First the Global Financial Crisis, then the Euro Debt Crisis, now the Big One.

By Nick Corbishley, for WOLF STREET:

In its 21 years of official existence, the Eurozone has already been through two brutal crises — the Global Financial Crisis and one of its own doing, the Euro Debt Crisis — that nearly tore the bloc apart. Now, it is in the grip of another one that is already exacting a larger toll than the first two, despite having barely begun.

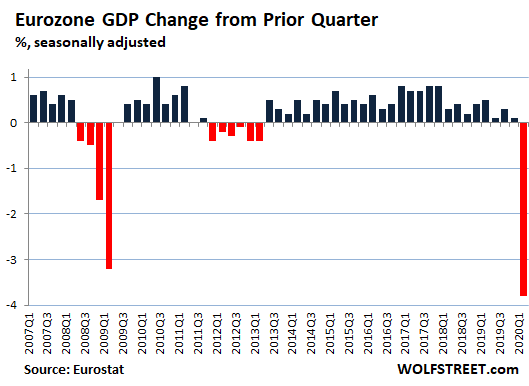

The preliminary GDP in the first quarter for the Eurozone fell by 3.8%, according to Eurostat’s flash estimates (for the entire EU, it fell by 3.5%), “the sharpest declines observed since the time series started in 1995,” Eurostat said. This is despite the fact that most of the region’s lockdowns did not begin until mid-March:

All things considered, the Euro Area’s biggest economy, Germany, got off relatively lightly. It shrank by just (!!) 2.2% compared to the previous quarter. It was still its biggest contraction since the the Global Financial Crisis, more than a decade ago. German industrial production was particularly hard hit, tumbling by 11.6% year-on-year in March, when the lockdown forced factories to close. In Q4 2019, Germany’s GDP growth rate was already negative (-0.1%).

But many other Euro Area countries fared a lot worse. Of the four worst performing economies, three are the bloc’s second, third and fourth largest, France, Italy and Spain, which between them account for almost 45% of Euro Area GDP. The other was Slovakia. Spain, Italy and France suffered more cases of Covid-19 and resulting fatalities than any other countries in the Euro Area. They also imposed the most draconian lockdowns. The impact on their economies has been brutal.

France suffered a mind-watering 5.8% collapse in GDP in the first quarter, the “biggest drop” on a quarterly basis since the Second World War, according to the country’s INSEE statistics agency. Even in the second quarter of 1968, when France was roiled by civil unrest, mass student protests and general strikes, the economy still shrank by less (5.3%) than it just did. In the first quarter of 2009, when the financial crisis was pummeling Europe’s markets and Greece was beginning to teeter, France’s GDP shrank by a comparatively mild 1.6%.

As happened in Germany, in Q4 2019, France’s GDP growth rate was already negative (-0.1%).

Italy perennially troubled economy shrank by 4.7% in the first quarter — the worst reading since Eurostat began tracking Italy in 1995 — after having already contracted by 0.3% in Q4 of 2019. Italy was the first EU country to impose a lockdown and has also suffered the largest number of Covid-19 deaths. Given the size of its public debt and the fragility of its banking system, it is probably the least well placed large European economy to weather the current economic storms.

The Euro Area’s fourth biggest economy, Spain, also broke records with its latest GDP reading. Clocking in at -5.2%, it was the worst performance since the country began tracking economic growth in the 1970s and is considered to be the largest quarterly drop in economic activity since the Spanish Civil War, in the late 1930s. According to Spain’s National Statistics Institute (INE), retail trade slumped by 15% in March while Spain’s second largest bank, BBVA, estimates that consumption has fallen by half since the government declared a state of alarm on March 14.

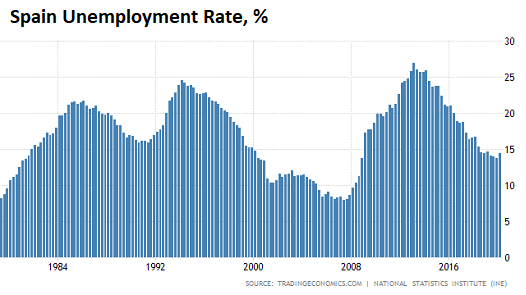

Spain already had depression-era levels of unemployment before this crisis even began. In the first three months of this year unemployment rose to 14.41%, from an 11-year low of 13.78% in the previous quarter. Given the speed of the slowdown and the scale of economic destruction it has already caused, particularly in the all-important tourism sector, it’s probably just a matter of time before that figure surpasses the 20% threshold for the fourth time in 36 years (chart via TradingEconomics):

Across the Euro Area as a whole, the number of employed people decreased by 0.2% in the Eurozone in the first quarter of 2020, compared with the previous quarter, according to Eurostat. It is the first decline in the time series since the second quarter of 2013, when the region began to finally emerge from the ravages of the Euro Debt Crisis but it is still a surprisingly low figure given what has happened.

Unlike the U.S., in most Euro Area economies the vast majority of so-called “non-essential” workers have been furloughed rather than laid off. In the case of France, more than 10 million private-sector workers are being supported by the state, through a scheme called chômage partiel (partial employment). In the case of Italy, the unemployment rate bizarrely fell to 8.4% in March – its lowest level for almost nine years. The government attributed this aberration to the fact that the unemployment rate measures active job-seekers, whose numbers slumped during the lockdown.

