$714 billion have gone up in smoke.

Bitcoin plunged to $3,738 at the moment. Down nearly 40% from two weeks ago, and down 81% from peak-mania of $20,078 on December 17, 2017. It’s back where it had first been on August 12, 2017. It looks like a magnificent bubble that is imploding, but “bubble” is a misnomer; it’s a magnificent scam, where people paid a lot of money – many billions of dollars – to get an essentially useless digital entity whose price then dissolved into where it had come from.

This chart via CoinMarketCap shows the drama of bitcoin’s market cap surge to $333 billion on December 17, 2017 and the collapse to $64.9 billion now:

There are now 2,071 of these cryptos, according to CoinMarketCap, up from 1,926 when I last wrote about it on September 9, and up from 1,400 on January 17, 2018, and up from just a handful a few years ago. These cryptos are multiplying like rabbits.

And each of these cryptos, those that are still alive, is constantly adding new coins through “mining.” This mega-dilution impacts some serious real money.

Market cap for each crypto is figured by the current number of coins, multiplied by the current price. Since new coins are created all the time through mining, it also creates new market cap when the price is stable, and it covers up some of the damage on the way down.

In overall market cap terms, new cryptos are created all the time through initial coin offerings (ICOs) and other methods, and each of these adds new coins through mining. And the overall historic market cap is figured going backwards, based on today’s existing cryptos to arrive at a theoretical market cap at a date in the past.

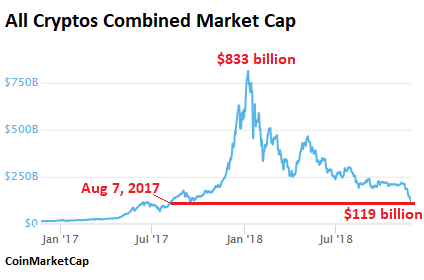

Back in January 7, the actual market cap on that day for all cryptos combined was $704 billion, according to CoinMarketCap on January 7. Today, this market cap figure for January 7 has been inflated, by the process described above, to $833 billion. As of this morning, this market cap has plunged 86% to $116 billion. By this measure, $714 billion have gone up in smoke.

This has been an obvious scam that peaked in the period between the end of December 2017 and early January 2018 and has since collapsed. It was so obvious that even I could see it. And it’s not like I didn’t warn about this on the way up – and people who read these articles would have had plenty of time to get out while the getting was good. Here are some samples.

- On October 23, I observed, Wall Street Piles into Cryptocurrencies, Others Speak of “Biggest Scam Ever.” I don’t remember ever having seen crazier times of more pandemic proportions.

- On November 12, 2017, I mused: “Bitcoin Cash” Quadruples in 2 Days. Bitcoin Crashes by $35 Bn. Peak Crypto Craziness?

- On December 11, I mused about the media’s gloriously infatuated coverage of this scam: “Peak Bitcoin Media-Mania Yet? In Ten Practically Funny Pictures. A scam of this magnitude cannot happen unless it’s being ruthlessly fanned by the mainstream media.

- On December 24, I mused, Cryptocurrency Mania is the Most Fascinating Financial Phenomenon I’ve Ever Seen.

- Here is my whole series on cryptos and blockchain.

These articles attracted lots of crypto-trolls of which there was a nearly unlimited supply because that too is part of this scam: Everyone has to promote it.

Some of these promoters are paid, such as John McAfee who admitted in March that he charged $105,000 per crypto-promo tweet. That’s a lot of dough for a few seconds of work. Others did the promos for free, hoping to do their part to drive the prices of these 2,000-plus cryptos into the stratosphere.

Paid or not, a slew of them came to WOLF STREET’s comment section and cited intelligent-sounding gobbledygook “whitepapers,” made spurious arguments that were out of this world and defied gravity while claiming that the earth was flat or something. Plenty of them said nasty things. I blocked most of these comments because I didn’t want the comment section to become toxic. Some of them I let through to have a historical record about the nonsense spouted off by these promoters.

And for a while, some befuddled reporters in the MSM, in love with this “new technology” or whatever, supplied the super-horsepower needed to get the scam as far as it did last year.

Holdings of bitcoin are very concentrated among a relatively small number of large holders, such as bitcoin miners, hedge funds, and family offices. And many of these hedge funds and family offices, in their infinite wisdom piled into it late last year and then “leaked” the information that they had bought into it to create hype and drive up the price further. This was eagerly reported by the befuddled media.

But there is no liquidity in these cryptos. Just as these hedge-fund purchases last year caused prices to multiply due to lack of liquidity, efforts to get out from under these positions is causing the prices to collapse. In other words, these hedge funds and family offices are stuck, unless they want to cause the price to collapse further.

Here are the half-dozen largest cryptos by market cap, and their percent plunge since their respective peaks. These are among the most alive. Hundreds of cryptos have already died:

- Bitcoin (BTC): -81%

- Ripple (XRP): -91%

- Ethereum (ETH): -92.4%

- Bitcoin Cash (BCH): -96%

- EOS (EOS): -85% (I ripped its stupendous ICO last year)

- Stellar (XLM): -85%

Certainly, they will bounce again, as they have before, enough to give folks some hope, before they will re-collapse when some of the big money is gingerly trying to get out without totally crashing the entire space. But for anyone trying to get some money out of the crypto space, new money – dollars, euros, yen, won, etc. – must flow into the crypto space in the same amounts. And it’s going to be harder and harder to get people excited about throwing their money at this scam.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

At least during the “tulip mania” tulips were real and did look nice.

And the beautiful paintings made of them still grace many a wall some three centuries later -good craftsmen, the Dutch painters.

Ah, those old bourgeois virtues: good materials, careful , well-trained craftsmanship and artistry: great value for money.

Patience too – a faculty that is now not valued at all, as it doesn’t fulfill the remit of instant personal gratification and easy enrichment with no dirt under finger nails.

All part ‘n’ parcel of a decadent/degenerate society.

My wife is of Dutch extraction and paints in the manner of Vermeer.

So, some of that real value (to me, at least) survives, here and there in the world.

Wish we could post pictures here.

Do you mean using that insane reflective / mirror method demonstrated / sleuthed out in that Documentary?

I have perfected a process to mine gold using computers with NVIDIA chipsets. For investment information please contact me at 1-800-FED-SCAM. Don’t hesitate! If you snooze, you lose! /sarcasm?

I HAVE found a way of extracting gold from old NVIDIA boards — it is called recycling ;-D

(The chip connections to the pins, and the coating on the pins, is, in fact, real gold.)

I’m not trying to start an argument here as I have no dog in the crypto hunt and never have. I’d like to know how Bitcoin is different than gold? Neither really have any intrinsic value. Sure, gold can be used in jewelry and wiring in spaceships, etc., but the real value is created by peoples’ perception of holding it as money outside the control of any government.

How is that different than Bitcoin? I’m not saying they are exactly the same but I can see advantages to both of these forms of money.

All “money” is a matter of confidence. “Con Game” is short for “Confidence Game”. Bank runs are an example of a loss of such confidence.

The dollar is much the same; as an example of a fiat currency.

Truly sustainable wealth is that which is retained over market cycles; the more the better. One market cycle can be > 10 years.

History started before we were born. People a long time ago were not stupid.

Be careful out there.

Crypto can be transfered instantly and at zero cost

Absurd. There’s a huge cost in the electricity needed to hash the transactions. And that’s not counting any of the existing internet infrastructure that already existed and must be constantly maintained – which adds some other unknown large cost to the equation.

If transaction is really at zero cost, who would be willing to provide computing power to log transactions once the last bitcoin is mined?

This statement is a big lie. “Crypto” is neither instant, nor free to transfer.

For instance, Bitcoin has a theoretical limit of 7 transactions per second globally. (A comparison, VISA does 35000 per second easily.) And that’s only if all the 7 of them are empty. The real limit is about 3. And don’t even mention the non-working vaporware called “lightning networks”.

And try to send a transaction with no transaction fee – it will never be confirmed. At the peak of the bubble the transaction fees were as high as $60 – hey, I can wire money cheaper. And that doesn’t even take into account the block reward, which is a huge subsidy to the miners – and which is shrinking exponentially, meaning that sooner or later the transaction fees will have to increase, or the miners will stop mining and the whole crypto currency network will freeze.

