The WTF stock chart of the year. And another WTF chart of just how tiny Tesla is compared to the top 10 automakers.

By Wolf Richter for WOLF STREET.

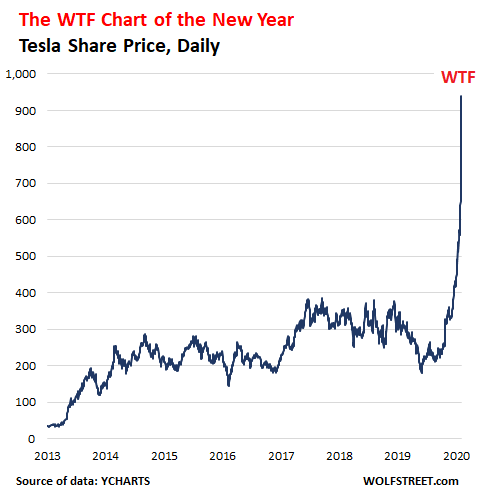

Tesla’s shares spiked another 20% this morning, or by $160, to $940 a share. Every time I write a few words, I have to go back and change the number again, because the price just keeps shooting higher. So far this year, TSLA has shot up 120%.

It could very well be that by this evening, shares are down by $300 or whatever, or that they’re at $1,100. They’re floating up high in the outer space or irrationality, and can go anywhere. So this the WTF chart of the new year with Tesla’s share price frozen at 9:51 AM Eastern Time (stock price data via YCHARTS):

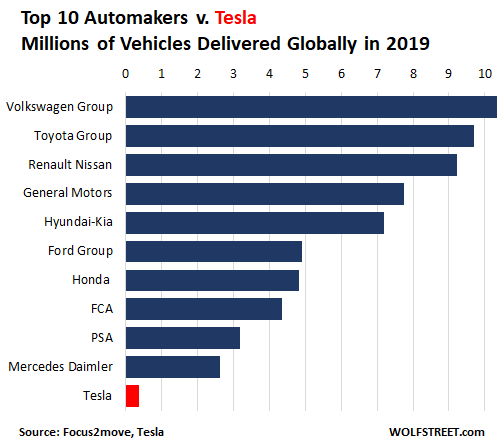

A tiny automaker among giants.

The market capitalization of the company at that price was $165 billion, far ahead of the second most valued automaker in the world, Volkswagen, but still behind number one, Toyota. But in terms of the size of the company, measured by vehicles delivered, Tesla is a flyspeck.

Tesla delivered just 367,500 vehicles globally in 2019. Volkswagen delivered 10.34 million vehicles globally, according to Focus2move. That’s 28 times as many as Tesla. Toyota delivered 9.70 million vehicles. That’s 26 times as many. General Motors delivered 21 times as many. Ford delivered 13 times as many. The smallest of the top 10 automakers, Mercedes Daimler, delivered 2.62 million vehicles, or 7 times as many as Tesla. I colored Tesla’s bar in red so you can locate it without having to resort to your magnifying glass:

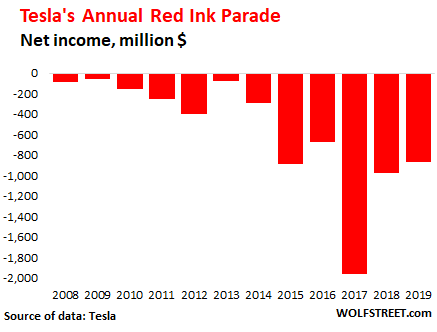

Tesla’s Annual Red-Ink Parade.

And Tesla isn’t a high-growth miracle tech company or data company or whatever. It’s an automaker in a stagnating industry. Tesla’s total revenues inched up only 2.2% in 2019 compared to 2018, and its automotive revenues edged up only 0.7% in 2019.

To top it off, Tesla reported a net loss of $862 million for the year 2019, despite selling $594 million in “regulatory credits.” These are tax credits that Tesla obtains from the US government and governments of other countries for building EVs. Tesla loses money every year and cannot use those credits, so it sells them to other automakers that are making money.

Tesla lost money every single year ever since it started disclosing its financials, from 2008 through 2019:

But I give Tesla massive credit for having put EVs on the map.

EVs have been around since the 1800s, competing with steam-powered vehicles. GM made an EV in the 1990s, its EV1, long before Tesla even existed. But there was no demand for EVs at the time, in part because battery-cell technology wasn’t up to the job (Tesla doesn’t own the battery-cell technology either, but buys it from Panasonic and now from Chinese battery-cell makers). And GM eventually threw in the towel. Here is GM’s EV1 from 25 years ago:

Tesla accomplished a big thing – putting EVs on the map and making them cool. And it spent many billions of investor cash to do it.

But the stock price is just nuts. But wait… just because it’s nuts doesn’t mean it cannot get even nuttier. Once something is totally irrational, there is by definition no rational limit to how much more irrational it might get.

I have been on record for years cautioning people to not short Tesla, no matter how fundamentally rational that idea might seem.

Short sellers are up against huge institutional investors that are stuck in the shares and cannot sell the shares without crashing the shares, and they don’t want to see the share price decline, and every time shares drop enough, they can jump in and buy more to turn them around.

There is little public float of the shares, and given the reality of Tesla’s business and financial performance and share price, it is one of the most shorted stocks out there. And these folks panic when shares rise, and when they panic, they have to buy back the shares that they sold short, this panic buying helps fuel these spikes in share prices.

So the jury is still out on whether $940 a share this morning was the moment of peak-insanity, or if there is an even higher peak-insanity coming. Meanwhile, I’m in awe of how Tesla has turned into a Supernatural Phenomenon.

OK, let’s look at the Tesla magic briefly. Read… Tesla’s Revenues +2%, Auto Revenue +0.7%. Net Income Plunges 25%. Without “Regulatory Credits,” it Would Have Lost $28 Million. Annual Loss Hits $862 Million. Shares Spike 12%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What do you think of Ron barrons comments ?

As for the chart of auto sales. It shows the potential of Tesla to dominate that market in 10-20 years.

Looking at the “Tesla’s Red-Ink Parade” chart, 20 years seems a stretch. At some point, the company has to make money or else it won’t be around.

Maybe Musk is banking on a GM type bankruptcy.

Stockholders get wiped out. Bondholders take huge haircuts and a favored political group gets ownership. Along with billions more of taxpayer bailout money.

They’re not GM and the economy’s not in shambles. There would be no appetite from either side of the political spectrum for a taxpayer-funded bailout.

“…favored political group…” = UAW union, which, along with their weapons-grade timid management, is what got them into trouble to begin with

And GM’s bankruptcy happened with Obama in the White House. The only way Elon Musk will get any favorable treatment is if Nancy Pelosi becomes President. The chance of that happening is slim to none.

Remember the old Far Side cartoon where a cow stands up and says “This is grass! This is GRASS we’re eating!”

At some point, that’ll happen to Tesla, and the stampede will be epic. The question is: when does the grass moment hit?

It’s not the grass. It’s what is coming out the other end of that cow that characterises Tesla’s performance

Tesla had around a trading volume of 50 billion dollars today at the stock exchange. Apple hat around 10 billion. Volkswagen had 200 million $ (in Xetra Germany) and the giant food maker Nestle 400 million $ (Swiss stock exchange), meaning that Nestle takes around 100 trading days to get this huge trading volume of Tesla today. Absurd…. sick.

Tesla is irrational and the high stock price will collapse. I assume that most short covering has happened over the last two days; therefore the huge volume. Put options are expensive because of the extreme volatility; most private investors cannot short the stock.

