Mall meltdown gets messier. But someone’s making money. Here’s how they shorted malls.

By Wolf Richter for WOLF STREET.

An internal hedge fund of private-equity firm Apollo Global Management made over $100 million shorting the commercial mortgage-backed securities index CMBX 6 and other commercial property securities, according to the New York Times. Jason Mudrick, of hedge fund, Mudrick Capital, estimated that he had also made around $100 million in doing so.

The biggie was Carl Icahn. He disclosed on August 10 that his proprietary investment fund had made $1.3 billion in the first half of 2020, by purchasing credit default insurance using the CMBX 6 index, according to Bloomberg.

Icahn took out the bet in 2019, based on the ongoing Brick-and-Mortar Meltdown. But as the Pandemic hit, and retailer defaults went into overdrive, he hit paydirt big time. Though Icahn did not disclose the size of his bet, he’d told Bloomberg in April, “We have billions and billions on the short side of this.”

The CMBX 6 index is part of a group of 13 CMBX indices, all tracking commercial mortgage-backed securities (CMBS). The CMBX 6 tracks CMBS that were issued in 2012, of which 39.9% are backed by mall loans, according to Trepp, the highest exposure to retail property loans of any of the CMBX indices. And so it has become a popular vehicle for shorting malls.

An unexpected benefit for mall shorts is that over 10% of the CMBX 6 index are hotel CMBS, and hotel CMBS got brutalized even more than retail CMBS.

The CMBX 6 is sliced into tranches by credit rating of the mortgages, including BBB-, one notch above junk.

At the end of 2019, the cost of protection for insuring CMBX 6 BBB- was about 500 basis points, according to Trepp, which provides data and analysis on commercial mortgage-backed securities. By July 2020, the cost of protection had soared to almost 2300 basis points. That’s where Icahn made his gains.

Pyramid Management Group, the owner of 1.3-million-square-foot super-regional Crossgates Mall in Albany, NY, is over 90 days delinquent on a loan of $261 million backed by the mall. According to Trepp, the loan is spread across three CMBS deals, all of which are in the CMBX 6 index, making them one of the largest components in the CMBX 6.

Tenants at Crossgates include department stores Lord & Taylor, which filed for bankruptcy in early August and is liquidating the store, and JCPenney, which filed for bankruptcy in May but for now has not listed the store among those to be closed.

Last week, Crossgates Mall sued six of its surviving retailers – four of them owned by Gap Inc. (Banana Republic, Old Navy, The Gap, and Athleta) and two of them owned by Genesco (shoe retailers Journeys and Journeys Kidz) – for a combined total of $825,000 in past-due lease payments through August.

The value of Crossgates Mall – the collateral for the loan – was slashed by 40%, from $470 million, established in 2012 when the CMBS were issued, to $281 million now. Pyramid was granted six months payment deferral on the loan, according to recent special servicer comments cited by Trepp.

That’s how messy the mall meltdown is getting.

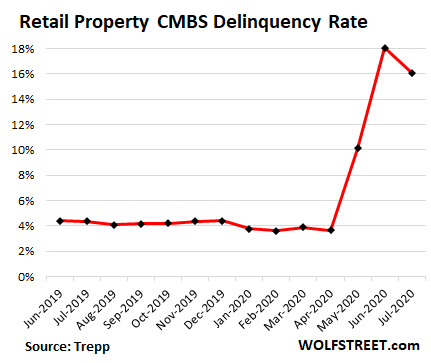

As of July, 16% of the retail property loans packaged into commercial mortgage-backed securities (CMBS) were delinquent. This was down from 18% in June, partly “due to forbearances and other relief assistance,” according to Trepp, which is when loans are marked “current” and are no longer counted as “delinquent,” though borrowers have stopped making payments:

Below are the metros with the highest balances of delinquent retail CMBS loans, according to data from Trepp, in order of the dollar-balance of delinquent loans, with Houston claiming the top spot, with $2 billion in delinquent CMBS loans. Among these metros, the delinquency rate tops out at 28.4% in the Dallas-Fort Worth metro, followed by 20.8% in the Las Vegas metro:

| Metropolitan Statistical Area | # of loans delinquent | Delinquent Balance, Million $ | Delinquent % |

| Houston-The Woodlands-Sugar Land, TX |

12 |

2,009 |

14.4% |

| Dallas-Fort Worth-Arlington, TX |

15 |

865 |

28.4% |

| Miami-Fort Lauderdale-West Palm Beach, FL |

13 |

452 |

6.1% |

| Las Vegas-Henderson-Paradise, NV |

17 |

520 |

20.8% |

| Riverside-San Bernardino-Ontario, CA |

12 |

541 |

18.8% |

| Los Angeles-Long Beach-Anaheim, CA |

22 |

334 |

6.6% |

| Atlanta-Sandy Springs-Roswell, GA |

18 |

226 |

8.7% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

17 |

298 |

6.1% |

| Chicago-Naperville-Elgin, IL-IN-WI |

36 |

371 |

16.7% |

| New York-Newark-Jersey City, NY-NJ-PA |

69 |

177 |

4.2% |

Commercial property mortgages are non-recourse, meaning the borrower can walk away from the loan and turn the property over to the lender, when the value of the property drops so far that it’s not worth making the mortgage payments or refinancing the mortgage when the balloon payment comes due.

This is now happening all the time, and even the biggest landlords are walking away from mall properties.

Simon Property Group [SPG], the largest mall landlord in America, which owns the Springfield Plaza – an aging 426,761-square-foot shopping center in Springfield, MA – wants to walk away from the $28.3 million mortgage and turn the mall over to lenders, according to special servicer notes reported by Trepp. The mortgage is in a CMBS that is part of the CMBX 7 index.

