I’m sharing this trade for your future entertainment so you can hail me as the obliterating moron that infamously shorted the greatest rally floating weightlessly ever higher above the worst economic and corporate crisis imaginable.

By Wolf Richter for WOLF STREET.

I hate shorting. The risk-reward relationship is out of whack. It feels crappy. I lost a ton of money shorting the worst highfliers a little too early in late 1999. It’s just nuts to short this market that is even crazier than in late 1999. But this morning, I shared in a comment in our illustrious comment section that I’d just shorted the SPDR S&P 500 ETF [SPY]. My time frame is several months.

I’m sharing this trade so that everyone gets to ridicule me and hail me as a moron and have fun at my expense in the comments for weeks and months every time the market goes up. And I do not recommend shorting this market; it’s nuts. But here’s why I did.

The stock market had just gone through what was termed the “greatest 50-day rally in history.” The S&P 500 index had skyrocketed 47% from the intraday low on March 23 (2,192) to the close on June 8 (3,232). It was a blistering phenomenal rally. Since June 8, the market has gotten off track but not by much. It’s still a phenomenal rally. And it came during the worst economy in my lifetime.

There are now 29.2 million people on state and federal unemployment insurance. There are many more who’ve lost their work who are either ineligible for unemployment insurance or whose state hasn’t processed the claim yet, and when they’re all added up, they amount to over 20% of the labor force. This is horrible.

But stocks just kept surging even as millions of people lost their jobs each week. The more gut-wrenching the unemployment-insurance data, the more stocks soared.

Then there is the desperate plight many companies find themselves in, and not just the airlines – Delta warned of a host of existential issues including that revenues collapsed by 90% in the second quarter – or cruise lines – Carnival just reported a revenue collapse of 85% in Q2, generating a $4.4 billion loss, and it is selling some of its ships to shed the expense of keeping them.

These companies are in sheer survival mode, and they’re raising enormous amounts of money by selling junk bonds and shares so that they have enough cash to burn to get through this crisis.

This crisis hit manufacturers whose plants were shut down. It hit retailers and sent a number of them into bankruptcy court. It crushed clinics and hospitals that specialize in elective procedures. It shut down dental offices. It sent two rental car companies into bankruptcy court – Hertz and Advantage. It has wreaked untold havoc among hotels and restaurants, from large chains to small operations. And yet, stocks kept surging.

The situation has gotten so silly in the stock market that the shares of bankrupt Hertz [HTZ] – which will likely become worthless in the restructuring as creditors will end up getting the company – were skyrocketing from something like $0.40 a share on May 26 to $6.28 intraday on June 8, which may well go down in history as the craziest moment of the crazy rally.

There were stories of a new generation of stuck-at-home day-traders driving up the shares looking for their instant get-rich-quick scheme. And those that could get out at the top made a bundle (but HTZ closed at $1.73 today).

The smart folks at Hertz and their underwriters, Jefferies LLC, saw all these sitting ducks ripe for the taking, and they came up with a heroic plan to sell up to $1 billion in new shares into this crazy market, while informing investors that those new shares would likely become worthless in the bankruptcy proceedings.

The bankruptcy judge – likely shaking head in despair – approved it. As HTZ began plunging, the size of the offering was reduced to $500 million. This would have been like a donation to the company’s creditors, who now run the show.

Hertz would have likely been able to pull off this stunt in this crazy market, but then someone at the SEC woke up and asked some questions, which put the whole escapade on hold. But you can’t blame Hertz. They need money badly, and they’re just going where the easy money is.

Even during the crazy dotcom bubble in late 1999 and early 2000, the day-trader frenzy hadn’t reached these levels. But back in 1999, the economy was strong. Now this is the worst economy of my lifetime.

This kind of frenzy has been everywhere in recent weeks. They bid up nearly everything unless it filed for bankruptcy – and even then, they bid it up, as Hertz has shown. This would have been an inexplicable rally in normal times. But these are not normal times.

These are the times of record Federal Reserve money printing. Between March 11 and June 17, the Fed printed $2.8 trillion and threw them at the markets – frontloading the whole thing by printing $2.3 trillion in the first month.

And in this manner, the otherwise inexplicable frenzy became explicable: The Fed did it. And everyone was going along for the ride. Don’t fight the Fed. Spreading $2.3 trillion around in one month and $2.8 trillion in three months – in addition to whatever other central banks globally were spreading around – was an unprecedented event. And the fireworks probably surprised even the Fed.

Credit markets that had been freezing up for junk-rated companies suddenly turned red-hot, and speculators started chasing everything, including junk bonds sold by cruise lines and airlines though their revenues had plunged 80% or 90% and though they were burning cash at a stunning rate. The Fed’s newly created money went to work, driving up stock prices.

But over the past six weeks something new was developing: While the Fed was talking about all the asset purchase programs it would establish via its new alphabet-soup of SPVs, it actually curtailed the overall level of its purchases.

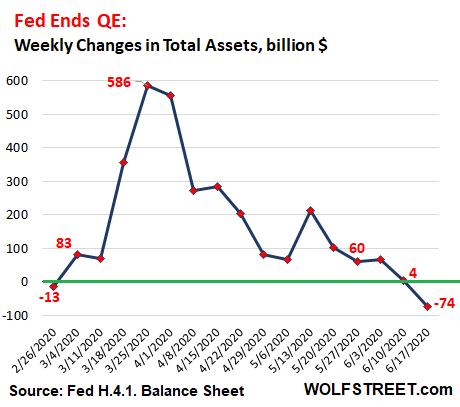

Then in the week ended June 10, the Fed’s total assets of $7.1 trillion increased by less than $4 billion. And in the week ended June 17, its total assets actually fell by $74 billion (you can read my analysis of the Fed’s balance sheet here). This chart of the week-over-week change in total assets shows how the Fed frontloaded its QE in March and April, and how it then systematically backed off:

And there is another big shift in how the Fed is now approaching the crisis. It’s shifting its lending and asset purchases away from propping up financial markets toward propping up consumption by states and businesses, and ultimately spending by workers/consumers via its municipal lending facility, its PPP loan facility, and its main-street lending facility. These funds are finally flowing into consumption and not asset prices.

So the superpower that created $2.8 trillion and threw it at this market, and that everyone was riding along with, has stopped propping up asset prices.

And now the market, immensely bloated and overweight after its greatest 50-day rally ever, has to stand on its own feet, during the worst economy in my lifetime, amid some of the worst corporate earnings approaching the light of the day, while over 30 million people lost their jobs. It’s a terrible gut-wrenching scenario all around.

And so I stuck my neck out, and I’m sharing this trade for your future entertainment when it goes awry, and you get to have fun at my expense and hail me as the obliterating moron that infamously shorted the greatest stock market rally of all times as it was floating weightlessly ever higher above the worst economic and corporate crisis imaginable.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Don’t worry Wolf. I am joining you. We’ll be idiots together if this thing goes to infinity and beyond.

Already there. 3x Bear S&P 500 for a couple weeks. All in no holds barred. I’m not going to waver as I lose money in short term upticks. This market will die at the hands of the money printing Fed. They will run out of ink. Stay firm. Stock prices can only be manipulated for so long. Sorry millennials but you will learn about the very real bubble of Irrational Exuberance. Take care and be safe.

That is the worst way to short. It is ok to hold for few days, but stay for weeks and the up and downs will erase your capital. The power of percentages being more destructive on down rather than up.

I dont short, I am too scared. But also i missed the greatest bull market, so I am a fool

You’re not a fool. Just how does one make predictions about the actions of the insanity that is the market? It is not really tied to Main Street.

You can buy put options on most leveraged products. While volatility is low premium is low. They don’t ring a bell at the top. You hold these things because selloffs are sudden and deep. You can own both bull and bear leveraged simultaneously. This works when prices of the shares change, and one bull share is equal to two or three bear shares, that bull share becomes a hedge. When the market turns you sell one side and hold the other. You own these things, rain or shine, when things go completely off the rails they may not allow you to buy. Leveraged ETFs become a closed end fund. The myth of (Central bank) monetary inflationary bias in stocks, ends when the market functions more like a futures market, one buyer, one seller. The only fundamental in a futures market is economic growth, earnings and revenue, and the currency in which it is denominated. The commoditization of stocks (through ETFs, and Federal Reserve policy which lifts all boats, bad credit or good) demands a futures market determined outcome. (when futures contracts expires and there is no storage,(pension funds, investment banks) and no market, futures prices will go negative, just like oil. You don’t short stocks, you short the market. Stocks are a commodity, and they are destroying the value of the underlying currency and inflating asset prices. Eventually the monetary base shrinks and prices come back down.

