Large-scale shifts triggered by work-from-home, staggering unemployment crisis, and oil-and-gas bust. Rents respond in real time.

By Wolf Richter for WOLF STREET.

Rental markets in the US are shifting in a massive way, with some of the most expensive cities, cities across the oil patch, college-focused cities, and tech and education hubs such as Boston booking sharp year-over-year rent declines. But 60 of the top 100 rental markets booked rent increases, and 23 of them booked double-digit increases.

San Francisco, the most expensive market, skids hard.

The median asking rent in San Francisco for one-bedroom apartments dropped again 2.4% in July from June, to $3,200. This brings the two-month decline to 4.8% and the 12-month decline to 11.8%. From the peak in June 2019 – which had barely eked past the prior record of October 2015 – the median asking rent has now plunged 14.0%. That’s a lot, very fast.

For two-bedroom apartments, the median asking rent dropped 3.0% in July from June, to $4,210, bringing the two-month decline to 4.8% and the 12-month decline to 12.1%. Since the peak in October 2015, the median asking rent for 2-BR apartments has now dropped 15.8%.

In terms of 1-BR apartments, this makes San Francisco the third-fastest dropping rental market among the top 100 rental markets in the US on a year-over-year basis, behind Syracuse, NY (-15.5%), and Madison, WI (-11.7%), but ahead of oil-patch cities Irving, TX (-9.6%) and Laredo, TX (-9.6%).

In terms of 2-BR apartments, San Francisco’s rents fell faster on a year-over-year basis than any other city.

Despite these declines, San Francisco remains the most expensive city to rent in, among the top 100 rental markets in the US, according to Zumper’s Rent Report. But in terms of ZIP codes, San Francisco doesn’t have the most expensive ones; there are some in Manhattan and in Los Angeles that are even more expensive.

Rents in San Francisco hat hit a ceiling in October 2015 and then spiraled down by close to 10% over the next year-and-a-half before the Trump bump kicked in and rents rose again. 2-BR rents never got back to their October peak, but 1-BR rent did briefly eke past it in June last year. Now the Trump bump has totally unwound, plus some, in just a few months.

What are “median asking rents?”

Median asking rent means that half of the asking rents are higher, and half are lower. “Asking rent” is the advertised rent. This is a measure of the current market, like the price tag in a store that can be changed to attract shoppers. Asking rent is not a measure of what tenants are currently paying on their existing leases or under rent control.

These rents are for apartments in apartment buildings, including new construction but do not include rents of single-family houses, condos-for-rent, rooms, efficiency apartments, and apartments with three or more bedrooms. The data is collected by Zumper from over 1 million active listings, including from Multiple Listings Service (MLS), in the 100 largest markets.

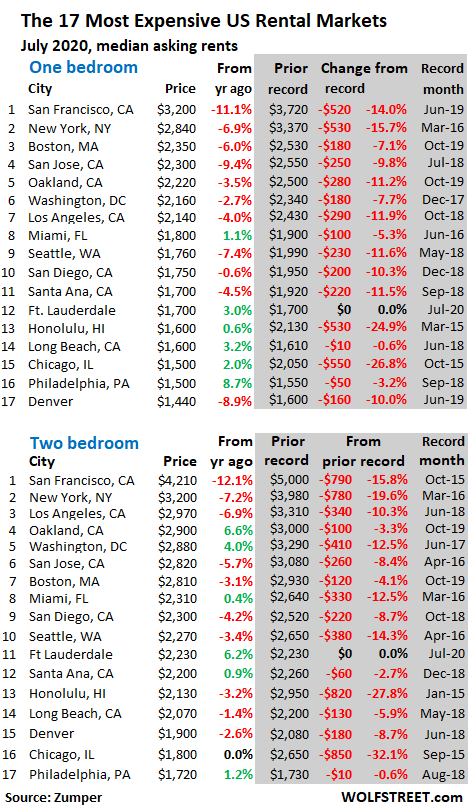

Red Ink in the 17 most expensive rental markets.

The table of the 17 most expensive major rental markets by median asking rents shows July rent, the change from July a year ago, and, in the shaded area, peak rent and change from the peak. The “declines from peak” are led by Chicago and Honolulu in the range of -25% to -32%, though they seem to have found a bottom recently. Numerous cities – including some of the formerly hottest markets – are have booked double-digit declines from their peaks. But Ft. Lauderdale set new records:

The 35 Cities with declines in 1-BR rents.

The table below shows the 35 cities among the top 100 rental markets with year-over-year rent declines in July for 1-BR apartments, led by college town Syracuse, NY, Madison, WI, and San Francisco. In addition to Silicon Valley’s San Jose and some other unicorn-startup-bubble hubs with a large university presence, such as Boston, there are a bunch of cities on this list that are in the hard-hit oil patch in Texas, Oklahoma, and Louisiana, with Texas being the epicenter of oil-and-gas company bankruptcy filings, and also being represented by seven entries on this list:

| Decliners | 1-BR | Y/Y % | |

| 1 | Syracuse, NY | $820 | -15.5% |

| 2 | Madison, WI | $1,060 | -11.7% |

| 3 | San Francisco, CA | $3,200 | -11.1% |

| 4 | Irving, TX | $1,030 | -9.6% |

| 5 | Laredo, TX | $750 | -9.6% |

| 6 | San Jose, CA | $2,300 | -9.4% |

| 7 | Denver, CO | $1,440 | -8.9% |

| 8 | Aurora, CO | $1,090 | -8.4% |

| 9 | Seattle, WA | $1,760 | -7.4% |

| 10 | New York, NY | $2,840 | -6.9% |

| 11 | Providence, RI | $1,400 | -6.7% |

| 12 | Charlotte, NC | $1,240 | -6.1% |

| 13 | Tulsa, OK | $620 | -6.1% |

| 14 | Boston, MA | $2,350 | -6.0% |

| 15 | Fort Worth, TX | $1,090 | -6.0% |

| 16 | Anaheim, CA | $1,650 | -4.6% |

| 17 | Orlando, FL | $1,240 | -4.6% |

| 18 | Santa Ana, CA | $1,700 | -4.5% |

| 19 | Virginia Beach, VA | $1,050 | -4.5% |

| 20 | Louisville, KY | $860 | -4.4% |

| 21 | Los Angeles, CA | $2,140 | -4.0% |

| 22 | Raleigh, NC | $1,040 | -3.7% |

| 23 | Salt Lake City, UT | $1,030 | -3.7% |

| 24 | Oakland, CA | $2,220 | -3.5% |

| 25 | Houston, TX | $1,110 | -3.5% |

| 26 | Pittsburgh, PA | $1,050 | -2.8% |

| 27 | Washington, DC | $2,160 | -2.7% |

| 28 | Spokane, WA | $830 | -2.4% |

| 29 | Corpus Christi, TX | $830 | -2.4% |

| 30 | New Orleans, LA | $1,400 | -2.1% |

| 31 | Durham, NC | $1,090 | -1.8% |

| 32 | Plano, TX | $1,150 | -1.7% |

| 33 | San Antonio, TX | $880 | -1.1% |

| 34 | Scottsdale, AZ | $1,420 | -0.7% |

| 35 | Minneapolis, MN | $1,390 | -0.7% |

The 35 Cities with the biggest rent increases in 1-BR rents.

In total, there were 60 cities with increases in 1-BR rents – compared to 35 cities with declines. So you can see where this is going: In aggregate, averaged out across the US, rents are rising. The table below shows the 35 cities with the biggest rent increases. The smallest increase among those 35 cities was 5.8% (Atlanta). In 23 cities, rents increased by the double digits. In 10 of them, rents increased by 15% or more! None of these 15-percenters are expensive rental markets, compared to San Francisco:

| Biggest Gainers | 1-BR | Y/Y % | |

| 1 | Cleveland, OH | $940 | 16.0% |

| 2 | Indianapolis, IN | $870 | 16.0% |

| 3 | Columbus, OH | $810 | 15.7% |

| 4 | St Petersburg, FL | $1,270 | 15.5% |

| 5 | Reno, NV | $1,050 | 15.4% |

| 6 | Chattanooga, TN | $900 | 15.4% |

| 7 | Cincinnati, OH | $900 | 15.4% |

| 8 | Baltimore, MD | $1,360 | 15.3% |

| 9 | St Louis, MO | $910 | 15.2% |

| 10 | Norfolk, VA | $920 | 15.0% |

| 11 | Lincoln, NE | $770 | 14.9% |

| 12 | Detroit, MI | $700 | 14.8% |

| 13 | Rochester, NY | $960 | 14.3% |

| 14 | Chesapeake, VA | $1,130 | 14.1% |

| 15 | Memphis, TN | $830 | 13.7% |

| 16 | Bakersfield, CA | $830 | 13.7% |

| 17 | Des Moines, IA | $920 | 13.6% |

| 18 | Newark, NJ | $1,290 | 12.2% |

| 19 | Boise, ID | $1,070 | 11.5% |

| 20 | Nashville, TN | $1,300 | 11.1% |

| 21 | Akron, OH | $610 | 10.9% |

| 22 | Sacramento, CA | $1,430 | 10.0% |

| 23 | Fresno, CA | $1,100 | 10.0% |

| 24 | Wichita, KS | $670 | 9.8% |

| 25 | Philadelphia, PA | $1,500 | 8.7% |

| 26 | Oklahoma City, OK | $750 | 8.7% |

| 27 | Arlington, TX | $890 | 8.5% |

| 28 | Gilbert, AZ | $1,310 | 8.3% |

| 29 | Tucson, AZ | $700 | 7.7% |

| 30 | Richmond, VA | $1,150 | 7.5% |

| 31 | Colorado Springs, CO | $1,000 | 7.5% |

| 32 | Winston Salem, NC | $820 | 6.5% |

| 33 | El Paso, TX | $690 | 6.2% |

| 34 | Buffalo, NY | $1,050 | 6.1% |

| 35 | Atlanta, GA | $1,470 | 5.8% |

The Big Shift.

