“Not seasonally adjusted” retail sales spiked to a record. “Seasonally adjusted” retail sales fell. Both: +16.9% from year ago. What the heck is going on?

By Wolf Richter for WOLF STREET.

What was in the headlines all over the place is that retail sales in December, including at restaurants and bars, fell 1.9% from November, seasonally adjusted.

What wasn’t in the headlines is that this was up by 16.9% from December a year earlier, which is a huge gigantic jump in sales.

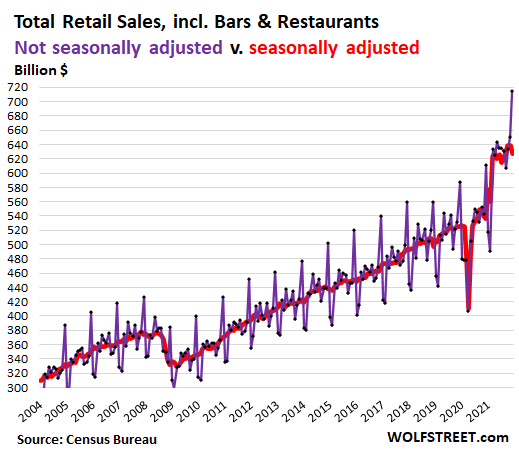

And what wasn’t in the headlines either is that “not seasonally adjusted,” retail sales spiked by 10% from November to a new blistering record of $715 billion, also up 16.9% from a year ago, according to the Census Bureau today (red = seasonally adjusted; purple = not seasonally adjusted):

I see three major complexities in our understanding of today’s retail sales:

- Rampant inflation that increases sales in dollars. In the biggest retail category, auto dealers, accounting for 20% of total retail sales, prices exploded

- Shortages in a few areas, including the biggie, at new vehicle dealers;

- Seasonal adjustments when the pandemic has upended seasonality. Adjusting for this seasonality-gone-rogue is a tricky affair. In late 2021, a complication to seasonality was that people front-loaded their shopping to outrun the expected shortages in December.

But retail sales are so brutally seasonal that not-seasonally-adjusted sales give you whiplash. So I’ll stick to seasonally adjusted retail sales. One exception: nonstore retailers (mostly ecommerce) where not-seasonally-adjusted sales spiked to a huge record, but seasonally adjusted sales plunged. I’ll show both, and you can decide what the heck that was all about.

Retail sales are sales of goods at brick-and-mortar stores and online. Sales of services, such as insurance, healthcare, or haircuts are not included.

That enormous 16.9% year-over-year spike in retail sales in December is a product of huge sales gains during the year, goosed by stimulus money and $4.7 trillion in money-printing since March 2020, by interest rate repression leading to a boom in mortgage cash-out refis that then gets spent, by soaring prices of stocks and cryptos, and by raging inflation as the purchasing power of the dollar goes WHOOSH!

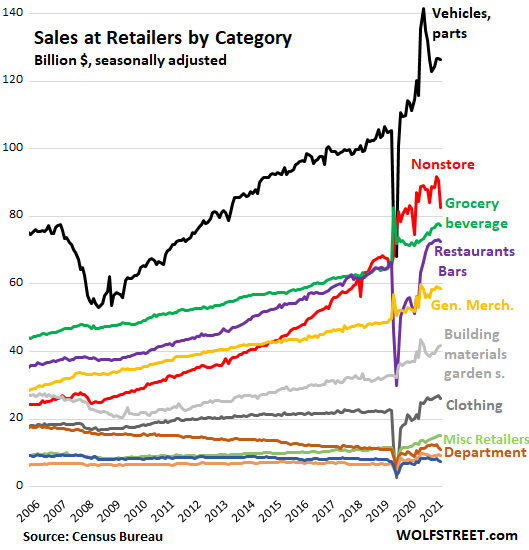

Size of each retailer category by sales volume. Auto dealers and parts stores are the largest retail segment (black line); followed by nonstore retailers, mostly ecommerce, 16% of total retail sales (red); followed by grocery & beverage stores, restaurants and bars, general merchandise stores, building material and garden supply stores, and all the rest, with department stores near the very bottom:

Exploding prices in the biggest retail category hide the decline in unit sales.

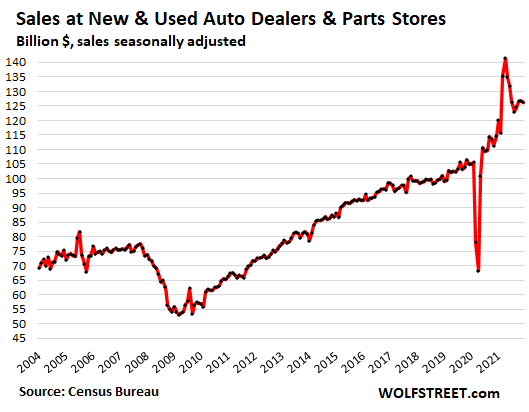

New & used auto dealers and parts stores: Seasonally adjusted sales, measured in dollars, dipped 0.4% in December from November, to $126 billion, but were still up by 10.2% from December 2020, and by 20.4% from December 2019, driven by ridiculous price increases in used and new vehicles, and by a systematic prioritization of higher-dollar models:

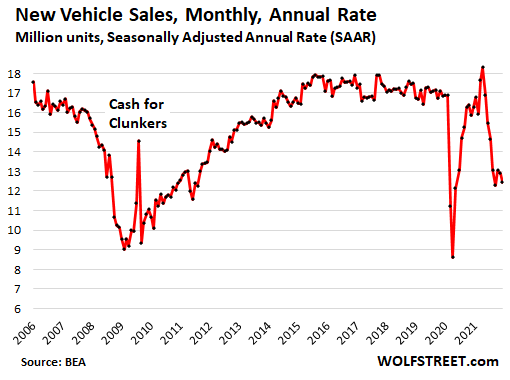

But the number of new vehicles delivered to end users plunged in December 2021 by 24% from December 2020 and by 26% from December 2019, to a seasonally adjusted annual rate of 12.4 million vehicles, amid widespread shortages and mind-boggling above-MSRP prices at new-vehicle dealers.

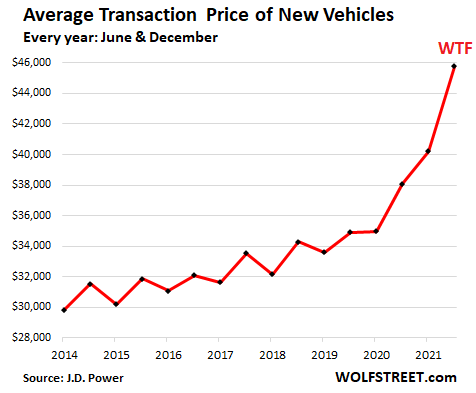

The Average Transaction Price of new vehicles spiked 20% year-over-year to $45,753 in December, according to J.D. Power estimates, driven by ridiculous price increases and the shift to high-dollar models:

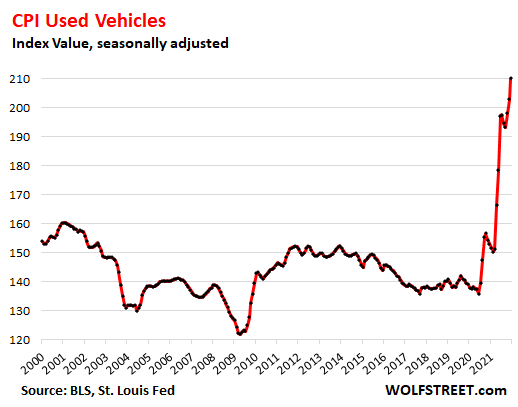

The number of used vehicles sold at dealers in December was flat with November but down 5.5% from December 2020. Inventory is now piling up. At the end of December, supply was 20% above average. Potential buyers have finally gotten spooked by these ridiculous prices. But these ridiculous price increases – the CPI for used cars and trucks spiked 37% year-over-year – whipped up the retail dollar-sales at used-vehicle dealers

The other retail categories in order of sales volume.

