The Fed could instantly claim victory and pocket the kudos.

For the first time in history, the Fed is officially and vocally considering the use of monetary policy to increase inflation, or at least inflation expectations. On Friday, it was the turn of Chicago Fed President Charles Evans to drill this message into the minds of recalcitrant consumers and workers, whose fruits of their labor get eaten up by inflation:

“Because inflation expectations seem to be below our 2% objective and it’s been stubborn…it tells me our current setting for policy is on the restrictive side,” he told reporters. He sees two rate cuts this year, of 25 basis points each, not because the economy needs it, but to hammer into consumers and workers that their hard-earned dollars weren’t losing their purchasing power fast enough, and that they should change their attitude and gratefully expect more inflation.

But the problem isn’t that there isn’t enough consumer price inflation. There’s plenty. Everyone has their stories. Inflation is different for everyone. When your rent rises 10%, and 50% of what you earn goes to rent, and when in addition, your health insurance premium rises 30%, and 20% of what you earn goes to health insurance, no matter how you look at it, you’ve got a shitload of inflation on your hands.

And so that you can deal with this increase in your costs of living, there is 3% wage inflation, hahahahaha….

Other people don’t face those kinds of massive inflation pressures. They may live in places were rents are flat. People who own their homes – over 60% of households do – face little inflation on the housing front unless they move. Electronics, furniture, appliances, apparel, shoes, and many other things have gotten cheaper over the years if you know how to use the internet. So it all depends. And it all gets averaged out across the US, across everyone in the US, and this data gets summarized in various consumer-price inflation indices.

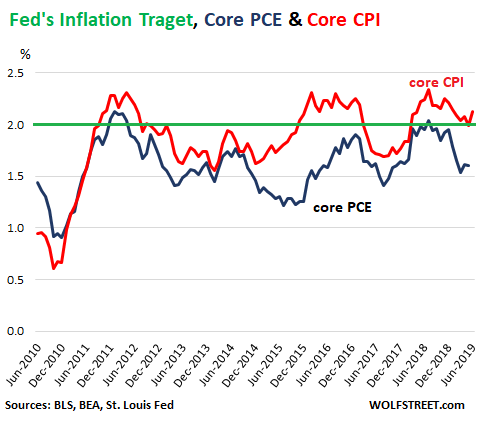

The consumer price inflation index the Fed uses as yardstick for its 2% “price stability” target is the PCE index. This index usually shows the least inflation of the major indices. And the Fed focuses on the PCE index without food and energy because those two categories are highly volatile; food and gasoline prices can surge and plunge.

The Fed’s target is “symmetrical,” as it keeps saying, meaning that inflation can be a little above or below target without triggering a monetary response.

Then there is the Consumer Price Index, or CPI. It too comes with a “core” version without food and energy, which makes it a lot less volatile. The CPI is usually higher than the PCE index.

There are constant complaints about CPI – that it doesn’t reflect the full brunt of increases in costs of living that consumers and workers experience. As mentioned above, everyone experiences inflation differently, and no one is going to be happy with any national average, but that’s what we’ve got.

Nevertheless, core CPI is a notch less unrealistic than core PCE. The chart shows core PCE (blue) and core CPI (red), and the Fed’s target (green). Note how the red line (core CPI) has been slightly above or below the Fed’s target in a fairly “symmetrical” manner since the Great Recession. If the Fed chooses core CPI as its target, its mission of “2% price stability” is accomplished, and would have been accomplished for years, and it can pocket the global kudos for “accomplishing” its mission:

To further improve the Fed’s success ratio, after switching its yardstick to core CPI, the Fed could have harangued the Bureau of Labor Statistics (BLS), which puts the CPI together, to be less aggressive with “hedonic quality adjustments.”

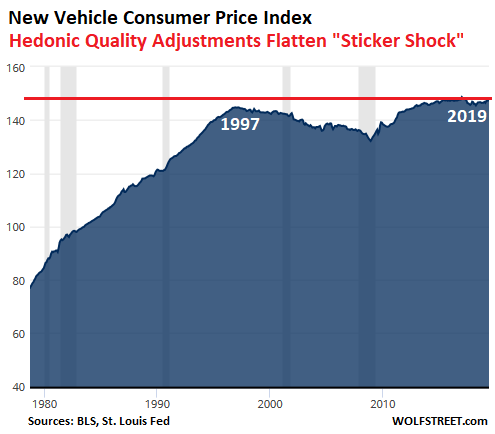

The “hedonic quality adjustments” make sense on a conceptual level. For example, with cars. They are a lot better today in myriad ways than they were in 1980. Performance, comfort, safety (multiple airbags, side-impact protection bars, crumple zones, antilock brakes, traction control, warning systems, etc.), electronics to dream of in the 1980s, backup cameras, suspension systems, emission control systems, materials, durability, etc. All this costs money to develop and build.

So if new cars get better year after year, this additional cost, as it is added to the price of the car, is conceptually not inflation because you’re getting a better product, and so you’re paying more for it. Your cost of living goes up, but you’re presumably safer and more comfortable and get better quality of life.

This is a key thing about inflation: If your cost of living goes up because you’re buying higher quality products, the portion attributed to the costs of higher quality is not inflation: Yes, life gets more expensive, but it gets better presumably, and that part is not inflation. Inflation is when the same thing with the same qualities gets more expensive.

So price increases that are based on product improvements are adjusted out of the inflation index. These “hedonic quality adjustments” for new vehicles are based on these factors, according to the BLS: Reliability, durability, safety, fuel economy, maneuverability, speed, acceleration/deceleration, carrying capacity, comfort or convenience, and added or deleted equipment.

