Illustrated with 13 whiplash-inducing charts.

By Wolf Richter for WOLF STREET.

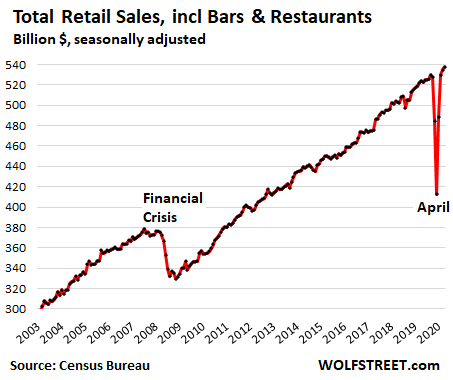

Total retail sales in August inched up by 0.6% from July, to a new record of $538 billion (seasonally adjusted), according to Census Bureau data this morning. It was the second month in a row of only slight upticks, after big bounce-backs in May and June, from the plunge in March and April. Compared to August 2019, total retail sales were up 2.6%, not adjusted for inflation, with large differences in various categories, from restaurants to auto sales, and we’ll get to those in a moment:

Powered by stimulus.

Consumers received the stimulus checks of $1,200 per taxpayer and $500 per child, starting in April, and those who were on state or federal unemployment insurance received the extra $600 a week in federal top-off money, which expired in July, and now many of them are receiving the extra $300 a week that started in August.

But the extra $600 a week and now the extra $300 a week don’t necessarily arrive one check a week. There has been a backlog in processing these claims, and suddenly consumers receive lump-sum payments to cover weeks of claims. For example, California started sending three of the $300-a-week in extra money as $900-lump-sum payments starting on Labor Day. Recipients might not get any unemployment for weeks, and suddenly they get a catch-up payment of thousands of dollars.

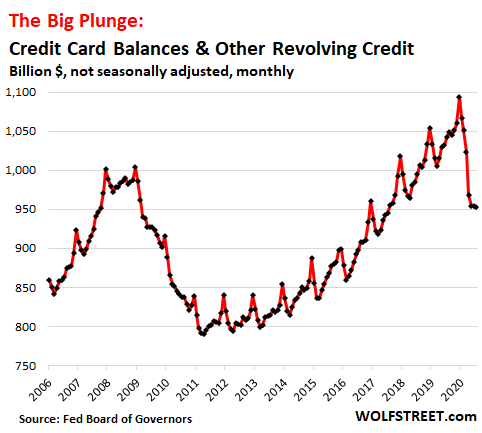

And what did they do with it? Similar to the stimulus money in April, many people used these funds to pay down their credit card balances and other revolving credit, which have dropped by nearly 10% from February through July, including the biggest plunge on record in April when the stimulus checks arrived. Credit card balances are now back to levels first seen in 2008:

People created room on their credit cards and then they spent these funds more or less gradually by charging up their credit cards again.

Other people used these stimulus and extra unemployment funds for down-payments on a car. In addition, this summer few people flew to go on vacation – with air passenger traffic still down about 70% in August from a year ago, and others didn’t go to the dentist and delayed other healthcare spending.

In addition, over 7% of all home mortgages are still in forbearance, and homeowners don’t need to make mortgage payments and can spend that money elsewhere. And eviction bans have given renters some leeway in how to spend their money, shifting some rent payments to retail and other categories.

In other words, the stimulus and extra unemployment money didn’t all get spent in the month during which the government sent it. The spending was spread out over time, and spending priorities shifted in massive ways, and went in bursts, such as sporting goods, some of which then faded.

Retail sales by category.

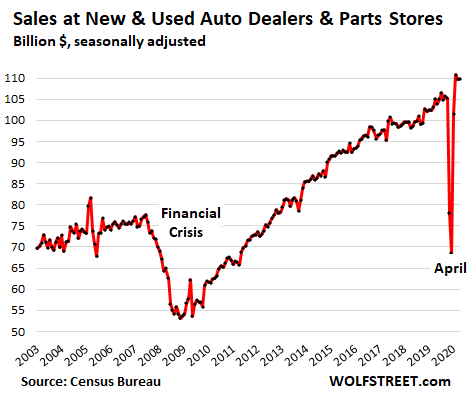

Sales at new & used auto dealers and parts stores were essentially unchanged in August, compared to July, and just a hair off the record in June. At $109.8 billion (seasonally adjusted) the largest category in retail sales, they were up 4.5% from August last year.

These dollar-sales come amid still sharply lower unit sales. In August, new vehicle sales in units were down 15% year-over-year, and used vehicle retail sales in units were down 2%. This disconnect between rising dollar sales and still-down unit sales is driven by two factors:

Price increases that were particularly sharp in used vehicles; and demand for expensive new vehicles, such as higher-end pickups and SUVs. The average transaction price of new vehicles across the industry in August jumped by 7% year-over-year, according to J.D. Power estimates, reflecting price increases and a larger proportion of high-end units in the sales mix, in line with the “K-shaped” recovery:

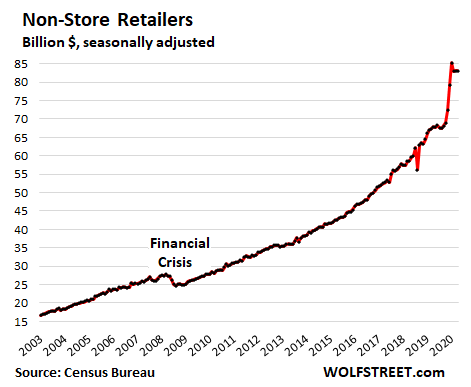

Sales at “Non-Store Retailers” (mostly ecommerce) ticked up a smidgen from July after having spiked during the months when many brick-and-mortar stores were closed, and when consumers switched to ecommerce for items even when stores were open, such as groceries. Sales of $83.1 billion in August (seasonally adjusted), the second highest ever after the record in May, were 22.4% higher than in August last year.

