Those that believed the hype and hoopla and didn’t get out in time got thackamuffled.

By Wolf Richter for WOLF STREET.

Palantir Technologies, which went public in September 2020 via a direct listing amid enormous hype and hoopla, has now earned a much coveted spot in my Imploded Stocks column.

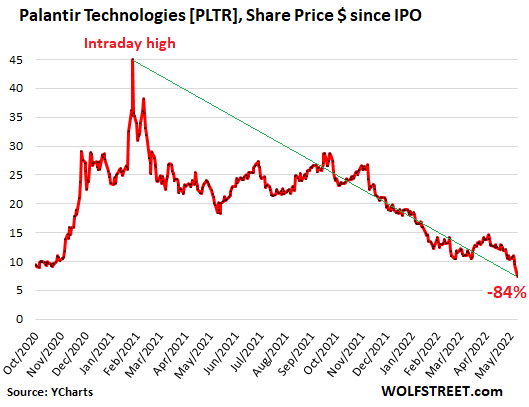

Today, Palantir reported another huge loss, this time $101 million, on $446 million in revenues, bringing its total loss over the past four years, to $2.86 billion. Its revenue outlook for Q2 was below what Wall Street expected. Shares [PLTR] kathoomphed 22% so far today, and 84% from the peak in January 2021, to $7.40 a new all-time low. They’re down 26% from the first trade in September 2020 (data via YCharts):

The intelligence startup sells automated data analytics systems to the Pentagon, CIA, NSA, ICE, and other federal agencies, and to state and local agencies, including to police agencies. Feeding at the public trough of government agencies in this manner sounds awesome for Wall Street in a grisly sort of way.

Palantir became infamous when it emerged that police departments were using Automatic License Plate Reader systems (ALPRs) that take images of every license plate (plus of the vehicle and occupants) that comes into view, and that Palantir’s software was used to comb through the data. But for Wall Street, it just fed into the hype and hoopla — think of the unlimited prospects of these systems being installed in every city around the country and the world!

When the company went public in September 2020 via a direct listing, shares started trading at $10, giving it an inexplicable market cap of $16.5 billion. Shares where then whipped to $45 intraday by January 27, 2021, more than quadrupling in three months, giving the company an even more inexplicable market cap of around $80 billion, which shows how crazy this whole sh*tshow had gotten. And then shares got shookalacked.

The company has been marketing its software and services to corporate customers, but government customers still produce over half of its revenues, and revenue growth in the government segment slowed to 16% year-over-year, Palantir reported today in its earnings release, the slowest since the company began disclosing it as a public company in 2020.

But Corporate America, which has been profoundly immersed in surveillance of consumers and competitors, is the bright spot: Revenues to US companies jumped by 136% year over year, and total global commercial sales rose 54%.

So the business of selling surveillance technologies of all kinds to government agencies, Corporate America, and global companies is thriving. And revenues at Palantir are growing, though more slowly, amid a huge appetite for more surveillance and better analytics of the data thus obtained.

It’s just that Palantir keeps losing a ton of money doing so year after year. It’s like the big taxi enterprises Uber and Lyft losing a ton of money year after year, despite their huge revenues. Or like the huge used-car dealers Vroom and Carvana losing a ton of money selling used cars; and they now entered an existential crisis.

And even if Palantir were to ever make a net profit of $100 million a quarter (instead of losing $100 million a quarter), it would amount to earnings per share of just 5 cents at the current number of shares outstanding, and a year of that would amount to EPS of $0.20, and with a PE ratio of maybe 20, if revenues continue to grow, it would amount to a share price of $4, if the company ever figures out how to get there.

They and hundreds of others all operated on the same principle. None of these companies were ever designed to make money. They were designed to bamboozle investors. And that worked for a while but started coming apart company by company in February 2021. And those stock jockeys that didn’t sell in time got thackamuffled.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How does a company consistently lose money on big government contracts? That has to be a first.

Yes, it’s baffling. It’s like, how can you lose money year after year selling used cars?

The answer is that these companies were designed and structured to lose money, and they were promoted by Silicon Valley in an era when losing money was good. And their founders and executives were encouraged to make the company lose money. The more the better.

And now that era has come to an end.

By all reports, palintir’s services are highly valued. But very costly. About 5 years ago a customer told me gruffly that he was not interested in a “palantir pricing model”. The govt has deep pockets but eventually figures out when its being screwed. (LMT and BA are politically protected, so are still getting business despite basically never meeting contractual cost / schedule commitments.)

Fascinating comment, but: LMT=?? BA=??

LMT = Lockheed Martin

BA = Boeing Aerospace

Stock tickers.

So are Crowdstrike’s but it’s a huge money loser too.

Speculators (no, not investors) fall in love with some theme and think that because the product or service is useful, the sky is the limit.

CRWD offers useful products and services. It still doesn’t deserve a market cap of $33B+ on $1.45B (per CNBC.com) in revenue even if it wasn’t losing buckets of money which it does.

Assuming it ever does consistently make a profit, with a “reasonable” margin, maybe it should be worth high nine figures or slightly over a billion, if it can pay consistent competitive dividends.

PLTR is a laughing stock right now, but Palantir stay of strategic importance for the DoD. They can’t go bankrupt and still got plenty of cash.

That said, I’m -50% on my position, and won’t buy any more shares till they stop giving ’em away, and start making real money.

This company’s in desperate need of a better management, obviously. A less arrogant CEO would help, as would Peter Thiel staying out of the GOP’s business, with Biden’s administration.

If you see the word “disruptor” in the company description, run! Do not pass “Go”for you will surely not collect $200.

Disruptors now being disrupted by market disruption.

Maybe we should get Michael Keaton to break down “disruptor” like he did – hilariously – with “prostitution” in the film Night Shift

To that question, perhaps Carvana needs to fire their executive management and hire people from Carmax instead. One is losing money hand over fist, the other is making money and been in business for more than 2 decade now but it’s not the new shiny object to Wallstreet geniuses

Carvana is a similar formula to Zillow. Propeller-heads design a website and an app and then pretend to be real estate / automotive gurus.

It’s like the old joke…. “How do you get a million $ in the car business?