This gives us a situation where new vehicle prices show essentially no inflation since 1997, while actual transaction prices have surged:

Conceptually, I get these quality adjustments. But they’re applied to many items, such as consumer electronics and the biggie, housing costs (rent and “owners’ equivalent rent of primary residence,” meaning a nicer apartment, house, or condo). And even slightly aggressive quality adjustments, spread across the items in the basket, have a significant impact in the peculiar world of judging the Fed, where folks labor over one or two-tenth of a percentage point – say, an annual inflation rate of 1.8% (below target = Fed failed) versus 2.0% (on target = Fed succeeded).

But these quality adjustments are aggressive – and likely overly aggressive by enough to where actual inflation is understated by some relatively small amount that makes a huge difference with regards to monetary policy where a change of five-tenth of a percentage point can cause Fed judgers to go into hyperventilation, especially on the undershoot side.

So the Fed needs to first switch its yardstick from core PCE to core CPI, which would solve just about all of its current “low inflation” problem in one fell swoop.

And then, once the switch is accomplished, the Fed needs to lay out the data points for the BLS to be less aggressive in its quality adjustments. Just a tad here and there. And core CPI, even with today’s price data, would be uncomfortably high above the Fed’s target and “low inflation” would be vanquished.

The Fed could claim victory on the “low inflation” front and pocket the kudos and build its iron-clad credibility that it will always vanquish “low inflation.” And then, it could switch its rhetoric back to fretting over how to contain inflation, and how this spurt in inflation was just “transitory,” or whatever.

Oh, it’s here alright. But we’re a little squeamish about calling it out. Read… With all this Money Printing, Where’s the Huge Inflation?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A bit off topic. Shorted the previous housing bubble better than the pros and getting reading to start my version of “Shorting the US Housing Bubble 2.0”, so your graphs are invaluable to me.

That said, why has been Dallas dropped from this adorable monthly series:

https://wolfstreet.com/2019/06/25/the-most-splendid-housing-bubbles-in-america-first-year-over-year-drops-since-housing-bust-1/

ShortIt,

Dallas has not been dropped. It has been moved to my new series (now there are two series), the very first chart:

https://wolfstreet.com/2019/06/26/from-less-splendid-housing-bubbles-to-crushed-markets-in-america-june-update/

Curious what you think the housing bubble 2.0 is going to look like, any predictions?

@Wolf, I know you frequently post about the splendid housing bubbles. What do you see happening?

I think demographics and migration to major urban areas with limited space is driving at least some of the price growth beyond inflation in major cities, so I am not sure we’ll ever see the historical averages return (which may have been a rare window of opportunity whereby housing was undervalued). I do continue to think that current valuations are unsupportable with current household incomes, so a 10-15% correction over 3-5 years seems like a plausible outcome to me. After 5 years, that’s a significant correction in real-dollar value, then back up it goes.

Massive inflation in the essential needs of life – housing, health care, higher education, energy, etc.

Deflation in things you want to make life more convenient. Computers, TVs, cell phones, data, online entertainment, etc.

Very true. When I tell people that I will consider a candidate who wants to charge me more for healthcare than what I use/need ONLY after I have access to decent and cheap housing… Democrats tend to get outraged.

It’s just a budgetary constraint: the same government that inflates housing costs against me cannot possibly expect to extract more from me for healthcaree or any other “essential”.

The extra % of my income that is going to housing due to the government’s “let’s inflate home prices” policy is going to have to come from somewhere, in my case, in great part comes from not spending a cent more on healthcare than what I absolutely have to. Until housing is not fixed, I cannot entertain helping out on healthcare.

That’s why they like to raise the gas taxes so much here in Cali. Another swipe at the lowly working class who can’t afford rents near work. They don’t want any taxes that could reduce their asset values after all.

Housing: Last 20 years especially are especially steep. See monetary policy/low interest rates + lack of regulation in various financial markets/transactions. Also, supply of housing/space is tight in many areas due to urbanization.

Health Care: this one is a real challenge due to the rise in technology. As I’ve mentioned before, things as mundane as MRI didn’t even exist 30 years ago, let alone gene therapy, and advanced diagnostics. Think about joint replacement; the list is long. Supply went from 0 to non-zero and some are seen as necessity- thus huge inflation (ignoring other factors, such as market manipulation by pharma, etc.)

Higher Ed: warehousing of unemployed in college + loan risk assumption by the taxpayer + unethical academic administrators= out of control prices.

Or as Rob Dawg on hooocoodanode forum used to say, “inflation in what you need, relation in what you want” . Biflation for the

working class for sure.

Like we have a choice of what’s inflated and what is deflated?

The Fed is toothless and probably clueless, sucking its lips.

1) Something in Germany cracked and the German 10Y, fell from +0.58%, in Oct 2018 straight to (-)0.40% last week, for a total of 1.00%.

2) If a German 10Y positive reaction rise to just below zero, the downtrend is still very strong and the next target is at least minus 1.00%, or below. The US yield curve middle and the US10Y will be dragged down by gravity. At this point, rates between 3M to 30Y in a trading range, within the narrow bottleneck, taking a break..

3) If reaction jump higher above water, to +0.10% or more, the next target is (-) 0.70%, or higher, depend were it start.

4) A retracement to (+)0.10 or above will weaken the downtrend.

5) In order to stay afloat, the German 10Y have to popup, in a sling shot, to reduce the resumption of the German or European banking panic from spinning out of control.

6) The global banking system put a band aid on some kind of injury, invisible to US investors, healing the zombie wounds.

7) If it will get out of control, in order to protect themselves, the US

big international banks might constrict lending or stop providing US treasuries, as collateral, for swapping debt.

7) Big size 2008.

Why look at Germany. US 3-year bond went from 3.05% to 1.65% even faster. What cracked here?

The inflation index that FEDs use are food prices, rent and others but does not include galloping housing inflation! The younger generations have been fooled once again by the benevolent FEDS! We have been lied too as the public!

Exactly. I tell “Medicare for All” enthusiasts that until housing prices don’t become affordable again, I will have to vote against the candidates that push for it simply because I cannot help with it until housing is solved.

