Here’s how I got walked through Denbury’s bankruptcy proceedings.

By David in Texas, a long-time WOLF STREET Commenter:

On April 24, 2020, I purchased 5 of the 6.375% bonds of Denbury Resources, due on August 15, 2021. I didn’t risk a huge amount of money. Rather, I saw this as an experiment since I had not bought individual junk bonds before. I would learn something even if it failed, and if it worked, I would make the proverbial ten-bagger or more.

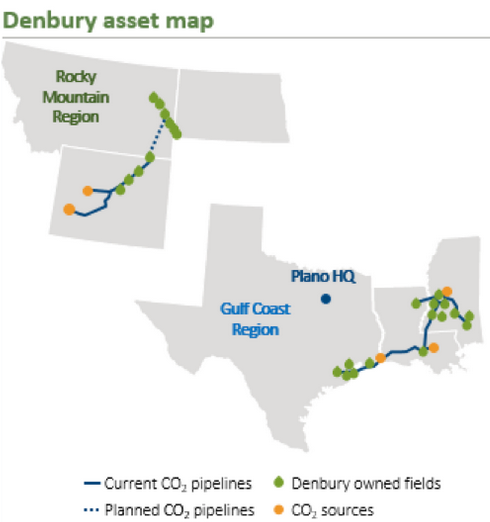

Denbury is an oil & gas producer that focused on “enhanced oil recovery.” This involves injecting CO2 into underground rock formations to act like a solvent for oil, removing it from the oil-bearing formation as the CO2 travels through the reservoir rock. This process can recover, on average, an additional 10% to 20% of the original oil in place, long after the fields have been abandoned by conventional producers. A great idea when oil trades at $100; less so at $50.

The five bonds I purchased had a face value of $1,000 each, for a total of $5,000, with semi-annual coupon interest payments due on August 15, 2020, February 15, 2021, and the final payment on August 15, 2021, when they would mature.

By the time I purchased them, these bonds had already collapsed and were trading at 7.675 cents on the dollar (7.675% of face value of $1,000), so I paid $383.75 (5 x $76.75) for the bonds. I was also responsible for paying the interest that had accrued since the February 15, 2020 coupon payment ($64.64), so my total outlay was $448.39.

My logic: All Denbury had to do for me to make a killing was survive beyond August 15, 2021, without defaulting.

In that case, I would have received the $5,000 face value, plus 3 coupon payments of $159.375 each, so my total return would have been $5,478.13, or 12.2 x my initial outlay.

Of course, I did recognize that bonds trading at 7 cents on the dollar meant that the odds of bankruptcy were pretty high. Nevertheless, the reward-risk ratio seemed reasonable.

Making the investment wager seem even better, if Denbury only lasted until it made the next coupon payment on August 15, 2020, I would receive over 1/3 of my initial outlay back, just from interest.

Alas, this was not to be.

As a licensed paramedic, I should have known better than to invest in a company with the ticker symbol “DNR.” For those not in the medical world, elderly patients will often have a DNR (Do Not Resuscitate) order, which tells emergency medical personnel “don’t stick any tubes in me and let me die in peace.”

On June 20, there was some brief excitement. Early in the morning, someone managed to get the wire services to publish a fraudulent press release that announced that the company had received a buyout offer. The Robinhood crowd jumped on it, and shares spiked by multiples, despite a quick denial by the company. And this blew over too.

I knew I was in trouble on June 30, when Denbury defaulted on an $8 million interest payment due on its convertible notes, and announced that the company was “evaluating its strategic options.”

This reminded of the scene in the movie “Twins” after the debt collectors trashed Danny DeVito’s office and repossessed the furniture, where DeVito tells his ever-loyal secretary that he’s going to have to let her go because the “corporation is entering a restructuring phase.”

For a few weeks, not much happened, except the bonds had ceased trading. With no bid, I was a passenger on this train whether I wanted to stay on board or not.

