Priced right, any home will sell. But sellers are not wanting to price their homes right.

By Wolf Richter for WOLF STREET.

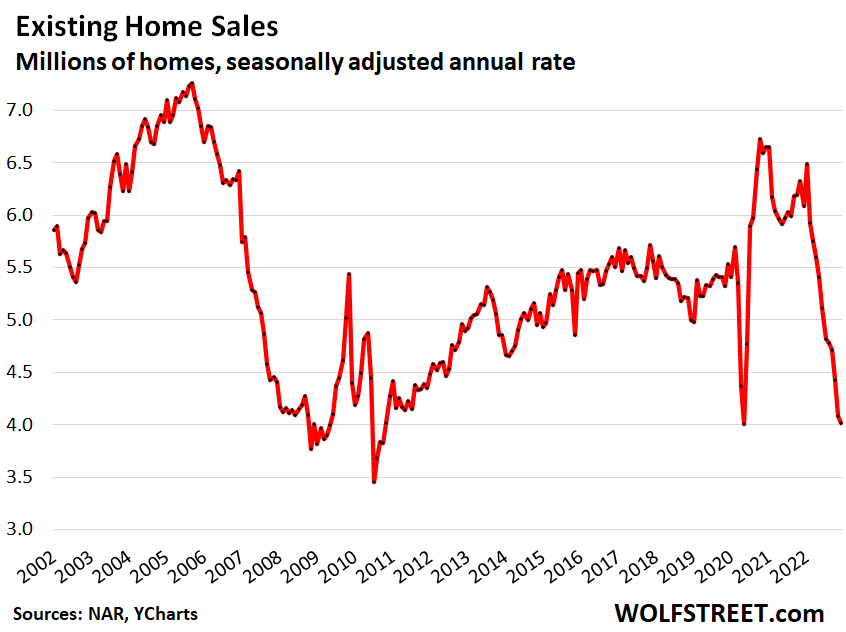

This is getting relentless: Sales of previously owned houses, condos, and co-ops fell by 1.5% in December from November, the 11th month in a row of month-to-month declines, and by 34% year-over-year, to a seasonally adjusted annual rate of sales of 4.02 million homes, roughly matching the lockdown-low in May 2020, and beyond that the lowest since the depth of Housing Bust 1 in 2010, according to the National Association of Realtors today.

Priced right, just about any home will sell, but sellers are not wanting to price their homes right. And potential sellers are sitting on their vacant homes, hoping for a quick end to this downturn, or they’re putting it on the rental market or try to make a go of it as a vacation rental, rather than dealing with the reality of a mind-blowing housing bubble that has loudly popped (historic data via YCharts):

Actual sales in December – not the “seasonally adjusted annual rate” of sales – fell 36.3% year-over-year, to 326,000 homes (from 513,000 homes a year ago), according to the NAR.

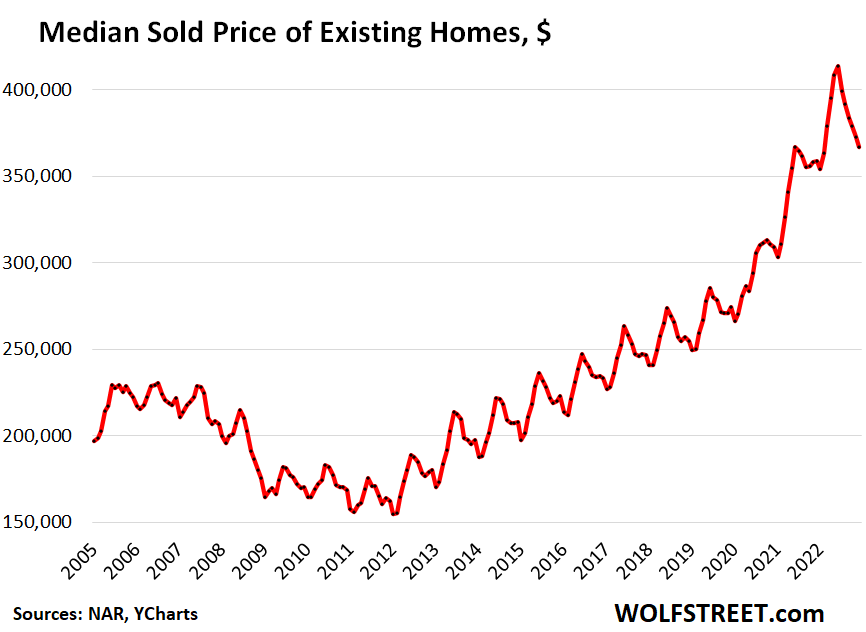

The median price of all types of homes whose sales closed in November fell for the sixth month in a row, to $366,900, down 11.3% from the peak in June. This drop whittled down the year-over-year gain to just 2.3%, from a year-over-year gain of 16% in the spring of 2022.

Only a portion of this June-December price drop is seasonal: The average June-December decline over the six years before the pandemic was 5.8%, with a maximum decline of 6.4% and a minimum decline of 3.8%. This shows that the current 11.3% decline goes well beyond even the maximum seasonal decline.

Additional confirmation that much of this decline was not seasonal is provided by the rapidly shrinking year-over-year price gain, down to just 2.3%, from 16% in December 2021 through the spring of 2022 (historic data via YCharts):

In some markets, the median price has plunged a lot further. For example, in the San Francisco Bay Area, the median price has plunged by 30% from the peak in April 2022, and by 10% year-over-year, according to the California Association of Realtors. But other markets are lagging behind, to produce the overall national average.

All-cash buyers, investors, and second home buyers pulled back massively. All-cash sales plunged by 22% year-over-year, to 92,000 homes (28% of the 328,000 homes sold), down from 118,000 in December 2021 (23% of 513,000 homes sold). In other words, buyers that pay cash didn’t want to buy these overpriced homes either, though they didn’t have to worry about getting a high-rate mortgage.

Sales to individual investors or second home buyers plunged by 27% to 52,500 homes (16% of 328,000 homes sold), from 71,800 in December 2021 (14% of 513,000 homes sold). They too pulled back from this market.

Sales of single-family houses fell by 1.1% in December from November, and by 33.5% year-over-year, to a seasonally adjusted annual rate of 3.64 million houses.

Sales of condos and co-ops fell by 4.5% in December from November, and by 38.2% year-over-year, to a seasonally adjusted annual rate of 420,000 units.

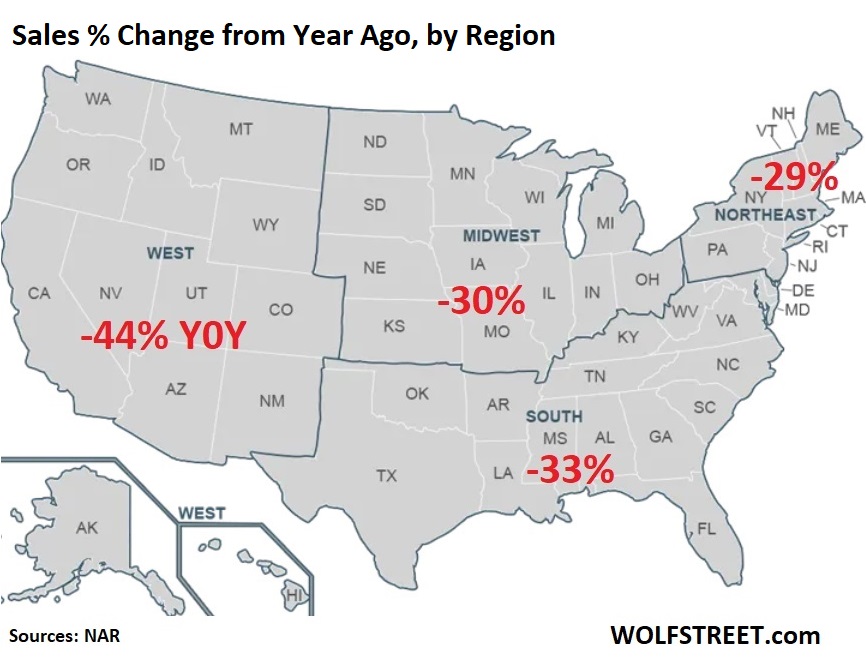

Sales plunged in all regions, but plunged the most in the West. Year-over-year percent change (NAR map of regions):