As somebody with an actuarial risk that only justifies a premium of $51/month, I cannot be f*cked both on housing AND healthcare. It has to be one OR the other.

Medicare for all saves 2$ for every 1$ it spends. So what you are telling Medicare for all people is “I refuse the save myself and the nation money because I can’t afford to.”

timbers — that’s the craziest statement I’ve heard in a long time.

timbers – that is what they will sell you, but the problem is that the current government is not capable of holding costs down on anything. there is a way to get healthcare for everyone at lower prices, but that would really decimate the market capitalization of the whole healthcare industry. so even if medicare for all became law, it would end up costing us more and we would get worse healthcare for it.

the problem is that washington is rotten to the core. i watched a documentary on brazil and how corrupt it is and saw alot of parallels to our system. The main difference was that politicians took bribes in brazil, but in the US, those bribes are called campaign contributions or are political action committee donations. We have a much more subtle form of bribery.

Ed C,

Then you need to hear it more often. Medicare costs about half of what healthcare in the U.S. costs. It would save us trillions of dollars. And it could be improved with single payer applied to drug monopoly pricing.

U.S. healthcare is about twice the rest of the world (and lower quality). Medicareforall costs about half private insurance, and more in line with the rest of Planet Earth.

gametv,

“the problem is that the current government is not capable of holding costs down on anything.”

This is correct, and proof of that is our current medical system being twice as costly as the rest of the worlds.

But you got it backwards:

The antidote to our current government polices is…MEDICAREFORALL.

Medicare for all is not the screwed problem of the current government – it is the solution to our current government doing just what you said – jacking up medical costs for drug and medical monopolies and insurance companies.

All well and good until you get sick.

Universal system in Canada costs a minimum 30% less than US system with better outcomes. No employer coverage? You’re still covered. Example: My 89 year old father-in-law currently in hospital with failing heart (20% function). He has his own room, (new hospital), top quality care, MRIs (whatever) whenever the doc orders. (His doc is my doc…+ there is a visiting heart specialist contributing expertise). He has signed a release so that the ICU does no extraordinary interventions beyond his antibiotics for pnenomia. He has sought life quality for his end of days as opposed to just keeping going. It was his decision and they required a sign off to implement it. We are hoping to get him back into his own home early next week. No charge to him for care or medications. He wants to die at home, preferably while asleep. (Who doesn’t? + 89 has been a good run).

There is no reason in the World that a wealthy country like the USA cannot afford medical coverage for citizens. In fact, a few years ago we had a Uni Texas grad student up here doing research on fish. She fell and broke her arm, and had to pay for her own exams, X-rays, and limb set out of pocket at our local hospital emergency dept because she lacked insurance. She was charged at ‘cost’, and how she marveled and exclaimed. Apparently, her CDN repair charges were less than her co-pay in Texas.

Even mentioning that you would choose between health coverage and/or housing is beyond belief for most other western countries citizens. It is a false choice and indicates how far the decline has progressed, and how much people are willing to tolerate. If there is enough money for endless wars, hegemony, and cheap auto gas, (Space Force?) there is obviously enough for health coverage, ongoing health care, and affordable medications.

Respectfully, I suggest you should not have to make any such choice, regardless of inflation rates. You have doctors galore, facilities, pharmacuticals, everything already available….and people lack access? Crazytown. If war was declared tomorrow, magically the entire economy and group effort would be harnessed as needed, if it could be justified. Now why isn’t health care justified? The profit takers are picking people off one at a time, but…but you can bet they have health care. regards

Good points, but Canadians and Europeans free-ride off of US military protection and US research and development in biotech and medicine. We American taxpayers and consumers of medical services get stuck with the bill on these.

Outcome studies (which I have read) are not clear. The biggest health issues in developed countries are “llifestyle choices”: In the US there are more smokers and more obesity. That (among other things) makes a big difference in disease onset and outcome. Most of the studies do NOT adjust for this, which shows the bias, but that’s a different discussion.

The US pays for virtually ALL of the innovation in the medical field. Part of the problem with “non-profit/government” funding of any activity is that innovation/progress is sacrificed on the altar of redistribution.

No thanks.

However, the US system is clearly in need of reform.

(Note: the same is true of “tech” innovation- basically it’s about 90% in the USA).

In Ontario, if you want a private or semi-private room, it’s extra, otherwise you’re in a ward. My semi-private room was covered by private insurance through an employment benefit plan. There are many add-on costs in the Canadian healthcare system, as well as monthly fees, sometimes nominal depending on income level, for healthcare whether you use it or not.

In BC, an example of the costs for rooms are (the cost per diem for chronic care can be less):

Private room: $195

Semi-private room: $165

In Ontario:

The difference between the cost of a private or semi-private room and the cost of a standard ward room ($250 per day for semi-private and $300 per day for private).

Voting has no means, counting does.

The concept of single payer health insurance is good. Remember it doesn’t mean FREE. People pay Medicare. Instead of paying for private insurance.

As I write this, I’m in a hospital bed with an IV drip. Sure enough I am on Medicare. Thank goodness.

As I recall, the major topic here seemed to be people being forced to buy vehicle “features” that they personally might neither want nor need, increasing the per vehicle cost of transport, and yet not being counted as inflation, based mostly on a rather dubious set of “hedonistic” criteria. Not about health insurance they personally don’t need or want….at present.

And I also respectfully take issue with the USA paying for most medical innovation. I would invite you to pick any health problem, and go to NIH-PMID abstracts/articles and see just where the research is being done. It’s quite global.

Finally, a private hospital room is quite obviously hedonistic.

https://www.ncbi.nlm.nih.gov/pubmed/29295634

For example, here’s a recent one questioning the accuracy of the assumptions made during your A1C tests, and therefore the test results.

Yes! I agree.

