Slowest growth in orders since Oct 2009. Cleanest dirty shirt gets dirtier.

These are just the “Flash” Purchasing Managers’ Indices (PMI) which are reported a week before the final PMIs at the end of the month, and they represent just one view, but these are big moves, both, in US manufacturing and US services, big moves in the wrong direction, simultaneously, with both sectors now only by a hair still in expansion mode. The report by IHS Markit noted for manufacturing and services combined, with disconcerting implications going forward, that the rise in new orders “was the softest recorded since the series began in October 2009.” So one by one.

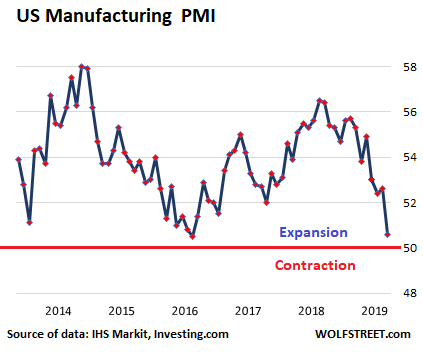

Manufacturing gets even weaker:

The IHS Markit Flash US Manufacturing Purchasing Managers’ Index fell two full points from 52.6 in April to 50.6 in May. Above 50 means growth, so this is still growth, but it’s a heck of a lot slower growth than a month ago, and very near the zero-growth red line in the chart (data via Investing.com):

Manufacturing has been weakening around the world, with PMIs falling below 50 in some major manufacturing countries. In Germany, it fell into the dreadful mid-40s, and therefor into steep contraction mode. In this context, the US manufacturing PMI had been the cleanest dirty shirt, but that advantage is fading quickly.

The report:

Underlying data indicated a broad-based slowdown in the rates of expansion for output, employment and pre-production inventories, while new orders declined for the first time since August 2009.

And new orders are a problem: “New orders were stymied by reports of weaker overall demand conditions and hesitancy among clients to place orders. The fall in new business was only fractional, but signaled a marked turnaround from the solid rise seen in April. Data suggested that demand from both domestic and foreign clients declined during the month, as exports also fell.”

This type of slowdown in manufacturing is “consistent” with annualized GDP growth of 1.2% in May. But…

“Worse may be to come, as inflows of new business showed the smallest rise seen this side of the global financial crisis. Business confidence has meanwhile slumped to its lowest since at least 2012, causing firms to tighten their belts, notably in respect to hiring. Jobs growth in May was the weakest seen for over two years.”

PMIs are based on surveys of industry executives without disclosing their names and companies. The “panelists” are asked whether certain aspects of their business are increasing or decreasing, compared to a month ago, such as new orders, new export orders, employment, backlog, inventories, supply chain delays, input costs, etc. Their responses form the sub-indices. For the headline PMI, they’re asked an overall question: “Is the level of business activity at your company higher, the same or lower than one month ago?”

PMIs are a boots-on-the-ground instant view by executives about how their company is being impacted by economic developments and precede by a good margin monthly or quarterly data released by corporate and government entities.

The manufacturing sector has been weak since February, but the PMI survey suggests that “the sector’s woes intensified in May to mean factories will therefore likely act as an increasing drag on the economy in the second quarter.”

“Trade wars remained top of the list of concerns among manufacturers, alongside signs of slower sales and weaker economic growth both at home and in key export markets,” the survey said.

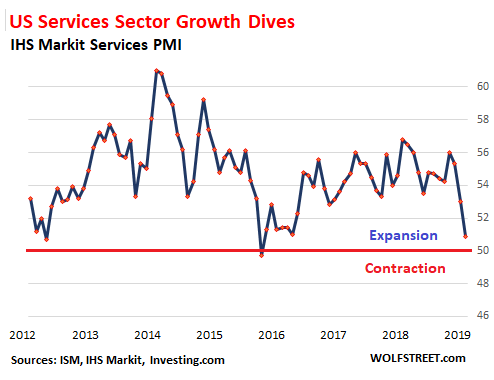

Services now dragged down too.

The IHS Markit Flash U.S. Services PMI Business Activity Index dropped 2.1 points from 53.0 in April to 50.9 in May, after a 2.3-point drop in the prior reading. The first quarter in services had been strong, but the drop in April and May combined of 4.4 points was the steepest two-month drop since March 2016 when the services PMI dipped below 50 into contraction mode. May’s reading is still in expansion mode, above the red line, but by just a hair (data via Investing.com):

In the service sector, new orders “increased only slightly, as the rate of growth eased for the third successive month amid softer demand conditions and intense competition,” and the backlog of work contracted.

