Everyone wants to know when inflation is finally going to cry uncle.

By Wolf Richter for WOLF STREET.

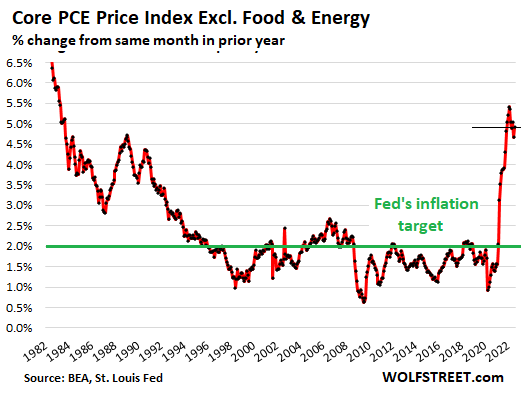

Just briefly here: The Fed uses the “core PCE” inflation index, released by the Bureau of Economic Analysis, as yardstick for its inflation target. This “core PCE” index – the overall PCE inflation index minus the volatile food and energy components – is therefore crucial in the current rate-hike scenario, amid red-hot inflation, when everyone wants to know when inflation is finally going to cry uncle.

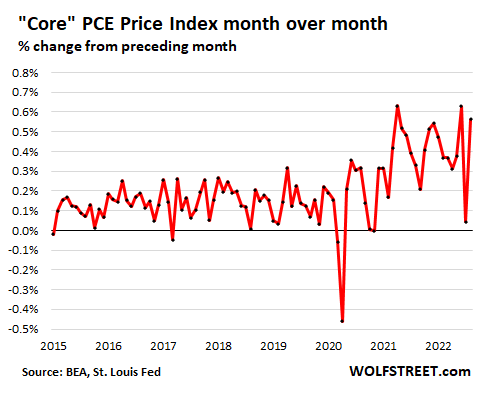

Some folks thought that happened in July, when the month-to-month “core PCE” inflation slowed to “0%” (rounded down).

Turns out this much-ballyhooed month-to-month “core PCE” reading in July of “0%” was just a one-off event. In August, according to the BEA today, the core-PCE inflation index jumped by 0.6%, same as the multi-decade records in June 2022 and in April 2021 (all rounded to 0.6%). As Powell had said during the FOMC press conference: Underlying inflation is just not slowing down.

This “core PCE” is the lowest lowball inflation index the US government provides. But it is crucial in figuring out where the Fed’s monetary policy might go, and how far the Fed might go with its rate hikes, and when it might pause.

Compared to a year ago, the “core PCE” price index rose 4.9% in August, up from 4.7% in July.

This year-over-year measure is what the Fed uses for its 2% inflation target. But given the huge volatility in inflation last year, Powell said that they would be looking at month-to-month developments to get a feel of where inflation might be headed. They’re looking for “compelling” evidence that inflation is headed back to the 2% target.

Since about April 2021, I said that the Fed would need to bring its short-term policy rates to 4%, combined with sufficient QT, to bring inflation under control, and then pause to watch it take effect. I said that this would be enough to tamp down on what was then already soaring but still much less inflation. That was my story, and I stuck to it until a few months ago. Now it looks like the Fed will take those rates above 4% by yearend, and higher still next year.

In terms of overall inflation, “core PCE” doesn’t mean much because it is geared toward measuring some underlying inflation beyond the most volatile items that end up dogging consumers the most. But it is very important in terms of understanding what the Fed is looking at when it decides where to go with its rate hikes.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nothing like running faster to fall further behind.

The solution is simple: Raise interest to positive real rate by 500 basis points.

Everything else seems to have been ineffective causing 99% of we, the people, to get screwed every day.

They’ll do it eventually, but they’ll take too long.

But doing it in one fell swoop would be too drastic, I think. You could announce a rate hike schedule that raises 50 bp every two month for 10 months.

inflation is a tax on gullible people. in ancient time it was called debasement, procedure is same.

The rule of 72 provides a simple and effective way to calculate how many years it will take to double your money.

In case of inflation, it will tell you, how fast your money is loosing value.

Actually, a big 500 points rate hike will work better than seven 75 basis point holes over next 10 months (Fed meets every 45 days). Reasons are:

1. It will create certanty that Fed really is working towards controlling inflation and will enf the Pivot debate.

2. Sudden collapse of assets will allow frozen free markets to start working again. The iwill make productive businesses profitable and higher production of goods and services will control inflation.

3. The slow hike will cause lasting pain and distorted asset prices will reduce productivity that will inturn fuel both speculation and inflation.

The average of the real Fed Funds Rate (FFR) from 1960 to 2021 is +1.1%. Our current FFR at -5% is neither restrictive nor neutral…

Simply put the Fed is trapped.

And watching the 10 year gilt be panic QEed by the BOE and yet the pound strengthened as the money printer goes “brrr”, we know the limited global CB playbooks, and the so called “tools” are unfortunately is long term inflationary, which makes the CBs look like tools, which erodes trust in the fiscal and monetary institutions. And once trust is lost, humans tend to panic…

Thus global CBs are both trapped and screwed.

Plan accordingly…

They should have raised 100 basis points last time, and the time before, and the time before. And then in hindsight they always say “we should have done more.” It’s intentional. This entire thing is intentional. I firmly believe the FED wants this inflation, and has been slow-motioning the response on purpose.

You’re probably wondering “but why would they be raising rates at all then, if they want this?” Because they have been/are operating in direct violation of their very mandate and purpose, which is “stable prices.” They have to appear as if that’s still their goal, because otherwise the entire charade blows up. Not that it hasn’t already, but they’re still keeping up appearances.

Depth Charge,

Look at the market! Already with the Fed going at its slow pace! If the Fed goes too fast, there is going to be a total meltdown in the credit market. And then everything comes to a halt. It’s better to go at a measured pace and let companies and investors (pension funds?) adjust to it.