Wolf needs to disclose how much he has shorted by. Is it $1 of wealth, or his entire wealth?

I think previous pandemics didn’t affect the stock market hugely so it may be a fast W. It is so hard to time things. As one reader pointed out, shorting too late is costly.

Short intelligently!

Watch three day chart down spike touch lower Bolinger band and wait daily chart move to 9 day sma and short upon reversal till it makes lower low for 3 days. Take profits and follow the process

Bharat I think you may have just explained why the market doesn’t make sense any more. People are trading based on analysis of tea leaves discerned from various shapes of different graphs and names for common shapes within the graphs. They aren’t even looking at any kind of fundamentals, just strange voodoo logic about graph shapes.

It feeds into itself and the market no longer makes any sense when analyzed for economic fundamentals. It just makes sense if you follow voodoo graph logic.

Me too. I pulled my money and keeping on the sidelines for now and I now sleep well.

Agreed! Gary, do not hold leveraged (any inverse/leveraged etf’s) long term. They are inherently a decaying asset by the way they are structured (they lose on the roll). They are ok for short term hedges/trades and/or throw in a small % allocation as hedges and/or use leaps and manage the position (trade around it). You cannot time these things, especially with the worlds central banks massively printing on any healthy market correction.

What if they delist 3x short ETFs for greater good?

They will change rules on you before you know it. And you’re planning to stay in?

Diversify, even on the short side.

Indeed, when the rule makers can change the rules at any time, what’s the point of trying to put a rational trade on?

I may be wrong but I’ve played the 3X directional issues several times. I believe most of the 3X have now been listed 2X. Still risky.

https://www.prnewswire.com/news-releases/credit-suisse-ag-announces-its-intent-to-delist-and-suspend-further-issuances-of-its-velocityshares-etns-301080971.html

You’re going to lose all your money in those 3x ETFs. They are a day-trading vehicle and should never be held when the trend is going against you – like it is now.

You will lose 80% of your money. Cut your loses and sell now, and promise yourself NEVER to buy those ‘widow-makers’ again.

I’m with you. Diversified shorts between Russell, S&P, QQQ and DOW in non-margin callable positions. If the market goes against me 50% I lose half my money (temporaily) . If it drops, I double my money. 2:1 Asymmetry in my favor even it there is equal likelihood of up/down movement, which history suggests isn’t the case.

I can afford to wait as long as necessary…

Are you really implying that losing 50% not exactly the inverse of gaining 100%?

Let’s remember on the upside there is no limit in profits, on the down-side all you can lose is all you money.

Also these ‘calls’ or ‘puts’ all lose much more than a simple linear relation, when you have say your 50% down-day.

The majority opinion here seems to be a down market, but then this tells us the market will rise, as majority is always wrong.

Some people back in the day, did get rich on ‘shorting’, but those are exemptions, like Jim Rogers, you made it a life of shorting in the 1970’s. I think that people who ‘dabble’ in shorting, lose 99% of the time their funds, and of course those who play options and/or ETF’s lose their funds 100% of the time.

Like some body above said, Wolf probably put $1 of his net-worth in this bet, long ago he told his he played a similar move.

Lastly, even the great RE drop in 2007, everybody knew the market was going to collapse, but only a few guys had the right timing, for every 100 early, there was only 1 that got the timing right.

The real big money is/was made on derivative, but then you really need to think of it as insurance, and you $1M USD just a non-refundable premium, to cover your +100M net worth.

Lastly, as was said in the open, shorting has a limited upside, and unlimited downside. It’s like why would any one play that game?

How much longer til it collapses is the question

Be careful, Gary. Google the Caracas stock exchange- it has outpaced all others the past few years. It only goes up. Venezuela. What does that tell you?

Hi all, I am not a finance person so most if these comments don’t make sense to me. I came across this article & have to ask, how does one short with the money they already have invested? Should I transfer $ to bonds instead? I am looking to maintain my retirement account and know this high market can’t sustain, but don’t know how to do save the bottom line.

K Hood – This is a really dangerous environment and shorting is not for amateurs or for people trying to preserve their retirement account.

Speaking to a financial advisor would be the best.

I personally have 60% stocks and 40% gold/cash. I hate it but see very few opportunities right now.

I rarely defend my generation, but the level of enthusiasm for the irrational millennial trope is truly irritating. I have not reviewed any data on this yet, but I have no doubt that we are less confident in the market than our parents. In fact, I moved my entire 401k into “safe” low yield fund possible (treasuries, short term bonds, etc) in late April at a loss. My only regret is that I did not do it in late February, when my warnings to my parents and gen X brother were being mocked. Specifically, I warned them that at best, there would be only 200k-300k deaths from COVID19 in 2020 (I know the data well and it is clear we got there weeks ago) and experience a recession beyond anything in their lifetime.

Millennials already know about it. We remember the debacle in 2008/9 and the effect it had on our job prospects coming out of college.

Millennials don’t have much money in the markets. We don’t have much money period. That said its interesting to watch when you don’t have any skin in the game.

Speak for yourself

On 6/23/20, the rsi of qqq was over 70. The rsi on sqqq was 29.

Way to take the Put Plunge!! I took it way too early, but am still at it. Here is my list of Puts as of today June 19. FYI: I didn’t bet the bank, but enough to sting a bit if it doesn’t work out, but party if it does. There were no shortage of companies with truly awful finances… and those were financials in the best of times. I think the market has not seen its lows yet for this recession.

AMC Dec 18 2020 9 Put

BC Dec 18 2020 80 Put

BG Jan 21 2022 50 Put

BYD Jan 21 2022 32 Put

CBRL Jan 21 2022 150 Put

CCL Jan 15 2021 15 Put

DFS Jan 15 2021 40 Put

MRNA Jan 21 2022 80 Put

NBL Jan 15 2021 15 Put

PPL Jan 21 2022 40 Put

PUT (AGNC) AGNC INVT CORP COM JAN 15 21 $8 (100 SHS)

PUT (AGNC) AGNC INVT CORP COM JAN 21 22 $20 (100 SHS)

PUT (ARES) ARES MANAGEMENT SEP 18 20 $40 (100 SHS)

PUT (ARI) APOLLO COML REAL NOV 20 20 $12.5 (100 SHS)

PUT (ARR) ARMOUR RESIDENTIAL JUL 17 20 $2.5 (100 SHS)

PUT (BA) BOEING CO COM JUN 17 22 $165 (100 SHS)

PUT (BCS) BARCLAYS PLC JAN 21 22 $10 (100 SHS)

PUT (BFAM) BRIGHT HORIZONS FAM SEP 18 20 $70 (100 SHS)

PUT (BOX) BOX INC CL A SEP 18 20 $10 (100 SHS)

PUT (BXMT) BLACKSTONE MORTGAGE JAN 15 21 $30 (100 SHS)

PUT (BYND) BEYOND MEAT INC COM JAN 15 21 $145 (100 SHS)

PUT (CHDN) CHURCHILL DOWNS INC SEP 18 20 $45 (100 SHS)

PUT (CS) CREDIT SUISSE GROUP JAN 21 22 $10 (100 SHS)

PUT (DB) DEUTSCHE BANK AG ORD JAN 21 22 $10 (100 SHS)

PUT (DX) DYNEX CAP INC COM DEC 18 20 $10 (100 SHS)

PUT (DX) DYNEX CAP INC COM JUN 19 20 $12.5 (100 SHS)

PUT (DX) DYNEX CAP INC COM JUN 19 20 $7.5 (100 SHS)

PUT (ENB) ENBRIDGE INC COM AUG 21 20 $15 (100 SHS)

PUT (HESM) HESS MIDSTREAM LP CL AUG 21 20 $2.5 (100 SHS)

PUT (HYG) ISHARES TR IBOXX HI SEP 18 20 $73 (100 SHS)

PUT (INDL) DIREXION SHS ETF TR JUL 17 20 $15 (100 SHS)

PUT (IT) GARTNER INC COM SEP 18 20 $85 (100 SHS)

PUT (IVR) INVESCO MORTGAGE JAN 15 21 $4 (100 SHS)

PUT (IVR) INVESCO MORTGAGE OCT 16 20 $6 (100 SHS)

PUT (KKR) KKR &CO INC CL A JAN 15 21 $35 (100 SHS)

PUT (LYFT) LYFT INC CL A COM JAN 21 22 $40 (100 SHS)

PUT (MAIN) MAIN STREET CAPITAL SEP 18 20 $30 (100 SHS)

PUT (MT) ARCELORMITTAL NY JAN 15 21 $20 (100 SHS)

PUT (MTN) VAIL RESORTS INC COM JUL 17 20 $90 (100 SHS)

