Quantitative Tightening has shed 40% of the assets added during pandemic QE.

By Wolf Richter for WOLF STREET.

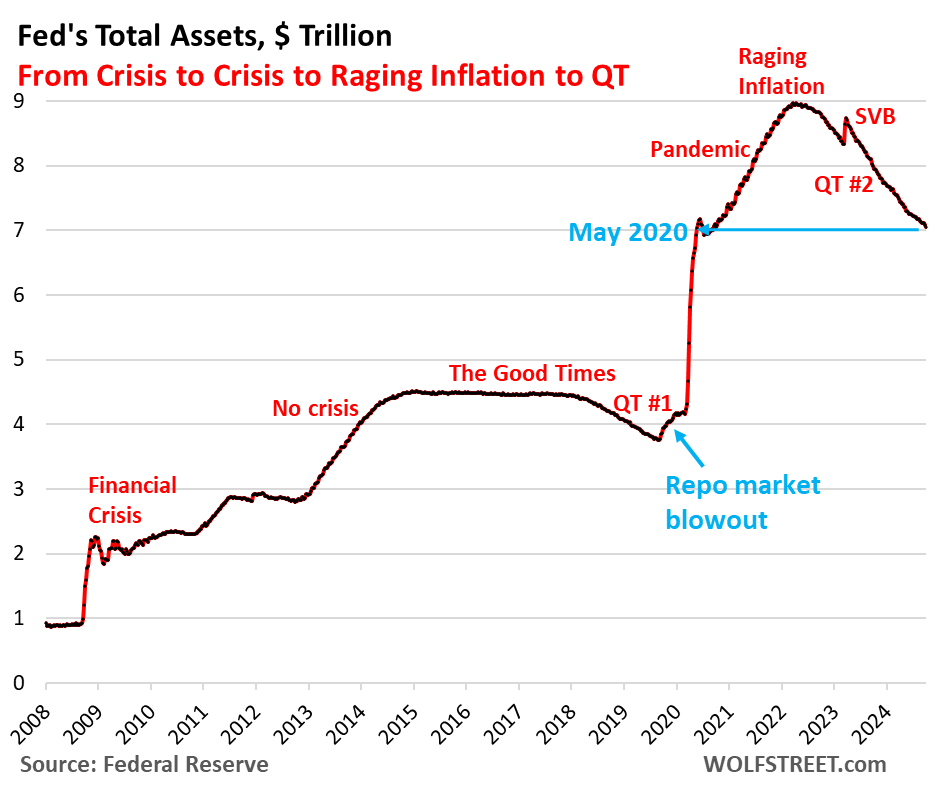

Total assets on the Fed’s balance sheet dropped by $66 billion in September, to $7.05 trillion, according to the Fed’s weekly balance sheet today. The balance sheet first reached this level on May 20, 2020, towards the end of the three-month mega-QE (blue arrow in the chart).

Since the end of QE in April 2022, the Fed has shed $1.92 trillion, or 40% of the assets that it had added during pandemic QE.

QT assets by category.