I too would like to see the bandaid ripped off but if that bandaid was covering a wound that would cause the patient to bleed out, then a more measured approach must be taken.

I can’t imagine what things will be like in three years. More than the interest rate needs to change for this economy, but I don’t know what.

Wolf, we have a process to manage meltdowns. It’s called debt restructuring through bankruptcy.

These unproductive businesses and asset bubbles have become unsustainable parasites on real economy.

There is nothing wrong with making these unproductive businesses go bankrupt. This will give a chance to productive engineering and manufacturing to return and that will only happen when asset prices are no longer fake distorting profitability.

Protecting unproductive businesses is what is increasing taxpayer debt and causing inflation.

A big fast reset that allows new businesses to take over is way better than slow death to whole economy where everything freezes for years as we try to protect a non-productive system.

WA, if you go too quick, the good companies will fail too, not just the zombies. I think the Fed was absolutely derelict in their duties from at least November 2020 through March of 2022, but I think once you consider their poor decisions from before that to be a sunk cost, they’ve done okay since then.

“Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.”

— Andrew Mellon

Sad to see so many Yosemite Sams so so angry and yet so totally unable to articulate anything even remotely close to a remedy for what is bothering them. So what if they make your dream come true and raise the FFR to 20%? That will be heaven for “we the people”? Guess what…That doesn’t mean anyone has to pay YOU a dime more on your savings account. Oh, you say, “no problem, I will switch to this other bank with a high yield savings”…hmmm, looks like they just got bought out. Ah, you say, “but I am a sophisticated little whipper-snapper so I will get that through my TreasuryDirect account!” NOPE, wrong again. By the time you even realize what is going on, someone else will have pocketed that 20% interest (it does go somewhere) and bought up all those tasty assets you were lusting over👍. You are so screwed you don’t even realize how badly.

That’s the problem with the financialized mindset and culture we’ve developed over the years. Damn hard to get ahead just working hard and putting your time in. People scoff at retail traders and crypto enthusiasts, but what other choices did they have? Normal folk haven’t been able to afford real assets for quite some time. In a way, I welcome this inflation to some degree. It sure makes my business harder to run but we’ve got to get wages up as much as those asset holders saw their assets go up.

No, if iterest rates go to 20%, the big banks will meltdown and there will be nothing to take financial bets. The financial side of economy will die allowing the real side to start working.

Nope, sorry. These silly fantasies of a financial “meltdown” that will somehow accrue to your benefit are completely delusional. The big banks have TRILLIONS in reserves, the entire balance of which they are currently being paid 3.15% interest for every day by the Fed. How much interest are you getting? Risky liabilities were packed up and sold, those are now insured by Fannie and Freddie (ie, you). Together with their “regulators”, big banks have wargamed thousands upon thousands of crisis scenarios since 2008, and you can be sure they will not be holding the bag if/when something breaks. If “interest rates” (not just the FFR) go way up, then yes, someone will get screwed, but not them, not this time. That ship has sailed so you might as well stop dreaming about it.

Do as you say and “We the people” will definitely get screwed

I feel like I’m running in place and life is passing me by, but that may be something different.

“I feel like life is passing me by” is one of the stupidest remarks I ever heard. My not so bright, but very beautiful, ex-wife said it at around age 23-24. First time I ever heard it.

I’m still not sure what the hell it is supposed to mean, but it seems sorta logically nonsensical. Maybe it’s just poetic?

I would LOVE a translation, as I have GREAT difficulty grasping the concept.

Maybe too much acid and Zen when I was on Haight St?

Maybe seeing life LITERALLY pass people by.

“Thank goodness we have inflation, because other than that we can’t afford anything at all!” (Yogi Berra-style)

I realize that things are a lot different than they were in 1980ish, but I remember that time and I remember that it took extraordinary measures and a lot of time to tame inflation.

I seem to remember getting medium-term CD with an 18% yield for quite a while.

I don’t think inflation is going to give up without a serious fight, and I don’t think the fight so far is even close to serious.

I remember in the very late 90’s it was just a matter of logging into Etrade and using a really crappy interface buying CD’s at 7%.

Was that because those were inflationary times or money was scarce (all in the market) or … ? How’s that compare to now. Watch for 7-18% yields before there’s a turning point.

Insanity:

Expecting the arsonists to know how to put out the inflation fire…and actually believing it will work…

Hey, at least Wolf’s final graph demonstrates the Fed is meeting their “symmetric about 2%” inflation goal.

The graph IS symmetric: Really high on the left side (1970s-1980s), really high on the right side (2021-2022), and low in between.

The FED and politicians have caused this entire shit show and yet there are no honest conversations about it, just a pretend circus where they act like inflation showed up out of nowhere, through no fault of their own.

Every time you go to the grocery store, the hardware store, the car lot, the fuel station or any other place where life requires you to, you are paying for this recklessness. The overpriced food on your dinner table is paying for that Lamborghini that some PPP “loan” recipient is driving.

Forget it, Jake. It’s Washington.

When is your next “Margin Debt”, article, Wolf?

Waiting patiently.

TIA

Michael

Plenty of people selling to cover calls today, probably one factor causing the rally attempt in the pre market to fail.

Looking forward to that too, but it’s a slow process with margin debt. The raw data show $935B peak a year ago, then some drops, especially from May to June. For June-July-August it’s been kinda steady around $685B. September will almost certainly show a drop, but we’ll have to wait until FINRA wants us to know.

It was redistribution rewarding the reckless, and now stealth taxation to pay for it. Classical activities of a representative government, but without representation, as the Fed is “independent.”

Someone dig up Milton Friedman and tell him that Austrian Economics called and wants an apology. Better yet, tell Bernanke and Yellen we want a refund, the money printing show isn’t fun anymore.

