What this means going into the slowdown.

By Wolf Richter for WOLF STREET.

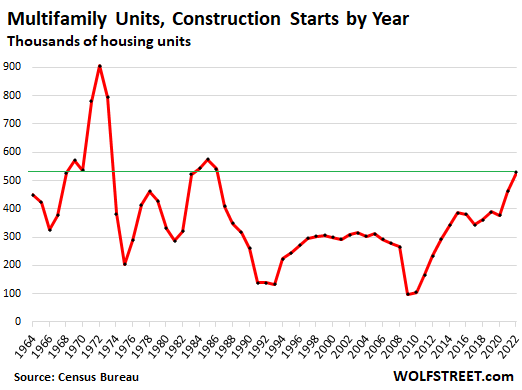

Construction starts of multifamily projects, such as condo and apartment buildings, with five or more units jumped by 14.5% in 2022 from the prior year, to 529,000 units, according to data from the Census Bureau today. This was:

- Up 35% from the range between 2015 and 2020.

- Up 75% from the range in the decade before the Financial Crisis.

- The highest annual total since 1986, nearly matching the three peak-years of that boom.

- Way below the crazy boom of the early 1970s that then turned into an epic bust.

Multifamily projects tend to be big and have long lead times. Projects where construction started in 2022 were in the planning stages years earlier. So these are long-term trends.

In many densely populated cities and urban cores – think of Manhattan, San Francisco, Boston, etc. – multifamily is just about the only type of housing that is getting built, and much of it is higher end, because that’s where the money is in expensive cities. Single-family construction takes place further away from urban cores.

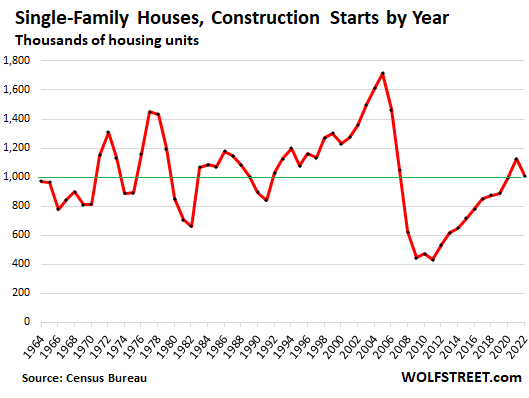

Construction starts of single-family houses fell by 10.6% in 2022, to 1.01 million houses, after a decade of increases that followed Housing Bust 1 which nearly destroyed the homebuilder industry.

The number of single-family starts in 2021 had been the highest since Housing Bubble 1, which became infamous for overbuilding. But beyond that, the years 2021 and 2022 were roughly in the middle of the range of the years before 2000:

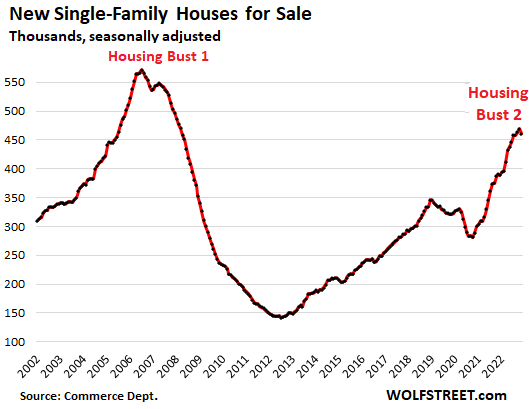

Homebuilders sit on huge inventories, which is why they have cut back. Inventories of houses in various stages of construction have been piling up for two years and have now reached levels not seen since early 2008, according to data from the Census Bureau released in December – 461,000 units, seasonally adjusted. Home builders have faced a plunge in orders and large-scale cancellations of orders that they did get. So they’re heaping on incentives and mortgage-rate buydowns and what not to move the inventory they have, and they’re finishing projects that they have in the pipeline, but as an industry, they have dialed back new projects:

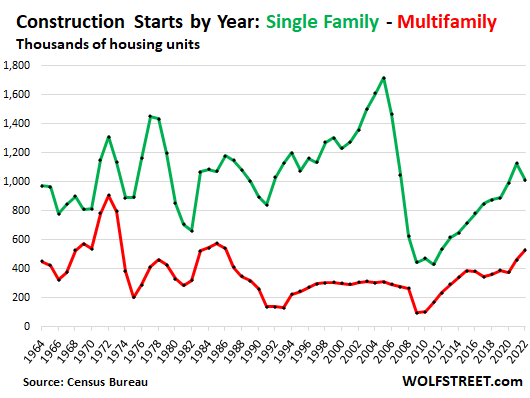

Single-family construction dominates. In 2022, despite the dip, single-family starts still accounted for 65% of total residential construction starts. Multifamily of 5 units and more accounted for 34%. The remaining 1% are starts of multifamily buildings with 2-4 units.

In the chart below, we can see the booms and busts in construction of single-family houses (green line) and multifamily units (red line).

The long lead times of multifamily projects – often many years for big towers – see to it that once a project gets rolling, it keeps rolling unless the developer goes bust – such as the Oceanwide Center in San Francisco, which has been a huge dreadful eyesore for years. While homebuilders can cut their plans fairly quickly, developers of big projects cannot. And that shows in the chart above. During Housing Bust 1:

- Single-family starts peaked in 2005, then plunged in 2006 through 2011.

- Multifamily starts kept going until the Lehman bankruptcy in September 2008 put a stop to everything, and starts plunged in 2009.

The slowdown shows up in single-family starts first, and well before it’ll show up in multifamily due to the long lead times with these big construction projects. Once the project has advanced enough, with financing lined up, and years of work invested in it, the projects tends to keep going.

Also there is the cyclical nature of housing and the economy. When construction on a big project starts just before or during the early innings of a slowdown, the project will have less trouble finding labor and materials, and will likely run into fewer cost-overruns and delays, and can therefore be completed for less than one constructed during boom times when everything is in short supply, including labor. And by the time the project comes to market, the slowdown is likely over. And that would be great timing. Pricing might not be where it had been imagined years earlier, but that’s always a risk.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Tw o years go framing was $7.50 a square foot. Yesterday the framing contractor said he had to get out of the business because four of his eight person crew quit. The other four he put to work doing other things than framing. His cost is now $25.00 a square foot to frame because he’s hiring another framing contractor. Still no slow down in sub contractors. Just try to get a call back if you want a job done.

Google/Alphabet also cut 12000 jobs. These are all very high paying jobs. Clearly quarterly closing numbers are pathetic and will reflect in coming quarterly results. Correct for 7% inflation and most tech earnings will seem ugly.

