The number of jobs created was even upwardly revised, for a change.

By Wolf Richter for WOLF STREET.

As you’d expect from an economy that is plugging along just fine, the number of jobs created in the prior two months was revised up by 198,000, for a change, after a long series of downward revisions. And in September 336,000 jobs were created, per the survey of employers by the Bureau of Labor Statistics today.

It beat some economists’ expectations, and stock futures tanked instantly when AI-powered trading bots saw the headline and the upward revisions because Wall Street wants a big fat recession that would “force” the Fed to cut rates and end this horrible record QT and start QE all over again in their dreams because QE is now the only thing that works for stocks.

And over the past three months, 799,000 jobs were created, including the upward revisions for July and August, and that was fine.

Growth in overall employment, which includes the self-employed, per the separate survey of households, was fine too, rising by 576,000 over the past three months. The labor force continued to rise, and that was fine. The number of unemployed rose a tad but remained near historic lows. The prime-age labor participation rate – people between 24 and 54 – remained at the two-decade high, and that was fine. And the narrowest measure of the unemployment rate was unchanged near historic lows, and that was fine, etc., etc.

Folks can quibble with some of the details, but overall it was fine – it has been fine every month all year, exactly what you’d expect from an economy that’s just plugging right along.

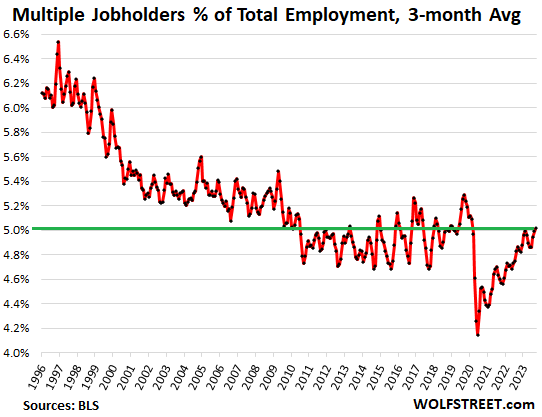

So one of those details, the multiple jobholders.

They always come up in some gruesome way, like Americans are so poor that they have to hold down two to four jobs to even be able to live from paycheck-to-paycheck or whatever, and that these multiple job holders inflate the employment numbers, etc., etc., though for lots of people, a side-gig is a great thing – working from homers have become infamous for it.

The number of multiple jobholders rose in September to 8.15 million.

But the total number of workers has grown over the months, years, and decades. For example, over the past four decades, the number of workers has grown by about 40 million, along with the total population.

And so the number of multiple job holders as a percent of total jobholders was 5.0% in September and has been around 5.0% all year, in the middle of the range before the pandemic. In September 2019, before the pandemic, it was 5.3%. Those rates are historically relatively low. In the 1990s it was over 6%, and has trended lower since then. The chart shows the three-month-moving average, which was also 5.0% for September:

So that didn’t inflate the job numbers, what a bummer. And it’s right within the range with the Good Times before the pandemic, and it’s historically low. In March through June 2020, the number of multiple jobholders had collapsed, as had total employment, but since then, it recovered and is now back to pre-pandemic levels, and there is really nothing to get excited about, except maybe that people who want a side gig have a better chance of finding one in this tight labor market.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great article Wolf. So far so good for the economy.

What will crack the stock market may not be the economy, but the bond market. TLT (20-30 year treasuries) set new 3-year low today. Down 50% from the top.

The chasm between the stock market and the treasury market is so wide something will snap. And what will snap will be the Magnificent 7. Give it 2-3 months, tops.

Yes, The stock market specially Mag-7 is so detached but it’s a matter of time I think.

Potentially it is when TLT snaps back that Mag-7 crashes. Look at Feb 2020 for example. Could be related to the yield curve “un-inversion” which just happened on 3-year and 30-year. I am sounding more and more like our local quant Micheal Engel.

seems that pandemic caused to many BOOMERS to retire

taking all their knowledge with them

now we have 15% fewer SKILLED workers

with no backup

of course UNEMPLOYMENT isn’t even consideration given paltry amounts they offer

try hiring handyman for basic household problems

$50-150 an hour given skill

“Give it 2-3 months, tops.”

How many times have I heard that in the last 2-3 years?

You heard it one times now. But keep looking at indexes, see how far that gets you. Informative reply, not.

Andy, my point is simple… You sound pretty sure of yourself. But market timing is notoriously difficult. It’s pretty common to see WS commenters promising that another great depression is just weeks away, so forgive me if I wasn’t supportive of your prediction.

I’m not hinting that a recession is impossible. Simply that 2-3 months seams a little slim when jobs aren’t showing weakness, the consumer remains strong, and the gov continues to dump new debt directly back into the economy to the tune of $2T/year, probably cancelling QT’s effect and then some.

Since you confidently put a timeline on it, we’ll know exactly how informative my response was in 2-3 months.

Not Sure, yes, fair enough, and totally agree about predictions. All I can say I put my money where my mouth is – loading up on June, Sept, Jan ’25 puts in obvious suspects. I like to leave enough time for self and the next guy. Plan to add next week. So will pay for being wrong. But, once in a generation opportunity, clearly.

Also, did not say anything about depression. This could be a fallacy that depression/recession must precede market crash. The Great Depression didn’t happen untill thousands of banks went under. Japanese were living large right up to the Lost Decade. We are in the roaring twenties 😄

“loading up on June, Sept, Jan ’25 puts in obvious suspects”

What % loss are you targeting for strike price on your puts?

I have play money to burn, and agree with your position, but I’m too smooth brained to be able to read the tea-leaves like some here.

Ben, please do not take this as financial advice whatsoever. I do not know what Im doing.

If I wanted to play russian roulette with burn money, I would go with (deep out of money ) Nvidia, Eli Lily, Meta and Msft. Like 200 12 months out. Very important to keep the cost down, but Vix is 19 now. Tesla would be good choice but expensive.

Even more important is not to sell to soon. This one is not easy.

Remember the old saying – “The stock market climbs a wall of worry”

The stock market was climbing 40-year bull in bonds. That is over now.

The stock market climbs on a wall of QE, LOL

Responding to To Andy, Wolf:

The stock market returned between 20 and 30% each year from 1995 to 1999.

Did the “bull in bonds” or QE figure significantly in these huge gains ?

Or was it just extreme enthusiasm for all things technology, especially the relatively new internet (and great revenue, earnings for some

companies) ?

There was the significant dotcom bust from 2000 thru 2002…Nasdaq and large growth stocks were especially hit hard. Small cap and value mutual funds survived much better.

(Example: Fidelity Select Electronics sported a 10 year annualized return of 30% early in 2000. It lost 75 to 80% over the next year or two. Once bottomed I believe it recovered somewhat more quickly than Nasdaq as a whole (not sure of that). Nasdaq I believe took over 10 years, possibly 15… just the index reaching level…and ignoring the very minor dividends that Nasdaq threw off.

(Below I’m just doing a quick estimate here, someone could provide exact numbers if desired).

S&P 500: Figuring a 25% annualized gain per year 1995 thru 1999 and then perhaps S&P off 50% from the double peak in 2000 (1520 or so) to just under 800 in October 2002…this leaves one with a 60 to 70% gain at its trough… and after about 8 years (I’m including the 1.5 to 2% dividends the s&p 500 provided annually in addition to the index gain/loss). Of course the market recovered fairly strong from the lows of fall 2002 thru spring 2003.

But my original question remains…was the 1995-1999 market boom primarily driven by great revenue and earnings or other factors as well ? I just followed my fund returns at the time… didn’t understand market dynamics well.

Still dont.

The dotcom bust wasn’t as scary as the GFC as value stocks and some small company stocks held up well. During the GFC it seemed everything crashed …including real estate.

My favorite: The market can stay irrational longer than you can stay solvent.

I was going to comment. The problem with the economy is the all-asset bubble (caused by Fed policies). The asset bubble climbs a wall of QE. QT will implode the asset bubble. Employment is a lagging indicator of that….