Rational investors wait for much lower stoce prices before buying again.

I wonder if there are not *some* tools out there that could at least provide a hint (buy order size distribution for instance) that could at least provide a few clues as to the type of investors (beyond, foolish) that are pushing Tesla up.

It could be the SF tech cash out crowd – sizable but smaller order sizes.

WeWork type backers funding the next idiocy (also including not so brilliant ME money looking to hedge oil long term) – much larger order sizes.

Retail momentum jumpers – smallest order size.

I estimate that the annual WORLD WIDE luxury auto sales by brand in 2019 is the following

Mercedes-2.34m

BMW-2.17m

AUDI-1.85m

LEXUS-.76

VOLVO-.71

JAGUAR-.39

TESLA-.37

CADILLAC-.36

PORSCHE-.28

ACCURA-.15

LINCOLN-.11

TOTAL=~9.49m

Let’s play around with these numbers a little.

Suppose TESLA displaced all the other car manufacturers and had an average sales price of $50,000

This would mean annual sales of

474 billion. Assuming an after tax profit margin of %10 , that would translate into an profits of 47.4 b

Putting an 10 p/e on this number means a market cap 474 b

Of course the assumption of displacing all of the other car manufacturers is patently absurd, but I just wanted to show that MR Barons statement of 1 trilllion was ridiculous.

Let’s assume that in 5 years TESLA achieves a %33 market share.Using a selling price of $50,000 means total revenues of $158b and an after tax profit of 15.8b. Placing a p/e of 10 on this number means a market cap of 158b.

I ,among almost ,other observers think that TSLA has zero chance of achieving a 33% market share in 5 years. And to produce that many batteries creates other huge problem.

My current question is with TSLA ‘s stock price soaring , when will they replace their huge production tent in Fremont?

Total=

Mercedes sells trucks and is very big in vans. Smart is not luxury and maybe not even the A class.

BMW has Mini (and the 1 series)

But the other brands sell plenty of cars above $50k

A profit margin of 20% for a luxury brand is what BMW has as target IIRC and i think a margin of 30% is something than can be expected to be possible in late stage ICE to EV era. Also the American stock market is so overvalued that a 20 p/e is conservative. 20% margin 20 p/e is with annual sales of luxury cars of around $500Bn and 33% market share $660Bn stock value. or 1 Tn with 30% margin, 20 p/e and 33% market share.

Or differently average sales price $50k, 2 million cars, margin 30%, 20 p/e = $600Bn

I have a problem with the American stock market and its p/e ratio that is too high. TSLA is fair priced if you look at the rest of the market

Yes if they can continue to lose billions per year for another 20 years this would be the most successful company ever (if you apply today’s measure of success).

Porsche has it all wrong with the Taycan. It’s a far superior vehicle to Tesla, so that’s where they start to go wrong.

But their biggest folly is they will try to make a profit on each Taycan they sell – because they are working off the old paradigm where profits were sexy.

Taycan is doomed.

Elon is a genius, or as some might suggest an anti-genius

New paradigm. Profits are obsolete. Liquid capital is a liability. The goal is to achieve the highest investor funds burn rate. Like a hybrid hot potato twisted game of chicken. Everyone staring at each other passing the bag around. No one wants cash. Fed prints, banks distribute, companies dispose of or burn it. The shadow players earning the skim.

An Economic engine powered by Critical Mass Ignorance now seems able to finally achieve Financial Escape Velocity. Allowing some to leave behind the surly bounds of Earth and touch the face of the monetary cosmos.

No wonder the Nobel family is really pissed about that non-existent “Nobel Prize in Economics”……it’s just not a science.

Bravo, sir.

Not a Tesla Fan stock wise but if you want to buy the best EV then Tesla it is.

I don’t understand, why other Car makers have not yet joined this so far with good force.

Kia and Hyundai makes good EV but they cost as much Model 3 and who is gonna buy them.

“I don’t understand, why other Car makers have not yet joined this so far with good force.”

It’s not easy for companies as huge a car manufacturers to turn on a dime. There are many internal politics and in-fighting; the old guards want to keep their conquered realms. To transition to EV, it implies new ways of doing things, new skills, new tech, new mindset. This means many people feel threatened by this change. EV is a lot about software — that’s the secret sauce. And gawd knows hardware makers, especially car manufacturers, suck at writing software. Finally, other car manufacturers, unlike Tesla, still need to make money so that’ll slow them down.

IMO, it’s gonna take five years before we see one true competitor to Tesla, and another five for the rest of the industry to get there.

Profits, selling an EV wont show a profit for the next decade if you are not using Boeing accounting, but selling an ICE in 8 years will be virtual impossible in the First World.

Time, designing, testing and creating the production line for a car takes time. VW went full in after the Diesel scandal and they are only now coming out with electrics. And they had started out before theDiesel scandal.

Osborne effect. saying that you will come out with an full electric in 2 years may negatively influence your sales now.

Porsche makes a loss on every Taycan, just as every Tesla is sold with a loss. But the variable costs are much lower than the sales price. Just as with Tesla. Problem with the car industry (as with the airplane industry) is that it takes years, even decades to return the investment.

Now Tesla is off 20% and a bunch of analysts are making fools of themselves by trying to predict next week’s price. Typically they are splitting the difference and pretending this is a result of studying charts or casting bones or shells or maybe taro cards. ‘It was 600, it went to 900 and I’m calling for a 700 bottom followed by a head and shoulders haircut, followed by a technical breakout if 800 is breached or a retrenching if…. ‘

Bla bla. The day after the 23% one day crash in 87, Lou Rukeyser turned to head tech Bob Nurock and said: ‘So do still believe in this stuff?’

Needless to say Nurock had given no hint of the crash and needless to say he declined to throw in the towel on his reason for being on TV.

I think the robin hood Ponzi might be robbed soon.

FT: Saudi Arabia slashes exposure to Tesla via hedging deal

Move comes months after chief Elon Musk settled fraud charge over buyout claim

https://www.ft.com/content/d501c670-2307-11e9-b329-c7e6ceb5ffdf

Amazing short squeeze. The rubes that shorted when everything financial was going to kill them get killed. Their problem is looking at fundamentals like any backward walking jackass does. It is a new age I tell you!

Erle gets it.

This wasn’t a short squeeze; the short interest was too low to be the catalyst for this move. Most if not all of the shorts had been flushed out hundreds of dollars ago.

TSLA has been squeezed. Armchair stock analysts can not see it.

I can not fall asleep in my Chevy while driving without wrecking. Build a safer car and people will wait in line to buy it.

Tesla did file a battery patent though right? https://www.forbes.com/sites/arielcohen/2020/12/30/teslas-new-lithium-ion-patent-brings-company-closer-to-promised-1-million-mile-battery/#63a3b37033e3

The key to ALL rechargeable battery life is depth of discharge, and avoiding high rates of discharge, and , of course, excess heat. By never going below 70% of full charge, and avoiding drawing high amperage, I made 2 6 volt (giving me a 12 V lighting system) golf cart lead acid batteries last 10 years, and they were still working great when I sold the home. Their usual lifetime was given as 2-4 years, or 2-300 full discharges. It applies to ALL batteries, and varies by type.

And incidentally battery “memory” is a myth from (naturally) battery manufacturers, based on one scientific experiment where they tried to achieve it….for no reason, just pure science at work.

Finally the REAL key to making EVs work is braking energy recovery. We have full throttle by wire with a strong throttle spring as a default (limp-home mode) and yes the Toyota software glitch did kill people.

But what is the default for full brake by wire? Or steer by wire, for you self driving car fans.