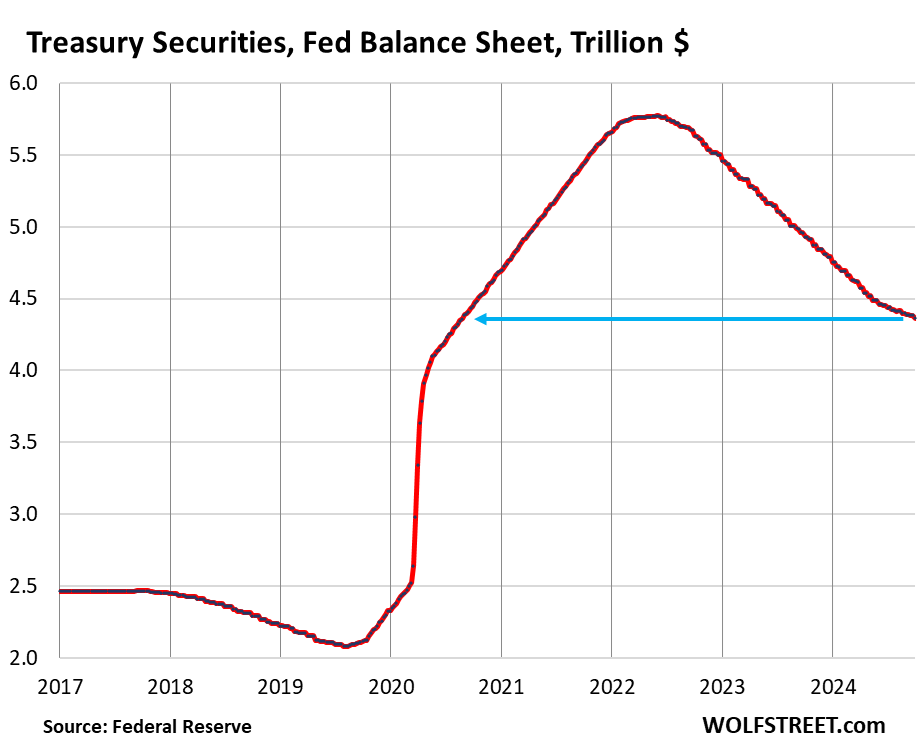

Treasury securities: -$24 billion in September, -$1.41 trillion from peak in June 2022, to $4.36 trillion, the lowest since August 2020.

The Fed has now shed 43% of the $3.27 trillion in Treasury securities that it had added during pandemic QE.

Treasury notes (2- to 10-year) and Treasury bonds (20- & 30-year) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off is now capped at $25 billion per month. About that much rolled off in September, minus a small amount of inflation protection the Fed earns on its Treasury Inflation Protected Securities (TIPS) that was added to the principal of the TIPS.

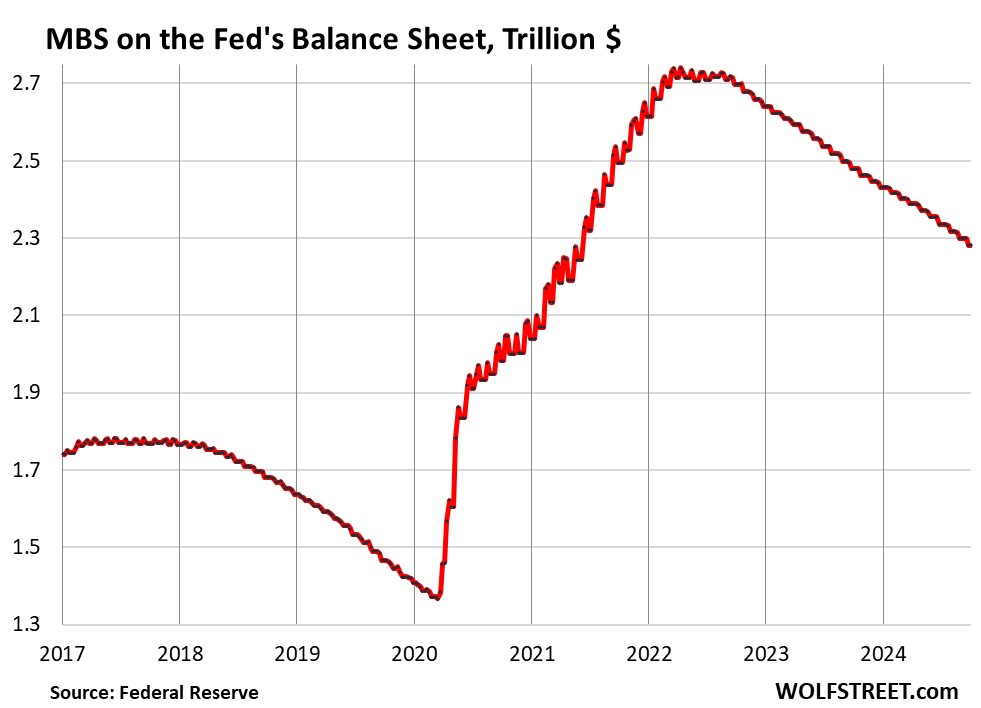

Mortgage-Backed Securities (MBS): -$18 billion in September, -$458 billion from the peak, to $2.28 trillion, the lowest since June 2021. The Fed has shed 33% of the MBS it had added during pandemic QE.

MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made. But sales of existing homes have plunged, as had mortgage refinancing, though over the past two months, refinancing has risen sharply but is still low. So fewer mortgages got paid off, and passthrough principal payments to MBS holders, such as the Fed, have been reduced to a trickle. As a result, MBS have come off the balance sheet at a pace that has been below $20 billion in most months. The Fed only holds “agency” MBS that that are guaranteed by the government, and is therefore not exposed no credit risk if borrowers default on mortgages.

Bank liquidity facilities.

Only two bank liquidity facilities currently show a balance: The Discount Window and the Bank Term Funding Program (BTFP). The other bank liquidity facilities — Central Bank Liquidity Swaps, Repos, and Loans to the FDIC — are either at zero or near zero.

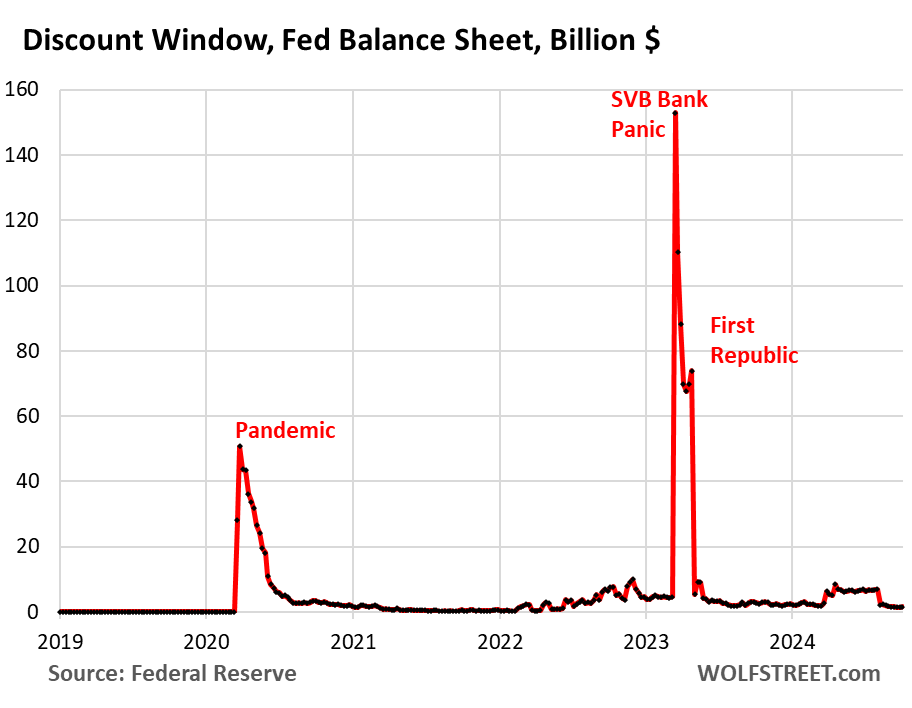

Discount Window: roughly unchanged in September, at $1.6 billion. During the bank panic in March 2023, loans had spiked to $153 billion.

The Discount Window is the Fed’s classic liquidity supply to banks. Since the rate cut in September, the Fed charges banks 5.0% in interest on these loans and demands collateral at market value, which is expensive money for banks. In addition to the cost, there’s a stigma attached to borrowing at the Discount Window. So banks don’t use this facility unless they need to.

The Fed has been exhorting banks to make more regular use of the Discount Window, or at least figure out how to use it (apparently SVB hadn’t), practice using it with small-value exercise transactions, and pre-position collateral so that they can use it when they need to.

