But consumers again paid down their credit cards; let’s be honest, that’s abuse of stimulus.

By Wolf Richter for WOLF STREET.

Who would have thought a few trillion dollars, channeled into the right pockets, could be such a big deal! Now everything depends on US stimulus: The stock market, the wealth of the wealthiest, and consumer spending – thereby not only the entire US economy but also imports from other countries, and thereby the economies of China and the rest of the world.

After yanking the rug out from under stimulus negotiations in Congress Tuesday afternoon, causing stocks to swoon, Trump today corrected his error and tried to push the rug back under the stimulus negotiations, and in addition promised voters a huge stimulus deal if they reelect him, while Biden is promising voters a huge stimulus deal if they elect him.

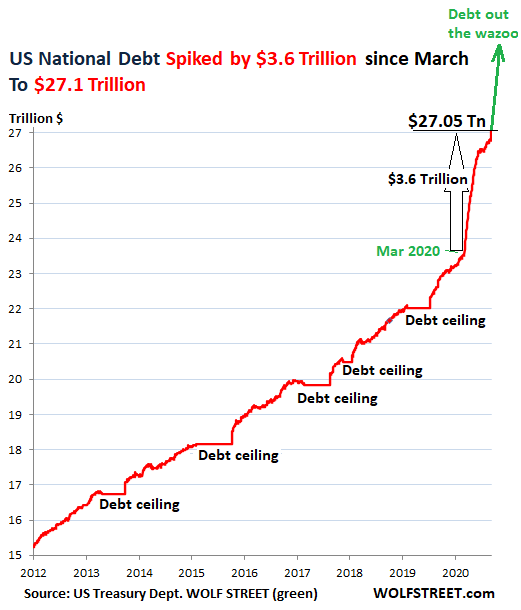

With all these trillions flying around, it’s hard to choose which trillions to go for. Meanwhile, the US national debt surpassed $27 trillion, hitting $27.05 trillion as of October 5:

Upon the news that Trump was trying to push the rug back under the stimulus talks in Congress, stocks related to retail spending soared today. Some examples:

- Amazon [AMZN] +3.1%

- Kohl’s [KSS] +5.9%

- Ford [F] +3.6%

- GM +4.0%

- Harley [HOG] +3.0

- Delta [DAL] +3.5%

- American Airlines [AAL] +4.3%

- Carnival [CCL] +5.3%

- TJX [TJX] +3.1%

- Abercrombie [ANF] +6.2%

- GAP [GPS] +6.2%,

This bonanza today followed another billionaires-came-out-on-top report by UBS and PwC, cited by Reuters. The rally in stock prices since the stimulus and central-bank shenanigans kicked in globally pushed the wealth of just over 2,000 billionaires finally over the well-deserved $10 trillion mark, beating the previous record of $8.9 trillion at the end of 2019. Between April 7 and July 31, billionaires in the technology, healthcare, and industrial sectors saw their wealth (the many billions) increase by 36% to 44%. No billionaire’s billions left behind.

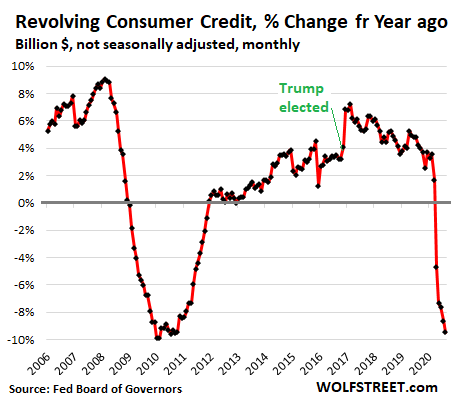

Meanwhile, American consumers with credit-card debt continued the awful and disappointing habit of temporarily paying down their credit card accounts – instead of passing the money on to said billionaires – with the trickle of belated stimulus checks, and belated $600-a-week and $300-a-week in extra unemployment benefits that state employment offices are finally catching up with, and whatever miscalculated federal PUA unemployment benefits for gig workers or fraudulent workers or whoever are still arriving in lump-sum payments.

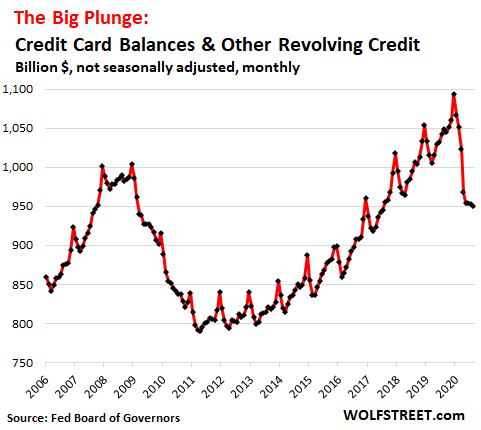

Credit card balances and other revolving credit fell “unexpectedly” by $3 billion in August, to $950 billion (not seasonally adjusted), according to the Federal Reserve today, the lowest since July 2017, and a level first obtained in September 2007:

How are banks supposed to make any money in this zero-interest-rate environment if their credit card assets that they charge 29% on are dwindling? That was a rhetorical question. Well, OK, that’s why the Fed gets frazzled when consumers pay down their credit cards. Let’s be honest, that’s abuse of stimulus.

Credit card balances and other revolving credit fell a devastating 9.5% from a year ago. These declines included the record plunge in April when people used the first wave of stimulus checks to temporarily pay down their credit card accounts, so that they could charge up their credit cards later. People use credit cards as a form of cash management, like a company would use a credit line, instead of having a big pile of money in savings account. And with more room on their credit cards now, they can spend more later:

Note how during the Financial Crisis, credit card balances eventually plunged by 10%, but it took a year to accomplish that, and it was mostly done by people defaulting on their credit cards, and banks writing off the balances. Stimulus had nothing to do with it because that stimulus was only $600 per taxpayer, not $1,200, and because it came in the spring of 2008, and credit card balances continued increasing throughout 2008 and didn’t start falling until 2009.

This is not the case this time. This time, delinquent credit card balances are getting moved into a deferral program to where the borrower doesn’t have to make payments, and the lender agrees not to exercise its rights and try to collect (yeah, good luck), and therefore doesn’t need to write off the delinquent balances.

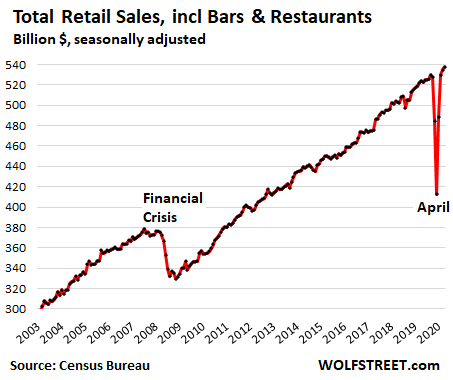

These declining credit card balances in August occurred even as retail sales hit a record of $538 billion, after already hitting a record in July, as consumers, flush with stimulus money and extra unemployment benefits and federal PUA benefits, went splurging on stuff.

So let’s bring on more stimulus. And don’t forget the bailouts for the airlines that are facing the crappiest recovery ever and are demanding $25 billion for $50 billion in total, after having burned $45 billion on share buybacks. The more stimulus and bailouts the better, for the billionaires and for China. And the $27 trillion in national debt that will turn into $30 trillion by early next year, doubling since 2012, well, don’t worry, be happy, the Fed’s gonna buy it if no one else wants it…

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

it comes down to human nature at the end of the day, doesn’t it? After all, give people free money, what do you expect them to do with it? Give people opportunity not to pay rent, do you think the deadbeats will?

But, the powerbrokers decided that this is what the people want, let’s give the mob what they want.

And that doesn’t even start to talk about the really rich who are benefiting from all the stimulus.

“Hash browns and bacon strips

I love the way that you lick your lips

No fooling, I can see you drooling

Feel the hunger grow” … Motorhead

There is no mob.

Its just a few politicians and economists.

Those are the power brokers.

MCH

No, it’s just a few politicians running for re-election, buying (arguably, stupid taxpayers) votes with taxpayer money.

There’s a reason state parks and national forests have signs posted that tell visitors not to feed the bears… because the bears won’t forage for their own food… they’d rather get the hand out. In other words, they’ll take the easy way out, and of course, humans are the same way.