It seems that those in charge didn’t really understand why assets were inflating but not prices and so were willing to let it continue. Now it seems obvious that prices have to do the same eventually, and even race to catch up, but was there any previous evidence that this was the case?

While the Fed is certainly to blame, hindsight is always clear and they did have other, more pressing, problems to deal with at the time. Being at fault doesn’t necessarily mean being wrong if the action prevented something worse.

“It seems that those in charge didn’t really understand why assets were inflating but not prices and so were willing to let it continue.”

They are in charge and knew exactly what was happening. They have 400 PhD economists at the FED and I’m sure at least one of them was watching out the window and noticed what was going on.

That’s not how bureacracies work. No one is going to speak out against the prevailing view. “It’s hard to get a man to understand something when his income depends on his not understanding it.”

Bruce,

I’m a big quote fan, too. The Sinclair quote contains a ton of VERY relevant wisdom, for sure, but I have been trying to promote

KIN HUBBARD here..

….he was praised by all the big and more well known “Quoters” of the time and later….don’t know why he never got his well deserved rightful place in Americana lore. I love his thinking and humor.

“While the Fed is certainly to blame, hindsight is always clear and they did have other, more pressing, problems to deal with at the time. ”

———————————-

the FED created the problems. The FED is to blame, is at fault and is wrong. But they appreciate all gullibility and attempts for any reason to give them cover.

The FED’s job is to transfer wealth to the class they work for from the population at large.

Congress sure did their part. Powell is having to deal with their profligate spending. Seems like damned few politicians have a clue about economics or behaving responsibly. It isn’t only on the Fed. The next generation or two are screwed. They are inheriting an insurmountable nation debt that requires servicing, now at higher rates.

See… That’s looking only at what happened because of their actions. The question really is where would we be if they had acted differently. It’s easy to see that we wouldn’t be in the current mess but I don’t know anybody that can difinitively say we wouldn’t be in a completely different mess if they had done otherwise.

I see the choices of politicians to be far more problematic because they are much more about doing what is popular now over what is best long term.

Wolf,

Stanley Druckenmiller commented in an interview earlier in the week that Yellen’s actions have largely been offsetting the effects of QT so far.

Are you familiar with what he might be referring to and do you agree?

Wolf,

Here is Druck’s exact quote of what he sees Yellen doing and how long it can be done for:

“ QT has been almost entirely offset by Janet Yellen running down the Treasury savings account. By the way, pretty amazing policy. She could have sold ten years for under 1 percent during this time. Instead, she runs down the Treasury savings account. So all of that has mass liquidity shrinkage, but it really comes into full gear, and she can continue this for a while. We can do the SPR for a while, stimulative stuff. But by the first quarter of ’23, it kind of goes the other way.”

Mike,

Hahaha, thanks, I see, another insidious manipulative hedge fund gangster going on the QT denier path to pump up his own investments that have been bleeding badly. What else is new. What he said is total BS.

1. The checking account of the Treasury Dept. at the Fed, the TGA, is far higher than it used to be, and it will stay higher than it used to be before the pandemic. It actually went up a bunch since the beginning of 2022 – so the opposite is actually the case from what this A-hole said. See chart below.

2. The TGA balance is a function of how much the government spends (outflow), Treasury maturities that are paid off (outflow), new issuance of Treasuries (inflow), and tax collections (inflow). It will vary based on those factors.

3. The TGA is a liability on the Fed’s balance sheet, just like the overnight reverse repos (RRPs). The RRPs have shot up to $2.4 trillion and dwarf the TGA ($665 billion). So if he wants to talk about those liability accounts in those terms, he should have said that the RRPs added $2.4 trillion in QT on top of the Fed’s QT on the asset side, hahahahaha.

4. Why doesn’t anyone in the media challenge these insidious manipulative hedge-fund gangsters when they come out with this BS? These people need to be crushed in public view when they throw around this BS around to pump up their own investments. But then those hedge-fund gangsters wouldn’t come on the TV show, and the TV show would lose its ratings and the money would go down and the host would get fired… and that’s why no one is challenging these hedge-fund gangsters.

Thanks so much for breaking it down Wolf!

Perhaps I’m misunderstanding where you feel he is being disingenuous or maybe I should have provided you the full interview. (Here it is:

It appears he’s not a tightening denier, more so that he believes the effects will be increasingly felt by Q1 due to a limit of Yellens actions.

…or maybe I’m interpreting wrong. You’re my go to trusted source for all things on central banks so I appreciate the replies.

Thanks for the link. In terms of a recession in 2023, I’m not going to quibble with that. There’s a good chance of it, and we need it – not a huge one, but enough of a recession to clean out the excesses and the cobwebs.

In terms of what he said about the TGA, he’s just wrong. Look at my chart. He just heard something and is repeating it. The data of the TGA says otherwise. See chart.

In terms of liquidity, the TGA is minor. He needs to look at the RRPs: $2.4 trillion in Treasury money-market liquidity is sitting there, and the Fed will have to do a lot of QT to burn it off. And then there are the reserves — bank liquidity — $3 trillion, although that has plunged by $1.3 trillion from Jan 2022, with some of the liquidity having been shifted into RRPs.

So the excess liquidity may be in the range of $3.5 trillion, and those tiny moves in the TGA just don’t matter. And yes, the Fed will have to take years of QT to burn off that $3.5 trillion. Given how markets are reacting to just the beginning of QT and the rate hikes, it might be a rough ride getting there.

Just think, if we hadn’t shut down everything in 2020 we woulda got all that inflation then…………… almost like the goal of the shutdown was to keep the inflation from all that printed money from seeping into the general economy. Just a thought

Read The Premonition by Michael Lewis for what it actually takes to combat a pandemic and the abysmal state of public health in the United States. It does for the COVID-19 pandemic what the Big Short did for the 2008 Financial Crisis. The entire period was a shitshow of reactive thinking.