The service economy is a huge piece of the pie. But consumers typically buy services on an as-needed basis rather than waiting for a sale or for the price to go down. I can’t see how targeting higher levels of inflation is going to help the service economy. However higher inflation might cause people who are already strapped to forgo needed services. Nobody is going to go out and get an unnecessary root canal just because inflation is kicking up and the dentist is likely to raise prices are going up.

Our grocery bill has doubled in the last four years. We are not buying twice as much or twice as good. Maybe 5% is for special items.

I don’t know how people on fixed incomes are surviving. I understand a new social security bill being passed now is increasing benefits about 3%, what a joke.

right. and isn’t that why the fed wont just do what Wolf is recommending? If they actually “succeed” in getting their inflation then there will be bills to pay. so they’ll keep doing what they’re doing all the while scratching their heads.

meanwhile, life will become too expensive for many people. it’s where deflation and hyperinflation meet; not enough money and tomorrow even more so.

Please quote some products with their current prices and their ~4 year ago prices if you would.

The list is too long, but I just bought a small bottle of real maple syrup $12, four years ago it was less than $4. My morning muffins were $1.99 for four, now $4.99. The box of a dozen big brand soda cans is now $5.99, four years ago $2.99 or less. Real strawberry jam is now $6.99+, four years ago $2.99.

Groceries were expensive four years ago, now they are off the charts. Maple syrup, strawberry jam, and real mayonnaise are luxury items.

Bake your own muffins. Mix your own mayonnaise. My experience is that raw ingredients are inflating much less than processed goods. What extra you paid 4 years ago for the convenience of ready-made may have been reasonable, but you will now find it isn’t. And the self-made stuff not only tastes better, but tastes a whole lot better now also – the quality of ingredients in processed foods has gone down also.

Oh, and buy in bulk when stuff is in the flyers. Get organized.

You might consider growing some of your own stuff too – start with a few herbs, which anyone can grow anywhere, and are expensive in the shops.

P.S. Happy Bastille Day everybody.

Resulting in a land of ‘half a loaf’, hyperinflation, price controls, and headchopping for not selling goods you don’t have from empty shelves that used to be full. Vive la revolution …

Robt-

Aww, come on……what does a change in leadership matter to a serf, anyway? History is full of such events, and so far there are usually enough of us left.

I went to the Dollar Store for my Hedonic Hamburger Helper and my Hedonic Hair Shampoo and my Hedonic Heinz 57 and dammit, they were all $2

Helldonics I feel like I got Fedonic dildo

1) Yes, yes, the American dream have change from owning a home

to shopping online.

2) In the last 40Y the “queen of the house” was empowered at

the expense of the man of the house.

3) The man of the house had a good chance of being kicked out of the house, if he didn’t yield to his queen,

with the help of judges and lawmakers, paying household

expenses, but deprived of his family and his dream house.

4) Shopping online is safe & easy with prime delivery.

5) AMZN one trillion dollar was built on hope and the new American dream.

Are you implying that society has shifted towards protecting female interests? Are we at a perfect balance now between protecting male and female interests?

ME/DR: don’t forget to add that the expansion of the overall labor force (more women) has reduced the value of labor in general, the gender inequalities baked into that expansion notwithstanding (that was/is the simple arithmetic of supply and demand). The race to the bottom continues, with Orwell’s ‘newspeak’ blaring from many outlets…

May we all find a better day.

Interesting times.

Europe has made a convicted financial criminal the head of the ECB.

The Fed plans to openly break the law (which requires “zero per centum” inflation). They will fail to do their jobs in order to save their jobs. More criminals.

Dale,

Good point there.

and as PDS writes in his book American War Machine

“Elsewhere I have written of civilization as “a great conspiracy/of organized denial.”8 I mean by this the creation of a partly illusory mental space in which unpleasant facts, such as that all Western empires have been established through major atrocities “!

If you apply that “ criminals in charge “ observation of yours you’ll come to the conclusion that Professor Dale have arrived at that Selective memory to events in the past create a whole “ new reality “ a figment of imagination that take you as an individual or a Nation straight to oblivion with No second chances.

This is Not a cheap Chinese Video game!

It’s your lives!! When are the Americans going to realize this?

They are building a satellite Internet service for people in isolated locations. The price of a satellite used to cost $150 million. Now one costs about $1 million.

A Hershey bar cost 5 cents during the 60’s. Now they are more than $1.00 in some places. The stock market outperformed inflation since then; excepting market downturns. Past performance is not guarantee of future returns.

Core inflation was .3% last month, that is about 3.6% annualized. People panicked and asked the Fed for cheaper interest rates. The Fed controlled short term rates. Market supply and demand controlled long term rates. If this is how they act when there is no recession, what will happen when a recession occurs?

Don’t forget that Hershey is genetically modified and now a better product, just like M&M’s and Nestle chocolate chips, etc … Your paying more to get a smaller quantity of something engineered to aid with your digestion (bawhahahaha)

Changes in quantity and package size (weight, count, etc.) are included in the inflation calculus.

But do they count quality? I suspect not. Here in the uk all confectionery is of such a poor quality now it is inedible. Chocolate now tastes like congealed vegetable oil. I received some chocolates (cadburys dairy milk) for my birthday and they were so bad that i spat the first one out and chucked the rest in the bin.

This makes sense but do you have a citation to prove this? Otherwise “otherbrother” could be correct.

DanR,

The citation that changes in quantity and size are included, from the horse’s mouth:

https://www.bls.gov/cpi/questions-and-answers.htm#Question_11

It’s a sad irony that candy and cookie package sizes and weights are factored into the CPI while 30% home price inflation is relatively ignored.

Wolf, thank you for the cite. It is fascinating how much analysis and scholarly effort goes into tracking prices and behavior of consumers in the USA.

and the good grocery chains price things by the ounce including sale price reductions, which is how I buy.

David Hall-just an update. As someone who lives in a very rural area (within 100 miles of SFO, no less!), we’ve had satellite inet service since the early aughts (WildBlue/Exede, Hughesnet, and probably others…). Just another cost borne by those who choose to live in and (hopefully) maintain the countryside.