But this sort of aberration will not last for long. Even though we are beginning to see some easing of the lockdown restrictions, it’s likely to be too little, too late for many businesses, particularly those in the hardest hit sectors such as transportation, retail trade, leisure and hospitality, which are so vital to Southern European economies.

To keep its own domestic economy alive, Germany has mobilized €750 billion in grants and loan guarantees to companies, both large and small. But few EU countries have Germany’s fiscal firepower or bureaucratic efficacy. Certainly, Spain and Italy don’t. In Spain, just 20% of small companies that have requested emergency loans have actually received them. In Italy, the government has pledged a whopping €740 billion in crisis funds — just €10 billion less than Germany — but as of the end of April, only €3.1 billion of those funds had actually been released.

As long as this dynamic continues, the prospects for Spain and Italy, two economies that are still living with the hangover from the last crisis, are beyond bleak. France is not looking much better. As such, if first-quarter GDP for the Euro Area was already woefully bad, the reading for the second quarter — what we are in the middle of right now — is likely to be much worse. By Nick Corbishley, for WOLF STREET.

A big driver behind soaring rents — the “Airbnb effect” that removed countless properties from global cities’ long-term rental markets — reverses. Read… Airbnb Gets Disrupted. Hosts, “Super-Hosts” Try to Survive. Apartments in Prime Locations Suddenly Flood Rental Market

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The current Premier of Ontario, Doug Ford has closed the Ontario Housing Tribunal due to this Pandemic. But this problem is much deeper due to the massive amounts of government and media collaboration with extends from Municipal Leaders to the Prime Minister’s office.

Keeping people tied to this illusion of ownership has a multitude of advantages from taxes to movements of its citizens.

Municipalities heavily tax the home owners with promises of looking after the infrastructure of water, heat, sewer and garbage disposal. Pet projects have been added over the decades such as arenas and Transportation. In larger cities, even police services are added. These all increase the home ownership costs in a multitude of ways with fees and renewals, etc.

Banks and real estate have a multitude of ways that fraudulently increases the price of the housing market with government and media collusion.

Monetary deflation is due to using the American dominated trading Dollars and paying fees to use this system.

Real estate inflation is encouraged by Governments, Banks and Real Estate Brokers with media encouragement. A multitude of fraudulent schemes has been used to sell the idea of ownership in a multitude of ways encouraging people to own and stay in these areas. With the suppression of wages, many areas too expensive to live off of them and cover expenses.

Some areas, the prices are so inflated, that cashing them out can buy 5 other of the same houses in different areas and many have done this.

I know first hand of 2 different people doing this for different reasons.

One cashed out his auto dealership in Toronto and bought a business, two houses and a small apartment in Midland, Ontario.

The other person teamed up with a local real estate broker and was buying up cheap houses to turn into duplexes to charge the highest rents.

Other schemes such as condominiums and timeshares tie you to a permanent contract that can be passed down to whoever is next of kin with payments that cannot be broken.

The truth will never be published.

Take care,

Joe

Real Estate is an illusion of ownership.

True data! Try skipping your rent payment (property tax) and see what happens.

And as I told my daughter the first time she had to pay income tax, you only rent your freedom from the government.

Can’t be more truthfull. We are not living in a free world whatsoever

Good comment, Joe. You explained very well why many of us live rural. My property taxes on primary residence is about a $900 bill per year. If I had the same place in town it would cost around 6K.

Water is provided by a drilled well which cost 7K 10 years ago, and will never have to be drilled again. Unlimited water source. I did put in a shallow well at a rental for $1500, all in. Garbage pickup is $135 per year, is mandated and done once per week to ensure no one throws crap away in the push. Plus, we have 3 major cleanup pickups every year. Sewage means septic, which we pay cash to have pumped every 5 years. Last time the owner driver wanted $175 cash for the pump out and I gave him $225 and a smile.

RE is not an illusion of ownership. Renters pay the taxes, it is included with rent. If you pay off your home, you have no payments beyond maint, which face it, is miniscule for even the most challenged homeowner.

Few jobs in the rural areas, how do you make money?

With 5G being rolled out, ubiquitous broadband will be a reality in rural areas.

You’ll be able to earn the same that you do in San Francisco, NYC, or Los Angeles… While living a more sustainable and much-lower-cost rural lifestyle.

The era of jobs being tied to geography is over. COVID has proven most professional and knowledge work can be done remotely from anywhere — and often at a higher rate of productivity than in a noisy open plan downtown office with an expensive, hellish commute to an outrageously expensive overtaxed and overpriced local rental or jumbo-mortgaged house.

All he has to do is make *enough*. Plus, I am guessing that he learned early on the difference between wants and needs.

Needs are few, but wants are unlimited.

A few good friends, food on the table and a warm dry place to sleep… life can be pretty good!

Paulo – Were I to pay off my mortgage (cash has been available for years) I would continue to be liable for two payments of around $3000 every year. If I do not pay the taxes the Township will auction the title to the property. I do not own my home, I own a note to a bank that has a lien on the property. It is obvious that the Township owns the property.