The mall was valued at $39 million in 2013 when the CMBS were issued. Now the value has dropped so far that Simon Property Group wants to walk away from a $28.3 million mortgage to get rid of the property.

Simon Property Group has walked away from a number of malls already, including last year as part of the regular Brick-and-Mortar Meltdown, when it turned the 1-million square foot Independence Center in a suburb of Kansas City, MO, over to lenders: The $200-million CMBS generated a loss of $149.7 million for CMBS investors (75% loss) when the mall was sold in a foreclosure sale, which, according to Trepp at the time was “the largest loss ever incurred by a retail CMBS loan.”

At least 11 malls owned by Brookfield Property Partners are delinquent or are seeking debt relief on at least $2 billion in CMBS debt, according to Bloomberg.

Starwood Capital Group is delinquent on 17 of its 30 retail properties with nearly $2 billion of CMBS, according to Bloomberg. An appraisal slashed the value of a group of four of those malls by 66% in one fell swoop, wiping out Starwood’s equity, which makes the properties a prime candidate for jingle mail.

The Pandemic Economy Massively Changed How Americans Buy Stuff. Read… Ecommerce Sales Spike 44% in Q2: Even Groceries, Building Materials, Garden Supplies, and Furniture

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So: what happens when a mall is sold in default? For example, Independence Center is now a $50MM property instead of a $200MM property. Does it remain active as a mall, with a significantly lower nut for the new owners? At that number, does it become a candidate for conversion to something else? is the land worth that much after the building is torn down?

If the mall is viable, the new landlord will try to make a go of it with a lower cost base. If the mall is not viable, even at a lower cost base, a developer will buy the mall, tear everything down and build something new (housing, office, etc.). If the property had a couple of gas stations on it, maybe no one will buy it (because remedial costs may exceed the value of the land) and the lender becomes the end user of it :-]

It seems like the last remaining tenant in malls across the land is GNC

GNC is bankrupt as well I think. They have plans to close 1200 stores.

Starbucks and Apple stores are probably more reliable tenants.

People buy stuff from GNC when you can find the same products online for 20% or more less???

And I forgot the largest new mall of all which just opened a year or two ago — the “American Dream” which is next to the Meadowlands sports complex in NJ. These malls are doing just fine..

My local GNC store (in a small strip shopping area) closed about a year ago. The store sat empty for months and then a seller of marijuana products moved in.

Apple is very cautious about what malls/areas it goes into. There are quite a few cities that have well performing malls with no apple store, even when there is no apple stores within a 60+ minute drive. They seem artificially scarce for some reason.

As for Starbucks, the question is can they maintain their size in a work from home world? Also, in a world where not as many, might be willing to pay their prices. But, maybe in a work from home world, Starbucks might actually attract people using laptops doing actual work. Might actually be a boon for them, if they can keep those people paying.

Starbucks should not be used as an extension of ones office that is the purpose for places like WeWork

Starbuck is not a destination of itself but lives of footfall. No footfall means no business for Starbucks. I wonder about their contracts with malls that are now zombie. can they break those contracts for a price they can survive.

If the anchors holding down the Mall of the Future were to be, say … nail salons, barber shops, and tattoo parlors … who might become the new retail tenant fill-in ??

you forgot Starbucks, Skechers, Foot Locker, and Ulta Beauty amoungst others…

A new mall just opened in FairField County CT – the SONO collection which is off I-95 in Norwalk CT which a Nordstrom dept store.

Mike M,

GNC filed for bankruptcy in June and will close up to 1,200 stores.

Who is on the losing side of those CMBS shorts?

Is there an institutional investor on the other side of these trades or have credit default swaps come back from the dead? Is there an insurance company involved somewhere in this process?

Not in my local mall. They left years ago. The only viable tenant, now that JCPenny went kaput, is the county motor vehicles department. They practically have it all to themselves. Even the vape shop couldn’t make it.

what happened to the good ol’ days of Orange Julius ?

The pot industry is already online. While the state of Ca has legalized, most cities reject B&M storefronts but they must by law allow delivery. Not sure how the sales tax revenue works out. Maybe sales will migrate to corporate pharmacies, but online seems to be working. Lot easier to get pot than renew my meds when I am out of refills.

Mike M,

I think the mall food court has lost its edge. I think the pizza places in them (very common) raised their prices alot, Asian (and other speciality) restaurants and food can be found at more places besides malls now, and the food courts are often filled with almost exclusively common franchises now. I remember some of the malls in my area used to have stuff like nice snack shops with uncommon snacks and nice buffet places, but, now they are almost exclusively food franchises you can find anywhere outside the mall.

The ‘Rona simply accelerated the death of malls by 5 years.

Ave María to that!

Very smart to short the Malls…as the outlook has been horrible for YEARS — and this 2020 Pandemic the catalyst. The Big Short.2…PJS

And if AIG or the responsible CDS counterparties can’t pay, Joe Taxpayer will. Thanks, O’Bummer and Timmay! The casino must always pay out, afterall.

The government was paid in full for the loan and made $22.7 billion on the AIG loan. That’s a 15% return on investment. You are correct in thanking Obama.

Y’all keep repeating this as if taking bail and paying it back is some sort of honorable or good thing to do. They took the bail out and then obtained money through loose monetary policy of the fed to pay it off. I expected more of wolf street commenter.

Didn’t see that in Ed Barrett’s comment at all.

He just commented on the fact that Obama did a bail out that was repaid plus some.

That’s not a complete and final accounting of everything related to AIG… and since you mentioned Obama, I bet you knew that already?