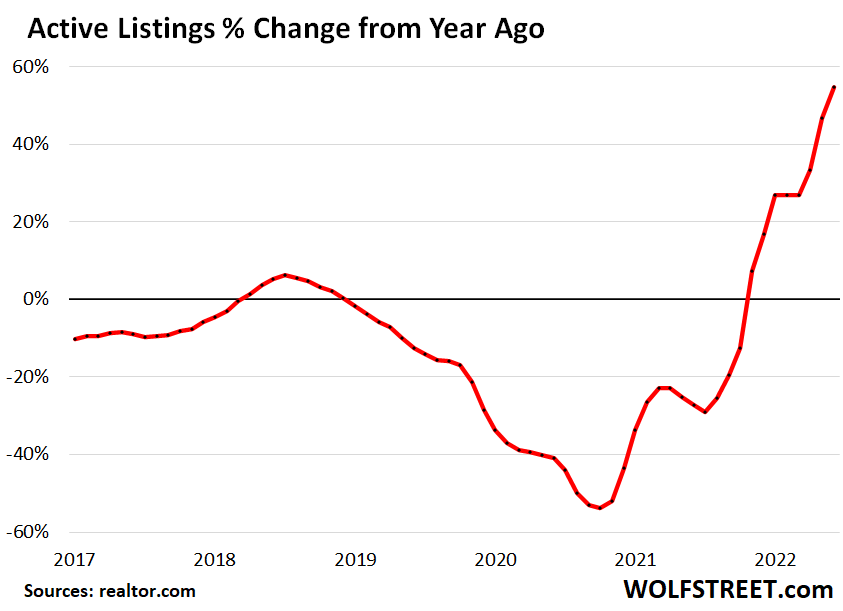

Active listings jumped by 55% from a year ago, to 690,000 in December (active listings = total inventory for sale minus properties with pending sales). Just before the holidays, lots of sellers pull their homes off the market, and then put them back on the market for the spring selling season. This happens every year; active listing start to drop before Thanksgiving and don’t rise again until the spring (data via realtor.com):

Active listings, though up hugely from a year ago, are still relatively low as potential sellers are determined to wait out what they expect to be a brief ripple in the market, and meanwhile they’re putting their vacant homes on the rental market and they’re trying to bring in some cash by putting their vacant home out there as a vacation rental. And many are just sitting on their vacant homes that they hadn’t sold because they’d wanted to ride up the market all the way to the top with huge gains of 20% or 30% a year. But that show is over. And now what?

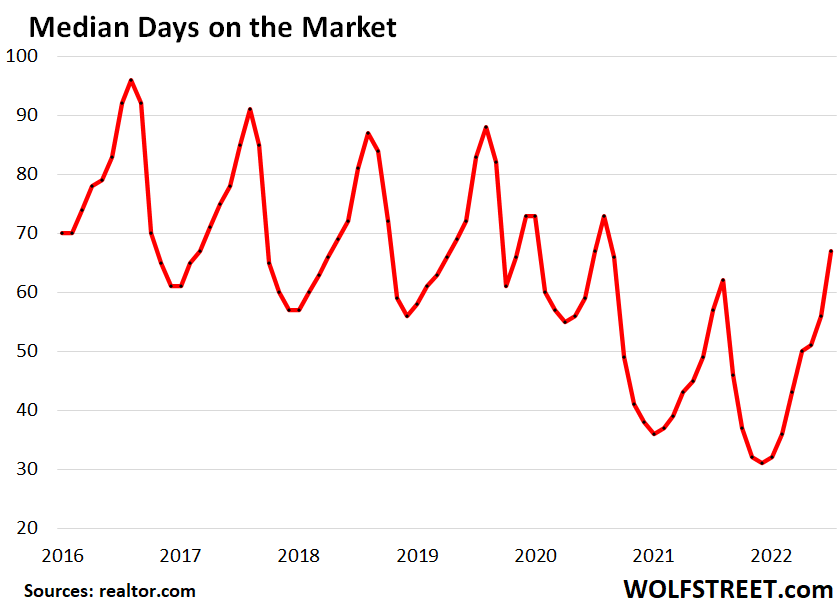

Median days on the market, before the frustrated seller pulls the home off the market, or before the home is sold, rose to 67 days (data via realtor.com):

Price reductions: Active listings with price reductions hit a new high for any December in the data by realtor.com going back to 2016: 25% of the active listings in December 2022 had price reductions, up from for example 17% in the pre-pandemic December 2019.

December or January is usually the seasonal low point for price reductions. Rather than cutting prices, many sellers pull their homes off the market and wait for the spring selling season, before they re-list it. That sellers are cutting prices over the holidays to this extent shows that they’re getting a little more aggressive.

Hoping for a quick reversal of this downturn: This combination of plunging sales, dropping prices, rising active listings, rising days on the market before the home gets pulled or sold, an increase of active listings with price cuts, but still tight supply, indicates that many potential sellers are still hoping for a quick reversal of this downturn. And they’re letting the vacant home sit to wait for better days, or they’re putting it on the rental market or try to make a go of it as a vacation rental, rather than dealing with the reality of a mind-blowing housing bubble that has loudly popped.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

We all see the carnage but does Powell? Does he care is the better question. I suspect things as a whole are going to get a lot worse in short order and QE will suddenly become a topic again.

I don’t think QE will be on the table for some time to steal Fed speak language lol.

The really interesting thing is how housing seems to be picking back up just a tad bit. Applications and what not aren’t down quite as much lately with rates getting closer to 6%.

I’m in no way saying this will last but the belief that a pivot and price appreciation will re start soon is pretty amazing. It’s become a stand off but I’ll take the Fed to win

I’m sure Powell is taking note of this and the loosening of financial conditions.

Bob, What’s wrong with house price falling? Why should QE be started to protect house prices?

Housing is the suckered that’s destroying real economy and converting Americans to debt slaves.

People are paying many years of their lives saving and interests, only to buy a decent house in the so called “land of the free”.

Most of this price is speculation and not productive value. Do we want to be a country that keeps building houses for speculation, that remain empty and gather mold, while we face food shortages and hyperinflation?

China is building speculative, empty, investment housing by the hundreds of thousands of units. Seems like they see some value to doing so. Some insist it is the only viable investment option for the Chinese who wish to obtain some level of wealth. Sort of the housing equivalent of bit coins.

Most people who want to own a house already own one. To lower house prices now hurts a lot more people than it helps.

roddy6667-

Nonsense. Lots of people currently renting are looking to buy. And every day, as people get older, have kids, etc. they move out of the city and into suburban houses. The churn is constant (Also, older empty nesters sell their houses, move into cities / Florida / nursing homes).

The real issue is that the people who don’t own houses tend to be younger, just starting out in their life, while the people that already own houses tend to be later in their life. House prices is generational warfare by another name: lower prices benefit young folks who don’t have houses, and hurt retirees looking to sell their house. Higher prices do the opposite.

Those in the middle don’t really care because if they sell a house, it’s to roll into another one so prices don’t really matter once you’ve entered the treadmill. It only matters to those looking to either enter or exit the treadmill.

roddy6667 coming in with the ultimate “I got mine” foolish comment. Yeah, I’m sure all those without homes don’t want one anyway.

I agree. I think house prices need to come down a lot more.

roddy6667,

You do understand that housing prices went up 200% in many locations the last 10 years, don’t you?

That was an inappropriate artificial gain created by Federal Reserve policy error. The removal of that windfall is the only fair thing to do. If housing drops 30%-50% from here, it would simply be bringing things back to normal.

Homeowners don’t need protection after 200% gains. They need to earn their money, like everybody else.

Bought a nice 3/2 in ’98 for 100k. Housing boom went to 600k. Housing bust went to 90k. Went back up to 300k Fed free money and sold it. RE is extremely volatile and has no correlation with the real economy. It’s like a car, it’s worth what you can get for it. Rented for years after that. Built my own place dirt cheap. It’s a home not an asset.

Dear CreditGb,

They were building that many but now their sales are so down that the CCP is funding them to complete the homes they sold, got a large series of payments on to finish, and never finished. Evergrande just made restructuring proposals for its foreign lenders that are so funny that you should read them for a laugh — so long as you do not own their Ponzi bonds, of course.

If you got caught in the CCP-Wall S T R E E T Ponzi schemes, be aware that many prominent companies and individuals in the US (even one media company) have so misrepresented the dire state of those CCP companies (because they are clearly linked to the CCP and compensated by it) that you have causes of action against them under some state’s laws, such as for acting as promoters of securities frauds. They were and are acting as CCP Ponzi shills in getting Americans to gift their money to the CCP for Ponzi scheme bonds/shares– “gift” because most foreign investors will not get it back.

Just read recent news about Evergrande and its foreign creditors, AKA big time losers. It is not a good idea to give your money into a country with no law but the whims of a gang of kleptocrats.

I’m good with a healthy market that actually is a market driven market. We haven’t had one of those for a long long time. Personally, if the market drops I don’t care as it’ll be a good time to buy. The national association of realtors may not agree because for them and the mortgage guys things always need to appreciate, otherwise what would be the point of the investment.

So much meddling has happened in our economy, who knows what’s going to happen next?

For San Francisco and Seattle, the housing tone is set by recent mass layoffs. These techies may only get hired at half the salary, if lucky, due to spreading hiring freezes.

Then they will realize that this very expensive mortgage on a very premium house, at an extremely expensive city doesn’t make any sense.

Many will move out to work remotely from a cheaper area, putting their houses up for sale. So the real storm is yet to come, I see a sad spring season!

Presumably those workers should be able to continue to pay the mortgages for as long as their severance pay period lasts (for someone laid off from Google after working there 5 years, that’s 6 months). Should be interesting to see what happens to the market when that ends.

