Jobs not galore. And the target keeps moving.

By Wolf Richter for WOLF STREET.

In October, there were 142.4 million employees on the payroll at “establishments” – businesses, non-profits, governments, etc., but not counting gig workers. That was up by 638,000 employees from the prior month, and still down by 10.1 million employees from February (152.5 million), based on surveys of these establishments by the Census Bureau, released by the Bureau of Labor Statistics this morning. At the low point in April, there had been 22.2 million fewer employees at these establishments than there had been in February. In other words, these establishments recovered 12.1 million of the 22.2 million lost jobs.

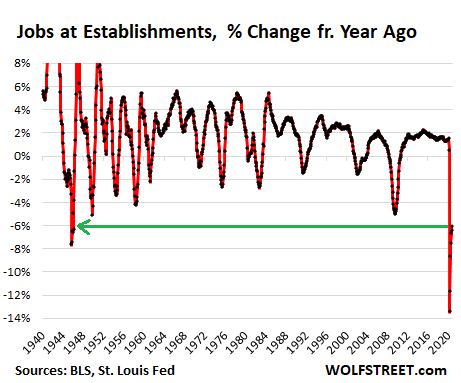

In percentage terms, employment in October at these establishments was still down 6.1% from a year ago. While this is a big improvement from the 13.4% plunge in April, it remains the steepest year-over-year drop in employment prior to the Pandemic since 1945:

I’m going to ignore the official “labor force” metric here because it is based on surveys of households, and if the respondents answer the questions in a specific way, they get surgically removed from the “labor force” though they still exist and would still work. You can see this as the labor force was down by 4 million people in October from February. These 4 million people still exist and would still work, but they answered in a specific way and got erased from the labor force.

But wait… In the three years before the Pandemic, these establishments increased their staff at an average rate of about 177,000 employees per month. It was enough to absorb the growth in the working-age population that was interested in a job (not the official “labor force”).

And that growth in the working age population that would work has most likely continued at a similar rate during the eight months of the Pandemic as it had before the Pandemic. And the labor market will have to absorb them.

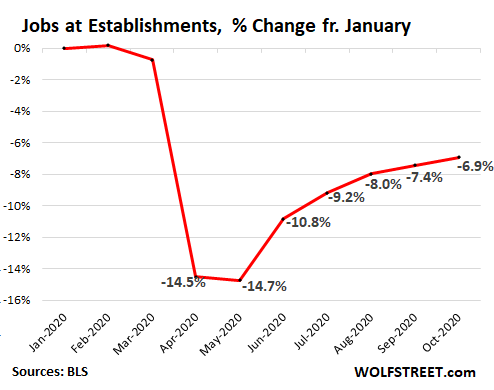

So not only does employment have to go back to where it was before the Pandemic, but it also has to make up for the growth in the working age population. This is a moving target. Note in the chart below, the slope of the line of employment at establishments before the Pandemic and where employment will have to go for it to catch up with the long-term trend.

Given the average monthly increase of 177,000 employees over the three pre-Pandemic years, the gain in jobs in October (+638,000) means that employment approached its long-term trend level (let’s call it the “approach speed”) by 461,000 jobs (638,000 minus 177,000):

