Years of painfully slow growth slashed in one fell swoop!

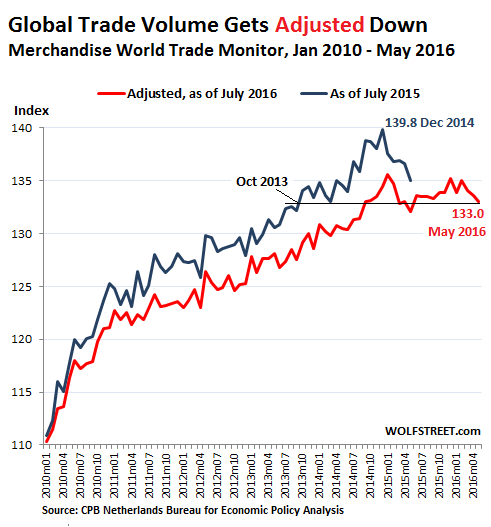

Something funny happened when I didn’t look: the global trade numbers were adjusted down. By a lot. The post-Financial Crisis recovery in trade is suddenly a heck of a lot less vibrant than it looked. And it has completely stalled out over the past two years.

The CPB Netherlands Bureau for Economic Policy Analysis, a division of the Ministry of Economic Affairs, just released its Merchandise World Trade Monitor for May. It was, in its own right, not very uplifting.

World trade volume shrank 0.4% in May, after shrinking 0.3% in April. The index fell to 133.0, the lowest level since May 2015. It’s back where it had first been in September 2014.

But wait…. Last time we wrote about the World Trade Monitor (WTM) was July a year ago. We’ve kept our eyes on it because it is a valuable and unique tool in trying to gauge global trade. So this time, something jarred us, and we went back to look at the data from a year ago: the entire data series going back to Adam and Eve has been adjusted downward, with the most significant adjustments kicking in after the Financial Crisis.

Turns out, the recovery of global trade was a lot weaker than the original data had indicated. Today’s WTM level of 133 is where it had first been under the old data in October 2013! Two-and-a-half years of painfully slow growth wiped out in one fell swoop!

So we did something vile. We overlaid the old data and the adjusted data, for all to see. This chart includes the old data released as of July 2015 (blue line) and the new adjusted data released today (red line):

Note the 5% drop from the trade peak in December 2014 (original data) and May 2016!

Trade volume was adjusted down every month by 2% to 3% in recent years, in a world where economic growth is stuck at only 3.1% in 2016, according to the IMF. And that includes the glorious GDP numbers from China that no one believes. So a 2% or 3% reduction in global trade numbers is worrisome. Does it mean that global GDP was also significantly overstated? We don’t know, but we don’t exclude the possibility.

Aggregating economic data from all over the world is a devilishly difficult task. No one actually sits there and tracks trade volume by land, sea, and air. The CPB accomplishes that by collecting data that has been published by a number of countries in very disparate forms, such as on exports, imports, and production. It harmonizes the data (converting it into US dollars, for example) to create a global image out of this patchwork. Kudos for even trying!!!

At the country level, these data series get revised all the time. For example, a couple of months ago, the Commerce Department revised downward the wholesales data going back many years, which we reported, astonished by the magnitude of the revisions [Why this Economy Feels Even Crummier than the Data].

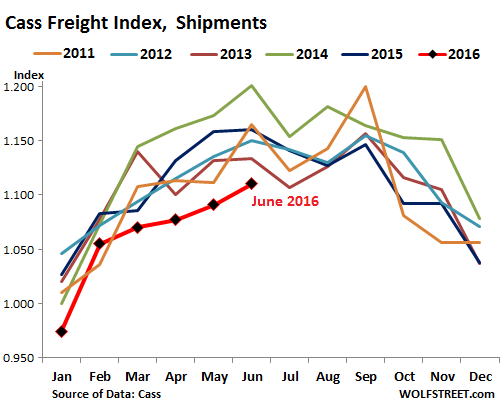

So the world trade numbers are a lot worse than they looked before, but now they reflect more closely what we’re seeing elsewhere, including how the slowdown in global trade is dragging down the US freight sector.

Freight shipments by truck and rail in the US, excluding commodities, fell 4.3% in June from a year ago, and 7.6% from June 2014, according to the Cass Freight Index. It was the worst June since 2010. And not just a blip: shipment volume over the first half was also the worst since 2010.