The downtown business district lasted for over 200 years before it was mostly wiped out by malls and walmart. The shopping mall looks like it will only make it about 60 years before being wiped out by shop online. I expect that shop-on-line will have an even shorter life and be gone in less than 10 years due to degradation of the grid , financial collapse and the poor energy efficiency of the arrangement.

you forgot the zombie crows from resident evil #whatever… it’s all make-believe, to begin with…take a death breath if you like… this is an opportunity to shape things in a better way, or not…it’s up to you

I have lived all over the globe.

There are many places in this world where there is no mail delivery and no package delivery.

The streets are just too dangerous to the delivery employees and everything would get stolen anyways (unless delivered F2F).

The Amazon business model only works where there is law/order and safe streets.

You can extrapolate a timeline for e-commerce with that in mind.

The Amazon business model only works where there is law/order and safe streets.

It seems to be working here in America and we don’t have either.

Americans are sheep. Wait till Jeff Bezos gets into the ballot.

Unless it is delivered by the militias themselves !

The security costs for a mall in such a situation of high crime are also very high so the Amazon model still works

“Shop-on-line” – well it may survive domestically, but the way the mail system is going on around the world………………

Here in magically, lockdown Oz, the domestic mail system is totally stuffed.

Some recent examples:

1. A package from 40 klicks away went to Sydney first ‘for processing’ and then back to Melbourne. That took 14 days to get to us.

2. I sent a registered letter three days ago and it has actually managed to go from our local post office to the processing centre down the road. that’s 15 klicks away or 5 klicks a day. us in Where from there? Who knows………….

3. Another package from up north near the border being sent to us in Melbourne hasalso gone to Sydney and has been there for 4 days now without moving.

And internationally?

No mail now since sometime in April from Japan to Australia. Some countries in Europe have had no mail service to Australia for just as long. the list of countries in Europe not sending mail to othe countries is huge.

Still waiting now for three weeks on a letter from the UK.

And a letter I sent to the USA has an expected delivery date of…………..December!!!

So much for voting in the upcoming election.

Mail is not the same as packages. They use very different systems. There is also real competition possible in package delivery while competition in mail is only good for ideologues

But package delivery is iffy at best too. There is a complete bog down of packages in the United States though it isn’t as bad as Australia, and that is just for domestic mail. Add mail-in ballots to that list and it is clear that the election isn’t going to be as smooth as some people expect.

International packages to and from Australia are even worse.

If you have the service they are taking even longer than letters.

In the late 1800’s you could send a postcard from Europe to Australia and get it there in 30 to 35 days without the use of airplanes.

Today you can’t even send a letter or package from many countries to Australia.

Just think about that for a second: you can’t use the Post Office system to mail a letter or package to Australia from Japan.

The other way around: from Australia to Japan is still working, but the time period is ridiculous.

Some people have seen their items sitting at the processing centres here in Oz for a month before leaving the country and you don’t know if the item is going by ship or air…………………

True enough about the down towns SC, except that it was a lot longer than 200 years if you include the major cities of Europe and east of there, some of which been going downtown for at least a thousand or so, eh?

And to be sure, many of the smaller cities of USA have made a very good job of rebuilding, re-branding and revitalizing their down town areas in the last few decades I can testify from personal experience doing some of that rebuilding for both in AL, CA, FL, GA.

Also involved in rehab/brand change of hundreds of ”big boxes” over the same period: And the most important element for success of both appears to me to be community connections; those stores and cities with it have done fine in the face of wally world, etc.; those without have now closed in most cases, no matter if the same brand, (Kmart) or city in the same area.

The downtown of today’s European cities was the complete city 200 years ago. Plus some empty fields.

Thank you Amazon…and Thank you China!

Ever wonder why Trump is so brutal on Amazon and the Post Office? If Amazon’s mailing rates are 50 cents per package off (not an unimaginable thing) millions more square footage of retail space will become empty.

If, after all this happens, the Post Office says, “Opps…rates should have been higher!” where do all these small retailers go for redress?

The US Post Office has no business bidding on the Amazon contract.

Amazon’s amazing contract with the US Post Office was signed in 2013.

It expires this year.

Just in time for Amazon to replace the post office. That will happen if Joe Biden gets into office.

Of course the USPS is entitled to bid on the Amazon business.

Too bad lite-weight USPS managers didn’t know how to ensure their bid was profitable.

If you’ve seen any of the recent brutal, but undeserved, congressional mauling of the USPS postmaster, you’ll understand why few competent managers want to work in agencies governed by the congressional cess-pit.

the US breaks treaties all the time. why is the amazon contract so sacrosanct?

Because they actually make money with Amazon, but lose it with letters from rural Idaho to rural Alaska for 55 cents.

Yeah that’s the problem with USPS. The 17 letters a year sent between rural Idaho and rural Alaska.

A close friend of mine was hired by the gentleman that is now the postmaster right after he sold his logistics company to XPO. She loved him and said he was a wonderful man.

He and his wife were big Republican donors so the Dems were out to get him. My favorite line from the hearing was when he said he couldn’t believe nobody in the room cared the postal service was losing $10 billion a year. This coming from a man that worked his whole life to build a company worth $670 million.

From my understand the USPS can never be profitable because most of their revenue goes to fund their pension system 75 years into the future. This was done some years ago to fatten the pension system, bankrupt the operational side, and make it a huge honey pot for privatization.

If they take the USPS private the pension system will be used to leverage the deal, pay huge dividends to the new owners, and bankrupt the operational side. The new owners walk away richer, the customers get gouged and eventually stranded, and the workers get screwed.

Keep an eye on who wants to privatize it, it’s the same bunch that voted for the crazy pension system funding.

Petunia is spot on – the entire Post Office system is being setup for a private equity looting scam. The amount of money to be stolen is going to be enormous.