Canadian – 5G is very short range, designed for high-density population and industry. Unless there is a sufficiently large local population no carrier will build a tower, or multiple towers, and pay for the necessary the necessary backhaul. The only option for remote areas is a satellite internet service such as Hughes.

‘Real estate inflation is encouraged by Governments, Banks and Real Estate Brokers with media encouragement’

Isn’t this phenomena going on universally, all over the world!? 2008 was a warning but conveniently ignored and more debt created to cover up the problems! None of the underlying, not addressed but masked by insane credit creation

Now the corona is a just catalyst which UNCOVERED the ROT under neath our financial and the Global financial system! I feel sorry for the bottom 90% of the society from the action of top 0.1% and enabled by the next top 10%!

When the DEBT has been used as a panacea for all the financial problems in both public and private sectors, all over the world, what would any one expect in return?

SHANGRILA?

The KARMIC backlash for all that INSANE/reckless debt spending is on progress! Corona was just a trigger!

I’m not quite sure what you’re complaining about. Real estate is globalized. Toronto is an international safe haven for assets. ….not least because it’s North America’s largest and fastest growing city. Buy low, sell high. Global population will increase by 2 billion over the next 25 years, hundreds of millions will enter the middle class, and hundreds of thousands will migrate to Canada every single year. You literally can’t lose with real estate.

Media is doing a dam fine job of cities being cootieville and full of slimy germs all over will elevators that are too confined laced full of germs.

Everyone wants to escape to the suburbs and country now.

Toronto is far from America’s largest city. It has annexed its suburbs and exurbs to try and “look bigger,” but actual real Toronto (as serviced by the TTC) is a smaller, cleaner, more parochial Chicago.

No, fortunately you Canucks in Toronto don’t have the equivalent of the South and West sides of Chicago. Eh! Don’t be a hoser.

Cashed out of Metro RE years ago..Rent and invest..Never looked back… As the economy turns, and as the population ages… Get out while you can…

I’m not saying I disagree with you, but instead of trying to write your own article, maybe try responding to what Nick actually wrote here?

Interesting tidbit of first hand knowledge…….the major mall in Ontario that the Ontario teacher’s pension owns and is funded by, supposedly only 20% of tenants are paying rent. And these are high end tenants like Lululemon, Hermes etc. Fuking pensions……..not sure about Cananda but they will be the downfall of the US economy. These pensions are all overbought in the market and it’s going to be hilarious. This is why the scramble to save the markets at any and all costs even destroying the future generations of this country.

Germany’s GDP is worth €4.3 trillion or something along those lines, so €750 billion comes off at over 17% of pre-crisis GDP. Italy’s GDP was worth about €2.6 trillion, so the pledged €740 billion come off as over 28% of pre-crisis GDP.

It’s evident to everybody that even if these benefits and this stimulus money is spread over 3 years it amounts to something absolutely unsustainable and I am fully convinced politicians have now realized the absurdity of their pledges and are attempting to backpedal. Their bookcheck cannot cover their pledges.

That’s a big part of the reason why the new word in Europe is “get them back to work as soon as it is remotely safe to do so”. Starting tomorrow all businesses in Italy will be allowed to re-open in phases, including museums and gyms, and the present agreement is for all internal EU borders to re-open on June 3.

The Lufthansa Group will resume flights between over 100 destinations in June and IAG (British Airways, Iberia, Vueling etc) and Ryanair will resume a similar level of activity in July. Wizz Air of Hungary, one of Europe’s Big Free LCC’s, expects to be back to about 30% of pre-crisis flights by then.

Hurtigruten, the Norwegian shipping company, has announced the date for their first post-Covid-19 cruise (June 16) and TUI is already pulling aircraft and cruise ships from storage. The latter will restart operations at about 30% capacity as soon as hotel crews can be found for them, not an easy task right now.

We have literally gone from one excess to another: everybody here knows I was a “re-open now type” but I did not expect something like this.

I suspect the reason for this “adelante, Pedro, con juicio” decision (very pertinent citation to show off a bit ;-)) is the absolutely crippling blow not just to economic activity, but to social cohesion. As Spain has shown us, high unemployment is not good for politics, and we have politics even more than the virus to thank for the present mess we are in.

Now if you’ll excuse me I have to go outside and survey the damages. I suspect it won’t be pretty.

I hope you have nice weather and can survey from one of your motorbikes!

Yes, the weather is nice this morning, thank you very much.

Apparently few EU countries (like the US) have the same efficacy in administering grants, as Germany. (No 3rd Reich jokes please) These SBs don’t have access to corporate deep pockets, which I think describes a lot of EU mercantile class businesses. Europe is not franchise America, or is it? In the US we can fund another moon landing, then use political appointments to walk back the administrative budget, cut funding, put in place acting heads. Makes we wonder not how the Germans manage, but how the rest of the EU mismanages, or is mismanaged.

When the EU was being “created” – they basically promised truckloads of new made up EU money for joining the EU.

Basically – something for nothing, which it was. And it worked for awhile as you saw the new signs go up for bridges and roads getting repaired.