This is still very early in the game, so to speak – the game being the consequences of the large-scale move to work-from-home which allows people to live anywhere for now, historic unemployment – over 30 million people are claiming state or federal unemployment insurance – and the oil-and-gas bust that has been washing over the producing regions. In addition, the unicorn-startup bubble already burst last year; and the Pandemic came on top of it.

So part of what we’re seeing is people leaving some expensive markets and moving to cheaper markets, maybe moving back home, or whatever, either because they lost their jobs or because they’re allowed to work from anywhere.

For renters in markets where rents are increasing 5% or 10% or 15% a year, this is going to get tough. In this environment, wages are unlikely to explode higher at this rate, even for the lucky ones who’re still working. Which leaves me wondering: How long can those rent increases in those markets be sustained? As along as the stimulus money keeps flowing?

Top 100 rental markets, most expensive to least expensive.

San Francisco tops the list; at the bottom are Tulsa, OK, and Akron, OH. The median asking rent in San Francisco – despite the sharp declines – is still over five times as expensive as in Akron and Tulsa.

The table shows 1-BR and 2-BR median asking rents. The cities are in order of the dollar-amount of 1-BR rents. You can search the list via the search box in your browser (if your smartphone clips this 6-column table on the right, hold your device in landscape position):

| City | 1-BR | Y/Y % | 2-BR | Y/Y % | |

| 1 | San Francisco, CA | $3,200 | -11.1% | $4,210 | -12.1% |

| 2 | New York, NY | $2,840 | -6.9% | $3,200 | -7.2% |

| 3 | Boston, MA | $2,350 | -6.0% | $2,810 | -3.1% |

| 4 | San Jose, CA | $2,300 | -9.4% | $2,820 | -5.7% |

| 5 | Oakland, CA | $2,220 | -3.5% | $2,900 | 6.6% |

| 6 | Washington, DC | $2,160 | -2.7% | $2,880 | 4.0% |

| 7 | Los Angeles, CA | $2,140 | -4.0% | $2,970 | -6.9% |

| 8 | Miami, FL | $1,800 | 1.1% | $2,310 | 0.4% |

| 9 | Seattle, WA | $1,760 | -7.4% | $2,270 | -3.4% |

| 10 | San Diego, CA | $1,750 | 0.0% | $2,300 | -4.2% |

| 11 | Fort Lauderdale, FL | $1,700 | 3.0% | $2,230 | 6.2% |

| 11 | Santa Ana, CA | $1,700 | -4.5% | $2,200 | 0.9% |

| 13 | Anaheim, CA | $1,650 | -4.6% | $2,000 | -10.3% |

| 14 | Long Beach, CA | $1,600 | 3.2% | $2,070 | -1.4% |

| 14 | Honolulu, HI | $1,600 | 0.6% | $2,130 | -3.2% |

| 16 | Chicago, IL | $1,500 | 2.0% | $1,800 | 0.0% |

| 16 | Philadelphia, PA | $1,500 | 8.7% | $1,720 | 1.2% |

| 18 | Atlanta, GA | $1,470 | 5.8% | $1,890 | 8.0% |

| 19 | Denver, CO | $1,440 | -8.9% | $1,900 | -2.6% |

| 20 | Sacramento, CA | $1,430 | 10.0% | $1,660 | 10.7% |

| 21 | Scottsdale, AZ | $1,420 | -0.7% | $1,900 | -5.5% |

| 22 | New Orleans, LA | $1,400 | -2.1% | $1,650 | 7.8% |

| 22 | Portland, OR | $1,400 | 3.7% | $1,750 | 2.9% |

| 22 | Providence, RI | $1,400 | -6.7% | $1,680 | 6.3% |

| 25 | Minneapolis, MN | $1,390 | -0.7% | $1,910 | 6.1% |

| 26 | Baltimore, MD | $1,360 | 15.3% | $1,620 | 14.1% |

| 27 | Gilbert, AZ | $1,310 | 8.3% | $1,520 | 3.4% |

| 28 | Nashville, TN | $1,300 | 11.1% | $1,410 | 4.4% |

| 29 | Newark, NJ | $1,290 | 12.2% | $1,740 | 16.0% |

| 30 | St Petersburg, FL | $1,270 | 15.5% | $1,630 | 5.2% |

| 30 | Austin, TX | $1,270 | 5.8% | $1,570 | 1.9% |

| 32 | Chandler, AZ | $1,260 | 4.1% | $1,440 | -1.4% |

| 33 | Dallas, TX | $1,250 | 1.6% | $1,700 | 0.0% |

| 34 | Charlotte, NC | $1,240 | -6.1% | $1,420 | 0.0% |

| 34 | Orlando, FL | $1,240 | -4.6% | $1,440 | -2.0% |

| 36 | Henderson, NV | $1,180 | 4.4% | $1,350 | 0.0% |

| 36 | Tampa, FL | $1,180 | 4.4% | $1,380 | 4.5% |

| 38 | Richmond, VA | $1,150 | 7.5% | $1,370 | 11.4% |

| 38 | Plano, TX | $1,150 | -1.7% | $1,550 | -4.9% |

| 40 | Chesapeake, VA | $1,130 | 14.1% | $1,250 | 2.5% |

| 41 | Houston, TX | $1,110 | -3.5% | $1,360 | -2.9% |

| 42 | Fresno, CA | $1,100 | 10.0% | $1,300 | 14.0% |

| 43 | Durham, NC | $1,090 | -1.8% | $1,250 | -1.6% |

| 43 | Aurora, CO | $1,090 | -8.4% | $1,370 | -8.7% |

| 43 | Fort Worth, TX | $1,090 | -6.0% | $1,350 | 3.8% |

| 46 | Boise, ID | $1,070 | 11.5% | $1,180 | 7.3% |

| 47 | Madison, WI | $1,060 | -11.7% | $1,320 | 0.0% |

| 48 | Phoenix, AZ | $1,050 | 5.0% | $1,290 | 3.2% |

| 48 | Reno, NV | $1,050 | 15.4% | $1,360 | 3.8% |

| 48 | Virginia Beach, VA | $1,050 | -4.5% | $1,260 | 2.4% |

| 48 | Pittsburgh, PA | $1,050 | -2.8% | $1,350 | 3.8% |

| 48 | Buffalo, NY | $1,050 | 6.1% | $1,350 | 14.4% |

| 53 | Raleigh, NC | $1,040 | -3.7% | $1,220 | 1.7% |

| 54 | Salt Lake City, UT | $1,030 | -3.7% | $1,280 | -6.6% |

| 54 | Irving, TX | $1,030 | -9.6% | $1,410 | -6.0% |

| 56 | Colorado Springs, CO | $1,000 | 7.5% | $1,300 | 8.3% |

| 56 | Las Vegas, NV | $1,000 | 1.0% | $1,250 | 8.7% |

| 58 | Milwaukee, WI | $990 | 2.1% | $1,130 | 10.8% |

| 59 | Anchorage, AK | $980 | 5.4% | $1,200 | 4.3% |

| 60 | Kansas City, MO | $960 | 1.1% | $1,160 | 8.4% |

| 60 | Mesa, AZ | $960 | 5.5% | $1,200 | 3.4% |

| 60 | Rochester, NY | $960 | 14.3% | $1,130 | 15.3% |

| 63 | Cleveland, OH | $940 | 16.0% | $1,000 | 14.9% |

| 64 | Jacksonville, FL | $930 | 1.1% | $1,100 | 4.8% |

| 65 | Norfolk, VA | $920 | 15.0% | $1,100 | 2.8% |

| 65 | Des Moines, IA | $920 | 13.6% | $990 | 15.1% |

| 67 | St Louis, MO | $910 | 15.2% | $1,280 | 11.3% |

| 68 | Chattanooga, TN | $900 | 15.4% | $1,030 | 15.7% |

| 68 | Cincinnati, OH | $900 | 15.4% | $1,200 | 7.1% |

| 70 | Arlington, TX | $890 | 8.5% | $1,180 | 8.3% |

| 71 | San Antonio, TX | $880 | -1.1% | $1,100 | 0.0% |

| 72 | Glendale, AZ | $870 | 1.2% | $1,100 | 0.0% |

| 72 | Indianapolis, IN | $870 | 16.0% | $930 | 14.8% |

| 74 | Louisville, KY | $860 | -4.4% | $960 | 0.0% |

| 75 | Omaha, NE | $840 | 1.2% | $1,040 | -1.0% |

| 76 | Memphis, TN | $830 | 13.7% | $880 | 8.6% |

| 76 | Spokane, WA | $830 | -2.4% | $1,050 | 5.0% |

| 76 | Baton Rouge, LA | $830 | 1.2% | $910 | 0.0% |

| 76 | Corpus Christi, TX | $830 | -2.4% | $1,060 | -0.9% |

| 76 | Bakersfield, CA | $830 | 13.7% | $1,030 | 14.4% |

| 81 | Winston Salem, NC | $820 | 6.5% | $900 | 8.4% |

| 81 | Knoxville, TN | $820 | 2.5% | $990 | 10.0% |

| 81 | Syracuse, NY | $820 | -15.5% | $1,050 | 0.0% |

| 84 | Columbus, OH | $810 | 15.7% | $1,050 | -4.5% |

| 85 | Tallahassee, FL | $790 | 3.9% | $910 | 3.4% |

| 85 | Augusta, GA | $790 | 5.3% | $880 | 6.0% |

| 87 | Lincoln, NE | $770 | 14.9% | $940 | 5.6% |

| 88 | Lexington, KY | $750 | 0.0% | $940 | -4.1% |

| 88 | Oklahoma City, OK | $750 | 8.7% | $900 | 1.1% |

| 88 | Laredo, TX | $750 | -9.6% | $880 | 0.0% |

| 91 | Greensboro, NC | $740 | 1.4% | $850 | 0.0% |

| 92 | Albuquerque, NM | $730 | 4.3% | $940 | 10.6% |

| 93 | Tucson, AZ | $700 | 7.7% | $900 | 1.1% |

| 93 | Detroit, MI | $700 | 14.8% | $800 | 15.9% |

| 95 | El Paso, TX | $690 | 6.2% | $800 | 1.3% |

| 96 | Wichita, KS | $670 | 9.8% | $720 | -4.0% |

| 97 | Shreveport, LA | $650 | 0.0% | $800 | 14.3% |

| 97 | Lubbock, TX | $650 | 3.2% | $810 | 1.3% |

| 99 | Tulsa, OK | $620 | -6.1% | $820 | 1.2% |

| 100 | Akron, OH | $610 | 10.9% | $720 | 1.4% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

You have to be kidding me. Miami, Florida rents are higher than Seattle?

Yes, I too took a double-take. But the trend was visible before. In June, 1-BR-rents were equal, and in the prior months, Seattle was ahead to way ahead.

