Meta? Didn’t it just spike? Friday is going to be interesting.

By Wolf Richter for WOLF STREET.

A bunch of the biggest tech companies reported earnings after the market closed today, and their shares tanked, and Friday is going to be interesting, after today’s short-covering action.

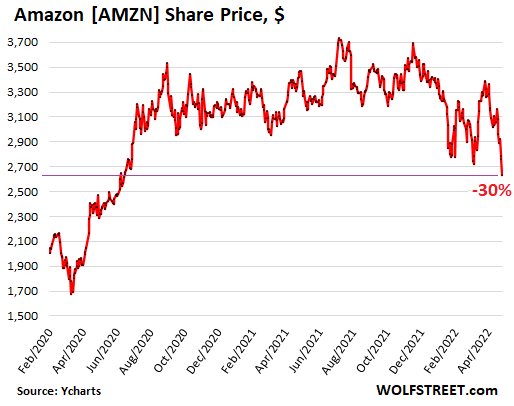

Amazon [AMZN] shares plunged as much as 11% afterhours and currently trade down 9%, at $2,631, down 30% from their 52-week high, and back where they’d first been in June 2020.

This debacle is occurring despite the huge bout of financial engineering in early March to stem the slide of its shares at the time: Its announcement of a most-splendid but useless 20-for-1 stock split and an even more splendid share buyback program that it wants to fund with an enormous amount of borrowed cash. But the bloom has come off the rose, even tried-and-true financial engineering doesn’t do the trick anymore, and shares just let go (data via YCharts):

This makes Amazon the third giant, behind Meta [FB] and Alphabet [GOOG], whose hyperinflated shares have broken and are falling apart.

The debacle this evening was caused by Amazon’s earnings report, which disclosed that revenue growth was only 7% year over year, the slowest since the dotcom bust (compared to 44% growth a year ago). And guidance for the next quarter was even worse, suggesting even slower revenue growth, as slow as 3%, in an economy where CPI inflation is running over 8%.

Speaking of inflation: Higher costs are now biting Amazon in the butt: Total operating expenses jumped by 13%, including fulfillment costs which jumped by 25%, and sales and marketing expenses which jumped by 33%.

Operating income plunged by 59% to $3.7 billion. Amazon’s guidance for operating income was shitty: In a range of a loss of $1.0 billion to income of $3.0 billion. The middle of the range would be down by 74% year-over-year!

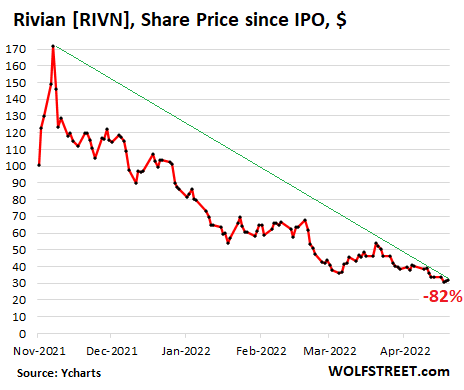

And there was a big-fat net loss of $3.8 billion, its first net loss since 2015. The net loss included a $7.6 billion write-down of it investment in EV maker Rivian [RVIN], a prime member, so to speak, of my Imploded Stocks. Its shares have collapsed by 82% from the high in November shortly after the IPO.

Amazon was an early investor in Rivian, at a much lower cost, but since Rivian’s IPO, Amazon has to mark to market its investment in Rivian, and Rivian’s shares have done nothing but plunge.

On March 31, Amazon’s quarter-end date for mark to market, Rivian’s shares were priced at $50. And that share price of $50 caused Amazon to take a write-down of $7.6 billion.

Since then, as of this evening, Rivian’s shares have plunged below $32. If this keeps going, Amazon’s write-downs will have to chase down Rivian’s collapsing stock (data via YCharts):

Apple [AAPL] also reported earnings, and its shares fell as much as 4% in afterhours trading and now are down 2.2% at $160.

Revenues grew 8.5%, in an environment of high inflation, including 8.5% CPI inflation in the US. All revenue growth does is keep up with inflation.

But unlike Amazon, Apple has pricing power, meaning consumers are still willing to pay Apple’s mega prices, and its profits are therefore huge, $25 billion in the quarter, up 6% from a year ago. Apple has turned into a slow-growth cash-generation machine.

What spooked investors this evening was likely CEO Tim Cook’s warning about supply chains, that Apple was “not immune” to them. And CFO Luca Maestri warned that supply chain issues could drag down sales by up to $8 billion this quarter.

Apple said that its Board of Directors authorized share buybacks of $90 billion in the year. And it increased its dividend to 23 cents a share.

Intel [INTC] shares fell 4.0% in afterhours trading to $44.97, after it reported that revenue declined by 7%, but no biggie, CEO Pat Gelsinger said on the call with analysts, “We have solid growth across all the business areas of the company.”

Guidance disappointed. The PC business is softening, in part because Apple is now transitioning away from Intel chips to its own chips. And Gelsinger said that the chip shortage is now going to last into 2024, or whenever….

Tesla [TSLA] didn’t report anything, but shares just kept sliding, and afterhours fell $23 or 2.6% to $854.50. They’re now down 31% from the peak in November last year. But the CEO, who walks on water, is busy preaching about “free speech” and lusting after Twitter, thereby forgetting to hype Tesla’s shares by hook or crook (data via YCharts) .

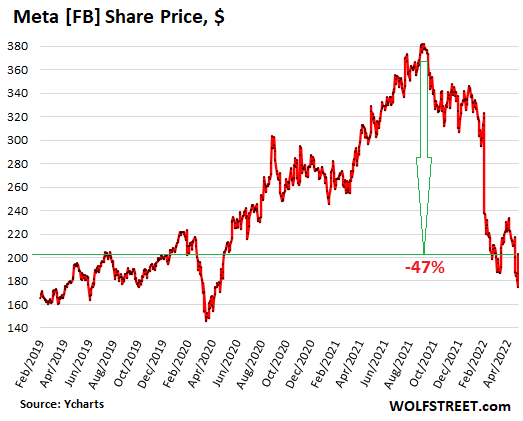

Meta [FB], my goodness, its shares spiked 17.6% during the day, then dipped 1.3% afterhours, but shares have plunged so far so hard that the huge big fat mega giant spike today is barely visible on the chart, and it has the glorious looks of a feeble dead-cat bounce-let, with shares down 47% from the August peak:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

BTFD fo eva!

Just kidding.

AMZN and FB have a long way to fall. Look out below.

I hope for the same: Some sanity in pricing of stocks and value of labor (dollars).

Meanwhile, retail investors don’t get to trade after hours and have to wait till tomorrow morning. Sometimes I feel that after hours trading is just to set narrative much like Fed Jawboning or like Analyst Estimates where stocks then just trade up / down based on how the numbers were relative to estimates rather than relative to last year!

e.g. Revenue beat of 7.5% vs expected 7.2% that is really a 1.0% decrease in revenue when accounting for BLS 8.5% inflation!!!

You can trade after hours all you want. Just ask your broker.

Andy, with low volumes and high involvement of institutional investors, the odds are heavily stacked against retail investors in after hours trading. Why would you want me and other retail investors to lose money on my options?

Meanwhile, we see today that Amazon had a deep cut, while Apple and Meta came up fine. My Hypothesis: Amazon’s high share price means that the 100 share Put options without margins are 10x more expensive for retail investors. So few retail investors short Amazon. So Apple and Meta had short squeeze while Amazon would have to wait for its 20 to 1 stock split before it can enjoy benefits of screwing retail investors :).

But liquidity is very poor, judging by the bid-ask spread after normal market hours.

Trading after hours is a different animal. I once heard it described as the wild wild west. You are right. It’s a low volume/liquidity institutional investor environment. I don’t trade options so I don’t know what after hours is like for them. But done properly there are deals to be had.

My favorite time to buy/sell stocks is 2 – 2 1/2 hours before the opening bell. But I don’t force a trade. I wait patiently for my price target to be met. If it’s not met I don’t trade. This means I normally end up NOT trading. But when I do it’s a very sweet deal.

Yep, 24/7/365….just have to have the right connections….and I suppose wealth, as usual.

