock are rentiers. Leeches. For them to “make” money it requires other Americans going out and doing real work to raise productivity which raises the cost of land (ala Ricardo).

Americans think that two people who both end the week $1k up are both adding value. Adam Smith had a more complete view on this. As did Henry George.

This site lacks that nuance, from the ten or so articles I’ve read thus far, plus based on the total absence of this nuance in the many comments I’ve read.

g

I am an admirer of the ‘classical’ economists, especially Smith who was born within 20mls of me.

But with the greatest of respect I don’t think they could even imagine QE as a concept in any of their thinking.

QE does not appear in the index or Glossary of any traditional economic textbook I know of.

In my opinion it is a ‘monster’ at the party and all other issues are subordinate to that one.

It would be great if we could get the opinion of Smith, Ricardo, Keynes, Galbraith, Friedman, et al but we can’t so we have to try to figure it out for ourselves. Most folk don’t appear to give a to**, so that’s what makes this site valuable.

We do know what Ricardo, Keynes and Friedman all wanted:

they all supported a land value tax and the suppression of rentier activity.

> In 1978, Milton Friedman said that “the least bad tax is the property tax on the unimproved value of land, the Henry George argument of many, many years ago” (https://www.econlib.org/land-taxes-the-return-of-henry-george/)

Taxing rentier activity has no dead weight loss.

G

I agree with you about the ‘rentier’ economy. I am aware of it as ‘Financialisation’ and it’s got very bad in the West.

I would argue that QE provides the cheap money that rentiers use to buy the assets they rent out to others.

Ergo if you cure QE, you cure or diminish the financialisation problem.

It’s a long discussion and this site moves fast to keep up with the news.

Cheers.

You must have missed the bumper sticker on the back of the Toyota Prickass…”Practice Love and Kindness”. Practice it, …..with extreme prejudice. But never discuss those plans on a public forum.

“The convoluted rationalizations and denials coming out of the Fed trigger nothing but bewildered head-scratching.”

I am not so sure about ‘bewildered head-scratching’. Rather I think the reasons are clear as daylight.

1. The other central banks are pygmies in the game as compared to the Fed.

2. What other central banks do does not matter an iota. What the Fed does matters and matters a lot!

3. If the Fed tapers QE or increases rates the markets will sink. And not only in the US. And we do not know by how much. Imagine the havoc across the world.

4. The Fed expects by lingering around a miracle will happen.

What if… what if FED messed around and broke the game. Knowing they have painted themselves into the corner they are now trying to explain that they carefully crafted this whole recovery. Now they have to pursue the game till the bitter end. They can try to let a little wind out of the sails. But they are not fools. They have to balance the most spectacular and FED made bubbles ever dreamt up. Not taper in any reasonable manner all while dealing with-

1) US debt ceiling talks

2) Pandemic Unemployment expiration

3) Eviction moratorium

4) Student loan forbearance

5) Unknown unknowns

The mind of an ordinary man boggles at the task.

But then the supermen at the Fed are Hercules and Atlas rolled into one – at least they is what they and the markets think and that is all matters for now while the party is ongoing. But then, may be that is why they are pussyfooting!

” the Fed are Hercules and Atlas rolled into one –”

That’s the problem. They were designed to be Clark Kent….but have morphed into a monster.

Refreshing to witness the actions of the central banks of these countries NOT operated and controlled by the nefarious, but watching out for their People and Currency.

Refreshing indeed.

1971 to 2021 =50 years

My friends in August sometime will mark exactly 50 years to Nixon unplugging gold from debt expansion it will be interesting to see who gets to benefit from the Jubilee year ,who knows maybe the commoners or maybe the corporation but one will definitely get a break from their debts

Pension blows up ?

Both common themes in Canada and New Zealand is the Chinese destroying the housing markets. No matter how high home prices go the Chinese will push them forever higher. This is where the real problem or root cause lies.

Foreigners can’t buy real estate in NZ, it’s all up to Kiwis to keep their used homes the most spendy of any country in the world.