So, spare me the bullshit.

Bitcoin is different from gold because, in Bitcoin, your ownership stake is just a number in a distributed ledger that you do not control. The two groups that control the ledger, the developers and the miners, can wipe your stake out with a few key presses.

Now, Bitcoin will say this isn’t true but it is 100% true. In fact, there are example of it happening.

In 2010, someone found a flaw in Bitcoin and was able to give themselves tons of coins. Google “value overflow incident”. The bitcoin developers (the central control of the whole thing) erased those transactions from the chain and made a new chain.

The miners can also block transactions from happening if they operate as a group or if one owns enough computing power.

However, if they try that, the real central control, the developers will change the code to block them. The DAO in Ethereum is another example where the developers erased someone’s coins.

So, the reason it isn’t like gold is because I can keep gold in my basement and some random people that don’t care about me can’t erase my ownership of that gold. If someone comes to steal it, I have a legal system that will support my rights to get it back.

With Bitcoin, you trust some random people (who are scammers in the first place) with your assets. They are not under your control at all. And that’s just the beginning of the problems with it.

The developers have even talked about how they would mess up the people processing transactions (miners) if the miners tried to block transactions or double spend. Here’s one talking about it. You can see him say “we will kick them off the network, rework the protocol around them..”.

He’s talking about how the developers can do whatever they want to whoever they want. They are not accountable to anyone. If they want to take your coins or block your transactions, they can do it. They control the rules of the game and are unaccountable to anyone.

That isn’t true for gold. Gold in your basement or in a safe deposit box can’t be confiscated by random people (some of them anonymous) without a legal process in the US.

Now Bitcoiners were scream about the blockchain and how it is secure and all sorts of garbage like that. But it is just a data structure maintained by a bunch of programmers who can change it any way they want, for whatever reason they feel like. Unaccountable to nobody.

https://youtu.be/ncPyMUfNyVM?t=46

You completely misunderstood what Andres was saying in that video. Good God — you don’t even understand what you are talking about. When a transaction happens on bitcoin it is put into a immutable block — what Andreas is saying is that it would take an insane amount of effort to create one fraudulent block, which would be exposed. The block chain is done through a consensus (that is why transaction sometimes can be costly and can take a few hours) if a miner was able to try to double spend a bitcoin it would be found out — all his work would be for 1 ten minute block. Dude, you do not have the knowledge or understanding to even comment on bitcoin — your are just showing your ignorance. It is quite sad and a little pathetic. And FYI — of course their are developers & miners that work on btc – where do you think it came from??? But the work is all open source – it is not owned by any one group or corporation.

Its different because Gold is real.. Tangible etc. You can actually make a product from it.. Crypto’s on the other hand only have hype value. It can never be used as a currency because its way too volatile in price.. Gold is stable for the most part and so is silver.. People treat crypto’s like a stock, not like a currency.. Had people not been greedy it might have free’d the human race from central bank bondage but it just made things worse.. Not to mention how badly it screwed up the price of video cards..

Gold has seriously important uses, such as in computers people are reading this on. Palladium is a near substitute and its price and gold are almost always quite close.

You can make things out of gold – virtual currencies are just electrons.

That said, things are only worth what someone else is willing to pay for that thing. At the one oasis in the middle of the desert, water is worth far more than gold. Different result where drinking water is plentiful.

U still believe in this bit shit? Amazing.

Tom, from what I have heard about gold. Classically its biggest selling point as a currency has been that it is scarce, hard to counterfeit, and easily divisible into various amounts making it an ideal currency in a pre fiat world. I would say in most economies that aim to simplify quantifying trade value. We seem to end up on choosing something rare, that is also easily and can be made small.

Older people I think still cant get fully behind the fact that something being purely digital essentially carries nearly all the same value. Minus some real world utility which frankly was likely never the real reason for the currencies value.

I think back to Diablo 2s trading economy where SOJs a unique ring became the default trading currency. Because it was small, rare, had high utility and was easily identifiable.

If any particular coin survives the block chain format offers a lot of utility as a currency, which should only grow in the future. The risk now is that with all the bubble speculation its possible none of the original coins will take hold.

But overall a digital currency will eventually become dominant as long as we keep advancing. No physical currency can compete with the utility of digital. Unless there is a physical catastrophy.

When you trust human and guns, you go fiat. When you do NOT trust humans and you think their guns are smaller or weaker, you go gold because NOBODY can do anything to gold. If you do NOT trust human and guns and you trust MATH running on electricity, human can modify the math and can destroy electricity, cut cables and you lose your savings.

Simple answer:

Gold has a history as money for thousands of years, and is held by the world’s central banks.

Gold is highly liquid, meaning you can enter and exit large positions with having much impact on the price.

Gold is thought of as a safe haven in that people have been confident it will hold value in a financial or currency crisis.

Bitcoin is relatively new and is not held by central banks.

Bitcoin is not very liquid, meaning large cash transactions will noticeably affect the price.

Bitcoin behaves as a risk asset, which investors flock to when assets rise and investors flee when there is trouble.

Any rational investor will admit that there is a significant chance the value of Bitcoin will go to zero, whereas the chance of Gold becoming worthless is practically nil.

Gold is a real substance with true rarity. It is only found in certain sites and requires much real effort to find and take it out of the ground. It is in no way at all like any Crypto. Bitcoin and the rest are totally worthless. They are electronic bits that are created by using enormous computer power and electricity. They have absolutely no value at all. They are in no way scarce. Thousands of them exist and more are created daily. They truly are a scam.

Reality is different than fantasies.

How do you store the fantasies?

Gold is limited as available material and cannot be man-made.

The fantasieshave not limit, especially after crosiing the border of decency or better said, insanity.

If you bought GOLD between 1978 and 1982, you would have lost more than 84%, some lost more than 90%.

Did this mean that GOLD ceased to be useful?

Hey, Wolf I hate what they have done to Bitcoin, and your right 99.99% of these clones are just a cheap fake, sold by conmen, as any kid can take the bitcoin open-source, rename and redeploy

Bitcoin is useful, for instance in WAR where wealth can’t be carried, or even USA where I can’t travel carrying more than $10K USD, Bitcoin is very useful, and like GOLD if I were using GOLD to move wealth at the wrong time in history I could lose.

I concur that +99.9% of these Alt’s as we call them will go to zero, but I think Bitcoin is here to stay, albeit certainly $2k, maybe less. For instance there is a alt called zen/zcash clone, and they pay people to host, for instance with Bitcoin, now there there is no incentive to mine, there is no host to transact, but with the Zen model, there are 1,000’s of encrypted secure servers that will continue running because they get paid a profit that exceeds the cost of supporting a virtual server in Siberia.

If you smuggle stuff in PEACE time, BTC could work. In WAR time? The first thing they take out is communication (internet), the 2nd thing they take out is electricity, and then factories that make NVDIA chips.

Do you realize how much business is dependent on the internet?? I guess if WW3 happens nobody will be worrying about their investments.

Yes, I concur with the following, the internet will never go down, its here to stay, or something like it,

DARPA (CIA) invented the internet so that missile silos could continue deploying bombs long after USA destroyed, the internet is designed to live like a cockroach, long after all the humans are dead.

…

Very interest news here that Jack Ma just became a Communist Party Member. ( Relates to bitcoin )

The question is then not how many confirmations suffice, but how long an adversary can hold 51% of the network’s hashrate.

