“Potentially Destabilizing Outcome could emerge if elevated risk appetite among retail investors retreats rapidly.” But what the heck.

By Wolf Richter for WOLF STREET.

Only part of the leverage in the stock market is tracked and disclosed on a monthly basis. Much of the leverage happens in the shadows, including Securities Based Lending (SBA) that banks may or may not disclose on a quarterly or annual basis; leverage at the institutional level such as with hedge funds, an $8.5 trillion industry; and leverage associated with options and other equities-based derivatives.

It’s only when something blows up that we can see tidbits of this leverage emerge in all its splendor, such as when Archegos imploded earlier this year.

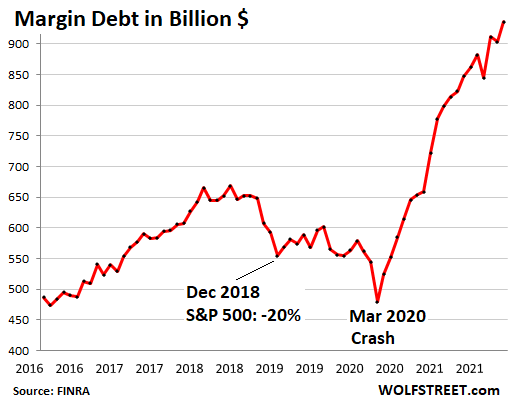

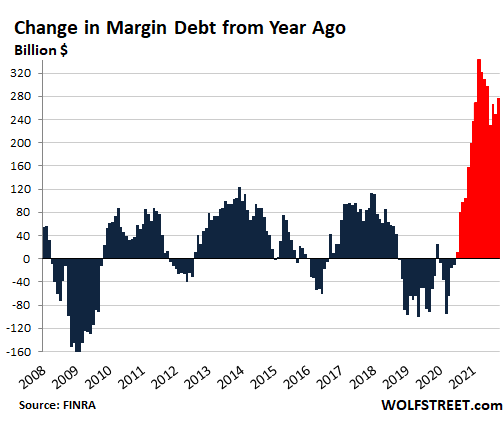

The only leverage data we do get on a monthly basis is margin debt at brokers, reported by FINRA. And we got another doozie: Stock market margin debt spiked by $33 billion in October from September to another all-time high of $936 billion, up by $277 billion, or by 42%, from a year ago, and up by 67% from October 2019

The increase in margin debt has become a huge outlier, compared to prior years, with margin debt ballooning by 42% year-over-year and by 66% in two years, summarized by this chart of year-over-year changes, with the period since March 2020 in red:

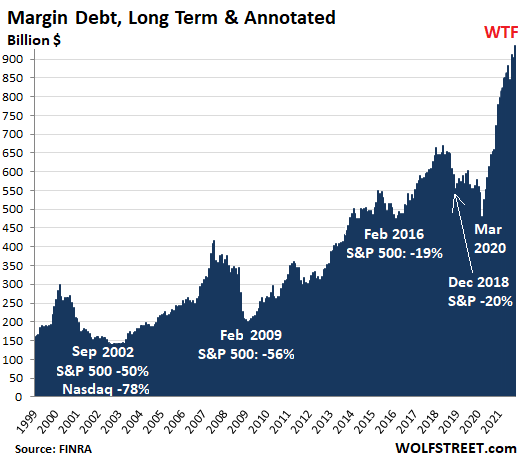

This type of stock market leverage doesn’t predict when the market will crater. What it does predict is that when this market is going down hard enough, it will trigger massive bouts of forced selling as margin calls are going out, and leveraged investors have to sell stocks to pay down their margin debt, which then pushes down prices further, which then triggers more forced selling, and more fears of forced selling, as portfolios are being liquidated, thereby accelerating the swoon.

This is why leverage is a risk to financial stability. And why the Fed keeps talking about leverage in its Financial Stability Reports.

But apparently no one at the top of the Fed – least of all Powell and the other members of the FOMC – ever reads these Financial Stability Reports because the FOMC, out of the other side of its mouth keeps encouraging ever more leverage with its interest rate repression and money printing.

Margin debt is the big accelerator on the way up, as borrowed money enters the market and creates new buying pressure.

And margin debt is the big accelerator on the way down, as this borrowed money gets drawn out of the market and vanishes by paying off debts, thereby creating selling pressure.