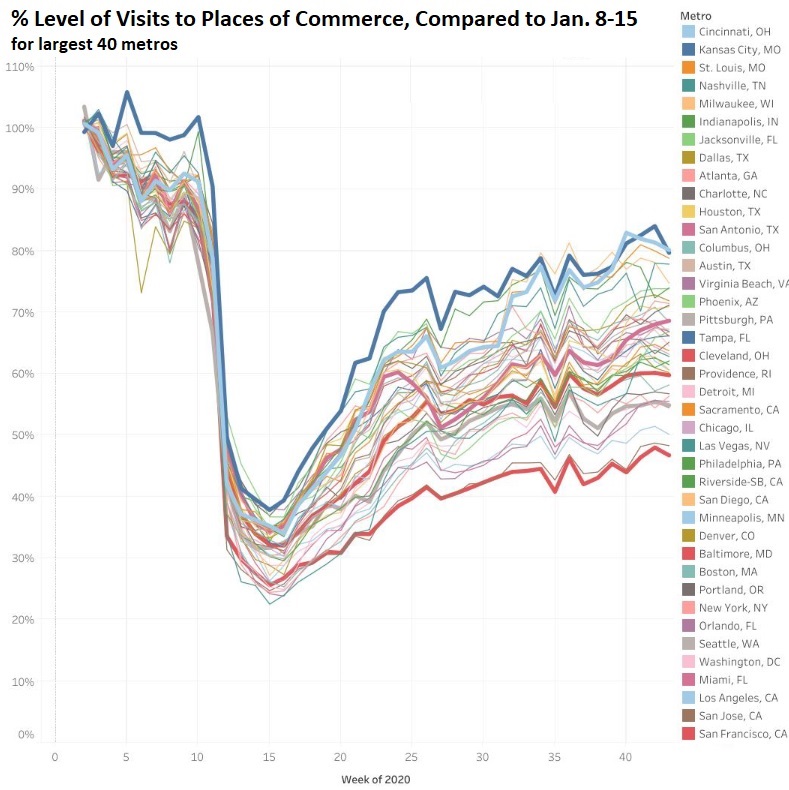

And this forms a pattern in the recovery that is being duplicated in many other data sets: After the initial plunge came the bounce, and the recovery continues but at a slowing pace and remains still very far from where activity levels had been. This can be seen in the two charts below: first jobs, and second a broad index of activity. Though the charts are very different, the slopes of their lines are very similar.

In October, the employment levels at establishments was still down 6.9% from January. Note the slowing recovery that is by a wide and historic margin below the January level:

And second, the very similarly shaped weekly index of how many people are going to “places of commerce” in the 40 largest metro areas in the US, based on cellphone GPS data. These places of commerce include offices, stores, malls, restaurants, hotels, movie theaters, airports, hospitals, other places of commerce and other points of interest. The index, released by the American Enterprise Institute, compares the number of visits on a weekly basis to the number of visits in the week ended January 15.

The top bold blue lines are Cincinnati and Kansas City (both at 80% of January level). The bottom bold red line is San Francisco (47% of January level). The bold lines in between represent San Antonio (69%), Baltimore (60%), and Seattle (55%). Click on the chart to enlarge it.

There are some aspects of this weirdest economy ever that are rocking and rolling, particularly retail sales, and particularly of durable goods that have spiked to record highs, triggering a boom in imports, in port activity, and in the transportation sector, amid rumors of capacity shortages ahead of the holidays, even as consumers themselves are super-gloomy about holiday spending. But retail is only a relatively small corner of the economy, and is not enough to make up for the still dismal performance of the other sectors.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The per capita impacts of our slow economy were in place before the pandemic, and now that trend is amplified. I assume slower consumption is ahead and in terms of per capita, the economic age we’re drifting into will be far uglier that The Great Recession.

No problem…the Big Guy is on the case!!!

Remember Obama’s Job Commission, headed by the Disney CEO.

Turned out it only met once or twice!

Shovel Ready!

(Right into public sector employee union/Dem public sector vendor donor pockets).

Meanwhile, entering third *decade* of ZIRP.

Its kind of funny that Zirp is stimulating gold production industry. It’s ever harder and harder to get out of the ground but somehow production has gone up by about 50% in the last decade. Must be demand for some reason.

Old School,

There are many factors that stimulate higher gold production, alternatives to ZIRP being one of them and without going into too much detail, here are just a few fascinating but driving factors:

– Higher gold prices (as measured in decreasing $US value) stimulates profits of production especially for large positioned producers (think the Newmonts and Barricks of the world) who can ramp up quickly economies of scale, i.e. mining lower grades on a bigger scale or lower grade blocks of ore that were ‘stored’ for better times. Think the opposite during sustained lower gold prices, i.e. ‘high grading’ of production to maintain profitability and plenty of mine closures or ‘storage.’

– Increasing demand from investors, sovereign states/banks, industrial high tech, jewelry and cultural/demographic etc. Over half of gold demand comes from India and China alone. It is fascinating for instance, to think of the potential explosive gold demand that could result from the Indian marriage culture/demographics. India has a relatively young population, average age 29, and plenty of marriages on the horizon (and plenty of gold gifting required).

– Recycling, jewelry etc. due to higher gold prices. increases the ‘harvest’ of old/new production. Incidentally, unless an individual is desperate, this is a really bad deal. I once took in to a ‘harvest event’ a bunch of old rings and chains of exact known weight (careful here, gold is measured in troy ounces = 31.1 grams, not ‘bakers’ ounces = 28.35 grams!) and karat (24 karat = 99.95+ purity; 10 karat = 41.7% purity). They offered me one third of the true value! However, they were willing to give the exact spot gold $US price per troy ounce that day for a reputable, unaltered bar of gold with ‘4 nines’ or .9999 purity stamped on it ( less for a ‘3 nines’ bar)!

The labor market was historically as tight as it as ever been, before the pandemic, which I assume means working-age population. That is an unsustainable growth curve, period.

“which I assume means working-age population.”

Nope…the 25 to 54 employed-to-population ratio has never hit its late 90’s high again. Check FRED or BLS if you wish.

