Brazil’s central bank struck back with shock-and-awe rate hike. Mexico’s central bank faces tough spot after big hit to economy. Argentina’s inflation exceeds 42%.

By Nick Corbishley for WOLF STREET:

Around the world, there has been massive fiscal and monetary stimulus, an unprecedented growth in government-guaranteed lending, an explosion in the broad money supply, coupled with low inventories, supply chain shocks, rising shipping costs, and surging demand for certain commodities and consumer goods in developed countries, particularly the US. Companies are able to raise prices and pass on higher costs without triggering a buyers strike as the inflationary mindset has kicked in.

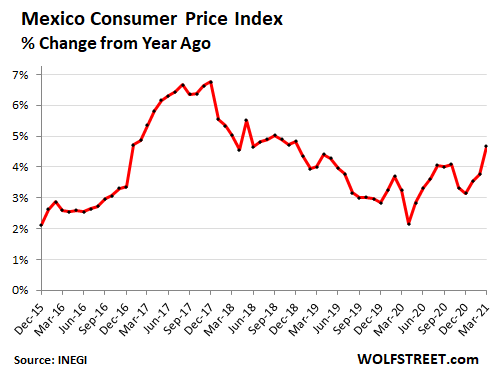

Many emerging economies are also having to contend with the additional inflationary impact of weaker domestic currencies. They include Mexico, where consumer prices rose to 4.7% in March — their highest level since December 2018. Prices are now firmly above the Bank of Mexico’s target inflation rate of 3%, with a one percentage point tolerance threshold above and below that level. In March alone, consumer prices grew 0.8%:

The items that saw the biggest month-on-month price increases were domestic LP gas (5.2%), low-octane gasoline (6%), and staple foods such as eggs (8%).

Surging commodities prices are being passed on to retail products. The price of corn reached $5.68 per bushel in March, up 74% from a year ago. Since last June, the price of this essential grain, for both human and livestock consumption, has risen every month. With consequences: The price of corn tortilla, Mexico’s most important staple food, rose by almost 3% in March from February.

Last year Mexico’s economy suffered its biggest contraction (8.5%) since the worst year of the Great Depression, 1932. It also appears to have contracted in the first quarter of 2021. But prices continue to rise, leaving the Bank of Mexico little choice but to abandon its plan to cut interest rates this month.

Rising prices force the central bank to hike interest rates, which is the last thing a shrinking economy needs. This is precisely what happened in Brazil three weeks ago.

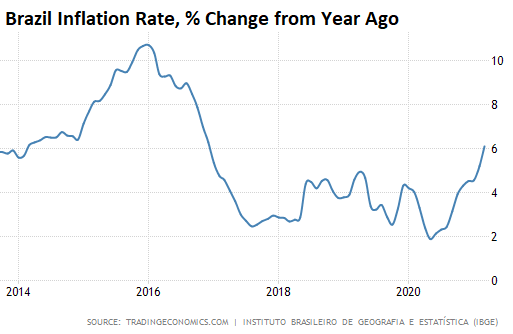

Brazil’s central bank, spooked by a surge in inflation, struck back with a surprise shock-and-awe rate hike of 75 basis points, bringing its Selic rate to 2.75. It was the first increase in six years and the biggest in over a decade. The central bank has indicated that it will raise rates by the same amount in May, barring a significant change in the outlook.

It will take time for the first rate hike to have an appreciable effect on consumer prices. In the meantime inflation continues to rise. In March the consumer price index rose to 6.1% — the highest since December 2016 and well above the upper limit of the central bank target of 5.25% (chart via Trading Economics).

Producer prices in Brazil had risen in February at their fastest rate since comparable records began seven years ago. The monthly rate of factory gate inflation jumped to 5.2%, and the annual rate jumped to 28.6%, both the highest since statistics agency Ibex’s data series began in January 2014. On an annual basis, the biggest rise in February was a 87.6% spike in mining industry inflation, IBGE said. But food price inflation contributed to nearly 8 percentage points or more than a quarter of the overall annual rise.