[/quote]

At what date did ‘ANTMINER’ go live? That’s when BITCOIN entered the ‘matrix’, you can take the red pill or blue pill, the blue pill you ignore the 500LB gorilla ( china, alibaba, antminer,amazon), red-pill you deal with reality.

since antminer went live, they control 90% of the bitcoin mining, that means that whatever they have been doing since then, they have been in control, as they decide the consensus, and nobody else,

funny thing about these red/blue pills is that this site right here is hosted by amazon-services, who is tied to alibaba, who is tied to jack-ma, who own majority interest in antminer, and jack-ma just got entered into the communist party of china, this is a big-deal

continue on folks, live in the matrix, and this time its brought to you by amazon/alibaba

Another way to use the MATH is apply the ‘Kelley Criterion’, as the differential eqn, optimized solution for max wealth is all the same, 2P=F, once you hit 50% ( 0.5 ) then your in 1.0, say china ( alibaba/amazon ) control 90% of bitcoin mining ( consensus ), then they’re 1.8, ownership/control and some more

More interesting thing about the Matrix, and china’s social-score ( facebook ), is why would amazon/alibaba want to control all the digital-money on earth, when they already control all the shopping? Why even ship a product, when you own the printing press? Me thinks this is largely a supplier problem, as suppliers to the GORILLA can be PAID in ‘crypto fiat’, and of course the sheep who work in the factory’s too can be paid in crypto-fiat

The Matrix is Real.

In above I’m talking about bitcointalk.org, which is hosted by amazon. No reflection to wolf, I just thought this new development is very interesting, this is a big thing that jack-ma just got brought into CP-CHINA, it means he will be leading the new world order, and the crypto fiat universe will be brought into the CP. FYI, for those that are not aware, amazon/alibaba are very tight. IMHO eventually baba will buy amzn,

Jack-Ma has carefully purchased most of the bitcoin assets in china, and of course bitcoin has this deal with 51% consensus, where originally it was peer2peer, but now 90% of mining is done in China by Ma held rigs, up until recently free electricity to boot. So in effect this all means the CP now controls BTC, which could explain why USA interests will either go nuts, or USA-CP will become partners in crime.

What you say is not at all true. Many people bought gold in the time frame you mentioned and made a lot of money. Like any investment one must get in and out at the right time. Buying gold at its’ low of around $260 and selling at over $1,900 near its’ high would have made one a fortune. Stocks went no where at many times in their history. Successful investors in stocks could make a fortune. The same is true of gold. For the record, after stocks crashed in 1929 it took approximately 25 years for them to regain their previous highs.

Electro-Magnetic pulses are making these fake units to dissappear.

Gold can be melted but not evaporated.

….

The Man found the reality and understood his relation to it.

This is “objective” creating “subjective”.

Now, the ideas are pushed to be accepted ad a reality, OK virtual but not “objective”.

Pretending that “subject” equals “object” is insane.

I know, Hinduism, Jung-ism brought this idea to illeterate masses… but you do not live within your ideas, but in the physical reality and if you do not believe, I can kick your ass to wake you up!

What’s especially impressive about your warnings over a year ago, is that you may have even beat Nouriel Roubini to the punch. He was noted for predicting the 2008 financial crisis, but I don’t think even he went public on what he calls the ‘mother of all scams’, until last month. Take a bow.

https://www.cnbc.com/2018/10/11/roubini-bitcoin-is-mother-of-all-scams.html

At the time, it was very lonesome out there. I got pooh-poohed from all sides, even in my email inbox. But now I have good company. Feels nice :-]

I was never able to see Bitcoin or the rest of these cryptocurrencies as anything other than a scam. Then again, the Everything Bubble blown by the Fed’s deranged money printing was rife with such scams and Ponzis, with the biggest ones being the stock market and Housing Bubble 2.0.

Your Right,

There are Three very important elements never mentioned,

1.) 2008-2018 there was free money, and that money flowed to stupid things like intangible virtual assets, thank the FED for BITCOIN to the moon 2004 to 2008.

2.) Post 2006 BITCOIN went ‘mainstream’, and the credit-card was the preferred model to buy for this ‘once in a lifetime to get rich’, most of the gain in BTC from 2006 to the 2017 high was credit-card flow. That got shutdown in 2017, and called in early 2018 as most of the purchases could no longer cover their debt.

3.) The futures market for BTC (BITCOIN short form) was opened in DEC2017, up to that point there was no way for whales to ‘exit’ without losing money, the Future allowed the whales to BUY INSURANCE. The whales proceeded to unload.

All things came together in DEC2017, the closing of credit-cards for the MUPPETS, and the WHALE exit for the biggest fish. But let’s not forget here if NOT for trillions of FREE MONEY handed out post 2018 there would have never been a ‘bitcoin bubble’.

Bitcoin is here to stay, it holds an important future feature of allowing chinese money and usa wealth to flow out of hostage country’s both before and during the coming Orwellian-Wars. During WW2 ‘Holocaust’ people used Gold&Diamonds to move wealth out of ‘war zones’, in the future with the advent of detectors of both, wealthy people will use something like ‘bitcoin’ to move their wealth when the exit. Per Marc Faber, never stick around during a civil war, survivors are always those that bailed early with their wealth.

EDIT

But let’s not forget here if NOT for trillions of FREE MONEY handed out post 2018 there would have never been a ‘bitcoin bubble’.

[WHoops post 2008]

For many of us, it’s why your column is the first opened everyday. Then Bloomberg, Yahoo, Reuters, etc. I figured I must be a dinosaur because I couldn’t see the value of something mined with a keystroke on a computer until you came along and let us fossils know we weren’t crazy.

While we’re on economists who missed the 2008 boat let’s add Krugman, Bernanke, Greenspan.

A sweet and deserved victory, Mr Richter. But I sincerely hope it doesn’t become an Albatross. I hope you do not suffer the “Roubini Curse”.

You do not want to be referred to forthwith as “the person who predicted the Bitcoin crash” by each and every commentator and journalist. That would be an unfair label to someone whose contributions to humanity are much, much greater.

OTOH, neither Time nor Krugman called it a “curse.” On the contrary:

http://content.time.com/time/specials/packages/article/0,28804,1894410_1893209,00.html

Auld Kodjer,

I’m just the little guy. If I’m lucky enough to be referred to at all in a positive way, I’m referred to as “this guy said….” I don’t see that changing. Suits me fine. So don’t worry :-]

Well, you DID have some INFERIOR company, back then. Guess who?

Not “inferior” :-]

@wolf

As long as long as you’re not referred to as “Californian man….”

Those sentences usually don’t end pretty.

i.e.

“Florida man…. alligator…”

I knew the game was over the first week of February when my office manager told us ( About 30 Real Estate Agents) that crypto and especially Bitcoin was the wave of the future and that people would be buying houses with it on a regular basis within a year.

He’s a hell of a salesman and like every highly successful salesman I have ever met both delusional and highly optimistic.

The fundamental value of an electron seems to be quite variable…

Hello Curious (and Wolf),

Actually, Roubini was pounding this drum from the bubble peak.

https://twitter.com/Nouriel/status/956482056254455809

Does CNBC mention how many times Roubini has been wrong since his 2008 call? Hardly.

Bitcoins: The Second Biggest Ponzi Scheme in History

Gary North – November 29, 2013

I hereby make a prediction: Bitcoins will go down in history as the most spectacular private Ponzi scheme in history. It will dwarf anything dreamed of by Bernard Madoff. (It will never rival Social Security, however.)

To explain my position, I must do two things. First, I will describe the economics of every Ponzi scheme. Second, I will explain the Austrian school of economics’ theory of the origin of money. My analysis is strictly economic. As far as I know, it is a legal scheme — and should be.

https://www.garynorth.com/public/11828.cfm

The phantom wealth that has been created will, and is evaporating.

The entire crypto sphere is nothing but smoke and mirrors.

There truly is “no free lunch”.

What we are witnessing is the deflating everything bubble:

Energy junk bonds

Corporate debt ($6.4 trillion of investment grade bonds)

BBB graded bond debt

Stock markets

Tech startups

Emerging markets

Auto loans

Credit card debt

Residential/Commercial real estate bubble 2.0

Crypto currencies

Shadow banking sector

Sovereign bonds

There are many more.

“In a country well governed, poverty is something to be ashamed of.

In a country badly governed, wealth is something to be ashamed of”.

– Confcius

Apologies to the “Master”.

CONFUCIUS

There are plenty of free lunches if you know the right people. :-)

Proposed correction: replace “free” with “paid for by somebody else”.

Why not just print, errr, add more $UST?

BTW, Thank you for keeping the comments section nice and tidy. Much appreciated.