There is a reason why wages have stagnated (at best) and the country is as angry as it has been since the Great Depression.

Wolf,

Along these lines, any chance of you running and posting the trendline analysis you did above…*but starting at 2000*

The job growth shortfall cumulates every year when things are bad, so 20 yrs of mostly bad has created a huge jobs shortfall (even pre C19).

There is a reason the Fed entered into a suicide pact with ZIRP for 20 yrs. Job growth has been almost unprecedently poor for two decades.

There were some decent yrs, but never nearly enough to catch up with the cumulative shortfall.

That is why the 25-to-54 employed to Population has *never* regained its late 90’s high…even before C19.

It’s interesting to look at the labor participation growth rate before pandemic by age group. A lot of the growth was in the older demographics and not in younger group. I think there was still some slack in that group, no pun intended.

“A lot of the growth was in the older demographics and not in younger group.”

Yes, people in their 50’s and 60’s are starting to realise that they will never get the pensions they anticipated and their savings have been destroyed by ZIRP/NIRP

After getting laid off 3 times in 5 years from big employers, and every time they sucked back their matching 201k contributions(which they shouldn’t be able to do)

I went contract work(database programmer) in 90’s

what a niche market with companies upgrading computer systems due to Y2K

made great $$ til 9/11 – which is when I hung up my programming hat(in my late 30’s

pensions were NOT GONNA HAPPEN unless you got into executive suite

I setup our family investments around the buffet design – ie you MAKE YOUR MONEY ON BUY(collect when sell)

we’re ok – but coming DEBASEMENT(massive) of $dollar is gonna make paupers out of 99.9%

under HARRIS administration – she is gonna accelerate it greatly

Productivity increased 2Q, while hours worked decreased. which reminds me of what I used to say to some of my fellow workers, this place runs better when you stay home. Now let’s all take a deep breath and hope they pass a really big stimulus bill.

That’s what happened since we sent millions of jobs to China, India, and Mexico. Same amount of workers competing for fewer jobs.

I think those charts are about to get ready for the down leg of the W with daily Covid cases now above 100k per day, this recession hasn’t started yet.

I don’t think COVID will have the impact it had in the Spring. COVID is spreading, but I sense people are less afraid of it. The virus is potentially deadly, but I sense the majority of people believe the virus is not deadly enough to shut down commerce again.

Most stock market investors believe that as well, based on stock price levels.

‘I don’t think COVID will have the impact it had in the Spring. COVID is spreading….’

You are mistaken. the 2nd covid spike appears to be more aggressive b/c of very reasson ‘ people less afraid’ of it.

Look at the increase in hospitalizations in the rural area hospitals.

Look at the 2nd wave doing in Europe!? Is it comforting?

Besides 3-4 months to go!

Not sure which news streams you listen to but the way you wrote suggests a mindset of fear as default.

Here in Europe we have learned to be rather sceptical about projections of deaths – which is what really matters in this pandemic.

Yes, quite a wave of new infections (although tests are very unreliable and vary from region to region), but given the high % of entirely asymptomatic cases 925-80% depending on which ‘authority’ you consult) and quite bearable if briefly nasty infections which do not require hospital treatment, let alone carry a risk of death, we must wait and see how it all pans out, and not get jittery.

We will most likely find that the very severe and probably irrecoverable economic and social (and mental!) consequences of the lock-downs will not seem to have been justified when weighed against deaths.

And I write this as someone who is most likely ‘high risk’ – but I do not over-value myself against the need of society to actually function.

The damage being done to civil liberties is also preoccupying, as we slide into arbitrary and authoritarian government and policing.

Local government has set up trigger levels, if cases rise then the types of businesses, and how businesses can operate, is changed. Students were in school, go back to online. At this point everyone gets it. Fed said yesterday, the statement about “running out of ammo” was a typo. Their willingness to jump back in signals economic trouble, which is stimulus for the stock market. At least there is a modicum of testing which makes some ordinary social contact acceptable. This is the wave where people “get it”, Uncle Bob is dead. The most serious source of contact is (tada) the workplace, which previous admin largely ignored. Labor is evidently the lowest form of animal life.

The ammo they are talking is the SAME ammo they have been using since March of ’09. Repeat and rinse and expect different results!

Think:

If QE1 was enough why start QE2, then QE3 and NOW QE 4

120B/ month pur chases continue.

Without a B I G stimulus or Trillions and Trillions of QEs,

the Mkts start melting ;ike ICE cubes under the Sun!

Without-qe-the-s-p-500-would-be-trading-closer-to-1-800-than-3-300-says-societe-generale

MW Nov 6

Trump will make sure the Prez race will dragged all the way to end of Dec ’20

“…but I sense the majority of people believe the virus is not deadly enough to shut down commerce again.”