PUT (NCLH) NORWEGIAN CRUISE JAN 15 21 $22.5 (100 SHS)

PUT (RCL) ROYAL CARIBBEAN JAN 15 21 $65 (100 SHS)

PUT (SIRI) SIRIUS XM HLDGS INC JUN 19 20 $5 (100 SHS)

PUT (SIRI) SIRIUS XM HLDGS INC SEP 18 20 $4 (100 SHS)

PUT (SWCH) SWITCH INC CL A AUG 21 20 $14 (100 SHS)

PUT (SWCH) SWITCH INC CL A NOV 20 20 $12 (100 SHS)

PUT (SWCH) SWITCH INC CL A NOV 20 20 $18 (100 SHS)

PUT (TJX) TJX COS INC NEW COM JUL 17 20 $30 (100 SHS)

PUT (TQQQ) PROSHARES ULTRAPRO SEP 18 20 $72 (100 SHS)

PUT (TWO) TWO HBRS INVT CORP SEP 18 20 $7 (100 SHS)

PUT (UBER) UBER TECHNOLOGIES JAN 15 21 $33 (100 SHS)

PUT (WORK) SLACK TECHNOLOGIES JAN 15 21 $35 (100 SHS)

PUT (XLC) SELECT SECTOR SPDR SEP 18 20 $51 (100 SHS)

PUT (XLK) SELECT SECTOR SPDR SEP 18 20 $90 (100 SHS)

PUT (XLY) SELECT SECTOR SPDR SEP 18 20 $120 (100 SHS)

PUT (YUM) YUM BRANDS INC OCT 16 20 $100 (100 SHS)

PUT (YUM) YUM BRANDS INC OCT 16 20 $40 (100 SHS)

PUT (ZM) ZOOM VIDEO JAN 21 22 $250 (100 SHS)

QQQ Jan 21 2022 280 Put

RAD Jan 15 2021 17 Put

REV Nov 20 2020 20 Put

SPCE Jan 15 2021 5 Put

X Jan 15 2021 10 Put

XLRE Nov 20 2020 37 Put

Please, You are picking puts where downside is priced in and then some. You may get lucky and break even.

I mean X 10 put? Come on.

Shorting in this situation was a good bet, I believe. You were just couple weeks too early….

Questions:

1. In the money or outside?

2. # of interest and open positions – liquidity!?

3. No calls or hedges in case of unexpected whiplash, like Powell throwing 3 Trillions into the mkt, just like he did in March!?

BTW: All my puts have a few calls as hedges.

(Been in the mkt since ’82)

This is the most sURREAL bull mkt of my life time! Lost NOTHING during GFC – made profits. Afterwards a different story b/c death of true free mkt in America – since ’09!

Wolf ….long time no chat ….

You cant short this market … they will rip you to shreds ….

but there is another way to play it ….

just sell theta, because the VIX is insanely high these days …

Sell the SPY short if you must, then sell covered puts against it … so many Robinhooders are buying puts that the pricing is crazy ….

Sell theta? How does that work?

END OF QUARTER MARKUP BY THE BANKSTER BOYZ! = Worst fking time to short! Then MnueSCUM will rig markets for 4th of July . They will hold this fraud up thru the 4th of July, MnewSCUM can declare it a nat’l emergency without a new high by the 4th. WATCH! There is no limit to this FRAUD.

I’ve been doing a strategy of long precious metals and short IWM.

I’ve gotten creamed on my puts since April, but my long gold miners positions have made up for it, kept me a bit above even.

In my opinion, Wolff is being a bit conservative… he’s early in his call. It’s the end of Q2 and institutional investors have 1.6 trillion in cash that they’re being pressured to invest to show some gains.

In the 3rd quarter we’re very likely to see a drop like we saw in March – with an equally big fed reaction like we saw in March. My plan is to balance long gold miner positions with IWM puts so that I’m covered either way when the fed reacts.

Also, I’ve been burned too much on shorter term puts … I’m thinking long and in the money is the safest way to go. It won’t get you those 10x gains, but it won’t go to zero either.

Agree with that sentiment. Burned on shorter term puts and would only do them for quick scalping now (even with longer duration ones).

What link or how can I follow yi want to thank you guys.

Yeah, I’m in too. The lunacy just ended.

I won’t count on that!

Mkts can remain more irrational, and longer than you being solvent!

Abso-fucking-lutely! But…if you understand surreallo-complex financial fantasy engineering and hypercalifragilistic equations, it is a perfectly cromulent time to invest.

I agree… nothing but puts at this time. This week will tell us alot as S&P is struggling at Hull 20 day moving average.

Exactly. If you think you have just found a short or medium term pattern in the market then hide your wallet. Their is a pickpocket nearby about to rob you blind.

Call me a cynic, but I predict the “Federal” privately owned, bankster cartel called the “Federal Reserve” is keeping the market inflated until it’s cronies bail out of bad positions. If they can, they will also try to keep the market or parts of it inflated until November.

Ultimately, the market prices will collapse but when? That is the problem. In a manipulated market the stock prices (or most of them) can stay high enough for long enough that you will lose your shirt. It depends on how attached the banksters are to this administration.

Darn tablet changed its to the wrong word. Is there any way to short the market for December 2020 or April 2021 as of now?

By that date, the market will surely collapse.

M.,

“…the “Federal” privately owned, bankster cartel called the “Federal Reserve” …”

You need to keep this straight: The Fed is a hybrid organization. What is privately owned are the 12 regional Federal Reserve Banks (NY Fed, Dallas Fed, St. Louis Fed, etc.). The Federal Reserve Board of Governors is a federal agency, and its employees and the members of the board, including Powell, are employees of the federal government.

But the USD Printed by the FEDRESV are Loaned Out to the GOVT_USA at (IIRC,) 06.0% APR.

Hybrid in Actuality; but Privately Owned and Operated De Facto. Governors are mostly Revolving Door Rentier-Banker Muppets.

That being mentioned, I recommend reviewing Prof Steve Keen’s (his main beef is with the Private Debt Burden) Minsky System Simulations Models on this Present Economic System. Forgot the Link; but it’s on YouTube posted years ago.

Sim Depicts Econ System Failures that start with Labor, followed by Industrialists as Banks Own Everything.

Hybrid Economies like CHN and RUS looked more promising to me ever since.

FED can NEVER GO bankrupt!

Never been audited. No accountability or real challenges by the majority of Lawmakers!

It has become central Bank for the rest of the global banking system. I think there are additional 3 International Banks’ rep on the board.

Can do anything under the excuse of

– financial stability

-to keep the markets working smoothly (Powell’s words)

Cannot tolerate more than 5-10% correction of the indexes.

FED is the mkt, now!

END OF QUARTER ! It’s a dumbass short, Wolf. Then, the 4th of July WILL BE RIGGED HIGHER. WATCH! ( via MneuSCUM) The 4th is always rigged higher.

Fed is ABOVE THE LAW. Like Trump. You are about to lose money.

But since the whole government is nothing but a revolving door between the public and private sector. That statement don’t hold water. It’s a private entity controlled by commercial banks. Got news for your there is no Santa Clause either lol.

That’s right. It’s a global market. The fed can’t let. Any bank fail. Deutsche Bank. Chinese banks. If one goes they all go. The problem is with rapidly deteriorating asset bases, they are all going to fail.

“the Fed can never go bankrupt”.Correct , the Fed will bankrupt us all instead by de-basement.

My guess the (Marketonparade) the banksters buy their own stocks to achieve a new high by the 4th of July. ===

buy FAS (don’t short into end of quarter, that is suicide.

Completely agree.

Who will blink first? The Fed, its cronies, the banksters or the Trump administration? If Trump’s chance of re-election becomes practically nil, the cockroaches will all run for the exit and the con job will collapse.

All true what you have said except you haven’t factored in the election. Trump cannot allow stock prices to fall significantly before the election. So I expect the fed and the plunge protection team to step in and prevent a major sell off until after the election.

The Fed wants Trump gone. They will lower the market substantially by October to assist in that goal. Don’t fight the Fed.

I fight the fed sucessfully 24 /7 and 365 days a year by being Debt Free. Even while I am sleeping.

Isn’t the fed helping those who are in debt by keeping interest rates low? If they do actually successfully spur inflation then doesn’t that help holders of debt who get to pay it back in devalued dollars? Do you even know what the fed does?

I guess if you mean by losing to the fed that you’re fighting the fed that may well be the case. What are you in? Cash or overvalued stocks? Bonds that will barely break even? What are you defining as success here? Spending 100% of paycheck on beer brewing equipment? That’s probably the best option for beating the fed.

wrong

It’s frustrating when you have a company sponsored retirement plan and your options are very limited. I have no choices to short the market only to move my money into a safe fund that makes no interest. So my money is tucked away semi safe but not making me anything.