In Brazil, as in Mexico, when food prices soar, those living on the margins struggle to fill their food baskets. They represent a large part of the population. Widespread hunger can quickly give way to widespread anger. In Mexico eruptions of popular anger have triggered nationwide rioting twice in the last 15 years, in 2007 and 2017. In 2017, a one-off 20% hike in gas prices — the so-called gasolinazo — sparked days of protest as thousands of people all over the country marched on Pemex gas stations, blocked roads and picketed refineries, to register their rage.

Prices are soaring at the pump once again, in both Mexico and Brazil. In Mexico gasoline prices have risen on average by 30% over the last year while diesel is up 11%. in Brazil fuel prices have risen 11% in the past month alone. When energy prices rice, the price of many other things rise too.

The Bank of Brazil, like many central banks, asserts that a “large part” of the recent rise in inflation is due to temporary “factors” that will soon disappear, like “short term fuel price rises.” It is the same message we can expect to hear from central banks in more advanced economies when inflation reaches or soars past their target rate.

But there is quite a lot of divergence between countries in Latin America. In Colombia annual inflation clocked in at 1.5% in March, less than half of where it was a year ago (3.5%). In Peru it was 2.6%, in Uruguay, 3%, in Chile, 2.9% and in Ecuador -0.8%. As for Venezuela, it has been in full-blown hyper-inflation for years.

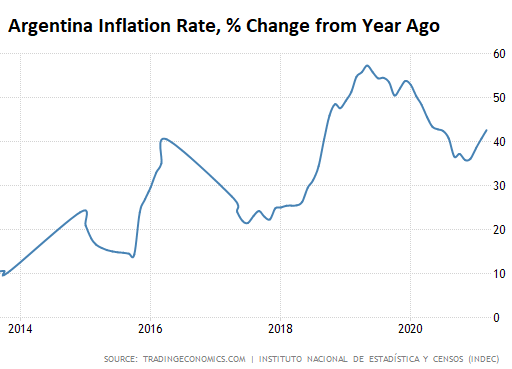

But in Argentina, which has been willfully destroying its own currency and, aided and abetted by Wall Street firms, regularly abuses bond-fund retail investors with serial defaults and haircuts on its foreign-currency bonds, inflation is red hot with an annual rate of 42.6% in March:

All countries in Latin America have relatively fresh memories of high, if not hyper, inflation. In the 1980s, annual inflation twice soared above 100% in Mexico, wiping out the savings of a large part of the middle class. In Brazil it reached over 6,000% in 1990. These countries have all seen the economic destruction high inflation can wreak and they don’t want to see it again. By Nick Corbishley, for WOLF STREET.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Those behind the corruption and mis-management in all countries escape the fallout of their actions and reap the rewards while the masses get the hits, same old playbook.

Yep. Yet the dumbed down masses think they’re getting ahead because they got a few stimulus checks when in fact the entire amount and then some is already sucked up by the inflation in the cost of living. If I give you $5 but then take $10, are you ahead? Petunia would say yes. I would disagree.

Well, if you only make $20,000 a year, getting $20k extra in “stimulus” IS beneficial, even with inflation.

So the people who benefit from the inflation are the poor for whom the extra money outweighs the inflation and the rich who ultimately get the money through their ownership of the capital.

The middle class gets reamed, as per usual.

Actually no. Those poor people are the ones who will be destroyed by inflation. It hurts the poor the most. It’s a highly regressive tax. That’s why the FED plays stupid. “We don’t really understand inflation.” They don’t want to admit they intentionally destroy poor people to pad their bank accounts.

Depends on how poor, Depth. If someone makes $20k a year, and they get $20k in stimulus, prices would have to have DOUBLED for them to come out behind.

Say prices go up by 25%. Then they effectively have $32k versus $20k they had before, so they’re still up.

