A gigantic spike at the very end after two of the craziest trading days I’ve seen. Here’s how my trades went. But that’s it for me. I’m staying out of this market, it’s just too crazy.

By Wolf Richter for WOLF STREET:

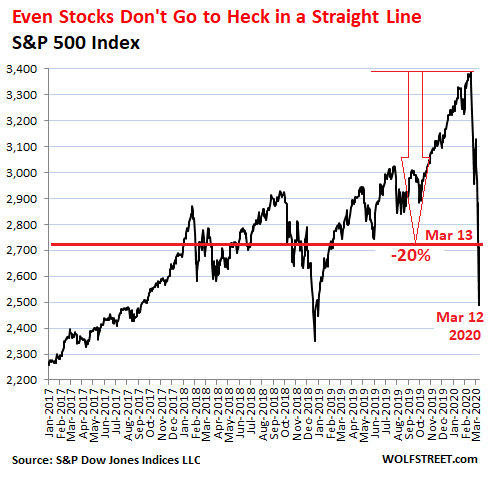

Holy moly, that was fast and whiplash inducing. Today, the S&P 500 exploded higher by 9.3% to 2,711, nearly erasing yesterday’s 9.5% plunge, which had been the steepest plunge since the 22.6% DOW collapse on Black Monday in 1987, which had been the steepest in history. Today’s action was a classic bear-market rally. Even I could see it coming after yesterday’s plunge. “That was fast, too fast,” I mused yesterday, as the S&P 500 Index was going to heck in a straight line. But that is simply not possible, according to our proven-beyond-a-scintilla-of-doubt and utterly indisputable WOLF STREET beer-mug dictum: “Nothing goes to heck in a straight line.”

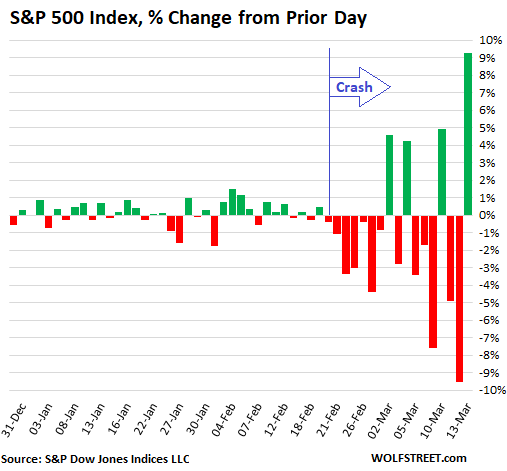

Over the five days through today, the S&P 500 jumped or plunged between 4.9% and 9.5% a day, with two moves over 9%, one move of 7.6% and two moves of 4.9%:

This pattern of five trading days in a row with moves of over 4.9% hasn’t occurred in the data going back to at least 2008. In fact, there haven’t even been five days in a row of 2%-plus moves. In fact, there haven’t even been four days in a row of 2%-plus moves – and this includes the gyrations during the Financial Crisis. This is how crazy and record-breaking whiplash-inducing this market is.

But these moves are not surprising, according to our beer-mug dictum: “Nothing goes to heck in a straight line.” And just when you think the beer mugs are wrong, the market snaps back violently and proves them right. During the Financial Crisis, as stocks were crashing, the violent one-day-wonder-bounces were a sight to behold, with several exceeding 10% — in the middle of a crash!

This is typical of most crashes, especially now with algo trading being dominant, and with stock markets being equipped with “circuit breakers” that are supposed to prevent that kind of bottom-fell-out-event that we saw in 1987 (-22.6% on Black Monday).

I consider today’s event a bear-market bounce that confirmed that we’re in the middle of possibly a historic crash, given the already historic volatility, the historic level of stock-market overvaluation in February, and the challenges facing the economy and businesses, of which we’ve only seen the first signs. So today’s bounce was not a good sign in my book.

And one more thing, over half of today’s jump came in the last 30 minutes of breathlessly frenetic and chaotic trading. It was completely nuts minutes before the close, with stock prices on my screen jumping all over the place.

After today’s violent bounce, the S&P 500 has now dropped 20% over the past 17 trading days and is back where it had first been in January 2018.

Like many human and algo dip-buyers – no “Plunge Protection Team” required – I reacted in two ways to the historic plunge shortly before the close yesterday: One I covered my short position that I’d taken out on December 30; and two I bought, as I said, “some of the worst beaten-down crap for a short-term trade that I hope to unwind over the next few days without getting drawn and quartered.”

And I added, “Please don’t follow me in my footsteps. Watch the spectacle from a safe distance. I’ll try to entertain you with the results.” This afternoon, I unwound all those trades. So here we go with the results.

When I started selling, the market was up about 4%. At the close, it was up 9.3%. I missed much of that end of the frenetic spike because I wanted to make sure I got all this crap unloaded before the close. The worst piece of crap stock in my lineup surged over 70% in the last few minutes! And this reeked of manipulation.

Not everything was a win at the time I sold. It was chaos at the end. Ten minutes later, they would all have been the hugest winners. Yup a few minutes made a year’s worth of difference today, which is another sign of how nuts this market is. So these are the results:

- Two of “the most beaten-down airlines”: +3.2% and +2.1%

- Two “abandoned hotel REITs”: +17.9% and +5.1%

- One “sunk cruise-ship operator”: +9.3%

- One “crushed aircraft maker”: +10.9%

- One “near-collapse shale-oil driller”: +23.1% (it went on to surge over 70% in the last few minutes, clearly heavily manipulated)

- One “crushed automaker”: +0.4%

- One “wrecked rideshare outfit”: -3.7%

- One “internet furniture-retail cash-burn machine”: +6.1%

So folks, the way I see it, we’re in a historic market. We’d been in a historic run-up through February, amid historic stock market euphoria, reaching historic bubble highs during a period of languid global growth. And now we’re already in a historic crash, in terms of volatility. We’re facing the bit-by-bit shutdown of parts of the economy not just in the US but globally, with governments and central banks lining up bailout programs for companies, homeowners, banks, and others. That’s how bad it is – unprecedented really.

And even if all this blows over by summer, the consequences will linger for a long time, and some shifts and changes will become permanent.

As me for me, I’m going to stay out of this market for now, because this is just too crazy for me. And I’m going to watch it from a safe distance.

The Fed is going nuts trying to contain this. Read… As Everything Bubble Implodes, Frazzled Fed Rolls Out Fastest Mega-Money Printer Ever, up to $4.5 Trillion in Four Weeks

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Is that you, Wolf? :-)

Seems like it, no?

he probably meant the line

“By Steve Saretsky, Vancouver Residential Realtor, Stevesaretsky.com:”

also, in the very end – safe distance, not save

I see what you’re saying. Fixed! Thanks.

Worse than ’29 with all the global debt.

The House always wins. Always.

We focus too much on asset prices in my opinion. The SP500 is a proxy for the US economy. Your adult financial life is 60 years split between accumulation and withdrawal. Daily asset prices shouldn’t mean much. Accumulate 10 – 15% of your salary on the up side and withdraw 3% – 4% of portfolio on the down side and it’s a long enough period that asset noise washes out. 100 – age in stocks still is a pretty good rule of thumb.

That very much depends on what your portfolio consists of.

How do I buy a mug?

C in MP,

There are two ways:

1. For $25 with free shipping in the US. This is where commenter RIPP runs the show:

https://www.wolfstreetstore.com/wolf_street_store/shop/home

2. If you donate $100 or more. But then you’re not “buying” a mug. Instead, I will personally send you the mug as free thank-you gift.

https://wolfstreet.com/how-to-donate-to-wolf-street/

Wolf,

What do you think about metals at these prices? If the everything bubble affects fiat currency, would it be possible to see a new uptrend in gold or silver? Not in a matter of days, but weeks to come.

Thanks for your insights.

Martin,

I got burned with silver badly early on. If you buy precious metals as a trade, you need to watch the long-term trends. They’re very long with PMs. You could end up being on the wrong side of the trade for far longer than you intended to hold the PMs. It you’re buying PMs and you never intend to sell them, then that’s a different story.

https://wolfstreet.com/2018/09/04/my-theory-about-gold-and-silver-for-long-term-investors/

In terms of fiat currency, what you need to watch is inflation … different kinds: consumer price inflation, wage inflation, home-price inflation, general asset-price inflation. They’re all a measure of how fast the dollar is losing purchasing power. If the current set of problems cause home prices to come down, the dollar is gaining purchasing power v. homes. So I don’t think the connection is going to be clear and simple.

