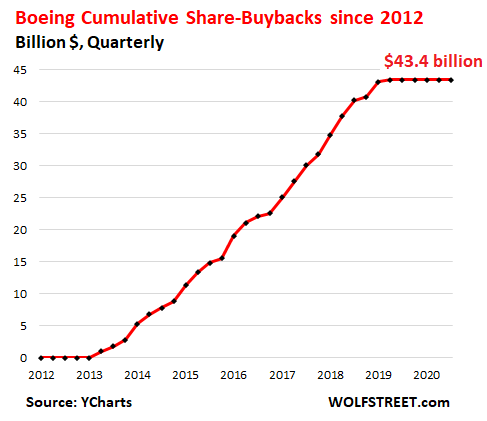

$43 billion incinerated on Share Buybacks since 2012 to manipulate up the share price would come in handy now. Shares -60% since June 2019.

By Wolf Richter for WOLF STREET:

“We anticipate a workforce of about 130,000 employees by the end of 2021,” Boeing’s CEO Dave Calhoun told employees in a staff note. At the beginning of 2020, Boeing had 160,000 employees. This would mean a reduction of 30,000 employees. About 19,000 job cuts are already expected for 2020. So Boeing added 11,000 cuts to those expectations.

The 737 Max, the misbegotten plane on which Boeing staked so much before two of them crashed, is still not flying. It has been grounded since March 2019, and the time when it was supposed to fly again keeps getting pushed out. Today Calhoun told CNBC in an interview that the company, in terms of getting the plane back into the air, was “getting very close to the finish line.”

“The Max has cost us a lot of money, and we’ve had to sort of up the ante with respect to liquidity to make up for the fact that we couldn’t ship the world’s most popular airplane,” he said. “Most popular” with whom, exactly?

Then came the Pandemic which clobbered the airlines as passenger traffic collapsed. Currently, air passenger traffic in the US is still down around 63% compared to a year ago, according to TSA checkpoint screenings. And airlines, which are in their own fight for survival, stopped ordering planes, cancelled what orders could be cancelled, and are in negotiations with aircraft makers to cancel more planes. Airlines really don’t need more planes of any kind at the moment. About $16 billion in new and grounded 737 Max planes are cluttering up storage lots at Boeing, awaiting delivery.

It is in this environment that Boeing reported third quarter results today:

Total revenues in Q3: -29% to $14.1 billion. First 9 months of 2020: -27% to $42.8 billion. Including:

- Commercial airplanes revenue: -56% to $3.60 billion in Q3; first 9 months in 2020: -54% to $11.4 billion.

- Global services revenue: -21% to $3.69 billion.

- Defense, space, and security revenue: -2% to $6.85 billion, now dwarfing commercial airplanes revenues.

Net loss: $466 million, or $0.79 per share. Year-to-date net loss: $3.5 billion; 12-month net loss: $4.5 billion.

Free cash flow: -$5.1 billion in Q3; -$15.4 billion in 2020 year-to-date; -$18.1 billion for the 12-month period; -$22 billion since Q1 2019 when the 737 Max fiasco took off, so to speak, with the grounding of the plane. A billion here and a billion there, and pretty soon….

Cash burn: In Q3, it burned through $5.3 billion in cash and marketable securities.

Total debt: $61 billion, up from $27.3 billion at the end of 2019. In other words, Boeing added $33.7 billion in new debt to survive this crisis and have lots of cash to burn through. This was what the Fed had in mind when it created the biggest bond market bubble and credit market bubble in history, sending investors chasing after any and all yields, and making it easy for companies such as Boeing to raise money (the Fed itself bought only a minuscule $15.8 million in Boeing bonds).

Remaining cash on hand: It still has $27.1 billion in cash and marketable securities, good to go for a while longer at this cash-burn rate.

Deliveries of commercial airplanes: 28 planes in Q3, down from 62 a year ago. Year-to-date: 98 planes, down from 301 planes a year ago.

Negative net orders: Due to cancellations so far this year, Boeing lost a net 381 orders for commercial airplanes.

Brilliant future. Boeing said in its presentation that it expects passenger traffic to “return to 2019 levels” in about three years, and a “return to long-term trend a few years thereafter,” which would be closing in on the end of the decade. That’s passenger traffic. Demand for aircraft, according to Boeing’s estimates, would continue to get hit for a decade.

The unlocked shareholder value. Over the past nine months, Boeing racked up $33.7 billion in additional debt to first borrow its way out of the 737 Max crisis and then out of the Pandemic crisis. Alas, from 2013 through 2019, Boeing blew, wasted, and incinerated $43.3 billion in cash on share buybacks to “unlock shareholder value,” as Wall Street likes to call it, in other words, to manipulate up the price of its own shares until the liquidity crisis from the 737 Max fiasco forced Boeing to stop the practice in Q2 2019. Since then, its shares have plunged by about 60%, unlocking shareholder value, so to speak. At the moment, Boeing shares [BA] are down a little over 3%, roughly in line with the market (data via YCHARTS):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

And the Chinese are threatening sanctions against anyone selling arms to Taiwan…

big deal

let them all go bankrupt

and then move defense industry into new company with new management/shareholders – call it IPO of sorts

NO MORE BAILOUTS NEEDED

then provide $25,000 for re-training to each unemployed worker

And what, pray tell, are they going to be retrained” to do?

Lets start a school to train ‘retrainers’. Who can train the ‘retrainers” when they lose their jobs due to the fact that there are no jobs to retrain for.

IOW, a gigantic Circle Jerk. That pretty well describes the country as a whole.

RepubAnon,

There are only 2 companies in the world currently capable of making large planes like the Boeing 777. China has very little leverage, and it’s evaporating quickly, especially, in the face of their large food shortage this year. Sanctiions against Boeing are not a significant threat. Though china running out of money and not being able to afford new planes will cause them to shrink further.