We cany undo 20 years of interest manipulation in 1 year ,this will not be fixed until there’s a washout . Always is now they want to produce a 1 trillion dollar platinum coin ,don’t think countries holding our debt will appreciate this

Powell doesn’t care. When he drove to work at the Fed on Constitution Ave he didn’t like the sight of homeless tents on his way in. He wanted them off the streets and parks and away from the Supreme Court. He got his wish.

How will the next generation save to buy these overpriced houses as wages lag inflation!

Our kids will be living in our basements or go homeless!

Wrong. There are plenty of jobs for hard-working young people out there. Now, thanks to a change in Fed policy, they’ll be earning a decent return on their savings. Let’s hope the Fed keeps interest rates high, for sake of the younger generations.

If they keep rates high, housing prices will come down and home affordability will be much better going forward, and progress will be sustainable. Rent today, buy a few years from now when prices are much lower. Have patience. Let high interest rates bring prices down. It will take a few years.

I’m 33. As a kid we learned to put money into savings, and invest based on reason. For years, everything has felt like chaos. I’m very cautious with money and, now that the casino is on fire, I feel comfortable with how to proceed for the first time in my adult life. HYSAs are just fine by me. Let the rates rise!!!

I wouldn’t be so sure, Bobber. Things will have to substantially change. The median individual income has only risen by about 14% since 2000, while the median rent has doubled and median home price has tripled. Since 2000, the ratio of median income to median rent has gone from 4:1 to 2:1. Median rent has actually increased more in the last two years than the median income has in over two decades. There may be plenty of jobs out there, but there’s an objectively dismal lack of pay given how much wages have stagnated over the years.

Greenspan and Bernanke’s policies put those people onto the streets. There were very few people living on the streets when mortgage rates were 10+ percent and rents were affordable.

Not so fast RT:

In the distant past of my 75+ years, there were many folks walking and riding the rails into and through our small town in SW FL.

Our local cops would help them on their way, as in ”get the hell out of here and never come back” , sometimes either paying for bus or train, sometimes just burying them out in the groves…

Miami was the eventual destination for most of the hobos and other bums who did not want to work,,, as it was one large city with plenty of hobo villages hidden out of sight, as they all were in those days where one could sleep out all winter and not die from the freeze…

Other destinations, especially for any wanting to work were the citrus groves, the tomato farms, etc.

Trust me, homeless and ”migrant worker” situation been going on long long time, made worse by what is still the greatest depression in USA.

Mass homelessness wasn’t a thing long ago. Then cities started banning SROs and prohibited motels from letting people stay in them as long as they’d like.

More people choosing to take hard drugs is also a contributor to mass homelessness.

Of course, he sees it. It’s exactly what he wants. Listen to his exchange with Senator Shelby from last year and it will tell you everything you need to know about his resolve. He’s become a masochist and I love it!

Personally, I hope he doesn’t start to pay attention until the median price approaches $250K. He literally created this mess, so he has to own it.

Powell doesn’t care about house prices (or more accurately, it’s lower on his priority list). He cares about inflation and employment. As long as inflation is high (which it is), he’ll continue to raise rates, and continue QT. When inflation gets under control (unlikely to happen this year) what he does next is anybody’s guess and will likely depend on what the rest of the economy looks like.

Home prices have much to fall.

Lower home prices would be beneficiary to society in the long run.

But people who are deeply invested in real estate may not like it and would pray for qe.

I don’t see qe returning anytime soon

There is no carnage. There is nothing remotely resembling carnage. The recent downtick in housing prices has only erased the gains of last year’s blowoff top. Prices are still far, far, far too high–by at least 30% in many markets, and by much more in some local markets and on the lower end of most markets.

Correct. Interest rates must be high so housing prices can return to normal. If you are a homeowner who wants to preserve your gains, the best thing to do is sell now, before prices come down. Don’t expect a bailout from the Fed. Those who want to buy housing should have patience and wait for prices to come down. Powell told people this.

Hmmm….so we’re advising buyers not to buy, and sellers to sell. Seems like something’s off there…

So, Sellers should sell. And Buyers shouldn’t buy. Got it.

There is no reason to think anything in this data or anything in Powell’s public remarks indicates a return to QE soon or even ever. Nor is this ‘carnage’.

Carnage will come soon enough. Booms beget Busts, and Busts beget Booms. Well at least for the last 71 years of my existence.

I bought my first house in 1975 for $16,000.00. $1000.00 down and real estate contract at $90.00 per month. I charged $105.00 per month in rent and had to lower it to $100.00, as the renter threatened to find another house, cheaper. Sold the house 8 years later for $32,000.00. Then I did it again and again.

America is full of millions of these same stories. Kept on buying and selling, building and selling. It sure was fun to be a young boomer. Now I am an old boomer and I sold my last house for a pot of retirement gold.

Again, this is not some kind of magic witchcraft. Just work your butt off, save a little, then put it into a starter house and keep doing it. I love America, well the old America. Obey The Pug

I’m skeptical that Powell won’t return to QE sooner than people think, I have been patiently waiting for a real estate downturn here in San Diego for such a long time. I though it might be the start of some price adjustments during the taper tantrum, but no go, he reverted course and quickly. Then the pandemic QE spiraled real estate prices right out of the stratosphere here.

And when the Fed should have clearly stopped their QE juicing of the economy during the pandemic. When it obvious and clear to any layman or person on the street that price inflation, home prices, car prices, stocks and just about everything else were rising way out of control, why did the Fed just sit idle and continue with their QE on steroids and keep rates at zero? The economy seems, well, addicted to QE to “function” and not go into a recession.

My guess is that as soon as inflation reverts back down to some acceptable level like below 3-4% for a couple consecutive quarters the Fed will go back to some kind QE program.

I don’t think the Fed will have the guts to keep interest rates as high as they need to be for as long as they would need to be for “sticky” real estate prices to come down to even 2019 levels. I *really* hope I am wrong. I’d like them to come down further than that.

“My guess is that as soon as inflation reverts back down to some acceptable level like below 3-4% for a couple consecutive quarters the Fed will go back to some kind QE program.”

But there is no reason to believe that.

One person’s “carnage” is another person’s “return to reality”. The fact that the Fed’s actions and Federal government deficit spending caused huge asset bubbles in real estate and equities is broadly accepted now. The popping of those bubbles is viewed by most people as a positive thing. Sure, if despite all warnings to the contrary, you stretched yourself to the utmost in order to buy a house in June, 2022, it is going to be a loooooong time before you see your home value return to the same level. But the same could be said if you bought in June, 2006. The last real estate bubble took six and a half years to bottom out. If you bought into a white hot real estate market after the Fed had started QT – you have only yourself to blame. And the Fed is not interested in the RATE of inflation as much as the CAUSES of that inflation. And as long as people continue to spend money like drunk pirates, the Fed is going to continue to tighten.

QE better not happen again, ever. It created this mess in the first place.

So goes housing so goes the economy. As the higher interest rates begin to sink into folks that have to sell these vacant homes ad they become more burdensome. Also looks like housing will get some competition from the condo projects that are in progress. Thanks for the update the 2008 low did not hit bottom until 2011 so more to come !

Easy, hoss! the 30YFRM is down from a high of 7.24% in mid Oct to 6.15% currently. The 3-month trend is down and will keep going down.

Once it breaches 5.5%, housing will start to stabilize. At 5%, the decline in prices will cease and will begin a slow march north, al beit not at 15-25% a year.

The spread is shrinking as expected when desperate mortgagors have no customers, but the floor is rising. There’s a bottom, but with a moving target it’s not 5%. Lenders have to make a profit, don’t they?

iMHO we need 12%_15% street rates on a 30 year. Auserity age is going up in France and people are pissed. UK and US will follow suit. This are in crush mode world wide. Reit investors are in for more pain.

No, it won’t.

Cash buyers pulled back hard

No we’re able to find other SAFE investments that keep our CASH SAFE for now

no hurry – didn’t start buying in 2009 until obama landed

As treasuries move above 4% to 5% all the cash buyers will be sitting on the sidelines. They will park the money there and enjoy the ride. I’m rolling all my CD’s over to 4%.

Credit unions now offer 5% CDs.

Six month Treasuries are 4.86% and exempt from state income tax.

Not a good investment in a environment where budget is in gridlock

@joedidee Zactly. Sitting on the sidelines getting almost 5% on 6-mo T-bill with the cash for the house gets even sweeter while prices decline.

Nothing pays like patience, nothing!

Looks like the ugliness is starting to set in. Just imagine how ugly this is going to look when the employment starts to falter…..

But on the bright side, your government has only spent you into about $250K worth of debt for all the things they think are necessary, like wars and supporting millions of immigrants….

Not to mention paying people to go shopping during COVID, whether for flat screen TVs or boats/RVs.

This is the most empty sentence I’ve read in years. Can you give the figures you’re comparing… like money the govenment (fed? states? which states?) is spending on war and the money on war?

Betty, we’ve already given Ukraine 100 billion dollars. DoD gets hundreds of billions if not more.

On the state and local level, a significantly high percentage goes into labor costs which are exacerbated by public union pressure on public officials in exchange for votes.