Ecommerce and other “nonstore retailers”: This is where seasonal adjustments play a huge role. “Nonstore” includes online-only retailers and the online sales of brick-and-mortar retailers, as well as sales by mail-order houses, street stalls, vending machines, etc.

- Not seasonally adjusted, sales spiked by 11.4% in December from November, and by 9.7% year-over-year to a new record of $115 billion (purple line).

- Seasonally adjusted, sales plunged 8.7% in December from November, but still jumped by 10.7% year-over-year (red line):

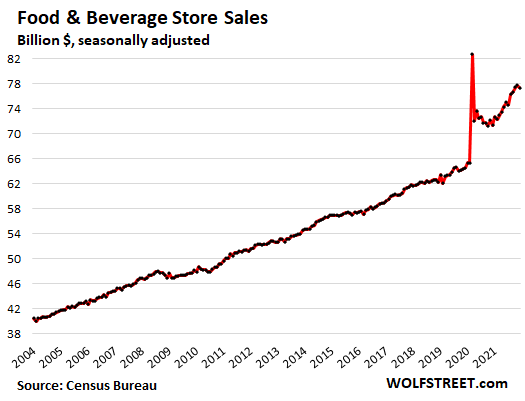

Food and Beverage Stores: sales dipped 0.5% for the month, seasonally adjusted, to $77 billion. This dip occurred even as the CPI for food-at-home rose by 0.4% for the month. Year-over-year, sales jumped by 8.4%, as the CPI for food-at-home jumped by 6.5%:

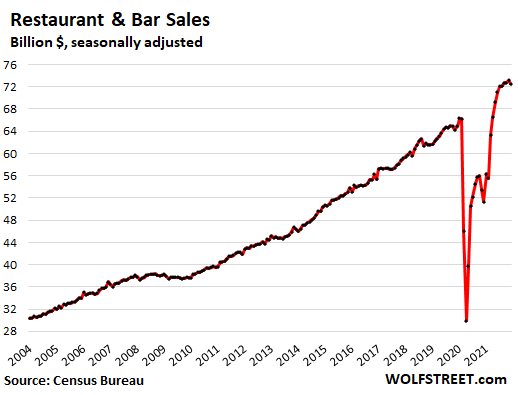

Food services and drinking places: Sales dipped 0.8% for the month from the record in November, to $73 billion (seasonally adjusted), up 41% from December 2020, and up 12% from December 2019 – amid big price increases: the CPI for food-away-from-home jumped by 0.6% for the month and by 6.0% year-over-year:

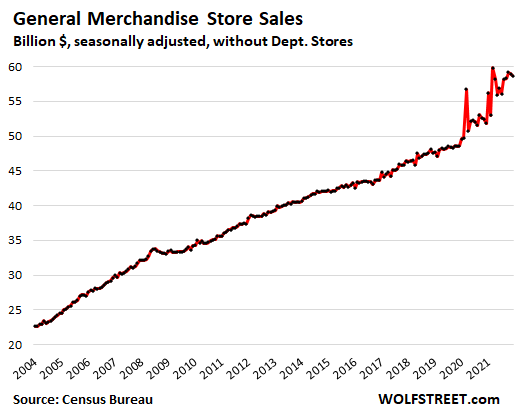

General merchandise stores: Sales dipped 0.5% for the month to $59 billion, seasonally adjusted, for a year-over-year jump of 13.3%, and up 21% from December 2019. Walmart and Costco are in this category, but it does not include department stores.

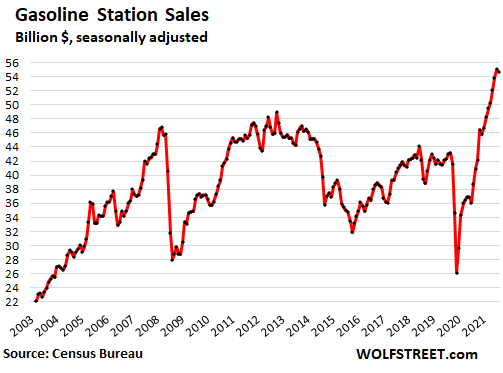

Gas stations: Sales ticked down 0.7% for the month, from an all-time record, to $55 billion (seasonally adjusted), pushed down by price declines of 0.5% in December from November.

But year-over-year, sales spiked by 41%, powered by huge price increases: CPI motor fuel spiked by 49.5% year-over-year.

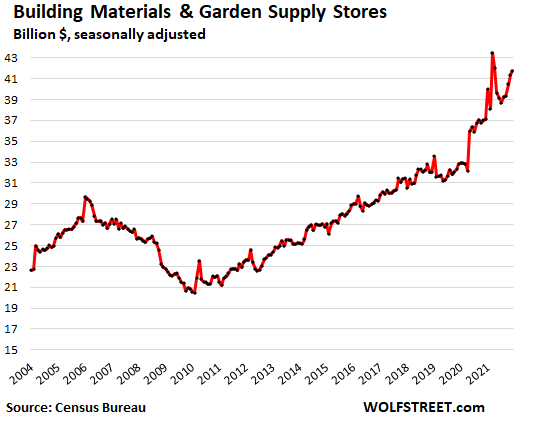

Building materials, garden supply and equipment stores: Sales rose 0.9% for the month, 12.5% year-over-year, and 27% over two years, to $42 billion. Note the stimulus-fueled DIY-spike in March that is now ancient history:

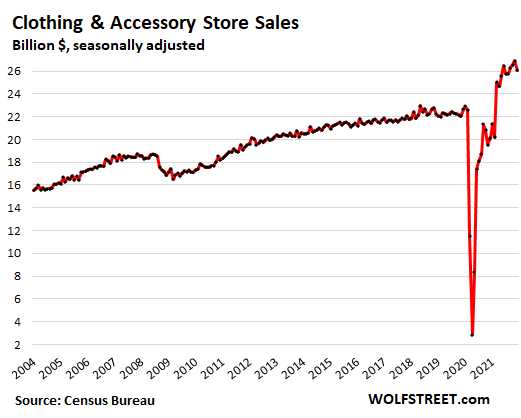

Clothing and accessory stores: Sales dropped 3.1% for the month, to $26 billion, but were still up nearly 30% year-over-year, and up by 15% from two years ago:

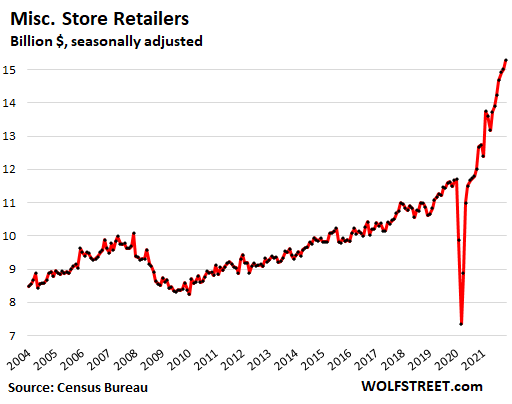

Miscellaneous store retailers, including cannabis stores: Sales jumped 1.8% for the month, to a record of $15.3 billion (seasonally adjusted), and by 21% from a year ago, and by 33% from two years ago. This category of specialty stores includes most prominently cannabis retailers, but also stores that sell beer brewing supplies, telescopes, art supplies, etc.