The current tech layoffs are mostly global, and are mostly focussed at recruitment, HR, Sales and administration. So the 6% layoffs won’t cut costs by more than 1% to 2% as the highest employee expenses are local and in engineering cogs. So this first round is just messaging and is more of lip service to investors.

Not only that, given the good severance packages in this sector, these cuts won’t reduce any costs for 2 quarters. Also we expect tech earnings to fall further as consumers are spending less.

So we have reasons to believe that there will be a much deeper second round in next quarter (april?).

These laid off folks will not be able to find another job due to hiring freezes.

Meanwhile Netflix earning came in at 70% below expectations. Still wallstreet is back to selling subscriber growth based on ad tier, even when there are big doubts if the ads will really bring earnings in this economy.

Wallstreet thinks that its investors are morons!

“These laid off folks will not be able to find another job due to hiring freezes. ”

Nah. Once you work at a “top” company like goog, the hallow effect will land you a next job or 2 even if you are bad. However, salary won’t be the same. Then again, chances are there will reduction in bonuses and salary cuts in near future for those who remain.

I’m starting to hear construction companies are getting picky and actually want experience

they are looking – but for lower cost skilled labor

meaning they don’t want to pay for real skills anymore

The weekly UE claims data are saying that everyone laid off so far is finding a new job incredibly fast…

Lots of industrial companies and other other companies have been looking for tech workers, and have been overpowered by the rich pay packages that Big Tech offers. They’re now breathing a sigh of relief. They can now actually hire some tech workers. But for tech workers, it might not be very appetizing to work for Ford’s EV division, at a lower pay than they made at Google and without stock options.

As long those re-hired google kids get their thirty minute massage and foosball break every hour at Ford, I’m sure they’ll be just fine, Wolf!

Two beers — quit that venom aimed at tech workers. The perks such as massages are overblown and overrated (and they are not free anyway, but subsidized) – and in practice difficult to access. False advertising and clever PR – just like the sub-$30k Teslas.

Comments like that reek of jealousy and far left-inspired class warfare (though they lately focus on race-baiting). Don’t fall for that, the so-called upper middle class techies (who are still one serious life event away from being homeless) are not your true enemies (even if many of them, I give you that, are morons wrt their political choices).

codedude-

“[..] and in practice difficult to access”

I’m so very sorry for your travails!

As for “far left-inspired class warfare,” the far left didn’t “inspire” class war. Class war has been waged unilaterally top-down on worker people by the titans of capital for as long as our economic system has existed, and it’s only getting worse, because there is now no actual “far left” left to oppose it. Today’s supposed left party, the Democrats, are to the right of Richard Nixon on practically everything, in substance if not always in style or statement.

I don’t think you and your fellow cohortees are my enemies; you’re just the witting or unwitting tools of the vulture capitalists that, while it was essentially free, threw billions of dollars at any and every disruptive pizza delivery app that came down the road. This isn’t to say that “tech” hasn’t produced some useful products. Look at me! I’m posting to a blog using my computer – I must be a hypocrite!🙄 Your cohort is the object of my ridicule, not my wrath. There’s a big difference!

Sorry for the political sidebar, Wolf, but, well, it was solicited…

Yes indeed. Forget the cost, if the crew actually shows up at the job site per schedule – That’s already a win.

Many of the smaller builders of single family homes are told to “sharpen their pencil” in times like this, which means find a way to cut costs. They’re still building single family homes, but I wonder if home additions and remodels will become more affordable in the coming years as new construction builders get squeezed.

Alas, sometimes quality also gets cut out by the pencil sharpener…. I suspect the best houses to buy are those built on the tail of a bust, when labor and materials have gotten cheap and prices have begun to rise again…

Not really, since at that point years of bad habits and corner cutting are imbedded in their methods.

Best house is the one you have build for yourself. Of course, the better you want it, the more headache and lost sleep you will have.

This is true carfan:

Saw a video taken a day after hurricane Andrew wiped out Homestead, FL neighborhood: Most houses flat or close, but then one with a few shingles off roof and owner sitting on front stoop with shotgun across his lap.

Turned out he was only one who built his house with his own hands— all others by ”piece work” folks with tons of structural stuff either completely missing or done wrong.

VintageVNvet

I actually toured the area around Holmstead AFB in 1993 in person. It looked like a Neutron bomb went off there. Most of the problem was the builders not putting metal trusts to secure the roofs of the homes. When the roof blows off, it'[s goodby home. Those builders who did this should have gone to jail.

Funny bro. I built the house I live in after I retired from planes. Saved a ton of money, like the place to boot. no debtsky.

I would advise the builders to start moving their inventory at steep discounts as the mass layoffs are “Just Starting”. They now have zero chance of fooling a first time buyer using lack of price transparency in RE market.

Looking at unreal listing prices on unsold homes will be a very big mistake, as market fundamentals are pointing to 2016 prices already. They would be lucky to get away with 2019 prices.

it’s great all this building of class A rentals

only issue is workers are fleeing to class C

due to over priced rents

which is putting pressure on top end

I for one waited about 2 weeks to get new tenant at 8% increase from previous tenant

100% full in class C – Tucson

Wolf this is still over analyzing. The new construction statistics are from large commercial residential (residential R 3 and R 4 residential four floor with mix use , most without parking for residents.

Most of the holes in the ground

, let’s use the Seattle residential block for my example are going strong to finish though in the interim the smaller non commercial building starts are not even nibbling at the dried up money supplies.

Peace my friend from the beautiful California coast after the storm.

Heading north to the Wild Shore of Washington in a couple of days.

To parallel Seattle’s greatest “Jim Hendrix,

There ain’t no life nowhere”

– S

I remember tough times. In 2008, my company wired 300 new homes. In 2009, we did 8. The market dropped off a cliff. I had to survive by switching to remodels, service calls, and commercial work. 2009 through 2012 really sucked. Luckily, I don’t need to go through this downturn because I’ve retired. I see a lot of pain ahead in the construction industry but sometimes we need a cleansing period. The “briefcase builders” are going to get wiped out.

I really wonder if Powell understands the meaning of “pulling demand forward” and what it does to the boom and bust cycle.

I remember 2009-2014 – great time to buy buy buy

made lots of lemonaide in 9 properties (some pre-2009 purchases/loans I foreclosed on)

by 2017 I was in great cash flow position

2022 – was transition from class C- properties to B+

I didn’t care about price as it was sideways move

—

debt free in 2023 is nice position to be in

—

I have 2023 work plate full with lots of smaller projects

before vacation time hits – may 15 to sept 30

Same here. Survived the housing depression. I can only speak for the little sliver of fly over that I own my business. This downturn SHOULD allow for some “cleansing”. Nothing like 09-12. To few of us left here.

