Coddled investors, not taxpayers, should step up to the plate and fund the “daily cash burn.”

By Wolf Richter for WOLF STREET.

October 1 is the day US airlines that accepted their portion of the $25-billion bailout under the CARES Act can start involuntary layoffs of their employees. They’ve been shedding large numbers of employees since March but through voluntary buyouts, early retirements, and other programs that induced employees to temporarily or permanently leave. Now the airlines are engaged in a desperate lobbying effort to get legislation signed into law that would provide the next $25-billion bailout package. Threats have been flying, so to speak, to motivate Congress to get this done.

American Airlines CEO Doug Parker told CBS News on Sunday that if there isn’t a new bailout program, “there are going to be 100,000 aviation professionals who are out of work, who wouldn’t be otherwise.” This would include the 18,000 employees American Airlines has threatened to lay off.

So airlines have been lobbying hard. “You know, we have everyone putting us in every bill they have,” Parker said. “We just need the bills to be laws. We need laws not bills.”

American Airlines was also the airline that blew, incinerated, wasted, and trashed more than any other airline on share buybacks. Buybacks ceased in the second quarter, but from 2013 through Q1 2020, American Airlines incinerated $13.1 billion in cash on share buybacks. That cash would now come in very handy. 2013 was also the year Mr. Parker became CEO of American Airlines.

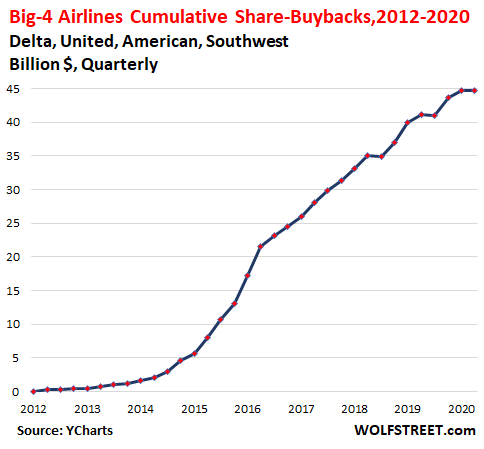

Delta blew, wasted, and incinerated $11.7 billion in cash on share buybacks over the period; Southwest Airlines, $10.9 billion (starting in 2012); and United $8.9 billion. In total, the big four airlines blew, wasted, and incinerated $44.6 billion in cash on share buybacks from 2012 through Q1 2020, and now the airlines want an additional $25 billion bailout, for a total of $50 billion, much of it in forms of grants, from taxpayers (data via YCharts):

OK, the demand recovery has been the crappiest ever.

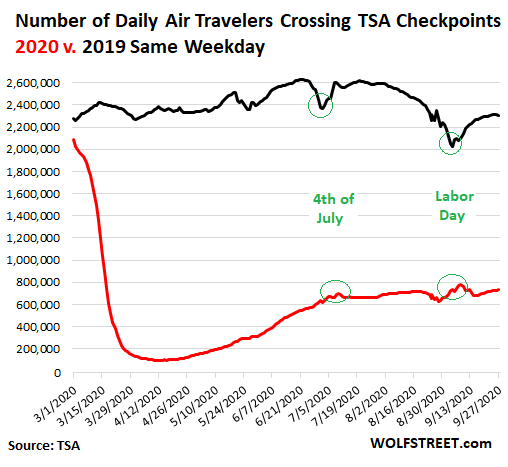

In terms of the numbers of passengers entering airports in the US, over six months into the Pandemic, the business is still down nearly 70% from last year, according to TSA airport screenings. The interesting thing is how the recovery is not happening, and how the strong seasonal patterns have disappeared.

Normally, the passenger count drops sharply in the weeks before Labor Day from the summer peak in June, July, and early August. But after Labor Day, business travel picks up, and older folks with kids out of school start traveling, and the passenger count rises sharply in September. But none of that is happening this year.

The chart below shows TSA checkpoint screenings per day, as a seven-day moving average through September 27, last year (black) versus this year (red):

The very lucrative business segment has gotten crushed as companies still avoid sending their people anywhere unless they absolutely have to; conferences and large meetings are still mostly shut down; and job applicants are interviewed remotely. And among vacation travelers, older people with no kids in school, who would normally take advantage of the beautiful and less crowded fall months, are avoiding getting on planes for health reasons.

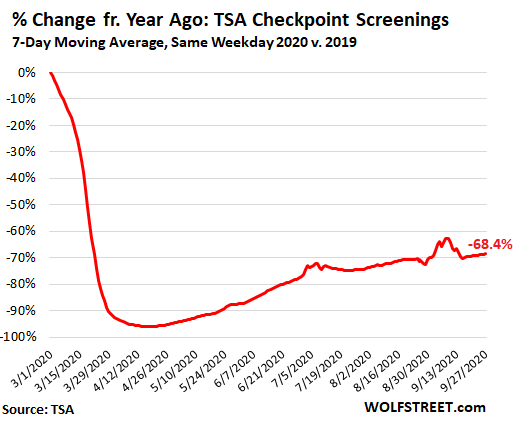

Over the past seven days, from September 21 through September 27, the passenger count was down each day in a range of -64.4% to -73.0% compared to the same weekday last year, putting the seven-day moving average at -68.4% as of September 27. Part of the year-over-year bump around Labor Day was due to the calendar shift with Labor Day falling on September 7 this year, compared to September 2 last year:

In terms of international travel, flight restrictions and quarantine requirements in the US and other countries make this a tough situation for willing American travelers. And for US airlines, that crucial and lucrative segment is unlikely to bounce back quickly, given the once-again rising infection rates in the US and many other countries.