I have the same problem in my company 401-k, just mutual fund options available. About a month ago I sold $100,000 even in my 2030 target date fund (VTHRX), while holds about 30% bonds and lots of large cap growth exposure, & simultaneously bought $100,000 of pure small cap exposure (VSMAX). That trade is currently up an incremental $4,500 vs if it was all still in VTHRX.

Based on Wolf’s article maybe this coming week I will rebalance another large chunk (almost 80% of this 401K balance is still sitting in VTHRX)….

The fact that you took control of you 401K and went into SMALL CAPS does not make you a fking genius, but admirable… TAKE FKING PROFITS IF YOU ARE NOW A ” SELF-DIRECTED IRA/401K) “Don’t be a greedy schmuck!

Let me get this straight. You think you are a genius b/c you switched into small caps when 30-50% of small biz PROBABLY IS GOING OUT OF BUSINESS! And here you are boasting about it instead of looking at the whole picture and locking-in profit?

gordon n the market is not about reading fundamentals. It’s about reading sentiment. Who cares about bankruptcies in small businesses, most of them not even public. You have to play the sentiment game, with all of the casino style gambling that entails.

I’ll probably move all of my 401k into treasuries soon like I did at the start of the recent crash. I followed Wolf before and it worked out well for me. Not so far as to short the market, but when he shorts, I get out. My big mistake last time was not getting back into the market when he closed his short position last time.

I join. It is the second best thing to establishing a party to bring down the central banks and it is less laborious.

put options or call options just too hard to make money after factoring the time decay where no one knows how to calculate. Just buy gold if you are bearish much simpler.

You don’t have to calculate Theta. Just select it as a column in your option chain. The value displayed is the daily decay of the premium – ceteris paribus. Smart option traders sell puts/calls with a short duration to expiration. If you’ve correctly predicted the direction of the underlying the option expires worthless. You keep the premium. Or you can take 25-50% gain while the option is still active and exit.

Definitely on board with this “Big short move” but i think the time line will be longer. The fed will be buying all these shity worthless bonds pumping $80mil per month to prop up markets for two years at most. (If they don’t “F” it up first in which case we get an earlier win.)

The trade idea is good – but timing is important – things will change after Independence Day and worse in August

Jpow is gonna wreck you guys

At this point, it should be clear to anyone watching closely that the dem candidate is a stalking horse.

For whom is the question we all need to know and ASAP.

Seeing some, “Anyone but Trump” yard signs now in an otherwise very conservative ‘hood where the vast majority of signs are for him…

Tons of troubles coming our way on the political front will farther confuse the economic mess we are currently experiencing, not to mention the public health mess in many areas of USA and the globe.

Some folks are even beginning to worry about their cash, and that alone should be warning enough.

“The Dem candidate is a stalking horse… for whom is the question”

As of May 2020, 94 billionaires own Biden, via Forbes.

He has promised them, “nothing will fundamentally change”.

Did you forget that it’s near end of quarter markup by the Bankster Boyz?

WRONG >>> Biden= Trump continuation

I agree, short selling stocks is a fool’s game even when the stock is as lame as a Hertz. Now selling options in a market where margin calls are running loose like lame chickens is a whole different situation.

Good move, Wolf.

In 1971, after “drug riots” in Seattle,

it was “lights out”; the city nearly shutdown.

Our “Woodstock”, 1969, at Alki Beach,

was a drug riot.

When kids have no future, they drug riot.

If you check the history of “drug riots”,

and compare them to the stock market,

you’ll see that it’s a leading indicator.

There’s no indication that protests and riots of late are “drug riots”, though.

Uhh Ya. That’s because drugs are legal in half the states…

I went all in on $290 puts. Hell, there wasn’t even any interest. It’s like a cheap suit you buy for your mother-in-laws funeral–you’ll never wear it again.

I don’t know about the “drug riot” thing, but I do remember the late 60’s and early 70’s. The overall sense was one of societal upheaval and I have to admit it was similar to what is happening today. It divided the country and created an atmosphere of hate between the opposing groups. It was not a good environment for business, and stock’s went through a multi year bear market. I think a lot of the enthusiasm we are seeing is naive, and investors are indulging in the kind of optimism I have not seen since the dotcoms, and we all know how that ended…

@Jdog – the 60’s and early 70’s was also when the government was forcing young men to put their lives on hold and go to the other side of the world and risk dying. A bit more of an incentive to protest than we have now. I do agree that with current circumstances we will see some sorts of protest until conditions improve for the common folk.

This is myth-making of the first order.

They weren’t drug riots, they were riots because “urban renewal” (the projects) displaced thousands of people living in rent controlled apts.

In those days the projects were middle income housing, you needed to be employed in a good job to rent. Most of the initial residents were city and state employees, post office, and hospital workers. Eventually the cities had to rent to welfare and low income residents and the middle class residents moved to the suburbs, leaving the projects we know today.

@Petunia – that was the time period when the US government sent 2,700,000 people to Vietnam. A lot of them were poor. A lot of the young felt they weren’t represented in government. A lot didn’t want to go.

Good move indeed. The risk/reward ratio makes the move almost a no-brainer.

I really hope you both make a ton of money, but wow, that’s risky. We know the Fed has no standards and Powell wants desperately to stay in Trump’s good graces. So not sure if this will pay off for you. I’d wait till after the election to short.

If I had to guess, the real reason here is to tank the stock market in addition to the economy right around October. Then let’s the fireworks happen, because that’s going to put paid to the current resident at 1600 Pennsylvania Ave. You notice all of a sudden, there is talk of a second wave on C19. In reality, this is just prep work for the fireworks that is going to happen in the fall, when the real second wave will start. It’s prepping the battle field if you will.

Well, for all the political games that is going to go on, none of it will matter, certainly not the resident in that particular house. The economy is going down the toilet, and no amount of JP is going to save it.

The idea that a second wave will be larger than the first is a fallacy. The first time around, we had no idea that tens of thousands in NYC were infected, no ability to test on a large scale, no one wearing masks, and people packing bars, subways, and business travelers flying all over the world. People are starting to get back to normal, but none of this crowding stuff will be at even half the level it was before, so please hold off on the fear mongering, we will never see a nationwide daily peak larger than we saw in April, and there is zero chance of ICU overfilling, which is the real danger with this pandemic.

Are people going to continue to die? Yes, and 80% of them will be 70+ and half nursing home residents. That’s tragic but it’s not the apocalypse.

I would suggest that if schools open back up this fall social distancing and masks won’t matter much.

Happy1 – in the beginning of the first wave there were very, very few infected, mainly in cities with extensive air travel. Now the virus is establishing itself almost everywhere. As we relax controls the second wave can be much bigger. E.G go to a bar without a mask and rub shoulders with strangers for a few hours.

The real question is how deadly the virus to young people. So far, it doesn’t seem too bad. We’ll see.

No, it’s not apocalypse, let’s be real, even if 100 million people died from this, it wouldn’t even be 1.5% of the world population.

Spanish fever knocked off about 2.5% of the world population. So, it would take a seriously bad turn to make this thing approaching anything like the Spanish flu.

The world didn’t end.

But right now, the economic effect is magnified because of the velocity of news, real or fake. So, in the fall, there could be another 10K death or 100K death, and it’ll be the end of the world if you listen to the news. Never mind that proportionately the hit will be quite small compared to the Spanish flu.

NCH and Happy1,

You guys talk about lives as if they were pieces of lumber that you can just dispose of once they’re damaged, and no big deal if it costs a little extra. If you don’t value a human life, including the lives of other humans, not just your own, what do you value? This whole discussion is nuts.

Do you have any background in epidemiology or public health?

It seems like you don’t because your conjectures stand in stark contrast to the facts, models, and critical analysis provided by a basic epidemiological framework.

I genuinely want to know your honest answer, though.

Wolf Richter,

This is America. The baby boomers and the silent generation have grown too accustomed to their lifestyle and think that as long as they vote to keep the status quo, at the expense of the younger generations, everything will be fine for them. America will hold together enough to keep them satisfied for their lifespan. A few lives here there, no big deal. The younger generations have picked up on this mentality, and will put their own spin on it. This mentality exists to a varying extent across the world.

The CCP19 saga is just another struggle in the intergenerational fight. The baby boomers and the silent generation are responsible for China growing out of control, the tolerance for corruption that allowed the WHO to act as it did, and Americas (and the rest of the West’s) pathetic response to the entire situation.