And Congress is no different. Check out this link:

“Congress doesn’t actually write legislation….Lobbyists write the laws; congress sells the laws; lobbyists then pay congress lucrative commissions for passing their laws. That’s the modern legislative business in DC.

When we talk about paying-off politicians in third-world countries we call it bribery. However, when we undertake the same process in the U.S. we call it “lobbying”.”

https://www.theburningplatform.com/2020/10/04/there-are-trillions-at-stake/

My question is, what are the consequences of this? If the fed keeps monetizing the trillions of new debt but is locking all that debt in treasuries, does it matter? We see deflation happening at the same time that fed policies would arguably cause inflation, but the money velocity is so low via the fed purchases that it hardly seems to matter how much new money is created. When does this stop? How can it stop.

The MMT economy can last a long time. The Bank of Japan has been at it since 1990.

not in merica it can’t

when DEVALUED $Dollar can’t buy much they steal wheel barrel instead

with 10-30% inflation in things we need the DEFLATION thing is for 1% holding commercial property

Essential life staples are indeed inflating in fiat $ terms. The nonessential part of the human activity picture has been largely pushed off the table (entertainment, pro sports, restaurants etc)

This shrinkage should slow $ velocity overall? Velocity within the remaining active “essential” economy is as high as ever.

This can all flip over the edge rather abruptly into massively accelerating inflation. Inflation can go hyper, and this would constitute a another “national emergency” similar to 1933.

Japan is a net exporter and USA is a net importer.

MMT can last long for USA as long as USD is reserved currency

I see no alternative to USD as reserve currency yet

It is a question of what makes you feel better: “tax and spend” or “borrow and spend.” MMTheory would have you believe that there is no end of sovereign “money” and banks can create “assets” through extending credit. Once they hold the “paper” it is theorized it is as real as any other asset? But is it? No one is holding the reins, and the US Dollar is only as good as the faith and credit of the country. So, back to Japan, is their “faith and credit” as good as it was in 1990? Or, more likely, are they getting out on thinner and thinner ice?

Ultimately, it works for so long as foreigners are willing to take these devalued U.S. dollars for their goods and services.

Wolf’s excellect article here: https://wolfstreet.com/2020/09/29/how-has-the-us-dollar-held-up-as-global-reserve-currency-during-q2-turmoil/

Probably safe for a few more years.

“does it matter?”

Only if they ever lose control of rates and the interest paid on the national debt thereby becomes ruinous. Until then, it’s “only” $500+ billion per year:

Grotesque Math Error On Treasury Website Misrepresents Interest On US Debt By 30% – 7 Oct 2020

https://www.zerohedge.com/markets/grotesque-math-error-treasury-website-misrepresents-interest-us-debt-30

“…add across the individual monthly totals and what you should get is full fiscal year total of $517,640,843,766.42. Instead, the stated number is some 30% lower, or $368,102,426,277.71, which would have been appropriate 15 years ago, but certainly not now.

We have asked the Treasury whether this kind of “non-GAAP” math is used elsewhere, like for example in calculating the total amount of US debt, which is now a record $27.05 trillion having surpassed $26 trillion on Oct 1, but if the US authority which literally prints money can’t afford calculators, we wouldn’t hold out too much hope for computers or other email-enabled devices.

@ Anton and @ Wolf –

What deflation are you talking about?

Anton said: “If the fed keeps monetizing the trillions of new debt but is locking all that debt in treasuries, does it matter?”

_______________________________________

How could it not matter? You are increasing the amount of dollars in the system by Trillions, making the existing dollars worth less.

Those trillions of new dollars are not trickling down.

Expect inflation in the stock market, old world masters, and vanity properties.

Those bonds have no name. They don’t exist, it all depends on how much of that debt actually is changed into cash. Money which is provided to serve as collateral (reserves) never becomes cash, unless there is an event which causes collateral to be surrendered as part of deleveraging, then you have hyperinflation probably at a time when markets are really stressed. No problems arise the debt vanishes to whence it came. Negative outcome when the supply chain is disrupted, shortages, and prices rise, without jobs or economic growth. They burn all that money after having created it digitally and parking it in your account, they remove it again.

@ Bierce, @ Wolf –

I would like to understand this if there is a point in there somewhere.

It sounds like incoherent econobabble from my vantage.

If it is that I am dense and can’t grasp something worth grasping, someone please educate me.

How can it stop? When can it (Fed stimulus) stop?

It will stop when hyper inflation which cannot be controlled by the Fed goes through the roof and all confidence & VALUE in the Dollar is lost!

Even though the Fed would love to see the velocity of $ increase, they should be VERY careful what they wish for!

If the debt was used to create long term physical assets, from which the building of, created jobs, incomes and families, then it makes economic sense.

Paying middle income people to stay home and be fearful – essentially squandering Trillions on Covid-19 panic, is the real danger.

and don’t forget the LANDLORD who doesn’t get dime because of ILLEGAL actions by govt – ie declaring eviction moritorium til 2021(then they extend again) which is VIOLATION OF CONTRACT LAW

I have to many ‘squatters’ who owe thousands each

maybe I can pay income tax/property tax with same unpaid rent vouchers

As D.J.T. has said, it is not illegal when he does it.

You can pay income taxes of the income earned. With respect to property taxes, you as the owner bare the payment burden of taxes along with the risk of rent nonpayment in exchange for a chance at property appreciation and annual yield. Its call capitalism, this is a crisis, and your risk Taking didnt pay off. Stop whining, nobody has sympathy for you the same way you had no sympathy for anyone on the way up.

Landlords seem to be out of vogue right now.

If you can hang on you will have a loss carry forward and have the potential to pay $750/year (or less) in taxes as you use up the yearly limit of loss deduction until it is exhausted. It’s our tax code.

True. What is missing is a BIG IDEA, a new idea. So far, everything happening by reaction is designed to put us back where we were. That is not going to happen because the pandemic won’t go back into the box, no matter how much consensus there is on peoples desire for it and voting on what we want.

The Big Idea will look at a bigger picture, and write a new understanding of the dynamics. E.F. Schumacher had some ideas a while ago when he wrote “Small is Beautiful.” He described smaller economic cycles in smaller, more local systems. Not to say it is perfect for the present, but to say that no Big Ideas are being offered. The person who needs the $600 thinks it is for his problems, when in reality it is to shore up his or her contribution to “The Economy.”

Maybe there is more than one “Economy” and we are chasing only one of them.

The Fed’s HUBRIS is off the charts!

Winning!

I like how Wolf’s once ironic “debt out the Wazoo” arrow is no longer steep enough to represent the current rate of debt growth.

These articles are definitely my favorite – thanks Wolf!

The steep arrow started out as sort of a joke. I had no idea at the time how real it would become :-]

You are a prophet!

Wolfstradamus?

Or might he become Grigori Wolfsputin? Perhaps a secret plan to short it all once his evil experiment is finished and he is ready to unleash the forces of darkness upon the markets. What evil lurks in the…and all that. Baaahaahhahh. Methinks he doth protest too much the praise of fellow men heer.

Yes you did.

Forty years of privatization, deregulation, financialization, budget cutting, tax cutting, and union-busting has shifted the government spending on healthcare, education, infrastructure, pandemic response – you name it – to individual consumption – you’re on your own here, don’t trust Uncle Sam to save you (yet somehow bonds are still flying off the shelf at auction even at zero rates). Anyway, we work and save to pay for things that our parents didn’t mostly because all this stuff didn’t exist – especially in healthcare, pharma and firearms – but also because the government was too timid to put a floor under its population by spending on this stuff. Now we’re way under capacity. This is the shiny hill we were promised – why are we upset?

The premium for a bronze-level, ACA-compliant contract for a couple over 50 on the individual market is $1200 PER MONTH with a $7,000 deductible while the CEO of at least one health insurance company was paid $25M last year when he couldn’t even make the website work.

Our parents didn’t spend 10% of their income on health insurance but they didn’t have MRIs either. But why do MRIs in the US cost $1300 when they only cost ten bucks in Japan – Jack Welch a long-gone CEO still getting paid.