Growth in employment “dipped to a 25-month low.” The service sector is still increasing employment, but at a slow pace.

Manufacturing and services combined.

The IHS Markit Flash U.S. Composite PMI Output Index, which combines the manufacturing and services PMIs, dropped from 53 in April to 50.9 in May, barely in expansion mode, the slowest expansion in overall business activity since May 2016, “as a struggling manufacturing economy was accompanied by a notable downshift in gear in the service sector.”

Recall that 2016 was the year that GDP grew a miserably slow 1.6%, the slowest expansion since the Great Recession.

“Growth of business activity slowed sharply in May as trade war worries and increased uncertainty dealt a further blow to order book growth and business confidence,” the report said.

Fears are now rising that the manufacturing “malaise” is spreading to the service sector, “growth of which slumped in May to one of the weakest since the global financial crisis.”

The service sector is the largest component of the US economy, and its performance is “a key gauge of the health of domestic demand.” And this slowdown spreading into services “poses downside risks to the outlook.”

Concerning inflation pressures and the much-threatened but mysteriously missing impact of tariffs on prices, the report said: “Input price inflation eased for the third month running in May, despite continued comments from panelists regarding the ongoing impact of tariffs. The slower increase in costs and greater competitive pressures underpinned a renewed fall in output charges, the first such decline since February 2016.”

And so the outlook by these businesses for the coming 12 months deteriorates: “Business expectations fell to their lowest since the series began in July 2012. Reduced confidence was commonly attributed to hesitation among clients and increased uncertainty, which were both often linked to global trade tensions.”

The weakness in manufacturing has been well-documented. But this sudden deterioration in the all-important service sector, from still strong in the first quarter, to hitting the skids in April and May, according the IHS-Markit PMI, is disconcerting.

The Flash IHS Markit PMI is only one view. There are others. The broader ISM Non-Manufacturing PMI for May hasn’t been released yet, and for April, it was still strong, though slightly less strong than in prior months. Other data on services in the second quarter will emerge over the next few months. And we will see if they confirm that growth in services is fast disappearing.

Where are the foreign investors in this phenomenon now playing out in the US housing market? US Home Sales Drop, Drop, Drop Despite Lower Mortgage Rates. But Mortgage Applications Jump. What Gives?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Now you understand why EFF is over IOER. It is b/c banks are hoarding money. They are hoarding because no one wants loans. If the Fed lowered to -10% AND bought every bond AND bought every share of stock AND every debt, the situation would not change.

The economy is collapsing. Now what?

“The economy is collapsing. Now what?”

I know, it’s fun to say this kind of stuff.

But after a while, your elaborate everything-is-in-total-collapse-now theories get a little old. This entire article is about slowing GROWTH. The economy isn’t “collapsing.” It’s still growing, and employment is still increasing, but the growth is slowing. Please read it and try to digest the data.

So where’s the beef? Backing out the growth of debt in about every aspect, it’s difficult to identify sustainable growth where the debt is actually paid down.

Yes the bearish toned articles are deafening, primarily in hindsight.

@Mean Chicken

Dr Lacy Hunt repeats this over and over. Extensive Financial-asset appreciating Debt-financed growth is ultimately non sustainable. This is the worst type of debt, because it’s ultimately unproductive.

The monetary tools that are being used to sustain this type of growth encourage and produce massive amounts of reckless debt.

And it is a vicious cycle. The productivity of each additional dollar of this type of debt towards real GDP (growth) encounters an accelerating rate of diminishing returns as more debt is successively piled on. (Productivity function).

There’s literally an acceleration (second derivative)of diminishing returns from each dollar of debt relative to the growth it produces. Thus the amount of aggregate cumulative debt begins to increase disproportionately relative to the unsustainable growth that it produces.

They need to stop with the traditional monetary tools. These very same tools have failed quite miserably over the long-term vis-à-vis the experiments in Europe and Japan.

“The productivity of each additional dollar of this type of debt towards real GDP (growth) encounters an accelerating rate of diminishing returns as more debt is successively piled on. (Productivity function).”

WHY do we never see up-to-date graphs of that? Seriously, I’d like to know. Here’s an old one:

https://yelnick.typepad.com/.a/6a00d8341c563953ef0120a51c48d4970b-500pi

This is the correct view, and this is what is, conceptually, rather hard for people to grasp.