You seem to be right that many Americans no longer believe they have to protect themselves from Covid 19. Which probably explains why a record-setting 121,200 new cases were reported yesterday.

The more people DON”T believe and or NOT following pre cautionary measures, more number of infections to follow!

More hospitalizations.

When there is no hospital beds for ‘NOT so elderly’ they get the message. it is the strain on our health system, which they all ignore, b/c they are ‘young’ and invincible.

This is a human health crisis nothing to do with political ideilogy, constitution or one’s right to freedom blah, blah

You may be interested to learn that on a per capita basis, there are more active cases in the EU than in the US right now. So this is a human thing more than it is a US specific thing.

No, stock market investors are doing what they do because they believe that the “Fed has their back.” It’s that simple. COVID, the economy, or anything else has nothing to do with it at this point.

Yep. In it’s most basic form the stock market is PxE and Zirp inflates both numbers. They have created Frankenstein and it is going to have scary ending.

Remember when Greenspan hinted at Moral Hazard, with ZIRP, and now, with the genie out of the bottle, debt and risk are morphing into unmanageable monsters, offset by monster speculation. It’s a biblical collision unfolding like a pandemic.

I agree with what you are saying, but if you follow the news, you will see Europe is beginning shut downs again.

I can foresee at least the blue States and cities doing the same as the numbers increase. That is enough to cause supply line interruptions which translate into less commerce.

Oh it’s started. Economy down 3% this year and Fed debt up 3 trillion dollars. That’s eating your seed corn pretty fast. Next year could be a repeat.

I was wondering why my bank stocks were not

recovering.This explains it.

And my oil stocks are stuck in the mud!

Gorby,

GAAP and the G give banks a *large* amount of leeway to fully write down their losses over time (see extend and pretend).

But institutional investors know this and are just assuming the banks’ loans are in fact gut shot and bleeding out…even if the current financials only show “merely a fleshwound”.

That is why banks’ stock performance is far behind many other sectors (some of which are insanely overvalued anyway).

This pandemic is going to speed up the rush to “Europeanize” the USA workforce. Most people I talk to can’t comprehend a “normal” unemployment rate over 20% with under-30 rates approaching 50%.

Now the Dems have picked up the Presidency but lost seats elsewhere it’s going to get interesting to see how the economy is going to swing.

GRID LOCK.

Nothing will pass without compromise!

And look at the ‘cooperative spirit’ across our landscape!!?

A needed reason for the coming great RESET! Hope you have hedges!

“And look at the ‘cooperative spirit’ across our landscape!!?”

Well…each side wishes the other would die…so at least they have that in common…

With respect, only one side expanded healthcare, ten years ago, by passing a bill which was designed by the other side who all then refused to vote for it. Then that same side sued to have the law thrown out at the same time they tried, and failed, to repeal it in the congress so they could “replace it” with something better which they’ve never put forward because it’s just a lie. And then that same side kept suing to kill protection for pre-existing conditions right on through a pandemic, threatened to withhold pandemic aid from states with Democratic majorities, told its constituents to drink aquarium cleaner for a cure, and don’t wear a mask when you bring your guns to protest vote-counting because only Democrats wear masks. So no, with respect, it’s really only one side that just wants people to die.

@lenert – So true. Unfortunately the “new side” wants an official majority of voters to be existentially and permanently dependent upon government largesse. I’d rather be poor and free.

Lisa

If you are poor you are NOT free.

“If you are poor you are NOT free.”

In today’s America this may be true, but in principle this statement is patently false. Poverty and freedom are not closely related. Being poor AND being free means you are able to make the best of your abilities and raise yourself up economically through work, risk, and endeavor. It also means you have the ability (freedom?) to FAIL, something seriously lacking in today’s society. The early American settlers were not exactly rich people, but they endured (and often failed), continuing to work hard to eventually succeed. The U.S.’ founders recognized the value in their freedom, and fought to enshrine it on their soil.

If you believe freedom has anything to do with prosperity, then you really do not understand the meaning of the word…

Possessions very often own you, considerably more than you own them.

Wolf,

Is more pain coming to the market relatively soon or continued weekly swings? Not sure if I should invest or continue to sit on the sidelines. Crypto looks tempting… bitcoin is around $15k today. I just don’t want to be caught holding the bucket if it drops dramatically again. I’m a novice investor so easy on the replies Wolf readers.

Dont get caught up.in FOMO.re Bitcoin or you just might lose money

The 2020 Election may not be over until December 2020.

2 senate seats might have run off in Jan ’21!