If you shop around you can get MRIs for much less I had a lumbar MRI in 2014 in Manhattan for 250 dollars You have to schedule it ahead of time , maybe have it late at night but it can be done Obviously in Japan they are government subsidized

Frederick

When I have my stroke and am drooling and paralyzed……yeah, sure, shop around for that MRI…that’s the ticket !

Frederick:

“Obviously in Japan they are government subsidized.”

Obviously in Japan (and other parts of the civilized world) they have different priorities on how to spend their tax monies.

We refuse to joint the “civilized world” because it would cut into “profits”.

regarding: The premium for a bronze-level, ACA-compliant contract for a couple over 50 on the individual market is $1200 PER MONTH with a $7,000 deductible

The premium for a top quality universal public healthcare plan with better health outcomes….at 60% of the total cost, is (get this) $0. Zero. The deductible is, get this, $0. Zero. (British Columbia)

Salary for the chief operating executive for BC Med is in the hundreds of thousands dollars. (I could not find the exact amount but it is not even in the top 10 of Govt salaries) BC.

I’m 65 and just had a full workup for preventative health care maintenance and the bill was $0. I requested the lab work by phone from my Doc, and was able to have the lab work done in a primary care facility in a nearby village by a nurse practitioner.

regarding: Our parents didn’t spend 10% of their income on health insurance but they didn’t have MRIs either. But why do MRIs in the US cost $1300 when they only cost ten bucks in Japan

Our MRIs have no charge provided one has a doctor’s referral. (BC) I have had several including 6-8 CT scans when fighting cancer 8 years ago.

I watched both debates so far and all I can say is that the People have a terrible struggle ahead to wrest control of all services from private corporate profits.

The use of stimulus money to pay down CC debt in order for ‘room’ in case an individual has a future emergency requiring ready cash is the best news I have read this past 6 months.

I wonder how much Dear Leader paid for his stay at Walter Reed and for the current regiment at the WH? Will this indebted oligarch have to use a CC to buy food next month?

Oil up the pitchforks. Rant over.

Paulo, if it’s that great in Canada, why did my neighbor, a Canadian citizen, move here 10 years ago for medical care for his sickly wife? He and his wife are now U.S. citizens. And she is doing well after a couple of open heart operations. Should I tell them they made a bad decision?

I saw a report that said trumps Walter reed vacation cost a we $100k

Why does Canada care so much about Trump or US elections?

“I wonder how much Dear Leader paid for his stay at Walter Reed and for the current regiment at the WH?”

$750

A Canadian doctor, spending the season in Florida, said he worked half a year because his salary was capped. Once he reached his salary cap he stopped working and came to Florida. I think the salary cap was ~C150K. This was maybe 8 years ago when the Canadian dollar was higher than USD.

To Anthony A

If you are rich enough, moving to the US for medical care for certain kinds of conditions can make some sense. For the vast majority of Canadians it makes zero sense.

To SC

Canadians care about US elections because as Trudeau Pere once put it, “Living next to you is in some ways like sleeping with an elephant. No matter how friendly and even-tempered is the beast, if I can call it that, one is affected by every twitch and grunt.”

Yale Study Says Medicare for All Would Save U.S. $450 Billion, Prevent Nearly 70,000 Deaths a Year

https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(19)33019-3/fulltext

Anthony A

Why don’t we ask her and get a complete rundown of time and charges ? All the details laid out nice and clear.

Oh no…..can’t do that ! Much more fun to speculate with little solid information but plenty of innuendo. USA USA number one !!!

Guillotine earrings are becoming quite popular on Etsy. I didn’t see any on Amazon, but it may be because a few of them have resin replica of Jeff Bezo’s severed head attached below them.

Lenert,

Why the hell are you paying 14K for insurance with doesn’t protect you from going bankrupt? Your base risk is $20K a year, with unlimited risk on the upside(your copay). If I were you, I would drop the insurance and save the premium. The savings will pay for any short term medical care you need here. And you can get long term care in another country, like Mexico, Columbia, Philippines or Thailand.

If you keep rewarding them, they will keep taking your money.

If only it were that simple – many docs (especially the increasing number now owned by hedge funds) won’t book you without insurance. And the Canadians (rightly) still won’t let me over the border. But the short answer to “why?” is uncertainty. Now if you’re familiar with Part D you know big pharma got their uncertainty taken care of in the bill – you don’t pay now, you pay a 1% annual penalty for every month you didn’t take the coverage for the rest of your life.

Technically, The answer is simple, medicare for all.

Then no one will have any cause to complain anymore.

The state has become the be and end all for a large segment of Americans. Given this, many of these sheeple are ill equiped to function in a global technology-based economy. i.e. dependency

“The state” is not “them.” It is “us.” Starting with that, what is the adult citizen to do? First, be willing to pay some taxes in order to have interstate commerce and defense. So far, so good.

Next, take a second look at two things: tariff protection and the criteria for a corporate charter. The individual income tax did not begin until funding for the American War Between the States, with the Revenue Act of 1861. Prior to that, the US was funded by taxes on economic activity such as imports, exports and profit.

Somehow, tax breaks were initiated and we now have cheaper rates for long term capital gains. Fine, that rewards sustainability. We stretched eminent domain to include taking of private property from one individual and giving it cheaply to another as if “public good through new taxes” was the same as “public use.” Not so fine. We deregulated mutual aid societies and super stockholders made more than the man in the street while changing not-for-profits into for-profit enterprises. We looked the other way while boards of directors raised each other’s salaries from 40x of the average worker to 400x the average worker. Not so fine.

All the while, “no new taxes” is understood to mean breaks for business, even when downsizing devastates whole geographic areas. We adopted “defined contributions” as if it spread the risk the same as “defined benefits.”

So, the rhetoric is styled that salaried workers unthinkingly think they participate in the Greatest Economy the world has ever seen, while really, their effort only makes it possible for someone else.

Now, back to taxes. Tax cuts do not help the average working person. Whatever break trickles down, alongside it is a concession that makes the top executive layer gain and retain more compensation. Look to the corporate raiders, aka activist stockholders, for the worst lobbying against corporate persons sharing the tax load.

And I’m guiltily one miniscule part of those supporting those bonds, as I (as a foreigner) have been picking up medium and long dated US treasurys via the IEF and TLT ETFs the past couple of days, as the dollar went down and the rates up.

I suspect the inflation story will be quite short lived, as it requires a constant supply of helicopter money to spenders, and now the political deadlock makes that appear less likely for some time. I also suspect that funds will increase their purchases as rates rise and the prospects of stimulated unicorns and rainbows fade, thereby contributing to rates declining again…

So I’m essentially not buying based on some fundamentally good reason. I’m just betting that the recent rise in rates will be pretty transient. I also reckon the USD will begin to float upwards again as participants start to give up on the reflation story, and if so there is benefit in local currency terms both from higher bond prices and from a rising dollar.

Weirdly enough I’m selling gold equities and buying US bonds. In a way I guess I deserve to get it wrong and get flattened…

The value of the U.S. dollar will fall off a cliff in 2021 and after the 2020 election. That I can guarantee 100 percent as I’m betting my own money on the surest thing since death and taxes. Death, taxes and a plummeting U.S. dollar. Anyone long the U.S. dollar in 2021 will be completely wiped out. Take my advice or lose all your money.

Hey, Tony, I would not argue one way or the other about that.

I’m also loaded up to my gills in physical gold (but that is a separate thing from what I consider my investment capital, as physical gold is my long term insurance policy).

But for the next month or two or three I’m certainly betting on a higher dollar and lower gold. I have no problem switching in and out along the way, should the conditions upon which I place my bet change.

And, I reckon, once a new or incumbent spendthift becomes established in the White House with a base of power to support more spending, all my bets are off. My supposition is that that such an event will also trigger the rapid loosening of fiscal and monetary conditions in Europe and elsewhere, and then I’ll (hopefully with anticipation…) do a rapid about turn.

In the meantime I’m betting against precious metals in my liquid portfolio, and betting on long and medium dated US Treasurys instead. In a way I hope I’ll lose on that bet. Although it’s not a constant bet, as I’ll happily trade in and out along the way.

It sounds like US billionaire’s billions are growing much faster than the national debt. Wolf should compare the doubling times.

Love to see that chart!

The billionaires’ billions go up and down with asset prices. The US debt only goes up. A another comparison would be the billionaires’ billions and the Fed’s assets.