“Start with $10M and buy a dealership.”

Suspect the same end is coming to the US government and its budget deficit

The budget deficit is coming down and the US govt has the power to tax and print money so if the govt does out business which it will not, Covid will be least of your problem

The market is doing a poor job of really understanding business models. Losing money in an early stage of a company is not a terrible thing, if the money is being used to grow the company into a really large TAM without too much competition.

I am invested in a stock in the telehealth space, HIMS. It has gotten whacked, but the difference is that HIMS has beaten growth projections, is growing at 80% year over year and has a 74% gross margin. The company is over-spending on both marketing and G&A, but those are investments in a very big future. They earn payback on their marketing dollars and the lifetime value of a customer far exceeds the marketing cost to acquire the customer.

As long as the lifetime value of a customer is far in excess of the marketing dollars spent to acquire the customer (and the G&A required to service the customers in future periods), then it is a good investment. Trouble is, many of these companies have been throwing money at growth where the lifetime value is not high enough.

The market is throwing out a couple gems with the dreg right now. It will get sorted out in the next couple of quarters and some companies will rise from the ashes, while many others will need to cut back massively on spending and some will go out of business.

Double down on your gems then. More stock for you.

A good business does not equal a good investment, not in a mania at mania prices and valuations.

Look at CSCO. HIt a peak $82 during the dot.com bubble and then crashed to $8. It’s at $49 today, down almost 40% in 20 years. Maybe close to a zero return or slightly more counting dividends

Was that a good investment? No, it wasn’t but it’s definitely a good business.

“Was that a good investment? No, it wasn’t but it’s definitely a good business.”.

If you bought at $8 it was a hell of an investment.

One can cherry pick the other way too.

Not on this one. Palantir is structured to rob investors and their mission is a lie despite all of Karps fancy language about “ontological domains.”

Share dilution from 244 million at IPO to 1.6 billion. One of, if not THE most heavily compensated CEO of any US company in 2021. Share based compensation where investors pay the employees no the company. SPAC investing in ridiculous companies to get said companies to sign a contract for services. This contract then added back in to PLTR’s books commercial growth. Then the pharma investments where there is quid pro quo direct investment. This is some voodoo accounting. Expect subpoenas in the near term due to class action lawsuits and fraud allegations.

gametv, do you do this professionally for someone else or on your own?

That is a significant insight, can you elaborate on the angle. I can’t see the details of how maximizing the losses of exchange listed companies is a wise investment. Worth a full post, Wolf.

My view of where the three market bubbles are, what stage of their deflation from a manic delusion they may be, cautioning that what I say is more likely to be wrong than right, I quote Churchill who some up my view, no matter what I think of the man:

Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.

Yes, I’m probably going to do a whole podcast on it (an episode of THE WOLF STREET REPORT), which gives me a lot more room to roam and dive into the nitty-gritty than a regular article.

I worked there for about 7 months. Their turnover is extremely high, even for the tech industry. If they keep cycling through people as they have since November 2021, they are going to exhaust the labor pools.

The main question I asked when Trump was running was how do you bankrupt a casino? Shouldn’t the house always win?

Casinos go bankrupt all the time. You need customers just like any other business. Nevada is littered with the carcasses of bankrupt casinos.

AI, PLTR, QS, SLDP, & HJEN are all companies that I’m willing to dump $1,000 each into in the next 4-6 months depending on how we progress towards a recession. The first 4 will likely be acquisition targets in the next 1-3 years. HJEN (hydrogen ETF) would be a 10 year or so play. Hydrogen in industries like metal smelting will be a very big deal in the coming years.

There will be some gems among the wreckage. It’s a dicey landscape though. I do have dry powder at the ready!

Likewise phleep. Powder is dry and ready to deploy. The chinese symbols for crisis come to mind: one for danger, one for opportunity.

“The chinese symbols for crisis come to mind: one for danger, one for opportunity.”

You better find out what the Chinese symbols for “Bamboozled” and “Shookalacked” are!!!

The Chinese had a symbol for “thackamuffled” before Westerners knew how to make fire. They are the rightful inventors of thackamuffling! Then it was stolen from them!

— Your friendly neighborhood Nigerian Prince

Are you comparing the future wreckage to 1942 when John Templeton bought all the penny stock equivalents?

If you are, back then, companies didn’t get away with anything close to what they have since 2000.

When the actual future bottom arrives, practically all of these companies should have either filed for bankruptcy or end up in liquidation, assuming there are any actual assets of any value to salvage.

When the mania is over and cost of capital reflects actual risk, recent valuations attributed to these company’s intellectual property with little or no actual value is going up in smoke.

It’s not like very valuable assets will be selling at huge discounts.

It will be priced at or close to zero because that’s what it is actually worth, outside of manic financial conditions.

I just looked at PINS (Pinterest) and see that in the past year it generated 300 million in profit and looks like it will generate 500 million in profit for this full year. So the 13 billion valuation is about a 26 p/e multiple fo 2022. Coke trades at a P/E of about 28 right now, but Coke is not growing rapidly, while Pinterest is still growing.

There are still alot of gtech companies that were way overvalued, but there are some that are actually very cheap now. I actually feel like there are lots of stable companies that are not growing that are more overvalued than the good tech companies now.

It’s using tax loss carryforwards to report that net income. It’s good news because it previously lost huge amounts of money.

It has a good balance sheet but has never paid a cent in dividends.

It’s not a tech company, it’s another seller of advertising masquerading as one. That’s what it sells, advertising. It doesn’t sell technology.

You’re familiar with the asset mania, right? Well, the fake “growth” in this fake economy also artificially inflates ad spending. There is also an ad bubble if not mania too.

When the asset mania craters and the economy tanks with it, so will ad spending. It will be one of the first things to be cut – drastically – when corporate budgets have to be cut in mass across the board.

In a real bear market, stocks crash and initially look “cheap”. Then earnings collapse as the economy heads into recession (or depression this time around). Then dividend get cut or eliminated, cost cutting which will include ad spending, asset sales, and bankruptcies follow. That’s what happened in the GFC but it was only temporary because the bond mania kept financing cheap.