Speaking of bid ask spread, when I had my TD Am “learning acct” I found I could pick a low vol small stock and watch the bid ask lines after hrs just moving along, and once in while, Pop!, a trade. Kinda cool. I knew all the tickers of the big outfits that ran in a range and could pick up $25-$100 once in a while, maybe weekly, which seemed like a good use of my time since I couldn’t get a job due to “criminal record”….they go back to 18.

Anyway, I got 600 free trades and got out with a small loss to most, but big to me, mostly from “well diversified VG funds.

Between that and the tax lady bill and learning about the “free trades” I NEVER went back. Then I even got self righteous about it and said I didn’t want to help the bastards, anyway.

Remember the observation that ‘real wealth’ is only created by growing things, manufacturing things or mining things. Only Apple, Intel and Tesla apply and should rebound. The rest are services that could dry up and blow away and increasingly look to be on their way. Amazon may rebound, however, with a deep downturn that crushes the rest of it’s brick and mortar prey.

Don’t kid yourself. Apple is not invincible either. Without easy lending and credit card debt, how many of Apple’s customers could fork over $1,000 for a new phone every year?

They always seem to find a way.

The phone is folded into the monthly wireless bill….. if you’re always paying for a new phone, the impact to your budget is minimal.

Apple’s current position reminds me of Nokia at the top.

Everybody wanted a Nokia phone.

Apparently, the credit mania supposedly doesn’t exist.

If the bond bull market from 1981 ended, the credit mania is over. It’s just not going to happen “overnight”.

A new sucker every minute

No one is building phones – China is shut down ,next quarter will be interesting

All 3 of those firms also have their own vulnerabilities. Electric cars are obviously in growing demand for good reason, but the established automakers more and more are catching up to and surpassing Tesla in key areas. It can’t dominate even in its own niche much less in automaking in general, no way to justify even a fraction of its stratospheric stock price, and in past it’s been “profitable” only thanks to (ironically) government welfare, grants and offsets. Apple does make a good product but there’s no way for it to dominate its space at such high profits for much longer, consumers are tapped out and like Einhal says have been buying new iPhones (at a premium compared to Android and Pixel for example) basically thanks to rising credit card debt. Apple is acutely vulnerable to the rising inflation in the US especially, it’s a luxury purchase with that brand and price premium. And Intel has lost its edge in its own specialty, it’s why the whole world is basically depending on Taiwan and South Korea to supply the chips.

Thanks Miller:

Good and better analysis and comment…

Going to now be ”VERY” interesting times for WE the PEONs going forward from here, as the vast and clearly UNKNOWable ”financial” assets come to ”Jesus” or how some ever fools want to call what is now happening and is clearly gonna get a ton worse.

Tried to tell this to young friends, but they have NO reference point to which to relate to what is said,,, GEE, wonder why that is???

Total propaganda just might be one reason, eh

US foreign policy belligerence is going to ultimately hammer companies like AAPL. Just wait until the US sanctions China like it has Russia and AAPL gets kicked out of that market completely.

Yes, I know the idea is insane but it’s not beyond the US to do it anyway to support the Empire.

Endeavor, the number one form of wealth is increased productivity … this includes saving people time. Amazon and Google in their heyday earned their goodwill by saving people time in finding stuff and information that they needed. Nowadays they have issues, and I don’t invest in either because I abhor monopolies, but let’s not overlook services that genuinely add value by enabling others to create other types of value more efficiently.

IMO WS you are being too kind when you say #1:

Also IMO, the ONLY way to increase REAL wealth is from labor and capital WORKING TOGETHER.

Just from the current situation where capital has gone to various and sundry ”financial” assets with NO,,, repeat NO basis in REAL production, etc.,

WE, in this case WE the PEONS who have been screwed by OUR GUVMINTS and corrupted politicians of all and every stripes absolutely bending over and grabbing their ankles and allowing WE to be done SO bad will equally be made to pay back ALL their illegal and immoral ”gains” at our expense…

Looks like the bears are now in charge of tech and short sellers are having fun.

Good 45 minute interview out today with Bill Fleckenstein. He has been around the block a few times and seems to have good grasp of financial markets and tends to be a short seller. His take on what is going on in Japan, on current US stock market structure and on central bank credibility is interesting.

Ah yes I enjoy Adam’s interviews quite a bit. Fleckenstein has interesting viewpoints for sure. I too am watching the bond market, and would love to see it pull the printing press away from the Fed.

China really needs to get it’s act together concerning these draconian lockdowns. The CCP has to realize at some level that what they’re doing isn’t working. Hell, their own citizens are even sick of it. This is going to be a real bad look during an election year if the unwashed masses start taking up pitch forks.

The stimulus faucet has finally been turned on in China. They can wait it out.

My suggestion would be that they get a real vaccine from an outside source and stop playing Russian Roulette with the one they have now. Just a common sense solution. They should have jumped on this last year with the rest of the planet instead of hoping and dreaming that COVID would just magically go away.

The Chinese strategy has worked well for them. Their infection and death numbers are microscopic. And it did not destroy the economy. I was there in 2020 during the first lockdowns. Almost nobody complained because they worked so well, even before widespread availability of vaccines.. Don’t believe the Westerrn media reports of large numbers of citizens revolting against the quarantines. The first thing you learn when you live in China is that almost none of it is true.

Djreef—

Their Sinovac vaccine stinks and they know it, but their pride won’t allow them to admit it. Thus the panic lockdowns. The Russian vaccine (Sputnik) is better, so perhaps they will at least consider that one.

China doesn’t owe other countries anything. If their citizens are against the lockdowns let them use their votes.

China…votes…Those words don’t seem to go together.

Everybody in the world gets to vote…………….. either by paper or pitchfork.

Troy,

Of the first point you make, that is very true.

Of the second point you make, all I can think of as a reply to you, is one of the pears of wisdom my father told me at a young age: “Son, remember that half the people in this world have below average intelligence.”

I will leave it to WolfStreet readers to decide which half your intellect resides in.

“If their (Chinese) citizens are against the lockdowns let them use their votes.”

nah Dan:

Gardiner, et al published approx. 50 years ago a complete ”refutation” of the entire concept of IQ as measured by the Stanford-Binet measuring anything other than how one did on THAT test, even though it was and has been accepted for eva…

IQ and subsequent ”tests” were a function of the NAZI effort to be able to classify people to be able to consider them ”defective”…

Not going too far on here, but please consider when was the last time the MD or other ”doc” was even able to do simple maintenance on their car,,, as I put it to a doc who was supporting the IQ as equal to intelligence when Gardiner had made the case, very clearly, that there are at least 18 kinds of intelligence.

IOW, respect the intelligence of the farm workers and mech I necks and truck drivers, etc., as equally ”valid” with those of us who test high on the S-B…

VVNV,

IQ test replaced by Wonderlic…

Allegedly gives a greater indication of aptitude of an individual vice rote intelligence…

That’s not how averages work. Someone should tell George Carlin about median vs mean as well.

I always loved Garrison Keillor’s fictional town Lake Wobegone where all the children are above average in intelligence!

I must be below average IQ because if I’m understanding correctly you’re insinuating that the Chinese populous do not get to vote? Or are your saying that a Chinese citizens’ vote matters not in their elections?

Either way I’m sure a genius like yourself understands the inter workings of Chinese politics better than myself

Troy, it is a question of time being in lockdown vs voting & a change thereafter from a result of the votes. That could, in theory, be a long time.

“Time is relative”- Albert Einstein

People are not individually intelligent. Their society on every level contributes to intelligence. This is not easy to measure. And neither is intelligence, since there is no standard definition of intelligence, although attempts to include emotional factors etc. are a step toward a better definition. But very small steps.

I think a big part of this is that the current versions of its (China made) vaccines suck, as many countries using them found out early on and had to rely on more natural immunity. Due to the timing of what variants hit which country China ended up having less natural immunity and now its less-effective vaccines seem to really be struggling against BA.2.

It’s a really varied picture on China’s COVID response though, even the Chinese are openly critical of the Shanghai fiasco but other regions are doing better, and latest research on COVID long term damage and long COVID says even mild infections are a big hazard. One of our key managers is China-based, she points out most of the country (95%) is humming along normally with managed tracing, testing, vaccination and masking plus better air filters, so this should relieve at least some of the supply chain mess from Shanghai where local gov management was incompetent. (Chinese social media is very openly critical of the government, not censored–they keep it open to vent and read public opinion.) The Chinese factories built some redundancy apparently so there’s a lot of give elsewhere, and even within Shanghai itself there’s still a lot of production going on with the isolation and protection zones. We just notice the supply chain hit now a lot more since Shanghai port area itself is down, and one of the biggest in the world. (Ironically this will probably boost China’s overall economy since it’s now earning even more with its export purchases from the other ports though.) Hopefully that’ll tamp down at least some of the addl. inflation.

