Auto loans jump after historic price spikes. Credit cards still in stimulus wonderland. Student-loan borrowers count on debt forgiveness, mmmkay.

By Wolf Richter for WOLF STREET.

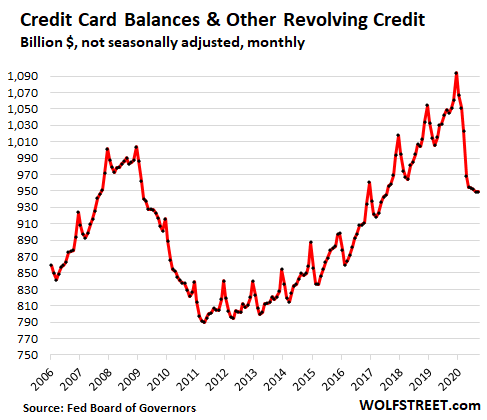

Consumers have undertaken an astounding project instead of consuming: Paying down their credit cards. In September, outstanding balances of credit cards and other revolving credit ticked down by a tad to $949 billion, not seasonally adjusted, the lowest since July 2017.

Credit card balances spike in December during the shopping season and then decline during credit-hangover season in January and February. In March, they start rising again. But not this year. In March, credit-card balances fell, and then in April, when the stimulus checks arrived and when people stopped going out and spending money, credit-card balances plunged the most ever. And they have continued to tick down every month since then (not seasonally adjusted). By the end of September, according to Federal Reserve data on Friday, they were down 9.2% from September last year:

And it’s not because consumers are defaulting on their credit cards, with banks writing off the defaulted balances. On the contrary. Credit card delinquency rates have also dropped. It’s because consumers are paying down their credit cards, and they’re spending less.

They had a lot of help in form of government money – the stimulus checks and the extra unemployment benefits of $600 a week, and then of $300 a week, both now expired, and the federal Pandemic Unemployment Assistance [PUA] program for gig workers that has been surrounded by allegations of massive fraud, and so on. Whether fraudulent or not, this money got into the hands of consumers.

But many spending options disappeared: Vacations in foreign countries, cruises, even domestic flights to see friends, and the like were taken off the to-do list, and that money wasn’t spent. And some people refinanced their mortgages to take cash out of their home. And others stopped making payments on their mortgages and moved them into forbearance programs. And some people stopped paying rent, now that eviction bans are in place. And the whole flow of consumer money changed course.

This aggregate balance of revolving credit includes many people who don’t have credit card debt at all, and who pay off their balances every month. And it includes people who use their credit card as a cash management tool. They have no savings, and the money that comes in goes into paying down their credit cards that they use to pay for nearly everything. And with some of them, there is no margin for error.

Auto loans & leases.

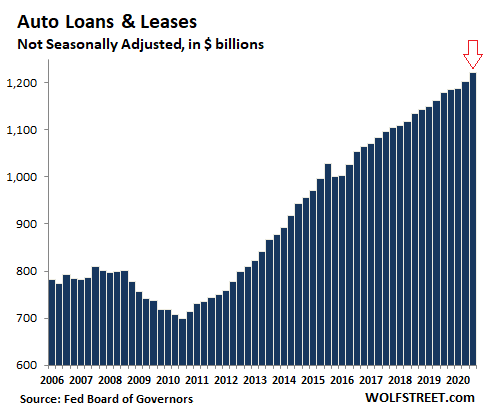

While consumers bought fewer new and used vehicles in the third quarter, they bought more expensive vehicles, in part because prices surged. Used vehicle retail prices spiked 15% in July, August, and September, the largest three-month spike in the data at least since 1984. New vehicle prices rose too, but people also bought more upscale vehicles – because those were the people that benefited from the Fed’s bailout of the financial markets. So they bought fewer units, but spent more dollars on them, and they took on more in loans and leases to do so.

In addition, lenders moved many borrowers who were struggling with their loan payments, or had fallen behind with their loan payments, into deferral programs to where no payments needed to be made, and the loan was not marked as delinquent, but the unpaid balances added to the overall outstanding auto loan balances.

Total outstanding balances of auto loans and leases in Q3 rose by $20 billion from Q2, to a new record of $1.22 trillion. It was the largest quarter-over-quarter increase since 2016, after having already risen by $15 billion in Q2. Compared to a year ago, balances were up by $42 billion or 3.6%:

Student loans: stalling repayments & counting on loan forgiveness.

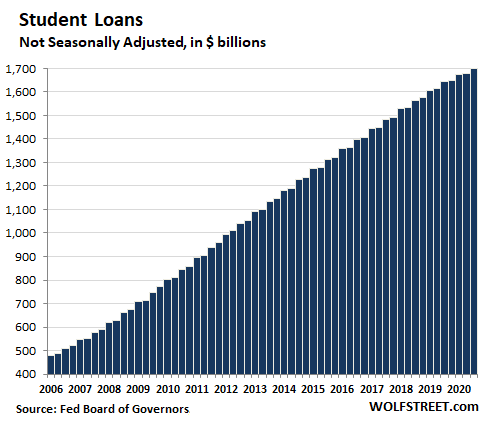

Inexorably, student loans continue to surge, despite declining enrollment since 2010. In Q3 outstanding student loan balances jumped by $23 billion from Q2, to $1.7 trillion, and were up $54 billion from a year ago.

One of the primary factors that has been driving the loan balance up is that fewer and fewer former students made principal payments. Then came the Pandemic, and student loans were moved into automatic forbearance programs. The story I keep hearing is that you’d be a moron to make payments on your student loans because they’ll be forgiven anyway. Mmmkay. So existing loans are not getting paid down, and new loans are being added, and the balances continue to balloon:

In total…

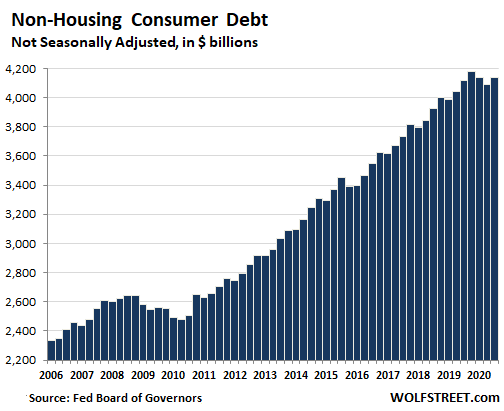

Total consumer debt – student loans, auto loans, and revolving credit such as credit cards and personal loans but excluding housing-related debts such as mortgages and HELOCs – rose by $51 billion in Q3, to $4.14 trillion, not seasonally adjusted, after having dipped for the prior two quarters. Year-over-year, given the 9.2% decline in credit card balances, total consumer credit was up just 0.6%, the smallest year-over-year increase since the declines in 2010:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Debt is not the issue, the issue is it doesn’t have a matching or better “productivity”. Will another stimulus package happen to send the market miles higher? Will another lockdown happen with 100K new cases and 1k death everyday? Will the Fed go negative happen with economic and health crisis both accelerating? That’s what determines the short term financial outlook, long term we are screwed no matter what frankly.

” Debt is not the issue” What are you smoking?!? Debt is always the issue.

Debt is only a issue when productivity lags behind significantly. We can have 100T debt but guess what tomorrow we figure out controlled nuclear fusion tech, 100T isn’t a big deal no more. My point is don’t focus on debt but productivity figures such as labour participation rate, exports, GDP etc in relation to debt.

Debt goes under the assets column.

As long as stimulus checks take care of monthly payments, debt are an asset.

Of course this is all from Fed and an economist’s perspective. Not common sense perspective.

Common sense economics is long dead in this country.

compound interest on debt always grows faster than income for the vast majority of working shmucks. Productivity gains are extracted by corporate suits before they are ever seen by ordinary wage earners.

Richard,

Get your point *but*…

If the cumulative debt has been rising relentlessly, mercilessly for *decades* an honest person has to look in the mirror and ask themselves, “When is the productivity payoff supposed to happen?”

Because it never happened sufficiently to have a period of debt paydown…almost *ever*.

You are making the pitch that politicians’ pet economists make (ie, don’t worry…debt is growth).