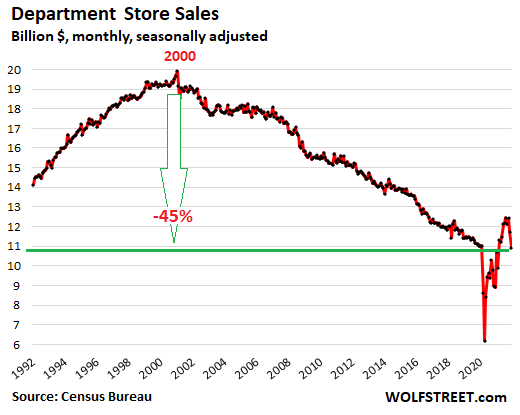

Department stores: sales plunged 7.0% for the month, after having already plunged in November, to $10.7 billion (seasonally adjusted). Compared to December 2020, sales were up 22%, but compared to December 2019, sales were down 0.7%, as the demise of this way of shopping, after a brief respite in mid-2021, continues. Sales are down 45% from the peak in the year 2000. For what it’s worth, Macy’s just released another list of department stores that it will close in 2022.

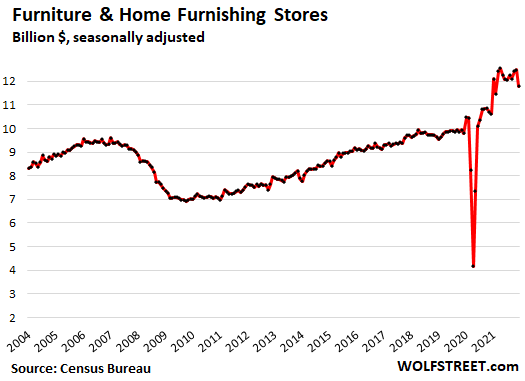

Furniture and home furnishing stores: Sales plunged 5.5% for the month, to $11.8 billion (seasonally adjusted), but were still up 11% year-over-year, and by 20% over two years:

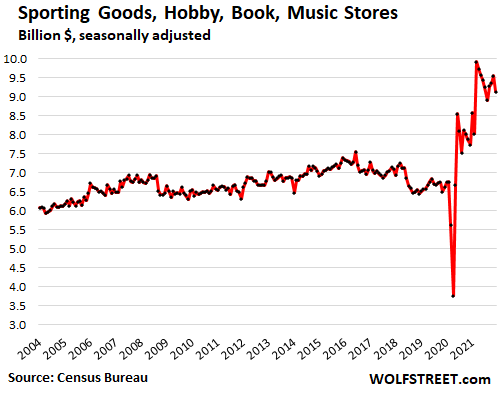

Sporting goods, hobby, book and music stores: Sales dropped 4.3% for the month, to $9.1 billion (seasonally adjusted), but were still up 18% year-over-year, and 38% over two years:

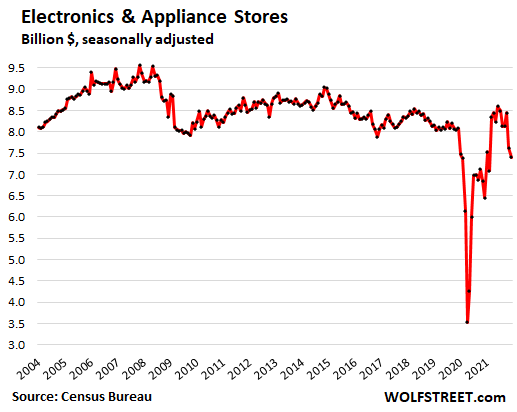

Electronics and appliance stores: Sales dropped 2.6% for the month, after the plunge in November, to $7.4 billion, a pre-pandemic low going back decades. While they were still up 15% from December 2020, they were down 8% from December 2019.

This category includes only brick-and-mortar specialty electronics and appliance stores, such as the brick-and-mortar stores of BestBuy. Electronics and appliances, a vast industry, are now mostly sold online and at brick-and-mortar general merchandise stores (i.e., Walmart) and home improvement stores (i.e. Home Depot) that are not included in this category:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just to get a handle on how fast home prices are rising in SoCal beach cities, check out 400 Pirate Road in Newport Beach.

It sold in Aug 2020 for 2.8Ms. Now, it is on the market at 4.5M. It was rented then cleaned up and painted. This guy is planning on a gross profit of 100K per month. However, this 100K per month number seems to be back loaded … running higher now than it was last year.

In the 92625 zip code, there are examples of ocean side of PCH single families rising substantially more than that. This makes the 2006 era look mild.

For perspective, the house I bought (new) in Thousand Oaks, Ca in 1985 for $229,000 or so and sold in 1992:

2065 Hopewell Ct, Thousand Oaks, CA 91360

Off market Zestimate®: $1,346,300

No ocean view

One good earthquake away form $0.

At least it won’t slide into the ocean!

Near the ocean here in San Diego (where I’m heavily in real estate), there is always North Korea’s potential seasonal adjustment to $0 via missile export. See what the charts do then!

For phleep

Grand uncle sold great granddad’s house on the cliff in La Jolla for peanuts when the Japanese appeared off shore there in 1941,,, last I heard from a cuz, it sold for $2MMMillions about 20 years ago,,,

Vowed never again to hold any RE in any zone very likely to slide into the Pacific…

Keep in mind you younger folks, boomers especially,,,

”No matter what you do, you are NOT going to get out of this life alive.”

For me, it means doing my very best to help as many folks as I can, especially my very very elders these days,,, folks in their 90s mostly, who consider me at 77+ a youngster, eh

The land is the main cost. Not understanding that the main cost is created by society is killing the USA.

That would equal to roughly a 4.9% rate of inflation compounded annually since 1985. Seems reasonable…

At 10% down, return goes from 4.9% to 11%, which about half of the gain being tax free.

OK, more perspective only:

House we bought in berzerkeley in 1980 for even $40K now valued at $1.3MMMMMMMillion…

As has been said on here many times, just another indication of the degradation of value of USD and wages.

According to the ”official” BLS Inflation calulator, $1.00 in 1913 was worth $28.74 in December 2021, it’s latest iteration…

But that is likely low, compared with the real price of anything, eh

Thus the young people’s anti-work movement. Not worth working if you can’t afford to buy housing. So just check out of the system, or operate externally to it.

I would like to see a renters strike nationwide, or at least the threat of it.

Been trying to sell my vacant land, with ocean view. Semi rural, semi redneck city planning dept which won’t get involved in developing private roads and then handcuffs you with covenants. Most property owners are raging socialists, they want the government to protect their property rights even if it means restricting others. Then you have to bribe your neighbors to get them to sign off. The more problems you run into the more you want to charge for your property, the more you want to screw everybody because that’s what they’re doing to you. My definition of asset inflation.