An advanced economy can continue to ‘grow’ – however pimped the GDP figures are, however unsustainable the debt burden, however rapidly comparative or even absolute impoverishment is spreading among the lower classes, etc – while the civilization itself (in our case globalised industrialism) is already into the collapse curve – as we very clearly are.

Look at the causes of civilizational collapse identified by historians and archaeologists, and we tick all the boxes: over-population, overshoot of the resource base, ecological degradation, etc. And this time on a global scale, quite unprecedented.

So, both at the same time: tepid growth (short-term) and certain collapse (slightly longer-term).

This is what makes our times so interesting, in the Chinese proverbial sense.

“Look at the causes of civilizational collapse identified by historians and archaeologists”

From a financial perspective according to his study of past empires, the S-Curve:

https://www.oftwominds.com/photos2019/Scurve-empires3-19.png

But the TREND is sharply down. Emphases on “but number is still positive” reminds me of the guy who has jumped from the roof of a hundred-story building, shouting as he passed the sixteenth floor: “I’m still OK!”

And on a positive note Ppp :

– New home sales are up Y/Y

– Median price of new homes up BIG Y/Y.

– Importantly, truck tonnage Index up in April and up 7% Y/Y. I will leave

the rest of the good news for next month.

Barrack was sharp enough to tell us to go out and buy stocks back in

March 2009. He knew.

Everything is fine.

Existing home sales (which make up by far most of home sales volume) are down, 14 months in a row. Prices are stagnant, and declining in some areas. New home sales have always been volatile and not a good indicator of trends.

All of what you’re citing is built on the back of tons of cheap, unsustainable debt.

My friend is a commercial construction credit manager at a smaller-ish regional bank. He says business has been dead the past couple of months; like fell off a cliff dead. What had been driving loans the past several years, hotels/multifamily/self-storage/spec industrial, is completely oversaturated, to the point his bank is requiring 65 % LTV. which means no loans are being made, just re-fi’s.

what till this trickles down…

No surprise. The shoppers have left the building since discovering their wallets empty.

Do I see Wiley Coyote starting to drop towards the valley floor after spinning his legs out over the cliff suspended in mid-air for an unnatural amount of time?

Construction is super active in Atlanta. You can’t find a contractor and everywhere I go it is under construction. We might well be at the peak, but I understand they have backlog as well. Business is really good in Georgia generally outside AG. Just a small region of US, but sharing….

Builders had tons of backlog in 2006, too…

I think you hit the nail on the head! Always a time lag for Wiley to realize he is not on the ground anymore! Curious to see what happens at the bottom of the service chain, with Uber-eats, Skip-the -dishes.

Whether business is cutting back because of trade wars, (and now the stimulus battle) over the most over anticipated recession in history, thus causing a self inflicted wound, or global economics are simply too tough to ignore.

In late 2018 Nobel prize winning economist Robert Shiller (Yale) stated we (USA) are in the third largest housing bubble since 1890. Often people do not realize there are bubbles or toward the end of a business cycle. Ignoring these things does not make them go away. As people notice their investments are losing value, they may lose confidence in making non-essential purchases, or attempt to deleverage.

Some time ago a Chinese real estate billionaire sold his Chinese real estate holdings and stated China real estate is the largest real estate bubble on earth. Their rapid drop in auto sales shows some sort of pull back even if their official statistics show growth. If you build an empty city, it contributes to your GDP, but can you rent it out for a profit?

I suspect we’ll never really know what’s happening in China right now: after all Western historians still bitterly feud among themselves over the causes of the Taiping Rebellion which happened over a century and half ago.

What we do know is that the massive stimulus unleashed by the People’s Bank of China just before the Lunar New Year has been nowhere near as effective in stimulating demand as previous ones.

Another big problem China has and which so far the National Bureau of Statistics hasn’t “adjusted” yet is the fact they are apparently running out of real estate buyers. In 2018 52% of real estate purchases by households were second, third or even more far removed homes. Many of these are in the infamous “ghost developments”: here I’d like to remember most of these “investment properties” are sold unfinished and that owners tend to avoid living in there because 1) finishing said properties is usually far more expensive than developers advertise 2) a property which has never been lived in has a far higher book value 3) they already own one or more properties, often in more desirable areas.

Real estate in China will hold up until the government can “tacitly” back up the secondary market and “quietly” loosen lending standards and valutary controls for investor buyers. That’s not the main problem right now.

The main problem is that China, Europe, Japan and their supply chains around the world have hit some sort of “growth ceiling”, no doubt closely tied to the fact they have been frontrunning growth for years now through extra-loose monetary, financial and tributary policies.