“The closer to the trough the bigger the hog”.

The Federal Reserve makes the feed and D.C. fills the trough.

One would think that interest on the debt would stop the spending but at zero rates I don’t know. If the deficit keeps growing I think eventually we will get inflation and look out below.

When the FED is forced to raise rates due to runaway hyperinflation it will be game over in my opinion

The fed at best will only lag what the private market is already pushing rates too…

Negative premiums with swap and collateral spreads in response to supply and demand will ultimately drive rates to the point where the cost of carry is too high and unwinds of the underlying will happen (re: sept 2019, fed didnt see it coming, and still has no explanation for why it happend).

The feds main tool is their open throat operations, and those can only go so far…

Can you explain this further? I sort of understand what happened with the repo window in September, but not totally. Thanks.

@RightNYer

SOFR-30y spread was in decline from april 2018 and spiking lower EOM. This means that the cost to use the longest dated acceptable collateral in repo was getting more and more expensive. (typically spreaders dont have these, but borrow the treasury collateral and lend it in repo for cash overnight and collected the positive spread between the yields)

However it wasn’t until aug 2019 where the spread went negative and not EOM. This means that it cost more to borrow the collateral and then lending it in repo for the cash, so spreaders had no incentive to step in and lend in the market. This negative spread lasted for less than a month before it went 1/0.

Frbny stepped in and the spread widened back positive… but push the problem has not been solved. I think the problem will show it self next in the basis swap market when dealers start have to discount agaisnt SOFR and not LIBOR around oct 16-19. Which to me explains the record leveraged short OI by funds in treasury futures. More about this basis swap issue here [0] and here [1] and the volatility on the long end of the UST cash.

[0]: www[dot]clarusft[dot]com/spreadovers-vs-sofr/

[1]: www[dot]risk[dot]net/our-take/7692916/big-bang-sends-basis-swaps-on-roller-coaster-ride

Are you saying at such low rates of interest the liquidity preference of investors is to just hold cash instead of bonds?

@lenert

im saying that when the cost to keep the position open (not strictly only bonds, depending on kind of position, a position can take the form a combination of different things) is greater than what the position yields, at some point, it makes no sense to keep the position open.

This can have negative repercussions on actors that may be reliant upon the cashflows from others keeping those positions open

The Big Whimper is the inverse of the Big Bang. As the system approaches a singularity the behavior becomes indeterminate. Will the dollar be worth nothing or almost nothing? A whole lot of nothing is still nothing, but a whole lot of almost nothing is powerful.

“Monday, nothing

Tuesday, nothing

Wednesday and Thursday nothing

Friday, for a change

A little more nothing

Saturday once more nothing

Sunday nothing

Monday nothing

Tuesday and Wednesday nothing

Thursday, for a change

A little more nothing

Friday once more nothing

’29, nothing

’32, nothing

’39, ’45, nothing

1965, a whole lot of nothing

1966, nothing”

The Fugs

If literally everyone in power – – the Dems, the GOP, the Fed, and the rich – – are all committed to debt-out-the-wazoo … Is the only check-and-balance left really the death of the dollar?

Can’t anyone speak up sooner and rally for change?

Let’s get the “Wage-Earner-Lives-Matter” movement started. Bank CEOs desperate for interest income will lead us… And a coalition of finance/econ journalists and their audiences will man the trenches.

Who’s in?

Pacific Northwest Guy-that’s why i am horrified how we’re continually divided over identity politics, at our own peril.

“Can’t anyone speak up sooner and rally for change?”

I nominate …. yourself.

Home of the BRAVE here, we don’t rely on someone else to rely on someone else ad infinitum to speak and rally for change.

…. Wait, we do. Time to change the anthem.

Hey monkeybiz,

1) it was a joke

2) My comment is literally asking other folks to rally with me – – I’m already in, who’s with me

FWIW, like our host Wolf, I try to teach others how money and economics actually work. I try explaining that we’re all trying to climb a wealth ladder while it’s sinking in monetary quicksand. But everyone tells me “so what, we can’t change anything, best we can do is play the game.”

And maybe that’s true. Maybe “it is what it is.”

Ah well, being an idealist is more fun… Even if it tends toward disappointment.

O’er the Laa and of the Fear

And the Home, of the, Slave

Not the death of the dollar. A debt jubilee where all the dollars owed are put back into circulation, like magic.

Silly question probably, but does any interest need to be paid on the govt debt that the FED buys?

Aert,

Yes, the Treasury pays the Fed the normal amount of interest on each Treasury security that the Fed holds, and the Fed reports this as interest income, and remits most of it back to the Treasury.

Every year in early January, the Fed discloses this interest income data, and how much it remitted to the US Treasury, and how much it paid the banks for their reserves, and how much it paid in dividends to the financial institutions that own the 12 regional Federal Reserve Banks. I cover this every January. Here is the one from January 2020:

https://wolfstreet.com/2020/01/12/fed-pays-35-billion-to-banks-6-billion-to-reverse-repo-counterparties-in-interest-for-2019-remits-55-billion-to-us-treasury/

1) Mrs. Martingale // Mrs. anti Martingale.

2) She is talking like a mother. There is nothing equal to mother’s power.

Mothers, especially lawyers mothers, are the head of the communication

department of the family.

3) It’s all about power. After getting into family feud and troubles, the mother purge her husband.

4) The ex pays monthly stimulus and dividends. Peace and tranquility in the broken family to be followed by volatility. The mother becomes best friend with her teenage daughter, doing few motherly on her son. It’s all about love.

5) After having a baby ==> the new husband like her teenage old daughter coming out of the shower, better.

6) Mrs. Martingale is going to purge husband #2, get two stimulus checks, for two broken families and start a new one.

7) Or Mrs. Anti Martingale : cut her losses, admit her limits, understand that her gambling with her family led to destruction.

8) If Mrs. Martingale ex #1 and ex#2 have no money ==> u pay the

stimulus checks, supporting her and her new #3

WOW that was deep Michael So deep it went right over my head ?

I liked your old posting style better. This sounds like a daytime SOAP. (LOL)

I’ve seen better bots.

yup. when the ex’s throw in the towel everyone has to pay.

Has Netflix bought the rights to that yet?

“Lets be honest, that is abuse of stimulous.”

I am not sure it is that simple. If they are paying down debt because they are expecting to effectively need stimulous later but are worried that there may not be more stimulous later when they are expecting they will still need it, then that isn’t really abuse. Instead it is simply planning to most effectively use the stimulous over the time they expect to need to do so relative to the stimulous they expect to get over that time.

To prevent this “abuse” they would need to be certain either the economy will be roaring again next month guarenteing them full employment then, or that they could expect to get more stimulous then. In the absence of either of those asurances they are just tring to maximize their use of stimulous over the time expected to need to. That isn’t really abuse even though I do agree it isn’t how the stimulous was intended to be used either.

Just like the savings from corporate tax cuts were intended to be used for capital investment, expansion, and additional hiring, not stock buybacks and dividends.

Once you give people the money, it’s hard to control what they do with it.

In any event, I read Wolf’s description of it being an “abuse” of stimulus to be tongue-in-cheek.

Didn’t they give everybody $1200 to buy stocks?

If I had any creditcard debt I would use that money to pay it off too. I agree this isn’t abuse. They are just making themselves less vulnerable to what is coming.

However, you can argue that the stimulus itself was overdone. Looking at retail sales and paying off CC debt, they could have done with a lot less stimulus.

Nat,

That was sarcasm — making fun of the economic theory that consumers paying down debt (“deleveraging”) is bad for the economy and should be prevented.

That it was sarcasm should have become clear in the article itself where I discuss how consumers use their credit cards (as cash management system).

Wolf-the tears were still rolling down my face from your sarc,

but now continue (and not from mirth) because it didn’t seem obvious to more than a few. Thanks again for your tireless work, even in the face of the thick smokes billowing from this ongoing existential fire.

May we all find a better day.

I got a new preappoved card in the mail yesterday. It had 36% apr plus 150 annual fees. Something must have changed since my other ones have 26% apr.

So I was incensed and I tore it up, but after paying for my girlfriend’s birthday party I am wondering if I was wrong. Or at least I could have used it to scrape the crumbs together.

What’s that sound?

