“I do believe that in North America it is a cyclical downturn”: Cummins COO.

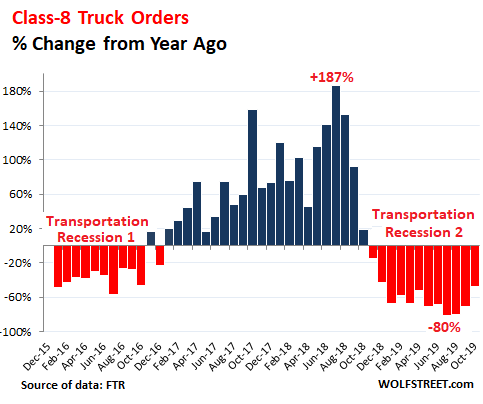

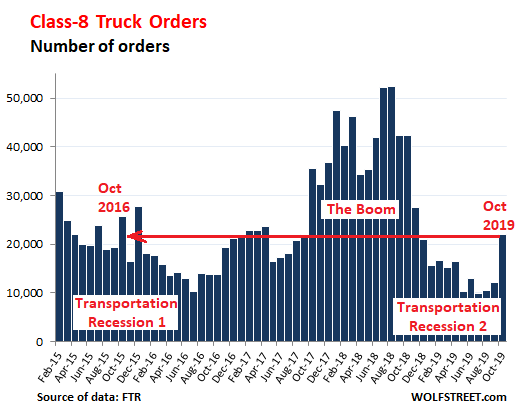

Orders for heavy trucks, after the historic boom in 2018, plunged this year, but they may have finally bottomed out. In October 2019, truck makers in the US received about 22,072 orders for Class-8 trucks, according to preliminary estimates by FTR Transportation Intelligence. While up by about 10,000 orders from the dismal levels in September, and the highest number so far this year, orders were still down 51% from October last year ago, “signifying a subdued beginning to the traditional start of the ordering season,” FTR said:

“The order level was boosted by a couple of big fleets placing large orders into 2020, but otherwise smaller orders were placed for the first quarter build,” FTR said in a statement. “Cancellations are expected to remain elevated as OEM’s shake out excess 2019 orders from the backlog.”

These OEMs are Freightliner, the largest truck maker in the US, and Western Star, both divisions of Daimler; Peterbilt and Kenworth, divisions of Paccar [PCAR]; Navistar International [NAV]; and Mack Trucks and Volvo Trucks, divisions of Volvo Group.

The historic boom of Class-8 truck orders that started in late 2017 and roared through most of 2018 was a result of a series of events triggered by all kinds of companies trying to front-run potential tariffs. Companies ordered excessively to dodge the tariffs, and they filled their warehouses, and it triggered a shipment boom. To meet this demand, trucking companies responded by ordering a historic number of trucks.

But this boom began to unwind in late 2018, and then turned into a collapse of orders that lasted through September 2019 when it appeared to have hit bottom. October looked better. But October 2016 looked better too, only to be followed by a very tough year. Orders in October 2019 were the lowest for any October since 2016:

“Orders increased in October as expected; however, caution prevails,” said Don Ake, FTR VP commercial vehicles, in the statement. “The trade and political turmoil are producing a highly uncertain business environment. Fleets are only ordering for their immediate needs. They are not willing to speculate much beyond the first quarter of next year. The OEMs have plenty of open capacity right now, so carriers are willing to approach 2020 a step at a time.”

“Freight growth is flat, as the industrial sector slows, and manufacturing struggles a bit,” Ake added.

The historic boom in orders in 2018 created a historic backlog of truck orders that then allowed the OEMs to continue production near capacity, even as orders have collapsed this year.

Truck makers have floated through most of the collapse in orders on a high note, as they were building out the historic backlog on their books. Paccar, for example, reported that Q3 revenues in the US and Canada rose 16% to $3.5 billion, and unit sales rose 12% to 31,700 trucks.

But that backlog has largely been eaten through, and truck makers are starting to cut production.