Bureaucrats around the world have been busy redefining inflation to squeeze nominal GDP growth out of stagnation at worst and crummy miserable growth numbers at best. That’s why it’s unlikely we’ll ever have a period of nominal GDP contraction lasting more than a quarter or two in any country. ;-)

As expected….industrials first, services next

I think this is a good article that captures the pulse of what is going on out there.

Some anecdotal musings:

As a mid range baby boomer, I have definitely benefited from all this engineered expansion – it has never felt real. I do feel for the younger generations…highly unfair this pile of garbage being left. So, when reality hits will probably be quite severe as nothing goes on forever – particularly the engineered variety. I have been preparing for a possible valley since last summer. Thankfully, I have no debts of any kind courtesy of the immigrant mentality my parents instilled – I believe this (not having debts) is important to weathering any coming storms. My old dad would say that “in order to have have peace of mind, you don’t want your possessions to posses you!!!”

I also see many folks who are tapped out credit wise. Tough on a society whose growth depends on credit expansion.

We have been dancing for far too long, and pretty soon the musicians are going to want payment. After every peak there is a valley. This has been one long engineered peak by trying to fool the natural business cycle with a credit expansion cycle….and I have to hand it to the FED for unleashing a speculative fever that I never thought possible to this extent. It’s NOT nice to fool mother nature. Best wishes to all.

I disagree boomers benefited unless they ignored the subsidy-driven offshoring wave. Corporations took advantage of the wage arbitration b/c they were provided the incentive.

We’ve been through the greatest transfer of wealth in history of man yet nobody seems to grasp the faintest inkling of what was happening as we were being sold down the river, still to this day.

I import the same Chinese goods duty-free, bypassing the middleman who’s purpose is to import from low wage countries, slap his name on and mark them up 100%

I keep praying one day people will wake up, it’s not going to happen.

Amazing!

The coming end to this long engineered bubble will be best personified by the greek goddess Nemesis,

”

Nemesis was the goddess of divine retribution and revenge, who would show her wrath to any human being that would commit hubris, i.e. arrogance before the gods.”

I think Nemesis has hot date scheduled with that wild & crazy dude Chaos ! … the question will be ‘who picks up the tab’ ?? I think they’ll dine-n-dash … leaving the accrued bill for the wait er .. the one who doubles in this gigged economy as a ferry operator in his spare timed, piloting that ‘dead-in-the-water’vessel, otherwise known as the Good Ship River Stix … where Everyone gets a ride ..

Save your coins, you’ll need em !

Yes, Polecat: two coins for one’s eyes, to pay the Ferryman. Exactly.

And a hedge fund dog named Cerberus guarding the entrance…

Well, Trinacria, one can never fool Mother Nature: she’s seen what we’ve been up to, issued countless warnings, and soon will send us all up to bed – without any supper – after a damn good spanking….

√

TOM,

Please try to locate the CapsLock key (usually on left side) and disengage it. No comments here in ALL CAPS

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

When the autoworker loses his job he doesn’t buy an new boat or ATV but he keeps paying his car insurance and getting his haircut so he can get around and interview for a new job. But when the unemployment payments run out and no new job materializes then the insurance man and the barber end up on the short end of the stick.

Since the 1930s it’s been observed that people will hang onto their cars and that the car will be the very last thing to go.

Because in our society you need a car to get a job, also the old “you can sleep in your car but you can’t drive your house” equation.

When the car goes and you no longer darken the barber’s door, you’ve really lost everything.

BTW Seneca, I believe your name is the term for the classic curve of what in electronics is called a “Relaxation Oscillator”. Say a voltage builds up slowly until it reaches a breakdown point, then the voltage drops much more quickly than it built up. I believe this is a fairly common thing in Nature, like the build-up and dieoff of algae in a pond, etc.

More exactly,

The term is named after the Roman philosopher and writer Seneca, who wrote Fortune is of sluggish growth, but ruin is rapid

hmmm Like a parabolic blow off top

Oh yes, I looked it up. Good old Seneca, said something like “empires build up slowly then collapse quickly” and I’ve seen the Seneca curve on any number of peak oil sites, and I recognized the good ol’ relaxation oscillator curve right away.

Both measures dipped nearly the same amounts in 2016, according to the above charts. What was the issue then? Is it the same now? Why did both measures recover in 2016? Trump bump? Something else?