If the bear market is bad enough, rinse and repeat just like on the way up.

DIS looks like a bargain at a PE of 64………

Loving every minute of this…come one dip buyers? Where you at?

Next up, hopefully housing will crash like this or at least bring the price back down to fundamentals..a man can dream..

all you have to do is wait. patience is a virtue, you’ve made it this far

Phoenix, nice to hear you cheering up – I recall your desperate posts on RE.

Wait a bit more :)

Our politicians will likely come up with a rescue plan to keep the housing market ridiculously high. In Australia, for example, the Labor pols are promising to contribute up to 40% of the the price of a new house. Everybody wants to keep the ball rolling…

I feel like this might be the case. However, taking it with a grain of salt for now but there’s a post on reddit Superstonk pointing out the major threat the looming CMBS problem and the tie to residential housing market. If there’s any ounce of truth to it, the pricing action can unwind much faster this time than 08. Guess we’ll have to see, since this is coming from Reddit I’ll take it as entertainment value for now

To Alku, yup feeling slightly better, this is still the first inning and a lot can happen between now till the end but really still hope RE can get back to somewhat normal price

The end of cheap money and a crashing currency will end that delusion, unless the vast majority with the most economic and political power doesn’t mind trading their influence for temporary fake wealth.

I highly doubt that’s going to happen.

When you say “crash like this” — let’s keep in mind that this isn’t even a crash yet. The actual crash is just getting started.

We’re still up near the top, not even 20% off the peak. It’s a loooong waaaaay down. Take 15% down from here – that would just get to the top of the Spring 2020 pre-COVID bubble level, back when markets were priced assuming low-inflation, low-interest-rates forever.

And that’s not going to hold.

The dividend yield on SPY is a whopping 1.45% as of today after this “crash”. It’s a farce.

No, there hasn’t been a crash.

Indeed. I remember thinking in Jan 2020 (before most people had even heard of Covid): “what a ridiculous bubble is this!”.

But it was all goldilocks then. Now things look really grim, even longer term. Not only because of interest rate environment, debt saturation and central banks being forced to reverse. But also because of the deglobalisation trend. Remember that much of earnings growth in past years did not come from business at home.

ARKK was only down 9.86% today so it’s becoming a dip buyers dream. Soon the ARKK letters will turn gold color on CNBC and that’s the time to jump in.

I’m going to watch Mad Money today to get Cramer’s take on the market…..

Maybe he will tell his braindead followers the same thing Saylor has been telling his peeps but instead of bitcoin, buy the dip at all cost..

“Once you know how it all ends, the only use of time is…how do I buy more bitcoin? But take all your money and buy bitcoin. Then take all your time, figure out how to borrow more money to buy more bitcoin. Then take all your time and figure out what you can sell to buy bitcoin. And if you absolutely love the thing, that you don’t want to sell it, go mortgage your house and buy bitcoin with it. And if you’ve got a business that you love because your family works for the business and it’s in your family for 37 years, and you can’t bear to sell it, mortgage it, finance it, and convert the proceeds into the hardest money on earth, which is bitcoin.” – Michael Saylor

I wish him luck that his big stash of Bitcoin doesn’t go down far enough that he gets a margin call. I think I read the magic number is $21,000.

“Those that believed the hype and hoopla and didn’t get out in time got thackamuffled.”

They believed there was no reason to get out in the first place. The Fed misled them to stay in the Casino because the Fed would provide unlimited chips and cover their losses.

That would be the prolonged believers’ faith- based thinking and inattention. I am not going to try to transfer their failings onto the Fed, screwy as the Fed was. You feed the pigeons too much, too long, you get too many pigeons, then the free food supply shifts, you get a die-off. It’s nature’s way. It’s the core of risk. Humans or the Fed didn’t invent it. Caveat pigeon.

Those investors’ greed wasn’t a primary factor? Their self-generated fantasies of tech riches?

Wolf , you should look at the Brazilian companies both locally or at NYSE/Nasdaq .

The very same pattern .

My favorite to follow is STNE .

Lots of insiders dumping PLTR was a problem. Jumping ship. And to be “relevant” it bought a bunch of bitcoin.

“Thackamuffled” is a fitting sound effect. First investors got thwacked, and then they’ve grown VERY silent — muffled — as are so many of last year’s self-proclaimed new-age geniuses.

No, they never bought any crypto. They bought physical gold.

Private companies can spy on us and sell the data every which way. Gov’t is restricted by laws. 1984 is coming fast. Corps are doing the dirty work.

Surveillance capitalism knows SO much more about you than 1984’s scenarios ever dreamt of. And the line between gov and corp is SO porous.

Meh, for a real good laugh take a look at RIVN

We’ve already taken lots of looks at RIVN over the past 12 months, documenting the big kathoomph along the way, including most recently here, where the chart takes you from $170 to $32, a decline of $138. The $10 decline since then is just pocket change

https://wolfstreet.com/2022/04/28/afterhours-massacre-as-amazon-plunges-apple-intel-tesla-even-meta-dive/

Have you done a piece on DNA – Ginkgo Bioworks? I’d be curious to see what adjectives you use for that :)

Biotechs are in a category of their own because they raise money from the public in order to develop some pharmaceutical product. When a trial fails or when the company just announces a dead-end, then the stock tanks and essentially disappears. This is a way for the public to bet on some future pharma product, like a VC would. So you buy 10 of these early state biotechs and hope that one of them makes it. And if you’re very lucky, one of them might make it, and you’ll make some bucks. It’s like buying options: most of them expire worthless. So I don’t lambaste those early-stage biotechs.

Motortrend magazine had an article on the Rivian truck. The 135kWh battery lost 45% of its charge after they towed a load 39 miles. Great value.

Yep, physics is for real.

“But this time it’s different!”

Would you try it on Interstate 39 north of Normal, IL, during a blizzard?

JeffD,

Car & Driver:

“At 75 mph, we found the R1T (unladen, with just a driver) to have a highway range of 220 miles.

“But with 5650 pounds of BMW E91 328i wagon strapped to a Futura trailer, the real-world range is cut in half at similar speeds.