Non-store retailers, the second largest category behind auto and auto-parts sales, overlaps with much of ecommerce but includes other non-store retailers such as mail-order operations, door-to-door sales, and sales at stalls and vending machines:

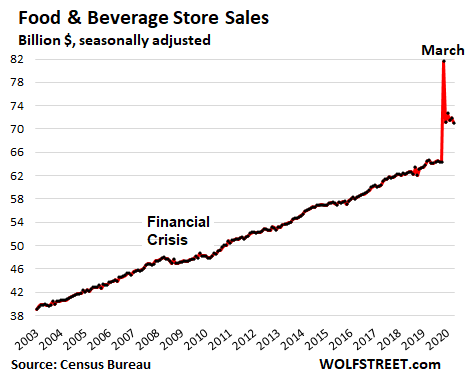

Sales at Food and Beverage Stores fell 1.2% in August from July, to $71.0 billion, continuing to unwind the spike in March ($81.6 billion) that had triggered the “empty shelves” phenomenon. But they were still 10% higher than last year, as much of the spending in restaurants, cafeterias at work and schools, etc., has shifted to the home:

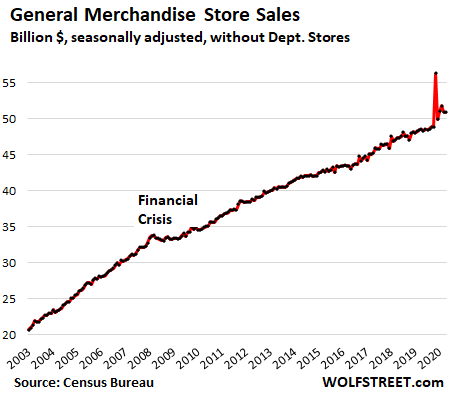

Sales at general merchandise stores (minus department stores) ticked down a tad from July, to $50.9 billion, having unwound most of the 15% spike in March, but were still up 4.9% from a year ago. Walmart and Costco are in this category:

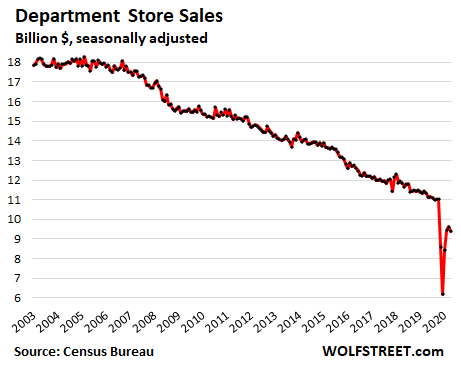

Sales at brick-and-mortar department stores fell 2.3% in August from July, to $9.4 billion, down 16.9% year-over-year, after having declined relentlessly for 20 years. The Pandemic accelerated that process, with numerous chains filing for bankruptcy, and some being liquidated. Even the survivors shed countless stores, abandoning mall after mall because Americans have abandoned department stores. Some department stores, such as Macy’s, have vibrant online sites, but those sales are not included here. This is just brick-and-mortar, a sad sight, having long been obviated by events:

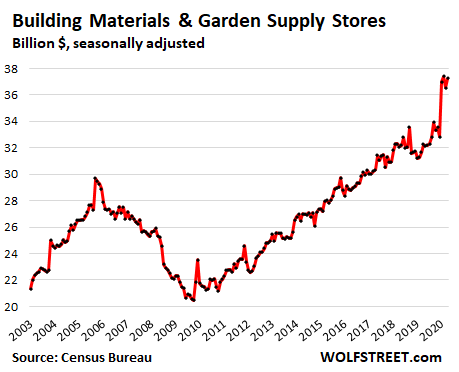

Sales at building materials, garden supply and equipment stores rose 2.0% in August, from July, but remain in the same high range of the past four months, up roughly 15% from a year ago, after having spiked in May. These stores include everything from neighborhood hardware stores to Home Depot. This surge in sales is confirmed by what these types of retailers have reported, and by innumerable stories about homeowners spending money on their homes, particularly decks and backyards, to be enjoyed during their extended staycations:

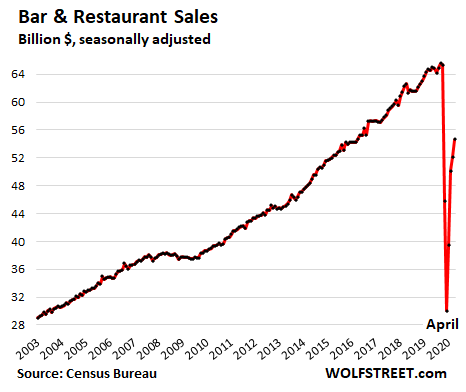

Sales at Restaurants & Bars rose 4.7% in August from July, to $50.9 billion, but were still down 15.4% from a year ago. This includes fast-food places and drive-throughs that never shut down, along with sit-down restaurants, many of which were still only open for outdoor seating, or have not re-opened at all:

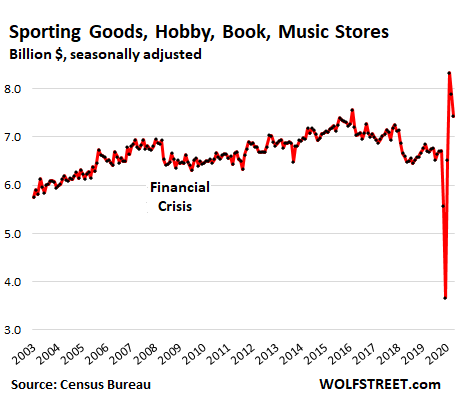

Sales at sporting goods, hobby, book and music stores fell 5.7% in August from July, to $7.4 billion, but were still up 11.1% from a year ago. It was the second month in a row of declines, after they’d gone wild, first collapsing, then spiking. In the months before the Pandemic, sales had fallen below 2007 levels. But suddenly, people bought stationary bikes, actual bicycles, musical instruments, camping gear for their social-distancing vacation, and what not. Stories of shops running out of stuff, such as bicycles, were everywhere:

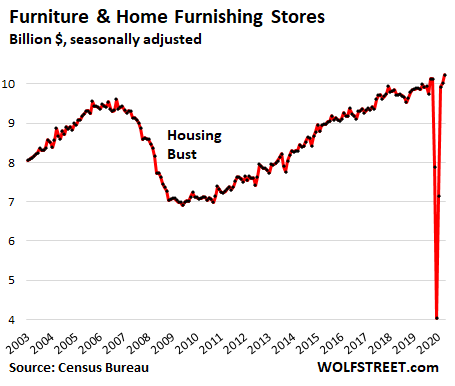

Sales at furniture and home furnishing stores rose 2.1% in August from July, to a record $10.2 billion, up 3.8% year-over-year, after having collapsed in March and April, and then bounced back, as people spruced up their homes and created work-at-home corners and what not:

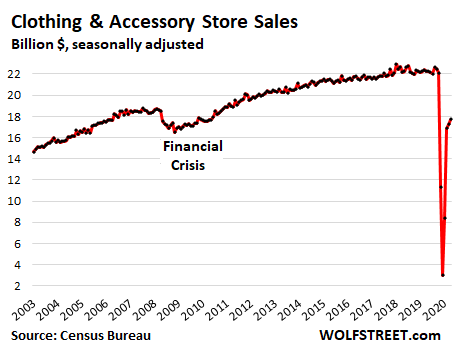

Sales at clothing and accessory stores rose 2.9% in August from July, to $17.7 billion, but were still down 20.4% year-over-year, after an 86% collapse in March and April. People still buy clothes, but much of that business has wandered off to ecommerce sites:

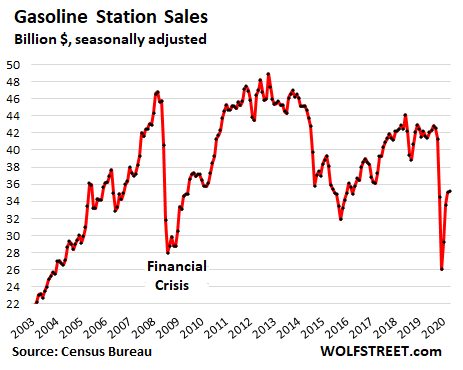

Sales at gas stations inched up 0.4% in August from July, to $35.2 billion, still down 15.4% year-over-year. These sales include junk food, beer, motor oil, coffee, and other stuff people buy at gas stations. Gasoline prices are highly volatile, and a part of the sales movement is due to price changes:

From the retailer’s annual sales point of view. For retailers that got hit during the pandemic, and then recovered, such as furniture stores, the year 2020 is still going to be a down-year. Sales in March, April, May, and June were sharply below the year-ago levels. And without a big over-shoot, those sales lost during those months won’t come back.

For example, furniture store sales set a record in August, but only by a small margin, and not a big overshoot, and year-to-date, sales are still down 11% from the same period last year, and a huge overshoot would be needed in each of the next four months to get even with 2019, and the way it looks now, that’s not going to happen.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Best recession ever.

Best depression ever.

Best deception ever.

Best inception ever.

It’s as busy around here as it’s ever been. High schools are back in session and I saw a big line of school buses on our road this morning as I was headed out to my daily ROMEO meetup group for coffee at 7:00 AM. Walmart is very busy and masks are being worn and enforced. Our local gin mill is still at 50% seating, but it’s full every night (looks like 50% is expanded a few %) LOL.

Traffic is everywhere….and chocked at rush hour. This is 30 miles north of Houston, TX.

Great recession.

The real nightmare hasn’t even begun.

“the real nightmare hasn’t even begun”…I believe this is 100% true. They more “they” postpone and the more games “they” play, the worst it will be. You can only defy gravity so long and we really are on fumes here as there is so much air under this thing. Will make Great Depression look tame in comparison. What a sad, sad chapter in our history. The fallout is unimaginable and whatever it is and shapes it takes , will last at least a decade. Will be much like Wolf’s report on other equity markets around the world that have never recovered. Japan is the most notorious with no recovery in 30 years. The human power of denial is so powerful and frankly, downright disgusting and nauseating.

Trinacria, if we all get lives as good as the Japanese have for the next 30 years that will be fantastic. Stock market falls from bubble highs are no metric for judging quality of life.

Big layoffs of high paying employees incoming. Wonder if we will see an article about the impact of middle-class layoffs here? My friends just had to sell off their dream home purchase after the bread winner lost his job. They bought a modest house they are calling their dream house 2.0 (one they could afford on one salary)

lol, this post is trying way too hard.