Petunia- basically correct. The USPS needs to re-visit its mission, its operations and finances as part of that.

In order to keep mail fraud and other legal/federal regs in force, we probably need some kind of USPS. I don’t think we want FedEx delivering official US Govt items (that have some legal force of law/priority).

The USPS can’t cherry pick delivery routes. Also because of this they probably can’t be “profitable”. The government should (try to) run it like anything else it runs- as efficiently/low cost as possible.

It’s probably a necessary govt. item, e.g. like law enforcement.

The USPS should be profitable like the military, fire departments, or even better, the legions of zombie corps pumped with taxpayers dollars.

Profit speak in the U.S.A has reached peak myopia.

The USPS make a huge profit every year. The issue is the GOP trying to kill them for years by forcing them to fund their benefits for 75 years into the future. No other govt. agency has to do this.

Don’t blame all of Congress please, for the actions of the GOP and their brand of crony-capitalism.

Drain the swamp = hire incompetent (mostly billionaires) to destroy the agencies they head. Brilliant idea? Look around at the results of having an incompetent silver spoon business failure/tee-vee star leading US.

The post office recovery act that mandated the 75 year pension funding was passed with bipartisan support. Both parties have dirty hands.

BrianC,

You’re absolutely correct that this was a bipartisan scam.

Notice who had to run back to DC to fatten the pig with another $25B, all while not giving the time of day to the unemployed, almost homeless, and hungry voters.

Why do you spread such blatant lies? I am 52 and the USPS has been in the red my entire life. This is nothing new. If you have an axe to grind with the Republican Party, that’s your business, but please try to base it on facts. The current retirement process of the sorting machines was started during the Obama Administration and is being carried out per plan.

My understanding is the post office is supposed to not require continuous government infusions as it is not a government agency like the state department. I think that Congress saw they were going to be on the hook for USPS pension benefits if they did not require the pension plan to be sound into perpetuity. Very fee organizations have sound pensions because it’s pretty easy to be cash flow positive today and the pension fund be bankrupt in 10 years.

If small retailers’ business is dependent on 50 cents per mail package, they’re already dead no matter how you slice it.

Kent S: says:

“…………50 cents per mail package…..”

Must be one of those new math and USA university educated persons. FIRST CLASS LETTERS are 55 cents.

Packages are a whole different category and price scale

Gees, gotta wonder!!!

He’s talking about a rate differential, not the rate itself.

A deep pocketed would-be monopolist can undercut prices, sell at a loss for a long time, drive everyone else out of business, and then own the entire market.

And actually yes, retail is low-margin so on a $10 item that extra $0.5 on shipping IS your 5% profit.

FYI…USPS has notified us that rates will be higher for the upcoming holiday season, beginning in Oct. Interesting, now that stores are closing, people are buying online,( stores may be closing because people are buying online too) it is now possible to actually charge the appropriate rate for shipping. The last mile of delivery is the most expensive. Hence amazon looking for different options, Whole Foods for example for you to go pick up items yourself. Buyer beware, shipping is not free! You will pay!

Ah yes .. the vaunted ‘Holiday season’ ..

This one .. or the one proceeding it, will be for the ages. Who knows .. it could be the last one of it’s kind! Who will save the economy by buy useless crap, if everyone’s scared, broke, or both?

The whole commercialization of our hallmarkian celebratory uh,’culture’s.. are poisoning society, both slowly, and all at once!

@Polecat: This is a really interesting question. I see where Wally World and some of the others are staying closed on Thanksgiving. While this is the right thing to do, I wonder if they’ve already read the tea leaves and expect a slow season.

No one is forcing you to participate. You don’t have to spend $1000 or more (which is the average people spend on “the holidays”)

Actually Starbucks isn’t that reliable. Stores that draw people into the mall damand preferential treatment. https://www.wsj.com/articles/landlords-fume-as-starbucks-other-chains-seek-extended-rent-cuts-11589889601

So several hedge funds had short positions on and were lucky that Covid hit just in time to make them major $$$

How fortunate for them…

Question: Who sold Icahn the cheap insurance? Who is on the other side of that bet?

Dave Mac,

They were already lucky before the Pandemic. This has been going on for years. I’ve been calling it the “Brick-and-Mortar Meltdown” since 2017 in my articles about retailer bankruptcies, mall and mall-REIT woes, and PE firm involvement in it all. For hedge funds who read my site, this has been an obvious trade for a long time.

Anybody who has been to American malls over the years should see the decline. They are full of T-shirt and dollar stores instead of solid anchors. The customer mix is obvious, also. Just look at the people walking around. Do they look like they can afford to make a substantial purchase? Is anybody carrying a large bag of things they bought, or are they all empty-handed? Twenty years ago I worked in a large CT mall. It was doing well then. Now they can’t even get the mall rats to hang out there. It’s doomed. J.C. Penney is at one end and Sears at the other end. Lord & Taylor left years ago.

JC Penney is about to screw the pooch, and Macy’s isn’t far behind. I remember Chris Rock doing a stand up comedy sketch about 20 years ago (yikes) where he said you had malls and you had ghetto malls. The regular malls (of that time) had all of the major chain stores while the ghetto malls had mom-and-pop stores, tennis shoe stores, and baby clothes. Now it appears most of the malls are becoming ghetto malls.

I didn’t get who is really left holding the bag? The tranche buyers? Insurance companies? Pension funds?

For every big winner there are losers in these things.

Thanks.

Yes, yes, yes. And yes.

Don’t worry, they are making up for their losses through the stock market, I am sure.

Holding the bag?

Property taxes won’t be paid.

And property taxes on malls ain’t cheap.

These numbers might go some way in arguing with the oft expressed belief, on this site and everywhere, that everything is being bailed out now and in the future. So not to worry.