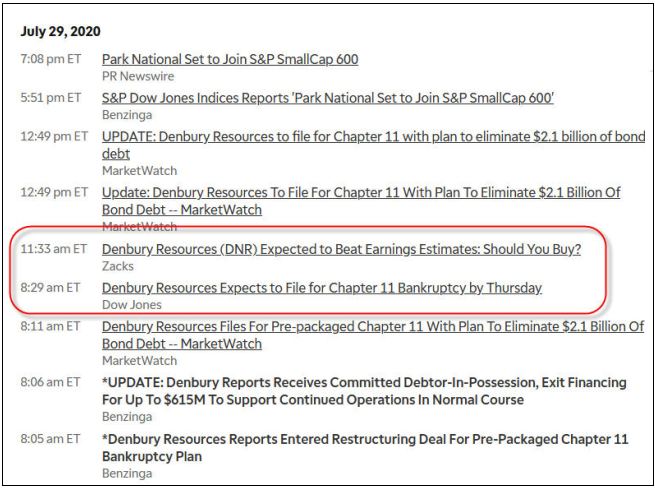

On July 29, 2020, the long-suspected event finally happened, although not without some humor. Here is a screenshot of my news feed for DNR on that day: At 8:29 a.m, the headline of Denbury’s Chapter 11 bankruptcy filing appeared. And then the humor: at 11:33 am, this headline appeared: “Denbury Resources (DNR) Expected to Beat Earnings Estimates: Should You Buy?” This 11:33 a.m. headline has since been removed from the archives – can’t imagine why (click on table to enlarge):

Denbury’s Chapter 11 filing was “prepackaged.”

Essentially, in a prepackaged bankruptcy filing, the company and its largest secured creditors agree to a deal before the Chapter 11 filing. Everyone else receives a “take it or leave it” proposition.

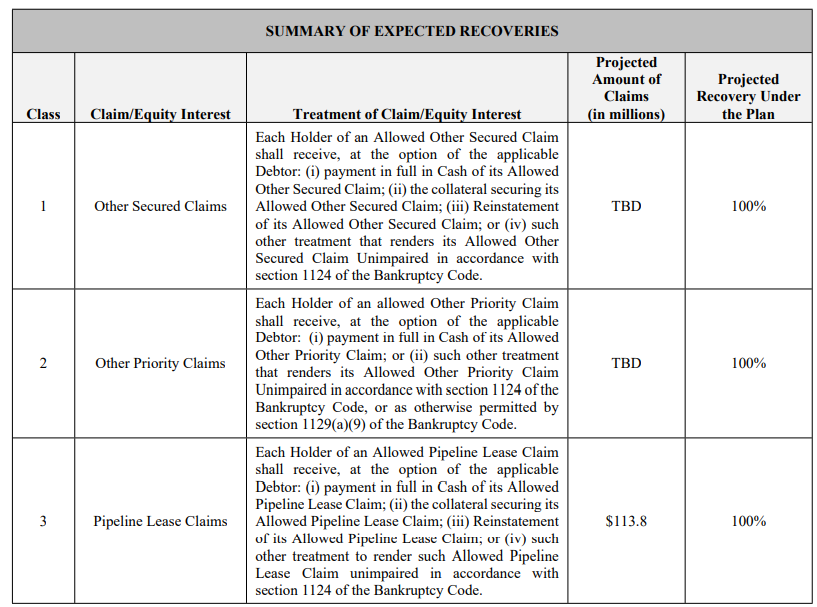

Although legal notices began littering my in-box, most of these were useless boilerplate. About a week after the filing, though, I learned where I stood in the order of creditors (hint: not whale excrement at the bottom of the Marianas Trench, but still somewhere on the abyssal plain where it’s cold and dark).

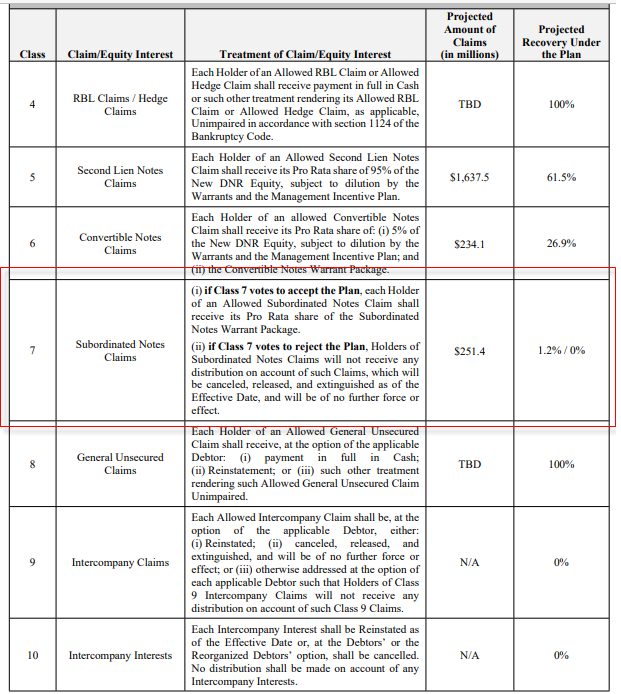

These tables were from the “DISCLOSURE STATEMENT FOR THE JOINT CHAPTER 11 PLAN OF REORGANIZATION OF DENBURY RESOURCES INC. AND ITS DEBTOR AFFILIATES” – 390 pages of $250-$900 per hour legalese. I scanned the table, looking for the claim class of my bonds (click to enlarge):