As for the aggressive anti-COVID strategy there, it’s probably excessive but is it entirely wrong? The docs are all now coming out with data saying even mild COVID infections are causing messed up hearts, brain damage, trouble breathing and a whole lot else in a huge number of people, maybe a quarter of infected. In our own firm we’ve had a lot of folks, young, healthy and productive, sidelined for months even after most (nearly all vaccinated) had what seemed to be mild infections that still got to the brain or hurt their hearts. This is one nasty virus.

Just an observation here. Seems TSLA spiked at the very same time as RIVN debuted, then both fell in nearly lock step before the end of 2021.

Why?

And why would anything spike in these very uncertain times, let alone the harbinger of a likely recession?

People seem to be running up the price of Utilities looking for safety. Our local regulated utility Duke Energy has ran up to $114 which means the dividend payout is less than 3.5%.

Old School,

My second largest equity holding is Xcel Energy with a PE ratio of 25 to 1.

Duke has a PE of 23 to 1. In today’s world, these seem like reasonable numbers.

As Anthony A. has commented with me in the past, he holds some CHS Inc., which is my largest position, and the stock price really does not move, but the dividend is 6.5%. A year ago, this was a good income generator, but now, of course it’s still not keeping up with inflation.

To me, the best strategy is to keep one’s portfolio conservative, diversified and in a bear market, treading water. Jumping up is always fun, but drowning and going under is not good. Duke & Xcel seem to be nice and conservative.

Put on a life vest when out boating, I say.

Dan-

I appreciate your comments past and current.

But I’m having trouble understanding how Duke or Xcel can be considered “conservative” in a rising interest rate environment.

When I entered my investing years in the 1980’s, public utilities traded in the single digit PE’s and paid dividends close to the recent inflation rates/government bond rates.

A return to similar valuation (assuming we are returning to a world of non-manipulated interest rates, maybe true, or not…) will have an arresting effect on public utility P/E ratios, won’t it?

Respectfully.

John H.,

Thank you for your appreciation of my comments. I do go off on tangents quite a bit, but try to keep them pertinent to the topic Wolf reports on — usually. And your comments are appreciated by me as well.

Your question is a good one, and my only answer is that it is just my opinion for the most part. Utilities are, as Old School states, locally regulated. Public Utility Commissions do oversee their operation and rates collected in many regards.

Wolf has reported on the demand of electricity usage in the USA, and how that may or may not shift with the transition towards EVs from ICE. People + industry will continue to need electricity. There will be demand for their product long term, but that may not be the case for stocks in this report. Ten years from now, there will be an Xcel transformer on the utility pole where my driveway and alley intersect, for example.

How long will Facebook be around as it is now?

I do agree that a PE for an electric utility, historically speaking, “should be” around 9, but now, “In today’s world …”

John,

I think you are basically correct on inflated PEs for utilities (utilities!) but ZIRP has deranged PEs in rotating sectors for quite awhile.

1) Almost all fixed income invts are priced at a spread to riskless Treasuries – whose interest rates the Fed has destroyed through money printing.

2) Accordingly, ZIRP (intentionally) chased a significant fraction of money that would normally be in the huge fixed income mkt into the much more volatile equity mkts (chasing *any* yield).

3) This had the effect of unmooring equity PEs from their traditional, financial performance related levels.

4) This unmooring was most noticeable among tech stocks – which are most prone to poorly thought out paint-huffing, hope-and-glory hype. PEs from 40+ to 100+ were indicative of this. Plenty of tech and bio companies had infinite PEs…because they weren’t making money, never had, and quite probably never would. At various times, about 33% of the Russell 2000 had infinite PEs/negative earnings…and that was when the US economy was doing “well”.

5) But the other ZIRP-related quirk was the *rotational* nature of the madness. Even as individual stocks/sectors saw their foolish PEs implode, there was a refusal to exit equities entirely (for ZIRP’ed fixed income) and so the valuation goofiness just rotated.

That is how you get no growth utilities with 25 PEs.

6) Now that the Fed (in desperation at the inflation it courted/created) has finally allowed Treasury yields to rise, all the hot air pumped into equities is being evacuated (think of it as a nationwide Fed Fart…held in for 20 yrs).

7) So the insane Tech PEs are collapsing and Utils are the rotational sector of the moment…but why hold residual risk Utils with a yield of 2.5% if riskless Treasuries go to 3.5%?

cas127-

“ but why hold residual risk Utils with a yield of 2.5% if riskless Treasuries go to 3.5%?”

That was the point I was trying to make. And what if rates go beyond 3.5%, as they did so spectacularly in the 1970’s?

Upshot: Public utility stocks have a relatively high probability of survival in the coming investment market firestorms, but a relatively low probability of maintaining their present valuations. IMHO, of course.

Clearly, utilities will get hurt by rising interest rates. They behave a bit like bonds. I have been using them while treasuries were not paying anything. Time is approaching to move out of utilities.

I had some CHS preferreds because I liked the dividend. The reason I sold it was that they said many years ago that even though the preferreds are currently callable they would not do so until I think it was next summer. Considering they are trading about $30, if they do get called at $25 you are looking at a 20% loss on your principal. Maybe I misread the situation, but it seemed like too much of a gamble to me. I just had 2/3 of my Safe Bulker’s preferreds called — 1/3 of which I had held since they first issued them 10 years ago or so. Fortunately my basis was $25.17 or something like that so I didn’t lose much in the way of principal. At 8% I was sure sorry to lose them!

I own the CHS preferred as well, because CHS is a co-op and the customer owners own a lot of the preferred, it’s very unlikely they’ll ever be called.

I work for a co-op, their governance structure is interesting and appears counter-intuitive to those accustomed to publicly held company behavior.

What is the CURRENT dividend in dollar terms and what is your COST BASIS?

Hypothetical: if you bought it when it was paying $1/yr and the price was $10, you locked in a 10% yield. If the price doubled and current yield is still $1 YOU are still getting 10% yield even though PRESENT yield is 5%.

I’ve noticed this apparent flight to safety on the Fidelity and Vanguard consumer staple ETFs (VDC and FSTA) too.

Per Hussman, all stocks are overpriced. Not to mention tresauries yield is catching up. Still, unlikely to lose 95% like Tesla.

Don’t buy utes until the dividend is 5% or higher.

And if possible, don’t buy utilities that are going to file for bankruptcy. There is a list of big ones that filed for bankruptcy. Your dividend goes to zero and the shares get trashed or go to near zero.

The great thing about the great Wolf is that there is nothing sacred!

Praise be the the Wolf!

Straight lines are sacred to Wolf. They never go to heck!

Timber…………

If the stock market crashes in the woods, does the federal reserve hear it/save it? It’s an age old question that’s been debated since the times of Plato. Still no one knows…

“Amazon’s guidance for operating income was shitty.” Telling it like it is! People, even higher income ones are becoming more price sensitive (bad for Amazon) but still spending to the max of course.

Amazon is still a solid company. Large retailers have been trying to copy thier online sales model for 20 years. None come close. A slowdown in sales should have been expected. For much of the last year online sales were driven artificially high by the pandemic. Now it’s getting back to normal.

I would be a buyer here, but I’m buying nothing until the fed gets done fighting inflation. When Bezos left I would have sold and waited for a correction. He was the creative genius and they may never be the same without him.

Bezos was not always the creative genius, but recognized good ideas.

Don’t forget the Fire phone.

And don’t forget options for delivery people to drop your package off INSIDE your house. And let me add drone deliveries.

Can you elaborate a little on what exactly operating income is? With the Rivian write down, did Amazon not get a bit of a boost when Rivian’s shares were appreciating ? Any idea if Amazon has much in the way of holdings of other risky start-ups ?

Rivian doesn’t go into operating income. As I said, Amazon invested in Rivian at a very low price, and some of Amazon’s prior profits were due to valuation increase of Rivian up through its IPO. Amazon had a big gain on that in Q4.

Wolf, I am a bit puzzled by your comment “some of Amazon’s prior profits were due to valuation increase of Rivian up through its IPO. Amazon had a big gain on that in Q4”.