Navistar announced layoffs in August in its medium-duty truck division. Freightliner announced layoffs at the beginning of October for two manufacturing plants. Suppliers to the OEMs have also announced layoffs, including Meritor [MTOR] which disclosed at the end of September a “restructuring plan to reduce salaried and hourly headcount” in order “to reduce labor costs in response to an anticipated decline in most global truck and trailer market volumes.”

On October 29, engine-maker Cummins [CMI] cut its revenue forecast and disclosed that sales in its engine business had dropped 11% in the quarter. During the earnings call, CEO Thomas Linebarger, in commenting on the slowdown in the truck manufacturing business globally and in North America, said:

“Maybe what’s surprising to me is it’s broader than I thought. Like we are seeing challenges in India, challenges in China. Even Europe is slowing. We saw North America coming, that was all part of what we expected.”

Cummins COO Livingston Satterthwaite added: “We are definitely seeing freight growth has slowed. We are seeing orders slow and production has got to come down to match the backlog and meet those orders…. I do believe that in North America it is a cyclical downturn.”

Commenting on the engine business, Cummins CFO Mark Smith, said that “in North America, the pickup truck market is the only one that’s been holding out steady and strong through the year.” Cummins builds engines for all kinds of trucks. He was referring to the Cummins 6.7L Turbo Diesel for RAM pickups. And RAM pickups have been hot among consumers – who’re still holding up their end of the bargain.

Now it’s hangover time, after the tariff-front-run boom last year. Read… Dual-Track Economy: Slowdown in Industrial Sectors Hits Truckers & Railroads. But Consumers Are Still Buying Stuff

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Cats bounce also I’m told

I had a 1992 dodge ram turbo cummins diesel

By 1993, the engine had blow out the transmission, u-joint, and rear differential,too much torque

The tranny got egg-shelled, which essentially means cracked like an egg

Even the front lock-hubs and front differential got torqued out, they were DANA 60’s I think 3/4 ton good stuff

Funny they put this 6L turbo diesel into a chrysler truck designed for a 283 6 cyl :)

Great truck, kept it alive until I sold in 2004, paid $18k, got $6k, I think I had replace every component except the engine, going to junk yards not buy from chrysler, the only component on the engine that died was the fuel pump died, because they no longer put sulfur in diesel the seals crack, I found out from truck drivers to put in some Ford F-1 tranny ‘red’ fluid, and that fixes the problem, 1/2 cup with every tank, and your running for real

….

Couldn’t get a long hauler in summer of 2018, too busy,

Now the hauler can’t find a haul,

What happened? Ask dTrumpf

Perfect example of ‘If it works don’t fix it’, but people can’t leave stuff alone

The engine doesn’t produce, thus the drive line doesn’t absorb the torque if your foot isn’t in the throttle.

The remainder of your post was even less insightful.

Yeah and I bet the truck would last forever if he didn’t drive it at all. His post was more insightful than yours.

Would it be insightful to glance at the PCAR stock chart, or are we bent on spreading misinformation?

I’d like to borrow your car, with a bet I can blow out the tranny before leaving the driveway.

Werner and other truckers have bounced for awhile as the data gets “less bad” and quarterly comps get easier

From the graph I see we had a transportation recession in 2016 as well – from the image appears not as deep. In fact, I can’t even remember it….was it ignored? I can’t even remember if anything happened of note. So, is this the real McCoy or are we simply going to ignore it as well and life goes on in these bizarro markets? It seems we’ve been “dancing a long, long time – so when do we need to pay the band? Are we even going to pay the band?

The 2016 transportation recession was caused mainly by the crash in the oil price killing shale drilling.

Oh yea baby, got me a great big 6.7L Cummins to haul my fat ass to the office park 5 days a week. Best part, the tail pipe is in the back so emphysema is your problem not mine. Powell and I can both agree, that’s well allocated capital.

Eyeballing that chart it looks like if you add up all the red and all the blues, it about evens out. Which would suggest trucking is a weird industry with lots of highs and lots of lows within a short period of time.