Uh huh.

The median individual’s financial status has stagnated/declined for decades in the US…so the “debt promises productivity” pitch ain’t cutting it anymore.

It is much more likely that declining prices would reflect true productivity…but the Fed has declared Total War on “dat evil deflation” (just look at the harm deflation caused the computer sector…)

Controlled nuclear fusion is the solution. I can’t understand why more aren’t talking about it.

Pandora-Because a “small sun in a box” will never happen.

Anecdotal, but I had two PhD friends (plasma physics and tritium) who spent whole careers based at Lawerence Livermore and they never thought it would. But who’s gonna screw up a fun, tons of big toys, and well paid lifelong gig? The tritium guy even got to make many trips to the South Pacific.

You can, however, think of solar cells, wind and wave/tide machines like long probes sticking into the actual sun, if the “controlled” adjective pleases you.

In Italian, if people behave badly, or try to cheat, or believe they can be recklessly and skirt by, etc. …..destiny speaks and says “corri, corri, pero’ qui ti aspetto”. Basically, this means, go ahead and run and do whatever you think to try and get away with wrongdoing, but “I” will be here waiting for you. We can keep on with the magical and unicorn thinking, but destiny awaits !!! This is biblical!!

Another domino falls. This will decrease the banks’ income, since they have gotten such huge portions of their earnings for a long time from funds procured at around 2.5% interest per year or less from their “Federal” Reserve and at 2% or less annual interest from gullible savers, which funds they lent to consumers at 7% to over 30% per year.

Banks and financial institutions already face gigantic decreases in the fair market (meaning immediately realizable in an ordinary market transaction) value of their assets for many, many months. This will result due to fall of the dominos of more and more business closures, more evictions, more mortgage defaults, etc. Pity the dire straights of the ultra-rich control groups of the financial institutions, who fear the loss of their goals to continue as economic parasites.

The asset portion of their banks’ balance sheets, which always reflected a thin amount of true, net-FMV, capital, will soon be overwhelmed by the gigantic and increasing, undiminished amount of their legal liabilities. In other words, they are now or will soon be legally insolvent.

Therefore, prepare to soon see the greatest *or the second greatest after 2008-2011) wealth transfer event/secret robbery taken from Americans and the US government to bankers and Wall Streeters, directly by bailouts approved by congress or by secret aid, if they cannot buy or deceive enough politicians, via their “Federal”

Reserve. I doubt that the massive aid just recently given to them by their “Federal” Reserve’s purchase of billions of real estate backed debts at inflated, way-above-FMV assets will be enough.

I do not want to sound like a broken record by speaking out each time that billions or trillions of US dollars are effectively stolen from Americans again and again and again and gifted to the ultra rich individuals that control financial institutions, but I must. Look, they are about to start robbing us and our descendants again!

Sorry about the typos. It is hard to write without them when children keep interrupting constantly.

more of an issue when the prudent are asked to pay for the credit criminals, the debt slaves…..

no different then crooked governments and corporations

todays corpocracy is bad for the prudent, best to just join them….

well remember that ‘stimulus’ this year added just $3,500,000,000,000 to govt debt(which we can’t pay and therefore won’t)

we went to restaurant last night – they raised their prices 25%(no inflation though)

and now under President Biden expect another stimulus of epic proportions – ie adding to debt

not to worry – our sub 2% inflation rate just means the REAL INFLATION will continue in the 10-30% range ANNUALLY

so sorry low wage workers but you won’t have chance – I just raised my hourly rate $5 an hour to compensate for debasement of $dollar

I don’t have an hourly rate anymore. I’m retired on a fixed income. I can’t wait for my 2% increase in SS this January. I suspect that will be offset by the increased premium in Medicare premium I pay. Medicare is not free folks. Neither is the supplemental Medigap policy you will need. Oh, that premium goes up each year too.

I suspect if we were totally broke (income wise), we could get *free* healthcare…just like in Canada.

We don’t pay much attention to the restaurant inflation stuff….my wife and I just split the meals anymore. Hey, we call it “dieting”.

Healthcare in Canada is costed at less than 60% of the US version for the total package. With, better outcomes and obviously universal access with no fees or co-pays.

Therefore, if the US decided to go that route you might save some money to apply to the debt.

Canada’s 2017 debt-to-GDP ratio was 89.7%, compared to the United States at 107.8%.

Direct quote from Healthaffairs

Canada not only has achieved universal coverage but spends substantially less per capita on health than the United States. Those favoring the Canadian model have tended to assume that the savings in cost come with minimal or no effect on the quality of care or health outcomes. On the contrary, because of universal coverage, health outcomes averaged over the Canadian population as a whole may even exceed those in the United States. However, the U.S. debate over whether the Canadian system is superior has paid less attention to health outcomes than to differences in cost and coverage levels. In Canada, by contrast, there is no serious advocate of the U.S. system.

“I can’t wait for my 2% increase in SS”

1.3%

@paulo

But then we’d have a collapse of our health care industrial complex. We can’t have that.

@Paulo,

When we compare health outcomes between USA and Canada I wonder if Canadians have better/same/worse habits/preventative care/well care/demographics/diet etc., etc and how that influences said outcomes. I have only been to Canada a couple of times years back and only on very cursory visits.

I know as an inner city ICU nurse, A LOT of our struggles in the USA are secondary to poor decisions, bad diet, lack of exercise, lack of access, stress, poverty and many other factors.

if eating out is too expensive don’t eat out … why are you eating out when there’s a pandemic anyway

Yeah! If eating is too expensive just cut out the eating! What, they have no bread to eat? Let them eat cake!

The DC all-you-can-eat never shuts down…

Joe Saba,

The real inflation rate is above 2%, but, 10 to 30% is vastly above what it actually is. It would be debatable what it actually is, but, I would guess it would be something like 2.5% above, what they claim on average over time (that still adds up very fast). It could go up faster in the future, but, as the current healthcare system is quickly going to fail, it cannot really be guessed; in the near future, large structural changes will be forced to happen to many aspects of America, and that will determine the economy going forward.

My wholesale chocolate costs have increased an average 8-10%, Hardly 2.5%

Restaurant food increases probably have a lot more to do w/ consolidation at every level of the supply chain, from the slaughterhouses to cold storage to Sysco, than dollar devaluation. Now restaurants have to raise all prices to offset the ridiculous fees charged by uBerEats, doordash, postmates, etc etc.

So, admittedly a little slow on the uptake here, but over the past 15 years students have borrowed $80B a year to go to school because rich people don’t want the government to spend the equivalent of 3 tenths of a percent of GDP directly on public education?

College used to be very affordable.

Loans, if needed, for college education were a private matter between banks, the college and the student.

Student debt could be discharged in bankruptcy.

Then government got involved…

hopefully this to will change

I’m for ENDING ALL STUDENT LOANS

any forgiveness needs to be matched by paying back those who were responsible and paid their debts

How about the government paying me and others who worked night shifts to get through college? That would be quite a nice Christmas present but I don’t expect Santa Claus to be coming this year.

debt serfs love for the prudent to pay for thier stupidity….these twits of today have it made…..while the tough have to pay for their vanity sheep brains…….the vanity nation whines about signing a contract…..tar and feather the fools

stop taking out debt, idiots….

sheep, too much grass, blind

why forgiveness? did they not know what they were agreeing to and signing? Going forward, perhaps a new policy for free college, but my guess is then it will be intellect tested. Only those deemed worthy will get educated. Be careful what you ask for, you may get it.

Paulo…MGH here in Boston loves Canada.

Stephen

” I did it so you whippersnappers will do it TOO ! ”

Another doddering codger spews……

Another whippersnapper with his hands out.

Dawn

Wrong conclusion.

I may be a geezer….but I’ve forgone the greedy part.

For my fall semester in 1978 tuition for 18 course hours was $378 at a 4 year school. I would hate to figure out what tuition is today and what percentage it has increased compared to salary orhoirly wage increases. I got 90 days same as cash and paid my way through with a small scholarship. College has to be one of the biggest ripoffs in the economy today. I pity the young people that feel obliged to pursue degrees that will ultimately not help them find “good” jobs.