So what to do with these airlines?

The airline industry invented a new metric during the Pandemic: “daily cash burn.” The purpose is to give investors a feel for the progress in implementing the airlines’ survival strategies. Every airline now cites this metric. The idea is to make this number as small as possible by cutting capacity, shedding employees, and reducing costs wherever possible.

Investors who’ve been coddled over the years through share-buybacks, have helped fund the airlines’ daily cash burn by buying the newly issued bonds and shares. They have done so because they counted on support from taxpayers and the Fed.

Investors should continue to step up to the plate and fund that daily cash burn. But taxpayers – they’re already sitting on billions of dollars in tickets they can’t get refunds for though they can use the “credits” or whatever in the future – shouldn’t be shanghaied into funding airlines. That’s Wall Street’s job.

And if Wall Street refuses to step up to the plate and one or the other airline runs out of funds to fuel its daily cash burn, well then, that debt needs to be restructured at the expense of investors, and that can be done in bankruptcy court, as Delta, American, and United have already proven and demonstrated in the past.

In the Atlanta metro, 53,000 FHA mortgages are delinquent. In the Houston metro, 47,000. Just FHA, not including other delinquent mortgages. By metro. Read... Subprime, No Problem? FHA Mortgage Delinquencies Hit Record 17.4%, as Fed Triggers Mad Land-Rush in Split Housing Market

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Burnt the Money on Share Buybacks?

Take Over Airlines which have,

Fire/Charge Execs+Board with Fraud and RICO.

Audit.

Put the Companies up for Sale to US Buyers.

Sell Off and Monitor.

There.

You know earnings didn’t grow much on the sp500 over the last 10 years. GAAP earnings was about $100 and people could buy the SP500 for 1100. Who knows if we will be back at $100 next year and people are paying 3 times as much for the same earnings. Short memories I think.

As far as airlines it fits my theory of covid has created real losses and those will get passed to people who are not connected to political power. Probably to mom and pop savers and small businesses.

@old School

‘You know earnings didn’t grow much on the sp500 over the last 10 years’

50% or more of the rise in S&P 500 since ’09 was due to massive buy-backs in billions!

Stock prices went up and overall equity went down is my understanding as companies leveraged up and bought in shares. Earnings has been creeping up slowly til covid. Now long term growth will be slower as we absorb the cost. PE expansion is one time feel good thing. Anybody buying now is paying very high multiple that must at least stop expanding with 3% long term gdp growth. That sounds more like 1000 than 3000 on sp500.

How about bailouts get U.S. taxpayers airline stock on par, only after all ceo bonuses are clawed back, to and including forced stock sales of every share they added to their portfolio since employment?

Why are we paying federal taxes again?

What do we get for our money? How many wars have been won, O.K., we did conquer Grenada? Not worth 55 cents of every tax dollar going to “defense”.

What preparation was there for the pandemic?

How is testing being delivered?

Why aren’t corporate “”persons”” getting the same dollar amount that U.S. Taxpayer persons are getting? So many questions, so few answers.

Concur.

Having the USGOVT Coordinate the ReOrg and Mixed Ownership of Bankrupt Airlines which engaged in (previously illegal) Stock Buybacks may be in Order.

I can see the USGOVT – via Sovereign Wealth / Sovereign Sponsored Citizens’ Collective Wealth / Social Security Investment Trusts – have Controlling or Partial Shares.

Dividend and Interest Income for the Funds as well as preventing frivolous sales of Airlines to Foreign Interests.

Add Employee Stakeholders as Shareholders.

Restrict Stock/Bond Ownership to Individual US Citizens(Bingo!).

Tony & Iron – this could be a way to (slightly) recoup potential lease payments to the Treasury lost when the Reagan Admin. oversaw and encouraged the outright sale of publicly-owned airwave bandwidth to private firms (who knew what was coming) for peanuts…

may we all find a better day.

Another question to ask is what merits these CEOs “earning” so much money, for example Parker’s net worth is $50mm. That’s over $7mm a year. Shouldn’t some of that go back into the business for times like these? Or is it just take take take, pocket everything and then tap the debt markets for more, and now they want a bail out. No.

The Trump administration fired the person and eliminated the position that had oversight of how these funds are used. Share but back and lining CEO and higher his pockets isn’t a bail out. Trump owns this.

No, he doesn’t. Buy backs have been a problem for much longer than 3 ½ years. Who did away with the Glass Steagall act? Bill Clinton did, by signing into law the Financial Modernization Act which repealed Glass Steagall. The current potus doesn’t not own this at all.

I don’t mind seeing United, Delta, American (and whichever airline) go bankrupt, if this is the correct procedure. They have undergone bankruptcy before, but they are still alive today!

Bailout does not exist in true capitalistic economy. Now we are doing socialism at the top, and capitalism for the rest of our society.

Let the business die. I bet you a dollar, NOT a single lead economist dare to speak out like this

More like corny capitalism for the bottom since real capitalism requires for investors Ie top bare losses in addition to collecting rent

So true.

True capitalistic economies (TCE) suck massively and the the US was never a TCE. beginning with Reagan the US became more TCE and began to suck more.