Would be nice to see the same chart going back 20 years to confirm.

Yes, it’s an infamously cyclical business. But last year was nevertheless extreme, and the reversion to the mean this year was extreme too.

If you avoid a technical official recession it is only because of the Fed’s hawkish dovism, “not QE” QE4, and rate suppression. Because stock buybacks require lots and lots of trucks.

Looks like a cyclical sub-recesssion in US trucking, starting in H2 2018, caused by the surprise Fed rate rise in December last year. Truckers got spooked.

With the Fed backpeddling and cutting rates in 2019, delivering cheaper finance, US truck purchasing should bounce back through 2020.

I find it incredible that such large capital expenditures would be made to ‘front run’ tariffs that can be turned on or off at the whim of one person, even without considering that they have been decried by a majority of economists as themselves likely to cause a downturn. (there are now 40, 000 requests for a waiver from them)

Where was the ‘win’ scenario in the truckers’ thinking? If the tariffs ‘work’ and China caves, they come off and things return to normal. If they are long term and the pain continues the economy slows down.

The only coherent argument for tariffs is ‘short term pain for long term gain’ which is the one the WH is making.

But that requires them to be short term, so spending vast sums on durable cap ex because of them is crazy.

Or is it possible that it while it was the retailers like Walmart who were front running (understandable, because ordering more TVs or shoes is not cap ex, they’ll be gone by Xmas) the truckers mistook this uptick for long- term organic growth? That would have been silly. Why not just ask the customers: why are you ordering so much extra stuff? If they say ‘to beat the tariffs’, what prudent business goes and orders trucks it ‘ll need to use for most of a decade to justify?

At any rate we now have a bunch of excess trucks.

I really like the usual standard explanations: Brexit, tariffs, political instability… it’s like being back in school and hearing the rather pathetic excuses people invented to explain the teacher they had not done their homework.

I’d like to hear some honesty for a change, such as “we expected double digit yearly growth from here to eternity and placed our orders accordingly” or “it’s not our money so let’s party like it’s 1999”.

Cancellations and delivery delays are trickling in the transportation industry: for example the much advertised “Dreams Take Flight” 787 Boeing is presently using for a rather desperate PR campaign had originally been ordered by GECAS for Hong Kong Airlines (HKA). While the aircraft was being assembled HKA announced they would not take delivery due to being borderline insolvent, so the aircraft remained at Paine Field. Until six months ago GECAS would have found a new leasee in a week but then is then and now is now, so Boeing quickly repainted the aircraft and their PR department spun a feelgood story while GECAS looks for a leasee or a buyer.

Cash-strapped airlines such as Norwegian Air Shuttle are increasingly delaying deliveries: outright cancellations are often too expensive so they just put the problem into the future, perhaps hoping something will happen and they’ll either become suddenly profitable or some Asian buyer loaded with cash will buy their aircraft on the production line at full price.

I keep on repeating what I always say: I have never seen anything like 2017 and 2018. Not even during the previous economic bubbles I had seen people ordering so many capital goods: frontrunning yearly double digit growth had become some kind of worldwide pastime.

Capital goods are not smartphones or even cars: they have to be in service for many years to pay for themselves and turn a profit. And money may be cheaper than it has ever been but said capital goods are not cheap. Even an ordinary Vickers hardness tester, nothing fancy, has a price tag well north of the 15 grands mark (discounted), and you don’t buy this stuff every year, in fact you want it to stay in service as long as possible.

What amazes me is that the deflationary wind hasn’t started to blow yet: everybody is clinging on to the hope that “something” will happen. Considering consumers worldwide are already doing their bit and that central banks have expended their last cartridges for no reason in particular what that “something” may be is left open to interpretation.

The Virgin Mary. Our last hope I would say.

Don’t forget, the government of Spain officially sought her intervention to deal with unemployment a few years ago…..

Agree if people are sincerely doing so…amazing how many folks “get religion” when they find themselves in the proverbial “foxhole” and the “bombs” are going off all around them, possibly like the secular government in Spain?

