Something is afoot here. And someone is going to be wrong.

By Wolf Richter for WOLF STREET.

That would be embarrassing: There has been the massive surge in shipments to and within the US, amid warnings of shipping capacity shortages, as companies are stocking up for the holiday shopping season because they don’t want to run out of merchandise, following record retail sales over the past few months, along with supply shortages. Americans were spending their extra unemployment money and stimulus checks, and spending money on stuff that they didn’t spend on services such as vacations, flights, and hotels, and spending money they made working from home and in the stock market. The expectation in the industry is that this surge in retail spending would continue and lead to blockbuster holidays sales.

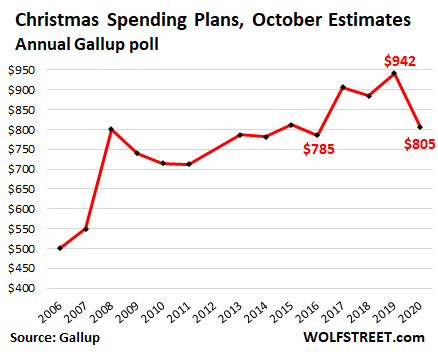

But now there’s the second major survey of consumer intentions that throws cold water on this thesis. Gallup asked consumers, as it does every year at this time, “Roughly how much money do you think you personally will spend on Christmas gifts this year?” The response on average was $805. That was down 17% from what folks told Gallup at the same time last year ($942), and the lowest since 2016 (there was no survey data for 2012), and the biggest year-over-year drop in the data going back to 2006:

This comes after the National Retail Federation had said last week, based on its annual October survey, that consumers on average expect to spend about $998 on gifts, holiday food and decorations, and additional “non-gift” purchases. This was down nearly 5% from the October 2019 survey.

The amount these folks said they’d spend on gifts was down just a tad from last year, and most of the decline in spending intentions came from non-gift items they’d buy for themselves or their families.

This 5% decline in consumer spending intentions for the holidays is in stark contrast to the 4% increase that the National Retail Federation found a year ago in its October 2019 survey.

Gallup came up with similar results as the NRF in 2019: In its survey in October 2019, Gallup found that spending intentions were up 4% from the prior year. But now consumers’ spending intentions dropped 17% from October 2019. Something is afoot here.

Gallup’s current survey, taken between September 30 and October 15, found that concerning holiday gifts:

- 28% said they’d spend less than in 2019 (highest % since 2014).

- Only 12% said they’d spend more than in 2019 (lowest % since 2010)

- 59% said they’d spend about the same (lowest % since 2014).

“A strong tilt toward less spending, as is seen now, is typical of consumer intentions during recessions and slow economic times,” Gallup said, adding that its annual question about holiday spending intentions – particularly the forthcoming November survey – “has been a reliable harbinger of annual retail sales in most years.”

So we’re looking forward to the November survey to shed more light, so to speak, on these gloomy spending intentions.

“Holiday sales typically increase year-over-year, rising 3.3% on average since 2000, with sales up more than 5% in strong years and around 2% in weak years, according to figures compiled by the National Retail Federation,” Gallup said.

“Since 2000, holiday sales have been worse than that only twice: in 2008, during the global financial crisis and December 2007-June 2009 recession, and in 2009, when the economy was still recovering from these events,” Gallup said.

If consumer spending intentions on gifts translate into some sort of reality, total retail spending may rise only 2% from a year ago, Gallup said but cautions that “consumers’ mindset is fragile and can change quickly in the event of economic or political shocks.”

And there are some biggies this year on Gallup’s list of uncertainties:

- The surge in Covid-19 cases,

- “The fate of a second round of stimulus checks” because now everything depends on stimulus,

- And the presidential election.

And so “the chances are high for a shift in consumers’ spending intentions on discretionary items like holiday gifts.”

Looking back at its prior October-and-November survey pairs, Gallup found that spending intentions declined from the October survey to the November survey in 10 out of the past 13 years. And if this repeats itself this year, “retailers should brace for even weaker sales.”

But wait… In one out of those 13 years, in 2011, spending intentions increased “significantly” from October to November, so maybe that’ll happen this year as well.

More realistically… Concerning retailers, Gallup said, “The best they might reasonably hope for is stability.”

So clearly, no one has any idea how much money consumers will spend over the holidays, and consumers may not either, but consumers are gloomy while the industry is acting like there is going to be a huge surge in holiday spending. If Congress decides after the election to trigger another tsunami of stimulus checks and extra unemployment benefits that arrive in bank accounts before the end of November – however impossible that may seem – well, then, maybe the wildest dreams may come true because in this weirdest economy ever, everything depends on free money.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So you are saying that come Jan 1, the Amazon Warehouses and Costco Pallet racks might still be stuffed to the brim with Bluetooth nutcrackers and rechargeable salad shooters?

Nope. Amazon and Costco are fine,

We are going to have a K-shaped Christmas to match the K-shaped economy. The WFH crew will still work from home and shop like demons. The bottom quintile are going to have a Christmas that looks like it came out of a Charles Dickens novel. The media will focus on how much Bezos earns, not the favellas that are popping up near every Interstate highway

DEBT…it’s what’s for dinner !!!

It seems to me that so many out there will just go down with the “shopping ship”….give me shopping or give me death must be the battle cry !!!??? Folks seem to care only about Amazon and Costco.

What spoiled brats out there !!!

My parents as well as my wife’s parents suffered greatly as children, then teenagers, then young adults getting through the 1930’s, then WW2 including Normandie Beach (amazing how one of them survived that !!!), one of them was even with the French underground, others had properties bombed, food rationed, malnutrition etc…this changed their perspective for a lifetime. They in turn tried to instill certain values in their children.

Well folks, stay tuned because it’s coming !!! All the BS (bovine scatology) in the universe including the nonsense that is MMT, won’t save us. I have to say this, because I believe it in my core from seeing the general behavior out there for so many years…what is coming is well deserved and self-inflicted to boot. There are no leaders out there as the so called leaders have been leading respective nations over the cliff. The corruption and graft isn’t even covered up anymore, it is so blatant and in your face !!! Yes, Wile E Coyote has gone over the cliff, but is still pedaling somehow and doesn’t yet realize that there is only air underneath him!!! The people certainly don’t lead, as the masses simply self anesthetize by shopping. This is beyond obvious as shown by all the whiplash inducing charts that Wolf has posted. Then we have pure nonsense like Twitter and FB that has made the reversion back to junior high complete. Every knucklehead out there wants to be heard now. Instead of reading a book, or taking a walk, or producing a garden or something, so many sad sacks spend their lives in these fantasy lands that have been created to distract the masses. Homes have become commodities and debt is to the moon.

What is coming will change people’s lives forever. I only hope the coming tornado will bring back an attitude of gratitude and a realization that “less is more” as “we” are truly out of control.

Thank you Wolf for such a great site.

Butt alas, no T P ….