Also:

“Fortunately, describing how the Rivian pulls a trailer can be summed up with one word: fabulous. It never feels sluggish off the line or when passing thanks to the four motors and their prodigious torque. When slowing down, the regenerative braking feels natural. Plus, we didn’t detect a hint of trailer sway, which is greatly a function of how the trailer is loaded, but we didn’t even feel so much as a tug from crosswind.”

https://www.caranddriver.com/news/a38911919/rivian-r1t-towing-tested/

Note that there is no comparison to what towing “5650 pounds of BMW E91 328i wagon strapped to a Futura trailer” does to the fuel economy of an ICE truck. And that would be the real number to compare it to.

Also note that you are talking about a truck from a startup company that doesn’t know what it’s doing. Which is fine. That’s fair game. I would never buy a vehicle from a startup company. Period.

But — and this goes for you, Anthony A. as well — when you extrapolate from that startup’s EV to all EVs, you dive head-first into BS.

If you want to talk about towing with the Ford Lightning, wait till it is available in large numbers, with all the different packages and options, including battery options.

The electric truck is twice as efficient as the non-electric. But the 135kWh battery can only hold about 1/6 the *energy* that the smallest truck gas tank can hold. Towing loads is about energy expenditure *not efficiency*. So even though you are twice as efficient, you are going to tow at most 1/3 the distance of that truck on a full tank, meaning at least two stops to recharge for a trip of the same distance. And there’s the rub. The wonderful handling and efficiecy is a bonus, but not the main concern of people who tow substantial loads.

That’s one of the reasons I’d never buy A Rivian. The battery is the key technology, as I said in the interview, and Rivian doesn’t have it.

PS Concerning regenerative braking, you get around ~25% of the energy back, (theoretically highest, real world much lower) vs what you expend driving forward. So, regenerative braking is definitely a nice bonus, but it doesn’t solve any real distance problems.

OK, so electric can be as much as 3x efficient, but that means you may only have to stop once to recarge rather than twice. Still pailful. And the F150 large tank holds over 50% more energy than the small tank, so there is still no comparison between electric and non electric when it comes to energy capacity, which is what really matters to people who do a lot of towing.

But — and this goes for you, Anthony A. as well — when you extrapolate from that startup’s EV to all EVs, you dive head-first into BS.

Wolf, all I said was (the laws of) physics are real. Meaning that those laws apply to all vehicle towing, EV, gas, diesel, whatever.

I read the Motor Trend article weeks ago covering the months they had the Rivian truck and they loved it. Very little failed, no matter how much they punished it. If I recall, it won the Motor Trend Car of the Year award.

“Note that there is no comparison to what towing “5650 pounds of BMW E91 328i wagon strapped to a Futura trailer” does to the fuel economy of an ICE truck. And that would be the real number to compare it to.”

I can give you first hand info on tow mileage vs unladen mileage in my full sized diesel powered one ton truck, Wolf. I get 17.xx mpg on summer fuel, unloaded. That drops to 15.xx mpg on winter fuel. Keep in mind I probably carry around 750 pounds of tools and gear on average. My truck weighs just shy of 8,000 lbs on the scale with said gear.

When I tow my 7,000 gvw trailer, loaded, I get around 12 mpg. When I tow my 16,500 lb trailer, I get 10 mpg. Most of the towing is in the summer months. Hope that sheds some light for you.

PS – I wish they’d start with a hybrid one ton pickup that can tow heavy. I’d be up for it.

Anyone who owns a Tesla knows that EVs are the future. Every time I drive past a gas station I am glad I’m not paying 6 bucks a gallon. But only the best companies in this area will surive and thrive.

Just like everything else, good companies will get thrown out with bad companies and the way to make money is to sort them all out.

I saw my first Rivian in person. Every bit as silly and ugly looking as in the photos online. Obviously a toy for some rich dude. As far as being an off-road capable truck, how much battery life does this thing burn off pavement? I know towing it’ll be close to useless. Probably one of many reasons why we haven’t seen the Tesla Semi yet…

I’d imagine off road and low speed is where an EV would perform quite well.

If I take my carbureted V8 off road, I’m idling or barely off idle in first and second in 4wd lo. I burn a huge amount of gas just keeping the engine spinning using none of the power it can put out. Not to mention without expensive diff locks, it’s really only 2wd in effect.

A four motor truck with 95% torque at near stall rpms and no idling effect will probably make EV soon the dominate choice off road. Not to mention you could strap solar panels to the roof or in the bed and charge it a bit way out in the sticks if you run out. You’re not making gas or diesel out in the woods. Overland adventures up mountains also charges the batteries riding the brakes on the way down. With other vehicles, it’s still drinking gas going down hill.

EVs will soon have superiority in nearly all aspects of performance over ICEs. There is a reason nearly all machine runs off electricity and not steam or fossil fuels now. The only area EVs will lack for some time is extended range and towing. I don’t see electric long distance locomotives or semis coming around for quite some time. Diesel has too much energy to it’s light weight. Refueling time is 10 minutes. Even still, a DC motor will outperform a diesel engine quite easily if it is designed to and likely be cheaper to power. It will just be stationary.

Assuming modern auto makers don’t go to subscription based auto sales before cheap used EVs hit the market, I’d love to have an EV vehicle. I’d be on board with a market for retrofitting EV motors to older vehicles. Assuming it wasn’t garbage, I’d love to rip the gas guzzling small block out of my truck and bolt a big motor to my bell housing and stick a high density battery bank under the bed.

Soon the old Mitsubishi plant in Normal will be empty again.

Not so. I have a close friend who works there.

They have hired record thousands of people

No sign of layoffs (yet)

Looks like Rivian stock also dropped some today. More great news for Amazon’s balance sheet next quarter.

And Ford’s balance sheet.

Although Ford supposedly unloaded 8+ million of the 100 million plus shares they own of Rivian through Goldman.

The retail investors are still, ignoring the fact that there is NO Mkt of any sort, any where in the world without FED!

DIP buyers are now ‘falling knives’ catchers! Good Luck!

More bleeding on the way!

Finally a Dow spring.

“Analytics.” That is the buzzword of professional sports. The new Minnesota Vikings general manager is, “The NFL’s first general manager from a primarily analytical background.”