All that debt helps to keep the proles in their place.

You say that like its a bad thing,

I’m looking at the results from decades of K-12 “free” education and can clearly see we did not get our money’s worth – for the kids. It has been a relatively successful public make-work jobs program for adults. However, the insolvent pension fund payouts are coming. Don’t worry about being slow, most folks learn more as they grow up.

True. Nothing can be done to improve outcomes for kids until parents improve their parenting. And in this country, that is not likely to happen any time soon.

The wife works in education, and I get to hear all kinds of stories about the parents. Any kid who acts like a little terrorist and refuses to learn and assaults the other kids almost always has parents that are basically children themselves or who don’t seem to care whatsoever that their child is acting like a young criminal. Many of these people do not value education at all. I ask her what the dad does, if she knows, and more often than not he’s an oilfield worker or something similar.

schools are finding out right now that enrollment is down 10-20% in public schools

do to HOME SCHOOLING

better to home school than have baby sitters teaching snotty nosed kiddies

Nonsense comment. Public education actually allows people to work without paying daycare these days which is exactly why there is so much push to keep them open in a pandemic, but the primary purpose of universal schooling was to create good little workers for the manufacturing economy based on the same industrial model. Now that manufacturing is done somewhere else?…….

Furthermore, students that come from motivated families that are involved with school work and attempted outcomes always do well. Students from families that don’t support education don’t do as well.

Everyone has been to school so is an expert on education, just like folks who have a computer first consult Dr Google before going to their own Doc.

And yes, I do have a Masters degree in Leadership and Training from Royal Roads University that I paid for myself with no debt. Plus, two trade certifications and and one technical degree. That is precisely why my son is an electrician. :-)

Your comment that school is a public make work project is highly insulting and so far off the mark I should have kept my thoughts to myself. Imagine, just imagine how great society would be without schools and all information is simply gleaned from computer searches and social media. Now that would be a fun place to live and raise children, wouldn’t it. :-) I always wanted someone like Steve Bannon to raise my kids.

Paulo, I always read your comments with relish and respect. I have no axe to grind with the concept of schools; however, publicly funded mandatory elementary schooling in the US has been a disaster – so far. And, twelve year olds should not require daycare.

On reflection, schools got in my way after 4th grade when I found I could read for myself – which led to a self-educated mechanical/electrical engineering career, no internet until 1994. Yes, advanced maths and law were the hardest ;-). It’s hard to keep children raised by good parents down, mine were the best.

Were I currently involved in kid raising I would try to be sure that they could discern elements such as Bannon for what they really are.

Personally I have no use for the current “social media” craze that I believe has even more deleterious effects than public elementary schooling. From your comments it’s obvious you have a very level head on your shoulders and I’d bet your children do too, thanks to you.

Hopefully the internet will change our schooling practices. This experiment has begun in earnest because of the virus, despite the public/private for-profit education industry. I fear that we now have far more “workers” than we require for the current economies and their future is much more unstable than when we both were young. Big changes a’comin. We do the best we can every day.

“just imagine how great society would be without schools”

False choice, P.

The choice is between better and worse, and the incentive structures and organizational pathologies that lead to one or other.

The current state of American public education is the ever more toxic product of Teachers’ (Etc) union political gamesmanship and predation.

Public sector unions are the organizational and financial backbone of the political Left in the US and, in stark contrast to their publicly proclaimed platforms, ensure that they eat first and best with regard to the general US public.

They aren’t that far from the old Soviets, with better PR.

Paulo,

You might want to read Isaac Asimov’s “The Fun They Had”, a 1951 short story about the future of education. It’s coming sooner than you think.

Visit Australia and you’ll see various levels of ‘educational outcomes’ in public schools ranging from totally pathetic to super outstanding and better than anything you’ll find in the USA.

Overall Australian education is much better than in the USA especially in the big cities. The university level, well, it has turned into a business more than education for a lot of departments, but even saying that, overall the kids here are probably better educated than in the USA.

Although as I have stated in other posts, the level here has fallen quite a bit over the past 25 years or so.

Private schools ofter better outcomes and if you’d check the university entrance test scores for private versus public you’d find that the highest scores come from private schools.

For example, this means that if you want to be a doctor the chances of you getting in by going to a public school are very slim. Yes, it happens, but nowhere near compared to the number sent by private schools.

I also have a Master of Education degree and it it worthless (from an Australian University too!), taught here in Australia and Japan, so I do know what I’m talking about.

Greg H

Asimov was a writer of FICTION.

Hardy an authority on education systems.

Oregon just passed a ballot measure to give free preschool at a cost of 1.5% on incomes over 125k and five years later it increases to 2.3%.

Hardly anyone even has kids any more. This is yet another single mom bailout.

$1875 a year at minimum $125k is more than I want to pay to sponsor spawn that is not mine. About to throw in the towel here in Oregon and maybe head back to the Florida beach from where I came.

Income taxes are between 5 and 9.9% here already. The politics are so conformist, intolerant and cognitively dissonant. Nature is all that is worth sticking around for with everything closed… .

The uhaul one way prices are very telling. Leaving NY or SF costs $2000 more than moving there.

… 9% Oregon income tax rate begins at $8900 individual and $17800 for a couple. A poor working couple making the combined total above will pay $1602 for income taxes.

Rent for a one bedroom in Portland is about $17800.

This dam won’t hold.

… adding to all that, Portland is in debt about $20k per person, not household.

Oregon State has a budget surplus though.

Lots of blue, purple, pink and green Portlanders enjoying the largess.

I’ll stop now.

Let the Nike pontificators pay for it and ditch OR.

The US is a huge country with 49 other options (some which can be scratched off, a la OR).

To say that our public education has been anything else but a disasterpiece is somewhat charitable. Kids leaving high school without a lick of understanding basic finances is one of the biggest travesties ever. It has created generations that had no clue how to balance their checkbook and gotten more mileage for the banking industry than Madoff and his ilk could’ve ever done with their Ponzi schemes.

My nephew just pulled his kids out of Wake County, NC school system when they went virtual and he saw how poorly instruction was, at least on line. He and his wife are going to home school. They are both professionals and work from home.

“no clue how to balance a checkbook”

That is a feature, not a bug, from DC and the MMT crowd’s perspective.

MCH,

“…generations that had no clue how to balance their checkbook.”

I think I know what you mean, and that you’re using this as a figure of speech, and I agree as such.

But balancing a checkbook went out the window with online banking and electronic payments, where I can just log in and see if everything is correct, if there are fraudulent charges, etc. and get the instant balance. I write about 3 checks a year. All remaining payments are made electronically, most of them automatically, and they show up in real time. I stopped manually writing into a checkbook and reconciling it back in the 1990s, thank god for the internet.

Kids don’t need to learn outdated and useless low-level skills, such as balancing a checkbook. But they do need to learn about financial issues and responsibilities in the modern context.

Most public schools these days would qualify as child abusing entities only a generation ago…

@Old School

Yes, online school is absolutely distressing because you actually get to see how the kids aren’t doing anything. I think unfortunately, there is an out of sight, out of mind mentality. After all, as said by someone else, public schooling is nothing more than a set of publicly funded day care for the most part. It really is pushed on the kids to want to learn, and then they have to buck against the system to get into better classes that are more challenging. Left to their own devices, most of these kids can’t even get through Algebra. I have doubts about their ability to solve something as simple as quadratic equation. It is a sad state of affairs.

@Wolf

Yep, a figure of speech. Two things here:

One:

You are correct of course, checks are rarely used except for paying property taxes, checks are used far less often. Another “feature” of our society, the gradual destruction of paper money in my opinion is something that as citizens we must fight against. Because fiat currency in digital form is a guaranteed way to tyranny.

Let me pick an example that’s not so agreeable to many people, but imagine this, everything is a digital dollar, something that is actively monitored by the Feds and they have “access.” Marry that to our surveillance state, so, now here comes the pandemic, and the government mandate mask wearing. (just using this as a convenient example, you can put any other scenario here) They find that you do NOT wear masks via cameras mounted literally everywhere. Now, the Fed decides as a punishment for not following mandates, your funds are frozen for a period of three days as punishment. What else would you call this but tyranny. The whole point of fiat currency is a form of control, digital currency makes that more likely, not less. The only question is when will governments consider outlawing things like bit coin.