I live in the Seattle suburbs, and I just renewed my lease (SFH, not an apartment) a few days ago for the same terms as last year.

Around here everything feels hot (RE, rental, and heck, even the temperature these days :)). As long as the extend and pretend continues, there is no reckoning with reality.

Buy stawks while you still can. If not, you’ll be sad you missed out! ;)

I live in South Florida, and,according to my realtor friend, there have been a swarm of people who have moved here in anticipation of working remotely forever. Many of these people were previously living in the Northeast and never really liked winter or the expense, and this provided a perfect excuse to get out.

I’m hearing of college students packing up to go to the beach towns for the whole semester. With school going online, they don’t think they need to be on campus. So why not move the frat house to where the action is, and have spring break for the whole semester?

The more studious kids aren’t doing this… and not every school project can be done online from a beach town … it’ll be interesting to see which path turns out better in the long run.

what is the point of obtaining education at this point. The US response to the virus is an utter failure. We are toast as a society. Sweden on the hand did very well without completely destroying their system. The US is lost cause. It’s wrap.

Tony,

Such lethal BS.

Deaths per million people:

Sweden: 568

California: 241

In Sweden, 135% more deaths per capita than in California, and Sweden’s economy is in tatters too. How many hundreds of thousands of lives — other people’s lives — are you willing to sacrifice to get what you want??

how many lives?

ALL OF THEM.

EVERY LAST ONE OF THEM.

Virus or Antifa, take your pick?

I live in Seattle (Bellevue) and my 2-bedroom lease is expiring in a few months. There are a staggering amount of deals around currently. Almost all apartment complexes are offering 1 month off, and a few are offering 2-3 months off. Though I’d prefer to stay in my current apartment because moving is a hassle, I think I’ll move to take advantage of the insane discounts being offered. I’m speculating that the deals will only get better in the next few months.

before you leave your place you should try to renegotiate a lower rent and show them all the listings of places you might go to. a lot of people are successfully renegotiating rents when their lease is up in this current climate

go to your landlord and explain you want a reduction in line with what’s currently available. Odds are he’ll deal.

Good advice. Need to remember that in a buyer’s market, everything is negotiable.

Thank you all for the suggestions. I am viewing several apartment complexes to gather the necessary information to make my case for a reduction. Worst case if they do not budge, I will actually move. Also – I just received my renewal notice yesterday and though they will not raise my rent, they will raise my parking fees by $75. Are they trying to get me to leave? :)

Welp, with rents going up in affordable places and rents still unaffordable in other places, I guess the homeless population is going to explode again. Even without consideration of the large numbers of unemployed.

Lynn, I was thinking the same thing and thats terrible.

Send the homeless to where the rents are declining, and then there’s commercial vacancies that could become dormitories.

Anything in San Francisco that costs over $100 a day for a one bedroom is theft, in my humble opinion. So to are the B.S. Craigslist ads for “one bedroom studios” where an alcove that the head of a cot fits into is a ‘bedroom’ etc.

If enough people flag the fruaduent ads and outrageous rents, it will help drive down prices.

Why 101

Where’s Toledo for instance

Thought of Toledo myself. My rent was 450/mo in a 1980’s 1b apt, roughly 500sqft 5 years ago. 80% of what I looked at were in the 550-700 range. Can’t imagine it has changed too much. So much poverty there.

I’d be curious what the rents impacts are in the suburbs. How much city flight out to surrounding areas versus other states?

I am in flyover land. House prices have increased 10% for anything under 300k since the beginning of 2020. What is good is this also means I can raise my rent that has been stuck at the same rate for 6 years.

My tenant is about to finally feel the effects of inflation. As a landlord I have been experiencing inflation because the cost of labor, materials, etc have been increasing.

4 years ago I got a bid on siding = 8700.

I decided to wait and the next year the bid was 9500.

I decided to wait and the next year the bid was 10700.

I hurried and locked that bid last year even though I could have waited another year. The 8% – 10% YOY increase was starting to worry me but at the same time I could not raise rent as house prices were stagnant the past 10 year.

But just in the last year and 1/2 I have seen this house appreciate by 20%. Everyone is raising rents around me and I will too.

Yes, raise rent when many are out of work. It’s ok. Hard working parents can find money on trees. You’re pushing the cost of your wait and laziness upon them. Glad people like you live in flyover states.

Looking at NYC and SF rents, there are *plenty* of aggressive landlords in the “socialist paradises” of the coasts too.

As has long been said of Hollywood, “they talk like hippies but act like mobsters”

Hey Realist why not buy a property and give some out of work people free rent?

Realist? For Real? Really?

Spoken like a person without a lick of economic sense and who probably thinks landlords shouldn’t even be charging rent in these terrible times.

Landlords have the absolute right to earn a reasonable profit or cover carrying costs. If a tenant loses income then rent can be deferred as per arrangements, but it should not be up to a landlord to right the ills of a society without an adequate safety net or conscience. They cannot afford to, nor should they have to.

However, it often comes down to leverage in the local market. If a property owner has little to no debt, they can charge reasonable and affordable rent. If many landlords in an area have lots of debt for their speculative purchases, then they set a high floor for rent levels to the point where it tips and people choose to move away; must move away

I’m a landlord and charge very low rent to a friend. I will be buying another place in the next year or so and will do the same for another tenant. Win win as far as I’m concerned. We can choose our tenants and they are happy to stay and take ownership. I am also currently looking after my sons rental and he has done the same thing as he is working away for a few years. A friend of mine is renting his house and is paying about $300 below the local market. It is all he can afford and still get by with a cushion.

My wife and I have talked about this at length. We have enough. This is our community and home. We will not take advantage of the price situation. I love it when I see our renter speak fondly of his place and treats it as if was his own. And the fellow renting my son’s place is like a pitbull when strangers come around and use the boat ramp or trespass. When we are away guess who looks after our place?