A few years ago the Minnesota Twins brought in an “analytical GM” as well, and this has been used in baseball longer than it is now in football.

One of my good clients in the ticket business starred in both football and baseball at the U of MN. He also played for the NY Mets organization for a few years, and had this to say.

“Dan, we had analytics in my day too.” he said to me in sarcasm. “But then, we just called it statistics.”

So Palantir Technologies “sells automated analytics data systems,” eh? That sounds really cool and high-tech.

DanBob will now apply statistics: “They done lost about $715 million bucks a year, for the last four years.”

Analytical conclusion: “Shit, they expert at throwin’ away Straight Cash, Homey.”

Didn’t you read the book or watch the movie “Moneyball”? It was about how the Oakland Athletics became the first team to use data analytics to assemble a roster of players that could possibly win a World Series on a severely restricted budget. It was the only way for the A’s to stay competitive at the time when the Yankees and Red Sox were spending money hand over fist. But then the Red Sox adapted much of their strategy, followed by the Tampa Bay Rays, and both of those teams ended up in the World Series, and the Red Sox won two of them in the 2000’s. Soon, everyone started using analytics, and the Chicago Cubs and Houston Astros both won the World Series after gutting their teams and rebuilding them with analytics.

Yes, we both were “in the loop” on that.

When I started competing on the velodrome in the late 1980’s I had no coaching and not much to go on for strategy and technique. But I had a Betamax VCR and every World Championships and Olympics event on tape that I could find. Frame-by-frame, I studied the East Germans and Soviets to try and copy their exact technique; especially the initial launch off the line in the Kilo Time Trial.

DanBob did analytics with a Sony Betamax long ago my friend.

But, at some point, it comes down to who’s the best athlete. And, at some point, it comes down to what kind of profit does a business earn.

Now, when I watch the Olympic Match Sprints, it hurts me to see that a surprisingly large number of sprinters do not have an instinctive understanding of strategy in the chess match that takes place on the track. Again, raw speed and jump does usually win the fight — but not always.

Wall Street should lose the fight with companies that do not have raw profit making power.

At what point do these imploding cash incinerators run out of money and go Chapter 11 or even 7?

Now that the

“Everything Bubble”

has popped,

can we start

calling it the

“Everything Crash”

yet?

Not until Elon tweet a rally cry 📣

There’s a parallel between Palantir and Uber. Both were trying to muscle into a business that already had old companies making a steady profit. Palantir was trying to compete with Raytheon, which has been selling surveillance equipment since the 1930s. Uber tried to compete with real taxi companies, making a profit since the 1920s.

Running a permanent loss is not the sign of a successful Disruption, it’s the sign of an obviously idiotic idea.

Their idea was actually quite good. The problem is that there aren’t any serious barriers to entry that could stop competitors from taking market share, whether it be Lyft, a car rental company, or a local ride sharing company.

The real inovation for Uber was pushing the major fleet costs back onto the employees.

There is a reason there is no traditional taxi service at any scale in most of the US.

It’s not economical, except in high density locations.

It’s too expensive for the customer. Fares have been subsidized with a dumpster fire of investor money and by drivers who are (or were) mostly desperate for cash flow or didn’t understand the economics of driving.

Not even close.

The complexity and scale of human and technical resources required to operate Uber and Lyft is an enormous barrier to entry into their markets.

Looks simple from the outside.

It isn’t.

What an outsider cannot know is how much money Palantir pays off to politicians to get its contracts. Not campaign contributions, straight out transfers of cash to numbered accounts. Decades ago, the payoff was in bricks of hundred dollar bills in attache cases. The problem today for citizens is that there is near total censorship of news sources. For an example, look at how in 1996 the painkiller Oxycontin was marketed by the Sacklers as the first opioid that gave you up to 12 hours of pain relief. Other opioids only promised 6 hours of blocking pain. The FDA approved the Purdue Pharma ads even though its “scientists” knew the ads were lying. Oxycontin only provided 6 hours pain relief like all the other opioids on the market. For 20 years, Oxycontin created millions of drug addicts, treating its users like Pavlovian dogs. Thanks to an article in the Los Angeles Times, I first read of the Sacklers’ Oyycontin fraud. A crime which normally would put someone behind bars for decades. Like Palantir’s scam artists, the Sacklers are above the criminal law.

We may see in bankruptcy courts, variants of the “Texas two-step.” (No, I did not invent he nickname.) Some state insolvency laws (which are applied in federal Bankruptcy Court) allow a bankrupt debtor to toss all of its liabilities into a “bad” company shell, and cast it off, and hand the good assets on to a “new” debt-free company.

These companies have been designed to fleece investors. To a large extent, it’s millennials fleecing other millennials. I don’t see a lot of older investors putting serious cash in these pyramids. They’ve been around the block.

This is eerily similar to 2000. The entire illusion was help up by Microsoft, Intel, Yahoo, Dell, and Cisco. Once they cracked the entire market imploded.

Fast forward twenty years later:

FB -48%, AMZN -42%, NFLX -75%, GOOGL -25%, MSFT -25%

Those losses are from the absolute, trillion dollar stimulus driven peaks.

I’ll start loading up when they are back to about 2017 prices.

Fintech startup UPST reported after the close today. DOWN almost 43% in after hours trading.

That one is a doozie. Will have an article on in a few hours when I get a chance to work on it again. Another Goldman Sachs creature.

So the company narrative is as fictional as the stone it is named after? Shocker!

Not just fictional, but foolhardy. The fictional Palantir was a mind-control tool disguised as a crystal ball.

From the movie (yes, book is better, but…):

GANDALF: A Palantir is a dangerous tool, Saruman.

SARUMAN: Why? Why should we fear to use it?

GANDALF: They are not all accounted for, the lost Seeing Stones… We do not know who else may be watching.

The United States chief product these days is Bamboozle. We are world class producers.

“When the company went public in September 2020 via a direct listing, shares started trading at $10, giving it an inexplicable market cap of $16.5 billion. Shares where then whipped to $45 intraday by January 27, 2021, more than quadrupling in three months, giving the company an even more inexplicable market cap of around $80 billion”

That January 27, 2021 market cap is at least somewhat explicable by the fact that PLTR was a popular meme stock on wallstreetbets. GME peaked on January 27, 2021 too.