It won’t end well, that kind of chart never does! The only question is when did Musk develop that Tesla share anti-gravity device. Looks a bit like the 2017 Bitcoin chart.

Thanks for explaining; the size and fear of institutional investors in the Tesla game.

You know, it is easy to feel like you are being left behind, and that others are in sync and you are not, (that I am not). Regardless, one has to stick with what one knows and feels comfortable with. I don’t feel comfortable with much about this new economy. I still believe it is a tottering house of cards and a complete mess.

What did Thoreau say? “If a man does not keep pace with his companions, perhaps it is because he hears a different drummer. Let him step to the music which he hears, however measured or far away.”

Not only is the Tesla model unsound, (excuse the double entendre), I still go by 2.1% addition to the deficit for a 1.9% GDP growth rate, and the GDP nonsense is all FIRE.

Thank you Paulo for the quote from Thoreau …most appropriate. I had never heard that one, but will need to remember.

just remembered, I always say that when a graph looks like the left side of the Eiffel Tower, at some point we will see the right side of the Eiffel Tower. Enjoy while it lasts.

I saw an interesting chart today that overlaid TSLA with Bitcoin’s rise in 2017 and their trajectories over the first six months of the chart are neck and neck…

And even the South Sea Bubble, in which Isaac Newton lost his shirt. (He initially did well, cashed out, then got back in … FOMO, early 17th Century).

Having lived through such madness in 1999 and 2007, I never thought we’d be doing this all over again a little more than a decade later. Thanks Fed!

This is just nuts isn’t it? Does it end the same way? Can the FED do this a 4th time? A friend bought TESLA back at $400 and I thought he was nuts. He said it’s going to $1,000……and looks like he’s right. BTW this guy has no clue about the company whatsoever, never heard of carbon credits and didn’t know TESLA has never made a profit…….and doesn’t care.

He’s the smart one and i’m the fool.

When a 20 dollar stock sells for 1000, you don’t have to know anything about it, just as you don’t have to know the fancy plays on roulette to place a bet. Just play red or black, and hope for a good outcome.

The price action on TSLA is like a recurring penny stock pump n dump.

I believe Wolf would disagree with your contention of Tesla being a $20 stock selling for $1000. Wolf’s reply to a reader comment above would imply that your number is $20 too high.

i would suggest the realization that it just might be a good time to take some profit would be a good thing to know about the stock. i tend to be fiscally conservative, so take MHO for what it’s worth, or isn’t…

But that’s the problem–no rational allocation of resources whatsoever, just gambling on a wheel of fortune. Capitalism works when people are making money making things. It’s a fiasco in the making when it’s an exercise in using money to make money (and “hypothicated” debt money to boot).

Know someone exactly like that…the more I see this stock up, the more I loss faith in humanity as a whole…

Really starting to feel like that episode of twilight zone, when you wake up and everyone else looks like pigs and they freak out you look normal.

Yes, you/we may be fools over the short term, but their bubbles will eventually burst. However, they will keep printing money and pumping it into the stock market and making $$$ until it no longer works. If you know when that will happen, please let me know…

For this 1 success, that kind of investing has 99 failures – yet the irrational, likely “doomed” success gets all the attention.

Even among rational investors, there seems to be a lot of short-termist envy – I think of the 99 other implosions of idiot companies and don’t really pay that much attention to Tesla – knowing that in all likelihood the foolishness is going to flame out – but I have no interest in trying to time it or gnawing my innards every day it does not happen.

Everyone knows guys like your friend. It’s the type who shout on rooftops that they have a position in cryptocurrency during the hype. Then, when the market came down crashing, we never hear about that again. It’s an unfair debate — you only hear about their wins but never aboug the losses. You only hear them when they are right, never when they are wrong. At the end of the day, it’s all about the stock price, not about fundamentals. If the sky is grey but everybody else agree it’s blue — you are the one in the wrong. And this is the fundamental aspect that feeds the market folly.

The first lie they tell you about the stock market is that it is rational.

Go to any large casino and talk to the winners coming out the front door. You know the guys, an expensive hooker on their arm and a newly purchased Rolex on their wrist. He just won a lot of money. If you look at his business model, you might assume that heavy gambling is the path to success. If you go to the side doors, you will see the losers slinking away, headed to their beater cars with the child seats. They just lost the rent money and now have to explain it to their wives. Is the first guy smart?

We oil demand falling and gasoline heading back to less than $2/gallon the economics for an EV just don’t make sense to me.

It makes sense from a defense point of view.Oil is imported, electricity does not have to be. Besides tax is the biggest part of the gas price in most first world countries so the barrel price of oil is not that important in the economics of electric vehicles.

Yes America has plenty of coal to power EVs.

Meanie.

Or gas, wind, sun, uranium and even hydro and bio power. Or use less electricity for other things by being more efficient.

Other countries may not have the gas, hydro or coal but solar, wind, efficiency and uranium is something they all can have

ps. buying uranium for the next 50 years is for a small country do-able, oil not

or use less electricity by, well, using less electricity. cut back rather than pray for efficiency to come from somewhere, anywhere, riding on a splendid unicorn to save the day.

i have no faith in the people making the decisions about how the predicament we are facing will be dealt with. exception: i do have faith that the decision makers will profit from humanity’s collective loss. so it goes.

The USA currently produces enough oil to not need to import it all it. Is only transporting prices that keep the USA importing petrol.

I doubt most people buying Teslas even worry about the price of oil; they’re buying for the “cool” factor.

Painful as it is to admit, 0 to any-speed-less-than-100, a $58K Tesla S eats my $80k BMW’s lunch. Not that I would ever drag-race at stop-light or anything like that…

Tesla is clearly the winner in the insane asylum that is the stock market but to have its shares soaring when the largest auto market in the world is SHUT is beyond crazy.

February 9 is when China is expected to end the extended Lunar New Year ‘holiday’ but there is no reason to assume that next Monday will be any different than yesterday save the number of cases and deaths from nCoV will be both larger and more widespread.

I would suggest the investor class turn off their Bloomberg terminals and spend an hour or so watching the video coming out of China on #coronavirus to reacquaint themselves with reality.

You assume reality has anything to do with these markets.

I read him say that the markets should reacquaint themselves with reality.

Who got liquidated?

Is this another reason for a massive REPO?

Will Tesla pay back all those subsidies and tax credits?

There will be a story tomorrow about what short got slaughtered.

It’s so funny how bearish you’ve been all these years and so wrong.

You could have been much richer, grown your site much larger, and gotten more respect if you weren’t always doom and gloom.

Derek,

Yes, I missed out on many goodies, such cryptos. Ripple, which was going to replace the US dollars or whatever, soared by many multiples. Then one day (Jan 4, 2018) it was over, and it collapsed. It’s now down 93% from that peak. I have seen this crap time after time. I don’t feel the urge to participate in every hype and scam.

And folks like you will reply after the fiasco like Ripple, “Yeah, but that’s different. Ripple isn’t Tesla. Tesla is going to $7,000 and stay there.”

And my site is doing just fine. Thank you for worrying about it. Had another record year in 2019.

Agree with that sentiment SO much: started ”investing” in the stock market ( with help from someone who made their living trading ) in the mid 50s, and, after the first couple decades realized I had actually made money only when I had what is now called ”insider” information, never mind any and all publicly available info, including ”trends”, fundamentals, etc…

But, still learning a lot, and appreciate this site, your analyses, and the many commentors who appear well informed.