No policy plan ever survives contact with a politician.

Yeah but at least if you disagreed with housing run up and the way it was handled you weren’t censored………………………

“abysmal state of public health in the United States.”

Also this isn’t new. We’ve known for at least two decades that healthcare in the US is akin to higher ED, aka a grift, what truly opened my eyes was how if you do your best to scare the living daylights out of people, they’ll even fight for your terrible ideas!

Some of us have been too busy living our lives to realize the reality of things and just how utterly screwed we’d be had something more serious happened.

The book covers *public* health, different from the private health networks that put profits over people and other perverse incentives in health care that we are all too familiar with. The CDC is not your friend, and that book drives home that reality.

Yes, there is a kind of loose consensus with social media companies on certain ideas and topics (similar to what today’s CEOs might believe on certain ideas and topics), but at the same time, there was also a significant amount of dis- and misinformation being used to advance certain political objectives.

Social media, to avoid liability for what was put on there, wanted to be treated as neutral platforms in the eyes of the law, so they put themselves in that position of getting backlash whenever they stepped in, trying to have it both ways. As much as it is their right, as private organizations, to remove posts on their content platform.

Nonsense. The printed money still seeped into the general economy, it just did so in the form of Amazon online purchases rather than hotels and haircuts.

But of course, you must make sure your friends get all the printed money first. We all know those who get the money first get the biggest boost before inflation begins.

“Inflation is transitory” – Powell the greatest comedian of all time

The FED’s mantra is “Just lie. Period. Just lie and make up anything and say anything. Lie your ass off. Lie. Did I mention lie? Just lie some more!”

“That was my story, and I stuck to it until a few months ago. Now it looks like the Fed will take those rates above 4% by yearend, and higher still next year.”

It’s a totally reasonable story, so I wouldn’t abandon it just yet. A lot could happen in the 4th quarter, and nobody realistically has any clue what next year is going to look like. A lot of commodities are back to pre-pandemic levels, and that will show up in product pricing given some lag time. House prices are moving downward and construction is going flat which will show up in services, also with a lag time. And let’s not forget that there’s always the specter of some currently unknown part of our fragile financial sector imploding at any time, just ask the Brits. How long until something in our credit markets buckles under QT with a growing FFR, prompting “temporary” Fed intervention?

I’m just scrambling to not be one upon whom the next exciting phase of rebalancing rebalances. So far this year, so good. But it has taken some sacrifice and care. With help from wolfstreet.

IMHO, the problem is there is still an insane amount of money in the economy which will pounce on assets the second the Fed even hints of a pause which will cause big run up on stock/bond prices and we’ll be back where we started. QT is the key to destroying the excess as Wolf has pointed out. IF they pause QT then we will have never ending inflation.

We here in California are still going to get our stimulus checks, I mean inflation checks, to pay for all this inflation, hahahaha. Up to $1,050. They start going out in October. The state is sitting on a record amount of money and doesn’t know what to do with it, so it’s going to get spent one way or the other. Other states, and cities too, are similarly flush with cash. And this cash will get spent and it will continue to stimulate the economy. The Fed is gnashing its teeth. This inflation will be a long and tough slog to get rid of because all this stimulus is still circulating and will continue to do so.

Political stupidity knows no bounds.

Georgia is planning to send out a $1 billion refund to tax payers.

Second one this year.

Fortunately, with gas between $6-7/gallon again in CA (I paid $6.80 for regular today), the stimulus checks will be gone almost immediately and inflation can then subside. /s

Even our tiny town of 6000 is meeting to decide how to spend their suddenly flush coffers in a deliberate multi year plan, so as to not show a spike in spending this year or next. A long way to go.

The state is sitting on a massive surplus due to all the investment gains last year and then there are the increased property taxes. But once all of those stock gains turn to losses this year, the state will have no money and go begging to the Federal government for a bailout.

Politicians are so morally corrupt. They are not this stupid. Just corrupt.

Some politicians just can’t get ahold of the idea of a “rainy day fund”. Especially when they’re trying to buy votes with our own money.

There is a Rainy Day fund in California, and it’s chock full with money. There is money everywhere. It’s hard to imagine just how much money there is everywhere now.

This is such disgustingly gross behavior by politicians. People are fed up with the free shit everywhere.

It’s no easy trick to un-print trillions of dollars that the FED/GOV sloshed all over the place.

Sure there is.

Tax it back so the Government can sit on it, really sit on it not immediately re-spend it.

This might be unpopular with the General Populace.

Inflation is a two-headed hydra. I see nothing that is going to slow government spending. War, energy subsidies, millions of immigrants each year, forest fires, hurricane rebuilds, infrastructure, etc, will just keep coming. The Federal government reacts in one way, throwing money at a problem. Without fiscal restraint from our politicians, I am not sure the Fed can tame the inflation beast. The Federal debt seems to double about every eight years.

Plus wages are trending up. We don’t see it broadly yet for some reason. But there are billboards advertising $30 per hour for warehouse work. CDL billboards advertise 100K per year. McDonalds is advertising $15 per hour.

That explains why my favorite cheeseburger is no longer on the dollar menu. In healthcare, our local Hospital pays an $75 per hour, to any RN that works extra shifts. It sure feels like the Fed will need to keep going with QT beyond this year. Good article.

Instead of bubbles bursting, runaway price increases.

Still seeing massive, and I do mean MASSIVE price hikes in all sorts of products. Inflation is raging out of control. But don’t worry, Jerome Powell and his squirt gun are aggressively fighting the raging inferno.