How are they going to pass any kind of stimulus in a ‘lame duck’ sessions of the Congress. the hate being spewed doesn’t allow any compromise. But the Mkts are zooming as if it accomplished!

I am guessing if the market tanks by 30 – 50% the reds and blues will come together so fast to spend money it will make your head spin. All it takes is treasury secretary to say the titanic is going down to get some action.

If spending DEBT was/is the panacea as a solution for all our private/public financial problems (world wide), we would ALL be rich!

Wonder why did ‘dot com’ bust in 2000 and ‘housing bust’ in 2008(GFC) happened? Their cure, create the 3rd largest ‘everything’ bubble of the 21st century with insane credit creation without regard to underlying fundamentals to create a productive ( NOT a financialization) economy?

None of the structural problems of the global banking got addressed, just mask it with more debt! Barnake was called a hero, for saving economy! Where is he now? Getting rich by giving speeches to ‘clueless’ simpletons.

BTW

NO country in human history has progressed to success by spending debt on debt!

May be it is different this time, right?

BTW

Did they save the TITANIC?

It still went down!

Time to change the national anthem to “Nearer My God To Thee”?

Anecdotal:

Three businesses in family all located in Silicon Valley:

1- Home mortgage business….”best year ever!” (In the business for more than 30 years)

2- “tekkie”….lost approx 40% of business since advent of the Covid restrictions; downsized physical offices/warehousing; everybody including owners taken pay cuts; no seeing of any improvements in near future. Contact with all customers and some competitors in same field same thing. (Again in business for more than 30 years)

3. “Regulated” pipe fitters internal construction: long term contracts for regulatory maintenance…that part is almost “overworked”. New construction….continuing layoffs and very few incoming build contracts. (More than 30 year longevity…..so far)

Several grandchildren because of lower rental rates, able to either upgrade their apt. living in or obtain their “first” apartments away from living either at home or BnB to work, both in Silicon Valley and San Francisco.

Some winners; some losers……and those “losers” are worried.

Watch out for the percentage of people unemployed 27 weeks or longer.

The Fed is having a blast, because to maximize employment, it will soon be compelled to print to kingdom come.

More stimulus (aka, free money) will only fuel buying big pickup trucks, Teslas, iPhones and other Chinese junk. No one pays rent or mortgages anymore.

Amazon forever!

Bezos is an American God!!!

They don’t pay rent or a mortgage because they’ve moved back in with mom and dad.

We need to quickly retrain cocktail waitresses as ICU nurses and that’s just for the gunshot victims when the legal and illegal voters have at it.

If we run out of hospitals, we can use the shut down restaurants as new ICU’s for those new patients. The converted cocktail waitress nurses will be at home there.

woohoo, revival of the service industry, quick, sell more guns.

What illegal voters? Can you name some?

Zan-i’d like to believe Mr.Bierce felt the sarc was obvious.

may we all find a better day.

Perhaps so, my comment probably more likely indicating my frame of mind that Mr. Bierce’s intentinon. Thanks for the clarification.

Only one side of the political spectrum resorts to violence when they lose. And they won. Mostly anyway.

You need to start consuming a wider array of news sources…

Boogaloo and other Neo-Nazi groups were trying to wag the dog impersonating BLM…

https://www.theguardian.com/world/2020/oct/23/texas-boogaloo-boi-minneapolis-police-building-george-floyd

https://www.startribune.com/police-umbrella-man-was-a-white-supremacist-trying-to-incite-floyd-rioting/571932272/

https://www.courthousenews.com/minnesota-officials-link-arrested-looters-to-white-supremacist-groups/

I’m betting the need for private security will rise after the food riots, myself.

I think there’s also COVID-19 fatigue. People are just tired of the constraints. I had dinner with two doctors this week. They wanted to shake hands when I came in, and apparently they are frequent fliers at that place because waiters were coming over to say hi and shake hands.

When they asked for my drink order I got a glass of wine and a side of Purell. Seriously.

I understand that. But I can say that in the bay area of CA, the aggressive techniques used do seem to have worked. I am honestly proud of the degree to which the orders for masks, social distancing, etc have been so universally followed, to the extent that our covid rates are some of the lowest in the USA. Soon they are going to actually start re-opening my kids’ school (well, soon as in January) and I think that with the degree of caution and also just general smarts by which they’ve dealt with this entire thing, I think it’s going to go well with very little uptick in covid cases.

So yeah we suffered harshly for a long time through tough covid restrictions, but the payoff is that we’re going to be like Asian countries that can actually open up slowly to more normalized life without significant covid.

Contrast with other parts of the country, who will probably never get rid of it and just have to live with death and disease until a vaccination finally comes along.

Time will tell. Because how would we ban the people from those other parts of the country from coming in?