Two:

If there is one thing that needs to change is the educational system in the US. When I grew up in the 80s, I thought we got more out of our public schools. But as with anything that gets too powerful, the school unions have gotten way out of control, more in jackass run states, but let’s face it, this is a problem everywhere. The problem is basic math is not taught well, neither is anything related to finances, our kids are growing up pretty much ignorant of the basic things like how its useful not to spend more money than you have, that those shiny credit cards are nothing more than traps designed to make people into debt slaves.

I think if there is one thing that this country has failed under every administration, it is the area of basic education, and the problem is worsening year by year. There is the usual cry from the jackasses that we are failing basic education and all that BS about not producing enough scientists, but that has never been one of their priorities. The subtext is we need to put more money to the teacher’s unions so that they vote for us. It’s utterly sickening.

P.S. One other comment, Wolf.

“they do need to learn about financial issues and responsibilities in the modern context.”

I agree completely, but who is going to teach them? Their teachers are as incompetent and ignorant of these things as the students, this is easily a multi-generational failure.

I think others have said it the best, the only real line of defense are the parents, and that resource is now being stretched to the limit.

LH,

Bravo.

Every time I hear the Teachers’ (Administrators/Aide/Clerical/Janitorial/Bought Vote) union talk about how it is “All for the Kids”…

I immediate flash back to Saddam pawing that poor kid in Gulf War 1…

(Ditto for AARP commercials using children to pimp for SS…)

obviously lenert is right the federal govt should buy free higher education for every person in America!

And that free education MUST include! Numerous professors who don’t do much cannot be reached and actually delegate all the teaching to TA’s who barely speak English, Beautiful campuses with immaculate landscaping, free transportation to/from school, free food at school, free housing at school, lectures delivered in person to small groups regardless of youtube, luxurious gyms, multiple olympic swimming pools, social halls, dance lessons, private music lessons, and huge buildings that are barely used.

And anyone who is rich must pay for this! Anyone in the top 1% of income earners globally must pay for this! (top 1% globally includes anyone earning more than $30k / year)

You forgot the stadiums. Must have stadiums. Big stadiums for sports television.

Not so fast my friend. Those stadiums and football teams generate tens of millions of dollars for the school. Take a look at my Alma Mater, the University of Florida, or my wife’s, Florida State University. They are very profitable, and fund all of the other athletic programs like gymnastics, track, baseball, as well as almost all Title IX programs. If your school, and others have visions (delusions) of grandeur because you think “if we build it they will come” and the program operates at a loss then close the programs down and move on..

I think that if you look at college sports using GAAP and include the cost of the stadiums, the classrooms, the salaries and benefits and PENSIONS of the staff, you have a losing proposition.

@Tankser,

Revenue from televised college sports is part and parcel of the ruinous financialization of the University experience, detailed below by Wolf.

In Ohio, the highest paid public employee is the OSU football coach. Highest paid by a mile.

In the meantime, China is sending its best and brightest to our graduate schools of Science, Math, and Engineering. We’re forcing our brightest to become life-long debt slaves because unlike every other form of debt it can’t be discharged in bakruptcy (BTW, thanks for that, Joe Biden).

Tankster said;

“those stadiums fund all of the other athletic programs like gymnastics, track, baseball, as well as almost all Title IX programs.”

And WTF do those pursuits have to do with education???? The descendants of field hands bred like animals, running around chasing a ball has nothing to do with culture, values or education.

Michigan State University’s new vice president/chief diversity and inclusion officer (CDO), Jabbar Bennett, was offered a cool $315,000 per year salary, as well as a $700 “monthly vehicle allowance,” according to The State News.

It is interesting to see how public educations role has gotten larger. When my dad went to school, you got yourself there without a bus and you provided your own lunch.

Now even when school isn’t in some systems provide lunch. I don’t know if it’s progress or not.

Here in LV, the public library system has started providing “monitored” (mm hmm) remote learning/free lunches for school Kids.

This follows a huge, multi yr ELS push (taking up about 20% of library sq footage).

They have also, over the last 5 yrs, cut the book inventory by about 30%.

Bureaucratic entities don’t care about their “mission”…like everybody else, they follow the money.

yeah… sure… the morons can’t even get basic schooling correct, and they want to pay for free higher ed. Where the criteria of applicant is the color of the skin, and not based on any real merit.

What a joke. Let me know when they kick out the crazy polysci nutjobs in place of some more practical personnel like Algebra teachers, accounts, and chemists. Then I’ll considering supporting such an idea.

Or better let, let me know when grade schools in this country can produce functional young adults who do not immediately get sucked into the Wall street money machine primed to turn every non-college educated (and a good number of college educated) kid into a debt slave.

The debt is paid by all, rich and poor alike, via devaluation of the currency which harms the poor more than the rich.

Why should a person who never has or will attend a university, with it’s upper middle class lifestyle and costs, pay for the future desk jockeys of the world? Many become productive in society in careers which do not require a degree. Ask your plumber or a truck driver if he wants to pay for your child’s 4 years of pampering.

Used to be that plumbers and truck drivers dreamt of their kids going to college. Now they are waking up to degree dilution. Or so says my retired comfortably at 50 electrician. His kids are using Kahn Academy/MIT/Stanford online as they complete their apprenticeships.

Ask your plumber or truck driver if he wants a shortage of doctors, teachers, ready to go military officers, epidemiologists, scientists, architects, civil engineers, and all that other good stuff that college educations make possible. You can’t say you want world class cancer care, bridge engineers, and even paper pushers who can navigate national emergencies to get things where they need to go, etc., and not be willing to supplement higher ed. If you extrapolate your view- why should childless couples and old people help support public schools? Because we all benefit from having an educated populace, at all levels, to fill society’s needs. Are there slackers, self-indulgent naval gazers and societal moochers at the college level? Sure. But they exist at every level of education and income. There are also true geniuses and hard-working highly skilled people at every level of education too. But that does not negate the need for a populace that has an adequate and proper education for the myriad services they expect. Public support of college is also a way in which we put our faith in the American dream, because it aids upward social mobility. (Then college debt due to bloated university infrastructure takes that away…oh the irony.) In any case, I am happy to support all levels of education, because we do not want to slip back into superstition and the dark ages.

Well said, thanks.

re: “… we do not want to slip back into superstition and the dark ages …”

40% of the country is already there.

Thank you Kristine. I was just too pissed off at the resident education experts to reply.

I am reminded of the recent joke:

“My Facebook friends are so amazing. Just 6 months ago they were all constitutional experts and scholars. And now they are epidemiologists.”

Like I said up above, everyone has been to school so everyone is an expert on education, or at least has an opinion. My 93 year old neighbour often says the same kind of things, but his boogies are doctors and dentists. He likes to exclaim, “Nine out of ten dentists have no idea what they are doing”. My personal favourite, “60% of Doctors don’t know anything”. Arrhhhh,

I’m OK with giving money away to the poor and disenfranchised, whatever that means, as long as that’s before the trillions given to rich bankers in direct payments and to technofascists in tax breaks.

Oregon actually just paid reparations to people of African descent, no matter the proportion of said descent. It was around $60-$70 Million if you could prove hardship based on your ethnicity to an independent sympathetic body.

“ready to go military officers, epidemiologists”

Forever war (military Genius, General failure)

Pandemic.

When it comes to government in America, just because you pay for it, doesn’t mean you get it.

Quantitative easing/money printing/fraud writ large means never having to be accountable.

Kristine & Paulo

Bravo and well said !!!

Well stated! Thanks!

And Calf Bob, I watched in horror in the 1980s when the USA started eviscerating public education.

Fast forward to 2020 and many are getting their “news” from Facebook and most of the GOP believes the Q-Anon BS…. These things make the case for better public education or the whole society goes backwards.

“40% of the country is already there.”

Are those the 40% going to BLM peaceful protests?