Congress creates new money when it pays a bill. Spend in. When Congress raises taxes it eliminates money. Tax out. Spend in, Tax out. Pretty simple. Congress should spend into the economy right now, particularly down to labor and the middle class. Congress should also prop up state and local tax revenues. There’s a lot of unemployment still. We could solve the unemployment issue by creating a national job guarantee. If you want a job but cannot find one, Congress will hire you. Employer of last resort. There’s little to no inflation there because you are hiring idle labor.

Chris Herbert,

Where does this nonsense — “Congress creates new money when it pays a bill” — keep coming from? Is there a nest somewhere???

Congress shifts money around: it borrows money and it collects money via taxes, and then it hands this money thus obtained to others via unemployment benefits, bailouts, paying bills, buying weaponry, etc.

The entity that “creates” money is the Fed.

The thinking comes from Modern Monetary Theory. The idea is that public debt for the United States as a sovereign, reserve-currency printing Power, is a fiction, that Congress only chooses to borrow money in its own currency, and that Treasuries are nothing more than interest-bearing dollars. That the Fed monetizes this debt further intertwines fiscal and monetary policy. Taxes in this view are a policy choice to reign in inflation and to punish or reward desired behaviors.

Yes, I know that this nonsense is MMT. And there are MMT trolls everywhere. That’s what I called the “nest.” MMT is a religion, and the faithful refuse to add, or just cannot imagine adding 2+2 together. They rather have faith in their deity. And for people outside of that religion, it just doesn’t make sense.

Dont get me wrong Wolf, I’m no fan of fiat or MMT. The founders knew what would happen with fiat (i.e. Seven Years War and the Revolution), but we’ve doing MMT for the last 20 years now.

The politicians spend without any intent to any sort of relative balance of inlays and outlays. The relationship between taxes and expenditures is laughable.

Herbert is correct in the sense that money gets created very time Congress passes some monstrosity and you have a FED that just doles out the digits. We can all talk about various entities buying bonds and “paying back” those bonds with new bonds but people know here know it’s a charade.

As diverse as the crowd here is, I bet if you polled the question as to whether people believed that there were real entities (not the FED pretending to Ireland or whomever) buying US treasuries- the answer would be a resounding no. Now there are central banks helping other central banks juggle number games called balance sheets, but that is part of a charade whose gears are grinding hard.

We essentially saw an acknowledgement of this with more talk about new central bank digital currencies (even though the existing various currencies already look like the cryptos) in the past few weeks. The IMF calling for a new international agreement smells of desperation.

The central banks are doing what you did when your mom told you to clean your room. You shoved it under the bed. The national debt load is being transferred to the Fed balance sheet. Once that looks too absurd, the junk cant go under the bed. Itll be the closet. That new closet will be the new system that is put in place to deal with Central bank balances.

I bet many people on here would like to hear your thoughts on what this new arrangement may look like.

The central banks have a lot to answer for. In using QE since the financial crisis they have given life to the notion that this could be done ad infinitum without inflation. The fact that there has been rampant inflation in certain sectors (or asset classes) is conveniently forgotten. Now the leftists who are historically incontinent with the finances are jumping all over this to fund yet more of their misguided nonsense and it is being bought hook line and sinker almost universally.

Quite right Harvey.

If you go to a bank and borrow money the bank credits your account with new money created out of thin aur and puts yout IOU into its books thus removing the money in an accounting sense. The money though is really there and you can spend it.

A question for Wolf,

If the government doesn’t create money, then where does it come from?

topcat,

“If the government doesn’t create money, then where does it come from?”

Two sources:

1. The Fed (created $3 trillion in 7 months).

2. The banking system overall, not individual banks (as asset/collateral values rise and these assets are sold at higher prices, proceeds turn into higher deposits among banks, even if briefly, and new buyers borrowing more to buy said asset. Opposite happens when asset/collateral values decline = money destruction in the banking system … this is on automatic pilot).

An individual bank CANNOT “create money out of thin air.” It can lend out only money it already has (cash from deposits or cash from other debts, such as bonds or loans from other banks with excess cash). The money creation/destruction takes place in the banking system overall between banks.

If a bank could create money out of thin air, no bank could ever collapse, period.

Reading the article along with the comments brought back to mind the wonderful poem by Kipling. Wolf, I hope it’s ok that I posted it below….a little wisdom for ages me thinks.

If you can keep your head when all about you

Are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

If you can wait and not be tired by waiting,

Or being lied about, don’t deal in lies,

Or being hated, don’t give way to hating,

And yet don’t look too good, nor talk too wise:

If you can dream – and not make dreams your master;

If you can think – and not make thoughts your aim;

If you can meet with Triumph and Disaster

And treat those two impostors just the same;

If you can bear to hear the truth you’ve spoken

Twisted by knaves to make a trap for fools,

Or watch the things you gave your life to broken,

And stoop and build ’em up with wornout tools:

If you can make one heap of all your winnings

And risk it on one turn of pitch-and-toss,

And lose, and start again at your beginnings

And never breathe a word about your loss;

If you can force your heart and nerve and sinew

To serve your turn long after they are gone,

And so hold on when there is nothing in you

Except the Will which says to them: ‘Hold on!’

If you can talk with crowds and keep your virtue,

Or walk with kings – nor lose the common touch,

If neither foes nor loving friends can hurt you,

If all men count with you, but none too much;

If you can fill the unforgiving minute

With sixty seconds’ worth of distance run –

Yours is the Earth and everything that’s in it,

And – which is more – you’ll be a Man my son!

The GARBAGE that is MMT persists because the two steps forward, one step back accumulated wealth experience during the bubble/bust process benefits those “elites” in a position to demand a change to it while it also allows politicians to promise and spend far more than tax receipts would allow. Thus, no one in a position to change it desires to do so.

The quotes should be around “money.”

“…it borrows money and…” The Fed prints new money to buy T-bonds that fund Congress’ deficit spending. Intermediated through Primary Dealers, but those new $’s get spent.

Isn’t there one case where the congress can create money? In my understanding that is when the congress commands the treasury department to mint coins and increase the number of coins in circulation. This is of course a trivial amount of actual currency, but possible.

Gold coins… but even Congress doesn’t get the gold for free. Whoever mints the coins had to BUY the gold. No free lunches.

And sure, with the quarters, dimes, nickles, and pennies in your pocket, the manufacturing and material costs are lower than gold coins. But wait, it costs more to manufacture pennies and nickles than they’re worth. I mean, now the argument is getting into the absurd, given the $2 trillion in paper dollars in circulation (handled by the Fed, and a liability for the Fed), and the $27 trillion in federal debt.

My theory is the U.S. should print and buy the heck out of gold while it can. Print a dollar, convert into gold. Now there is a free lunch. Americans don’t get, most of the world sees gold as the ultimate store of wealth. This is what China and Russia are striving for, majority ownership of gold.