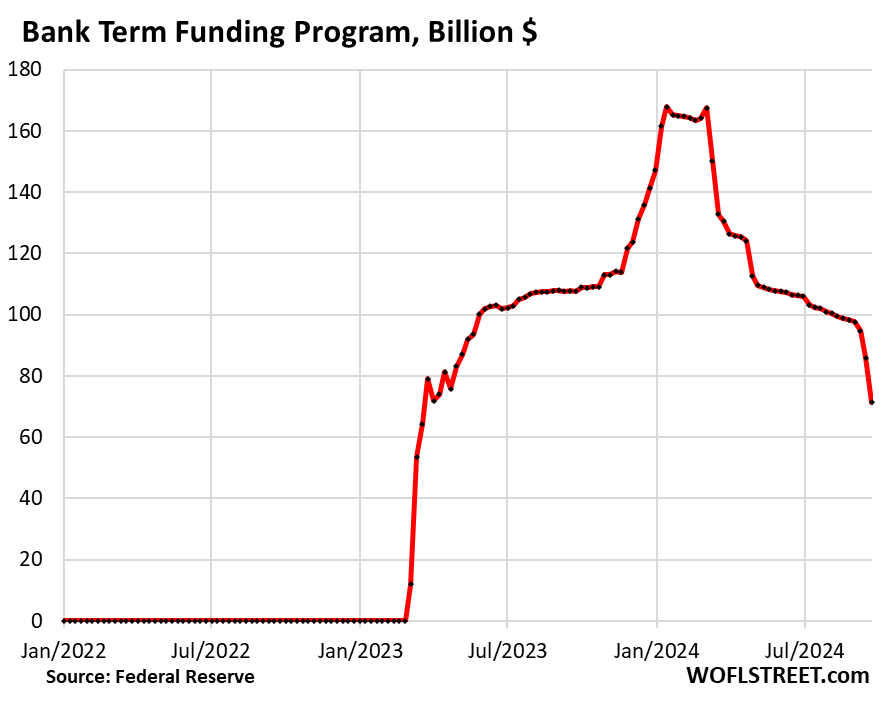

Bank Term Funding Program (BTFP): -$27 billion in September, to $71 billion, the lowest since March 2023.

The BTFP had a fatal flaw when it was cobbled together over a panicky weekend in March 2023 after SVB had failed: Its rate was based on a market rate. When Rate-Cut Mania kicked off in November 2023, market rates plunged even as the Fed held its policy rates steady, including the 5.4% it paid banks on reserves. Some banks then used the BTFP for arbitrage profits, borrowing at the BTFP at a lower market rate and leaving the cash in their reserve account at the Fed to earn 5.4%. This arbitrage caused the BTFP balances to spike to $168 billion.

The Fed shut down the arbitrage in January by changing the rate. It also decided to let the BTFP expire on March 11, 2024. Loans that were taken out before that date can still be carried for a year from when they were taken out, and that’s what we’re seeing here.

No later than March 11, 2025, the BTFP will be zero, removing another $71 billion by then from the Fed’s balance sheet.

Balance Sheet below $7.0 Trillion…

The level of the balance sheet, today at $7.047 trillion, will fall below $7.0 trillion when another $48 billion in assets come off.

Currently, Treasury securities roll off at a rate of about $24 billion a month, and MBS at a rate of about $18 billion a month, so about $42 billion combined. In addition, there is the BTFP, whose decline is unpredictable, but can be substantial, as we say today. In addition, there are other smaller balance sheet items that can go into different directions, and if they add up to anything more than just a few billion we discuss them here.

At the current rate of decline, with no other issues interfering, the balance sheet is likely to get very close to, or drop below $7.0 trillion with the Treasury roll-off on October 31 (to show on the November 7 balance sheet); and if it misses in October, it will drop below $7.0 trillion in November, and that would be another round-number milestone for QT, from $8.97 trillion at the peak in April 2022.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Quantitative easing is a wordy terminology for a misguided approach to manipulating the markets.

It’s not “wordy.” It’s only two words. And it’s abbreviated with just two letters. Your description is a lot wordier.

Very nice, steady as she goes. I know I’m not supposed to hope that the total balance sheet will drop below $4.5T, and that we’ll see a headline here “lowest since X 2014…”. But I do hope that. Maybe if global cash holdings drop under a trillion and there is no more panic QE?

I know that’s not happening. It seems now that instead we’re permanently stuck in the Spring of 2020 – pandemic world. Kind of poetic maybe that the legacy of QE will be to constantly remind us of one of the ugliest and most uncertain social and financial periods seen in our lifetimes.

BOOM!!! Look at that big drop in BTFP… $27 billion! THAT is why the Fed slowed the rate of QT so much in April and dropped the Fed Funds Rate a half point this month.

I’m amazed BTFP isn’t at $0. It’s the most costly funding in the entire market for a bank now.