But a middle class family making $90k now has $110k after stimulus. But that $110k is only worth $88k, so they’ve LOST out.

But you are right in that if the prices remain high, but the “stimulus” isn’t repeated every year, the poor people will be hurt.

so like everyone else I’m raising rents this year

our rent CPI is +7.4% and that is WHAT I”m GOING UP

no need to keep deadbeats, I’m 100% full

took 9 years to go up $100 a month

now I’m poised for $100 a month MORE in just 3 years

of course I will now be displacing POOR $700 month SSI RETIREES

no longer my problem

Despite your 20,000 example, that person would still be hurt more because a person at that income level has no choice but to spend all their income, and on necessities at that,. The low income people have no real assets that would rise in value along with the other inflating items so they must pay more in future consumption also, (think housing, energy, transportation, healthcare, education…all items that they need to have a chance to better or just maintain themselves) while middle earners likely own some items with inflating value and are not forced to spend every one of their dollars just to survive.

Would you prefer to have choices and a bit left over or see all your income disappear just to keep body & soul together all the while watching your potential future and hopes priced beyond your grasp?

DC,

You are right, I do think I’m ahead. The $6400 we have gotten so far I consider an additional refund of our taxes. We are ahead a set of tires we couldn’t afford, some furniture we couldn’t afford, an expensive car repair we would have had to charge to CCs, and a pair of silver earrings which make me look amazing and I can sell when the SHTF again.

Ms Swamp got her $1,400 rebate. I got nothing. Nor did I get my Dec $600 stimulus payment. Signed up for the vaccine in Feb. I’ve heard nothing.

I’m 0 for 3.

In baseball that’s called a strikeout.

In my case they gave me zero and took back $10. I got nothing except the inflation. They checked my posts on “Wolf Street” and denied my the rebate because they didn’t what they saw.

Here’s the message I got:

Payment Status – Not Available

The IRS is working around the clock to deliver Economic Impact Payments to millions of Americans struggling with the pandemic. Payments typically roll out over several weeks.

We’re unable to show your payment status because:

Your payment has not yet been processed, or

You’re not eligible for a payment.

INCOMPETENT IRS – thank you

So my dilema with IRS is that I send in my tax returns on time – in fact went to post office today 4/15/2021 and sent off personal

anyway I do same for companies(3) just simple llc’s for my different jobs I perform

oh, this is dec 2020

______________________

got notice of LATE FILING for 2 of the LLC’s – one $210(1 month late) and other $420(2 months)

I sent them NICE reply with copy showing IRS zipcode(IRS gets it’s own zipcode) mailed to by USPS employees on USPS receipt

2 months later – THREATENING LETTERS saying they’re gonna place liens on my assets/property

for $600 – which I DO NOT AND WILL NOT PAY – ie owe per (incompetent) IRS

Exactly!!!!!!!!!!!!!!!! :-) Got That 4 Months and finally some obtuse message saying na,ya get 0!! :-) Havent given up on behalf of now,18 year old sonDont want wird scam rebate,do not have to file.Not getting my bank info or any other info.,pay up,scheistermob!! :-)

Hey DP, let Petunia speak for herself. I guess I don’t have to stick for her, she’s a big girl.

It’s “DC.” Anyhow, she speaks for me, Panamaboy, so I’m returning the favor. OK, white knight?

Two wrongs don’t make a right, it just makes you both wrong.

Thats If you ever got any of the checks.Son and I did not.CFPB,IRS,Treasury,my Fed Senator and Rep.=0 help.Reapplied many times,etc.=0/nada.I am not alone as Ive talked to others in same boat.Funny how T. Dept.’s father was head of yuuuuge Hedgiefund and it took less than a week to get Billions$$$!

Yeah, Former President Carlos Saúl Menem in Argentina died without going to jail for life, the most he got was house arrest.

Indeed.