Thanks Wolf for your work and to the regular posters here, I learn more here than anywhere else. So the Fed is tightening into what looks increasingly like a recession at some point, or the tightening will trigger off a recession, in any case here, wouldn’t they then ease once more? And if so, don’t we get the same problem all over again? Loose money looking for assets to buy. Tell me I’m wrong please….

In the 1970’s inflation kept on accelerating far longer than anyone believed possible. Back then the Fed funds rate was above the inflation rate. It was a wage price spiral but wages always lagged price hikes. This time around keep an eye on wages. If they can’t redefine the inflation rate only a terrible recession will kill inflation off. With the wide spread between the inflation rate and the Fed funds rate today this make hyperinflation a more likely outcome than a recession.

Mike…..

Two ways to look at it……..

1. As a regular person……let us hope they develop a better sense of what is happening in the economy and adopt policies that are more moderate and timely. Less inflation, less unemployment and an economy that distributes its rewards more equitably to everyone with less volatility would result.

2. As a financial speculator……let us hope they coontinue with these stupid wild moves……it is what provides us the best chance to cash in big time.

Examples…….TBT (inverse long rates) and SQQQ (short nasdaq) have been almost like taking candy from a baby the past several months…..and in the medium term are probably still good holdings……and don’t be naive……their friends are doing exactly that with insider info.

I was hoping it was THE Mike Trout but there’s an Angels game going right now.

Haha. I’m not in the US so had no idea who the REAL Mike Trout was. I’ve since looked him up. Impressive!

There is the inflation problem and there is the limit on future “printing” from the DXY, proxy for the USD exchange rate.

DXY is at a 20 year high which provides some leeway but I don’t think it’s a long leash.

My assumption is that when the economy visibly cracks, the FRB will look to Congress to pick up the slack through fiscal policy.

They may try some QE but agree with Wolf it won’t be what it was recently. Fiscal leash isn’t that long either, not with $2T deficits during the supposed “good times”.

Yes, they are both painted into a corner.

The key on what they can get away with is substantially psychological, as that’s what made both the asset mania and the cheapest financing and loosest credit standards in history possible. The actual fundamentals totally suck and have for years.

If the bond mania from 1981 ended in 2020, there will be a bear market rally at some point but it won’t last or be as stimulative.

“The key on what they can get away with is substantially psychological”

Very true.

I’m watching Japan with great interest, because they are stuck with ~260% debt/GDP and trying to cap 10yr yield at 0.25%, which is now finally starting to thrash the JPY (increasing import inflation). They essentially haven’t had a real bond market for years (BOJ is often the only buyer). It is remarkable how people haven’t lost confidence in the JPY, but that may become unhinged soon. This could become the first reserve currency to blow up.

When that happens, expect panic. Market participants will immediately start looking who is next, as always happens in currency crisis. A massive rate hike could support the currency, but will bankrupt the country fiscally.

There is no clean way out. This was always the case, but as you wrote: it’s psychology. If YOU still accept the currency, I’ll accept it too. But once you start shunning it, I’ll start shunning it too.

Therefore, the whole thing can literally collapse overnight. Or continue for a few more years, depending on psychology (though I very much doubt that at this point).

I’d expect the USD to be the beneficiary of any JPY crisis, at least initially. The next candidate is probably gold but there isn’t enough of the physical metal to absorb the “printed” JPY at any scale without sending the price to the moon which defeats the purpose of anyone trying to buy it in volume.

Once the USD approaches or falls below DXY 70, things will be get interesting and chaotic.

I agree with YuShan’s assessment of JPY. And you wonder whether if these recent moves are an intentional, slow-walk towards a default.

I also agree with Augustus Frost that the dollar will be the primary beneficiary.

@Augustus

I agree that the dollar is the likely beneficiary in the short run. It is the cleanest dirty shirt. But don’t forget that the USA has the same problem, especially when taking unfunded liabilities into account. Eventually the chickens will come home to roost.

Longer term, I see gold playing a big role again. Especially since the USA has crossed the Rubicon by freezing/confiscating Russian central bank reserves. This should scare the hell out of everybody who holds dollar reserves (i.e. almost every country), so reserves that can be held locally will become more important. Gold is the obvious choice.

I think that when looking back a decade from now, this confiscation of reserves will in hindsight prove to have been a watershed moment, almost comparable to Nixon defaulting on US$ gold convertibility.

However, it is impossible to abandon the large US$ reserves anytime soon, as long as the USA runs large trade deficits. After all, somebody MUST hold these deficit dollars. But there will be a large push to stick them to somebody else, because reserves that can be confiscated aren’t reserves. But deglobalisation will change international trade too, perhaps shrinking the trade deficit and with that removing the need for other countries to absorb US$.

It has been a very interesting start of the decade and it will get even more interesting later on, but not in a good way I’m afraid.

This will never happen unless G7 agrees on it. FX is heavily manipulated nowadays.

Mind that, G7/G20 has FX stability pact. Once there is any extreme volatility, G7 and/or G20 will step in and wipe out all the speculators.

FX JPY still trades slowly within range.

They will never allow the currency house of cards to fall one-by-one.

I feel like I’am attending an out fashioned 100 car pileup. Even the nice ones like Apple and Google are getting zonked pretty good now.

They are back to 2020 levels. I wouldn’t call that getting whacked, unless you are a market timer that bought at the top. I didn’t hear anybody asking questions when the stocks went up 100% for no reason.

It’s nice to finally see some consequences.

LOL….I’am not complaining…..I’am short and having a great time.

but….the poor souls that were suckered in at the top with p/e’s of 100’s…….lots are down 75%.

I totally agree…it was time…..hopefully we’ll see 1500 on the S&P and really get some rain to wash away the nonsense.

Of course I also hope nobody that is innocent loses their job or home due to the financial mal practice by this collection of mobsters called the fed.

Have a great day!

If there was one stock touted as a can’t lose stock for all the future years on youtube it was this one. So many said to average down as it fell from it’s all time high.