So we should just let Russia slowly take over all of Europe? Or just half of Europe? I’m sure Putin would never hurt us. He only has the best intentions. Better than our very own intelligence agencies, in fact. 😳🙄

Just like we couldn’t let the Taliban take over Afghanistan or North Vietnam take over South Vietnam. Goes to show what an intelligence agency is worth.

Tina W, do you have any idea how far away Ukraine is from the USA? Setting aside for a moment the ridiculous fantasy that Russia has any interest or intention of mounting a transoceanic invasion of the US (unless your fevered imagination pictures a trans Arctic one instead) there isn’t the remotest likelihood of its success.

Where do such notions come from?

eg – might guess the book, and lingering lessons, of WWII are still fresh in Tina’s view (after all, Stalin was rendered almost catatonic when the Reich double-crossed the recently-old Polish border…), with the added bonus of modern military long-range strike capabilities.

Goober – honest intelligence has the constant burden of being buried beneath governmental political policy, and national hubris based on prior successes (i.e.: ‘fighting the last war’, the Plame ‘yellowcake’ affair). If a nation is fortunate, it overcomes that burden, and does it’s best to rectify those failures, and especially, identifies and rectifies the failures found in its successes. If not, standing back from ‘eternal vigilance’ (in domestic, as well as foreign policy) guarantees, at best, a much higher casualty rate…

may we all find a better day.

Tina, do you really think it makes sense to start WW3 over who rules Crimea? I am sure most of the wold does not want to leave that decision up to our Military Industrial Complex.

Jdog,

With that logic, you just let Putin take the rest of Europe that was part of the Soviet Union, including former East Germany? Putin’s territorial ambitions MUST be stopped. They should have been stopped in 2014, but the West let him get away with it. He counted on the same this time around. And if he can pull it off, what country is next? Take a look at a map. US support of the Ukraine fighting off Putin is the best long-term investment the US made in my lifetime.

I predicted this war in Ukraine would end up as a stalemate. I was correct so far. There will be no winners or losers, only big losers on both sides. It’s time to negotiate a settlement, like we did in NAM. Sending all of the arms will not change the outcome. Many of them are from different countries which will have separate supply chains and will require separate logistics and training. This will not work, and will not make the difference. Putin will throw a million Russians up to age 60 into that meat grinder if necessary. It will be another Stalingrad. Putin will eventually win. Putin wants a warm water port for his navy in the Black Sea. That’s what the war was all about in the first place.

another old dog howling at the moon. it’s a lot more fun to be a wolf.

Most people don’t care, because future generations will have that burden on their shoulders. To those children, Its like being born into indentured servitude, because current generations saw never ending credit as a way of life.

NAH carfan:

”Future” generations will know better than to honor contracts entered into by obviously corrupt folks.

Many such contracts will be voided or at least Avoided as they should be.

Much if not all of this current ridiculous type of so called derivatives will eventually be abrogated.

Only real challenge for WE the PEEDONs will be to go on with our lives, as ALWAYS, or at least ALWAYS in what our HIS AND HER stories tell us from for ever, SO FAR.

BTW, someone recently posted we have now attained $250,000.00 DEBT per person, or $900,000.00 per family; that is so absurd that anyone with any common sense realizes that DEBT will never be paid back, eh???

There is an old saying that nothing matters… until it does…. then it matters a lot. People who shrug off the real danger of out of control government spending are simply denying the reality of the consequences. The bill is coming due, and it is going to impact each and every one of us to a much larger extent that it does today.

It is not just future generations. Your rapidly increasing cost of living is a result of it impacting your life now.

Supporting millions of immigrants? Keep on drinking the Kool-Ade. Immigrants work harder than any American does and they take jobs that Americans refuse to do at any wage.

Interesting.

Does your comment apply to immigrants who are Americans, too? Or just to the knes who aren’t?

I’ve heard this argument ad nauseum and it is not true. Pay someone enough to earn a living and they’ll do the job. That’s a fundamental rule of labor. Companies are too cheap to pay the labor costs so they cheat and steal and lobby to bring in more immigrants who live ten people in a house.

America has the right to have secure borders, just like every other country. I don’t see those other countries who are sending their immigrants here allowing immigrants into their country.

But for some reason, if America doesn’t do it, we’re racist.

Jon – …yet we continue to want to have it both ways…(enforceable card-check an energized fourth rail, voltage reduced or increased (depending on viewpoint) by the export/automation of ‘average’ ‘Murican jobs, but not much export of that surplus ‘average’ labor…).

may we all find a better day.

Immigrants are also essential if we don’t want empty produce shelves across the country. I’m not sure about the middle aisles.

Tina W,

You are under the delusion that produce must be picked by low-waged people. Meanwhile, those of us in the lower 80% of this country will continue to thank you for your concern for your fellow citizen.

Yep!

There is no such thing as a job people refuse to do at any wage. Ask any septic pumper if he enjoys his job, then ask him how much he makes, and you will understand why he does it. Labor like everything is a question of supply and demand, and when you artificially pump up supply by allowing massive migration you lower demand and therefore lower wages across the board. Every action has an equal and opposite reaction.

Jdog I agree that immigrant labor only temporarily reduces prices. When enough of those folks start shopping for condos and eventually single family homes (which they do, because they work hard) it reverses our downward price trend. A lot of those “crap jobs” are experiencing price discovery as we’re seeing now. Makes me wonder, will inflation be tamed by increased labor participation or by unproductive companies going out of business?

Great trend, still a long way to go for SoCal, feels like we’re not even at the first inning given all the price listed in desirable SoCal areas…if this is the best market can do, then it’s disappointing at best. Hopefully this is just a function of time and market won’t pivot anytime soon.

It will be really interesting to see what the Spring season will look like and if the demand that MSM like to tell people will come back in busy selling season

That “Great trend” is called “reversion to the mean” and it will be hell to pay for all the asset bubbles. Bernanke still believes that those statistical laws do not apply to central banks with a printing press, and apparently someone gave him the Noble Prize for thinking that way.

I don’t think anyone, including the Nobel Committee, actually thought he was deserving of the Nobel prize. I think it was more a way of shoving their thumbs in our eyes. Much like giving Obama the Peace Prize in 2009.

The Nobel Committee did not give Bernanke a Nobel Prize in economics because there is no Nobel Prize in economics!

Svenska Riksbanken, that is the central bank of Sweeden on the other hand did give Bernankee

“THE SVERIGES RIKSBANK PRIZE IN ECONOMIC SCIENCES IN MEMORY OF ALFRED NOBE”

And that is not a Nobel Prize. It is a hounorable price handed out by a central bank. In this case to the head of anothe central bank.😉

In my hood in socal I am already seeing prices down 15 percent or so.

I think so cal would fall hard in due time

I am a home owner by the way and not looking to buy anything

I’m in Mission Viejo. A home 3 houses down just sold for cash of 1.3M to a Chinese buyer. It’s a big house (2900sf), and from a $/sf perspective it’s a fairly big drop ($450/sf vs $650 last year). The buyer apparently just moved from china 6 months ago and does plan to live in it.

That said, these bigger homes in the area tend to sell at a discount on a $/sf range. But that will be a comp that most people in the area won’t want to see. Two places on the same street sold last may for $900/sf and $650/sf.

Most people would list my home around $1M, but at that $/sf it would be $815k (which is still higher than it’s worth).

For the most part prices in this are are still ridiculous and on par with last year, but there does appear to be some downward movement. Very few people who actually live in this area could afford the payments for a home 60% of what they are priced at. Either these prices will come down hard over the next couple of years or the makeup of this community will be utterly changed from middle class to very wealthy.

“But sellers are not wanting to price their homes right.”

What I am personally seeing on the ground is that sellers are trying to find a bag holder first and see what happens. If no one bites then they lower the price a bit, but after 90 days on the market buyers smell blood.

Unfortunately that’s human nature, sorta like former beauty queens in their 40s and 50s who are looking for Prince Charming, simply because they listen to their social media friends that they deserve everything and “should not settle.”

Home owners are acting the same way by listening to their agents, until both groups end up lonely or bankrupt.

Florida, every single house has a price reduced status, but most of the price reductions are like $2k. It’s not moving the needle yet. I see houses on the market 100+ days now though and my only thought is mold, water damage, strange smells, bad foundation, or something else very wrong. In reality it’s probably just morons hoping to get that bubble price after the bubble is long gone.

Side note: Developers keep “developing” yet quality of life continues to go down. Maybe having just 1 more strip mall with a grocery store and chain quick-casual restaurant will make everyone happy. Never mind the 90% abandoned strip mall over there, that one doesnt have a fancy faux-stone facade. What we need is to mow down some more trees and flatten the land to pave over.

Too many areas are a collection of strip malls masquerading as a city or town. We are so over retailed its absurd.

True. Today we drove to our favorite Subway for lunch…which entails driving past another Subway along the way.

You’re spot on about the morons. In the area I’m looking at, everyone seems to think their home is worth at least $400k, when two years ago it was priced at $200k. Many homes are sitting on the market for over 100 days with little or no price reductions. I can wait it out, but it’s going to be interesting to see how long this seller denial lasts.

In Florida, people seem to be convinced that because of permanent “work remote,” that there will constantly be a steady supply of people with New York and D.C. salaries migrating to Florida such that prices can only go up.

People said similar things back in 2007 by the way.

I challenge your Florida “this time is different” thinking and one up you on SoCal (LA/OC/SD) version of “this time is different + this area immune + it’s the weather” mentality. I have a feeling Florida version is much more tame by comparison

Phoenix_ikki, you must travel in my circles. I hear that rationalization nearly daily.

Home prices are set ar the margins

People who don’t have to sell won’t sell.

But some people may he forced to sell and these sales would fix the price of other homes in the neighborhood

Some are Ian causalities.

Yup – I got one. :-(

“Home owners are acting the same way by listening to their agents, until both groups end up lonely or bankrupt.”

Or, lonely AND bankrupt…at least they have each other, even if its a pyrrhic “togetherness.”

Please point out on the doll where the female hurt you. Every comment you make always has some sort of demeaning slur towards women.

You are right about one thing, women should not have to settle for you!

The ex is probably glad that she’s finally rid of you and your attitude.

Dr. Christine Blasey Ford, is it you ?

Sounds more like Andrea Dworkin.

INS – would observe, when looking at all genders, a sense of entitlement is where you find it…

may we all find a better day.

Spot on. I keep seeing those price reductions, “contingent”, “off market”, “back on market”, “new listing” for the same house over and over. Hoping some desperate buyer will go for it. Just shows how desperate listing agents are for that commission.

Just price the house fairly and move on with your life.

How do you fake a contingency? Because there is this turd of a McMansion in my area with a view of Costco and a road two feet from the front door whose owners were too absurdly greedy that they couldn’t even unload it during the times when anything sold at any price. Now I’m expected to believe they magically found a buyer in December that is going to pay above their most recent asking price!?!? Last time they did this – about six months ago – they came back with a higher price than their most recent listing. And what kind of lowlife realtors are they working with?

Realtors are going to have to work a little bit. The days of signing up a seller and the house being under contract in 1-3 days is over. Let’s see how many realtors are still realtors in a few years or even months.

(Oops, I forgot the pretentious registered trademark sign that you are supposed to put after saying the world Realtor)

Show me on the doll where the realtor hurt you.

On the back of my butt, where my wallet usually resides

Lot of wisdom is this statement. Well said. Couldn’t agree more!

The older homes are really a bad deal at today’s overpriced levels.

Not only do you have renovations to update the home, you have problems from mold/mildew, window issues, roof and gutter work, cement/driveway issues, overgrown or unsightly landscaping, electrical plumbing, etc.

The initial purchase price breaks your back, the other issues bleed, and the then the dropping home value and job change puts a nail in your financial coffin. In 5 years, there will be lots of people crying in their beer, wishing they never watched HDTV, surfed Redfin, or heard of AirBnB.

Renting a home or apartment is a magnificent idea at this time.

New homes are a worse deal. They’re made of cardboard and plastic.

Let’s staple Tupperware to the outside of new homes and see if people are stupid enough to buy it.

Yup. Barnum was right.

You ever see the fit and finish of some of these gigantic multi-family complexes going up? I hesitate to even call it fit and finish.

Not to worry, prospective residents are dazzled by the granite counters and the vinyl flooring (Errrr, I mean wood)

crazyt – over 70+ years, I never fail to be impressed by the sheer marketing power of cheap, and soon-to-fail, flashing lights on sticks…

may we all find a better day.

That’s *Luxury* vinyl tile. Hahahahaha…

“The older homes are really a bad deal at today’s overpriced levels”

I don’t know about that …… I wouldn’t go near one of these desperation new home builds – just imagine the corner- cutting the builders are doing on these stapled together gems as they try to unload .

I’d take a well-built older home in a second.

Tradesmen here. Just yesterday I had a long time client question my billable rate. He owns several apartment buildings (where he has jacked rents up with the pandemic above what his working class tenants have seen in earnings increases…there’s no secrets here, these tenants tell me everything!). My rates are raised as needed, based on what my real costs are. I said, “that’s a 2011 work truck sitting outside that won’t pass inspection next time around. It used to be a less than $40k truck and now it’s replacement (which I’ll note does not have much technological advancement on the old model) is $60k”. He said, okay I understand.

FYI work is not slowing down for me. On the residential side I largely stay out of new construction (which makes me an oddball since everyone and their brother was chasing big money). But their work is slowing down. And while they were ignoring existing clients I have been picking them up. And as things slow down I’m seeing many more subs available to handle the increased work load.

This ain’t my first rodeo – third boom and bust of my working career. I’ll take slow and steady any day.

I like the cut of your jib.

Digger Dave

Nice summary of the SOTU in construction / remodel.

Can I ask what market (State / City) you are in ??

I just read on politico that we are at a 50 year high on apartments under construction. Where I live about an hour from Raleigh residential single and multi-family is booming.

Tech employment in Raleigh has been up 22 months in a row. If we crash land, there are too many projects underway. State has gotten very business friendly the last decade and went to a flat income tax and keeps chopping rate. It’s under 5% now and going lower I think to 4.75%.

“I just read on politico that we are at a 50 year high on apartments under construction.”

Don’t you read anything here?

Posted on January 19 — two days ago — with charts too:

https://wolfstreet.com/2023/01/19/residential-construction-splits-multifamily-starts-in-2022-jumped-to-highest-since-1980s-boom-single-family-starts-dropped/

Touche. Lol

If Old School is anything like me @ late 70’s, he may have read it, but can’t remember that he did. LOL!

@Anthony A.

Regarding your comment below, too funny!

I wish Wolf would write an article about what’s going on with existing home prices.

🤣

My coworkers who have recently gotten into bidding wars for apartments less than 1/2 the size of my house, while paying 30% more than my mortgage, would disagree.

Bidding war recently ….

Truly said.. a sucker is born every minute 😍

A couple decades ago I visited a new retirement complex of single family homes in the Boynton Beach, Fla. The home of the relative had just moved in. Every single door wouldn’t close properly. The cabinets were all mounted on an angle and the doors wouldn’t close. The whole house looked like it was built with cardboard. I couldn’t believe that anyone from NY would move down to Florida and buy a piece of crap like that. Most of the houses in Florida are built just like that one.

If you take Amtrac down to Fl and look out the window. All you see is one slum after another.

Builders in NW Montana are still fully booked for the entire summer. I called 10 concrete foundation contractors and only 3 returned my call. Their quotes are still high. Maybe by Fall 23′ things will slow down here.

You have 10 foundation contractors in NW Montana? I was a custom home builder in the PNW for 30 years and I wasn’t aware of any “foundation contractors” in my area. We always did our own foundations.

Two words: frost depth.

Coastal Washington frost depth is zero inches. Literally.

— your local neighborhood Nigerian Prince

It’s 18″ actually in my County -Western WA. Most of our foundations are on steep slopes so they’re a lot of work, but not exactly rocket surgery.

In Minneapolis, the rule of thumb is 48 inches deep for support.

Twenty years ago, my wife and I built a new front deck and stairway to our home. Rented a one-foot wide post digger, and set up a few cement holding tubes four feet into the ground at the deck’s perimeter. Poured the cement columns inside the tubes and built the deck on top of them. So far, so good.

Older homes need maintenance, but if the foundation and framework is in good shape, it’s a good option. Most of the homes on my block are a century old, or close to it.

Unless Powell caves to political pressure as he did under the previous admistration, I think this summer will be a blood bath for RE.

From what I read at the time, he was directed to lower rates or be fired…leadership at the time wanted negative rates. Could happen again.

Yeah, well, that makes him a coward. He should have said “If you want to fire me, go right ahead, but my name will not be on what you want me to do.”

That’s right. And it doesn’t bode well for his alleged courage in the near future if anything at all shows signs of breaking–even things that should break.

Powell showed his strength when he tightened 75bp right into the election. The dems must have been screaming, but he remained on inflation watch.

I don’t know what Trump had on him. Perhaps he was convinced the covid lockdowns were a severe enough deflation event that he needed to accomodate.

Interest rates fell one year before Covid-19 hit when Trump was president. I always thought it may have had something to do with Trump’s real estate holdings.

TRT – referring to the previous executive’s non-blind-trusted preexisting ‘core’ business, nay? (…when everyone’s interested, how could there possibly be a conflict?).

may we all find a better day.

He caved into Trump before the whole Covid pandemic.

Trump was and is an economic illiterate. This inflation started on his watch. Powell should have told Trump to go pound sand and kept increasing interest rates. We would not be in the mess we are in now if he had done the right thing back then.

And what did he do to “Drain the Swamp??? absolutely nothing.

Your comments…just wow…sort of reminds me of comments from ZH or housingbubbleblog…just wow

You seem to be rather short on historical knowledge and a basic awareness of how politics works.