Fully agree wrt trends, fundamentals! I tried to develop an automated Forex trader based on indicators – which only lag minutes – and I came to conclusion that is a losing game in principle. Talk about fundamentals. Ended up developing an algorithm to detect the pivots in real time, and get in. Kind of “shoot first, think later”. This has a chance to work.

I am curious what you make of Ripple now, as they have been around long enough to prove their business idea. See any light at the end of their tunnel or is it all black hole all the way down?

Ripple? LOL

Dogecoin is where its at man.

Nah. Ripple was only 10-12%……Night Train delivered the goods!

Wolf – you could also have bought lottery tickets.

Because like lotto tickets, there is no logic behind trying to identify which of these companies is going to defy gravity and see the share price hit the roof, when they all lose billions.

Better still, go to Vegas (don’t go to Macau because the casinos are now officially closed) and put a million bucks on red.

Don’t you just love how stupid people without a clue, throw their money into the next craze, and mock everyone if their one bet goes right (but won’t say a peep when they lose it all)

Such people need to google Dunning Krueger – they are suffering from this

Wolf,

An interesting post might be made out of the Top 5/10 high profile flameouts of the last year/decade.

Showing people just how much and how fast valuations can fall (frequently) with pre/post numbers might tamp down some of the wackadoodle short-termism I see among a lot of posters (mkts up or down).

It is like a big chunk of the investor class is walking around with CNBC pumped directly into their head and day trading into their soul.

And you can smell the FOMO coming off them – even on a site dedicated to exposing the widespread BS of the mkts.

Ripple? You can only buy that in a ghetto liquor store. You can only buy it if you are drunk.

For what it’s worth, I respect Wolf infinitely more than I respect you, given the comment you just made.

i couldn’t have said it any better. tip o’ the hat to you Z!

People said something similar to Michael Burry. Remember him? Probably not.

And I don’t think making this site just another of thousands of ignorance-is-bliss market cheerleader sites would get you “much richer”. lol

So, you’re a Tesla billionaire or may be a bitcoin millionaire? What are you doing coming here then and wasting your time on such a pointlessly bearish site that obviously don’t hold the same wisdom as you do.

But since you are here, what is your prognostication on the next big thing that’ll go exponential or parabolic. It’s ok, I can understand if you don’t want to share, after all, why would you share the secrets to your success… right?

The market cap is $165B.

Last year’s sales were 367,500 vehicles.

$165,000,000,000 / 367,500 = a market value of $448,979.59 per vehicle sold last year.

Round it to $450K.

Per sale.

And, they aren’t making a profit on that sale, but a loss.

The loss per sale is $862M/ 367,500. $862,000,000 / 367,500 = $2,345.57.

Round it to $2,350.

Per sale.

And this is after they sold $594M in “green credits” from various governments – $1616 per car.

Hmmm, how many synonyms for “irrational” can I remember without cracking open a thesaurus … ?

Between this and the Iowa caucus results still not being tallied by noon on the following day, we may be near peak absurdity in the USA.

Any precedent for such exponential rise in particular companies – stocks in 1999-2000, Nifty Fifty or 1929 where it didn’t crash?

Maybe the take down will be like Madoff’s accounts: the long holders will only sell Tesla stock to raise money when the rest of the market crashes first.

Ensign Nemo, I don’t know what is wrong with me but I found your post to be uproariously funny. Numbers have always held a fascination for me. That proves that I am unstable.

We are at the point where anyone who can think quantitatively and knows how to type numbers into a calculator (or use one on a computer) has a huge advantage over the average investor.

It’s trivially easy to figure this stuff out – type one number, hit the ‘/’ key on the calculator, type a second number, hit ‘enter’.

You just need to have an ounce of intellectual rigor and a bit of curiosity to realize that things are going crazy.

How can the people who program algos for high frequency trading omit the simplest possible financial calculations, such as this?

It’s akin to reading about the 737 MAX crashes and finding out that the Boeing software engineers didn’t even bother to use *both* angle of attack sensors, and then compare the two of them to see if both gave about the same angle. They were intellectually lazy and used just one, so if it malfunctioned the entire plane would suddenly go in the wrong direction.

Massive equity sale to remove debt risk? Leads to solid financials for next few years.

If institutions are buying here why not buy newly issued equity?

An interesting documentary: GM’s 1990s roll out of their electric cars titled “who killed the electric car?“ Obviously, the big 3 automakers were uninterested in promoting electric vehicles. GM refused to sell their cars; they leased them. When leasees sued to take possession of their electric vehicle they lost in court. GM then crushed all of the cars except a few for their auto museum.

Missing from the documentary is the part where all of those early EV cars were given a variance to skip going through the NTSB’s crash safety tests. I’d guess the people that had the EVs also signed away some rights to sue in the event of an accident. Part of that variance was that the cars would have to be returned.

They are specing and playing the future card together.

What if the temp rises another half point.Will they have to

ban carbon cars and who would be in best position to benefit.

Smart folks see $32 Billion in market leading revenue this year from Tesla, up from $11 billion in revenue in 2017. Phenomenal growth in 3 years. They are not swayed by the cherry picked y/y 2% revenue growth data point.

The executives at Porsche, Daimler, Lexus and BMW know what is happening to them.

Anyway, i see the Tesla headline everywhere (Bloomberg, CNBC, Yahoo Finance) . Powerful click bait.

Coronoa virus will have to take a backseat for a while.

akiddy111,

“Phenomenal growth in 3 years.”

Utter nonsense. Revenue growth in 2019 = 2%; automotive revenue growth in 2019 = 0.7% (all of them below the rate of inflation).

One pro analyst a Cathy something is calling T grossly undervalued and calling for 7000 by 2024.

With the Dow up 400+ so far in the face of a likely 4% (or 0 %) growth in China…who needs reality.

It’s hard to figure out what the fans think T has that the others don’t. Only one I can see is early start and we know how many times the early adapter is overtaken or disappears.

All the talk about battery research hasn’t moved the needle. If someone DOES make a real breakthrough and it isn’t Tesla, T is toast.

Battery research is bad for Tesla. Their strong point is making very cheap standard lithium batteries. If a real breakthrough (another chemistry or so) would be commercialized they would be toast

Today’s +20% Wall Street spike (Feb 4, 2020) is obviously the US shorts panicking and covering their crippling positions, after Panasonic Japan overnight said its Tesla battery operation was (finally) profitable. Tesla is now on the cusp of being a major, global, profitable, mainstream carmaker, autonomous vehicle leader, and big-data tech giant.

Tesla’s path to becoming the world’s first $1 trillion carmaker by 2025-2030 is still on track.

US grid can barely support current (pun intended) demands. Let’s add in 1MM EV’s and see what happens. Also, I saw today a headline about a new coal plant opening in Japan.

Tesla > Einstein,

ALL electric utilities love EVs. In the US, the problem that electric utilities have is the long-term stagnation of electricity sales, and the continued increase in capacity and capital expenditures:

https://wolfstreet.com/2020/01/15/us-demand-for-electricity-declined-in-2019-stagnated-for-a-decade-but-2020-capacity-additions-are-wild/

Utilities have been hoping for years that the mass-arrival of EVs would boost electricity sales in the residential segment, as EV owners would begin utilizing the enormous and costly “idle capacity” of the grid and power generation in the middle of the night to charge up their EVs in their garages.

EVs are going to solve a huge problem for utilities: reducing this enormous and costly idle capacity at night. But this hoped-for growth in revenues from the arrival of EVs, and the increased capacity utilization at night they’d bring, has been, for utilities, frustratingly slow in coming.

I final understood what people*) meant when the say big data tech giant. Tesla is going to be a middle man refueling their cars. There would be serious money in that.