My bonds were not in the 100% recovery section. Well, surely I’ll be pretty high up. Or maybe not. I finally located my bonds in Class 7 (click to enlarge):

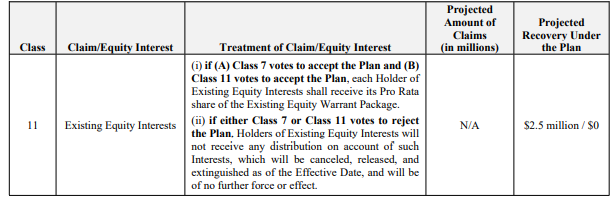

At least I wasn’t an equity holder, which got as close to zero as possible without being actually zero, namely $2.5 million split up between all old shares — the lowest class, Class 11:

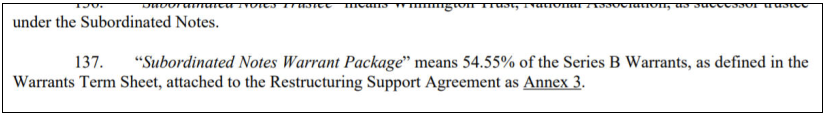

After I waded deeper into the 390-page morass, I found that my class of creditor, Class 7, would receive the Subordinated Notes Warrant Package.

At this point, I had a simple choice: I could vote to accept Denbury’s Reorganization Plan, in which case I would receive the warrants, or I could reject the Plan and receive nothing.

I voted to accept getting crushed.

They sent me an online link, and the whole process took 5 minutes.

Of course, no company can go bankrupt these days without the Robinhood crowd piling in, and on September 14, DNR – by then, DNRCQ – launched skyward (unfortunately, I didn’t get a screenshot of the stock chart and the symbol is no longer available).

On September 21, my brokerage account was dinged $38 for a “Mandatory Reorganization Fee.” I suppose one of the lawyers needed lunch money.

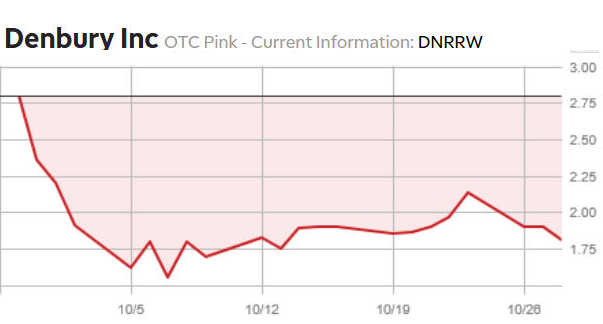

Then, on September 28, I received 32 Series B warrants, trading under the ticker DNRRW. The new stock — the old stockholders got none of it — now trades under the DEN ticker, and the Series A warrants trade under DNRWW.

Checking the price, I found that I could sell them for $3.50 each. Reasoning that a bird in the hand was worth more than hopes for the future, I promptly sold them, and received $105.35 after commission.

The chart below shows why selling the warrants turned out to be the right call. They now trade for just over half what I made:

All in all, here’s the ugly math, even though I’d bought the bonds after they’d already crashed to 7.675 cents on the dollar:

- Outlay: $448.39

- Recovery: $105.05, or 23.4%

- Loss: 76.6%.

If I had been an original bondholder and paid face value, my recovery would have been $105.05 from $5000, or a 2.1% recovery – for a capital loss of around 98% – not too far from the typical fate of unsecured creditors in a bankruptcy. By David in Texas, a long-time WOLF STREET Commenter

The American Oil Boom Was Where Money Went to Die. Read… The Great American Oil & Gas Massacre: Bankruptcies Hit New Milestone as Bigger Companies Let Go

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wow. Interesting, and definitely not funny although appreciate your candor and humour.

I think I would have asked for an office tour and gone for the pens and pencils, printers and computers, etc. Pay phone bomb threat would expedite things.

This is crazy. Better off buying Suncor for sure.

Dude, it was staring you in the face the whole time!

“DNR” medical code for “Do Not Resuscitate”, i.e. Dead already.

Paulo, are there any Canadians that recall the ream job on Stelco? That was as crooked as Canuck law gets in an engineered BK.

We used to say… Imagine the Stock Market as a VAST CASINO.. with mostly Mobsters running it..

The Mobsters are the smart ones.. dumb mobsters are doing street level crime.. Smart Mobsters figured out a long time ago.. that the Stock Market is a far better place to operate.. the payoffs are far bigger.. the risks far less.. and many more fall guys.. to go to jail for you.. if things go sideways..