Angry,

For manufacturing back then, one of the big issues was the oil bust that caused the oil industry to slash expenses and investments as if there were no tomorrow. This had all kinds of ripple effects. This was NOT the only factor, but it was easy to see. Auto sales peaked that year, but auto sales for US brands had peaked in 2015 and were already slowing in 2016. That didn’t help. Consumer spending was weakening too. There were many other factors. The “transportation recession” was one of the consequences of this slowdown in the goods sector.

Back then, the slowdown in services was short and it came as a “surprise.” It wasn’t supposed to happen. If I remember right, the Dallas Fed published a paper that I covered at the time; it pointed out that it was very unusual for services to dip like this at the same time with manufacturing and not lead to a recession.

At the time, I ran a series headlined “Recession Watch.” But it never quite got there. Eventually, manufacturing and services bounced back.

At 1.6 GDP was pretty crappy in 2016. There also has been a massive counter cyclical debt fueled stimulus of a tax cuts and increased spending. Problem being how can fiscal policy stimulate the economy in a downturn when you spent all your money at a late night party. Looks like it will have to be pure monetary policy. I sure everyone will love that.

The funny thing is that if people talk about recessions for long enough, eventually it happens. This one is overdue for a while. And one has to wonder in this case if the recession was something that Trump is forcing on now through the tariff situation. Or if it is something else. I suppose if he hadn’t pushed the tariffs, there is a chance that this stuff might not happen. One thing though, the timing of the drop off seem to come right after there was a no deal announced on the trade talks in March., and see, to drag on thru May. I would bet the next month is another drop off due to sentiment surrounding China.

Keep in mind that around the start of the year we reached the baseline of the tax cuts. So now we are again comparing apples to apples.

The trade war is the last nail in the coffin of this late cycle economy. I wonder if Trump isn’t pumping the gas on tariffs to push the Fed to cut rates. In his plain simple binary mind, we can wonder Trump thinks to raise internal consumption, increase domestic production of stuff being made abroad and low interest rates will be key in his plan. Maybe this is the beginning of the end of this stage of globalization with the raise of nationalist and populist governments and the break up of much of the transnational logstical chains…

whoa whoa whoa…

stop using those big words like internal consumption, and stages of globalization, and transnational logistical chains. It hurts my brains.

Let’s keep it simple on the 3rd grade level ok?

Tariff: good. Because they hurt China more than US, ergo, China must come to table.

Higher interest: bad. Cause everybody says so.

With the tariff, now someone can point to it and claim it is the reason for the recession, but it’s a good patriotic reason because it’ll bring jobs back to the country. Short term pain for long term gain.

Not sure if anyone believes it though.

Suddenly US Service-Sector Growth Dives, Manufacturing Gets Even Weaker

Well, gosh, it’s a good thing the US economy is doing so great or this could be a real problem.

But since the US economy is doing so great, it’s not a problem at all.

Same goes for all the other problems the US economy is having. Make your own list. They’re not actually problems because the economy is doing better than it’s ever done, best in history.

Maybe it’s just the Financial Industrial Complex. All is well so long as the profiteering class can cannibalise the Real Economy without having to resort to even nastier strategies.

Again, those people cheering on the Fed hike in December havent a clue. The next move is a cut and by 50 points or more.

If the first cut is 50 points.

You lot are heading for something that will ,make 1929-1941 look,like a Sunday school picnic.

Based on current data and my opinion the majority of households have not completely recovered from the 2009 Great Recession. What’s restraining GDP? Household income which has been slow to recover for the majority is holding inflation in check. 1.6 percent annual GDP could almost be construed as a rounding error, albeit positive. It seems that growth in the supply of goods and services can be increased faster than current demand and could be the cause of short term GDP oscillations. This may be an indicator of very sensitive price demand and the constant readjustment of supply being overestimated. In other words it looks like the supply side has the capability to easily overpower the demand. If real price discovery were to occur the market could clear on its own, although that would be wishful thinking.

> If real price discovery were to occur the market could clear on its own, although that would be wishful thinking.

It will happen, it always does, once the punch bowl get kicked over or bankers end up in nooses

Great primer and update on the flash PMIs Wolf! 2 questions:

1. Do you know if it is common for a sustained (3-4 months or more) drop in the manufacturing PMIs to not be followed by a comparable drop in the services PMIs? My feeling is that they will catch up with a vengeance.

2. Do you think stock market moves affect now more than in the past people’s sentiment and a quicker impact is noticed on macro indicators such as the PMIs?

I’ll give your first questions a shot. Your more complex second question is beyond my pay grade. Maybe someone else can give it a shot.