The USA wont end w/o free college tuition. Enough with the nanny state. How about we try to balance the budget and then work on the national debt. I know, I’m an old codger. :)

The craziest part is that it took like 185 years to have $1T in national debt and like 225 years to get to $4T. In most recent fiscal year the deficit was over $3T. That’s what a parabola looks like. Yet, lets pay for everyone!

BTW, when stores were open, it seemed 1/2 the young clerks cuddn’t count change. Seriously, my GF and i would laugh about it all the time. Sending those morons to college on a free ride is a fool’s errand.

Obama codified a predatory sickcare system. Now you want the same for college education. USA has highest medical costs and 37th in quality. BTW, both my chillrens did advance and law degrees abroad. Even with the non-resident charges, still much less expensive than comparable degrees here in USA.

“Ask your plumber or truck driver if he wants a shortage of doctors, teachers, ready to go military officers, epidemiologists, scientists, architects, civil engineers,”

What does it matter if he and his family cannot afford the insurance payments to access the doctors, if the school teaches Orwellian brainwashing to villify their family and its history and their father’s job, if the military officers lose pointless wars, the epidemiologists, scientists, architects and engineers are never used to produce anything longlasting for the public good?

re: “And Calf Bob, I watched in horror in the 1980s when the USA started eviscerating public education.”

Me too. At one time, California had one of the best public schools systems in the world; I’m a product of that system and feel I had the best education I could handle. UC was recognized as one of the best ‘elite’ school systems anywhere, but the state colleges were as good as, and in some cases better–grad students in computer science at CSU Chico taught PhD candidates at UC Davis because they were the most qualified instructors available –and was generally affordable to most aspirants. Scholarships, ‘student aid’–a realistic loan/grant program–and a part-time job worked for many. I got a free ride because my father worked himself up from near-poverty to comfortable middle class–with my mom’s help–through the system and he believed in education (he finished his career as a career counselor in a community college). Oh, and the community/’junior’ college system is a great stepping-stone, either to the trades–nursing, auto mechanics, welding, etc.–or as an affordable step to a 4-year degree. I recently took a couple welding classes at the local JC; the instructor was not only an incredible welder and craftsman and one of the best instructors I ever had, but he was selected as department head with ‘only’ an AA (2-year) degree. That’s how a ‘merit system’ should work.

we seniors do pay for public schooling. property taxes.

Wolf..useless skills, balancing a checkbook. is outdated, but the accounting, math skills are not.

These are not being learned, new hires ($20/hr)here can’t make change for a dollar. Don’t tell me that is useless either as everyone pays via phone. It is the knowledge that is lost. There is no thought analysis, reasoning or understanding how systems work.

Yes

Link to recent Oregon reparations because it was unbelievable to me too. I tried to apply but my ethnicity is too vague.

https://www.theoregoncaresfund.org/

Thanks for that info otis. I was unaware. It doesn’t surprise me. Every recent proposition in OR. was passed. Even the decriminalization of hard illegal drugs (meth,LSD,etc.). The people and govt. of OR. have completely lost their minds. It is the land of no personal responsibility. Even the high school drop out rate is a staggering 22%. But hey, they know how to build shelters under highway overpasses. I would move to Montana or Idaho if I wasn’t tied down here.

lenert,

I don’t think that’s a complete assessment. Look at who ultimately ends up with that student loan money. Students are just the conduit.

Look at what happens at universities these days: “student housing” has become a global asset class with its own CMBS, and landlords/investors are (were) getting rich off student loans. Tech companies supplying the equipment and software are getting rich off student loans. Video-game and console makers are getting rich off the student loan money. Universities are on a land-grab, buying properties and building palaces, and they’re getting rich off student loans. All kinds of vendors and retailers and bars are going after this student loan money. This student loan money has created and nurtured entire industries.

That said, the median (half are over, half are under) student loan debt for ex-students is $17,500. It’s not huge. Only about 10% of the students have huge debts, including $100k-plus which make good click-bait headlines, that skew the often-cited “average” (something like $34K), and these are students that pursued graduate degrees, sometimes multiple graduate degrees, that take many years.

Understood – you’ve covered this in detail. But students have always been the conduit – they have no income and no collateral – no banker in their right mind would make them a loan without a government guarantee. And decades of budget cutting means schools have to “get creative” and privatize and securitize student housing, for example, because we just won’t fund it directly which would cost less. Meantime, as you point out, CEOs, University presidents, Coaches, Athletic directors, and investors get paid while the students end up with the financial obligation and the G covers the bad loans. This is by design.

‘Ummmm, Tasty collegian nuggets, yomm yomm yomm’

So saith the 1%+ .. with a whole host of PMCs, and a gullible public at their bidding.

The kids should be tearing these people apart, but no … let’s ‘build’ some Chazs-n-Chops, instead …

To clarify,

My point being, that the directional angst that the youts

are experiancing, are but a deflction of and by the real perpetrators of student debt – the Grift and a Raker Class and their hangers-on, much of which comprises the vaunted persons that we have elected – for decades!! to CONgress .. and in a largely clueless 80+% of the public,who believe a college degree is the key to the Realm’s chocolaty nougat center, if only they DO what they’re told, by berneysian academia’s virtue klaxons ..

.. and here we STILL are .. at each other’s throats! cuz the Ball is in THEIR court, as always!

“And decades of budget cutting means schools have to “get creative”

Here is the UC system’s own version of financial reality from 1998 to date.

https://www.ucop.edu/operating-budget/budgets-and-reports/current-operations-budgets/index.html

Expenditures have quadrupled.

That does not say good financial stewardship or cost control to me.

There have been no “budget” cuts from either the State or the Fed (and there are some mysterioso revenue sources that I wouldn’t be surprised to find out are State or Fed, in UC budget drag).

It is interesting to see what a huge chunk the UC hospital system makes up…it is also interesting to contemplate whether it really shouldn’t be reported/analyzed separately (a lot of skim can be hidden in somebody else’s larger operations).

And this is the version of finances most generous towards the UC system.

(Audited? Audit standard? Gvt independent audit?).

Financials on Pg 2 of 1997-98 report.

Page (ahem) 175 of 2020-1 report.

How many students, their parents and grand parents know who made the law exempting the student loans to be discharged under the the usual bankcruptcy law available to any one or business in America!

Our newly elected Joe Biden, when he was VP! As a favor to Banksters! Most of Banks & Us mult-Nationals are incorporated 9many just under PO BOX) in DELAWARE !

The former vice-president and 2020 presidential hopeful backed a 2005 bill that stripped students of bankruptcy protections and left millions in financial stress

Guardian

JOE BIDEN’S ROLE IN CREATING THE STUDENT DEBT CRISIS STRETCHES BACK TO THE 1970S

As a senator, Joe Biden supported several bills that contributed to the rise in borrowing from $1.8 billion in 1977 to $12 billion in 1989.

-the intercept

Biden Tanked Student Loan Debt Discharges For Finance Industry (in 2005) While Complaining About His Own Law School Debt, If It Matters

-abovelaw

Both parties serve Corporatocracy!

Don’t bring up facts – it insults the intelligence of the voters.

Actually it was part of the tax increase during the Clinton administration that was written into the bill by the GOP to try to sabotage it from being passed in the first place. As a result it was passed strictly along party lines with all of the GOP voting against it along with a few blue dog Democrats, with then-Senator Bob Kerrey being the decisive senator creating the 50/50 split in the Senate which caused then-VP Al Gore to cast the deciding vote. Kerrey retired in 1994, which led to the GOP taking that Senate seat which they have had ever since.

My feel is that making essentials like housing, education, rent, and food more expensive – and to incrementally squeeze juice out of average people, will come back and haunt those who think they can dictate what the level of suffering is acceptable to them.

Medical access is the important part

otiz-in other words, ‘…the beatings will continue until morale improves…’.

may we all find a better day.

Almost everything the government gets involved with turns to crap. Less government is the best government.

Do you tell that to your friends in the Marine Corps? Have you ever used Windows?