Apparently you forgot when Bernanke went to congress and decaled “we will not have an economy on Monday” unless TARP was approved and he stuck the taxpayers with the bill that the banks should have paid. Same story with Powell.

When banks and businesses need to create panic and get bailed out this is how they do it.

There is a house in the Seattle area that was listed for just under $1,000,000 that the seller took off in the fall. It is now listed for rent for just under $4,000. Purchasing that house with a 20% down payment would have made the mortgage close to $6,000. Why would anyone tie up $200,000, pay an extra $2,000 a month, and have to perform the maintenance themselves? Waiting until the calculus makes more sense to buy seems to be the best move.

Because math is hard and greed is easy

Good line…I’ll be stealing it in the future…

That sums it up so well! Perfectly put.

You’re assuming they only put down 20%. With an all cash, that’s 4% gross. Mix in the tax benefits, and a pinch of hopium that someday it will be worth a lot more and/or generate a lot higher rents and POOF, you got someone thinking it makes sense.

Gattopardo & Josh

You are both pretty much right. Even with a cash purchase (as you (Gattopardo) state – the margins are dismal. For SFH rentals, this S*** needs to drop 60%+ and/or rents need to go up 60%+. I fear the era of the SFH rental is a goner.

Very few people who actually have a million dollars in cash will want to tie it up in a house that *may* throw off four percent, in a visibly sinking real estate market, when they can get four percent risk free in Treasuries or CDs. Neither of which will call them at 3AM with a plumbing emergency.

It still doesn’t make sense. 4% gross is strictly on the purchase price. You haven’t factored property taxes or maintenance. Yes, they get a tax benefit, but if you’re renting it out, it’s not your primary home, and so the amount of depreciation you can take each year as a passive loss is limited. And that doesn’t include the hassle factor of being a landlord (something that first-time landlords severely underestimate).

All this for a *possibility* of capital gains in a few years, with a strong *probability* of significant capital loss in the short term? You’d be better off buying some dividend yield stocks currently down on their luck; your dividend will be higher than 4%, your hassle factor will be a lot lower, and your chances for capital gains are probably the same (if Powell lowers interest rates and/or stops QT, the stock market is just as likely to go up as real estate).

There is a difference between investing using real numbers, and having the unshakable religious belief that RE is the holly grail to wealth.

For one person to make money on a deal, another person has to lose. I can remember a time when everyone understood that and behaved accordingly.

guessing you did not get the memo re: win win win JD…

Better luck next time, or, more in tune with reality, better actually that pre-nup, ” pre contract due diligence,” etc., etc.

Reality is NO ONE needs to ”lose” in any contract for RE sales or any other type of contract controlled transaction;;;

IF<<< and only IF WE, do the due diligence and either sign a contract that is good for all parties, as some have done for ever,,, or just stand up and walk away, as some singer suggested in the last few decades.

What the memo actually said is there is really no such thing as win/win.

If there were, we would not have worst wealth inequality of the developed nations. When 10% of the population own 70% of the wealth, you have a whole lot of win/lose, and very little win/win.

The system is designed to keep the plebs making payments their entire lives while accumulating very little real wealth. What wealth the do amass, is usually eaten up in medical expenses and inflation in their final years.

Josh or any Seattle residents

I checked with Vpike.com to see if the house I lived in in Seattle in the early 70s was still standing. It was on Capitol Hill, on Summit Ave E. From the street scenes I couldn’t recognize anything. What the hell happened to that neighborhood. It looks like is all Apartments now.

SW Florida homeowners have been putting hurricane damaged houses on the market. Probably some flood damaged cars at some auctions. There are waiting lists for roof, lanai, and other repairs. The local hotels are full. Active listings in my area are the highest in months. Vacant lots remain vacant. Plenty of land, not enough skilled workers.

More tech layoffs in the news. Wayfair cut a thousand and Google cut ten thousand.

Don’t let these overhyped tech layoffs fool you. Tech companies do layoffs every year, while the left hand is hiring thousands as fast as they can. They are constantly trimmin off failed initiatives and trying new ones.

Keep watching wolf’s consumer spending articles. That’s all you need to know the economy is running fast, for the time being at least.

Harrold, these layoffs are different (this time it is different?!?). As you said many tech companies (most famously Amazon) do fire employees every year based for performance reasons. However, the numbers this year are much higher and they are combined with hiring freezes. Many companies are giving out 4+ months of severance so I don’t see them starting the hiring cycle again at least during that time if not longer.

But I do agree that until the layoffs spread to other industries, the spending number won’t suffer too much as tech is only a small part of the economy.

The BLS has monthly net job changes for every metro and state.

Not company-level granular, but helpful in determining if layoffs are mere churn or trends.

However, tech seems to be a huge percentage of second home online cash buyers, from what I can tell.

As Wolf mentioned in an earlier article, those announcements of layoffs represent reductions in the global workforce, yet maybe a fraction of those jobs are American workers. That would be the equivalent of GM announcing they were laying off 20,000 people in their global workforce, yet if all those jobs were in China and Mexico it would have no effect on the American workforce. Also, people forget many tech firms like Google, Facebook, and Twitter are media companies that rely on advertising to pay their bills. Yet with inflation going through the roof, it has sucked up all the ad budgets for a ton of companies, and as a result this income has dried up for these “tech” giants.

I work for a tech giant like Google.

Also I am an ex Google employee.

I have seen it many times in many big companies..

If company is laying off employees to cut cost they won’t cut much in cheaper location e.g. India

Most of the cut happens in usa as labor is expensive.

Also companies like Google lay off people even during good times for many reasons but they are smaller in number.

Shouldn’t have moved here if they couldn’t handle the weather. That storm was a joke. Two counties got a bath. Big deal.

‘Probably putting some flood damaged cars on auction’… really, you think? Nah. No way. Hmmmm. I have seen some of them! And you know, I looked and didn’t see anyone forcing me to buy a flood damaged car… so I didn’t.

‘Plenty of land, not enough skilled workers’… Seriously, you must be related to carpet-bagging Rick Scott. I take it you want a few more million to move here in the next couple of years. And don’t start this everyone is from somewhere crap, I’m multigenerational.

That statement epitomizes everything that is 100% wrong in Florida. We sell a dream of beach living, seeing a cartoon character mouse in the afternoons and ‘freedom’ and free golf for the rest of one’s life because why not, but meanwhile a drive that took 20 minutes two years ago takes an hour now. But by all means, let’s get some ‘skilled’ workers for more houses for even more people to move here, to cry foul about storms ultimately to bilk FEMA cause their SW Florida crapshack is missing some Spanish tiles.

The bubble has popped in Florida. More northerners will become halfbacks because insurance is unaffordable. Not because of hurricanes (new and updated housing stock did well), but because of the roof replacement fraud which the Republican controlled legislator refused to fix. I feel like I was the only one in my neighborhood that actually paid for their replacement roof. A name stormed starts at 35 mph. Once one person in your neighborhood wins a lawsuit everybody wins. Insurance companies pay attorney fees for both sides. Major law firms were vertically integrated Adjuster to contractor. A huge business. Now homes are discounted for a roofs which easily cost $50k and take more than a year to get. The DeSantis leadership sold out to two election cycles. 2024 will be interesting for the climate change denier.

Low lying areas of Fort Myers and near Estero Bay flooded. Older houses were not built on stilts, nor were they built on an additional six feet of sand. Many of these older homes have been abandoned. Some trailer parks are ghost towns. No car in the driveway, nobody home. This also happened in New Orleans after Hurricane Katrina flooded the lower neighborhoods. People moved to Houston.

After Hurricane Andrew in 1992, Florida amended its mobile home building code. The newer mobile homes are sturdier. Thinking older homes are better might be a blueprint for disaster.

All across America the number of new homes under construction is at high levels, especially areas of high population growth like Florida.

Cry some more. You don’t have a right to freeze your state/locality in amber as you remember it through nostalgia goggles. Long commute times? Expand the highways, pay for it with tolls.

Preface, I believe it’s a bubble. But geez is the NE not believing it and still buying at these prices. Too many idiots in my opinion.

Very tough to stay patient. But I guess it’s not really patience when our family can’t afford a house.

@George: FWIW, the first two houses I bought were both foreclosures following runups, then crashes. Waiting a little longer might get you into a home you can be comfortable keeping.

Question:

Is it that you can’t afford a house or you can’t afford a HGTV house?

Before you snap and start with the ok boomer stuff, I’ve read several articles regarding the refusal of young people to buy a home that isn’t TV show ready…. with all the amenities they desire – which greatly reduces the “affordability” as Formica is far less expensive than solid surface. As such, it’s not a “geezer” thing… it’s a legit question.

Our first home was a POS. That’s how I learned how to fix stuff. I lived in a neighborhood of tradesman and we all helped each other fix up the houses. I didn’t know jack about most, if not all, construction trades, but I could be a helper and translate that learning into fixing my own. A HVAC tech let me use his discount to buy the furnace and A/C equipment… my brother in law (a body man) did the tin work. I set the units and pulled the wire. An electrician neighbor checked the wiring. The gas company did the final connection. The HVAC guy did the startup. Baby boy’s heat rash cured over a long weekend.