$2201/sqft on a postage stamp lot. YIKES. I paid $114/sqft for my house on 7 gorgeous wooded acres. Granted, I can’t see the ocean from Kentucky, but that’s OK. It’s VERY OK. YOWZA.

Buddy down the street secured a Victorian for $3000 back in 53. Worth $2M today. We reside in the inner-west, Sydney.

I know contortionist’s ready to explain the phenomena with ease..

Bet y’all know a guy too..

Gotta love life!

The fascinating thing about this “Pirate” listing is that the homeowner’s monthly payment is $21K.

But the rental estimate is only $5-6K per month.

So the homeowner monthly payment appears to be 3-4 times the rental payment AFTER plonking down a $1m deposit.

So either this rental estimate is far too low or it’s vastly cheaper to rent a comparable property than to buy this one.

To the untrained eye, that would appear to be a bit of an overvaluation red flag.

What am I missing here?

People think houses only ever go up and are in a terrible hurry to get rid of $’s they can see are being devalued daily…

I read, but don’t recall the source, that 33% of corporate residential purchases is foreign money.

Corporate purchases, foreign and domestic, are driven by the value vs the potential replacement cost, which continues to soar.

Add in, of course, the Fed lending to the mortgage industry at 4% below “reported” inflation of 30 years. (Why would the do that? Still do that?)

Regarding historicus reply to your comment, I doubt inflated replacement cost is a big factor here since surely most of the value is in the land not the structure built on it.

Negative real mortgage rates are an issue but that’s a national thing not a local thing, and nationally monthly homeowner payments are not extremely disconnected from rental payments so that can’t be the full explanation for this discrepancy.

Dazed ..

I have read stories, (everything I read is not necessarily true), that there are speculative ventures out there buying real estate….and one of their parameters is can they buy it beneath replacement cost.

Cash dropping 7% a year and real estate rising 15% a year is quite a diversion. Who can afford to sell their home, by the time you close you are probably out 10%.

Interesting

If the owner were called by BLS to give the Owners Equivalent Rent as his inflation input, I wonder if he would use the $5-6K/month?

What a wacked inflation number that gives. I’m sure that’s why housing inflation is done this way. I can’t imagine a house worth $100K renting for $10K/month, but I can see a $4.5 million house renting for $10K while the investor solidifies his business use and waits to flip it.

Joe

Yep, the BLS uses a “survey” when Case Schiller has mountains of real data. The “survey” must serve their “unbiased” purposes.

historicus,

There is a conceptual thing here: the BLS is trying to measure “consumer price inflation,” not “asset price inflation.” So the purchase cost of an asset (such as a building) is outside of consumer price inflation. But the cost of the service that this building provides (this service is called “shelter”) does get included in the CPI. So how do you calculate the monthly cost of shelter as a service? The BLS uses the owner’s equivalent of rent measure to establish the cost of the service of shelter.

Look at it the other way: when house prices crashed between 2006 and 2011, the massive price declines did not turn CPI negative because rents kept going up and the cost of “shelter” as figured in CPI kept going up. You can see that in my chart of the two indices, the Case-Shiller and the CPI for owner’s equivalent of shelter:

Defending the way land prices feed into CPI?

Oh dear! This is burying the USA. Please reconsider.

A few years ago, something like that would have rented for $6K. Today, more like $10 K to $12K … still a big negative.

Those figures were from Redfin.

I looked on Zillow, and it has a Rental Zestimate of $11K+ which is more in line with your estimate.

The other thing Zillow showed was that this property was actually offered for rent at $6K per month in Sept 2020, less than 2 years ago, so that’s a very impressive rental growth rate.

If that rental growth rate is sustainable, it might explain the high valuation.

Dazed And Confused,

The rental estimates are often very off. However, it’s entirely possible that renting out a property, can only yield a fraction of the mortgage, this can happen quite often in booming property markets, especially those in bubbles.

I’ve seen this mentioned alot in China. It’s very normal for this to be the case, especially in teir 1 cities. Because owning multiple apartments is the main form of investment in China; people will buy as many as they can, but rent them out for whatever they can get. Over time, as the bubble grew ever larger (in China), some of these apartments started renting for more than the mortgage.

Usually though, you just make what you can from a property renting it out and then you sell it (when you are ready) for, hopefully, a large profit.

If someone were to try to rent, because, it’s currently cheaper than buying, they might eventually be priced out of buying and their price to rent might also go way up.

Also, if you think severe continuous inflation will hit your country (this applies anywhere), it might be a great time to buy a house as the mortgage will become ever smaller, as inflation sets in. It can be hard and risky to get loans after the high inflation settles in though, better hurry.

Room for an arbitrage? In real estate that can be very slow with lots of frictions and variance, though ….

The way things are going, retail sales will hit new highs in dollar terms but the entire economy will consist of nothing but expensive sacks of potatoes.

Trading spuds or eating spuds?

Let them eat spud NFTs.

Seneca’s Cliff,

Correction,

It will be expensive plastic bags of wheat and corn.

All GMO :(

… Mylar bags of GMO corn chips, ranch flavor, with natural ingredients added.

Where I now live, I am surrounded by potato fields – I’m a future billionaire!

;)

You will be a billionaire, unfortunately a new truck will cost a trillion dollars :(

Amen. With inflation increasing, unit sales as opposed to sales measured by dollars or euros would be more informative. It appears that some spending is being cut by many to pay for increased prices for other things.

So…”What the heck is going on?”

Things are starting to slow down as the consumer is getting ready to go on a price too high strike?

or

The screaming headlines of “Retail Sales, expected to dip a toe into negative territory, instead did a belly-flop: -1.9%!!!!!” is just hype and things still are on track for screaming along (with inflation) and the QE funny money is still sloshing around?

And the Fed is going to use the screaming headline to slow down the turtle like tightening into snail like tightening?

2banana,

In case you didn’t catch the significance of the first chart: actual retail sales (not seasonally adjusted) spiked 10% from November to a new record, purple line: And yoy retail sales are up 16.9%. Not much of a slowdown here. Q4 consumer spending is going to be strong. But it will be dented by inflation:

Yes and who cares when it’s all financed by debt??? All of this asset nonsense is fueled by debt/credit and the ability of a person to meet a monthly payment. Average new car monthly payment in the US is over $500. There are A LOT of new cars in my area. Are all these people heavily invested in markets? Two household incomes pulling in over $100k+ a year. Everyone and their idiot brother posts stats and data all day long but no one ever explains HOW much money it takes to afford these varying lifestyles. How many Americans % wise even make over $100K? Only what? 10% of the American population even owns stock and the 1% of that 10% is the majority owners. I make $80k a year at 42 yo. $1550 in rent and a $370 car payment on a 2013 Jeep. Im doing a lot wrong I guess in my life but worked hard for every single thing I have including my career. I horrible for those less fortunate than myself.

A lot of random people I know have made quite a bit of money on stocks like Tesla, or vaccine companies or whatever.

Stock market / Crypto market dropping hard might shake things up a bit.

My friend who makes considerably less than you and I do drives a 45k vehicle (purchased before vehicle prices started skyrocketing). She also pays the same amount in rent as my mortgage. No idea how she can afford either comfortably given her income. Perhaps she will never be able to retire but hey, she drives a nicer car than you or I drive. Priorities…..