Stawk Mawket Mobsters.. (SMM’s) hire the best Law firms money can buy, and Lobbyists.. To write deeply complex contracts and schemes.. that they understand far far better than you..

Then they operate.. and they Dunk, Wash, Scrub.. hang out to dry.. rinse and repeat..

On a good day.. everything is Legal.. what???? you didn’t read the 402 page prospectus and the 807 page contract/agreement?

Did you fail to understand page 207, clause (ii) sub section III???

Really.. you should have had a good Lawyer :)

In the Casino.. you are the mark..

Some sort of confessional?

Michael Grace,

No, read the article, not just the headline. What David in Texas, the author, walked us through is how an unsecured bond gets dealt with in bankruptcy. Kind of technical maybe. But essential to know for investors because there are a lot of unsecured bonds out there. And their yields are tempting. And junk-bond funds hold them too.

It also shows what happened to the stock in bankruptcy court.

Excuse my ignorance, I’m not deeply familiar with U.S tax laws. Would the capital gains loss enable David in Texas to offest these losses against tax gains in future years to his advantage? I acccept these losses are relatively small in scale.

I’m more interested in the principle of how billionaires can apparently make a tax loss in one year and then seemingly profit (legally) from the tax system as a result of that earlier loss, for many years afterwards?

Very good question CR,

After being able to deduct from income each and every ”business expense”,,, from payments to sub contractors to almost every maintenance cost for home office, trucks, labor of course, etc., etc., I was still required to pay a lot of fed income tax most years…

And, over those years, I always wondered how the gazillionaires managed to pay nothing.

OTOH, one of my mentors told me to be glad to pay income taxes because it meant I was ”successful.”

I think the “risk” you took are about as well thought out as it could be. Given the 3rd grade math involved, you probably assumed you’d lose everything. The upside would have been huge.

So, you should’ve been pretty happy overall. It’s not as if you plowed $10,000 into this thing. Think the education you got through the process was worth more than what you paid for.

There cheaper way to learn.

For example I read his experience so it is supposed that I should not make the same mistake.

Before getting to the pool ,first learn how to swing.

Never star in a business you know little.

Original investors also got the 6%+ interest* over a number of years so that needs to be included in the recovery rate. It ould still hurt.

* my calculation of the numbers in your post, probably incorrect

Great Story…! I have a few to match, including recent. I most appreciate those who can tell their “failures” well.

If I took the average of all stories I hear on the whole, you’d think everyone is making 50% returns every year. Maybe a bit of selection bias?

Thanks again, had me laughing.

I bought XOM in Nov ’19 at 68.50

I think think there are only too advantages retail investors have:

1. The ability to hold a position for a long time because our job doesn’t depend on short term performance.

2. Knowledge of a particular industry because you are employed in it.

In most other ways when you buy a security you are at an informational, political and skill disadvantage so your performance is probably going to be less than the market. It’s how retail investors on average under perform the market most having been better just to have bought CDs.

Having said that, speculation is fun. I tend to do it with about 10% of my portfolio and sometimes I am way up and sometimes way down, but overall my speculating is under water.

Old School,

Yours is a very accurate post IMHO.

Having worked in the oil & gas industry for over three decades (retired now), there are scores of small operators like Denbury who are in the process of crashing and burning. I worked in M & A and saw many deals that were on thin ice even during the good times.

At least you got a few bucks back. Many investors don’t. The winners are the CEO’s and the law firms. Guys at the top take big bonuses on the way to the court house,

I believe the correct weasel words are “employee retention payments”.

Yeah, across the HY unsecured spectrum its looking like 0 to 2 cents on the dollar in recovery. Retail bankruptcies having the same payouts as O&G…

People wish this was 2008 and could get back 40 cents on the dollar.

Yes. Covenant lite comes home to roost. Always does. No protections, little recovery.

I do think being a buyer at these discounts will be a great opportunity, but I think we need to see wholesale liquidations first to force weak hands out who would rather not liquidate some of their HY positions but are forced to in order to meet overall collateral calls and reduce portfolio margin debt (the play now has been buying tail risk protection on HY which has the same expected losses as buying for pennies on the dollar with high prob bankruptcy, but upside goes up with the declines in the unsecured underlying bonds/notes, but spreads are going up quickly again).

Hedge funds and PE firms are going after secured bonds, buying large stakes so that they occupy lots of seats at the table in bankruptcy court to obtain the outcome they want (such as ownership of the assets or the new shares).