The 737 Max and 787 are flying coffins.

Boeing Execs strategy:

Wreck 787 business (check)

Wreck 777 business (check)

Wreck 737 business (check)

Wreck Military business (tbd)

Wreck Space business (tbd)

Too bad the shareholders can’t claw back the $million dollar pensions of all these Boeing execs!!!

But they saved a bunch of money hiring $9 HR programmers from India!

Petunias, +100!

They must have one senior guy to go over it? You don’t just hire a bunch of gypos and not check their work?

And there are the secondary effects too.

Raytheon Technology (merger of Raytheon and United Technologies) is planning a lay off of 20,000 workers (up from 15,000 projected earlier) primarily in the commercial aviation sector (United Technologies). They build jet engines and other aircraft tech.

The only bailout the Boeing execs should receive is a nice jail cell with three squares a day and a spot on the prison horse shoe team.

I’d reduce that to 2 cold squares a day and no rec time. Though, they really deserve only the harshest gulags.

Boeing is a microcosm for our entire economy.

The 737 Max was aerodynamically unstable due to the necessity to change engine positions from the original position on the 737.

So instead of scraping the design because it was fundamentally flawed, they decided to put a flawed design in the air with complicated software that would compensate for its dangerous design.

The bottom line is no matter what you are dealing with, if you do not have a solid foundation upon which to build, at some point the end product is going to malfunction. Our technology is really not good enough to make unstable airplanes fly, to make cars drive themselves, or to deny the laws of mathematics, human nature, and the business cycle, without eventual disaster.

@Brady

Right! But they gave themselves great big bonuses on account of all the money they saved by hiring illiterate Software Engineers from Goatroapistan.

In the words of ‘old perfesser’ Casey Stengel about the early NY Mets: “…doesn’t ANYONE here know how to play this game???”.

may we all find a better day.

this is for Petunia and at first i thought it was wrong to try and tack this on here so early, on a seemingly unrelated subject. / but i’m not yet sure it’s unrelated:

Petunia:

i went to the gym in my superhero kitty pants in hi vis yellow accents, and ran into trader joe’s with my bicycle and crazy vest on instead of locking things up and putting the vest away and going incognito as whatever i am. / i had only a few things to get and it takes longer to lock my bike up than shop for a month’s of groceries. (my leather seat got stolen once and i had to ride with a fully loaded bike up little hills without sitting down and buggering myself on the stem).

getting just a handful of things, i made people so happy just in how i looked (all that was different was the vest), and one young girl ran up to me and asked if i was in the ROLLERDERBY!

i felt punched in the stomach, just like when i read the title of this Wolf article and skimmed it for the eviscera, but punched in a GREAT way. i said, “girl? what is your NAME?”

Jola pronounced Yola.

i bowed before her and screamed, “JOLA I AM 53 AND THAT IS THE BEST COMPLIMENT I HAVE EVER GOTTEN IN MY ENTIRE LIFE!!!!”

and then i go outside and a woman about 10 years older than me smiled and came up to me and asked how far i needed to take all the groceries (another older woman weeks earlier once offered to DRIVE MY GROCERIES home with me following, because she wanted to help me out!), and this woman got bouncy and raised her fist and turned to go.

i was almost safely gone from the helmet part, til she whirled back around on her foot and asked if i had a helmet… of course? i said no, my big hair was warning enough that i was big enough to do serious front end buck damage to someone’s car.

i got lectured for 5 minutes and by the end of it, i wasn’t so swaggery and cool anymore. i felt 8 years old.

point is… I’M STILL BROKE BUT I SUCCEEDED regarding my goal for the Future World i wanna help make, as america is on fire. that’s what my clothes are SUPPOSED TO DO in our isolated age: BULLY PEOPLE INTO GOING UP AND TALKING TO EACH OTHER BY ACCIDENT. (i’m gonna save that line, actually)

so i got the art supplies from Wolf and the Secret Sweetheart’s gifts and i’ve got the brushes pens and ink out and i’m working on a young neighbor’s logo i offered to do like granny cookies to protect him, and when i warm up, THEN i’ll do art for Wolf and the Secret Sweetheart and take a photo and show you all the art.

but Petunia! i’m borrowing SoCal Jim’s tiara (he wouldn’t listen and instead wasted all his swagger on beer with some other gloating cat so i’m using the tiara and will bang my own pots and pans that i was RIGHT!)

i’m tiny small and insignificant. i feel like a minature spec underneath a looming wave of destructive forces to put it mildly, reading articles like this.

but this $100 is going hella far.

watch.

these here are secrets in the sediment. more later.

big hug to you, Petunia. my goal is to make 70 year old women wear push up bras alone in their houses just for fun. no more muumuu earth ship clothes.

i saw Tempest Storm dance with a push up, a feather boa and platform shoes in the desert, high noon, in her 70s and can’t no one tell me i didn’t witness Truth God and Reality.

if you all don’t remember this money stuff was originally about getting the girl, even if she’s a dude, i WILL.

and SoCal Jim, if my dance card weren’t already far too full, i’d come bang my pots and pans with you but San Francisco needs me more while you gloat, i’ve got other plans up here.

we need defibrillation here.

x

Wolf, you censor my comments and those of others but this gets a G.O.?

I “censored” some of kitten’s comments too.

This was pretty fucking tame for Kitten.