The Index does not cover bulk commodities, such as beaten down coal, but is focused on consumer packaged goods, food, automotive, chemical, OEM, heavy equipment, and retail. Since it’s not seasonally adjusted, it shows strong seasonal patterns. In the chart below, the red line with black markers represents 2016. The colorful spaghetti above it represents the years 2011 through 2015:

In her report, Rosalyn Wilson at Cass Transportation blamed global trade right out the gate:

For the first five months of 2016, US exports were down 6.9% compared to 2015, while imports were down 5.2% for the same period. These obviously had put a damper on freight performance.

And she concluded with these observations:

The first half of the year’s economic performance has been perplexing. Consumer spending has been growing, although the effect on freight is small as most of this increase has been in the service sector (which hired 256,000 new workers in June). Inventories are mostly unchanged at uncomfortably high levels, but the inventory-to-sales ratio fell in April for the first time in over a year. Exports and imports are down, residential and commercial construction has been slowing, and consumer spending on goods is weak….

There’s another aspect to this “perplexing” economy: Pharmaceutical products are the single largest category in US wholesales, and thus in the goods-producing sector. In dollar terms, they account for over 12% of total wholesales. They’re even bigger than groceries. Year-over-year sales have soared 10%, in a sluggish economy, not because of volume increases, but because of price increases.

Yet, drugs are small and expensive, and shipping volume is relatively small. Since much of the wholesale increase came from price increases, shipping volume has been minimally impacted.

But without these soaring drug sales, the remainder of the goods-producing economy (“ex-drugs”) at the wholesale level has been heading south for over two years, including in May. This is reflected in the crummy US transportation data over much of last year and so far this year. The growth in drug sales due to price increases covers up part of the weakness in the goods-producing sector “ex-drugs.” But the freight data, where drugs play a smaller role, bring the weakness of the goods-producing sector “ex-drugs” to the foreground.

So the massive multi-year downward adjustment of global trade volume brings it more in line with what’s happening in the freight sector in the US – and in many other countries.

What’s holding American consumers back? For them, asset bubbles just aren’t helpful. On the contrary. Read… Americans’ Economic Gloom Festers as Stocks Hit New High: Gallup Stumped

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Hi from Oz. Wolf asks “What’s holding American consumers back?” May I suggest a few candidates: Poor full-time employment prospects; Falling incomes; Debt; Lack of Political Leadership; Fear of Climate Change. Sorry, the last one was my little joke – I don’t think that it stops most people consuming. Good luck, USA.

However, climate change has it’s own significant problems with almost annual data adjustments (usually to warm things up faster). Some events from living memory (cold European winters in WW2) have almost been eliminated.

Cold European winters have almost been eliminated? Really?

https://en.wikipedia.org/wiki/Early_2012_European_cold_wave

https://en.wikipedia.org/wiki/Winter_of_2010%E2%80%9311_in_Great_Britain_and_Ireland

https://en.wikipedia.org/wiki/Winter_of_2009%E2%80%9310_in_Great_Britain_and_Ireland

https://en.wikipedia.org/wiki/Winter_of_2009%E2%80%9310_in_Europe

https://en.wikipedia.org/wiki/2006_European_cold_wave

There have been more unusually cold winters in Europe in the last 10 years than the past century combined.

My generation, the millennials, have a rather interesting dichotomy. On the one hand most of us have been conditioned into believing radical environmentalism and so we demand “something be done”, “live with less”, etc. But simultaneously we are probably the most materialistic generation since the greatest generation, we ogle high end Bentlys and Audis. Because of the mutually exclusive nature one of these will inevitably give way to the other, most likely materialism will win out, but that produces highly dysfunctional environmental policies that are aimed more at making themselves feel good than achieving practical results.

Of course there’s Brexit… :)

It looks like the “valeant” model is alive and well while the rest of the economy tanks. What could possibly go wrong?

Looks like a buying opportunity to me. The glass is either half empty, or half full, as they say.

Of course, buy at the all time highs while PE ratios are also at nearly all time highs. It’s that old saying on Wall St. Buy high and sell low.

What’s holding American consumers back?

The US has $62 Trillion in total debt, 94.517 million working age Americans are classified as Not in labor force, another 7.8 Million Americans are classified as unemployed while another 6.34 million are employed part time but want full time jobs. That’s close to a 109 Million people who are not at their full potential as well as gigantic debt loads that have grown much faster than GDP (income). Meanwhile productivity increases have been dismal and mostly hype in the distraction economy – social media and pokego. There hasn’t been a global mainstream revolutionary innovation since the iPhone way back in 2007.

Here is an employment statistic that provides a more accurate look at the strength of the U.S. jobs market:

http://viableopposition.blogspot.ca/2016/06/temporary-workers-canary-in-american.html

The pattern that is developing suggests that the Federal Reserve will find it increasingly difficult to raise interest rates.