To my knowledge, principles of conservatism under GAAP allow for asset prices to be revised down when market prices come down…but they do not allow for asset prices to be revised up to indicate profits.

Would appreciate your clarification.

Sean Shasta,

Rivian is publicly traded, and it’s not a subsidiary of Amazon, so Amazon needs to do mark to market every quarter. Ford had to do the same thing, and it also booked a huge loss for Q1.

From Amazon’s Q4 2021 8-K filing, for the quarter ended Dec 31, 2021, showing the detail of where it wrote up Rivian’s stake following Rivian’s IPO in November. The IPO was the trigger for Amazon to write up its investment. It booked a gain of nearly $12 billion on its Rivian shares:

https://www.sec.gov/Archives/edgar/data/0001018724/000101872422000002/amzn-20211231xex991.htm

GAAP should be changed to reflect it directly in shareholder equity and bypass the income statement entirely. Same thing for numerous other transactions to reduce the ability of management to manipulate the income statement and meet EPS expectations.

@ Augustus Frost –

Agreed. It is confusing to blend the Income Statement with the Balance Sheet.

Think of it this way: The income statement is a measure of flow throughout the quarter. The balance sheet is a measure of stock on the last day of the quarter.

And they’re intimately connected. When you write down the value of an asset on the balance sheet, that write-down shows up on the income statement as a loss.

When you rake in lots of profits on the income statement, some of it shows up on the balance sheet in various forms, including an increase in “cash” and “accounts receivable,” reduction in debts, increase in “accounts payable” (because you sold more stuff and have to pay your vendors), and also in the capital accounts, such as “retained earnings.”

I recommend everyone to take at least a basic accounting course at their community college. It’s very helpful and very cheap. All kinds of investment stuff suddenly makes sense.

@ Wolf –

My accounting is rusty……….

As I remember, income was from operations, with a recognition of a capital gain if and after an asset was sold and REALIZED a gain.

Wolf said: “IPO was the trigger for Amazon to write up its investment. It booked a gain of nearly $12 billion on its Rivian shares:”

If the booked gain on the IPO required, via GAAP accounting rules, Amazon to book a gain then that is something I have forgot, or was never aware of. I suspect this is the root of my confusion?

I have owned a few stocks, and though their fluctuating valuation affected my balance sheet, they never affected my income or income statement until sold.

Yes, do take an accounting course as refresher. It will be very helpful.

Brokerage computers will probably be working overtime tonight issuing margin calls..

I believe we are approaching the edge of the cliff here.

1. Amazon, Apple, and now Netflix have stalled. It really shows how important the massive stimulus payments were to the earnings of these companies. For example, Mississippi has one of the lowest median unemployment compensations in the nation at $166/week. Uncle sugar was paying out $600 a week extra during the pandemic. So much of that new income went into the pockets of Amazon and Apple.

2. Russel went down first as Wolf has shown. Money piled into DOW and seemingly safe S&P and NASDAQ companies like Tesla and Apple. Once they crack, it will be the 2000 bust all over again since faith in market will crumble.

3. The Fed only protects the banks and not the stock market. It will let the private investors eat the losses this time now that many bank-generated loans such as mortgages are sold to private investors (unlike in 2008). The market still believes in 1% rates and then reversal and QE once stocks enter a bear market, and as such faith is the only glue holding this broken market together.

4. I believe companies are running out of cash for buybacks and will have a hard time borrowing once rates approach even 1.5%. Much of their collateral will take a huge hit in the repo market.

That “extra $600” was the most f**ked up idea ever, nearly on par with the PPP loans. The people running the show are grotesquely incompetent and should be fired for what they have created.

Never let a crisis go to waste.

I remember going from childhood illusion of thinking adults were so smart to realizing there is a lot of adult stupidity in the world.

One theme throughout life is Federal government narrative of always having a single crisis narrative to focus on.

It used to be terrorism. Wasn’t that long ago that there were guys outside our local airport with semi automatic weapons yelling at you if you were parked for more than 15 seconds. Now no guards around and if it’s not busy you can park in front of terminal for 15 minutes and nobody says a word.

Pandemic was a crisis and it didn’t go to waste. Ukraine is a crisis and it will not go to waste. Current proposal is for $33 billion, but this thing has potential to be another trillion dollar boondoggle. Big Pharma and MIC has incestuous relationship with big gov.

Everything federally funded, regulated, licensed, subsidized, guaranteed, or taxed has an incestuous relationship with Big Gov.

FIFY.

And the tax code itself never gets simplified because of the legal and accounting interests. So the incestuous relationships metastasize.

Austrian econ has a term for that: “malinvestment.” Often with government’s slow reflexes it is fighting the last war. Vast resources are trashed.

Now with these FANGs too, I think we may be entering a new era. Beliefs and bets will be revised with some pain.

It is possible that “the people running the show” you refer to _were_ fired during the 2020 elections, although perhaps not for the specific reasons you have in mind.

Investopedia: “The Consolidated Appropriations Act, 2021 (CAA), signed into law by President Trump on Dec. 27, 2020, included new funding for the Paycheck Protection Program (PPP), which had expired Aug. 8, 2020. The PPP was created by the CARES Act and originally included $349 billion in funding. However, that money was gone within two weeks, resulting in the second round of funding totaling $320 billion.”

USA Today Dec 20 2020: “Lawmakers struck a roughly $900 billion COVID-19 stimulus deal that includes another round of stimulus checks and badly needed jobless benefits for struggling Americans, ending a long standoff in Washington with one of the biggest rescue bills in U.S. history.

After months of impasse, negotiations came down to the wire as 12 million people are set to lose unemployment benefits the day after Christmas. The deal includes restarting a $300 boost to the federal unemployment insurance benefit, extending eviction moratoriums for renters by a month and a $600 direct payment to most Americans….”

I’m sorry, come again? I missed where CONgress was cleaned out. They are the ones who pass legislation.

Not sure why giving money to poor people can hurt the economy. And PPP was Trump’s policy. Which wasn’t a bad idea, just one that was highly susceptible to fraud.

Ideas highly susceptible to fraud are always bad ideas. No exceptions. There are ALWAYS better alternatives.

Perhaps PPP was attractive to policy makers because it created risk-free new business for banks and finance companies. The banks made money whether the PPP recipients were fraudulent or not.

You’re not sure where printing and giving money away can cause inflation and encourage speculation and idleness? Okaaaayyyyy….

PPP was a bad idea when local food banks went empty! Just for starters. It was an example of how not to do it.

Buybacks and other forms of financial engineering have only worked because of the mania. If or when the mania is over, these gimmicks will fail to inflate the stock price and will massively contribute to future bankruptcies.

There have been a few high profile examples of this like Boeing and the airlines. When the major bear market arrives in full force, it will be a major contributing factor to unprecedented losses.

Today, most corporate balance sheets more closely resemble stable rags and the only reason they can borrow cheaply is because of fake “growth” and the bond market mania.

Interesting article in today’s WSJ (B12). Seems there is a dawning realization that the cost of obtaining Lithium, nickel and cobalt has rocketed. GM announced a deal with Glencore for Cobalt and is working on something similar for nickel. Where does that leave a boutique manufacturer like Rivian?

I don’t even know a single person who owns an EV, nor have I heard of any who want them. A couple hybrids is all. The government is, like always, pushing something way too hard when the infrastructure and such is not even remotely ready.

You must not live in CA. They are everywhere at least in the Bay Area. I’ve had one for 10 years and they are a great car to drive and I love never having to go to a gas station (not even about the gas price but just the hassle of going to the station). I’ve never had range anxiety but our other car runs on gas so we have always had another car for road trips. I would recommend that all 2+ car families that have access to a garage look into them. Prices these days are on par with comparable gas cars. All the people I know who have bought EVs (mostly Teslas model 3 but also Nissan Leafs) are very happy.

I have considered whether to purchase an EV. My main reason to not buy one is the potential cost to replace the battery pack. I could be ignorant but sounds like they are expensive to replace. Did you take that into consideration?

If that’s your concern, you can lease an EV :-]

Back when there was a soviet union, we called this “central planning” and we mocked it mercilessly. Now we seem to love it. We forgot that it always ends in tears — shortages, high prices and slowing productivity.

Five people in my family have EVs and one has a hybrid. I live in Texas and they are becoming quite common.