You don’t have to back your currency, only become the world’s majority holder of gold. Set your own price ($50K?). Then you have the means to stay the reserve currency. Of course, it would take some prudence from leadership the U.S. doesn’t seem to have.

@ Brant Lee- Interesting idea, but I think a while back, and it was glossed over quickly, it was revealed that most of the gold at the Fed was actually missing, as it was “loaned out” to provide collateral for other people loans. Insane. No one knows how much is in the ether, but I believe it took over 4 years for just the Germans to get their gold back. Anyone else remember this? I probably read it here.

T-bills are in reality money just like a $100 bill is money

And it is not the fed that print those

T-bills ain’t like Franklins because a $100 bill (with Ben Franklin on it) is printed; the only costs are the paper ink and printing press.

But a T-Bill has to be sold to someone who already has Franklins. Or to the Fed, who has the power to create digital credit without a physical printing press.

If the Fed creates money anytime the Treasury asks for more money – It sure looks like the Treasury “creates” money.

Sounds like you think the Treasury can have a failed auction.

Modern Monetization Theory is here.

I believe the last time the Treasury actually created (printed) money was in the Kennedy administration. The bills were titled United States Notes and I believe they were issued at the direction of Congress. You hardly ever see any of them in circulation. I have a couple of Fives that have lost almost all their 1960’s value in the time I have had them. Even at only 2%, annual inflation, paper money looses a huge amount of value over 50 or 60 years.

Actually, the bond market buys nearly 90% of Treasuries via auctions. The Fed only buys a fraction of the Treasuries, so they are subject to the willingness of the bond market to purchase them. If the auctions are “sticky” and Treasuries are not selling well, they have raise the interest to attract more buyers.

Congress will hire you when nobody else will? What would you do?

And, besides, there are enough people in Congress with jobs that already don’t do anything productive. Your post is gibberish. Are you trying to be funny?

Great idea. Let’s borrow even more money for our children and grandchildren to pay off. Worked great for Japan. Not to mention Argentina.

how much will you spend and on what?

$150 books and an outing for the kids

Besides gifts for others, I imagine alot of people will be buying stuff for themselves, as is typical for this part of the year. This could be part of the gap between estimated gift spending and retailer expectations.

Electronics spending will probably do very well this holiday season, though, I don’t expect electronics to be able to maintain their current spending levels very far into the future. 5+ years before declining significantly, I’d guess, only so many big tv’s you need and most electronics are running out of significant yearly improvements.

My Christmas electronic gift to myself will be a Gaming Computer. I was leaning towards a PS5 as I have a library of PS4 games. However the Gaming Computer will play games not available on PS as well as do non gaming stuff like reading Wolf Street. Being over 60 with type 2 the internet and my PS4 has kept me somewhat sane these last few months at home.

Very accurate post Wolf. We just had discussion about doing more of a family grab bag type Christmas etc. And half of the public is going to be incredibly upset about the election result. That won’t make them spend. Maybe on ammo.

My wife and I have cash and could buy whatever for family. But I am a solid woodworker and will be making personal gifts in my shop. Wait a minute, do you possibly think there could be a connection to having financial security and living mindfully?

Christmas, Halloween, Thanksgiving, summer vacations, automobiles, have all morphed into absolute consumer debauchery. Mindless consumerism.

Keep it simple and maybe donate to a charity? Most of the World has sweet eff all. Donate locally. Volunteer fire department? Search and Rescue? SPCA? Anything is better than more plastic crap in the landfill.

Oh boy, you brought back a memory. My 50 year old niece was (and still is) basically destitute and I was helping (enabling) her by slipping her a hundred or two now and then. That all stopped when she sent me a picture of her best friend’s two sons (teens) holding up new iPods and her saying, “Aren’t you happy for me? The money you sent was spent giving these kids something they really wanted.” The kids were far better off than she was. SMH

Let me add that I normally consider a gift a gift and you can do with it what you want, but she was literally short of groceries and about to be booted from her apartment.

Stockings of 9mm and 7.62?

Harbinger for the Xmas season, I had a department store card which was closed on me a few months ago with no notice. I found out when I tried to use it for some holiday shopping. Accounts are being closed with no notice and buyers will find out when they try to use their cards.

I don’t mind that they closed the account, but they could have notified me. Now I no longer feel bad that they are on the verge of bankruptcy, they deserve it, if they are closing good customer accounts.

Interesting point.

And not just for store cards.

I don’t think most people think about it a lot, but both consumer credit cards (and to a lesser extent, corporate credit lines) can be throttled down/closed entirely at the unilateral discretion of the issuer.

Not so great in emergency situations.

Consumer card balances are actually down for now (thanks to insane pandemic unemployment subsidy) but if card issuers start seeing a significant hike in write offs or spiking demand, they can flip a switch and cut off consumer “spending” power pretty damn quick in order to shield their own financials.

With little warning to card holders…who may have had unused credit lines of $10k+…for years/decades.

Therefore, one should always charge everything*, but pay off balance every month to avoid interest. That way, if they cut you off, you owe them something and can negotiate with them to reinstate you, or “Without credit, my business plan fails and you won’t get anything from me for a long time, or never.”

*Except family owned small businesses where one should always use cash.

Not a great plan. They would eat you alive with fees if you fail to make a minimum payment, and they will drown you with interest if you DO pay over multiple months.

Just be grateful they continue to give you a “free ride” (minus merchant fees) for as long as they do, and be prepared for when they don’t.

Even if the credit card is paid off every month, people are proven to spend substantially more when using credit cards. For fast food places, I think on average using a credit card will result in you spending 30% more.

Had a major internet bank cut my seldom-used Venture One (zero balance) credit line in half. Had it over 10 years. FICO 850. Always paid statements in full. Someone is in trouble.

A major bank cut the credit limit on my line-of-credit last June or July. Same story. I have excellent credit and am a long-time customer of the bank. They said in their letter that I never came close to using the limit, so they reduced the limit to what I actually use. Apparently, the banks are very worried about people getting over-extended during these COVID times.

Same happened to me….$30K limit cut to $10K.

I have an 830 credit rating and have had the card for 20 years. Never missed a payment (always paid it off)

same for me. Credit limit for major card cut in half with credit rating of 825 plus.

re: “… Never missed a payment (always paid it off) …”

There’s the problem: you’re a Deadbeat* (banker’s term–they can’t fleece you with interest and ‘fees’).

* Me too.

They actually want you to use it! Spend, spend, spend!

If you don’t have outstanding installment payments (car, mortgage), it’s almost impossible to have an 850 rating.

…and by outstanding, I mean not payed off.

That’s the only reason I keep only a small mortgage payment with a 27 year perfect record. But one bank still cut a slightly-used perfect-record credit line. (FICO does vary 844-850 depending on who reports.) Someone’s preparing for trouble.

Nope. They really want people to carry a balance on their cards, ideally paying the minimum amount only.

If card-holders don’t want to play along with a simple thing like that, then, their credit line is cut appropriately. If one doesn’t use it, one will lose it!