PMIs can go in opposite directions. For example, here is Germany’s situation (red = manufacturing, blue = services). The PMIs sort of ran in parallel until recently. Now they’re going in opposite directions:

The Markit services PMI doesn’t go back far enough to compare over decades. It started out during the Great Recession. So we don’t have enough data.

I would think that a brief dip in the manufacturing PMI might not be paralleled by the services PMI. But if manufacturing really dives for a sustained period, the services PMI sooner or later would have to follow, in part because manufacturing entails a lot of services (engineering, finance, healthcare, etc.)

Interesting. Thank you. It does look that by and large the Services PMI is a laggard, at least for Germany’s case. It would be interesting to see what that recent divergence will turn into in the next few months.

1). The Fed is still in monetary easing mode. It has never not been in easing mode for 10 years or so. And we’ve experienced subpar growth. There is meaning it that. Why can’t the Fed see that, and advocate correct policy instead of incorrect policy?

2). As long as the Fed points to inflations as a reason for it’s rate setting, it will bias itself to eternal easing. Because the Fed don’t see no inflations because the report was designed that way and to exclude asset inflation the Fed’s easing is causing.

3). The Fed advocates austerity. Someone should tell the Fed that anti-austerity – fiscal policy that robustly increases social spending – it many times more effective that monetary policy and getting the economy to grow.

So I would like to toss a bomb into this little discussion to get the reaction of the group to the following hypothesis. Since the early 80’s, when Volker broke inflation’s back by raising interest rates into the high teens, there appears to have basically been a stagnation of wages (when I went back to grad school in 80 the minimum wage was $3.10 minimum wage now of course is $7.25. inflation adjusted the 1980 rate should today be $10 .15) with a transfer of wealth to the investor class and coupled with contemporaneous a increase in availability of consumer debt. Add to this continued increases in public spending (debt), exacerbated by a series of inane tax cuts, and you basically describe the events which have lead us to our current smelly kettle of fish.

In the collapse of 2009 the overall consumer demand function shrank and has never truly returned to its former form. QE1 made sense to underpin a collapsing market and inject liquidity at a time of crises. QEs 2 and 3 have contributed to our current asset bubble.

So…..what if the minimum wage was raised to $15/hr, thus stimulating demand, but consumer credit standards were raised such that we, over time, reverted the economy back to a more pay as you go standard which was more the case back 40-50 years ago? It is my nascent thought that the stimulative affect of injecting that much spending into the economy would more than offset the increased wage expense incurred and possibly even spur productivity as capital expenditure for automation would in all probability increase being justified by the labor savings. In the meanwhile tightening consumer credit standards would place a governor on inflation as households would be unable to borrow recklessly. How this would be accomplished I have no clue. But, does the above make sense to anyone other than me?

FUD. Fear, uncertainty, doubt. Next year and a half will be political fighting. Wages haven’t risen enough yet. Not enough cash flow to even make a first payment on loans. Democrats have been fighting Trump instead of making deals with him. Trump figured out it was a bad idea for him to give Congress 2 trillion dollars to buy an election with. Election hinges on who looks the most promising to voters. If Trump was a traditional Republican he would be toast. I see plenty of jobs replacing China trade. Start deporting illegal aliens, cut back on H1A/H1B visa holders, crack down on voting by non-citizens. Wages soar even as big-cap profits crater. Trump reelected, promising big business that support him prime cuts of the two trillion. Democrats are toast. Trump has control of his own fate. Democrats don’t.

I laughed out loud at this one.

If every narrative has to end with total annihilation-Mad Max in Thunderdome, then sure, all the Zero Hedge Qanon guys might one day have been right one time. Picturing the first Oompa Loompa-American president stumbling into Bartertown to show people how to cheat at golf and lie about everything all the time makes a great movie in my mind.

I think we muddle along and won’t get the kind of moment where we get to tell everyone our little apocalyptic moral narrative (of any flavor) was right the whole time before expiring dramatically. Archaeologists don’t know anything either-they just tell different just-so stories, as other storytellers like Diamond do, that serve their purpose today (moral scolding! jeremiad!) rather than portray an actual reality. ritholtz_dot_com_/2018/08/impeachment-markets-dont-care/

it was always facetious argument that the service sector would be immune to a slow down in manufacturing. As Dr. Krugman, would say, “my spending is your income, and your spending is my spending.” if a factory working, loses or thinks he or she is about to lose his/her job, she/he will not be buying items, going to buy a pet, or go out to eat.