Dear Mr Shaman-

i didn’t mean to offend. i’m struggling mightily with all that’s going on and i’m trying to share my process of trying to make something new come into being during all this Death of Everything.

i’m not as nasty because i feel more awe and humility than i feel “victimized.” i see us all as in this system that’s a playing out of the old saw about the first generation making money so’s the next generations can completely squander all that hard work and all those miracles and sunspots.

now we have to MAKE our own sunspots and luck. i’m trying to share the mechanics by taking Wolf’s and the Anonymous Sweetheart’s $100 and show where it takes me in ideas, gifts, accomplishments.

if money is energy i want to inspire the other artists and entrepreneurs here who’ll step up to the next opening lucky moments and sunspots.

it’s US. we’re powerful here. i’m trying to show how a broke pipsqueak like me can add to something new and inspire contagion of that kind instead of adding to the contagion and climate of constant FEAR and Victimhood.

x

Anyone who is capable of inspiring Petunia to write three paragraphs should be given maximum discretion vis a vis censorship!

KL,

You are right to sense that you and Boeing are in the same boat, so to speak. If you don’t survive you can’t succeed. I learned that early by being around the music business. Talent is not enough, even perseverance isn’t enough, you have to be able to survive doing the thing you’re doing.

At some point, you have to deal with the business side of the business you are in. You have to sell the product. You have to produce what sells. Sometimes that thing isn’t your best work, or the thing you were sure was great, it’s what others think is great. Sometimes you have to go where the opportunities are.

I’m not trying to piss on your parade. I think you are extremely talented. But if you can’t get someone to pay you to do it, it’s just a hobby.

(smile)

Touché.

and no, you’re not doing anything to my parade. anything decent has to withstand a horrendous shredding and beat down.

i’m wondering if i’ll be leaving the clothing for a bit, though. i’ll send Wolf what i did today because of that $100. / i haven’t done work for anyone else since Wolf’s mug here, and the $100 said i had to pay it forward by giving my art or something to someone who’ll come up. / so when i saw my neighbor kid home from Brooklyn where he lives now, i saw his movies he makes and like with Wolf, this idea for him just appeared so i’ve been working on it to warm up on my thank you cards with art to Wolf and the Anonymous Sweetheart.

i’ve been having a hard time writing, and now i know why. when my fingers are better than what was in my head, it’s like dancing in place. so euphoric.

(sending to Wolf after i write this)

and no, you only want me to do well. i haven’t been in california THAT long that i can’t take a beat down and need a b.s. smile.

and you forgot magic. i’m not boeing so in lieu of all that endless cash, i’m gonna need a lot of magic…. check. got it!

x

Hi Petunia – in my 6 years in music recording/production during the 70’s the biggest factor for success that I consistently encountered with hard-working, persevering musicians was luck. Right place, right time, right people, good moon phase and right number of sunspots.

Intellectual property in the arts is a farce. Technology isn’t really any different, but you can’t weaponize a song.

A.B.-Oh yes you can. Just look at how songs were used in CWI, WWI, & WWII to encourage support for the war effort. Just as deadly in their effects as any pea shooters in a turret.

Lisa-in my 22 years involved with m/c roadracing, i found the similar factor-the joke was ‘…if you have to choose between talent or luck…choose luck…’. 3x 500gp champ Kenny Roberts agreed, with the addendum: “…but you know, the more I practice, the luckier I get…”.

may we all find a better day.

Oh, Kitten, you are so wonderful!

We are all in awe of your attitude!

The 737 Max is a self-inflicted head shot. No pity there.

Hey, maybe Amazon will by them out…they got the cash. AmazonAir…it’ll fly.

Amazon Air is already flying.

Maybe Amazon can use their big assembly and production buildings for warehoused goods? Most of the engineers can be re-employed to learn how to run the truck loading conveyors. win/win!

MiTurn,

It’s the executives who will keep a mass amount of money, who caused all the damage. Over a hundred thousand employees, America, and every air traveler in the world pays the price.

Just retool to build only 747 freighters. I’ve never seen so many in the air in my life. Just cross your fingers that JetA stays this cheap forever.

When you get used to seeing only 737’s most of the time (and there are thousands and thousands of those), seeing a 747 fly over you (say within 5 miles of an airport) is really something else…those suckers are *huge*…to the point where you think something is wrong and the plane is flying too low.

I think the seating capacity of a 747 may be like 3 times that of a 737.

The 747 was engineered and drawn by hand. At one point they had full scale blueprints and the draftsmen walked around on them in special shoes. Yet it is regarded as one of the safest and best flying planes ever. Makes you wonder if computerized engineering is a good thing.

Slide rules were used on the 747 design.

The best automotive aeronautical engineer, Adrian Newey, draws and models his designs. Then he has them digitized to be looked at by computers. Most everybody else does it in the other order.

Seneca

Did you ever go to Boeing surplus down in Renton? Those were the days, before they shut it down to the public and probably just scrapped the stuff.

Drill bits by the pound. Waffle composite flooring. AlClad aluminum pieces. Cloth to use for fibre glassing projects. Ear protection…..just about anything imaginable. The scrap aluminum was amazing.

In those glory days their shops were so busy it cost more for people to stoop down and find a dropped drill bit than to just grab a new one. Same for everything. It was just sorted out into bulk bins with takeaway pricing.

I’ve been fixing business jets since 1979, half of that at one of the bizjet OEMs, including work on 3-4 new designs/programs.

The whole history of aviation has involved making the airframes better, while reducing weight. Weight = lower performance and/or higher fuel burn. Since the defacto speed limit of jet aircraft is in the .72 to .90 Mach range or thereabouts, every product improvement/new design since 1970 is mainly intended to reduce fuel burn.

Old school airplanes are overbuilt/overweight compared to new designs CADAM has just made it easier to estimate stresses, which means you can cut it finer on the structural weight.

The downside is that newer airframes are less tolerant of damage/corrosion, assembly and repair errors. Especially aircraft that use “composites” for primary structure.