I don’t mind bailouts but i think a complete nationalization and restructuring is called for. Airlines are to far gone. A little bit because of extraction done by the top (share buy backs etc.) but mostly due to covid.

Airlines are public transportation. They have a very high spin off effect by creating businesses that otherwise wouldn’t be possible. Those businesses die without the flights so simply letting the airlines die is simply not possible

Again, if the demand is there, they won’t “die.” Someone will buy their assets, the current equity will be wiped out, and the secured creditors will take over. That’s how it’s supposed to work.

exactly !!!!!!!

Agree. There is no demand. There won’t be much demand for a couple of years going forward. Are they willing to bail out the airlines for that time frame?

All the businesses that live from supporting the airlines are dead. I don’t see much help for them from Gov & company.

“there are going to be 100,000 aviation professionals who are out of work, who wouldn’t be otherwise.”

There is no ‘otherwise’. There is a now that is a reality where in there is no demand dor their services. Let it die and let the bailout money go to where there is demand and it does something usefull, like earn some profit.

Sure it is Let those businesses that rely on them readjust or disappear It’s called reality I know it’s a difficult concept after so many years in Neverland

Buffet was smart to sell out early at a loss. His logic was something to the affect they are well managed companies with no customers. That’s not a business you want to own.

Your comment said, all the more reason they should be fiscally sound and not looking for a bailout after squandering everything on buybacks to line their pockets as execs retain the most shares..let em crumble..

America:

Socialism for the rich

Harsh capitalism for everyone else

I agree that the stock buyback scam should not be rewarded. However, the bankruptcies of United and Delta were hard on the pensions of their average working employees and disastrous for the retired. The PBGC paid only dimes per dollar for defined benefit, and pays nothing on defined contribution.

How ironic that global airlines have received the most “free” bailout funds of any type of company while by far the most responsible for quickly spreading the pandemic across the entire globe in a few short weeks. Devils in the details, yet facinating nevertheless…

No V-shape recovery for airlines, instead an apocalypse has started. Taxpayers wont finance these cash burning machines for ever and it seems that these lock downs and flying fears persist.

The thing is that the taxpayer is financing all of this. Isn’t that what you voted for? I am waiting for a bailout for the companies hurt by Amazon.com and Walmart.com hurting their traditional sales

Wolf,

It sounds like it all leads to Boeing too.

Boeing sure shot itself in the foot didn’t they

I used to engineer products. As an engineer you are taught a certain way of thinking about risk and are usually wanting more time to perfect the product because you know you will get the blame if it doesn’t work and product life may be 10 – 50 years.

Most CEO’s have very little education in product development and some really do a poor job supporting the process because it’s a longer term investment and doesn’t fit well with quarterly earnings mentality.

Boeing is more likely to sort it out with their main customer: the US Air Force. The military is just made for times like these: to stimulate spendings and save jobs. I mean I’m sure there are always a few jets and transports that could use a refit, more advanced successor or even a completely new type of aircraft could be introduced.

I wasn’t sure that was true, but you are right. Pentagon is largest customer at 30%.

And those douches had the gall to file suits asking for steep US tariffs against Canada’s C-Series jet, (Boeing doesn’t even make a close competitor) claiming it was subsidized. This came just as the plane had to book orders, having almost bankrupted Bombardier in its development. It had a big US customer order but under threat of tariffs it fell through.

Was it subsidized? Of course. Today all big aviation is subsidized one way or another. Apart from its usual write-offs etc. every Pentagon order is larded with juice for Boeing. Sure it’s been caught a few times but what is the US going to do, order from Airbus?

But the last laugh may be on Boeing. Bombardier was forced to sell to Airbus, which has far deeper pockets to market it and finance the buyer. They’ll sell more than Bombardier could have alone.

“Taxpayers” (actually more inflation) are funding the railroads forever so why not airlines. Not that airlines are already massively subsidized. ut that is normal with public transport

Put the money that would have gone to bailouts into soup kitchens Nobody will starve at least like the dirt cheap but good “milk bars” in Poland subsidized by the government

Wish we had bar mleczny in the US, food is better and healthier, not simply cheaper.

After the elections the bailouts will resume in short order.Politicians count on the short memory of the American public.Don’t forget that those very CEOs belong to the same clubs as our politicians.Their kids go to the same $50k per year schools.The fact finding junkets in exotic locations will abound for the election winners.D or R makes no difference,same coin.

YOU AIN’T GETTIN’ MEDICARE FOR ALL OR FREE COLLEGE

The American corporate way of today: create higher reported profits with financial engineering, buyback stocks with funding used from the sale of corporate debt (made possible by the artificial higher profits), split the company stock when share price has been elevated to sufficient levels, then repeat. If anything untoward happens with the plan, simultaneously beg the Feds for a bailout while threatening massive job cuts should the bailout not occur.

You are correct. Since the Great Recession when banks blackmailed our society and got their bail outs it has now become modus operandi for all big corporations, give us money or we fire the workers as if all of the sudden their main purpose was to keep the workers employed.

We have bankruptcy laws and they work, use them please.

Extortion is the name-of-the-game … and both the red, as well as the blue player pieces keep receiving complimentary getouttajailfree cards, courtesy of the House .. with the Senate palming the dice, hoping as always .. to roll snake-eyes!

They’ll use the bankruptcy laws just as soon as they extort enough taxpayer money to give all the executives colossal bonuses for a job well done. Then they’ll turn it over to the lawyers and the courts, while they sip margaritas on their yachts called “Lolita”.