I think it’s Milton Friedman rolling in his grave or laughing.

I think I know where we are heading in the long run: a full reserve fiat system.

The signs are already visible. All the major central banks have announced ‘Digital Currency’ that bypasses commercial banks and provides direct money to people. This is money that, unlike the money we use now, is not credit money and doesn’t have counterparty risk. It is really cash in a digital form.

At the moment, QE is used to buy up government debt. But the future is central banks directly funding the government with this Digital Currency. Suppose average productivity growth is 2% and inflation target is 2%, the central bank can then simply print digital currency and fund the government to the tune of 4% GDP per year (handouts, no borrowing). If government deficits are below this, government doesn’t have to borrow any additional money (but they still can if the want to).

However, to make this work, money creation has to be taken away from commercial banks. All current accounts will be exchanged into digital currency, to be held in accounts at the central bank. We then change into a full reserve system, where banks have to borrow 100% of the digital currency that they want to lend (no more fractional reserve banking). So unlike the current situation where commercial banks create most of the money in circulation by creating deposits and lending them out, then only the central bank expands the money stock.

So instead of ‘stimulating’ the economy with low interest rates or QE, central banks will target the money supply by printing money and giving it to the government, who can then decide who gets the money (as opposed to the current trickle down policies over which they have very little control). And as said, this can be done to the tune of ~4% per year without inflation going out of control, provided that we change into a full reserve system.

Savers have two options then: either keep their money in a current account at the central bank at 0% but 100% safe (no counterparty risk) or in a time deposit at a commercial bank that pays interest. But time deposits will be like bonds now: risk bearing. Deposit insurance will disappear.

This also means that no bank, however big, will be too big to fail. Because unlike now, payment system would be separated from anything that banks do. Your digital currency is not a bank liability anymore that can be defaulted on but is like real physical cash that won’t disappear with a bank default (but it’s value can still be hollowed out by inflation).

On the surface things won’t look much different though. Commercial banks (or fintechs) still provide the interface with the customer. But their opportunities for profits will be much less than is now, so I expect banks will oppose this.

But I think this is where we are going anyway. Given the fact that QE cannot really be reversed (i.e. base money has permanently increased), you’ll have to make the fractional reserve multiplier smaller (and eventually abolish fractional reserve banking completely). And because of QE, in the USA the excess reserves that banks have are already massive (this is where most of the freshly printed dollars eventually end up), so it is only a small step to convert that to digital currency held by the Fed and move to full reserve banking.

A full reserve system has many advantages. It is much less prone to asset bubbles (the current system is inherently pro-cyclic: banks expand credit during booms and cut it off during busts). And governments/ central banks can accurately target stimulus when required and are not at the mercy of capital markets.

Whether you like it or not, I just feel we are at the moment slowly morphing into a system like this and 5 years from now we will probably discover that we are then actually operating under a full reserve fiat regime.

You have possibly read the runes very well: the old system is certainly in hospice care – after just over a decade in a nursing home, since 2008, and there can be no recovery at this stage.

Great comment, YuShan. Wondering if all the central banks coordinate on digital, will they go for the brass ring and try to solve the reserve currency/balance of trade issues. One world currency or a basket of currencies. That would find a lot of resistance from various power-holders, so it would perhaps require a massive crisis as a stepping stone. Your thoughts on this would be much appreciated.

To implement this, I don’t think a massive crisis is required (other than the one that we have been in since 2008, and now we have reached the end of the road).

I think we will slowly morph into this new system. First, Digital Currency is introduced. This will work as a parallel currency for a while to facilitate online payments. When that all works well they will do the complete conversion.

Regarding foreign central banks, I expect the major ones to do roughly the same, but they don’t have to be in alignment. If your currency gets too strong, just print more of it. If your currency gets too weak, raise interest on the Digital Currency deposits.

With what do you make the periodic interest payments when you raise the interest rate on the too weak Digital Currency deposits? Return some of a depositor’s currency – a Ponzi? Or just print more – which is your solution if the currency is too strong? Or do you envisage two systems where leakage between them is impossible. There are always leaks.

@Lisa_Hooker:

This is a good point. If you raise interest on deposits, you’ll have to print new money to do that. In practice, that means that instead of handing out ~4% annually to the government you can only give them 2% or 0%. In effect, it is at the expense of the taxpayer.

However, this is also the case in the current situation. Profit and loss of the central bank goes to the treasury. If the Fed at some point needs to increase interest on deposits, the taxpayer pays for that through less revenue for the treasury. Net revenue can even become negative if that interest exceeds the income from the treasuries they have on their balancesheet.

However, I would think that in the new system you would still have tons of government debt, both in private hands and on the central bank balance sheet, that keeps being rolled over. So the Fed can still do QE or QT to expand or shrink the money in circulation. The difference is that only the central banks can do this now.

YuShan: that’s some nice thinking. Well done.

To stir the pot, “so what?” What if the Fed cuts the bank out of the loop, and so forth. Does that change any of these fundamental problems:

* concentration of wealth-earning capacity in the hands of a few, with corollary effect of concentrating…wealth

* systematic and continuous reduction in the value of labor. mid-class HH real income declining w/no end in sight

The existing banking system, with all its warts and abuse, would continue to work fairly well if HH incomes were increasing due to benefits of tech advance captured @ HH level.

Until the middle class is producing and capturing more wealth, no bank reform nor Fed handouts will stem the outgoing tide that is lowering all boats.

Nor does it address, of course, the further problem of eco-system collapse, which is set to undermine everything.

This proceeds every day and globally, remorselessly.

Large middle-classes arose in cities enriched by commerce, in a fertile and resource-rich environment we’ve blown all that in the last 200 or so years.

This was an historical phenomenon which will, quite simply, not be repeated.

Xabier/ double-check.

May we all find a better day.

@Xabier: yes agreed. No fiddling with monetary policy will change that. However, some policies are better than others

Yeah, Xabier, all the rest is really just us fiddling about in the meantime. The destruction of the natural world is the true horror story that is often too grim to look at…

You may expect future phenomena that rhyme very closely. Prediction is very difficult, especially about the future.

The rich will always do well, in any system. However, I do think that things will become a bit better if it were to happen the way I described.

First of all, the economy would change from ‘trickle down’ to ‘trickle up’, because you basically have a central bank providing revenue to the government instead of just pushing up asset prices. Yes, governments get lobbied by monied interests, but at least they can be held to account by voters, unlike central banks that do QE, buy corporate bonds at will, etc.

Second, in a full reserve system you cannot just take big loans, buy property and see it rise in value much faster than inflation year after year. Any developing bubble would soon get smothered by rising interest rates. So it is a brake on rising concentration of wealth.

Apart from different monetary policy, the main things that need to change is to get money out of politics and reinforce anti-trust laws (breaking up monopolies etc). Only then would you really get a better system.

YuShan, theoretically your scenario seems right enough to me, but I believe it does require an even greater crisis than this one. That is because those profting from this mess will not give up their privilege without a fight.

Also, I think it will be one global currency, but only for international trade and investment. That may well be a gold backed currency. The rest of us proles will be a computer file in a dystopian nightmare.

@Fat Chewer:

Yes, some monied interests are not going to like this, but if it happens it happens :). Also, even though it looks on the surface as if commercial banks are going to suffer… perhaps it won’t be too bad. The new system would probably lead to a steeper yieldcurve and that would really help bank profits.

I don’t think a bigger crisis is needed, because the essential step is already in progress: the introduction of debt-free (sovereign) money in the form of digital cash at the central bank. Then the Rubicon has been crossed and it will expand and eventually take over completely. At least that is my expectation.

I think the chance of a gold-backed currency in the developed word is close to zero because it ties the hands of government/ central banks and offers no advantages for them. However, the emergence of alternative currencies (like gold) will put a limit on what they can get away with (like negative interest rates).

@ Tom Pfotzer and @ YuShan –

Tom said: So What?

_____________________________

So what is right. End the FED. (not allow them work arounds to cover their ineptness and theft)

Tom said: “The existing banking system, with all its warts and abuse, would continue to work fairly well if HH incomes were increasing due to benefits of tech advance captured @ HH level.”

_________________________________________________

The reason existing households are in such bad shape is largely because of our banking system that creates money out of nothing, promotes debt, and picks winners and losers and turns commoners into debt slaves.