If one wants to be offered a bigger credit line, run the card up to 10% of the max, leave it tantalisingly there for a couple of months paying close to the minimum, then pay it all off. Do that a couple of times and they will offer to increase the limit. Of course their AI is now hoping that one will run it higher still and then not be able to pay it off. Which, after all, is how they make most of their money!

There is of course some evil logic for everything a bank does. But if you are never charging up to your credit limit, why worry if that line is cut? If you need more credit, say for a luxury trip, just ask and they’ll increase your limit. After all, they want you to spend, spend, spend beyond your means in the hopes you’ll blow your budget and not be able to pay off your monthly balance.

Yea, they actually pay me to use mine.. I use it for almost everything, but pay it off every month and collect the rewards. I cannot believe how quick they pile up. They pay me to use their money for a month… I guess I should be grateful to the people who carry a balance….

Yeah. I had a credit line backing my checking account canceled. BofA must have “forgot” to tell me.

Be careful out there.

I use the outside Christmas lights indicator. When lots of people in my neighborhood decorate their outside homes, Christmas sales will be good.

We are going to spend less this year on Xmas/holidays (in Texas, near Houston) . We already had that conversation with the kids (4) and grandkids (3). Two of our children are furloughed from oil company jobs since April and the others have high medical bills (thanks, ACA) and other challenges .

We are retired and just holding back spending proactively until the dust storm settles.

Talking with our friends and neighbors in our age group, this spending reduction/cutback is a common theme.

Why can’t people give gifts all year around? It’s stressful to be bound by a meaningless date.

Kasadour no one is stopping you from sending gifts year round. I would be so happy if you sent me gifts every time you get paid. My address is 1600 Pennsylvania Ave NW, Washington, DC 20500. Oh wait, you already do! Thanks so much!

Lol!

Kasadour – you meanie – you don’t send birthday presents?!

:)

This will be a record breaking season as long as supply chains are not held up. There are new gaming consoles (PS5/XBox) as well as accessories being released this season. With the shortages we saw of the Nintendo Switch over the summer it looks pretty clear that people will not be shy about purchasing high dollar items this season.

Those new systems are not that impressive, switch caters to a wider crowd, and there’s less money sloshing around now compared to the summer with no stimulus in sight.

One of the Sony execs tweeted that there were more PS5’s sold in 12 hours than PS4’s sold in 12 weeks. I have a feeling people are underestimating the power of gaming and new electronics in general, let alone when people are stuck at home during a pandemic.

They actually had money in the summer. A lot of these people’s UI runs out end of December. I don’t know, but with the way Americans operate you might see high spending right up until the very moment the ball drops. New Year’s day could be quite the hangover. Rent? What rent?

Just got this from a Democratic friend, “If Trump disputes or disrupts the outcome of the election we need to not march in the streets, WE NEED TO STOP BUYING STUFF. That will get the Republicans to pressure Trump to back off and leave the White House peacefully.” If that catches on Christmas could really tank.

Baloney, we need our stuff!!

What happens if he wins? Gulp.

Does said friend then leave the country or go “protest peacefully” on the streets.

No. They’ll simply drown their sorrows in a bottle of hand sanitizer.

Reyn Blight:

Reading and hearing this future fable always amuses me…..

If DT is defeated and he “refuses” to leave office the US Secret Service will carry him out of the WH just like Franklin Roosevelt did to the head of Montgomery Ward, Sewell Avery. It was hilarious to see the major newspapers’ photos of him actually still in his “executive” chair being carried out of his offices.

Never fear; if DT (or any other president) refuses to leave office on loosing any election I don’t believe there will be any tolerance whatsoever to “remove” him from office.

As far as other comments on Christmas my only response is:

“Bah, Humbug!”

It’s all a scam………………………………

My mother used to say “Everyday your healthy, and eating well is Christmas.”

And yes we were still Consumers.

Perhaps buy a bag of junk dimes for when things settle down.

And for those of you awaiting the Great Pumpkin – it will not be broadcast for free, Apple bought it for Apple TV+. So much for traditions.

Peanuts is owned by Iconix Brand Group now. But you are in luck, Iconix is up for sale!

Thank God Sesame Street still gets to PBS.

The fact that HBO subscribers get the new episodes 9 months early doesn’t deny kids the show. I believe it’s a sign of the times but not deeply troublesome. Probably PBS got a price break.

Yeah well, those muppets aren’t really who you think they are ..

If you download the Apple TV app, you can watch The Great Pumpkin for free on Oct 31 & Nov 1.

@Apple – Only if you’ve bought into purchasing and maintaining iStuff. I have no iStuff.

And I point out that streaming “free” programming isn’t free, you pay your IP connection. Broadcast TV/radio is as close to free as you can get – if you can stand the commercials.

TANSTAAFL.

Apple app is available on firestick, roku, android devices and some of those smart tvs.

Thanks, Harold, I didn’t know. I guess I should send some money to Apple, it’s un-American not to.

Possible theory: Who’s right (businesses or consumers) depends on the result of the election.

Remember the Trump bump? A sizeable portion of the electorate became suddenly optimistic after his election. This alone caused a surge in economic activity. Back in ancient history (2016), the conventional wisdom on Wall Street was that Republicans were better for business. Coupled with lower-income families’ new-found hope that a Trump presidency would bolster their fortunes, the economy and stock market surged in unison.

Now, Wall Street has developed a new affinity called Biden/Harris. But lower income voters still have a strong preference for Mr. Trump. If he loses the election, Christmas spending will suffer, as those voters psychologically dig in and and save harder. If he wins, they’ll feel more hope and willingness to take some chances with their credit cards.

Upper income voters will likely spend the same either way. If Mr. Trump wins, they won’t like it, but it’s very doubtful they’ll spend less. If Mr. Biden wins, they’ll celebrate afterwards, but it’s very doubtful they’ll increase their holiday spending.

Just a theory. FWIW

The data appears to show lower expected Christmas spending during election years. You may be on to something. But I suspect your wrong about upper income voters disliking a Trump win. I base that anecdotally on the number of Trump boat parades that have taken place.

Speculation … not too many 40 ft + twin diesel sportfishermen with sky high tuna towers in those parades … just a bunch of center consuls and runabouts with monthly payments

Diesel’s expensive. I’m not running my work boat in anybody’s parade. That’s what the fun boat is for.

Lower income voters favored Clinton over Trump.

Only way low income people are going to spend big again would be with more stimulus, which is only happening if Dems sweep and even still won’t come until like February at the earliest. So a bit sparser spending this season.

Also seems like gonna be fewer gift giving opportunities overall. Nothing in office and smaller/fewer family get togethers.

Nick:

“….smaller/fewer family get togethers.”

Yes.

In our case we are not having our traditional get together in 2020 for the first time in almost 30 years.

A large family gathering that almost always draws up to 50 family members and friends.

Not this year.