The OEM I worked for looked long and hard at primary composite structures back in the 80s, and made the decision to stay with aluminum and titanium. Their competitors on the other side of the airport, and the other side of town decided to go the composite route. Following three Charlie-Foxtrot designs in a row, they are now out of the airplane building business, and are a subsidiary of my former employer.

Which brings me to another point. We are losing/outsourcing the ability to design and build aircraft, at least Air Transports and General Aviation aircraft, and from the looks of the F-35, military aircraft as well.

Worldwide, how many OEMs have successfully designed, built and certified a ‘Clean sheet of paper” jet design in the past 20-30 years, on time, on budget, and met or exceeded the announced performance targets? Less than five?

Boeing screwed the 787 pooch, by farming out much of the design work to “partners”, then spend the money to have hillbillies build the airplanes with OJT. The cost overruns associated with the 787 cost so much, that Boeing management compounded the fook up by stretching the 737 AGAIN, instead of designing a new airplane. The MAX has aerodynamic problems that can only be fixed with band aids. They then went with the low bid on the band aids.

We have a saying in the airplane maintenance business: “FAST” – “CHEAP” – “DONE RIGHT”…….Pick Two.

It has been my experience over the years that “Done Right” hardly ever gets picked by the suit trash, unless there is a regulation that forces them to.

Boeing was a great company when they were an engineering company. Unfortunately like many companies they have long been run by corporate financial decision makers.

Boeing is too important to let fail but it’s terrible because this company was completely mis-managed. Meanwhile the executives and board were paid billions to effectively ruin a great company.

How many of these board members are really qualified to run Boeing?

Arthur D. Collins Jr. – Former Chairman and Chief Executive Officer, Medtronic

Kenneth M. Duberstein – Former White House Chief of Staff

Edmund P. Giambastiani Jr. – Seventh Vice Chairman of the U.S. Joint Chiefs of Staff

Lynn J. Good – Chairman, President and Chief Executive Officer, Duke Energy Corporation

Lawrence W. Kellner – Former Chairman and Chief Executive Officer, Continental Airlines

Caroline Kennedy – Former U.S. Ambassador to Japan

Edward M. Liddy – Former Chairman and Chief Executive Officer, Allstate

Susan C. Schwab – Former U.S. Trade Representative

Ronald A. Williams – Former Chairman, President and Chief Executive Officer, Aetna

Mike S. Zafirovski – Executive Advisor, The Blackstone Group

Should I add Nikki Haley…..

To Poorly Paid Minion. I know the company across town and back in the 90’s the company that owned them robbed all of the profits and once used up put the company on the street. What a shame for Olive Ann’s legacy.

By todays standard they would be the San Francisco of planes for new ideas that ultimtely didn’t pay.

Thank you for that analysis Poorly Paid Minion.

737 is older than the 747

Fast, cheap, or done right; pick two. I’ve noticed this trade-off is pretty universal when you’re at the ground level dealing with stuff. There are always lazy people who could probably produce both more quantity and quality if they just pulled themselves together. Laziness being something of an instinctual evolutionary trait for conserving energy is a curse to management however. They like to alter this concept to believe it’s an exogenous disease that afflicts all workers as a 100% moral choice. What it allows them to assume is that at all times people could be doing things faster, cheaper, and correctly/at higher quality. They get angry when expectations about this fail. If you do deliver on expectations however, the ante gets upped every time. If you’re stuck working with people who simply can’t perform above a certain level though, for whatever reason, it’s a real pain. Then it feels like you’re always making excuses or throwing them under the bus. I’m afraid if the shift towards plutocracy continues, then eventually they are going to resurrect eugenics.

Seneca: It all depends on who you hire to write the Software.

The harsh fact is that 80% of the population are no good at writing code, and maybe only 1/2 % are proficient.

The stupid MBAs keep thinking that they can hire half-priced, half-educated half-wits from some half-civilized country and get good results.

The problem here is not computers versus pencils. The problem is what happens when management hires the cheapest engineers.

When will stock buybacks be recognized for what they are? It may well be that companies cannot come up with a better use for the money spent on stock buybacks or is it just a disguise for senior company executives feathering their own nest given that they tend to hold significant amounts of company stock and/or restricted stock units. Either way it is a sad indictment of those companies that plough money into stock buybacks.

It’s also a way to launder income into capital gains, which has tax advantages for most people.

Sociopathic investors are equally to blame. They want to assert themselves as the sole residual claimants to a firm’s assets. This is only true legally during bankruptcy.

Investors want to override other stakeholders like customers, employees, bondholders, communities, suppliers, creditors. Equating a company’s value to its stock price enables them.

Idaho-one of the clearest and coherent comments i’ve ever read here. (i usually wonder why so many investors don’t/won’t realize they’re walking into a BIG casino and the lumps they’re risking. Expecting the ‘do-overs’, perhaps, just like the large actors seem to get…).

may we all find a better day.

That’s one reason that countries nationalize their airlines and other important industries.

Um, the shareholders are the OWNERS of the business. If I own a business, I am doing so to make money. I can only make money long term if I take care of my customers. If I take care of my customers, I will be able to employ people. “Stakeholders” is a weasel word for people who want to take the profits of a business from the people who own it, nothing more, nothing less. Would you share your personal salary with “stakeholders”?

Please read “The Shareholder Value Myth” by Cornell U Prof. Lynn Stout.