Yes, to back up what Wolf said:

my mother bought 1000 oz of silver at $11 during the first spike (in the 80s!). She used it as a doorstop for literally decades.

I offered to buy it from her in 2005 for 10% over market cost then: $8.50/oz.

I then used it as a doorstop until 2011 – when I dumped it for $45/oz.

After that bubble popped, silver has been bouncing around in the mid teens.

Decadal time scales…

Martin:. Wolfe is 100% correct!

You buy metal for insurance!

You will never get rich owning metals.

You can most certainly grow very poor owning metals.

Metal prices are rigged and have always being rigged!

If you buy metal, you will be fighting the central bankers!

The central bankers can print money longer than you can stay solvent and longer than you will ever live!

Backed up by over 6 plus decades of very painful experience!

People would be better off thing of metals as 0 coupon collateral that CBs cant print (not an acceptable collateral type with frbny bailout desk), thats also used as collateral and subject to margin calls (like everything else people are long when their portfolios are getting smacked), and banking rules like Basel III. If gov paper yields go up, metals will go down.

Fresnillo has the Juanicipio mine coming fully online in Q3 2020. Anticipated annual production is 11.7 million ounces of silver, plus about 45,000 ounces of gold. On top of that the new Pyrites plant will become fully operation about the same time: this will recover historic and present tailings at the large Zacatecas mine and and add a further 3.5 million ounces of silver and 13,000 ounces of gold.

In 2022 the two new gold mines of Centauro Deep and Orisyvo will start production: the latter alone is expected to produce 135,000 ounces of gold per year.

This is just a single mining company, albeit a large one, operating in a single country. And there are hundreds of similar outfits all over the world: they all have access to that free money to increase production by buying the tech to mine even deeper or recover tailings or bribe local politicians and mine squat in the middle of a nature preserve.

Like LNG or copper precious metals are facing an oversupply issue: too much supply increase in a market that only grows so much. And what happens when India starts seeing the same changes in precious metal ownership we have seen in Europe in 2005-2010? Who’s gonna buy all that gold and silver once the great sinkhole disappears?

I know I will probably sound like a burned-out idol on her way to graduation talking to fresh-faced hopefuls, but be very very careful about what gold bugs say. Most of them are just true believers, they are either genuinely convinced about what they say or need to keep repeating the line to justify the thousands of dollars they have sitting in a safe somehwere. But there’s a large number of scoundrels preying on true believers, newcomers and very conservative investors by pitching to them precious metals just before prices are about to enter a looooong downward slope or the shares of two-bit mining companies whose only product is hype.

If you want to get into this market, learn to do your homework by yourself and don’t allow others to lead you around, no matter how honest and reassuring they may sound.

Gold reached record highs against many currencies recently?

Around 2010 we sold my gold jewelry to survive. It was easy to sell, the silver they didn’t want, I still have it.

Wolf, the last couple of days were wonderful for traders.

Today’s dramatic rise was fully expected based on the Fed’s blasting the markets with money.

You could see the S&P begin to ‘air-break’ yesterday (jumps then slow declines). While the actual amount of today’s rise couldn’t be predicted, the leap up was well telegraphed. The only reason the market’s moved up during the last year was because of Fed largess.

If we get back to S&P 3000-3100 , I suggest you put back on your short. There’s nothing but dark days ahead.

Nothing goes to zero in a straight line.:)

I’m a dead man walking. 68 and on dialysis. A widower I am ambulatory with excellent lab reports. Withdrew from the transplant list because I do not want to take immuno suppressant drugs. In fact, it was my active immune systems that compromised my kidneys. The non PC condition is called Wegener’s disease. I have enough money to last 20 more years ( but I won’t ).

I mention all this because it is important.

Whom do we save? Do we let Donald Trump and Nancy Pelosi mortgage the future of the millennials so I can survive? Good deal for me but maybe not for them. 150+% debt to GDP ratios come at a price and I cost the taxpayer enough already. Were I to have to pay for my own treatment I might last 4 or 5 years if I was lucky. That’s reality. Maybe science would find a way to transplant pig kidneys into humans but, like most medical advances including a coronavirus vaccine, they are always in the future ( I remind you that the common cold, also a coronavirus, has eluded medical science.

We need to face some hard facts now. I can linger on and do what I can to avoid becoming infected even though my reality is going to a clinic three times a week where people much sicker than I am congregate or we can focus on those under 40 and give them a future.

472

Be assured:

‘There Are No Accidents In The Universe’

To confirm this, look up to the stars on a clear night with a clear mind and tell me there’s no order or majesty or purpose & meaning..

It’s all perfect, though hard to accept when in poor health and facing death (as we all do eventually; me too more imminently). It’s called ‘life & death’. No escape.

To be honest I don’t worry a lot about the 40 year olds’ or 30 or 20 year olds’ because.. well, see opening comment.

It’s how we act in the moment that makes a difference. You can’t change what’s gone & done, only what will be through what you do now. Even when close to the end.

Now, as the Wolf Man will delete this as OT finance, I’m doing a 180 to stay on track by saying ‘Keep stacking man!’

Agree totally with your comments. I have had out of body experiences and now have NO fear of “death” at all. My perspectives consequently radically changed. I always tell people that they will be delighted with their new (post “death”) estate. I like watching the markets as a hobby, but I am not worshiping money because you never know when the “great beyond” will tap you on the shoulder. Smelling the roses (not the lucre) is important. Yes, I know that none of this is “scientifically” believable. I am just having fun watching the (once in a lifetime) completely ludicrous market conniption fits.

Precious metals are for those who can’t trust their government and currency (like most of the world). Here in this American utopia, we’ve been conditioned to trust our leaders and our dollar because of these ‘good times’ of the last few generations. It cannot end, right?

Our federal government never asks the question “Can we afford it”? No, it’s print or borrow with no intention of ever paying it back.

What have the gyrations of the stock market of the last few weeks shown you? Take your pick:

1. A strong foundation of never-ending profit and security for wealth.

2. A floundering government-backed bubble of overnight evaporating I.O.U’s.

Someday Substance will have value in the U.S. again when we’re grubbing out a living. But that can’t happen, right? Take your pick.

@Gold

Looking up into the sky is looking at the past. No matter how elegant and static it may appear, it is a giant cauldron of temporary dynamic balances of yesterday.

The exact same as the markets.

One relatively benign virus and suddenly the globalist world we are supposed to love and embrace, and we have the whole deck of cards collapsing.

Unit472:

Very powerful comment and I agree, it is far from politically correct to discuss but shutting down civil society to essentially keep the oldest 5% among us alive has consequences, beginning with a financial crash that will perhaps be well beyond anything we have witnessed in modern times.

Think about how many young abled bodied people who’s livelihoods and futures are being trashed on a daily basis right now.

I have a few neighbors who are probably going to lose their homes and be wiped out by mid summer and at their age it will be difficult to recover financially in their lifetime.

It is the young as you say who will be left with our nationally debt and their personal debt. Keeping people alive at all cost has consequences that we are actively experiencing on a daily basis. An ethical dilemma that know one is discussing openly.

At age 75, but with 4 grand children for whom I feel really poorly about the world we are leaving to them, I agree with the concept that we should NOT continue to heap the burdens on the younger folks/future generations as has been done with the current run up of debt done by the ”crony” politicians/puppets on both sides of the aisle.

However, I will point out that many younger people in USA are also being supported either totally or majorly at this time, without regard to ethnic origin, etc., as well as many young folks employed taking care of the elderly, especially the very elderly. This work was formerly done in the multi-generation home, also enjoyed/benefited from the wisdom learned over the lifetime of the old folks.

The foundation going forward is real education of every person to act in their own and their family’s long term interest, education which is sorely lacking today either in most homes or in most public schools. IMHO, the ”elite” get this education both places, and that’s one of the reason many families continue to be elite. And I will add that I taught part time in two high schools for a couple of years, and was astonished by the lack of basic education of many of the students, almost seeming to be deliberate.