Central Bankers have inflation protected pensions and futures insulated from the ill effects of the policies they shove on us.

The unelected, dictating to the rest of us…

Imposing Inflation Taxation by edict. Only Congress can tax, and they must answer to the voters, eventually.

Digitally minting the nation’s currency, unilaterally. The Fed expanded M2 by nearly a third…..who gave them the power, authorization? The Fed is there to assuage temporary banking liquidity problems, not to make certain record closes in the stock market.

Those behind the corruption reap the rewards ..

I’m not so sure about the reaping of rewards bit.

I think that these playas do not have a clue about money .. banking .. commerce & how to run a successful CHOOK RAFFEL .. let alone a business or economy.

It’s like the manager of the store pinching dimes & quarters from the till .. believing that he/she/they are achieving FREE wealth in some way.

“Ha ha ha I took the petty cash & now there is no tea / coffee & biscuits for anyone .. oops & including me .. but I don’t care.”

Global Unrest…. great for stocks and housing prices.

what the 75% increase in prices for same

means our FIAT $dollar is DEVALUING EVEN FURTHER AND FASTER

Meanwhile…..back at Eccles……my favorite is Mexican Red……if you don’t breathe deeply I find the high is so much better.

– Does Nick Corbishley have data on at what pace the money supply has grown in the countries mentioned above ?

– Nope, here I blame the corporate sector. They saw COVID spreading around the world and started to (sharply) reduce production. But demand remained stronger than expected.

– Nope, Argentina is uffering under DEFLATION but then one has to look at a different angle to the economy. A LOT OF people only look at (rising) import prices and then overlook the signals of DEFLATION.

“Does Nick Corbishley have data on at what pace the money supply has grown in the countries mentioned above”

Click on the link in the 1st para in the a article.

Covid is hitting Brazil really bad right now. The worst is yet to come there.

Brazil’s COVID situation is still not as bad as America’s. They have about 66% as many cases/million and about the same death rate. Funny how the American media is pointing fingers at other countries.

I follow the Brazilian media.

They are extending red phase in São Paulo and Rio de Janeiro.

The USA has to most vaccines, give it a few months and Brazil will be number one.

Brazil had about 3,500 COVID deaths yesterday compared to about 900 COVID deaths in the U.S. yesterday. We are seeing a rapid vaccination program. The U.S. has a larger population.

If Brazil’s death rate per million is equal to the US’s, but they have 2/3 the per capita cases, that means that their death rate per case ratio is 50% higher then the US, so I’m not sure that’s a convincing argument for Brazil’s COVID situation being better especially considering the way their numbers are currently going.

Nick,

Is immigration into Latin America from the US and Europe a factor in rising prices? I have seen so many videos of expats in Mexico, Ecuador, Panama, etc., talking up these places for retirees. With costs in the western countries being ridiculous, is immigration into these lower cost countries pushing out their people too? Is this on their radar at all?

Petunia-Paul Simon’s lyric of years ago (and, having lived myself in areas that experienced influxes of people/money from other locales who were chasing lower living costs, then subsequently experiencing a rise in those lower living costs), true then and true today:

“…one man’s ceiling is another man’s floor…”.

may we all find a better day.

Petunia,

To be honest, I wasn’t aware that immigration into Latin America from the U.S. and Europe was even a thing, apart from some U.S. retirees moving to places like Los Cabos, San Miguel de Allende and other popular spots in Mexico and parts of Puerto Rico as well. I suppose that this influx will have had an effect on prices at the local level, especially in tourism hotspots like Cancún and Playa de Carmen, but not at the national level.

During the worst years of the crisis in Spain quite a few young graduates went to Mexico, Colombia, Peru and a few other places. But again not in big enough numbers to have a notable impact on prices.