Connecticut has banned visitors from over 30 states due to their state’s high infection rates (I can’t recall the threshold ). If you plan a visit from one of the banned states, you have to jump through a lot of hoops. If you get caught there without approval on file, you can be fined.

I was planning on visiting CT to visit family (I’m in Texas, a banned state) and will wait this out, but it may take many months now due to the rising infection rates.

All you are is more fragile and susceptible since there’s no immunity in the community. As soon as they open up, it will explode again.

There’s an old saying about people having to piss on the electric fence for themselves. Places that had serious epidemics up front took it seriously, but those who hadn’t experienced the full force of COVID laughed. I’ve noticed that where I live, a lot more people are wearing masks, keeping their distance and avoiding unnecessary contacts. We went through a rough stretch, and people learned. (Women, unlike men, find it much harder to piss on electric fences, which is why women take COVID more seriously than men.)

Kaleberg,

You may be on to something, in terms of women being more careful: In San Francisco (the only stats I conveniently have at my fingertips), 64% of the Covid deaths are men; 34% are women (1% “unknown”). Being male appears to be one of the underlying conditions.

Covid cases split: 54% men, 45% women.

But the sample is small: San Francisco has relatively low (though now rising) infection rates, and “only” 154 deaths so far, thanks to good behavior since late February.

No surprise. On the whole, the only thing the female of our species is careless about is spending one’s money….. :-)

Women have always paid more for healthcare and face more discrimination than men. Blue pills have long been covered on insurance but female contraceptives may or may not be depending on the religious views of their employer or the laws in their states. Pregnancy was considered a pre-existing condition until passage of ACA, and on and on and on…

So we’ve seen all the evidence about the ridiculous gap in wealth accumulation. We’ve seen the weakness of an economy where the employment levels can tumble massively. Add the illogical valuations of enterprises not facing any kind of reality. And throw in the potential for civil unrest, outbreak of disease, bankruptcies, evictions, and whatever. On top of this add a political standoff where no really effective change can come. Given that those at the top cannot function unless those doing the labor keep working, why is no one expecting that there might be a call for a general strike a few months down the line? After all, this isn’t your grandpa’s stock market from what we hear…and not exactly his labor population either if the argument holds.

1) A combination of : WFH, students emptied the dorms and the tourists are gone affect visits to places of commerce the most.

2) The chart looks like a cloud. Most cities bottomed out at week 15.

3) The cities at the top were rising the most between weeks 15 to 25.

Since then, the cities at the top have lost their momentum, more than those at the bottom.

4) The cloud front end is very wide. The top is tilt down.

5) Many of those on furlough and those with full time jobs are taking their

vacations now, before Thanksgiving and Xmas peak exits. They must do it

now, or lose what they got.

6) At week 52 the front end of the cloud will shrink. Those who visit

places of commerce the most will be out of town.

7) Fighting at the top might spread to the streets. The chaos will hit

the economy more than the virus.

8) The 240K Covid victims became statistic. We will get used to a combination of Covid and blood in the streets.

We have ~ 45 days before the end of the traditional holiday shopping season when many of these establishments will shed surplus employees, which will no doubt put more downward pressure on the horizontal axis of those charts. Then what?

On another note, will these statistics be relevant or even needed when UBI is instituted? Because from each according to his ability, to each according to his needs. Or something like that.

There are so many caveats, manipulations, ill-defined terms and falsifications in government statistics such as “GDP” and jobs reports that trying to parse and crunch the resultant numbers simply adds meaninglessness to meaninglessness…

The twisted labor stats are now the main excuse by the Red Senate leader today to enact a much smaller stimulus bill. The previous $5000/family of four stimulus plan is now reduced to most likely ZeRo. Increasing the child tax credit an extra $1,000 per child is now off the table, thanks to the phenomenal 6.9% unemployment rate. So $7,000 per family, perhaps more, has been washed away today due to “6.9%”. Such twisted data leads to twisted results and twisted perceptions. And twisted perceptions are what get politicians elected. Therefore at the core, politicians incessant desire to get re-elected will naturally pressure the unemployment data (and other stats) towards staying in power. I use the world “power” as even China manipulates their data, in order to remain “in power”.

