Inventories are slowly recovering, but remain below where they should be.

By Wolf Richter for WOLF STREET.

Consumers hung in there in Q1, and despite raging inflation, their spending grew at a normal pre-pandemic rate. Private investment grew, inventories recovered some, government consumption expenditures and investments fell again, and then there was the – excuse the technical jargon – shitshow that the trade deficit has become.

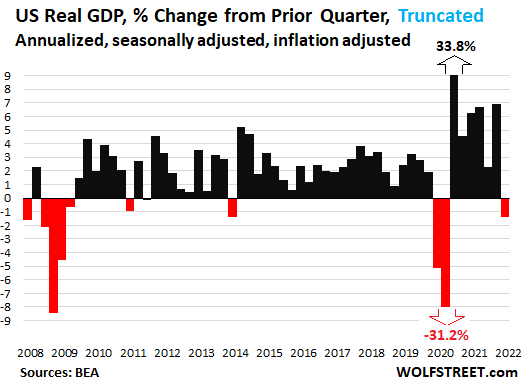

All put together, GDP, adjusted for raging inflation and seasonality, the so-called “real” GDP, fell by 0.4% in Q1 2022, from Q4 2021, which translates into an annualized rate of -1.4%, according to the Bureau of Economic Analysis today, following the mega-growth in Q4 of +6.9% annualized.

For a better view of the details, I truncated the two historic outliers, the 31.2% plunge in Q2 2020 and the 33.8% spike in Q3 2020 (annualized):

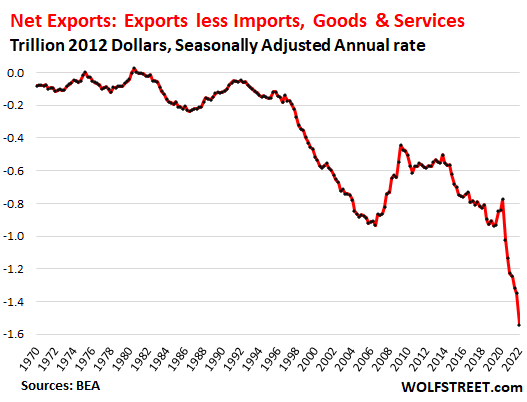

The shitshow that the Trade Deficit in goods & services has become worsened by $192 billion, adjusted for raging inflation (via 2012 dollars) and annualized, the second-worst ever in dollar terms, behind only Q3 2020.

Exports add to GDP, imports subtract from GDP. The so-called Net Exports (exports minus imports) has been a negative on GDP for decades, with exports rising moderately but imports soaring as Corporate America is globalizing production and importing more and more, from Walmart to Apple. Many overseas vendors are now selling directly to US consumers via Amazon and other third-party platforms. During the pandemic, consumers splurged on goods, many of them imported, and the trade deficit exploded.

The WOLF STREET dictum that “Nothing Goes to Heck in a Straight Line” may have to be revised:

So, compare that $192-billion worsening of net exports, which is subtracted from GDP, to the overall decline in GDP $70 billion!

The chart above shows what the overstimulated pandemic boom in consumer spending on goods, many of them imported, has done to the trade deficit, which was already in terrible shape – and it hit GDP good and hard.

It’s an indictment of globalization over the past three decades, committed by our heroes: Corporate America, lobbyists, and governments over the decades.

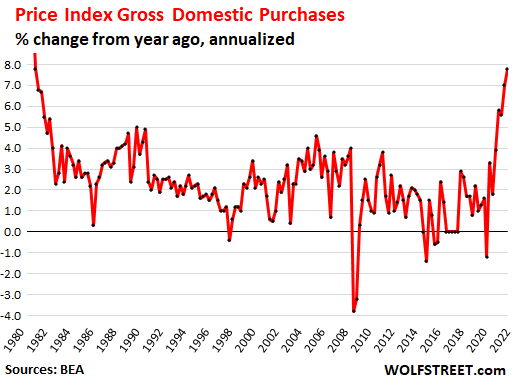

Raging-inflation adjusted: The Price Index for Gross Domestic Purchases, the BEA’s inflation measure that is part of the GDP report and roughly parallels its inflation adjustments to GDP, spiked by an annualized rate of 7.8% in Q1, the worst since Q2 1981:

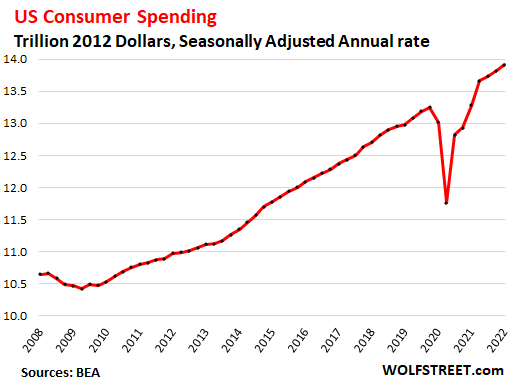

Consumer spending rose by an annual rate of 2.7% in Q1, adjusted for raging inflation. This was back in the normal growth range that prevailed between the Great Recession and the pandemic, and shows that consumers are making a mighty effort to outspend this raging inflation.

Consumer spending as a percent of total GDP, at 70.5% in Q1, was higher than normal (in the 68% to 69% range) as other factors in GDP, particularly the trade deficit and government spending worsened.

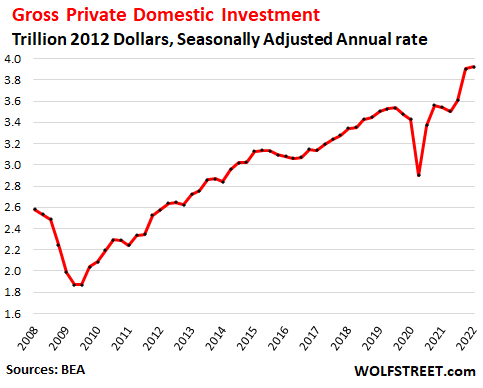

Gross private domestic investment rose 2.3% (annualized), after the large spike in Q4. This includes fixed investments, such as nonresidential structures, equipment, intellectual property, and residential structures. And it includes “change in private inventories” (more in a moment).

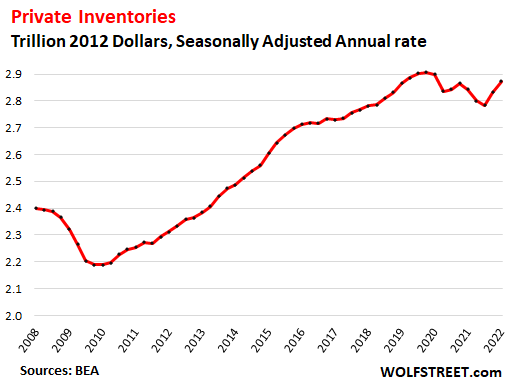

Private inventories rose for the second quarter in a row, adjusted for raging inflation, in a sign of progress in restocking, while the economy continues to be troubled by shortages. This includes the large category of new vehicle inventories which had been desperately low, and which are now starting to tick up. Growth in inventories adds to GDP:

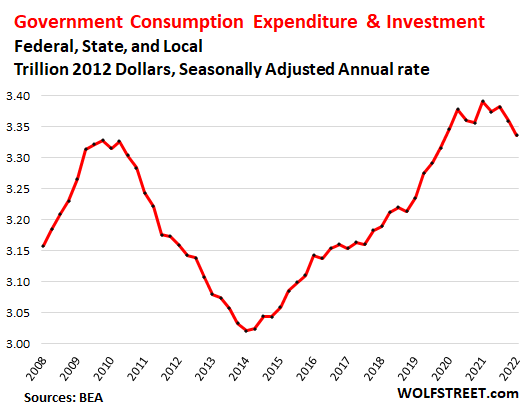

Government consumption and investment declined 2.7% (annualized), the second quarter in a row of declines, with spending by the federal government falling by 5.9%, and spending by state and local governments declining by 0.8%.