There is about 16 trillion US$ value of commercial real estate in the US.

Take a look at the Starwood write- down: 66 %.

But let’s be optimistic and just write the rest down by 20%.

One fifth of 16 trillion: there goes the 3+ trillion the Fed has injected since the crisis began. And as here in Canada, the flood of income supplement is ebbing, so retail of all types will contract further.

It was politically easy to get a one-time disaster bailout, an ongoing flood of money is going to be harder.

The ship is taking on water faster than the pumps trying to stabilize the flow.

And we haven’t even touched on the tightening of lending by the banks who aren’t in the business of rolling dice.

But could the Fed print to infinity? Sure, but not while preserving the US dollar’s status as number one safe haven. If you don’t think that can happen, because the US has nukes or something, check 1978 and a Fed rate close to 20%.

Looks like deflation to me.

Deflation and printing and the resulting currency debasement produces stagflation? There is no cure for that. Lots of inflation in groceries these days. When Shale finishes collapsing there could be higher prices in energy and that feeds into everything.

I’ve been complaining about the grocery prices for a few years now. Mine have easily doubled in the last 4 years. This is consistent with the inflation in financial assets which has been going on during the same period. People forget that food commodities are a financial class and don’t correlate it to the other financial markets.

“People forget that food commodities are a financial class and don’t correlate it to the other financial markets.”

Maybe food is the better indicator for inflation. Yup, we pretty much only buy from wholesale-style bulk sellers, like Winco, to save money. We (my wife and I) find ourselves buying more and more staples, less pre-prepared stuff, and cooking from scratch. And stocking up.

But we’re old enough to know how to cook from scratch! Maybe a generational thing?

I believe the US min wage was $3.35 hour when I entered the work force in 1983. Fast forward to 2020, what is it now? $7.50/hour?

So let’s call it a $4.15 raise over 37 yrs, gets you $0.11 a year increase over my life-time!

Greatest country in the world has 11 cents a year for the “little guy”!!

In other news, Don Trump Jr. was paid $50K for a 1 hour speech at the University of FL a few months ago.

The topic? Entrepreneurship! hahahahahahahaha….wow, irony is truly dead…….

nodecentrepublicansleft says:

“In other news, Don Trump Jr. was paid $50K for a 1 hour speech at the University of FL a few months ago.”

Gee, and how much did Bill CLinton get for speaking in Russia?

And the former Prez, what about him?

$50,000 for a speech? A small time piker comapred to all those others.

Food costs are heavily influenced by the pay illegal Mexicans get. I think you should look at that

Pretty good article today by analyst at BOA explaining how Fed has got the US in a doom loop. Higher and higher asset values and weaker and weaker main Street.

Another good graph today on CNBC showing earnings yield and bond yields converging on the big tech stocks down in the 2 – 3% range.

Another good article by someone is the Fed used up about all it’s got in good times and bad the last 30 years and we’re caught by the huge economic shock of the virus with a nearly empty gun.

I note and feel food price inflation too. Number one up here is beef.

But how did 2008 GFC crash begin? Not in food. It began with a crash in residential real estate. Now in the space of less than six months the value of the second largest asset class, commercial RE, has been written down by 20% and maybe by 50%, Who knows?

What we do know is that 3-6 trillion just went to money heaven.

And this was not high flyer money, this was supposed to be conservative money.

In that vast universe of 5000 US banks, (not branches, separate banks), or 50 times per person Canada’s, there were some zombies in shale etc. and now there will be more in RE.

The Fed knows about some of them but remember, Madoff was never caught, he turned himself in.

Re: Wall Street vs Main Street, an anecdote from the Depression, the real one where almost 10,000 US banks went under.

‘My dad had a hardware store. When the October stock crash hit he said: “Good. It’s about time those parasites got it in the neck”

Six months later we lost the store.’

Bezos will come in and buy these places up for pennies on the dollar to add to his already massive growing monopoly. He will then use them as local distribution facilities for the flying type drones to deliver goods and allow walk up drones to pick up their things they can’t live without. I wonder when the antitrust stuff will kick in.

Think about it, though, the most common things we order will once again be in the bankrupt mall shells. We order it and as long as it’s “prime 30” or something like that, you get it in 30 minutes or less, delivered to your rooftop, balcony, yard, driveway, etc. Then the whole complaint about bozos not paying the USPS fair rate will be a moot point as most of the junk we order is small and light in nature and can be droned in. Bye-bye excess postal worker needs, bye-bye multiple amazon delivery drivers, and bye-bye gig type delivery drivers using their own cars. Pair this up with groceries and prepared food and we’ll never need to go to the mall again, unless we want it in less than 30 minutes.

It’s coming folks and it isn’t necessarily a bad thing (monopoly is, but the progress isn’t). The pandemic accelerated things that were going to happen across the next 10-20 years into a few months.

Fly over my land** and I get free gifts and drone parts.

Have developed a wrist rocket powered, dart launching device, which trails a fine fishing line that fouls drone propellers.

If Amazon wants to pay me an air licensing fee, I will allow overflights. Am I a “disruptive” enterprise?

** Under 500 feet.

Shooting at an Amazon drone is illegal**

**Amazon pays enough politicians for that to be true

If there is one thing an American (rather than say a Japanese) should grasp is that drones are never going to be typical US urban delivery vehicles, even if all the issues about their payload limitations could be solved. Have you seen the size of the largest UPS van?

There would quickly evolve a whole subculture devoted to shooting them down, both for the fun and the booty.

I suspect it’ll be zillions of little drones carrying five pounds max back and forth all over the place, following public right of ways, no giant mother ships yet. The subculture is definitely gonna happen, too.

We can’t have zillions of pilots so they’ll have to be autonomous.