We have been hammering hours & backlogged for the past 4+ years.

Yet we are only doing half numbers we were doing 07. The bodies are just not there to do the work. Between labor, supply, and insurance costs, our average project cost is up 80-100+% from 2 years ago.

With the wave of retirements the past 2yrs……what a mess.

Wife does not allow me to answer any calls…..they know I will always say yes. What comes after the downturn? Who will do the work?

Briefcase builders is a new one. Do you mean people with a builders license who hire subcontractors and bid on projects but mainly engage in the sales side of the business? If that’s what you mean, I agree that being unable to self-perform some of the work just to keep your business going is going to be tough.

State of MN makes GCs do continuing education to keep our license current and I meet lots of people who are surprised to learn I’m a “working GC.” Lately I’ve found it’s less of a headache to charge subcontractor prices and bring a helper rather than hiring subs and take a percentage.

And to other posters’ comments about the lack of labor, I can agree. A decade ago, it seems you could find 10 tradesmen at any given bar. Now the number hovers around zero. I think the industry grinds workers into dust and now we find ourselves without any willing participants.

I do big projects for a GC in the heavy civil world. Most of the work is subbed out. Has it’s pros and cons. Agree with the lack of quality hires, but I understand. There are simply easier ways to earn a living. The good news for us who are still in the industry is our wages are skyrocketing. Depending on how scarce your skills are, there’s no age penalty either.

I’m very glad to hear many multifamily units are still being built. That means rents should go down even further for many people.

Nice data as always Wolf !!

We are still in the median range of housing starts when looking back to the 1960’s for SFH. Seems a bit early to call “Housing Bust 2” ?? (Chart #3). There may be the beginning of a trend there, but until the downslope is more prominent, new SFH sales could easily trend back to 2019 levels (still a long way to go down) and then normalize.

With higher interest rates continuing and other factors (including the most obvious – the tilt toward multi-fam), HB2 may still materialize for SFH, but I’d say jury is still out and a “correction” is more likely based upon existing trends.

I’d be careful about making too many assumptions that Housing Crash 2.0 has been averted. The past 2-3 years represents a major shift in social and political trends, and in government and central bank policy. The Easy Money era is over, and probably the Cheap Labor era too, and I have a very hard time believing a shift like this occurs without a painful adjustment. We are early in the game still.

CSH

I hear what you are saying and I am no longer in RE myself anymore except holding a couple hard money loan notes on SFH. From personal experience in rental investing 2004-2020, with so much $$$ out there – it will take a loooong time for that $$$ to dissipate. It is my belief the SFH market is going to land softly and whereas many (including most RE haters on this site) will tout 40-50% drops nationwide as proof of the “crash,” it will just be a reversal of the ridiculous upward spike.

When prices go back to a normal L to R trend line connecting 2018 / 2019 to 2024 / 2025, I believe we will see SFH followed a normal trend with maybe a 5-10% correction at most – not a “crash.” Unfortunately, that trend will likely still be unaffordable for many Americans.

I stand at the ready to get back into rental real estate with idle $$$, but SFH rentals with viable cashflow returns are gone forever unless rents get to 1.5 to 2X their current levels. This is most likely why multi-fam is the ONLY future, at least for rentals anyway.

Or unless prices go back to 2008 – 2012 levels.

Do demographics play a role here? With 50% of American females being childless and unmarried by 2030, who would need a family home?

Recently 22% claimed in a survey that they would pick a cell phone over a man if they were given a choice.

Backs up the statement of women choose the relationship. men choose who they marry.😅

I have three millennial daughters, all educated professionals. They fall into early , middle and late age cohort distribution. One is married, two have children and the youngest has decided not to have children and may never marry. The largest hinderance to marriage in this cohort is the failure of banking services to adapt to cohabitating mix of this generation. Finances are complicated before children are added to the mix. Student debt, normal age related debt (auto, cc), mortgage debt, 401k’s, inheritance prenups, and the economic uncertainty that haunts this generation. Many graduation from college during or shortly after the great recession. My youngest has been laid off twice. But the biggest challenge to getting married and having children is their cost. My youngest daughters friends living in permeant relationships have chosen not only to not marry but many of the men are taking the financial uncertainty of children into their own hands by getting vasectomy’s. A mid millennial friend who is an assistant HS principal in a high income community says that the biggest issue she faces with her students are mental health issues. As for having children the cost burden is two much. One family friend just had a third child mid December. It wasn’t planned. An unexplained health issue sent the newborn to the hospital. 3 Days in the NICU, new year new deductible. Third child in daycare. This generation is getting crushed.

In the mean time the cowboys in the house will throw us into a recession. These not too bright individuals have their heads in the sand with their failure to understand their own party polling numbers. The under 40 crowd is voting majority blue. With SS not funded and the cowboys threatening SS and Medicare their younger Boomer parents will soon join them.

Yeah, just vote for free stuff, and keep borrowing and printing. What can ever go wrong?!

/s

The pendulum swings both ways. We have a college age son that is moderately conservative, along with nearly all his friends. The vast majority are STEM majors, of some sort. If most do not marry and have children, I will be greatly surprised. I fail to understand the childcare angst. It is not as if children of the past exited the birth canal self sufficient. Every generation figured out the issue, but now it is insurmountable? It is likely more an issue for those residing in parts of the country that are too expensive for their wages. Some of us are less worried about the cowboys in the House, than the husk in the White House. If a recession arrives, the latter will likely be the cause.

Sick anecdote but all of the broad demographic studies and data refutes your point. Maybe think a little bit harder about the childcare angst. This is a global issue affecting nearly all advanced economies

I’m a Gen-Xer, and our child-care cost with two in daycare was more than our mortgage. This was about 15 years ago, and average child care cost in the Charlotte, NC area was $1600 monthly. Not to mention that our oldest son was born with a congential heart defect, which required open heart surgergy.

The USA is becoming too expensive for the majority.

You should actually check childcare prices where you live instead of imagining what they are like.

We pay 240% of our total house costs (mortgage, property tax, utilities) for childcare with two kids in a low cost of living area. You could not be more out to lunch if you tried.

The cheap political shot at the end of your comment is not a worthy addition to the real problems the rest of your comment touches upon. The house “cowboys” are show boaters and virtue signalers for sure, but if people of both parties, especially the left, don’t do something about our current entitlement spending trajectory, we are all headed for a less prosperous future.