Wolf,

One human life matters as much as the next. The point here is just that statistically we’re much better off than when the Spanish flu hit at this point. Yet the economy has pretty much tanked as if it was the end, a good part of that has been induced.

The contextual point is that if it did manage to get to that level of the flue, what would be the effect on the rest of the world at that point. One would shudder to think.

I suggest that you read the history of the 1918 flu. The second wave was much more virulent than the first.

The fallacy is that the first wave ended that never happened it is spreading thank goodness Trump’s rally was vacant.

Get your facts rights.

50% dead are nursing home residents Age 70 Plus.

20% in hospital are UNDER 40.

The doctor who discovered COVID in China was 31 and he got it and died in a ventilator tent.

And even if you survive, because under 60, do you want to go to the hospital for a week? Or spread it to your Mother who dies from it? Not too much of a guilt trip in that, huh?

COVID is 1000X more contagious than other corona-virus. including The Flu, Ebola, SARS, etc, because it has 3 different receptors to invade the human cell, not just one ACE receptor.

If you want to scare yourself, read Thailand Medical News.com All the first research reports out of PhD China, confirmed by PhD Europe, and now PhD US weighing in as well. Ugly.

Come on guys. Wolf is 100% right. I agree short entire MKT. It’s just timing as to when.

The US and World economy is in for a tremendous shock for the rest of 2020 and deep into 2021…even if a ‘great vaccine’ is actually discovered that works well…and how long to make 8 billion doses for world distribution? Huh? Years. Just to vaccinate US EU Asia to keep the world going will take months, after the months to MFG. Vaccines are MFG in China, so who get it first? Not the USA.

What are your epidemiology credentials?

In the 1918-19 Spanish Flu pandemic, October was the deadliest month.

Noticed cases skyrocketing in FL, Arizona, Texas, etc.?

Noticed all the buffoons who refuse to take the basic precautions?

You are vastly understating a situation not the experts or you understand.

We are in uncharted waters with a sociopathic “leader” who disbanded the Cabinet-level Pandemic Response team, ignored the Pandemic Playbook left for him by the previous administration and who ignorantly bragged yesterday he asked his people to NOT test.

The lack of testing means the real #s are unknown and under-reported. “Zero chance”….please, please don’t pretend you know how this ends.

Wait ’till all the kids go back to elementary school in September and the virtually everyone has Covid-19 thanks to these kids. If Brampton is any indication in Canada everyone will end up with Covid-19 in America.

Question is: how much money you put on the table?

Are willing to bet the farm ?

At the end of the day you gonna be right, but there are two more months of the this craziness to come.

Would you stock up on your shorts ?

I am on Russell 2000 short. I think they will do the 1T/1.5T/2T infrastructure spending soon. Yes, Ctrl-P GDP. If you think recession can happen? GDP dip -7%? WE CAN PRINT 2T/20T=10% GDP! Who gets those .gov contracts and revenue? I think it is those S&P/Dow companies. I am more comfortable with Russell. But I am with you Wolf. Together, we will be ridiculed. Stocks ONLY go UP on a rocket!

Nut case Powell is pulling up on the Printed Money because he knows that the Dollar is on shaky ground even more so than before the Bat Flu struck. U.S. the largest debtor nation in the history of the universe, so too many Dollars makes Yen, Euros, and Yuan look better all the time. The U.S. will default on its debt in some fashion, and loss of reserve status will accompany a collapse of the Dollar accompanied by hyperinflation. Sound far fetched?? No country has ever printed its way to prosperity.

The second quarter earnings, or more correctly, the lack of earnings, will put author solidly in the pink. Stay safe, stay short, and most of all, stay patient. Every dog has his or her day.

One thing to remember is whenever the next big recession comes both the P and the E are going to get marked down. It is not unreasonable that both could get chopped in half which would give a sub 800 SP500 bottom. Think it’s one reason the Fed is doing everything to keep it all going

TIL: “Ctrl-P GDP” ?

A bit too early IMHO, but, as was the clear instruction from JPM, not the recent JP, ”buy on the way down knowing you can hold through the bottom” is still, as far as I can tell the best buying advice for any market. With shorts of course you have to be able and have the fortitude to hold not only on the way down, but also on the bounces up on the way…

Going to be a while due to all the very extensive malarky(s) of the corrupt crony markets, but, again IMHO, we won’t be done with this crash until dow about 12K, the SNP about 1800, and I almost think the new one similar.

Good luck WR, and may the Great Spirits bless us all this weekend and always going forward in good faith

May be a little early, yes, but if so, very little.

I think the SP 500 goes all the way back to the 2009 low of 666, the mark of the Devil since the Devil is in the details of NO EARNINGS FOR 25% OF AMERICAN COMPANIES. We are now in the Greatest Depression of all time that likely will be made worse by a Second Bat Flu attack in the Fall. Once the lemmings get hit over the head with reality, its every person for themselves trying to get out of a shrinking exit door.

Last time you told us about the shorts, stocks indeed fell down. The real reason could be corono, end of bull market, panic, lockdown or something else. Now, you are shorting again. The reasons i believe market is going down again this time

1. second wave or news/rumor of a possible second wave not only in the US, even in Russia, China, India and Latin America

2. “peaceful” protests (cough..cough…)

3. end of the bull markets and a correction is needed to clean up the markets

4. Record unemployment. no sigh of a ‘v’ shaped recovery. Just \________/ shaped recovery.

5. Closed stores, self-emptied stores are not opening soon

6. Even the shops/malls/restaurants who got a green-light for 50% opening are not opening because they might not be profitable

7. The foot traffic, vehicle traffic suggest a smaller than anticipated recovery.

8. Reality of the recession

9. Shoeshine boys in the streets are warning about the Robinhood traders (Kids in mom’s basement gambling on stimulus money).

10. Jupiter is doing its retrogression for one year.

One thing I notice on the streets is “Hope and confidence” is low/absent. People lost their “trust” in government, companies (your HTZ example), media and future in general. Even the FEDs attempts to give hope by economic means failed. I expect the bad times between approximately Jul 4 2020 to Jul 4 2021 (Jupiter Jupiter…)

Mkts can remain irrational longer and more than one, can remain solvent!

Fed can produce digital $ out of thin air – unlimited! He said it without batting an eye – scary!!

Watch Mr. Powell ‘s interview 50 minutes – CBS, recently.

The Fed is not omnipotent!!! We are already at the point of maximum balance sheet expansion of the Fed due to a shaky Dollar and strained U.S. bond market. Treasuries do not go to the moon without a default risk premium on captured rates, and Uncle Sam does not get to borrow without limit as Powell tries to buy 65% of all new issuance to keep the Banana Republic of America afloat. Hertz may have better numbers than the U.S. of A. Already the sea of U.S. bonds is starting to stink up the global bond markets.

Watch for JAPANIFICATION of America!

America’s DEBT to GDP is a lot better compared to Japan

120-130% vs 300%

Cannot afford to let the hot air leak from the 3rd largest ‘Everything’ bubble of the 21st century!

No one is raising hell re increasing deficit or DEBT in the Congress. Debt can easily exceed 10 T or even 20T – ALL in the name of financial stability and allow mkts to function smoothly, at any cost. View the Powell’s interview at CBS – 60 minutes

Same with other Countries! DEBT has become the panacea for all our private and public sectors world wide. This is the most SURREAL bull mkt of my life time! (been in the mkt since ’82)

The Fed is omnipotent. The Fed stops the worthless currency printing, watch the market reverse.

I like the astrology angle. Btw, as you may know, this weekend is a hell of a time if you are an astrologer – New Moon, Summer Solstice, Solar Eclipse and other astrological arrangements. Tons of energy coming in. Best to be quiet and meditate. Yes, the next year could be challenging, but remember Charles Dickens in the novel ‘A Tale of Two Cities’: First sentence reads – ‘It was the best of times, it was the worst of times.’ Choose the side of the ‘reality divide’ you want to live on!

i am looking for some way to short the future. wolf picked the SnP, i would prefer a broader based ETF, something that tracks western civilization as we (think) we know it.

Do you think the market has even gotten to price in a possible (possible) blue wave in November yet?

I know early polls are suspect, and we all saw 2016, but if these are even in the right zip code, not only is Trump/Kudlow/Mnuchin and others gone, but the Senate could go blue too. Again, very early.

You have to think that means undoing TCJA (a 12-20% hit on corporate earnings), among other changes. It seems like we’re so focused on case numbers and the Fed that we haven’t even gotten to that yet.

(Well this also assumes that stocks have been trading based on earnings, which they haven’t lately anyway).