Just a nod to the contrary- if DT wins, a lot of people may hold onto their money anticipating more expensive healthcare costs if they have pre-existing conditions. I fully expect them to pull the old everyone has “access” to healthcare, meaning only that it exists in the marketplace, not meaning that people who need it can afford it. I imagine health insurance companies are standing on their heads trying to make this happen, as there will many who have survived covid but are left with expensive chronic conditions. My family will squeeze each penny till Lincoln screams, right up to the transfer of power. Very tiny Christmas this year.

I am always surprised that American sheeple need so much materialistic stuff to be happy.

My income is not affected at all by Covid-19. My plan is to save as much as possible (and save in gold and other appreciating assets). I firmly believe that the future is very grim for the vast majority of people. Getting ready for raining days, namely peace of mind, makes me happy.

I read somewhere, “the best things life are not things”. Love, health, peace of minds. The only things that are more important than the “best things in life” are fresh air, clean water, quality food and a safe neighborhood.

You said it yourself, ‘sheeple’.

Before buying another bike, I asked my Friday Night Grill Club buddies if I was just being a spoiled rich fuc#. Three good answers. 1) If you can afford it, if you use it and enjoy it; then, no. 2) If it doesn’t create environmental issues or issues for the workers who build it; then, no. 3) You ride every day. Get the best!

In the sunshine this afternoon, it was -2 C, with a 20 kph wind. I rode to the river, up & across, down & across, along the creek, around the lake and home 25 km later for a quick spin. Couldn’t have felt better! Using my materialistic stuff does make me happy, I will admit, but it also keeps me healthy and gives me peace of mind.

Here’s to health and peace of mind for everyone out there!

Rhetorical question?

‘I’d rather have a hole .. than a piece of mind.

mumbled by some guy named joe

one CANNOT have too many bicycles.

ask me how i know …

And you are absolutely correct

No amount of money can buy happiness, enough money can rent it. – Lisa_Hooker

That’s why you lease a hooker?

Leasing allows you to drive what you could never afford to own…

“Something is afoot here.”

Companies are preparing for more stimulus checks. Those that do not have inventory will miss out. If there is no further stimulus then many companies will go under anyway. But I guess they’ll have more inventory to liquidate.

The way I see it, the top 10% who don’t need the stimulus money will splurge on luxury goods. Everyone else will tread water.

The Senate has recessed until after the election. There will most likely not be another stimulus bill until next year.

The election is Nov 3. Plenty of time to pass another giveaway before end of the year, maybe a Christmas present for Americans (isn’t that like re-gifting?).

And they will be back because the Continuing Resolution (budget) expires Dec 11, 2020.

… and electoral votes are cast on December 14.

Ted Cruz is already talking up how bad the deficit is, so there will be nothing passed until after the inauguration.

Apple,

You mean giving JACK a new @$$ho!e for his pitiful response with regard to the TwitMob’s God-like ability to censor, for wholly partisan reasons?? THAT Ted Cruz?

Sometimes, it takes a snake .. to sink a Fang within another poisonous viper.

For a free gifts that really “counts”- Send extra blank voting ballots to loved ones today for an early holiday gift. Everybody knows that it is ok to vote as many times as you want depending on the size of your obsession :>{)

I thought you had to be dead to vote more than once?

Remember this happy holiday news?

“Trump’s tax plan sets the stage for Dow 30,000

Published: April 27, 2017 at 11:50 a.m. ET

By Nigam Arora

132

Lower corporate taxes could supercharge the economy and boost company earnings”

– “28% said they’d spend less than in 2019 (highest % since 2014).”

Gallup shared interesting data, offering free intellectual entertainment to the general public

Even if “28%” is obviously greater then the other “12%”, does Gallup reveal how these segments are spread across the wealth spectrum? Or this information requires a payment?

Beyond Gallup’s emotional survey, there are many reasons to wish to build up the stocks.

The times of volatility invite to increase the level of minimal stock.

The fear of inflation may motivate to lock more capital in goods.

Engin-ear,

Good lordy. Instead of getting tangled up like this in nonsense, you could have just gone to the linked sources for the details that you might be interested in. So here they are again, for your amusement:

https://news.gallup.com/file/poll/322829/201026ChristmasSpending.pdf

https://news.gallup.com/poll/322796/americans-plan-scale-back-holiday-spending-year.aspx

https://www.gallup.com/201200/gallup-poll-social-series-work.aspx

Just read attentively all three links. Thanks.

Found no indication what is the gift budget of those 28% who intend to spend less. How it would impact the overall Christmas spendings.

I like your site. I call it in my head the “Wolfstreet School of Economics”.

Reminds me on an engineering joke (I will try to summarize):

1. Three people condemned to death in France by guillotine.

2. For the first two people, then guillotine would not release and they went scott free as is tradition.

3. The third person, the engineer goes up for his turn and proudly proclaims: “I am an engineer, and if you only loosen those two bolts up there…..”

LOL.

I just watched a video by Steven Van Metre (calls himself the Bond King) You can go to youtube and search.. I don’t think Wolf likes us posting links.

Anyway, he showed charts of not only the past recessions but what is going on currently with the banks and lending. Lending is already slowing down and he expects more of that. So those writing about credit cards and lines of credit, this is part of the normal cycle. I thought it was worth watching.

As per stimulus.. If Trump wins, there will be a big stimulus package and everyone will be happy till they aren’t.. If Biden wins, which looks more probable right now to me, then there won’t be one until after Biden is sworn in. I think the hard ball being played by the Republicans will want Biden to be facing as much damage as possible so they can say, look how poorly he’s doing and try and take back over in 2 years.. Van Metre’s charts suggest the second scenario.

The first stimulus must have spoiled every one. I mean, $1200 to everyone and an extra $600 week to the unemployed? That weren’t too smart, but Congress can’t be accused of smarts anyway. It doesn’t take long to get used to that kind of extra money. It doesn’t take long to blow it either, so, another round, whoever I vote for before the banks and corporations get theirs?

The service sector (including insurance and banks) will depend on stimulus now to stay in business just like the stock market does. There still seems to be no clue from anyone that the production of goods is the only way out.

The banks got it twice if most people were paying down lines of credit. 450 billion from uncle fed that they prob leveraged 10 times and the “stimulus” sent to individuals who then used it to pay down credit lines. A true WIN WIN

Paying down credit lines is bearish for banks since that decreases the assets on their balance sheet and decreases future cashflows

So then the Fed buying all their garbage in 2008 at par was bad for them, right!

@Mr. House

Maybe you should look at all the failed banks in frbny website from 2007-2008… lulz

@Mr House

My bad, FDIC, look how successful the frbny was in 2008 when you look at all the banks that were failing from 2008-2011!

www[dot]fdic[dot]gov/resources/resolutions/bank-failures/failed-bank-list/banklist.html

There are a ton of smart people that are worried about what the next few years are going to look like for the country. Grantham, Druckenmiller, Einhorn, Jim Rogers, Stockman, Hussman and many others. All of these guys are extremely bright and know the everything bubble is not going to end well. Less face it, the average consumer is pretty bad with money and will be spending until they lose their job and not see it coming.