I assume by “entitlement” you mean social security for people who have paid into that planned retirement system or surplus for their entire adult lives?

Tina, it doesn’t matter whether people have “paid into the system.” At some point, the productive capacity of America has to be enough to pay for everything, and that may soon not be the case. Then what? Do you suggest that younger people and other workers starve so that other people can get the “dignified retirement that they deserve?”

Yes, Einhal. That is exactly what the Tina’s and Tom’s of the world think. They got theirs, and who care if you are the one paying for it. They earned it by virtue of their bithdate.

Kind of a putdown to cowboys; more like eunuchs & liars.

Thank you, Tina — I’m also past weary of that jazz. ‘Unfunded liabilities’ was another pet shape from a few years ago which got parroted for one too many seasons by all the fear-mongers & their pilot fish.

That’s not a very fair comparison. It’s hard to live without a cell phone these days.

Not to mention that, with a cellphone, you can just upgrade to a newer model whenever you want.

LOL

John Apostolatos,

“Recently 22% claimed in a survey that they would pick a cell phone over a man if they were given a choice.”

hahaha, maybe the men’s fault?

I’m a woman. I would absolutely pick even a very early model cell phone, or a landline, or really nothing, over some of those making comments in this thread. 🙄 Not you just in general.

Marriage? Pfffft. Let’s say you find a great partner. Does that matter if most American men and women feel like they can’t afford to have children? $1100 is what we were quoted for childcare per month, 3 days a week. That’s nearly a mortgage. That is a payment for two very nice vehicles. That is a 401k contribution. Healthcare and childcare in America is broken.

What is interesting is the higher the average income the less children a family has.

Woman who earn less than $20k a year have 66 children per 1000 woman.

Woman who earn more than 100k have 44 per 1000.

Thus the poorest demographics have about 50% many kids. The poorest demographic probably get free day care and other entitlements so the burden of cost is probably not as high as the higher demograpics. LOL

Women who have better access to education and family planning services, have fewer children. That is a global phenomenon and the primary solution to poverty. Many women simply choose to do more interesting and creative things with their lives.

There is a great movie about that. In the 15 or so years since it came out it seems to get more and more prophetic.

lol @ Joe. Great reference for those who know. It really is a documentary of the future.

Joe-

A movie that started as a comedy that turned into a documentary and is now a horror…

@ OutWest –

What is more creative than creating a life?

My 48 year old son and his wife and two young sons just moved to San Miguel de Allende where me and my wife live. They moved from Austin where property taxes are so ruinous that they felt they. Hold never get ahead. Their boys are in a great private school, have lots of affordable after school programs. They keep telling me they are surprised and delighted by the high quality and affordable healthcare. They have help, a wonderful home and, thanks to the pandemic, the ability to mostly work from home. Our son does go up to Austin occasionally to take care of business so their travel expenses have gone up but that’s a small price to pay for an amazingly rich and happy life.

It pains me to see how broken the USA is but more than that, in my humble opinion, is the sanctioned incompetence and corruption. It’s incomprehensible.

A shout out to Wolf! I admire and respect your fair and straight forward reporting.

Three days per week is roughly 12-13 days per month and if it’s full-day care, that’s generally 9 to 10 hours per day. At 9 hours per day, that’s 108 hours per month, which is about $10/hr for the daycare. That’s pretty reasonable. One caregiver can handle more than one child, but often the state sets limits based on the age of the children. Also there are substantial facility and insurance expenses to running a daycare.

The unfortunate fact is childcare is a very expensive service to provide and there’s no real way to make it significantly more efficient without making it less safe by increasing the caregiver to child ratio. When our son was an infant the caregiver ratio was 4/1 and we were paying $1,600 per month for full-time care (15 years ago). That means 4 children brought in revenue of $6,400 per month, but the facility needs more than one caregiver for each group to cover breaks and the extra hours needed because the parents themselves can’t drop-off and pick-up within 8 hours due to their own jobs. There are also payroll taxes, worker’s comp insurance, etc., that further reduces what is actually available to pay caregivers. As a result, daycare costs a lot for individual families, but the economics are such that daycare workers are still paid relatively little. As much as I hated that bill, I don’t know what the solution is that can make quality care more affordable unless it’s subsidized by the government. Generally not a solution I prefer, but perhaps unavoidable in this case.

How about the typical red position — don’t have the kids if you can’t afford them? And by the way, as a woman in a childless couple, I really don’t want to pay taxes to assist this effort or schooling. I mean fair is fair bc you guys wanted to take our paid health care as small business owners — and are now also threatening our earned social security and Medicare. Child care for children that don’t have to be born (or even those already here) is not more important than health care. Full stop. Maybe if you didn’t needlessly prevent unwanted babies — that might at least help a little??

Oh and if you weren’t opposed to banning killing machines that should only be on remote battlefields, then maybe we could say least slightly reduce the health care you hate funding so much. Don’t even get me started on what should have been done in the earliest days of covid to prevent insane and very expensive amounts of long term disability, by our dear leader, and his enablers, at the time. That financial effect will be much more than slight.

And… Maybe, just maybe, if we actually taxed large corporations a reasonable amount, the richest nation in the world would have the money for housing for the poor, guaranteed health care, child care, elder care, and college. My taxes were among the few professions that did not decrease and we are still doing fine.

@Tina.

“…if we actually taxed large corporations a reasonable amount”

– We do, but it doesn’t matter how much we tax them. Consumers ultimately pay the tax (via higher prices, etc).

Wow, crazy post. The government doesn’t have a revenue problem, it has a problem with spending money on a bunch of BS that doesn’t help out the people who live here. In today’s America, no way the interstate system would have been built, we can’t even maintain basic infrastructure anymore. But we have unlimited money to kill people on other continents.

Tina W,

I’m afraid I don’t understand your reply. How does “Oh and if you weren’t opposed to banning killing machines that should only be on remote battlefields…” even apply to me or my comment? I don’t believe I’ve ever expressed an opinion on this forum about “killing machines” and my support, or lack there of, for them.

Furthermore, my comment only related to childcare and I actually concluded that government subsidies may be the only solution. Somehow, out of this, you’ve concluded I hate funding health care. You’re certainly entitled to your opinions, I just don’t comprehend why you posted them in reply to my comment.

Tina W,

When I first replied, your comment from 3:07 wasn’t visible. In response to that comment, I’ll say I paid for my childcare, and was fortunate to have the resources to do so. I realize this is a difficult issue for many people and was commenting from my experience that reducing the actual cost of childcare is difficult because the workers already don’t earn very much. I’m open to subsidizing childcare, you aren’t. That’s fine.

However, I do find the cognitive dissonance in your comments interesting. You don’t want to pay taxes to assist with childcare or even schooling, but society needs educated children to pay the future taxes that will fund your future social security (yes, it’s a pay as you go system) and provide medical services for your medicare. I don’t think childcare and health care are an either or, they are both needed for a functioning society.

Finally, you say: “Maybe if you didn’t needlessly prevent unwanted babies — that might at least help a little??” What are you talking about and where are you coming up with this nonsense? You’ve made a lot of assumptions about me in your comments, none of which are accurate and probably reflect more on whatever’s going on in your mind. Good luck with that.

The reasonable amount to tax corporations is zero. “We” don’t have tax money, governments do.

Tina W said: “Don’t even get me started on what should have been done in the earliest days of covid to prevent insane and very expensive amounts of long term disability,”

——————————————-

Please get started. What should have been done?

Elder Millenial/formerly called Gen X. Decent childcare on East Coast, paid $800/week for two under 2. Anything cheaper and was dealing with injuries, illness, poor staffing constantly. By the time they hit school age we could have bought a house, pre-2020. Its obscene.

The younger Millenials and Z’s are paying attention to the older Millenials’ struggle with work, family, culture and housing. Despite the older folks slagging them for not falling into the trap, I think they are smart as hell and don’t begrudge Z’s in the slightest. The cat is out of the bag. Hell, my wise-above-their-years 9 year old told me they don’t want kids (pronoun game for privacy not ‘wokeness’). Its their spin on this Earth not mine, no pressure here.

Seeing more parents my age teaching our kids to value financial responsibilility, reliable shelter and dignity instead of being corralled into college student loan debt/insane mortgage/2.5 kids fantasy trap. Anyone who thinks that’s wrong probably hasn’t experienced the shite end of the stick entering adulthood in the last 20 years.

And marriage is just a horrible legal contract. Many see no need to get law involved. Even prenups are being ignored by divorce courts. A rash of divorces ending with an ex-spouse jailed for not paying obscene alimony happening recently in NYS, something sketchy going on with the judges here. Plenty of ways to keep a relationship rock solid, or not, under your chosen spiritual or religious beliefs without a license.

Throw in another housing bubble and a whole lotta nope. Damn the older folks’ torpedos. You do you, kids.

No offense to you, JB.

Yes, having kids is really expensive. Here’s why….so many couples decided to both work, starting 30-40 years ago, so they could make more money and “get ahead”. All that did was drive UP the cost of housing and childcare (and everything else), while driving earnings DOWN from the added supply of labor. Now so many couples both work, and have driven up costs so much, couples pretty much NEED to both work to keep up. We’ve done this to ourselves.

I posted something like this on a NYT column once, and got roasted. “Oh, so women should just stay home???” Sighhhhhhh.

I think families went to both parents working because of the cost of living going up all the time and the parents trying to feed, clothe, shelter and provide a better life for their children. The kids we complain about so much might have turned out better if one of the parents was able to stay home with them. In the 90’s, my wife and I had five kids in seven years. We both had to work from home to raise them. Kids need their parents to be present in their lives today more than ever.

Interesting take on an article about construction where women are almost completely absent. How do you explain that?

Flashman, no, both parents GOING to work is what made the cost of living go up (more than it would have), and wages to flatten. I’m talking ’70s, ’80s, ’90s here.

Ugh is nowhere on the internet safe from bitter men? If you’re going to bring up demographics, why only talk about half the population?

This is semi safe. Give ’em hell, I say!

1) Multi units : in the flyover areas Price is x12 Rent. Two BR rent can go for $800/m – $1,000/m. Demand is high. Vacancies rates are low.

2) In the 70’s, between 1966 and 1974, on the way up, on the left of the bubble, the breadth is x3 – x4 times larger than today’s breadth. Starts rose from 550K to 800K units.

3) During the bust, on the right, down from 800K to 400K units. Mixon roller coaster

4) In the 80’s multi starts were more conservative. Between 94 and 2009 there was nothing going on in multi. Multi were out of fashion. Contractors built a single bubble,

5) Today, turtle speed. Builders are testing the market. The multi might win. Then speed will rise, unless Shi infect us again…

Wolf and Friends,

I’ve been reading this blog for a long time, since the days of Alex In San Jose. I am turning 40 this year, and I have never had a car loan, never had a home loan, never been on unemployment, never received ebt, never went to college or received a school loan/grant, never had children, never got married, and never owned a credit card (I am told I have an “F” rating).

I’ve been punished, blacklisted and ostracized my entire life because of the lack of debt aka “credit score”. My parents are dead and left me nothing (back in my 20s, I was informed there would be a warrant for my arrest if I didn’t get my suddenly dead father out of the morgue within 72 hours). All I’ve done is work retail and pay rent to live on floors and couches for seriously 20 years. Nobody cared. I have been told roughly *1000* times by everybody and their uncle to open up a credit card account (put down $200, build it up, blah blah blah blah blah).

Everybody so obsessed with debt it has totally alienated me from society. No one will touch the elephant in the room. I’ve worked every holiday for so many years that I am numb to it. It’s hard to make friends because most my peers are clinging to their parents like their life depends on it (into their late 30s/early 40s now). I cut them off, all of them.

I guess this leads to my question for the folks here…why so much contempt for Mr. Powell and The Fed? Aren’t most of you millionaires? I feel like many posters are biting the hand that feeds them. Have any of you worked any kind of low wage job? Why did you accept a mortgage? It seems like all of you took the bait, so I don’t see why that is Powell’s fault for providing the credit *you* demanded?

Please enlighten me, I don’t really know why I come here anymore, I guess it is habit. The Fed is protecting you guys in reality.

Again Wolf, I’ve been reading you for many years and I am bitterly disappointed because the “bust” never arrived. 2008 *never* happened. I’ve suffered so much because of you people, you’ve taken everything from *me*, I didn’t do anything wrong. Most of your readers would never rent a room to me because I actually refused *all* debt.

I have not lent, nor have I borrowed, yet all of them curse me. – Jeremiah 15:10

If you never borrow money and repay it it’s difficult for strangers to know how reliable you are. Laying this problem at the feet of an economic website (that posts free articles, btw) is unhealthy.

You have to learn how to leverage resources (money) in a healthy way to be successful in life.

Adapt or die. Sorry to be blunt, but making your stand on a hill that you created and then blaming everyone else for the consequences is a toxic combination.