@Wolf

Yeah I get that, but you one doesn’t necessarily know what their hair cut rate is going to be a head of the time when you are seeing the entire spectrum being repriced.

I.e you might see 1LN-NT trade down to B-NT or S-NT levels, then maybe a BK happens, then maybe months later you realized that the 1LN-NT you thought was going to be 1-2 on the dollar was actually break even on Par

Thanks for the detailed report. It always helps to have a step-by-step guide.

You knew what you were getting into and bought in very low (and still lost).

But I really, really wonder about the initial bondholders who buy in at par (100 cents on the dollar).

In modern American finance, companies are laden with so much debt at such poor yields, that absent thoroughgoing diversification (which ZIRP comes near to making impossible…since everything becomes correlated to the fictive interest rates) the whole exercise of investment starts to look like a suckers bet (at least for unsecureds).

Tiers upon tiers of creditors (that you briefly highlight) all have claims on the sunken ship…the Fords and GMs of the world frequently have over 500+ distinct bond issues/classes outstanding at any one time.

Leaving the pure, doomed financials aside…imagine the BK costs involved (which get paid first) in trying to sort out that army of stiffed creditors.

Most of whom are unsecured and have *zero* right to *any* collateral.

And yet, DC engineered ZIRP has made leaping into that well of despair standard operating procedure. For peanuts.

It is that reality, ruthlessly repeated yr after yr, decade after decade, that must ultimately drive any sane investor away from the terminally damaged dollar.

Nice post!

Triple-check.

may we all find a better day.

This is a beautifully written article of the angst on a trade that is not even $500!!

I would give you money to invest, just to make you write a newsletter.

drg1234,

David told me about his Denbury bond trade back when I posted my article about DNR before the bankruptcy filing. At the time, we still didn’t know how it would come out. And then he kept sending me the installments by email, which were fascinating. I eventually suggested that after he is totally out of the trade, for better or worse, the whole thing should be put together in one piece for everyone to enjoy.

Thank you once again Wolf Richter, for once again leading we folks who want to see truth, as opposed to we all know who, who know it all, don’t need no education from any source, and are totally willing to share, eh?

This just one more step in my education, because to be honest, this kind of bond, because of the yield of course, is what we were thinking of buying until the local RE market, of which we are participants for 70+ years, returns to where it should bee for any kind of sane buyers.

In spite of, or because of buying RE in various regions of USA over the last 60 years of so, I still do not see any very clearly ”non liquid” market to be better for returning, and/or maintaining ”value.”

We ”Wolfers” really should have an open, extensive, hopefully concludingly, and, of course, carefully moderated by Wolf discussion/debate focusing on contemporary concepts of value versus price versus cost per gold, other PMs, USA dollars, other national currencies, etc.

With Wolf’s grate graphs, some of WE the Peedons might be able to understand how we have been done out of our wages and other metrics of value/price/cost of work done by workers, etc.

hahahahahahahahaha, funny.

drg1234,

That’s a great idea. I’ll think about it.

I do wonder, though, how much of a market there would be for a confessional newsletter – “Idiot Trader” or something to that effect.

It seems like there’s a bigger customer base for “How to Double Your Money Each Week Like Clockwork with No Risk.”

But in the absence of a time machine, I haven’t figured out how to do that yet!

Please do, this article was highly amusing, and as a medical person, the DNR ticker was especially delightful.

David-great article, also displayed Wolf’s excellent editorial chops.

It seems to me that the ‘bigger customer base’ misses enough of the observations and lessons available in the mundane (dare i say, ‘real’?) world to parse and see the titles of both newsletters as meaning the same thing. (heck, Madoff did pulled in plenty when promising even smaller returns…).

may we all find a better day.

Unless I misunderstand something, your return is even worse, because you forgot that random $38 charge in your accounting.

Actual recovery: $67.05, or 14.95%, for a loss of 85%.

Mar,

No need to kick a man when he’s down. I think many of us learned something from this and it is refreshing to hear accounts from an honest trader. (Of course your point is accurate, but I think we don’t want to discourage honest discourse–something sorely lacking in our present climate.)

MarMar,

Yes, you are correct. I forgot to subtract the lawyer’s lunch!

Next disc up on Investor’s Playlist…Conway Twitty with “It’s Only Make Believe”. Consult your local stations for play times.

David:

Great post & insight, and very well written.

Personally, I learn a hell of a lot more & a lot faster if I have some skin in the game, but you definitely now know a hell of a lot more about “junk bonds going bad” (a tautology if their ever was one) than this retired CFO.

Maybe the Robinhood crowd could have helped perform CPR on this turkey…(sarcasm).

1) When u don’t know what u don’t know u can lose 85% – 98% fast.