Government consumption and investment does not include transfer payments to consumers and companies, such as stimulus payments, unemployment payments, Social Security payments; nor does it include government salaries, and other direct payments to consumers. Those payments enter GDP when consumers and businesses spend or invest this money.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

US Treasury Secretary, Dr. Janet Yellen says more shocks likely to challenge economy…

“The shitshow that the Trade Deficit in goods & services has become worsened by $192 billion, adjusted for raging inflation (via 2012 dollars) and annualized, the second-worst ever in dollar terms, behind only Q3 2020.”

Thanks for this. Most people only focus on the budget deficit, which can be papered over by the Fed and central banks like Bank of Japan (the latter nation has a trade surplus which is why Yen has not completely collapsed so far).

Trade deficit cannot be papered over as easily. Other nations need to accept out digital fiat for their sweat and labor. But for how much longer?

The US Dollar is more accepted and desired than it has ever been and is rising dramatically because it is the best currency in the world and will continue to do so throughout 2022 and may go as high as 120 or even higher on the DXY.

Finally someone else sees the handwriting on the wall. The rise of the USD is going to precipitate a worldwide depression of unparalleled scope. In fact WW3 will probably be a result of the ensuing chaos and misery.

“The US Dollar is more accepted and desired than it has ever been…”

Did you even read Wolf’s article on “US Dollar’s Status as Dominant Global Reserve Currency at 25-Year Low” before making comments like this?

Is that why Russia is not accepting it any more? Is that why China is reducing its exposure and accepting alternative currencies? The BRICS also since they are afraid to be sanctioned next? Saudi Arabia in talks to sell oil for Yuan?

Sheesh…

The Dollar is just a better looking witch than the other hags in the covenant, no offense to witches. Currency valuations are just relative to other competing currencies and give no absolute determination of the worthiness of holding a particular currency. 120 on the DXY, whoopeeeee!

Beach Dude may be right for a short period while the arbitrary sanctions destroy the economies and currencies of other countries. But it’s like borrowing at a variable rate and lending at a fixed rate in a rising interest rate environment. Looks good for a while. Everybody always forgets the other guy is not a dope.

The dollar value is rising against other currencies. That is not a sign of weakness, it is a sign of strength. The economic hassles right now are shared globally. The U.S., in fact, has weathered the headwinds as well as anyone, including China. The dollar block may be irritating to some nations but these nations do not come close to providing the liquidity and ease of commerce. Nor do they want to, in reality. The U.S. balance of payments deficit greases the wheels of commerce internationally. Without that you would see a bunch of ‘beggar thy neighbor’ trade conflicts and a worldwide recession, even after the pandemic is long gone. You want economic warfare? Just have the U.S. stop issuing those unnecessary Treasuries (they don’t fund anything anyway) and adopting policies to correct its balance of payments deficits.

Gunlach is saying once the current war crisis is over he has a lot of conviction dollar is going to 75 on DXY due to outrageous size of budget deficit and trade deficit.

And don’t forget the proclivity of the U.S. Central Bank to print money to buy the never ending debt of the United States!! If this ain’t Banana Republic stuff, no offense to bananas, then I don’t know what is. Also, a key determinate of relative currency values is the internal inflation rate of a country, and the U.S. is already on its way to the 10% inflation rate that is baked in the cake from morsels of housing costs to the consumer, and food stuffs, wheat and grains come to mind, and rare materials such as lithium that the Go Green crowd has not acknowledged as a real carbon generator in its open pit mining.

Never trust ANYONE who lives (among many other places, I’m sure, but this is, I think, where he runs his LA “The New(est) Bond King” empire from) in a $25-30M+ high walled compound with at least two full time ex-Seals manning his security system.

It’s just a personal rule of mine, feel free to disagree.

He took over from the previous “Bond King”, Bill something.

You know, the guy who wrote those mystic sounding letters to fund members. Think they worked together for a while even, but bad blood developed?

Love it when filthy rich bastards fight, makes me less worried about an organized oligarch takeover, which would doom us peasants for SURE….and literally. Bad enough that they have pretty much paralyzed government.

At the risk of breaking my arm by patting myself on the back:

Last week my new preamp, amp and DAC arrived from Schiit Audio of California. Fantastic sound, quality and entirely USA made. (With a slight caveat: the vacuum tubes are Tung-Sol, from Russia. Tung-Sol began life in Newark in 1907. DanBob began life in Newark in 1962. Sort of completes the circle, eh?)

In January, my OTSO gravel bike arrived from Wolf Tooth Components of Minnesota. While not entirely USA made, with some Shimano & DT Swiss parts on it, it’s about as close to made in the USA as a bike can be. (My two road bikes have HED wheels from Roseville, Minnesota. DanBob went to public school in Roseville.)

For years and years down the road (pun intended) I intend to use and enjoy these durable goods. Knowing that they are made in the States simply adds to the satisfaction I will have when using them.

I figure, it’s the least I can do. And never let it be said, I didn’t do the least I could do. -DanBob

Also speed green appliances made in USA – f——— k CHINA ,S KOREa

Do you mean Speed Queen? Those were the best washers and dryers. Not sure anymore.

One of the top things we should have learnt from 2 years of shortages and backlogs is to bring manufacturing back home.

Three decades of offshoring – from needles to airplanes. No effort to stop or reverse it.

Speed Queen still made, assembled a better term, in same factory up north part of flyover USA somewhere, but it is now owned by some alliance or another…

Every replacement part so far, for 6 year old W&D, mostly due to operator error I’m sure, have been ”Made in Mexico.”

A friend just replaced a 25 yo SQ washer, ”because they were tired of it”…

Wrong Nacho,

Offshoring started in the early 60’s…the Honda 50. By 71 I was in Detroit visiting wife’s pen pal and bumper stickers everywhere said, “Hungry? Eat Your Toyota”.

Japs wised up and let engineers run their companies, not MBAs and marketing men. No more “Jap Junk”. Kicked our “nation of innovators” ass plenty damned good.

Take from someone who spent most of his adult life in factories.

I also recall an article from that time, probably a bike or car mag (mostly all I read), that said the diff between CEO and avg worker pay was not all that much. Forgot ratio. Same article said if Mr Honda himself arrived late at factory, he parked way out in the lot and walked, only assigned spot was for company nurse and related medical people and vehicles.

All while our CEO’s were rubbing our noses in the “difference” between us and them. Another reason they kicked our ass in manufacturing. Their workers also willingly gave good input on assembly procedures, etc, and were LISTENED to.

Japanese aren’t Calvinists.

Too bad the average consumer can’t afford these luxuries.

Whether they can afford it or not, the numbers that Wolf provided show they are clearly buying it. I would find it hard to believe that 20% of the people are buying 70% of the stuff.

intosh,

The “average consumer” doesn’t care wether their music is a compressed Spotify digital approximation of what music really sounds like — or not. Some of us do care.

Preamp =$950. Amp + $700. DAC = $200. Not cheap, but in reality, a steal at that price.

@JeffD

Buying what? Are you saying 70% of the stuff people buy are Made in USA?

@Dan Romig

“Some of us do care.”

That’s my point. Many of the stuff “Made in USA” are niche luxury items. Their target market is the enthusiasts or connaisseurs willing to pay a premium price. That’s how these businesses can survive. But this model cannot be extrapolated for the entire American consumer market.

Very good (and true) point intosh.

It looks like there may soon be a made in USA alternative for some popular tube models that were previously supplied by Russian companies. Western Electric, in Rossville, GA, a manufacturer of high end amplifier tubes is gearing up to expand their line to include popular tubes used in guitar amps.

Thanks, I’ll keep my eyes out for this when it’s time to replace the four GSN7-GTB tubes.