They way it’s written about you’d think the stimulus was $100K or something. It was $1200. The median income is $60K. So for the typical person it’s about a week’s pay. And it was in April, and most likely spent in May or June.

Which means its effect on spending in August is probably right around zero.

Just Some Random Guy,

“Which means its effect on spending in August is probably right around zero.”

???

The stimulus payment was $1,200 per adult, plus $500 per kid, with some limitations. Median HOUSEHOLD income is about 60K. Median household = 2.6 people. So that stimulus money per household is closer to $3k. There are 128 million households: if 80% received $3K = $310 billion.

Plus the $600 a week for the tens of millions of people claiming unemployment, which YOU yourself have harped on for months, and now the $300 a week. Through July 31, the extra $600/week that has been paid out amounted to $250 billion.

So: $310 billion stimulus plus $250 billion of $600/week through July = $560 billion.

This does not include the $600/week payments paid out late in August. And it doesn’t include the $300/week paid out in some states in August.

Total retail sales over the past 5 months = $2.5 trillion. Over the same period, $560-plus billion in total stimulus was paid out = 22% of total retail sales.

As I said in the article, supported by credit card data, people used part of this money to pay down their credit cards in April and May so that they had additional spending power later.

You see, the magnitude of the stimulus was HUGE. And it is getting spread out over months, and will continue, via the function of having paid down credit card balances in April and May.

This also doesn’t account for spending that shifted from some services, such as travel and lodging, to retail spending, or the spending that shifted from making mortgage payments (in forbearance) to buying stuff. Etc.

Some eligible for the stimulus check in April have still to get it because the govt didn’t have their details. There was a deadline given by the IRS about this money recently. Some of them are people who didn’t have to file in 2018 or 2019.

You see it all wrong. 60K minus taxes, minus rent, minus car payments, minus insurance, minus student loans, minus credit card debts, minus food, minus utilities and internet, minus iPhone installments, minus dog food. Before you know it you have $1200 saved for the year. Then they double your money. Now don’t forget sales tax.

Just Some Random Guy:

Well, it wasn’t 100k, but in the case of our household, it has amounted to about $14,000 above ‘normal’. My retired wife taught a part time class at the local senior center 2 nights/wk for pocket money and social interaction. Paid her around $400/mo.

Center closed (still closed), so what the heck….she applied for unemployment, since it was now open to independent contractors (which she was…..1099’ed at year end). She got the State minimum UnEmployment of $120/wk + the additional 600/wk, starting 1st of April. Plus we got the stimulus $2400 for both of us that month.

April: $2880 (UE) + $2400

May $2880 (UE)

June $2880 (UE)

July $3600 (UE x 5wks in July)

Aug $480 (UE x 4wks @ 120….the $600 dropped off)

$900 (lump payment of the Trump $300/wk x 3wks)

Sept $240 (UE x 2wks) + $300 one week

Today is the payment date to hit our checking account, so not sure what it will bring yet. Payment posts around noon.

Add all that up and it amounts to over $16,000 income versus the approximately $1800 she would have gotten (paid per head of those attending her classes), for a gain of over 14k over ‘normal’. This is also over and above her pension payments (retired teacher), and both our social security payments.

We had no debt to pay off, so it has gotten spent on gold (because clearly this stupid stuff can’t keep going) and additional solar panels to expand our home power system.

And I won millions a few years back in the lottery. So ur wife’s pittance isn’t even worth mentioning.

Loser.

“So ur wife’s pittance isn’t even worth mentioning.”

maybe not to you, mr. fancypants lottery winner. to lots of us out here in the real world, an extra $14K would be a godsend. i have managed to stay employed throughout the pandemic. i worked from home for a bit. my hours were cut, etc.

in a nutshell, i was one of the lucky ones.

i would have made more money from the $600 per week than i take home from full-time work at my current job, let alone any state benefits. yet i find it hard to disparage someone who plays by the rules and benefits from the system, at least on the small scale.

as to the bezos types who have profited immensely as the joe/jane mainstreet crowd suffers, i can disparage til the cows come home.

Jj: I’ve made it a point to never play games for the math challenged. Assuming you actually won millions….and frankly the odds are you are simply lying….how much do you have left ?

The typical “winner” is broke within in a few years because the same stupid thinking that caused them to be one of the “This NEVER happens to people like us” also carries over to their lack of money skills in handling a windfall.

Why bother commenting something so brainless like this? Are you that thicc?

Every day is leg day for JSRG.

I disagree, the effect on spending is not going to be dollar to dollar with what they received.

Free money has a psychological effect on people. So does the depression of being cooped up in their homes. Both those things often spur manic behavior.

People do not spend what they earn, or what they have, they purchase on credit, taking on new debt based on their confidence levels.

The free money gave many people a false sense of confidence, and for some even a feeling of euphoria, causing manic behavior, that lasted even after the money was spent. Especially those who were experiencing a windfall by earning more on unemployment than they ever did working.

There was no stimulus cash. Nominal sales sales are irrelevant, I suspect this number will be revised down and there will be no real gains by the end of the year. September is almost definitely a contraction. That 300 dollars is mythical. No state is releasing it persistantly and they frankly, can’t.

I agree. .2% increase was lower than the .3% increase from last year……..how about that????? YrY is 1.6%.

Many Californians have already received $900 (3 weeks of $300). As have many people in other states.

Just a crazy thought here.

If the US pump in more fiscal stimulus, one would assume that this would still be backed by more moratorium on rent and forbearance for mortgage.