Right. And you’re all, in your own words, “progressives armed to the teeth.” (I have a long memory) When I see your name, for some reason I read “Enigma.” I’m kind of smelling some of that Texas Longhorn bull excrement.

So do I.

“Look everyone! We have a psychopath here!” -DC

A well thought out argument by your standards?

I’ve seen only a handful around here in central Illinois. One customer talked about the heat problems with his electric car on a cold day. The Bay Area doesn’t exactly see temperatures of -10F in the winter.

Many people do not like the idea of EVs around here. And that’s putting it mildly.

Depth Charge, Wolf has gone into great detail about our current electrical grid, how it is barely used during non-peak periods, think nighttime when most EV’s would be on charge. I suspect electric utilities are in board for further EV production, at least for the future

The grid is not exactly what I am referring to. The supply chains and production capabilities are not there.

The costs of EVERYTHING have skyrocketed. All kinds of shit is up 50% and 100% and more over the past 12 months.

Such as?

A few examples, US, year-over-year, commodities:

Crude oil +60%

Gasoline +65%

Diesel +65%

natural gas +148%

Heating oil +103%

Naphtha +58%

Uranium +82%

Cotton+57%

Wheat +51%

Coffee +50%

Cheese +34%

Palm oil +83%

Orange juice +62%

Oats +76%

Tin +41%

Zinc+40%

Nickel +91%

Magnesium + 104%

:-)

Wolf, You had that list ready and raring to go didn’t ya?

My “Great Value” yogurt at Walmart went from $1.24 to $1.82, or just under 50%.

Today, nine holes, senior rate at the local golf course is now $40.95 versus $27.50 two weeks ago.

Hang onto your hat!

@SoCalBeachDude

Go ahead and bury your head in the sand if you want.

Solar panels +50%

Furniture and other FF&E for hotels +50% (NOT INCLUDING SHIPPING WHICH HAS AT LEAST DOUBLED, IF NOT TRIPLED +EVEN MORE TARIFFS; PERHAPS ALL TOTALING THE +60% RANGE)

Copper wire for electrical, I believe now in the +50%

I’m taking a screen shot and putting it on my desktop plus a copy for my WS folder. Thanks.

Please note he left out the cost of golfing. Every time I see those 4 big pipes going over the Grapevine it makes me hate golf worse.

That’s North CA water and a lot of electrical power.

Most everyone up where my off grid land is has a horse shoe pit.

Some of the best players are often around 80. It requires a LOT of skill and very little money, plus they are usually much happier than any golfers I have ever seen, and I have seen a LOT. Even some well known Congress Critters.

Just a much more planet friendly suggestion, to those who might care. And money saving, to stay on topic.

I’m trying to identify the items that are DOWN in price to somehow arrive at the miraculous 8.6% inflation, because everything I’m seeing is up 50%+. I’m not having any luck.

Silver is down from a year ago (much to the displeasure of my portfolio, but at least I’m just playing with fun money). Maybe the US secretly got back on a silver standard, has anyone seen Powell and William Jennings Bryan in the same room together?

Up in the Iron Range in Minnesota, there is a battle being waged over nickel and copper mining. From 26 January 2022: “Interior Department revokes mine leases. A controversial copper-nickel mining project in northern Minnesota has been put in jeopardy by the Biden administration’s decision.”

Twin Metals is a Chilean company at the center of this dispute. Things are split amongst the locals like Paul Bunyan’s axe being driven through a stick of firewood in all this. The Bureau of Land Management seems to be the decider in the question of Boundary Waters Wilderness vs the need for these metals & where they are sourced.

The University of Minnesota (my alma mater) is working on nickel ferrite battery tech, but nothing seems to jump out in the progress of this recently.

“The synergistic effects of NiFe2O4 species with multiple oxidation states and 3D porous carbon with a large specific surface area offered abundant active centers, fast electron/ion transport, and robust structural stability, thereby showing the excellent performance of the electrochemical capacitor.”

“Overall, the presented work offers a guideline for the design and preparation of advanced electrode materials for energy-storage systems.”

A battery powered EV made from Minnesota’s iron, nickel and copper may very well happen … some day, eh?”

The main problem I have with “green” is the government distortions compounded by Wall street’s desire to fleece gullible investors. Remember First Solar boom and bust. Seems to be happening in EV right now.

From reading Berkshire’s annual report I think a lot of big corporations have been reaping huge credits from investing in clean energy. In Berkshire’s case (biggest producer of wind electricity generation in US) he said the investments would not have made sense without the tax credits. He can move the credits from the utility to lower overall tax rate of corporation if I remember correctly.

There are no supply issues at all on lithium, nickel, and cobalt from either the Russian Federation or the People’s Republic of China where they are plentiful and readily available at excellent prices.

China has gone on a worldwide lithium mining buying spree. They understand the future and are positioning themselves appropriately. I can’t say the same for the US.

California has some of the largest lithium deposits in the world, but we are very opposed to that stuff being mined here as it would be detrimental to our karma.

Lithium is up over 400% for the year. I don’t think you can find it laying around every corner just for the pickings. Cobalt is only up 70% and we all know about nickel. Silver isn’t ripe yet but look out.

Ahem….

Four months after tech stocks start cratering should start show up in falling Silicon Valley housing prices…

Wasn’t Theranos “valued” at $12 billion and about to take over the world of healthcare? How could 12 billion disappear into the abyss?

Could this extinction event be coming to other companies in silly con valley once their frauds are exposed too?

SO we’re seeing the first smaller layoffs here, biotech, tech, etc. Nothing huge yet. Twitter is going to be interesting. The Nasdaq isn’t down hard enough yet to really hit the housing market. Give it a little more time.

Musk may downsize some departments at Twitter, but the technical infrastructure to run the business and the company is gigantic and very complex.

Cutting corners there would be disastrous.

It won’t be long before the Powell Pivot Part II du jour. Despite what occurs next week at the FED May meeting and their expected 50 basis point hike, it won’t long before they’re cutting and printing like the mad swashbucklers they are, AGAIN.

Back in 2009, no one knew what Central Banks were really capable of doing. But today everyone sees through the hubris. There is no escaping the cataclysmic results of over a decade of insidious malfeasance, and their backs are now pinned against the wall.

The only alternative now (for the FED) is to back track on the hawkish narrative. Start cutting rates back to zero and stimulating yet again with tens of trillions of more stimulus. The global economy is in a terminal death spiral. We’re at the end game and they know it.

“It won’t be long before the Powell Pivot Part II du jour.”

It would be a given if:

Credit market or bond market seizes up

Banks start failing

Financial system instability is threatened

Recession – may be not even the milder variety for now

IMO, if inflation stays where it is or goes higher and above does not happen, you can kiss the Powell Pivot goodbye.

Inflation has done what no one could do – force the Fed’s hands.

I agree the Fed has to continuing tightening until asset prices drop. People in the lower half are extremely upset. In Seattle, young families are getting priced out of their homeland. They have the choice of buying a hugely overpriced home or putting up with rent increases of 10% per year. Some of them are hightailing it, while harboring great disdain for economic leadership.

People are getting stuck between ridiculous home prices and ridiculous rent increases in many parts of the country. They don’t like it. They think about it every time they buy anything, because the inflation is broad.

This doesn’t sound much like the American Dream I once envisioned.

Powell is going to be forced to make a choice. We don’t know for certain what he will do, but he has to convince the bond market that he is going to fight inflation or the central bank is going to join the long list of central bank losers like Weimar and Zimbabwe and dollar becomes fire starter.

Hyperinflation episodes (Weimar and Zimbabwe) come from supply collapses. “Too much money” is caused by financial incompetence.

March 2020 was total fog of war, with no idea where the bottom or the end of the tunnel was. Congress hadn’t stepped up with enough fiscal support. But before and after that, the Fed was pump-priming and begging for more inflation. Finally it HAD to happen.

Nope. There will be many – likely 6 to 10 – increases ahead by the Federal Reserve FOMC as to its Federal Funds Rate, but that affects very little and key interest rates to watch are the yields on US Treasuries, particularly on the benchmark 10 year US TReasuries.

A burned speculator says what?

“Would you like fries with that?”

The FRB is not going to trash the USD and voluntary abandon global reserve currency status. This is necessary for the Empire and the economy, public, and markets will be thrown under the bus to preserve it.