But this will leave the utilities short as this will lead to even more wind/solar competition to their old plants

*) some people, for most it is just buzz word jargon

Should be pumping water uphill. Proximity of the Mojave to the Sierras is just begging for it. AZ, CO, and NM have good spots, too. Battery banks for utilities are absurd. Maybe making Hydrogen when the tech is right.

California has some of those installations from the 1970s, and they’re still in use. But they’re very inefficient by nature.

Or perhaps there are people desperate for a non-fossel-fuel-guzzling lifestyle, who have had no alternative until now.

Auto culture, even electric auto culture is not sustainable. (My opinion, yours might vary.)

I’m living a minimal fossil fuel lifestyle right now, and have been for ~20 years. It’s a big part of my “retire early” plan.

Move to a human scaled neighborhood and buy a bicycle. Works fine most of the time. (Caveat – I live in a metro area with a somewhat working public transit system.)

Occasionally I rent a U-Haul to move stuff, or a car for vacations. My last Enterprise rental was a Subaru Outback for one week at ~$217. Unlimited mileage. The only reason I keep my 22 year old truck is for the insurance.

Here is a local woman, embarking on that alternative path right now:

https://bikeportland.org/2019/12/17/introducing-our-new-column-becky-jos-carfree-life-308695

Thank you for your concerns and effort, Brian. We are doing what we can where we are, and I am well aware that nothing is sustainable, including me.

If you want any insight into Musk’s thoughts, there is an old Rolling Stone interview with him that is quite startling. I’m sure it is still available. It’s fundamental to why he has some of his following. Another is his success with SpaceX.

Cramer did say “this is the end of fossil fuel, fossil fuel is tobacco.” Tesla doesn’t have a monopoly on the EV, or a good moat. The crash in the oil sector is going to result in higher fuel prices, not lower. The new head of IMF is predicting much higher global electricity costs.

World coal consumption has been rising. Renewables can not keep up with demand as China and India want more.

Tesla has a fanatic following, thusI did not sell it short.

Bitcoin does not make sense to me as there may be a zillion ways to make block chain currency. Bitcoin has more than doubled off its low. It is a method of payment preferred by pirates.

I remember the dot com mania. Valuations were in the stratosphere. Toys R Us bought toys.com. Both went out of business. Store fronts might be turned into multifamily housing same as during the 2006 real estate bubble. A town can only support a limited number of restaurants and food delivery enterprises.

Yea, yea, yea.

IMF’s old head (who has since moved on the the EU’s ECB) said the IMF’s 2018 $57B (largest ever) would solve the Argentina problem.

It didn’t; only gotten worse.

It did solve Argentina. It was not to make Argentina better but to enslave them to the IMF, in which it will likely succeed.

Argentina’s problem is that it is a raw material exporter. Argentina would be better with much less raw material exports but that would be bad for the importers. That $57Bn makes that road very difficult

Its the end of the road for the stock market, when you see parabolic charts like that on individual stocks, that aren’t even worth 1/100th of the price. Its the year 2000 reprised.

End of the road for the PUBLIC stock market. We have less than half the public stocks we did in 2000. Through buybacks, mergers, and all sorts of financial engineering EVERYTHING (and I mean EVERYTHING) is going PRIVATE EQUITY, private ownership.

Think of it as one of the Prez’s private country clubs….members only.

7 out of the WORLD’S largest FOOD producers by SALES are PE! (might be 8 now, that was 5+ years ago). They will chose what’s on the grocery shelves, just like auto companies choose what your transport choices are

And that’s just two types of business.

Yeah, go ahead and hate your OWN government, or rather what’s left of it that is “yours”, and laugh at the “financial” absurdity of a Green New Deal.

Abe Lincoln saw the writing on the wall, and that’s what the Gettysburg address was all about.

I don’t plan on living forever, and maybe that’s my major problem with this culture, but I’m sure not afraid to die when I alone decide life isn’t worth living.

Sorry, 7 out of the 10 largest food producers, per Yahoo, so maybe it’s only more developed countries…..was the competitor list for ADM I was looking up, I think.

The stock should be investigated for manipulation on multiple fronts. This is far from normal behavior. Maybe the Algo trading has moved it beyond artificial intelligence into retard redundancy as this is too far out of the norm where it has never happened before.

Supposedly Musk pulled his short stock availability today in order to squeeze the shorts , especially Einhorn

Wild-assed guess with absolutely no inside knowledge: I seriously doubt guys like Einhorn are playing with actual short stock; almost a certainty the fun has moved to derivatives.

Derivatives are still exposed to roughly the same size margin-calls, but Elon’s stock doesn’t DIRECTLY impact Einhorn.

I think we will all be driving Telsas soon. That looks like the plan.

If one wants to short Tesla – and those with weak stomachs would be wise to just stay away – the only way I can think of that makes any sense would be risk-defined, such as a long-dated (January or March 2021), out-of-the-money put spread.

Looks like a deep out-of-the-money put spread (with strikes around $400-$500) with a $10 interval can be had for $150-$200, which is max loss. Max gain would be $750-$850.

Again, not for the faint of heart. If one is inclined to short, keep it risk-defined.

+1

I get annoyed by all the media parrots calling the TSLA stock price chart a ‘parabola.’ A parabola, by definition, is symmetrical; I don’t recall TSLA having been over $900/share, then dipping substantially, then going back over $900. Asymptotic, perhaps, but not ‘parabolic.’

Parabolic is the common term for a stock’s trendline going straight up, almost vertical on a 1 year chart. I’m not sure who gets to determine the industry standard terminology, but “rocket ship to the moon” is a better analogy

Everybody knows they are referring to the positive momentum of the parabolic curve in Quad I. They don’t need to refer to the limit of the curve because it is obvious the limit is zero to infinity.

Touche’

Tesla gap up to 90,000 feet.

If Ilan ECM fail him, he will leave behind a huge selling tail.

They can’t use the tax credits, so they sell them to companies that do. Wonder what that comes under when filing? Senator Grassley mad a comment about tax credits awhile back. So institutions are keeping it up. Sounds like collusion amongs managers. Doesn’t seem too questionable? Thanks Wolf.

Selling tax credits is a business these days. Investors buy them for resale to businesses that need them.

That stock price trajectory looks like a “major computer malfunction” to me (I still believe in gravity):

https://www.marketwatch.com/story/tesla-casino-lures-back-famed-short-seller-2020-02-04?siteid=rss&rss=1

Isn’t it possible that Mr Musk is a charlatan in the mould of John DeLorean?

Isn’t it therefore possible that he has been allowed to peddle his snake oil because he’s implementing a plan, drawn up by others; perhaps the UN and its population control agenda, Agenda 21 and Agenda 2030?

Or is he just a very talented Innovator and business man?

By looking at this WTF stock for the last couple of days kind of makes me loss all hopes for any resembling sanity or fundamentals in the market…600ish to 900ish per share over couple of days…insane

My 2002 Camry is so quiet, I have to be careful driving through all the bicycles, rollerbladers, pedestrians, and skate boarders here…these tourists and students don’t even look both ways.

A silent car would mow them down…Mr. Musky will have to get a loud recording of a 70s muscle car on the hood of his Teslas. This will excite attention and all will be well…especially when they flood the used car lots looking to buy such a wonderful sound!!!

Rather then a 70’s muscle car sound I would prefer a clop clop of a team of horses. Carbon free, ya know!

Endeavor: They tried that in NYC during the late 1800s/ early 1900s. Over 100,000 horses in the city back then. The city was happy to see the advent of the horseless carriage because they were literally drowning in horse manure. That horse concept works in low population density areas…..not so much in high density ones.