A year ago, my system ran using homemade subwoofers and an active crossover from Seattle’s AudioControl. My preamp ran in passive mode for this. When I upgraded to the fantastic, JL Audio (from Florida) subs last year, the configuration now requires an active preamp. (The subs have their own crossover inside.) My Schiit Sega (which I replaced last week) does both passive & active, and is solid state only.

But in tube mode, the new Schiit Freya + sounds better than the Sega does. Plus, the smart option that the engineers at Schiit (thank you Mr. Stoddard & Mr. Moffat) have put into their flagship preamp is the ability to run it in passive, solid state or tube mode with a push of a button. This lets me save the tube’s hours for when they aren’t critical, watching a Premier League game, by running the preamp in JFET solid state mode.

Again, US made & the best that there is. At a fraction of what one can spend for other brands’ flagship preamps that are made in China.

I have a buddy from a former job that lives on a farm in downstate Illinois.

He’s not a farmer. The best description would be a bespoke electronic engineer.

He – mostly – rebuilds tube amplifiers for audiophiles.

He knows I’m an “antique radio” buff and attend swap meets here in the Chicago area on a regular basis. He asks me to look for certain vacuum tubes.

When I find them I wrap them carefully and them down to him. He says most of them are excellent for his purposes.

I guess people who want their amps etc. restored like having older tubes.

Cathode filament helps heat Dan’s house, too. Cold up there.

Imagine if the US still had to settle trade balances in gold.

Obviously, that stuff has no financial relevance whatsoever and never will have any financial relevance.

I am bored shit-less at the moment and so I will entertain myself by this response. “No financial relevance?” Russia protected the Rouble from a 150 collapse back to 75 /USD after the attack on its CB by doing two things. 20% interest on all private sector Rouble deposits and fixing its Gold Reserves to the Rouble at 5000 / gram or 141875 Roubles per ounce. . If it were not for physical Gold payable on demand their currency would be worthless. This is the power of Money.Quite frankly you could call this “un-even” floor for gold as the Putin Floor. This is the power of Money. Gold has no counter-party risk as the weaponized fiat dollar has. Dumb ass Americans do not know the difference between Money and currency. This ignorance has led to de-basement and out -right theft and taxation of their Money. Congress and the Fed has used this ignorance to steal our ability to project an hours worth of our youth-ful labor to the future when we are infirm due to old age. Currency is not money. Bit Coin is not money. Our currency in the bank is an un-secured loan to the bank. Class C stock is worth less than butt-wipe in terms of actual assets of a company.

Me too, Doom.

The next person that brags about really expensive planet destroying needless shit bought with all their “hard earned money” is gonna get it.

If my back pain pills don’t wear off first and my consciousness switches to my lower back first.

That would bring discipline, to the point of catastrophic deflation and war. Last examples: WW1, WW2.

While BOEING has 400 -787 jets setting can’t deliver – must be FORD,S cousin same story

I have said in the past here that there has to be something still rational in what the FED and other central bankers are doing, although we know it will be hurtful economically. It seems one goal of letting inflation running is that it helps kill national debts. Yeah, the FED might want to do that do ya think? : )

Beneficiaries from inflation are governments.

So here it is, from Fraser Institute in Vancouver BC: (and with permission from Wolf if you’re ok with that Wolf)

“Inflation – it’s a word we have heard a lot of lately.

Canada’s inflation rate recently jumped to a 31-year high of 6.7%!

Most Canadians born after 1990 have never experienced a serious episode of inflation like this, and don’t know what to expect.

As you might know, our motto here at the Fraser Institute is “if it matters, we measure it”. Since not much more matters than the overall health of the Canadian economy, we have spent a lot of time studying this recent rise in inflation.

One recent study noted who the beneficiaries of high inflation are: governments.

You won’t hear that from our political leaders, but it’s true: governments are the clear beneficiaries of inflation, in two main ways.

First, by reducing the purchasing power of the Canadian dollar, inflation effectively reduces the real cost of servicing and retiring outstanding government debt.

Considering that the latest federal budget projects federal debt will reach $1.3 trillion by 2025, the federal government stands to benefit hugely from higher inflation.

Second, while personal income taxes are indexed to inflation by the federal government, asset values used to calculate capital gains taxes are not.

This means that increases in the values of equities, real estate and other assets – that are purely the result of inflation – will push many Canadians into higher tax brackets when they are sold, increasing government tax revenues even though the inflation-adjusted incomes and wealth of most Canadians do not.”

I highly recommend Fraser Institute (as well as Wolfe!).

“First, by reducing the purchasing power of the Canadian dollar, inflation effectively reduces the real cost of servicing and retiring outstanding government debt.”

BoC is increasing interest rates even faster meaning a higher % of tax revenue is needed to service the Govt. debt. The Canuck Millenials who vote for Trudeau’s Liberals are facing both higher future taxes and unaffordable housing.

Complete nonsense.

Inflation that rises faster than incomes hurts most households. You can’t hurt most households and then claim that benefits the government. After all, it is households that pay for the government. The government benefits from prosperous households, not those suffering from inflation.

And the tight money needed to slow inflation, and the recession it causes, will not benefit household.

If the Fraser Institute is trying to say inflation is good news, they need their heads examined.

You didn’t even try to understand what Fraser institute said buddy. Read over please.

He’s not your buddy, guy.

That’s why everyone calls inflation the stealth tax.

The enormous benefits of globalization are more in evidence than ever as the prices of imported goods falls significantly due to the value of the US Dollar soaring upwards in value and reducing the costs of much better imported goods for all Americans as this year progresses and sales of imported goods reach new highs in the US.

Are you and I living in the same world?

Wolf, could you add an “Ignore” option if one is available? Some commentators here are beyond hope. I used to read them just for humor, but lately they are not funny anymore since they really seem to believe what they parrot.

I think you got too much Sun beachdude

For sure you’re a Russian or Chinese troll

Ah yes, it must be the Russian or Chinese. All of a sudden globalization is considered a foreign scheme.

What next? Those truckers of the “Freedom Convoy” up north were Russians and Chinese in disguise too?

You can’t read sarcasm too well can you? : )

BeachDude – you need to let whatever you’re on wear off. Your comments are too much.

You are correct about the higher value per dollar spent on imported goods. People with low or fixed incomes especially benefit from inexpensive imports. US households gets products they want, at prices they can afford. Chinese (and other) businesses get pieces of paper, called Dollars, that lose purchasing power. They can buy US products, invest in US companies and real estate, or hide their Dollars in their pillows. If they don’t spend or invest the Dollars, they’ll lose 5at least % of the purchasing power each year.

In 2022, people are facing price inflation that’s usually rising faster than their incomes. As a result, cheaper foreign products become more desirable.

For the week ending last Friday, the Chinese renminbi is at a one year low versus the US Dollar, but down only -2.23% versus the US dollar y-t-d.

While the Japanese Yen is at a 20 year low versus the US Dollar. Considering all the goods we get from China, it’s hard to believe the Yuan – Dollar exchange rate had much effect on the prices of goods from China.

The Wold Richter comment that insulted your comment was rude, especially because it failed to provide any explanation of what “not living in the same world” meant. That is a leftist style generic character attack, and not one that makes the attacker look good.

Does the handle Million Dollar Bonus ring a bell?

Gnarly.

It’s a sh*tshow alright! 100% agreed. The stock market is going to fight this tooth & nail for the next couple of months.

Prices of stocks will simply falls as global depression sets into the US and the global economies, and prices of all bubble assets will deflate back towards normal, reasonable, and fair values as needs to be the case. Most stocks have already fallen around 20% and only need to fall another 70% or so to reach stable equilibrium valuations.

For all the guys with shorts and put options, this GDP decline was met with fierce stock market increase. Even Meta jumped in 2 digits despite slowing growth, new zero user growth and lower than expected revenues!

Where are the guys that I warned against shorts, who were telling me that Put options are not shorts as if these options don’t lose money to both time and share price!