I know a lot of posters here believe the FRB will “print to infinity”. I’ll take the “under” on that bet, until the government can no longer borrow cheaply and the economy is already in an economic depression, a real one.

Besides, if the credit cycle turned in 1981, it won’t work the same way anyway. The type of “printing” you are describing will almost certainly lead to a global deflationary asset crash and no, there is nothing central banks can do to prevent it.

They can only react after the fact.

I think Meta were being grilled at the time of their last report by the govt and so and wanted to talk down their influence.

As reliant as the overall market was on the FANG stocks… it should be no surprise what happens when those same stocks start to collapse in value.

James Turk wrote (The Money Bubble, 1913):

“For a sense of how an over-indebted financial system enters a catastrophic collapse, imagine a spinning top. For a while after being set in motion, the top stays in one place, spinning smoothly. But then a slight wobble creeps into its rotation, gradually becoming more pronounced until it turns violent. The unstable top then shoots off in a random direction to crash against whatever is nearby. That’s the way the financial markets will behave when the Money Bubble bursts.

As this is written in late 2013 our imagined top is spinning smoothly again after a huge, near-catastrophic wobble in 2008. With US stock prices at record highs, interest rates still historically low and daily fluctuations in major markets reasonably muted, all looks well. But soon, probably in 2014 but almost certainly by 2015, the fluctuations will begin to increase until the system spins out of control.”

Oops, he didn’t understand how long the Fed could keep that top spinning with the scream of a revved up Lamborghini. But the predicted acceleration of wobbles may be happening at last, with inflation being an oil leak that will blow the engine.

Image search undamped oscillator for a good mechanical analog. Then look at S&P chart since 2018. The next wave down is going to be a doozy.

Its finally happening to the big boy techs…we were living on borrowed time for the last two decades. I’ll be wearing my brown pants.

Tech wreck…

Money heaven must be working overtime for three to last 6 months. So much money disappear into thin air..

For all those FOMO hype stock chaser busy preaching about stock will only go up and cash is the ultimate loser.. How do you like it now that cash so far is only losing to inflation compare to 40% like some of these loser stocks and potentially much more much faster? Personally I sure am enjoying this show with my buttered popcorn

The USA is a consumer led economy (like the UK)

no consuming

equals

no economy

It’s not rocket science….

Don’t underestimate the “buy the dip” crowd. They have more money than the shorts do … The USA’s total stock market cap is about $15 Trillion and around $5 Trillion is parked in money market accounts…..

Stocks will soon go to the moon. Once all the stocks Tripple, we can sell it all and pay off the National Debt of about $30 Trillion…and have our principle intact. I just love economics when all the numbers round-up perfectly – I am now qualified to take Powells job.

I hope this is sarcasm. Or else, what were you doing in 2001 and 2009. Sleeping, or not born yet?

Good luck in your investing.

I think the goal of Fed to inflate assets will end up being the biggest mistake of all times. Markets tend to have booms and busts without Fed throwing gas on the fire. It doesn’t seem to be too bright to inflate housing, bond and stock markets to record highs as a policy.

“ Don’t underestimate the “buy the dip” crowd. They have more money than the shorts do … ”

It isn’t “real” money until you close out your positions…

Assuming you can get out with any money if you’ve overplayed your intelligence…

Until then, you’re playing a game (with life consequences) on a screen…

This is sarcasm right?

Only bears here in these comments…

I’m going to ask a stupid question: why would anyone buy any stock that is not paying dividends or that is not in hyper growth mode and expects to pay dividends in the future? The way I look at things is that all companies will eventually become obsolete and their stock will go to zero. Maybe quantum computing will make AWS obsolete, Tik Tok will make FB go the way of MySpace, etc. I know people buy these stocks hoping that the price will go up and get out before the company stops growing or goes bankrupt but why do the new people buy the shares? (yes they also hope that someone else will buy at a higher price). I know this is a pretty basic question but I’ve never understood the thinking.

I agree with you. I only buy stocks that grow dividends or ETFs that track DGI indexes, or industries that pay more than the overall market, like real estate or utilities. Only go with the cash flow.

As Johnnie Cochran might put it: If a security does not pay, you should walk away.

I think its a legit question. A blue-chip company like Microsoft doesn’t distribute dividend often, instead it invest it in itself. Though it passed its hyper growth stage, it still grows. You don’t really know when a company takes off, look at Apple, it isn’t till the ipod/iphone came along that it became a tech darling and before that the stock was like $1.

A business will adapt to make money. Netflix dropped their dvd service and Amazon used to sell only books.

We all can thank Chairman Xi from China. Last time stocks dropped, he said some sweet words and markets bounced quite a bit. Today he again offered reassurances about tech companies in China and Asian markets rallied.

Shorts will get pummeled today.

How did that prediction work out for ya?

Why never a mention of the carbon foot print of Amazon?

The fleet of delivery vehicles leaving the distribution centers is mind numbing…..

Is Amazon too woke to be criticized?

and the impact of gas prices must be damaging

People waste a lot more gas and time driving all over town looking for a good quality product. Amazon reduces that carbon footprint.

Local American businesses love to nickle and dime the captive customer with a limited variety of mediocre products. And corporations love to set up captive markets to jack up the price of available products.

You should define exactly what you mean by “woke,” instead of hiding under the skirt of a right-wing attack word.

It only takes a little scepticism to see the bipolar policy of government. The policy to offshore to China was one of the most environmentally destructive decisions ever made.

“The policy to offshore to China was one of the most environmentally destructive decisions ever made.”

Instead of blaming corporations, where the blame properly belongs, you prefer to blame the government, their proxy under coercion and handy scapegoat, which is exactly how corporations want the blame deflected away from them. It sure keeps the corporate grifters off the hook, doesn’t it?

And you guys keep falling for it. Although from the scent of the rising reek it may be that you’re not fooled at all.

Unamused. Corporations are in bed with politicians for sure. US Treasury determines who US corporations can play ball with as you can see with Russia.

Old school……and the deregulation of the financial sector continues post 1980 culminated in Enron, Madoff, Indian nations being fleeced by political lobbyists, Stock buy backs by Corporations, profit motive in healthcare, Citizen’s United. Yes the “legal” system has been corrupted. Choice your venom.

It Started With JAPAN.

Yes, it was all hand in hand. Bill Clinton was all in favor of globalization-offshoring. So too both President Bushes.

It is like the surveillance state: once data leaves you, it goes into hands of corporates and the national security apparatus welded at the hip (as in MSFT, GOOG).

“Instead of blaming corporations, where the blame properly belongs, you prefer to blame the government, their proxy under coercion and handy scapegoat, which is exactly how corporations want the blame deflected away from them. It sure keeps the corporate grifters off the hook, doesn’t it?”

This is braindead stuff. Who do you think allowed the corporations to do it? If the government doesn’t regulate, corporations will do anything they want, which includes utilizing child slave labor or worse.

“Who do you think allowed the corporations to do it?”

Who do you think coerced the government into allowing corporations to do it?

Your turn.

Sorry, bud, corrupt politicians can’t blame the person who paid them off. Get real.

“Never argue with a stupid person. They will drag you down to their level and beat you with experience”

-Mark Twain

+3.

“right-wing attack word.”

Pardon to interrupt, the “woke” word came from the LEFT.

You know what it means, dont you?

You assume it saves gas. Delivering one item at a time when shopping entails more time, less trips.

‘the “woke” word came from the LEFT.’

Which the radical right methodically turned into a swear word, according to the customs of extremist disinformation and misinformation.

‘Liberal’, ‘socialist’, ‘communist’ were getting a little worn out, weren’t they? Or is this just how the radical right does vocabulary building?

If it were 1984 the process would be made much more efficient with that Two Minutes of Hate. Maybe it still is. Or is still to come.

“If it were 1984 ”

The government would come out with a Disinformation Governance Board …… like the Ministry of Truth.

True Liberals invite debate, digest facts, apply reason and logic.

Those who shout down opposing points of view are hardly “liberal”, yet they wish themselves to be, so as to adorn themselves with a false intellect.

The decline of a society can be identified when chanting replaces debate.

“True Liberals invite debate, digest facts, apply reason and logic.”

And radical conservatives do the opposite. They ‘do their own research’, vote for the biggest haters available, deny science, invent conspiracy theories, never ever EVER admit when they’re wrong, engage in violent political coups, worship their overlords even as they’re being gutted, and pretend schools in Minnesota provide litter boxes for students who identify as cats.