On a side note : at least back then there was plenty of usable compost compared to the unusable mountains of Bull manure being generated in todays stock markets. ;) lol.

Yes, book Here Comes Exterminator! goes into horse culture before, during and after WW I. Exterminator helped raise funds for both WW I and WW II.

“Left, the legendary short seller behind Citron Research, is back at shorting Tesla Inc. (TSLA) stock, which on Tuesday vied to top $900.

“This is obviously a computer-generated rally, it’s not a reflection on the company, or on valuation. It’s just a trade,” Left told MarketWatch. “Yes, I’m shorting it … whoever bought it at these prices has to flush it out, and when it flushes, it’s going..”

How powerful is the liquidity? Liquidity means you can keep your profits, you name your price and we will hold it for you….. J. Powell

The shameless Fed actions here have no historical corollary.

900 puts on TSLA are about $5K, for a 100 share contract, if the share price drops 100 that is $10K, which is even money on a plus 10% decline. You pay to play.

$930 a share. Was 500 a couple of weeks ago.

BOOM

Wow, I guess sometimes things do go up in a straight line.

Someone is going to have to show me the real long term value in these tech stocks.

Google: An unchecked monopoly on search and advertising.

Microsoft: A captured audience monopoly with a controlling operating system any tenth grader could dream up these days.

Facebook: Another monopoly unchecked around the world channeling mischief, hate and mayhem.

Apple: Great products but the world is catching on.

All of these companies have the benefit of collecting personal data, overpowering any competition by sheer size, and are in bed with the rogue nations, just to name a few. Oh well, if that’s the way we make money

Thank you for mentioning Microsoft in the league of monopolies because the media and the government are giving them a free pass.

There is no more blatant monopoly than MSFT in the tech sector. Azure (vs AWS), Teams (vs Slack), OneDrive (vs Dropbox), all these are competitive thanks to the Windows stranglehold in the enterprise.

They bundle their other services with their Windows license sales for an offer the locked enterprise customers cannot refuse. Oh and why don’t you order 1000 Surface devices with that order as well? What? No? Well, in this case, your Windows licenses will cost you 20% more. Take it or leave it.

Don’t believe this is a short-covering rally or a massive short squeeze, as most of the shorts had already been shaken out $400 or so ago. The high volumes don’t support the “short squeeze” theory either – Short interest as of yesterday was still low at 1.3 days as well.

Gonna throw out a SWAG that with the exceptionally high vol in this name that a lot of folks (and big institutions) sold naked calls to capitalize on the huge premiums and are now forced to cover. Throw in the leveraged nature of these instruments and there’s your “BOOM.”

Entered a short today with Charles Schwab.

Got an email back to the effect that the stock was unavailable to borrow

For those who are interested in buying puts , one must understand puts do not grow out of the sky. The party selling you the put will hedge your put by selling short the stock and buying a call. If there is a short squeeze with little stock to borrow , than price for puts will soar to ridiculous levels

If short interest is increasing again, then that’s a potential catalyst for further price appreciation.

I’d wager that one of the primary reasons TSLA is unavailable to borrow is that most (if not all) brokers are outright prohibiting naked shorting of the shares out of an abundance of caution given the recent moonshot.

Fluffcat, Thanks for the lowdown. Now it makes more sense to my brain.

Hey, I’m a Tesla Fan yet as Alan Greenspan so aptly said this another example of irrational exuberance.

Tesla expects to sell 500,000 vehicles worldwide in 2020.

Porsche sold 260,000 vehicles worldwide in 2018.

Tesla is still a start up and Porsche has been around since 1931.

As Elon Musk said plenty of times: “Go ahead and short the stock”.

Porsche is just a division of Volkswagen AG, which also includes VW, Audi, Skoda, SEAT, ŠKODA, Bentley, Bugatti, Lamborghini, Ducati, plus a heavy truck division, part of which it spun off via an IPO recently. And little-bitty Tesla is worth more than Volkswagen AG (and Volkswagen AG is profitable).

Just admit it with a smile: Tesla’s stock price is nuts!

I would much rather have the Porsche… even the Porsche Taycan. Perhaps its specs aren’t as good but I’d have much more faith in the quality of its engineering and QC. Besides that, owning a Porsche feels like success, owning a Tesla feels like being a guinea pig.

Increasingly I think the only thing that can help bring Tesla stock value back to reality will be when they finally fail to make a bond payment. The thing is whenever major bond payments for Tesla approach due billions of new dollars magically show up in new investment to roll things down the line seemingly indefinitely.

The time to short Tesla will be at the moment of their next major bond principle payment that vastly outstrips their free cash flow at a time when new magic “roll-it” money doesn’t suddenly appear out of nowhere to save the day almost at the last moment. Until then Tesla’s stock price can be whatever Musk wants it to be and no aspect of reality or reason can change that. The problem is how do we as potential short-sellers correctly estimate when billions of dollars worth of new magic “roll-it” money won’t make a last-minute save to kick the Tesla default can down the road?

Things like this lead me to conclude we already have socialism in this country with big unprofitable Soviet-like state industries. People just mistake the little vestigial remnants of the puppet democratic government in Washington as the actual US governmen, instead of recognizing that the actual de facto US government is the shakers on Wall st. This leads people to ignore the fact that the giant unprofitable de facto state industries (Tesla, many of the other new tech unicorns, a bunch of “”””tech”””” unicorns, the Fracking industry, etc…) only continue to run because of their perpetual state subsidy.

I wonder if Irrational Exuberance even exists.

What DOES exist, is ever expanding Fed liquidity. Irrational exuberance is JUST A WORD, well 2 words. Fed liquidity is real.

I’m sensing a new round of Fed liquidity pouring into the markets. Because a flu virus. That’s as good a reason as any. Well, a bit more…the human reactions to flu virus.

Mr Market hissy fit? – Fed liquidity to the rescue.

Possible technically statistical recession? – The response is Fed liquidity.

Hoarding bank no want to lend? – Let’s try Fed liquidity.

POTUS says very mean thing to Fed? – Fed liquidity to the rescue!

Get the flu cold? – No worries, Fed liquidity.

America is fortunate to have an innovative and dynamic central bank.

Will Tesla now do what AOL did back when it’s stock was overpriced and riding high (i.e., buy Time Warner)?

Tesla buying Ford or GM via a share transaction would be the equivalent.

The concept is interesting because Tesla, on its own, may not be able to add enough production capacity quickly enough to meet the growth expectations built into its stock price. It may need to acquire existing production capacity (including engineers, workers, machinery, buildings etc.) to meet expectations.

Chrysler is worthless and i expect Ford and GM to own a lot of leases etc. so i don’t know if they are worth anything if you include those assets. The problem is not that Tesla is overpriced but that all car companies are overpriced or off limit because of national states interest or family ownership

I seem to recall some traders losing big from shorting the Nasdaq in 98-99.

Fast forward 20 odd years and shorts are getting hammered in Tesla.

We are in our very own “Roaring Twenties”

Truly epic!

The roaring 20s ended epic as well.

This stock price is pricing in $75b in revenue and $10b in FCF by 2025. Very doable. But the stock is up 23% today and market cap is $170b.

Starting to get a little expensive, even i will admit.

TSLA 3.55 PM red

I always hesitate to comment on Tesla because it’s a company people love to hate. But my opinion is the value of Tesla is not about the cars, it’s about Musk.

Right now, I can’t think of anything more exciting going on in tech than Musk’s space ventures. A network of satellites need something to track to calibrate the network. The data from all those cars is invaluable.