Gizz-lane did NOT commit suicide but I believe her dad allegedly died after having a yachting accident

Amen. Fire away I say. I’m so tired of the irresponsible fiscal behavior and then the heavy lobbying to get their next financial fix off taxpayers. Pony up investors, let’s see what investment got you.

“Investors who’ve been coddled over the years through share-buybacks, have helped fund the airlines’ daily cash burn by buying the newly issued bonds and shares. They have done so because they counted on support from taxpayers and the Fed.”

You’re leaving out our army of public union workers.You know,the real constituents for Democrats.Haven’t missed a paycheck in either the housing crisis,or the Covid crisis.

Ask your senators (advisors) and congressperson (lawmaker) if “their main purpose was to keep the workers (voters) employed.” This has little to do with business economics.

Of all the 186+ Nations affected by Covid 19(China virus) only Australia has challenged China for accountability.

Rest (Europe ++) just cowed for the sake of trade!

Wasting money on discovering who is culpable will produce very little. Cost benefit = zero as whoever is responsible can never compensate for the damage.

Not wasting. It’s newly printed free money, don’t you see.

The largest buyer of stocks since 2009 has been the companies themselves. Not mutual funds, not pensions, not insurance companies, not investors, not speculators. The whole economy is in the same boat as the airline companies. Watch out for mixed metaphors when the bubble pops.

I think this idea is discussed before.

Can lawmakers explicitly state that the bailout money must be used for employees not for stock buybacks? Or its like they can but they won’t.

The other idea is to use bailout money in as they please but increase foot space between seats? Even myself at 5’7” is having trouble. Think about the tall 6 foot guys and those tall+obese people.

No. Money is fungible. You can’t tell them they can’t do X with Y money. You can simply say they can’t do X PERIOD if they accept Y money. Otherwise, it just becomes a shell game of moving money around.

Share buybacks instead of prudent management. Criminal.

We need to take some moments to consider the employees and their personal tragedies that are unfolding in this economy because all of us know damn well what end of the stick they’ll end up holding.

I wonder how much in taxes the average airline worker paid this year? You think it was more than $750?

We are witnessing a circular firing squad this year, with real bullets.

I wonder how much each individual paid in real estate taxes, city state fees, how many folks are on your payroll? That also means matching s.s. taxes. All is not profit, and skimmed off the top. All is not simple black and white. There is a lot of gray. However, we need to consider, as you say, everyone and their successes and tragedies, find balance.

Share buybacks or massive bonuses should place certain businesses in a “do not rescue” position. Maybe shareholders will wake up.

The executives are lining their pockets with share buy backs that kick in the stock options they possess. The partners of investment banks (one turned commercial in 08) pulled massive amounts of money out each year’s end.

Maybe bailouts could be conditional on “claw backs” for those who cashed out and depleted the companies assets while doing so.

Rising asset prices papered over a lot of bad behaviour as it always does. At some point in time we must be grownups and deal with the real state of the economy. Recessions are when you have to make the choice about are you going to keep wealth destroying institutions alive or force them to restructure or collapse.

Old-i agree about growing up, but there are sooo many Waynes & Garths, workin’ for the weekend, partying their raison d’etre…

may we all find a better day.

Yeah, they privatize the profits and socialize the loss. Simple do a share offering and recapitalize your operations.

When the wealth transfer is complete, they die and pass it on to their snotty children along with a superiority complex and the pedigree certificate. This is the circle of life.

Yup I ran into a few of those snots when I lived in the Hamptons Scarily pathetic a couple of them They called themselves “trust fund babies” and they sure were horrible people

Frederick-‘trustafarians’ out here in North Coastal California…

a better day to all.

And the trust fund population is increasing dramatically (Educated but Moron) without the Ikigai that was instilled in the children of the Gilded Age.

Ah, but after a period of time .. the past being a generation or eight .. the circle completes .. Hubris, and it’s twin Avarice .. reach their respective apogeal trajectories, the tumbrels start rumblin – be they pulled by EV’s, animal carraiges, or rides of MADmaxian design .. then “BLAM!” .. things flip.

.. thus, there We will be, to begin anew, whatever THAT means .. and They, some of them anyway, will find themselves ‘ceasing to function’ …!

We have to face the possibility that in the post-covid world air travel may be at a significantly lower level than it was before the pandemic, even if all the effects of the Corona disappear someday. The average 1st world citizen may be so much poorer that air travel will no longer be practical. Trying to keep the airlines in place at the same size as before may be as pointless as trying to maintain the draft horse population in 1915 if their had been a big horse flue pandemic. The (theoretical) flue may have drastically culled the horse numbers, but they were headed in that direction anyway.

Right. I can at least see the argument for keeping the airlines afloat if the disruption was truly temporary. But as I see it, business travel will be depressed for years, if not permanently. Too many companies have now realized that it was silly, tiring and unproductive to fly people around the country for meetings. And most of the people I knew who used to travel frequently for work have loved NOT doing so for the past 6 months.

Within the last 5 years, I was asked to fly from Tampa to Baltimore to pick up a single permit (it had to be done in person).

This huge corporation had people in Baltimore, DC, etc. that were far closer. I considered it ridiculous and wasteful but being a company man, I said “No problem.” when asked. This was the action of a California based “tech company”.

It was but the tip of the iceberg when it came to corporate stupidity.