>> Landlords have the absolute right to earn a reasonable profit or cover carrying costs.

Whut? Please say you did not mean that. It makes no sense at all. If a landlord overpaid for a property and cannot rent it for what they expected, that is called competition and capitalism. It ain’t the renters job to save landlords that made bad decisions.

Do a little thinking. He has the property as a risk investment. He is not assured a profit. He has real expenses that include property taxes, insurance, maintenance and income taxes. Plus if he is self managing he has headaches with self managing. For all of this he might net out a single digit return. The house didn’t get there by itself. There are about 2.5 man years of labor to build it. Someone had to pay for that plus the government skim along the way.

I wonder why landlords are the only “investors” who act as though they are entitled to a profit

Realist

(I’m guessing that’s a wildly misleading name)…free food has got to at least qualify as a human right…

So, who are you giving all your money to (you’ve never met a Wall St capitalist pig, so that’s really not an answer)? I’m guessing hardy anybody, if anybody at all.

Nah, he shold have incresaed the rent back then and had 4 years of increased income.

Wonder if they could have afforded the rent increase back then.

I also wonder if those that are renting are out of work?

Ridiculous comment based on zero information on your part.

@Realist. I might came off as a bit harsh but not being able to raise rent for so many years while trying to keep a property in good shape gets to a point where you feel like your subsidizing your tenants. Then year in and year out I see house prices shooting up like crazy in the East coast and west coast. Lol. I rent a 3 bedroom house that has about 1200 sq ft living space for $665 I started rent at $625 in 2003. I dropped rent to 550 during the housing bust. Talk about no inflation….yet i can tell you insurance and property taxes have risen a lot in 16 years. I am just excited to see some pricing increase so i don’t have to sell the house after 16 years for no gain. In following Wolf the past several years I used to wish I was living in Vancouver when I bought my rental.

shouldn’t have been that hard to comprehend what was said. Costs go up, so does the rent.

Hope that helps.

My tenants have gov’t jobs or pensions. Plus now an extra $1200 and more coming.

“I am in flyover land. House prices have increased 10% for anything under 300k since the beginning of 2020.”

Same. My flyover burg doesn’t have anything under $300K left. $400K is the new $300K here.

How about those constant flyers and post cards asking to buy your property. I am now constantly getting them for my two burb properties, 50 miles outside of two of these ‘hot’ cities.

It is interesting to see the increase in costs of renting a two bedroom apartment in the different cities.

In Akron the extra bedroom will cost you US$110 a month more. In Dallas it will cost you an extra US$450 a month.

Still rent in the big cities in the USA, based on these figures, is quite expensive compared to Australia.

That’s an interesting detail to look at. As a dollar amount, the second bedroom is (median, blah blah blah) cheapest in Memphis or Wichita at $50/month; in ten cities it’s $100 or less. SF is the most expensive at $1,010.

The percentage difference is probably more useful. In Akron, a second bedroom is 18% more; in Dallas it’s 36% more.

Percentage-wise, the cheapest second bedroom is still in Memphis: 6% extra. The most expensive is in St Louis, MO: 41% extra.

Spot on Wolf. I live in Buffalo, People are moving here from NYC. I met a guy yesterday from Brooklyn. He said when he heard what rents were here, he damn near spit his coffee out.

It’s not snow time yet. There’s a reason for the lower rents in Buffalo! LOL!

Yes, buy that snowblower NOW!

Are most of these apartments on one-year lease commitments? If so, that suggests to me that people are either breaking their contracts and leaving their rental properties early (and losing any security deposits) or this is simply a convenient time for people not to renew their leases and move elsewhere. Which might mean that this trend is going to continue and this is just the early stages.

Good work Wolf. Interesting stuff!

I suspect the latter, which also bodes poorly for commercial. A lot of businesses are in the middle of a ten year lease, but won’t renew at current prices when the time comes.

MiTurn,

These are advertised asking rents, typically for one-year leases. “Asking rent” is what the landlords want for their apartments that are vacant, or are soon going to be vacant, and that they need to fill. And in cities were rents are falling, there are a lot of vacancies, and landlords are struggling to find people to lease the units.

Do these rental prices take into account units with included utilities?

DawnsEarlyLight,

Whatever is included in the asking rent and is paid for by the landlord is included in the rent data.

Generally, tenants in big apartment buildings pay some of the utilities, such as gas and electricity, and that would NOT be included in the rent.

But tenants rarely pay for garbage and water — the landlord pays those — and that would be included in the asking rent.

For example, in San Francisco, the asking rent of Unit X in apartment building Y is $3,000. It includes water and garbage (free to the tenant), and the landlord pays those. But the tenant has to pay for electricity and gas.

Single-family houses are different, but they’re not included in this data here.

“Single-family houses are different, but they’re not included in this data here.”

Interesting.

On one year leases for houses and apartments in Victoria the renter pays for the amount of water used, but not the supply charge.

Garbage is paid for by the owner.

All electricity useage and supply charge is paid by the renter.

And now for the big hit. If your apartment or house is new and didn’t have an Internet connection – the actual physical hookup, the first person renting the property has to pay for it.

(The builder/owner of the property already paid for the cable to the building and building box.)

IIRC I think it is somewhere between A$300 and $A500. Then you have to, of course, pay for the monthly fee on whatever paln you pick.

If you are lucky the owner of the property will pay for this. Otherwise the first renter gets stuck with the cost and every renter after that only has to pay for the regular plan fee.

Tony,

“The city leadership beyond hope.”

Because the mayor is a black woman??

Having been in the Kansas City MO rental market as a real estate investor since 2017, I can attest to these stats. Though I do only SFH, mostly 3BR, the upward trend on rents in the Midwest (in general) started 2 years ago. Covid factors have amped it up.

Like ru82 states, anti-lanflord politics and rising maintenance costs combined with wage stagnation made the Midwest not so attractive for decades. I am hoping the migration continues.

I love that electric tram going through town!

Damn, I shouldn’t complain about my rent. I live in a huge 1 bedroom apartment, 3 blocks from the beach for $730 mo.

SF rents are still insane.

San Francisco has rent control, as do a number of other cities that are expensive to rent in. Rent control encourages people to stay put so only a small part of the rental market is in play in any year. In some places, property tax benefits encourage some people to stay where they are. The most obvious case is California where Proposition 13 passed in 1978 initially cut property taxes for owners and then dramatically slowed the rate at which they could increase. Years later, Federal tax laws changed the way capital gains taxes were levied on the sale of owner occupied homes, encouraging long time home owners to stay put.

Anon1970,

In terms of San Francisco, about 60% of the apartments in apartment buildings are under rent control. These are buildings completed before June, 1979. Units in newer buildings are NOT covered. Condos and single-family houses for rent are NOT covered. Rent control means rent can be increased in line with inflation.

In 2020, rent control allows for 2.6% rent increases on those units that are covered, and unlimited increases (hahahaha) on the other 40% of apartment buildings that are not covered.

When the tenant moves out, the unit goes on the market at market rent.

Rents in rent-controlled units will continue to be increased at the max allowed rate every year, even while asking rents are falling, until the tenant moves out. Then the unit goes on the market at market rate. This is the counter-balance: during times of rent declines, rent-controlled units have rent increases until the tenants move out.

Re: rent control

Isn’t the annual rent increase based on a fraction of CPI? Theoretically, if aggregate prices in the area are flat or down come December, there shouldn’t be an allowable rent increase by the rent board.

(I’m not sure what is in the basket of goods that calculates the SF urban CPI).

GSW,

It’s based on the CPI for San Francisco, which is higher than the national CPI.

I’m not a SF rent lawyer. But here is roughly what I think I understand:

Yes, if CPI for San Francisco goes flat or turns negative, landlords cannot raise rent-controlled rents.

But rent control is a cap. Landlords are not required to change the rent. Some small landlords don’t raise the rents though they could. But there is nothing that forces landlords to cut rents.

It’s when the tenant moves out, that’s when market rate kicks in. So, if the rent in this rent controlled unit (usually a dump) is too high compared to a dropping market, the tenant moves out and moves into a beautiful new apartment for the same rent, and lets the landlord deal with the rest (remodeling the apartment and putting it back on the market at market rent.

Wolf,

one would have to wonder how this is now playing out with C19 induced rent moratorium. Would the renter in rent-controlled apartment “take advantage” of the situation? This is a double edged sword for the owner after a fashion, if the renter don’t pay, when the time comes, does the owner attempt to evict or collect back rent, knowing full well that if he does, he could charge market rate on the next tenant, but that there may not be anyone willing to pay market rate.

Think in this case, it just sucks to be a property owner. Especially as it is more than likely that property taxes are going to be going up to support the budget problems that all of the bay area municipalities will be having

“put so only a small part of the rental market is in play in any year.”