Historicus: “Delivering one item at a time…”

Most Amazon deliveries are done by trucks going to several hundred homes in several neighborhoods. They are taking that many cars off the road – and most trips if not all of them would be short ones creating more pollution.

Then there is the running from store to store because you can’t find the product that you really need – creating even more pollution.

I think drifterprof is right. Amazon reduces the carbon footprint, makes it easy to find the best products, and has them delivered right to your doorstep.

Other than Amazon becoming a possible monopoly – which Walmart and Target have to fight with better products and processes, I don’t see any downsides with Amazon.

…….amplified by the far rights continued exaggeration of their political opponent, save our children.

Carefuwl, Therez feewings getting Huwrt here.

“ People waste a lot more gas and time driving all over town looking for a good quality product. Amazon reduces that carbon footprint.”

You ever see the lineup of cars waiting to pick up kids from school… what a traffic jam….just sitting there in climate controlled comfortable… all over the country… probably uses more fuel and has a larger carbon footprint than all of the Amazon delivery vans use put together….

Not to take away from your point though…

They should use school buses. Amazon should be broken up and same day delivery should not exist (both for workers and for the environment). All can be true, it doesn’t need to be one or the other. Whataboutism is exhausting.

Don’t forget all the carbon and methane that is coming out of those kids orifices! It’s got to be a huge number!

We’re in that school traffic jam. Why? Something about the lack of viable bus service. This year, the bus routes are 90 minutes long in the morning and almost 2 hours in the afternoon. I can make that trip in my car in 20 minutes. Add in a few extra minutes for the traffic jam and it’s still a huge win. My children get to work on their homework at a comfortable desk instead of on a noisy/chaotic bus.

And there’s the pickup location: Major road that cars routinely fly down at 40 – 50mph, even in the winter. When the snowbanks are high, there is literally no safe place to stand. When we point this out to the school district, we got a giant shoulder-shrug and a comment the speed limit was only 25mph on that road.

One van going down a specified route delivering 50 packages is more efficient than 50 SUVs driving all across town with people trying to buy stuff.

HOW ABOUT UNLIVEABLE WAGES AND BENEFIRS?

HOW ABOUT COMPANIES PRICE GOUGING AND CHARGING WAY TOO MUCH FOR CONSUMER PRODUCTS AND THEN HAVING TO FIRE STAFF OR SHUTTING DOWN BECAUSE NOBODY WANTS TO PAY FOR THAT NONSENSE?

True, but what is the net effect when you consider that a low cost, efficient online retailer overall increases propensity to spend and consume?

Imagine if it was hard to do. People would buy less?

Not sure which one emits more carbon. Hard to say.

You have to consider how many shipped items are returned and then reshipped, proper size, different color, not what was expected etc. Some of those items probably have made several roundtrips.

It’s simple. They are all going back down to the 2020 breakout level. Then the acid test will start. Twelve years of moral hazard

The piper will be paid. So far yet to go

Toonces

Everything that happened since Pandemic breakout is hot air in my opinion. More debt. Lower work force participation. Lower real wages. It was all just helicopter money drop that has to be financed by someone.

In Intel’s case, the stock is currently testing support going back to 2018. Intel was a once great company, but when Grove exited as the CEO, the company has never been the same. The company employs 122,000 people, top heavy in management and diluted in the technical ranks (fellows and principal engineers.) Gelsinger, true Intel blue, to be sure, will go down with the sinking carrier, but long after he’s cashed out his chips. And for those of us who live in a local economy dependent on Intel, we better pay attention.

Grove was an excellent manager in his younger years. Intel’s golden goose was always the “x86” architecture and the “replicate exactly” manufacturing philosophy. Ironically, what hurts Intel now is “Moore’s Law” (one of Intel’s founders). Transistors have become so plentiful & cheap that low end implementations are “good enough” for most uses.

Current Intel CEO Pat Gelsinger was the creator of the Intel 386 architecture on which all of Intel’s CPU microprocessors are currently based and Pat said recently they are headed to the first ever 1 trillion transistor CPU. Nobody knows Intel better than Pat.

Pat says to simply be patient, as Rome wasn’t built in a day, and it takes years to build new foundaries and put in place its latest chips. Intel remains the leader – by far – in CPU architecture globally.

And Pat is lobbying and haranguing the US government to give the semiconductor industry tens of billions of dollars in handouts to build those factories!! Same Pat. Gotta get the moolah from the taxpayers.

Wolf,

Yep, Gelsinger has sold Intel’s soul to the devil. And in return, has committed Intel to be “carbon neutral” by 2040.

12 years?

It’s a lot longer. For the stock market, at least since LTCM in 1998.

Through other distortions, a lot further back than that.

Yeah, there was no way that the spectacular rise in corporate profit margins since the great financial crisis was going to survive the intense inflationary episode we’re going through now – in which PPI components have been rising even higher than CPI.

That sort of situation (a large gap between PPI and CPI) can only persist for so long before it starts being reflected in corporate earnings – which we are starting to see now and given the Fed’s feeble attempts at controlling inflation will probably continue for a while. So if you are an equity investor then keep your seat belts on. It’s gonna be a wild ride!

One thing I learned from Hussman is big government deficits are going to flow right into corporate profits.

TSLA should be less than than $50 and need to crash over 90%. There is still a long way to go.

Even Musk bailed out and keeps selling shares every few months.

“Even Musk bailed out and keeps selling shares every few months.”

Think of it as a structured slow-motion pump-and-dump ploy. Very fashionable these days with the disruptor/unicorn con artists – er, entrepreneurial geniuses these days. Hence the Imploded Stock listings.

Elon: “Suckers.”

A lot of growth stocks just can’t be valued as it’s not even known if they are going to survive. The law of large numbers says growth of large companies like Apple and Amazon have to slow to not much more than 10% if they live for 50 years or so.

Basic ideas, and creators, dating back 20+ years (Jobs’ iPhone, AMZ business model) are showing their age. It feels like the end of a regime. Those personalities are leaving the stage. This coincides with the decline of globalization/neoliberal business models. There is space for innovation — or chaos or lots of both.

I could easily see this, and it’s what I don’t get about the Tesla mania. It’s a good product and growing industry, but the valuation ultimately has to be something that makes sense based on how much of the market it can command. The current valuation of TSLA puts it above all other automakers combined–even though Tesla’s market share is a tiny fraction of any one of the major automakers, even though all the legacy automakers are already starting to eat Tesla’s lunch in its own niche.

Toyota and Honda are both pouring a lot of their best skilled workforce into it. VW and Peugeot both have major EV research divisions and VW is already coming out with a far superior battery and charging mechanism. Hyundai is already beating out Tesla in some markets. Ford is putting EV front and center and GM isn’t too far behind. Nissan is building from the Leaf concept to a whole new fleet. And all this while TSLA still struggling with its self-driving, safety, infrastructure and spare parts woes. Do these Tesla fanboys not realize they’re being played for fools here–basically giving their money away at these nosebleed?

Matt Levine at Bloomberg calls it the Elon Markets Hypothesis — that “value” is a function of proximity to Elon.

“Even Musk bailed out and keeps selling shares every few months.”

What’s funny is reading some of the Twitter comments from his sycophant followers. There was one from an Asian crypto speculator with a name like “Mr. Big Whale” or something and it was imploring him to pump Dogecoin.

Don’t think of it as The Great Unravelling of 2022.

Instead, think of it as GFC Part II.

The present turmoil is the predicted result of Fed policies implemented to deal with the meltdown in 2008.

NIRP/ZIRP, QE, buying up toxic assets, and special loan facilities contained the panic, preserved the banks and the paper wealth of the privileged, and reinflated the bubble.

But these policy actions did not actually resolve the distortions, but instead preserved the distortions and amplified them.

And now the general population is going to pay for them with inflation and recession while the Fed figures out how it’s going to privatize the gains and socialize the losses this time around.

Will there be any gains to privatize ? It seems to me that this time around there may only be the losses, and that these losses will hit top 1% hard. This is just a gut feeling, I haven’t actually look at historical precedents like 70s inflation or 30s calamity.

The majority of the 724 billionaires in the US are going to lose most of their fake wealth when this mania implodes.

There were 13 in 1982 or 1983.