Point one: a currency does not become a wholly other ‘digital currency’ because the account record is in a computer, like it is now. People will think you mean Bitcoin or something if you keep referring to a ‘digital currency’. Nothing you wrote proposes a new currency, just a new way of banking the existing one.

Also, I assume you aren’t in favor of a cashless society which the term ‘digital currency’ suggests. Because most people won’t consider that proposal.

Your proposal for (I think) a government bank that pays no interest but is an absolutely safe place to keep your money, sounds benign enough, however:

‘by printing money and giving it to the government, who can then decide who gets the money’

I think most people will take a very jaundiced view of government as a competent decider of which businesses merit loans.

I don’t have the expertise to discuss this national bank idea in depth, but one hazard looms: it becoming the servant of politicians, as the Fed increasingly is now. Would this institution be able to refuse a loan to the commercial banks if the government wants the loan made?

As much diversion as it is to contemplate a fundamental radical change that will enable loans but make risk disappear, there is also the idea of ‘sound banking’ which has existed. The Canadian banks seem to function pretty well. They have been profitable (pre- covid). No one lost a dime in them during the Depression when about 10,000 US banks went under.

BMO hasn’t missed a dividend since the Depression. It may not have missed one then but not sure.

But the system has one big advantage: far fewer banks. That number above: 10,000, is not the total number of US banks in 1929. it’s the ones that went under. How do you regulate a menagerie like that?

Today the US has 5000 banks, Canada has six

majors and very few others. Adjusting for a population ten times the size, the US has about 90 times the banks per person. Try and find any other business with that disproportion.

When Paul Manafort was still wheeling and dealing, parleying his new job as Trump’s campaign manager, he managed to get a loan of about 10 million by promising the small bank’s manager that Manafort would get him made Secretary of the Army. Manafort got the loan. Later, the manager actually reported at Army HQ, where he was asked: ‘Who are you?’

The poor devil ended up being charged.

The point is, this was almost the bank’s entire capital.

Going back a bit, Clinton’s old buddy McDougal bought a bank in Arkansas for about a million. It soon acquired a major new real estate client who borrowed all its capital: McDougal.

First step to stabilize US banking (or anything else with this many moving parts): consolidate to about 500 banks, or (roughly) ten times Canada’s per person, instead of a hundred.

There should be room for lots of competition and fewer dominoes for the regulators to regulate.

@Nick Kelly:

“Point one: a currency does not become a wholly other ‘digital currency’ because the account record is in a computer, like it is now. People will think you mean Bitcoin or something if you keep referring to a ‘digital currency’. Nothing you wrote proposes a new currency, just a new way of banking the existing one.”

You are missing the main point here! The point is not that it is “digital”. The point is that this money is not a liability of the banking system. What we now see as “money” is actually a promise of money, made by a bank. So most currency in circulation is created by commercial banks and disappears when paid back or defaulted on.

The Digital Currency as is now considered by the central banks cuts the commercial banks out of the system. This has massive consequences for the way the monetary system works!

I agree with your scepsis about politicians. I am very cynical about this myself. The system I describe can work or can be a complete disaster based on who pulls the strings.

As a counter argument, you can argue that money creation is currently done by commercial banks. Do you trust them more?

In any case, imo you would have to put the powers to print money in an independent, bureaucratic, rule-based entity to keep politicians away from the printing press.

yu shan, If i am correct, you propose gov’t. take back the right of SOVEREIGN currency, cutting out its borrowing from private banking cartels, eliminating interest on the national debt?

In any case, imo you would have to put the powers to print money in an independent, bureaucratic, rule-based entity to keep politicians away from the printing press.

Hahaha, we used to call them central banks!

YuShan said: “So most currency in circulation is created by commercial banks and disappears when paid back or defaulted on.”

________________________________

Not one dollar in circulation disappears when the loan that introduced it into the system is defaulted on. The dollar is already lose in the system, where it stays.

Hence, the most fundamental question in finance: How many dollars, physical and digital, are in existence, who owns them and where are they?

cb,

You have asked this same question many times, and I have replied many times. It’s like you do NOT WANT to know the answer.

We know “to the dollar” how many physical paper dollars are in circulation (“currency in circulation”) = $2.04 trillion ($2,038,364 million) as of yesterday evening. This is reported every week on the Fed’s balance sheet.

https://www.federalreserve.gov/releases/h41/current/

Electronic dollars are an accounting entity, nothing more, like miles, or acres. They describe something. It’s used to measure stuff. You can describe the same thing in another accounting entity, such as euros. For example, you can say my house is worth $550,000 or €500,000, same house. If there is a transaction, it can be undertaken in any electronic accounting entity you agree to, from dollars to yen. It doesn’t matter. What DOES exist are the assets (and their counterpart liabilities), such as cash, houses, bonds, stocks, etc., and they can be denominated in different ways.

Example: 1 million miles of highways: the government might own the highways, but it does not own the miles. Miles is just a measure to describe something. You could also use kilometers.

So please stop asking that question. It’s a waste of my time if I constantly have to reply the same way to the same person because the same person keeps asking the same question, claiming that no one has answered his question.

@ Wolf –

My primary intent wasn’t to ask you the question again, only to share with YuShan my view of how essential the answer to the question is.

In your original answer to the question, you did not answer how many total dollars exist. You did address how many physical dollars exist according to the number that the FED shows as a liability on its balance sheet. Does this account for all those dollars that were not loaned into existence, but were exchanged for gold in the early days of the FED. You also did a good job of defining “electronic” dollars, which we know are far more numerous than physical dollars. I appreciate and agree with every clarification you made.

I am and have been for a long time perplexed by this question. Perhaps it’s as easy as trusting Shadowstats M3 estimate of the money supply.

I don’t expect you to answer this question. If I ever figure it out, I will share it with you. I know how smart and knowledgeable you are. I know you also have a business to run.

cb,

YOU MUST UNDERSTAND that this concept in your head of “how many total dollars exist” is a FIGMENT OF YOUR OWN IMAGINATION that I cannot drill out of you, no matter how hard I try. It’s like the concept of “how many total miles exist.”

You made up this concept in your own mind. It’s your own fantasy concept. And you’re searching for proof that it exists. It’s like your quest of the holy grail or something. And you do not accept that it DOES NOT EXIST. This is what I have been telling you each time, and you REFUSE to even understand what I’m trying to tell you – and you refused just now again!

So read my comment above again. Therein lies the answer. If you refuse to give up on your fantasy concept, that’s fine with me. But as far as my website is concerned, this fantasy concept of yours is dead, and I don’t want to waste my time with your quest of the holy grail anymore.

@coalman:

“yu shan, If i am correct, you propose gov’t. take back the right of SOVEREIGN currency, cutting out its borrowing from private banking cartels, eliminating interest on the national debt?”

Yes exactly!

Btw: this is not my proposal or anything, it is just what I think is going to happen. (Though it think it is probably the best way out at this point, if implemented correctly)

@Fat Chewer:

“Hahaha, we used to call them central banks!”

Yes, that is was always the idea of central bank independence: to let no politician near any money printing press.

@ Wolf –

Wolf, I think your frustration with what you think are “imaginary constructs in my mind” are misplaced. Right now I have physical dollars in my desk drawer. I also had some digital(electronic) dollars that I transferred from a bank account to a brokerage account. In that brokerage account some of the digital dollars were exchanged for stock. The remaining dollars are swept to an FDIC insured account. The dollars I purchased the stock with, I no longer have any claim to. I still have a claim to the digital dollars in the “sweep” FDIC insured account, but I am not sure that I own them (I may have relinquished ownership of them if the “sweep” FDIC insured account is considered a loan; I may just own an account receivable). But those dollars exist.

My question expresses no interest in the amount assets are valued at in dollars. Stocks valued at one million dollars, are not dollars at all. They could be valued at zero in a moments notice.

I am not asking about miles traveled, I am asking about miles of road that exists. The fact that you and I give each other a dollar back and forth all day does not increase the amount of dollars in existence.

My contention remains that at any point in time, there is a finite number of dollars, the summation of physical and digital, in existence. I have many other questions about the monetary system and debt, and the inter-relationships that transfer into inflation and deflation.