Old School:

I’m dumber than a billion year old rock and I already knew definitely after year 2000 that none of this would “end well.”

I guess I’m really a dumb genius!

I would make a good economist!

(How do I know? I was born at the beginning of the Great Depression and remember the life my family and their friends had to live then) (And yes, I’m that old!)

So do these yearly surveys take into account consumer goods inflation in holiday money spending? I would assume so but who knows? If dollar amounts are not inflation adjusted they are not reliable.

Also, do they ever do a retrospective survey to judge if consumers really did spend close to what they claimed they were going to do?

Heinz,

1. “So do these yearly surveys take into account consumer goods inflation in holiday money spending?”

The surveys are not adjusted for price changes.

But, but, but… the Consumer Price Index covers all goods and services. Some of the goods that people buy for Christmas got cheaper and better (such as electronics). So careful adjusting Christmas gifts for CPI because it doesn’t apply to what people buy on Christmas (1/3 of CPI is housing, 7% of CPI is energy, then there’s healthcare, etc.).

2. “Also, do they ever do a retrospective survey to judge if consumers really did spend close to…”

No one cares about the dollar amount that consumers say that they will spend on average. What matters is how that dollar amount changes over time, up or down, and by what percentage. In terms of the direction, those surveys are normally on target.

My father once gave me a (brand new, giftwrapped) toilet seat for Christmas. He did the installation, seems the old one was pinching my mothers soft side. It was nice of him to include me in that relationship, and probably a way to instill good etiquette, that I might always use it properly, since I was the owner. Raise the lid before and close the lid after, and avoid scatological references at the dinner table.

Reminds of the time my father sent us a case of toilet paper, after we failed to stock the guest bathroom. What he failed to notice, was that he subscribed for monthly delivery! Dad, RIP, and thanks for the future investment!

Smart dad.

National Federation of Independent Business (NFIB) Small Business Optimism Index is extended much higher than the Conference Board Consumer Confidence Index released today. The spread is somewhat rare to this degree, thus fitting with Wolf’s research. I can only guess the PPP funds have given biz a sugar high while the lack of new $1,200 consumer checks have the consumers down and out “temporarily” (I read president wants “bigger” $1,500/$1,000 checks versus $1,200/$500 last round, via a leaked source, so there could be a flood of consumer stimulus in the next 1 to 3 months depending on election results). I think the blue tide vs blue wave will be critical to how much consumer stimulus gets sent out. Red Senate could be least stimulus (markets no likee), no matter any other election results. I avoid politics at all costs, yet I try to calculate what is coming policy wise and I think a Red Senate could impede future stimulus. Why? Humans tends to repeat

One a side note Bierce – I just swapped a 10 year old toilet that cracked due to poor install (uneven tile) with a $230 mid-grade Kohler toilet and really shocked how many advancements in just 10 years. It uses about 1.2 gallons instead of over 2 gallons, it sits higher off the ground for easier use, it flushes strong like the old 5 gallon commercial ones 20 years ago (one flush and done), it has a tiny profile and tiny tank so it makes the bathroom look bigger, a slow shut seat and lid, and it only took 20 minutes to install because all hardware (even wax ring) was included, and it had great installation instructions. J-Pow should print every American $500 to replace two old toilets as that would save a lot of energy and fresh water and last perhaps last for decades.

Fersure – Totos are well worth the extra dough.

Just be sure in those low flows that you don’t use abrasive cleaners, they have a special ceramic glaze.

The difference of $137 per person will be rectified by a massive spending bill on Nov 4th.

An average of $138 will be handed out to the little people thus putting consumer demand on a upswing. The interesting thing to watch is whether people will tap their credit cards.

This is an Easy Button . More stimuli and tapping that vaunted historic credit card debt pay down reserve along with skipping rent and mortgage payments and any thing else you can think of should do the trick. ABC will cheer along and declare them all heroes. Christmas 2020 is going to be great. Thank you Saint Jerome an Xi.

If you bet on the United Spenders of America, you’ll never lose.

Buffet says so!!!

Exactly. Christmas spending depends on whether the unemployed get more checks from the government.

If the unemployed get cut off by the Federal and state governments, it’s hard to imagine a wildly successful Christmas for business, unless that business is a Mercedes dealership or selling Faberge Eggs or something else that catches the attention of the market-enriched.

Anyone who buys underwear, socks, clothing or tools before the post Christmas sales is either:

A. Rich and doesn’t care.

B. From foreign country and doesn’t know how things work here.

C. Is innumerate.

Went to Kohl’s, owned by the Senator from Minnesota’s family, bought underwear at 60% off, got a coupon when buying that for a two for one, went back upstairs and bought twice what I had earlier at the same low price.

How to avoid inventory being gone: Go in before the sale, pick what you want, hide it somewhere in the store, behind furniture is great, then breeze in once the sale is on and buy it as described above. Don’t forget cash back credit cards from the store.

Number one rule for xmas shopping….

“If I can’t find it in a liquor store, you ain’t gettin’ a present”.

I sure hope retailers overstock big time. Especially those Christmas-colored Reeses’ cups candy they have to mark-down half price after the holidays. 90% off is nice on Christmas lights and stuff. Hopefully, all kinds of stuff has to be marked way low at the first of the year. I can put off Christmas until Jan 10.

Thanksgiving black Friday, cyber Monday and return Tuesday will be an indicator of the general mindset people have. Red or blue this November, they must pass a good relief bill with all the necessary funds for everyone not just the top cats. Expect a second or third COVID stimulus check in your mailbox by Nov-end or Dec 1. The money will buy stocks, gifts and pay for any credit card bills.

I am planning to replace my 6 year old laptop. Lot of families now include 1 laptop per person due to the online WFH, study from home purposes. Exercise equipment are also on the list.

May be add “Bear Skin Rugs”

For me and several of my friends, the holidays are kinda like sports right now. In the past we followed these secular traditions, but this year, they’re all kind of bleh.

Except bike racing…

I wonder how the cosmetic industry will fair this year. I keep getting ads from Lime Crime for half-priced lip gloss. Why would anyone wear lip gloss? The only place to wear that is at home. I’m sure it will be a disappointing shopping season for cosmetic brands.

Kasadour,

You’ve touched upon an interesting point. There are lots of murmurs coming from the industry. None good.

But, but, but… My wife puts on makeup before she goes anywhere, including inline-skating and figure-skating (rink now open by appointment only). Personally, I don’t quite get why you would need to put on makeup before working out, but there are a lot of things that my wife does that I don’t quite get.

She has also been going to the office every day (her company, being in the food supply chain, has considered itself “essential” from the first day on), and she puts on makeup for that too. So at least someone is buying that stuff.