Seasonally adjusted = overtly manipulated.

Without new government stimulus money, will boom turn to bust?

We know that the Fed targets a (arbitrary) 2% inflation rate.

The Fed says it would raise and lower inflation to make that 2% rate a long-range thing.

At 2% (annual rate, compounded daily) one dollar in 1922 would be around $7.50 today.

In 1922, an ounce of gold was $20.66, today it’s $1820, yielding 88 times less gold per dollar. And it would be even less gold per dollar without (arguable) gold market price suppression.

This means that the dollar has suffered at least a 4.45% (compounded daily) inflation rate over the last century.

We should be extremely grateful that the Fed is targeting such a low 2% rate! /s

I keep watching to see how gold and silver are pacing inflation. I mean, that is the idea isn’t it? They are the standard. Boy are they lagging.

Look at the historical spot price of silver up to 1934 and it won’t be a surprise. The gold-silver ratio was arbitrarily set at 16-1 but this didn’t reflect the market price. Gold was fixed at $20.66 but silver was not. The price fluctuated all over the place. I don’t have a long-term chart now but know it fell to about 25c in the Great Depression. Silver coinage frequently had much less proportional “melt value” versus face value.

After the Comstock lode was discovered around 1870, there was such a huge glut that the US government minted hundreds of millions of Morgan dollars until 1904 to soak up the supply and then stored it until the 1960’s.

The price of gold is not cheap. Look at what it buys. It’s relatively cheaper versus two years ago but nowhere even close to historically cheap.

Gold being cheap versus fiat currency doesn’t mean it should be far more expensive versus everything else. The purpose of one form of money (gold) isn’t to acquire other forms of money (fiat currencies) but goods and services people need and want.

The 2% target inflation is still institutionalized plunder of the citizenry and currency holders.

Most people are just too economically ignorant to connect it to the activist government they overwhelmingly prefer which must be paid for, one way or another.

There is never something for nothing.

The dollar is what’s cheap. And getting cheaper by the day, maybe even the hour.

Gold is only one one thing to compare against. Price nearly ANYTHING against a buck, and you’ll find you’d need more simoleons today than last summer.

Precious metals are special because the banks know that the dollar’s jig is up if gold goes through the roof. Banks buy and sell immense amounts of financialized gold to keep a lid on that boiling pot. Banks will regularly unload huge piles of notionalized gold and silver (paper) at the oddest market hours, when few buyers are around to soak it up, causing the price to drop substantially. This is not how rational metals investors operate – but it’s also not precisely what the banks seek to profit from by doing so.

Could we see Au approaching the current value of Bitcoin in a role reversal when the latter goes down to it’s fungible value, which is precisely zero?

If you mean intrinsic (rather than fungible) value, then yes.

Bitcoin suffers from a number of problems, but most innate is the incredible ease at which other, identical Bitcoin equivalents can be reproduced. Does ‘Bitcoin™’ trademark legal protection, if it even applies, serve as adequate means of ensuring monetary value?

Add to that the “counterparty risk” of a failed internet infrastructure and you can clearly see the problems of Bitcoin vs. physically-held monetary metals.

Gold, silver, etc. is not reproducible in so many ways, yet completely produceable when held physically. It’s no great leap of thought as to why it’s the historically favored money.

The value of crypto is not exactly zero!

For example, Musk just twitted that Tesla merchandise can be purchased with dogecoin.

A whistle shaped like Tesla’s Cybertruck costs 300 doge (about $59 in current dogecoin). Or, a commemorative belt buckle to celebrate Tesla’s Gigafactory in Texas is 835 doge, ( about $164).

drif-

I/we said INTRINSIC value.

Like the current dollar, there is significant (though fleeting) value to the various currently popular cryptocoins.

By the way, I’ve heard plenty of good arguments about the meaning of the word intrinsic. Another time, and probably another place, are good for arguing this. But for now, let’s just say irreproducible. Gold – the substance with unique properties – where among which mining and refining is production, and virtually everything else is reproduction.

Crunch –

I was just joking about Xavier’s statement that Bitcoin has a fungible value of zero.

There seem to be various definitions of intrinsic value. For investment assets, technical calculations of intrinsic value may involve discounting, cash flow, cost of capital, etc. (the predictive use of various forms of “discounting” is something that I’ve never felt that I adequately understand).

Alternatively, intrinsic value in terms of behavioral psychology is something that is a primary reinforcer. For example, a baby would not react positively to a dollar bill. But later on the dollar bill would be a secondary reinforcer for a child, knowing s/he could acquire things with it.

Back around 2014 I bought a modest amount in Swiss PAMP Lady Fortuna gold bars, with the idea that they have intrinsic value. But the carrying cost, and how I would sell them (liquidity), makes me a little uneasy. They do have some psychological intrinsic value. The bas-relief art of Lady Fortuna with gold coins flowing out of a horn of plenty is beautiful. It makes me want to buy lots more shiny beautiful gold.

driftprof,

Regarding buying more gold: You can always buy beautiful gold chains for the Mrs. and you get to see your gold everyday. Also link chains are great for when the SHTF and you have to sell the gold in smaller quantities.

Gold and the DOW in 1980 were about a 4 to 5 ratio. Today its about 4 to 76.

I watched professor Steve Hanke again. He reiterated inflation is going to run around this level into 2024 and if Fed doesn’t slow money supply growth it’s going to go longer than that. He said ignore what Fed says and watch what they do.

Crunchy

Exactly. Suddenly, just a few years ago, the Fed self mandated 2% inflation.

Just 2% rips 22% off the dollar in ten years. The alleged upper range, 2.5%, rips 28% off the dollar in ten years. Not a word of objection. Curious.

Juxtapose to the “stable prices” mandate. Ridiculous.

And now the “Inflation Dog” is off the leash, and the Fed will have the devil to pay IF they attempt to reign it in.

If the Fed wanted to promote hyper inflation, they would bump the money supply, say 30%, then keep interest rates at zero. It would look just like this, wouldnt it?

Demand is imploding with skyrocketing inflation. If prices are going up 20% and wages 5-8% you are screwed, and prices raise ahead of wages.

Measuring unit sales trends is the only way to get a true handle of economic activity. The rest of this is just near hyperinflationary money printing crap.

“Measuring unit sales trends is the only way to get a true handle of economic activity.”

And in general, this is harder info to get (wonder why).

DC and Corps tend to trumpet gross revenue figures (by definition directly inflated by price level) and tend to mute/bury unit production stats.

That’s because DC can print money…but it can’t print a house or a car or a pound of ground beef. It directly controls the supply of the former, often at the cost of destabilizing the supply of the latter.

It really helps to view government as a master forger that can (temporarily) paper over its policy (Iraq/Afghanistan/China etc) and operational (Covid) f*ck-ups by buying itself out of the immediate consequences for the citizenry (who vote).

But it is all balloon animals made by the Elephant Man – the financial pressure relieved in one place gets engorged in other, less predictable (and less responsible) places.

So printed money pays for tens of trillions lost to China, trillions pissed into Middle Eastern sand and billions used to pay CDC employees whose primary focus/skillset appears to be selling real estate/watching porn during work hours, while meat producers get slandered as top hatted, market cornering monopolists (big surprise).