Yep. Never bet against Musk or Bezos. Well unless you like losing money.

TSLA is a perfect example of how massive injections of central bank liquidity can create ludicrous pricing in equities.

This is why we don’t short the market without a hedge – ever! I’ve sometimes made more on the hedge than what I expected to make in the original short.

The only time I’ve lost big time is shorting without a hedge. Just imagine shorting TSLA at 300, but had a few cheap OTM calls as a hedge. Loss turned into victory.

I’m happy to hold my gold miners at 10 PE’s free cash flow and no debt. Where will Tesla be in 5 years? No one knows. How much will gold weigh in 5 years? Yes you know the answer.

Gold miners lol. The miners are in the toilet so you know the price of gold is about to take a tumble. It’s probably a good time to buy but it’s going to take a decade or two before they get back to where they were a few years ago.

Are they? PE ratios of 10 no debt and free cash flow is the toilet now? You’re clearly not paying attention.

Furthermore hedge production means locked in future EPS therefore commodity price fluctuation as you’ve mentioned above are largely irrelevant.

1) IWM, Russell 2K ETF daily, fell into the Ichimoku cloud and gap up twice on falling volume. Today high to Dec 27 high stretch is great for PnF count.

2) IWM daily refused to move all day. Few buyers showed up.

3) IWM big demand bar, on big red volume, inside the cloud, exceed every green volume and bar size.

4) XLF, the financial sector ETF, in a trading range. Today large volume on tiny doji candle. Look like distribution.

5) DIA, the DOW ETF gap up, on falling volume, closed < Jan 2(H).

6) Tesla back burner lifted its stage III beyond the MAX 90,000 feet. Its ECM system failed to warn retail investors on time, in the last seconds, to jump. They didn't get the signal to open their parachute, after a long free fall in the stratosphere.

7) TSLA weekly will be the last dead cat bounce.

1) Tesla weekly opened at 650.

2) Its weekly volume is almost as high, so far, as the highest volume on the chart, green or red.

3) In order to counter Tyler Durden followers, market makers might lift Tesla > 1,000, in short covering, just as they did today and yesterday, countering the hateful little people like Tyler Durden, in pursuit of a cool Ilan demise. Small minded people like to victimize a superstar like Ilan.

4) It cost 100 shares x1,000 to short Tesla, if u could.

5) If the market makers get u, and they can, you will panic and buy 100 pcs, dump Tesla in short covering and lift Tesla > 1,000.

6) There are 3 trading days left this week.

7) If Volume will end up red, it will paint a huge red selling tail, for sure < 650.

8) If green, the weekly candle might still end with a huge selling tail, but red or green, definitely on the highest volume in Tesla history.

My appology : Tesla weekly at the open @ 883.

It take me > an 1 hour to write 3 – 4 inches comment, I get tired

give up and fail to correct mistakes.

Michael Engel,

Your 1st statement was correct. TSLA opened yesterday at 647. It opened today at 883. Frankly, I don’t get a lot of your comments, sounds like quanty-love-the-shape-of-the-numbers stuff to me but, I do enjoy your additional perspective and I will get tuned into the lingo. Hopefully, I just need to keep paying attention.

But it’s not that hard to spell Elon Musk’s name correctly. It’s four letters and phonetic.

Tulip stock.

My thoughts exactly. The Dot Com (later DOT BOMB) has nothing on Tesla.

Please, please put a giant red arrow on that chart my old eyes can’t find the red bar ;)

With that kind of valuation Elon Musk should seize the day and make Tesla a profitable company and pay out dividends to TSLA shareholders.

Today TSLA shed 20bb off its valuation though.

Tesla is part of the New Age Fantasy Thinking, that a whole lot of things are going to come about based upon Hope of Change. Key to this is that Carbon based energy, oil, coal, natural gas will disappear because of Wind, Solar, Tidal, etc…replacing them (also Nuclear is out). A world that likes to use the word “science” as justification for much of their view offers up solutions that are not remotely practical, that is scientifically possible on the scale they propose. Add in, the stock market will go up for ever, cryptos are the money of the future, alternative energies will replace existing ones, they believe them all. History is dead, reason is dead, science is dead, we just have the Future, Faith, and Science Fiction. So, why not just go for it people, Solar, Wind, take up space kill birds, and why stop at Carbon Negative Technology (another fantasy), lets have Power from the Kinetic energy of the Earth, Car engines that run on Salt Water, or get William Shatner and find out what planet those Dilithium Crystals are on….we can print money so we are all Billionaires, but still whine like we are paupers, and then and only then, the Dodo and Passenger Pigeon will return from extinction to join the freshly clayed Unicorn and Phoenix to feast on green pastures and sunny climbs as Mother Earth returns to her rightful place, No doubt she will come Back to the Future in a Tesla.

Let not your heart be troubled.

I don’t know if Tesla is Now a Supernatural Phenomenon but it’s stock price fits.

Or maybe more Supernova than Supernatural? Maybe it evolves into a black hole and sucks the Dow into it?

Ha ! Yeah a bit crazily overbought now, but not “supernatural”. Tesla’s mission statement is pro-nature. If every human affected by climate change gave Tesla just $20 to keep to it’s mission that would be $151 billion right there – almost its market cap. Worth it!

What other company is beyond mere money-grubbing – and succeeding at it – changing multiple industries?

Tesla’s mission statement is pro-nature.

Tulips are natural.

Nobody pays any attention to the ‘mission statement’, unless it also happens to be the theme song of a popluar sitcom.

I never thought I’d see something more absurd than crypto currencies.

The new putrid currency is muskcoin.

I’m not convinced this is all irrational retail. This smells like short squeeze, possibly orchestrated by a fairly big player with deep enough pockets to see this through. Back during the financial crisis in 2008, there was this one stock that briefly defied gravity in a setting of general collapse: Volkswagen. It went from 200EUR in September to 1000EUR end of October, only to return to 250 in December. For anyone interested, here is the background to the magic rise and fall of VW: https://ftalphaville.ft.com/2018/10/31/1540962002000/The-day-Volkswagen-briefly-conquered-the-world/

Tesla has bonds yielding just over 5% due in 2025 rated B- by Standard and Poors.

This is deep junk. I would not buy Tesla bods below 9% . There are a number of convetibles rated B- as well. Also trading in the stratosphere.

When this company implodes, bondholders have first call on remaining assets. Where does that leave the stock.

Does Theranos come to mind?

Funny how history repeats, or at least rhymes. Tesla is very much like the Stutz Motor Car Company of America, Inc., an innovative advanced “sexy” vehicle, and heaps of stock price manipulation.

OMG, I am curious on exactly how many sellers there are; because the volume today indicated that a third of Tesla’s market cap turned over. I wonder what happened to all the famous short sellers like JIm Chanos. I’m sure he hedged and covered, so it couldn’t have been that bad.

And once again, I am grateful because I was busy, and a bit lazy about trying to short Tesla two weeks ago. At 10 shares, and shorting at $550, I would be down about $350 a share depending the time of day. Here is a toast to busy and lazy. Saviors all around.

Speaking of enterprise value and decisions, may be Tesla should buy Ford. Then threaten to turn its entire line into all electrics… and then toss the sales model into the trash bin. Ha ha, suddenly, credibility of a real automaker with volumes, and couple it with magic the puff dragon Elon. That should vault valuation into the trillion mark.

Regarding: A tiny automaker among giants.

Didn’t Tesla earn $1.4 Billion gross profit on selling 112K cars last quarter, with a profit margin of 22.5% profit?