Another reason to not short: Put options give floor to market and tells the wallstreet when to pump to squeeze puts and take your money!

Leo1992,

Check out the afterhours massacre. Forget the little ones that are getting crushed. Look at the biggies, AMZN -10%, AAPL -4%, GOOG -1.6%

It’ll get interesting tomorrow.

So, Wolf, do you think it’s advisable to take a pass on grabbing a share or two of Amazon before it splits in July?

My logic says maybe given that the long-term trajectory for Amazon is unionization. Granted, that will take a while, but I just wonder if this pressure will build in the months following the stock, putting downward pressure on the newly split stock. Extra patience beyond the split might be advisable. Certainly, there will probably be a significant selloff or two after July as the Fed’s QT extends into this fall.

Certainly, everyone should expect Amazon to react by increasing automation in the next 3-5 years to undo some of the cost pressures associated with labor unions.

With Google, I’m inclined to buy one share before July and then later this year when a significant sell-off occurs.

Thoughts?

I donated $20 for this great content. Plus the cussing.

Thanks!

That wasn’t cussing, but a technical term that most precisely describes this situation.

I’m shocked, shocked that cussing is going on in here! Everyone out at once!

“GDP Sunk by Trade Deficit Shitshow”

I admit, I haven’t the article yet but the headline is why Wolfstreet.com

MAKES ECONOMICS FUN!

I went against my plans for this year and just bought a used piece of equipment for an almost unbelievable price. That’s the only reason – it was too good to pass up. I figure at the current rate of inflation it can’t hurt and I can make money with it.

Despite “the numbers” I am seeing first hand that high fuel prices and high inflation are destroying people and businesses, hence why I was able to secure something used in a cash sale – they needed the money.

Despite narratives to the contrary, things are not good out there at all. I see and hear of the tales first hand. Businesses are having a harder and harder time passing off the higher prices to customers, and both sides are getting crushed.

U mean make more Monopoly money,be careful I see deflation on the horizon

Agree DC:

Out there, in the real world on the streets of the saintly city of the tpa bay area, there are now appear to be 10 times as many homeless wandering around or living in their car, etc.

And ”moving sales” have become much more numerous, with tons of ”curb alerts” advertised for some really decent looking stuff, etc., even in the high rent areas.

Dumpster diving is now competing with pre-dumpster ”gleaning”, and donations of food to church groups is increasingly being used as folks cannot afford the increases, some really vast, of cost of almost every food.

Can’t see how this is going to end well,,, reminds me of the days on the streets in London in early 1970s era, except a cuppa was six pence, and a pint was one shilling — (and 20 ounces,) so we got by on wages of $5 PER DAY as long as we could pay no rent.

Definitely gonna be ”living in interesting times” for a while, eh

It’s a tell that the real economy is getting crushed first. I see and hear the same things from small businesses that actually have workers, COGS, overhead and customers.

Salaries and bonuses are still up in OPM Land. Government workers, are doing fine now too – customers are not an issue. But it’s an inverted pyramid.

GDP sunk and stocks exploded today. All indices are up violently.

Everyone knows that as long as USD is the reserve currency, we can continue to spend like a drunk sailor. Its like playing in a game where one team controls the gravity experienced by every other team. No matter how hard the other teams work, they will be at our mercy. And somehow we will never lose in spite of being fat, unathletic, and lazy, almost magically.

And there is no end on sight to the party. People wishing for US asset price implosion will keep waiting and getting poorer by the day.

Kunal,

Check the afterhours massacre. The BIG ONES, AMZN, AAPL, et al. Forget the little ones that collapsed. Tomorrow will be interesting.

It was a short squeeze

Everybody bought the dip and the market went nuts.

Not me. My IRA has been 100% cash since February. The downturn is going to be long and brutal.

Till now 4170 level on the S&P is holding and you are getting a bounce from that.

The Fed has raised by only 25bps and done no QT yet.

Inflation shows no sign of coming down any time soon.

Looks like war will not end anytime soon.

So the direction is clear.

One has to wait as ‘Nothing goes to heck in a staright line’ as Wolf says.

Kunal, while it’s possible we are headed upward from here, todays run in the market was a classic “C” wave right into the 1.0 extension (missed it by 3 points).

A good portion of the time, this means we are headed lower. In the NQ, it’s looking like another 2000 point drop could be on deck before we bottom and turn back up hard.

SPX doesn’t have as far to fall.

Wolf- the trade deficit indeed has blown out, but for historical graphs it’s probably more accurate to show trade deficit as percentage of GDP. While we’d still show expanding deficits, the difference isn’t as big given our greatly expanded economy, and IMHO that’s a more truthful look at how imports are affecting our economy.

A lot of GDP isn’t real economic production.

This isn’t new but distorts how much the US economy has progressed or regressed over time.

Lune,

Wait a minute. You’re being illogical to hide the logic. The trade deficit is PART OF GDP. Trade is one of the big components. And it’s inflation adjusted. So are you going to show GDP as a percent of GDP also?

Good lordy, the hoops people jump through in an effort to hide reality!

For balanced trade, that chart should be a straight line across at zero, with exports = imports, so that exports minus imports = zero!

Yes, but adjust at fake numbers? Or at reality check numbers of 17%?

Imports and exports are adjusted by the price indices for imports and exports, not the overall CPI.

I just checked: the import price index for all commodities to end-users jumped 12.5% yoy.

OK Wolf. Please help me understand something. Why are government expenditures included in GDP? I could see why if the budget was balanced, since then it would just be the government spending your money instead of you. But it allows trillions of borrowed money to be counted toward current GDP. And we all agree the debt will never be repaid.

joe2,

OK, I didn’t invent GDP, and I don’t know why the inventors did what they did. And I don’t like it either that GDP doesn’t consider where the money came from (such borrowed money) that was spent.

But let me clarify something here: Not all government expenditures are included in GDP. Included are only investments (buying equipment, buildings, etc.) and “consumption” (paying for gasoline, rents, paperclips, red TOP SECRET stamps, and the like).

Most of the expenditures of the government — salaries, social benefits, unemployment, etc. — are NOT counted in GDP. They’re counted when the recipients spend this money later.

California is increasing the fuel tax on gasoline and diesel in July to help mop up the huge amount of extra money still sloshing around in the California economy from the vast federal wasteful and inane ‘stimulus’ programs in the past 2 years.

Just think of how nice your roads will be once the gov spends all that new money on road repairs.

Wolf,

Excellent as always. The long term charts illustrate just how long DC has ignored/papered over major economic problems in the US.

One question – do you know offhand how much a role oil played in the Q1 trade deficit?

Oil tends to be a major component of US trade deficits (Foreign autos and Chinese computers/smartphones/machinery are the other biggies) and a volatile one.

If oil did play a big role (my guess), then it might be worth while mulling over the dynamics of that mkt. For instance, I’m thinking that US oil production has been slow to re-up production…but I’m not 100% sure…or why if so.

Cas127

“… much a role oil played in the Q1 trade deficit?”

The US is a net exporter of crude oil and petroleum products, meaning it exports more than it imports on a volume basis, so it would REDUCE the trade deficit.

US exports of natural gas, coal, crude oil, and petroleum products have soared and the US has a trade surplus in ALL of these products. This is just about the only category (energy) where US trade is doing well.

The US is the largest natural gas and crude oil/petroleum products producer in the world.

“The chart above shows what the overstimulated pandemic boom in consumer spending on goods, many of them imported, has done to the trade deficit, which was already in terrible shape – and it hit GDP good and hard.”

I’m really tired of these make China great again policies. I haven’t heard a whisper of any sort of plan to rebuild the US, just more of the same.

If there is any plan, it’s to make most Americans poorer.

GDP contracted by a more-than-expected -1.4% but the market loved it – up 2.5% today!

I guess bad news is good news again.

Mister Market is hoping The Fed will go easy on raising interest rates. He’s manic-depressive that way. Probably other ways too.