“Upstart just tanked -42% after earnings, now trading at $48”

Another one bites the dust.

Wolf,

I am not seeing the flight to the safety of bonds. The 10 year yield is about where it was this morning, so bonds, stocks, and cryptos are being sold off. There must be a liquidity issue brewing due to margin calls. Any thoughts on a vicious bear market reversal? Without the Fed reversing course I just don’t see the selloff abating.

John Apostolatos,

I expect a bounce pretty soon. Last week was volatile, but the week ended down just a hair. So that wasn’t a biggie. Today was kind of a biggie because the breach of the 4,000 by the S&P. So I think this would lend itself to a bounce.

If there is no bounce pretty soon, I’m going to fasten my seat belt.

The 10-year Treasury at 3% is toxic at the beginning of a tightening cycle with CPI-U inflation at 8.5% and CPI-W inflation at 9.4%. I have no idea why ANYONE is buying 10-years at 3%. So flight to safety isn’t the 10-year. It’s short-term cash instruments, from bank deposits to Treasury bills.

“I have no idea why ANYONE is buying 10-years at 3%.”

People who buy 10-years at 3% are presumably paid a commission to malinvest Other People’s Money.

Other People, in turn, are comforted by the idea that 3% is lots better than a savings account or malinvestment in a stock market that’s about to be corrected because it’s gotten things so very, very wrong.

Does Sell the Rally work better than Buy the Dip? I’m into symmetries these days.

Which is to say, does Sell the [bleeping] Rally work better than Buy the [bleeping] Dip.

The Commenting Filters apparently filter out anything that looks like hypertext with the open tag and close tag symbols. Oopsie.

Other than your “Nothing goes to heck in a straight line” for the bounce

“The U.S. financial system has continued to function in an orderly manner, though valuations of some assets remain high compared with historical values,” said Yellen

May be the Fed and the US Treasury are starting to worry about the orderly manner a weebit. After all, orderly manner can become unorderly easily since a financial chain is as strong as its weakest link. One blow up can do the job. LTCM was not the biggest company around when it blew up.

In that case the “Timid Fed” will now trot out talkers who will talk down rate hikes and QT. Means a relief rally is in the offing.

Now the question arises – will the Fed blink if things turn unorderly?

Recent price action (before yesterday) supports your point. For years, every time stocks fell noticeably, UST rallied.

But not this time, at least so far this year.

Tip of the iceberg. Mr. Wolf’s excellent articles only tell us the hyped investments which are out in the open.

The real issue is in PE and leveraged loans.

Software firm I worked at bought last summer for 3.75b on 300m in sales and 80m in EBITDA with no growth over five years (no $ for the enployees of course). Was for sale and valued at 2.25b.

PE firm used 2.3b loan from Wall Street and 1.45b in investors equity.

How long can PE keep it valued above 2.3b before Wall Street calls in for more cash down and PE realizes their 100 perceht loss.

There is always a lot of stuff under that radar that suddenly emerges when there is a crisis.

I wonder how “systemic” it will be this time. Last time it blew up the banking system and the Fed /gov was forced to step in. But that may not be the case this time. If it is just rich individuals and pension funds losing capital, that is not necessarily systemic.

Its a symmetrical market. The business model works because you also have investment companies that are paid to lose money, so as to get pension plans, IRAs, and 401ks to finance spying on their beneficiaries so they can be gutted by other corporations, all willing to pay hefty fees for a piece of the action.

So it’s a hugely profitable company, just not for its investors. But it’s really not so much a ‘company’ as it is a racketeering operation. Which never would have been possible until financial racketeering was legalized and the SEC taken over by the banking cartels. Hence the calls for more deregulation, so as to legalize bigger and better financial racketeering operations before the economy hits its expiration date and the bottom falls out.

Not that the US actually has an ‘economy’. It’s more like a collection of scams that lean on each other so they don’t fall down.

Hahaha the only product of the Unicorns is their stock. This is what the unhinged Fed has done. The markets will now taketh away.

1) Putin disappointed market makers. NDX will rise, before the next plunge

to retrace the virus rise.

2) RRP might provide liquidity to engineer the next move up.

3) If JP cannibalize the $2T RRP, – if the Fed will not provide enough liquidity to the spoiled US consumers – the market will plunge.

4) Major trend, Major change.

5) From inflation to deflation.

Why would investors need to be “bamboozled” they’re more than capable of deceiving themselves. Don’t all these cruddy startups exist because of investors demand?

‘Why would investors need to be “bamboozled” they’re more than capable of deceiving themselves.’

They don’t need to be bamboozled at all if their investments are managed by Experienced Professionals who are paid by companies to buy their [bleeping] stock. They need only be in a 401k plan made opaque for this very purpose.

There’s no need to retail deception if it can be wholesaled and institutionalized.

“The TIAA, or Teacher’s Insurance and Annuity Association, is the leading financial services provider for individuals and companies in the academic, research, medical, cultural, and governmental fields.”

TIAA’s growth account option (QCGRRX) is now down 30% from it’s high in Oct. 2021. That can’t feel good for the many individuals who were feeling so splendidly flush in newfound wealth.

Wolf, you need a new mug logo: nothing gets thackamuffled in a straight line.

(Well, unless you’re a tech unicorn… :)

Very good.

Good! The Vulture Cap is finally getting the blood sucked out of its craven maw!! Only few K moarrr to go, eh??/

Trust me, the WHOLE planet would be better off without these venture, um ..’firms’.. squeezing humanity plum fn dry – and for what .. Craven profit$ at All Costs!

We have the absolute worst “leadership” in history. In fact, I can’t even call politicians “leaders” with a straight face without gagging. These people are are the epitome of the Peter Principle. They have pretty much destroyed the US.

When you look back on the past 2 years, it’s utterly despicable. Handing out over $1,000 per week to people not working, and also allowing them to start stiffing the landlord so they could turn around and start gambling in the stock and crypto markets, and buy up all the new vehicles, RVs, boats, phones and computers is truly sickening.

We mortgaged the future for that? How morally bereft and ignorant are these pukes? We need to fire all these aszholes.

I didn’t miss paying one dollar on any bill, always on time. I guess we’ll see now what that got me. But I am proud not to be among the careless wastrels, or their enablers.