Please see the following Twitter thread regarding exactly this question.

https://twitter.com/Bitfinexed/status/1066797034961813505

Agreed

ZeroHedge used to have a great comment section. But the bad forces out the good.

Exactly right. ZH is now taken over completely by alt right and white supremacists. There used to be a lot of common sense in the comments but not anymore.

Wasn’t there a story during the tulip mania of a Dutch merchant’s servant who ate one of his master’s enormously expensive tulip bulbs, stupidly thinking it was an onion, and consequently being sent to prison for theft – when the price of tulips collapsed to common vegetable levels, his master got out of jail, stating that he himself was the biggest fool.

The version I read said it was a visiting English sailor who was completely unaware of tulip bulbs.

Because we know from their cuisine that the English basically can’t tell a tulip from real food. ;) *rimshot*

Tulip bulbs are not really good for eating, taste is ok, but they are somewhat toxic:

https://www.bbc.co.uk/history/ww2peopleswar/stories/63/a8158863.shtml

But for anyone trying to get some money out of the crypto space, new money – dollars, euros, yen, won, etc. – must flow into the crypto space in the same amounts

Truest words ever spoken.

It’s much the same for any asset class, which i think why the pig in the python will create severe dislocations.

If you want a good laugh, read the comments by the Bitcoin bag holders trying desperately to get their (vaporized) funds out of Coinbase.

http://bittrust.org/coinbase

My favourite part was “they won’t let me trade with it”

What do you mean, they won’t “let” you? Aren’t you “being your own bank”?? This is the unstoppable future of decentralised money we’re talking about here?

Haha, perfect.

I like how it was taking 3 days and $21 in transaction charges to clear when buying a $5 cup of coffee.

“That’s not right.” I slowly thought to myself…

I’d really like to see the pro BTC commenters tackle how similar BTC and gold are in light of these Coinbase comments.

I have appreciated your insights on many stock market related predictions and I enjoy the information that you share. Unfortunately in this particular instance I can assure you you are incorrect. I also predicted that Bitcoin would crash in 2018. Not because it is a scam, but because of the irrational exuberance that took place in 2017. I also predicted this current deep crash that is happening as we speak. I actually just bought in yesterday because I have been waiting for this price to arrive. So far in 2018 we are simply in a resting phase from 2017 s over-excitement. Bitcoin will continue its longer-term upward trend. If you want to see how well my predictions have come true feel free to visit my YouTube postings at bestcryptonewsletter.com. this is not a Spam posting. Please just take a look and see if I am making any sense.

But still, thank you once again for all the good advice you have shared in the past.

Well… who knows. But you also may be wrong. Looks like you are staring down the barrel of a 20% loss since yesterday.

Perhaps you will think differently of me a week from now when I am in complete profit. Just watch.

3500 was a number that has some support and if inside days start lining up GBTC is the play….with stop easily managed risk now…

He could have bought in at that price with previous profits, we don’t really know.

I think you are laboring under a misconception. You are placing value on crypto currencies, rather than on the technology behind them, namely blockchain.

The technology will proceed forward, but rather think the crypto currencies will be left out.

Actually I have to agree with you that 99% of cryptocurrencies will get squashed. All great technologies will attract scammers. Bitcoin and ethereum for example will thrive while, as you said, many will disappear and get crushed. So I do agree with you on that.

Please explain Why bitcoin and ethereum thrive and the others fail?

Check the above link to the coin-base comments and tell us why we should “invest” in BTC.

How about this for a strategy:

1. I keep all of my liquid wealth in gold and cash.

2. WHEN I want to do an online transaction I buy a BTC type currency with my cash and instantaneously execute the transaction.

If I can do this, why do I need to care about BTC etal? They are just transaction mediums, NOT stores of value.

It’s similar to people betting on Napster or BitTorrent or Netscape. They may be pioneers of a new technology but their successors perfected the application of the technology AND the business model. Those companies are what you want to invest in.

Don’t knock Napster. The software worked better than

anything Microsoft has put out.

Scaled to fit user-client defined financial relationship. It will be huge..

Hey, please sell all your assets and buy bitcoins.

Will make you very rich.

methinks you forgot the /sarc

If you believed what you say, you would be quiet and not try to pump the price. You would want BTC to fall further. You would seek an even lower entry point. But you need people to buy BTC to sustain the price. You need greater fools. But greater fools are running thin. Tick tock, tick tock, tick tock…

Old people have a difficult time accepting CHANGE… Crypto’s (BTC/LTC/and few others) are the future!

This present day CONTROLLED SCAM called paper-ponzi-money system can only end badly.

If the PEOPLE can keep crypto’s out of the hand of the usual scoundrels, then they achieve a new level of freedom… something that old folks do not enjoy.

Sure, with crypto “the people” can achieve the Freedom from any of those trappings that having real money will give one!? It’s happening even now. And, Indeed, I am way to old to enjoy that personally.

In former times thousands of pure hearted young people would seek the same kind of freedom from worldly obligations by giving everything away to Hara Krishna or Scientology. They would rant and bore everyone with their “cause” back then too.

However, being “old people” and I gather therefore per-definition a bad person, I must confess that I really do enjoy the spectacle of righteous, principled, people getting their ideological knickers in a twist and going down a flight of stairs or two over it.

That part never gets old.

I knew the cryptocurrency market was going to crash at some point,especially when I heard the stories of people taking out second mortgages and investing their life savings in Bitcoin and other cryptocurrencies. I didn’t think it would drop this far so soon, as it was still relatively unknown to most of Americans. I thought it would drop about 30 to 40%, trade at a horizontal level, and then head back up to the moon before crashing like it has now. I was waiting for it to reach mainstream media consciousness, when stories would be routinely covered on the nightly news shows and morning news programs, when Law & Order: SVU did a show about a sex trafficking ring being supported by Bitcoin, when some up-and-coming hip-hop superstar had a huge hit about his Bitcoin stash, talking about how some hot shawty wanted to stroke his loins when she found out about his Bitcoin, and most tellingly, when some late night infomercials popped up showing average Joes how to get rich in the cryptocurrency markets. Then I expected all hell to break loose.

More proof, as if it were needed, that when it comes to the greed/fear cycle that drives all the bubbles we seem to rely on given the fact we decided manufacturing is old hat and debt-fueled speculation is the way forward, that it is never ‘different this time’.

The only thing we learn from history is that we don’t learn from history…

I predict multiple federal prosecutions involving cryptocurrencies in the near future, especially if someone rich and powerful got burned. The feds like to use “wire fraud” as a catch-all term that can basically make anything involving the internet into a crime.

I predict multiple federal prosecutions involving cryptocurrencies in the near future, especially if someone rich and powerful got burned.

Right. Our corrupt Justice Department and regulators will get right on that.

If someone rich and powerful wants a prosecution, they can say “Jump!” and the DOJ will ask, “How high?”

Remind me again how many bankers went to prison for causing the 2008 financial crisis, or committing multiple felonies while defrauding investors.

Oh, right. Not a single one.

Go on YouTube and watch Eric Holder explaining “To Big to Jail” or why the really big criminals enjoy total impunity thanks to our catastrophically-misnamed Justice Department turning a blind eye to their crimes and swindles.

“Free Jon Corzine!”

As Wolf says in the article, it’s likely a lot of hedge funds and family offices lost big money in cryptos. The notion of being ripped off by a bunch of computer geeks in a basement would probably not sit too well with a Master of the Universe(tm). The Revenge of the Nerds will not be allowed. When the hedge funds give up on prices recovering, the prosecutions will begin.

You bring up an interesting point @David Horowitz. I have always thought it obvious that the autistic geeks were being groomed as the nascent technocrat class supporting automation and the MotUs while the rest of us “useless eaters” could go zombie ourselves on opiods and the Basic Universal Income/Allowance.

But now that those upstart geeks have begun fleecing the “real thinkers”/d’elites, what is going to happen? I doubt the MotUs thought of that. To the popcorn popper, Robin!

From the very, very beginning of this carnival of human folly, Yves Smith at Naked Capitalism has used the apt term “prosecution futures” to refer to Bitcoin.

Tunnel vision, tech utopianism, hubris, a thermodynamic/environmental disaster, individual and group madness, fraud… this baby’s got it all.