May we all find a better day.

The government will never do this. There is no incentive to sound money. They get to short change SS by using chained CPI etc. They use same calcs for other programs as well. It pays to lie. If you are a government.

I wonder if rates are lowered than the fed can offload its debt at a higher price?

It could if it did. But for now it is only allowing maturing debt to roll off. That is, it gets paid face value for all the Treasuries that roll off.

Re: “Electronics, furniture, appliances, apparel, shoes, and many other things have gotten cheaper over the years if you know how to use the internet.”

I’m just about to buy a Brooks running shoe online. I paid $65 for their online Adrenaline GTS 10 4/18/11 — and I paid $72.00 for a GTS 17 11/02/17.

They used to have an online sale section, for poor people like me (looking for deals) and tonight, Brooks no longer has a sale section, but, the Adrenaline GTS 19 is offered @ $130.

To me, that’s obviously an inflationary trend — and a great example of a company that just depends on people with higher incomes to pay a higher market price. I knew this would happen, after Warren Buffett took that over …. I think I’ll bypass Brooks this time around!

I’ve noticed the same. Over the years I’ve become an afficianado of Salomon trail running shoes. But over the last 4 years they have doubled in price.

As with Apple and (as Wolf has been reporting) auto OEMs, companies prefer a higher profit margin on lower sales rather than conversely. This endangers their growth and even eventually their solvency as they become more dependent on fewer customers. But it is what witless investors want to see.

Dale,

If a shoe doubles in price on you, it’s time to figure out how to use the internet to your advantage.

otherbrother,

In 1985, I paid $109 for the New Balance model — the first running shoe that allowed me to run more than once a week with my ragged knees (torn meniscus). It was a huge chunk of money at the time for pair of running shoes. My last set of running shoes (Saucony), bought a year ago, cost less than that, and is far better quality than the 1985 New Balance (lighter, more flexible, and more comfortable, excellent cushioning and great support), and the sole will likely last a lot longer than that of the 1985 New Balance, which wore out very quickly.

My understanding is that all manufactured things get better and cheaper over time – shoes, cars, MRI machines.

How is this fact cooked into hedonic adjustments at BLS?

GP,

Yes, it’s “cooked in,” and that’s why CPI for durable goods (washing machines, cars, etc. but not MRI machines because they’re not consumer products) has been declining for years. However, consumers spend most of their money on services (shelter, healthcare, financial services, insurance, etc.), and there is a lot of inflation in services. More here:

https://wolfstreet.com/2019/06/14/my-personal-dive-into-the-murk-of-official-retail-sales-inflation/

After 200-300 miles, running shoes will offer significantly less protection for your knees. There are obviously some variables like shoe construction, your weight, running surface, etc. and some say shoes last longer than that, but experience has reinforced donating my shoes between 200-300 miles. Whoever has my size is getting a new looking shoe that is fine for walking.

Thanks for your shoe background — I’ll look into Saucony and hope that shoe inflation is contained!

According to the online calculator I used, $109 shoes in 1985 would cost approx. $260 today. That’s a lot for shoes!

Retail clothing and home furnishings are getting cheaper because they are going out of business. 75,000 store closures by 2026. That’s from Bloomberg 7-11-19. Overall, things are not cheap especially housing and apartment rentals. CNBC announced that the reason the Fed is raising rates is because of the inversion of the yield curve but the Fed’s own charts say there is currently a 33% of a recession. https://www.fxstreet.com/analysis/recession-probability-charts-current-odds-about-33-201907090135

So, what’s the real problem? The U.S. has so much debt that most of the money we take in will go to service the debt. However, lower rates will only encourage politicians and failing companies to borrow more at lower rates creating a vicious cycle of even more debt. The debt is unsustainable. Congress will raise the debt ceiling again in September.

It’s the inflation FRAUD that’s the problem not the inflation.

Damn…,,I am impressed with the content , command and tone of this piece. Of course I am in the 2nd dram of my single malt.

only the second? wait till the fifth.

Core schmore. If they want to attenuate volatility, all they need to do is use the standard smoothing technique of taking a moving average.

Bill,

Yes, but you would need a two-year moving average: during the oil bust, CPI went negative in January 2015 and stayed essentially negative or barely positive through September 2015. The oil bust formed a near-perfect “U” in the CPI inflation rate, starting in Oct 2014 and going through Oct 2016. So a two-year moving average would have ironed out that volatility. But then, at the time, you would have had no idea what the current rate of inflation is because it’s all averaged out over two years.

The Fed reacted to the oil bust because credit in the energy sector was freezing up and was threatening to spread. It halted its rate hikes — it hiked in Dec 2015 and was going to hike four times in 2016, but then skipped three hikes, and hiked in Dec 2016, by which time the oil bust had blown over, largely.

Wolf,

Thank you for your great articles which I always read but very rarely comment upon.

But here I think that you neglect some massive inflation that could be called “negative hedonic”. That is the regular replacement costs of what once were sturdy, solid, well built and strongly enamelled items that lasted a lifetime, to now flimsy items that have to be replaced every few years.

I’m thinking of washing machines, fridges etc., but almost anything made of metal is now flimsier and has a much shorter life-span. Sure they may have better electronic gadgetry, but they don’t do the job any better and have to be replaced at an ever-increasing rate.

When I replaced my fridge 12 months ago the repair guy said “sure you can buy a new compressor for 250. But this fridge is seven years old. They all last 8 tops. You will be needing either a new fridge soon or constant repairs”. We bit the bullet and went new. Seven years to go for this one!! The repair guy had no reward in telling us. Just how it is. Now. We buy stuff on a planned failure arc. Winning!!

When I started working for Cisco years ago I was surprised to learn of a whole engineering approach called “Cost Reduction”.