But doesn’t that fiscal stimulus just end up going into assets of any type. Whether its crazy Robinhood traders pumping up stock, to those people who just buy more iPhones and such. (ok, probably not in CA, but elsewhere) This would keep propping up the stock market in conjunction with the crazy Fed action?

It won’t last forever, but it won’t stop either

The unemployed in Az got 5 weeks. It has ended now.

Somebody I know got his 5th $300 payment this week, he doesn’t know when the next one is coming.

Bobby Dents:

Wife got a $900 lump in August and one $300 in Sept (so far) in addition to the normal unemployment amount.

The real BIG picture will emerge in Mid January 2021!

Until then DATA chaos with claims of economy going north or south!

Fed’s Powell today was cluless re growth and expectation of inflation, going forward. All he promised was ‘ More printing’ ahead!

As the total debt increases, Velocity will go down and so does the growth rate. The inflection was starting from 2000!

Eh, I didn’t get that from Powell at all. He looks a little flabbergasted on the rehires, which he didn’t expect so fast. Looks like a “flat” Fed until next year.

One result of the massive transfers was the paying down of debt.

1) NDX & SPX log RSI lines : Mar 23 low to Sept 9 close.

2) Today, both NDX &SPX breached this line.

3) Until both NDX & SPX produce big red HQ supply bars, on high volume, the trend is still up.

You are forgetting this is a leap year. Shift all your charts 6 degrees. You gonna see big red bars like starting tomorrow

Remember Wolf, real sales prelim were only up .2% and ex-auto/gas they fell. I suspect August was the top for the latter 2. Year over year retail sales even fell a tick. I don’t pay attention much to nominal sales.

Looks like real yearly retail sales will average about 1% in 2020.

With so much liquidity around it will take something huge to stop the party.

Not sure what that event could be.

Bulls still in the driving seat.

Looks like a correction has already started. There isn’t that much liquidity left. These things go in waves.

“These things go in waves” ..

Everyone should be on the lookout for a Tsunami .. might even catch a glimpse of Warren getting buffeted on the rocky shoals.

What is liquidity, debt, that’s their way of saying debt, there is limited supply of Dollars, or whatever currency ya talking about, I never have seen a loan with no repayments, even though the policies recently would suggest that’s possible, the party has already ended, it’s just people haven’t realised yet, like being happily asleep breathing carbon manoxide from a leaking pipe or boiler, ya can’t smell it, taste it, see it or feel it, ya just not waking up in the morning, that’s society today, they believe those clever people at the top wouldn’t lie, of course we all know they paid for their degrees, masters & doctorats, they are dumb as can be, anyway that’s all liquidity is, debt, banks wont lend cuz no one can pay it back & most are up to their eyeballs in debt, so like I said the party is well & truely over, just a short while and people will have to start paying up & getting repossessed & evicted, the markets collapse.

you sound like a verbose version of “dandy” don meredith on monday night football back in the day. well done!

Here in Western Oregon the wild fire smoke is so bad that even the garbage men are taking the week off. Just got notice that there would be no garbage service for the next week where I live. Went in for an annual checkup today. Big medical office complex shares the parking lot with a big hospital. Parking lot was only 20% full. Medical business is in the dumper too.

Medical “business”….business it is.

No rent payments, no mortgage payments, $1200 cheaque, $500 per child, $600 a week, $2400 a month on top of unemployment, 3 trillion stimulus, not a surprise really, just give it a few months to see the bodies, anyone can raise debt by 3 trillion, pause trillions in payments & say recovery, they can’t do stimulus for long, if ever, banks will have to be paid, they will have a tsunami of defaults, once people get the taste for free money & no bills they never wanna pay, it’s sad this manipulation is going on, anything but reality?? This will make it it many times worse, like not getting checked early enough & then finding out it’s cancer, these policies are for one reason, election, the price will be very high, for many ruiness, this attitude of sweeping things under the rug reallt does stink, the economy is dead, the free market is dead, the collapse of these markets is coming, people should prepare, very hard times come not cuz people want them, very hard times come cuz people refuse to face reality until reality smacks them in the mouth, to any untrained eye the number look good, to the trained realists, they know it would have been better to seen a crash and flatline with debts reduced and no missed payments, kind of pathetic with Powell today spitting so much of nothing, bullshit basically he has to clear his throat twice every sentance, tool box, plenty of tools, yeah ok, the only tool they have is bluffing & propaganda.

Spot on.

Listened to Powell today – the only new thing I heard was that he “was not saying that the bubble popping is not impossible”

I noticed the futures spiked down when Powell said he currently had no long end treasury curve purchase plan (which would inflate stocks even harder) and also when he stated “Lending powers are not spending powers”. Today was not the best bluff for Powell, although another denial of creating inequality was good for a chuckle. Makes me wonder if he is getting concerned about markets going higher from here, as he could have said a few things slightly different that would have put markets up 1-2% today instead of markets going down. I’d be nervous too if I were J-Pow, as the next 2-6 months could be extraordinarily volatile…

Almost on every chart, up or down, the last x3 dots are shortening the thrust. Credit cards balance under 2009 high is a spring.

Wolf, I am a huge fan of your blog. Apologies for trying to stay anonymous. Two blog posts ago you wrote: “There are solutions, as Tharman Shanmugaratnam pointed out, but they’re more complex to implement and don’t involve the ever so convenient printing press.” What are they? I cannot find any constructive solutions that seem credible. This appears to be one of the biggest questions of our age: how to get out of the hole we’re all keep digging further into. As long as their is not a credible path forward that does not involve a huge depression with uncertain outcomes, digging further seems to be the only path ahead.