I think Trump loses in Nov and the stock market folds faster than Superman on laundry day signaling a new Great Depression. After the crash gold goes to $10,000 and silver to $200. It’s the Republicans that are in the stock market and have confidence in the economy. That goes away when Trump loses and they start buying gold by the truck loads.

definitely could be in play….their will have to be a disruption in the comex, china treasury move…..

Wolf was right in the end, patience tied to risk is helpful to rest easier

If Trump loses, what’s left of stocks will tank. The Repubs

will try to blame Biden, Covid 19, lack of a reliable vaccine,

protests, ad nauseum. Wolf, you might be a tad early, but

I agree with your analysis.

I’m not that enthusiastic in my trading strategy. Of the many times where the present caught up with future, the moves were never as dramatic and desperate as I envisioned. I have a hefty position in a well known large cap gold mining ETF with a 30% gain here but will begin selling once Gold see’s between $2100 and $2200/oz.

Why there? Well let’s start with Gold here in the doldrums around $1725/oz. Unless everyone’s blind to what the Fed’s doing, Gold has to eventually peak above $1850. Once that happens I tend to belive Longs will become entranced by the siren’s call of Gold’s all-time record high of $1961/oz. And like eating potato chips, once you’re that close to $2K/oz, might as well go there. But here’s where I believe the ‘Market Troll Effect’ go into play. You know that tendency for an asset to go much higher and then much lower with what looks like a deliberate intent to wipe out both Longs and Shorts. About 5% to 10% above $2000 Gold looks like the perfect place for market makers to create the most pain at peak euphoria. And face it, Gold above $2k will not only be technically overvalued but will be splashed all over MSM news and inadvertently make the Fed’s inflation model look like a clown show act. What are they going to do, raise rates? Not in this universe, but something ‘will’ need to be done about it. So the early morning LBMA-Comex monkey hammer will come out and futures traders will be all too happy to take their gains and go home until more bargains appear.

So my strategy is to hold my mining ETF until Gold see’s $2100 to $2200/oz but sell all of it there. If Gold rises significantly higher after I’ve sold then it means Silver is even more voraciously overbought, so I take a small amount of my profits and short it with leverage. But what happens if I’m wrong and Gold see’s $2700 to $3000/oz? Well if you’ve traded miners as long as I have, you know that if Gold see’s $3000/oz and falls to $2500 then those miners will be at the same price they started from when Gold was $2000K/oz. So in that case I ease back in at the same price I got out at, but only with my original principle.

If my strategy works and I get out in time, then I wait for Gold to dip to $1850 (with miners having panic sold and down 30% to 40% from their $2100/oz highs) and use both principle and profit to start easing back in Martingale style {doubling my position for every $100/oz Gold falls} all the way down to $1550 if it gets there. And that is where my real Gold trade begins…with the $2000/oz barrier having been thoroughly trolled and the debris cleared away for institutional hedging to come in for what looks like a long haul towards unprecedented Dollar inflation or a hot war with China.

But what if Gold instead falls back to say $1550 or $1450 from here in another sell every thing to round up Dollars panic? Then in the words of Steve Martin in LA Story, “Wonderful, Wonderful, Wonderful, Wonderful” I get a second chance at loading up on Gold mining ETFs ahead of what will be the biggest inflationary event in the USD since August 15, 1971. BTW if you have seen Steve Martin’s LA Story check it out, it holds up.

But I thought gold was a store of value, how can it ever go down like any other commodity?

Petunia: Gold is not like other commodities like oil, wheat, pork bellies etc. It is held by central banks as capital and is classified as a Tier one asset. It is traded on the FX desk of major banks and is held by the IMF as reserves. It does not go down in its own terms and cannot be printed by governments to fund deficits… thats why the USD price of gold has increased 50 fold since 1972… reflecting the devaluation of the alleged money of the realm.

But what if gold goes to a hundred million bazillion dollars as expected? What then?

Petunia, Lisa_Hooker,

remember that Thomas Wolfe is not buying gold. he is buying ETFs. miners no less. he is buying paper. the very thing gold hedges against.

“…ahead of what will be the biggest inflationary event in the USD since August 15, 1971”

that right there is the problem. ’71 was the break of the then paper-market for gold (dollars defined as a weight of gold). the paper became worth much less relative to the gold it once represented. it happened overnight and it gapped. same thing playing out here. you can’t hedge against paper with paper. true gold advocates buy in the expectation of paper and physical separating. thank you

“Thomas Wolfe” is why I love reading these comments.

Sorry Tim, but Trump will be easily re-elected. Historic landslide in the making.

It doesn’t matter which side of the coin is up in November we are hooped. Don’t care much for Trump though…

Thanks for the laughs! But seriously, who would have thought a mentally unbalanced charlatan would make such a traitorous, crappy “leader”?! Such a surprise….I’m just shocked….wow….

I agree….wall street and bankers got what they wanted and this is reward….August should be telling….Snp might get to 1800 if democrats win….load up on lead…..winters coming

The premiums for November puts are quite a bit expensive than those for October puts.

Sell in May and walk away has never looked more prescient to me.

Hahahahaha…..Florida had 32 red counties in 2016, now they have 42 and climbing.

Was is just the Fed stats, or was their something in particular that hit you in the head this morning?

One other good reason, I think, is that the consensus about Covid-19 is looking worse. It’s looking like (1) the vaccine won’t show up until next year and (2) the economy will be suffering all through next year, potentially.

I notice stocks like Six Flags and Cedar Point are looking like they may have started back down. Those stocks and the cruise stocks had been going back up purely on virus optimism.

There has never been any realistic option of a vaccine until late next year, unless they release one which isn’t properly tested (which is not impossible). I think there is a good chance there won’t be an effective vaccine, or one which only has short term effectiveness.

I believe that is what Trump is planning for his October surprise. There will be a much ballyhooed announcement of a vaccine, which either won’t exist or be so ineffective that it will not protect against the virus, but he couldn’t care less if his supporters dropped dead as long as they don’t do it before election day.

I’m with you but I’m using puts instead of shorting so I can limit my losses also get more bang for my buck. Mostly 3rd qtr puts.

Wise.

Puts = risk-defined.

Shorts = theoretically infinite losses.

Cover @ 2350 SPX next Friday. See you then.

Yes, I shorted last week. Im with ya. A lot of Ca Options expired today, and there’s a lot of Puts on the books.

I looked at the premiums of SPY put options… they’re really fat.

It’s not strange. VIX is still up for the year at around 35. If I am not mistaken premiums are related to the level of the VIX.

I prefer ‘ out of the money’ positions. Very rarely in the money.

Enough # in ‘interest and open positions’ for liquidity.

Begin with less than $500. Double it if I am convinced in my analysis.

Sell at 25%+ profit and sell at 50%+ LOSS.

Discipline is the one of the key factors in option trading.

Wolf, I remember when you covered your shorts in March and I posted you were wrong, the devastation was just getting started. I lost a lot of my profits.

The put options market never really disconnected from reality the way the stock prices did. AAL went from $9 to $19 and a bet on AAL being $0 by Jan-22 stayed pretty constant. With AAL at $16/share, you have to pay $4 for a $10 put… risking 4 to win 6. Winning dollars by the time they’re zeroed out may not be worth much. I’m betting with Peter Schiff, even moved to Puerto Rico for the tax haven and I’m buying call options on gold miners now.

You cannot buy puts without some protection with (far out) outside money calls!

I learned my lesson long time ago. Same with inverse Etfs or Bear MFunds.

Been in the mkt since ’82. Option trading since 2003.

This is the most surreal bull mkt of my life time. Price discovery is actively suppressed by Fed’s actions since ’09.

You are braver than me to short this market.

Fundamentals don’t matter anymore…until they do.

I am selling a bunch of winners and will hide in cash.

Wolf, You are very brave, fighting the Fed when they have endless fire power and will use it upon the slightest market dip. Good Luck!

But that’s the point: I’m NOT fighting the Fed. I’m with the Fed. The Fed has stopped propping up asset prices.

But how do you know they won’t start again as soon as the market goes south?

I think you are doing the right thing but there is so much craziness…

They can, and they did last time I shorted, and I clicked the “cover” button in time.

You got lucky on your first short Wolf because of the Covid, don’t forget that otherwise the Dow will be above 30k. You are misguided on the thinking the Fed is giving up on supporting asset prices. Just like you when you were forecasting the 10 year yield above 4%.

Fed is operating in illegal territory and will not go down without a fight.

But I salute your courage to short this market and go public about it. Respect.

Wolf’s bet against the market earlier this year was solid. There were plenty of problems before the plandemic came stateside. Just betting on the supply chain disruptions out of China was solid reasoning. I went with him and made a TON of money but gave back a lot because I didn’t cover when he did.