I don’t want to alienate you, as you are a great professor of business, finance and money. I benefit from your effort and teaching.

If I do make reference to this concept again, please ignore it. I will try and avoid the question.

Feel free to delete this post, if you choose.

You’re STILL not getting it because you refuse to get it. “Dollars” is a MEASUREMENT, like “miles.” You insist on wanting to know how many dollars and miles there are. But in fact, you cited as examples assets and liabilities that are measured in some currency, dollar, euro, yen, whatever. You didn’t “dollars” as examples.

And we know the value of those assets and liabilities. We know how much cash in bank exists, and that’s reported by the banks — but those are not “dollars” but assets and liabilities. We know the value of stocks, bonds, and all that. That’s not a secret. But they’re NOT DOLLARS. They’re assets and liabilities measured in some way, for example in dollars or euros or yen.

You’re totally hung up on this figment of your imagination that doesn’t exist. And you refuse to give up on it. And you refuse to understand it. So it’s your baby. You live with it. That’s the last thing I’m ever going to say about it.

If we reduce the number of banks in the USA to “six majors and very few others”, or even 60 majors, then they will all be “too big to fail”. They could commit crimes and fraud and never suffer any real consequences, other than paying a small percentage of their profits from crime as a fine to the government, if they are even caught. The taxpayers will be looted and cheated, just as they were in 2008-9. TBTF in the real world means that these banks could rig markets and cheat and lie and steal, and nobody except a token low-level flunky would ever be charged with a crime.

There was a time when capitalism meant that bankruptcy was something that happened to banks – that’s why “bank” is in the name. Now it almost never happens to banks. It happens to businesses and individuals, but banks are almost immortal. During the Middle Ages people left their possessions to the church when they died to try to buy their way into heaven. Soon the church became the largest landowner in England. The same thing is happening with banks today, as they are never allowed to die and therefore will own most of everything, as normal companies and people are allowed to die. An immortal entity will eventually everything, and mere mortals will own nothing.

Ask any stockholders of banks the FDIC took over if the bank they held shares in was immortal.

“one method in philosophy is to remain resolutely simple- minded”

But first: you put a few words of mine in quotes and then add words of your own to a sentence as though I wrote it:

‘If we reduce the number of banks in the USA to “six majors and very few others” or even sixty…’

Obviously the number of banks has to be corrected to population but I went beyond that by an order of magnitude. I suggested reducing the number of US banks to…

FIVE HUNDRED! Not six or sixty. Five hundred, at which point the US would still have ten times Canada’s banks per person.

Try and think of ANY other business with that amount of divergence.

To think that after 1929 almost US 10,000 banks went under, so was there a separate bank (not a branch) on every street corner?

Re: being simple minded…how about the ‘proof of the pudding is in the eating’.

No one lost a dime in a Canadian bank after 1929 while millions of Americans lost their deposits. Of course the Canadian banks are ‘too big too fail’ in the sense that government would have to rescue one, but it has never had to because they ARE very big.

(Pu-lees don’t drag in the Fed’s extension of facility in 2008. That was unsolicited, never needed or used)

Simply: the Canadian banks have been profitable, competitive and safe.

The problem I see with your model is based on real world execution. All the better tech people already work for the banks. At the banks they are allowed to build systems as deliverables. In a bureaucracy, they will report to managers with zero understanding of how systems are built. It will be a disaster.

See the California unemployment mess for the proof. If you want to have some fun, read the want ads for govt tech workers. They want a PHD for everything, not understanding these people have little real experience. It’s funny.

One of the better comments I’ve read on here YuShan. The question that comes to mind is whether we are heading there by intent or by circumstance default…

@Antichrist2020: I think a bit of both. To me, everything points roughly in this direction, but I’m not sure if all important players realise where this is likely to lead eventually. But as much as I loathe some of the central bankers, I don’t think they are stupid, so I think there is an (informal) plan of sorts.

To me, the most telling is the open announcement of Fed, ECB and BoE that they are working on Digital Currency. And the interesting thing is not the technology (blockchain – many focus on this aspect) but the fact that it bypasses commercial banks. That is really the big thing here. It implies a massive change to come in the monetary system.

But there is other (circumstantial) evidence too. For example, that also non-bank entities can soon (or already?) access the Fed. This not an exclusive right of banks anymore.

Another interesting thing is that Lagarde (ECB) keeps telling everybody that one of the missions of the ECB is fighting climate change. That’s a strange objective for a central bank! And how are you going to do that with QE and interest rates? Or is she preparing the ground for a radical change, where the central bank facilitates direct funding for such projects? This would fit my theory very well.

The ECB plans appear to me the most developed. The first experiments with Digital Currency are (if I’m not mistaken), planned for 2021.

The ECB also has much to gain. Consider that Italy’s debt/GDP will likely reach 170% next year. That is not a good situation to have with low growth an a falling population. Much of this government debt is held by Italian banks. Suppose the ECB buys the government debt held by the Italian banks with digital currency and cancels this debt! Money in circulation doesn’t change, so no change in inflation and government debt reduces by a large percentage. I can already see policy makers salivating…

They could do that for every member state in amounts corresponding to the same key that they now use for QE. Is it against European treaties and founding principles of the ECB? Sure! But so were QE and the OMT programs. Italy’s (and some others) debt is not tenable, so something has to give. What I’m writing may seem far fetched, but nothing surprises me anymore.

So what do the Italian banks do with (no income from government debt) the digital currency they cannot convert into money in circulation?

YuShan said: ” Much of this government debt is held by Italian banks. Suppose the ECB buys the government debt held by the Italian banks with digital currency and cancels this debt! Money in circulation doesn’t change, so no change in inflation and government debt reduces by a large percentage.”

______________________________________

Whay difference does it make if they do it with digital or physical currency. Digital currency is spendable.

When you trade new currency for bonds, by definition you are increasing the currency in the system. That is definition of inflating the money supply. You are just monetizing the debt.

@Lisa_Hooker:

Not sure what you mean exactly, but the central bank would buy these bonds at market value. The amount they can buy is depending on how much money is held in current accounts, so these are then 100% backed.

@cb:

“Whay difference does it make if they do it with digital or physical currency. Digital currency is spendable.

When you trade new currency for bonds, by definition you are increasing the currency in the system. That is definition of inflating the money supply. You are just monetizing the debt.”

______________

Yes, you are monetising the debt and no, the money in circulation does not increase, because you move to FULL RESERVE BANKING. All money that is on current accounts is 100% backed by Digital Euros that are on deposit at the central bank and directly registered in the name of the owner.

Don’t get distracted by currency being digital or whatever, the key here is the move to sovereign money and full reserve banking, away from the current system of credit money/ fractional reserve banking.

YuShan said: “Yes, you are monetising the debt and no, the money in circulation does not increase, because you move to FULL RESERVE BANKING.”

__________________________________

Two different issues I believe. I suspect we are working from a different set of premises.

‘And the interesting thing is not the technology (blockchain – many focus on this aspect)’

Listen up folks: the thing he doesn’t want to talk about is the digital currency, because you won’t like it.

Wanna get rid of the commercial banks and have it all done by govt? Been done. Do you think there were commercial banks after the Bolshevik or Maoist revolutions? The bankers were either swinging a shovel or swinging from a lamp post.

A digital currency will have no physical existence. It can only be paid into or spent from a digital wallet. This is not most people’s understanding of ‘cash’ and most people (especially in Germany) do not want cash to disappear.

The odd thing about this presentation for a digital currency, repeated over and over. is that it’s how to rein in the banks.

Politics is the art of the possible. It would be easier to get almost any legislation about banks passed than the legislation to make all transactions electronic and controlled by govt.

Suggestion number one: a drastic, no nonsense, right now, cut in credit card interest rates that soared decades ago with the Fed rate and have never declined as the Fed rate has plummeted to near zero. Instead of 29 % how about 9.9%?

If Visa or whoever can’t make money borrowing (via bonds etc.) at 3 % and lending at 10% maybe they need to do something productive instead.

Whereby transactions are more and more becoming ‘touchless’ – all this is doing is prepping the sheep for sheering – total control of currency in digital form and no more paper currency – the state’s means of total currency control.

Progressive tax rates will solve the problem. There is no need to develop any new monetary regime. Just tax the wealthy more. It’s not that complicated.