“You’re going to need fiscal reforms, not simply cutting down on spending, but quality spending and ways of raising revenue that don’t dent growth”: Tharman.

He also said that governments must incentivize private investments to increase productivity growth. That’s a huge issue in the US, where corporate investment is focused on share repurchases, M&A, and offshoring production.

Tharman said all that but no doubt both GIC and Temasek are invested in US equities. Are they investing in Singapore’s private sectors? The later’s also throwing a ton of money into Singapore Airlines. Now, don’t get me wrong, I love flying Singapore Airlines, but creating and supporting an airline with ZERO domestic market is probably the ultimate folly.

Places like Singapore and Hong Kong (to a very similar extent with Cathay) are always going to face those problems. Singapore Airlines’ legacy stretches decades back so foreseeing a Covid-like situation wasn’t quite on the books then. That said, yes, this would probably be the biggest existential crisis for such airlines to date.

And yes of course the sovereign wealth funds there invest in the US markets (not always terribly intelligently). They also have other political obligations that might influence investment decisions.

Similar to the airline situation, the domestic industries aren’t ever gonna have as much of a domestic market AO island financial centers are always tied to global fluctuations.

Temasek is invested in domestic firms through government linked corporations (state owned enterprises lite) and some venture funds. Uneven effects to say the least, including the government linked firms having market dominance in a small market. There is only so much pie to go around and this world is for neoliberal trickle UP economics.

The country is falling apart and the crooks in congress still think it’s their money. Hurricane Sally caused a bridge collapse in Pensacola, FL and all they got was rain.

Us infrastructure is simply wearing out and the governments are “investing” in pensions instead of maintenance.

Wolf, I believe the US along with so many other nations are in such a bad “checkmate” situation now, and it is politically impossible to get anything of real substance accomplished. The mountains of debt, both on balance sheet and off, are just too big. No party, no politician will want to be the bad guy. We are simply way, way, way beyond our means in everything, and the party rages on. This is like that lousy “B” movie where there is a runaway train carrying nukes…but in this story, no one stops the train…. -:( More important than ever now to gird one’s loins !!! PS: just out of curiosity, why is it that you don’t seem to talk much about gold and silver ?

Gold & silver? Apparently Wolf tries to keep religious discussion off this website. Except for Frederik who is cool about it. We thank him for that.

In the USA the government is owned by the corporations and billionaires. There won’t be any reform until the peasants revolt. UBI will keep the peasants placated on life support. It’s the American way! (TM)

1.Harvard did a study and found everything medical in the US is the most expensive in the world. It has also been alleged that over 200 billion is wasted. How can you charge ten times the Canadian price for insulin when you get it from China?

Don’t know if this includes the waste of the most valuable time: the MD s as they spend hours fencing with insurers about what is covered.

2. We all want a robust US military ( even a Canadian!) but with spending more than the next 5 countries combined, there should be room to save. Note: it happens a lot in the US especially to the Navy that it says it doesn’t want something ( e.g. Sea Wolf sub) but politicians force it to because the work will go in their district.

3. This may get some blow back, but via the ZH Enquirer, originally in Forbes, the public sector salaries in San Francisco are insane. (I assume it is not unique but ZH listed a bunch of SF’s)

One that stuck out was a sheriff getting over 300 K. IN OVERTIME. His base was around 200 K . So you could hire one more at 150, solve the OT.

There were 19,000 employees getting over 150K

Total comp was 5 billion.

This is back on Sept 3 but if you enter Zero Hedge San Francisco Public Sector salaries it pops up. To repeat, I’m sure SF is not unique but it may be a poster child.

Well,I think its safe to say that the Generation’s old and Propagandized habit of “Shop until you drop” mentality is finally being even further weaned by ‘Pandemic’ issues and it’s related economic forces. However,the more things change,the more they remain the same..since just as Netflix is nothing more than an Internet Theater,Amazon and its related online ilk,are nothing more than internet department stores…aloha amigos

In other words, ordinary people are stubbornly sane and sensible, while governments are utterly insane and murderous.

Yup. Winter is coming.

We’ll see how outdoor dining works in Boston, Chicago, etc. in December.

Not often I am in the main stream demographic. The only thing I feel certain about is that there will be shortages far worse than in the first month of the pandemic. There will inflation in utility prices.

When you look around, especially if you peel back the layers a little, there is destruction everywhere; yet we keep whistling by the graveyard…either this is the recession that will never arrive, or “we” have done one heck of a job of covering up. Once has to wonder when the debt will finally matter. Tired of this sword of Damocles crap!!??

With 29 million unemployed (not counting their families) and little physical production (Things made to sell) in the U.S., the economy figures now have to be all about stimulus and printed money. Eventually, nothing comes from nothing even in the land of the world’s reserve currency.

Where will even 5 million unemployed people find work now? Corporations are set to lay-off en masse soon. This is not pretty.

Exactly…with 29 million unemployed, how is this happening??? Is everyone else crazy and throwing caution to the wind? Or, am I the crazy one for being careful and having a very comfortable nest egg? But, but, but… I could not sleep at night if I lived on the edge as tens of millions seem to do; at least that is what I get from reading through the lines in this article. I could not believe the chart of the furniture sales, so called bigger ticket items. Man, I just can’t wrap my head around this. That old European immigrant thing is hard to shake. Wolf is right…not only whiplash…I’m getting vertigo and had to go lie down !!!