My spouse and I both worked our way through college and worked full time ever since, ( up to last year for me) and have no mortgage or long term debt.

I really had no idea how unusual that is for folks who have mostly worked manual labor most of their lives until learning about it on this site, looking farther and finding confirmation; one answer may be that beyond the new pick ups I have bought for biz and travel, we pretty much buy what we need and only what we need.

I think I am done ”working for the man” now, but in any case, that work has only paid for increased investment in wine futures the last few years!

You’re just as alive as any of us, don’t let the deplorables start shoveling dirt on you

@Brant Lee

Leave the politics out of it.

PMs are for the return OF your money as opposed to the return ON your money.

It is insurance, not a magic wand, and is insurance against liquidity risk.

Do you really see that coming, given the trillions printed in the last decade plus?

Most importantly: there is actual precedent for the US government cracking down on PMs: FDR passed an executive order where all gold was forced bought by the government – in order to reprice it. In that era, you could not open a safety deposit box without an IRS agent present.

So any significant quantity of PMs is simply not liquid in a true TSHTF situation unless it is an actual zombie apocalypse – at which point food and ammo is more important. That ain’t what’s going to happen here.

The reaction makes no sense because people have no notion of how to deal with a supply/demand shock that’s independent of financial interventions.

How do you deal with a strategy that boils down to social distancing? Where’s the playbook for that? I met with a landscaper today. He wouldn’t shake hands but he let me use his pen. Useless.

Are you signing for your credit card purchases using the provided electronic pen?

Are you using touch screens at the ATM?

How about pumping gas? Wearing gloves?

Have you been stopped for speeding and handed your license to the cop? Wearing gloves?

There are so many holes in our only defense and they can’t be plugged up with money.

The elite are running to their hidey-holes. Have the flight attendants on the private jets been screened for the virus? Who used the private jet before you did? Read Poe’s Masque of the Red Death to see how power and privilege are not protection against plagues.

This time really is different. It’s not a financial crisis. The financial crisis is a result, not a cause. Here be dragons.

Glad to read you are out of the long positions Wolf, and not to worry about losing a dime or two; there are certainly going to be some really good buys when this settles down, which it will sooner or later.

Meanwhile, since it should be clear to anyone paying attention to this virus that it must now be assumed to be everywhere, as a small payback to you and folks here, I suggest the following protocol I worked out to protect my family when I was carpentering on a huge PEMB, the columns of which were being sprayed with friable asbestos for a couple of weeks, and then later, taking all kinds of asbestos out of many older houses in the SF Bay Area before any of the laws passed to mandate asbestos removal protocols.

When getting home from anywhere even remotely possibly a contagion situation:

1. Gently brush off and then take off outer clothes either outside if possible, or inside in front of the washer, and put them into the washer. Don’t touch them again until thoroughly washed.

2. Walk directly into the shower, remove any remaining clothes in the shower and place them into bucket and then into washer with other possibly polluted clothes.

3. Shower thoroughly, working from top to bottom, and either use pre prepared ‘neti pot’ or similar to wash sinuses.

I started this right after the first articles on the new ”science” of epidemiology came out in the New Yorker magazine in 1977, before anyone in the construction industry was paying any attention to the asbestos/cancer connection, other than Johns Manville, etc., who apparently knew about it in the 1930 era but suppressed it to their eventual demise.

Other than that, after really messing it up in 1992, my doctor told me the only way considered reliable to strengthen immune system was lots of Vitamin C and lots of the best fresh and unprocessed food I could stand to eat.

Good luck to all of us, eh?

Reminds me of when I was being “trained” to use a Tyvek bunny suit and respirator. I had to teach the instructor how to remove the suit by slowly and carefully turning all of it inside out to contain surface contaminants as much as possible. Also had to tell the instructor to tell people to take off the respirator LAST as he had demonstrated removing it first.

One simple thing not being discussed.

Washing your hands is completely useless if you do not use a fingernail brush to scrub the hidden bugs from beneath your fingernails.

“Poe’s Masque of the Red Death to see how power and privilege are not protection against plagues”

–

Excellent cite

–

30 years later when they emerge from their “hidey-holes” I’ll be waiting outside, a zombie, ready to eat their brains!

Unfortunately, they have no brains, they are still edible though. Will make a tasty snack.

Go long.. on long rich dork !

‘;]

I’m here in Qingdao, China. I see everybody wearing masks but they have bare hands. They touch everything, including each other. Washing your hands when you finally get home is not the answer. I have a huge box of the blue medical examination gloves. That’s what I wear when I go to the market. Early in the outbreak, my wife and ,I flew to Seoul and back wearing masks and the blue gloves. I’m normally semi-paranoid about germs. I don’t touch door handles, elevator buttons, escalator rails and all that. I carry a package of antibacterial wipes when I’m outside. In ten years I have had the flu once and only about 3 mild colds.

re: “… I don’t touch door handles, elevator buttons, escalator rails and all that. I carry a package of antibacterial wipes when I’m outside. In ten years I have had the flu once and only about 3 mild colds.”

So, you have no immunity whatsoever?

As with bare hands, just make sure you don’t touch your face with your gloves on. Those gloves still can have the virus on them! And take them off carefully and then wash your hands.

I too wore blue latex gloves to the grocery store. I get them from my dialysis clinic as we have to ‘hold’ the area when the needles are pulled out. As for elevator buttons and door handles I have found a use for the plastic grocery bags ( not yet banned in Florida). When I have to go out I take a few and use them to pump gas, grab door handles, etc. I hang another one on my gear stick in the car to put the ‘used’ ones in and throw them away when done. I was never a germaphobe before but I am now.

I am sure, documentary makers like Micheal Moore are taking notes about plots of the story. I have a few questions about this flu

1. what took so long for WHO to declare a pandemic. By Feb 25, couple of weeks ago the disease was already in Asia, SE Asia, Middle east, Europe and US. who influenced WHO to stay quiet?

2. How come in USA, economic questions came to the forefront? Fed chairman and Larry Kudlow are in focus while Surgeon General, CDC head and other doctors were in the back seat?

3. Did CDC really botched the kits? WHO was distributing free kits to countries like India. Why cant US get the kits from CDC. Rumors has it still now only 5000 people were tested?

4. What is the major roadblock to close the schools, daycare, theaters and non-essential offices until the situation resolved?

Feel free to add your questions…

CP, I read that there was a “pandemic” bond issue of several hundred million dollars (paying high interest to the bondholders) in which the payout (and loss of bondholders principal) was dependent on whether a breakout of disease was designated as a pandemic.

This could be a reason it took so long for COVID19 to be declared a pandemic. Wolf may have some insight into this.

OSP:. Goes to show you how corrupt the WHO is!

Those bonds came due this July, so the WHO were desperately hoping to wait until after July, before using the dreaded word “pandemic”!

Simple answers to all you questions:

Kill off old and sick people, “burdens”.

Hide the financial sins.

But the politicians acted soon enough to “do something”.

Taylor made virus, released at a perfect time and place.

It was not real till a few celebraties got it.

I will take a counter approach which is not necessarily my opinion.

1. Is this really a pandemic of biblical proportions or is the mass injection of panic from every angle part of plan?

2. Why shouldn’t economic questions be at the forefront in order to distribute the greatest amount of supplies, to the most people, at the lowest prices?

3. Do you believe testing kits spring from thin air, when supply chains to make those tests have been disrupted?

4. Should we be closing down all of these functions, vast swaths of economic activity, wiping out earnings for months? And schools too? Placing children in fear? Perhaps the economic harm and the imprint of fear will in the end lead to more death and suffering than the virus itself?

Just asking questions is all.

Cheers

Right on all counts…and the tests are only to show a transient virus that is probably on it’s way down the toilet, not sickness itself.

The fact that “Mr. Rogers” has a public display of it gives the game away.

Personally I believe only half what I see and nothing I hear! But peace, faith, and healthy eating are worth more than gold and worth betting on!!

My main questions is – why is China only showing 10-15 new cases per day lately? A few weeks ago, they had 80,000 infections across the country. And now they are almost all back to work????????