“Tax the rich, feed the poor, ’til there are no rich no mo.”

@ YuShan –

Better to just End The FED. With your proposal they are not necessary. The Treasury can print money out of nothing as well as the FED can. The FED has already proven to inept if not worse. Why bother with them?

Hasn”t this already been done? In 1776 america financed its victory over the british empire with directly issued “continentals”. During the Civil War Lincoln did the same with “Greenbacks”. Neither resulted in interest bearing debt on the population?

1) Sept QQQ daily, – in a stimulus disputes period, – look like accumulation.

2) NDX weekly with the cloud(9, 26, 52)

3) K, – the halfway h/lo in the last 26 weeks – will leave it’s lows behind in the next 12 weeks, sending K up.

4) T, – the halfway h/lo in the last 9 weeks – will be flat for the next 4 weeks.

5) T&K might have a bearish flip in late Nov, unless PnF send NDX higher, to a new all time high.

6) NDX will glide above the red flatbed, flyover and tumble until late Jan early Feb 2021.

7) A more conservative cloud(18,52,104) will send NDX flying

high & above all the way until late 2021. Plunge into Al Quatraz & SF bay area, in June 2022.

8) This is MechE.

Good Sir ME, I nominate you to be the official Q of wolfstreet. I know there is incredibly important information in your declarations. I just can’t understand it.

“It Ain’t What You Don’t Know That Gets You Into Trouble. It’s What You Know for Sure That Just Ain’t So” – Unknown Alt-Economist.

You either believe stocks are going up based on fundamentals or because of inflation. If the latter then maybe look for a better explaination than hubris for how more inflation causes them to permanently fall.

Stocks go up because of the emotions of stupid people in large groups.

Of course, the credit card debt that people are paying down is REALLY stimulus that people issued out of their own sense of civic duty, before the government decided it’s stylish to stimulate.

It’s a sign that the government stimulus is too little and too late, and the government should step up to its full responsibilities. That’s the real abuse of stimulus.

There still are credit card balances, therefore the stimulus was insufficient. Q.E.D.

9) If u swim in the cold water, u can collect NDX pcs for free.

10) Don’t forget to rub yourself , back and front, with a good hairbrush, to stimulate your blood !!

The old & new $1,200 stimulus checks, stimulate & save the banks

If the rest of the world will take our worthless debt I say print and ram it down their gullet.Stimulus for everyone. If 3 trillion is good then 10 Trillion is better. Brrrrrrrrrrrrrrr……. Money printer goes Brrrrrrrrrrrrrr…… Downside is we lost Van Halen for the guitar work as the printer cranks along. Personally, I think no sane person would confuse credit room on a card as an equivalent to a pile of cash in hand. Buckel up cup cake it’s going to get crazier.

And we lost Johnny Nash too. All very sad.

I wonder if credit card balances are dropping because banks are proactively decreasing the credit limits. Seems like a possibility. Around July, a bank sent me a letter saying they decreased the credit limit on a line of credit I maintained.

Balances are what people owe. A bank can decrease someone’s credit limit, but what’s owed is owed. I think the more interesting question is what happens if someone is already at the old (and higher) credit limit and his/her limit gets cut? Would the person be penalized? If yes, that could be the reason behind people paying off some of their balances.

believe it or not: this is how the Trump Administration deals with everyday life thanks to a willing Congress and willing non US nationals that pay for it thanks to ECB, BoJ, SNB, etc.

…. they make good on everybody and their relatives giving hand-outs to recipients from billionaires to the poor. No problem! Foreigners get their part as well with the swelling of the trade deficits of the US. But the clue: the US does not pay a penny – they run a balance of payment deficit in the trillions of US$ p.a. and willing international “investors” (i.e. speculators with borrowed money) come up (to the rescue) with the cash that they borrow from their own central banks. And here we are: everybody should be happy that the US are scarifying them-selves to help the world to make even more absurd non-interest baring debt for a totally unproductive spending spree. Nothing matters (anymore) and anything goes. Until ….? Nobody wants to own this mess and we shall go to Hell nicely together in a hand cart rather sooner than later…

You guys are too pessimistic. China is going to pay for everything!!! Two people have said it already.

https://wolfstreet.com/wp-content/uploads/2020/10/US-Fed-Balance-sheet-2020-10-08-total-2020-long-term.png

How much steeper until this chart starts to bend back on itself?

The billionaires know this is funny money, and they won’t be able to keep it. The next decade belongs to the real economy, not the financial economy, but they are positioned to make a few dollars on that, and all too willing to pump the fiscal side, if they have to do it themselves, in order to make that money back again in profits. I don’t think any billionaires are happy with this, how many luxury bunkers in NZ can you own?

Oh, they’ve moved on now. At the moment, they are working on building private armies and putting the control systems in place so that they can be assured of troop loyalty in the event of a crash – after all, if the dollar wasn’t worth anything, why wouldn’t the troops take the bunkers and contents instead of continuing to work? This is some of the most interesting work being done today – the refinement and development of control systems – it’s all being done on the surface but under the guise of a different purpose. All you old guys holding on to real estate are missing the real investment opportunity – high tech bondage!

I don’t think control systems ( shock collars?) will help them when the time comes. They will be badly outnumbered will not have time on their side. Genghis Kahn had that all figured out. As his hoard approached a walled city he would send out his emissaries to talk with the loyal troops and guards protecting the lord of the realm and his fellow aristocrats. The offer to the guards was that if they put down their weapons and opened the gates they and all the common folk would be spared, and they would get a share in the lords wealth and have the opportunity to join the hoard for further profit. If they chose to stand and fight all would be wiped out when they inevitably lost to Kahn and his mighty undefeated army. Wisely most of the troops and mercenaries took Kahn up on his offer.

An apt description of JP Morgan, Bank of America and Citigroup.

Anti-you forgot programmable loyalty in a slaughterbot. Further reduce the need for those costly (and always, potentially unreliable) human warriors.

May we all find a better day.

Started a couple presidents ago, before CIC talks to the troops in the field they have to unload their weapons first.

“Programmable slaughterbot”…Radio Shack back in business??

Trade deficit 3rd highest ever. August intermodal rail car loadings back up to highest levels. They’d better start packing on Stimulus for the Christmas buying binge. Maybe the banks are counting on gift giving consumers loading up the Credit Cards

I wish to invest my coming bonus in “Bubble” lights, if it’s in keeping with the situation sir.

‘abuse of stimulus’

Who is surprised ??

&

Really ??

.. unemployment is through the roof & getting worse

.. prices are up across the board

.. business on mass is headed for bankruptcy

.. hospitals a no go at all costs area

.. a new & bright tomorrow after COVID-19 / prospects of recovery abysmal

Big Question .. is there a comeback from COVID-19

Bigger Question .. for who & how few ??

example: sunny Queensland .. a scuba diving tourist business .. “our boat carries 14 people & we make a profit .. when we start up again .. with restrictions we can only carry 8 people & we cannot survive”

!!

So .. the billionaires will survive & go forward .. Hooray !!

Without customers I fear.

Will the stimulus give the customer cash to pay for healthcare ??

Because if you can’t pay you get no service.

By healthcare .. do you mean compulsory vaccination & therefore BigPharma is considered to be the only viable healthcare of the future ??

Australian hospitals are effectively shut down .. the only windfall / stimulus here is that they are saving money by not working & no one in their right mind would go to hospital today .. this is where COVID-19 began & was spread by healthcare workers to the surrounding community.

The fear is that in hospital you will die of the covidvirus.

And so we pay our debts .. stock up the freezer & lock down for the crisis yet to come .. BOOM BOOM.

ABC .. 4CORNERS – Surviving Australia’s COVID-19 recession: Life after Jobkeeper ……

With restrictions & COVID-19 safe reorganisation of the work place .. no one will buy into or take over businesses.

Public transport will shut down .. you can’t run a bus with only 20 people on board. ? ?♀️?♂️?♀️?♂️

Premier of Victoria .. the thinking is that his tyrannical overreaction to COVID-19 was as a result of a mental breakdown due to stresses of the job .. ??

That’s funny.

Might add that deaths from all other sources, other than Covid, have also declined. See what a little financial incentive provides.

My Airline Bailout Plan: