There will be a recession, there’s always a recession eventually. But we’ll just have to keep watching for it.

By Wolf Richter for WOLF STREET.

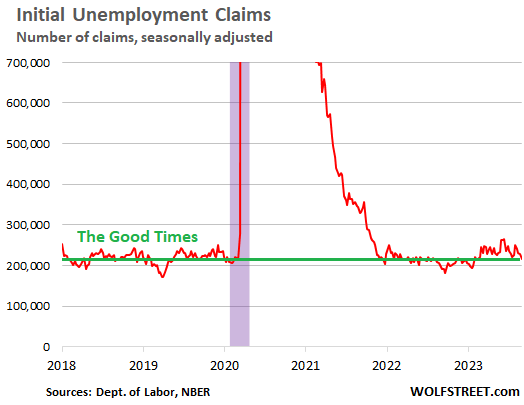

We’ve been on a recession watch here ever since the Fed started hiking rates. Sharp increases in weekly claims for unemployment insurance benefits – especially “continued claims” – are highly correlated with recessions. So we keep an eye on it from time to time. The data did show some weakening from September 2022 into early 2023, but remained in the range of the Good Times lows, and in recent months, the signals backtracked, as unemployment claims fell. The expectations of a recession this year have been cancelled months ago, and by now, there’s no recession in sight. Maybe next year, maybe whenever.

Initial claims backtracked into the Good Times.

Initial claims for state unemployment insurance benefits by people who’ve lost their jobs fell to 216,000 in the latest reporting week, according to the Labor Department today. This was the lowest since February. The number has been wobbling lower since the end of June:

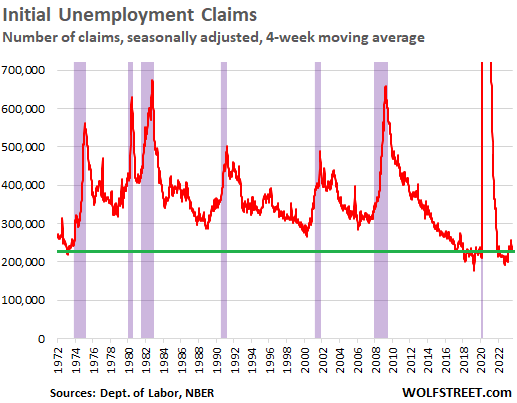

The four-week moving average, which irons out the week-to-week ups and downs, declined to 229,000, a historically low number that has been seen over the past 50 years only in the two years just before the pandemic and in the hot labor market coming out of the pandemic.

This is the view of the four-week moving average going back 50 years, with recessions indicated in purple. Note how unemployment claims begin to surge shortly before recessions begin:

- By December 2007, the official beginning of the recession, initial claims were piercing 340,000.

- By March 2021, the official beginning of the recession, initial claims were piercing 380,000.

- In the three recessions in the 1980s and 1990s, initial claims were spiking through 400,000.

So the labor market today, as seen by claims for unemployment insurance benefits, lost just a little steam late last year and earlier this year as the layoffs started to show up in the numbers, but it has regained some of the lost steam and remains solidly in the range of the Good Times.

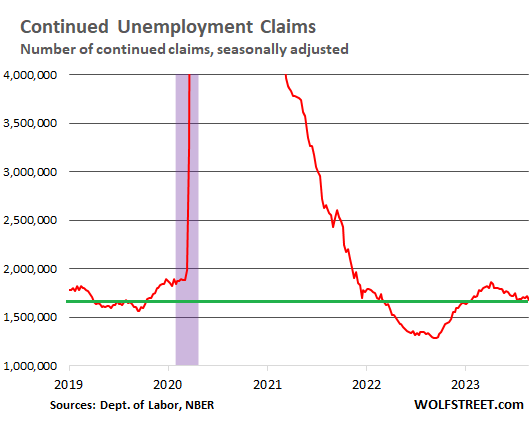

“Continued Claims” backtrack into the Good Times.

The number of people who are still claiming unemployment insurance at least one week after the initial application – people who haven’t found a job yet – has meandered lower since April, and in the latest reporting week dropped to 1.69 million, back where it had been in February.

It means that fewer people are losing their jobs, and those that do lose their jobs, find new jobs more quickly than late last year and earlier this year and come off the unemployment-benefit rolls faster.

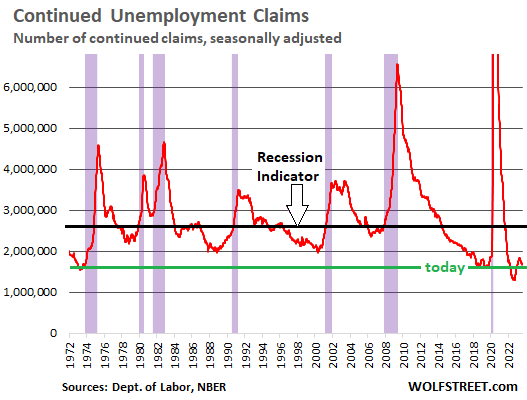

The recession indicator.

Recessions from the Great Recession back through the early 1980s began when continued claims for unemployment insurance spiked through about the 2.6-million mark.

So this 2.6 million line (black) for continued-claims is one of our recession indicators – and my favorite. But continued claims have been backtracking since April, and today’s level of 1.69 million is far below recessionary levels, and has been pulling further away from the recession line:

The long-term view shows that the labor market, as depicted by people continuing to claim unemployment benefits, has strengthened since April, after having weakened a little in late 2022 and early 2023. But throughout this period, it has remained historically tight, and even at the worst point earlier this year, it was in the range of the Good Times just before the pandemic, and much tighter than in the prior 50 years.

What the labor market is telling the recession watchers here is that there is no recession in sight. There will be a recession someday – there always eventually is a recession – but it is not in sight, and we’ll just have to keep watching for it.

We’re seeing similar labor market indicators from other directions, such as the spectacle of a surging labor force in August, and the sharply dropping layoffs and discharges, after the acceleration earlier this year.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

That doesn’t stop the howling from Wall Street and the rest of the elite apparatus (including the media) that the Fed needs to pivot or there’ll be a parade of horribles.

“a parade of horribles” – 🤣❤💘💥 I might hafta steal that from you

Haha, I wish I could take credit for that. I read it somewhere on the web years ago.

how many gig workers are unemployed??

or are they just getting regular jobs now

The term is used in legal briefs a lot. Usually to downplay the dire warnings in an opponent’s kegal brief.

Thanks. Makes total sense.

Don’t recommend you do kegels while wearing briefs 😆

Or “chamber of horrors”. From another law school professor.

For most investors, the official designation of when a recession starts is not helpful.

Examples:

1) Most of the huge gains from the Big Short mortgage trade were booked prior to the official start of the late 2007-2009 recession, which was not declared until many months after it had started.

2) By the time the 2001 recession started, which again was not officially declared until many months later, the stock market was already down by 35% from the peak in 2000.

————————–

Furthermore:

A) The labor market is a lagging indicator… the last thing that companies do is lay off workers = By the time unemployment surges, most companies are already in trouble.

B) The current labor market is distinctly different from any market since WW II… The baby boom generation, the biggest bulge in workers ever, are now retiring.

===================

Bottom line:

The designation of when a recession officially starts is not very helpful to most people… Because by the time a recession is officially declared the train has already left the station.

This labor market is different from any in our lifetimes….

= Using unemployment indicators to figure out when a recession is officially declared will be even more useless than usual.

Kenneth M Luskin,

“The baby boom generation, the biggest bulge in workers ever, are now retiring.”

The Millennials are the biggest generation ever, and they’ve fully entered the workforce, followed by the Gen Zers. I posted a chart about the spiking labor force here. Have a look, it’s below somewhere.

And millennials — largest generation ever — have entered their peak earnings years, and they have become voracious consumers because they make good money and have to furnish the houses they bought, and they have to get cars and dates and go on fancy vacations, hence the strength in consumer spending.

2. “This labor market is different from any in our lifetimes….”

Yes, it’s a lot tighter than anything we’ve ever seen, and with the biggest pay increases we’ve seen since in decades. It’s just about impossible to have a recession with this kind of labor market.

It’s also just about impossible to have a recession with this kind of government deficit spending.

For investors, what was great since 2008 was the combo of QE and near-0% interest rates. That’s what whipped asset prices higher. Now we have QT, 5.5%, and higher for longer. So asset prices are going to take a hit, and they have already taken a hit despite the strong economy.

We had the reverse in prior years, a so-so economy but huge asset price gains. Now we have a fairly strong economy and asset-price drops.

It makes perfect sense: Since QE and near-0% in 2009, the stock market has been disconnected from the economy. Now QE and near-0% are gone and the stock market is flying through a vacuum until it finds the economy again.

Don’t confuse economic growth with rising stock prices. Rising stock prices came as a result of QE and 0%. And the opposite is taking place. The economy can do just fine while stocks tank. We’re already seeing that.

I disagree. The last thing businesses do when they need extra cash after laying off workers is sell durable assets, land, and buildings.

But this is America, we need people back in the office so the commercial real estate market doesn’t go bust from the work from home boom. It’s a conspiracy man (satire/humor)

>>>”the NBER typically doesn’t declare a recession until well after one has begun, sometimes for up to a year. Economists consider a half-point rise in the unemployment rate, averaged over several months, as the most historically reliable sign of a downturn.”<<<

= The obsession with date of when a recession officially starts is not helpful for those who are trying to plan ahead….

"If you fail to plan, then you are planning to fail"

See my comment above, including the last paragraph:

“Don’t confuse economic growth with rising stock prices. Rising stock prices came as a result of QE and 0%. And the opposite is now taking place. The economy can do just fine while stocks tank. We’re already seeing that.”

Wolf do you still do a podcast? I used to listen to each of your podcasts but have not seen any lately.

Not often. You’ll see them here and on my YouTube channel when I do one.

Wolf, you wrote >>>”It’s also just about impossible to have a recession with this kind of government deficit spending.”<<<

#1) Many of the past recessions came about because of exogenous "black swan" type events.

a) 1929 stock crash, b) 1973 Oil embargo, c) 9/11 attack d) 2007-2008 asset bubble popping

#2) Govt. deficit spending is now finally being offset by QT, interest rate increases, many banks shrinking their balance sheets, student loan payments now accruing interest again, with the potential for a crippling UAW strike, then followed by a Govt shutdown.

#3) The 10 month decline in PMI is the precursor of a recession, that you would have said is "impossible with this kind of govt deficit spending"…. But, its happening.

==================

Conclusions:

a) With Money supply shrinking fast, there will be a recession even though there are "long and variable lags."

b) History has proved numerous times how amazingly fast people will stop spending when something bad happens.

c) Most of the LEADNG indicators are pointing to a recession starting in late 2023 or early 2024….

d) The 2022 stock market decline was not long enough or deep enough to erase the massive gains from 2020 and 2021.

Bottom line:

When this financial house of cards collapses, and it will do so sooner than later, you will see will see a recession that rivals that from the GFC.

You’re “hoping.” You’re dragging black swans in by their feathers. You’re trying to talk yourself into a recession. Yes, maybe the sun will not rise tomorrow, who knows… But that’s NOT what the data indicates. The data indicates that the sun will rise just fine tomorrow.

In reply to Wolf Richter: “The Millennials are the biggest generation ever, and they’ve fully entered the workforce, followed by the Gen Zers. I posted a chart about the spiking labor force here. Have a look, it’s below somewhere.”

The biggest generation in the United States yes. Not in any other developed country in the world or in most developing countries in the world.

“Yes, it’s a lot tighter than anything we’ve ever seen, and with the biggest pay increases we’ve seen since in decades.”

Tighter because of low supply as opposed to high demand. Once the job losses get going this fall, say goodbye to those pay increases.

“It’s also just about impossible to have a recession with this kind of government deficit spending.”

I have no idea how you came to that conclusion. Government spending takes productive capital out of markets and wastes it. All recessions are exacerbated by government spending and controls, if not the main cause of them much of the time.

“For investors, what was great since 2008 was the combo of QE and near-0% interest rates.” Both Jeff Snyder on Eurodollar University and Steven Van Metre have addressed this fallacy. There is no evidence QE or 0% Fed interest rates did much, if anything.

The Liberty Advocate,

“Government spending takes productive capital out of markets and wastes it. All recessions are exacerbated by government spending and controls, if not the main cause of them much of the time.”

You’re confusing the bond market & other financial markets (“capital out of markets”) with economic growth (“wastes it”). When the government spends borrowed money (“wastes it”) on salaries, equipment, buildings, roads, bridges, other infrastructure, supplies, fuel, computers, subsidies, transfer payments, etc. in the US, it contributes directly to US economic growth because government “consumption and investment” is an important factor in GDP. It pulls that borrowed money from global financial markets, not the economy, so it pressures those markets (prices down, yields up). And it may add fuel to inflation. But it contributes directly to GDP growth.

You might not like it, but that’s how it works and that’s how it’s calculated, and that’s why deficit spending is so simulative (but obviously, there are constraints and consequences).

Here is the government consumption and investment portion of GDP:

https://wolfstreet.com/2023/07/27/businesses-governments-joined-the-drunken-sailors-consumers-still-in-party-mode-tough-to-see-a-slowdown-with-this-setup/

I don’t think there needs to be “government deficit spending” to have “government spending”. Sure it isn’t politically pretty to budget for extra spending in the omnibus budget each year but that doesn’t mean it’s impossible to plan ahead for extra expenditures. For instance, increasing the FEMA disaster relief fund to say, $500 billion dollars would be slightly excessive but then at least this type of spending would be better planned for and look more organized than the current firefighting and passing of indivual disaster bills in Washington each time there’s a crisis.

The last time the budget was balanced if you mean that was when Bill Clinton was in office, most likely won’t ever happen again.

It’s a modification of the opening line from one of the greatest novel passages of all time, via Blood Meridian by Cormac McCarthy, describing the onset of an Indian raid in the old west:

“A legion of horribles, hundreds in number, half naked or clad in costumes attic or biblical or wardrobed out of a fevered dream with the skins of animals and silk finery and pieces of uniform still tracked with the blood of prior owners, coats of slain dragoons, frogged and braided cavalry jackets, one in a stovepipe hat and one with an umbrella and one in white stockings and a bloodstained wedding veil and some in headgear or cranefeathers or rawhide helmets that bore the horns of bull or buffalo and one in a pigeontailed coat worn backwards and otherwise naked and one in the armor of a Spanish conquistador, the breastplate and pauldrons deeply dented with old blows of mace or sabre done in another country by men whose very bones were dust and many with their braids spliced up with the hair of other beasts until they trailed upon the ground and their horses’ ears and tails worked with bits of brightly colored cloth and one whose horse’s whole head was painted crimson red and all the horsemen’s faces gaudy and grotesque with daubings like a company of mounted clowns, death hilarious, all howling in a barbarous tongue and riding down upon them like a horde from a hell more horrible yet than the brimstone land of Christian reckoning, screeching and yammering and clothed in smoke like those vaporous beings in regions beyond right knowing where the eye wanders and the lip jerks and drools.”

Wolf, I get what you are saying about GDP, but what about GDI? The spread between the two is the biggest ever, if I remember correctly. And the GDI is already showing us in recession.

The Liberty Advocate,

No one ever talks about GDI, and now all of a sudden, all the recession-mongers are dragging out GDI, LOL. There is always a big difference between them, in both directions.

On a quarter to quarter basis, GDI was positive for Q2. And the recession mongers drown that in silence.

It’s only the year-over-year data that now has gotten the recession-mongers all excited.

On a year-over-year basis, which is what you’re talking about, GDI was much stronger last year in Q1, Q2, and Q3, than GDP, and none of the recession-mongers last year said anything about it, and there were lots of recession-mongers last year, including the Biden-changed-the-definition yokels, and now that it’s weaker than GDP, it’s suddenly a big deal? Come one.

Year-over-year growth rates:

Only a parade of horribles for them , casino is fun business when you have money to burn with little consequences both acquiring and spending

Recession Ghouls aka Shadenfreuders

Your analysis Wolf is superb but I wonder,

The property market man time leads the market into recession.

The property market is in the dumps with office vacancies in major markets down 30%

The housing market also down on higher interest rates.

Interest rates tripled to 7%

At this time the « rich millennials » will have to pay triple for house payments, when they buy the Mac mansions from the baby boomers, unless someone believes the home prices will go down 70%

This is not a winning recèpe for a thriving economy

“So this 2.6 million line (purple) for continued-claims is one of our recession indicators – and my favorite.”

Shouldn’t this be black?

Please delete this comment.

Yes, thanks, changed the color, didn’t change the text.

No problem sir.

I greatly appreciate your dilligent work. Found your site during Covid lock down and have never looked back. This is where I come to see the real data, as it seems like the only place that doesn’t have some bizarre pivot/hopium narrative.

Thank you for your work.

It appears as though the US may need to ramp up military spending even more which is stimulative I think.

It’s only stimulative if it involves production in the US.

With a few of the knuckleheads in charge, I would not be surprised if they sent the production work to China or Russia.

🤩

We still make most all the warmongering stuff here? That’s been my take on our foreign policy for decades. Gotta make enemies to blow up the old stock so we can make some new stock… preferably with debt so our buddies can score too.

Thoughts on GDI vs GDP? GDI is supposed to decline 1.8% in Q3 while GDP is set to increase by 5% or more.

I’m wondering if, because we are no longer in baby boomer mode, but in a reduced workforce mode, if this indicator is no longer as valid as it once was. With mass numbers of old people retiring and/or getting a nice retirement package during the COVID times and the next gen numbers being far fewer, it’s possible the unemployment number indicator may be the very last one to show recession. There are a number of other indicators showing the beginnings, including changes in the credit cycle (see Knowledge Leaders Blog for details). Once more, mainly small, companies are forced to refinance, the cash flow is going to dry up in a hurry. Then the numbers will increase rapidly.

“but in a reduced workforce mode”

What kind of clueless BS is this??? And then build a whole clueless theory on the foundation of clueless BS? Good lordy, what kind of idiot bloggers are you reading?

Labor force spiked to record high because millennials are the biggest generation ever, and they’re now fully in the labor force, and they’re followed by Gen-Zers, DUH

and employment rose to record high:

https://wolfstreet.com/2023/09/01/labor-market-sorts-out-the-distortions-from-the-pandemic-labor-force-spikes-wage-pressures-stuck-at-high-levels/

It’s hard to find any one who can compete with Wolf when it comes to data, but ALSO, when it comes to answering comments. I LOVE IT!

Increased labor force means the unemployment claims are even better when compared to prior times with less workers.

Wolf! Why is tax receipts lower even if more are employed

EVERYONE knows this: Capital gains tax receipts plunged from a historic spike. QE caused huge asset price gains in 2020 and 2021, and so capital gains taxes paid by April 15 in 2021 and 2022 were huge and caused a historic spike in tax receipts. But 2022 was a shitty year for asset prices (stocks, bonds, cryptos, etc.), and capital gains taxes paid by April 15 2023 plunged (the Q2 figures you’re seeing). This was widely predicted, even by the CBO, and it happened.

Excellent thanks Wolf. Been wondering about that part of the next decade…

It would be interesting to see your recession indicator line adjusted for population growth over that period of time. It would make this goldilocks economy look even better.

We’re definitely not in a recession but I think we can all agree it’s on the immediate horizon, ie, within the next year.

We cannot agree. There is no recession in sight at all, not on the immediate horizon and not on any horizon. If you’ve been at sea, you know that the human eye cannot see beyond the horizon, and land may be a long ways away. There are no recession indicators that say a recession will be next year. There will be a recession someday, but maybe whenever.

Here’s 2 recession indicators that indicate a recession is close:

https://i.redd.it/stjj9hnkliib1.png

https://i.redd.it/a6jonzv8iidb1.png

Apologies for the links.

Both your links are to charts that are based on the Treasury yield curve — and its inversion. All the yield curve inversion tells you is that the Fed raised its short-term interest rates, while the bond market is slow in following with long-term yields. So the front end gets lifted, and the back end rises too, but more slowly, and voila, the yield curve inversion.

The reason why the Fed hikes the short-term rates is to SLOW the economy, meaning a recession to halt inflation, but those efforts haven’t been successful this time around, for a variety of reasons, some of which we discussed here.

It’s nearly impossible to have a recession with this kind of labor market, these kinds of wage gains, this kind of consumer spending, this kind of government deficit spending, and trillion of dollars in excess liquidity still floating around out there. Where is the recession supposed to come from?

Any thoughts on how the US is staving off recession, with UK at -0.1 for Q2, EU at 0.1 and 0.3 the last 2 quarters, China slowing, Japan stagnant for decades. Have we decoupled enough to avoid contagion? Has our economic leaders navigated us through the eye of the needle?

Yes, that’s been an interesting thing in terms of Europe (not Asia, see below). Part of the explanation is the hugely stimulative deficit spending by the government, and part of it is the super-hot labor market in the US, and the big pay raises, and part of it are the trillions printed by the Fed that are still floating around out there, at all levels, and that have created such huge amounts of paper wealth, and part of it is the consumer attitude that has been flummoxing me for months, which is why I call them the drunken sailors – they just refuse to slow down.

But let me update the growth numbers here:

So it’s in Europe where the slowdown is taking place seriously, not in Asia.

Like Wolf said it’s mainly due to ongoing massive government spending in the US and much bigger deficits and national debt (one of Wolf’s other recent articles) of almost $33 trillion (130% of GDP) and fast growing, for ex. read Wolf’s “Curse of easy money” article a few days ago on the ballooning US debt and surging interest payments for it. Unlike the rest of the world that dialled down the government stimulus after main part of the covid pandemic, it’s been ongoing in the USA (and we had much higher stimulus to begin with). A lot of debate on how sustainable that is and not a clear answer.

There’s nothing wrong with higher stimulus if it leads to things like capital and production investments that continue to pay dividends once the stimulus is withdrawn, but it’s a question how much bang for the buck we’re really getting with all that extra deficit spending and debt, esp if it’s mainly just juicing consumption while the faucet is open. There are a lot of crisis indicators in the US right now, ex. record levels of homelessness, rising defaults and delinquencies esp with auto loans (more than credit cards), plunging life expectancy (we’re now officially worst in developed world right now, below even Cuba). And even for all this the US economy did contract in Q1 and Q2 2022 so the United States actually hasn’t staved off economic contraction even with all that stimulus still in the pandemic–it wasn’t a recession (unemployment stayed low) but that data point is worth keeping in mind.

One could argue that the UK esp has the opposite problem and could use more stimulus. OTOH despite all the media memes about China slowing it’s tech sector has been surging recently and on a hiring spree, and several companies there have made breakthroughs while exports are surging into new markets (we just a did report on this). So in reality the “slowing” there just seems to be more of a shift from real estate to tech and more productive areas (without bailing out or propping up the housing bubble), and without need for as much stimulus. (They cut interest rates recently but they have no inflation, so that’s an option) I feel like a big concern here is that in addition to the ballooning public US national debt, we’re also seeing ballooning US household debt. And more consumer stress, with the articles recently on the loan delinquencies and Americans tapping into retirement funds to pay for food. That’s not a good combination.

For what it’s worth, it appears Japan’s annualized GDP estimate was revised down to 4.8% earlier today. Still hot, but not as hot as the 6% initial annualized GDP estimate from a couple weeks back.

No recesion until tech bros lose their shirts on margin bets on Nvidia (and bitcoin I suppose). 3 months tops (+3 months to sell the Model X).

I think all of these sh*tcoins must go to zero or near zero. There are still too much stupid money around and until people stop spending or buying these stupid scams, a recession is not in sight!

LOL, yes, I have that suspicion too occasionally.

qt, agreed. Look at the stock market today. At 10:30, “investors” swooped in to “buy the dip.” AS long as every dip in any asset, no matter how ridiculous, is considered to be a buying opportunity, we won’t have a recession.

qt there’s one born every minute

PT Barnum

not likely to get better soon either…

Bitcoin and other crap will never completely go to zero.

Note, I am not a electronic coin bull. I think owning bitcoin is just a game of greater fool theory.

I just know that is not how bubbles in unproductive things end. Do you know that there are STILL Bennie Babies that sell on eBay for hundreds of dollars? The volume has gone way down from its peak, but there are still people selling to each other who believe in the value.

Many years from now there will be people still selling bitcoins to each other at silly prices.

It isn’t the price that matters, it is the volume. The asset price bubble won’t be over until thrn.

Should

“Don’t fight the Fed.”

be changed to

“Ok, sometimes you can fight the Fed and win.”

?

Apparently.

Treasury yields going up.

Liquidity steadily being sucked out of the market and locked down by those juicy yields.

Fed balance sheet being trimmed.

I expected a recession within 6 months of the 3mo-10yr yield curve inverted on Dec 21st, 2022.

Maybe I’m just early, but early is wrong… so I’ve been wrong.

If there is not a recession by Dec 21st, 2023… I’ll need to re-think my belief in “Don’t fight the Fed.”

The labor market is a lagging indicator, lags made worse now by the greatest monetary debauchery (so far!). By the time unemployment turns, the economy will be well within a downturn.

If you want predictions about the future, look elsewhere.

You will see continued claims rise for weeks before the recession begins. You will not even know that the recession began until months later when the NBER calls the recession, and you will see that the beginning date will be where continued claims pierced the 2.6 million range. So the rise to 2.6 million is a LEADING indicator of a recession, and it’s weekly, rather than monthly.

Slower growth is NOT a recession. It’s still an expansion, but at a slower rate.

The Conference Board publishes leading, coincident, and lagging indexes designed to signal peaks and troughs in the business cycle for major economies around the world:

https://www.conference-board.org/topics/us-leading-indicators

>>”The leading index continues to suggest that economic activity is likely to decelerate and descend into mild contraction in the months ahead”<<>>”“The US LEI—which tracks where the economy is heading—fell for the sixteenth consecutive month in July, signaling the outlook remains highly uncertain”<<<

======================

Well yeah, they goofed didn’t they?? Recession mongers like you are grabbing at anything that’s supports their dream. According to their chart, we should already be well into the recession, LOL. Goofballs.

The need to pay back student loans after inflation deprived many of so much income, Fitch’s potential downgrading of dozens of US banks (already legally insolvent) until they are below investment grade and can only borrow from their not-Federal “Reserve, reduced global demand (e.g., the EU is in a mild recession, reportedly), decreased capital availability as baby boomers retire, and other signs may lead to recession. That is my expectation.

“By March 2021, the official beginning of the recession, initial claims were piercing 380,000.”

Wolf, did you mean March 2001 and not 2021? Please delete my comment if you’d like. Great charts and trends, thanks!

perhaps in light of demographic changes and variations in the participation rate we can have a “full employment recession,” especially in light of the number of part time jobs and multiple-job holders. people squeezed by inflated food and energy prices would be accepting under-employment rather than unemployment.

BS. Multiple job holders:

feels like I’m looking at the VIX chart

– GDI (Gross Domestic Income) is my favorite indicator for an recession and that indicator is going down.

BS. GDI has been going up:

look at the yoy change…

whenever the yoy change for GDI is negative there is a recession.

I meant to say take a look at *Real* GDI yoy.

Sorry, for the double comment.

Now you’re getting cause and effect confused. Real GDI goes negative at the end or after the recession because people got laid off and make less money, and business incomes plunge, etc. as a RESULT of a recession. So look closely at the dates. In this case, it would mean that the recession is already over, LOL.

In fact, the minuscule drop came off the huge spike in 2021 and into 2022, the most gigantic spike since 1950.

No reply button on your response.

I would agree that the GDI bottoms out towards the end of a recessions.

But if it is a deep recession (like 2008) it can go negative before the recession even starts, or at the start of the recession (like 1982), and the yoy change becomes much worse.

Separately, one could argue that the “most gigantic spike since 1950” was a reaction to the most gigantic decline ever, and now, as things settle out the economy is facing major headwinds such as high interest rates, high consumer prices, slowdown in world trade, CRE, inverted yield curve etc.

Real GDI is also highly correlated to real GDP but right now they seem to be diverging. We will see which one is right. In 1989 and 2007 for example, real GDI led real GDP into recessions.

I believe a recession will start when inflation stops, and inflation won’t stop until the Fed significantly reduces the money supply and government materially reduces the annual deficit. Neither of these is on the table.

The Fed is trying to down the inflation monster with a BB gun. Short term rate increases do little. If the Fed were serious, it would sell off it’s balance sheet much more quickly.

Inflation may be the FED’s favored way to deflate assets bubbles and get a “soft landing”. High “inflation” as mesured by CPI and stagnant assets prices do in practice deflate the asset bubbles.

That the USA government reduces the budget deficit significant and start a recession is probably not likely.

A recession then may start because of economic system weakness or impact from external incidents. Natural disasters, social incidents (unrest) or technical incidents (power/comunication outages) may be the most likely.

There is nothing that the Federal Reserve can or will do to reduce so-called ‘inflation’ which is nothing other than GREEDFLATION caused entirely by reckless and mindless speculators.

Incorrect. It wasn’t “mindless speculators” suppressing yields by buying treasuries and MBS.

Given how interwoven the global economy is maybe in modern times all that’s needed is for the bottom to fall out in another country?

At current US interest, conditions are described as “mildly restrictive” by analysts that I’m reading anyway, but here in Canada for instance our rates are pretty well in line and they feel quite a bit more restrictive for us. We don’t have 30yr fixed rate mortgages so a bit more pressure is applied to homeowners quicker, RE and rent/leases in our country I think make up just under 15% of GDP and construction is another 8% or so. I’m not sure how that compares to US but I suspect US economy is a bit more balanced/diverse than that. Anyway, I think if a recession is on the horizon then Canada gets there first, Europe is also seeing measly growth (as per Wolf’s comment just higher up) at the moment. I’m not sure how right this is but I don’t believe Canada can be too far off on rates from US because then we may experience capital flight, at least from what I’ve been told over the years. So if US keeps hiking and we follow then our RE sector could go under pretty quick, if we don’t then inflation will hit working class from the other side while the economy (heavily dependent on RE and construction) slows. I don’t see a rosy outcome this side of the border. Maybe one of the global partners takes a beating, other economies slow as a result, and US gets it’s soft landing? That’s my crackpot theory anyway.

Bobber, You got it right !

Read John Hussman’s monthly letters

They are all archived They are free

The most knowledgeable Economist i have ever read

This month’s letter he wrote on the Fed was awesome.

Cool, guess house humpers/pumpers can breathe are sigh of relief as no force selling from recession on the horizon which means it will keep home prices high, especially in hot areas like SoCal. People still have their jobs and flooded with money to FOMO buy whatever comes online for sales..Good times..

Phoenix,

Good times only for those who bought an overpriced home in the last 3 years. Bad times for those who didn’t and tried to be responsible with their money.

Those grapes are sour anyway.

Or those who weren’t in a position to buy based on their age, career point, or whatever.

Indeed Lucca. But Phoenix only cares about those who are having good times – cares about them crashing and burning. And for no apparent reason.

Having said that, I think it’s a very narrow view to generally call homes bought over the last 3 years overpriced. I am sure some were, there is a lot of high-earners spending stupid money, but that’s always true. But it might be that homes bought in the past 3 years combined with the lowest interest rates ever was actually a good and even responsible move, provided of course one did adequate homework and considered short- and long-term enough.

Gotta resist the FOMO & let the last of these greater/est fools and their EZ spoils boil off. It will still take some time.

OR, say to hell with it: reach up your chute and pull out a vital organ or two & buy at the top/blow off top. Then cross every extremity & digit on your being in the vain hope that things march inexorably higher.

Wondering how the employment statistics are impacted by the growth of the gig economy?

The “growth of the gig” economy? Actually no. It has always been there, and it will always be there. You can see it in the difference between employment by “establishments” (mostly W-2 employees, via the establishment survey, blue line) and total employment (all workers, including gig workers, via the households survey, red line). The difference has actually been shrinking, meaning relative fewer gig workers as employers have hired them:

Teenage Burger flippers are making US$20/hr, while in Toronto, MBA grads are having difficulty securing a C$20 (US$14) job because there are way too many applicants with more work experience and qualifications.

Supply and demand. Too many MBAs and too few nurses and crane operators.

And too few Toronto burger flippers too apparently.

Any thoughts on the workforce participation rate and how its affecting the overall labor picture or is it a mute statistic as far as being recession related.

Google “Brampton job fair long line”. Grocery store jobs are hard to find in the Greater Toronto Area.

And Canada relies on TFW and persons on student visas to work in fast food.

It’s true, at this time still most contractors I’ve talked to aren’t able to fill positions. Not sure how long that will last but right now if you’re in any trade you’re working, and not for 20/H.

Seba: You’re right, everybody who’s worth a damn became a contractor, making it difficult to hire employees. Young contractors with a few years experience are making upwards of $1500/day in carpentry trades.

Nurses had to fight for their wage increase. They were initially offered a 1% increase per year. Nursing is a tough job. I can’t stomach (no pun intended) the sight of blood, decaying wounds, using bedpans, cleaning after patients, etc.

Nursing is a profession that one fails to be grateful for, until there are long wait times in the emergency.

While continued claims are still low – they are rising – so I think caution is warranted.

They’re NOT rising. They’re falling. RTGDFA.

If you don’t want to read, at least look at the pictures.

“If you don’t want to read, at least look at the pictures.”

ROFL!!! Oh that’s too funny!

“While continued claims are still low – they have risen from the previous lows – so I think caution is warranted.”

Is that better? What are you cautioning against?

I’m probably banished, but the last time the three-year Treasury was at its current level, and initial claims were at this level, was September 30, 2000.

Although the recession seems increasingly unlikely, it’s still very much a possibility that may explode out of nowhere.

Sure.

Oh geez how does Wolf not lose his sanity with takes like this: “Although the recession seems increasingly unlikely, it’s still very much a possibility that may explode out of nowhere.”

So it sounds like you’re saying a recession either will or won’t happen. Have you considered a career in politics?

Reminds me of a dolt I worked for: “Some will. Some won’t. Some do. Some don’t.” This was a quote from him when someone questioned his flawed hypothesis regarding expected “take rates” of a customer offer and he had no logical answer to defend it, so he spewed BS.

How do you account for voluntary quits? When federal aide to Child Care Facilities stops flowing at the end of Sept there could be an uptick in quits as families tackle how to afford the rising costs vs staying at home.

1. Voluntary quits don’t qualify for unemployment insurance and have zero to do with this data here today.

2. Maybe some of them will just pay for childcare, and maybe others will shanghai grandma into taking care of the kids during the day? We’ll see if there is an uptick in quits for the October JOLTS data (to be released in December).

Howdy Folks. Can our Govern ment spend enough to never have another recession?

They’re damn sure going to give it a try. You can bet on that. In Germany, the government has recognized the gravity of their economic situation, and cut the budget by 30 billion Euro. Our overlords in the US would never stoop to such lowly gestures.

Germany doesn’t have control over the Euro, while the U.S. Government has complete control over the dollar.

Saved by the deficit spending over and over. Just fire up the printers.

At the most simplistic level it seems like the choice was between an 08/09 type recession or a few years of hot inflation.

Lots of valid criticism for either option, but inflation is a much slower burn than mass eviction/repossession/foreclosure/etc. Inflation rarely brings out the pitchfork brigade, empty shelves eventually will.

Sure!

See: Argentina

Bloomberg: US Dollar Set for Longest Rally in Years as USA Defies Global Gloom…

AAPL gap lower today because – NQ 1M Oct 2011 to Feb 2016 lows,

parallel from Nov 2014 high – stopped its rise.

English please (?)

IMHO, Canada got lots of immigrants in the last 30 years from developing countries (to shore up their financial situation) but these folks in general go after degrees rather than blue collar work. Hence the problem.

A Canadian in my previous life with a Ph D. in engineering from there :)

A recent personal experience is an indication of the sorry state of the labor market today:

I took my computer to my local Micro Center where I’ve bought all my computers for the last 20 years. Their service department was depleted with only 7 techs working there. All the old timers (nurds) who grew up with PCs from their inception were gone. In their place were young morons who most likely just left their job flippy hamburgers or driving Uber riding sharing jobs. They knew nothing and did nothing. My PC came back with the same problem booting up. I took it to another repair shop and they replaced the motherboard which was the problem. This experience has been repeated over and over with Comcast and other high tech companies. It’s a complete waste of time if you are trying to run a profitable business. There are few skilled workers left to take the available jobs. The ones that are out there can demand top dollar and get it. You are left to deal with incompetence everywhere when you have a technical problem with all your technology which you need to run your business.

All this claims data masks the bigger problem which is a massive shortage of skilled workers in the workforce.

Wal – Mart even worse employees can’t even direct you too right aisles to get products

How in the world would wal mart have employees directing one to products ? Everything is electronic for them and they are not staffed for the DIY storefront

Install the WalMart app on your phone. Its search function will direct you to the correct aisle. Their entire inventory for every store across the country is available online.

Ask a WM person where Aunt Nellie’s Pickled Beets are located and see what happens!

All WMs in recent years have both employees and contractors filling shelves/setting up displays, etc.

I have been shown locations of products many times by employees, contractors are now more polite saying they don’t work there and don’t know.

Think I understand why they keep rearranging their stores, but still wish they would not, eh, as we tend to purchase the same or very similar products that keep moving around, sometimes to different departments even???

Find the Instacart folks… they know where everything is.

Replace the Walmart employees with robots. They would probably do a better job.

RE: Walmart robots.

Have you been to a Walmart lately? It’s all self checkout with 1-2 employees in the front. The robot overlords already took over.

Every time I ask a Walmart or home Depot or Lowe’s employee where something is, they grab their phone. I can do that unassisted. So I stopped asking questions of telephone operators.

SC,

My son has been building high speed computers for gaming for over 15 years, since he was a teen. Several years ago when he was unemployed he applied for one of those geek squad jobs and was not hired because he had never taken a “course” in computer repair. You can’t make this sh** up, but such is the state of the labor force. The people who could have hired him could not even evaluate his skill level. That’s why you can’t get your computer properly fixed at these places.

Petunia

To clarify, I think things have changed in the last 3 years. Once upon a time you were able to get competent people to fix you high tech equipment. NO more. Now you have to search and search to find people to do these critical jobs. I spent at least 40 hours and 5 separate trips to get a simple PC problem fixed. The Comcast fiasco took 6 trips by techs to my home. All this time is time lost to serve my business customers.

There are plenty of skilled workers out there, people just don’t want to pay for them. I am sure there are plenty of older workers who could have figured out your problem but have been filters out of the workforce via age discrimination/hiring cheaper younger workers.

Kurtismayfield

I don’t buy this crap you are peddling. If you take a job with a company then do the f>ckin job. AND It’s not an old worker vs young worker issue. Recent experience with Comcast, I had them out 6 times to fix my TV connection issues. All but one out of 6 were older workers. Each time they came out they made the problem worse. The last one hooked up a new cable box which I was forced to go pick up myself which had all these fancy features that I didn’t want and which distorted the picture making every figure look egged shaped. The dude must have been half blind not to see the shapes of the human figures who look like martians from another planet. I almost felt sorry for him. I finally told him to install the old SMALL simple cable box that just did the proper conversion to digital signal and it worked great. No distortion. I now have a functioning Cable TV and spent 30 to 40 hours of time lost from work to get this done thanks to COMCAST.

Thanks Wolf.

So we can’t figure a recession with the job numbers now, and higher wages. So what we don’t see is a black swan event right? How about the regional banks? How about commercial real estate? How about oil prices and inflation there? Or even more regulation with price controls?

Ain’t happening no matter how hard you wish.

Black swans are not common. White swans on the other hand are common. Natural disaster is one, or rather a varity. Someone said the USA is two huricanes away from going down if they strike something important. Another is technical breakdowns. An “oops” with an automatic Windows uppgrade could wreack havoc. (Some years ago one telecom operator brought down their nationwide mobile phone services for a day here with a botched software uppdate.)

The black swan event is already here. It’s inflation. “No one saw it coming.” It’s a huge problem. Dealing with it causes massive dislocations. Now all previous assumptions are out the window. It’s the biggest economic black swan in 40 years. It’s huge, it’s all-encompassing, it’s global.

Thanks so many of my friends and the press and the politicians recognize the blackswan inflation ! Devastating!

I would argue that inflation was not a black swan, maybe not a white swan, rather some shade of grey, but not black.

There was monetary inflation, asset price inflation for a long time and it should be no surprice that eventually inflation would also show up in the consumer price index.

All black swans are that way. They (Fed, gov, Wall Street, etc.) will say afterwards “no one saw it coming,” but there were some people that warned about this black swan coming, including this inflation, and they were brushed off because no one wanted to see it coming, and because their warning was too early and didn’t turn into reality the next day, but sometime later.

Yes the numbers don’t show a recession but there are weird undercurrents in the Main Street economy that are not good. Just this week my favorite army surplus store ( in business for 80 years) closed down as well as my favorite craft cider place and old time diner.

Maybe it is just the old economy being sloughed off to make way for the new economy of Amazon packages, food delivery and video game entertainment. Perhaps we will never have a recession again, just a growing workforce of people who never leave home and work all day posting cat videos and censoring social media posts, awash in a sea of printed money.

Howdy Hubbers Curve. A retired old fool does not recognize much anymore either. Forests seem the same though….

The forests are on fire. Thats sorta different.

Howdy Sol. Thats true but not as many fires this year as usual. But the data could be corrupt…..

But look at all the new businesses that opened up, and the old businesses that are expanding in leaps and bounds, if they can find the people to do so. Never ever take a small store as an indication of the US economy. You will be misled.

Maybe that the government deficit running 2x ($2T) is holding off any recession? Seems to have worked for the past decade as our debt grew to $32T. Living on borrowed time.

More attention should be paid to this.

This is the best news for savers tbh.

Those yields are already mind blowing for us young people!

I’ll take 5% to wait for a recession all day long.

Before the “Inflation blah blah blah. We’ll all eat cat food” crowd shows up: TIPS, I Bonds & Dividends too.

We’ll gladly pay you 5% interest with a smile, as we cram 6% inflation down your throat and talk about reaching a 2% target. Oh, and don’t forget to pay us the 30% tax on that interest “income”.

-The Powers That Be

Who pays 30% tax? The U.S. has a bracketed tax rate…. I doubt that anyone in the 30% tax band is clipping 5% interest rate coupons and yelling “Woohoo!! I’m RICH!”

Your statement is confusing. I pay more then 30% tax and I enjoy getting 5% (mostly) risk free.

You pay 30% tax in aggregate? Do you make over $1M a year as that’s likely what it would take to get there. Don’t include SS or Medicare as that’s not collected on interest income. State income tax? Mebbe.

If you don’t understand “bracketed”, you might simply look at the IRS.gov site. It ‘splains where 24% kicks in… (everything below that amount is less – $190-364K for couples). So bracketed means…. first $x of dollars pays 10%. Next $x pays 12% but not retroactive. blah blah blah until you hit the max of 37%, but again, it’s not retroactive.

@El Katz, he’s probably talking marginal tax rate, which is the rate that matters if you have money to invest, as it is the rate that applies to the first dollar of interest in that instance.

Lots of people are in that boat if state tax is included, some are far higher with state tax, for instance in Oregon, a married couple making 250K faces a marginal tax rate of 33%, if they live in Portland, 36%.

250K is upper middle class for sure, but not 1% kind of money, in SF or LA it’s not even enough money to buy an average home.

I do. When you add up my pay at the end of the year and you factor in the 1100 hours of overtime I usually do, it skews me up into the 40% range, since they like to take almost 50% of the overtime pay I make. Effing retarded law if you ask me, I work harder to provide for my family so you tax me even harder.

Better than a 6% inflation rate while stonks drop or trade sideways for years.

My tax rate is obscenely low. I’d have to look, but like 11% on ~$200k. This year will be even lower, def single digits. (Legally)

This year it should be high single digits on ~$240k AND doing ROTH 401k instead of regular.

People look at brackets and don’t understand how taxes work.

Also, get I Bonds (tax deferred) or Muni Bonds if you’re high income.

Here are some tax pointers: MAX 401(k), HSA, IRA, IRA catch ups, have kids (haha), donate to charity using “clumping,” loss harvest, put high tax assets in tax deferred vehicles, put money in 529 plans, etc.

Some assets and stocks are more tax efficient. There are even tax efficient ETFs.

It’s different for everyone. E.G. – BRK/B pays no dividend for a reason, but if you’re in a low bracket dividends are good. Muni bonds are BAD for ME, but GOOD for high tax bracket folks.

You guys need (legit) tax planning if you’re paying high amounts.

Easy to do this if you are retired and living on dividends and capital gains, as a married couple can earn 89K in such income this year and pay zero Federal income tax, only pay only a 15% rate above that until 500K or so.

If you have 200K in earned income, you are paying a ton of FICA and Medicare taxes that make your true rate much higher than 11%, probably closer to 20%.

Not including state taxes of course, it could be much worse than 20%.

Howdy WaterDog. Be a saver of some of your hard earned $$$…. Life is better with little debt, lots of cash….

Just in my moderately short lifetime it seems the word recession has changed in connotation. What was formerly a benign description of a general slowdown in economic activity is now some prowling menace threatening to impregnate my wife, kick my dog, door ding my pickup truck, and drink all my favorite beer while I sleep.

It’s really only something to FEAR if you’re leveraged up to your eyeballs. Oh… well yeah now it makes sense…Never mind.

When non-stop growth becomes the norm, recession seems like a giant punt to the gonads.

LOL, and true.

Really good article Wolf!

It’s very difficult to find the logic to all this, but in my opinion something is not right here, the effect of rate increases will end up breaking something, once it happens many jobs will be lost and it could happen quickly, unemployment levels are always low just before recessions start, too much money was injected and is the cause of the delay.

Something huge already broke: price stability! And the Fed is now trying to glue it back together.

Every recession since WWII was both predictable and preventable. I don’t have confidence that the next one will be so obvious. The FED eliminated the only credit control device capable of managing the money stock (legal reserves). You could predict the swings in the economy by using required reserves.

The O/N RRP drawdown has injected a lot of liquidity into the markets. This is the most probable reason why Atlanta’s GDPNow measure is so high for the 3rd quarter. And the decline in M2 has been offset by 1/2 through deposits being shifted into large time deposits. This plus the change in the composition of the money stock has propelled the economy.

Thanks wolf,

After October healthcare gets added to the fed inflation numbers that should ensure more hikes, after all Fed Powell was hawkish. Between healthcare and energy and rate hikes a recession should come into view. I guess that’s up to the Fed.

Honestly we all know the best indicator. When men who live alone buy new under ware, is the tried and true indicator. Assuming that men went shopping post COVID because they absolutely had to, the next Recession, barring unusual sales, should end about 24-30 months from mid 2022. Assuming a very mild recession drops in early summer next year men should have to buy new under ware in the fall of 2024 right after the election. This will signal the end of the oft predicted Recession. Speculative assumption #2, politics being what they are, they won’t declare it was a recession until well after it is over.

So….buy stonks??

Opposite. Higher rates for longer (not higher stocks for longer, LOL). Higher rates are not good for stocks.

What has been great for stocks since 2009 was QE and near-0% interest rates.

Now we have QT (nearly $900 billion so far) and 5.5% rates, and you can see the results on stocks. Higher for longer means that this will drag out for a long time.

Really admire your patience with this reply. Admirable!

Sorry – as a stupid economic layman I have to ask: What does it mean “higher rates for longer”? As you have stated, something big has already broken – price stability. So, real instead of nominal indicators need to be tracked and it is not even clear whether the “higher” territory has yet been reached. Moreover, “real” seems quite elusive because one cannot be sure whether to use spot inflation or expected inflation in the next year and, if the latter, estimates of expected inflation may vary among different economic actors which makes the indicators very subjective. Bottom line: those in charge have screwed up the whole economy so badly that no one can predict anything any more, like in a hall of fake mirrors.

1. Stick to nominal for day-to-day stuff. Stock prices are nominal, yields and coupon interest are nominal, your mortgage rate is nominal, your salary is nominal.

Once you nail down nominal, you can play with “real” by using whatever inflation rate you wish to use.

So if you figure that your personal inflation rate was 8% in each of the past two years, so about 16.6% for the two-year period, and stocks as tracked by the S&P 500 are down 3% from Sep 2021, then you’re down a “real” 20% on your stocks. You can play with that, kind of fun.

2. “those in charge have screwed up the whole economy so badly that no one can predict anything any more, like in a hall of fake mirrors.”

🤣 yes

The Fed might stay put, because we are facing UAW strike and a gov

shut down.

Results : higher unemployment and lower gov spending.

There will a recession but it will be event driven. The black swans are all in a row. The biggest is the NVDA scandal, and the yield curve, where yields are back to levels which caused the banking event, and financial conditions which are no longer as loose. The employment problem, 1.7 jobs for every worker can’t cause a recession, you can’t get there from here but there are plenty of other catalysts.

“The black swans are all in a row. The biggest is…” INFLATION.

It changed everything for years to come. All previous assumptions go out the window.

Inflation means higher rates for longer, and it means continued QT ($900 billion so far, going at a clip over over $100 billion a month now).

What has been great for stocks since 2009 was QE and near-0% interest rates.

Now we have QT (nearly $900 billion so far) and 5.5% rates, and you can see the results on stocks.

The black swans you list would be the cherries on the cake.

Inflation may indeed be a black swan but please don’t tell me anyone is doing anything about it.

More Stop Go Stop rate hikes that just nurture the inflation rather than treat it should be expected.

No Landing! Enjoy the flight.

Yes well the wealthy LOVE inflation. They have more than enough to live on, profits are rising, and the extra dividends in the portfolio are welcome. And as long as wages are rising, working people can ride that fixed 3% mortgage like a rented mule. Government raises money through debt auctions and then subsidizes homeowners? The gap between bond yields and mortgage rates has to close. Prime plus 1/2%?

Higher for longer, for sure. But does this also mean that mortgage rates are going to go a lot higher?

We’d be in recessioin if the Federal budget was balanced.

That is the big picture to keep in mind.

Most of the rest of the world doesn’t have the ‘luxury’ of running huge deficits payed by other countries and their citizens. Or if they do have big deficits, their currency gets creamed.

“We’ve been on a recession watch here ever since”

2011. And rightly so. But so much money was poured over the last technical recession that we can’t really even call it a recession in a traditional sense. Nobody lost their house as foreclosures basically disappeared. Anybody who lost a job was handed money to pay their bills, and for a while some got more money than they used to get paid. More jobs have been open than people available to fill them. 2020 didn’t look like or act like any past recession in U.S. history.

The path is clear and there is only one page in the central bank playbook… We will throw money at every recession right away and deal with the “transitory” inflation later. Wolfstreet readers will continue to wait for a proper recession that never comes until the dollar eventually has no more juice left in it and collapses some day probably still many years away.

Will the resumption of student loan payments have a material effect on the economy? Asking for a friend.

I doubt it. Not many people seem to be actually making payments, and the payments have been reduced so much … and nothing happens if they don’t make the payments… And after 10 years they’re forgiven?

We’ll see… Starting this year the REPAYE –> SAVE plan boosts the excluded income from 150% to 225% of the poverty level AND no longer includes spousal income for those who are married filing separately.

The rest is supposed to go into effect July 2024. The payment 10% of eligible income drops in half but only for undergrads. The forgiveness in 10 years is only for those with total original loan balances of $12k or less… Then one year is added for each for each $1k of additional borrowing up to the maximum of 20 years for undergrads or 25 years for grads.

Situations will vary… My wife and I wouldn’t benefit from making changes this year. Next year my wife may see a benefit of ~$70/mo by switching plans from IBR, assuming nothing changes before then. As for myself… I took my loans before we were married when the student loan rates were indexed to the 10-year treasuries plus a margin… and you could consolidate existing loans down to whatever the prevailing rate was. I locked in at 3.875 take a 0.5% discount for making electronic payments and then deduct interest from gross income in a 22% tax bracket that makes my effective cost to borrow is 2.63%… Last I checked that was a negative real rate and I’m stretching repayment out as far as I can.

Makes me feel like all those kids (and my wife) graduating into 7% loans originated during ZIRP got hosed.

The resilient economy, with eye watering GDP growth, is challenged by several forecasts that do see trouble ahead, including, the New York Feds Yield Curve as a Leading Indicator Tool, which indicates about a 75% probability of recession by next summer.

Obviously, that bullet proof research is riddled with inaccurate stupidity, which is inconsistent with the resilient narrative.

All the yield curve inversion tells you is that the Fed raised its short-term interest rates, while the bond market is slow in following with long-term yields. So the front end gets lifted, and the back end rises too, but more slowly, and voila, the yield curve inversion.

The reason why the Fed hikes the short-term rates is to SLOW the economy, meaning a recession to halt inflation, but those efforts haven’t been successful this time around, for a variety of reasons, some of which we discussed here.

It’s nearly impossible to have a recession with this kind of labor market, these kinds of wage gains, this kind of consumer spending, this kind of government deficit spending, and trillion of dollars in excess liquidity still floating around out there. Where is the recession supposed to come from?

I know this will (does) sound ridiculous and absurd, but that’s what a tsunami of expert economic gurus were saying in November 2000 and before the GFC

I think the recession literally comes out of nowhere. We’ve all been highly aware that recession mania has been lingering for over a year, and many of the factors you site are contributing to resilient strength, offsetting many lingering concerns.

I think being overly optimistic is still dangerous at this point, and I’m not suggesting you are overly exuberant or irrational. Many recessions have appeared when unemployment is very low and GDP looking great.

No, a recession does NOT come out of “nowhere” — unless there is a lockdown, like there was in March 2020. The run-up to all other recessions has been well telegraphed including by unemployment data cited here.

There are gazillion bloggers out there who’ve been saying for 10 years day-in and day-out that the economy is collapsing, that consumers are collapsing, that whatever is collapsing, and it’s just BS. It never ends.

Yes, a recession could “come out of nowhere” if there is nuclear war, or another deadly pandemic hits, or hostile aliens appear. No doubt.

However most recessions can be seen in advance by looking at employment numbers. It is simple.

I guess all the “most spectacular housing bubble” articles have now been rendered useless. High home prices forever!

Howdy Sol. I dont think so. Trillions printed, lots of $$$ out there. This nonsense could take a decade to unwind.

I see a lot of parallels between now and the late 60s/early 70s. Even the same tense cultural and political landscape. I have zero faith in our leaders right now no matter which side of the aisle. Have you seen Mitch McConnell lately? Not only do these lifetime politicians already have one foot out the door, they’ve also got one in the grave

One in the grave and the other on a banana peel.

McConnell is clearly ill. If Biden ever actually interacted unscripted with reporters it would be even more frightening.

Another decade of renting. Yay. I can’t wait to have the freedom of having a pet or to hang a personalized decoration on a wall.

Home prices are gradually dropping nationwide even if slightly. Also, inflation needs to be considered as well. If wages keep rising at a very high rate, then housing prices do not look so silly anymore.

Not that it is much of an indicator but I’m seeing Amazon and Target run some discounts on their inventory. Pretty much buy X $ amount and we’ll give you a gift card. And prices of a lot of items are coming down at least 20% from highs.

Also I was at a beach area over Labor Day weekend and it was eerily dead. Not many tourists.

I feel like something is changing. But who knows?

Costco was sheer pandemonium this afternoon. Multiple carts for each of several customers. Flowers. Cases of booze. Snicky snacks. Guy in front of me dropped $2K+ on consumables for some weekend sports ball hoopla.

I felt like a piker only spending $200 ($70 of it was on a fifth of tequila).

Once the Costcos are abandoned you know we will have a big problem.

We we in the Tahoe area over Labor Day, and it was a total zoo. We were stuck in stop-and-go traffic on Friday from San Francisco all the way to the foothills. It was totally nuts. Coming back Monday wasn’t much better.

With the amount of FREE Money sponsored by Fed, it would another 10 years before we see a recession.

After 1.5 years of so called “Aggressive QT” by Wolf, the Fed only see 700+ Billion reduction, still have about 4.5 TRILLION to go.

Rest Assured, any hiccup in banking finance or GDP, Powell would add a few hundreds billion around.

And Wolf is cheering so called “MOST AGGRESIVE QT” ever, conveniently ignoring the FACT of MOST MOST ACCOMODATING FED of 5.2 Trillions printed.

Well, they already unprinted nearly $1 trillion. So that’s a start.

High Growth/Employment/Inflation is a boom

Low Growth/Employment/Inflation is a Bust

Stagflation wasn’t possible until it was

High Inflation Low Growth/Employment

So what do you call it when there is

High Employment/Inflation Low Growth

Or even maybe…

High Employment Low Growth/Inflation

I know we’re not there yet, but I think we’re going to need new terms.

I’m a bit new to analyzing this data so pardon my ignorance but aren’t these lagging indicators? How do we use them to forecast recession risk if the date doesn’t actually show a recession until we’re already in one?

These are leading indicators. You’ll see them rise on a weekly basis well before the recession begins.

Yup, claims are going to permanently plateau at bottom

It seems intuitive to me that your Recession Indicator line should be trending up in line with the size of the total potential workforce, no? The indicator is fixed at an absolute 2.6 million people over the last 50 years. But you’ve posted other graphs above in your replies showing that the workforce has expanded by ~ 15 million in less than the last decade alone. What is so dispositive about that set number of unemployed people for suck a long time period?

That’s the line that the historical data generated. Maybe next time, the recession will start at an ever higher level, that would make sense. But in the past, the recessionary levels were around that line.

Maybe you can’t be in recession with the kind of deficit that the US is running?

Wolf,

“Sharp increases in weekly claims for unemployment insurance benefits – especially “continued claims” – are highly correlated with recessions.”

Absolutely! Dropping long term held equities before you see this is 80-90% of the time a mistake.

My hypothesis/conspiracy theory for why we are seeing so much negative financial news is that the rich who own the media got horribly caught offside on their interest rate bets and would love a recession to clear up their problem.

Jobs and GDP are strong. Inflation is worrying so own things, not cash.

I’m using the Vanguard Utility ETF as my recession indicator…right now it’s trending downward.

5.5% Treasury yields make dividend stocks, like utilities, less attractive, and higher fuel prices increase costs for gas and electric utilities?

The USA consumer has been spending like a drunken sailor. Based on what I witness and no real data, I believe many if not most millennials have never learned to live within their means and live on debt. Consumer debt delinquencies are starting to spike and the spending orgy may actually be coming to a somewhat abrupt end.

We just came back from the Tahoe area on Monday. Total zoo. No abrupt end, or any end, in sight.

When I was in school the argument for recession was based on GDP and other statistics. Unemployment was a LAGGING indicator and would rise well after the recession began. A major banking shock/failure could start a recession very soon. Current employment statistics have nothing to say about that.

Wolf live the articles and you do a fantastic job my friend. Enjoy it and thanks again.

I’m no economist but I have followed the markets since a kid •79 stock broker first year in 87. Lost tons of everything and real estate early 90 .. made it all back and more z90s…. Took hit 2000 ..

saw 2008 coming in 2004/05 sold everything 2006 yes too early but bought it back 2009-11

Then 2020 was 98% huge recession and real estate decline but guess what they skirted 2018,2019 then Covid saved the day. We have not paid the full price for 2008 yet.

It’s been a fake economy since 2009 so we’re in a monopoly game in the matrix.

Employment numbers are still good as it’s the common way to cope with inflation.

No, Wolf, I think you’re wrong again.

Recession before 2024.

Like to make a wager?

“Recession before 2024.”

So you mean by Dec 31, 2023? You only have 3.5 months left, and Q3 is looking pretty good so far. That’s going to be tough.

Everyone has by now given up on their recession call for 2023. When the Fed started hiking rates in the spring of 2022, folks started predicting a recession for late 2022, no way in hell could this economy stand higher interest rates, and when that didn’t happen, they started predicting a recession for 2023, and instead so far, the economy accelerated, and everyone by now has thrown in the towel on their 2023 recession prediction. Now the recession is predicted to occur after 2023 maybe in 2024 or whenever. “There will be a recession, there’s always a recession eventually. But we’ll just have to keep watching for it,” is what I said in my subtitle for a reason. But in 2023? That train has left the station.

You are correct but you are ignoring a black swan event.

Like a collapsing banking system with trillions of depreciated « junk government bond »

I know the FED buys back at face value but the global south is dumping them.

Not sustainable

Except the powers that be have figured out that banks can collapse (stockholders lose everything and bondholders take a big hit) as long as savers at the banks are not affected.

The biggest banks are no where near collapsing (they might even be thriving). Lots and lots of little banks can collapse and as long as account holders are protected it will not affect the economy (beyond the minor hit of a business going under which happens all of the time).

It’s hard to make predictions, especially about the future…

I feel pretty typical of the Millenials I know in terms of spending and probably fueling the labor tightness/inflation. I got laid off when COVID hit from my 50K job after just having had my second baby in Spring 2020. We were totally miserable for a while as I was trying to get my family to a better place. Then I got a new and better job making 85K and my spouse also got a better job, though we had to move cross-country for these jobs. Now we’re spending more than we did pre-covid, partially because of increased cost of living/housing and also since I feel anxious to kind of ‘catch up’ on giving my kids (6 and 3) experiences since we didn’t do anything for so long sitting at home in pandemic-layoff-newborn misery… We’re now getting into ballet lessons, soccer, visiting the Zoo, etc. Though I’m afraid of more hard times or a recession, I guess I feel like we can’t postpone life. We don’t have any credit card or student loan debt and are saving for retirement — but I’m not penny-pinching the way we did during COVID since it was so depressing for so long and really hard on the family. Last night I took the fam to a local college football game and it cost $50 to do it — but I don’t regret it! My pandemic baby who had a pretty severe speech delay during the pandemic is catching up on verbal/social skills now that we are living life normally again, and my 6 year old is starting to enjoy living in our new area and less sad/enraged about the move. So I am spending the money on the soccer and the art classes and the food to have friends over for dinner, etc because it seems the right thing to do. Maybe another terrible disaster will hit and we’ll be poor and depressed again and I”ll regret not having saved every penny right now, but in the present it seems urgent to give my kids a taste of good life.

I am amazed how many people start with an outcome (crippling recession, out of control inflation, whatever) and then look for data to support it while ignoring everything that doesn’t.

Wouldn’t it make more sense to look at the data then arrive at an outcome?

I think this matches a lot of what is happening politically. There seems to be a certain segment that wants to see mass pain in the U.S. Whether it is recession, runaway inflation, or an upending of the institutions that have made this country what it is.

I don’t understand it.

Jim

With regard to the banking situation you seem to ignore an important fact even if bank stock holders get wiped out, there are still 62% of account holders who are not covered by FDIC, they will lose tons of money and drug down the economy with them

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

William Butler Yeats