I still have an April 9th CNBC interview by billionaire venture capitalist Chamath Palihapitiya bookmarked in which he said, in general, about the bailout program the Fed was orchestrating……,

“When a company fails, it does not fire their employees, it goes through a packaged bankruptcy…the people that get wiped out are the speculators that own the unsecured tranches of debt or the folks that own the equity. And by the way, those are the rules of the game. That’s right. These are the people that purport to be the most sophisticated investors in the world. They deserve to get wiped out…just be clear, like, who are we talking about? A hedge fund that serves a bunch of billionaire family offices? Who cares? Let ’em get wiped out. Who cares? They don’t get to summer in the Hamptons? Who cares!” And he went on to say that instead of helping the people on “main street” who are the ones that are truly getting “wiped out” (IMO thru no fault of their own) “what we’ve done is disproportionately prop up and protect poor performing CEOs, companies, and boards. And you have to wash these people out.” Right on Chamath!

Who is by the way looking to launch IPOD thru IPOZ onto the SPAC markets.

He isn’t wrong, but I doubt he is getting wiped out right now either.

Summering in the Hamptons is overrated I lived there and I know It’s gotten over crowded by a very nasty group of psychopaths and the traffic is bad Used to be a lovely place back in the 60s when it was middle class people like my family and the old money along the ocean Those days when you could walk barefoot through the farm fields is long gone and much missed frankly Had many a fond teenage memory on those dunes my friends And that was before Ticks and Lyme made that sort of thing imprudent

It all started with bailing out Long Term Capital

The bailout of Mexico in 1995 set a precedent for LTCM in ’98.

Somewhere along the line it will be necessary to look into who is facilitating this theft of taxpayers monies, and its transfer into the coffers of the corrupt and thieving corporate managers.

Then, such facilitators must be pursued for every penny of the theft they enabled, on the basis that they are/were accomplices in a criminal act. Including all their assets, their families assets, and when there is nothing left, even their body parts when and where these can produce returns.

Facilitators are of course, living in an enterprise called “government”.

Until such time when this type of compensatory retribution can be effected immediately upon the crime of theft of taxpayers monies being committed, all the complaints are just barking at the moon.

As an example, and this is slightly OT, we have an MP here in U.K., let’s call him Kiss Whiteling. This destructor of public money has spent tens of millions of public money awarding Brexit related ferrying contracts to companies without ferries and moved on to award similar size compensations to other companies that did not get availed of similarly juicy gigs, as is their human right.

Now the dear Mr Greenling is about to get £100,000 pa for ten hours a week worth of work from a private company let’s call them Bitchinson ports, for ensuring bitchinson’s contracts and more importantly arbitrary profits projections, are underwritten by the U.K. taxpayers.

Here, a potential prime target of a desired and urgently necessary corporal sharia-like legislation designed for real life punishment of grand theft.

This is how the system is designed to work. Former PM of Canada is getting $75,000 per public speach gig. Same with Clintons and Obamas of the world,they earned millions from public speaches and gigs after end of their public service. Convince me that these are not kickbacks.

I’m coming from Eastern Europe and politicians there are corrupted as hell, for example they caught one minister with 100,000 euros in a bag. But you don’t need to do that in a western country. There is a well oiled mechanism, public speach, donation, charity…

This is called the “post bribe”. They do what their masters want knowing their will make millions after it is all over.

Remember what Obama said to the Banks: ” I am the one standing between you and the pitchforks.”

$400,000 a speech after he left the WH, and a nice complex on the Vineyard that makes the Kennedy’s Hyannis place look quaint.

As long as the RH investors still love $jets and the airlines, let them fund these companies. If the government ends up providing grants, they should claw back 50%+ of the options exercised by the top execs at the airlines.

Clearly the thing to do is to sell those bought-back shares, and get their $45 Million back.

Exactly! Reissue the shares and do a public offering. It’s a little dillutive, but so what?

Totally, $1/share, sell 7-8 Billion shares (a la GE or Apple). Hurry up before it hits 5 cents.

That was Billion with a B, not Million with an M.

“Coddled investors, not taxpayers, should step up to the plate and fund the “daily cash burn.””

You know that’s not going to happen.

My theory is that enquiries would show that executives get shares as part of their package and then sell them to the company. These get given to the executives as part of their package. They then sell them to the company. These then get given ……….

A few checks would confirm or contradict this.

Yesterday on the ASX the travel type companies were big gainers. I guess based on hope that by the end of the year people MAY be able to travel between New Zealand and Australia………………

And as for Victoria?

We had our lockdown rules somewhat relaxed on Sunday.

This entire lockdown and spread of the virus here was a direct result of the inept and incomp state Labor government that screwed up the hotel quarantine program and allowed the virus to spread in the community and into aged care where most of the deaths and cases have been.

In this “I know nothing” SGT Schultz government an independent inquiry has found that according to the people in the State government that nobody was in charge, nobody made any decisions, and nobody ran the program…………..it was all magic!!

So the changes:

1. No more curfew. When questioned on who brought up the idea to have a curfew SGT Shultz was the originator. The ONLY reason that this was eliminated was that the day after the elimination there was a court case to be heard about it.

A person sued the government for various reasons and then the government tried to hide the legal advice it received about the curfew. The judge made the government release it which stated that it was probably illegal.

So rather than have the case go ahead, they dropped the curfew. So now we can go pick up KFC at 9:30pm or 10:30pm instead of at 9:00pm.

2. More than one person from a household can now go shopping each day and you can even go shopping with another person from your household.

3. Masks – you now have to wear a ‘proper’ mask. Scarves and bandanas and the such are no longer permitted. Yes, I’ll remember to wear my mask at 10:30pm when I take my walk around the area on the empty streets to make sure that I don’t catch the virus.

4. Real estate – private inspections by only one person can start up again which should help out people that were caught up in the mess. Rental inspections and sales inspections are now okay. Only only auctions though.

5. We can now go to the dentist again for routine work and elective surgery will be able to go to 75% of capacity.

6. The fine for breaking the rules has increased to A$5000. Guess they’ll need to get more money from each person as they can’t fine them for breaking curfew now.

7. Gardners and landscaping workers can now do their jobs, but only ‘sole traders’, ie one person. If you have two people on your team, you can’t work. Go figure, but construction work is okay.

8. Oudoor pools can open again. Well tough luck if there isn’t one in your area and you are more than 5 kilometers from the ocean: you aren’t going swimming any time soon. Gotta make sure that you don’t get the virus from swimming in the ocean!!!

What hasn’t changed is the 5 kilometer rule on travel, eat in dining, and non-essential work. Essential industry can increase their capcacity to between 100% to 90%. The left wing rag estimated that around 125,000 people would return to work with the changes, but according to the government unemployment stats only 43,000 people lost their jobs in Victoria as a result of the lockdown…………..

Maybe this capacity change will help sort out the post system mess which has totally screwed it up. Still waiting for a package from Perth sent to me in Melbourne: 20 days and counting.

I can get junk mail from Liechtenstein in Europe faster than a domestic package, but no mail from countries such as Hungary to Australia!!

When the postal systems around the world return to normal then you can pretty much say that the problems with this mess have been solved.

Travel stocks up again today so far in trading in Oz.

Some clarification on pools:

“Apartment complex swimming pools: “All pools, indoor or outdoor at residential premises, including apartment complexes, are closed. Only outdoor pools at non-residential premises are open in the second step.”

So the virus police better not catch you swimming in your indoor pool at your house or you’ll be fined A$5000!!!

And other asinine rules:

Dog groomers: “In relation to animal welfare issues, which have been raised with us consistently, in metro Melbourne [grooming is to occur] only in retail stores. Not from home. It can occur from home in regional Victoria.”

Painters: “Emergency repairs can take place at occupied properties. That means no interior design, no [renovations] if the property is occupied.”

Remember, the Gipper said it best:

“I’m from the government and I’m here to help.”

New Oz bumper sticker?….”When bandanas are outlawed, only outlaws will carry bandanas”. Man, someone is in need of a good neck-wringing in that oberfurher regime. Didn’t Aussie’s use to have a set in their trousers?

Wait til utilities companies have to raise rates to offset revenue lost during the shutdown. Like you think they’d cut divvies first, right?

Anyone an expert in tax laws? The Prez supposedly committed a criminal violation because he took a 700 million dollars writeoff while receiving a hidden benefit (5% in a new company out of bankruptcy).

Don’t worry guys, I am sure we are still better than China.

That is not a straight forward assessment like you make it out to be. We dont have all of the details but IRC permits certain accounting or treatment with respect to large company groups or high networth individuals. On their face rules apply the same to everyone but you or me aint in position to take advantage of such tax benefits due to our limited wealth. The more complex the tax code, the more unequal the society.

Agreed. That is why there is hundreds or more pages of tax code so that certain targeted individuals and companies benefit. If you don’t take advantage of the tax code then you are just being stupid. If you don’t like the tax code then vote for representatives that support flat tax.

That’s why I said “supposedly”. I was also asking for a tax expert’s opinion. I am certainly not one.

Seems like nowadays people read what they want to read.

Oh, you are referring to that dude that filed for bankruptcy 3 times through his businesses? Maybe he ought to speak with the airlines and give them some financial advice. Seems like he figured out this shortfall thing.

Gov’t edict destroyed their business. If gov’t doesn’t make good on that it would be about as immoral as a deadbeat dad.

That, or they jammed seats so tight smelling next person’s breath is not good for social distancing.

The Pandemic destroyed their business. People COULD fly, at least within the US, but they DON’T WANT to fly because they don’t want to catch that friggin virus. I’m not flying either unless I have to, and I don’t have to. This pandemic is similar to a natural disaster.

You don’t know what you’re talking about. I tried to fly in May, flights were cancelled 4 times before my window to do some specific hiking closed due to summer. Had another trip in July that was also cancelled 4 times before I finally found a carrier that would go. Tried many different airlines. Airlines that took PPP money were obligated to maintain a minimum level of surface. Many of my friends also had multiple cancellations. Airlines were booking flights that they had no intention of honoring in my opinion. Lots of people want to travel, it’s a breeze through TSA and flights are 15% occupied at best but part of that is due to airline idiocy.

Antone,

I know several people who had zero trouble flying, one on a packed flight including middle seats, others on nearly empty flights. Don’t extrapolate from your sample of 1 to the entire industry.

Wolf, I live in upstate NY and work from a home office. Probably averaged 10-12 flights a year between business and personal travel. Have no issue whatsoever at this point in getting on a plane and going somewhere. The problem for us is we have a governor who unilaterally dictates what we can and can’t do. We have 33 states currently on our mandatory quarantine list. If we travel to any one of them we are ” required” to self-quarantine for 14 days. I get it that some people are afraid to fly right but for those of us who aren’t , we still can’t reasonably do it.

Watch the series Air Disasters and that’ll cure you of flying as well.

After the way American Airlines treated me on a business trip where they told me to go to hell after they lost my luggage and didn’t have any way to track where it was I will not lose any sleep if they lay off 10,000 employees or better yet file for bankruptcy. In fact, I may even go out and have a sip of champaigne to celebrate.

I had a similar experience with AA . After they lost my suitcase and milled around looking baffled for an hour, they asked me to describe what suitcase looked like.

I told them, “it’s… uh… black and square shaped, with wheels on the bottom and a handle on the top.”

I knew at that moment I wasn’t getting it back anytime soon.

But to their credit they did eventually find it and send it to me after I returned home.

Bankruptcy courts for the airlines is the smart approach. Let someone else purchase the assets. Can’t sell them for what they’re ‘worth’ then tough-titty is my view because they’re only worth what a willing buyer will pony up! best part, the next asset owner will have a better cost basis in the assets and can offer more competitive pricing. Win-win! What part of this don’t people understand?

Blasphemy. What part of ‘assets inflation’ don’t you understand.

How is Greyhound doing? Any bailouts?

Never mind, it’s Canadian now.

At the end of the day, airlines would get what they want. Taking main street as hostage as this is an election year. Both parties want to win, so promising an easy solution of bailout is a win win for politicians.

This is a country keep telling the whole world of it animal spirit of capitalism & free market. What a joke!

I have the impression both parties wanted to lose the election, but only by a little so as to pretend they might have won but for the other party’s fraud.

I for one would like to get an accounting from the majors of every last penny they got from the last bailout and see how it was spent.

The situation is a hard one, yup, these guys did stock buy backs, no doubts there. But that’s in the past… it was not prudent, but you can’t unincinerate that money, if they go through a structured bankruptcy, it still involves laying off tens of thousands right? So, it is at this point the politicians come into play… if it was just regular economics, so be it, they die.

But does anyone foresee the Dumbos and the Jackasses calmly letting these people go into bankruptcy? Thanks to C19, we have found an excuse for zombie companies… oddly, I never imagined that this would be the way that the zombie apocalypse would unfold.

?

Any graduate student in Zombie Apocalypse Studies can tell you that zombies can only be the former dead who eat the flesh of living humans. But what do I know, I only went to State Uni, not an Ivy League!

Also odd that according to postmodern, critical theory holding sway at many Zombie Apocalypse Studies Departments, Zombies are infected with a virus. Perhaps Zombie companies are carriers of a particularly virulent strain called Cov-Greed-20.

I suppose these planes can be parked somewhere until further notice along with the pilots and cruise ships. OK, about 2025 things keep squeaking along, business a little better up and down, the planes showing their age. Would you rather board an old mothball jalopy or a new plane from Boeing? You can roll the dice even before you get to Vegas.

Strange concept: The cost of keeping airlines afloat should be borne by their passengers, not taxpayers. Enough of this bailout crap, already.

White House promises to throw $750 on top of those 25 billions. That should hold them for the while. Don’t spend it on at once, boys…

Anecdotally I have been hearing more flights on approach to Logan (Boston) lately. Certainly nothing like pre pandemic, but definitely more than over the past summer. And for whatever it’s worth, airlines have had a couple of decent days on Wall Street….but overall they look to be trading pretty flat and will probably continue to do so until all the layoffs soon to come.

On another note, today I received credit for future travel on Azores airlines due to a cancelled trip to Lisbon. Hoping the company will remain solvent long enough to use it.

At least SuperShuttles won’t be asking for a bailout.

So why can’t the airlines issues shares to get capital?

So why can’t the airlines get bank loans?

Oh yes; because nobody would buy the shares and the banks wouldn’t lend any more money.

So why should the government (tax payers) bail the airlines out?

But wasn’t that the same scenario with the banks in 2008?

Cashboy,

They already raised tens of billions of dollars issuing shares, issuing bonds, getting bank loans, doing sale-lease-backs on their planes, etc. But it’s a lot cheaper to get free money (grants) from taxpayers than pay junk bond investors 10% in interest.

And yes, if they cannot raise enough funds to fuel their cash burn, bankruptcy is a good option.

Wolf…

The Federal Govt can borrow for ten years at about .65%.

So the Federal Govt floats some ten years, and lends the money to the airlines at 1.5%. Easy peasy. The Fed buys the ten years and it goes on the magic balance sheet.

The Federal Govt can also do this for all the broken states and cities across America.

And this, IMO, is why governments should never be allowed to borrow at such low artificial levels, for there really isnt an answer for why they shouldnt or couldnt do these things.

“…for there really isnt an answer for why they shouldnt or couldnt do these things.”

yes yes yes yes!!! Some call it MMT.

The government can do this for all the broken cities and states across America and re-build them all!!!

Why on earth would you want to prevent them from doing this? Have you got some basic puritanical suffering disorder?

M(ore) M(oney) T(oday)

As a CEO, I can use the company’s money to do share buybacks, to boost the share price; get my bonus and top dollar for my shares.

What is there not to like?

Share buybacks were found to be a cause of the 1929 crash and made illegal in the 1930s.

What lifted US stocks to 1929 levels in 1929?

Margin lending and share buybacks.

What lifted US stocks to 1929 levels in 2019?

Margin lending and share buybacks.

A former US congressman has been looking at the data.

The whole point of having a stockmarket is that corporations can raise their own capital. If a corporation fails in doing that, bankruptcy court should be next.

If taxpayer funds were ever used to support such a company, the government should behave as a responsible and skilful investor on behalf of the taxpayer, so it should only invest if a massive risk-adjusted return on that investment is to be expected. However, this implies that such a situation would almost never happen, because if it was a good investment opportunity private money would have found it already!

If for some reason a company is deemed too big to fail (i.e. national security is involved or potential failure causes to much harm to society), it shouldn’t be private in the first place but be 100% government controlled.

However, I don’t believe commercial airliners fall into this category.

Amtrack of the sky cometh.

No – companies afer the IPO never raise money on the stock market. Never Ever.

topct,

Companies routinely raise money in the stock market after the IPO. That’s part of the deal. It’s called a “follow-on offering.” In addition, companies raise money all the time in the stock market long after the IPO. Look at Tesla. It raised over $2 billion in February by selling shares and it’s now raising $5 billion by selling shares. The airlines too have raised billions of dollars by selling shares since March.

yes, ok I was a little strident there, but the sums raised are teeny weeny – most issue bonds or borrow. The stock market is just a betting shop with a fixed number of shares being bought and sold again and again and again.

The use of money to buy back their stock…to kick in the stock options for the board members, etc…should put the company in another category when “bailing out” is suggested.

When the “investment banks” got caught speeding in 2008, many were bailed out despite massive bonuses to partners, like clock work at year end.

Year after year, capital was dispensed so that money would not be at risk if something big happened. Very similar to a buy back scheme. When the buffer is needed it isnt there. The Govt should not be the rescuer of all, especially those who use money that could be a cushion in bad times to fluff the shareholders and partners when times are good.

Gigantic corporations know these kinds of crises are going to happen every decade or two. I find it “suspicious” that they don’t plan for it. It’s like that wonderful children’s story, If You Give a Mouse a Cookie. But sinister.

I’m really starting to understand that the federal government at large is no friend to responsible middle class taxpayers.

Why subsidize the higher passenger capacity level (in terms of personnel and equipment) when the demand is not there and no one knows when it will return (if ever?)

The taxpayers would basically be paying to maintain the infrastructure of a period of much higher demand – and that period is over. The airlines need to take their medicine and downsize. Additional personnel and equipment can be added back if and when that previous demand level returns.

Its time to allow these goliaths to sink or swim with no bailouts and its time for there to be consequences and measures put into place to punish their irresponsibility. That money is needed in other places and why should we save companies that nickle and dime us for everything as consumers but their CEOs get golden parachutes. Its time we turn our torches and pitchforks on the failing airline industry.

That CBS clip of Mr. Parker wasn’t very, shall we say, auspicious of a good outcome.

The problem isn’t that American Airlines needs a bail out. The problem is that all the airlines, the entire, global. airline. industry.needs a bail out. And these CEOs that fast tracked billions in company profits to enrich themselves as individuals (buybacks), not to actually build and maintain a business, boo hoo, why shouldn’t they bail themselves out? But again, these same ones want to shift the economic burden onto the middle class- who’re backbone of this industry these ones suffer for the greed and the mistakes of the protected class, time and time again.

There is good debt and then there is bad debt. This is the epitome of bad bad. The airlines and other companies have been raising money any way they can just to burn it.

The Fed and government have enabled and even encouraged this behavior. I have little doubt the airlines are going to get their bailout.

Doug Parker(American Airlines CEO) made $11.5 million in stock gifts in 2019 and about the same in the previous years. If they would just begin taxing this as regular income and close up the tax loopholes for the rich it would stop a lot of this buffoonery.

When Warren Buffet said that there nothing wrong with stock buybacks when used properly he was being disingenuous. The fact of the matter stock buybacks are typically used just to inflate stock prices thereby increasing the executive and board members compensation which is taxed at a lesser rate. There are companies that borrow money to buyback their stock. What idiocy is that? It enriches them while eventually destroying the company.

Buybacks are simply burning cash. This cash could be better used for R & D, acquisitions, even marketing :)

I puzzle when folks think in binary terms of heaven and hell instead of in terms of life, existence and death. It’s the same for race- we won’t necessarily have think in binary racial terms at all when all people finally become aware of who exactly is perpetuating, encouraging and otherwise facilitating the theft of the citizens that live here, and together march on the Eccles building in Washington DC. This article says it all.

Kas-I’d very much like to shake your hand (gloved, at present, natch…).

may we all find a better day.

Obviously, the U.S. no longer requires all of these large airlines.

The world doesn’t need 5,000 carriers or whatever the total is these days. Probably less than 1,000 would suffice.

We need laws not bills lol

“The more numerous the laws, the more corrupt the government”

Tacitus

We sure as hell don’t need more laws. There’s so many now not a lawyer on the planet could know them all. What we need is a revolution and to start from scratch because this country is just plain pathetic. In a capitalist society businesses that can’t survive go under. Let the airlines go under. A new one will buy up there assets.

Randy-in my nearly 70-years listening to my fellow ‘Muricans, “…there oughta be…” or “…why isn’t there…” a law about (fill in blank) is a refrain i can’t remember going a week without hearing at least once. ‘Muricans LOVE laws and pass them frequently. Reviewing/revising/removing them for their current relevance, and effectively respecting and enforcing those on the books, not loved so much…

may we all find a better day.