Jdog, with respect, I’m sure you can come up with your own examples where government does a job that the private sector won’t touch without the government offering large incentives – sure – military contracting. And I’m sure you can recount many colossal business failures – new coke? – as well as companies that wouldn’t exist or wouldn’t be profitable without some kind of direct or indirect gummint support. This categorical is just so tired when in reality the biggest spending lobbyist, last time i checked, was Verizon – which at one time lead the nation in consumer complaints. So maybe it’s not about having less gummint but who it works for.

Please list the post 1940s military conflicts that we have “won”, or that have led to peace and stability where they occured. I want to see what I am getting for the 55 cents out of every federal tax dollar that I am obligated to pay.

Maybe president Biden could elaborate on the half century of his voting record in the senate and Obama presidency?

Mario,

“Have you ever used Windows?”

Touché ?

NASA, NOAA, roads, bridges, military, research………. Gotta love these libertarian memes.

I get it now. We’ll get that new bridge because some rich guy thinks we need one. Or the Coast Guard ships. Some rich fishing company will protect out shores for us because it’s the right thing to do. And why have courts and a justice system when we could just get together and tar and feather some folks? Maybe buy some rope instead of paying for police.

Yeah, let’s get rid of Govt as much as we can. Stuff like the EPA. Hell, I never lived near the Love Canal. I don’t drink Flint water. Screw um. It’s interfering with my income stream.

At least in the USA multinational corporations ( which also control media)and the military industrial complex have a huge influence on big government. This is why at least some Americans are not supportive of our ever larger government.

Man, loved my Tacoma public utilities. They always pick up the trash on time. The city sends one bill every two months for water, sewer, garbage, and electric at 3cents a kWhr. They even ran inexpensive, highly reliable internet service before the whiny carriers forced them to privatize it again. On Christmas day 2010 the water main broke in front of our house and city workers came right out and fixed it. Because the system was designed and built with redundancy no one in the neighborhood lost water and we all had Christmas – except for the city workers who left their families for us. But yeah – freedom.

The American electorate in general wants government to do a lot for us. Where we disagree is whether government should do it for all of us.

The most vocal libertarians I have met are either farmers or military contractors.

Paulo

Great comment on Libertarians.

Libertarian motivations derive NOT from well thought out ideaology.

Libertarians are the way they are due to unresolved ” mommy” issues.

NASA, NOAA, roads, bridges, military, research…

At the Federal level, defense spending is 16% of the budget. NASA, roads, bridges, and all other project spending is another 15%.

The rest is interest and transfer payments (SS, Medicare/Medicaid, SNAP, unemployment, welfare, etc).

I would be fine with vastly limited transfer payments and the roughly 30% of spending that actually helps the common good (defense, infrastructure, etc).

State level spending is more variable but in most states K12 and higher education is 50% of the budget and Medicaid another 25%, and Medicaid has increased vastly with ACA.

But people always want to talk roads and bridges. If that were what I was getting for my taxes, I would be very pleased.

Happy, To whom software does not allow a reply

‘Defense spending is 16% of national budget’

Where did you get those numbers?

“For 2020, Congress spent $690 billion on the Department of Defense (DoD). That’s just the base budget. There’s also an Overseas Contingency Operations (OCO) fund and Emergency funding in addition to the base budget. There are also many other agencies, such as Homeland Security, that have a role in defending America. To really understand U.S. military spending, these must all be added up.”

“Other agencies that protect our nation include: Veterans Affairs ($218 billion), Homeland Security ($92 billion), the State Department ($33 billion), and the National Nuclear Security Administration in the Department of Energy ($15 billion). That’s $374 billion not necessarily accounted for in defense spending, plus the interest on the debt that paid for those…”

TheBalance point com

Interest payments owed on the national debt are $523 billion.

The FAA & NTSB has issues.

Though I’d be hard pressed to have

the private sector do a better job.

Hint: BA’s front running the certification on the 8200 (aka MAX) comes to mind.

Jmho from the flt. deck.

Let’s just have anarchy! Seriously, the same people who scream about oppression are the first ones crying for FEMA after a disaster strikes.

Sure, there has to be a balance but the blanket statement that all govt is bad is silly.

If you have bad govt regulations/etc, you fix them. You don’t throw the proverbial baby out w/the bathwater, imho.

Somebody is going to have to explain the Windows reference to me.

Sounds vaguely similar to Gore’s internet…

Cas127,

The way I understood it is this way: Windows is made a private-sector company, and it’s a huge mess (“time suck” is the technical term). This was in response to Mario’s comment that “Almost everything the government gets involved with turns to crap. Less government is the best government.” The reply meant to say that companies too produce crap.

Wolf,

Thanks, that clears it up.

I have no problem believing companies can produce crap.

The difference is that it isn’t compulsory crap.

And companies’ crap self corrects from lack of demand.

The G’s crap self-perpetuates through the taxing power, control of the fiat, and implicit armed force.

All government offices, federal, state and local, use Microsoft based products so that files can be swapped.

Why should the public, most of whom make less than $50K, pay for overpaid cost of education. Is it the public’s fault that colleges pay glorified teachers $200K a year? Is it the public’s fault that administrators make twice that or more? Is it the public’s fault that pensions are obscene?

Why do people who never had the benefit of a college education have the duty to provide a free one for someone else?

The problem with this country is everyone is looking for something for nothing, paid for by someone else’s hard work…

So now college education is beneficial? Even for unpaid athletes?

Because providing for an educated populace is a public good.

As a graduate of a land grant school, Montana State University (Bozeman MT), I would like to think that the income, the business I run, and higher taxes I pay go some way towards paying for the heavily subsidized education I received.[1]

Also in todays academic environment no adjuncts or grad students, that actually teach the classes, are making $200k a year. For salaries in that range look to the bloated PMC administrative ranks.

History Lesson:

The land grant system was established as part of the Land-Grant College Act of 1862[2]. Also known as the Morrill act. Reference – https://www.britannica.com/topic/Land-Grant-College-Act-of-1862

[1] – When I attended, the legislature paid ~90% of the tuition. Looks like pretty close to “free” back in the olden days. I could live on campus (room/board) for 3 quarters and carry a full 18 credits for a cost of under $1900. I could stand in the woods and run a chain saw and make $2400 in a summer. This was 1978-1983. Good luck doing that now.

[2] – Even back in 1862 it was recognized that a public system was worthwhile.

See also the passage of the GI Bill after WW II. Reference – https://en.wikipedia.org/wiki/G.I._Bill

Fun to note, as our elites try to destroy the USPS, that our founders explicitly created the postal service to unite the nation. Reference – https://en.wikipedia.org/wiki/Postal_Service_Act

True.

jdog

By your acount…..if teachers have such a sweet deal, why don’t you become one ? Ya know just jump on that gravy train !!!

We know the real reason you don’t.

You can’t.

You just don’t have what it takes….

OTB:

Here in Oz, if you want to teach on a full time basis you more than likely need a PhD and that is pretty much a requirement all over the country.

And there are a huge number of applications for jobs when they open up. The last full time job that opened up at the university where my kid works had over 460 applications.

In fact that university went about a purge a number of years ago in numerous departments that got rid of everybody that didn’t have a PhD even if they had been there for years.

Sessional work is given to mainly PhD students or sometimes to a special ‘talking head’ that has some ‘superior’ qualities such as being a minority and can lecture on ‘terrorism’ or ‘security’ despite never ever having worked in the area or taken a class in it.

And if you have a PhD and taught at a university here you are not qualified to teach at the the primary or secondary levels. You have to go back to school to get a teaching certificate in order to learn how to teach!!!

One problem here in Australia is that a lot of the teachers at the primary and secondary level at public schools are hired on short term contracts which may or may not be renewed so there is a lot of turnover.

And for those do have qualifications and do want to get a teaching certificate, well, as I was told by a bigwig high level school administrator friend of mine: why would I hire you:

I can hire two newbies for the same cost.

Teachers suck, they are the reason our country is failing. Why would anyone want to contribute to that?

jdog-c’mon, you can do better than that.

A geezer’s observation over 70 years is that in the face of disappearing, well-paid&pensioned private-sector union jobs, many found well-paid&pensioned government jobs in the search for, well, well-paid&pensioned jobs-not such a surprising , or consciously nefarious trend if frankly considered.