Remember, there was no worldwide economic shutdown in ‘08 but that market tanked. Bubbles pop.

Have you ever considered that the people the Fed wanted to bail out have been made whole. Perhaps those same people are going short now? A lot of people have been complacent because they believe the Fed will always bail them out. It’s worked for a decade. What if the Fed now leaves the market to its own devices?

We will see. I’m not shorting now. I am waiting for a signal. I don’t have to be early. I will let the charts tell me what to do.

…

……………………………,……………… …,,****,**.**

/(,……………………………………………………………..(*,*.

*(/*,,,……………………………………… ….. ………..//***.

.,/ .(*,……..,,,,*,,,,,,………………………………….,,,,,,,,,,,/(,,*

./ ,***//////***…………….************,,,,,,,,*,*****,

,*,,. ,/(###%#####%#%#%#%######(((((((#((#(****.

/. ,. *(##############%&#####%#(#(((((((((((((/* /

(, / (###&&&#&#&*,.(*#/,,,/##/,# …#*….,/*/ &&*////

(, / (#..?……..?……?..???..?…….???../

(, * (##..?..?.?..?…?….?…?…….?……….//

/, * (##…??…??….?….?…?…….???./

/* * (##%..?……..?……???..??..?……….//

(* * (###%./../*.*,*/.*,/,………………………,#…#,/./,*/*//

(* / (###%(……(…#,/#,.,……………………………,*,. #,,,/..*(

// / (#..????..???..???..???…((/

,/ *. ((…?………………?…..?..?…………?……/((/*

* ./ (#..?…..??..?……?..???..???../((.

, / (#…?………..?..?…..?..?…………………..?..///

,, (#…????…???..???..???../((.

.,*.*/######(((((((((((((((((((((((((((((((((((((((((((((((((((((((((//*

*/######((((((((((((((((((((((((((((((((((((((((((((((((((((((((((//*

//((((((((#…..?????….???………..(((((. //

#**//(/((#(…………?…………..?……?…….####((/

//**/**//////………?…………..???……*****///

/######(((((((((((((((((((((((((((((((((((((((((((((((((((((((((((.//

/#..??…..??..???..???…?…….?./

/#..??…..??..?…………?…………..?…..?../

,,….?????..???..?………….???../

/*..??……??..?…………?………….?….?../

/#..??……??..???..???..?…….?./

/######((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((////

/######((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((////

Guess too big for the window. It’s your Mug saying

“Wolf Goes to HECK”!

WOLF GOES TO HECK?

????

Secret was to take off my reading glasses and step back six feet, and it’s clear as daylight.

May be for now but if the mkts tanks 5% or more, Fed to the rescue immediately! That has been the pattern so far. Can It afford that before Nov? I think NOT!

20% I think is the line before this Fed gets nervous (2018 and 2020).

Wolf,

Why not short the QQQ or other specialized index *most* over weight in the basic handful of FANGs and adjacent idiocies that are the true keystones holding this sucker (mkt) up.

A Q2 GDP hit of 20% to 25% will take everything down, so the SPY will take a mjr hit…but that’s the sort of hit that will get the Fed printing again.

But the FANGs have the most to fall and are so narrowly focused that the Fed will be ok with them taking much more massive hits before printing.

The QQQ is too focused on the big tech stocks, and they have enormous staying power. I shorted it last time, and it under-performed my SPY short.

But wouldn’t you expect the Fed to restart propping up markets when they start to tumble?

MarcD,

Yes, when it gets bad enough, when the credit market starts freezing up again. Just like last time. That will be the time to cover the short, as it was last time (I got out too early though). However, I don’t expect that kind of crash.

They are NOT letting even 5 or 10% correction since March 23rd!

Mr. Powell can throw many Trillions and no will complain or object!

Fed is the mkt, now!

Tongue in cheek time again….

Which is why this particular Wolf-o-lution has been approved. In fact, you should be hearing from Marketwatch, Business Insider, and CNBC shortly.

Congratulations, now you will be famous, because you are getting on with the right narrative. A little too early perhaps, but that’s ok.

Already happening:

“He hates shorting the market and ‘lost a ton of money’ betting against high-flyers in 1999, but he’s at it again”

https://www.marketwatch.com/story/he-hates-shorting-the-market-and-lost-a-ton-of-money-betting-against-high-flyers-in-1999-but-hes-at-it-again-2020-06-21?mod=mw_quote_news

Hallelujah!

Until our dear leader tweets again and Jerome heeds.

So for this to work Trump needs to have palpably lost authority. In other words, never mind the economic absurdity, behold a position laden with political risk!

Don’t underestimate these democrats. The left is in large part, financially illiterate, and from their perspective, if the bailouts to big business are intended to flow “keep people on payroll” or “prevent job losses” then they will not only allow, but encourage the Newly merged Fed/treasury to ramp up Stimulus.

Look at the amount of money and authority these 2020 Dems gave to Trump/Mnuchin/Powell only 6 months before the election. I’m not sayin to ply politics while Americans are suffering, but these democrats agreed to give Mnuchin a lot of firepower to blast into the markets on the eve of the election.

I expect Trump to use the $500B plus 10x leverage to be used by a Mnuchin/Powell to target industries with huge union and/or swing states votes. Trump will take the money Democrat’s gave to him and force people in swing states to vote against their financial interests. Dems

Will be in a tough spot railing against big business, given the distressed industries in swing states looking for a lifeline from the two Candidates.

Think about how Democrats restructured PPP to allow recipients more time to put workers back on payroll in order to become eligible to get free money.

The result? A flood of fake hiring in October and November to beat the new deadline(s). Dems don’t think things lie this through, and the result could be losing this election.

Trump lays to win and Dems need to remember this and beat him at his own game.

Yes, they have throttled back in propping up prices, but only for a couple of days. We will see how long it lasts. I would recommend a short term trade. They also tried to throttle back QE in 2019 and how long did that go on? I’m afraid the Fed is in it for the long haul until hyper inflation stops their game, when they will repeat history and destroy the printing presses. How long that will take I do not know.

Hi Wolf –

I followed you in the first time, and made a fair amount of money. Unfortunately I then lost most of it on the way back up. I should have listened to you both ways!

I’m hopping in again :)

It’s not war all the time. Fed has done what was needed and more. The money in the system is sufficient. You are shorting corporate credit, and Fed efforts are 100% in that direction. The virus couldn’t knock out CC, it is bulletproof. Loss of earnings is offset by new loss cost borrowing. Devaluing the dollar feeds asset inflation. Virus restructures the economy, and excess monetary stimulus flows into a smaller number of stocks. To be short something you need to be long something else.

Wolf- I like the trade given correlation between Quad Witching and major market turns, but I think you may be a bit early. I’d say watch out around the week of 9/18, possibly as late as December. All of the federal programs that have bailed out businesses and consumers are ending this summer. That means that all of the loans made to main street will begin to default. All these loans are rolled into CDOs and then trillions in side bets are made on them. Major financial firms (looking at you Deutsche bank) will start failing in Sept. when they need to pay these bets and voila, 2008 all over again. That is why Powell is begging Congress for more stimulus, he sees it coming. Only wild card is that Trump will announce a vaccine around Sept/Oct no matter what the actual effectiveness is so that could make markets rocket higher right before election.

Wolf

Instead of shorting the “SPDR S&P 500 ETF”, why didn’t you just buy the SPXU? The SPXU is a EFT that does the shorting of the S&P500. There is are no margin calls to you when the SPXU purchase goes against you if the market goes up?

Or the Bear Russell Small Cap 3X

It is 3x leveraged inverse ETS against S&P 500. deadly. for very short time -24-48 hrs only. after that there is decay.

I use mostly SH 1x and some times SDS 2x. I prefer PUT options with hedges.

Spxu and spxs are good in a ‘decidedly’ secular bear mkt but not in this surreal mkt managed directly bt Fed. ( been in the mkt since ’82)

When you measure beta decay on 3X ETN’s (unless there’s a liquidation event), it’s around 1% to 2% month depending on volatility of the underlying asset. There’s no shortage of unsubstantiated ghost stories surrounding overnite decay used to scare folks out of their positions.

Let’s take JDST for example during an 8 month period

Went from $42 share (Gold $1330)

To $9 (Gold $1650)

Back up to $42 (Gold $1450)

And there were no reverse splits during that period.

But of course there’s the liquidation horror stories like DWT and XIV. But those were not due to run of the mill beta decay but instead major dislocations due to panic selling of the underlying asset.

Not saying these financial WMD’s are safe but they can be held for weeks to even months at a time if you’re in that top 97% of ninja level traders with an ability to suppress all emotion and monitor them minute by minute.