The relationship between interest rates and market behavior is an incestuous one and as a result generates all sorts of defective offspring.

I’m a little concerned about Mr. Market. It’s been a few years since I’ve seen him have mood swings this quick and severe.

Are “interest rates” and “market behavior” the same gender? Just wondering…

Check out the afterhours massacre, AMZN, AAPL, etc.

Right on Wolf. I figure this was just a short squeeze so I unloaded my FB, Paypal, Saleforce, Spotify, etc. I’m still down on some shares but I figure this is just the beginning. Remember, nothing goes to Heck in a straight line!

Real estate prices are falling in the USA & Canada. About time!

Can you believe that Canadians were paying C$1.5 million for a cottage near Lake Erie or the Georgian Bay? Insane. The jobs there pay minimum wage and are seasonal tourist trap jobs.

The prices aren’t based upon Canadian wages, they’re based upon Chinese money laundering speculators. Your government sold you out.

Depth..They have the cash, Canadians think they do but don’t.

The game in my town is to send the youngsters from China to high school here, then off to college. Once they hit 18 they can buy property, get residence then bring the family er money out of the country. We have 2000 new students in a town of 35000 from China just in the past year.

Justin loves it!

A Canadian town of 35,000 with Manhattan prices? Is it the legacy of Mike Harris and the eColi in the water supply?

“Your government sold you out.”

Your corporate masters sold you out. They own the government. Mostly.

The only thing standing between you and your utter domination by corporations is the government, and only your hated government prevents the general population from falling into squalid, immensely profitable servitude.

Next year that will change. There will be nothing.

I think you meant nothing but silence. None of that nasty truck horn polution.

Getting rid of monetary policy (a reduction in government) would result in most corporations disappearing entirely, including large ones.

Yes, I would like to abolish monetary policy, since it’s a form of legalized theft. It’s one which the overwhelming majority even from among those who know what it is still support.

On a more basic level, it’s government that makes corporations possible to begin with, since a corporation is a legal construct.

Without government, either few or no corporations would exist, not as it exists today.

The modern corporation mostly came into existence with the modern concept of the nation state. There are a few exceptions which predate it, but not many.

“Getting rid of monetary policy (a reduction in government) would result in most corporations disappearing entirely, including large ones.”

Monetary policy is controlled by central banks, which are controlled by member banks, which are large corporations, and they are not likely to simply ‘disappear’ if you somehow managed to ‘get rid’ of monetary policy.

I seriously doubt you could make a case relating the size of government to monetary policy, but I might find it entertaining if you tried.

August Frost

“On a more basic level, it’s government that makes corporations possible to begin with, since a corporation is a legal construct.”

As you say the modern corporations came into existence with the nation state that itself is a legal construct. Still, the basic foundation of both is power.

A corporation can exist governed by its internal rules as long as it has the power to fend of competitors and foes. If powerful enough, the corporation can take the role of both emperor and state. The corporation do then both make the law and enforce the law.

Una,

There are plenty of toxic, vested interests living in and off government as well (my guess is that even you aren’t a fan of a $800 billion annual military budget after 1.5 failed wars for whom nobody was held accountable).

A reasonable estimate is that 25% to 33% of all agencies’/programs’ spending is lost to waste (read theft…because every time G money is “wasted” somebody is profiting from it).

And unlike any given corp, those figures are applied against the entirety of a national economy.

And this has been going on for 50+ years, through Dem/Rep admins/congresses. With essentially no improvements in program oversight/spending (because G “waste” is *somebody’s* profit).

I don’t disagree that *some* level of G spending is necessary – but it is well below where we are now (it isn’t a mystery how you end up with a G debt to-GDP in excess of 100%, and even that only “saved” by vast G money printing).

It is entirely possible to think of both corporations and governments as being filled with self-serving sh*ts.

But only one can *compel* you to go along with their schemes and only one enjoys the MSM endowed cloak of “good intentions/ignored outcomes”.

Corporations started out with TIME limited government AUTHORIZED CHARTERS, either a number or years, (and actually, at first, when they COMPLETED the mission they were chartered and given their extra legal protections for, starting with RISKY voyages of exploration, which could possibly benefit the entire Nation who granted their charter.

They now exist (along with all their extra protective legal “rights”) in perpetuity….they have been “enthroned”, as Lincoln said.

They are Private Fascist States (often way larger than most real Nation States) who’s members (including their ruling party; the C suites, board, and shareholders…and now only the largest shareholders) suck up all the benefits the other citizens have in any Nation State they happen to exist in.

They constantly use their immense wealth and power to lobby for monetary favors and especially even more favorable legal rights, granted to them by our government in the form of law.

They have even become recognized as “persons” and picked up those legal rights as well, (when they choose to define themselves as such).

They are the ENEMY of ANY government’s attempt at freedom and democracy. However, they do extremely well under dictatorships, police states, Military States, Kingdoms, etc, etc.

As I have said before, probably time to remove the quote from the Lincoln Memorial, unless the kids can force a Massive Comprehensive Green New Industry.

As a Biologist I am fascinated by the entire story of how molecules reproduced themselves 4+ Billion years ago, and over the last 1/2 Billion years even developed multicellular reproduction. It’s happening very fast now, in geologic time.

And it isn’t so strange if you consider the fact stars constantly die and reproduce themselves, although have even longer incubation times, and don’t reproduce quite as accurately as most “life” does.

I don’t particularly care for how our cultural evolution has shaken out, and study it looking for major bad (to me) turns.

Corporations are definitely one of the more recent bad turns.

Middle class immigrants are not happy with Canada either:

MARCH 23, 2022 – A new national survey conducted by Leger on behalf of the Institute for Canadian Citizenship (ICC) — Canada’s leading citizenship organization and the world’s foremost voice on citizenship and inclusion — challenges some cherished Canadian assumptions about immigration and citizenship.

“Canada is a nation of immigrants — and one of the stories we tell ourselves is that we are welcoming to new immigrants, wherever they may be from,” says ICC CEO Daniel Bernhard. “But while this may be generally true, new survey data points to the fact that many new Canadians are having a crisis of confidence in Canada — and that should be ringing alarm bells all over Ottawa.”

Survey findings include:

30% of 18–34-year-old new Canadians and 23% of university-educated new Canadians say they are likely to move to another country in the next two years.

While most Canadians and new immigrant Canadians alike believe that Canada provides immigrants with a good quality of life, Canadians have a much more positive outlook on Canada’s immigration policy compared to new Canadian immigrants.

New Canadian immigrants are more likely to believe that Canadians don’t understand the challenges that immigrants face and feel the rising cost of living will make immigrants less likely to stay in Canada.

Immigrants with university degrees tend to have less favourable opinions on matters related to fair job opportunity and pay than other immigrants.

Among those who would not recommend Canada as a place to live, current leadership and the high cost of living were the top two reasons.

The whole former UK is turning into a bunch of maids, nannies, schoolmarms and tax accountants for expat kleptocrats.

In the UK, I heard that the police knock at your door if you post anything critical of the Queen or gov’t but turn a blind eye on laundering from Equatorial Guinea or Saudi.

Shout out to all the dedicated consumers

💵This is your god💵

Their god is signalling fake prosperity to each other, as none of the rest of us care.

Signaling prosperity, fake or otherwise, has been a mainstay of humanity since emerging from caves.

I bet those caves has appreciated a lot in value, and being rented out

Zark Muckerberg is the funniest moniker of 2022.

‘It’s an indictment of globalization over the past three decades, committed by our heroes: Corporate America, lobbyists, and governments over the decades’

It was open day light robbery on American workers! Along with allowing China into World Trade without prior requirements re FAIR TRADE!

Those with Capital flourished and those labors, earning one paycheck to next got clobbered. And then the most reckless Fed created easy credit creation which again favored at the top and the financial repression for the rest

All those ‘EASY-PEASY” printed out of thin air will have serious consequences to global economy. GFC was a walk in the park.

Don’t confuse fierce rebounce (Bear traps) for a ‘recovering’ Economy!

Productive economy got sidelined by a short thrift and a kick by the’Buy-Back shares’ mania! 50% of rise in S&P since ’09 came from Buy-backs and NOT earnings!? How this is going to play forwards? This time is different, right?

Now the globalist neoliberal world order is crumbling. But I’m not too sunny about whatever comes next. Just because something grows moldy and toxic doesn’t mean the next thing is good.

phleep, you’re characterizing this as a conspiracy. This isn’t about “globalist neoliberals” (convenient straw men). This is the “free market” at work. Libertarians and oligarchs would go hog-wild if the gubmint instituted an industrial policy that limited offshoring or truly balanced imports with exports. People here rage against the government but fail to see that what they’re boiling their blood over is an inevitability of free markets – increasef profits. Everyone here is salivating over the prospect of buying stocks and houses on the cheap, when the crash comes. But they’d bust a gut if their bargain-priced stocks began shrinking their profits or their new home didn’t increase in price over time.

What’s needed is a reasonable balance, for labor and corps. But that doesn’t jive with survival of the fittest. Fairness is a fantasy.

The cultural version of “survival of the fittest” is ALWAYS heavily influenced by those who are presently more ECONOMICALLY “fit”, e.g., wealthier than most. They also have powerful and expensive programs for brainwashing those closer to the economic/educational bottom….and will continue until they don’t have to indulge in ANY “democracy and voting”….they are licking their chops right now, as they just came very close.

So, it’s coming rather soon I expect….sadly, unless the kids (who have the most to lose) stop it.

Molecules playing a similar game (from which the term was stolen and spun), but much slower, (and to me a far more interesting and complicated game), aren’t “trying” to influence ANYTHING. Absolutely nothing.

The Chinese covid vaccine hasn’t worked so well apparently. But still, even with enormous rising costs in shipment and port delays, American corporations, banks, and retailers will continue business as usual.

It’s just too convenient and profitable to use labor where there are no regulations, no overtime pay, laws or anything to protect workers. Much less benefits.

These companies are our trade representatives and negotiators. The face of America. Feel proud USA.

GDP is down, but somehow the Dow is up by over six hundred points?

Hee hoo, economics. This makes less and less sense each day.

Check the afterhours massacre: AMZN -10%, AAPL -4%, smaller stocks got crushed.

First, your site really is helpful. It’s the only place I get full historical perspective.

Second, with the trade deficit at $1.6t and the budget deficit at $3.3t, who will buy the bonds necessary to finance this?

Old Answer: The dollar is the world reserve currency, so everyone will, and has. Don’t be a sniveling fact checker.

New Answer: Not so fast. How did the dollar become the world reserve currency? In 1970, Kissinger, concerned about the $100b trade deficit caused by the Vietnam War, knew that no dominant world power lasted with a trade deficit.

Kissinger then set in motion the dollar as the world reserve currency by convincing Saudi Arabia to require oil to be sold in dollars. He was highly successful. Everyone needed oil. Everyone needed dollars to buy oil. Trade deficit problem solved. q.e.d.

But now, in 2022, the trade deficit is not $100b, but $1.6t. Oil is priced–not just in dollars–but in yuan, rubles, and rupees. Ukraine has accelerated this bilateral trade. The Shanghai Cooperation Organization (SCO) with about 40% of the world population, and 30-40% of world GDP, includes China, Russia and India, but not the US.

SCO wants off the dollar standard.

Inevitable that the dollar will lose its world reserve currency status. Impossible to know how long it will take.

When the US cannot convince others or its own banks to buy $4+t of bonds every year, interest rates rise, with all the familiar consequences.

Your and my grandchildren will then no longer be able to fund annual trade and budget deficits totaling $4+t.

Think of what that means for your grandkids future.

I would say the dollar as a reserve currency goes back to WWI and really took off after WWII. With the gold exchange standard the dollar was supposedly as good as gold, until the US couldn’t contain foreign spending and ditched even the pretense of exchanging the $ for gold in 1971. It’s been up and away since then.

Great comment. One country can’t fight the US Gov’t. Now a group of nations can have an impact. That is being played out before our eyes

After freezing $300 bil. in Russian reserves everybody will

think twice keep it in dollars or other currency

nook1000,

Nah, but everybody (Putin) will think twice about invading another European country and butchering its people.

“ but imports soaring as Corporate America is globalizing production and importing more and more, from Walmart to Apple”

The stimmie and giveaways have allowed a whole bunch of folks to buy things they couldn’t or wouldn’t have bought otherwise…

One can always delay the inevitable with a few dollars squeezed from here and there but the writing is on the wall for the people who have bought what will be eventually landfill fodder…

With inflation screaming, when these purchases fail or becomes non tenable, ( see Depth Charge above) the choice between the shiny new thingy or home and groceries, many of these purchases will not be replaced or substituted with cheaper alternatives…

I can see many, many opportunities coming…

I also think the export numbers were somewhat depressed because Boeing had problems delivering crowd killers…

When I think of the coming fire sales, the first thing that comes to mind is the RVs that seemingly everybody went out and purchased. Aside from maybe boats, I don’t know anything that historically has a worse depreciation schedule, yet used ones were even appreciating for a time, and they are almost like glorified cardboard construction. Ten cents on the dollar does not seem a stretch.

It’s going to get a LOT worse. The USD skyrocketed today almost to 104 on its way to an all time high of 120. This is going to absolutely CRUSH US exporters and delight China. It will also bankrupt many emerging economies with debts in USD. The rise of the dollar is going unnoticed by most but it’s going to be the star of the show before we are done.

Good time to travel to Europe as the dollar heads towards par with the euro

A while back I got an email from a guy in Sri Lanka with whom I’ve traded coins. He said it’s a big mess these days. Food riots and whatnot.

Our politicians are in a new world and failing horribly.

For 200 years it has been about going to DC to steal as much as you can, transfer as much back to home as possible and helping your folks avoid paying their share for what they receive…..while they drink, smoke, snort and f— themselves into euphoria.

Today it should be about policies to reduce both deficits and keep us from engaging in every foreign spot fire while promoting healthly growth…….which are not the type of actions that promote popularity or personal advancement….hence no interest.

They used to say God save the Queen……in the US it should be……God save us. We are in for it.

“We are in for it.”

Yes, but the coming dystopia won’t last more than a few years.

That’s the bad news. There is no good news.

“All humans are created equal. All humans have the right to Life, Liberty and Freedom.”

That my friends, is thee code for how it should be, forever more, here on Earth.

-DanBob

It is now almost May, 2022 and new car inventories at dealerships are still cleaned out. This was supposed to have been resolved by fall of 2021. At this point, it doesn’t look like auto inventories will be replenished until 2023 at the earliest. This is definitely a shitshow.

Depth Charge,

I have a mug for you (well, a spot on the Mug List). I received DR DOOM’s donation, and he wants me to send you the mug. I have emailed you to your login email. Not sure if it’s working. But please let me know how to proceed.

Thanks!

Wolf-

That email is just a dummy for login purposes on your site. I will send you a donation by mail with my mailing address.

Thank you! In your mail, include what you want me to do with the mug DR DOOM wants you to have. To send it to you, I need name, street address, and phone number. Functional email would be good too.

I was so distressed about the large bounty being offered on the mug that I should have instantly offered one of mine at a close to original buy. NOS—never used as I drink from the can.

1) We export sanctions and import oil.

2) EU export sanction and import even more oil in devalued currency.

3) Private inventory is rising, because 50,000 completed F150 are waiting for chips. Are they.

4) Change in private inventory is going crazy since Q1 2020.

5) USD/RUB bubble have plunged to the bottom.

I’m long volatility and oil. With a side of cybersecurity.

FINRA wants to put all kinds of hurdles to exotic ETF/securities trading (pass a test, high net worth, all kinds of permission and cooling off days of no trading). Wants to protect us from ourselves! They put out proposed regulations. Hopefully your broker makes it easy to comment against this.

They want to sit over us like a disapproving Woodrow Wilson with a big ruler in hand. What, to force me to go all long SPY?

Hey wants the Market Technician take on the “Friday Effect” getting wilder before the crash? I expect more than I learned from the CNBC talking heads in 07-08, and since all things change over time, (like QE) please address that also.

Thanks.

Wolf: I have always agreed with everything you’ve written, except for now. It seems as if you’re vilifying globalization and offshore manufacturing. As a periodontal surgeon and small, FDA regulated, start-up medical device manufacturer, my medical device business would simply not exist without globalization. The small disposable surgical parts that I invented and sell for a few dollars apiece are made in China for about 50 cents apiece and are excellent quality, passing all the massive regulatory hurdles thrown at us by the FDA. This is in contrast to the identical USA sourced version that costs 20X as much. The Chinese version allows my doc customers and all our patients (i.e. everyone) to benefit from this lower cost and faster procedure to treat the most common chronic infection known to humanity. Sure, I support “Made In The USA”, but in so many cases its simply not financially feasible for many of us to purchase these USA sourced goods. From my perspective, the cause of all this is the ridiculously overburdensome regulations foisted on us by our government that does nothing except increase costs beyond anything anyone can afford; therefore I feel the trade-deficit is largely our fault, not China’s, since we can’t make anything that anyone else wants at the right price.

I don’t think that is true.

Yes, things are cheaper to import than have made here, but not 20x, unless you are really bad at shopping around.

The real problem is usually that the person selling here wants absolute maximum money, so they import.

It is entirely possible to buy here and make less money. But that’s no fun.

Another thing that is possible is to pay more, but be more efficient, which is an advantage smaller companies have over giant ones. You can (I do) sell to international companies, and make good money, while buying things locally, just by not having the awesome overhead that giant companies must support.

It’s important to see both sides of the coin. Too many reactionary stance on globalization.

Why does Germany seem to maneuver through globalization better than does the USA? Maybe because Germany reinvest more of the wealth back into the industries, the community and the people, while in the USA, the wealth is stuck at the top?

You whine about just one extreme small personal example, and aren’t aware of how huge the technical/industrial complex that the US sent to China/India, just because of your poor negotiating skills, and it makes you support this wreckage of 10’s of thousands of factories/systems, and industries being offshored to China/India, and the economic strife suffered by this country – this is extremely myopic Doc!

Please read what I said above, and I will add my programming/systems job of 40 yrs was outsourced too, – however I had the skills/drive/sacriffice to start a small company, working 80-100 hours a week for years, – Ya think that’s healthy Doc? – I’m just one of the 10’s of millions of jobs outsourced/offshored, and so many folks lives and families were destroyed, thrown into poverty, divorces, drug use, crime, suicide, etc, etc, by this myopic thinking – I heard all the stories 1st hand, and you didn’t, and I lived thru hearing about my friends stories about those consequences, – the ones that didn’t die.

Stick to being a DDS and make a king’s ransom selling a small piece of porcelain used for a tooth at probably a 1000x you buy it! – You are certainly are living in a different reality, – probably in huge houses with bucks to heat your houses with!

I’m thankful for globalization and free markets that allow me to seek the best product at the best price no matter what area of the globe it comes from. The government understands the benefits of free trade to the point that I don’t actually even get charged for duties or taxes on the import because it’s a medical device that, during surgery, cleans out the infection that causes the most common chronic disease known to humanity. This disease (periodontitis) is a major cause of death due to increased risk of heart attack (#1 cause of death in the USA) stroke and cancer. Plenty of peer reviewed published papers in major scientific journals at NIH as evidence. However, now everyone can benefit from this treatment due to globalization. Restricting trade to benefit you at the expense of everyone else helps no one but you. Despite all your complaints of death and destruction, it really just comes down to the fact that you can’t compete with those that do your job better and cheaper than those in other countries. Restricting trade so you can keep your job is the same as keeping zombie companies alive with printed money or forced charity. We’re a democracy; do you see the majority voting for reshoring your job? Nope. Everyone sloganeers “Made in the USA” on their way to Walmart to buy everything made offshore, demonstrating very clearly that the majority is voting with their wallets for globalization.

The US taxes income from labor. It should reduce the taxes on labor and slap 25% tariffs on everything that is imported, goods and services. That removes some of the incentive to import; and it would cut taxes on working people. So if you want to import, fine, go do it, but pay the tariffs. And then, in return, your personal income taxes are lower. That’s how this should be handled.

If people ever wise up and start all surface quick brushing and then methodically pressure packing all their gum lines daily (instead of today’s paste brushing and flossing instructions) with baking soda, you and your device are history. Minimal acidic biofilms and minimal acidic plaque. Just a once a year quick cleaning to get a few of the missed spots, is all I need.

One toothbrush lasts years, (in fact, works best when flat, holds more baking soda) and baking soda is dirt cheap…might even be heart healthy, too.

Cutting back gums is as stupid as bleeding people….sorry.

My joke with the dental hygienist is that I’m trashing the bug’s houses. She gets it.

I see that some of the comments refer to industries going back to the USA. Obama and Trump tried it but it did not go well for them. And not because China intervened, but because most companies don’t want to leave behind low-wage, well-integrated export infrastructure in Southeast Asia.

The companies don’t give a damn about the Americans, they are so high up that they see us as lice.

We are at the end of globalization and I don’t know which way the hares will run

best regards

This is stock market Southwestern style: you climb on board and try to hang on for 8 seconds.

Wolf – This is exactly what I believe and from your article:

“It’s an indictment of globalization over the past three decades, committed by our heroes: Corporate America, lobbyists, and governments over the decades.”

And I will add that three decades ago I said this would happen, along with China becoming a military foe that we will have to reckon with, – like protecting Taiwan, and today China is flexing their military warship muscles in the Pacific waters already, and now we have to spend tons of money and resources to counter this threat – disgusting – and they are laughing their rear-ends off at our unbridled greed, and they sold the US the rope to hang this country with, – and we are supposed to be trading friends??????? – pure insanity in my book! – they got stronger and we got weaker – they were a bunch of backward serfs three decades ago, and we created a monster to wreck us.

But wait there’s more, we have rebuilt their country with our best technology, and vast amounts of our tech companies reside over there, along with countless other entire industries, and the CEO of Ford said how much he liked communist China – yeah they slobber over all that cheap labor, and iron fisted autocratic communist ways.

All this offshoring, outsourcing of companies and tech work has been a disaster for our country, and people said I was a “protectionist” in the 90’s – Ahhhh yes, – you are GD right, and I believe what is good for our country comes first, because it’s National Security, and economic security and it got sold out – people don’t laugh at me anymore!

All this chaos has torn our country apart with immense financial hardships, and political unrest that was a direct result of all this nonsense that lined the pockets of corps, and politico’s of both sides of the aisle – Thanks – (deepest sarcasm)

Was going to read a few comments. Yours was the 1st & last.

Nailed it!! Thank You! Mom & pop business for 30+ yrs. Watched what happened in our part of flyover as DC & corporate gutted blue collar.

Tom15 – Thank You!

The “trade deficit shitshow” is not so much a “result of globalization”, it is more a result of the “strong dollar”, which is in reality a crashing Yen and Euro. And turkish Lira as well, although that’s a minor player.

Assets in crashing Japan and Europe are bought for “pennies on the dollar” by U.S. financiers with “strong dollars” and goods are imported likewise. That hollows out the domestic economy, which will eventually lead to a crashing U.S. as well.