Oh, and apologies for not giving Wolf a well-deserved tip of the hat for his fine work on this and every other topic.

– I never touched any of these crypto currencies. I did read W. Richter’s warnings and decided to wait. But now I don’t have any appetite anymore.

The technology behind it is very interesting and one day it will perhaps be put to productive use. Once again, it was exploited for greed. What a waste of capital for the masses.

This happens in medicine and the pharmaceutical industry all the time.

Greed and exploitation.

Very sad…….

In the past year I’d come across dozens of these nasty postings by bit coin enthusiasts and every one of them was hostile and obnoxious. Not a single one of them ever presented an even half-way reasonable argument for the value and greatness of bitcoin. I kept asking these trolls: If Bitcoin’s value is defined by fiat currency — what will define its value if all these “obsolete” fiat currencies go by the wayside? To which they would answer: “You stupid #%^$%#&* you don’t get it. You’re too stupid to get the genius of bitcoin.” Or something generally along those lines.

Hahaha…I do pleasure at the thought that these trolls were also invested in it, and invested big! :)

There have been similar swindles to Bitcoin, and similar confidence men promoting them since time immemorial.

“There is no new thing new under the sun.”

-Ecclesiastes 1:9

Hahaha…I do pleasure at the thought that these trolls were also invested in it, and invested big! :)

The Bitcoin fanboys were an odious and obnoxious lot, without exception. They would incessantly bash “old bugs” (gold bugs) as being fossils whose physical precious metals were languishing in value, while touting the virtues of Bitcoin and its unlimited growth potential. Now they’ve vanished from the forums they used to haunt, unmissed and unlamented, as their scam currency plunges closer to its intrinsic value: zero. Such wealth destruction couldn’t happen to more deserving bunch.

Not always true. A local I know had made a lot of money on paper with his cryptocoin purchases. He had a schedule for converting bitcoins into fiat U.S. currency at various prices on the way down. I haven’t seen him lately and don’t know whether he was actually able to get out according to his orderly plan.

He also has squirreled away quite a lot of physical silver and gold, financed with bitcoin sales on the way up.

He explained his strategy to me and understood my eschewing it – never was odious, or anything of the like.

Some “gamblers” are classy.

Finding a counter-party for converting Bitcoins-to US$ is…well,,,not easy to find even when times are good. Was your buddy actually convinced liquidity existed to do this on the way down? Were adult beverages involved?

True story: I have an (ex) wife who was absolutely convinced selected beanie-babies were worth hundreds, perhaps thousands of dollars. She bought them from the 18-year-old usher at the local movie theater for “3 for $5”. And, yup, this was an issue in the property settlement.

Right. I’ll admit it. Last year, during those scary rises, I was thinking of getting in, riding the wave for a few days then getting out. Getting out was the problem as, at the same time, (non-US) banks all over the place were freezing accounts used for Bitcoin trading and/or outlawing such txns, not to mention the exorbitant rise (and time lag) in getting anyone to convert prior to deposit. I knew that if I entered, I’d be riding that tiger’s tail all the way down again. No way, Jose.

But damn, it was tempting for a couple of weeks.

Gershon,

Well, you know Max Keiser is a proponent of the Bitcoin crypto…he may be heavily invested. Sooner or later he will comment on the current blood letting.

One of the reasons I stopped watching the Kaiser Report was the endless touting of BitCoin and then “MaxCoin”. As a 50 year old programmer the only value I could and can see in xyzCoin, as in fiat, was and is faith.

To those struggling to find the difference between gold and xyzCoin, indeed fiat: Why is it that millions of dollars are spent searching for and recovering gold from the bottom of the ocean etc.

Gold is the world’s immortal money.

I do agree with you Lisa that many people in the cryptocurrency space can be very emotional and immature. To answer your question, anything of value can be priced in fiat currency just as easily as it can be priced in gold or silver. When Fiat currencies do disappear then Bitcoin will be priced in whatever monetary instrument remains. Good question though.

Chartwhisperer —

“When Fiat currencies do disappear then Bitcoin will be priced in whatever monetary instrument remains.”

But crypto-bots always insist that cryptos will be the currency that remains.

Scroll a bit down and you’ll find a few more. These people just don’t know when to keep a low profile.

For me it’s amazing they don’t understand people like Wolf are entitled to a little payback because of all the nastyness if not downright evil these crypto-trolls have spouted for months.

Just like with the Cult of Musk I honestly don’t understand if these crypto-trolls are merely paid-for promoters or true believers that lack the wherewithal to get onboard and hence develop some sort of fanatical attachment to the object of their veneration.

It would take a heart of stone to read about these Bitcoin “investors” getting their heads handed to them, and not laugh.

I still think there are only 3 kinds of Bitcoin investors:

1) Guys who steal coins (if blockchain is such a secure technology, why isn’t it theft-proof?)

2) Money launders (AKA crooks)

3) Millennials, you know,,,who don’t want to get their hands, you know…dirty,,,actually, you know…”working”

The only theft that occurs in Bitcoin is when you trust your Bitcoin with a company instead of controlling the encrypted address yourself. This is not the fault of the technology but instead the fault of those who choose to trust others rather than themselves.

While I no longer believe in the tooth fairy, I do see the effect it has on those that do..

From a practical angle my view of this whole debacle boils down to the absolute waste of materials and electrical power.

And I don’t feel even a bit of sorrow for the suckers, victims of their own greed.

Hear, hear… all that hardware and energy wasted on virtual tulips… and all for greed. I celebrate the gradual collapse of this ponzi.

I think part of the genius of bitcoin was enabling all the promoters who all “had a share” (c.f. “catch-22”) to get rich if they all did their part in promoting the concept across the net. It was Amway or Herbalife on steroids. Without any actual soap or vitamins to slow things down.

As a software guy, a public sharable transaction database is actually kinda cool. I’m not sure its worth $19,000 per “coin”, but the concept overall will have applications. Somewhere. Maybe like dotcom. There is a pony in there somewhere. I do think some coin, somewhere, will end up doing well as a result of providing actual value to someone. I can’t tell you which one, though.

But bitcoin as a financial instrument…always felt a bit like silver 1980 to me. The amount of dumb money piling in there was astonishing.

And now, the amount of manipulation in the space is equally astonishing. Look up “Tether” and “bitfinex” and see what comes up.

The technology is very overrated. It is simply a distributed database with a lazy, inefficient update mechanism. It does not scale, period.

Blockchain by its very nature is inefficient. There has to be some other overriding principal such as anonymity to make it worthwhile. Really needs a mainstream killer app, which as of yet does not exist.

I think the ‘killer app’ has always been black market drug dealing and money laundering.

Lightning network is addressing some of these issues. A new technology always takes time to work out the Kinks.

I definitely agree that the bitcoin implementation is weak – a cheap hack which punted on the hard problems by forcing everyone to retain everything. But it was good enough to demonstrate the concept. Certainly it has been more widely adopted than anything I’ve ever written. Ultimately, it was “good enough”, which is all you really want in version 1.

And given how much money has been thrown at the space, I suspect that some useful implementations will eventually appear. The basic concept of a public database whose transactions are validated through cryptography will be useful somewhere. We just have yet to see them.

I’m struggling for a metaphor. Hammer in search of a nail. Something like that. Its pretty unusual that a specific software implementation gets turned into a bubble. Calling it the transactions “coins” certainly did get everyone’s attention, didn’t it?

I’m a supporter of bitcoin, a HODLer in bitcoin parlance. I think being able to send a digital token over a network[1], so that only one party has control of the token, without going through a trusted third party, is the innovation of the century. It enables us to have digital cash that works much like physical cash. I think that that alone gives it value, and I don’t mean just in a monetary sense. For instance, while the state you live under remains democratic things are fine (maybe), but with the way things are going who can be sure that will remain so? It’s no good waiting until it turns totalitarian before you act, as then it’s too late. Those that control your money essentially control you.

Anyway, I’ll just leave it at that. If only because Wolf will likely (and rightly) kick me off if I ramble on much more, besides I’m not here to teach you about, or convert you to, bitcoin.