An increasingly automated, ‘economically efficient’ world has, and will continue to to increase the desperate competition for a ‘decent’ (admittedly a relative and debatable term) living among our increasing human numbers.

Entropy never sleeps. Keep one eye open in your own slumbers.

May we all find a better day.

I don’t know of many college professors making $200,000 a year, and nearly all of those who do mist likely publish papers or write books to supplement their income independently of what they receive as salary. You should look at the administrators first, or better yet the school’s head football or basketball coach. In fact someone reported a couple of years ago that in 44 of 50 states the highest paid public employee was either the head of the state college football coach or basketball coach. The exceptions were either the land management director (Alaska, Montana) or the gaming commissioner (Nevada).

Read a very long article on Liberty University on Politico, but it probably could apply to nearly any public or private institution. They have somewhere around 120,000 and most have always been remote learning. If I remember correctly they receive about $2 billion per year from student loans. They have if I remember correctly a $1 billion dollar building program underway. The Falwell family has lived a pretty good life on the student loan dime. You can forgive the loans, but the money has already been spent and tax payers are on the hook.

A degree at a university in Oz will now cost you about $A4000 (US$2900) a year in tuition in one of the preferred areas such as teaching, nursing, math, etc. That is a 40% reduction in cost.

A course in medicine cost about A$11,000 a year – if you can get in.

And people here still complain that it is too expensive.

Of course, with the virus and very few international students, it means the universities here are dumping staff and teachers like crazy. The government prohibited the universites from accessing the job subsidy program that they set up for every other business in the country.

Even the bigwigs are ‘taking a beating’ by reducing their pitiful salaries from A$2.1 million a year to only starvation wages of A$1.8 million a year.

Australia has some the highest salaries in the world for people in admin at universities, city councils, and state and local government.

You need to compare it to California public salaries if you want a shock.

Details:

“Despite California’s $54 billion budget deficit and $1 trillion unfunded pension liability, there are 340,390 government employees bringing home six-figure salary and pension checks.” Forbes

[https://www.forbes.com/sites/adamandrzejewski/2020/05/19/why-california-is-in-trouble–340000-public-employees-with-100000-paychecks-cost-taxpayers-45-billion/]

Let’s get more local:

Why San Francisco is in trouble – 19,000 highly compensated city employees Adam Andrzejewski | September 2, 2020.

“We found truck drivers loaded up with $262,898; city painters making $270,190; firefighters earning $316,306; and plumbing supervisors cleaning up $348,291 every year. The mayor, $452,460 etc.

[https://www.truthinaccounting.org/news/detail/why-san-francisco-is-in-trouble-19000-highly-compensated-city-employees]

… because rich people don’t want the government to spend the equivalent of 3 tenths …

No, not that.

It is because rich people don’t want other people access to the same freedoms and advantages that they had, because of the clear risk that others also may become successful, maybe get new innovative ideas and perhaps become even get richer than they are.

Look at how hard those softie “flower-power” hippie people came down on drugs use and unemployment as soon as they cloaked themselves in power. They immediately wanted to stop anyone becoming like them!

Loading “the competition” up with student debt and medical insurances linked to employment provides a nice leash on them.

The rich people would prefer to just kick the ladder away completely so that nobody “gets in” after they had theirs, but doing that would leave too few people to run their affairs with – therefore the huge investment in “AI” and Machine Learning!

This debt deleveraging cycle that the FED and the media are pushing is an illusion. “Consumers”, or wage earners, that comprise the majority, simply cannot simultaneously drive retail sales AND deleverage. It just doesn’t make sense. Furthermore, the majority of consumers never had the available discretionary income to afford trips, cruises, or foreign vacations, prior to the pandemic. So, it is my opinion that the FED is giving a false impression that these ones are using this discretionary income now – income they never had in the first place- to pay down debt that was taken out to maintain an unaffordable lifestyle, regardless of any meager government transfers payments.

Creative frynance? Certainly the Fed would not be allowed to misinform the public…such power is strictly allotted only to the Commander-of-Cheats when told to do so by the money thugs skimming the take.

It’s very simple: households deleveraging happens because the debt is moved to the government, facilitated by the Fed monetising it. There is no mystery here.

This will probably continue for some time, because everybody now thinks that inflation = wealth creation (“Look! My house has increased in ‘value’!”). Free money, no consequences. We should have discovered this earlier. Why even work? Just print money and buy stuff from China! Even the Chinese love it. Their economy is booming now because of this. Everybody gets rich. What’s not to like?

Once this pandemic is over, I would bet that credit card debt growth increases faster than before. There will be pent up demand for vacations, other travel, more goodies from China (long live Bezos!), and dining out.

We Americans deserve to have this lifestyle, especially after being punished by the constraints of the pandemic!

We only “deserve” what we are “entitled” to. /s

Beautiful socio-economic-ethnographic correlation.

(That’s a real term used by today’s education pedagogy “operant conditioning-adaptive learning” programming.)

I think you are right. But there may be a huge backlash of rent deferrals with millions evicted. Huge corporations are buying up foreclosure housing to turn into rentals. So after this is over, we may see a surge in rentals vs. owners, with local housing market monopolies easily eating up what used to be disposable cash. I think it is no coincidence that there is a surge in camper van sales- this gig economy will give us a generational subset of nomadic workers. Sounds like fun, but then who will build the stable and thriving middle class communities? Will the Levittowns become mostly McMansion tenements with in disrepair? I see a lot less disposable cash to feed pent up demand. But I also see desperate people putting extravagances on credit, because they “need” them, after all of this.

In my opinion the costs of the virus continue to grow and probably will for several years. It’s being papered over by increasing dishonest money as in the money was conjured into existence and affects real saved capital.

There are going to be winners and losers. Basically if you are getting more money directly or indirectly from the government you are a winner and if you are getting less or paying more taxes you are the losers.

Overall there is going to be a drop in real income maybe by 10% that’s going to be experienced. It might appear as inflation or deflation but the virus is going to set us back. We have gotten lazy on asset inflation, but a high asset price is not the same as a durable income stream.

– “increasing dishonest money”

“Dishonest” – you mean unearned?

I don’t know what is worse: the shower of money or the shrinking of services and products the money can buy.

US government transfer payments are far from meager.

What do you mean? I’m talking about ordinary citizens not corporations and banks. My husband and I each got some stimulus money but it wasn’t enough to write home about.

Consumer spending is way down because consumers spent less on services, the biggie (down 6% from February). Income is up 6% year-over-year because of the extra unemployment and stimulus payments. Here are the numbers — they explain what’s happening to credit card balances:

https://wolfstreet.com/2020/10/30/do-we-really-need-more-stimulus-to-print-more-millionaires-billionaires-enrich-fraudsters-and-balloon-the-trade-deficit-no-we-dont/

Potential free stuff from government is a powerful motivator for behavior.

If it ever happens, there will be mucho strings attached and qualifiers.

Those “bailed out” homeowners in the last housing bubble popping should be a warning.

There ain’t no such thing as a free lunch.

“The story I keep hearing is that you’d be a moron to make payments on your student loans because they’ll be forgiven anyway. Mmmkay. So existing loans are not getting paid down, and new loans are being added, and the balances continue to balloon”

For your “free” lunch you must consume a lot of beer. Same goes for the free peanuts. If, over the long term you don’t, the free stuff goes away.

I don’t think there is anything inherently wrong with a shift from consumption to saving. In Japan the household savings rate, expressed as a percentage of GDP, is significantly higher than the U.S. yet they seem to enjoy a fairly nice lifestyle. Being frugal is the antidote to debt enslavement. Resist the urge to piss away your paycheck on plastic toys, Starbucks coffee, Chipotle slop bowls and $70,000 pickup trucks. It feels great having no debt after a lifetime of indebtedness. Having a high FICO score means nothing to me because I have no intention of borrowing any money.

We got into this money trap because instant gratification wasn’t fast enough. Now the bill is coming due and find yourself out of work. Funny how this stuff works.