Something doesn’t pass the smell test!!!!

There are a lot of disparities across countries and even within single countries across time.

Some of it is probably just chaos (I think people tend to overestimate the proficiency of the medical industry…the more experience you have with it, the more you realize its good reputation may not entirely be earned…like a lot of “institutions” in theoretically advanced nations..).

Some of it due to natural variability.

And some of it due to political/media shaping.

I think the best you can do is to look at it across countries (some sites break out the detailed data) and try to puzzle out for yourself what may be going on in each.

Ditto for the pct breakdown of severity (unhospitalized illness – which seems like it must always be an estimate, hospitalizations – more accurate but with a lag/chaos, ICU admissions – more accurate still because lower numbers, fatalities – presumably the most accurate due to post mortems, but even there errors in cause can occur…was it C19 or traditional flu that triggered the ARDS that led to death? In a swamped environment, errors, oversights, and sloppiness will occur)

I’m having the same feeling. My spidey senses tell me something’s fishy.

Probably an elaborate masquerade to prevent massive panic and market crash. It just took some time for the authorities to plan and set up the masquerade.

I can’t help but think the Chinese government is looking for a “fall-guy”, those dastardly ” foreigners, to blame for supposedly re-importing the virus and causing a spike in the death rate which I believe is being under-reported now. Compare the infections per million population with countries in the west and try coming up with a different explanation for the discrepancies. In doing so, the government might just survive what could be coming.

Probably because they implemented draconian measures to contain it, despite all the criticism from the rest of the politically correct world.

And every country that implemented severe border entry restrictions after the China outbreak has had limited impact from the virus.

re: “2. How come in USA, economic questions came to the forefront?”

You’re kidding, right?

@ Cobalt Programmer CDC did not give any kits to India. India does have a functional pharma manufacturing sector. These kits and most essential drugs are manufactured in India itself. 100K kits were passed out last week. More are being made available.

WHO gave it to India and other smaller countries I guess. My idea is US can get it from WHO rather than CDC

Cobalt Programmer: No questions; maybe some semi-answers.

During the fog of war decisions must be made with incomplete or erroneous information.

“Theory” of operation of some aspect of response can be simple, but in times of crisis capacity/numbers get to be the problem. There is simply no way to plan for the numbers or tests, amount of medical equipment or hospital beds one could imagine as worst case scenario.

1. Mistakes will be made.

2. Everything seems obvious in hindsight

Historic Volatility Tells Me This Stock Market is in the Middle of an Equally Historic Crash

He might be depressed again on Monday, but today Mr. Market was, well, manic. Not only is the herd mentality striking, but Mr. Market is responding strangely to the signals.

For example, just because Fearless Leader has gotten on board with dealing with the pandemic doesn’t mean the late, inadequate, and reluctant response is going to prevent any serious damage to the US economy. But that’s how Mr. Market acted.

And there are other examples.

The US banking sector hasn’t been doing all that great but has been able to disguise it. Otherwise it wouldn’t be needing such a huge bailout so early in the course of the pandemic, and the recession in the real economy hasn’t even hit it yet. Mr. Market doesn’t seem to appreciate that. He doesn’t seem to be appreciating what’s going on in the fossil fuel industry either.

We know he can turn on a dime, though, because he keeps doing it. The financial markets can’t really be expected to behave all that rationally anyway because there’s all that constant gaming going on. Lots of unpriced risk.

Today I compared the difference in actions between Canada and the USA with regards to this pandemic. In the US there are brinkmanship negotiations going on about the relief package, namely, the Dems want to bail out people and the Repubs want to bail out business and threaten to scuttle everything if it involves paid sick leave for workers. It is all being done in the hostage aura of an election year.

In Canada, the PM had a press conference this afternoon and stated no Cdn citizen would suffer not being able to pay their rent because of the virus, or miss their mortgage payment, or not be able to buy required food. Additionally, all business would be supported immediately by fiscal changes and adjustments. Unemployment insurance waiting periods are reduced for longer term layoffs, and of course testing is actually being done throughout the country, is free, as is hospital care to address any illness. Unemployment is a Federal responsibility in Canada whereas in the US Feds want to download any costs to states and local Govt that ultimately control state unemployment programs. There is also insistence of medicaid caps and not getting rid of co-pays for the benefit of the medical insurance industry.

A country that has no heart for its citizens will not survive in the end. Pure and simple. The US, (any country), must look after its interests and not just the interests of selected industries and the connected wealthy.

What ever happened to by the people for the people?

Today, there was a call in our local news feed to stop all WA ferries that enter BC. Furthermore, all levels of Govt urged Canadian residents not to travel outside Canada, anywhere, including to the states. If they leave they should self-quarantine for 14 days. Travel medical insurance will most likely be void for Canadians if they contract illness in the US. Our skies are still open to Europe, but all intl passengers are funneled through select port of entries for enhanced screening. There are no blanket embargoes.

The point of this comment is to state my belief that the US is at a turning point. I do not believe it will survive in its present form unless it pulls together against the virus. The economy is just the seasoning, the garnish. More people have to start winning and sharing the wealth going forward.

regards

All true. Thank you.

Paulo – likewise as Unamused, and I will add it’s obvious which US party cares for the middle-class, and poor.

The other party cares about the survival of the rich, and the hell with the rest of the people. – It’s always been this way.

“it’s obvious which US party cares for the middle-class, and poor.”

indeed. the one we don’t have.

P Coyle is right…the way I see it, one party will kill us, while the other party will kill us, but with “care”. This is all coming down folks…Canada included. Sorry to say, but I believe it. And, it was a bipartisan effort…democans and republicrats. Interest rates have been on a downward trajectory since the peak in 1981. If money is priced too cheaply, ultimately bad things will happen. Too many folks have been seduced into borrowing to buy crap they don’t need. Governments and big corps. have borrowed too much as well. Well, this is a fine mess they’ve gotten us into Stanley (as in Laurel). I am not kidding when I say, gird your loins. In summary, gov’t., corps., and consumers behaving badly…a sociological event over time that will manifest itself financially in a ruinous manner…they rest of the world and Canada included.

Seen it all before. I was “screened” and made to wear a dust mask when I flew to Argentina back during… Hm. The LAST great financial meltdown. And who even remembers the name they gave to THAT viral horseman of the Apocalypse. Chicken flu? I defaced my dust mask with “paranoia” and enjoyed sharing maté, wine and social kisses with those who still enjoyed life. Wag the dog.

Rudy Gobert did the exact same thing and single-handedly shut down the NBA.

This virus is way more infectious

This a great opportunity for these over indebted companies to discharge a lot of their debts and start fresh . Bailouts would allow the money renters (Bankers) to continue extracting their pound of flesh .

The government can never be big enough to take care of all of our problems. Our founding fathers recognized that men were not angels. We are living in la la land that we each can shirk our personal responsibilities and shift that to the government. Now we just say it would be nice if we lived in utopia and print the money to make it happen. It is the road to be slaves and not free people. Taking care of yourself and your family is a lot cheaper than giving your money to the government and letting them manage it.

Yes, but bureaucracies alone can’t do it It has to be a cultural improvement in neighborhoods, families, person to person, churches that care more about the living than about sound systems and buildings.

A country with a Fiat currency and no fiscal discipline will not survive in the end. Adding more and more public, private and corporate debt is eventually unsustainable.

I agree with the actions of the Canadians and our lives and health are the priority.

However if the virus is the pin that busts the “everything bubble” there is going to be a lot less wealth to share in the future.

The Fed has the ability to elevate asset prices, but elevating the price of the asset class doesn’t alter the future real earnings stream.

In reality if someone pays the elevated price their future real rate of return is lower. In many ways it’s a deception to instill confidence in society that we are wealthier than we are.

Just answer this question. Would a central banker prefer to have assets over valued, correctly valued or under valued. We know the answer is over valued (wealth affect).

Paulo, the old trick was having some (plural) children out of wedlock to develop a government income stream – at least for 18 years.

I fear a new trick is to be officially tested positive for COVID-19 so that you qualify for free rent, mortgage and student loan holds, etc. This seems to be a reasonable strategy for the young as the recovery from a mild case is quite certain. It’s obvious from the drug problem that many are not particularly concerned about health. But you do need to be officially tested and certified.