Can’t those gross profits be increased by significant increases in the volume of vehicle deliveries?

Would you disagree that the value of a company is solely based on future profitability expectations (how much will they make and the future growth rate), not on how many cars they made last year?

Well the answer is really simple, its the same financial entity levitating the US stock market as a whole to create the so-called “wealth effect” the same one that levitates other giant failing corporations:FB, BA, LMT, TSLA, NFLX just to give a few.

The only way this ponzi-scheme doesn’t fail, is if space x becomes profitable enough to cover both companies.

1) In the future market SPX is up 25 pts, while Tesla is down

25 pts to 862.

2) Suppose some investors short Tesla at 862.

3) Group A short TSLA with 1% risk mgt, trigger a buy order when TSLA hit

862 x 1.01 = 870.

4) Group B short TSLA at 862 with risk mgt of 1.5%, or with a buy order

when TSLA reach 862 x 1.015 = 875.

5) Market makers real job is to get investors money, clean their pockets.

6) Market makers can click a very large buy order, triggering a buy

order that send TSLA price to 870. 870 trigger group A buy order.

7) Group A short covering, – a buy order at 870,- send TSLA share higher to 875.

8) Group B short covering was triggered, sending price even higher.

9) During the day groups A and B can have several round trips, bleeding.

10) Market makers will be buying til 3.55 pm. At 3.55 pm they will click a large sell order, taking profit, creating the next plunge, from above

1,000 to below 862.

Has a parabolic move like that ever not ended badly?

Check IBM, my broker tells me this one is going higher, they fired their CEO (last 12 years she did nothing) Surprise choice, man is a longtime insider.

IBM is a company I’ve been cautiously positive on for some months. I’ve noted with interest how they’ve been capturing market share in my own regional sphere of operations.

When the middle class is completely wiped out soon thereafter the “rich” will become the new poor. No one on Earth will be able to afford a Tesla automobile.

What is the actual public float for Tesla? WSJ says 134M public out of 180M…

I’ve noted that a number of people openly question whether Tesla is doing Enron/Worldcom style accounting fraud.

Specifically:

1) Interest paid on cash held is suspiciously low

2) Treatment of warranties as profit makers rather than loss reserves

If the actual non-Tesla/non-Tesla investor owned float is small, that would go a long way towards explaining the stock price.

That stock chart looks like Bitcoin to me, time to sell if you are in and short if you are not. Might settle out above $500 for a while but I can’t see this madness lasting long term.

Mr. Richter,

May I suggest that the Term “Maniacal” be used instead of “Supernatural”?

This isn’t a Logical Phenomenon.

Green Hype, Hopium, and Government Mandated Directives away from Petroleum Fueled Cars fuel the Climate Change/Early Green Adopter Hysteria; and

Brokers Lending Out Shares make Money Regardless.

As the Industry Shift to Roll Out more FCVs and BEVs – some by National Mandate, we may see the Early-Adopter Hysteria regarding TSLA be subdued once Others Roll Out and Sell FCVs+BEVs in Volume.

For the historical record: TSLA hit a peak of 968.99 yesterday 3:48pm EST, and then dropped sharply by 108.99 to 860 at 3:54pm EST, before rebounding by 47.72 to 887.72 at closing time 4pm EST.

Today, TSLA opened at 823.86 (-64.14 from close). So far daily high is 845.98(+22.12 from open) and the daily low is 747(-76.86 from open). A minute ago it was 754.60.

Quite a rid,. Wish I had the conviction to short yesterday, but the amount of speculative fever driving the price was so illogical I could not stomach it.

NARmageddon,

If you wanted to short TSLA yesterday by short-selling the shares, you probably would not have been able to borrow the shares. This has been reported by many people who tried, including one here in the comments.

Wolf, just for kicks I put in a limit order TSLA short today, at a safe dustance above he market price. No complaints from Vanguard about the order.

I don’t think you had to borrow the shares today. My understanding is that you will have to borrow them when the shares hit the target price and Vanguard is trying to fill the short-sale order — it’s then that you’ll effectively have to borrow the shares… that’s my understanding. So if the shares are not available at that moment, the order may not fill. Correct me if I’m wrong. And let us know how this turns out.

Tesla, buy the car, buy the stock ,who cares, its your money, do with it what you will. Hope it all works out for you.

What I detest is my tax money which I cannot withhold, being used to subsidize plants, and sales.

Let them compete with features and price like everyone else. If they succeed, more power to them, but don’t use my money to do it.

>>If they succeed, more power to them, but don’t use my money to do it.

Wall St *IS* using your money to speculate, that is the problem.

All speculators in the stock market are using Fed-printed reserves and resulting ballooning debt creation to create asset inflation. You lose, part1. Then, after the market goes to crap, YOU have to pay again because the Fed will again print reserves, enable debt, and your savings will be worth less. You lose, part2.

“Let them compete with features and price like everyone else. If they succeed, more power to them, but don’t use my money to do iT.”

There was great comment at NAKED CAPITALISM today that’s relevant to your comment CreditGB: ‘In Ian Welsh’s classic formulation: “[Politicians sell out cheap] because it’s not their money. It’s like selling your neighbor’s car for twenty bucks.”.’

There used to be a strategic mohair wool subsidy until the last decade. The military hasn’t used Mohair since 1960 for uniforms.

Hi everyone (long time lurker, occasional poster)

I agree with Wolf’s sentiment regarding how T has put EV on the map.

The performance advantages the EV has over ICE due to an electric motor is astounding …0-100 etc….

However, how many of us knows what make, model, or power outage of the electric is found in our washing machines, tumber dryers etc.

The point i’m trying to make, is that when EVs finally do become dominant, would the customer not be able to purchase any motor off the shelf, leaving manufacturers only to the design of said vehicles

Tesla closed Feb 03/ 04 gap, will popup to test the high.

There are people who watch ‘Married At First Site’. Everything is logical.

One final punch in the face of Tesla:

Tesla’s U.S. sales tumbled 39% in the third quarter

https://wolfstreet.com/2019/10/29/tesla-discloses-us-revenues-collapsed-39-americans-sour-on-its-cars-pent-up-demand-exhausted/

And for the moment, their China child is still-born with the factory closed due to the coronavirus, and China eliminating EV subsidies.

So pray tell why the share price is where it is????

In a sane world the company would be headed into Chapter 11 any day now.

SOMEONE with a lot of pull wants this thing to stay alive.

Probably the same someone who is levitating global stock markets in spite of the China situation.

Just a precursor to a time in the medium term future where Fed’s buying corporate bonds to enable these insolvent ventures called corporations buy back mountains of stock.

But that’s illegal right? Yep, right until the next mini crisis that pushes it up for vote…and Congress critters won’t be able to rubber stamp it fast enough (right after loading up on S&P shares of course).

The corporate debt bubble is only just getting started. All-time-highs followed by BTFD panics from here on out. And the USD ain’t even close to crashing; look at the rest of the world. Hell, it took 3rd world paper like the Bolivar 5 years to go from mildly concerning devaluation to outright hyperinflation.

2019: Learn how to Code.

2020: Learn how to Trade.

Nice article in a dutch online magazine about sales and costs of Tesla for the dutch taxpayers. We are the third in Tesla sale, but not anymore.

Link to article https://www.ftm.nl/artikelen/noorwegen-nederland-tesla?share=l3BL9r7ljYTgwiSIJZzAI6zWeBuaklh06K83jdbLHCUnKaNG8dSXX2Nd8MI%3D&utm_source=Twitter&utm_medium=Social&utm_campaign=TeslaNederlandNoorwegen&utm_content=FTM0900