BTW. Good to see some posts have been “let through to have a historical record about the nonsense spouted off by these promoters”. Hopefully this page will be left up too, so as Wolf’s claim it’s a scam will have a historical record too.

[1] A network such as the internet, phone network or whatever.

medialAxis —

“It enables us to have digital cash that works much like physical cash.”

You mean physical *fiat* cash I’m assuming but the problem is your statement is flat out wrong. Fiat cash is legal tender and bitcoin is a capital gains-taxable asset. Just ask the IRS how much like cash your bitcoin transactions are. And by the way, did you list all your bitcoin transactions on your tax returns as required by law? Oops. slight problem with bitcoin that bitcoiners never mention (hoping none of their marks have the brains to look into).

“but with the way things are going who can be sure that [democracy] will remain so? It’s no good waiting until it turns totalitarian before you act, as then it’s too late.”

Well this make no sense. If our government becomes completely totalitarian then you really won’t be able to use bitcoin without risking big penalties (obviously a totalitarian government will want to destroy bitcoin).

You also said : “Those that control money essentially control you.”

Well mostly true. Those who control money control your money. So what are you really saying? –> you better get into bitcoin before the increasingly tyrannical government makes it even less usable. Okay so hurry up and get what’s probably a doomed currency. Great plan!

Anyway your sales pitch isn’t quite working for me. And repeating my earlier question which bit coiners never answer: if in the event that fiat currencies all collapse and become worthless what will then define the value of bitcoins?

Beanie babies, POG tokens, or Magic cards, yourE choice.

What you have to understand Lisa, is that Bitcoin is a world currency. Therefore if your government becomes totalitarian then you have the option to go somewhere else to spend your money. This is one of the great benefits. Be open-minded. I’m not against you as I think you ask great questions.

“What will then define the value of bitcoins?” One school of thought says the KWH is the ultimate unit of currency. Like Ag & Au, the KWH ties wealth to credit in a single common denominator. The USD is only a decimalized Thaler, turned to paper in recent decades, and more recently to very rapidly refreshed ledger entries, with no paper analog in view. We are conditioned from birth to denominate everything of value in $ terms. This habit may be hard to shake. “Methods used by computers to run a 350 year old equation may also offer answers to bitcoins outsized demand for electricity.” “The Great Internet Mersenne Prime Search found and confirmed the biggest known prime number, a 23 million digit long figure discovered with the math of the 16 century French monk Marin Mersenne, according to a statement earlier this month. That effort, along with other collaborative computing methods, are advancing the science of cryptography, which is essential to creating and tracking bitcoins.” (Jonathan Tirone / Bloomberg) This is Bloomberg hyping cryptos, without any real direct connection to the foundational math, which is out of almost everyone’s reach.

“You mean physical *fiat* cash I’m assuming but the problem is your statement is flat out wrong.”

Not necessarily, just physical cash in general. So, for instance, gold coins or cowry shells. My point being that it works much like physical cash in that trades involve no trusted 3rd party (it’s essentially just you and the vendor, as it is with physical cash) and the vendor has no need to know anything about who you are – you can trade anonymously, just like with physical cash. With our current card system that is not the case, as spending using a card requires you give info sufficient for the vendor (or the vendor’s agent) to identify your bank account and to draw money out of it. Sorry if I didn’t make that clear in my original post (but I’m wary of going on too much, lest I break the rules).

BTW, I’m in the UK where the tax rules regards crypto differ. My apologies for not declaring that.

I’ll think I best leave my reply at that. Just add: I’m not here to convert you to bitcoin. But when making posts on this site I will try to inform you and others about aspects of bitcoin (how it works and such) when it’s appropriate to do so. Hope that’s okay.

Dude, what about the power lines and fiber optic lines and satellites? Bitcoins move over a physical structure. If your government goes totalitarian, do you plan to start laying cable? Because I’m pretty sure your dictator isn’t going to let you use his/her wires to hide wealth in crypto. Your sense of control is an illusion.

medialAxis

God, I hope my ex-wife (with the fabulously valuable beanie-babies) does not find you…

I think being able to send a digital token over a network[1], so that only one party has control of the token, without going through a trusted third party, is the innovation of the century.

Ah, Sorry, but, Come On!

Some dudes living in tents along the Silk Road figures this out like year 500 BC, it’s called a Hawala Network.

This one sentence represents Everything that is wrong with Silicon Valley “thinking”. The very idea that just because some dudes and dudettes can wrap some digital process around something already well worked out in the analogue domain, thereby making it vastly more complicated, power hungry, brittle, hackable and error prone (I will concede ‘scalable’, except that the fails scale too) then it is now Revolutionary and Will Change The World!

Crypto is what it always was. It was “precious,” the value of which depended on whether there were more buyer than sellers.

No different that almost all paper financial assets. I mean, is anyone buying stocks like AMZN or FB for “intrinsic value” or non-existent dividend? They’re buying those stocks because they think there will be more bagholders in the future.

I think crypto is an amazing technology with the people that developed it (yes, its multiple people) being brilliant – and I’m not british – but the hype overshadowed the reality by orders of magnitude. We may not even have a notion of how crypto will ultimately be used in society at this point.

I assume the speculators which were 110% of the market have moved on to pot stocks with any money they might have left.

What Bitcoin shows is that people want an alternative to a currency that inflates 3% per year every year. That desire remains unfulfilled and will not go away.

->What Bitcoin shows is that people want an alternative to a currency that inflates 3% per year every year.

What it shows it that people want to be able to make money out of nothing, knowing there are plenty of fools desperate to rush in where angels fear to tread.

What it shows is that people want to hide transactions from the prying eyes of government.

Ah yes, the global financial crime wave, well into the trillions and still accelerating, and still promising to swallow the world whole.

https://www.nakedcapitalism.com/2018/11/global-financial-crime-wave-no-accident.html

Or, we could talk about chump change.

Screw “deflation”. Who cares? What I want, and the world actually does need, is a currency that allows me to buy some good acid from Novartis and us not ending up in a FEDERAL database somewhere!

->$714 billion have gone up in smoke.

Virtually all of it a mere accounting fiction, representing no real wealth. Just prosecution futures.

Meanwhile, real global resources are blithely wasted by the trillion, day in and day out.

Don’t it always seem to go That you don’t know what you’ve got til its gone . . .

Never mind.

I was going to mine it with my computer when it was slightly bellow 1$. Hawing then windows I couldn’t figure out Linux part, beside my graphic card was not AMD based that was better for hash-rate and i was hearing a lot how electricity cost would be bigger per BTC mined so it is not worth it. And I decided not to mess with it, sadly.

One thing about the technology, block chain, open ledger. It is the future. Can be used in so many ways, if say every expensive art picture gets cataloged, verified for authenticity and put on blockchain, you will always know it is an original. If all retail properties gets (after tile verification) put on a blockchain, there would be no scams and double selling… things like this. Stocks. After every trading day, there are missing shares. There are (officially) allowed scams by double counting, double assigning, naked shorting… If every share would be locked into blockchain, everything would be transparent and there would be no more scams from brokerages and alikes…

One thing that bothers me the most is how banksters have free license to print ‘money’. This way we are almost slaves, forking for free, working for some imaginary electronic numbers. (Bitcoin is at least backed by cost of electricity production), fiat currencies printed by banksters are not backed by anything tangible.

There is place here for blockchain also. Get currency backed by something tangible, then lock it into block chain and allow only so much printing/expansion, how much economy grow over the same period. Something like that, im not coming from finance world, no economic background, but you gt my point. Money shouldn’t be just printed out at will and distributed to chosen few.

Bottom line, blockchain technology could and should change our life big time. But there will be wast special interests fighting every step.

The crypto currencies will leave behind some useful ashes: they brought into attention some useful digital technologies, which otherwise would have languished outside corporate suites.

Secondly, it shone a harsher light on that other Ponzi scheme, the central banking money-for-notin printing scheme.

Beside that, like every Ponzi scheme, there will be winner and losers. The earth is a clear loser for all the extra energy burned.