Here’s an excerpt:

“Although laymen sometimes have difficulty understanding the point, corporations are legal entities that own themselves, just as human entities own themselves. What shareholders own are shares, a type of contact between the shareholder and the legal entity that gives shareholders limited legal rights. In this regard, shareholders stand on equal footing with the corporation’s bondholders, suppliers, and employees, all of whom also enter contracts with the firm that give them limited legal rights.”

https://evonomics.com/maximizing-shareholder-value-dumbest-idea/

I for one, have paid more for a product or service than I would have vs. playing hardball with the seller, mainly because they were worth it, and I wanted them to be happy to work for me again. But that’s not “Business 101” in the US these days.

The “Shareholders” argument, is much like the tale of the scorpion and the frog. It’s in their nature to screw everyone else, as long as I get mine.

Potato, employees, bondholders, and shareholders all have contractual relationships with a publicly traded corporation. Shareholders are the only class that can direct corporate boards and governance. You can call it what you like, but if you can affect governance, that constitutes ownership. Employees have a contract to provide labor for a given salary and benefits. Bondholders have a contract to be paid a specific rate of return. Stakeholders is a weasel word that implies a corporate duty to share profits in an extra contractual way which is not in keeping with the law.

Minion,

I agree that a business owner or shareholder, or for that matter, a customer can make decisions for reasons that aren’t purely financial. Sometimes the best price isn’t the best value. In fact that is frequently the case in my own business. The point is that the customer or shareholder or owner gets to make that decision, not some poorly defined stakeholder. If an employee doesn’t like their employment situation they are free to seek alternative employment. Wise owners also understand that the least expensive employee may not be the best value either.

Happy-these days it seems the term ‘wise owners’ has the same weight and meaning as that of ‘noblesse oblige’.

may we all find a better day.

The reason stock buy backs are rampant is corporate officer pay structure. The days of 20yr tenure CEO’s is long gone and now CEO’s want to make their fortune in 5yrs and get the hell out. They could not care less what happens to the company after they get theirs….

Stock buybacks used to be illegal.

There was a “reform” a few years ago.

I think Bill Clinton and Phil Gramm were the main culprits. . .

I railed about this when it was going on.

BA scrimped in engineering the “Max” while recklessly spending billions on stock buybacks.

Have the directors who pushed that folly resigned?

Silly you………you have this antiquated view that managers (especially upper managers) who fook up should be fired. And when you eff up bad enough, banished to Greenland or Antarctica, with no stock options, bonuses or buyouts, never to be asked for your opinion again.

I vote we call it “Liberated Capital Value!”

First, the drop from $440 to $150 is a bloodbath.

Now, the reality is starting to hit, that share value might just be $0 in two years or less. And there is nobody going to bail them out until it comes to massive layoffs (payroll going to be held at roughly 100k), and the military wing will be hived off to Cerebus, L3, or some other connected company in exchange for the short term cash burn of commercial aviation.

In short, the 737 max has kicked off a deathspiral.

But it won’t end in Chapter 11 until the biggest pigs get the truffles.

I pity the five small shareholders left holding the bag.

Meanwhile, look at the markets begin another covid contraction, with everything red.

Pretty amazing watching fake values slowly begin a drop that ends, well when?

Commercial real estate, meh, dead.

Residential, oooooooh hot, for now. Evictions and foreclosures yet to come due to severe extend and pretend.

Bonds, record low yields, with return of capital going to be the prize.

Metals, slowly floating down from the first panic high.

Oil, smoking crater, buy whomever manages to buy assets for pennies, again. But not yet!

In short, everyone wants and dreams of the 2008 V bottom, with a nice long 12 years of good times.

What we get is going to feel pretty miserable.

1) Boeing lost it’s diamonds.

2) JP assets high above the skies.

3) US shale asset have been busted from : 1,700 rigs in 2014 to 200 on they down.

4) Seattle was chopped and vacuumed. WFH blew up NYC & SF RE.

5) Fed assets change of character – from hyper activity to tranquility – will come when our old Fed will fall in love.

6) If JP will not turn the lights on and keep us warm, energy shortages will send energy prices higher.

7) Darkness in combination with Fed climax expiration create inflation.

8) JP shuttered open window will force shotgun marriages.

9) Investors love Tesla, but hate oil and coal.

10) when the public will fall in love with the energy sector, ==> prices and inflation will rise, but the real value of US gov debt will be down.

It is not just Boeing that manipulated its stock price using share buybacks. When Reagan’s SEC chairman John S.R. Shad pushed through rule 10b-18 legalizing share buybacks in 1982. That change pretty much repealed Sections 9a-2 and 10b of the Securities Exchange Act of 1934, passed to prevent again the market rigging during the Roaring Twenties.

Shad, who made a fortune on Wall Street as an investment banker at E.F. Hutton, was the first Wall Street executive to be SEC Chair in 50 years in 1981. Shad hired corporate lawyer John Fedders to be the SEC Chief of Enforcement. Fedders, a 6’10” former college basketball player, resigned his post in February 1987 after the Wall Street Journal reported he had beaten up his wife at least 7 times in 18 years.

Shad ended his career by accepting on April 13, 1989, the job of chairman of Drexel Burnham Lambert’s holding company. Drexel back then was forced to take Shad on after its “junk bond” scandal. A year later, on July 18, 1990, Drexel gave Shad his walking papers, his appointment didn’t do them any good. Shad “resigned” three years to the date he left the SEC on July 18, 1987, months ahead of the October 1987 stock market crash his laissez faire policies caused. Shad gave Harvard Business School in 1987 a gift of $20 million for a “Business Leadership and Ethics” program. Shad’s career shows that him, money, not “ethics,” was all that counted. If anyone can claim the honor, Shad can claim that he is responsible for the wreckage that is Boeing today with his repeal of Rule 10b-18.

One article I read stated that from 2004 to 2013, 454 companies in the S&P 500 Index spent 51 percent of their profits, $3.4 trillion, on repurchases, ahead of the 35 percent of profits going to dividends. Wall Street running America’s businesses, with private equity billionaires feasting on the remains of American capitalism. And the road down starts with Shad’s repeal of SEC Rule 10b-18.