Trinacria, you must have really enjoyed the stock market’s ascent to nosebleed-er levels these past few months and news of record sales of Laptops, smartphones, peloton bikes and treadmills and home renovation materials and services then.

Sure seemed surreal or at the very least truly a K shaped recovery. And punishment for the prudent continues apace.

Not bad, the stable dividend payers did ok, but still keep sell stops on them. But I did enjoy the move in gold and silver and related mining shares as well.

Isn’t this Friday “Big Friday”?

Major employers need to give their employees two weeks notice for a layoff. Two weeks from this Friday will be two days past the end of September 30th. Friday might be an ugly day for a few people.

Thanks for the heads-up!

That’s for businesses with over 500 employees, kept on the payroll until September 30, so that they can keep their PPP loan money as a grant.

“Small businesses” under 500 employees, had the exact same situation, with the last day to keep employees on the payroll June 30th. Wonder how that affected July numbers?

I figured it out. In the post 2008 world most money is loaned in to existence or given out straight away. Most jobs are just ways to redirect credit created funds to the peasants. But as we have learned in Wolf’s charts jobs just get in the way of spending money. The fewer jobs, the faster and easier spending can take place. Onward and upward to utopia with zero jobs and infinite GDP.

Thank you for your excellent articles; but wolf, the Y-axis in the second chart (credit card balances) is based on billion $, not trillion $.

Thanks. Getting too used to the trillions flying by here at the shop :-]

After reading WS comments all week I’m picking up some more paper towels this Friday. :-) Towels lead to Powell, who said today that interest rates will be kept to near zero for many years to come. This means RE prices will undoubtedly stay high and personal/corporate debt will continue to power the economy.

Until it doesn’t. If the dollar continues to lose strength interest rates will be forced to climb and the so-called economy will tank. I think…..

Low interest rates won’t be enough to keep the housing market upward if people are unemployed, Unless they start issuing mortgage on unemployment benefits and keep the forbearance going for another couple of years or so.

Paulo – always carry a towel, and “Don’t Panic.”

The import container counts for the Ports of Los Angeles and Long Beach improved month-over-month and not only is well into expansion year-over-year but is also at record high levels.

Best recession ever continues. We should all be thanking China for introducing the virus while continuing to send us stuff.

Can we have another virus tomorrow?

China needs to send us stuff because we don’t make much of it here anymore.

But if I work at Walmart and my neighbor works at KMart, we can shop in each other’s store and buy things from each other. Presto! Jobs, buying things, WM & KM make money, production for China….everyone wins.

No one’s denying it, and if there’s another virus tomorrow, stimulus money will double and we can buy double the things from one another.

Here’s something you won’t see in any chart. In the last few months, I have noticed many McMansions with builtin 3 car garages, who have built an additional detach garage. Some of these homes have 3, 4, or 5 cars in their driveways or on their properties. These garages are not for an RV or boat, they are regular additional garages. Looks like the kids or parents have come for an extended stay.

Have you ever seen inside those 3-4 car garages of McMansions?

Maybe space for 1-2 cars (mandatory “mommy missile” parking),

Stuff racked & stacked (in color coordinated storage bins) to the ceiling with carryover’s from ‘Afluenza’ here in Intel/Nike ‘hood. Seems Fedex/Amazon prime delivering 24/7.

Very few neighbors work from home. 50% are retirees.

50% of millenials are now living at home with parents or grandparents, thanks to this BOOMING economy.

Sign of the times,huh?

What really gets me is watching the area where I live change over the past 25 years or so and especially in the last 10.

You used to see the nice cars parked in the driveways with the ‘work truck’ telling you that the person was one of those rich electricians, bricklayers, or plumbers here.

Now you see the fancy cars in the driveways and on the streets and many of them have no work truck.

You also see the yard a mess and grass not cut, but A$300,000 or more of cars sitting in front of those 7 figure houses. Couldn’t they hire somebody to at least do the yard work?

It is fun to play the guessing game and wonder what kind of car(s) the new neighbours will be driving…………..

Still waiting see what the latest new Chinese neighbour has………….the previous owner that sold had an X5, a couple of Mercs, and a couple of ‘work trucks’……………..

But one neighbour must be hurting as the wife works in real esate and her AMG is gone though…………the plumber a couple of houses down the street must be doing great as there is new sports car there though………

And speaking of cars, the price of used cars here has exploded:

“Australians are driving up the price of used cars at record rates, taking advantage of the cheapest petrol prices in two decades and big incentives for businesses buying equipment and vehicles amid health fears about using public transport.

While new car sales have dived, demand for used vehicles is now so high prices for second-hand cars have jumped 25 per cent above what they were in August 2019 according to Moody’s Analytics data, which tracks transactions at car marketplace Pickles.”

So if and when the government here stops paying 100% of the cost for childcare and these new ‘used’ car prices get factored into the data along with the upcoming increase in tobacco taxes, we may get a nasty case of an increase inthe inflation measures.

It will be worse if the weather turns to crap too.

When I drive through the “poor” neighborhoods (the flipping prices on some of these ratty houses in Denver area the last 3 years basically disqualify any neighborhood from being poor) that’s where I see all the work trucks. The nicer the neighborhood, the fewer the trucks, other than a few pristine shiny masculinity boosters. The middle middle class neighborhoods have some work trucks probably higher paid tradesmen or dual income of equal heft. Very few people are getting rich by getting their hands dirty. Maybe you’re seeing the project managers’ or superintendents’ trucks.