But that’s not to say it won’t happen in the future. If you’re able to work remotely and are getting paid in dollars or euros, then you can live pretty cheaply in many parts of Latin America, especially given how weak many of the local currencies are. A friend of mine from Barcelona just spent two months living on the outskirts of Salvador de Bahia. She and her Brazilian boyfriend were paying less than 200 dollars a month to rent a reasonably spacious house by the beach.

Forgot to mention, she was getting paid in euros and lived like a queen.

Yes, it was and I’m sure still is.

Mexico may be an outlier though- foreigners are not allowed to own residential properties in many areas.

What we need is a “transitory” deflationary bust to correct for all the past inflation.

We need adults to lead. We are led by children.

Actually, in the USA, we’re being led by a generation who’s rallying cry, 50 years ago, was, “Don’t trust anyone over 40!”

Now they’re electing Presidents over 75 who can’t climb a flight of stairs to run the country.

I think mandatory retirement for all politicians should be set (as it is for most State and Federal jobs in other fields) at 65.

It was 30. Don’t trust anyone over 30. I was there. ;-)

Me too Lease AH,,,

But then, after a couple decades of absolutely following that mandate/dictate,,, I began to go the totally other way:

Don’t trust anyone without a good bit of gray hair took over for the main way to be able and willing to trust folks,,, at least for this old boy in NoCal in the later part of the 70-80s, when SO many of the ” old school ” reliable sources of materials went to ”heck” in at least some semblance of straight lines… and many of those sources never came back, ever, to this day…

Everything is transitory…..it will be over soon.

What, exactly, will ne over? And how soon is soon?

This crazy inflationary binge will be over soon and the hangover won’t be fun

Exactly.

The inflation in the US hasnt even begun. Yet…

I visited Argentina in 2015 when the (black market) exchange rate was 15 against the US$. Now it’s 93. Their currency is constantly being debased, so according to all these smart economists Argentina should be super competitive. However, it is not a cheap country at all.

Every time I visit a country that debases it’s currency in a big way, I see all that b0llocks immediately debunked. Their governments struggle with debt. Economies are not doing well and people are in constant fear of the economic future.

It is extremely difficult to move money out of Argentina.

Legally.

Illegally? Ever heard of the Triple Frontier in Argentina? Hilariously Corona is what has tightened controls around that zone.

160 pesos to get one dollar, if you are getting it cheaper than that is due to people desperate to sell.

Hello everybody. I am from Argentina and there are two interesting facts regarding inflation, they are already part of the habits of Argentines. 1st you have a retail business and they warn you that there is a 10% increase in the product you sell, so you increase it 15% because you already give a discount that will continue to rise! we can call it “inflation anticipated by inflation” 2nd Argentine society is hypnotized by the price of the dollar, so if the dollar increases 10%, you increase your product 10%, despite the fact that salaries, taxes, and many other expenses have nothing to do with the dollar. I would call “Inflation by the Dollar God”

Thank you for this first hand info. So how do you protect for the long run? Does everyone keep lock boxes with foreign currency?

My friends that live in Argentina purchase and store small consumer goods like microwave ovens, toasters, TVs, etc.

To whom to worship? Joe Biden or Jerome Powell? Will it rain cash if we dance for them?

No my fellow Argentine, if the dollar increases 10%, you increase your product as far as you can. As proven by the dollar rising less that cow meat did last year.

With the excuse of the pandemic, they are charging whatever money they can get away with. To give an example, in two different supermarkers from different chains, the same product may be cheaper or more expensive if you compare prices from both supermakets. I have seen the exact same milk up to 15 pesos more expensive to give a small example.

“inflation anticipated by inflation” is the hallmark of hyperinflation.

What would you do if the Dollar became worthless?

The sheeple are about to learn there’s no free lunch. When the squealing and pain are on high, we can remind them “but you got that laptop and a fancy car loan with the stimulus money, remember?”