So the air corridors will need beacons, or beams to mark path.

Would be a lot more feasible if landing point is not the guy house but a local depot.

It (drone delivery as anything other than a rare novelty) is not going to happen. I stake my reputation on it.

drone delivery already happens on a regular basis, albeit by the war dept. surely the more efficient private sector will have an impeccably consumer-friendly version ready to go at the most profitable moment?

I agree. Ground transportation is inherently cheaper and the drones can’t carry anything heavy. Do people fly to work in a drone? Didn’t think so.

For the moment, drones are only workable in controlled environments like warehouses. And given the state of American streets, I would not put autonomous delivery vehicles in the cities. It’s begging to be robbed. Suburbs however are still reasonably safe. So, I would have zero hesitation putting such vehicle in places like Cupertino… while the streets of Portland or Baltimore would be off limits.

There are already concept vehicles been planned, why do you think Amazon bought Zoox, it isn’t because they care about moving people.

You can easily think of a small van type vehicle that makes stops in front of doors, requiring a code or a scan or whatever to open up its payload bay with only your stuff. Ian’s the target isn’t the hundreds of Amazon delivery contractors, it is really UPS and USPS.

Bezos is in this for the long haul, in 10 years, he will have roving robot vans solving the last mile problem. Hell, I can see a robot in a robot that is dropped off and rolls a sufficiently small package to your front doors. see Scout.

It will be a novelty until it becomes a reality.

And drones are noisy.

Where I live people shoot at drones, at least they say they do. I suspect it would be the same in some inner city neighbourhoods.

Paulo,

Your neighbors are shooting (I assume) high-powered single-shot rifles that they know how to operate. They should be able to take a drone down with one shot vs. the Uzi-spray method more common in our urban communities.

My point? Don’t know that I have one…just a random observation from the mountains. Maybe buy ammo futures?

Shotguns, I think. :-) better spread.

The drone is replacing the police helicopter. Much lower noise and visibility profile. The bullet proof drone is probably in the making.

And ones that shoot back, too.

It will become a national sport.

Jamming and spoofing for profit.

Nets between buildings.

Blind optics with lasers.

No need for da gunzs

street urchins may finally get their day in the sun.

A small drone towing several strong strings that break away easily. Fly it over the target drone and allow the string to be entangled in the prop blades. Hunting drone will become a sport. The prize is the package being delivered.

I am not up on drone tech but doesn’t it take a guy sitting there at a desk to drive a drone, like I see in the war movies, the pilots sitting in an air base in Nevada, killing terrorists in Afghanistan? Is that what malls will become, places to line up drone gig-pilots in cubicles? Or are these self-driving drones?

The average drone (a success after the flying car) would carry something that is worth a few dollars. The bullets for shooting are likely more expensive. And bullets have the habit to also go down.

Disagree 100%. The payoff is too low vs. the risk – and – GPS / sensor / camera technology will have the shooter’s name and address in the post office (i.e. police data files) before the drone hits the ground.

you can disagree all you want, but pirates will always exist in some form. once upon a time they used flags instead of our fancy newfangled technologies to track them. those crafty pirates always seem to find a way to stay ahead of the game somehow.

P Coyle,

I think you’re right. They’ll probably even know the preferred flight paths and ambush them there. Shoot, grab, run.

Nah, to this I answer: “what police?”

And I am sure Bezos will laugh maniacally and say: “this police.” As he unveiled ED-209.

Torch a neighborhood, fine, burn up the local Coffee ship? Knock yourself out. But mess with the Amazon delivery bots and you get air strikes called on you.

Maybe it can save all these people getting shot every nite now before saving drones of the future.

Road based drones are much easier and don’t have a weight problem.

Most malls are going to convert some space to residential. Fashion Island in Newport Beach has a number of condos worth close to 5 million each. Malls are perfect for upper end condos and rentals.

I’ll bet they aren’t conversions. There have been hundreds of abandoned malls in the US for years. It is not practical to convert ground floor space (i.e. most of it) to condos or even rentals at anything like current US living standards. That is why it hasn’t happened. No windows, limited plumbing, and the only way to change the plumbing is to jack hammer all that flooring.

Some office buildings are good candidates. They have windows or able to cut new ones and it is way easier to add plumbing on floors above ground level.

Of course with the changing demographic it is becoming economic to either add residential to adjacent space or demo some and build new.

You could build a crawlspace for plumbing, hvac and electrical given the high ceilings in the mall.

How do you get the sewage to travel up to the ceiling?

IMO you are correct about conversions SS, but just some of the time, and for some of the SF/cubage of some malls.

While it is fairly cheap to sawcut and remove slab on grade to install sanitary sewer pipes, the only pipes/wires/ducts needing to be down rather than up or vertical, the window and exterior doors will be the limiting factors. All the dozens of malls I have worked on the last few decades have had ample room above the drop ceilings for every kind of mechanical chase needed.

Some smart operator, likely buying cheap cheap cheap on the rebound as mentioned on this thread, will figure out how to convert each mall into a village, with housing at exterior of and probably above existing structure, various combinations of education, exercise, retail, guv mint, etc., etc., in those areas not so cheaply converted to residential.

With the right combination of guv mint tax relief, creative design, and community based research, this seems to me to be a huge opportunity.

There have been literally hundreds of malls abandoned,some for ten years. There are lots of smart people into residential conversions. They don’t do malls because it would be cheaper if the mall wasn’t there. The main barrier to reuse when it’s gone back to the lender is the cost of demo, trucking, and the exorbitant dumping fees.