This is a good point, rarely made.

It goes a long way towards explaining the huge true scarcity of supply despite the theoretical apt base.

Which in turn explains the pricing pathologies of places like SF/NYC.

(In addition to the traditional role of more or less telling builders to f off, implicitly or explicitly.)

LLs that can (repeat: can) may choose to keep units empty or unrented versus renting out and dealing with what could be long-term tenant in a ‘temporary’ market dip.

Many units are emptying out, but not all are going right back onto the market to be re-rented. Rent control and many overseas LLs stashing money in the value of the dirt more than the rental income brings several other variables in what should be an easy supply/demand equation. LL’s who have the means to ride it out don’t want to get stuck with a 20-year tenant at depressed rent if they can avoid it.

SF is an outlier given these quirks.

I have heard down in SoMa (which isnt rent-controlled), its an exodus. Friend down on Rincon Hill walked into the leasing office and on the spot got a 20% rent haircut to reup for 18 months.

There should be a huge tax on any unoccupied housing unit, be it rental or owner not-occupied. That would help return some of this idle inventory to market.

“I live in a huge 1 bedroom apartment, 3 blocks from the beach for $730 mo.”

Is that in the Aleutians?

Joking aside, there may be some locales along the Gulf (non FL) or in the rain drenched, rock strewn Northwest that can hit these numbers.

But in general, I’m guessing any beach proximate properties with theses rents get pretty cold in the Fall/Winter.

SW Florida

Sounds like Cape Coral. Once thriving, hit hard around the 2008 crash, never really fully recovered, and a lot of property sitting vacant. People are glad to get anyone in their homes. Empty homes don’t bring in anything, yet still need maintenance and babysitting.

Not particularly consistent with other FL metros in Wolf’s Zumper survey.

Might be accurate but that is an awfully wide spread among metros in same state.

Isn’t this how inflation is so insidious though? It eventually affects everything. Rent is notoriously “sticky” because the time it takes for households to react to it is measured in years.

Everyone thought it was a coastal thing. Well, now it’s moving everywhere like it always does and won’t stop until rough parity is achieved. Hot money has been sloshing around in the global economy for years — a result of the post-GFC monetary policies. Now it’s flowing from the international cities to the heartland, and I can’t see anything in place to stop it.

The inflation moving from the coasts to the heartland was originally created by all the loose money from the 2009 financial crisis.

Where will the inflation land from today’s money printing?

Meanwhile Apple quietly reaches $1.9 Trillion valuation. Thank you President Trump.

Not “quietly.” But with a HUGE amount of hoopla and hype.

Wouldn’t it be thank you Apple for the stock split and everyone buying before the deadline?

And thank you to every president and legislative rep who allowed the Fed to do this. And to everyone who voted for the.

Andy

Consumers drive most of this. Apple just happens to make products & services that hundreds of millions of consumers want (total 2.2B iPhones sold; 725M still in service).

The Big 5 are just short of $7 Trillion. Probably $8T next week. Winning.

Places with low rents see increases, those with high rents decreases. Cleveland rents are 1/3 of SF? I would like to know what’s inside, sq footage, parking, amenities. Proximity to drug dealers, homeless, shopping. Maybe a Cleveland apt really only has about 1/3 of what an SF apartment has? Cleveland has a lake, are these lake view?

You left one out, ‘proximity to drug users’.

Ambrose Bierce

Cleveland apartments are a lot further away from sidewalks with human poop, but then there’s no accounting for some people’s tastes.

Cleveland has lost over half its population since 1950, as have many other rust belt cities.

But Cleveland Rocks!

Yes, you can warm yourself in the chilly winters by the burning river…

To be fair, the river only caught fire once…

Cleveland: More affectionately known as “The Mistake on the Lake”.

I think that referred to the baseball stadium, not the city itself, LOL

The river really caught fire in 1972 and it made the papers.

…and, ‘The Price is Right’!

Cleveland also took part in the housing bubble and hasn’t recovered. Pittsburgh on the other hand didn’t take part in the housing bubble and is now going gangbusters. Pittsburgh will be in the same shoes as Cleveland soon enough. Love my city but really we’ve only got slightly better in the last decade because every job here is subsidized by the feds. Meds and Eds baby, Meds and Eds.

Meds, Eds, and Feds.

Ultimately, deds.

In the era of internet transparency, when people get sufficiently pissed at taxes and long zeroed out interest rates, it isn’t hard to find out just how corruptly subsidized “politically favored sectors” are.

@Cas127

The funny thing is, most of the jobs in those industries are just warehousing people. Honestly i know, i finally gave in and got a job with one of them. I’ve never done less work for more money. After 12 years of this none sense and limited job prospects because of the great economy, i gave in. Been working for one now for a little over a year.

Dr. House,

I hear what you are saying, those sectors have long given off the smell of government subsidy to buy political support/”social stability”.

With actual usefulness of the additional personnel playing a far, far, far distant second.

Actually, they usually increase costs (despite the supply of personnel going way up) and harm efficiency through increased bureaucratic stupidities and fief formation.

But an economy can only survive wasteful economic distortions for so long, before it crumbles under the weight of its political payola.

In the name of “social stability” (and the perpetuation of their power) DC and state political classes are recreating the USSR.

I have a friend who lived in Cleveland for years. She moved. She calls it “the mistake on the lake”.

She’s prob from Pittsburgh then. Thats what Steeler fans call Cleveland.

combining this article with the previous one about too much retail space, i am fantasizing about millions of square feet of retail being either converted to living space or torn down and rebuilt as apartments to drive rents lower.

I have actually thought about renting an office and sleeping there because the location was awesome and the rent was about the same as an apartment further away. I wonder how many people do that.

That’s how the loft craze began in NYC in the 1970’s. Old downtown light industrial/office space was cheaper than a studio apt in the nice areas. Artists were the first to go into SoHo.

Petunia cool thx I didn’t know that

The major problems with housing for low income or “homeless” are 1) NIMBY and 2) culture.

People with houses that are costing them $500,000 do not want to have more housing of lower value (with the population that entails) cheapening the investment they’ve worked hard to afford and maintain. Add to that most of those “rezoned” type conversions would require massive investments in local infrastructure (streets, power, trash, etc) that local governments are increasingly unable to fund without increasing taxes which would have to fall on the current property owners , not the low income/homeless as they (obviously) could not afford. So basically you’re asking people who currently live in an area to pay more, and accept a decrease in local resources, while watching their investment devalue. Understandably that’s not very popular with those who would be impacted.

Likewise, the “homeless” issue is less of a “cannot afford a place” issue than it is a “drugs” issue. A culture of politically correct acceptance of public drug use, anti-social behavior, and lack of responsibility on the part of the individuals, and a lack of strict enforcement of the law on the part of the local government, police, and judiciary just makes matter worse.

You cannot raise the standard of living of those unwilling or unable to contribute to society without lowering the standard of living of those who do.

FYI without market manipulation and interest rate suppression they prob wouldn’t be able to afford the house anyways. Hence all the hand wringing with regards to evictions.

“…lack of responsibility on the part of the individuals…”

i.e. human feces on the streets. Gross.

MiTurn

i.e. human feces on the SIDEWALKS.

There, I fixed it for you.

“You cannot raise the standard of living of those unwilling or unable to contribute to society without lowering the standard of living of those who do.”

Politicians know this. They also don’t care since it doesn’t affect them. Gavin Newsom won’t have any homeless people relocated to his neighborhood. It’s middle class neighborhoods that will be decimated by moving the homeless in.

You can, however, raise the standard of living of non-contributors by printing money and surreptitiously, stealthily devaluing the standard of living of everyone else through “2% inflation”.

If you’re good at it, you can also raise the standard of living of your family and cronies by siphoning off a bit here and there for yourselves.

What you have said about the homeless issue being a drug (and alcohol and schizophrenia) problem is spot on.

Working at a Non-profit, there’s quite the difference between the visible “street people” and the other classes of homeless people.

Street people are often mentally not all right, like to be homeless, or drugs yes… (And they all eat each other like crabs in a barrel)

However: I’ve seen a lot of 65-70 yo homeless folks lately. A lot.

Often stay at home moms whose husbands leave or folks who never really got that “boomer money” to begin with. Reganomics has been cutting wages since the 80s. Some people say 80, 90, 00, 10s as a series of bad to worse.

And i know many young people priced out who earn 30k or so (which is a college grad wage) but in San Jose thats not gonna do any good (I left at 60k cause it was plain stupid to stay)

There really has been a subsidy of landed aristocracy in the US as i see it. And while titles are illegal here, most the aristocrates arent even from here. CCP and Emirates are who got bailed by Bush/Bama.

I am no expert, but this premise seems very unlikely.

The problem is that HVAC is really expensive to put in. Malls and large retail are infamously bad in terms of bathrooms vs. unit square footage.