But then prices of everything “rose” to EU levels but salaries did not.

Which was fine if you were German or Dutch, not so much in eastern or southern Europe. Affordable food and housing are a distant memory.

And then came the insane bureaucratic decrees from unelected bureaucrats in Brussels. And the ever rising taxes.

Finally, there was now no way to leave the Hotel California of the EU. Greece found that out the hard way. Britain barely escaped, with much agony, and only because they had kept their own currency the entire time.

These crises will never stop.

They are now looking to integrate more poor countries, hoping to envigorate the ailing EU with fresh blood. But will it help? Hardly. When you have Britain leaving and Albania joining, this is hardly going to be helpful.

2banaña:

Why would anyone want to leave Hotel Brussels?

Maastricht Treaty: government deficit to GDP (at market prices) 3% and government debt to GDP ratio 60%.

So much for the EU and its treaties.

Germany’s GDP may be down only 2.2% but don’t forget, Germany’s GDP depends on exports especially of expensive cars. Three of its biggest markets are China, the USA and the UK and I can’t see many in those countries rushing out to buy a new car anytime in the near future. Here in the UK, the Government has planned on most people not really getting back to full work until November. On top of that I can’t see the 50 million or so unemployed in the USA thinking, oh boy time to buy a new BMW…

A lot of those German exports are to other Euro countries as well, so no help there either.

That said, Germany will weather the storm better than almost all Euro nations.

Which surprises…no one.

Germany can weather the storm better than anyone. Pre-Covid they had about a 2% budget SURPLUS! When was the last time you heard that word?

Autos are big alright, as in Japan, but they are virtually the only product the North American consumer sees. A lot of Germany’s and Japan’s exports are to manufacturers, who use them to make the stuff the consumer sees. Neither has any interest in selling to Walmart or Dollar stores. The prudent manufacturer also has little interest in budget machinery ( although Japan broke into markets with quality and price)

On TV the consumer ads say ‘cheapest, cheapest’.

The manufacturer is more likely to respond to another pitch: ‘we don’t compete on price’

Lotsa new bimmers here in SF, latest models not seen before shutdown, cabrioletes. Fewer drive, but those that do drive in style.

In AZ, the convertibles all came out…. people taking pleasure drives with the tops down to keep some semblance of normalcy. Ours is 17 years old…. still looks more than presentable…. and many others were of similar vintage on up to the newest Lambo’s and Ferrari’s were out romping in the foothills.

Lambo’s and Ferraris in Arizona. That’s cool.

Meanwhile in San Francisco main streets’ buisnesses are boarded up with plywood as if harricane is coming.

Politics will find ways to push those cars and other stuff. Owners of old (being 5 years or more) petrol and diesel cars will be encouraged with a ‘cash for clunkers scheme’ to get a new one, because the old one is allegedly ‘dirty’. This is also allready suggested for home appliences like fridges. It may work for a short while. But in contrast to the ECBs, peoples money is not unlimited.

And for the southern countries: their predicament is allready blamed on the Dutch for being against buying out banks and insisting on the new money only to be spend on keeping employees in their jobs. And the receipt for all the borrowed money will be handed to the Germans, because, lets be fare, “they started the last war” (the ever returning argument). The southern’s never have and never will take ownership of their bad decisions and always push for solidarity from the Dutch, Germans, Austrians and Fins, the ‘mean’ countries. The FrIS (France, Italy, Spain) don’t realise the ‘means’ can’t keep up with their spending thrift. And there will come a moment those mean countries will throw the towel, like the Britains did. The latter couldn’t have chosen a better time to get out of the EU.

Meanwhile my PM’s (precious metals) and mining stocks do very well.

Median US household income is $82,604 and a large number have two cars (two earners). The problem is that a $10,000,000 income household does not purchase 242 cars. The rich just don’t spend enough. They buy stocks. They used to buy bonds when there was some yield. Darn wealth just won’t go away. Will they be hiring direct servants (see Downton Abbey)?

The weak economy that has been accepted by the EU is a tragedy for the whole world. Compared to the US, especially per capita, its innovation and therefore economic growth has been and will be weak for the foreseeable future. Just as one example, the pharma companies in Europe just threw in the towel over the past 20 years on new medicine research- relocated to the US.

The US pharma industry has its own issues, but ~75% of new medical innovations come from this country. This is because of the economic system in the US vs Europe. Again, it’s sad for the whole world. ~400,000,000+ people in Europe (a lot of very smart ones) could create a whole lot of innovation, and because of various economic disincentives, they do not.

Opportunity cost in its most obvious form (but most people don’t understand it.)

“the pharma companies in Europe just threw in the towel over the past 20 years on new medicine research- relocated to the US.”

But of course they did, because this country charges a ton of money for all sorts of medicine. Which corporation would not love the chance to rob customers of every last penny?

Has nothing to do with innovation at all. And speaking of innovation, it works both ways, the US also created Private Equity, the scourge of corporations, as well as Twitter, the world’s biggest toilet wall,

And don’t forget, this country can print money at will. We’ll see how it performs when it’s lost that privilege.