One more thing about technology part. I sent some money across the pond to another continent. It took me appointment at the local bank since only one lady can do it, it took over 40 minutes, something went wrong in the process, she called technical support (I don’t know who) twice, it took over 3 weeks for money to arrive and several banks on the way took their fee it cost me almost 90$ for sending i can’t remember, 1,000 maybe 1,500.

When I sent (years ago) to someone some crypto currency, it arrived in a few seconds, cost me few cents, and I could do it out of my home when I had an extra minute free.

I would say, there is quite a difference in ‘user experience’ I had. ;-)

You used the decades old “bank transfer” method. It is not fair to compare it to modern cash transfer methods. Even Paypal is cheaper and faster. Transferwise, OFX, WorldFirst, and similar platforms are likewise very cheap, very fast, and not fraught with fraud like crypto currency.

Transferwise are good.

In Europe, it is trivial to send money to a foreign account, once one has obtained the SWIFT/IBAN “address” it can go via the internet banking.

The real problem/risks with banks is that if your money touch something / someone on the way, that Washington does not like this week, but is still legal in both ends of the transaction, they will simply confiscate your money and the bank will just say: “Pah! Force Majeure”. Ordering some cigars from Cuba, for example.

Next: weed stocks.

But, but . . . just like the world’s major fiat currencies are tethered to their underlying economies, Bitcoin is tethered to hype. Shouldn’t hype be at least as good as an economy that produces things? Especially if it’s “digital / tech hype?”

The real question is not why it is crashing, but how it fluctuated between $5000 to $6000 for as long as it did.

“But for anyone trying to get some money out of the crypto space”

I’ve said it 100 times and a few times in this comments sections that all these crypto tards ALWAYS quoted the value of their coins in dollars, Yuans or pounds fucking sterling……in other words, real fucking money

Same with gold. Pisses me off.

I recall being amazed some time ago watching the vaunted Bill Miller tout bitcoin and brag about his holdings. Of course after an excellent run as a fund manager he hit the skids in the great market meltdown years ago. Wonder how he is feeling today and if he shed his bitcon, er bitcoin, exposure anywhere near the top.

Simply, if it takes exponentially more energy to operate, it will collapse.

what is it about human nature that the more something goes up in price the more people want it and the higher they think it will go? Max Keiser Comes to mind.

I’m old enough to remember when the financial section in the newspaper printed P/E prominently next to the stock symbol, because stocks were priced as bonds, with various premia factored.

Now, when people are shopping for mutual funds in their 401ks, all they care about is 1 or 3 year returns (which is how we got the FAANGs bubble).

Veblen goods come immediately to mind here.

“what is it about human nature that the more something goes up in price the more people want it and the higher they think it will go? Max Keiser Comes to mind.”

Roughly correlated with lottery tickets: sales go up exponentially as the ‘jackpot’ gets larger (and, of course, the odds don’t change). I guess winning a few million just isn’t worth the trouble.

Congrats, Wolf. You nailed it. I hope you cover the marijuana industry and its players.

Nick Kelly, who is closer to weed than I am, has posted an article on this topic recently. Maybe someone can talk him into posting another article sometime soon? Nick are you reading this?

https://wolfstreet.com/2018/09/27/pot-stocks-soar-as-pot-prices-plummet/

Perhaps the bubble in pot stocks is because it attracts investors who have used the product with “irrational exuberance”.

I read somewhere (wish I could remember) that the modern pot strains are GMO-ed, ginned up and act more like baby-opiods than anything *koff* *koff* therapeutic (*). Is this true? Could there be a market for “heirloom marijuana” seeds? ;)

(*) Actually, I’m being facetious. A friend of mine uses cannabis for pain relief and tells me it works well. Although expensive, it’s still cheaper than Big Pharma side-effecty pills.

Please don’t ask me anything about the medical aspects of cannabis or the various strains, etc. I inhaled twice in my life and felt terrible both times. End of story. But I am interested in the financial aspects. I can’t wait for it to become legal under US federal law, and then some Midwestern farmers will use the efficiency of modern agriculture to grow cannabis on a million acres. Should do wonders for the price :-]

This is true. Just look at Elon Musk’s “420” tweet, it is not “Granpa’s Mellow High ™” anymore.

Last time I was in Amsterdam, in a fit of nostalgia, I smoked maybe 15 mm of a joint I and was completely smashed for a few hours (luckily I have some experience from a misspent youth, so I did not panic or anything). This was not fun at all and I don’t really understand why, even, if anyone actually enjoys this. Metaphorically speaking, the modern pot feels like a toilet plunger that attaches to your face and sucks you right into the high whatever you like it or not and it’s sticky and takes effort to pull off!

Your skin will continue to reek of “joint” for days also (In case anyone still want to have a go: Do it on the first day!)

I’d buy the olde, classic, stuff. The skunk is unhealthy and garbage, IMO. If I really wanted to have a “debilitating high” I’d prefer psychedelics, at least they are cleaner.

If cannabis became legal under federal law would the cig tax be applicable? Are we looking at a new ‘stop smoking’ regimen? Hmmm… I might give it a try :-)

I can tell you there are dozens of commercial growers in Morocco, Pakistan and especially India (which already grows most of the opium imported legally in the US by Big Pharma) waiting anxiously for the moment pot will be legalized in the US.

It will be a blast seeing the mad scramble for a market that will be massively oversupplied in under a year.

“Certainly, they will bounce again, as they have before, enough to give folks some hope, before they will re-collapse when some of the big money is gingerly trying to get out without totally crashing the entire space. But for anyone trying to get some money out of the crypto space, new money – dollars, euros, yen, won, etc. – must flow into the crypto space in the same amounts. And it’s going to be harder and harder to get people excited about throwing their money at this scam.”

In other words:

“I have no idea what’s going to happen because I barely follow the space but in two years’ time when bitcoin is above 50K (because there are only 16 million of the freaking things out there) I can claim that I predicted it. And if it doesn’t get there I can claim I predicted that, too.”

No one has been more wrong about cryptocurrency than those calling it a scam from the beginning. No one.

I worked in a mall near a store that sold Beanie Babies during the peak of that nonsense. You wouldn’t believe the otherwise-rational people waiting in line to buy the latest one.

I have also lived and worked through two real estate bubbles and witnessed the “if-we-don’t-buy-now-we-will-be-priced-out-of-home-ownership-forever” syndrome twice. I got chewed up and spit out by the first housing bubble that started to collapse in 1988. I had allowed myself to get into a position I could not liquidate rapidly.

No more True Believer for me. I detect bubbles and mania with my nose now. They all have the same smell.

Did the $714 billion actually “go up in smoke”, or merely change hands? Appears to be another transfer of wealth which is endemic to most scams. Every Ponzi scheme seems to have the same element, greedy investors whose aspirations of getting rich quick generally separates them from their money, much quicker.

Some people sold and so made money. Each transaction then set a new price on the way down. But all of the holders who did not sell watched their virtual wealth disappear into thin air. This is how it works and why a lack of new buyers is the real death spiral for crypto.

The nasty little secret of BTC is that a BTC holder needs a fiat buyer. Good old dollars and yen are the lifeblood of crypto.

Commented earlier here about this shitty bit nonsense and its collapse albeit late. Some stupid government is even behind promoting it. The entire ecosystem 0f this bit shit will see the light of day. Then I even tried promoting my bithair at $1 dollar apiece.

Oh well, easy come, easy go.

I wonder though, with the bitcoin price collapse, is anyone still trying to mine bit coins? I’m sure somebody is, but is it even economical at this point. And if no one is mining the stuff, doesn’t that start to defeat the whole purpose of crypto?

Just curious. I don’t know anything about cryptos.

Yes, miners are still mining bitcoin (most likely all are mining at a loss) but fewer of them (as then they don’t lose so much). This will cause the cost of mining to go down eventually (not sure how soon, but within the next two weeks). If the cost of mining, after going down, remains unprofitable the process will repeat, approximately every two weeks, until it does become profitable.

The major downside to the reduction in the cost of mining bitcoin is it makes the network more vulnerable to an attack. That might mean the cost of mining has a bottom limit below which miners are unwilling to let it go, I don’t know enough to say if that’s the case or not.