People like to have refrigerators, toilets, showers and even kitchen sinks.

It also takes significant time and money to retrofit; lofts are exactly such spaces converted to residential.

With per-square footage residential rental prices falling in tandem with commercial real estate – it isn’t at all clear to me that the economics makes sense (i.e. still high price to purchase the commercial real estate, high capital to refit, more carrying cost before income generation etc).

Not to say it won’t happen, but if it does, more likely to happen many years down the road and after commercial real estate prices hit bottom.

Wolf has commented a thousand times about the cost of converting retail mall space to residential; always works out cheaper to tear down & rebuild.

especially with the condition many of the malls are in structurally. They may look sheen with marble and craftsman style plastering when walking through but through the service doors reveals much more about real problems.

They all went up so fast. We all drove by and said “wow that really shot up so quick, they must be working hard”

working hard, to save themselves a buck. Bucking that buck down the road to someone else.

If I could buy a pier 1 imports building cheap I’d live in it. That would be cool. Except the electric bill.

My data is more anecdotal and it’s a somewhat different market, but what I’ve seen from Craigslist is that rent for single rooms in San Francisco has not dropped.

Not sure why that’s the case.

I’ll throw out 2 theories

1. People who tend to rent single rooms don’t have much economic power or they’d rent an entire apartment.

2. People who sublet single rooms are slow to realize or admit that the market is falling apart and aren’t adjusting with the market.

Or…

3) Single rooms might be used for something other than residential.

Lets hope we see the Greedmerchants catch a cold, and have to eat humble pie to get people to rent there rooms.

They have been way over priced for years..

My wife and I walked by a mega student apartment about a mile and a half from San Diego State University last night and we were both stunned at the lack of activity and no lights on in the overwhelming majority of the units. School starts in three weeks and in a typical year these places are crawling with students. SDSU is open, online/on campus.

We own a few houses in the College Area and haven’t rented to students in years, but two of the houses went to students this year and it’s obvious these students come from money.

One short and simple answer…parents (who pay the bills) don’t want their kids living in a high density place so houses are going to be king for a while, apartments are going to suffer until they really, and I mean really lower the rents.

I know the chart shows a decline in the San Diego area but I have to say I haven’t really seen any significant decline in the area as a whole. I wonder what percentage of renters aren’t paying rent in the county. I’d imagine it’s way higher than the percentage not paying their mortgage.

“..stunned at the lack of activity and no lights on in the overwhelming majority of the units. ”

I wonder how this will impact the already-strained finances of the university. I don’t know by what percentage student dorm ‘rents’ fund a public school, but it must be substantial. I think that many universities across the US will be in dire-straits this upcoming academic year.

Talk about whip lash!

The real financial hit to the universities is football. Mega bucks have disappeared.

Petunia,

Don’t bring religion into this…

:)

The university where I work had 6000 students in uni-owned residence halls a year ago; now there are 400. The financial losses are huge.

At the same time, the beachside student neighborhood nearby is full. Word on the street is students remoting to other colleges are moving here for the lifestyle. We’ll see how long that lasts, as social distancing is nonexistent.

Brick & motar spiral is not limited to malls only.

Believe they would be more suitable for housing the homeless

than a Mall.

About three years or so ago Monash University in Melbourne finsihed building a huge number of stinking little ‘apartments’ in a IIRC about 5 buildings on campus. IIRC somewhere around 1500 – 1700 new units.

These were built to accomodate the huge influx of foreign students (read Chinese) coming to study at the university.

Cost per room per year ranges from just over $A10,000 to A$14,000 a year.

Rent for a new 2 bedroom apatment near one of the schools two campuses will run somewhere around $2200 a month. The area near the Caulfield campus has seen a huge building boom in multi-storey apartment buildings aimed at student accomodation.

Of course, with the ban on entry into Australia a lot of these are now empty and rents have fallen over the past year.

I wonder how many of those campus rooms are filled?

Honestly, I don’t mind if the semester tourists do not return. I hope they do online forever

Mr. House,

I can see your point. College towns are best when college is out for the summer and the students leave. At least my experience.

@MiTurn

Yes sir, and they put a floor under rent prices with very strong updrafts. Mainly the only economic activity they generate is at the university or bars. And the bars ain’t going to survive anyways. Not to mention the majority of protestors are semester tourists. Stay home kiddos

“San Diego State University has shifted all instruction to virtual modalities.”

https://sa.sdsu.edu/student-health-services/coronavirus

The majority of your classes can be online but one stinking lab means you get to live on or near campus. Lots of students are coming back also because they can’t stand living with their parents in Oklahoma.

Matter of time when places like San Diego , the rent as well as home prices would fall.

Last downturn, it took 4 years to find the bottom. This time, it is just the beginning.

This weekend my wife and I moved from our old apartment to a deluxe third floor, three bedroom unit across from a big park and nature preserve in the same building . It is located in the burbs of Portland in between Nike and Intel. Previously these 3 bedroom units had been for in-bound corporate relocation moves for families to rent as they searched for a new house. But with Intel in the silicon doghouse and Nike in the midst of big layoffs the corporate relocation market has dried up. so they gave us a great deal on this huge nearly new unit. At least a 20% savings over the previous rent. The suburbs are not immune from rent reductions.

Must be a big building to hold a nature preserve.

I spent much of my growing up years in Sherwood, Oregon. Saw that area convert from farmland to suburbia it what seemed moments. And the culture swung uber left. Remember Tom McCall? I don’t think he’d fit in anymore.

Beaverton was a nice place too. Let’s hope the Washington County Mounties and the locals keep those rioters and homeless from continuing to max in to Beaverton Creek.

I read that rents didn’t drop much during the Great Depression because families doubled up. I wonder how much these rent increases involve adult children moving back home.

I was talking to a woman who managed a large storage facility. She sees a lot of young (under 40) couples putting their stuff in storage and moving back in with Mom and Dad. $1000 a year for storage is a lot cheaper than $1000 a month for rent.

My middle son worked at a public university for about three years as an adjunct. Starvation wages. They kept promising him that ‘soon’ they’d hire him full-time, but it never materialized. We would slip him some cash every now and then to help him survive (married, then two kids, not three), but eventually he realized that he couldn’t continue waiting on an empty promise and moved his family in with us for about a year.

He has since found good employment and we together (his family and me and my wife) bought two near-adjoining houses on the same property. We were able to fund the down payment on the mortgage, but there is no way that he could have ever afforded the 25% down on his own. At least not for a decade or so. We now share the mortgage and co-own the property.

This is not uncommon. I know of two other families that did something similar, although these families are sharing larger homes.

I guess we’re simply doing what families traditionally did. Maybe this is not a new normal, but a back to normal?

Go over to The Atlantic and read the following: “The Nuclear Family Was a Mistake”.

What we’ve been doing the last 60 – 70 years is more like an aberration. The only ones benefiting from the current arrangement is richer people who can afford to hire “extended” family i.e. maids, chauffeurs, etc.

That’s was a great read, thanks for mentioning it.

Good on you Miturn. Great comment.

My son’s place is about 100 meters from mine. Some days it is a mixed blessing. :-) I give him space. As I said to his friend when he asked me down for a few drinks, “I’m the Dad, not the buddy”. Now that he is working away I miss him for sure.

Nice move MiTurn!

We did the same for our daughter and her husband, both of whom are struggling with lost jobs (oil industry gone south) and have some high, ongoing medical costs. And thanks to the ACA, they are almost broke, and THEY COULD NOT KEEP THEIR DOCTOR(S)!

We helped them with a down payment on a small house and with some medical bills. Until the Gov straightens the ACA mess out (if ever), they will need more ongoing help, but that’s what parents are for, I guess.

Anthony- I am genuinely interested in what happened with their medical situation, – financially and doctor choice. How did the ACA impact/cause that. I’m looking for your real-world example.

(We all know usa-healthcare is a mess, but what did the ACA do/not allow that made it worse.

Genuine question.

You wrote:”And thanks to the ACA, they are almost broke, and THEY COULD NOT KEEP THEIR DOCTOR(S)!”

Thx

M

My extended family lived together, in NYC, during the depression. Work was rationed to men, one or two days a week per man. People had to live together to pay rent and eat. Rent control came later during the war as part of the price controls imposed on the entire country. NYC never lifted them.

Many non Americans do this routinely. I know a lot of Filipino’s who’d come over, and there’d be a lot of ‘family’ living in one house. Brothers, sisters, aunts, uncles, children etc etc. They all pitched in to pay the bills, buy the food, and do the work. It worked very well for them. With this many relatives so close together, there was always someone around to take care of the kids. No paying babysitters, they had a few family vehicles, so insurance and maintenance costs were less, etc. From an outside perspective, it didn’t really seem to be that bad of a way to live really. The only issues I could see is when you get that one slacker relative who didn’t want to carry their own weight.