Not only those nations Tony:

Last time I tried to drive across LA to buy a truck and was stopped by an accident on the 101, late ’17,,, I looked around while stopped cold, and saw the vast majority of other drivers were Chinese or very similar;;;

Was working on bids for several new apt blds in SoCal at the time,,,

all canceled soon after when the CCP stopped the funding(s) being allowed out of China,,, in spite of what we now know that most of the funds were coming from CCP ”higher up” folks…

Just saying,,, CCP will, eventually, own most or close of USA RE,,, and that not a bad thing,,, at least they won’t try to use nukes and spoil their land holdings, eh??

While Canada and NZ have the biggest housing bubbles, it seems like its not a coincidence that both places are safe haven for climate refugees. While one could easily be bearish for the short term I think these places will remain unaffordable no matter the outcome of all this QE.

Transitory inflation is still permanently higher prices. Think about it. Inflation is the slope (derivative) of the price curve. If there is a “transitory” steepening of the slope of the price curve, the higher prices are permanent, unless we can get a negative slope for a while. It will probably be a cold day in hell before the Fed allows THAT to happen.

Then there is the difference between asset price inflation, consumer price inflation, and wage inflation. The Fed always enriches the wealthy with asset price inflation, which is what you get when they print money against govt debt (rather than make wealthy people pay more taxes, which is what *should* be done whenever there is a calamity like Covid19), also known as “Quantitative Easing”. Then eventually after creating massive bubbles and unaffordability in housing and stock markets, the Fed will start wringing its hangs about (especially) wage inflation.

I’m not a fan of any kind of inflation, but asset price inflation is always the worst kind. Think unaffordable housing for the have-nots, and an increasing wealth gap for the bottom 99%. QE is an obscenity that should not be allowed. Unfortunately, the average homeowner still thinks housing inflation is a good idea. Homeowners do no grasp that their wealth as a fraction of the total keeps slipping unless they happen to be in the top 1%. And so it goes.

Has anyone noticed how housing inflationistas always like to talk about “price growth” (NZ quote in article) when there are price INCREASES? “Growth” sounds much better, does it not? Everyone likes “growth”, right? “Price increases” does not sound nearly as good, does it.

You never hear anyone talking about “price growth” at the grocery store, do you. Oh no. Then it is called “inflation”.

Come to think of it, for the stock market, saying “price growth” about the cost of a share of TSLA or AMAZON or AAPL might actually be a good thing. Just a little bit subversive, because nobody ever says that. “The price growth in AAPL has been almost 20% so far this year”. That might actually make people think. Or maybe not.

Neoliberalism – The Great Leap Backwards in economic thinking

Keynesian economics is really bad.

Don’t you remember the 1970s?

Oh yes, I remember that.

Neoclassical economics is really bad.

No one could remember what happened last time.

What is wealth creation?

Isn’t it rising asset prices?

Everyone always thinks that with neoclassical economics.

At the end of the 1920s, the US was a ponzi scheme of inflated asset prices.

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth.

1929 – Wakey, wakey time

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth, but it didn’t.

It didn’t then, and it doesn’t now.

It took them a long time to disentangle the hopelessly confused thinking of neoclassical economics in the 1930s.

This is the second time around and it has already been done.

The real wealth creation in the economy is measured by GDP.

Real wealth creation involves real work, producing new goods and services in the economy.

That’s where the real wealth in the economy lies.

Real estate – the wealth is there and then it’s gone.

1990s – UK, US (S&L), Canada (Toronto), Scandinavia, Japan, Philippines, Thailand

2000s – Iceland, Dubai, US (2008), Vietnam

2010s – Ireland, Spain, Greece, India

Get ready to put Australia, Canada, Norway, Sweden and Hong Kong on the list.

It wasn’t real wealth, just a ponzi scheme of inflated asset prices.

Will they ever learn?

It doesn’t look like it, does it?

The foolishness of housing “Asset Prices” is that you own or are buying a depreciating asset. If you spend no money on a house, in 50 years only the land is left. The second point is that these “Asset owners” think they are making money when the sale prices rise. They don’t, they lose money on the buying and the selling and the upkeep. Two identical homes, one sells for a “profit” of $100,000 but after all costs including interest if you go to buy it the other the owner will want more. It is a ponzi scheme.

The USA is far behind other developed countries. They will get a clue and catch up soon hopefully. The corruption runs deep.