I sense a perpetual pattern of politicians making poor decisions for the citizens on numerous matters, due to the self-centered acts of constantly attempting to make leadership decisions based first and foremost on staying in power and/or getting re-elected. For example, we know the Fed is systematically destroying free capitalism across the globe, stopping the natural force of creative destruction, eliminating the time value of money, etc. Who has the power to pressure the Fed? Who gains if the Fed is pressured to continue such long-term financial destruction? Politicians do, first and foremost (along with big money lobby “bribes”, rich elites, etc…yet Politicans are the largest players in the perception game). Politicians pressure the Fed to delay the natural recession cleansing process as it is very difficult to stay in power when voters are hurting economically. Most politicians pressure the Fed to provide free money to voters to buy votes, not empathy for strangers. Look, due to various reasons that are complex, we tend to elect politicians that have higher rates of narcissism and sociopath tendencies. And thus these same politicians throw free money at voters because it allows them to ultimately get rich and powerful, often times to compensate for various psychological reasons from difficulties in their past. And if you notice, these types of politicians can never seem to stop, they tend to “love” one of the most stressful jobs ever invented. They tend to get addicted to the power and literally pass away on the job due to old age, and tend to never retire until forced. The more mentally stable politicians do tend to “retire early”, or tend to lose elections based on not manipulating the populace as sucessfully as the opponent. Does this seem like a healthy way to run a complex society? Sure it may have worked well via the Telegraph age, yet how can it be expected to work as well, without modifications, via the Internet age? I do not have a solution, yet it is obvious we need to attempt some changes as what we set up hundreds of years ago is not working efficiently in today’s more complex environment of digital everything and excruciatingly expedient social challenges….

Very well stated Yort. In essence, it’s all about the power and money at the top. And that top layer extends quite far down the political ladder. We see the same crap going on in our small community. And it doesn’t matter what political party it is.

As a matter of observation, the parties are at each other’s throats to get in power. And not much of substance being *promised* (and held accountable for) to us citizens who pay their salaries.

After spending my entire 77 years in this country, fighting during a war, paying my way through all the years, and raising a respectable family, I have never been so sick of what’s going on. The scumbags used to steal from us in private and now they do it in plain view. Sick.

You are not alone in how you feel, this vet feels likewise.

Ditto.

Guess I’ll triple dog dare on this. And I suspect there are enough additional boots-on-the-ground to make a very thundering noise if the ranks came together again with the same resolve.

Agree, totally antA, except for the ”salary” part:

We the Peedons pay only the ”nominal” salary of the political puppets, while the vast majority of their ”pay” is taken in campaign contributions and other forms of corruption, as can be seen very clearly in the current crop, and has been well known for centuries otherwise and other wheres, etc.

Our potential president quit working at 30. (Never met a payroll, which is an interesting life event in itself.) Elected to a suburban county council in 1969, be became a full US senator in 1972 after only 3 years of part-time public service. So far, 47 years of living off taxpayers. He must be one heckuva guy. Perhaps a Nobel Prize?

We bring our history to how we solve problems. A NYC real estate developer most likely sees politicians as another obstacle to getting the job done.

A politician with that long of a history sees the developer (private enterprise) as something that needs a lot of oversight.

Both have in common that they need other people’s money to be successful.

Civilization is a parasite on the working man.

I wonder if pissing on an electrical fence was ever tested on Myth Busters.

“‘MythBusters’ also found that peeing on an electric fence can be a shocking experience. Because the fence is higher off the ground than a train track is, urine won’t have time to separate into droplets, and the current can travel up the stream.”

1960’s book Where Death Delights by Chief Medical Examiner Halpern of NY covers guy who peed on third rail. Guess he had a strong current in both ways.

Since this is the first pandemic for over a century, and that one caused over 50 million deaths which is a tad more than the current one, it seems obvious that the depression following would not be as deep when considering employment of the survivors.

‘depression following would not be as deep’

your thinking basis?

Hopium or wishful thinking?

Recent job gains bearly matched rise in working age population!

How many jobs and business come back by next spring? 50%?

Or may be it is different this time, right?

You are talking like this is over. By my calculation, this is the beginning of a second of three waves, with the second being the much more severe wave. In addition, the death count is only one of the detrimental impacts. Many survivors have debilitating symptoms long after they considered “recovered”.

Most are more susceptible to a wide range of illness after being infected. Many have organ / brain damage. Most who are hospitalized will have very large hospital bills even if they are insured.

Many businesses that are just hanging on by a thread, will not survive another wave.

Forbearance is coming to an end.

The government will not pass another relief bill the size of the first one, and so despite this wave of virus being worse, there will be less spending.

I would liken were we are now, to being in the eye of a hurricane, which is getting stronger…..

” Many survivors have debilitating symptoms long after they considered “recovered”.

Most are more susceptible to a wide range of illness after being infected. Many have organ / brain damage. Most who are hospitalized will have very large hospital bills even if they are insured.”

This. I have family members who have treated COVID patients in the U.S. and India reporting that at least 50% of them have serious side effects that could be long-term.

This is completely inaccurate. Almost half of people with COVID-19 are asymptomatic. There are a small number of people with chronic symptoms but it is a small fraction of recovered cases as of now.