“I do not believe it will survive in its present form unless it pulls together against the virus.”

It’ll take much much more than this virus (which isn’t even that deadly in the first place) to take down the nation that essentially calls the shots on planet Earth. The USA is the game master, and as such, it’ll stay in the game for a long long time. It may come out of this with a small bruise but no big deal; and certaintly not enough to promote any real change. Even if when it’s all said and done this virus claims the lives of thousands of citizen, it will pass and everyone will go back to business as usual. You will be surprised how resilient the status quo is.

The Gov/Fed will print trillions (since they are the game masters, they can keep doing that for a long long time) and the millions of people, minus the few thousands who died, will still be able to buy their toys and enjoy their entertainment, while feeding themselves more food than they really need. Why would they want to get off their couch and demand (real) change? They aren’t even ready for Sanders for crying out loud; how the hell would they be ready for any real fundamental change?

Big difference between “game master” and banker. Ever play Monopoly? It’s only fun if the banker is honest and the play money is limited. In the 19th century England was the banker. How’re they doing now?

Premature rehypothecation

Hi Unamused,

You may already follow NC based on your highly informed comments. NC has some great articles today on our response to the virus. California can only do 20 tests a day and so is choosing to alter it’s response to the disease. The so called greatest healthcare system in the world can’t do what China other did (lots of testing) to narrow the disease.

It exposes the falsehood of those who keep saying we are prepared because we have the best healthcare on earth.

It really drives home how our privatized corporatized for profit healthcare systems is one of the worst in the world, makes us unprepared, and is 3rd world at best, and hurts all of us.

“The admission that the US, even if it had coronavirus test results, lacked the institutional capacity to do contact tracing, is a stunner. Gee, we supposedly live in a world of AI and big data, but our Silicon Valley gearheads can’t come close to what China has done?

But we can find the resources to do VIP contact tracing, like of the politically important attendees of the CPAC conference.”

And:

Public health officials in California’s state capital region announced this week they have stopped tracing the contacts of patients diagnosed with the novel coronavirus. They’ve also ceased recommending quarantines for residents exposed to people confirmed to have the virus.

It was a grim recognition of the virus’ infiltration — and is yet another sign of the detrimental effects of a lack of capability in the U.S. to test people for the deadly coronavirus as it continues to spread.

“The reason we have to move on is because testing did not occur. We’re still able to do about 20 tests a day,” said Dr. Peter Beilenson, director of Sacramento County’s Department of Health Services. “If you really wanted to quarantine and contain the situation, you would have wanted to know who was positive and quarantine them. Because we never had the tests, it’s kind of a moot point, and the horse is out of the barn.”

Yes, I’ve been following that. Thanks!

timbers,

This: “California can only do 20 tests a day and so is choosing to alter it’s response to the disease”– is uninformed BULLSHIT.

For example, Kaiser Permanente has set up three drive-through locations in the Bay Area where you drive up, stick your head out the window, and they will take samples (from mouth and nostrils), and off you go. 5 minutes. This is the system in place in South Korea. Drive-through testing avoids the issue of contaminating the whole hospital.

It was true when first reported. Things certainly move fast, don’t they?

Believe it or not, CA broke federal regulations by using test procedures developed by its university system, seeing that CDC kits were defective. So did other states. FDA has since then approved some of them.

Yes I agree with Wolf this comment is uninformed

Do you remember who the first country was to come up with an accurate reporting mechanism and post it on the internet ? China ? No, the US and Johns Hopkins university.

The issues with medical insurance aside , there’s still a highly sophisticated medical system in the US

Do you remember who the first country was to come up with an accurate reporting mechanism and post it on the internet ? China ? No, the US and Johns Hopkins university.

China built its reporting system during the SARS epidemic years ago. They’ve been through this before.

California is being forced to shift from containment to mitigation. So is King County in Washington state. That’s dangerous but they don’t have much choice. Testing did not occur in time and will still take weeks to ramp up.

Don’t argue it with me. Argue it with the governor of California and the California Health Care Foundation.

As of yesterday, the number of U.S. residents tested stood in the thousands, the efforts of Kaiser Permanente and others included. By contrast, South Korea has been testing 10,000 people a day for weeks. China has been able to trace tens of thousands of contacts each day. The US has been able to do that for top connected politicians, but only belatedly, and is almost unable to do that anywhere else.

The horse is out of the barn.

The issues with medical insurance aside , there’s still a highly sophisticated medical system in the US

Not that it matters. The logistical capability simply isn’t there. Decades of reduced and stagnant budgets have left public health departments trying to do more with less, from the top down.

And that was despite major outbreaks of other diseases almost every year. Naturally, the US has had ‘other priorities’.

Amen. WHO offered them tests reportedly. US is like a group of countries. it is not to late to improve in uninfected areas with travel restrictions to protect them.

Had an early dinner with Mr. Market and a few friends late Friday. One of us asked him what the heck was going on. He said he really didn’t know as he has been semi-retired for several years and on a vacation at home the past two weeks. He said he hasn’t been doing much business of late and that what we are seeing is just the result of random uncontrolled “noise” from ignorant money.

In my mind the the market target is at least the 2019 low.

you meant to say “safe distance”

yep it is like the GFC…. a lot of fixed buy orders I put in were not filled as some others orders were filled way up into unrealistic prices no one would buy at during the GFC so I was only successful with a few buys and waited it out. A portfolio simulator I ran on different crisis scenarios said it would survive and it did with a large recover bounce one year after but my cheeks turned red when I first saw how much it cratered.

Here on the TSX it now appears more orderly but I am waiting on the sidelines and watching a few stocks.

Some plumbing in the fanatical system has sprung a leak…pun intended.

In normal times I put in a buy order for 500 shares of some bank and it came out as 5000 shares which was unnerving to correct but it did not cost be much except the anxiety at the time.

Just came from reading Garth Turners blog where he says all is good and life will be normal soon. What does he know with his balanced fund strategy typically takes 3.5 years to break even like all of them during the GFC if one checks it out.. I read it for the housing market insights..

https://www.greaterfool.ca/2020/03/13/jungle-juices/

I took “save distance” to be literal: saving one’s money by staying on the sidelines and not getting back in the game.

Garth Turner is a financial advisor and I feel he wrongly told all his readers and clients to hold tight and dont sell this….

No one knoes the future but reading Wolf Zero listening to experts like Gundlach and Shiller, something was up.

I hate arrogant financial advisors.

Advisors can be wrong, and sometimes spectacularly so. It’s in the human nature to screw up, sometimes catastrophically: only pathological liars, braggarts and fanatics never commit mistakes.

But general rule of thumb is to use extra-caution around people peddling books with titles like “Sheeple” and “The Strategy”, and even more so around people who give away their supposed secrets for free or nearly so.

Probably the best financial advisor was Mr. Boggle that founded vanguard. Use sp500 index and total bond index and don’t monkey around with it and you will beat about 80% of investors.

So 90% who follow this Boggle’s investing will beat the other 80%. Got it.

To be fair both Shiller and Gundlach completely predicted this crash within about 6 months of it happening !

Yes they are experts with a great productive track record.

It’s wise men like Wolf who stay away from giving advice and being objectively independent that don’t vs arrogant clowns like Garth Turner that spew arrogance on their blogs all in the probable self promotion of their offerings for profit.

The bounce was not unexpected if one considers the size of repo operation and liquidity injection by the Fed.

When you shorted the market in the beginning of the new year, I thought it was a brilliant trade but personally my guess at the time that it was too early, and I was right.

At current level, I disagree with you that this is a historic market crash. In fact, we are in the middle of a overdue correction. If Hyman Minsky were right, this is not what he would call “the Minsky Moment” like 2008 GFC. My assessment is that the market has not reached the “ponzi stage” of the Minsky model and there are still way to go.

Anyway, I am happy for you that your shorts and subsequent longs have worked well for you. I strongly advise you to reassess the current market situation and think over again.

That wasn’t a injection of liquidity. Nor did it have anything to do with the market “reversal”. It was just shaky traders deciding they wanted to hold into the weekend. This happens all the time.