Get out line and fail to hand over your production for our dollars and men with guns will be at your door. I want another and then another of stemmie checks. We don’t have inflation in America . It is against the law. The rest of the world gets our inflation. Powell the Great has decreed that the size of our debt is not a problem. I say print untill the rest of the world cries uncle. We make the world pay for our invasions so hand over the goods and load up on them dollars. What ever you do you had better not try to use gold or silver to pay. We will make you pay to invade you. Get them red-hot dollars and send me your stuff.

What in the world are you smoking? I guess facts and reality are an inconvenience to you?

Depth Charge. Paul Krugman quote ” the dollar is backed with men with guns”. China does not exchange our dollars for Yuan on the Forex to pay for our shit we consume. China prints the Yuan instead,ergo we export our inflation to China.Only 2% of Yuan is in foreign reserves. If China starts doing what Germany and other trade countries does and go to the Forex,game over for us on inflation. This is the “special relationship ” forged by the Nixon administration and Super K. Therefore armed with these simple facts I suggest people get aboard the Powell easy money train and ride while you can.I am Smokin’ the reality as it is not like I would wish it to be. I want sound money and productive debt. Ain’t going to happen with the Fiat Train with Casey on the throttle. It’s headin’ toward White Oak Mountain. All aboard!

I think he forgot to type /sarc maybe?

Owning precious metal (if possible) is a no-brainer in most countries. Owning anything that holds value is better than holding most currencies.

Common Americans don’t get it, (yet). There has to be a growing mad rush in most places to shed foreign cash, it’s all as good as worthless. Countries around the world are having to print money and/or raise interest rates to slow inflation, there is no other choice.

I have silver coins from most Latin countries. Every country in the world believed in backing their money until the middle of the 20th century. Fortunately for the rich, Fed, and politicians, we have the new thinking now that hot air is all we need to be stable. How’s that working for you now, everybody?

The inflation rocket has also hit India along with the second wave Covid .

https://www.bloombergquint.com/economy-finance/wholesale-inflation-surges-to-eight-year-high-in-march

The United States has the largest gold reserves in the world.

It is not enough to pay for the 2020 Federal budget deficit.

As long as the rest of the World loves USA dollars, they can keep getting away with the dollar scam.

Fort Knox has not been audited as to true gold holding since 1953 I think. Can we really trust a Government that has Presidents that regularly commit Perjury and lie to the American public on a daily basis? I think the majority of this physical gold was lent out years ago to other central banks and monied insiders, probably never to return. Maybe the I.O.U.’s are typed on Gold Paper! It is a major question how much gold the United States actually possesses. Dollar in major trouble regardless, because the Trillions of Dollars floating about the world are many thousands of times in excess of any physical gold reserve on the books.

When income disparity between the rich and the poor reaches the proportions that we are starting to see here in the USA, this is when revolutions and wars start. The Peasants with Pitchforks are not going to let themselves get crushed like one of out commentators suggests (hopefully jokingly) in his tile “Crush the Peasants” .

I’m still waiting for someone to answer my Triva question

“What war or revolution began on August 1st, succeeded, and dramatically affected a great power and it’s citizens”. Give me the country and approx year. Hint: It was sparked by just what is said above. Wealth disparity. I’m a history buff. Only 1 in 100 would know the answer, because they don’t teach this stuff in schools nor anywhere for that matter.

Are you referring to WW1?

I feel current situation has more resemblance to pre-Bolshevik revolution.

There are enough Marxists minted out of our public education system. Lot of SJWs with savior complex.

And then there is the Fed.

Previously one had to work hard and long to be successful, to be rich. But Fed has made it easy for anyone with assets to gather more riches. No hard work necessary, just a robinhood account or a house or two.

Summer of love can quickly pave way to a communist USA.

Not a bad try, but I think you would agree WWI started with the assassination of the Archduke of the Austria Hungarian Empire on June 28th 1914, and wasn’t about the peasants with pitchforks revolting.

I would say the Russian Revolution started when Russia entered WWI, August 1, 1914.

I think that was in 1917. August 1st Germany declared war on Russia. Also this wasn’t about Peasants with Pitchforks.