Thanks! An important piece of history. I hadn’t heard it before. It’s obvious that we need to rewind the securities laws to 1939 or so, but it ain’t gonna happen.

https://www.sec.gov/news/speech/1982/012182shad.pdf interesting read about this deregulation

87 stock market crash was caused by deregulation? Probably caused by people deciding that prices were ahead of earnings. Back in the quaint 80s, the government allowed price discovery.

W.-Last section…”shares have plunged”. Might qualify that as the “market price of” or “valuations” just to avoid any confusion with number of outstanding issues still floating. [It’s a minor thing, but backseat editors must have something to do while twiddling thumbs.]

As a CEO, I can use the company’s money to do share buybacks, to boost the share price; get my bonus and top dollar for my shares.

What is there not to like?

Share buybacks were found to be a cause of the 1929 crash and made illegal in the 1930s.

What lifted US stocks to 1929 levels in 1929?

Margin lending and share buybacks.

What lifted US stocks to 1929 levels in 2019?

Margin lending and share buybacks.

A former US congressman has been looking at the data.

even worse. when interest rates are this low, and the company’s money is locked in an overseas tax haven, corps are borrowing to pay stock buybacks and dividends.

Share buybacks were the cause of the 29 crash? That is highly disputable. Bubbles happen when prices get ahead of earnings. They can be encouraged by bad policy (see Fed interest rate suppression), but share buybacks don’t alter price vs earning dynamics.

Among other Boeing things to be afraid of…airliners are one of the very few export industries where America is still (er, was?) competitive.

We’ve had decades of horrendous trade deficits (along with decades of DC hand patting) and Boeing was one of the few US companies that helped mitigate things…at all.

So, things just get worse and worse.

Cas,

Intel not far behind.

Nothing a huge juicy bailout for more share buybacks can’t fix.

Melbourne, Australia (5,000,000 pop.) reported 0% COVID. They went to 100% reopening.

after a complete lockdown

Its not a complete opening plenty of restrictions size of gatherings etc BUT remember to wear your mask, its for the greater good.

Cool story bro

In other news, COVID19 is increasing all over Europe after long lockdowns. Follow up on this during Australian winter, I have a hunch it might be different again.

Australia is an ideal place to handle pandemics, because, there is a limited amount of cities with large distances between them (cars also help). America and the Schengen area are the complete opposite and make handling a very contagious outbreak, exponentially harder. The structure of the economy factors into this as well, also benefiting Australia.

More restrictive lockdowns will have other consequences later on.

Of course most of the small businesses are now broke, or close to it, and we are now just beginning another world wide wave…

A comment for those of you that have watched the mob movies

A modern S & P 500 executive…….A made man.

Their job descriptions are amazingly similar.

Somewhat off topic, but related sentiment. Quite a few years ago pre-Murdoch time, the WSJ had an opinion piece comparing the job description of a drug distributor to that of a marketing manager.

The reasoning was that companies should consider hiring out of jail. These inmates had proven financial, logistical, HR and marketing skills. And a proven track record in meeting and satisfying consumer demand.

Yep, agreed. La cosa nostra was never eradicated by the govt. It exists and is alive and thriving on Wall Street, no question.

Boeing should be the poster boy for the last decade in America. Once known for excellence, innovation, pioneering. All washed away for greed by a few CEOs and board members. You can’t even blame the Chinese for this one. Money was flowing in, throw in sizable tax cuts, the stock, through all the years rising as it should. But, heck no, let’s go for the glory, super-charge the stock, right? And of course, as we have seen in all these cases, the high management wins no matter what.

Doesn’t Boeing have the largest building enclosure capacity (hangers) of any company in the world? Forget the malls, try filling up all those suckers with apartments.

As people pay attention to $BA, they ignore that around 1/3 of the US market is in even worse shape.

Corporate governance has been MIA for quite some time. C-suite execs used financial shenanigans to pump stock prices while loading up on debt, all to make those bonus goals.

And why not? The average C-suite exec lasts only a couple of years, so no incentive to align with long term growth. The “market” pays them so much more to “engineer” the company so they can loot it while pumping the stock price.

Meanwhile, Congress is MIA, the SEC is totally asleep at the wheel, and shareholders oblivios to actual value.

Can the Fed bail this all out?

Waiting & watching…

From all the articles I read on the 737 max, Boeing cut corners everywhere. Instead of investing in the future of Boeing and making the best possible airplane, they had bean counters in charge trying to cut costs as much as possible. Even outsourcing some of the flight software development to cheap overseas software developers. This highly critical software should have been handled by expert in house software developers. As history is proving this was a very bad decision to outsource this type of critical software just to save a few bucks. This is not the behavior of a company that wants to be a world leader.

That, and getting the FAA to buy into their DERs reporting to Boeing management, instead of to the FAA software experts that they used to report to.

OTOH, maybe it didn’t matter. Thanks to “Regulation is Bad” crowd, all of the old FAA guys who knew enough to ask the right questions were sent away on the early retirement bus, and replaced by newbies with either no experience, or no skills.

The Feds knew that they didn’t have the expertise in place to review the designs, that Boeing (supposedly) did, so the FAA rubber stamped the certification.

The real leader in aircraft certification is now EASA, not the FAA.

What’s going to be really fun is when the MAX “fix” is approved. I can almost guarantee you that mods will need to be made to the existing aircraft.

Boeing will need people to build the parts. They will all be laid off by then.

Vendors will need to supply components. They will have laid off their staff as well, if they haven’t gone out of business.