High levels of stock market leverage are one of the preconditions for a massive sell-off. It’s hard to have a massive sell-off without a lot of leverage.

In its Financial Stability Report, released this month, the Fed is particularly warning about high leverage among young stock market investors.

“The median leverage ratios of younger retail investors are more than double those of all investors, leaving these investors potentially more vulnerable to large swings in stock prices, as they have a larger debt service burden,” the Fed said in the report.

“Moreover, this vulnerability is amplified, as investors are now increasingly using options, which can often boost leverage and amplify losses,” it said.

High leverage is a sign of high and growing “risk appetite,” as the Fed calls it. And concerning the risk appetite of these investors, and their reliance on the social media, the report warns:

“A potentially destabilizing outcome could emerge if elevated risk appetite among retail investors retreats rapidly to more moderate levels,” the Fed said.

But what the heck.

Out of the other side of its mouth the Fed is still repressing short-term interest rates to near zero, and it’s still engaging in large-scale money printing to repress long-term interest rates and heat up further that risk appetite that it warns could retreat, and when it retreats, could produce “a potentially destabilizing outcome.” So…

Here’s the long-term view of margin debt. Given that the purchasing power of the dollar has dropped over the period, it’s not the long-term increases in absolute dollar amounts that matter, but the steep increases in margin debt before the selloffs, and the magnificent increase underway now:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So whats the problem……….signed……… J Powell

Looks like we need more stimulus………L Brainard.

We must step in and support the markets that are at levels they never should have been….

We are smarter than the free market………just ask us.

Powell to have his

“What have I done” moment ala Alec Guiness in “Bridge Over the River Kwai”

https://www.slantmagazine.com/images/made/assets/house/film_bridgeontheriverkwai_780_440_90_s_c1.jpg

Excellent. Another of your super contributions. Do please keep up the good work…it is much appreciated.

“The median leverage ratios of younger retail investors are more than double those of all investors…”

Remember those stories from the late ’20s, right before the market crashed, about shoeshine boys giving investment advice? Everyone was playing the market.

Sounds like Robinhood.

It’ll be the “middle investors” who lose the most money when it goes pair shaped, regardless of their collective age. People who have wealth and retirement tied up in the market, but don’t have many valuable tangible assets beyond their home/homes. Rich people will just lean back in their deck chairs, sipping bubbly on the Nourmahal while society acts surprised.

When this mania finally ends, a lot of very wealthy people are going to be almost or even totally wiped out.

If this seems so hard to believe, look at what these people (including the billionaires) actually own and it’s current “value”. Often, much or most of it is a bag of hot air.

Corporate America has also collectively gutted it’s balance sheet through stock buyback since 2008. Balance sheets are leveraged to the gills.

Many companies look “cash rich” but it depends upon what they own, as they don’t actually have cash, but someone else’s debt. Possibly including the garbage debt of other weak debtors.

A quick internet search states 724 US billionaires. Back in 1983 or 1984 in the first Forbes 400 issue I bought, it was around or even less.

This number didn’t remotely increase because the country is actually so much wealthier and it didn’t happen because inflation mostly caused it either.

It’s because assets which were worth a relative pittance are now so ridiculously inflated.

In a prior post, I mentioned that Fortune magazine estimates the value of the NY Knicks basketball team at about $5B. Much of this “value” is “status value” (as it always has been) but it’s also the result of a concurrent bubble in media rights fees, advertising rates, and ticket prices. Only a portion of it can reasonably be attributed to new revenue streams such as digital and foreign markets.

By comparison, using 1937 TNEC data, Ferdinand Lundberg estimated the Rockefeller family’s industrial holdings at about $5B somewhere around 1960.

The Rockefeller family was actually super rich, owning substantial stakes in important global strategic companies valued at modest prices.

To give you an idea of the hyperinflation in pro sports. the LA Rams sold for $19 million in 1972.

In my last post, forgot to add around 10 billionaires in 1983 or 1984.

The billionaires are steadily selling off their stock. Gates has been getting rid of M$ stock since forever and rebuying farmland and camera image footage since his departure days at the company he founded. The problem is you can’t sell a lot without it affecting the stock price. That’s the sticking point.

I still have the ticket stub from when I saw the LA Raiders play Dallas at the Coliseum in 1986. A mid-price ticket was $18, today they’re over $200.

The tax games of contracts (depreciated) and salaries (expensed) would be interesting discussion. Looks like double dipping….

First million dollar baseball contract (per year) was in the early 80s.

at least banksters will be protected since margin only allows 50%

“Gates has been getting rid of M$ stock since forever..”

Catxman,

That’s simply untrue. Recent Q3 activity shows his Bill & Melinda Gates Foundation Trust buying 3 million shares of MSFT.

The CCP’s Evergrande reportedly must pay billions by March or April 2022, which total more than their founder is worth. If there is not a formal default by them before then, they are teaching us in their current sales of $10 billion worth of assets for $1.6 billion, how to make a lot of money into a much smaller of money, while not enjoying the process, due to their desperation. LOL

If the world’s stock markets have not crashed by then, I suspect the complete sinking of such a big whale, combined with all the ongoing, other, lesser, CCP, real estate developers’ insolvencies, steel company insolvencies, chipmaker insolvencies, and other insolvencies in China will crash the stock markets by then or even earlier. I predict that a lot of US entities will ultimately have to reveal that they had massive exposures to China’s financial disasters– as those US companies announce their bankruptcies.

The US and other investors’ massive use of leverage will make them desperately vulnerable to market downturns due to the upcoming margin calls that will be made once their underlying securities (the stocks bought on margin) tank in value.

We are living in “interesting times.” God clearly has a great sense of humor.

You’re assuming that china’s housing market crashing, would crash the global economy. I’ve seen no evidence for this. Very few outside China, own a substantial amount of assets there (in reality the CCP owns everything and everyone in China). Chinese basically only invest in RE, if china’s RE collapses, we will temporarily see more money fleeing China, but over time the money leaving China will slow.

There is indeed some people significantly invested in China, but it’s usually only one part of a portfolio (China is the biggest part of “Emerging Markets Indexes”), and Emerging Markets Indexes are never the biggest or second biggest part of a portfolio. This amount isn’t big enough to bring down the US or European financial markets. While American companies are more invested than they claim in China, it’s not as much as some people seem to think it is.

The real major problem in America will come when enough people try to cash out their stock market holdings (likely coming with the booomer retirements) and not enough people buy in to prop up absurdly high prices. Another thing to note is that a large influx of houses will hit the market as booomers retire and pass away, possibly crashing house prices.

The chipmakers in China were always a scam that didn’t actually lead to anything, them disappearing means nothing.

The real effect of china’s RE collapsing, will be an economic depression for China, followed by a slow decline for China. Eventually, there will be a change of leadership in the future, and then they can grow again, but I don’t see them getting all the one sided advantages, they previously had.

It’s worth noting that Xi is intentionally crashing china’s RE. In general, he is trying to put China on the Northern Korea path, how far he gets though, is anybody’s guess.

I hope you are right but rumors of issues disagree. US/other banks/ companies have so many skeletons in their closet it must look like some ancient, major battlefield in there. LOL

Research HSBC and other companies with close CCP ties, meaning their buddies: the banksters and Wall Street financier parasites. Without any personal knowledge, admittedly, I suspect another 1929 is coming.

And it’s more than just banks and skeletons. The suddenly not so rich Chinesse will be selling houses in America to. And the fall in university students will bite.

I’m Australian, and it might be different in the US, but China’s real estate crashing will crash Australia’s real estate too, in my opinion.

It might crash the Australian housing market or some other small countries (population wise) like Canada. At first though, if china’s housing market crashes, we will likely see an increase Chinese buying oversees housing, how fast this trickles out is a big question. It’s possible that Xi would try to block all the money leaving, but, I don’t see him pulling that off at the current time. There is alot of questions, how China would handle the crisis and will capital outflow be ongoing for an extended period of time.

A big reason for buying oversees property is that CCP members do recognize their party could collapse or that they could be targeted. In general, in the event of a major crisis in China, the Chinese who can, will mostly flee China. Even if they stayed in China and began selling off overseas housing and other assets, there is no reason to believe they could actually keep the money. Alot of people could have that money stolen by the CCP.

Universities might have to make some adjustments, but, unlike various industries, I don’t think there is really much spillover effects from universities having to downsize, as long as STEM education itself isn’t effected.

HSBC is a British bank that famously has gone all in, no other western bank has done so to such an extent.

When you look at things like derivatives, the amounts of nonsense flowing through banks is vast. I don’t see most banks outside of HSBC, having enough exposure to China that it would take them down. In 2008, the exposure of US banks to subprime mortgages was vastly bigger.

There is a bunch of money that was put into China from western institutions, but it’s basically just a write off at this point. Most western firms doing business in China have already left, downsized there, or plan to (this is related to manufacturing investment). Money put there into factories can’t be pulled out, so most will use factories until machinery wears out, gets obsolete, risk of new IP being stolen is too great, or the cost of business gets too high. We will likely see a large drop in money being invested in Chinese manufacturing from abroad, but existing factories will mostly be used for awhile yet. Some foreign manufacturing, mostly low tech things, like certain products related to steel, will actively invest and continue in China, as well as some related to Rare Earth minerals.

What we are likely seeing is the writing is on the wall, and banks don’t want to lose any money, and so they are encouraging smaller people to buy in so they can sell out (this relates to Chinese housing investment).

This early AM Cramer on CNBC said to take profits in Rivian and likened it to the dot.com era. Then a while later I went back to copy it for WS and it was GONE.

Comments outside ‘the narrative’ get moderated fairly quickly these days.

It’s very hard to find information that was plentiful only recently.

It’s really scaring me.

In reality the very young are the only people that should be running a nearly 100% equity portfolio as their average holding period is 50 years. The exception is if you are old and have so much money that you are leaving most to your grand children.

If you are a normal retiree and need money to live on you probably need at least 10 years of safe fixed income to protect you from a draw down and we know that sucks.

You don’t have to be a genius to figure out that Fed has got world addicted to money printer. Once addicted you aren’t voluntarily quitting.

Scapegoats are already named. They are young, inexperienced, greedy reddit apes who wanted to game the system but got trapped instead. Obviously, the continuous money printing is not wrong. The big fish can swim and grow more. There is no problem. If there is a crash (if it happens with the money printer going brrr…), then tax payers must rescue the big fish like JPM, GS and pensions. Why pension programs? Because only the young inexperienced will be wrong. Pension programs and retirement accounts cannot be wrong. I understand the “margin” and “leveraged” positions of these reddit apes but on the other hand, what is the morality of taxpayer funded relief to the big fish. Now, I understand why President Truman wanted a one handed economist.

“Scapegoats are already named.” A huge amount of scapegoats UNAMED are people in retirement index funds, that have been gleefully riding the ‘wave’, with seemingly mass ignorance to any ill consequences.

Pensions will be protected becausethe majority of them are paid to government workers. Cynical? Absolutely. But that doesn’t mean I’m wrong.

Parts of Pension Plans (Defined) usually have some form of protection. Investments of index funds through IRA,401k, TSP, etc are not. I agree, Pension Plans (Protected Benefits) are becoming harder to come by, but they are not necessarily government workers.

I should know. I have one such defined benefit pension, courtesy of a former employer in the private sector.

From what I understand, those things have become very rare indeed.

Pension plans already have gotten preferential treatment to private savers. If you live in a state with a massively underfunded pension, the quicker you can get out the better.

Given today’s absurd valuations, most pension funds and retirement accounts will be devastated by a real bear market, one that lasts any duration.

Those who thought they could “ride it out” will either sell out of fear or necessity. In 2008, the stock market tanked, people lost their jobs, the real estate market busted, and then they lost their house to foreclosure.

Given the actually precarious state of the economy, financial systems, and most individual’s financial circumstances, it won’t take much to wreak havoc on the majority of Americans.

No, there is nothing the FRB or US government can do to perpetually prevent falling living standards.

The average American is destined to become poorer or a lot poorer in the future.

Just read that reverse engineering stock market price, it is pricing in 19% perpetual growth. Going to take about 17% inflation to or it ain’t going to happen.

Wolf, what do you think of Calpers announcing they are investing in alternative assets and taking on leverage?

It seems they feel they have no choice but to move further out on the risk curve in order to meet their obligations in this climate.

DanHeld,

By destroying yield, the Fed is pushing pension funds to take huge risks. Income from their entire bond portfolio has collapsed, thanks to the Fed’s interest rate repression. But pension payments are rising thanks to the Fed’s inflation mania.

So yes, they’re reacting to the Fed’s shenanigans. They have other choices, but they want to maintain their projected returns, and they cannot get there with the fixed income portfolio not producing much income.