2) Banks clamp on unsecured credit cards for consumers who do know, with 848 Fico.

3) Banks forbearance support people who don’t know, who cannot

pay their monthly bills.

4) Consumers will retard Xmas spending. Car buyers put their brakes on new cars sales.

5) The gov put support for the unemployed.

6) Fed assets will expire after reaching a climax.

7) From wild, wide, crazy, totally uncontrolled osc, SPX latest spikes are milder.

8) The system is resting, it’s slowing down. The collapse of the bottom was prevented and the rise of the Pareto top will slow down. The system put a clamp on spending and painful speculations.

9) The $100M NYC apartments spikes of wall street experts are gone. Their wild exuberant will be phase out by the ghost towns. RE collapse got support from the nearest suburbia.

It would be interesting to know what the average Robinhooder lost as they zoomed in and out……We will never know unless there is “another”, David in Texas, doing those trades(small amounts, of course….)

Looks like the company spent more on the bankruptcy plan than the business plan.

Low rung oil companies usually write both plans at the same time and include executive team bonuses for when BK actually happens.

Most revealing comment of all

10) AI moderation and the virus moderation, after almost killing US,

will open a door to a Positive reversal (PR).

Michael,

I think the only people to benefit from this positive reversal will be the families that own most of this planet already.

Wait…. u can buy individual junk bond w/ 1k face value? How? I thought the minimum is around 100k

Back in the 80’s when I did a fair amount of junk bond buying and selling, I rarely ever bought more than 10 bonds (10K face). Sometimes up to 30 and sometimes as few as 5. I can’t remember what brokerage I used, but I think it was Schwab. Whoever I used had no problem with my small trades. Seems like I was charged 5 dollars a bond.

Back in those days, the days of Milliken et al, I made some good money in them. Anyone remember some of those that were payment in kind, at 17 percent? Regardless, you had to do your homework.

If you learn to read the company balance sheet that is in the annual report, you might detect debt vs asset values. In the income statement there are various income and cash flow measures as well as numerous expenses. Quarterly statements update changes to these accounts. It is called fundamental analysis.

Insiders read the Off-Balance Sheet.

And, simply not possible to have total certainty what an “insider” is until you have been one.

Very interesting article. This is of course how the entire economy is supposed to work, without all of the implicit “backstop.”

Clear insight to a complex deal. thanks for sharing.

This place is the best.

Do not invest in junk bonds unless you love to speed read, savvy about debt covenants and are fluent at calculating financial ratios.

I think it’s a losing proposition, regardless of your skill. In a small company like this, you should assume many of the “investors” are getting inside information from family or friends, business acquaintances, bankruptcy lawyers and workout specialists, etc. There are tons of people involved with a situation like this. Best to stay away.

In this case, the bonds were trading at $.08 on the dollar likely because a lot of the holders knew a prepackaged BK was in the works and the bonds were getting next to nothing in return.

I learned my lesson buying Enron stock on the way down, before there was any public knowledge of fraud. At some point, the stock price became too good to be true on the way to zero. As it turns out, many insiders knew about massive fraud, but the information didn’t go public until many individual investors had been suckered in.

Next time try buying 400 lottery tickets and see how that works out. Probably better recovery rate.

David in Texas:

As a licensed paramedic, I should have known better than to invest in a company with the ticker symbol “DNR.” For those not in the medical world, elderly patients will often have a DNR (Do Not Resuscitate) order……

Classic line, LOL. Spit coffee all over my keyboard.

Wolf – How come the Class 8, General Unsecured Claims, got 100% reimbursed in cash if they were unsecured?

I’m new to this.

joe2,

OK, so this is David’s story, and I don’t have the document and all the definitions. But just guessing…

Class 8 looks like trade claims, such invoices by suppliers of goods and services. And they’re getting paid. This is often the case in these big bankruptcies. They want to keep the suppliers alive.

Joe2,

That is a very good question…and I suspect that the answer will hint at how legally convoluted creditors’ rights are in practice.

1) Note the bit about form of pmt being at *Debtor’s* discretion…the Debtor has a plan…at this pt the creditor is just along for the ride…

2) Note the bit about Reinstatement…I think the Debtor’s plan may be to simply make pre-BK general unsecureds into post-BK general unsecureds…that is a very good way to avoid a fight…keep your largest creditor class whole…well, at least until your next BK…

3) Note the author held “subordinated” bonds…picture the long line of creditor classes as victims on a pirate ship gangplank…each class has distinct rights, in a hierarchy…the least protected (who likely bought highest yielding bonds) get pushed off the gangplank first…and then creditor class follows creditor class, until the pirates (debtors in BK/Court/etc) are satisfied.