There’s nothing wrong with giving a relative a hand up. Where the problems start is when they start expecting constant hand outs.

This is exactly what I’m seeing happening with all the large developments on Alameda Island where I live. Or out in Dublin. The old navy base is being developed into townhouses that are all 4 bed/3 or 4 bath which are 3 stories. The lowest are being offered by KB Homes etc for 1 million.

They have steadily been building the area out for about 3 years now.

I don’t see any traditional nuclear families.

Its almost entirely Asain and Indian multi-generational extended families moving in.

Will be very interesting to see how long this lasts.

There is 1000s of new units just like those starting construction or still under construction.

That is why the majority of of people in certain areas with Covid are Hispanic. i.e. 80% of cases in Marin.

Not just the crowded multifamily, multigenerational living, multiple friends from point of origin. you mention, but lack of education, an unwillingness or plain ignorance of social distancing and healthier healthy living, plus poor health, lots of obesity.

Crappy jobs because of low education and language ability often working in the company of friends and family from the same village back home.

https://abc7news.com/covid-cases-latino-california-coronavirus-marin-county/6329375/

You are describing a very well trod immigrant path, it has always been this way and will be as long as people immigrate here from the 3rd world.

@Wolf (and community),

Great info, but the $64K question is: where is the SF/big city dip likely to end up?

My thoughts:

1) SF rents should not be higher than NY. Both are falling, but SF is still ahead

2) SF rents jumped enormously over the post-GFC startup bubble. Retrace to 2012? 2010 overshoot? Or will it possibly be worse, since there was a major real estate bubble prior to GFC to boot.

With Proposition 15 on tap plus the general economic disaster (from COVID-19 lockdowns as well as startup bubble popping), I lean towards the more pessimistic albeit this is offset somewhat by the massive asset price pump from all that printing…

my gut feeling is that higher population density cities will get harder than ones with lower ones. In that case I’d expect eastern cities (with more multi unit dwellings) to experience greater flight/rent reduction than western cities (which built out, not up).

The tech sector is responsible for the bulk of the increase when it comes to rent in SF. Once there’s an all clear from big companies that WFH is here to stay and people are free to work from wherever, rental in SF will drop even faster.

Right now, people are only told that it’s ok to WFH till 2021, not forever.

But, if people are successfully working from home, there becomes a big case study to continue that. If you are working from your home and doing what I need you to do, that saves me a lot in the long run. I don’t have to pay for an office space for you, no heating, A/C, lighting for you. If you trip and fall, it’s on YOUR property, so I am likely not liable for that, my insurance costs go down.

On your end, you are not spending all that wasted time commuting back and forth to / from work. Possibly not having to pay a baby sitter now or day care since you might be able to juggle the brats and your job from home. The benefits of WFH are tangible.

This might be the start of something permanent. Time will tell.

Although there are tangible benefits to WFH, there’s also disadvantages.

If you want to move up, you’ll need to build alliances and it’s hard doing that using Zoom.

Remoting to a job where you’ve already established a reputation in-person can work. Trying to change to a new remote job from hundreds or thousands of miles away is a little trickier.

A whole lot of assumptions are being made in your statements.

A company in Florida that I know, has been trying to WFH.

The problem is that it turns out half of their employees don’t have high speed internet at home.

Will the company pay for that?

Then there’s other things like copy/scan/fax, specialty printers (architects/engineers need them), filing cabinets (and files/filing), etc etc.

Child care is talked about as a bonus – in reality, trying to watch your kids while working is not going to work out well – even if the parents are willing to try it.

Sure, the lack of commute is nice for those people who live far from work – but that’s rarely a problem for management.

Now toss in all the interesting ways WFH can be abused: ghosting, coasting, data theft, etc etc.

A good tell is call centers. Call centers by definition are remote-capable – they’re literally just taking calls and responding via a computer programmed or paper script.

Why haven’t call centers, anywhere, gone WFH?

It turns out that you need close supervision to keep people’s nose to that particular type of grindstone…

I’m sure WFH will increase, but I’m equally sure that it will be a lot less than anyone thinks – once the lockdowns end.

@c1ue,

There are many call centers in the US and overseas doing WFH, WSJ ran a profile on this phenomenon in the Philippines month or two ago.

c1ue,

Here is a long-term chart with data from different sources that show the periods you mentioned. It has not been updated since Q1 and does not show the last four months. It’s for buildings with at least 50 units. All data points are Q1. Click on the chart to enlarge it:

So this is still all about reflation of the dot come bubble based on that chart eh? Have we really had any economic growth since 1999? I don’t think so. I think some sectors have seen inflation to the detriment of others. But all around growth, meh

@Wolf

Thanks for the chart.

So a 1/3 drop from present levels is not out of the question.

Interesting times.

Great info Wolf. Thanks!

Landlords sure like to gripe about tenants, taxes, and maintenance. I never hear ’em gripe about capital gains when real estate prices go up. Must be nice to make money in one’s sleep.

When I was able to drive, I could only afford to do so because I did my own repairs. It was the same when I was farming. It’s the same today for my modest home and 50 year old tractor.

Why should it be different for landlords? If they are doing their own repairs, then they are actually earning the rent. But that takes actual physical skills other than writing checks and understanding tax codes and bank rules. Plus it’s hard dirty work.

US pensioners are completely screwed. Even the cheapest city listed in the article would cost half my Social Security. People don’t live to “ripe old ages” when forced to live on the street.

The USA Titanic has hit the iceberg and is listing. Meanwhile Dear Leaders have formed a circular firing squad and there is no recognition of the dire emergency.

I keep thinking about the horrible living conditions portrayed in “Soyent Green”. The US is nearly there.

I think what you describe are landlords who mistake short term “cap rates” for long term outcomes.

I know a number of extremely successful landlords – but they are successful because they buy cheap houses (this is outside the Bay Area), put in another 20% in repairs and rent them out at 15% above the low end of market rates for single family, 2BD homes.

They recoup capital expenditure in under 2 years; after you hit 50 homes, the process accelerates because you can hire a full time handyman instead of outside services plus skip fire insurance (basically 10% of the homes would have to burn down to compensate for fire insurance for 50+ over 10 years).

On the other hand: someone who pays $1m or more for a multi-unit expecting to get $60K net; doesn’t take too many empty months to blow out the expected cap rate nor is this person likely to offer lower rent price for extended periods of time.

they are doing their own repairs. They used their talents and time to acquire the land you choose to pay to live on. They repair, by paying professionals with the money they obtained using their time and and talents.

Not everyone wants to be a bottomfeeder. Some people prefer to make money while they sleep instead of shuffling from one disappointing part of life to the next.

The absolute jealousy in your post is astounding by the way.

I think the current set of circumstances ( Covid, end of 40 year debt cycle etc.) will be an extinction level event for most existing landlords ( be they individuals or corps or what have you.) Unless they have a very low cost basis the coming cascading deflation in rents will wipe most out. Only as the owners of rentals default, get auctioned at a lower price, rinse and repeat will the cost basis of rentals get back down to where they need to be to be cost effectively rented to the broke renting class at a reasonable multiple of take home pay.

The highly leveraged will fail, but that doesn’t describe most successful landlords I know.

Keep in mind that there are leases for retail and medical tenants that stretch to 15 years, and are net-leased, with contractual increases each year. The way to invest in real estate is to own net lease reit’s. In fact, even if re-leases or vacancies enter a lower market, this is typically accompanied by lower interest rates on unsecured debt, which keeps the investment spread.

One year to three year leases are certainly going to hurt landlords with LTV above 70%. Those are risky deals as-is, and so if markets are ever allowed to clear without bailouts, this will wash out the debtors.

Stay out of the mortgage market! I would not touch Quicken Loans, or any mortgage reit that owns rmbs or particularly cmbs.

Moving companies are doing very well moving peoples “valuables” into self storage. Not just out of state. Uhaul trucks have 3 weeks delay.

And yes just like the depression era renters have been joing family to buy 2 family houses (sure that title will have to be changed soon)

3 – 4 family members buying houses here and splitting them into 10-12 rooms. I have neighbors that currently have 8-10 vehicles on the block for what technically would be 2 or 3. This is how NYC buyers have been coping with purchasing. Converting houses as such is a huge fire, safety and health hazard.

People flocking NYC for buffalo are still trapped in a socialist dystopia. There is no escaping NYC even if you go upstate or CT or NJ. It’s nice when you get there but scratch under the surface lift some rocks and you will find the truth what lies ahead.

I have been travelling the last several weeks within the tri state area and must say the capital of capitalism is dead. No one holds the title now it’s all up in the air thanks to remote learning and remote working!

You can run but you cant hide…

Rents and prices will rise for the first rush off demand. Business will flock as people abandon their investments into what they perceive to be the next best place to live until the mob shows up, people bringing their politics with them like their baggage.