It’s a terrible situation – not just for savers that are getting pushed into cryptos or whatever in the hopes of making some money, but for pension funds, insurance companies, etc. The Fed has already and repeatedly pointed out the high leverage at insurance companies as one of the vulnerabilities of the financial system. But insurance companies are just reacting to the Fed’s yield repression.

With public pension funds, such as CalPERS, if they cannot earn enough return on their assets, taxpayers can be on the hook to cover the results of the Fed’s wealth transfer operations.

What the Fed has been doing is atrocious on so many levels – including for pension funds. But of course, the folks a CalPERS or any other pension fund or life insurance company or wherever are not allowed to ever criticize the Fed. That’s an instant career-ender.

Calpers could have cut benefits to conform with their returns. They already payout the most ridiculous benefits on the planet.

petunia, that is true, but even pension funds supporting pensions that weren’t overly generous are going to have a hard time meeting their projections.

Under state law and/or the state constitution, it would be impossible for Calpers pension benefits to be cut for existing employees. Even the Terminator governor could not get pension reforms (cuts) passed when he was in office and these cuts would only have applied to new employees.

It’s astonishing the assumptions they have made and that even with the markets the way they have been most of these pensions are underwater. They will all have to be bailed out in one way or another.

It’s one of the reasons we know that an obscene amount of QE is coming the next time there is a 20% drop.

California lost it’s first congressional seat. New York state has been loosing seats for a long time. Fewer people to pull the wagon.

No matter what pension law says, when the resources run out, they run out even if the constitution says your pension can’t be cut.

California was dumb enough to make their tax code very leveraged to economic cycle so when pension crisis hits, it’s going to hit at exactly wrong time for state to throw money at it.

When it comes to pension plans the only sucker would be tax payers.

“What the Fed has been doing is atrocious on so many levels –”

They hold the beachball under water with one hand and spin plates with the other.

Who knew they would not stand to their post and raise rates to meet the inflation? Who decided they would not? And why does it seem so many knew they would not, and were flat out locked down long equities with the bravery of “knowing”?

In NC we have a culture and history that is somewhat anti union. State employees are unionized, but the union is relatively week and state employees are not generally over paid relative to private sector. The pension obligations are relatively small and we usually rank around #2 as far as best funded.

The entire southern region has been made very competitive about attracting retirees and business. We used to have progressive income tax in NC that topped at 7.5% if am not mistaken. State went to r

5.5% flat tax and has been dropping it every few years. Latest proposal is 3.99%.

Being competitive and having a small welfare state brings population growth of opportunity seekers and solves a lot of the states revenue problems. It does create high real estate values for young locals who grow up in booming areas.

NC or SC, not places you ever want to find yourself being poor.

If I was Wall Street and I knew a crash was coming, wouldn’t it be prudent to blame it on cryptos and the like instead of the usual suspects?

That’s the set up i’m seeing…

When people get hurt in one trade, they tend to be forced to get out of the good trades

The “smart” people are all long CRYPTOS which, when at the cocktail parties in the Hamptons, can not explain how they work

What of Cryptos if interest rates rise to meet inflation.?? What then of Cryptos? Being hurt in one place makes you want to avoid being hurt in another. This could flip the stock market……could, maybe.

Cryptos and Robinhood are the baseball cards and swap meets of yesteryear. Your Hampton’s investors are in a reality based video game they don’t understand. These millennials don’t even care if they make money, they are simply leveling up in a game. The crypto is the token for the micro transactions they use to stay in the game.

Your Hampton’s investors are going to be surprised when the players get bored and move on to other pursuits. And they won’t even care about the chips they may hold.

They will blame it on people who bought houses they couldn’t afford and poor people.

Petunia…. :-) ..The Big Short…and no one is going to jail when it is all over…We the people…the tax payer will just bail them all out?

Going into a recession is supposedly the time the smart money distributes their stocks to the dumb money. After the recession they buy their positions back at fire sale prices. Worked like a charm time after time. But what if you had an economic recession but the stock market didn’t go down? The smart money would find themselves “off sides” and in a quandary. Do they buy back at a higher level? Do they short the market trying to “force” a decline? Maybe the retail crowd (ie, the dumb money) didn’t have the wherewithal to accept distribution.