BTFP valued bonds at par, vs the PCF which values them at mark2market.

Seems like big banks would rather meet their liquidity needs with IBDAs from the FHLBs than borrow at the discount window, at least for the time being.

If the FFR goes above IORB, then we should be concerned about liquidity.

I don’t understand why M2 continues to rise, since Jan 2024, if the fed still is implementing QT. Would think it would go down. Would love to see a story on that.

M2 is an outdated bullshit measure. If I have a $200k CD that matures, and I put that money into 2 CDs of $50k each and leave $100k in my checking account, M2 jumps by $200k.

You need to look up what it includes and what it doesn’t include, and you’ll see that it’s a bullshit measure in modern times, which is why no one with a brain uses it for anything.

That was my entire story on it.

In addition, a growing economy with growing profitable businesses creates “money” naturally as a matter of course. And that’s not a problem.

The problem was the artificial money-creation by the Fed during QE.

M2 is an outdated BS measure. If I have a $200k CD that matures, and I put that money into 2 CDs of $50k each and leave $100k in my checking account, M2 jumps by $200k.

You need to look up what it includes and what it doesn’t include, and you’ll see that it’s a BS measure in modern times, which is why no one with a brain uses it for anything.

In addition, a growing economy with growing profitable businesses creates “money” naturally as a matter of course. And that’s not a problem. When the economy tanks and businesses have big losses overall, money gets destroyed as a matter of course.

The problem was the artificial money-creation by the Fed during QE.

Wolf I am sure you were simplifying it but economic growth doesn’t necessarily increase money. Money is only created by debt. But generally debt growth goes hand in hand with economic growth

Conversely tanking of the economy destroys money only if debt is forced closed as it was in GFC. Economy can tank even with increasing money supply as it did from 2008 till 2013.

And yes totally agree with you that Fed actions have distorted several of these reliable indicators.

Yes, but. Money growth is a result of a chain reaction in the economy: higher profits and cash flows lead to more valuable and productive collateral (building another factory) that allows debt to be issued against that additional productive collateral and be serviced with the increased cashflow from that collateral, which generates more activity, profits, and cash flows cross the economy and allows for more debt to be issued against….

There are only two types of capital: equity capital and debt capital. Profits also lead to higher equity capital that is then invested in more economic activity, leading to more…

re: ” Economy can tank even with increasing money supply as it did from 2008 till 2013.”

You can’t look at it that way. M2 is mud pie. And the economy, R-gDp, N-gDp, etc., is driven by the lag effect of money flows.

That’s why we’ll either have a recession beginning in the 1st qtr. of 2025 or stagflation in 2025.

The grandparents born in the 1890s told me to look at the M2 money I believe that was reported in the newspapers of the 1960s. The grandparents went through the depression and were unshakeable in their conviction.

During Volcker’s time, M2 was being targeted – so it was in the media (rather than rates). But how cash is kept, and where it’s kept, and how things are paid for with this cash, have changed a lot since then, which is the problem. M2 hasn’t been updated in a long time to capture the changes.

The only bank credit contraction since the GD occurred with the NBFI’s credit crunch during the GFC (largely because of a monetary policy blunder, aka, the payment of interest on reserves).

Doug: Money is the measure of liquidity. It is the “yardstick” by which the liquidity of all other assets is measured.

Wolf, what’s the best measure of the money supply?

Why do you want to even measure it? The worry is the money the Fed creates and destroys, not the money the economy naturally creates and destroys with the ebbs and flows of economic activity.

The money stock has always been fraught with errors. Economists don’t know a bank from a nonbank. Over time, we know less and less about money.

Thanks for sharing Wolf. Looking forward to drop below 7T in October itself. Now federal funds rate dropped by half point and financial conditions loosened up, I guess lot of BTFP balances will come down. Why Banks will pay so high rate when they can get money from deposits at lower rate..Wall St is promoting people to lock in rates on CDs and all before rates go down further.

ONRRP has still 300+ Billions. So long way before Banking reserves start dropping. Hope FED will follow what they said, slower so they can go longer. But again its FED. We all have know and seen how credible they are in last 15 years.