States that hosted retirees use to be a plus to move to will take a huge hit thanks to the impact of tourism.

Mortgage forbearance along with eviction moratoriums, oh how about those unemployed??

All will catch up to this demand and smash the euphoria.

It will still take time thanks to the confusion people rushing here rushing there. The numbers of the new movements rising rents, prices etc.

If your looking to buy a house outside these dystopia areas rent an apt and invest your money in the commercial real estate if at all possible.

But only if its outside these markets. Municipal burdens, state debts it’s all going to catch up.

All not part of the convo as people are fleeing. I for one think it’s time to be a global citizen. How do I live here there and over there and back here again throughout the years. Because we are literally years out from society getting done reshaping its self.

The biggest challenger – those such as myself with families, those in their golden years, and those whom already lived the global citizen lifestyle and reverting back to it can pose its challenges. The single or pets only couples will be able to take full advantage of this new world if their employment permits.

Good luck!

My landlord called me in april or march to check and make sure i still had a job because she suspected we were in a financial crisis. After i told her i was still employed and not to worry she started to talk about a rent increase. Which i immediatley squashed and said that if she could come up with a fair argument as to why the rent should increase i’d be willing to listen. Then around May (my lease expired May 15th) she texts me and says same lease terms, she’ll drop off the lease in my mailbox for me to sign. Oh and she tells me she likes to do things via text so she has a record of it, which makes it all the funnier that she called to ask if you still have a job instead of text. Great i think, about 10 mins after i take the lease out of the mailbox she texts to ask if i have renters insurance. I’ve been renting 12 years and never once had renters insurance. I tell her this, she says she has a new policy and all renters will be required to get renters insurance. She then wanted to discuss it, and i’m thinking well what is to discuss, either you get it or you dont. She goes radio silence for a few days, then asks if i’d be available to meet at my apartment on wednesday at 8 pm. I said sure thats fine, the date and time roles around and i hear nothing from her. I figured it would be hard for her to forget because she was showing the 1st floor apartment. 8:20 comes and goes so i head down to the front porch and the guys who will be moving out are hanging out. I ask was the landlord here? Yes and she left an hour ago. I texted her then asking if she was coming and she said she forgot and blah blah blah. She lives 10 mins away by the way, not oh i’m sorry i’ll be right over to discuss this thing i should have told you months before your lease expired. Long story short, she was doing everything in her power to make me want to move out, so she could raise the rent for someone new to move in. I have absolutely no trust in her at this point and consider her a small time shyster. I do have a lease renewal and i did get renters insurance, but it took until the end of july before i finally had it in my hands.

Let her try to get someone else Mr. House…

Just read that FL has 1.1MM renters who are not able to pay rent, and have not paid rent in months… so guv extended four bear ants til Aug31..

Same article said estimated approx 17.3MM in USA in the same fix…

Wait to sign lease until THAT information is made concrete or our pres ”dictates” endless rent for the bare ants, and see what your LL says then, eh?

”What a find mess you got us into this time Stanley.” (from Oliver Hardy) is likely to be the motto for all LLs going forward for the next few years IMO,,, we are SO glad to be out of the LL biz…

Cash buys and cash sells for us from now on, far shore

In 12 years of renting i’ve never missed or been late for a payment. I did have a landlord once who told me he didn’t receive my rent check. Dropped another off and then he cashed both. I had like ten dollars until my next paycheck.

Get together with a couple other tenants and demand a rent reduction that equals or exceeds the renters insurance (never bluff; be prepared to move).

I’m signed up thru may of 2021. The two guys that lived below me moved out, the girl who lives above me i think is a mole for the landlord. I vented to her about this one day (suspicious she was already repeating everything you said to her) and the next time i spoke with my landlord in this never ending fiasco she just happened to bring up some of my complaints that i’d never mentioned to her. People are awful, the short and the long of it. Also i cut the grass the place. If she paid a neighborhood kid (good luck) to cut it, i’d say its at least 20 a pop. You’d think she’d be like, you know what forget renters insurance since you cut that grass and that would cost me 180 a year. Its all about the fact that i refused to let her raise the rent. Oh and the day i met her to sign the lease for my first year here, she texts me an hour before hand to ask if its ok if she raises the rent 25 bucks a month due to a high water bill. I didn’t like this “tactic” but you know, just met you, i’ll let it slide. It’s become routine now.

She can be annoying as she wants, the bottom line is she didn’t increase the rent. If she wants to tantrum like a two year old, well those are alot of people you have to deal with these days.

Charge her for the grass cutting. Send her a monthly invoice via text.

As businesses fail, because many will not be able to pay rents or will have owners or officers or employees that cannot pay their own rents, rents will go down in the worst affected areas. Indeed, areas with common lobbies and transportation like subways may be less desirable particularly if this “widespread” pandemic continues until 2022.

That is what the latest comments of administration experts are hinting. If immunity cannot last more than a few months, and those over fifty have reduced response to any vaccine so that they do not develop enough antibodies, this may be like the 1918 flu albeit not in the total, massive number of deaths but in the persistence of the virus in the population for years.

I think that our nation’s urgent need for real funds mandates that the gigantic, decades-old, tax loophole allowing billionaires to avoid paying taxes by setting up foreign shell corporations be eliminated. For many, many decades, the ultra-rich have been able to avoid paying virtually any US taxes by setting up a foreign shell company.

They set up US laws so that they did not have to report any income tax on foreign income, etc., until those earnings were formally returned to the US. There was an attempt just a few years ago to get forgiveness for those earnings, so that the billionaires and huge companies that have avoided paying taxes through that loophole, could avoid ever paying taxes on those earnings.

Think about it, if you were a millionaire, you could and can invest your money in a foreign tax shelter in the Cayman Islands, for example, and you could still own US/EU stock or real estate indirectly thereby, usually indirectly by owning stock in a non-dividend paying corporation or being a beneficiary of a trust, which in turn owned chains of entities that actually owned the US/EU stock or real estate. Until you allowed the entities lower on the chain of shell companies to pay dividends or sell their assets, the foreign shell companies or trust would not even have any taxable income realized!

This has gone on for so many, many decades that truly GIGANTIC fortunes have been accumulated. That is why I do not have any hatred toward certain, US public “billionaires.” Some are genuine billionaires. Some actually are agents who are running companies for the benefit of the true owners, billionaires (or reputedly, trillionaire families), who actually own the companies through a chain of shell entities.

Now that the US is in deep trouble, after doubling or tripling their security details, I hope that the next congress will abolish that GIGANTIC loophole and finally collect the billions in unpaid taxes that have accumulated over decades. It is time to collect that money for the benefit of the poorer 95% of Americans.

Our country needs it to save its legitimate and smaller companies. I believe that the billionaires (or reportedly trillionaire families) that have been benefiting from this tax loophole are those referenced by Simon Johnson as having taken over the US government in “The Quiet Coup” in the Atlantic Magazine.

I believe these people or their agents are most of the 15 billionaires referenced by Forbes magazine as owning most of US media. It is time to take back our country from these persons, who I will not call crooks, despite the claims of a person who claimed to me that many had links to a huge, governing portion of US organized crime and drug dealers.

M

Steven Terner Mnuchin, the 77th Secretary of the Treasury – He has several of these off shore trusts. Not one several.

Let’s build a phone app that lets the common joe do the same thing easily. Then everyone will have access to the same tax avoidance systems.

I saw somewhere that the expensive art market is also a giant tax avoidance system.

I rent in Seattle. While rents may be going down at the moment, prices on single family homes are still climbing at over 4% a year and homes are often selling higher than than the asking price.

Well, I stuck my head out of my hole and looked around and read some stuff. Same ol’ same ol’. The Fed’s omnipotent still. Rents don’t really matter,just don’t pay. It will take a couple of years to evict. You can DIY Motions in Civil Court for peanuts while the landlord pays out the nose to respond. The Courts bend over backwards for a Pauper’s Plea ,piece of cake .Take some advice from Mick , “Time is on my side,yes it is”.

Wolf –

You could make your headline really attention grabbing by multiplying the two month decrease of 4.8 x 6 for the “yearly rate!” I know how you love it when the media do this to the GDP reports. “SF rent declining at 28.8% pace.”

“Annual rates” are such headline grabbers ?

You have to wonder about what markets’ are thinking……………..

Curfew announced in Victoria and then a sweeping change to economic life which will see some 250,000 or more people lose their jobs by te end of this week.

People don’t even know if real estate sales and auctions will be taking place after yesterday for the next six weeks.

So what happnes?

After initially falling by about 1% yesterday the share market closed down about 2 points. The Australian dollar fell by about 1%, but reversed all its losses in NY trade to close………..basically unchanged.

And today, despite all the bad news, the share market here has zoomed by by 117 points or almost 2% in the few minutes of trade.

Maybe we should just shut the country down and the share market here will go up 100%!!!

Unreal and ridiculous.