After a new network switch was released, they immediately started the cost reduction engineering. This basically meant finding ways to make the product cheaper while charging the same amount or more. This approach occasionally came back to bite them in the ass.

I argued in vain for reliability enhancement rather than cost reduction.

Apparently this goes on in almost all industries.

Including Boeing. See what is happening with 737 Max. You can say their ‘cost reduction’ bite them in their fat asses. Fortunatelly for Boeing’s stakeholders the money bonanza keeps their shares afloating…

Yep. Instead of building a stable extra capacity airframe, they tried much cheaper gimmick work around. It would be more stable if they added just a much shorter “standing passenger” fuselage section in the rear. I believe Airbus already holds a patent on such “seats”

Anyway, any idiot can see that airframe is tail heavy as hell, and of course it is close to stall speed on climb out.

This was(is) Boeing’s philosophy. It has cost over 300 people their lives and might eventually bankrupt the company.

I know this site is about financial matters, but I just to have to mention that the “planned obsolescence” trend makes me so sad for our environment and the human race.

another American invention that has been taking the world by storm … really sad indeed, ultimately it is going to make modern society obsolescent as well.

Correct. This is the big hidden cost.

People like Paulo and a few regulars around here…build their own stuff, and produce some of the products they consume.

One way – and it’s just one way, and not for the masses – is to get good at building the big stuff your family will use a long time. Like your house, your barn, your power system, your food system. Build once and well.

If we build well, keep kids <= 2.0 per HH, we solve a lot of problems. If you're a kid, you get to inherit a paid-for, last-forever house w/food, water, and power provided at-cost-of-your-labor. (ergo: built-in market for your labor).

Plenty different.

Yes, but cheap white goods is what the public have demanded for ages, so I’m told, and so that’s what they’ve now got – cheap. It goes with the absurdity of replacing your kitchen every 4 or 5 years, I suppose. As is said, only a rich man can afford a bargain.

However, with global warming and all that, we are likely to see a reversal back to goods that last and can be repaired. Back to how it was in my youth.

Excellent comment, and in my experiences, very true.

You just can’t make it up. They deliberately low ball inflation, and have done with increasing dexterity for decades, then they complain it is too low. Meanwhile in the real world peoples spending power is going up in smoke and they then complain there is low growth.

They deliberately low ball inflation . . . then they complain it is too low.

One can only wonder at the “adjustments” they have to make to avoid reporting negative unemployment rates.

Stephen Jay Gould once projected that, given price and size trends at the time, the Hershey Bar (you know, the sweet brown crayons) would disappear entirely by 1998 and cost forty-seven cents.

Which can only mean that if you’re really into greased pigs, statistical projections are definitely for you.

They have to low-ball it. Otherwise, if they had to compound 3, 4 or 5% annual rates, the indexed expenses of government (like SS) would balloon so massively that they’d have to put a tourniquet on it, like Volcker did, to stem the hemorrhaging.

I think I have said this but it bears repeating. MIT has a project called the Billion prices project. If you overlay MIT’s data vs the CPI data , they closely track so the BLS is doing something right. there is no conspiracy to miss-report anything.

Wolf, is this artificially low inflation number (core PCE vs PCI) also used to calculate the inflation adjustment component of TIPS? If so, the inflation protection of these bonds is inadequate, and more of a sales pitch, right?

Good question. I had to look it up. The inflation adjustment component is based on the all-items CPI for urban consumers (not core CPI).

As I’ve said here before, simplistic garbage economic theories used to create simplistic garbage models fed with politically manipulated data give us the mess we’re in today. But those problems are never fixed because those in a position of power to make the changes benefit from it: the pols can continue to promise more than can be afforded via tax receipts and the wealthiest always benefit from the two steps forward, one step back of boom/bust asset inflation.

If the Fed actually used accurate inflation data, it would counteract the intent of this:

Why Michael Boskin Deserves Our Contempt

January 19, 2010 by Barry Ritholtz

“The debate about the CPI was really a political debate about how, and by how much, to cut real entitlements.” -Greg Mankiw, chairman of George W. Bush’s Council of Economic Advisers from 2001-2003

https://ritholtz.com/2010/01/why-michael-boskin-deserves-our-contempt/

For those of you who may be unaware, Boskin is the economist/weasel/fraud who helped to officially distort the CPI, making it more or less worthless as a measure of inflation. The Boskin Commission was an act of fraud, a backdoor method to suppress Social Security cost of living adjustments (COLAs). To be blunt, it was an act of cowardice. Rather than man up and say “fix this, its broken, we can’t afford it” the commission took a different route — they fabricated a series of nonsense adjustments that artificially lowered CPI by 1.1%.

The Boskin Commission’s massive government falsehood allowed former Fed Chair Alan Greenspan to take rates to absurdly low levels, as the official CPI data showed no inflation, despite double digit price increases.

As such, he is one of the contributors to the financial collapse.

The specific fraudulent methods of the Boskin Commission are laughable. That the Economics profession failed to kick him out of its membership is as much an indictment of the profession as it is about Boskin.

My two favorite pieces of Boskin intellectual fraud are substitution and hedonic adjustments.

Winston,

“My two favorite pieces of Boskin intellectual fraud are substitution and hedonic adjustments.”

“Intellectual fraud?” Time to read the article above.

There should be hedonic adjustments for food, but it would involve using negative values.

On the other hand, royalty in previous centuries would marvel at how well the typical person lives today. Why those with eff you kinda money have allowed this to happen over the past century is a real mystery.

For food I there is very significant inflation if you just buy organic/bio; at least in my country … but in our supermarkets most prices have gone up very little over the last 20-30 years, thanks to “hedonistic adjustments” in the content and shifting much of the cost to others (environmental damage for cheap meat, packaging/transport etc.).

Yes, nowadays most people in the first world including those on social security in many ways (especially in the strictly material sense) have a better life than royals of past centuries. But why not, what matters most for those in charge is the distance to the serfs and that has remained (growing income disparity etc.).