Oh I see, how interesting, so this whole thing is essentially a pump and dump scheme totally dependent on the good will of miners whose profit motives are slowly disappearing as bitcoin astart to lose value. I recall hearing that at some point, when all the bitcoins in the world finally gets mined, that to keep people interested and motivated in providing mining support, there would be a user fee attached to bitcoin.

I know nothing about the other cryptos, so don’t understand how they would be sustained here. Given the ever increasing need for computing power to make bitcoin work, the user fee must increase as well to keep up, not sure if that’s true. But if it is, doesn’t that mean either bitcoins value must keep exploding, or it enters some type of death spiral, where as it’s value go down, less and less people would want to use it, and so on? Would be curious to see how this works out.

Here’s the mechanism:

10 CPUs mine 10 bitcoins daily worth $100. Price goes to $60. The 4 most inefficient CPUs shut down, not profitable. Remaining 6 CPUs mine 6 bitcoins daily. Protocol calculates there are fewer CPUs, makes Bitcoin 33% easier to mine. The 6 CPUs mine 10 bitcoins daily.

After 4 years, X CPUs mine 5 bitcoins daily. Repeat every 4 years – 2.5… 1.25…

The miners also get the transaction fees, but at the moment those are like 1% of their income.

For other coins, who knows… Scams, frauds, ponzis.

@Vadim,

Appreciate the explanation on this. It’s interesting, but what happens when the magical top limit of bitcoin is reached? No more bitcoins right?

Then the user fees go up? Otherwise, why would any miner put effort into making the blockchain happen once their prime economic motive is gone.

That’s the way I always understood bitcoin, that at some point, the party will be over, and those who are left holding the coins are the suckers. The time frame at which the party is over depends on how fast it become uneconomical to get to the next bitcoin. I don’t know if that means Bitcoin will be eventually worthless or not, but I remember selling fake in game gears about 20 years ago, and making $25 a pop for essentially an in game prop. Now, it was kind of entertaining, I never understood why people would spend money that way, but it was kind of fun. Bitcoin and cryptos in general has that kind of feel to it. The only difference is, those in game props were pretty honest, people knew going in that they were worthless, cryptos are billed as an investment.

@MCH

Well, that top limit is after 100 years, so around 25 halvings. No more bitcoins afterwards. Because the limited capacity for transactions, only who pays enough fee will go through. A market for fees is formed. So the fees are dependent on the demand for transactions. The idea is to slowly transition from new coins to fees (existing coins). If there is no demand for transactions in 100 years, then miners leave and Bitcoin dies.

The difference between bitcoins and those in-game gears is that bitcoins can’t be cloned or duplicated. This is the actual innovation. It has other weaknesses, of course, but for now, bitcoin looks fine from a systemic pov.

My silver dollar will buy more cripto than last year but I’ll keep my dollar. Thank you.

Bitcoin may be a scam but crypto is not. With the emergence of new stablecoins such as USDC they can actually be used in commerce with very little risk and at very low cost. It’s just a matter of time until merchants start adopting this technology and screwing Visa/Mastercard out of billions in transaction fees.

The “stable” coins are total scams. The tether (USDT) $2bn ponzi had a major contribution to this mad crypto bubble. Only Bitcoin is not a scam. Sure, it can go down 10-50 times further from it’s current value. But it will stabilize eventually.

Tether, bitfinex Ponzi scams + ICO craze + manic speculators + media hype + QE ZIRP abomination – this is what you get.

Wondering how far the designers and the miners represent the same groups of people. After all, a good scam requires full control.

Digital ‘Currencies’ Are ALL A Scam

2017-06-17

https://cryptorum.com/threads/karl-denninger-says-digital-currencies-are-all-a-scam.217/

I would like to express that I fully agree with:

Chartwhisperer

Nov 25, 2018 at 2:13 pm

I have appreciated your insights on many stock market related predictions and I enjoy the information that you share. Unfortunately in this particular instance I can assure you you are incorrect……

First because I really appreciate the commentaries in this site.

Second because I find it is very professional and well informed, basically stating facts and points of view and no opinions.

And third, because it is most respectful with any contrarian well-exposed arguments….

All this to your credit.

But having said that, I am amazed at the fact that no answer to so many evidences have been put forward. And to crown it all, I can see on the side of this article the book which explains it all: 1913 by Aaron Kerkman.

I can assure you that all and every bitcoiner knows pretty well what this book keeps inside. And that the common “investor” does not know, let alone understand.

Yes, let me sustain -along with all bitcoiners- that the Emperor has no clothes and that the members of his court are desperately trying to avoid it spelling out…

You forgot to add the Dollar in here, around 2% of its original value. So far Crypto is STILL a better investment. Embarrassing.

Ha, what cryptos accomplished in 11 months — losing 85% of their purchasing power — took the dollar about 100 years. That slow dollar… Very “embarrassing.” Even worse, over these 100 years, you earned a return on your dollars, such as bond coupon payments, interest payments, dividends, etc., whereas crypto owners won’t ever have to bother with coupon payments, interest payments, or dividends. They’ll be forever free from them.

An old Wolf…

If you call $714 billion have gone up in smoke… a SCAM, then what do you call a $978 billion gone up in smoke in FAANG Stocks in a smaller time frame?!

Just curious!

I’m not calling the losses a scam. I’m calling the whole crypto concept a scam. Losses are just results of various factors, such as a scam, or hype, or an earthquake.

If that’s in fact true, than its worse. The concept of crypto in far more useful than the concept of stocks.

But you never said what you call stocks?

Both – stocks and crypto – are pretty much the same! They are virtual! Or do you have paper stocks in our drawers, like in the old old… old days?

Clearly you don’t understand the concept of stocks. So here is some remedial finance: Stocks represent a share of ownership of a corporation. You can own the entire company, or half the company, or 5% of the company, or just a tiny slice. Your choice.

There is nothing “virtual” about stocks. They represent legal ownership of a company.

I own 100% of the shares of my little corporation. It’s not virtual at all.

Look! As of today if you own one of the formerly very expensive FPGA mining machines, far more efficient mining hardware than the GPU (graphics) cards most use, you can LOSE $92.14 every month mining Bitcoins!

https://www.cryptocompare.com/mining/calculator/btc?HashingPower=4730&HashingUnit=GH%2Fs&PowerConsumption=1293&CostPerkWh=0.12&MiningPoolFee=1

Even the huge outfits are shutting down:

Crypto crash spreads: Mining firms shut down as bitcoin continues to plummet

22 Nov 2018

“The impacts of a massive drop in the price of bitcoin and other cryptocurrencies is spreading, as crypto mining companies began shutting down operations and declaring bankruptcy Thursday.”

I see it as all downhill from here. I think this will be a positive reinforcement cascading process. As a benefit, the price of graphics cards are going to plummet as cards formerly used for mining are sold. Of course, the GPU card manufacturer aren’t going to like this as it will kill their sales of new cards. This is probably why NVidia sold their high end cards direct to gamers so those gamers could bypass the retailer gouging of prices due to imaginary money generators (miners) paying prices much higher than MSRP for those cards.

I here lots of crybabies here, you must of made a big fat 0 on crypto, not me, bought in last year in Sep BTC, ETH, LTC about 50K worth, dumped it all right after new years around the 10th or 12th of Jan and did very well, have not got back in yet but will look again sometime in the spring of 2019, crypto is here to stay. PS did it all through coin base with no problems.

Wolf,

Bitcoin and the cryptocurrencies are one thing, but should not be confused with the underlying blockchain / distributed ledger technologies.

Google the latter, and there’s a lot of quiet progress going on with distributed ledgers, especially in the China – Russia – BRICS world, outside of the US. The main paradigm shift, earth shaking if it happens, is that this could eventually replace the US dollar as a world reserve currency.

No more “world dollar shortage” and cheap imports, to be replaced by inflation and big problems for funding that huge Federal debt.

I’d like to see you shift your focus away from the obvious “bitcoin is a scam” topic to the very real ongoing move towards distributed ledgars in world finance.

Whaddya thunk?

Gandalf,

All kinds of companies are trying to figure out how to use blockchain in a way that it makes sense for them, and there are various experiments going on, from Walmart (tracking lettuce from farmers through the entire supply chain) to finance.