Sorry,

You need some kind of modern payment method – credit card, debit card, or other electronic method — so you can buy stuff online, make travel bookings, etc.

Just because you have a credit card doesn’t mean you have to borrow money on it. Just use it to buy stuff, get the 1.5% “cash back” or whatever the bank offers, and every month before due date, you pay it off. This way, you will not be charged interest, but you’ll get the “cash back” incentive, and it counts as “credit” on your credit report.

This, a thousand times over. I used to say this *very* same thing to my Econ students. Doing this will allow you to build up a “reputation” among creditors, which leads to a better credit rating but no debt. Use the system to your advantage, or stay outside the system and accept the consequences of that choice.

Why so much contempt for the Fed? For one, their actions took retirees, pensioners and other fixed-income people out back of the woodshed and murdered them, in the form of dramatically low rates on fixed-income bonds/investments those people often rely upon for living, while at the same time caused inflation that further eroded those people’s purchasing power.

Second, they pushed more and more people and organizations into high-return, high risk investments *just to stay ahead of inflation*, which means a huge number of Americans have portfolios that can best be described as “ticking time bombs” should the equity and real estate markets turn (which they will/are).

Third, their reckless ZIRP and NIRP policies encouraged all SORTS of financial shenanigans which would otherwise be considered unwise in the extreme. Taking out a loan to buyback shares? Leveraging debt to invest in crypto? Not to mention how these policies have prevented the clearing of the chaff of zombie companies from the system.

Lastly, their policies did NOT make millionaires of us all – I’m an ex-teacher and current government employee who makes below the median income of the nation – but rather enriched the already rich, through the mechanisms of QE, which benefit only those closest to the spigot…banks, big time investors, and those in the inner sanctums of power. Not you, not me, and I highly doubt Wolf either.

I grew up dirt poor. Went to college and law school on debt. Obtained a mortgage on a small house well within our means in terms of payment. Now still many years from retirement working very very part-time for the duration, we own 20 single family homes, about to add a vacation home (I know terrible time to buy but we like it and think it’s an unusually good deal), most purchased with cash. Primary home has been paid off for several years. My income ranges from 600K – 1 M working part-time before the rental income. I really don’t care what they do with credit.

There are definitely way richer people. But not many my age who also work when they want, and not many hours. Also not many with my health and fitness profile (made possible by working fewer hours).

This was all possible by education, which is not too late for you to obtain. “You’re never too old to become what you might have been.”

oh wow.

@ Tina W –

you are an outlier ……

By waiting for the bust, I guess you mean a real correction or reversion to the mean in prices. I think we’re seeing some of that right now here and there in some markets, albeit very slowly. But yeah — I understand your mental anguish. It’s been an interminable staring contest with the Fed and the Treasury for a lifetime now, and it’s created a nasty, negative sum game. In other words, it sucks.

HELL NO, by the way — not everyone here is a millionaire, or even a wannabe millionaire. I’m working class — no debt, engaged in honest work. So why I am here among the “mom-n-pop landlords’ and closeted smash-n-grabbers? Because every single thing in my possession I got up and worked for, from the jacket on my back, to the dog at my feet, and I’m protective of my tiny empire, as well as the leftover drippings from my labor which sit in my credit union savings account. So, no — not everyone on here is the cashmere and kale chips crowd. I’m here in a bid to avoid losing what treasure I do have. I pay attention to someone like Wolf who’s maybe rounded a few more corners than I have and seems to have a better tuned antenna array than me when it comes to the decimal stuff. He’s generous enough to share his insights and I really appreciate it, as well as a lot of the comments here.

Finally, I agree that credit cards are BS and that the whole system of establishing credit is crass; but at the risk of engaging in whataboutism — so too are so many of the other modern contrivances foisted upon us in this life, from velcro to the five day work week. The signal-to-noise ratio is shockingly low out there, but if everyone has tinnitus, then no-one has tinnitus, so…we learn to live with the din until we find a way out/a way back in. The alternative is to play full-tilt refusenik and trust me, too much of that is bad for your vital organs. Period.

My .2

Velcro is a wonderful invention. No more zippers and buttons that break. Other great modern inventions are the self adhesive stamp and yoga pants. What a wonderful world we live in.

Should’ve been specific — Velcro shoes or Velcro trouser flys.

Flash-agree with bul that much of our domestic commerce relies on selling fixes to things that weren’t broken…

may we all find a better day.

Sorry,

You get extra points from me if you can live your life without debt and a credit card. I am not alone evidently. Now that the pandemic is over I might go back to cash only. If nobody uses cash it will go away along with the privacy it provides.

6) In the 70’s the multi were in big cities, especially in NYC. Today, in the flyover areas.

7) The 500K – 550K is resistance. During the breakout speed will

rise.

8) New innovations might make the multi cheaper, faster, cleaner and more efficient.

Interesting chart Wolf. Looks like multi units will dip and follow residential homes according to prior downturn.

I’ve shorted the Dow Jones u.s. real estateSM index using the Proshares ultrashort RE ETF.

Sold half my short in october for 22$ ish, but now down to 16,5$.

Looking at the history, it bottomed out Dec’07 and Nov ’08, after Lehmann.

So looking to load up again, as this indicates that the bottom is still ahead?

“The bottom is still ahead” is definitely the way I am reading the current market conditions, and I can’t speak for Wolf, but I imagine his view is similar. We are not even 1 year into high interest rates. Real wages have still been negative for a long time, i.e. inflation is still eating ALL of the gains in wages, which have not been small compared with the trends of the past few decades. I do not believe the Fed should or will pivot. There is still major labor market uncertainty. None of the trends are close to playing out yet.

How are multi-units especially condos financed? Loans mostly? From whom? and role of pre-sale with deposits? Where I live there have been controversial re-zonings to approve oversized multi-units only to see the projects fail due to inability to finance. Impression is that Planning Commissions anxious for development ignore financing when approving re-zoning.

The single family collapse in 2006/2011 is similar to the multi collapse in the 70’s. The single family might enter a trading range for decades.

There might be a shift to the flyover area, where Price/Rent is cheaper

and landlords have more freedom, unlike the urban areas, where

space, labor and regulations are against landlords.

The banks, which favorite RE, will have to look for other outlets.

Michael,

Normally I would never answer your comments although I do read many of them.

Your general use of the term Fly Over in this context caught my attention.

Fly Over is a big area.

Average rents for newly/recently constructed multi family (0-4 years) are far more than 800-1000/month in most all of Fly Over areas.

I analyze recently constructed Multi Family markets throughout major Fly Over areas and depend on this construction type for my business survival.