Nice explanation for the fall in freight, despite rising GDP. I have had trouble accounting for it and so far yours is the best explanation I’ve found. US oil production being at its lowest level since March 2014, is another contributing factor too I believe.

Rising GDP is in part being powered by rising rental income – both actual rental income and imputed rental income.

As unspendable as imputed rental can be nevertheless imputed rental income from homeownership still counts the same as actual rental income and (the horror) there are those who believe imputed rental income should be taxed the same way actual rental income is taxed.

Rising GDP…..lets see, one minute we have this imaginary number, and the next minute we have that imaginary number. One minute you believe this and the next minute you don’t.

Why is it, that we have been shown over and over again that any numbers, especially from government, are as suspect as an empty chocolate wrapper and a kid with chocolate all over his face.

Why can we suddenly trust any so called date from governments when the history is dubious at best.

Your best data is your own eyes. Get out and drive behind stores where the dumpsters are. Look at what is at the curb for trash day. How fast is UPS delivering compared to last year. Does it seem like there are less trucks on the road. Are grocery baskets loaded to the brim like they used to be. Everything you need to be-in-the-know is right in front of you.

If you’re in debt up to your yin yang, which most people are, then sooner or later consumption has to slow unless you just had a big goose to your pay cheque. From what I read, that didn’t happen, either.

Recessions are a natural occuring rebalance. When delayed with debt and low interest rates, it just means things will be worse when it does arrive. Add to that an economy built on consuming many products and services that simply are not needed, sooner or later the manipulated consumer must balk.

This forum’s contributors working in trucking have been telling this for over a year. Apparently, they were right!!

I like it that these economists use a lot of decimal points in their projections; This demonstrates to the world that they have a sense of humor.

A judicious application of decimal points to data implies precision and this implied precision implies accuracy of the data.

Indeed. There is a difference between precision and accuracy.

However, any marketer knows if you want to add credibility to your numbers just add precision. No one ever checks on accuracy.

Well some people try.

Try asking for error bars (basically the +/- 2 std deviations around the data trend, better known as the 95% confidence level) and listen to the laughter.

I am not a fan of either of our choices for the upcoming election. It’s interesting to see the headlines in the MSM this morning on Trump’s speech from last night ( I’m talking NYTimes, WaPost –the gatekeepers of the status-quo). There is open mockery of Trump’s ” apocalyptic, dark” diagnosis of the state if the country, None of the analysis that Wolf offers is on their landscape. I keep on asking the question, ” if things are so great” why do we continue to see rates at levels that suggest crisis for the economy”. We all know the answer. It’s just sad to see what were once great publications present themselves as less than mediocre.

“I keep on asking the question, ‘if things are so great’ why do we continue to see rates at levels that suggest crisis for the economy.”

I’ve heard the figures that 80% of Americans are economically illiterate and only 3% will understand or make the effort to understand the complexities we discuss on this blog. These figures definitely include journalists, most of them apparently further hampered by an apparent total lack of critical thinking skills combined with unjustifiably inflated egos. That is why they never ask that question or make that connection. Unfortunately, they don’t know they’re ignorant (the Dunning–Kruger effect).

Journalists live in a very segregated community. They don’t interact with working people in any meaningful way. When they take a bus or subway in New York City, it is a ride totally confined to the nice side of the city. They shop in the upscale stores which are all in the upscale neighborhoods. They dine in only the trendiest (expensive) places. The only time they leave their comfort zone is on the way to another comfort zone. They only interact with people just like themselves, so it is not possible for them to see any further.

Kinda like most politicians …….

re journalists: couple of other option to explain inaccurate reporting:

1) Are not well educated in economics, statistics or other things they write about (aka: wouldn’t know a bad number if they saw one)

2) They have decided t take political sides and “spin” the news instead of “reporting”it (aka: wouldn’t care if the number was wrong)

3) Lots of reporters are young and inexperienced (aka: cheap) as the internet devastates the media

That sounds just like the establishment in Washington!

My ex was a 20 year journo- now teaching in Uruguay. I have been a newspaper contributor, not a staffer but have known many. Where you get the idea that a typical journos salary permits dining in the trendiest ( expensive) places only you and god know.

Are you by any chance thinking of the 1 % at most who are on national TV? Most journos are still working in print and photos either on paper or on line.

Unless you are management, salaries top out were fire, police, education, health and many PUBLIC sector jobs begin- about 50K.

Fire in my city just negotiated 95 after 5 years with no education needed. So at 20 something you can be what here is the upper class ( triple average income)

Most journos never get there or anywhere near.

The Wall Street Journal pays about 35K- like many publications in this notoriously cheap industry the idea is that a young person with a degree would do it for the fun of it, but since they have to live…

I suspect the 80% number is much lower than actual.