Monkey Business-

As stated above, the US Pharma industry has its own problems. It is highly regulated, and lobbies legislators hard. It is illegal to buy and use meds purchased outside the US in most cases. This is a bad law, obviously, and the Pharma companies lobbied congress for this.

Businesses have a responsibility to maximize profits. The government has the responsibility to provide a legal framework to promote competition- so that profits are “reasonable”.

This is a failure of the government. There seems to be nobody who will do their job in government to properly regulate many industries.

However, if you have had a loved one helped by a newer medication, it probably was invented in the US. That is extremely valuable and the EU contributes very little to this worthy endeavor, tragically.

wkevinw:

You can’t purchase meds outside of the US, but they can!

The law was changed so meds do not have to declare country of origin!

Even your doctor can’t tell you where your meds were made!

The big pharma spends MORE on marketing than R&D, well recorded by the former editirs of NEJ of Medicine!

The VA hospital can negotiate the drug prices but NOT Medicare, although both are Govt agencies!?

Bush Jr passed a law that specifically ‘forbids’ Medicare from negotiating unlike VA! No public outrages, complaints or accountability! Why? B/c once they agree to Medicare, private insurance will demand the same! ALL this is done in DAYLIGHT but no public outrage! Wonder why?

Check out online how each Big Pharma Cos donated to Bush Jr!

CRONY Capitalism is reigning in America, Not the good ole, genuine Free MKT Capitalism which died at the hands of Fed in March of ’09!

Ret MD ( been in the mkt since ’82)

In short: countries that adapted the € are in deeper trouble than those that kept their national currency. What a bad luck.

Especially curious if that gigantic unemployment in Spain will fuel the wake separatist movements – so many bored basques, catalans and andalucíans with nothing to do in a makeshift country that they don’t feel they belong to. In many such environments the government will have to pledge to major spending not just to keep the economy rolling, but to prevent crime and radicalism from spiking.

Prof.:

The irony is that if the Spanish government spends money they don’t have, they will get where they don’t want to go, quicker!

Spain unemployment level is “different”. You have to understand the idiosyncrasy of the country. Pre-covid, a significant percentage of unemployed people were working in “black” and receiving the unemployment benefits on top. It is a win for the employee, for the employer and big lose for the society well being and the welfare state

1) People want to sit down close to each other, shoulder to shoulder, sing a song, sway from side to side and drink beer.

2) Online shopping peak bubble was pricked by the Chinese virus. People are fed up being locked up, facing the stupid screen.

3) Its dangerous to extrapolate online shopping at peak bubble. Its going to have a change of character from zoom zoom to boom, doom & gloom.

4) France & Germany were in bed with China have reached their demised. China put a face mask on Bernard Arnault, France most important citizen.

5) Its hard to believe how the Chinese Locus is eating alive its biggest customer.

6) For their arrogance Germany is paying the price.

7) The world will be dissected. Germany & France will have to choose

sides.

Punchy, blurred, categorical… was it generated by an AI driven chat-bot?

JPY! AUD! QQQ!

FLQ!

ETA!

I’m certainly tired of online stocking-up.

I’d very much like to visit my favourite delicatessen and buy some cheeses and pies from the lovely Scandinavian blonde who works there.

A ‘Thank you for your order we value it highly and will try to fulfill it sometime but can’t guarantee a delivery date’ email is just not the same…..

And the pies were damn good!

‘Online shopping peak bubble was pricked by the Chinese virus. People are fed up being locked up, facing the stupid screen’

???

Sorry, you are wrong!

Have you checked recently share prices of online ETFS like ONLN, XBUY and EBIZ?

They ALL are at or near year’s peak in their price. Corona made online shopping more common and increased than pre-corona days. And it is NOT going to change any time soon!

This is the second time in roughly a decade that the bailout has principally come from the Federal Reserve, i.e. a financial bailout that first helps the financial industry and asset holders.

Maybe this will change? It seems like it would be hard for the Senate not to consider the $3 trillion bill the House has passed.

But if it doesn’t change, think how angry people will be as this fact settles in.

Fact from the Fed this week:

Almost 40% of people making under $40,000 who were working at the beginning of the year have lost their jobs.

Ed:

The $3T House Bill is just the rich robbing the poor again.

Mostly goodies for the rich!

For the poor, not so much.

Better if this robbery is stopped.

Funny how even the dems can’t find money to fund universal healthcare, unless it’s for fence hoppers.

The money is there. It’s in the fees (and profits) currently paid to insurance companies and in the current system costs.

It’s a big step that many people seem unwilling to make, but . . . if you look . . . you can see the system works all over the world. It’s what most of the developed world uses and they spend, on average, much, much less than we do.

It’s strange that Americans cannot take what is good from other countries. The early U.S. did that all the time. We took one industrial innovation after another from Great Britain and the rest of Europe and made them our own.

Regarding “fence hoppers”. Of course, you can’t let the whole world use your free national health system without paying.

My wife got sick in the U.K. We were asked a few questions to make sure we were legitimate tourists . . . but then it was free. And we got better care, albeit for something routine, that we got in Austin, TX a couple years before.

I suspect the fact that we were Americans with health insurance kept the questioning simple and short. Would we really have gone to the U.K. for kidney stone treatment? Not likely.