I agree The Russian Revolution in 1917 was but not the August 1st German War declaration.

It was the beginning of the end for the Czar and the monarchy.

Petunia

I believe the peasants in Russia that were the main component of the armed forces fighting the Germans in 1914 starting shortly after August 1st, didn’t even know what they were fighting for, or who they were fighting. They were sent into battle with no weapons in some cases. You got the part about the peasants with pitchforks revolting, but that didn’t really happen until 1917 when they overturned the Czar. The other War or revolution that started August 1 is very similar. It started in another country, not Russia.

My apologies. The date I provided in my previous posts was incorrect. The correct date which I should have posted was Nov 1st “All Saint’s Day” .

Algerian War of independence?

Chinese Civil War?

1927 – The Nanchang Uprising marks the first significant battle in the Chinese Civil War between the Kuomintang and Chinese Communist Party. This day is commemorated as the anniversary of the founding of the People’s Liberation Army.

KT

Congrats!

Algerian War of independence?

You got it! started on “All Saint’s Day” Nov 1, 1954 in the remote areas of the countryside. It started with terrorism, and ended with a relatively peaceful coup in 1962.

The Peasants with pitchforks rose up and toppled the minority European lead government. Most of the Europeans went back to France and other mainland countries, and lost all their wealth.

The book “Savage War of Peace” by British historian Alistair Horne is a great read on the subject. Also the Movie “The Battle of Algiers” .

Only one person in a hundred would get this answer right. The new generation probably never heard of this since it is not taught in the public schools.

“Most of the Europeans went back to France and other mainland countries, and lost all their wealth.” As they should. lol. What the hell were they thinking? They can keep their colonies forever? o.k. actually France still has a lot of colonies to this day such as French Guiana and a lot of islands in the south Pacific and Indian Ocean but it is very sparsely populated. I think the reason this specific example is glossed over/not taught is because the bigger picture was that all the native people/”Peasants” were gaining independence from the major colonizers (France/England/Japan) after WW2 via fighting or peacefully. And this was encouraged by the U.S. in order for the United Nations experiment to work. I was actually born in a country that gained independence from France. I’m 24 btw.

Now riddle me this mr. history buff, would the U.S. have been involved in Vietman if it wasn’t for France?

Sorry, It was ZR who got it right. I’m nominating him for historian of the month award.

US got involved in Vietnam for a number of reasons. France was part of it, but I put the blame on our own leaders, McNamara, Rostow, Rusk, Lydon Johnson etc. Even JFK shares some of the blame.

Got Bitcoin? The Argentinians can save themselves with this measure. Eventually the CBs will stop printing when they realize all the savings are going into Crypto.

Replying to Swamp Creature above. November 1, 1700, War of Spanish Seccession.

That’s before my time. But maybe a duplicate instance. I was thinking of a war or revolution post 1800. I’ll hold off 24 hours before I give the answer. Hint: Think of the Day in question “All Saint’s Day”. A Christian holiday. That holds the key to the answer. The war or revolution succeeded in victory for the people that started it. .

The Battle of Vertières on 18 November 1803, establishing the first nation ever to successfully gain independence through a slave revolt.

A little inflation is good always good for real estate and equity investors.

A lot of inflation is only good in the short term for real estate and equity investors. In the long term, a lot of inflation is just bad for everyone. Society can unravel under high inflation.

So Socaljim says get real estate. We got it Jim. Pat pat.

SocalJim

Nope.

Inflation to pump the numbers, lose the value of the currency.

2%-2.5% inflation, the illegal target of the Fed…

RIPS 22-28% off the dollar in ten years. That’s good?

Now we have YOY at 2.8% and rising…

The Fed is INSTRUCTED per their stable prices mandate to FIGHT INFLATION. Why is that simple phrase “stable prices” ignored?