Yeah, you wonder how much of those ON/RRPs are skewed towards larger money center banks?

https://libertystreeteconomics.newyorkfed.org/2020/11/how-bank-reserves-are-distributed-matters-how-you-measure-their-distribution-matters-too/

https://libertystreeteconomics.newyorkfed.org/2020/07/a-new-reserves-regime-covid-19-and-the-federal-reserve-balance-sheet/

You see, the Sept. 2019 repo crisis was driven by the loss in overall reserves, not “concentrated” reserves, that were used to support the money market. Actually, it was the increase in the remuneration rate that induced nonbank disintermediation, viz., a predictable old-fashioned credit crunch (aka, 2008’s payment of interest on reserves).

Really bloated and gross balance sheet. Just disgusting.

… that’s getting less bloated.

Some people view the glass as half-empty. Some see it as half-full. Depth Charge says f*** the glass, it’s the enemy of the common man, robbing him of his precious bodily fluids.

How disingenuous. A trillion here, a trillion there…

Follow the fucking money, the Fed has enable bad behavior AND the greatest transfer of wealth to a few paper-pushing fucks in banking and finance at the expense of the working class in the history of the planet. FFS, can we all just be honest? The Fed’s own data fully demonstrates this.

To be fair, CONgress has taken full advantage to enrich themselves, and is fully OWNED via K-street. I don’t think it is an accident that they haven’t passed an actual budget since 1999, the year Glass-Steagall died…

…seems humanity needs to re-learn those depression era lessons.

Good god. This is perfect. I wish there was a way to rec posts here.

What is a reasonal balance sheet? $6T, $5T possibly $4T? Better question is, how much amunition will be needed for the next QE? The problems of our national debt and debt service are not going away and apparently it doesn’t matter which party is in the White House.

The question is what is the right amount of assets for a Central Bank. It should be give or take equal to the amount of currency in circulation. It had been that for decades until the Fed stated suppressing long term interest rates with bond purchases etc. Currency in circulation currently stands at around USD 2.4 Tr. That is the demand for money in the economy. On that basis the Fed hast to shed another $4.5 Tr of assets out of which 2.3 Tr MBS that have no place on healthy a CB Balance sheet, and $2 Tr of Treasuries (plus liquidate all the small tensioning subsidy/support asset programs. Then you are left with TSY assets only and those equal to Currency in Circulation. Needless to say interest rates would be much higher as they should be to return the real risk free 10-yr rate (10yr TSY zero yield) to the historical level of around 2.5%. That would wipe out finally the sick PE industry and finally allow financial resources in the economy to find their way into healthy businesses with good business models and a normal level of leverage and slowly eliminate the massive wealth gap that has exploded through QE primarily via PE

You are missing a bunch of stuff, including the federal government checking account.

The FED has made a ton of mistakes in the past, but you are letting your hangups on them blind you to what is happen going forward.

Ryan-

“What is a reasonal balance sheet?” and “The problems of or national debt and national debt service are not going away…”

I, too, was visually struck by the period of exponential expansion in Wolf’s Fed’s Total Assets chart:

2000 — ~$1T

2009 — ~$2T

2014 — ~$4T

2022 — ~$8T

An overlay of Federal debt would show:

2000 — ~$6T

2009 — ~$12T

2014 — ~$18T

2022 — ~$31T

Debt-as-%-of-GDP has doubled from under 60% to over 120%.

The twin growth in Fed footprint and outstanding federal debt documents the predictable outcome of the “Benankean Ample Reserves experiment.”

You ask good questions.

Yes. Essentially, the Fed has facilitated the greatest transfer of real wealth from the working class (Labor) to the financial/political class. It is disgusting and will have serious consequences…

…eventually.

Interesting times.

Weird since the statistics say otherwise. It must suck when reality smacks you in the face.

https://wolfstreet.com/2024/03/23/the-feds-liabilities-how-far-can-qt-go-whats-the-lowest-possible-level-of-the-balance-sheet-without-blowing-stuff-up/

At this rate it’s going to take another 5-6 years to get back to 2020. I don’t see inflation waiting that long. Until all this easy money goes away the drunk sailors will keep spending.

If Israel and Ukraine hit fuel infrastructure (and they’d be fools not to), and the port strike goes over 30 days that half point cut is going to look really foolish.