I really fail to understand how a cheaper system (as universal health care is the world over) can be attacked as a giveaway. I understand that there’s some trepidation before change but the nature of the attack confuses me.

‘But if it doesn’t change, think how angry people will be as this fact settles in’

People decide NOTHING. Congress will do whatever needed to elected for the next election

In 2008, when the TARP bill came it was rejected b/c of public uproar. Then 2nd time it got passed!

Congress and the WH are in pockets of Wall ST. Nothing will change, unless riots on the street, which they will defuse by UBI!

Rich know how to keep the bottom 90% at bay. Provide just enough to keep the crowd from getting hungry and mad. They are good at it.

I find it incredibly difficult to believe that you don’t think the Senate is as corrupt as the other two. Frankly, as the house of review, it is more corrupt. A house of review with no moral framework to judge laws against. As long as it contains some spending for their voter base, it passes.

OK send my UBI ASOP and I will keep AT BAY a while. OTOH if U lift the LOCKDOWN first U better watch U ASS!

…see also: bread, circuses. (If they’re out of bread let them eat cake.)

Please update the topic in 3 months.

I understand that your article is about 2020Q1 because of publicly available data;

but 2020Q1 is of “little” interest because Europe was in denial of covid19 until March.

The really ugly thing started to unfold from March : astonished citizen discovered that covid19 was here now and was here to stay.

So we need 2020Q2 data to assess the damage done to real economy and infer the risks for Eurozone.

Yes, your request for a 2020Q2 post will be greatly anticipated by many on WS!

Engin-ear,

Yes, the article did point out right up front this was just reflecting the March shutdowns. And it pointed out that we’re in the middle of Q2 now and that Q2 is going to be a lot worse. Q2 GDP data will be available in mid-August, and then you will complain that this is already ancient history… GDP works that way.

For data that is closer to real time, you need to look at the PMIs. The Eurozone services PMI for April came out on May 6, and I covered that on May 6, along with the manufacturing PMI for April that had come out a few days earlier. In early June, I’ll cover the May PMIs when they’re released. This is as real time as you’re going to get, but to get it, you need to read it when it comes out, or else you’re not going to get it:

https://wolfstreet.com/2020/05/06/service-sector-falls-off-cliff-in-the-eurozone-manufacturing-not-far-behind/

It does not matter that August has not happened yet. You can write articles based on “forward guidance”.

My only complain was about “mega-crisis talks” from one bad month, while what is coming is serious enough to bring us a giga-crisis.

The PMI is understandably black given the lack of visibility on next States decisions.

Everything else is fine and appreciated.

Clock seems to be running backwards toward Stalin’s last day on earth. More people and more stuff, but not much real change beyond a few partial social levelings. All that work kicked in the gut by one small bug, one giant leap for bugkind. We did set up the first off-planet junk yard on the moon, what seems to be the main aspiration of humans since the Great Wall of rocks. Time to take that big international covers-all debt note, place it in the chunnel, and open the flood gates? Then just re-value everything back to circa 1952-5? See if we came out ahead any?

A Mega crisis is a large asteroid wiping out a lot of Europe . The 12 year long economic crisis is just a good old fashion fleecing of the sheep. Nothing to see here unless the sheep get a lead ewe to form an army. Until then assume the position and hope your betters will be generous with the lubricant.

If a large asteroid were heading in to destroy the U.S. within 24 hours, the FED and Gov would load up themselves and all the corporate and bank CEO’s w/ boards, cash, printing presses, then fly to China to continue as usual.

Correct, I am a bot, how did u guess.

Me too. Or so all of my paid subscription say they suspect and so they make me help train their AI with all those picture labels in Captcha

;-)

In 20 years, I will fail those eye tests and no one will let me read anything anymore.

Ed,

You can always read WOLF STREET. There will NEVER be a Captcha on WOLF STREET. Ever. Those things are despicable, and I generally don’t go further when I encounter one, unless I absolutely have to.

I think it would be quite funny if you had one one of your charts posted as the picture, and the description read “select the squares that have QE in them”.

Raymond Rogers,

??????

I appreciate this.

I meant no offense… but honestly, your bullet points look like Da Vinci Code for me.

I might be too stupid… sigh…

Otherwise, this unnatural structure of text reminded me my last experience with chat-bot proudly launched recently by our corporate HR.

Hidden in the initials(?)…ME…that existential recognition that must be known before the self-awareness of I AM.

Quite right! It is incredible how obtuse one can be at choosing someone as Larry Summers for advice on economic matters or, for that matter, on anything else.

How myopic not choosing Bernie Sanders.

Bernie is not an economist. However, I don’t think one needs to be formally trained in the formal algebraic equalities presented in academia to have a better clue than many economists.

Summers is definitely a skunk though.

The usual lifespan of monetary union, in the absence of fiscal/political union, is 20 years. The euro’s days are numbered; Brexit and the coronavirus will speed things up. Appetite in Northern Europe for underwriting the banking losses associated with loans to Southern Europe is dwindling.

I learned this week that every euro banknote serial # includes a code designating the country of issuance. There may be a flight from “southern euros” by northerners who don’t want to be “bailed in” to the next crisis, a la Cyprus.