Socaljim deserves more respect. For a bit he was one of few who was right about rising real estate, as many here got that wrong, and yet still that didn’t stop the many from ridiculing him.

Brazil had 6000% inflation in 1990 ? Though I respect the S*** out of Nick – how is that even possible? $1 loaf of bread is $6000 a year later?

Equity owners in Brazil would go from Millionaires to MULTI-Billionaires in a year? How does that work ?

Beardawg,

Almost 7,000% actually. Nick was being conservative. Here’s Brazil’s long-term chart. Click on it to enlarge it:

WOLF – thanks for the graphics. You are the best at that – as always. However, being an American, this just does not compute to me. I have never experienced this type of inflation. At 7000% in a year, it makes one think the poor are dying in droves and asset holders go from millionaires to mega-billionaires. In truth, that does not happen. Streeters talk about wheelbarrows of Weimar cash for a week’s groceries 80 years ago.

Is it just an exercise in incredulity (the amount of $$$ to buy stuff), but yet it remains relative – and with 7000% inflation, it’s just a PITA to fill up your wagon with cash to get groceries – but you are still able to get your groceries?

Just having a hard time relating to these kinds of numbers. If goods / services still flow but the numbers attached to them are crazy – then what is inflation…really ??

Nitpick. 7000% is 70 times, not 7000 times.

Beardawg,

Venezuela has been in that range for years. It’s very difficult to do business and have a functioning economy during hyper-inflation, and this is what this is. It’s very scary. No one wants it. You end up using alternate currencies (such as USD) or cryptos or bartering.

I was there.

I remember the currency collapsing several times. It went from Cruzeiro, to Cruzeiro Novo, to Cruzado to… I think Cruzado Novo etc It’s now Real.

We had HYPERinflation.

The Fed is INSTRUCTED per their stable prices mandate to FIGHT INFLATION. Why is that simple phrase “stable prices” ignored?

The Fed is INSTRUCTED per their “moderate long rates” mandate to keep long rates “not extreme”, either up or down. Why is that simple phrase ignored?

Unfortunately, Congress enjoys the free money for their social programs (vote buying) and Thatcher was wrong, you dont run out of other peoples money …. there is a thing called QE Maggie.

(I know, tough to imagine that would be accepted practice of a central banker)

You still do run out eventually. QE makes it take longer though because you’re effectively taking the money from every holder of that currency.

H

You’re dead right to concentrate on the wording of these mandates, that’s how they could be caught out by legality of QE.

You should check out if your Treasury is mandated to ‘only’ sell it’s debt in the ‘open’ market because that means the Fed cannot buy it directly without the chicanery of QE.

It’s the biggest coincidence in the history of mankind that there always just happens to be enough money in the open market to always fund the Treasury’s requirements. Could it be that somebody is tipping them off in advance I wonder?

Rising prices plus flat wages = Crush the Peasants!

Too much inflation will result in civil unrest … not good.

USA death toll 2019 – 2,854,838

USA death toll 2020 – approx. 3.2 million

= approx. 440,000 death increase

in looking at the death toll from 2005 – 2020 there is an increase every year.

I spent the winter in Brazil, mostly in Rio de Janeiro.

And it was FANTASTIC. Inflation in the Real made me feel like a gazillionaire. And very few tourists. Hotels and tourists attractions were for the lucky few to enjoy.

I caugh the Covid one evening and took xxxx (I know that covid treatments are censored here ) and was normal the next day.

Flying there as a combination of devalued Real and less tourists was so cheap….

I remember my first time in inflationary Brazil in 1998 and I loved it. Same now.

If it were not a socialist country I would buy a nice Ipanema penthouse.

I recently quietly sidled out of any stocks I held with operations in Peru, as I suspect Castillo is going to end up flying in the elections there, and nationalisation (and inflation) will subsequently accelerate there too.

I’m not complaining, mind you. It’s a sovereign nation that can elect who they want and do what they want. I just want out the door at an early stage if poss.