Nevermind Lee, you’re Australian. Maybe they pay tradesmen decently in your country. Increasingly it is thought of as low skilled work for dumb people here. Back in the day I heard too many project managers say as much, and constantly be pissed about paying wages. Plenty of clueless beggars were willing to work for low pay though. Then they (the managers) would wonder why things kept getting screwed up. All the smart people were already gone after they decided not to put up with it. The trades here are a mess these days. I still miss laughing my ass off at the stuff some people would do and say though, it was good for something at least. At the current job people are intelligent and sane but boring.

In Oz, the magical land, those trades people with their tickets easily pull down 6 figure incomes or more.

If they have an apprentice or two then the numbers are even bigger.

Can’t remember the figures exactly, but most of those trades are getting well north of A$80 an hour and that was three or four years ago.

During the last big building boom here bricklayers were pulling in more than GP’s.

And if you look at the big projects done with union work here in Victoria, the pay will be even more. Unskilled manual labor at most of those jobs are pulling in $A125,000 – $150,000 a year. Skilled workers were getting A$250,000 a year.

Same type of system at the car dealers.

The big name car dealers here charge something like A$125 or so or more an hour for billed work. They put an apprentice on the job and pay them anywhere between $A8 – $20 an hour to do the work.

As a tradesman, my biggest bane were engineers who knew nothing about building. I won’t go into it here.

Anyway, this tradesman retired at 57. My tradesman son earns 200K per year as an industrial electrician. When Covid hit he stayed away working and earned enough extra for a down payment for a second home. It took him 5 months. He currently rents his primary residence out and plans to have a suite for himself in his new place and rent the main house out to pay the mortgage. He’s 36.

The point of this is that parents bought into the ‘have to go to university’ meme, hook, line and sinker. It is the main reason for the education and student loan racket. There is absolutely nothing wrong with working with your hands and brain at the same time, and no greater feeling than seeing a family enjoy a house you built for them. Not only do trades pay well in Canada, your skills are portable and you have many more options than people who are forced to work for an organization.

I thought my son’s college education–my ex-wife and I paid his tuition (he got a generic ‘business’ degree)–was a waste, until it got him into Navy OCS and his commission as an ensign. I see so little opportunity these days for most young people without a STEM degree that this was a blessing (he’s on one of the ships the news shows sailing around Taiwan, poking the Chinese in the eye).

Just came back from downtown Seattle

It’s not a city under siege but boy was I wide eyed at the sparse traffic downtown at 1:30 pm in the afternoon. The tourist area on the wharf walk was sparser yet. Fastest drive I ever had to get down the hill from broadway to the ferry. The smoke is still terrible. The ferry was totally encased in dense impenetrable smoke fog. My brother in the Columbia gorge has had his company shut down for days and his top supplier in Oregon was evacuated. Don’t know if they started back up yet. We in Sequim had a 260 air quality reading , Portland and in the gorge was plus 450. My other brother in Spokane hit 499

Yah winter is coming

The charts posted look unreal, but I do understand the points made; paying down debt and the spending coming from non-travelers, stay at home jobs….with all that “slush” money coming in. Then if things get real tough again loading those credit cards with that “empty” spending space…..

But, won’t the airlines begin their lay-offs in October??

I just can’t believe that with all the real economic damage done to so many tens of thousands of businesses that everything will be “hunky-dory”!

(And, I don’t imply that your posts Mr. Richter say that; not at all!)

On another note the skies here in the foothills of the Sierras are just now beginning to “clear up”. No blue skies yet but hopefully coming. It’s been a nightmare since beginning of August……Stay safe and healthy!

Speaking of stocks, Shopify dropped below 900 breaking resistance. I am guessing we’ll begin to see a reasonable stock market correction soon.

And now for the latest official government BS figures out of Australia.

I think I’ve commented on the way the government here comes up with the figures and stated that the methodology is total and complete 100% B>>> S>>>.

So earlier today the numbers were released and instead of an expected fall in employment and an increase in the unemployment rate……………..fell!!!!!!!!!!!!

The rate actually fell from 6.5% to 6.8%.

And the report included this little bit of information:

“The labour force includes the total number of employed and unemployed people. Between July and August the labour force increased by 24,500 people (0.2%) to 13,505,200. Over the past year the labour force decreased by 1.0%, while the total civilian population aged 15 years and over increased by 1.2%.”

Something stinks to high heaven here.

Fat fingers at work:

“The rate actually fell from 6.5% to 6.8%.” should be

“The rate actually fell from 7.5% to 6.8%.”

Wolf,

You wrote music stores, what are those? Is it like Starbucks, because they sell CD… ha ha ha ha.

MCH,

Stores that sell musical instruments and related products, like the Guitar Center on Van Ness here in San Francisco. There used to be a small piano store on Columbus here, but it closed. I’m not big into musical instruments, so I don’t know all the stores around here, but those are the ones I see/saw a lot.

When I look at the stimulus payments, extra unemployment etc it is just a stealth way to get helicopter money out and into the public’s hot little hands.

It is hard for the FED to straight up come out and say they are going to print Dolivars and hand them out without everybody suddenly looking sideways at the unsterilized monetary debasement and dumping the dollar.

Unfortunately that is not a great option at the moment for the rest of the world but the end is coming in ditching the SWIFT payment system and embracing the emerging BRICS system.

Time will tell I guess, it all comes out eventually.

It’s my understanding the BRICS system settles in Euros and gold, which means these guys don’t trust each other or their currencies.

The Euro is no alternative. Sooner or later, the European Union runs out of german money, to paraphrase Margaret Thatcher. And that will be the end of that monetary union.