Good One EK: (as usual for your very helpful comments on Wolfstreet.com)

Had our tankless electric water heater go out recently, and the neighbor union electrician down the block came and did his magic. When I tried to pay him, he said nah, just bring me a 12 pack… Of course I found 2 cases, eh

Been trying for years now to help folks understand it’s NOT going to be how much gold or anything, even bullets that will get you through what’s obviously coming to everywhere USA and GLOBAL,,,,

it’s the LOCAL COMMUNITY…

Maybe wife does not let him buy beer. So that’s his workaround.

VVNV – this. Certainly not at Florida levels, but have been working to impart (with varying degrees of success) the wisdom of your last paragraph to the numbers of SilValley refugees moving into our rural NorCal area. Our recent ‘unprecedented’ (only if you are under 35 or have moved here in that period) three-week storm siege has given many ‘Community religion’.

(‘Rugged Individualism’ only seems to flourish when founded on a society of general cooperation…).

may we all find a better day.

My grandfather was a German prisoner of war in WWII. After the war they had to rebuild Germany and they all worked together. Nobody was sitting in a bunker with gold and ammo protecting their tomatoes. When he died back in ’91 there was a line as far as you can see to pay their respects. Does post WWII Germany qualify as a collapse?? Doomsday preppers need a serious reality check.

I agree with what you said, but with a reservation. Where you live is going to make a huge difference if there is ever social breakdown. The composition of your local community is going to make all the difference. If your community is basically comprised of moral and ethical people, you are going to be OK. If your community is comprised of people with questionable ethics, and already has crime issues, then you are going to have a much harder time. Desperation causes people to abandon civilized behavior, and places with lots of population, and little resources are where desperation is going to be very bad.

“Before you snap and start with the ok boomer stuff,”

Sorry, but you’re asking for it with these out-of-touch fantasies. It’s not 1955 anymore. All houses are astronomically expensive, even the small ones that need to be fixed. Even the small ones that need to be fixed and are in neighborhoods where you’re likely to be shot on the way to Home Depot.

Yes, it’s not that I don’t WANT a fixer-upper, more so that I refuse to pay nosebleed prices for utter garbage in order to cash out some boomer’s retirement.

Around here it is $600k for a dumpy 3 bedroom ranch last updated in 1980. Median household income is $120k. Nice 4 bedroom colonials are $800k. Doesn’t add up.

Ok boomer…

Sorry, just had to say it :-) The reason those amenities are now becoming commonplace is because the primary cost of a house these days is the land and the construction cost. The actual fixtures, be they flooring, appliances, cabinets, etc. is pretty small.

The difference between all those “extravagant”, tv-worthy fixtures vs plain formica and Sears home appliances is maybe $50k. If you’re buying a $200k house, then yeah, that’s a significant discount. But if that house costs $1mil (due to location, land value, and construction costs), then tacking an extra $50k for nicer fixtures isn’t really breaking anyone’s bank, and you might as well if you’re going to be dropping a million on the place anyway.

It’s the same reason why high end options are standard in expensive cars and are optional in cheaper cars: the cost of the option is the same, and in an expensive car, it’s a much smaller proportion of the overall cost, so most people would rather have it.

That said, IMHO, my main beef with all those shows is that it makes rehabbing a house look easy, and so lots of young people think they’ll buy a rundown house and turn it into a TV-worthy place with no problem. I actually spend most of my time convincing my friends *not* to pursue a home renovation, and just buy a house with everything you need. Otherwise it’s like “Really? You have 2 young kids and you think you’ll be fine having half your house unusable for 6-12 months while you knock out walls and have contractors running power tools all day?”

Back in the day, I used to watch This Old House on PBS. In that show, Bob Vila would take *one* house and do a gut renovation for a whole season, going through every part they did in detail. Nowadays, those execrable HGTV shows will take 3 or 4 houses and do full gut renovations in a single episode, conveniently skipping the phase where the owner of the house can’t relax or have any peace and quiet, or even has to temporarily move out because the house is basically unusable. Is it any wonder people who watch those shows thing a “gut reno” is something that they can just snap their fingers and be done with in a couple of weeks?

Lune – well said. Have found (from miserable personal experience) these shows responsible for unimaginable domestic strife thanks to their utterly unrealistic presentation, esp. from those near and dear who have never hefted a hammer or run a saw…

may we all find a better day.

In the area I follow here in SoCal

There were 61 pendings through January 16th last year – when mortgage rates were in the low-3s and we were in full frenzy mode.

Through the 18th, this year there are 62 new pendings !

I havent done a detailed analysis yet but a quick glance shows that they seem to have sold at all time highs prices +/- 5%, this is the data.

My area in socal is similar, but cracks are starting to appear. See how many of those pending homes fall through and come back in the market.

Also, I think we are so early in the stage of the housing turn that we are just getting a lot of dip buyers. Prices down a bit, they have some money, rates coming down a bit, they’re jumping in thinking prices might drop a small amount over the next year, then off to the races again.

I’m quite confident they will pay a big price for getting in right now.

Until job vacancies disappear (markedly drop) there will not be a bunch of unemployment….the demographics just don’t support it. 10K boomers per day age into social security and a lot of them dropped out of the workforce and aren’t interested in coming back! Obviously I’m talking the well off seniors but they are the ones whose positions aren’t getting backfilled by younger, less experienced, cheaper people.

In 15-20 years there will be a glut of 2nd and 3rd homes for sale as boomers die out, before they die I think they retire. That many people leaving the workforce at one time then dying?! Welcome to the new normal.

Earnings per share will drop in the recession to be sure at salaries bite , input prices spike, and consumers pull back…but I don’t think we necessarily see an employment bust ….at least not for full time middle to upper middle class workers.

Really, the Boomers should have long since dumped a lot of homes on the mkt (earliest Boomers hit 65 in 2011 and 67 in 2013) but for some reason the Silver Tsunami never really occurred.

Would like to hear theories why.

Why would boomers “dump” their homes on the market? Boomers are now between 57 and 77. So let me give you a clue, per SSA actuarial tables:

“Life expectancy at birth” is not the same as “life expectancy at 77.” You’re thinking about the prior generation. And yes, they are selling, or their survivors are selling.

If you’re 77 today, one of the first and oldest boomers, your remaining life expectancy is 10 years for a man and 11.7 years for a woman.

If you’re a mid-boomer, you’re now 67, with a remaining life expectancy of 16.7 years for men and 19.1 years for women.

The late boomers, now 57: men have 24 years left, and women 27 years. They’ve got 10+ years of work ahead of them.

Why would anyone with this much life left dump their home on the market? Where would they live??? On the streets? Well, lots of boomers already live on the streets.

Boomers’ turn will come eventually, but not yet. Maybe in 15 to 20 years, you will see the large wave of boomers selling homes that you’re dreaming about.

SO true, as usual Wolf:

Reminded me of when I first looked at the actual actuarial tables ten years of so ago and was absolutely Schocked, Shocked I tell ya, to find out that even with all my challenges, I had to put up with this ”VALE OF TEARS” for SO many more moons…

Tried to stay out of trouble after that, but, being a guy, I can only try knowing full well it won’t happen..

Please Keep up the good work!!!

Wolf,

People used to retire and downsize.

This is not a radical concept…it was the consensus prediction 20 years ago.

cas127,

But that’s fake math. If you downsize, you sell one and you buy one, and there is no impact on the overall market, other than churn and Realtor commissions coming and going. It’s only when you sell and don’t buy that you add a unit to the market. This happens when you sell a vacant home, vacation homes, second or third homes, etc., of if you move into a nursing home or die.

“77 with 10-12 years left.”

Good lord are people actually this healthy now? I’m still young by this metric, anecdotally; I’ve never had any family member live past 70 that I’ve known. Most make it to 65 and at that point they’re likely wishing they were dead with all the ailments and diseases they’re dying from. All the others die between 45-60. I’ll be hitting 30 very soon and I’m already feeling the collapse compared to just a few years ago. Genetics are really something else. My parents are in their 50s and they’re both living with multiple diseases and major health problems.

I guess social security at 65-67 isn’t a scam after all. :Shrug:

Hey, I’m that 60 year-old boomer. Body’s been rebuilt a few times, but still riding fast enough every day to stay ahead of Father Time. He will catch me sometime, but until then …

“You got to keep on moving to keep on moving.”

Thank you Wolf! I’m a 70 year old in California who occasionally thinks about ‘downsizing’ but when I look at what that means and I realize it make little sense. I have a 3 bedroom 1400 ft sq house in a quiet neighborhood and pay a little under 4k in property tax. I have no mortgage. The only reason I consider downsizing is I have a pool and at some point the maintenance will be too annoying. Other than that, where am I going to go and pay less in property tax? If I have 18 years left I might as well stay put.

Trucker Guy, I’m 79 and still playing good golf twice a week. And I also walk about 10,000 steps per day. And my foursome is full of guys over 70. Yeah, we as a group are doing pretty good.