‘

Re: cutting the slab: you need big cuts for your main, and then side cuts into each unit, then repair with new concrete. It would be cheaper to demolish all interior walls, lay pipe and pour new slab. (This assumes the pipe serving the complex can handle thousand times the flow.) But there is still the geometry: this shell we are trying to save has a small amount of its space near exterior walls.

However, your mention of the word ‘village’ does suggest the possibility of a type of semi-communal living found in Spain, to name one. A mall has bathrooms, showers could be added. It has a food court. So you could have private living quarters with shared bathrooms and kitchens. The type of Spanish ones I’ve seen. though, are around a central outside garden area.

Another possible use is for educational institution. But current ‘first in world’ US expectations re: housing are too demanding for most abandoned malls to be converted to marketable housing.

Come a depression, maybe not.

If you go into the restroom on the first floor of a mall, they have a toilet, so the pipes should be adequate for a residence. I mean, what are you trying to move through there other than dropping a deuce?

Several hundred and thousands of gallons PM at peak time.

Just because the battery in a hand- held vac says 12 volts, doesn’t mean you can start your car with it

All is not lost. One of our defunct malls is being turned into an Amazon sweatshop. Wages will likely be somewhat higher than retail wages for those with the stamina to handle it.

I think the mall of the future should be fairly straight forward, an open air affair with an Apple store, a Whole Foods, a couple of Starbucks, a few chain eateries (McDonalds, Panera) the sort that pays their rent and won’t just belly up, a Nike or some type of athletic wear store, may be an anchor location like a Walmart, Target or a Costco, a small convenience store (think Amazon Go). Toss in a few small discounters like Dollar Tree and Dollar General, may be a Home Depot or a Lowes. Viola, instant stability… ha ha

yeah, I know, I picked just the most successful store concepts and shoved it all into a mall, but seriously, why not. After all, a mall is nothing more than a large plot of land to be rearranged as needed for the times.

you have described the currently successful strip mall where i live. well, without the apple store, hole foods and nike. and without ross. but i can easily envision this dystopian future of a successful mall turning out to work for strip malls once the big boys get humbled.

A mall is not a strip mall. They function completely different. A mall works by selling things >$10 and a strip mall works by selling things <$10 and is much more targeted at items you buy every week.

You can’t buy much for less than $10 (at least your total will be way more) when shopping at strip malls. CVS and Walgreens have raised their prices significantly this year..

Were you talking about buying a few packs of gum at a dollar store in a strip mall?

UGH. Our future is yet doomed to the corporate brands of Metropolis? Tell me it isn’t so. Give me a farmers market atmosphere with local made people and taste. Small business made U.S. quality apparel and merch.

McDonald’s? Walmart? Ultra expensive rent? Blah.

“Give me a farmers market atmosphere with local made people and taste.”

My wife works with a friend at a local farmers’ market every Saturday. My wife will sell our chicken eggs and some fresh produce, while her friend sells her handmade goat cheese. The reality is that the buyers at the farmers’ market tend to be upper-middle-class. It’s a market for the wealthy, not the working class.

Farmers’ market vendors do not take food stamps or the electronic equivalent.

Actually, I’ve seen signs at a couple of farmers’ markets that they accept the Florida food stamp card (SNAP? maybe) — you’re right about the demographics, but at least it’s possible. The bigger problem, IMO, is that farmers’ markets are rarely located conveniently or locally for poor people.

Clete,

I don’t think poor people are the target demographic. They normally don’t buy $6/a dozen organic eggs.

Haven’t been there in a while mit, but years ago, we poor people in Berkeley put together a block party to send one vehicle to the SF Farmer’s market every Saturday morning because the prices were much lower than Safeway or any other store in town.

Somewhere around half if memory serves after 50 years,,, but have seen similar in many places since then, with perfectly ripe picked the day before fruits and veggies, eggs, even some grains sometimes priced well below typical barely edible chain store stuff.

The rent wouldn’t be that expensive, and the companies I named are well able to absorb it. At this point, mall owner mentality will also be about survival. A mall with the mishmash of stores I described would be survivable in most cases and can generate reasonable income.

As for farmers markets, they are also survivable, relatively speaking because all they are renting out is a parking lot… I wonder about the nature and terms of the rent. But good luck suing them.

Barnes and Nobel was sold last year to Paul Singer, after closing 150 stores over the last decade. Tough for a large sticks and bricks bookseller to compete with Amazon.

I see people moving away from using Amazon. Their prices are higher than the competition, and the chance of getting counterfeit goods is greater. Obviously this is a small sample size—friends and family.

I’ve long ago moved away from Amazon. I buy nearly all non-grocery stuff online, but almost never at Amazon for the reasons you pointed out.

I consciously avoid Amazon and price is not the reason unless there is a big reason.

Whenever I buy good brands like Maui Jim, Armani Perfume, I never buy from Onlne retailer but buy online from the company itself.

Most of the items from amazon good branded things are fake but a good one

Facebook is even worse. I ordered name brand goods from a Facebook advertiser that were supposedly 50% off. They never came. Before knowing this order was going to fail, I placed a second order for separately advertised goods from a different vendor. What came were cheap Chinese knock-offs of something that were not the color or style I ordered. Complete trash. Facebook appears to have zero control over its advertisers based on my recent experiences.

The worse part is that this was the quarter in which Facebook touted a spike in advertising revenue. I was burned by Wall Street.

Those ads are all run by drop shippers. They take your order and pass it on to a Chinese company to fulfill.

Facebook makes a huge profit from these advertisers.

Harold, it’s worse than that. My direct experience indicates that Facebook’s advertisers will take your money and run, without shipping anything or shipping junk you did not order. I’m 0 for 2 on Facebook orders. Thankfully the losses are only around $100.