Not trying at all to minimize the crisis, in some states, hospitals are near capacity, and there has been a nursing home holocaust in many states. But the chronic COVID thing should not be a front and center concern here.

General strike.

Yep. I am thinking it will eventually be wide spread in animal population and will be with us forever like rabies. We will learn to live with it.

It seems the US is finally getting serious about eradicating rabies by means of oral rabies vaccine in bate packets, long since used in Europe.

Alas, probably won’t eradicate it in bats.

Some animals Are susceptible such ashorses.

re Civil Liberties, here in the UK protest on the streets has been declared illegal, we are all currently in national lock down, or as I refer to it virtual house arrest, and we are not allowed to leave the country, so it has become one giant prison, and still no one has raised so much as a whisper in protest, the politicians must not be able to believe it, and all for a virus with a 2% death rate.

The BBC must be hot on working up a convulted script for future programming by now. You have our sympathies in living under the Coburg Princes. Stay healthy in mind and body for the duration.

‘I just don’t see what the market is seeing’

I have gone through awful feeling more than a dozen times since ’09 and especially after 2013. This is mkt(s) born, fed and nourished by debt on debt in trillions, globally. I went thru mkts under good ole genuine American Free Mkt Capitalism until March of ’09.

Then the rules of the game got 180* upside. Everything I learned about investment matrix became INOPERATIVE under the Fed and the Congress starting with suspension of mkt to mkt accounting standard. the price of capital was made ‘dirt’ cheap with ZRP. Price discovery has been actively suppressed!

But for QEs, the S&P would be closer to 1800 than the current!

50% or more gain in S&P since ’09 came via BUY BACK shares program!

Mkt (S&P) cap to GDP is over 220%, a record. Hardly any murmur!

Global debt to GDP is 255T over 100T! S&P forward PE close to 36!

With Biden and Dems, Investors keep wishing and hoping the stocks will continue to grow( more QEs+stimulus!) , without any regard to underlying fundamentals or deteriorating global Economic conditions under Covid 19!

Most surreal mkt of my life time, needs badly a great reset. It is on it’s way one way or the other.

BTW

I had my puts always hedged with some calls in this casino, run by Fed, the cartel for Banksters! Made $ many a time on a rebound ( a relentless attempt to go back to the peak) by DIP buyers?algos!?

(Been in the mkt since ’82)

The classical definition of value of an investment is the sum of all the discounted cash flows. Government and Fed have control now as cash flows all depend on how much Fed is going to print and Congress is going to spend. We are hooked on the heroin and at some point the confidence is lost. There will be a reset either planned or unplanned. Wish I knew how it would unfold, but I will try to keep up to date and look for signs of what is going to happen.

I was awful once, so bad it was offal. And later, faloffal. Until, one day, I moved away from the fish rendering plant.

When I became a loaf, it was better, and moved back east to share it. After discovering the secret recipe, many tried it out. They had time on their hands.

In my neighborhood stores are closing early because they can’t find enough employees. When I was a kid and wanted a summer job, I just knocked on a few doors before I found one.

Most of my high school friends didn’t go to college. They took blue collar jobs. Since they were the only ones who showed up on time and stuck it out, they got the promotions and prospered in life.

If you don’t have a job, your full time work should be finding one. Not sending out resumes and watching TV hoping the phone rings. Not waiting until the unemployment runs out then being homeless or dependent on charity.

what a useless comment devoid of any hard data and totally ignoring any of the systemic issues that Wolf has written countless articles about. Do you even read any of them or do you just hop on here and spew out brain dead boomer tropes incessantly? Let’s start with asking where all of those blue collar jobs with promotions went. Do you think they still exist? Have you been in a coma for the past 30+ years? SMH

Synopsis of your reality flows along Moses Allison’s lyrics: “Because your mind is on vacation, and your mouth is working overtime.”.

Please seek professional help.

So much depends on our work ethic. I have a friend who is 31. His parents brought him here as a kid from central america. He is legal now.

He has his own small business. He makes about the same as someone with a good corporate job. He told me yesterday. It’s all up to the individual. He has good family network. They are living the old style American dream by working in furniture factories, doing construction, selling Mary Kay, raising good families.

ahh yes, living the american dream by selling Mary Kay. lol wtf

Whatever drug[s] you are doing, on…..you might consider detox as your perceptions are similar to addicts.

Re Mary Kay’s churn/failure rate is 99%

re Pyramid Scheme Alert

Exceptional biz model, ‘ya think?

Who buys furniture,burritos,or overpriced cosmetics when they cannot afford their copay,waterboll,propertytax,electricbill,foodbill,or whatever?