Wolf: both you and even more so the person you are responding to are not accounting for the leaps in radical life extension we are probably about to experience. Death will be forestalled for a long time for a lot of people.

I mostly agree. But people in their 80s often downsize from a larger home to a smaller one, or move into a nursing home or their children’s home where they are taken care of for the last few years of their life. So only slightly more houses come onto the market for the downsizing. But also, more larger houses become available and fewer one level ranches or condos become available as people downsize. So the larger (more overpriced) houses may be affected sooner.

It may made more sense to load the asset, real estate, with debt than sell it.

Take the money, spend the money, continue to live in the house and let the bank take the risk on future price.

As long as cash flow is managed till the end, going down underwater in debt is no problem. Debt stay in this world…

“As long as cash flow is managed till the end, going down underwater in debt is no problem.”

LOL That is a huge stipulation. In the case of home ownership it requires 30 yrs of no serious economic calamity either personal or otherwise. The past 50 yrs have not been normal, and I would not bet the farm on the next 50 being similar.

Jpup:

IN very very clear FACT,,, there is NO ”normal” anymore than there is any ”average” ,,,

Outside of statistics

OK, also outside of the dismal science that is anything but a ”science.”

Tea leafs are probably more accurate AND precise than either!!! LOL

There are lots of reasons people aren’t downsizing:

-Assisted living and senior complexes are overly expensive. Staying in your home actually saves money. Plus, for many people, it’s like putting one foot in the grave.

-Stress and exertion of moving.

-Extra space encourages visits from family and friends.

-Unused space doesn’t really cost anything, unless housing prices are in a long-term downtrend.

-House cleaning and landscaping services are reasonably priced and readily available.

-Snow-Birding is very popular with many people.

Like I said…”in 15-20 years there will be a glut”. The heirs will NOT keep all their parents’ homes. The upkeep and property taxes I think would be prohibitive. They will sell at any cost to get the cash.

The question becomes who will the buyers be? Who will the new cohort be that needs the same number of multiple homes and have the ability to pay for them? Do you expect the dollar to still be strong and for interest rates to still be low to facilitate new buyers’ mortgages??

20 years is a long ways off. Maybe starting LAST year there was a another baby boom and we’ll have new buyers for our homes and our parents’ homes in 2045!!

best of luck to us

Accepting these data fully, there must be striking regional factors at play.

Here in Philly, prices have moved down some but not a lot. I went to an open house the other day at what seemed to be a fairly priced 4 BR in the area’s best school district. Well, I attempted to go but the place looked like a Grateful Dead concert. People on the front lawn, the back lawn, leaning on the trees, a parade going in and out. It went from active to contingent in 24 hours.

When I compare this to SF, it must have to do with the employment outlook. Our biggest industry is really healthcare – which will not be laying off anyone anytime soon. So here the market seems relatively strong, at least for now.

Good luck going forward.

Same here in Portland, Maine. There are some price drops, but those are the late 1800s houses that have never been rebuilt, seemingly hoping to attract a flipper. Anything turn-key is still a race to see, race to get an offer in, etc etc and can go for 15% over asking, even though the asking price is still up 25% from 2021. It’s like interest rates never rose from sub-3%. I’m not sure what’s going on, but continuing to rent makes more sense than ever to me right now… despite never being more ready to buy.

Per a Google i just did, per Redfin:

Philadelphia home prices, December 2022, down 3.9% year over year. Median price 245k.

I’m surprised the median is that low.

Its not cheap to me for sure.

I rent in eastern Washington State.

Spokane Valley median sold price December 2022 at 390k. Coincidentally also down 3.9% YoY.

Philadelphia has more humidity than Spokane (i lived in Ohio and New Jersey) but otherwise I probably would give Philly the edge over Spokane weather wise. Philadelphia only gets about half the amount of snow, and definitely has nicer falls.

Spokane doesn’t get many drenching rainfalls though which is a plus. Again less humidity in the summer but last 2 years we have had 19 days with highs at 100 or above and over 90 days with highs 90 or above. Per accuweather website. Last six years summers on average hotter and wildfires throughout the Northwest.

FWIW.

@Randy: Is the smoke really bad during the fire season? We were in northern Idaho a few Augusts ago and could smell it even that far east.

Smoke in San Fransisco was pretty bad for few days with forest fires around the area. This also happened during covid lockdowns when city was totally empty, not even cars around.

Wolf posted here few pics that looked like from Mars (red planet). But pics do not really capture it. With empty city, smoke, and red sky it was like from Twilight Zone.

Clete – always remember that fires in the wild have little respect for state lines (former Newman Lake resident, here, recalling the fires of ’90…).

may we all find a better day.

North Idaho gets the smoke from WA, OR, NorCal, ID, and some from BC. The only place worse for wildfire smoke is Montana. Especially West of the divide when the smoke gets trapped endlessly. This last year wasn’t too bad but normally it’s an endless blanket from July to September.

Granted I live in the area so it’s more of a comment to my stupidity but I have no idea the allure of North Idaho.

The people are mostly all smarmy yuppie far right militant Californians and the ones that aren’t are bitter natives who are mad at the world, the winters are rough, the roads are horrible, the utilities suck outside of the CDA area, housing is utterly detached from local wages and rents are like living in downtown Atlanta, local wages suck, taxes and expenses are high, CDA has outgrown the infrastructure, and there is a month or two out of the year where it isn’t cold or covered in smoke.

I guess it’s scenic. That’s about it. You’re much better served by living in Washington. You’ll save a mountain of money. Unless you just have to have guns, there’s no reason to waste your time living in North Idaho, other than that, Idaho is pretty crappy. I guess it’s also a trendy place to move to.

Clete,

Depends on the year of course.

As someone already responded we get it blowing in from all directions.

California has had bad wildfires for many years. More recently western (southwest especially) Oregon and British Columbia been getting them (2 or 3 summers ago BC had 570 or so fires gone at one time… unfortunately winds here were out of the north … unusual). North Central Washington state consistently has bad fires. Last few years the north cascade fires have blown smoke into Seatgle… not just for a day or two. I’m sure this made real estate take a hit.

Really, you’re joking ?

Nope. I like the weather in Skagit and Whatcom counties (north of Seattle 50 to 100 miles) but now am reluctant to move there. Homes priced for perfection. But perfection (the rivers there didn’t just start flooding) has is no where to be found on this planet.

Now they too have wildfire concerns though still less than I do here in Eastern Washington.

No major fires here recently.

There was one before I moved here (been here 22+ years) called (???)

Fire storm. Through the Dishman Hills. Some houses lost. Definitely a big deal.

Guessing maybe early 1990s ?

Had Ice Storm in 1996 here, I was living near Seattle then. Really bad ice storm.

Iced up tree branches whoch took out lots of utilities. People w/o power for week or so I guess.

I’ve been lucky, knock on wood, Avista has been quick to get my apartment complex electricity up and running quickly when power outages occur (12 hours max outage in 22 years ?).

Dishnan Hills had another fire numerous years ago (10 to 15 ?). Ibthink a few homes were damaged but not extensive. My memory is poor here.

Lawsuit over possible negligence.

Smoke varies. From 2000 to 2015 smoke not much of a big deal.

But last 6 years its gotten worse. A couple years MUCH worse.

2 years especially bad. Had I believe 4 days in a row with toxic readings… AQIs 300 or above. Orange air. Very limited visibility. Some other days AQIs 200 to 300 again those 2 years.

Last year not good but not too bad either. Worst AQI was about 230. Just one day. Unhealthy reading.

Most readings were 60 to 140. Lasted early mid August to mid October off and on. Irritates my sinuses some.

Smokey, then clears up. Smokey, then clears up.

Only minor fires near Spokane last year.

A very small town south of here 50 miles or so, Malden, lost most of its homes due to a fire 2 or 3 years ago.

That scares me.

Back to last year…

But Idaho had 60 fires at one time (was this way thru much of September October timeframe if memory is right) from some fire map I looked at. Central and Northern part of the state. Not sure if any of the fires were really major fires… possibly not. Again fires in the north Cascades just northeast of Seattle and to the east of them (north central Washington). SW Oregon pretty bad fires again last year and California.

It blows in from all those places wind direction dependent.. who’s the “villain”.

Maybe Idaho is allowing fires to burn… philosophy let nature do its thing… I dont know just speculation.

wolves must have gotten word that Powell is going to power down his little machine that makes interest rates go up. ‘risk on’ trades powering the S&P up … bad news is good news again. lot’s of crap stocks catching a bid. just a few days ago bad news was bad news. somebody winked or did the special handshake. so i think it’s premature to celebrate the big bust of all bubbles. put that cake and champagne or whatever away. when billionaires lean into it the ship does turn.

Where’s your evidence that Powell is planning on pivoting?

So the S&P went down for three days, and then it goes up one day and retraces part of the three-day decline, and sure enough, there is another one these comments. It gets really tiring after a while.

Friday is normally a day of profit taking if the market is down for the week.

What? No Flame Thrower? You must have been ready for bed when you replied to that comment. :-)

ok ok my bad! and yes you have said nothing goes to heck in a straight line. gee!