The General Unsecureds didn’t get fed to the sharks (being a large group, they would put up a bigger fight).

But the Subordinated unsecureds got sent over the side…they were smaller, weaker (legally), and more costly to company/debtor because their Coupon carried a higher interest rate.

4) Now picture a GM/Ford/AT&T/Anheuser Busch pirate ship, with 500+ distinct classes of creditors. Each class with distinct rights/exposure to gangplank risk.

5) Creditors think they run the show because they supply the, you know, money.

Silly rabbit, Trix are for kids (and the ZIRP’ing Fed)

Large, powerful Debtor companies (abetted by invt banks and the Fed) *engineer* their creditor classes *in advance* so that things (among them future possible BK) can be fine tuned to the benefit of the mega-debtor.

6) Creditors go along because they have been ZIRP-slapped in Mistress Fed’s Dungeon of Perverted Economics for 20 years.

They don’t hold the whip hand.

They are the ball-gagged Gimp who lives in the steamer trunk.

(Hat tip, Tarantino).

I looked at the 390 page document again and Wolf is indeed correct. These are mostly trade claims and the like (such as utility bills); paying them is necessary to get suppliers to continue to do business with the company, post-bankruptcy.

Class 8 – General Unsecured Claims including unpaid amounts with respect to prepetition trade, executory contract rejection claims, litigation claims, and

numerous other types of prepetition liabilities not contained elsewhere;

Acknowledged.

I guess that I would just point out that the advantages of “passing through” large/powerful (ie, stronger legal rights) creditor classes while executing smaller/weaker creditor classes still applies, even if not operational in this case.

And when there are hundreds of debt issuances from a company (each with potentially distinct legal rights) it is extremely hard for the retail creditor to know what his actual rights in BK are.

That creditor has to rely upon invt banks (who structure and sell the bonds…on *behalf of* the debtor) and rating agencies (paid by the debtor companies) to guide their decision making.

But both parties are in fact being selected/paid by the *debtor*.

So retail bond buyers (institutional too, the truth be known) are not so much the customer of the IBs/rating agencies…as the product being sold (debtor access to investor money “advised” by IBs/raters).

This reality explains a lot of the perverted financial outcomes we have seen over the last 20 years.

And will see a lot more of in the yrs to come.

And, behind it all, the malefic influence of ZIRP.

Wolf – By the way, I enjoyed this article. These types of real life case studies are always informative. You have an eye for detail that others seem to lack on purpose.

Thanks for sharing with us! Good read, and something new to learn.

David – nice work. Back in 08-09 or so, Adam Davidson on NPR did a similar thing buying a “toxic asset,” some kind of CDO, to watch it go to zero.

What is your biggest lesson in this?

It was seeing how the process works, first hand from the perspective of someone with a financial stake in the outcome. We all see things from a different perspective when there is actual money at risk.

Wolf,

It might be worthwhile to post the yields/spread to treasuries for various rating level bonds (indexes/etfs exist for each tier and I’ve seen them on FRED) so that your audience can understand just how little yield they are getting for putting 100% of their principal at risk.

Of course, since almost all fixed income is priced off a spread to Treasuries (which are nearer and nearer to zero), the entire bond mkt is paying less and less as default probabilities rise and rise.

(Thank you, Mistress Fed’s House of Perverted Economics)

Got my comeuppance with -pgh-Bought

at 6 and watched all the way to 4 cents.

I learned debt levels are really important.

I was chuckling at your foolishness until I realized I have been buying RIG

shares under 2 dollars and may face a similar fate!

Always remember, stocks can go down 99% REPEATEDLY. 100 dollars down to one dollar and then down to 1 cent! Reverse split and do it again :-)

Equity holders are the first pushed off the pirate gangplank in any BK.

They are the sub-basement in any debtor company’s capital structure.

For the very very few that are more interested details this topic, and maybe trying to make money after bankruptcies, read: “When Gushers Go Dry, The Essentials of Oil & Gas Bankruptcy”, written by a bankruptcy lawyer. Bankruptcies do have one silver lining in that more is known about a company at that time than any other time, and there a lot of them now in oil and gas.

And their collateral, oil reserves (well, *estimated* oil reserves) and their resultant oil are theoretically very determinate in value and, ahem, liquid.

This can’t be said of many, many other types of companies in BK, whose asset values in the market are much, much less determinate and much, much, much less liquid (try selling goodwill, leaseholds, IP, etc at all or office buildings and cruise ships quickly…at anywhere near true value).