If you look at NIPA table 2.3.5 on the BEA’s website, you’ll see what categories make up the core PCE, along with the weights each of the categories has. Then think about how the Fed’s raising interest rates and letting Treasuries roll off will affect the inflation rate in these categories. The inflation decline rate in the bigger categories will determine how fast the Fed will reach its target. Other effects of the Fed’s actions are not how the Fed measures its progress toward its goal.

Translation: If you look at the mechanics of how the Fed “fights inflation”, you discover (a) it’s gonna take a while, and (b) there will be a lot of collateral damage, because the Fed’s policy tools don’t connect directly to the observables they’re trying to manage.

Fortunately, now that they’re hitting the Minsky Moment phase and triggering all the “unexpected” black-swan crises for which they’re justifiably famous, they’ll trigger lots of “nonlinear effects” (market crashes) that will help them get to their objectives a lot faster!

The FED’s whole reason for existence is to create collateral damage. Common Americans suffer the damage and are the collateral.

Well put. You and I are the collateral for the bond buyers domestic and foreign.

Not even close to capitulation yet. The VIX isn’t going hockey stick up like it always does. This could drag out awhile.

Markets are perched on support levels. I think the support breaks next week and we will see what downside looks like. Nike and Micron gave a preview of the bad news that might be hitting stocks with their quarterly reports.

Apple broke two days ago…next leg lower has begun.

Wolf being humble and adjusting his 4% estimate up a bit while ZH, MSNBC, Kramer, Krugman and just about everyone else have been more profitable to inverse than listen to.

I’m still bitter about deleting my link in comments a week ago but have to give due credit here.

2022 Federal Budget 6T,

2022 Federal Debt 31T.

Rising rates make it more expensive to service the 31T debt. Who cares, right? Deficits and debts don’t much matter if you borrow dollars but intend to pay back 50 cent pieces……then quarters……then dimes.

The impact of higher rates happens slowly, so it is not huge right away. It happens as they refinance the older debt. Of course, I think they have been using alot of short dated Treasuries, which would mean that stuff gets refinanced at higher rates very quickly.

The website you greatly dislike is indicating things are beginning to blow up with the little monetary tightening applied so far. Do you agree things are already beginning to break, in the US, not just Europe? Or is this merely more propaganda?

Looking at the 3 yr trend of the stock markets, the COVID bubble is already gone for the DOW, and almost gone for the S&P 500 and NASDAQ. As I mentioned prior, I didn’t believe things would become interesting or significant until this occurred. Now I believe things are more likely to become/signal dysfunctional and break.

Stock Markets 2/9/2020 vs today

DOW 29,400 – 28,700 -20.95% YTD

S&P 500 3,380 – 3,585 24.77% YTD

NASDAQ 9,700 – 10,600 -32.40% YTD

Oops Typo, S&P 500 -24.77% YTD

Roger Dodger,

The biggest thing that already broke is “price stability” and it turned into raging inflation. That’s a HUGE thing that broke. People forget that. And the Fed is directly in charge of that huge thing that broke. And so yes, the Everything Bubble is deflating, and I said it would under Fed tightening. QE and interest rate repression inflated the Everything Bubble. Now QT and rate hikes are deflating it. It was the most predictable thing in the world. It only surprised the tightening deniers.

But markets were busy fighting the Fed, which can get very expensive in a hurry, and now they’re finding out. I did a podcast on this on July 31 to warn people about this (people pooh-poohed me over this in the comments:

https://wolfstreet.com/2022/07/31/the-wolf-street-report-markets-are-fighting-the-fed/

Are some hedge funds or pension funds or whatever going to get into trouble? Sure. Are some zombie junk-rated companies going to file for bankruptcy? Sure. There will be quite a bit of that. Should have happened a while ago. Cleans out the cobwebs of the economy.

The costs of interest rate repression and QE are immense, as we’re finding out.

I have always felt that the market carnage coming from such a small amount of actual QT is the real story. I am coming around to the notion that this inflation at the core is more sticky than I imagined, which simply means that markets will fall even further.

We have not even come close to seeing what happens once real estate prices begin to melt. 8 percent mortgage rates will evaporate prices at a much more rapid pace. Home prices should hit pre-COVID within 9 months max and that will only be half way through the decline. I see massive carnage in real estate coming.

No reason to buy real estate until there are lots of foreclosures and short sales.

Although we dont have the same creditworthiness problem we had in the past, we have a different problem – affordability. The pool of buyers is much smaller and this time, the Fed cant react by cutting interest rates to put a net under it. That is the key, no safety net.

Mortgage credit standards are stricter than pre-GFC but still very lax, still in the basement.

Affordability is the immediate problem (for demand) but loan quality isn’t remotely what most people think.

A conventional 80/20 loan issued on bubble priced houses isn’t conservative or high loan quality. That’s a complete farce.

Borrower credit worthiness is equally weak. Cash flow is predominantly contingent upon a job market which is artificially distorted by fake “growth” while balance sheets are inflated from the asset mania.

Rising rates are going to noticeably reduce demand. The stock bear market is going to lead to much bigger layoffs, a weaker labor market, and increased supply. I am still expecting foreclosure moratorium and mortgage forbearance though.

The Break was the incessant creation of dollars for years. The price instability has been reflected in the years long asset bubble, healthcare and education costs, etc. It just didn’t happen to show in their joke manipulated “inflation” indicator because of the labor/regulation arbitrage opportunity offered by the Chinese and our Anti American Politicians.

I keep seeing a lot of people that keep pointing to the market as evidence the Fed will pivot. I don’t think a lot of people are listening to the Fed.

JP stated that it looks as though the market is getting the message; that was back in may/june I think.

Kashkari was just rooting the market downward last week.

Why does everyone think the Fed is so worried about the stock market? Is this just historical?

I think that the stock market dropping, so long as it is orderly, is exactly what the Fed wants.

Historically, FOMC board members are marionettes working for the government, and the government is directed by (1) asset/capital holders and (2) goverment employees (pensions).

This time might be a little different though, because it is very clear the FOMC members are to blame for breaking things, and they have a sense of obligation to fix it to avoid being painted as villians throughout future immemorial history.

I get that point. However, JP made it a clear point to crush the market last month. That seemed to be his sole purpose for the JHole 8 minute market crushing speech. They want the stock market lower. A disorderly bond market is another story perhaps.

But they have been crystal clear in the message that they want a sell down in the stock market.

I just don’t get why so many people think that because the markets are down 20-30%, that all the sudden the Fed is going to want to pivot to save the stock market.

of course a lot of people don’t listen to the FED. They are liars.

What is interesting is if you look at a lot of stocks, they have done a round trip and are back at pre-pandemic levels. Funny, but many are even lower.

R2K is back to pre-pandemic levels

QQQ is still about 20% higher

SPY is about 10% higher.

QQQ and SPY are heavily weighted by the Apple, MSFT, Google stocks which have been safe havens.

What is not funny is even though a persons investments are barely above pre-pandemic levels their everyday costs are not. This would include food, housing, cars, land, clothing are now much higher. Luckily wages have risen too. Not enough though.

The FED has raised rates fast and hard. Usually when this happens something breaks. It will not be the stock market, unemployment, or inflation that will cause the FED to pivot. The FED does not care if the stock market or housing falls. They want the unemployment rate to go up and inflation will drop.

The event that will cause a pivot is when the banking system freezes because they are moving to fast. I agree with Wolf, they should wait some to see the effects of rising rates and QT.

I am not sure if anyone remembers taper tantrum but the overnight lending was freezing up (just like during the GFC). Banks did not want to lend as they did not trust the counter party collateral. This will happen again, I just do not know when. Look at the Bank of England and Japan as examples. They both started buying bonds again. Come on man. We need a some short term pain for long term gains. They already cried uncle and inflation needs to drop a lot yet.

The FED will protect the banks and Hedge Funds to keep them from blowing up to stop any spreading contagion.

They learned their lesson with Bear Sterns and Lehman.

There was no core inflation raging at the Bear Stearns and Lehman time. They cant reverse the tightening this time.

They are actually going fairly slow this time. The US is different than UK because we are still the world’s currency. We get away with much more. I see some blow-ups on the horizon.

Value of the USD is still subject to collective sentiment.

It is subject to drastic repricing, just like every other financial asset. Like every other financial asset, no direct connection to the physical world.

That’s why financial values move so drastically (up and down) relative to the supposed “causal” fundamentals and how we ended up with the biggest asset, credit, and debt mania in the history of human civilization.

Relative financial value only exists in people’s minds. It’s not physics or chemistry.

The FRB has some latitude due to the DXY at 115.

When the dollar is a lot lower and at risk of sinking, it will be a different conversation.

Based on gametv and Augustus comments, maybe my fears of the FED losing control is not warranted.

I guess those cliff dives this past week of those mortgage REITS like Annally (NLY, DX, AGNC, etc) are not so worrisome?

Greenspan said: “Because monetary policy works with a lag, we need to be forward looking, taking actions to forestall imbalances that may not be visible for many months. There is no alternative to basing actions on forecasts, at least implicitly.”

But Powell only started tightening recently:

Reserve Bank Credit:

2021-12-01 8678.115

2022-01-01 8780.344 start

2022-02-01 8852.336

2022-03-01 8891.820

2022-04-01 8910.015

2022-05-01 8907.146

2022-06-01 8888.579

2022-07-01 8862.560

2022-08-01 8828.338

2022-09-01 8783.417

Yes, but QT started in June, not in January.

Not including the month-end Treasury roll-off today (it will be on the balance sheet to be released next Thursday), total assets are now down by $170 billion from the peak in April:

This graph is just as important as the rate increases the Fed is announcing, QT of 2% is essentially nothing, we will know much more when the Fed has run it’s vast pile of assets down 50 or 75%. Until they have, real price discovery doesn’t exist. This whole asset purchase thing isn’t really complete until it has been unwound. I personally doubt the Fed has the guts to see that happen in a meaningful way and that it may take 10+ years.

It is just crazy how much the Fed ran its Balance Sheet up by since September of 2021… over half a trillion dollars. They damn good and well knew by last September that there was nothing “transitory” about the inflation they were seeing.

I am not saying that they needed to start QT at that point… but would it have hurt for them to go to a neutral stance at least? When in a hole… stop digging.

They should have never ever done QE to begin with, not in 2008 through 2014, and not in March 2020 through April 2022. Then they wouldn’t have those kinds of problems now.

I’m just going to go out on a limb and predict 5 months or so until inflation is under control. Looking at the chart is been 5 or 6 months since the peak of what I’m hoping is a one time increase. Suppose there was an instantaneous 10% increase yoy in cpi. the yoy would take 12 months to show 0% inflation.

It is going to take a LOT longer than that. It took Volcker almost three years starting in the late 70s. It took Greenspan almost three years starting in the late 80s. Inflation doesn’t cure itself… certainly not when (as Wolf points out) there is this much excess liquidity floating around in the economy.

Wolf,

what do you make of this “surprise” monday meeting the fed has planned?

I have been seeing chatter about some special emergency meeting posted on the Fed website scheduled for this Monday.

They had one like that in March, about the same topic (discount window). I think they’re going to tweak some of the terms of their discount window.

“Surprise” is the wrong word. They announced it three days ago.

Not going to lose any sleep over it.

Re: Fed discount window

Dr. Lacy Hunt brought up the Fed discount window topic when asked about distressed companies needing a bailout in the near future. I think Danielle DiMartino Booth explained this conversation with Dr. Hunt as a sign of just how ultra-serious the Fed is truly going to be about tightening and taming the inflation monster, especially in light of the meetings Wolf is describing in the above comment.