The good news is that there will be plenty of laid off/unemployed mechanics and avionics techs to do the work on the aircraft. Unless said techs say “Screw this” and get into another, more stable/better paying line of work. Like Uber driver, or barista.

In your argument for regulation, you have exposed the fundamental long-term problem with regulation and why it is not the be all and end all.

Regulatory capture, that is the intermingling of business interests with the regulators who are supposed to manage them, is inevitable. It is impossible to maintain a non-corrupt regulatory environment.

The long run protection for people in any kind of business environment is that it is bad business to build planes that crash. Boeing is now finding this out.

Happy-Hope the fire department doesn’t demand a kickback before devoting their efforts on a burning dwelling of yours.

may we all find a better day.

Is anyone amazed that nobody went to jail for the engineering failures of the two planes that software nose-dived via Boeing engineering neglect? At some point, society needs to stop “fining” companies and start putting people in jail. For exampe, Goldman Sachs was recently fined $2.9 billion due to bribery corruption charges. Note the average bribery case in America carries a 2-3 YEAR sentence, and the amount of bribe is around $64,000. For some odd reason, people who bribe or even accidently kill other humans go to jail, they do not get the option to pay a large fine instead of incarceration. How is this fair with society? Either jail companies for the same crimes we jail humans, or stop jailing individual humans and offer them a fine instead. Shocking this is not discussed in the media. Oh wait, MSM is owned by big biz…now I understand. Seen Bezos is trying to buy CNN…not sure we want all the MSM companies owned by biz billionaires. That seems like a societal conflict of interest, does it not?

Nobody went to jail for 2008 either.

“One of the delightful things about Americans is that they have absolutely no historical memory.” -Zhou Enlai

As someone already pointed out, the 1929 crisis was caused by buybacks, and now we are just repeating the same thing.

The United Shoppers of America only care about three things:

1. What to buy today

2. What do buy tomorrow.

3. What to buy the rest of the year.

Enough with the ’29 crash being caused by stock buybacks please, that’s an unprovable and unlikely premise.

MonkeyBusiness:

I will add #4: “Where to store the that which exceeds the capacity of my 4 car garage!”

If you are suggesting jail time for people involved in very complex business decisions for critical machinery that doesn’t perform perfectly, you are really suggesting that such businesses move out of the US.

Then you should be in the plane that crashed. Afterwards, you can give us your thoughts.

You must love blaming victims.

Not blaming the victim. If you’re putting people in jail you need to prove criminal intent. A fault in a computer algorithm in an incredibly complex piece of machinery with tens of thousands of potential failure points likely won’t be sufficient to prove criminal intent. Hence the lack of criminal prosecution.

There is also the matter of the relatively undertrained crews who experienced these problems. Is there also criminal liability there?

And we should all remember that tens of thousands of flights with this plane have safely occurred. The accidents are still a terrible tragedy, but it took tens of thousands of flights for this very small problem to be appreciated.

The plane crashes are tragic.

Happy1

Not criminal intent.

Prove criminal negligence…..much easier…..and much more accurate.

Why not jail for criminally negligent suits ? Personal responsibility and “skin in the game” .

They are overpaid in the best of times….they should be made to pay for their deadly errors.

Being able to sit in a board room and make “business decisions” in which it is fully known you are going to negligently cause human death is criminal. To justify it is immoral. And to allow it is cowardly.

The reason it continues to happen is America is morally bankrupt.

Fine = Fee = Free = Complicity

and for the wee = just this

Justice = Jail Implicitly

A thousand employees here, a thousand employees there, and pretty soon we’ll be talking about some serious unemployment.

No problem though, because come next month, the unemployment rate is going to drop again.

Next year it will be : “Boeing is exploring opening a factory in China”.

Given all the consolidation in the airline industry I’d say we’re going back to much higher airfares in the future. Subsidies will not go on forever. Could be we end up with only two airlines in the end.

Whatever you’re paying now, double or triple it. The world is going to become much smaller. I vaguely remember tickets in the 1970s being much higher, although the industry was highly regulated then.

American companies are just financial engineering schemes with some sort of business attached. The business cash flow is used to leverage on the financial side, by borrowing to buy back stock.

It’s a state of perpetual leveraged buyout, of themselves.

I still can’t understand why Boeing still trades at 40% of its pre-covid levels, or for that matter why it stood still during the MAX scandals.

It has spent much more than historic profits on buying shares back – so its book value is now negative – minus $11bn.

Ignoring the cash which offsets debt, $86 billion, around 3/4 of non cash assets is in inventory. That is in the very planes it can’t sell and the parts and work in progress of new ones. Inventory is up $10bn on the year – planes they can’t sell is going into the books at cost price – no wonder their margins remain positive!

It loses close to $20bn cash flow a year. Yet it has a market cap of $86bn plus net debt of $60bn. Horrendous.

Then add these – $8bn of good will as an asset.

$15bn pension and health commitments – good luck collecting your Boeing pensions guys.

And incredibly there is $51 billion of pre-funding of purchase orders as a liability. That is the money up front for the back log of orders that haven’t been cancelled yet. Airlines (or their insolvency trustees) will want that money back, and certainly can’t find the remaining payments to complete purchases.

Then there is the military business. How are governments doing now? Gonna keep on spending on fighters?

The military side of the business will be the mechanism that the US Government transfers money to the “Too Big to Fail” Boeing Company.

Witness the $880 million or thereabouts that was sent to Boeing in April, that was being held by the USAF until Boeing fixed the problems with the KC-46.

– Boeing is a GOOD example on how (Crony) capitalism is ultimately devouring itself.

– No comments from “MC01” yet ?

Excess in stock valuation, asset bubbles and subsequent (ON GOING!) decline happened b/c:

1.Reagan’s SEC chairman John S.R. Shad pushed through rule 10b-18 legalizing share buybacks in 1982.