Someone could make money off of this by producing a t.v. show called “I had skin in the game at a demolition derby!”. All you need is a host who fronts the playdough and keeps yelling, “You’re fired!”.

Great and witty bit.

Now the bad news. The author knew it was junk and knew it was essentially a lottery ticket. But what if it wasn’t junk rated but was rated as investment grade? Wouldn’t that change things, like possibly tempting him to invest real money instead of lottery money. Maybe even his retirement money.

As we all know the ratings agencies are paid by the companies they rate. Dropping a bond rating below investment grade usually means getting dropped as a customer. So how odd is it that almost half the investment grade US corporate bonds are rated at the lowest possible grade allowing them to be investable:

Baa or BBB.

In education ‘grade inflation’ is the norm. The grade of F has all but disappeared, this may even be mandated in a school district.

If something similar has happened to bond ratings them a lot of these ‘just scraped in Cs’ should actually

be Ds or Fs.

If it is the case that 25 to 50% of these ‘barely investment grade’ bonds are in fact junk bonds a huge shock looms.

nick kelly,

Your scenario happened many times, including with the Toys ‘R’ Us unsecured bonds, that traded near face value at around 100 cents on the dollar, and three days later the were down 88%, which I covered at the time:

But the coupon was 8.75!!!!

(Snicker).

The creditors maybe got 4 years of interest (35 cents on dollar of principal) before Toys took Old Yeller out back and shot him.

Ya when I saw 8.75 my eyes bugged out. As far as I can see (with NO expertise) anyone who had to pay that even in 2018 is not investment grade.

It was junk-rated. And the company was owned by PE firms following a leveraged buyout, and was struggling, which should have been a warning to creditors. But because the coupons were 8.75% and the yield was near there, it was just too juicy to pass up. Happens a lot. “Chasing yield” — one of the most expensive things an investor can do.

Really fantastic read, you should make this a regular feature!

Not a bad trade for 10-1 leverage.

I see no easy way to determine, for a retail investor, what class of priority any given bond might be or might become during bankruptcy.

The SEC should require all bond trades and all bond information to be public and available to all. And that should include Credit Default Swaps and other bond-derivative instruments.

Yes, I realize Wall St might use such a rule to turn the bond market into a retail-level casino, just like the stock market, but still. Am I wrong?

You’re not wrong by Main St standards, but you are certainly wrong by Wall St standards. You are pretty much asking for a criminal to explain his modus operandi to you so that you can use it against him. That’s not going to happen.

There is this thing, called FIRNA Trace (ie. tools[dot]finra[dot]org/bondfacts/api/bond/[CUSIP]), where for any given CUSIP, you can get all the related metadata about the bond… when you are buying B-NT / S-NT, and not 1LN-NT/2LN-NT or SSC-NT, you cant be that surprised that things like this could happen…

You can get CDS info from IHS Markit, but most corps dont have CDS available for them and most CDX indecies for HY only have like max 100 of the largest HY rated corps where there are thousands of corp bonds on the market.

You can get CIK and CUSIPS for everything reportable in SEC…

Might not be “easy”, but its deff public, and def available.

Well, you are wrong in the sense that the details aren’t disclosed.

Pretty much all the relevant docs are available from SEC EDGAR online.

But the problem is that there are thousands (and tens of thousands) of pages, written in hyper dense legalese.

So, such “disclosure” covers corporate debtor *ss, while almost certainly leaving retail (and most institutional) creditors in the operational dark.

It really isn’t too much of a stretch to say that large corporate debtors could hide a legal right/guarantee (!) *not to repay* in the docs and no one would ever detect it on the creditor side.

Add to this the yield desperation that ZIRP creates among creditors/dollar savers.

On par with the entertainment/Hollyweird accounting protocols.

Hint: always go for a cut of the gross, never the net.

Great post! Sorry for your loss. It seems like the energy space is hated by banks and the capital markets. One day, the market may demand profits from the tech sector, but that day is not here yet. The big IB’s will continue to put a fire hose full of crap IPO’s and SPACs down the throats of retail investors until they choke.

7.67 cents on the dollar and hoping for a’ turn around’ miracle of some sort?

as a speculator this is the kind of trade that makes sense from a risk to reward ratio. Risk 450 to make 5k. Fact that you got back 100 bucks was a reward.

Are the same folks that took DNR into BK still running he show at the new company?

I feel sorry for all the people that lost money by ‘investing’ in DNR, but one should have looked at the way they treated their JV partner in Wyoming, Elk Petroleum.

Had people done that maybe they would have stayed away from DNR.

Great story

thanks for sharing

looks to me like you paid about $200 for a great real education

that is great value

there is nothing like learning things first hand – by walking through the process