There is no liquidity crisis. Period. If there was, banks would have traded off assets, but they ignored the Fed repo move and demanded higher interest rates.

I’m relatively young (39), fortunately sold a business in November before all of this chaos began, and have a bit of liquidity for the first time in my life.

I’ve been reading this site for the past few months. I have a bit of money across a few asset classes, but my basic thesis right now is that cash is a pretty good place to be while waiting for the dust to settle and opportunities to emerge. Is this perspective invalidated with the flood of liquidity from the Fed? Seems like cash would inevitably be discounted as a result.

Anyhow, just trying to get a sense for what smart people are doing with the money that they’d like to preserve and–ideally–grow.

Mike,

I sure don’t have all the answers, but have been investing since ’82 and this is the most extreme action I have ever witnessed. – I read tons of investment newsletters and Wolf is at the top of the list.

I’m all in cash until things settle down, and IMO we are in for a wild ride, and believe we will be in a sustained bear market, and the fallout from future business defaults, bankruptcies, mergers, bailouts, unemployment, and unforeseen problems, et, etc, – makes it real real risky to invest, and believe we will enter a recession or crash.

The interventions of the Fed make a “rigged market” and luckily exited all short option positions Thur. after I heard the Fed was going to intervene in a big way and knew the markets would most likely rally today.

I can’t recommend doing options, the learning curve is steep, and takes many years to grasp.

The market was weak way before the coranavirus, but believe this rally will be short lived as we enter a recession, and more downward action, or maybe a epic crash that will be worse than 2008.

Many here are in physical gold, silver, and cash too – read the comments of people like Unamused, and several others, I certainly have gained a lot of knowledge and insights too.

There isn’t a rush to invest in anything – stay in cash, you have made some wise chooses at ’39 – and capital preservation is key to investing – it will be many months before this settles, if ever.

ps – I also read Ray Dalio who runs one of the world’s largest hedge funds.

IMHO he’s over rated – he released the “cash is trash” article only a few weeks before this monumental crash. And ironically it crashed shortly after and his hedge fund isn’t doing very well

I would suggest following Jeremy Siegel, Yardeni, Jeff Gundlach and Robert Shiller. Jim Cramer has also done a much better job at following this event than Ray Dalio, no offence to the poor man ….!

David H,

Yes looking back he did say that, however he has given good commentary about the market and bubbles and crashes.

He did say cash is trash, – I thought he was crazy at the time Jan 2020, – but in Nov 2019 he had a 1.5 billion put on the market.

He said today he can’t believe he missed the move, but he got the 2008 move.

Thanks for the response. I guess patience is probably the best course at this stage.

I do have a bit of gold (physical and ETF) but with the GVZ >37 I am a bit worried that this is going to be subject to the same pullback as the larger market.

For now, sitting in cash and waiting for strong opportunity signals is maybe the best bet.

Appreciate your thoughts. Lots of experienced and smart folks on this site.

I’m in a similar situation (sold my business in August), I’ve been looking for a nice cashflowing business to buy but luckily haven’t found one yet.

You’ll probably be able to pick one up for pennies on the dollar once the dust settles. I am extraordinarily grateful that we cashed out when multiples were ridiculously stupid. It looks like things are going to tighten up quite a bit moving forward.

You “hit the nail on the head” using the word “manipulation.” That’s powerful and can explain many gyrations in heavily traded markets. Add to those “tools” the power of margin clerks to create and fuel downward spirals with the taps of buttons and you have an unmitigated horror show. The damage is unrelenting. The profits realized by a few are stratospheric to say the least. Fasten your seat belts girls and boys, the plane is about to do back loops and front loops!

Wolf- what is your SPX upper and lower range between now and year end?

I think this whole virus saga will peter out in a few months. Trading will probably stabilize after a few drops & rebounds. But I doubt the large correction (50%+) will happen – they won’t allow it.

I hope not but the fed pushing that much into the economy could cause hyperinflation in the cost of living (as it allready is) and that would force most people out of the markets while greatly raising debts(that are already out of control), more business closures, layoffs, causing another collapse and possible reset. If that happend pms will be a great postion to be in, physical holdings…

I think that the “hyperinflation” fear is way off. We haven’t experienced hyperinflation since forever. The fears in the 70s/80s were greatest when the CPI hit about 7%. Volcker jacked-up interest rates (while Congress was railing against him – may have just been theatrics…) and at its height, the FED raised the rates to about 20%. That was short-lived though. The economy sunk very, very fast – borrowing came to a complete standstill, construction projects were halted unfinished, and a deep recession hit. Major developers in Los Angeles went bankrupt. I don’t know about other cities.

Back then, what the FED was doing wasn’t front page news. Few paid attention to the FED until there was inflationary fear and some had nightmares about a true hyperinflation.

If the FED were to raise rates now to stop a serious uptick in inflation, the market would plunge, businesses would dive, banks wouldn’t have takers for loans, and whatever inflation was evident would be shut down pronto.

That’s not to say that the currency isn’t turning into toilet paper. It’s just that the fear of hyperinflation is exaggerated.

The US rate of infections mirror Italy at this point maybe worse for sure NY

here is an American living in Italy under their lockdown rules

p.S. Dr Ho from Columbia who created the antibodies that fight HIV and is currently working on COVID-19 said today that it will be months before any drugs can be developed and used. You are on your own.

Because you believe they are in charge?

Ultimately kind of ‘yes’. Rules can be changed. Fed can start buying stocks. Many different kind of rabbits waiting to be pulled out of the hat I think. See the big guns they pulled for just a 10% drop?

I asked this many times earlier, sadly wolf prevents the post from coming up. What happens when the market fixers themselves fall ill? The pres, vp and all the feds men get the virus.

Anmol,

What happens when decisionmakers get ill?

Well, even if they only get average care…80 pct are likely to not even have to go to the hospital.

That is what the worldwide stats continue to show…and the fatality rates are generally in the 1 pct to 3 pct range (of the hospitalized, not the entire population)

So far, the actual numbers don’t support the wholesale panic that keeps creeping back in.

Most of the major steps taken (national emergency) have been taken to slow the rate of infection (assumed to be high, although multiple other countries seem to have greatly limited hospitalization number growth) in order to make sure that the finite ventilator numbers in US are not overwhelmed by demand spikes from the 5 to 10 pct of the infected who end up needing truly intense medical care.

You mean QE for stocks? Can they do that??

Anmol,

Haven’t you heard? The Stable Genius is the healthiest and most virile man alive on this planet! His doctor says he is already immune to the virus and thus will never need to be tested, ever!

People get minor colds all the time!

Keith McCollough of Hedgeye has a trading rule. When the VIX is above 31, stop buying and relax. They’re smart guys (my “neighbor” here in CT).

Yep agree – “Macro show” Hedgeye subscriber here for a couple of years. Their analysis and trading approaches, even for infrequent traders like me, help take a lot of the angst out of trading. Not to mention help to make money ; works for me. Their 2018 bond call has been awesome and the “risk ranges” were spot on for increasing / reducing my position, but I finally sold my stake after things got wierd in the last couple of weeks. N.B. I also support wolfstreet by clicking on all the ads, but I confess that I never buy anything…

The unfolding stock market crash, the economic slowdown, and the overriding fear has to spread into other markets. Which bubble pops next, housing or corporate debt?

Here in Socal my friends who hold multiple properties think housing in southern California is immune to all things

I have been long a volatility index etf for longer than 6 months so I can say I am grateful for the gyrations. Here’s hoping the gyrations intensify a little bit and that actually fully reflects on the damn thing for a change.

I think the dow will drop 5,000 more points by the end of the year. I think the fed is simply trying to slow it down. Pms will decline until people run for it as a hedge than it will explode in price. Just my opinion. Inflation will push pms to the max, pms will be highly sought after in a year or two.

This “last hour” extreme spike seems to be a regular occurrence in the past two weeks. Algos? It doesn’t feel like human action, although I’ve long given up trying to predict the stock market.

Granted, Trump gave a speech today an hour right before the close, so that could explain the rise today; although from what I heard about the speech, it wasn’t one to inspire confidence.

Seems like it was the first minute and the last 25 minutes of regular trading hours. Like the algos going wild.