I wouldn’t count on the Fed Balance Sheet EVER getting back to 2020 levels. As Wolf’s analysis in March showed… it can really only go down to $5.8 trillion by the end of 2026 without things breaking in the economy. To get it lower than that requires that the MBS holdings go away with time… and that won’t be easy since most of the mortgages of the past 15 years are nearly a third lower than current mortgage rates.

The thing to remember with the drop in assets is the decline is immediately registered in the marketplace (i.e., no lag). That’s why it’s at a “measured” pace.

It makes me wonder about ROI on all the securities the Fed held/holds and how well did they do?

The corporate bonds, bond ETFs, etc. that the Fed bought during the pandemic and actually sold outright afterwards were all profitable for the Fed.

But those were the only securities the Fed sold outright. It lets the other securities mature at which point it gets its money back, after collecting interest along the way, and in terms of the MBS, it gets the pass-through principal payments at face value, and there are no losses either.

The Fed has “unrealized” losses on the balance sheet, but that’s just a theoretical number since the Fed won’t actually sell the securities to “realize” the losses.

“Active QT has a larger impact than passive QT, particularly on longer maturities. The implementation of QT has been associated with a modest rise in overnight funding spreads and a decline in the “convenience yield” of government bonds, but QT transactions did not significantly affect the pricing and market liquidity of government debt securities.”

https://www.nber.org/system/files/working_papers/w32321/w32321.pdf

That’s at a “measured” pace given ample-reserves regime (“refers to a situation where the reserve supply curve intersects banks’ demand curve on its nearly flat portion”)

https://www.federalreserve.gov/econres/notes/feds-notes/implementing-monetary-policy-in-an-ample-reserves-regime-the-basics-note-1-of-3-20200701.html

This is contrasted with a tight regime:

Some people think Feb 27, 2007 started across the ocean. “On Feb. 28, Bernanke told the House Budget Committee he could see no single factor that caused the market’s pullback a day earlier”.

In fact, it was home grown. It was the seventh biggest one-day point drop ever for the Dow. On a percentage basis, the Dow lost about 3.3 percent – its biggest one-day percentage loss since March 2003.

You see, Bankrupt-u-Bernanke was vacuous.

Take note that Bankrupt-u-Bernanke caused the GFC all by himself. He drained legal reserves for 29 contiguous months turning safe assets into impaired assets.

Yeah, banks weren’t constrained by reserves on the upside, reserve bound, e-bound, but they sure were on the downside with a 206:1 ratio.

He didn’t cause the Financial Crisis. It was set up by Greenspan. As new Fed chair, Bernanke tried to drain the craziness that had ensued after Greenspan’s rate cuts, and he did drain it with his two-year hiking cycle and then keeping rates there, which, by 2005, started to cause the overinflated and fraud-infested house of cards to come down.

And then he overreacted with QE to prevent the collapse of the house of cards.

Actually, going back further, Congress and Clinton caused the Financial Crisis when they repealed the Glass-Steagall Act.

And actually, regulators (the Fed) caused it because they allowed banks to violate the Glass-Steagall act before it was even repealed, such as Citi acquiring Travelers Group in 1997, which included the investment bank, Salomon Smith Barney. Less than 10 years later, Citi was on the verge of collapse and got a huge bailout. So 1997 is really where the seeds for the Financial Crisis were sown.

Wolf – I know, as a rule, you don’t like your most-excellent establishment to get overly-history oriented, but i can’t thank you too-much for succinctly reprising this now-generational background…

may we all find a better day.

Always loved this quote as a sign of the times:

“To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.” Paul Krugman, N.Y. Times, Op-ed, August 8, 2002

Greenspan (endlessly referred to by Joe Kiernan and other up and coming commentators as the “Maestro,”) dutifully complied.

As Waller, Williams, and Logan previously remarked. They “believe the Fed can keep unloading bonds even when officials cut interest rates at some future date.”

We are in that period now.

Slowly loading up the magazine with additional bullets to create another Wealth Effect that never trickles down to poor workers.

Opposite. It’s taking bullets out of the magazine, one at a time.

I love money!!!!!!