Something-for-nothing permeates the whole rotten ethos.

“When you look back on the past 2 years, it’s utterly despicable.”

When you look at the four years before that it was even worse. Your guy is clearly a monstrosity who has made a career of the kind of abuses you, as a ‘libertarian’, pretend to deplore. You can celebrate when he has burned down the country so he can rule over the ashes.

Call it a prediction.

These days the talking points strategy is obvious and transparent. Spread hate and distrust of everything governmental and safety net oriented. Because the more people who are converted to those sentiments, the better your team’s chance of winning on that kind of playing field.

Wolf,

Is thackamuffled what the mole feels when you wack it with the hammer in “Wack-a-Mole”? That is what it sound like to me and I believe that may sting a bit. Oh, and kathoomphed sounds like what happens when you hit the mole so hard it can’t get back up. Huh! Is that right? :D

They’re figures of speech, portmanteau words, not invitations to fetishize violence.

And when commenters start doing that, and promote radical authoritarian and corporatist memes, misinformation, and disinformation besides, without reproach, it is time to leave the comments to the trolls of the radical right.

Very disappointing.

La tristesse ne durera pas toujours.

Cela s’arrêtera lorsque personne ne sera laissé dans le deuil.

I imagined kathoomphed to possibly have a little bounce to it, dead cat style.

Something that definitely is not gonna bounce would sound more like kersplat.

Let me just throw a spitball against the wall too see if it sticks. Phase 2 of the asset repricing is characterized by the wall street wise guys holding the price high enough for a while, while they unload they’re inventory on the fools with stars in their eyes.

The real losses will come along soon when the Fed withdraws its table stakes. Which is the beginning point of stage 3 of multiple asset pricing deflation that aligns the future with the past

Luckily, we are all fools at various times in an awkward environment. And heroes and lovers and friends and and love

Apparently there is a conference on Friday this week in which John Taylor from the Hoover Institute at Stanford will place his hypothesis with evidence of his mathematical formula for Federal Reserve policy.

If people were rational, would they do what they do ?

The only rational response would be …….

With a description of the normal distribution that describes the randomness of our shared experience in whatever idea that is examined. Its pretty random for most of area of the curve, when measuring a characteristic attribute.

Palantir stock chart = “make mess.” As in, Ohhhh, did baby “make mess”?

No mention of Peter Thiel in the article or comments thus far. Creepy Thiel and his disruption empire- including Trump, for the sake of goodness and sanity, hopefully, will wane and wither away from any meaningful significance in this world. Palantier sucks, I’ve used it in cybersecurity at big banks. It’s overpriced and other more specialized products work better.

“Palantir became infamous when it emerged that police departments were using Automatic License Plate Reader systems (ALPRs) that take images of every license plate (plus of the vehicle and occupants) that comes into view, and that Palantir’s software was used to comb through the data.” And confirm whether or not the vehicle is registered.

I’m from Pennsylvania and as of January 1st 2017 the state stopped issuing license plate tags to verify that the vehicle was registered. Local police officers I talked to told me that they were typing over 300 plates into their computer every shift. When you consider how many local police departments there are in Pennsylvania, it seems like a tremendous marketing opportunity.

Hi Wolf – If you published analysis on Spotify I missed it. I see Mr. Eck has 50 million to put into his company to express confidence in its future while paying musicians next to nothing for their creativity. Somethin’ ain’t right here. Anyway, seems like another stock that has been hosed.

This stock purchase may have been funded by a margin loan from his company – I don’t know this, but that’s often how this is done. When the share price plunges further, Eck just lets the company have the shares and the company writes off the loan. A lot of the executive stock purchases are funded by loans from the company. This makes those stock purchases risk-free for the executives.

I personally know the former CEO of former American Capital, and that’s how they did it, and during the financial crisis, when their stock went to $2, all the execs walked away from the loans and let the company have the worthless shares. They then got new loans from the company to buy new shares at the low price, and that was announced with big fanfare too. Those deals designed to enrich executives in a risk-free manner and produce some propaganda value when the stock purchase is announced. These margin loans from the company to executives are perfectly legal.

Well nice summary; I am amused by your use of highly apt neologisms which are more inventive than mine in describing this stock (terms like ‘dogshit’, ‘used gum’ and ‘cigar butts’ crop up in discussions with my financial advisor and friends). But if course we must also mention why this stock was designed the way it is: to allow insiders to make loads of money by dumping their stock on a credulous market. Pump … dump…pump…dump…rinse lather repeat. I saw this crap in 1998-2000 and I haven’t forgotten it since.

When/if the govt cuts off palanturd for a cheaper model, which they can do anytime, expect a price target of 1.50. Don’t think it can happen? Look up ‘Thomas Group’. You’re welcome for the bedtime lesson

Please forgive my naivety/ignorance but I would like to put forth a theory for discussion.

To preface: I graduated in summer 2008 and have observed the economy & all its goings on over the past decade or so with bemused bewilderment.

To me it seems the elephant in the room here is taxation, or lack thereof. The problem as I see it is that the 1%-5% investor class simply has too much money and they don’t know what to do with it, hence there is “Investor Demand”, which imho is just a way for money managers to scam/syphon off large chunks of this money for themselves via a multitude of fees & (fraudulent? illegal? morally bankrupt?) financial engineering schemes.

This “Investor demand” is creating extreme distortions in all markets (housing, stocks etc) and it will continue to do so until it’s curtailed by increasing taxation on these people. Once upon a time the 1% might have built something like Grand Central Station, things like this impacted the “real” economy and had a positive impact on the cities/states they were built in and had a positive impact on the lives of “common” people just trying to make an “honest” living, but the 1% has no interest in these things today that I can see.

I realise of course that nothing will be done about this. These people have already bought every politician who might enact such change (they are also almost all part of this 1%-5% themselves), and of course government can also not be trusted to do the right thing with money either, but if some of this money found its way into the “real” economy to maybe fix some roads or build out rural broadband we might see tangible benefits and we wouldn’t have to depend on smoke & mirrors to pretend that the economy is fine, when most people can see that it really isn’t.