2. Removal of Glass Steagal Act in 1999 ( passed past mid night!) enablers – Bil Clinton and Gop Senator Graham Phillips!

Fed cannot win against Covid 19!

‘Flying Blind: Clueless about Risk, We’re Speeding Toward Systemic Failure’ Oftwominds Oct 28

Tomorrow Oct 29 anniversary of 1929 October crash!

I would suggest Fed policy has far, far more to do with asset bubbles than banking laws. Bubbles are an inherent part of human financial behavior in a free market, but the Fed destroying price discovery is building the most massive bubble in history.

Boeing will fly again. They still leaders of the industry, plus military contracts still there. As soon as virus will be dealt with, demand for air travel will pick up. Im for one sick of not being able to travel.

Are we giving up on discussing TSLA 3rd Qtr Financials?

Tiny automaker doesn’t deserve that kind of constant attention. Every now and then is enough. I didn’t write about Ford either. So here we go:

Ford: revenues = $37.5 billion; net income = $2.4 billion; EPS = $0.60. Share price = $8.02 after hours.

Tesla: revenues = $8.7 billion; net income = $300 million; EPS = $0.27. Share price = $407.80 after hours.

That’s how ludicrously overvalued Tesla is. Its shares would be appropriately valued somewhere in the $10 to $30 range.

IMO, letting Tesla implode would make a bunch of the techno cheerleaders, Wall Street suits and 1%ers look like idiots. Thus delegitimizing their “leadership”.

Better to keep torching cash.

ROTFL!

Fair enough. Thank you.

I was reading elsewhere that there was a noticeable trend – actual Declining YOY Market Share in DEU and CHN for TSLA.

Source somehow (stupidly) didn’t elaborate by mentioning corresponding Sales Numbers.

They claimed that the CY Goal of 500K Deliveries was still on; but it looks like a PR Bluff since they need to deliver roughly 36% of that in 4thQtr.

I found that interesting since TSLA have been aggressively shaving off Prices for their Models sold in CHN this CY.

We may possibly have witnessed TSLA Peaking/Plateauing in Market Share / Sales – just as SpaceX join the Military Industrial Complex.

Subsidy Schemes which recently made all kinds of Compensation Milestones for Mister Musk as several CFOs walked out during that Ascent, which one article repeated elsewhere claimed that Musk became the 4th “Richest” Person in the USA.

Thanks for covering the Alternative Energy Vehicle Market on Occasion. Besides Rigged EV Markets in NOR, figure we’re about to see PHEVs/BEVs/HFCVs see steady increases in AutoMkt Share this Decade.

Personally, I’m interested in seeing how Tokyo and TM (Full Disclosure: I’m from the Tokyo Metropolitan Suburbs; (Kanto Plain / Kanagawa); and my Cousin was a CEO for one of TM Subcontractor-Suppliers) Roll Out their NextGen HFCVs at their Hydrogen City / Transport Expo during the Tokyo Olympics.

TM recently Signed Off a Technology Sharing Agreement of Sorts with CHN Entities, so we should see TM and CHNese AutoMakers Roll Out HFCVs in CHN soon.

Kind Regards,

This is yet another deep body blow to the U.S. economy, and will no doubt have some measure of ripple effect. All of these traumas coming at institutions and industries themselves, sector after sector, is threatening the very foundation of the economic system.

Bankruptcy and management replacement with people who want to build planes is the only solution. Any “solution” that contains more than one sentence will not fix the problem .

Before being the CEO, Mr. Calhoun was briefly the Chairman of the Board. Since January, he has been the CEO, and I would assume that the Board of Directors approved this.

Mr. Calhoun has a bachelor’s degree in accounting from Virginia Tech.

That is the “solution” the Board came up with to fix the company’s problems caused by sticking big, heavy and fuel efficient engines to an air frame that was not designed to, nor is capable of handling the new engines.

BTW: this is not meant as a critic of Mr. Calhoun’s business or money skills – just an observation.

My take on this is eventually BA will spin off BCA. Thoughts?

Thanks Wolf

Good article and comments ?.

Time for a re watch or read of “The Big Short”.

So at this rate, they could conceivably burn through all their cash in another 5 quarters.

Nothing to worry about….. All is well.

Sort of off topic but in my opinion there is nothing Boeing can do with the MAX series. The (737) air frame is just not compatible with the way the engines are mounted. As we already know, Boeing tried to compensate for this mismatch with MCAS. It’s astonishing that pilots were not trained on the use of MCAS. This isn’t uncommon tho. SAS flight 751 was successfully “ditched” when the aircraft (MD-81) took on ice chunks and destroyed the fan blades destroying the engines themselves. When the engines began to surge, the pilot rightly throttled down but the ATR (automatic thrust restoration software) took over and throttled by up until the engines finally failed. The pilots were oblivious to the ATR to disengage it.

The MAX 8 (9, 10) is finished. In my opinion.

That money Boeing’s accountants saved by not doing a clean-sheet redesign of the 737 really paid off for them. /s

Cheapness has never been so expensive.

watched a 747 take off headed east w/ a space shuttle on top. afterwards, we headed up to get a sandwich. watching out the back window as it was getting smaller and smaller until, it started getting bigger and bigger. told the guys it was coming back they said naw it turned, I said yea, all the way around its coming back w/ a engine on fire. we drove back down to the lake bed and watched it land. it used some runway and was a little ruff on the brakes, but both flew again. burn fuel, cash or people.. pick one.

Nobody mentions the 787 deferred costs any more

this is a 18 000 000 000$ issue

and at 6 per month, the 787 costs are far higher than at 12/month

and there is no way the recover these costs

a serious auditor should depreciate this….