Been in the mkt since ’82. Retired 20 yrs ago. Investing is my hobby since late 70s.

Manage more than a couple of millions ( including my family)

During GFC, I was one of the very few who made profits in thousands+ I used a lot of 3x inverse Ets. Even calls on them!

But that was when true ‘American Free Mkt capitalism existed. NOT any more.

I stayed away from 3x over a year or 2 ago. All inverse ETFs have to be matched with long ETFs as a hedge, to reduce the loss, when Fed’s put became permanent! Same with options.

50% cash. Rest with diversified portfolio ( mostly Div paying ETFs of all sorts, world wide) with uncorrelated assets. With hedges I sleep better and also enjoy my retirement. Experience is a good teacher but tuition fee is high!

Again- TO EACH HIS?HER OWN!

Good Luck

You are not alone in the conclusion reached. I am there as well.

The author of the Great Recession Blog points out that the Fed had done a fine job enriching his pals. He just may be done…

My comment on that site:

“For those willing to see, the Fed has now told us the markets will now be heading down, since all the dimwits they need are already in (Hertz, anyone?). They always tell us in advance. From Shawshank, “Get busy living or get busy dying” now means “get out / get short or get killed. Powell will do just enough to keep us thinking we are safe, but not enough to keep things afloat. But that’s OK, their friends are already flush. Look out below as we bounce headlong down the staircase.”

Wolf compiles the record of what is actually happening in the financial world. He’s reality personified, knows the market is irrational, but he places a bet which depends on a rational market for its payoff.

Doesn’t make sense to me.

It makes sense to me. Perceptions move the market, so the moment everyday traders realise the money printer isn’t brrrrring it will turn (especially among the professionals who were chasing retail investors while knowing the market is overvalued).

Gravity will take over, and shorting ahead of July earnings and the $600 pw Fed stimulus ending is as good a time as any.

This is a mkt fluttering between FEAR vs FOMO. Complicated with Fed interference constantly. Now the Covid 19 , re-spiking!

Perception with positive(hopium) narrative from the Financial industry/Wall St vs the REALITY on the ground, kept at bay with insane credit infusion to keep the asset bubble up and floating as long as they can by Fed/Cbers!

With continuing volatility, this could be rolling coaster mkt with trading importunately only and NOT for the long term investing!

I shorted today as well. Shorted RCL $57 again today, KMX last night at $98, and bought some SPY puts that are now up 40%!! There is a supposed 1.3-1.5 TRILLION in pension funds dumping over the next two markets. If that’s true that will certainly exacerbate the downside. It would be nice if the FED stepped away from the markets for a couple weeks but i know they won’t… this market would probably crash 90% without FED intervention more than a week…… This whole thing has been fluffed up since march 09 and since then, stocks are so full of QE that they can never survive without it.

fyi

FED is the mkt!

Old Wall Street advice:. “Never position against the Primary Trend.”

This is the primary trend:

you are a brave man thinking that trend will continue. i wish you well. and, hopefully, being long mining stocks will work out for me, too.

The trend will not continue into the negative straight down. That’s not what I meant. What I describe as the trend is that the Fed has stopped QE. I expect its balance sheet to remain roughly flat, wobbling up and down on a weekly basis, as it did from Jan 1 through March 4.

Trend is in the eyes of the beholder.

‘Primary trend’ ends when the FED allows the our good ole, genuine, American Free Mkt Capitalism to function. Until then FED is the mkt!

They can keep throwing Trillions to protect the top 1-10%. All in the name of ‘financial stability’ and smooth functioning of the mkts’

Who is going to object? Congress? MSM? WALL ST?

We are on our way to ‘Japanification’ of America.

Japan’s Debt to GDP is around 300% or more. USA is around 120-130%

US $ will remain the global trading currency. And every one in the World wants US $ – the least dirty shirt out there!

Good luck, W, I think these climbing cases of Covid, which is extraordinary in some states like Florida and Arizona, is in the process of creating a perfect storm of failure for You-know-who. Plus, North Korea and the collapse of the China trade deal. When this perks into the investor hopium, kaboom, imho.

I will be astounded if you do not do well.

We have our eye on a prospective rental which will be coming up in the next year or so. The RE market will be down by then imho, and if it isn’t financed any rent is positive cash flow and better than 0% in the bank. Plus, I can do all required maintenance and live in the area to head off any surprises. Now that pot is legal in Canada, the risk of a grow op is very small, and like I said, it is a neighbourhood property and I will know the tenant.

Good luck!!!!

All depends where the RE is.

Major cities are going to lose population from those escaping the virus and unrest. And will be dumping their housing.

Outer burbs and small to middle towns will see an influx of these “refugees.”

Ha! We finally sold our place in the inner Sunset and moved across the bridge to Marvelous Marin. We’ve been hanging out there and enjoying America As It Used To Be in the 1960s-1970s, every weekend for decades. For family minded, ecological and economic pragmatists, it’s the best place in the Bay Area–more like a citadel, with only two bridges and one freeway in, plus a couple sideroads. “Defensible space,” and in spite of the woo-woo hypocritical blather, it’s very conservative.

The increase in cases in several states (FL, AZ, CA, etc) is interesting but it’s a fraction of what happened in NYC and not remotely a risk to the overall economy of those states. People are done with isolation, particularly young people. There will be a certain level of transmission for the foreseeable future and as long as we don’t run out of ICU beds, I’m not sure there is much to do about it.

It is not ICU beds you need to worry about, it is the overall capacity of the hospitals. People are becoming much too complacent about this virus, especially in areas that have not been badly impacted. Where I live you only see about 10% of people wearing masks in public, and the infection numbers are starting to ramp up at a fairly alarming rate. If this thing really takes off, as second waves sometimes do, and it overwhelms the hospitals, then people will begin dying of all kinds of causes because they cannot get adequate care. When the hospital is overwhelmed and you have even a minor heart attack they will not be able to give proper care…

This is not even a remote possibility on a national basis. The increase in cases in the states you cite is alarming, but is a fraction of what happened in NYC. And in my state, CO, which had a sizable problem, things are far better, as they are in most states that had a problem early. There is zero chance in the”late states” that hospitals will fill, this didn’t even happen completely in NYC, and hospitals are far more prepared now than they were then.

“There is zero chance in the”late states” that hospitals will fill…”

It would arguably be naïve to suggest that such a thing couldn’t happen in Florida, and for obvious reasons.

From a 6/18 NBC News article, but note that additional capacity is reportedly being added:

“Less than a quarter of hospital beds for intensive care patients are now available in Florida as the state grapples with a spike in coronavirus cases, data provided by the state revealed on Thursday.

There were 1,371 adult ICU spots available out of 6,064 statewide, which is about 22.6 percent, the Agency for Health Care Administration showed in an update posted at 3:32 p.m. ET.

That troublingly low figure includes data from Broward County, Florida’s second largest, which had just 20.9 percent of ICU beds ready at that time.

Hillsborough County, the state’s fourth most populous county, had only 19.0 percent available.

According to the same data, 26 hospitals throughout Florida had no available ICU capacity. Miami-Dade, the state’s most populous county, had three hospitals with no ICU beds available.”

Well, the crash is gonna be historical.

We just had a pretty historical crash about two months ago.

And then a pretty historical rally.

Correct- that was a real crash. The only “real crashes” I think of are ’29, ’82 and ’20. The rest were brutal bear markets. The last two were actually pretty textbook/orderly on their way down (2000, 2008).

Every odd intervention (like QE, etc.) in markets “breaks something”. The last two I am thinking of were related to gold-’34 confiscation, and ’71 (France wanted a bunch of gold, and the US figured out it couldn’t survive that, so: fiat!).

Something will break: inflation? (bonds and currency problems?) I don’t know.

I understand what you are doing, Wolf, and I am oh so close to following suit after being an orthodox market-matching index investor for decades. Sorry to ask a basic question, but once you get your money out of the S&P 500, where do you put it? If you hold it as cash in Treasuries or a money market, do you not worry about inflation while the Fed is printing money like there’s no tomorrow? I guess it’s better to lose a few percentage points to inflation than to lose half of your value to a massive market correction. Am I thinking clearly? Help!

Tom,

“Am I thinking clearly?”

Yes. Very.

But everyone has their own strategy to deal with this environment. And there are many valid strategies.

There are inflation protected Treasury securities out there, if that’s what you’re asking… for big investors, TIPS, and for small investors I Savings Bonds (they pay a variable yield that is adjusted to CPI). You can google them. You can buy them directly from treasurydirect.gov

Thank you for this. (and thank you Tom for asking)

I’m a near financial illiterate lurking here, trying to learn. Feel free to dumb-down your posts anytime :-)

Good luck!