“Trade Deficit Shitshow (Result of Globalization)”

More specifically “Chinazation” which created, due to the now proved to be factual “capitalists, when not prevented from doing so by bought politicians, will sell you the rope you hang them with” effect, a high tech militarized authoritarian state of 1.4 billion which will eventually supplant the US?

Globalization allowed American companies to bypass EPA regs, employees’ rights, child labor laws, etc.

For example we exported our pollution to China along with our manufacturing jobs. We paid the price with jobs, they paid the price with their lungs and polluted water.

People protest about child labor but don’t want to pay extra for domestically manufactured Nikes.

TANSTAAFL.

The Fed has made the truly horrible mistake of tightening financial conditions without coordinating this with the other central banks. The logical outcome is a stronger dollar which leads to exploding trade deficits and recession. With the BoJ and the ECB both not raising rates any time soon due to the insane levels of debt in their economies, if the Fed continues tightening it will lead not only to recession but to a dis-inflationary depression which would be a nightmare given the high levels of debt and collapsing tax revenues.

The Fed will have to stop tightening before they even started. They have no choice. And that will be the end of all fiat currencies.

Got gold ?

Franz Beckenbauer,

The Fed hasn’t even really tightened yet, it raised by only 25 minuscule basis points, and it hasn’t even started QT yet. And it has been telling the entire world since October that it would do that, and other central banks have had a HUGE amount of time to front-run the Fed, and many have, but not the BoJ and not the ECB, they have been stubbornly idiotic and have been brushing it off. At least the BoJ stopped QE a year ago. But the ECB’s braindead NIRP & nut balls are STILL doing QE and still have negative policy rates, despite record raging inflation. The extent to which they’re driving their vacuous idiocy to new highs leaves me speechless every day. So don’t blame the Fed for not “coordinating.” Blame the braindead NIRP & nut balls that run the ECB.

That’s blunt & direct. And true. Thanks…

The Rules of Money. NIRP is a crime.

You left out the PBoC, which also is even loosening financial conditions now.

So you have one central bank going a totally different parh from all others, seemingly being ignorant of the logical outcome of this, depression and dis-inflation and, in due course, having to do the flop on the flip from the flop they flipped from before.

This is not about blaming anybody. They are all trapped. And their economies will all go down in inflationary implosions which will finally deflate the bubbles. “finally” being meant literally.

But this “It’s my way or the highway” memtality is truly remarkable. Investment decisions should be made accordingly. Get the shiny stuff while you still can.

China has a huge demand problem on its hands, with consumers cutting back due to lockdowns and with one of the big economic engines in China, property development, in slow-motion collapse.

There is an even darker side to the balance of trade shit show, E-I, of the four component calculation of GDP = C + G + E -I.

It lies in the composition of US exports. Specifically, the largest export is the subsidized agricultural sector. We free traded high paying manufacturing jobs for slave level agricultural jobs. USA, USA

Central bank policy is coordinated with the latest elite academic brain fart, as it has been for the past 85 years in the US, in Europe, centuries, explaining and apologizing for the struggle of the unrecognized and justifying the success of the aristocracy, Even now, my favorite economist is falling all over himself explaining how inflation is an artifact of snags in the commie production lines and over eager serfs buying things with their bulging bank balances, and and

The Fed is about to make a terrible mistake by draining the mead cistern.

I just don’t know what to think. The wall street wise guys are paying so much money to entice the ivies to feel good about selling pablum. The soldiers seem so dedicated and happy.

Like when the GI was fight the Chinese commies in Vietnam.

Personally, I don’t care if I were to ride a donkey or and elephant through the muck. I am more concerned with the disequilibrium that bad policy has created and the sequential doubling down of bad policy as if more bad policy will surely prove it wasn’t bad policy.

All the way to QE, the suspension of the very thing that was sold as the ultimate panacea, by the so called capitalists, the free market.

IMO, Monday marks the end of QE and the sun comes up on QT, the removal of the juice that created at least 3 historic asset bubbles, in housing, stock and bond markets, and is the principle cause of inflation.

I have too chuckle at the horror that the wall street wise guys are hawking, recession, which will ruin the party.

The louts have been in a recession for the duration of the QE experiment. Not owning stocks, they have relied on the traditional savings vehicle, interest. Since it has been zero for the mutts, too bad, work harder.

Equilibrium is a concept that halts louts in their tracks, not wanting to disturb the process in which the ivies are engaged, QE, war, lattes, exercise and veganism, etc.

While the median lout, feels that world has selected him to lose, paying for the lattes.

The Federal Reserve is not so uncouth to even define equilibrium, a concept that would suggest that the louts are getting screwed by the Federal Reserve who prefers lattes to soiled work clothes because the soiled work clothes made it possible for the Federal Reserve to prefer lattes.

dang-the VC and NVA would rightly differ with you on who was fighting…

may we all find a better day.

dang,

I spoke with Pete Friederichs today in Foxhome, Minnesota. His family has run a seed business since 1887.

You are wrong about farming.

Trouble is brewing in the Red River Valley of the north. This is going to add even more stress to food supplies.

Correction: 1889.

Rain & cold. Mid-May at the earliest to get planted. A lot of rain, again in the last day. Flooding is widespread.

As a miner of 40+ years I completely understand the uncertainty of nature, as does every lout engaged in financing uncertainty. Rain is often not wet.

I see farming and Ag from both sides of the coin. Dad was head of R & D at Northrup King Seeds, a subsidiary of Syngenta, for many years before being given a platinum parachute at age 64 and getting his ass kicked out the door by a new CEO from Switzerland. To ‘shake up’ its US operations, a transformation towards younger top executives was put in place across the board in Syngenta’s USA’s structure of companies it owned and controlled. Dad got the axe.

But from working alongside Dad in our family seed company for 18 years thereafter, and driving through the farmland of northwestern Minnesota and the Dakotas during this time, I can say that the folks who live off the land and run the farms that dot the prairies, are a true breed of individuals and family collectives. They are on their own as they work to survive, keep their farming heritage going, and, most importantly, to keep us fed.

That is the point I make to you about farming.

And best wishes to you and yours as well.

Well, Dan, I don’t think I’m wrong on a macro scale but absolutely wrong about the small farmer, a dying breed like the small miner. I’m not sure which point, I made, that you object too. I am working from a macro understanding that the small farmer only comprises 2% of an agricultural oligopoly of four firms that control 90+ pct of agricultural production in the US.

They control congress and are subsidized by the US taxpayer. If I’m wrong, I’m all ears.

Best wishes

The world turns. QT is about to be instigated and no one knows, with any certainty, what is likely to happen when the QE experiment, ends. Since QE has never been implemented in the recorded history of mankind, obviously, QT, as the anti-dote has never been administered in the recorded history of mankind.

The repercussion may be severe like Y2K or inconsequential like the GFC in 2006.

As J Powell once said, “the banks are safe, and that’s the important thing”.

louts, by definition, are not quick on the uptake, eventually putting two and two together, and are surprised when the rule of law is changed in a manner that prohibits them from inconveniencing the rich people, who are superior in every aspect except fighting wars to protect their interests.

Luckily, America solved that problem, economically. Forget the crazy bullshit about conscription, of which I was a participant in the mid 70’s and replace it with there is no alternative.

Remember, we don’t want to inconvenience the masters of the universe, economically with the audacity to question their right to pay no taxes, be immune from the louts laws, etc

Once again the ivies are cautioning us against raising a stink that would disrupt the financial markets where great fortunes reside. Why ?

Because that’s the way that God himself has deemed as appropriate.

Live in a tent, obviously, a nuisance to American culture. I need too tread lightly hear, a situation of which I have no knowledge.

Anyway, it will be interesting to watch what happens while the three bubbles that Fed tolerated fall.

Will the rich be allowed the indignities of the poor that they insist are part of the doctrine ?

You are an ACE, dang. Us intelligent educated W-2 ers are a real pain in their asses…I hope. Dan, while a nice guy, is just another lower level but still silver spoon born, libertarian.