Pretty sure it’s cultural. https://www.nippon.com/en/views/b02602/

I’ve read somewhere that it’s rude for Japanese women to go out without makeup. My sensei is a Japanese woman and she wears makeup even though she’s teaching me through Skype. Doesn’t matter if it’s early morning or night.

Forgot to say that it’s probably related to the Tatemae thing.

Mr. Richter: I’ve always enjoyed wearing cosmetics- the colors and textures are amazing, and using proper brushes and blending techniques, one can create some really beautiful effects of color and light effectively transforming one’s appearance. But it’s not possible to wear make up under a mask, especially lip gloss and foundations, because firstly the mask covers it up, and then second, it smears off and makes a mess under the mask and on your face. I’m sure other ladies here can relate to that.

I got another coupon from Lime Crime today for half off lip glosses. Normally, I would snap that up in a heartbeat. I love their Wet n Tangy orange lip gloss. It even smells like tangerines.

Kasadour,

You should see my wife’s smeared masks!!! She washes them regularly. But yes, you cannot see the lip gloss behind a mask. But the eyes look gorgeous, now that’s this is all you can see and focus on. It’s really wonderful how, with masks, people focus on eyes, connecting with their eyes, smiling with their eyes, expressing appreciation with their eyes. I love that part of mask-wearing.

Cosmetics are said to do well in recessions based on the premise of substitution. If you can’t afford a new car then by golly you can still afford a better cologne, perfume, shampoo, etc. Take a look at the charts on Estee Lauder (EL).

Consumer defensive names are typically a decent way to ride out a normal recession after you have a market downdraft. I say this is not a normal recession due to the anticipation of massive fiscal intervention. Today’s move up in the dollar is saying no fiscal in the short term, and a Trump win.

Women that are working from home are wearing less makeup but using more skincare products. Skincare routines are more time consuming than makeup applications, so working from home allows more time to spend 30 minutes with gook on your face. All reports are that women’s skin has improved remarkably from this crisis. Don’t let a crisis go to waste is the operative slogan here.

BTW, Asian skincare companies are considered better than western ones, especially Korean companies. I happen to think French companies put out great products as well.

Got a strong feeling that when this is all done……

the kids (anyone younger than 40) will finally get to experience a multi year

bear that does not v recover. The fed has shot its wad……and things are falling apart. Co Vid remedies appear to be limited. The gov clowns are out of credibility……any further borrowing is going to cause even more troubles. Biden is just the trigger…..even if he fails to get elected and Trump somehow makes it, a demo senate will impeach him.

This is going to be a nasty time to be around…..adding sds to gld.

Peter Schiff comments discussing how consumers AND companies are “fiscally” sick:

We’re sick because we overdosed on government cures. So, nobody has these conversations. Yeah, people need money. Companies need money. And so we have to stop playing politics and give them the money. Playing politics is giving them the money.

The reason everybody needs the money is because we played politics in the past by making them so dependent on that money, by trying to delay and mitigate every single recession – now we’re in a depression. Had we allowed market forces to operate, we would have had a much healthier economy going into COVID-19 instead of a bubble. And the problem with bubbles is sooner or later, they always find a pin.”

I am 64 so I have experienced several economic environments. This one is new for me. My investment mistake was not understanding that money was going to flow from the Fed and Congress whether there was real economic activity happening or not. All money of course is not the same. Money that has been ‘printed’ and distributed still buys things but in my mind it’s like the farmer selling off a piece of the farm to make ends meet. It is an emergency action, not something that should go on year after year.

You’re right not all money is the same. When a farmer sells off some of his land, equity is unlocked, money enters the economy and that is expansive. Someone else borrows to buy that land, which only requires a small down payment. Less collateral is taken off the market. The system is self correcting. Only in periods of deleveraging does money disappear, and in an economy where global investment makes these securities all interdependent, there is never an unwind. The system may freeze, and the forex system is the weak link. The dollar is now tracking the market, which is a scary thought. The dollar can go higher nominally, and lose value, the rise indicates how many dollars it takes to buy a dollar.

The troubles with bubbles (note the clever alliteration) are that there’s nothing inside. They’re all just a thin veneer looking quite pretty from the outside.

There’s a bright side to all the department store closures…spotting fake Santa’s has been reduced to only two choices! But watch out, Ralphie may be upgrading from Red Ryder to 30.06 with all that money he got in the mail.

Santa is on the unemployment line, no joke, it was in the NY papers.

We mustn’t forget Santa’s support staff of elves, also unemployed.

I think you might have misspelled Ralphine …

…. polecat ducks quickly under little red wagon

Yowz, I gotta quit taking a look at night skies. 1:38 am PST just saw another lower altitude meteor burnout. Crossed same region as last one but this time NE to SE. Shorter duration with red flashout. Last one had 81 reports with 2 videos that classified it as an event. These rocks are getting a bit too near.

SPX weekly, in the cash market :

1) Price closed under Feb 2020 high.

2) Support : the gap between Feb 19 close to big red Feb 24 open. Also Mar 3 high and big red Feb 24 close.

3) MCD : bearish crossing.

4) Cloud (9,26,52) : price is high above a red flatbed. / T&K : next week T (9 weeks) will lose it’s Aug 31 high and turn down. / K (26 weeks) : by the end of next week May 11 low will be lost. K will move higher closer to T, stay flat near Feb 24 open, waiting for T, for a potential T&K bearish flip.

5) The front end of the cloud is very wide. It will become wider, since K keep moving up.

6) S&P 500 Futures weekly using Heineken Ashi : the current low stopped on top of the big red Feb 24 open. The current close @6AM ET is under Feb top.

7) The cloud(9,26, 52) shows a possible osc to the 2800 – 3000 range.

8) The cloud (18,52,104) shows a different story :

a) Price is too high above the cloud and T& K gap is very wide.

b) The cloud is thin. A thin cloud might not support price. Price might breach the cloud on the way down.

c) Big red Feb 24 close, a year later, built the Feb 15 2021 spitz. Price

might be attracted to the spitz, bounce back up, above a paper thin flatbed cloud between Mar to July 2021.

9) The bottom line :

a) price is backing up above/ below Feb 2020 high before moving up.

b) wider, wilder, crazier osc.

c) out of control system control with positive feedback loop, after x3 stopping actions start breaking.

The office cubicles are gone, send your present to Sophia Loren the most

beautiful woman ever in the white house.

Why spend on Nike if the looters get Nike for free.

Lol. Good one.

C’mon … they’re pieces-full protesters!

Get it Right! now ..

Get a room.

Not a lot of Christmas cheer this holiday season. Covid is re-surging, the riots are starting again, and the country is deeply divided and hostile towards anyone with a different political position. Not exactly the environment that fosters generosity and giving. If Trump wins, the left will lose their shit and turn violent. We could be seeing lock downs in the cities for other reasons than Covid and BLM by Christmas…. Oh and the market is beginning to crash, as it assesses what it sees…. Good times

I cycled through downtown Portland yesterday, and all the business’s that had not put up plywood over the street level glass were busy putting it up in preparation for the expected mobs on election day.