But the shifting of accountability that money printing affords has *always* been a feature not a bug for decaying governments.

JustTruth,

“Demand is imploding…”

Please look at the first chart!!

Hi Wolf,

I think you missed what CAS127 was trying to get at?

Unit sales. Everyone of the charts that you posted in this essay was measured in dollars. The only exception was “New Vehicle Sales” which was falling (for a variety of reasons).

It does not look at non-dollar measures, like miles driven, gallons of gasoline sold, number of hours worked, kilowatt hours of electricity, number of pounds of beef,chicken, port consumed, stuff like that.

Dang. Port should be “pork”.

masked ghost,

I wasn’t replying to cas127. I was replying to JustTruth’s comment about “demand is imploding.”

I report on unit sales all the time, including in this article. For now, unit sales of new vehicles are down because automakers cannot make enough units, but prices have spiked because there is HUGE demand for units, and unit inventories of new vehicles are catastrophically low. This is a problem of TOO MUCH demand with constricted supply.

I think a very important question, which unfortunately the stats can’t answer, is what proportion of sales is people stocking up/becoming producers, as opposed to increased consumption. Because this will cause a drop in future sales. So will sales of better quality (i.e longer lasting) items. So will sales of gardening tools and seeds cause greater value drops in later food sales, because they cut out the middlemen (and often a lot of wastage also).

Anecdotally, a lot of sales to acquaintances of mine, and myself, would cause a significant drop in sales in the near future. It doesn’t have to be, and I don’t think is, just crazy preppers. I think many are naturally stocking up due to supply problems (real or anticipated), and many are changing lifestyles to be more independent of retail.

I’d like to do what you describe with non-perishables but don’t have the space to store it now. Haven’t checked but assume I could cover it under homeowner insurance if something happened to it. Form of retirement planning by pre-paying future consumption.

Then you may have to do what I spent the first four months of last year doing – building more storage!

I agree that prepaying future consumption is the best form of inflation protection.

CPI Used Vehicles: TIAB (To infinity and beyond!)

I wonder if there is a count of used cars in inventory somewhere. I was at a Ford dealer this week. The sales manager told me he would normally have a 90 days supply of cars on his lot, but now has 30 days. The supply of used cars is so low the prices increased. People have money to spend, but it is worth less.

Unit-inventory numbers, new and used coming shortly.

Read Ford market cap hit $100 billion for first time ever. People must think industry is going to drink a lot from government teat as market cap was close to zero about 13 years ago.

My friend showed me photo of a guy she knows new Chevy pickup with payment of $1200 per month.

“My friend showed me photo of a guy she knows new Chevy pickup with payment of $1200 per month.”

That’s more than my mortgage payment!

At least the pickups these days are big enough to live in if you need to.

Those new car sales look very high but once they go through hedonistic adjustments you will see that the prices are actually coming down.

“Hedonistic adjustments” is one of the biggest rip-offs ever devised. The huge majority are unwanted, or worse, mandated. The consumer has no choice in what they are forced to pay for, and manufacturers are actually protected by the Gov’t when they pass the costs of building a “better” product onward.

Technology gets cheaper as it progresses. Automobiles are old technology for the most part. This is why, outside of First World countries, cars actually do get cheaper. And yet the protectionist mindset here in the USA is bound and determined not to allow those less expensive cars, or cell phones, or prescription medicines in.

Take the jobs offshore so things get cheaper, but don’t let the really cheap stuff in, because that would really upset the archaic distribution systems we’re so dependent on.

Used cars are a lot more expensive versus the US in a few countries where I did or do visit, in South America.

The “better” product is a form of planned or mandatory obsolescence. If the monopolists or oligopolists made products to maximize purchaser value, sales would collapse.

This is because of the very high duty on a used car entering the SA country. My ex took a Nissan Versa from Van Isle to Uruguay. They got it in as their own personal stuff but value went up by 250% .

The hedonic quality adjustments are relatively small each year, but cumulative. That normally works out so that the CPI new vehicles had for years been dropping. But they were not prepared to undo these kinds of price spikes from one month to the next.

1995: car gets you from A to B, costs x% of wages

2022: car gets you from A to B, costs x% * 3 of wages.

Cars at 1995 prices don’t exist so you can’t opt out of the “improvements”, so you are forced to work more hours for a car.

Hedonic.

A few things on the “dip” in December:

1. Everyone I talked to pulled forward their holiday shopping into October/November from December on supply chain concerns. Headlines were constant on supply chain and shopping early, and people did.

2. Omicron headlines were crazy in December. Presumably that led to some pullback in spending – particularly in-person.

3. If you look at the data on a quarterly basis instead of monthly, Q4 looks very strong, after a bit of a dip in Q3, due to Delta.

All this taken with the enormous grain of salt that “real” retail sales are not nearly as strong as the graph suggests. Retail goods inflation is sky-high.

Bank of South Korea raises rates to 1.25%

‘Surging inflation has ramped up pressure on South Korea’s policy makers to take action, as consumer inflation for 2021 as a whole jumped to 2.5%.

That was the fastest pace of price rises since 2011 and a sharper increase than projected by the BOK.’

From BBC

So if SK figures inflation of 2.5% requires a rate hike to 1.25% where should the Fed be?

SKorea actually makes stuff. US makes dollars.

So if SK figures inflation of 2.5% requires a rate hike to 1.25% where should the Fed be?

>>>>>> In Prison <<<<<<<

Mendocino…

Exactly. The Fed is so late, and apparently DELIBERATELY SO.

For 7 decades the Fed Funds stayed in the neighborhood of inflation.

It was the right thing to do. It protected holders of dollars and served to tamp down, PROMPTLY, inflation and the psychology of inflation.

This Fed is so inept, so late, so damaging. The inflation spiral is just starting IMO. The rate may be reported lower, and will falsely be reported as a sign of inflation ebbing….but inflation is cummulative and compounding….damaging.

The Fed should have a “Stable Prices” mandate or something…right? /s

Amazon.com’s 2020 revenue was $386 billion. Its rise is 9.8% year over year. That suggests to me that the retail sector is percolating along nicely and has room to grow. Amazon itself declares that it is only a small fraction of the overall pie. Walmart, for example, is still a bricks-and-mortar behemoth.

When Amazon.com exceeds Walmart is the day the stock market explodes.

Walmart sells online too. They’re a direct competitor with Amazon. I frequently compare prices between the two, and sometimes Ebay as well, when online shopping.

This reminds me of the 70’s.

Our company has some spare cash and since we get nothing in the bank we have been buying way ahead for stock. With prices increasing anywhere from 6% to 40+% on goods we are buying (and some things with crazy lead times), buying now is a great way to make some money (we are also raising our end prices) . Of course buying 2 years worth of inventory does pull forward demand … so at some point there will be a lull in buying – we can’t be the only ones doing this.

THIS is why interest rates need to rise.

When goods prices are going up, and interest rates don’t compensate, people will use cash to stockpile and hoard.

Wolf was wrong – we hadn’t reached the Everything Bubble until people started “investing” (actually speculating – but making huge profits!!) in used cars, lumber, KN95s and long-shelf-life groceries…

NOW is the Everything Bubble.