There isn’t enough actual wealth left for any other outcome and most of what they own now is a bag of hot air. The country isn’t that much richer where more extreme wealth concentration can change the outcome.

Manias and bubbles in bonds, stocks, real estate, crypto, sports teams, and multiple types of art.

From 1981-2020, “printing” coincided with relatively mild cost of living increases (in most components) while inflating asset values.

Except the reverse from future printing episodes.

I see a parallel to the global inter-war period (1919-1939). The problems were not solved, so the whole thing fell back into a more catastrophic replay.

The GFC for some was a buckling of US hegemony, on the financial and leadership side, along with the Global War on Terror fiasco (also with a financial side: tax cuts and funding on credit). The Fed seemed to be able to keep dancing and prolong a reckoning. But reckonings have a way of happening.

phleep-a flattened can is difficult to kick…

may we all find a better day.

Maybe its just me but it often seems there’s a concerted effort, although by who I don’t know, to rally on Fridays and end of month trading days. For that reason I ignorantly predict today will be flat or a weird bear rally. We’re also closing out a long forgotten mutual fund today so there’s some wishful thinking there too.

Not this time, S&P down 3.63% today.

Me thinks the fed put is around 3900 on the s&p. They just want to “blow the head off the beer” not spill the damn thing!

This is what inflation does- it is what it did in the 1970s in the US. Discretionary spending gets decreased, and rapidly.

The US Dollar is doing extremely well at 103.24 on the DXY.

From Yardeni research on rise in DXY:

The US dollar is soaring, and so is the US trade deficit. How can this be? Record capital inflows must be more than offsetting the record trade deficit.

That makes sense since interest rates have risen around the world so far this year with US rates well exceeding those in Europe and Japan, thus attracting global fixed income investors. Fed officials have been talking up US interest rates with their recent hawkish pronouncements, while the other major central bankers remain relatively dovish. The latest wave of the pandemic in China and the war in Ukraine have also convinced global investors that the US is a safe haven during these troubled times. Here is what the data show:

(1) Over the 12 months through March, the merchandise trade deficit totaled a record $1.1 trillion, as businesses who are worried about shortages front-loaded imports after Russia’s invasion of Ukraine. In the nominal GDP accounts, the net exports of goods and services was a record -$1.2 trillion (saar) during Q1.

(2) The US Treasury’s data on cross-border financial flows shows that over the past 12 months through February, net inflows totaled a record $1.4 trillion consisting of $1.6 trillion of private net inflows and official net outflows of $0.2 trillion.

(3) No wonder the US Dollar Index (DXY) is up 7.6% ytd.

But that data is year through February, before the Fed actually started the tightening cycle seriously in March. So those numbers appear to sort of indicate the opposite. The private net inflows would then just represent what we’d expect, the massive inflow from investors to US equities and real estate in 2021 pumped by Federal Reserve ZIRP and ridiculous QE while they basically had the Fed back-stopping the markets as inflation took off (and that inflation also pumping up the numbers based on valuations). That doesn’t seem to show the USD as a safe haven for that period, just that investors were getting while the Fed sang happy songs about transitory inflation and QE.

As for the ytd DXY numbers that seems something different, more like Fed withdrawing QE in more recent months and Treasury yields surging up, more than in Japan and most other places and of course, the ruble utterly collapsing and basically a whole swathe of forex buyers, oligarchs and investors from Russia and Central Asia forced into other currencies, the dollar and others too. (The situation in China right now is comparatively a nothingburger–like I said they have a lot of slack with the other ports and there’s still a lot of economic activity in the confined zones.) Obviously it doesn’t mean the USD is riding high since like Wolf has pointed out, the buying power of the dollar to get actual goods has fallen worse than anytime since the 1970’s, so it’s not like it’s a desirable investment overall. Against other currencies the picture’s mixed. Sure it’s doing better than the yen with the BoJ being so dovish and of course, the ruble collapse is distorting the forex markets in general. But if anything the central banks in Canada, China, Korea and a few other places have been a lot more hawkish.

US stock markets are trading mostly unchanged for the day after the Dow (DJIA 30) went up by 614 points yesterday.

Where I’m looking, the S&P 500 and the Nasdaq are down 1.5%, subject to change :-]

Now -2.1%

Where is the GDF Plunge Protection Team (PPT)?

Powell and Yellen are right now going from bar to bar trying to round up all the traders in the PPT and force them to go to their trading desks and start buying, according to sources familiar with the matter. But the traders are already drunk, and it remains uncertain what they can accomplish given the condition they’re in, according to one person who doesn’t want to be identified due to the confidentiality of the matter. Another source said that some PPT traders returned to their desks and fell asleep.

The New York Fed this morning has made $1 trillion in secret funds available to the PPT, and all they need is for traders to use those funds to buy stocks, any stocks, no matter what, according to the president of the New York Fed who doesn’t want to be named because of the secrecy of the matter.

Wolf, on your PPT remark: Elon will fly in to save the day, reviving he sloshed traders, as he will put the Coca back in Coca Cola.

The Fed called, they want those rose colored glasses back!

Does anyone has a guess where S&P and NASDAQ are going to stabilize, after all the gains that occurred due to the easy money policies will escape from the inflated markets ? All the way down to spring 2009 level ? Or to fall 2019 level ?

I don’t remember the woman who said this, some famous wealthy middle-aged woman with lots of media attention. It was 1987, after the stock market crash, and she was asked about the stock market that was in shambles. And she said, talking about her investments, wisely and in a self-deprecatory humor that I never quite forgot, something like this:

“It’s just like my body; everything is still there, but a lot lower.”

Thanks for sharing that Wolf, made my day

Minus the uterus and a boob or two.

Even if they escape those, gravity always wins.

For men it’s prostate problems or cancer.

You can be a trans man but you will never get prostate cancer. NOT FAIR.

Some advice as someone approaching 69: when you’re bladder gives the slightest signal, run to the rest room. And don’t trust your farts.

This might be a good investment strategy.

LOL

If memory serves, 50% of 50 year old men have prostate problems; 80% of 80 year old men. It’s not a matter of if but when. The 2 things that irritate me the most:

1. The harder you try the less you get.

2. When you do manage to relieve yourself you’re back 15 minutes later to get the second half.

When you are in your late 70’s like me (if you make it), Flowmax is your friend. And you are 100% right about those farts (also, don’t ever fart in bed).

I’m 51 and don’t know whether to laugh or cry.

(an old joke that will understandably be moderated off)-

two old friends decide to go to the cinema. well into the film, one leans over to the other in consternation to say: “…i just let a silent fart, what should i do???”.

the friend answered: “…change the batteries in your hearing aid…”.

may we all find a better day.

I know she died in 1980 (so it wasn’t her), but that sounds like something Mae West would say.

Regarding the stock market, you have the prophets and the Monday-morning quarterbacks, but very few focus on where and what the markets are doing today.

sticking with my forecast from early 2020 so far AK:

Dow 18K, s&p 1500 IIRC ( which memory is certainly suspect LOL )

didn’t do nasducks then, but suspect it may go even lower, percentage wise that the Dow and S&P

going to have to get back to some reality sooner or later,,, and IMHO, the sooner the better in terms of the pain/pane/pretension

Thanks for the insight.

That would be -50% down for Dow, and -68% down for S&P, from their tops few month ago.

The S&P would come to summer 2013, but Dow would only fall to summer 2016 level.

As always, I hear a lot of people making simple unsubstantiated comments about where x stock is going to go.

Would like to see more thoughtful theses with data to support – or at least try to support.

As far as short term day to day stock movement, I have nothing to add other than timing the market at that short term of an interval is extremely difficult. Your expected value may be highest by not doing anything at all ;)

“ As always, I hear a lot of people making simple unsubstantiated comments about where x stock is going to go.”

PG,

Here’s something substantial for you…

Everything you know about a stock is in the past… Everything you don’t know about a stock is in the future…

No thesis with any purported data is going to change that fact…

Your guess is as good as any fence post…

I personally would hate to see what you’re advocating… it would ruin this fine forum, in my opinion….

I only advocate for people to not do short term trading, because most people are better off not doing it.

That is all.

Your post is actually a reinforcement of what I touched on too. I’m glad we are in agreement

My market timing YTD is up 13.3%. Just sayin’.

phleep,

Only if you sell, brother, only if you sell…

But good on you !

So that’s what, 11% after taxes if you sold today if that’s all realized gain…

PG,