Back when I was a young boy, my Dad gave me a great nugget of truth to keep in mind. “Remember son, half the people in the world have a below average IQ.”

Those are the smart ones. The other half just think they’re smart.

Here’s another nugget:

The ‘smartest’ people make the biggest messes.

i have long found the film idiocracy instructive.

it’s here.

as to the economy, people have a lot of stuff, and more’s being made every day.

One of the primary reasons I believe, is the bailouts of TBTF criminal enterprise are ongoing. Bushfire is raging and I think they’re running out of water to douse the flames.

You will all be pleased to know that my relentless search for an affordable sofa finally came to an end. I purchased one on a Saturday and had it delivered the next Tuesday. The salesman apologized for the 3 day wait. I consider the entire saga a commentary on the economy. I visited every store in town, some more than once. My first choice was 3 times more expensive than what I ultimately purchased. The store obviously had plenty of inventory just waiting for a buyer.

Times have changed. I remember buying department store furniture in the 90’s and waiting 12 weeks for delivery. Now even the custom made sofas I inquired about had a less than 30 day delivery date.

Our society is awash in STUFF. And has gotten ever better at producing MORE STUFF faster and cheaper.

My 23 yr old middle son just moved out after saving up for a year by living at home after he graduated. My wife went with him discount shopping for a few items that we didn’t have, like a good bedside table. They bought a good looking, solid wood one at $200 (not an Ideal put-together) that was normally $650, but only bought 1.

So they are congratulating each other on such a great deal… but…. being a thrifty mom… she went to one of the non-profit consignment stores to look for other things he needs… AND FOUND THE EXACT SAME bedside table for $40.

Furthermore, as you have said before, they bought QUALITY that should last DECADES.

BTW, we have been blessed with considerable success and could have easily paid retail for both. But why abandon the thriftyness and willingness to work hard that got us to this point.

Is there any doubt that, MULTIPLIED MILLIONS OF TIMES, comparison/smart shopping like you and my wife do is reducing the need for freight?

P.S. Thank you Petunia for all your posts. I wholeheartedly agree with you and wish you the best.

Not only goods but a collective pessimism with the lack of technological progress that nobody wants to admit. People genuinely believed we would have flying cars and achieve similar wonders by 2015 when the Back to the Future 2 film was released, but now it’s still the same old 4 rubber tires meeting asphalt burning fossil fuel.

Neither I or either of my two exs ( still friends- one is a best) have ever bought new furniture ( except bedding) For the money we were willing to spend second hand offered much better value. But a lot of it was from people at work etc.

Once I was in a Zellers and was critically examining a sofa- I gave the arm a whack with my fist and it loosened dramatically- one more and it might have come off. I got the hell out of there.

Remember when furniture like cabinets were made of wood? They would go on and on serving different generations. Then along came particle board, and you can’t give that shit away- it sits on curbs with free signs on it.

Wolf,

I know this blog avoids politics but running for public office is now big business. I think an article on political spending and its impact on the economy, in this political cycle, would be extremely interesting. I think Trump has changed money in politics for the foreseeable future. Can/would you track it?

I might. But probably not.

I agree that money in politics is a huge issue. And it’s a complex issue. The US had codified and legalized what would normally be “corruption.” There are so many ways that money can now legally flow into politics that it’s actually hard for halfway informed operators to commit acts of illegal “corruption.” But I’m not informed well enough about all the legal ins and outs to tackle the issue in a serious in-depth way – though I could always write a rant (but that’s not very useful to our readers).

I’m not sure I get your point that Trump “has changed money in politics”.

He is openly soliciting campaign donations and most of the big Republican money guys, starting with Sheldon Adelson, were at the convention.

Trump won the nomination with a small staff and very little money, about $47M of his own money. Jeb spent $150M and got 3 delegates. Bernie raised millions, $27 at a time.

We have been told that money is the most important thing in politics. Now it seems that that is not necessarily true. The conventional wisdom has been proved wrong. The general election attracts the big money because the money buys access. I expect the general election to be financially different as well.

You have to put a price on the ‘free’ coverage obtained in the media for Trump being such a controversial figure. Yes, I am no fan of the staus quo, but if Trump enacts his protectionism God knows how much trade will drop, or how many job losses will trend in over time.

I really laughed at his characterization that ‘his trade deals’ will only do what is good for America. Why would other countries sign on, then? Trade, nay any agreements, are give and take on both sides. One way agreements never work. Both sides have to win. Both sides give up something in return. With NAFTA, Mexico got jobs and US Corporations received exploited labour rates and increased profits. With Canada, it was all about access to our energy, and hopefully water.