Thank you…love the blog by the way.

The Fed needs to ratchet QT up to $120 billion / month, with all the additional money targetting Treasuries. Hopefully that’s announced at this meeting.

While nominal risk-free interest rates (treasury yields) have been rising very rapidly this year and getting most of the attention, real (inflation-protected) interest rates (TIPS yields) have been rising even faster for all maturities.

The upshot of this is that 5 year breakeven inflation rate is now 2.14% which is basically back in the normal pre-pandemic range and where it was back in Jan 2021 when CPI was still below 2%. 5 year breakeven inflation rate peaked at 3.6% in March 2022.

“The breakeven inflation rate represents a measure of expected inflation … and implies what market participants expect inflation to be in the next 5 years, on average.”

I know that many folks are suspicious of any measure derived from the bond market due to the massive Fed manipulations of QE and now QT but I thought that this was an appropriate thread to mention this significant milestone that happened today.

They also “expected” inflation to be transitory. How did that work out?

Some Treasury and Fed officials and a few economists said that they expected inflation to be transitory but I haven’t seen any data or evidence to suggest that market participants expected inflation to be transitory.

Do you have any such evidence or data?

If so please share with the rest of us, thanks

Just a few Fed officials and their army of economists, so nobody important.

As a layperson I also raise an eyebrow at this data series. It seems to be based on treasury yields, but with QE and other central bank manipulations, do sovereign yields really, truly represent a “market expectation” of future inflation?

5 years ago the 5 year breakeven inflation rate was 1.75%. Apparently a lot can change in 5 years.

Powell said transitory over and over again, as the head of the Fed he’s hardly “some Treasury and Fed officials.” He’s obviously speaking for the institution. Don’t downplay the facts and then ask for data and evidence about what market participants thought.

That said, I believe Wolf has talked about how the Fed specifically targeted the TIPS market to obfuscate the “markets” inflation expectations. Now that the Fed is no longer buying bonds, that’s unwinding so it’s not a surprise that “real (inflation-protected) interest rates (TIPS yields) have been rising even faster for all maturities.”

The point is that TIPs yields have been rising faster than regular treasury yields.

Similarly 30 year mortgage rates have been rising faster than 10 year treasury yields (their benchmark).

QT is happening faster for agency MBS than for Treasuries which may explain why spreads have been widening between mortgage rates and treasury yields.

It’s possible that QT is happening faster for TIPs than for regular treasuries and that might be narrowing the spread between TIPs yields and regular treasury yields.

Does anyone know if there is faster QT for TIPs than other treasuries?

Dazed And Confused,

“It’s possible that QT is happening faster for TIPs than for regular treasuries”

Yes, there is some of that…

TIPS roll off in big chunks when they mature. On July 15, TIPS with an original face value of $9.6 billion plus $2.5 billion in inflation compensation matured, and that $12.1 billion rolled off the balance sheet as part of QT.

The next maturity of TIPS on the Fed’s balance sheet is on January 15, 2023. And that batch will roll off then.

The TIPS market is much smaller than the regular Treasury market, and the Fed only holds about $375 billion in TIPS, though that represents a substantial part of the TIPS market. So that roll-off in July reduced its TIPS holdings by 3% all at once, which is faster than the decline of regular Treasuries.

Thanks, Wolf.

Great insights, as always.

When inflation spiked in the late 1970s, Fed Chairman Paul Volcker crushed it by raising the prime rate HIGHER than the inflation rate. It was goddawful and gut wrenching, but it worked.

The Fed CANNOT do that now. The idiots in DC have spent us into a 30 trillion dollar hole. If the Fed raised its rates ABOVE the 8% inflation rate, there wouldn’t be enough tax revenue to pay the interest on the debt. Maybe not right away, but it wouldn’t take very long.

GODs honest truth, I don’t see how this ends well

PS to Dazed and Confused : if you think that “breakeven inflation” is an actual thing, and that somehow inflation is only 2.14%, you literally must live in a different America than I do.

Seriously, I am being generous to the point of night sweats by even going along with the pretense that inflation is 8% right now. its is a LOT HIGHER than that, and you don’t even need to go to the shadowstats to figure it out. Just GO GROCERY SHOPPING WITH YOIR EYES OPEN

Pablo,

CPI at 8% is an overall inflation figure. The CPI for food at the grocery store = 13.5%

https://wolfstreet.com/2022/09/13/services-inflation-spikes-core-cpi-jumps-food-inflation-worst-since-1979-even-durable-goods-rise-but-gasoline-airfares-plunge/

Let me repeat the definition of breakeven inflation:

“The breakeven inflation rate represents a measure of expected inflation … and implies what market participants expect inflation to be in the next 5 years, on average.”

It doesn’t mean that inflation last month was 2.14% or next month will be 2.14%. It’s the expectation from Oct 2022-Oct 2027 annualized.

Market participants are going to lowball their declared “expectation” because they don’t want to pay a higher price for borrowing money.

Dazed…

So, under that definition, inflation is breaking even with what, exactly?

Another definition of “break even” inflation is when you can hold a dollar and the interest rate you receive on that dollar “breaks even” with inflation. ie FFR = CPI

Now doesnt that make more sense than some “expectation survey” that is compiled in a fashion which no one can audit the accuracy or legitamacy?

Startling revelation – you are the first person to ever post this observation on WS …. NOT

Wolf debunked your arguments in an article a few months ago.

And there’s a general consensus that it might not be necessary for FFR to exceed CPI this time because massive QT may be enough to crush inflation.

All this has been discussed many times on WS before so no need to rehash it again here.