The stock market does not climb a wall of worry. The stock market climbs a ladder of growing confidence. When confidence peaks, stock prices peak soon after. Only then do the bear market worries begin, and increase, until the bear market hits bottom.

Confidence makes stock prices rise.

Worry makes stock prices decline.

Concerning jobs:

Low unemployment is fine.

Take home pay not keeping up with consumer price inflation is not fine.

That was some 5 years of returns !:

Read “Greenspan’s Bubbles” by Bill Fleckenstein.

The dotcom bubble was an outgrowth of Fed policies under Greenspan.

That was some 5 years of returns !,

“Figuring a 25% annualized gain per year 1995 thru 1999 and then perhaps S&P off 50% from the double peak in 2000 (1520 or so) to just under 800 in October 2002…this leaves one with a 60 to 70% gain at its trough… and after about 8 years (I’m including the 1.5 to 2% dividends the s&p 500 provided annually in addition to the index gain/loss).”

The S&P was lower than 800 in 2009, 7 years after 2002. Did everyone time it perfectly? The next question is what if circumstances don’t allow QE to inflate another bubble? We’ll see.

Andy promised on Feb 1st that markets would crash by summer. Instead it went up over 11%. 4,148.95 on Feb 1 to 4,607.07 on July 27.

https://wolfstreet.com/2023/02/01/job-openings-collapse-in-information-sector-most-since-dotcom-bust-but-jump-in-vast-other-sectors-amid-overall-low-layoffs-discharges-strong-hiring-still-massive-quits-and-chur/#comment-494824

Funny: Andy didn’t know that the Fed would throw $400 billion at the banks in mid-March, which boosted stocks, and then the Fed sucked it all out again, plus a whole bunch more, and the party was over at the end of July, and stocks started sagging in August and September.

Right you are, Wolf. They did bail it out that time, with almost half a $Trillion. Didn”t count on that. Let’s see what they have now. Mag-7 is $11 Trillion, give ot take.

Z33, can you please find the ones where I made 6-10 times my money shorting Amazon, Facebook, and Tesla. All on record. Leave no stone unturned. Valuable research. Thanks buddy.

Next stop: YCC with inflation > 4% to monetize the uniparty final debt binge. Where do you hide? Will US be Argentina or Japan?

I think the point is Andy didn’t know. Fed intervention is something people should certainly expect. Andy promised and didn’t deliver.

No one knows for sure but everyone knows that the valuations are not sustainable. But this can go on for quite some time.

The problem this time is: Interest rate regime has completely changed and it’s a new paradigm. Unless FED changes it stance, I don’t see market going up. I also know that FED is itching to do QE again in some hidden way like they did in March. FED is notorious to do QE in an implicit way and they don’t call it QE for obvious reasons.

FED needs to make sure that asset market remains elevated as they themselves are deeply and personally vested.

It is better to sit on cash earning 5+% plus than gambling on this market at these valuations.

The US Govt deficit does not help as well. It may mean rates have to go much higher.

My personal take is: FED’s balance sheet would be much higher than what it is today in next 10 years or so. 8 years back, who would have thought FED’s balance sheet would be this high. FED would use any and/or excuse to increase their balance sheet.

I know I differ from WR on this but I think time would prove me right which I hope not :-). We must remember one thing: FED is not working for common people but for themselves and their masters.

Keynes said an investor should treat the stock market like a beauty pageant. It’s not who you might consider the most beautiful, it’s who the audience (and the judges I suppose) think is the most beautiful. Sound to me like a ‘go with the flow’ strategy. The super 7 appear to be the beauty pageant winners. Look at their outsized multiples, Beneath them it looks like a ‘rolling’ reset downwards. I’d be very cautious at this time.

So, what’s happening with full time versus part time jobs?

but but but…..I want a recession…..where is my recession…..who toke my recession…….it was here just a minute ago……..

Lucky for eccles it looks like oil has topped for a while…….due to the recession……LOL……

When the UAW settles for a pay raise of 30% that ought to give the auto makers another excuse to hike car prices…….ready for it……..out the wazoo! Thank the lord for Toyota.

Looked at new vehicle inventory in St Louis this morning. One 2022 stood out as it was still considered a new car.

I remember some years past when new cars were being stored in a vacant drive in theater. Is it possible history is repeating?

The US Auto industry stopped innovating its supply chain of finished autos around 1922. They still believe that teh most efficient use of capital is to build large numbers of vehicles, put them onto the dealers’ lots and force the dealers to dispose them.

Just in time manufacturing is a concept that they are all well aware of, of they do not seem to practice it.

In 2023 there is no need for 60 or 90 days of supply of auto sitting in dealers lots rusting away, accruing inventory costs, etc.

The production process can be executed with small batch runs; supply chain is flexible and responsive enough that they could operate with 10 days of inventory and deliver special order vehicles in 15 to 20 days maximum anywhere USA.

Perhaps in another 100 years the US auto industry rediscovers the revolutionary new supply chain of 2023!

“The production process can be executed with small batch runs; supply chain is flexible and responsive enough that they could operate with 10 days of inventory and deliver special order vehicles in 15 to 20 days maximum anywhere USA.”

Oh man maybe in fantasy land but not when you have to import a bunch of your parts from China/Taiwan. Then funnel them through a Mexico Tier 3 with a minimal value add and then funnel them through the US Tier 2 with another minimal value add and then finally to a Tier 1 who will sit on it in a giant warehouse after some minor assembly. The supply chains are long to get to those cheap parts from the backwoods of China, which actually does keep car prices from entering the stratosphere. Imagine if every chip was manufactured in the US with US material prices and labor costs? Cars would be even less affordable than they already are. So the supply chains alone are why they keep the inventory they do.

You know nothing of automotive plant efficiency. “Small batches” doesn’t work. Vehicles are built in “lots”. My old alma mater built in lots of 50. “Just in time” has to do with the components. Plants cannot ramp up to follow order cycles by retail order. They’d go broke. Imagine if “just in time” as you describe was put into place in food markets.

Customers want their car now…. the “units rusting on the lot” fill the needs of the customers in Lahaina who lost their car in that disaster – or the ones whose cars drowned in NYC = and can’t wait 4 months for a bespoke unit to be built and shipped. The manufacturer also cannot order parts from the myriad of suppliers on a bespoke basis. “Hey, Hoiby…. we need a blue leather interior for a hupmobile Supreme GT… can we get one by Tuesday?”

The factories also have to maintain their skilled and semi-skilled employees. Ramping production up and down on retail orders doesn’t work for that purpose either. The engine casting plants can’t be cycled up and down because the cost to reheat the smelting furnaces is astronomical (they’re electric).

Might work for bluejeans…

Oh… and production plans are usually forecast out for 12 months in advance. Yes, they’re reviewed on a monthly basis but those forecasts are shared with suppliers worldwide (the wiring harness for the front bumper of my vehicle is made in Ukraine…. ) so they can acquire the raw materials to produce the harnesses and have them enroute to arrive “just in time” for production.

When short rates move higher it costs more for dealers to keep inventory on their lots even if vehicles are selling well. So, I would not be surprised tog see dealers not accepting as many new cars from the auto companies. Then the manufacturers have to store them somewhere. Strong car sales can be deceiving because sales are counted when the dealers buy the cars not when the public does.

“Strong car sales can be deceiving because sales are counted when the dealers buy the cars not when the public does.”

Total balderdash. The sales reports you see published in the newz are deliveries reported by the manufacturer that have been sold to the end user. It is not “wholesale” sales to dealers. It’s by RDR count (retail delivery record).

Dealers are insulated from interest rate hikes to a certain extent. First of all, the big chains own most of their inventory except for a few hundred $ balance – they leave that balance with their flooring source so they qualify for the insurance on said inventory. If they pay them off entirely, it’s the dealer’s problem if the vehicle gets stolen or destroyed. In addition, manufacturers (most that I am aware of) offer “floorplan assistance” in some amount and based on value of the vehicle (don’t remember if it’s MSRP or dealer net – pretty sure it’s MSRP.). If inventory turns fast enough, the dealer pockets the FPA as that amount is paid regardless of how long the vehicle stays in inventory.

Most dealers have floor lines with the manufacturer’s captive. Banks are fickle and get in and out of that business. The captives offer better terms in most cases and rarely will cut a dealer’s line of credit.

A 2022 MY vehicle is still considered new because it is still on it’s MSO / CO (Manufacturers Statement of Origin / Certificate of Origin). It’s not been titled so it’s technically “new”. If the dealer didn’t RDR the vehicle, it still has it’s full manufacturers warranty.

All Those new cars store in theaters and abandoned K-Marts some years back probably were the diesel VW’s that were being returned to VW for failed emissions.

There’s many reasons those vehicles would be stored. If you go down the access highway to Orlando Intl, you’ll see fields of cars there of all makes and models. None have plates that I could see. Those are likely rental inventory – either new or retired – waiting to be processed. New car haulers don’t often haul used because of potential fluid leaks and dodgy mechanicals.

Dealers have taken to using off site storage facilities as the land costs in the retail areas where they operate are prohibitive. It’s not necessarily a sign of ‘distress’, it could simply be that’s where the land they leased is located and either they didn’t want to or couldn’t (due to zoning) build a parking structure over/adjacent to the mother ship.

There’s also been – from time to time – a shortage of rail cars and a shortage of auto transport trucks. Cars come out of factories. They have to go somewhere. They go to available lots as the factory lots can only hold a few days production.

Other times what you’re seeing are auction storage lots where the vehicles are waiting to be reconditioned prior to sale. The exteriors get coated with shine juice and the interiors with mop and glo, a little pressure washing and detailing in those quounset hut buildings and off they go. Since the footprint of a vehicle covers several square feet and the lanes for them to maneuver are wide, it takes up a lot of real estate.

However, people see what they think they see.

VW’s: People I knew who had affected “dieselgate” vehicles bought them back from VW after VW cashed them out. IIRC, they had dinged titles but to people who loved their VW Passat wagons it made little difference because they were going to drive them until they returned to the earth as dust.

Can the automakers hike after the strike? I thought I saw that Tesla had cut prices again?

Big raises, profits turn to losses, government bails out Big 3, wash, rinse, repeat.

Last time, two of the big three filed for bankruptcy.

I wonder what a bailout of Stellantis would look like, it being a foreign company on its third bankruptcy in the US (not technically, due to changes in ownership). Wouldn’t think there would be much public appetite for that.

The thing is, I’ve been hearing about this” recession coming” for a whole year now, from the people I would expect know all these things, and are highly respected.

But I’m just mind boggled that nothing has happened.

It’s like Wolf is writing in his articles, the economy seems to be just working as it should be doing. But how is that possible? When everything people has been saying since Covid-19, is that inflation is out of control, the debt is out of control, the crash is here etc etc?

Even the ones i put my trust in are wrong about this whole thing, that’s what sucks.

I first started hearing the recession was imminent in February 2022. “Labor is a lagging indicator ”

By spring 2023 the WSJ started talking about “full employment recessions” and I stopped paying attention.

The yield curve isn’t some natural law it’s the combined wisdom of gambling addicts. And they can’t imagine an economy working without free money.

vvp – profound (…and the WSJ’s seeming attempt at changing the age-old lighting on: “…a recession is when your neighbor’s out of work. A depression’s when YOU’RE out of work…”. (…what constitutes ‘work’ a discussion for another time…)).

may we all find a better day.

Hopefully not until 2028 when the Trump corporate tax cuts expire.

“…..who toke my recession…”

Don’t bogart that slump, my friend. Pass it over to me.

Wolf.

Ford took a large loan or the company would have been along side the others.

I need an F250, but will purchase new rubber for a 2004 F250 before spending an exorbitant amount on a new truck.

Vehicle companies, or maybe all, have forgotten who made them profitable. Individuals will close the purse and stop spending. What does all think will happen?

We are going towards another Depression or worse in watching the scenario unfolding in the House. We must stop spending money in pits where corruption is rampant or the dollar will follow downhill.

Or we are headed for another Civil War.

Sorry for the politics but there is truth here!

Do I really have to go over and put a bullet in the head of my neighbor because he votes for a different party than I do? He’s actually a nice guy, just values things a little differently than I do.

Bannon would really like that, and there are probably many others like him…..although he would really prefer another series of Crusades, and unfortunately a big opportunity for just that, is taking shape as we all speak.

NBay – yeah, the Robespierre’s of the world seldom realize they are building the stairs that they, too, will eventually mount to the scaffold…

may we all find a better day.

Yeah. He still may run into someone he helped create who mistakes him for a Godless and lazy homeless drug addict, becomes “threatened”, and “stands his ground”…..during a visit to Mar a Lago.

Forgot to add or a terrorist……he’s awful seedy looking.

Auto makers can not hike prices without losing sales.

If hiking prices did not lose sales, why would they wait for a new UAW contract to hike prices? They could just hike prices anytime they wanted to. If they want to increase sales, they lower prices, as tesla keeps doing. Tesla had the highest profit margin in the industry in 2022 (except for Ferrari) so can afford to lower prices. The Big Three can’t afford to match Tesla price reductions, but competition will force them to, if they want to sell EVs.

The report if it does anything should help shut up the pivot-mongers and squawkers for once, they’re still droning on and on with their “Fed must pivot, Fed will pivot” towards rate cuts nonsense. Again and again, it’s just gotten to be noise pollution at this point. JPow and the other board members have clearly said they’re NOT pivoting and it’s not even in the cards. More interest rate hikes and QT are coming, inflation is still a serious problem and gets worse (on top of the damage from previous inflation), And, there’s still too much fiscal stimulus from debt spending while homelessness and shoplifting keep going up as rent and prices go up–everything from the evidence is yelling out loudly, inflation remains a major danger and the Fed is focussed on further rate hikes and QT to fight it. Which they confirm in their own words. But the pivot-mongers still don’t get it, they’re still babbling on like a bunch of drunks stuck on the same dumb message they can’t get out of their heads.

Speaking of drunks, one of our teams wrapped up a trip recently to some border cities for environment impact studies and from what they said, wondering if at least part of the “drunken sailor” effect from the ongoing consumer spending, might not just be from the like 260,000 people in September alone pouring across the US border every month? It’s hard to believe if you’re not there or haven’t talked to people in the region but it boggles the mind how many and how fast they’re coming–it’s not even mostly Venezuelans or Mexicans pouring in any more, the huge majority are from West Africa now esp they’re saying Senegal, Mauretania, Niger, Cameroon, and Nigeria and Mali along with some of the smaller countries there. Apparently flying in south of the border and then organizing huge caravans, one of the guys was saying in some cases whole villages in that region are practically emptying so the families can plead asylum in the US. A lot of them wound up in New York in the summer which is why we had those pictures from the Roosevelt hotel, literally no more space to fit them and that must be having effects on the monthly stats.

260K is probably even an underestimate, so just for the summer alone, we’re talking about minimum 900K to maybe 1.1 million people or so claiming asylum as refugees or economic migrants at the US border on top of other immigration. It’ll be years for their cases to be heard and they’ll need to be housed, clothed and fed in meantime, so those sheer numbers must be costing the areas hosting them a fortune and putting great deal of upward pressure on prices for a lot of areas of consumer goods and services, esp basics like housing, healthcare and meals.

This feels a little contradictory – on one hand you’re saying the economy is doing great, the job numbers mean we’re far off from a downturn. On the other you’re attributing the increase in job numbers to the increase in migrants. If that were the case, the job numbers are not really holding up that well at all are they?

You bring up a good general point though I don’t know about the specifics, I wasn’t attributing the job numbers themselves to the huge increase in migrants at the border, unless tons of temp jobs being created to provide their immediate needs–I still doubt that would be enough to make a huge dent in the overall report. But the numbers in other reports probably are being affected a lot by this historic level of inflow, again it’s on top of normal immigration so maybe in the summer alone, all together like 1.5 or 2 million people coming. That’s got to be a contributor to consumer spending and inflation numbers with the sheer price pressure from purchases by all those people coming in at once, and others catering to them. Eric Adams seemed to be saying that, with his cry for help a few weeks ago. Pointing out the migrant crisis would be costing NYC something like $12 billion or more. And despite all those pictures by the Roosevelt hotel, New York is still getting just a fraction of the migrant levels other parts of the US are getting.

Those costs and debts are rough on the city authorities and localities, but probably mean a lot of revenue for the businesses that get paid for those goods and services for the migrant flows. So that means a lot more spending and inflation pressure even though the overall picture is increasing stress on the communities. This maybe goes to your general point, that’s why the reports have seemed contradictory to a lot of commenters, good news in some ways but so many Americans seeming to struggle too. Both are true, the numbers are overall summaries and the huge migrant flow raises some parts of the USA economy while hurting others.

If the US is literally taking in enough asylum seekers to equal the population of Wyoming every month or so, then this would clearly increase spending and inflation and growth in a macro sense. It’s part of why our econ profs were always suspicious of the actual utility of GDP, nominal at least as a useful measure–it doesn’t tell you what’s actually growing, and it can come from things like polluting plastic plants or medical bills or migrant crisis as much as productive things for a community. And the effects on other figures are going to be mixed. It probably does create some jobs with the sheer immediate needs of all the new migrants, especially when coming from countries like Senegal and Niger where there’s a big need for immediate medical care and translation. But it also probably puts downward pressure on wages in other’s, and almost certainly making local rents and housing more expensive.

Can you please cite your sources for these wild numbers? The CBP report for June had a figure of 99,000 the lowest number in two years.

And if the asylum decision is “No,” good luck finding them. And perhaps now with American children.

Maybe the encouragement of illegal immigration is part of a plan to put downward pressure on wages, specifically wages of the lowest income earners. They can’t seem to help themselves but to screw low income earners.

Yeah this is one of the factors that doesn’t get talked about near as much like it should, that and the way the sheer numbers of migrants crossing the border must be contributing to the housing bubble and inflation generally all over the United States. The main cause of all these asset bubbles and the Everything Bubble generally has been the Fed’s reckless monetary policy over so many years especially with QE and the MBS purchases, that and the huge overstimulus from Covid–but for the affordable housing crisis across the USA, the worsening demand for housing with tight supply has got to be a big factor too. It’s already a struggle for young Americans to afford even basic starter homes as it is, but then add 260,000 asylum seekers (and probably a whole lot more) a month, and that’s pouring oil on the fire and putting even more upwards pressure on rent and mortgages.

They’ve been talking more openly about this in Canada and Australia too that also have terrible housing bubbles like the US, and they’re both taking in tons of migrants too. In fact a lot of the huge recent rush of asylum seekers from Senegal, Mali and the other West African countries have recently been coming into Canada and Australia with the same years long wait to get their cases heard (and like in the US few are ever deported even if their cases fail). Proportionally very high there though of course lower in totals. But there seems to be a lot more recognition about how the migration levels are eating up scarce housing and fueling high rents and the housing bubble there despite they’re doing monetary tightening.

It’s simple supply and demand, affects rent and housing prices like anything else. The only off-set I can see, it seems like lots more Americans leaving the US lately than ever before, that can free up at least some housing. Robb and the other reports are saying record numbers of wealthy Americans left America last year, and among people in our friend’s circle seems like everyone is going in their attic to dig up moldy old records about their great great great great grandfather from Poland, Italy, Germany or Ireland to get one of those “express citizenships” in Europe if you can prove your ancestry. (A hometown neighbor and his family just got their passport for France and are going next year) Same thing apparently also going on for Canada and Australia, but it’s hard to see this having enough of effect to off-set the population of Wyoming pouring into the US to plead asylum, every single month. Again, on the top of the normal migration levels. So this has got to be a factor on one hand putting downwards pressure on wages, and upwards pressure on housing costs on the other

Canada is taking in a lot of Africans from Nigeria or basically anyone who is desperate enough to come to Canada.

So in Canada immigration policy right now is roughly 1.25% of our pop, per year, for newcomers to the country. Those are pretty big numbers, coupled with increase from birth-death we are seeing almost 3% pop growth, something like 2.9% if I remember right.

We’ve done this for many many years and the pop growth through immigration has contributed to steady growth of the economy. IMO this was all manageable because those numbers were quite steady and predictable. Housing takes years to go from planning to move in ready, newcomers often take few years to go from entry level low skill jobs to skilled labour, businesses need to grow to accommodate higher consumer base and same for Gov services. You can do all that with a predictable growth in pop. However, durring covid we had a drop in immigration for a couple years, the gov responded by increasing it from 400k to 500k per year after that, and this up and down nature of it is a bit of a shock to communities, now we have some housing shortages for renters, we also have a labour shortage in trades which was brewing for a while and now it’s become exasperated, it’s not like many newcomers are coming with half their apprenticeship in plumbing or electrical or whatever they have to start fresh etc.

That’s kinda what I see in the US. Growing pop through immigration isn’t necessarily a disaster, it can work really well, but when you go through the “build a great wall” to “open the flood gates” flip flop process it’s going to be a shock and durring both periods really because when you close the taps you also put strain on businesses that relied on low skill labour for however many years. Mind you I’m not commenting on right or wrong of depending on newcomers for cheap labour or whatever but I think consistency in policy is the biggest thing even before the issue of numbers of people and type of immigration.

In recent years I am seeing more and more foreign born landlords and their kids in the Bay Area (from Asia, Latin America, Africa and Eastern Europe) buy property and pack in a ton of immigrants to maximize cashflow. One guy (born in America who grew up in home that just spoke Spanish) told me he maximizes his cashflow by “hot bedding” that is renting the same bed in the same room to a guy working in the landscape business to use at night and to another guy that works nights to use in the day.

P.S. My wife and I both have family that live in WY and I’m amazed how few people in the Bay Area have any idea that the “state” of WY (that is about 200x bigger than the “city” of SF) actually has LESS people than SF (or that the entire “state” of WY even has less people than the “city” of Portland, OR)

@The Real Tony

Yeah been hearing that too from our groups up north, Canada seems to have made a bizarre policy decision in the past decade, basing it’s whole economy on inflating and then re-inflating a massive housing bubble. To detriment of everything else in the economy, including young people’s prospects of ever owning a home or starting a family of their own. To keep the bubble inflated, the politicians and real estate investors had an actual agenda to increase migration levels to the moon to push up demand, apparently stuck on the idea that the migrants would be fine indefinitely to get stuck in squalor 8 renting and packed into a 1-BR together, making their landlords rich while they struggle for scraps.

But the authorities forgot one thing–if you drive up rents, home prices and other cost of living you not only squeeze out your own citizens, you make the country unattractive esp for skilled immigrants with a lot of choices. So social media is now filled with stories from Indian and Chinese migrants to Canada, some even 2nd or 3rd-gen who’ve been going back home in droves now they realize the opportunities to actually build their savings and a nest egg, much less own a nice home are shrinking even for big earning professionals in North America. The authorities then turn to other immigrant sources hoping they can bring enough of them in before most figure out how raw a deal it is to be stuck with such a bad cost of living crisis. That’s what the Canadian policy-makers have been doing lately with the huge influx from Nigeria, Eritrea and Somalia (the same thing Australia’s being doing with South Sudan and Congo) but there already signs that the newest waves are catching on to the bait and switch, and less and less seeing the benefit for all the costs.

The biggest irony is Canada’s cost of living excesses from all this are even driving out their own home grown citizens, making it hard or impossible to start a family and sending more to permanently leave Canada. Just like what’s happening in the US and Australia but even worse scale, so the politician and RE industry’s attempts to pump up the bubble are starting to flounder. Have had some friends and team members in Canada go that express citizenship route after digging up their ancestral documents, a perk of getting your passport in ex. Austria, Sweden or Hungary is, you then have the opportunity to go anywhere else in the EU. So a lot of them seem to be actually taking advantage of those much talked about ultra cheap homes in southern Italy, cold north in Finland or abandoned parts of rural France, Holland or Belgium, the ones where they say you can get a plot for around $20K tops. I always thought those were a bit sketchy but they’re apparently mostly legit. Although of course, you do have to do all the renovations and get things up to code yourself, which sometimes can be like just getting a new home constructed anyway. But it’s still a great deal compared to the bloated mess of a housing market they have back in North America.

@Seba

Agreed, a lot of good points. Some practicality would do wonders here, but authorities in the US, Canada and Australia just swing from one extreme to another like you said. That just causes shocks to the local economies with cost of living, housing and asset bubbles on one hand, then labor shortages and community break-downs on the other when the spigot shuts.

It’s frustrating, because it should be obvious a well managed policy, closely matched to local needs and businesses can do good like you said. But that requires discipline and a filter, and more than anything else, also means that authorities don’t get stuck on the idea of basing their economy on a housing bubble, massive unneeded government stimulus and all the fake wealth of the “wealth effect” that the Fed and central banks encouraged. So instead they open the flood-gates like now to get the artificial pump to housing prices and consumer spending while trying to paper over problems building underneath, esp with housing supply and poorly controlled inflation. Then things inevitable fall apart when the strain on the local communities gets too high, the spigot shuts off and businesses wind up in an even worse shock. Right now they seem to be stuck in the flood-gates fully open stage, even worse than such cases in the past. But already showing signs it’s not going to end well.

You are really a one trick pony. Do you ever actually research the express citizenships? For Ireland it is limited to people who have a grandparent not a great great great great grandparent as you write. Of course fir your purposes the facts don’t actually matter because you just manufacture “facts” to suit your agenda.

The cheap plots of land with decrepit houses on them are available in the U.S. as well. Wheeling, WV is one place as are numerous other locales in the fly-overs. Takes a certain type of person to take on such a project and many of them fail due to the time and cost.

In some areas you can get grants for restoring a “historic” home. However, those come with a whole bunch of strings as to what you can do to the property to remain in compliance.

You see these asset bubbles in terminally sclerotic countries where real growth has stopped decades ago but the exponential financial system demands more fiat printing. Asset inflation is a sign of productive economy being replaced by economic rent extraction to support the Ponzi. The bottom- immigrants, young people, workers – get squeezed as the financialized system inflates and suffocates any real economic activity. Terminal Fourth Turning action.

Mass third world immigration is an interesting issue, as it’s one where the West’s “elite” and governments have acted counter to the desires of the people for many decades.

Most Americans, most Canadians, and others, are supportive of some level of immigration, but not allowing hordes of illiterate impoverished people who have no means of supporting themselves. But the elite don’t care.

Einhal/Miller – you’re not wrong, but suggest stepping back to note also centuries of colonialism, coupled with the massive furnace of planetary resource consumption due to human increase and it’s technological development, coming home to roost…

may we all find a better day.

You need better sources of information. The ones you currently use are making you look foolish.

Nice summary. Everything is doing fine in this economy: job market, assets, RE. Everything is awesome in almost every sense, except for the inflation (Yes the asset prices, including RE, are just a little lower than last summer, but still in the historic highs). All the economic metrics are the perfectly perfect condition to move forward, or even speed up with the QT to kill the inflation.

Lots of kvetching on Wall Street. I once considered Lahart a relatively levelheaded journalist but now he’s a daily WSJ trumpet for those poor, sad easy money hounds. Bleep the peasants: we need the drip!

Remember the days when good job numbers would have boosted the stock market – weird times.

Looks like today maybe they have, green across the board right now.

When Telus & RBC announced massive job layoffs, their stock prices increased. It’s just like the activist shareholders at Xerox who gutted almost every permanent staff on the payroll, replaced the workforce with temporary labor.

That’s how sick the system has become.

Wolf said, “Wall Street wants a big fat recession”.

Yes!!!

Even the equity pros who aren’t hurting near as much as the bond pros wouldn’t mind a recession because it is easier for them to take money on the downside.

I don’t think the FED is going to accommodate them. I think the FED is going to obey their mandate.

I remain in my muddle-through portfolio but I am watching closely.

I don’t think the Fed would shy away from creating a recession to get inflation under control.

But they *would* pivot in the face of a major credit market event or a geopolitical black swan. If we manage to avoid the latter, I just see no chance of avoiding the former.

The Fed reflexively loosens in the face of cataclysm.

This is the problem. When they imagined QE out of thin air they set they precedent that they could meddle in political matters in a way that took pressure off of the decision makes (Congress & Executive branch).

So now the expectation if that the Fed has a role beyond setting interest rates and they will be heavily pressured to do so again.

It’s very hard to do something not, once, but two or three times and promise you’ve seen the error of your ways and will never overstep your bounds again, except now your masters expect you to make their job easier (and to be able to use you to deflect blame).

The ramifications of QE are finally coming home to roost.

Good post DD-

The banker’s dictum was “borrow long and lend short.” Keeping liabilities short and relatively UN-runnable, and maintaining a collection of assets that produces income longer-term, has always been the rule of the road for bankers: violate the rule, and an eventually a smash-up follows.

The rule applies to the central bank as well.

QE, including the unheard of purchase of longer maturity treasuries, and MBS (subject to maturity EXTENSION as rates rise), was a classic repeat of monetary experimentation. That QE is being unwound is welcome and healthy, but the temptation to backslide into subsidization and bailout whenever crisis arrives is ever-present.

Kipling’s haunting words: “… the burnt Fool’s bandaged finger goes wabbling back to the Fire.”

Two things I hope, halfway through the comments;

1. People would quit reading Kipling and seeing “GLORY” in WAR. (People like Dustoff deserve our admiration for trying to save lives during it and risking their own, though. So not everyone in uniform does the real BAD things)

2. Miller has FINALLY SHUT UP! And actually figures out a way to achieve his “dream” and LEAVE the country and not worry about ever becoming a minority. (which won’t happen in his pathetically short litle existence time, anyway….what does he care when his then (at death) current atoms become a rock or a silverfish, anyway?)

Sorry, I guess that’s 3, but still hope I’m lucky. I’m still struggling with understanding Wolf’s present economic picture in the article. It just doesn’t seem right or possible with such a ridiculous wealth discrepancy, which he does agree with. Perhaps it’s just the unspoken individual time dimension we both have on it.

And even if he gets out before he is dead, he is still a minority in everything but skin color, as he knows nothing of linguistic or cultural nuances which are mostly learned before 18.

TOTAL side note as it is just getting to me more and more and I just feel like blabbing more than usual tonite….I think…..

If there IS a Devil, one of the forms he likely takes is SPELLCHECK.

Today’s stock market shows exactly why I’m 100% in cash. Futures went from up to down 200, to up 300. It’s a big algo circle ****, and I can’t possibly invest by reading 10Ks and 8Qs when the market trades this way.

Technicals suggested the market was somewhat oversold after the 6% decline from Sep 14 to Oct 3.

Investors realize the worst-case scenario for markets is a continued strong economy with rates staying high. There might no longer be a Federal Reserve Put on stock market valuations, but there is one on the economy – and with up to 5.5% of interest rates to cut in a potential recession, that’s a lot of ammunition. That’s why, in my opinion, the Oct 2022 lows are unlikely to be breached again in this cycle.

Rate cuts work when overall debt levels are low. Over indebted economies cannot be stimulated by low interest rates. Japan is an example. US from 2009 till 2014 is another example. And it wasn’t low rates that propped up the stock market. It was QE…..which forced folks to take on more risk. QE is over for good.

And in this cycle we enter with even higher debt and unlikely any form of QE. Even the Fed would admit that it is a failed policy. So IF there is a downturn, one should expect it to be long and painful.

Our hope is that the economy keeps chugging along as it is and we have zero stock and bond returns for 10-12 years with some inflation to bring some semblance of normal economy.

The market seems to assume that just as inflation comes down, it is back to the races….this will turn out to be a big illusion IMO.

Then again I am not an economist.

Aman,

You lost me at “QE is over for good.”

QE and its hare-brained cousin “wealth effect” may be finished as a way to stimulate the economy…but if there is a serious need to goose treasury market or credit market liquidity – some form of is absolutely on the table.

We can talk about the dual mandate of inflation & jobs until we’re blue in the face…but the most significant dual mandate is rarely-mentioned – that of ensuring liquidity in credit and treasury debt markets.

Core PCE will rise again in October due to oil price increase. This isn’t a bad thing for all SSA retirees. But will increase inflation for all of us.

All the above entries express the hope we can continue to muddle along. I too hope for such an outcome.

Aman, I have to agree with BigAl. And add: The Fed’s 1st mandate is to keep the economy on its tracks, however they need to twist other mandates or invent new ones to do that. And since the “Fed put” was created, it will always be in the desk drawer ready to be pulled out and used as needed. Same for QE. Same for monetary liquidity.

The Fed cannot sit on its paws and watch the market collapse while the paper assets of major funds disintegrate. All insurance company, pension, 401-K, banks, brokerage funds are only as solvent as the stocks and bonds in their portfolios. Gold and precious metals are just conversation pieces.

Yes QE took 15 years plus minus to be implemented and the unwinding process is slow steady and maybe paused after the Fed reaches their QT targets from pandemic. Hard to wean 15 years of QE in just a couple of years. The phenomenon is global as well. As Wolf discusses something broke and that’s inflation. The British economy does not have cheap energy like USA does thanks to the shale oil increases since 2000. Actually Bakken development started in the 1980s. However global oil prices did not support development until post 2000. Higher for much longer based on current Fed comments. As Wolf mentions frequently inflation wack a mole game keeps things in perspective with oil prices car prices health care and of course the big one housing and rents .

But that’s the point. The equities market shouldn’t trade based on “technicals” or the “tape,” but upon the quality and performance of the underlying companies.

It just trades on whatever the bankers want it to do. They only lockup bankers in Iceland. No one except the bankers knows when the ponzi will end. The only thing we know is the bankers will be the first ones out.

Humans don’t trade on fundamentals. They gamble on perceived momentum. All markets work that way. Always have, always will. The idea of trading on fundamentals is just a concept used by market apologists to provide some idea of virtue to the wealth gains of traders.

Given the current set-up, I wonder if rate cuts, when they come, will be as effective as in past cycles? With so many consumers already locked into very low rate mortgages, lower rates really won’t improve their finances. Maybe it helps thaw the housing market to some degree, but the lower rates won’t help lower the monthly expenses of many people who’ve already locked-in low rates.

In any event, the Fed had almost the same amount of interest rate ammunition in 2007, vastly lower debt levels in the economy, and a much less significant inflation problem, and we all know what happened next. I may be wrong, but I think the Oct 2022 lows will be breached before the end of the next recession whenever that may happen. I wouldn’t bee surprised in the March 2020 lows are breached too. We’ll see.

Stocks and real economy diverged several years ago. A bad real economy is good for stocks (fed put) but a good economy is also good for stocks (because it gives more ammunition for speculation)

Unless the excesses of fiscal and monetary policy are washed out, I would expect this to continue.

But it is really good that for now the Joes are having a good time. The market is a side show.

The problem is that this cannot continue. Something gives and then likely the poor will bear the brunt….once again. Another stock market bust and the faith of the American public in government and policy will hit a new low likely setting seeds for some kind of a big change.

Thanks Greenspan, Bernanke, Yellen and Powell for getting us here quickly.

I wouldn’t include Powell in this group of divine idiots. He made mistakes, but has taken some corrective action. Of course, time might prove me wrong.

LIFO,

Huh?

Having the Fed buy MBS during the pandemic was quite-possibly the greatest own-goal the Fed ever committed. And that’s on Powell.

About 30 years ago I worked with a young rich USC grad who was always the Last in and First out of the office. He was a business major at USC so he had to take at least one accounting class but he never knew why we gave him the nickname “Lifo”,,,

Powell is no idiot. He along with his friends’ and families are worth 100s of millions of dollars.

Powell would make sure this party keeps on going. He may break the asset market but I am sure he’d liquidate his holdings first.

If you are holding 100% in cash in these times of galloping inflation…I think you are making a mistake.

BigAl,

“If you are holding 100% in cash in these times of galloping inflation…I think you are making a mistake.”

That’s what I think too. The 1970’s taught me that during inflationary times you own things things that rise with inflation.

I like strong companies (companies with big moats and long histories) that pay large ‘Qualified Dividends’ (most are ‘qualified’ but read the rules) which are taxed as long term capital gains and not as income. The tax difference can be quite significant.

You’re assuming that the big companies’ income won’t drop when consumer and business spending drops.

Einhal,

You said I was “assuming that the big companies’ income won’t drop when consumer and business spending drops.’… No, I am not assuming that.

What I am seeing is muddle through in the equity markets, up and down and around….

Further, if we have a recession which seems a little unlikely big safe company share prices will recover quickly afterward when economies and markets recover.

Meantime, in what I see as a muddle though market, I clip coupons and keep up with inflation and keep my taxes lower and stay in the game for the next hard rally which happens infrequently but carries a large share of equity appreciation. Timing for big rallies is very difficult!

I was a big rich bear last year. Best year ever for me when inflation was 9.5% and threasuries we’re paying ~ 4% I went short in a big way!

Now I see muddle through but if that changes I will change too.

Thomas Curtis, big safe company share prices may “recover” faster than others, and are less likely to go bankrupt, but the credit bubble caused by the 40 year bond market in bonds is now over.

That credit bubble (along with federal deficit spending) supports their businesses.

I agree that they’ll be worth something (as opposed to 0), but I don’t think it’s a safe bet that they’ll recover quickly to where they were, especially if many other businesses that were their customers go under.

I don’t see how any big companies, trading at high multiples with much debt to refinance at higher levels can do well in 3-5 yrs with uncertain revenues, perhaps divs make up for it but valuations won’t

Agreed Thomas Curtis. Qualified dividends are a great way to keep the tax bill down.

Combine those dividends with both reinvestment and concentrating on companies that have a history of raising their dividend every year and you have an excellent approach to beating inflation.

The problem is that it is not a glamorous investment approach and it takes time to work. It also rewards buy and hold, which of course the investment firms (who make part of their income on trading fees) do not like.

I’ve held shares in some of these companies for over 25 years. They have continued to increase their dividends each year regardless of economic conditions. The only difference is the increases are smaller when the economy is down.

Cold in the Midwest, again, the now over 40 year credit bubble provided a lot of support for the earnings of those “quality” companies.

Is the economy really three times as good now as it was in 2016?

100% cash could also mean cash parked in a HYSA safely earning

Yes, mine are in savings/treasury bills getting a blended 5.35%

The stock market is driven by a few big players, who jump in when the SHTF, like today, to “protect” their investments. Algos (computer programs) should have driven the stock market lower, as they did at the open. But then the big players threw a bunch of money at it. As in a casino, the owners (the house) have the advantage. I prefer not to play their stupid games.

William Leake,

“The stock market is driven by a few big players” — Short term yes!

Medium to long term the fundamentals matter. I am in my muddle-through/dividend paying/keep my taxes low and keep up with inflation portfolio because who knows when the market will get a strong direction?

A few Keynes quotes:

“If we consistently act on the optimistic hypothesis, this hypothesis will tend to be realised; whilst by acting on the pessimistic hypothesis we can keep ourselves for ever in the pit of want.”

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

“Markets can remain irrational longer than you can remain solvent.”

—–++

Incidentally, I am a Keynesian during good times and a Monetarist during bad.

Keynes also wrote “In the long run we are all dead.” But good luck to you.

William Leake,

See the first Keynes quote that I listed which incidentally is real important to me because I lean bearish.

“If we consistently act on the optimistic hypothesis, this hypothesis will tend to be realised; whilst by acting on the pessimistic hypothesis we can keep ourselves for ever in the pit of want.”

The stock market decoupled from fundamentals around the year 1993 forty years ago. Before then it used to predict the economy 6 to 8 months in the future.

One man’s optimism is another man’s pessimism, and vice versa. Do whatever floats your boat. Nobody gets out of here alive no matter what they do.

“Incidentally, I am a Keynesian during good times and a Monetarist during bad.”

Logic would, I think, dictate the reverse.

Keyne’s personal investment success was remarkably spotty, per Skidelsky and Mencken.

Just sayin’.

Just for fun, an example from Skidelsky on one of Keyne’s speculations in 1920:

“A few weeks after returning to England Keynes was ruined. Francs, lire, and marks had all started to appreciate against sterling. The movement did not last long, but long enough to clean him out. On May 27 he was forced to liquidate his positions.He lost all his group’s capital, and owed his broker nearly [5000 pounds sterling]. His debts — that is including his ‘moral debts’ to his family and friends — came to just under [20,000 pounds sterling].

And Skidelsky is a fawning supporter of Keyes! For a more unfriendly assessment, see Menchen or Rothbard.

Keyne’s was right on one count though: in the long run, he died.

We all know that the stock market is the economy!

My enthusiasm is more than a little tempered by the fact that MOST of the gains were in Services and Government.

Good-producing sectors didn’t even account for 1/10th of the gain.

Every month it’s the same, month after month: people are just nagging over this and over that, and the job market just keeps growing just about across the board, and these people keep being surprised by it. You need to look at the long-term charts and three-month averages of each category because they’re very volatile from month to month. Some go up, some go down on month-to-month.

Wolf,

A fair point, thank you.

Zooming out just a bit for the Goods-Producing Sectors, though, job growth here does look quite soft if you view the “3 month net-change” chart here:

https://www.bls.gov/ces/

In fact, most of the growth still seems to be concentrated in sectors that got whalloped during the pandemic.

Outside of those specific sectors, the gains are so modest over the past 3 months for the remainder that the BLS’s own 90% confidence intervals mostly do not rule out the possibility of an actual contraction within those sectors. And the 6-month net changes aren’t wildly different.

Am I missing something?

I stopped reading when I got to “Goods-Producing Sectors” — that’s a small part of the economy.

That said, amid the goods producing sectors, manufacturing gained jobs at a decent pace over the past two months (there were some small losses in the prior months, after a HUGE boom), construction gained too.

I posted the jobs-by-category multi-year charts in the past that show what is going on, so I don’t need to waste my time replying to this stuff, but people didn’t look at those charts, and you probably didn’t either or else you would remember them. So I stopped doing it.

Higher for longer…

Fiscal spending is out of control. Rates will continue to rise. Something will break. The Fed will then be forced to QE. Everything else is icing on the cake.

LOL! The “market” (i.e. central banks including the fed) can remain irrational longer than you can remain solvent… (unless you print currency too)

Fiscal spending is NOT out of control. It is in the high range of spending to GDP over the last 50 years or so, but it is heading down by that most important metric. It is only high because we are still at the tail-end of the recovery phase of the 2020 COVID collapse.

😂🤣😶🌫️😯🤑😨💩💩💩

Any comment on the number of full time jobs? There is plenty of work being done and plenty of work to do (hence higher for a lot longer in many ways), however, I don’t necessarily see a nation of multiple part-time employees as a good thing. Stability is important (in prices too Mr. Powell).

A 30 year old personal trainer who did not want an hourly job finally took a full time job in Sept to pay for high rent food and medical insurance . Found a job at a grocery distribution company in 2 days . Jobs are plentiful .

The ” Lag Folks ” will soon be right or wrong. All the talk about taking 12-18 mos. for rate hikes to cool the economy will play out in the next 6mos as the rate hikes started in March 2022.

Historically that’s correct, the Fed trying to front run interest rates to speed things up so far hasn’t disrupted that 18 to 24 month cycle.

The Fed historically has followed ‘market rates’. You must take a gander to identify the goose.

For an insight into the effects and damage the ZIRP years did to the economy, read “The Lords of Easy Money, How the Federal Reserve Broke the American Economy” by Christopher Leonard.

Excellent book. I have it.

I did not buy a house in 2011 to 2021.

I won’t discuss why.

However huge numbers of middle class (and even some poor people) did. Along with the wealthy and investors. They benefitted from it.

ZIRP may have had bad onsequences but there are tons of Americans who brag endlessly about their 3% or 2.75% or sub 4%, etc loan. These surely are not all wealthy households.

So all of you Wolfsteet commentators who incessantly complain about ZIRP… there is this positive aspect to it that cannot be denied. Did wealthy people benefit from it more than the middle class? Probably.

But the middle class benefitted too. Many poor folks did not benefit and that is a very unfortunate aspect of ZIRP. But to pretend only wealthy folks benefitted doesn’t seem accurate.

Of course when mortgage rates were driven up so quickly it caused the seller buyer standoff of the last year.

Maybe its the huge swings in interest rates people should complain about more so than ZIRP itself ?

Lots of people benefit from free money. That’s why free money is the best money. Everyone loves free money when they get it.

But there is a HUGE COST to free money, including horrible economic decisions, huge amounts of debt, super-inflated asset prices (including home prices) that can cause a financial crisis, and the worst inflation in 40 years.

Turns out, free money is not free.

+1

CME Fedwatch has cuts by mid year.

They’re saying like 70% chance of 425-500 by Dec 2024.

Bond Market still refuses to believe in sticky inflation.

Massive deflation will change many predictions.

Massive consumer price deflation?

Consumer and asset prices will decrease, but cause and effect are a bitch!

I’m skeptical about massive consumer price deflation in a fiat monetary system. Asset deflation seems very plausible to me, especially in financial assets. Bonds have already deflated a lot.

The lower prices initially will be local events, and then nationally as the effect of debt becomes obvious and events unwind. IMHO

Ha. Doubt we will even see deflation in housing on a national average. Let alone anything else.

So, you think everyone is a spending fool with unlimited income?

PS: (keep an eye on the comps)

Something is putting money into this economy that is difficult to find. A national sales tax would be broad based and would cool off the economy in a completely distributed manner.

Wow, the government is spending like there is no limit (?), and the answer is another tax on already taxed income?

Like a good man always reminds us

“may we all find a better day”

Well, actually it *might* be.

In most other countries, people complain about taxes and riot about inflation.

As far as I can tell, the USA is the opposite.

Good one!🤣

The “something” putting money into the economy are the largest peacetime US Federal deficits in many years, maybe in history.

Hi Wolf. Over the months you have sounded very pessimistic about the stock market short, mid and even long term (interests up for long) future because of the inflation going down not as fast as desired, and the resulting QT and Feds interests increases. These are head winds for sure.

But what do you recommend for stock holders? What have you done / planing to do personally? Have you sold all / most of your stock because of the pessimism?

Look, stockholders had it so good for so long, for 13 years, QE out the wazoo, stock prices out the wazoo… I think it’s fine for stockholders to hang on to what they have and give up some of those gains. It’s not the end of the world.

I suggest you look at some of the other big stock markets to see how long that process can take: China (look at a 20-year chart), Japan (look at a 40-year chart), look at 30-year charts for Italy, France, Spain, Germany’s DAXK (not DAX which includes dividends and cannot be compared to the others), etc. etc.,

Makes sense. And this is what _they_ say e.g. the Japan case.

But I think USA is different in the long term. I’m from Canada. And the greed of US population amazes me all the time. In USA they take 3 jobs just to buy X (crazy Musk stole the meaning of x…). In other countries there is no such consumption build in. I bet on the American marked ie greed, innovation, power status, dollar status, hard woking, limited social benefits, still strong institutions, law, limited corruption, not bad demographics etc.

All the other countries are not like that, and it is quite easy to tell why they have failed in the long term.

So many typos above. Hmm, not editable. Sorry.

Stock prices out the wazoo ?

Per internet, S&P500:

Annualized 10 year return up 12.4% thru mid 2023. Above historical average but not all that much (read 11.9% from 1957 thru end of 2021).

Now this is beyond the wazoo…

1995 to 1999: annualized return about 28%.

1990 thru 1999: just over 18% annual return.

Includes dividends.

At a base of 100 in 1990, by the end of 1999

it’d be at 530….so 430% cumulative gain. Again including dividend payouts not just index gains.

Kind of put real estate to shame, eh ?

At 18% your money doubles in 4 years (rule of 72).

BS cherry-picking.

1. Take jan 1996 through Sep 2002

2. Take Jan 1996 through March 2009

3. Take March 2009 through Dec 2022.

Stock returns look a lot better if you eliminate the crashes than if you include them.

My sentiments exactly Wolf we don’t want a 1929 crash .

In Q3 bears eat a lot of berries, adding fat, before hibernation. That’s

Bidenomic

You all holding shares of the big companies.

The big companies are the problem/bubble/ponzi/delusion.

Pound the table. How much of your income goes towards the “big companies?”

Is it 50% like the delusional hope for – and valuations agree in fantasyland?

Or likely less than one percent?

I do my math, you do yours.

The yield curve of 5.55% across the board is coming. Reeks of manipulation, eh?

My old geezer strategy is to drink moderately. It is the greatest long term strategy I see fit. Results may vary.

Peace and whatnot,

Hi Gary. So, instead you have been holding something like Russel 2000? Or bonds? Or crypto? Or gold? Or Whatnot?

How has it been working for you?

Hi Biker,

97% 4 week Treasury bills. Working great.

If shit hits the fan…Vodka futures.

Worst case scenario starvation.

What is your strategy?

Lol. Seems like you got a solid path forward for shortish term.

My strategy is all long term, US, with tilt for the tech. I will let it sit.

If shit hits the fan, maybe I become a con artist or so :) I mean a social influencer/celebrity. Tiktok maybe?

How badly would stocks and long bonds get pummeled if CPI started increasing again? With the economic data coming in strong and stocks and RE still massively elevated, increasing inflation is a real concern.

Are stocks standing on a trap door?

Bobber,

I don’t think the economic data is all *that* strong – apart from jobs reports – which are lagging indicators.

The oil markets got spooked by a bearish report on gasoline demand this past week and the latest trade deficit data would seem to suggest a slowdown.

IMO, markets went up today because the bullish jobs report was met with a muted response from oil prices and Amazon confirmed a report that they will be hiring more short-term warehouse & delivery workers over the holiday retail season than initially-expected.

Bobber,

Overall consumer spending has, of course, (c.f. Wolf’s posts about drunken sailors :-) ) held up well, too.

My sentiments exactly Wolf we don’t want a 1929 crash .

According to multiple indicators, CPI should increase in the next months because of base effect and health care adjustment.

It basically means either higher or more higher for longer which does not portend well for stock and bonds.

I’m no economist (understatement) but is inflation necessarily bad for stocks ?

If their (company) revenue and cost increases both match inflation … their earnings should increase in line with inflation…so goes the simplistic thinking.

(inflation 10%: costs 80, revenue 100, earnings 20. Year later: costs 88, revenue 110, earnings

22. Earnings up 10% matching inflation, cost and revenue increases.).

Sure this is ridiculously simple but is the gist basically correct ?

Stocks can deal with inflation just fine.

Stocks cannot deal with QT. And the effects of much higher interest rates dog stocks as well.

How are “multiple job holders” accounted for? I’ve a FTE with a W2 yet earn a significant income from services I offer under an LLC, this goes un-noticed in the stats. right? Even though I’m literally working multiple jobs..?

No, it doesn’t go “un-noticed.” It’s based on the household survey, where the respondent specifies data about each job they have, what they earn in each job, part-time, full-time, etc.

Wolf,

I know survey is all we have but with remote work, what person without young kids, wouldn’t want to at least try to work 2 full time remote jobs. It has to be undercounted and could also account for higher consumer spending. Just an idea.

That is precisely what IS accounted for because this is a household survey — going to individuals.

Yes, multiple streams of income are always good for consumer spending. Think of a software developer whose is also a small-scale landlord on the side.

All the people in the media constantly crying that the economy is about to enter a recession sound like they just lost a bunch of money on leveraged trades that went bad because they bet the economy was going to get worse and then the Fed would have cut rates by now. I guess their personal recessions have already started. They’ve been complaining now for many months.

Here here

A lot of them bought long bonds hoping the Fed would pivot. Bad move.

Market is getting very anxious over huge increasing federal deficits and chaos in Washington DC.

“would “force” the Fed to cut rates and”fuel stagflation/hyperinflation.

When was the last time Jerome was spotted buying his own groceries/pumping his own gas/paying for shelter?

Got Weimar anyone?

What I see with my own two eyes and my wallet is an overheated economy and rampant inflation that has not let up. Everything I buy continues to go up, including materials and supplies for business. There are shocking prices out there. “Let it run hot” is alive and well. Jerome Powell is an absolute disgrace of a human being.

My daughter complained about inflation for first time since leaving college in 2012. She and her husband are working for spx500 companies and low debt with 2.75 percent Mtg. However takes a few life experiences to start realizing inflation with things like kids illnesses Dr bills schools vehicle replacement services repairs and maintenance etc. Mr Powell and voting Fed please raise rates in Nov .

Powell talked a tough game then wimped out. There is absolutely no good reason for the two pauses other than an intention to let inflation run hot. They are trying to inflate debt away at the expense of the working classes and the poor. All of the fearmongering by billionaires about some imminent economic collapse due to raising was proven to be nothing more than selfish greed.

Wimped out because he didn’t cause the entire financial world to collapse? Depth Charge, we know where you stand on this. Nothing is going to make you happy unless the entire financial world collapses.

Wolf –

That was a total strawman argument you just made and you know it. Two chintzy 25 basis point rate hikes would have caused the entire financial world to collapse? C’mon, Wolf, you’re better than that. You’re starting to read like Jerome Powell’s wingman – a stunning reversal from “most reckless FED ever.”

I think Wolf is wise to say the fed should pause, as the rate of change and relative change has been so great that things have probably already broken in ways that will cause another financial crisis to show up in relatively short order, unless we get lucky.

Bondageddon is concerning, with rates having risen from a 5,000 year global interest rate low, in the second highest rate of change on record, to a level that has caused a record three year bond price blood bath in which every entity of size on planet Earth holds.

Higher for longer will work, it just takes 12 to 18 months to work its way through the system, thus just now are we starting to see the real wold effects.

Current rates are at historic median levels for the past few decades, just give it time to work its monetary magic another 3 to 9 months…

Oil has plunged around 10% this past week and gold has been falling sharply for months as have nearly all commodities including wheat and corn and other food commodities.

Is this just a complex way of saying that the US dollar went up?

All these ‘where is the recession’ comments are funny

Its in every text that FED hikes take a year to begin taking effect…sooo where was the FED rate a year ago on Sept 21 2022

It was 3 % !!

So why would you expect all the hikes since then to have already produced a recession ? It’s like the kid in the back seat: are we there yet?

And of course this jobs report almost guarantees the hawkish pause ends on next meet.

nick – perhaps the advent of electric lighting and its switching took root in the contemporary human brain, as well (…see also: ‘instant gratification’…).

may we all find a better day.

Good to have objective common sense writing, thank you!

I don’t know much about these things except what I read here. On a related note, I see that 99.5 million or so, are not in the workforce and that has roughly been the level since the pandemic scare. Is the economy now simply adjusted to a new level of “not in the workforce” numbers?

Seems like Wolf is the only one willing to discuss these things in any detail. Good on him!

“99.5 million or so, are not in the workforce and that has roughly been the level since the pandemic scare”

What BS is this??? Here is the labor force:

Sorry Wolf and commenters, I must have got something wrong. I got that number from the FRED “Not in labor force” chart.

I don’t mean to be contrary, the Not in Labor Force, Just seemed to be a number that rose to a new plateau after the pandemic.

2023-02-01 99,861

2023-03-01 99,541

2023-04-01 99,755

2023-05-01 99,800

2023-06-01 99,850

2023-07-01 99,899

2023-08-01 99,374

2023-09-01 99,498