Those with the cajones left to trade.

Doesnt matter how much cash you have/the Fed tips in -even trillions – if the price is not right, no-one will buy it.

And the price of US securities debt and equity has been rigged for years.

Equity is purging now, and debt will follow.

Until debt purges expect hi vol and low/no liquidity.

Even the Fed cant hold back markets forever, and the markets time has come.

In general, I think you are on the right track – despite the thousands in pt losses, we are only actually back a couple of years in terms of index price levels – ZIRP has pumped a ton of air into valuation metrics and only about half of that excess has been let out.

https://www.multpl.com/s-p-500-pe-ratio/table/by-year

ZIRP elevated SP 500 PEs to about 25, from a long-term, non-ZIRP norm of about 15.

C19 impact to date has dropped the PE down to about 20.

As the real world earnings hit register in the months to come, the lower multiplier will be applied against lower e(arnings) as well, dropping the price level further.

How much, unknown.

Again I ask, where are the Dow 40,000 folks in all this ?

Trinacria: I fess up , to being a Dow 30k+ parrot . I believe that covid19 was the pin that pricked the bubble.The bubble would eventually pop but but I still believe that the bb on the edge of the razor blade Dow would hang 10 till after the election .

Dr Doom – by “hang 10” do you mean Dow 10,000 – I believe it will happen … unfortunately … but hope I am wrong.

If covid19 didn’t happen dow could be much higher

People like shiller predicting for crash and others could never see predict it I guess

>>where are the Dow 40,000 folks in all this<<

Why wouldn't the Dow hit 40,000? As the currency is devalued, certain asset prices should rise. The goal is to pick the right assets to be in as the devaluation unfolds.

The playbook I'm going by says first there will be a burst of deflation (and a Fed response), then stagflation (and no Fed response or an underwhelming Fed response), and then hyper-inflation. My time line is 3 to 4 years on this playbook.

It will get there eventually, I believe you are correct, but I also believe it will take the scenic route and go below 10,000 first.

I am not so smart. But it looks to me that the Dow rose over 1000 points in the last 20 minutes …or so. And I would bet on thin volume in comparison to sell off volume. The syste is, of course , rigged.

Or Trump made a call to his wall Street buddies so his speech would look good. I’m going to trade when Trump gives his speeches.

I get very amused and laugh as the Bernoulli bands widen like a ballon. Trading on 2-3 sigma moves is better than caffeine.

I do note that market ‘stops’ are only for the downward direction.

If you think equity is crazy, well dont look at credit markets or UST markets LOL

Wolfe:.

Your feeling this time is different is backed up by how savagely the central bankers have hit gold but more importantly gold stocks.

Gold itself is only down 10% but gold stocks are down 40% and more.

Senior gold stocks fell another 10% plus today while the general market recovered 10%. So they are down 40% verses 20% for general market.

This something I don’t think I saw happen in 2007 in such a short period of time. Over time gold stocks nearly died!

I believe this time central bankers targeted both gold and gold miners.

I take it as a sign central bankers are much more desperate this time.

If you really think that the FED was targeting gold and gold miners, you should consider psychotherapy.

HowNow:. In a Fiat system, it is very important that there is no “real” horizon for reference. That is the reason central bankers need to keep gold and silver prices down.

It is just like flying an airplane. For the pilot everything is referenced to the horizon. As soon as a pilot looses sight of where the horizon is, he is in big trouble!

Ask Kobe Byrant what loosing track of the horizon means.

Speculatively true in terms of fiat G incentives…but hard to prove.

The fiat dollar is a very jealous mistress (having been turned out and abused for decades), and it is hard to tell just how far she might go to brook no rival (because she desperately cannot afford to).

But in the end, people only have use for stores of value that actually store…and they won’t stop looking until they find one.

DC’s power exists on ever thinner presumptions, having presumed upon them for so long.

Wes,

Well, in 2007, I dont think the mines were in danger of closing en masse. What happens when miners start testing positive? Plus, the underlying is also dropping? And they are heavily in debt.

Gold stocks went down because everyone took profits there to cover stock losses. Hang in with them. As read earlier here, they are insurance.

“Don’t under estimate the power of the Fed. The inability to generate profit or engineer planes transportation entertainment is insignificant next to the power of QE5.” – Darth Jerome.

Yeah, but look at how that turned out, Darth…btw, you still owe the mortgages on DS 1, 2, 3…

If the markets did not have breakers on them that halts trading, and the PPTs did not exist, the markets WOULD go to hell in a straight line.

And with supposedly 85+% of market trades are done with HFT and algos. I’m glad they are halting gyrating markets.

Not if they are going UP!

Wolf

The same thing happened with the Australian Stock market which is a day ahead of everyone else.

The All Ords started out about 7% down then rallied to close at around 1.6% in the green at the 4 PM close. Funny thing is after the close the All Ords rallied another 3% or more for the next hour. In a nutshell the All Ords rose almost 10% from high to low.

There’s definitely a pattern. Reckon all Central Bankers come up with a strategy in an emergency during a phone hook up and Australia due to its time zone advantage gets to be the first to try it out and the rest follow. Happens all too often.

” The same thing happened with the Australian Stock market which is a day ahead of everyone else.”

Or behind.

On a certain night in Oct 1987 couldn’t sleep, half listening to BBC World News….heard of the the SM crash, woke up real fast and by 8.20AM was on the doorstep of a managed fund office (MLC Centre) where I had a large chunk of cash wealth ‘invested’ (now use the term loosely).

Full withdrawal accepted, Bingo! They didn’t have a ‘wait’ clause. Out in full.

Raced to another fund in Pitt Street (CR) where another chunk of funds were ‘invested’. Ooops! Smarter lawyers, detailed fine print, suck it up.

Scary days, to be repeated now in spades… different scenarios, similar outcomes = Screwed.

Unless, of course….. Oh! if you haven’t figured it out by now, or are really, really smart and can catch a short falling knife, …never mind..

You must feel vindicated in that things certainly do not go to heck in a straight line, but huge zig zaggy ones.

I’m out too but will be back in with both feet after a 50 + percent drop stabilizes.

I can’t help but believe what we are seeing is induced deflation with the latest viral pandemic being the scapegoat. Call me a naysayer on TEOTWAWKI. Corona is a conveniant excuse. We are not all going to die.

There was too much money sloshing around the system. Orchestrated capital destruction is now a monetary policy tool. The punchbowl used to be pulled away with raising interest rates. That’s no longer an option.

You see, Mortimer, if we destroy “money” now, we get to create more “money” later.

Too bad that conspirators get to voice their wacko opinions. Absolute B.S., otishertz. You might be singing a different tune if a few in your family get a bad case of this. If people were less narcissistic, there’d probably a LOT fewer conspiracies floating around.

Yes, you actually “can’t help but believe”. It’s belief; it’s not reality.

Why so angry? It’s only an opinion. I could be wrong.

The aspersions you cast define who you are.

“Orchestrated capital destruction is now a monetary policy tool”

Well, G friendly Keynesians do hate ’em some private savings…interfering as they do with the theorized “optimal” growth path the enlightened G can always seem to envision, but never seem to achieve…

So you kept your SPY? If so are you planning to sell next week? I mean +%9 in one day seems a good win to me considering the situation, no?

No, I sold them short on Dec 30 and I covered them (bought them) on March 12 just before the close. Here is the story on this:

https://wolfstreet.com/2020/03/12/stocks-crashed-i-covered-my-short-positions-spy-qqq-because-nothing-goes-to-heck-in-a-straight-line-out-of-spite-bought-some-crap-for-a-bear-market-bounce/

Yes I have read that article and I assumed that you thought this is the bottom or near the bottom, but then today you sound to be not so sure judging from this article. It seems that you could have waited a little longer to cover your short considering the spread and the effect of the virus just started in the U.S….. I’m asking to learn not criticizing by the way

I outlined the three reasons in the article why I covered the short, and none of them indicated that I saw a market bottom:

1. I’ve had enough.

2. I feared we’d get a violent bounce-back on Friday (and we did)

3. The Fed’s new bazooka, and I wanted to see what it was aimed at.

These bounce-backs are now so violent that I don’t want take out another short. It’s just crazy. I’ve never seen the markets being this volatile day after day.