Trust me, 800-100/month Fly Over is only possible with affordable housing developments with strict income restrictions, and these developments are far and few in between.

Shocking : 2BR for $800/m, 1BR for $650, new units and

Price under x10 Rent do exist, in nice areas, in middle class areas.

No gov support, no housing support, no section 8.

The regional banks have a lot of work to do.

Googl fire 12K.

I want to know the towns were these exist, as I have a chance to move some place cheaper this year.

This is true only in smaller areas in the middle of the country, think Wichita or Tulsa or smaller cities around the Midwest and Appalachia. There isn’t a sizable metro in the country with rent like this except in neighborhoods that aren’t safe.

There are units for those prices in flyover country but not at any class A multifamily properties. They’ve most likely class C properties that have too much deferred maintenance and/or are located in shady neighborhoods.

Jon–move to somewhere no one wants to live. North Dakota has rents like that (and only two cities you might want to live in) and still decent wages given…no wants to live there. Just be ready for an entire month of February with -20F plus windchill.

Go to Calgary, and other parts of Alberta.

What’s missing from this analysis is the yields that Multifamily were built and bought. Price matters as much as volume. When 99% of the built units are class A multi (or A+ with high rise) at 5.5% Return on Cost or lower. These properties are underwater. There is roughly a $600 gap between Class A and Class B apartments. Plenty of room for Class A rents to fall. More than enough to bankrupt a lot of landlords.

Hey Wolf,

I was reading on Mortgage News Daily that fees for new mortgages guaranteed by Freddie and Fannie are changing. In their coverage, they characterize these changes as pretty dramatic.

In aggregate, it looks likes the changes are resulting in higher fees for borrowers with better finances (better credit scores and DTI ratios) while lowering the fees and costs for borrowers with poorer finances. [To be clear: The fees for borrowers with good finances are still lower than those with poorer finances, but the difference between the two has been reduced]

Do you have any thoughts on these fee changes? Are they as dramatic as portrayed by the Mortgage News Daily article?

My thoughts? The government should not guarantee ANY mortgages. Period.

Correct. It’s graft and should be criminal.

The government should not be guaranteeing mortgages for Veterans under the VA program period, especially for multi-million dollar jumbo loans. The benefit should be in the form of a one time voucher for 1st time homebuyer Vets, and should be limited to an amount as a percentage of the median sale price in the geographic area. The whole program is being totally abused and gotten completely away from its original purpose of rewarding Vets for their military service.

@ Wolf – “461,000 units, seasonally adjusted.

————————————-

What does this mean? Are there 461,000 units, or not?

All seasonally adjusted data is that way. A lot of data is seasonally adjusted. Seasonal impacts are well known because they happen every year, and they can be eliminated by seasonal adjustments so you can compare the numbers from month to month. Otherwise, when you compare Oct to Nov, for example, most of the change would be seasonal, and not due to economic differences. That’s why seasonal adjustments exist and make sense.

As i remember, you are not a fan of seasonally adjusted numbers?

right or wrong?

I question seasonally adjusted numbers and inflation adjusted numbers, thinking it’s just noise to keep the herd confused.

There is a lot of data that is so seasonal (retail sales for example), that not-seasonally adjusted (NSA) data become just about meaningless.

For example, here is an old chart of department store sales, SA (green) and NSA (red). It’s pretty, tho:

@ Wolf –

Thanks ………

call me thick, but I get the same message from NSA or SA. Rising sales through early approximately 2002, falling sales thereafter.

Yes, long-term trends are visible with NSA. But what you cannot do — and this is the reason why SAs exist — is compare month to month to see if sales were good or bad in a particular month compared to the prior month. For example, sales spiked in November and December and collapsed in January. But most of that was seasonal. In reality, did consumers cut back in January from December levels more than they do normally? Is the industry going downhill suddenly in January? That is the question SAs try to answer.

@ Wolf –

Thank you.

If I were a developer looking at the landscape, I’d see this.

Millions not in workforce, settling for govt subsidy life styles. Recession looming or started and layoffs being announced by big tech and others, savings draining, credit cards maxing out, auto dealers can’t sell anything, mortgage rates no longer “free”, inflation makes necessities claim a major part of budgets and on and on.

A lot fewer are left to build residential. What can the inflation ravaged gov’t subsidy crowd who can’t get, let alone afford a mortgage do but hope for a rental.

Is there really a mystery here?

“Millions not in workforce, settling for govt subsidy life styles.”

Yeah, I agree. All those early retirees mooching off govt medicare and SS!!! Get back to slaving away in the mines!

Oh wait, those aren’t the govt teat sucklers you’re talking about?

I wish people like you would just spell out exactly who you think the govt subsidy moochers are. Because the facts are, BY FAR, they are the elderly.

Personally, I have no problem with Medicare and SS keeping elderly folks from having to eat cat food to survive. But for people like you who complain about the so-called “gov’t subsidy crowd”, please spell out who exactly your beef is with.

The Federal Govt has credibly described as a giant pension fund with a side business in defense. Everything else is not even a rounding error. It’s a rounding error on a rounding error on a rounding error. So either you’re complaining about seniors, or your complaint is stupid and demonstrates a lack of understanding of the true numbers. Please tell me which one it is.

In our area, rents are down about 3.5% yoy, and there are plenty of vacancies, yet large multi unit projects keep breaking ground.

Whenever you have divergence in supply and demand, someone is wrong and market ends up the judge.

Wile E. Coyote, Big Bad Bear and Goldilocks will continue their lengthy paternity case (near late September 2023) debating collateral custody for Little Red Riding Hood’s hedged crypto bets that were commingled with real estate loans and commercial property development financial structures, that were embedded in off balance sheet ventures, which continued to decline in value, resulting in margin calls, which resulted in a chain reaction of defaults, which are impacted by the repricing of related party assets which are impaired and no longer providing cash flow.

The completion of construction on thousands of units will be temporarily delayed until this transitory development is resolved.

There are many projects in Florida uncomplete, still, do to inability to get supplies. My buddy is an electrician and works multifamily (gigantic apartment complexes to be exact). He works in Tampa and Orlando. He just left a complex on hold in Orlando because they cant get multigang boxes, or something or other. They have been trying for 8 months.

Every month that complex sits there, who is getting their rear handed to them in interest and carrying costs? How long until this breaks some backs?

Nationally, a floor may be put in place due to the cost of construction. Wage inflation, commodity inflation, and permit/red tape costs are out of control. Building an average decent home now the costs are $200-$400 per square foot, all the way up to $800-1000 per sq foot in luxury/resort areas. Until that comes down significantly that will eventually come into play.