Perhaps. My shop is always stocked with inventory/supplies that will cover the next few months of operations. Always has been the case. I never bought into this minimal just-in-time nonsense for the sake of cutting inventory carrying costs. Of course, I’m a one person operation and I just like having what I need to go out and complete jobs in a reasonable time frame. If larger businesses revert to this mindset we might see an awful lot of inventory/stock purchased in the next year or two. And then that theory of holding adequate inventory will be jettisoned 40 years later when the post-pandemic kids are running the show. We can laugh now, but my lived-through-the-Depression Nana never abandoned her frugal scrimp-and-save ways. Our kids may laugh at us when we have giant garages stored full of junk (do you have any idea how much it cost in lumber to build this thing???), until the scarcity crisis of 2065 hits and they realize we’re sitting on 17 pallets of vacuum sealed toilet paper.

Since we’re kidding, how odd that a fear of scarcity leads to stocking TP? When the first scarcity scare hit the supermart nearby, catering to a lot of Chinese, it was out of rice, not TP.

Lesson from older folks who remember Mao time: first worry is inputs.

james….

This speaks to the CREATION of the bottlenecks.

Every purchasing agent in the country knew that they had to have inventory in the coming inflation. They called their suppliers and said “Get me all you can at that price!” THIS created the bottlenecks, though the bottlenecks have made it worse. But this is why inflation is so nefarious…it knocks down dominoes…..and the inertia can be catastrophic.

From WSJ 1/13/2022

““Obviously the pandemic disrupted the economy and contributed to inflationary pressures, but U.S. production is higher today, and U.S. ports are moving 27% more goods than before the pandemic. Inflation, driven by excess demand, always faces supply-chain problems as production struggles to keep up. But supply-chain problems increasingly are the result of inflation rather than its cause.”

Not just seasonally adjusted but also for trading day variation (weekends, holidays, etc.). That said, even after adjustment, this is an insanely volatile and heavily revised series.

Creating’ inflation!

Across the nation!

The dollar, baby!

Is what I be debasin’!

You may live in squalor!

With a worthless dollar!

But when I raise them rates!

Bears all gonna holler!

Haaaaaoooohhhh!!!

Very funny :]> Keep ’em coming.

The stock market doesn’t seem too concerned about the hypothetical upcoming rate increases right now. It can’t even drop 5% without every dip being aggressively bought up.

Either it’s because real interest rates would remain extremely low even after 0.75-1% of tightening (in which case it’s time to move faster), or hedge fund gamblers are all playing musical chairs during the last few weeks of QE. Either way it’s time for the Federal Reserve to move NOW; it’s insane to be dragging this out for another 2 months.

The threat of the FED interest rate increase that’s supposedly coming is taking the “air” out of many high flying growth stocks. That’s what is dropping in the stock market right now.

Love my PM and CVX stocks. Keep up the rotation trade.

Netflix is jumping up their pricing again. 10% increase again after a 10%+ increase last year. From what I read the talk to WallStreet/Market was a copy paste from last year about production costs..blah blah…. suck it. Already have the lowest package with one device at Standard Def. Netflix will occasionally show me how nice HD version is and to upgrade click here. I am staying in the cheapo category. I just consider it my way of keeping the cord a bay and not allowing it to creep back into my life at $100+ month. Frugal Rock

And Netflix stock getting hammered.

No wonder the content on Netflix is so bad they could show it to people in the interrogation rooms to make them confess to crimes. Saying “I can’t take anymore, I confess”.

Netflix dvd delivery was and is the way to go. I saw somewhere on the internet where a guy said you could copy those.

Me, personally, I, me, I prefer forced indoctrination over paid because I’m cheap. All their new programming is exclusively for the pacification of npc nincompoops. Bleats my ears and fills me with shame and self loathing for being my particular gender and pigmentation but i have to learn my thoughts somewhere.

amirite?

“fills me with shame and self loathing for being my particular gender and pigmentation ”

I blame my parents…and genetics. I’m a victim…

Has any one created a chart comparing the time Covid money was “invested” into the public’s hand with the increase? I don’t have the timing or volume info so thought maybe Wolf could satisfy my curiosity.

How do these compare to, say, California personal income tax revenue aggregate and number of people paying income tax.

American consumers: How I learned to stop worrying and love inflation!

Who can complain with charts like that? Up, up, and away we go…

I suspect price fixing is really simple in today’s hyper information society. You don’t really have to conspire in order to develop a very tight fitting range of prices. Prices that are unshackled by competition. Or costs. Gas prices are identical. Retail prices all across the board move in concert. Consumers realize they must pay the prices. They’re all identical. One doesn’t have to take possession of a commodity, so the prices there act like equities. Portfolios are going up up and away! Try shorting that dynamic. And why bother anyway? Grab the premium! We’re in an unregulated *uck you society so we get WTF charts galore.

If the seasonal adjustment is out of whack, why not plot a 12 month rolling?

XOM weekly entered Jan 19 2016 fractal zone.

Michael, is that good or bad? I have a lot of XOM bought early last year…

How does WTI at 84 and change strike you.

Xmas sales sucked :

1) Dec retail sales are down.

2) Dec online sales are down, but the cost of the silk road to dominate

the fast shipping lanes are up. Online pickers hours plunge in Jan. Real wages are down due to the “transitory” inflation.

3) New vehicle sales are down from 22M/y to 13M/y, but transactions

cost are @$46,000/ car. Subaru midsize cars are almost gone, because GM & Ford betrayed their cars customers. Personally, I hate trucks, love jeeps

with 0.5 and a steel post in front.

4) Jan gasoline prices at the pump are down. People drive less, spend less.

5) Avoid red meat, fish, chicken, ham ==> food inflation is almost zero.

Adults don’t need protein to build muscles and bones. Our body

is not a construction site.

6) Dept stores, furnishing stores and electronic stores sales are down.

7) JP thanked Satya for doing his job, for sending NDX down.

8) I ate the worse filet mignon, waited 15 min to pay and gave the lady 18% tip, because she talked to me like talking to a puppy.

9) 0.50% – 3% profit /trade are good enough for me. I cannot tell people to

take 100% profit, it’s illegal.

I was in Best Buy last month at the peak of the shopping season and the place was dead. I think the buy early and shortage memes killed the season for them. I got a laptop as an early Xmas present, half the choices were in stock and the rest were available in other stores. I expected the inventory to be non existent, but came home with a nice gift.

Everything else I bought early and good thing too, because shipping was the slowest I can remember.

Why is it even a question. Crash the stonk market, everyone knows it’s a hyper-inflated mutation of graft and buybacks. Save the dollar, make the right choice. It’s time to rebuild through due diligence, not deceit.

Crash indeed and in fact and ASAP DEL:

Hard for this old pre boomer to comprehend the criminal actions of the FED that was first brought in to lessen the depths of economy swings,,, or so we were told for SO many years…

Now clear the FED is just another of the many controlling mech a nisms brought to us by the international and national oligarchs.

While WE the Peons can certainly celebrate that our owner/oligarchs can and do allow entry to their global groups, mostly never in the news… we can and should lament that entry of newcomers, Kochs, even many others such as ronny ray gun,,, will only be allowed when THEY,, the Kochs and similar, have proven their ”chops” with some kind of tremendous degradation of the ”wage slaves.”

And so it goes according to Kurt Vonnegut,,,

Very nice charts. Thank you for great visuals.

For entertainment, u tube : Maxim masterclass mit Hilary : Lv Beethoven Sonate fur klavier und violine Nr 9, A dur op 47. Nov 23 2020.