Again,great short!

These crashes create great buying opportunities.

I did raise some cash at end of Feb. It wasn’t because of the virus issue: the markets were showing quantitative weakness. (Note- if you can’t use quantitative measures that signal opportunities like this, you shouldn’t “trade”.)

In the next 1-6 months, assuming the virus is dealt with properly, there should be at least a several month long bull market (some kind of “mini-bull” at least).

Mid-2021? After another bull run-up-Could be very challenging.

Depends entirely upon the election IMO.

Though I am also thinking the oligarchy that own the world have decided to replace the incumbent pres by allowing and possibly encouraging this crash now, as opposed to after the election.

How soon the SM and commodities ”settle down” will be very interesting to watch, and add some clues to which way the election is to turn out.

Gold and Silver plunged hard again on Friday. “Nothing goes to heck in a straight line.”

Except gold and silver… for some reason. I bought some silver on Wednesday… so please don’t follow my investments, or you’ll be poor.

But “something can go to stupid in a perfectly straight line”. Stop “investing” in precious metals. It’s a manipulated market. May as well play roulette.

Took my late father-in-law’s late wife’s wedding ring into a few jewelry shops. Under a microscope, they identified a crack in the diamond. It was worth zero. The 24K gold ring? About $85. But his receipt for the ring, bought many years earlier, was $1200.

Jewelry isn’t an “investment”. You will inevitably always have to suck up the scrap/melt price.

Buy gold/silver for your children/grandchildren – wealth preservation.

You’ll be poor only if you sell at a large loss (and if you have to sell & that makes you poor maybe you bought for the wrong reasons in the first place?)

In this ‘once in a century event’, in this coming massive depression, the general sell-off will be epic, the liquidation unparalleled, and is only just beginning!

PM’s will take a huge hit and weak hands will be (are already) in capitulation mode. So all is on course, as planned.

China, Russia, India & others, plus CB’s are unlikely to part with their gold (maybe just a little, to encourage the sellers and to buy more). Then, when the streets run blood red with glistening streaks of unwanted gold, will come the denouement.

But will I be alive to see it? And does anyone care?

BTW all this (without the histrionics) was spelled out well over a decade ago by a very smart lady ‘Stoneleigh’ of The Automatic Earth. She’s long gone – to NZ I last heard, but so far her economic predictions have been spot on.

Congrats on your moves on this Wolf, you have been riding the lightning very successfully. I agree with getting out because its getting too crazy. If you look at your up-day v.s. down-day graph at the top of this post one scary thing becomes clear: the magnitude of both the ups and the downs are increasing with time …

Along those lines a bunch of large players bought VIX calls with a strike at 100 (something like 22,600 of them!) and an expiry at Friday next week. If these hedges or bets prove right then next week will be like nothing ever seen before in any financial market ever.

Out of curiosity, which “piece of crap” shot up 70% by close on Fri, because that definitely is eye-catching and brow furrowing.

Hi Wolf,

Comfort zones are important.

I’m a glass-half-full person. FWIW, still have NG shorts and Puts started around 2.20.

Have seen VIX blow up (not) like this a few times in past 40+ years. I was ready this time and have multiple strikes P and C. Bot in FEB APR25&30C at 14, to name a couple :) Bot multiple strike Ps when it hit 70 on Thursday :)

Not investment advice, just have the casino on the laptop because I have seen what happens when volatility is volatile. Parlay from VIX C positions opened in Feb fully funding the thesis.

Next week/month is going to be fun.

I’m a glass-half-full person

The glass is neither half-full nor half-empty. It is the wrong size.

This isn’t investing, it’s betting on how it’s going to be manipulated. I tied and pruned vines yesterday. That’s investing.

The road to hell is paved with unbought stuffed dogs. Not my fault.

Here’s a tip for everybody: Bold Enforcer in the fourth at Belmont.

TOO funny,,, and actually very amused!! Your best yet IMHO. Please keep up the good work.

So, since we all have had the ”wrong size glass,” I guess we should all immediately order one of Wolf’s mugs, ”believing” that the mug will be the right size glass going forward, eh?

Un – I’m not arguing, however…

glass-half-full = you can make money when stocks go down. Size is irrelevant. 60% is 60% in a $30 trade, $3,000 trade or $300,000 trade.

40+ years = seeing VIX rip to 40 only a few times then it goes back down. Look at any 30 year VIX chart. Beyond 35 to 70 is mind boggling. Delta of Delta and Theta are my friends here. Roller coasters and whipsaws come to mind. I have been waiting for this a long time and already beat last year, entirely, in three and a half weeks (and this doesn’t include taking STNG from 39 buying back at 25, that 6 million share finance overhang came into play;)

not investing = clearly stated “Not investment advice” and reference to casino. I apply no moral filters to trades.

Right now every horse in the race would test positive for Lasix. Bet accordingly.

Now, I’ll finish my eggs and go back to making Feynman diagram mobiles.

The 1918 flu was a symptom of WWI;

it killed-off 3 % of humanity,

5 times more than the war itself.

The 2009 flu was a symptom of

the Global Financial Crisis; 12 K died.

The 2019 flu is a symptom of the trade war;

5+ K have died so far.

// Boeing execs used share buybacks to

// extract 43 billion $ from the company.

//

// They know Boeing is “too big to fail”;

// so it’s: heads they win, tails we lose.

Q. How does one treat the flu ?

A. Painkillers like:

> > > heroin, religion, negative interest rates

> > > and negative risk premiums.

People lose their job and go insane.

People go insane and lose their job.

Hence:

– Heroin, Religion.

– Negative interest rates.

– Negative risk premiums.

It’s called TRADING. A cousin of gambling. A brother of exciting. It’s either in your blood or not.

I agree.

“You can either eat well or sleep well…not both”

No need to worry. The prez fixed it

“Staying out of this market”

Its a good strategy until the FED hit the print button. I had rotated to cash in early Feb and increased my bond holdings. The only stock I kept was a pipeline stock that got crushed, but eh I’ll just hold it, im not even remotely worried. I used about all half my cash to buy suncor shares at 15 YEARS LOW. Keeping half as a war chest.

Wolf, are you comfortable with large cash balances in bank accounts?

I mean not today or tomorrow, but intermediate term.

I am not. Currency will be printed in even more bizarre quantities.

Besides, bail-ins could happen and/or devastating inflation at some point.

Being comfy in cash is not warranted in my opinion. In the end, nothing will be spared.

Honestly asking because I am money stupid.

What would be a better position to be in? Holding assets that could tumble even further seems equally scary, especially when this economy takes a hard fall.

tumble against what is the question.

we like to value everything in currency, but that’s proven to lose purchasing power. with negative real interest at an ever higher speed. and i am not even talking about a likely pickup in inflation at some point.

currency is not a store of value. a simple thought experiment reveals the intuitive knowledge about this fact:

if you had to put your cash balances in a box and would not be allowed to touch it for two decades, would you put paper bills or PMs in there?

Andre,

I think you’re raising two points (if I understood you correctly): 1. The shitty income generated by bank deposits. 2. The safety of bank deposits. So let me address both of them.

I’m not “comfortable” with earning 0.02% at the bank when inflation is 3.0%. You’re right, it’s a rip-off. Many banks offer higher yields, but they’re still low. T-bill yields are also low. Right now, cash just doesn’t earn much, and earns a lot less than consumer price inflation. But that’s what it is.

The other option is putting your money into riskier assets. So you want to get the 10.7% dividend yield that Ford offers on its stock. You buy the shares to earn that yield, and three weeks later, Ford cuts or eliminates the dividend, and your yield is gone, and the shares plunge by 25%. If you invest in an investment-grade bond portfolio, you might get 2.5% or 3%, depending on how much higher-risk stuff is hidden in it. If you invest in an index fund, your investment might plunge 20% or 50%. These are among the choices and possible outcomes you have to struggle with. And that’s why there are no simple answers.

In terms of safety of your bank deposits, in the US, I’m not worried about deposits that adhere to FDIC limits and rules. The FDIC is part of the US government, and the US government is backed by the Fed’s printing press.