Shortage of mental capital leading to binge-buying of tangible capital?

Younger generation’s gotta learn some things the hard way?

Why is everybody blaming young people for everything? If I have to look at the CEO’s, CFO’s, presidents and the like who have taken these decisions they are all my age or older, in some cases much older.

Just two weeks ago I had to sit through a mournful lament by the CFO of a large firm manufacturing stainless steel tanks, pipework and fittings. He’s more than twenty years my senior and could well retire any day. He trotted out all the usual stuff on how bleak 2019 has been, how the government should step in with incentives, tax breaks etc.

He has apparently forgotten they had two astonishing fiscal years in 2017 and 2018 with double digit revenue growth. Did he and his boss expect those numbers to continue forever? Apparently yes. This particular firm has been in business for over thirty years, so they aren’t inexperienced upstarts. They should know better.

“Consensual hallucination” indeed.

1) The combine value of US & China Import/ Export was rising

in 2018, despite the trade war.

2) Demand is falling because Panama canal lane #3 compete

with UST.

3) A new order for remote control vehicles, equipped with class 6 engines, on tracks, with sophisticated AI, and an arm to lift a periscope, to clear mines, or give the opponent an uppercut, will boost vehicles &

engines production.

Those vehicles can be driven by mannequins.

When the opponent launch two Korconets, helicopter will fly their

pieces to a hospital. The leader of the Information War will claim final victory.

China and India, and this is a secular downturn?

China trade never happened! The CEOs and retailers thought domestic steel making and domestic manufacturing would come back! Home builders supposed to be a shipping boom with the millenniums pattered out due to sky high housing costs despite low mortgage rates. Retailers bought huge amount of Chinese goods before tariffs hit them.

All were wrong assumptions!

I notice PCAR is suffering big time from these slings and arrows.

Some kind of tax advantage plan? The whole industry sucks. I drove for years so I can speak from experience. People have no idea what takes place so food and goods are on the shelves. Farmers don’t get enough credit either.

I agree with you, Ron.

“U.S. Heavy Truck Sales up 3% Year-over-year in October”

https://www.calculatedriskblog.com/2019/11/us-heavy-truck-sales-up-3-year-over.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+CalculatedRisk+(Calculated+Risk)

Mean Chicken,

This data set, which I also chart in my articles (most recently a month ago) means trucks that were delivered to customers that month, but were ordered last year during ordering boom and were part of the historic backlog of orders that is now being eaten through.

This is what I wrote in October about it:

“Truck makers recognize a sale when the truck is delivered to the customer, which is months after the truck was ordered. For the industry overall, truck sales, as measured in deliveries, surged during 2018 and into 2019, to hit 47,300 deliveries in July (seasonally adjusted), surpassing the peak before the Financial Crisis, according to data by the Commerce Department.”

I then go into more details of August and September, including a chart.

Every truck maker has been thanking God for the historic backlog from last year that allowed them to keep production lines running this year. Well, that said, the layoffs have already started.

Your point is sales and deliveries aren’t the same phenomenon. The article linked, was titled “sales”, I agree deliveries are a lagging indicator.

No. You’re getting the lingo wrong. In the standard language of the industry, the Commerce Department, Wolf Street, and Calculated Risk: Sales = deliveries.

But “orders” is NOT sales. Orders = orders.

Most of the sales/deliveries recorded this year were ordered last year. Like I said, I have cited the same Commerce Department data, and explained the difference and lag between orders and sales/deliveries, for example here (third chart down):

https://wolfstreet.com/2019/10/03/as-orders-collapse-heavy-truck-manufacturers-start-layoffs/

When I discuss “auto sales” I also use the standard industry lingo of sales = deliveries. This goes back to Adam and Eve.

Orders and sales/deliveries are expressed in number of vehicles.

Dollar figures for sales in the industry are called “revenues,” which is an entirely different measure, stated on the quarterly reports by each company.