Mr Wolf are you gonna write about jobs report? We added so many jobs! :] this is good for NVDA

This will be the title:

“OK, Forget it, False Alarm, the Labor Market Is Just Fine, All the Bad Stuff Last Month Got Revised Away, Wages Jumped, No More Rate Cuts Needed.“

I love your sense of humor!!!

Here you go:

https://wolfstreet.com/2024/10/04/ok-forget-it-false-alarm-labor-market-is-fine-bad-stuff-last-month-was-revised-away-wages-jumped-no-more-rate-cuts-needed/

Remember when interest rate changes told you about the economy? Now the FEDs balance sheet is the most informative indicator. I liked the old way.

If the Treasury shifted the Treasury’s General Account back to commercial banks like it was pre-2008, would the Federal Reserve balance sheet drop by ~700-800 billion USD?

While potentially increasing the reserves (and liquidity?) in the commercial banks by the same amount?

I realize all real estate is local, but I am not seeing vacant homes come to market. What I am seeing, oddly, is a flood of homes people still live in being listed at unreasonable prices (high to even peak selling season comps) and inventory spiking to 7-8 months on a trailing 3-month basis. Is this a wide spread phenomenon? I have tax record “stalked” some of the owners and a lot are about retirement age, probably empty nesters and would probably like to cash out and I guess they were extending their stay in their kid-friendly suburb McMansions while prices continued to go up?

Sorry, added this to the wrong article! Biggest RTGDFA ever!

MW: US Treasury yields soar after ‘supernova’ jobs report

The last chart is the 10-year yield, quite a show:

https://wolfstreet.com/2024/10/04/ok-forget-it-false-alarm-labor-market-is-fine-bad-stuff-last-month-was-revised-away-wages-jumped-no-more-rate-cuts-needed/

Am I the only one that notices how the strongest economy in 2 decades is happening right as the Fed abandoned ZIRP and stopped repressing interest rates with QE?

Was the entire QE and ZIRP era a massive wrecking ball to the American economy that unnecessarily held back American progress for a decade?

“Am I the only one that notices…”

No, we’ve discussed this quite a bit here. You’re correct. This economy is doing well with higher rates (except for some parts, such as CRE).

That’s why I love your writing Wolf.

Everywhere else I turn from traditional media to social media everyone is talking about how awful the world is (while spending like drunken sailors) and wish casting for low rates to come back (despite making more money than ever before).

“the strongest economy in 2 decades”

Have a listen to Hannity, and you’ll hear endless b.s. about this being the worst economy in decades. Funny stuff.

People who listen to Hannity deserve to live in ignorance and be taken advantage of. They chose a poor source of information.

No need to cut rates – this means that FED continues paying 4.75%p.a. on $3.089 trillion of bank deposits in FED system and Treasury keeps paying 3.2%p.a. (or more) on its debt. Actually, Treasury reimburses FED for the loss. So I can imagine why establishment wants to cut rates.

Jerome screwed up, time to hike again. Higher for longer!

At least have the balls to be honest about your censorship Wolf. Don’t be another hypocrite, the world already has too many.

So, OK, I will be “honest” with you. You asked for it. I’m trying to keep people like you from abusing this site to spread toxic bullshit. The internet is full of it. I cannot police the internet, but I can police my little corner of it.

LoL, I love it when nutters ask others to be “honest” when they cannot even be honest eith themselves.

Look in the mirror before making demands of others.

You probably will play the victim and pretend this is insulting when in reality it is the best advice you will ever receive.

Your loss. The sad part is you won’t even understand why.

Wolf, what’s your thought on SOFR’s spike of few days ago?

Someone has argued that it could be the ending signal of QT in december already.

Thanks

Wall Street Crybabies have been clamoring to end QT ever since it first started. And they came up with all kinds of BS reasons to do so.

SOFR plunged by about 50 basis points after the 50 basis-point rate cut, as it should, being a measure of overnight rates, from about 5.34% to about 4.84%.

At quarter end, when lots of money gets moved around for balance sheet window dressing, it rose briefly to 5.05%. In October, it fell back down to 4.85%. It’s fine. Wall Street crybabies just hate QT and want the Fed to end it. They loved QE and want it back. Free money is the best money.

as we say today ->? as we see today