I also laughed at the idea of making other countries ‘pay’ for US military presence. Since when do people pay for outside imperial domination? I think they used to call it ‘rape and pillage’. Just because Iraq didn’t pay off as advertised doesn’t imply the conquest was atruistic in need of a payback.

I guess Canada will just trade with Russia, China, and Europe if Trump is elected.

Iraq has essentially already paid off the the US, oil fell by 50% and Iraq oil output is now above pre-war levels. Everyone wins.

Iraqi Government has also been a big buyer of US military hardware.

Your point would be more effective if Trump had kept his promise to run a presidental campaign on his own money, accepting no outside contributions. That would have been a game changer.

The funding for the 2016 campaign has been released- the main contributor to the GOP campaign will be the GOP National Committee -160 million.

Raised from the usual s……

folks.

Kasisch (sp?) was one of the many who passed on the VP slot. According to him, in their conversation Trump told him he, Kasisch would be responsible for domestic policy and foreign policy.

Leaving the question: what will Trump be responsible for?

“Making America great”

Apparently once Trump gets the job he wants to sub-contract it.

Rates will be coming down

I find it interesting that the only commodity to gain an increase is drugs. The reason I guess is more drugs being consumed to deaden the reality that people are facing and thereby the pharma’s make a double killing. More consumption and at a price increase.

“Trade, nay any agreements, are give and take on both sides.”

It’s pretty hard to compete with a 12 year old who’s happy to work 18 hour shifts back to back at 1/10 the pay. They live 12/bedroom in some factory dormitory apartments, no? I don’t imagine those kids buy anything imported from my country.

The reason we’re where we are today is a result of all this great free-trade and economic policy?

You mean the kid in Sri Lanka, Bangladesh, Pakistan etc. (China has moved up- its labor costs are up over the others) making budget apparel, shoes, toys or electronic assembly- the stuff in Walmart.

This is the fantasy being peddled by Trump ( which at least is a improvement on Trump U) that he can bring back the 50’s with tariffs.

The shoe making biz is NEVER coming back to the US, except of course in very pricey niches, (cowboy boots?)

The big wave of US prosperity in the 50’s the US was the result of WWII

The US was only exporter left standing, with a few crumbs left for bled white Britain. The US accounted for over 80% of manufacturing.

Those days are gone.

Similarly- deporting all the Mexican labor does not mean your strawberries will be picked by Americans- it’s not going to happen.

They will just be grown in Mexico and still be picked by Mexicans ( actually this job is often beneath Mexicans of Spanish descent- it goes to Mestizo Indians based in Mexico)

Now of course anything is possible- you could theoretically raise a tariff wall on those strawberries, then they’ll be $ 5-10 a pound.

Want to second Chris from Dallas’ comment about the end table.

It’s not just thrift, but a way of giving the middle finger to the powers that be, the credibility of the alleged economy and a means of exercising power.

We have plenty of money to buy whatever we want. I refuse.

Every item of clothing I have except underwear and socks has come from a thrift store or is a family hand me down. Most of the building material I use on our house or in the garden comes from used places. When I see good stuff in a dumpster, I pull it out if it’s easy and then donate it to the used building material place.

We do spend plenty of money on high quality organic food though, paid for with cash.

You can help this process and give lie to the economy. When you throw something out that might be repaired or is serviceable, put it next to the garbage can. Things like that usually disappear before the trash trucks come.

While these data do not include trade in coal, oil and gas, I would point out that a decline in the dollar value of trade in fossil fuels does impact trade in consumer goods. Countries that are net energy exporter have less cash for their consumer imports, and countries that are net energy importers need fewer exports to balance their energy imports. So on both sides of the energy trade, counter trade will decline.

An interesting piece in the Globe and Mail’s business section about the latest trade agreement between Canada’s provinces.

The authors dismiss the hype that it is some kind of revolution- and predict it will meet the same fate as similar much- hyped deals a decade ago.

Why? There is no enforcement mechanism. And as they put it, (roughly) : “what is the motivation for a local politician- to lean towards local producers or to protect interests in another province”

The answer for the authors is crystal clear and already at hand- as Canada’s first minister of finance put it over a century ago- The Federal government should act to prevent provincial barriers to trade.

Note that this would require overturning decisions taken by democratically elected officials. Of course, the elephant in the Canadian room is Quebec, which once famously tore up bricks laid in front of a public building because they were made in Ontario.

My overall point- a trade deal between different jurisdictions that does not have a dispute settlement mechanism that can override a local signatory is meaningless. It’s an unenforceable contract- an agreement to agree. The Canadian internal meanderings are just one example.