If you compare to one generation ago I doubt live has improved much, on the contrary most middle class people over here in Europe are worse off than their parents at similar age (it always depends, if you prefer to live in cyberspace these are better times …).

I would love to buy an orginal beetle 1977 cab inflated by your statistics. That car all new and shiny would cost about 10k today. Mby BLS can help me get one

well I think inflation is looking at essential items (the needs) as people life gets better more wanted to have a bit of luxury items (the wants) I think the wants easily inflate by 6-8% per year. so it really depends, if one is working for having meals and simple life than one should not have much inflation. it is the “wants” that is always running away.

It takes time and energy to monitor and reduce one’s own personal inflation rate. You have to shop around and be prepared to change suppliers/providers. (The vast majority of Americans don’t do this.)

Insurance policies should be the first priority. Insurance is a legalized racket and rates can dramatically vary. I was with 21st Century, and then Liberty Mutual, and now Mercury for home/auto while each kept their rates low in order to expand market share.

Higher education is another racket, one perpetuated by the student loan program. In most cases, obtaining a practical degree from a state institution provides a much better return on investment than following you bliss at gilded private college. Almost no one looks at the ranking of university programs by expected graduate earnings.

Razor blades, however, represent the worst in American profiteering. Through patent trickery and market intimidation, Gillette has been extorting the clean shaven for years. $20 boxes of four cartridges, each with seven blades programmed to vibrate at a calypso rhythm, have to be kept in locked cases at local Rite Aids. Dollar Shave Club entered the scene and offered a reasonably priced blade through a Internet subscription. (Proctor & Gamble, Gillette’s owner, sued Dollar Shave Club, of course. The suit was unsuccessful, but then Unilever then bought Dollar Shave Club for $1 billion.)

I learned all I needed to about the shopping experience at fourteen years old from the Clash’s “Lost in the Supermarket.”

“Razor blades, however, represent the worst in American profiteering. Through patent trickery and market intimidation, Gillette has been extorting the clean shaven for years…”

I buy the cheapest no-brand twin-blade razors (throw-away kind) in packs of two-dozen or so. They cost something like 40 cents each, and each lasts quite a while. Works perfectly for me. I agree with you, it’s the consumer’s job to fight inflation at every twist and turn, even if it means abandoning favorite brands.

Well, if you live long enough (too long?), what goes around comes to someplace else and razor inflation is banished locally.

The Oster electric clipper I used to shape up my poodle (now long gone) trims my beard and the shaver will no doubt be here after I am long gone and many a throw-away razor will be, too.

After shaving, place your razor blade-first into a small cup of extra virgin olive oil. The razors stay sharp for much longer periods of time.

One of my favorite topics! I also buy those “bags of 10-15” plastic cheapies. One razor will last me sometimes a month or more! I rinse and clean with an old toothbrush. One bag will easily last me a yer or more! I laugh my cookies off when I see the ads for these huge $$$$ razors that are supposed to make your life better and erase all the bad things you might experience!

“What Fools These Mortals Be!”

I got tired of being treated like a criminal while trying to buy blades and switched to the Dollar Shave Club for my family. It’s was half the price, although that is rising now. The other good thing was I was so mad I started buying drug store items in the supermarket, turns out that is cheaper too. Now I almost never go to the big chain drug store.

I like Mike “Mish” Shedlock’s definition:

Inflation: An increase in money supply and credit, with credit marked to market.

Deflation is the opposite: A decrease in money supply and credit, with credit marked to market.

What have we had for decades now? Credit expansion. What’s coming? Credit collapse.

Fear of deflation (and not just recession but depression) is why the Fed is so anxious to boost “inflation”. Unfortunately they are constrained to do so via credit, which is what’s already likely to blow up and cause debt deflation. Positive feedback loop.

They have already inflated money supply and credit by trillions in just a few years causing massive economic distortions. That alone is frightening enough, but then add in leverage, derivatives and counterparty risk and the fact that the whole world has been doing it. Pretty soon you’re calculating using orders of magnitude usually confined to astrophysics.

The complex interconnectedness of all this through derivatives, credit default swaps, paper gold trading, etc makes prediction impossible. Hold gold for inflation and cash for deflation. And as Polonius advised, neither a borrower nor a lender be.

Michael,

“Inflation: An increase in money supply and credit, with credit marked to market.”

That’s “monetary inflation.” There is also “grade inflation,” various types of price inflation, such as consumer price inflation (the topic here) and “asset price inflation” (the topic in a prior piece). They’re all very different phenomena.

Until you can come up with a unified definition of price inflation (which I have never seen) this all just arguing about angels dancing on pins. There is no fixed reference point.

My cell phone is more powerful than the PC I bought for $5000 in 1985. How do you figure out all the hedonic crap? GIGO.

In 2009 I ran a comparison between the price of eggs in dollars and in gold.

1900: gold $20, 1 dozen eggs $0.20

2009: gold $975, 1 dozen eggs $2.90

1900: 5 dozen eggs for 1 dollar

2009: 1/3 dozen eggs for 1 dollar

1900: 1 oz gold bought 100 dozen eggs

2009: 1 oz gold bought over 300 dozen eggs

Does gold or the dollar reflect what happened? Gold never changes; it’s always a lump of gold. And I daresay an egg is always an egg.

So why did the price of eggs drop vs gold but rise vs the dollar? My guess is that there was deflation in the real cost of an egg (gold) due to better production and delivery. The inflated price of eggs in dollars was due to monetary policy. Eggs don’t cost more; dollars are worth less vs eggs.

Ultimately what determines the course of an economy is the credit cycle. That includes prices paid.

I have a question to ponder: How many eggs could 1 share of AMZN have bought in 2002, and how many eggs can it buy now? Or how many ounces of gold could 100 shares of AMZN have bought in 2002, and how many ounces of gold can they buy now?