By the way, the elimination of the €500 note a few years ago made it much more appealing for Europeans, especially those associated with the “informal” sector, to hold their wealth in $. I expect these trends to continue.

“The euro’s days are numbered”

>

Or “absence of fiscal/political union” ‘s days are numbered.

Engin-ear.

Seems like chicken and the egg…

Which I honestly have to say are outcomes different only in the degree of their lack of appeal.

But I can’t see how the Euro can work ad infinitum without fiscal/political/military union, but I can’t see how any of those will appeal to the voters across many different countries.

It’s not that either the EU or the euro projects seems wrong in principle, just badly planned and executed.

Ho hum.

Karen, the present euro banknotes (second series) are different from old ones: the letter at the beginning of the serial number doesn’t indicate the issuing central bank anymore, but the physical establishment that did the printing. For example in first series banknotes X denoted the Bundesbank (issuing central bank), but now indicates the Munich works of Giesecke+Devrient, a German private company that won a tether with the ECB to print euro banknotes.

How euro banknotes are minted is actually a fascinating process: differently from the US Mint not all denominations are printed every year. For example in 2018 no new €50 bills were printed while 1.8 billion were printed in 2019. Each member central bank has the responsibility to print an allotted number of these bills: they may do this themselves or commission one of the officially authorized private companies like Giesecke+Devrient to it for them, or may opt for a combination of the two.

The ECB also has a number of private companies in non-member States under contract to provide extra bills should the need arise (contingency plans): an example of this is De La Rue, which is UK-based.

It’s a weird system, but not any weirder than Hong Kong where private banks like HSBC may literally print money. ;-)

AS the global commerce declines all the previous line of cracks are getting widened, as never before.

The delusion of Debt on debt solving all our financial problems, got destroyed by Corona – the pin for the 3rd largest ‘everything’ bubble’!

Btw NO country in human history has prospered by spending debt on debt!

People supporting MMT as a solution for the public sector debt, forgot that as long as the RATE of growth of GDP exceeds that of DEBT, no problem. No one cares about deficit or the National debt, at least in USA!

But once it stops and reverses like (it is happening- less GDP for more Debt spending)) in the last 2 decades, the choice of servicing the debt (interest payment due) will challenge the military and social spending.

Debt service vs Guns vs Butter!

Look for a big surge in the U.S. Dollar when the Euro nosedives.

Gold is also a good one to hold

When US $ surges the gold slumps! Check the mkt history!

Besides the price of gold is controlled by vested interests in Gold future exchanges for decades!

How do you come up with such nonsense while urging others to check the very charts that disprove it?

Between 1995 and 2005 the dollar index soared, yet there was a relatively small decline in the price of gold.

Between 2005 and 2012 gold climbed from ~$400 to ~$1900 regardless of what the dollar did.

As long as US $ is strong among all other currencies, there is no fear of inflation at least in USA, . In other currencies, yes, the price of gold goes up.

I do trade in gold including options and watch. I also made profit buy buying PUTS periodically. Deflation or Disinflation ahead (at least FIRST) more likely than inflation.

GOLD is NOT a religion to me just a TRADE just like any other commodity at he Mkt including oil. They FLUCTUATE!

(Been in the mkt since 1982)

The US $ is only strong as long as other countries are forced to use dollars in trade. That might change sooner as expected, because when all other currencies fall against the dollar, none of those countries will be able to pay for dollars to do trade. They will be forced to use something else as medium of exchange. What might that be? It shurely will not be (US)debt, because there is too much of that.

Beside Euro nose diving, there is already Dollar shortage outside USA in Euro-dollar pool, EM bond mkt those issued with backing of US $! Fed is addressing with dollar swipes with foreign banks but how long!?

Still optimistic about the Eurozone. Many people here still don’t realize everything that has to happen behind the scenes to reintroduce a national currency. IT systems will need to be rewritten (that takes a lot of time), contracts will need to be renegotiated, etc, etc

I know someone who works in a major bank in the US. He told me that the bank had taken a look at what needs to be done (system wise) if Greece were to exit the Eurozone, and let’s just say it’s not pretty. And we are talking about Greece here. And we all know the Fed will do whatever it takes to protect the banks. Heck a lot of US Dollars went to Deutsche Bank back in 2008/2009.

The Black Swan here is not the Eurozone collapsing. This is risk that has been known since 10 years ago, heck even back when the ESM was first introduced?

The Black Swan is uncle Sam collapsing before everyone else. There are serious issues in this country, and they only look “better” than problems in other countries because we live here, not because they are objectively better.

Always remember the EMU (European Monetary Union) won’t break up because of our idiot politicians whose poor understanding of how the world works landed us in this mess.

It will break up because it will have outlived its usefulness, and even then it may end up staying with us in indirect form for much longer: the late Roman monetary system of Diocletian resisted in the Eastern Empire until the great debasement crisis of the late X century and formed the basis of the Merovingian/Frankish monetary system, which in turn influenced almost every Western monetary system for over a millenium, with the last faint echos dying out on Decimal Day (February 15 1971).

That was an extra-credit education, MC01. Thanks for that, and thanks for your many illuminating comments!

COVID-19 might not have been wholely predictable.