This year, far more unemployed people will be baking cookies, with expensive flour, and wondering where the beef is. The virus, most likely will infect substantially more people and the fear factor will explode by Christmas.

It looks like the too big to fail states and cities will be bailed out by the US taxpayer. I thought this might happen, but never dreamed it would be triggered by something like a pandemic.

Even though they may be bailed out, I don’t see them returning to what they were in the past any time soon.

Want to see what this slow motion train wreck does? Look at the ratings of public/government K-12 schools in California over the past several decades. When I attended (back in Jurassic days), they were sometimes number 1 in the nation. Now they are between 35 and 45 depending on ranking system. This is a travesty enabled by California politics with a willing voting public.

Unforgivable.

Just checked and Dow down over 800 pts, dropping 100 in seconds.

Somehow, I think Christmas shopping is the least of the business muckety muck’s worries. That would be so long term planning. :-)

Down another 50 pts while I typed this.

Seriously, it’s like discovering gravity.

Gonna be some good deals (maybe). If not, they can sit on their inventory. I will be licking my chops awaiting those deals.

Agree jk, like totally dude ( or dudette as the case may be.)

We been keeping our powder dry since this time last year, and I am doing what I can learning, or trying to learn about these new fangled financial products by reading here on WolfStreet.

Now even more likely to be some even more great bargains coming along in the next couple of years as this virus event along with the bubbles popping events continue.

Last January my idea was Dow at 12-15000, S&P 1500 to 1800, but even that looks somewhat optimistic today, and this no matter which of the senile old fathers is elected next month.

You know VVN, this is one election where I would vote for a cartoon character if one was running. In my 77 years on this planet, I have never been so disgusted with the U.S. As a war veteran, and a person who worked hard all his life, it makes me sick to see what’s going on these days. And I make it a point to not see more than 5% of it.

I’m a dude! ? Good luck!

I’m sitting on cash waiting for those deals. So far not much.

Wolf,

In the green yet with your short?

Not there yet :-]

July and August were really rough on my shorts (stained them, as a commenter explained a while back). September undid a big part of that but not all. Late Sep through mid-Oct was rough again. Since then, much damaged has been undone. This has really been a rough ride. But so far so good.

Rough indeed. Well, the wait’s coming to an end it looks like before your short turns green. However, I think reaching the bottom will likely take many months if history is any guide. I look forward to good buys. This show is just getting started.

Good day to be in cash. Better day to be short. I understand Fed policy is to not get involved in markets prior to an election so if your short position is still on, Wolf, the next few days may present you an opportunity to get out even or better.

Hi Wolf,

Thanks for joining the debate by the way.

I see you deleted my comment which quoted the Bank of England stating that individual banks create money out of thin air, and that this is the main source of money in our society.

If the Bank of England tells you this, then why do you refuse to believe it?

Also, your explanation of where money comes from in the US economy is wrong. There are lots of instances of money being moved around, but when the GDP of the USA is bigger this year than last, then the difference is real money that had to be created by someone or thing, and that thing is the Fed (or the banks via the fed).

topcat,

1. You clearly didn’t even read my comment. So read it. You will see that I said that money creation comes from two sources: 1. The Fed and 2. The banking system (not individual banks).

So read my comment. And that’s the end of this discussion.

Does anyone seriously think there will be a new stimulus bill in 2020?

If Biden wins, the Republicans won’t go for it.

The Trump wins, the Democrats won’t go for it.

Even if there is a “blue wave” – the mechanics of switchover means there won’t be any change until next year, February at the earliest.

If Trump wins (unlikely), Dems will be more than happy to spend, in what universe have they ever been for less stimulus spending?

Agree if Biden wins. We watched that movie in 2009.

The fact remains, we live in a sick society, and a sick society breeds a sick economy and a sick market.

Three generations ago, if people had received during the Great Depression the level of stimulus that was doled out today, they would have saved it for food and other essentials. Today, they splurge on unnecessary consumer goods.

We no longer make anything except for financial services, and our biggest companies fluctuate by 5% or more in either direction based on nothing.

I don’t know when and where this ends, but I don’t like it.

I’m almost 70. My parents were kids during the Depression, but lived on ranches and grew their own food so didn’t suffer as much as many did, so I never head much about it. Most of my generation and those following have never seen really hard times, so it’s not in our frame of reference.

We’re a society that now breeds narcissists instead of real people with depth and empathy. The narcissists feed on those who do have morals and good values. We’re totally divorced from the natural world and seeing ourselves as part of it. It’s no wonder we’re sinking.

How about, ”Some” of our current society is sick rnyr?

Thinking back to the late 1940 to early 60s when, some of our town cops would give the creeps a choice the first time, either get on the train/bus out or be buried in the groves around town; black folks could not be on the streets after dark or anytime on sunday (out of their ”quarters;”) and almost all working folks could be beaten the first time, seriously hurt the second, and killed the third time for literally nothing except attitude, etc., etc., does not give me confidence these current times are worse.

I have worked with a lot of younger people (of all races and all the other current metrics,) the last ten years or so, and, just as always, most have been good folks, working hard and earning their keep, just like back then.

IMO, the big difference is that so much more of those kinds of activities are now publicized widely, as opposed to being hidden more or less completely back in those days.

And one need only read Woody Guthrie to learn about those kind of things in his times, and history abounds in earlier sick behavior in USA and all other nations, etc…

While you and others on here are not likely to be around to see how this event works out, IMO sooner and later, life in general will continue, and continue to be better in some ways, worse in other ways, as always.

Dear Vintage Vietnam Vet, Your comments are always so even-keeled and fair-minded. I for one sincerely appreciate and admire your contributions to this wonderful site. Thank you! (And thanks to Wolf, too, obviously.)

I believe people are really underestimating the impact from this coming wave of Covid. From all the data I am seeing, this wave appears to be much worse than the 1st.

It is already reeking havoc in Europe, and numbers are accelerating here in the US. Governments seem much too slow in their reactions to the escalating situation.

Hospital capacity is filling quickly, and that will eventually translate to more death, and more death will translate to more panic.

By Christmas, how much people are spending may be a secondary concern to the shutdowns, both mandatory and voluntary, not to mention the supply chain interruptions that will come as a result.

This is not accurate. Far more people died in the first wave both in the US and in Europe, and the hospitals were far more overwhelmed then also.

The EU as a whole is now having more cases per capita than the US. And parts of the EU and the US are worse than last spring. But overall, this is not the case.

That doesn’t mean it can’t get just as bad, but it isn’t there yet.

You did not understand what I said, you need to compare both waves at equal points. We are early in this wave, but it is accelerating much faster, with a half million new cases world wide just yesterday. Many States are seeing hospital capacity filling up quickly and we are no where near where we will be in a month or two.