Yes, “massive QT”. Do you think this will happen? The Fed has sold of 2% of its asset pile and is on pace to sell it all back sometime in the next decade. Wake me up this becomes “massive ” instead of “token gesture “.

I don’t think for a long time there has been enough tax revenue to cover the costs. They just raise it through bond sales and printing.

I have yet to see the Congress cut their coat according to their cloth so they and Yellen are fighting the FED as well.

I have to feel for J Powell as the head of the 12 Headed Hydra, not a job for a pansy

When will inflation slow down? When most Americans have become poor. Don’t worry … it’s coming.

Where oh where is SocalJim with a sunny real estate outlook…

Everybody thinks of Volckers high interest rates as the brake to inflation, but actually for the UK, fiat currency have been tried before (unsuccessfully of course) and abandoned.

During the Napoleonic wars which was the very start of the 1800s the metallic standard was abandoned, and of course inflation followed. However, the cure was to return to the gold standard in 1820 and then prices stabilised. This was a period of about 20 years. Our period is about 50 years not really so different.

In fact during the US war of indepence, out of necessity, the early new administration switched to fiat currency, and also inflation followed. The cure was to restore a metal link.

It does sound far out but the US does have fairly considerable gold reserves (having confiscated an entire population’s worth), and the government only has to redeem marginal demand for gold which would fall if the dollar was stable. Anyway I don’t think its impossible if the choice is between ruinously high interest rates or picking an arbitrary peg to gold. Larry Summers effectively hinted at a yes pegged to gold recently because of course the volatility of currencies recently must make planning impossible for business. I mean dollar 2.10 to GBP and just now 1.08 come on its ridiculous variety.

Give it up. You are never getting a gold standard again in a developed nation.

Ah yes.. the ‘I Don’t CARE$ Act, I Gots Mine!’

The Biggest of, er, the ‘recipents’ were for the most part the Big Playas ..who’ll NEVER be held to account. The lowly ‘forced’ couch potato, however, gets the eventual inflationary lash.

A stupid question about value vs money supply

When a stock market looses value does that decrease the total global money supply, or does the money just shift location or possession?

How does money supply move in a declining stock market? Is it like a game of cards where the one withdrawing and leaving is where the money goes or does some of it die- go out of circulation?

Lynn, all sorts of arguments/opinions can be formed around asset market movements indirectly affecting the money supply, but there is no direct link. The money supply is “the banking system,” with the Fed being the #1 bank. Money supply is far more directly affected by the Fed’s actions (‘tight’ or ‘loose’), which in turn directly affects how much money the rest of the banks lend out, which does affect the money supply.

Also, the stock market is mostly just quotations. Just because some meme stock with low float is quoting some ridiculous price on a Thursday and then on Friday it’s quoted half the amount the previous day, doesn’t mean all that market cap quotation money is flowing in out of the actual monetary system.

To further illustrate the point: take a very low volume “penny stock” as an example. Imagine one person buys one single share from someone else at some insane price for that one share. Then suddenly the market quotation for that stock, if it’s quoting Ask prices, is showing all the other shares possibly “worth” the same amount of money when in all likelihood there are ZERO buyers for that Ask quotation. The quote goes down when the next buyer pays significantly less, and it may be for one share again. Two trades on two shares of stock can move the quoted “market cap” of a low volume stock.

Thanks Sine99. I’m wondering about the stock market as a whole, but maybe it’s the same answer. So I guess shrinking credit is only sometimes a reaction to it falling and it is not a cause of that.

Sorry, I’m a bit late in responding..

The latest rate increase deniers are claiming that a future Fed ‘decrease of an increase’ from 75 basis points to 50, will be a pivot. Go figure! Denier Capitulation?

Excellent presentation of the facts, no B.S. If I may talk about what your article instigated me to think about various scenarios of the future, from the point of view from one, insignificant nothing, as described by Loyd Christmas.

The scenario that currently dominates is that we are experiencing an inflation shock and aren’t sure what the action we should undertake, as a Democracy, that is in the best interest of the “general good”.

A term that has a defensible statistical basis, strong enough that has it historical literature describing it as a common way of life. Such as the Constitution of the States of the United States of America.

Mindful that history is written by the victors, I’m forced to wade into the murk of the 70’s and 80’s. Paul Volker’s Fed, eventually came to the solution that he is famous for, in the lore of financial urban legend>

kicking ass and taking names

Interest rates at nearly 20 pct. Eventually reached the point that inflation is like an infestation of insects. You, probably, will end up taking drastic action to kill them, after exhausting more gentle approaches.

When Janet Yellen was the Fed chair, the Fed began normalizing the balance sheet with QT1. The leveraged financial market, immediately, started to contract. And the fool in the seat of the king, fired her and reached deep into the billionaires network to unearth Powel.

A Yale law grad, without the wear- with-all to lead the Federal Reserve Bank of the United States of America and the world.

The billionaires, liked zirp, which Yellen was dismantling, for obvious reasons, given the current dilemma the general good finds themselves in.

Obviously not willing to accept the party line that that smell is the scent of a bouquet of roses.

Of course, in those days, NYC was a bankrupt, shit hole rather than the condescending gentility they are exuding today, being pumped up by Financial engineering past decades.

Commentators blame the Fed for asset price inflation which i understand is the stock and housing markets. Presidents and Congress get a little blame too.

But why doesn’t anyone blame CEOs and the other higher ups within businesses (VPs, CFO, etc) for being responsible for current product and services inflation ? Is there some bias I am detecting or am I just not understanding something ?

It seems to me that businesses don’t have to necessarily passively accept price increases from, say, their suppliers. Maybe in some cases but not in others. But perhaps for reasons that don’t get discussed, the mindset of these business leaders is to simply pass along input price increases, i.e., don’t fight it (find another supplier, etc). If this is true, why is this the mindset now ?