But after the dot-com crash, didn’t the likelihood of the next become more evident through 2005? Was not the same pattern appearing again 2017 onwards?

There was such relief and hope after the fall of the USSR. Thank God that sh1t show is gone.

…..But what have we done with our time since..?

Tim:

I did my part to try and save Mother Russia from itself but obviously I failed!

After working in Siberia for 6 months in 1983, I was no longer afraid of the big bad communist!

…..But what have we done with our time since..?

Kept binging on DEBT spending as a panacea for all our financial problems

both in public and private, all over the world.

Then came corona, a catalyst which uncovered the ROT underneath our Financial and global banking system. All built on shaky foundation of debt on debt with leverage!

Witnessing the karmic backlash for all that insane credit creation! Solution? create more credit with more debt spending!

I get the feeling that “essential workers”

have no sympathy for “nonessential workers”.

Problem is, the “progressive” West has

deemed most of its population “nonessential”.

Apparently, not even schools are needed anymore;

it can be done online, like a YouTube channel.

I don’t see the Calvary coming to the rescue;

no solutions on the horizon.

It’s bad now, and getting much, much, much worse.

It is not just Summers. Europe’s core will suffer but ultimately do better than the USA. They do not have a parasitic, “Federal” Reserve looking out for the interests of the banksters and financiers (owned by and paying DIVIDENDS to them) while pretending to be a government agency.

Here, as Wolf reported, negative rates are out, because the banks stock prices would plunge. Here, as Simon Johnson reported in “The Quiet Coup” in The Atlantic Magazine, financiers took over government long ago.

Those parasitic persons will drag down the USA, while Germany, et al, recover then prosper. They have huge investments in China and are allied with those commies. Check Wall Street’s connections to China, so they will sink us to profit.

The CCP has no allies, it also doesn’t recognize foreign ownership in China. China’s economy peaked somewhere around 2015, and China, overall, is much weaker than people think. One of the big problems in China, is the way they implemented capital controls, basically, you are only officially allowed to take approximately $50,000 a year out of China, however, they try to block that even. Because of this, people in China have continually bought and raised the price of real estate in the Chinese cities to extremely high prices, especially, compared to the average wages. This has caused the price of doing business to rise enough over time, to the point that China has become uncompetitive. Currently, even Chinese companies are exporting jobs to cheaper countries like Vietnam. After all of the nonsense they caused with this pandemic, including blackmailing countries to cut off medical supplies and forcing foreign leaders to lick their boots; China doesn’t have a bright future.

The economies of the western world “USA/Canada/Europe/Australia/NZ” can recover the moment they stop all of their nonsense, rebuild their industry and greatly reduce corruption. Central And South America can do something very similar. Africa will be dependent on others and it will vary how well each individual country, ends up doing. Some parts of Asia can do well, most can’t.

The only thing dealing with the CCP has ever led to is poverty, disease, and licking their boots as they threaten you.

Gold, gold, gold…might the mighty Wolf be planning some new commentary since his last final howl on the PM’s? It seems some fur is bristling out there.

My grandfather was from Ireland….it will be interesting to see what the Irish decide to do as the UK takes a step back. They are in a tough spot. I think this mess will unite the Irish and they may take a step back as well. The Irish people need to unite over this because after all, it is a small island.

The EU was created by a capture of The Common Market by Germany. France was so weak and the bones tossed by the Germans made it look like France had a way out. Naturally, the Italians and Spanish saw the German economic success and wanted in. The Dutch were smokin plenty of weed even back then. So, with the Berlin Wall down, the party in Europe was on. They even came up with their own money, the Euro. All other decisions have devolved from the forgoing but add the political warm spit in a cup approach to what the equal policy between the member states is.

Of course, this ain’t gonna be a happy ending. BMW’s success might be a good micro-analogy for how it progressed. BMW was wanted by every little swinging ass in the entire US. We bought them all. Then we ran into the maintenance issue, which BMW simply jacked up the price and covered. The evolution was we wanted electronic stuff, and BMW delivered in spades. We swallowed the $70k price like there was no tomorrow, the 6 year financing miracle. Then, depreciation set in big time because the second owners were killed by the maintenance and repair. That $70 k BMW was now down to under $10, and lower because to keep it going would bankrupt the 2nd, 3rd owner. Only back yard mechanics have a slim chance of surviving the simple door lock issues much less the turbo or vanos problems galore. So, now its all going to recover like toast, pops up in a minute. And Germany is a one hit wonder, electronic car technology that the ROW thinks they want, but now not so much. Germany is like one of those LA car chases where the cops throw spike strips and the fleeing felons keep driving till the aluminum wheels start burning. And so will go the rest of the German creation, the EU.

Nick,

The phrase “chômage partiel (partial employment)” would be more accurately presented as “partial unemployment”.

Years ago Canada renamed its Unemployment Insurance as “Employment Insurance”.

What is constantly overlooked in these analysis is the fact that EUs private household wealth is in Italy one of the highest but is at the low end in Germany.

So Spain is probably the worst of.

Well, this was about the UK, not Germany or Italy or Spain, and it was about the BOE’s new openness to negative interest rates, and not about household wealth.