Freedom from debt is real freedom. My wife and I have been debt-free since 2004. We saved ten years and bought a home cash. I didn’t even have a credit card until the car rental agencies stopped accepting debit cards. I was wondering what my FICO was, with no debt or payments of any kind for over ten years. The first card I applied for gave me a $19,000 credit limit. I guess it’s OK. I never checked my FICO. I don’t care.

I have no debt but I take advantage of all financial instruments available to me. I don’t think you should consider it a badge of honor to limit yourself to debit cards.

I finally got a divorce over debt. At least that was my side of it. I was killing myself to keep it all going so I drew the line in the sand. She wasn’t ready to make a lifestyle change and we couldn’t resolve it. I got completely debt free in the year of separation so that I was free in two ways when I got my divorce. About 15 years of debt free solo living later, it’s pretty good.

Heresy! Saving is sacrilegious!

It’s fine for your household but people confuse this with surplus capital at the macro level. Apple has a metric-butt-ton of savings because they have a government-granted patent protecting them from competition. Otherwise iPhones would cost 50 bucks. Same with pharma – drugs are cheap but we make them expensive so CEOs can get rich trading the stock. But let’s blame the fed.

There are around 130,000 interlocking patents held by various individuals/companies required to build an iPhone. $50 wouldn’t cover the royalty payments.

Drugs are expensive in the US because of the costs necessitated by the government. I like government mandated drug testing. But it’s not perfect. That’s why I keep a physician’s sample box of Merck’s Vioxx on my bathroom counter as a reminder. US drug consumers subsidize cheaper drugs for other countries. It’s not the cost of drug manufacture, it’s the cost of failures of multiple candidate drugs, and necessary testing.

I don’t blame the federal reserve system. I blame the source – the US Congress that creates the requirement and permission to create money. What the US Treasury and FRB does is straightforward (convoluted) mechanics to meet the demands of Congress.

re: “Having a high FICO score means nothing to me because I have no intention of borrowing any money.”

And you have no auto insurance, and are not looking for part-time work to kill time and pick up a little ‘mad money,’ and presume you will never, ever have to move and rent a domicile, or take advantage of the ‘20% off your first purchase of furniture, etc. if only you open a charge account’ (you can immediately close after you’ve acquired the merchandise), or co-sign for a kid, or …

Fair or not–it’s not–your FICO score has a prominent role in your financial well-being (and it’s about as undemocratic as it gets).

There is some truth in it what you say, but it’s been no problem for me. I think the algos for car insurance are pretty smart. My car insurance is under $400 per year because I never have filed a claim and have clean record. Small town life I rent in the gray market. That’s the best market because the black market can get you locked up.

Try locking-down all 3+ credit reporting agencies (Experian, etc.). You might be surprised how often your credit get checked. I paid cash for my previous daily driver, and the dealership ran my credit and made me sign a loan agreement, in case the check bounced. It varies; I bought a new car a couple years ago and paid cash, and the finance officer didn’t even ask for ID (maybe because my mom was with me).

After my dad died, we wanted to put my name on her financial accounts so I could manage her finances. This was delayed until I unlocked my FICO score from one of the agencies; even though we weren’t even trying to get a loan or move any funds. No unlocking of report, no co-signing capability (this varies by financial institution, I’m told).

FICO may be the most powerful and secretive private agency around, and they aren’t accountable to anyone. I interviewed for a job at their HQ, and felt like I was in some top-secret CIA operation.

@Satya Mardelli

Cannot disagree from the core of your comments with re savings, free from debt and minimalistic life style.

However not everything is hunky- dory in Japan.

Japan’s economy stagnated in the 1990s after its stock market and property bubbles burst. Companies focused on cutting debt (but NOT enough!) and shifting manufacturing overseas. Wages stagnated and consumers reined in spending – hence high savings rate. Culturally it is a homogeous sociey, somewhat regimented, unlike others. Most of it’s debt held by Govt, their own Cos and citizens – a CREDITOR country. Not a debtor like USA.

The biggest problems it faces – sinking economy, aging society, sinking birthrate, radiation, unpopular and seemingly powerless government – present an overwhelming challenge and possibly an existential threat.

GDP per capita in Japan averaged 32621.09 USD from 1960 until 2019, reaching an all time high of 49187.80 USD in 2019 and a record low of 8607.70 USD in 1960. There is however no poverty similar to western countries especially USA.

Japan is a good lesson in debt. You accumulate the debt in good times and when times get bad you go oh sheet I have got to service this debt on less income. Japan has tried to manage it, but it’s like gaining an extra 100 lbs you have carry it around while you work it off by dieting or exercising.

I don’t like all this fiat and mmt stuff because it gives the wrong signals and incentives and when signals and incentives are wrong you are going to a bad place eventually.

The savings rate in Japan has fluctuated over the years depending on which measure one uses.

When I lived in Japan the better half managed the yen. It was really simple: she had the purse strings.

Her allocation was quite simple: 1/3 tax, 1/3 savings, 1/3 spending and in that order. If we didn’t have enough savings one month then we didn’t eat out. Thankfully, that bs only lasted a year or two and the spending portion wasn’t a problem as the income went up.

I even got ‘pocket money’ like all the Japanese husbands in Japan. Her initial amount suggested was huge and I suggested only 1/4th of that which I hardly ever used anyway.

Read Michael Pettis to understand comparisons of national saving rates.

Japanese household saving is higher because the money to be lent abroad to maintain the trade surplus has to come from the citizens pockets. You can’t run a trade surplus except by lending your customers the money to buy your stuff.

Japanese savings rates were/are also high because the national pension system for most people sucks.

The “Kokuminnenkin” (or National pension) that self-employed people, housewives, and others that don’t work for a big company or entity work for on a full time basis, has huge monthly payments now and a ridiculous low payout after paying in for 40 years.

And the amount of the pension is fixed – it never goes up or is adjusted for inflation.

Another reason that Japanese save more is that their income tax system is generally better than the USA’s (The various pension and national heath care costs ar quite high though.). They get to keep more of their money.

While the income tax system system in Japan has changed over the years, a person making US$100,000 or so and working for a company that is in the company pension plan, would see a bunch of basic deductions:

1. Work deduction from income of US$22,000.

2. Basic deduction for themselves, spouse, and each kid of around $3800 each. And depending onthe age of kid, if they are work, the spouse’s income, etc, those deductions could go up even more. So lets just use three people at basic rate or $11,000 or so.

3. Unlike in the USA, Japan allows payments for the national pension and national health insurance to be deducted from gross income before paying income tax on that amount. Using the US100,000 salary, the person would probably now pay around $US12,000 a year for that. So another $12,000 off the assement anount.

4. Then there are other various deductions which could apply including deductions for having life insurance, buying a new house, etc, etc, etc. Too complicated, but many would see some of them.

So just with the above deductions from income the person would be taxed on income of US$55,000 and not on US$100,000.

One of the interesting aspects of the Japanese income tax system is that there are certain income levels that impact quite heavily on taxes and pension costs. If your spouse doesn’t work, you’ll get a special spouse deduction and this will fall until they reach a certain level of income at which time you’ll lose all the deductions for them and they’ll also have to pay their own national health and pension costs – which could be substantial. IIRC the levels are around US$120,000 income for you and for them US$12,000 or so.

With this in mind, this allows companies in Japan to hire lots of women who want to work, but only part time at cheap part time wages.

And once you reach US$200,000 of income you have to list all your assets and more than likley will see a visit every few years from the tax man………………..

But anyway, in the situation above it bascially means thatat least the first US$45,000 of income you make is essentially ‘tax free’ from income tax and in many cases even more will be tax free.

The top tax rate in Japan is 45% for national income tax. In addition there is a 10% local (resident’s) tax on all income, bringing the total top income tax rate to 55%.

The only thing I might say, is that at least you get something for your taxes in Japan. Public transport works, public healthcare is generally good and convenient, homelessness is less of an issue in Japan.

In your example above, the married filing jointly couple would pay maybe 12% on their taxable income in the US, while a Japanese couple would pay 30%-ish.

“I don’t think there is anything inherently wrong with a shift from consumption to saving”

The consumption is the economy driver (read : stimulator) that brings you economic expansion, R&D, accelerated technological progress, the accelerated resources depletion, CO2 emission and the climat change.