You had me at “Search Maxim”…=)

Very nice….long. Currently favor the Bengals vs Raiders game right now.

Wolf should start a chart for the amount of product that is “flash mobbed” from stores, or stolen from trains, etc. Is loss product considered GDP?

The volume of organized crime store theft is really starting to hurt the bottom lines of retailers, and I suspect there will be a technology security revolution to address the loss, via automated security drones, both air and ground based.

Already you can buy drones that sit in charging containers and fly out and record around your house when motion is detected, an there are ground based robo-cops that look like small refrigerators on wheels that detect motion, speak warnings, and record via live feeds to security headquarter. At some point, even robots may start quickly replacing humans for security, like is the case right now for the military.

A future like “Wall-e” or “Terminator”, TBD….HA

Per Bloomberg:

LA Looters Raid Unattended Containers Amid Supply-Chain Chaos

Looters are reportedly stealing imports near main U.S. ports

If the consequences are greater for the store owner if they take action, than the thief, what will drones do?

Drones can analyze and record is great detail the images and video’s what will ultimately be uploaded into an central A.I. database for review, which will then ultimately send an automated transport and even someday an automated robo-cop to round the thieves for review in front of a single judge that will review evidence that is well beyond a reasonable doubt for prosecution. Once you remove the human “witnesses”, the evidence becomes more exponentially more accurate and easier to prosecute due to exacting fine details.

I’m not talking about tomorrow…but someday the tech, A.I. and automation will be advanced to the degree that humans will not be needed in enforcing the laws…

Not saying it is going to be a good thing, as I myself think that in 20-70 years, A.I will be the top existential threat to the human species. Currently the fasted supercomputers can compute in 1 second what it would take you or me 6 billion years, so just imagine the God like intelligence in 20-70 years, tied into all the infrastructure that humans depend on because they can not do any of it themselves by that point in time. Just writing this post would put me at risk in 50 years “Once” an A.I. becomes self aware, and we will be pets at best at that point IMHO…ruff ruff…HA

… Sales at Retailers by Category

I hesitate to suggest a change in Wolf’s very excellent charts, but if the vertical scale were % change we would see something interesting.

Consider grocery, general merchandise and Bldg Materials. Their rate of change appears to be equal. Let’s consider that the base rate of change and subtract it from all categories.

The above three categories would be flatlining at zero. Vehicles and Nonstore would be climbing with, perhaps, Nonstore climbing a little faster.

Restaurants is hard to call but appears to be a negative reading sliding back into flatlining at zero.

The others are so small that even small changes could cause them to whiplash up and down.

RedRaider,

As I pointed out, total retail sales were up a gigantic 16.9% in December from a year ago, and by 10% from November, not seasonally adjusted. And they hit a huge new record.

So here is the % change chart you asked for, just for you. Yes, it’s very interesting: growth in December (16.9% yoy) is a huge record going back 20 years, beaten only by the stimmie months that compared growth to the collapsed sales during the lockdwon in March-June 2020:

Wolf, reading the comments and your text article above, I don’t get the impression that the container clogs at the ports had any significant impact on holiday sales, except for maybe new cars that were affected by the chip shortage.

On a personal basis, I don’t know of any family member, friend, or neighbor that had any problem obtaining electronics (for instance the new X-Box for grandson was bought online), clothing, anything from Amazon, Walmart, Best Buy, Costco, etc. Even I bought and had installed a new dishwasher thru Costco in December.

While Covid sure screwed things up through most of 2021, this past holiday season really felt pretty normal from a historical perspective. We don’t spend a lot on holiday stuff anymore, but we didn’t have any problem spending what we did.

Prices across the board are certainly going up though and we know what that is all about.

Thank you very much Wolf! I tried downloading the category data from the Census Bureau and doing it myself but I’m not that good with Excel. What would it be? A 3D matrix presented in a 2D format? I wouldn’t know where to begin.

The chart clearly shows the magnitude of sales during lockdown period vs 2008 financial crisis. The lockdown period spiked so high because it first spiked down. That sort of makes sense. But where is the up spike following the financial crisis? There is a multi year bulge following. Were TPTB able to contain the financial crisis but not the lockdown? So many questions and so few answers. It could be scary.

My contribution to the retail sales spike over the holidays:

I spent $39 for my grandson’s scooter at Target. A take-out dinner for the family from my Irish Pub. The rest was gift cards to local restaurants which we’re having trouble spending as everything is closing up due to the Omicron

Curious about food stores.

Everyone has to eat, so that’s a “real” metric.

What would food store sales look like if adjusted for population? That is, if population growth (immigration) were subtracted, what would the numbers look like?

Oh for an edit button- Forgot to add Food Store Sales adjusted for inflation, as well as population growth.

Tony22,

In 2010, US population growth (births – deaths + net immigration) was 0.8%. In 2020, it was 0.4%. In 2021 it was likely around 0.4% or less.

Singapore’s exports rose 18.4% in December. Very very strong, comfortably beating forecasts by 5%. Muppets are still buying.

Wolf,

You wrote “Retail sales are sales of goods at brick-and-mortar stores and online. Sales of services, such as insurance, healthcare, or haircuts are not included.”

Some businesses are a mix of goods and services. For example, hospitals have doctors’ fees (services), but don’t they also (over-)charge for every physical item too–Aspirin, intravenous fluids, catheters, etc.? And most hair salons also sell actual goods in addition to hair-cutting services: shampoo, conditioner, combs, brushes, etc.

I think my credit-card company classifies (or used to classify) everything bought at a gas station as “gasoline” (even snacks and drinks from the convenience store).

So just to be clear, do all the sales for the sellers of goods in this data series get classified by the primary nature of the business, or do they also break down the actual goods sold by service businesses?

Thanks! (And please check your account and have another fancy beer on me.)

Pete in Toronto,

OK, we’re going to go into the weeds here :-]

“Retail sales” are based on data obtained from companies — what they sold. The surveys go to specific locations such as a store or online operation. Retail sales are seen from the company’s point of view.

What is a retailer and what isn’t a retailer is defined by NAICS codes. Every business location has a NAICS code. Retail sales are only reported by locations that have a NAICS code that is in the retail category. Retailer NAICS codes begin with 44 or 45

The retailer subcategory of gas stations have a NAICS that starts with 447. For example, a gas station with the NAICS 447110 (“Gasoline Stations with Convenience Stores”) gets the survey and reports its sales. It doesn’t matter whether that’s a Coke or gasoline. Sales at gasoline stations in the article above are dollar sales of goods at all gasoline stations (NAICS 447…)

There is a much broader category: “consumer spending,” which is divided into services, durable goods, and non-durable goods. It includes retail sales, but also all the other stuff, from rents to insurance to haircuts, etc. that consumers spend money on.

Hospitals are not retailers. Their NAICS begin with 622. They’re part of the Healthcare and Social Assistance category (NAICS that begin with 62). And their sales don’t go into retail sales. They’re picked up by the consumer spending category. The money consumers spend in hospitals is a mix, some for goods, and some for services. But consumers don’t spend all that much in hospitals; private and government insurers do the heavy lifting there. So consumer spending data counts what consumers spend on insurance as well.

I cover consumer spending separately when the data is released. Consumer spending is also released on an inflation adjusted basis (retail sales are not), and inflation is now a critical issue.