I hate to say it, but some of Facebook’s advertisers appear to be committing fraud, which is facilitated by Facebook’s lack of control over its platform. It’s very frustrating that a company with Facebook’s size and profitability is permitted to take advantage of consumers in this way. Clearly, they can afford to put controls in place.

Ebay — my favorite and go-to site, although not for groceries.

S &P hits record!! We need a virus to shut down the economy every year.

Boeing up on a name change of the Max.

All it needs now are customers and all the customers need are passengers and bailouts.

What’s not to like or to fear?

Feds been pulling stock values forward. If you look at past cycles, once we really peak it may take 25 plus years to make a new high. I get a kick out of Dave Ramsey telling people they are going to get 10% – 12% return investing in stocks. Not if you are buying at the top.

There used to be full service gas stations. An attendant would take your money and pump gas for you. Someone opened a self serve station and lowered the cost of gasoline. Soon most people were going to self service stations and pumping their own gas. Gas station attendants lost there jobs.

Amazon was considering using malls as fulfillment centers.

At $6.00 per delivery and cuts to the USPS, I think some stores will be in business. The USPS should raise the price of postage to remain solvent. They always did in the past.

Oregon does not have self-serve — all gas is pumped by an attendant. Normally the service is quick and easy. The original reason for not allowing self-service was for safety. Now it is understood to simply be a job generator.

We drove from Cannon Beach to Boise a couple of months ago, and the gas we bought somewhere around Pendleton was definitely not full-serve. In fact, the sole employee was hiding inside and complaining about having to mask up.

Correct, not full-serve. Only no self-serve. The attendant does not check oil, wash windows, etc.

Just keep the less-employable, employed. If you can’t flip burgers, maybe you can pump gas!

I hate to pump gas, especially if I’m dressed to go somewhere, it’s uncivilized and I would gladly pay someone to do it.

Petunia,

I can see an EV in your future. Just plug it in at night at home, and it’ll be ready for you in the morning. My wife (who is the one driving to work, while I’m on foot and loving it) wants one for that reason :-]

Agree with you 100% pet,,, no choice in most places, but driving across USA the last few years, we found ”full service” in a great small town in Texas, albeit with a line waiting to drive up to the pumps, and the attendants in most places in OR — small towns — were more than happy to check oil, clean windshield, etc., IF asked by this old guy, one even made a minor repair at no charge.

For some reason, NV small town was not so pleasant,,,

IMO we should have a federal mandate that all gas stations must have at least one line of full service, and be able to charge a nickle or so, (per gallon) which I too will be glad to pay, along with a tip as my mom always did at her fave local station.

As far as the EV goes, it would be nice for sure, but first they will have to ”pencil out” as far as lifetime expense, not even close the last time I tried; and second, 90% of my mileage is on the road across USA, not even remotely possible today with EV.

A few years back Oregon passed a law allowing self-serve, at least in some areas (mostly rural areas I think). From what I recall, quite a lot of people were upset and scared about the possibility of having to pump their own gas.

As someone who grew up in New Jersey (which also prohibits pumping gas) and since moved elsewhere, banning self-serve is idiotic. I knew someone growing up in Jersey whose family had a small plane (obviously they had more money than I did). He found it very amusing that he could put leaded 100 octane gas into the plane himself, but had to let someone else put 87 into his car for him.

For as long as I can remember all the cool people made fund of malls. They were in ugly boring suburbia and sold boring things to even more boring middle class people who drive boring minivans. Well there you go cool people, you got your wish, malls are dead.

Indoor malls are definitely dead, nobody misses them. Expect most to be torn down eventually.

Beatnik Haiku for the Last Mall:

The ma in your mall

is full, and sings. His nomad’s

mattress and box springs.

Last time I was in a mall, say a year ago, they still had that guy banging on the organ at the front of the organ store. Didn’t look like he was likely to sell any keyboards that day, but who knows?

With 3:1 retail to living space ratio in the US, you know it was out of proportion. Unfortunately, the semi-empty malls where I live become frequent places for spectacular victim crimes. Once that gets rooted in the news, then no one goes there. It snowballs. One business idea I saw is to convert a store or two into “last mile” distributions centers, that can be used to help build up non-Amazon online stores that use contracted deliveries.

Time to watch Other People’s Money again. That movie is more relevant now than ever. I love me some DeVito!

Not MSM Newsflash!! Eugene, Oregon area: In an region that has largely avoided heavy contagion, State Farm Offices now have signs in windows saying they won’t accept cash for payments, at all. Some offices are requiring appointments to even get past the locked door to see your agent. But even offices with signs stating “Open” are not accepting cash…but they will accept the paper checks that us presumably Covid-19 infected masses handle with our dirty deadly hands???? Plastic too from what I can tell. This looks like new policy straight out from corporate in Texas (land if the free-range cowboy, ha). So there you have it…American money has been declared dead by the very corporations that suck it all down. Who says the worst is not coming now? This is a Police E-State.

Good lordy, is there someone still out there paying for insurance with cash???

This sounds to me like a discouragement to burglarize the office – something like, “Look, we have no cash and no valuable here, and it’s worth your time to break in.”

People all across America pay bills and make purchases with cash quite regularly. If someone was hard up enough to want to commit a crime, they could walk into any McDonalds on a heavy weekend and get far more action from the safe behind the counter. And if they are hung up on B&E for offices, they could likely do better than just cash…should they eliminate the furnishings too or maybe just close all the offices? Bottom line…don’t want to do business in America, go the hell elsewhere and don’t use the government to mandate that the public should have to purchase your services. The state has their gun. The insurance companies are now showning us theirs. Where do you think this is going to lead?

BTW-The signage clearly refers to their concern about Covid-19 and all that dirty money. Not one word about crime, which has not been cited as a oroblem to date. Ooh, run…those anarchists are coming!