Haven’t commented in a while so I will plug Wolf here while I’m on. Thanks for all your research and articles. Top notch!

I work for a midsize construction company as a side gig. Midwest. Mutiple states. The last two years have been busier than I ever have been. Almost as much time spent as my regular job. They have focused more on multi family. Part of this switch has been they also have an arm that does the leasing and management of the properties. Long term income…. Anyway as I’ve learned over the years more about the business, most of these have a very high percentage of Gov’t assisted rents. Yes the people pay a portion, but really. Does it matter what the rent is? There are also shifts in monthly add ons like a garage and gasp, laundry in the units… but never mind. My point of commenting is two years ago the projects were affected by getting appliances and the costs of lumber. With no end to projects on the books. Now there have been a few layoffs with some job site Sups et al and projects on hold due to the increase in financing costs. Not a complete stoppage mind you. Just some job uncertainty and project delays or re-evaluations of the job itself. Though I appreciate the moment rest, I almost don’t know how to behave not having the pedal to the medal 24/7. I actually completed something on my own house this week…lol

Riddle me this people. Where do all the illegal aliens (yeah not politically correct term right?) coming across find shelter? Where do they go? Literally millions have crossed in the last couple of years and millions more are coming. Two and three families to a home? Explain it to us, Joe.

What people?

Sincerely,

Joe.

And get off my lawn!

10 to an apartment in every sizable city in the US, working construction, landscaping, restaurant kitchens, this isn’t anything new, it was Irish and Italian a hundred years ago, Latin America last 50 years.

What’s your point, Ed? How does that relate to what we’re talking about here?

We’re talking residential RE, aren’t we?

Some politics creep in. Get over it.

It doesn’t, of course, and he knows that.

I also know that in previous waves of immigration people followed the rules. They applied. They waited. They were not the law breakers that you liberals so easily condone.

You should try reading or watching factually accurate media. Also are you kids going to work in the fields to produce our food? 🤔

I don’t think we need 12 million farm workers. Or 12 million fentanyl pills.

Well you’re wrong.

Ed C

I’ve got an idea. Convert vacant commercial office buildings and churches in inner city neighborhoods into residential apts and condos and put the illegal migrants in them. Subsidize the rent by the taxpayers of the city. There’s plenty of unfilled jobs out there that Americans refuse to take. I heard there are 7.5 million Americans age 25 to 45 sitting home and refusing to take any of the 12 million job openings. I’m going to send this suggestion to the White House.

Swamp

Better yet have them move into the white House seems they are not really using it anyway

Government subsidies. It is a gravy train, which is why they came.

The illegals do not get government subsidies. They are actually keeping SS afloat by paying in with no hope of getting payout.

Stop watching Faux News and your question will be answered.

The answer is: millions and millions are not crossing the border.

In fact, from 2005 to 2015, there were more Mexicans who moved *out* of the US back to Mexico than came in. Yes, that’s right. For a decade, we had net outflow of Mexican immigrants.

And from 2007-2019, the total number of Mexican immigrants living in the US *declined*.

From 2013 to 2018, we had net immigration of ~150,000. That means about 30,000 per year.

Here’s a reputable article with the numbers:

https://www.pewresearch.org/fact-tank/2021/07/09/before-covid-19-more-mexicans-came-to-the-u-s-than-left-for-mexico-for-the-first-time-in-years/

Bottomline is that, despite Faux News hyperventilating about the border, the net number of people (including illegals) coming over is small. Think about it: if millions and millions of Mexicans cross over every year, and have been for many years, then this country should be completely Mexican by now. My guess is even now, Mexicans are a minority of the people you see around town. But who are you going to believe, Faux News or your lying eyes?, amirite?

Horseshjt, Fatima. There are places in this country that are completely Mexican. On a trip to LA a few years back I was the only English speaking customer in the McDonalds I went to.

Yeah, and I went to one IHOP in a trip to Alabama a few years back and got called a wetback so every person in America must be racist. Do I have your logic right?

Those places you went to have always had lots of Mexicans, since the time when, well, the land was part of Mexico. If indeed millions and millions of Mexicans are crossing the border every year, there would be a lot more places in this country that are completely Mexican by now. And they’re not.

The number of people of Hispanic origin in this country went from ~50mil to 60mil in the past 10 years. That’s ~1mil/yr growth. The *vast* majority of that was natural growth of U.S.-born citizens since Hispanics have a higher birth rate than other ethnic groups. Immigrants as a share of the Hispanic population continues to decline, because there isn’t much immigration, especially compared to natural growth.

But I guess your one experience in one McDonalds in one trip to one city overrides the actual numbers compiled by actual demographers.

“Area racist triggered by people speaking “Mexican”, news at 6″

Can someone explain to me what these 7.5 million abled body men of age 25 to 45 who have dropped out of the workforce are doing?? This is being broadcast on Fox business news on a near daily basis. The Former Education Secretary Bill Bennet was on there yesterday quoting these numbers and promoting “Workfare” vs “Welfare”. I see help wanted signs all over the place around here. 12 million unfilled jobs are out there for the taking. As Wolf explained, they are not collecting unemployment benefits and don’t show up on the government BLS data, but they must be collecting some form of government assistance in order to buy food, and pay rent.

It’s time to cut off all public assistance to these freeloaders and begin assigning jobs. Then they can start paying taxes like the rest of us, producing goods and services at the same time. That will bring down inflation. It’s a Win, Win!

Hi Swamp,

I’ve been self-employed since I was 22 (now 39), but am now basically an early retiree who buys Tbills and sells some options. I am one of those 7.5m, but I won’t be coming back. I imagine there are at least another million of me. We don’t receive any benefits.

Both single family and multifamily RE started their down cycle mid 2022. They have another two thirds more to go.

Riffing lightly off the secondary header, this might mean that the early hesitant efforts at zoning deregulation are working, and producing a little but of the housing we desperately need.

Thank you for a good article backed by statistics. In fact, I believe that multifamily projects will be the future one way or another, as the population continues to grow and the available space continues to shrink. From my personal experience, the main problem in such cases has always been the lack of a unified system for managing and exchanging documents, but today this problem can be easily solved with the help of construction management software. You can create a workspace with all the documents and customize access to them for each participant, and everyone will receive a report on time and will be able to control the work of builders, contractors or architects. So, in my opinion, such a simple solution solves the main fears of multifamily projects and makes their construction more efficient, although I would be happy to hear your opinion on this idea.