A few days ago you said: “The financial system is hideously complex and nonlinear.” This is totally awesomely true, from the narrowest sense to the broadest sense. But sometimes we expect some sort of linearity just for sanity’s sake, and we will be disappointed :-]

While I like gold as a yardstick it isn’t that simple. Just look at the price of homes (instead of eggs) measured in gold:

In my country, Netherlands, from 1990 to 2005 home prices in local currency (Guilder/Euro) increased 5-10x while the gold price in local currency was relatively stable (+/- 25%) between 1990 and about 2005. The cost of homes went up hugely when measured in gold.

From 2005 to 2012 home prices increased very little (major top in 2008/2009, bottom in 2012/2013) while the gold price in local currency surged by about 4x. Said otherwise, the cost of homes went down 75% when measured in gold.

From 2012 to 2019 the situation is similar to the nineties with relatively little change in gold price but huge increase in home prices – both measured in euro currency. Credit creation has been rampant from the early nineties and I don’t think the real cost of homes has changed much over here; they haven’t got much bigger or better, all cost increases are basically inflation due to higher land cost, materials and lately much higher construction wages.

This becomes way too complex to discuss via typing.

The property taxes on my old house that i bought in 1980 have gone from 1600 per year to just under 20k. I do not believe taes are in inflation.

Sales taxes back the in my area were 4%, now 11.25%. No state income tax pre 1970, now graduated 5-9%, but way better than CA.

Gasoline prices are “transitory” but gas in the 60s was under 30 cents at the pump, and its not in inflation.

If the true inflation rate was used, its different for everybody, but all the average wage increases we se down around 2%, would be 7-10% and we would have had hyperinflation already. And soc sec would already broken the bank.

Medicare for all. More expensive than Medicaid, so when we move 75 million from medicaid , tp medicare, then add another 20 million or so, who will pay that cost not to mention dynamics of increasing demand counted in the 10’s of millions, or allowing open borders to add just how many people full insurance and welfare.

Non of this passes the famous smell test and nobody even tries to justify it, just get emotions and expectations wound up with free stuff.

Investors should pool funds to make high inflation asset purchases, or as Ralph Nader suggested, cities should own NFL football teams. This is like junior league soccer, there are no losers

https://www.statista.com/statistics/193435/average-franchise-value-in-the-nfl-since-2000/

Can you explain how the CPI uses the hedonic regression model to estimate and apply a quality adjustment?

To illustrate the mechanics of a hedonic quality adjustment, it helps to begin with the generalized form of the hedonic regression equation:

(1).. (insert complicated formula here)

hmm ‘OR’ that shit sandwich you have been recycling/surviving on has long since run out of corn and has simultaneously increased in quality (price).

allow me to hedonically adjust that for you by placing a grain of rice in the space the kernel of corn once occupied.. your welcome.

bon appétit!

tommy runner,

Food is NOT subject to hedonic quality adjustments. Here is the list of the items that are subject to quality adjustments:

https://www.bls.gov/cpi/quality-adjustment/home.htm

In addition, here is how new vehicle hedonic quality adjustments work:

https://www.bls.gov/cpi/quality-adjustment/questions-and-answers.htm

Here are the guidelines for hedonic quality adjustments of new vehicles:

https://www.bls.gov/cpi/quality-adjustment/new-vehicles.pdf

The answers are out there. It’s not a secret. But it’s fairly complex, as you will see when you dig into it. The BLS explains the methodology on numerous pages, too many to list here. But it’s easy to google if you’re interested in the details.

“Other people don’t face those kinds of massive inflation pressures.”

Like career politicians and Fed officials? I liked your previous article on the 1960 home prices vs the rise in worker salaries.

In 1965 a member of congress made about $30,000 a year, while today they make $174,000 a year. That’s about a 5 fold salary increase since 1960!

https://en.wikipedia.org/wiki/Salaries_of_members_of_the_United_States_Congress

Oops thx, i thought i recalled cuts of meat (hamburger/steak) used as an example of hedonic adj.

tommy runner,

Yes, the issues of hamburger vs. steaks filters into a different inflation adjustment concept, that of “substitution”: when prices of steaks get too high, consumers switch to chicken, pork, or hamburger. So the buying patterns change, which impacts the weighing, etc. And there is a formula for “substitution.” I have not covered that issue yet because I have trouble wrapping mean brains around it conceptually :-]

sadly they also don’t correct for “real” inflation like inflating ham, fish or poultry with huge amounts of salt water so they can charge more while the product quickly shrinks to its real size in the frying pan. There are so many tricks nowadays for fooling food customers …

Well, consumers have to police quality deterioration. Stop buying that brand. Give another source a chance.

Under the general topic of Inflation, and ways to measure it, the query posed by MB732, July 12, “……How does cheap money inflate PE ratios?….” led me to wonder whether P/Es might be a pretty good first-pass index of Wall Street euphoria ? This is a little OT re the indices the Fed should use to adjust interest rates, but very much part of the big picture that they claim to study. And very much a propos of the general subject of Inflation; thx for this thoughtful series, Wolf.

If you want to see real inflation caused by monetary policy, we know we just need to look at stock and bond prices.

The economy is growing at around 4-5% including inflation, and that includes cars sold with all the new stuff that not in inflation.

If real inflation was used, real growth would be negative, but the how does that account for anSPX selling at 23x?

Non gaap and buybacks help, and thankfully the SEC started looking at that, which results should be available when companies no longer are using non gaap and buybacks.

The entire system is FUBAR and here we are trying to have a discussion using a lot of tainted data. But then again Congress and Fed are using same data.

Go figure.

People ignore the inflation that is raging in the construction industry. Does the BLS have sewer pipe or concrete curb in the basket of goods – NO.

Infrastructure upgrades, for instance, are extremely expensive for cities, counties and states. 10% per year is the rule of thumb in this industry. Higher construction inflation = fewer projects.