There are many questions but only one answer: the smart money seems to have gotten hoisted by their own petard.

except that we didn’t really go into a recession. there was a very, very brief decline in economic activity, like three to four weeks, and then all of that decline and then some was made up by all of the “stimulus.”

It’s not actually going into a recession that’s important. What caused the “off sides” is the smart money anticipating a recession that didn’t materialize.

The last chart is downright scary. This is not going to end well.

It’s not inflation adjusted, so maybe slightly less scary. But, it also does not cover shadow banking, so maybe more scary.

The book will be written…

Low interest rates are initially stimulating, but protracted, they are damaging as they encourage yield chasing and misallocation of resources.

Former Fed Gov Fisher admitted, unwittingly, that the Fed INTENTIONALLY FORCED investors to take more risk as they dropped the rates in the long end.

See “The Power of the Federal Reserve” PBS special.

When was it the job of the Fed to FORCE investors to take on more risk?

Transcript of PBS documentary

Correspondent: “With Americans still suffering and the banking system on the verge of collapse, Fed officials there at the time told me they felt compelled to go even further.”

Fisher is then quoted saying: “And then the question was, ‘What else can we do?’ And the committee came up with the idea of quantitative easing … put more money out there for the economy to take it and put it to work and to grow and to restore itself.”

So, ostensibly, growing and restoring the economy was their primary motive. Within this context, Fisher states “When you drive interest rates down all the way out, it forces investors into taking bigger steps on the risk spectrum.” This refers to big investors, banks and institutions, not retail investors.

In other words, when the economy is freezing up and banks on the verge of collapse, the strategy was to print money for stimulating the economy (and nudge “force” institutions to lend and invest). If the new money was put into conservative retail investments, (e.g., interest bearing bank accounts), it wouldn’t be adequately stimulative in the crisis situation.

I certainly didn’t feel forced into risky investments at the time the documentary describes. I held on to my money, and bought a house a couple of years after the crisis. How is the individual forced to do invest in specific ways in a short-term crisis? Would you describe current crypto investors as being “forced”?

More concerning is how Fisher casually waves off how QE exacerbated the wealth effect. From the documentary: “There’s nothing that you could really do about it. [mumble, mumble] … it would be one of the consequences that we just had to be mindful of. That doesn’t mean we shouldn’t have done what we did.”

Hmmmm, nothing they could do about it. And almost nothing has been done by Fed or politicians in the subsequent decade or so. Nice dodge.

Drifterprof

Is it not the charge of the 3rd mandate for the Fed to keep long rates “moderate”? Moderate = “not extreme”.

Yet all time lows in the long end can only be described as EXTREMELY LOW. Thus they intentionally broke their 3rd mandate…..thus they only refer to the “dual mandate”, #1 and #2.

The third mandate …keep long rates moderate….maintains a moderate balance between borrower and lender in the long end, but more importantly it prevents the emptying out of future generations and the dumping of massive and easily created debt out the long end. But they ignored it.

No wonder they always and only refer to the “dual mandate”.

I could make the argument that since household wealth has quadrupled since 2000, today’s margin debt of $900 billion is roughly equivalent to $225 billion in 2000. By this logic, we need to exceed $1.2 trillion in margin debt to surpass the dot com mania.

Similarly, if we think of assets like stocks and real estate as currency alternatives, then everyone is just looking for something to hold besides national currencies. Therefore, all conventional valuation metrics become less important and stock market capitalization needs to be measured in relation to the sum of money supply and zero interest yielding government bonds. By this metric, too, the US stock market can still grow another 30 or 40% before reaching 2000 dot com mania extremes. Of course, by that time, the money supply and government debts will have increased as well, so we might not be in dot com bubble territory until the S&P 500 reaches 6000.

Considering how cheap housing is relative to the stock market, we may need to see home values double or triple before we can talk about a housing bubble.

It would really be insane for the market to advance another 30% from these levels without a correction.. I think there was still a lot of growth potential in 2000 where now I don’t know where the growth is gonna come from outside of government stimulus.

Actually what I meant to say is that 30-40% does not get us to the dot com extreme because by the time this happens, we will have printed even more money, and my calculation was based on April 2021 data. We therefore need to add an additional 15%. The S&P 500 is currently at 4720 or something like that. Another 50% higher gets us to 7000.

There is another reason to believe that we may need equities to rise another 50% before we get another bear market. The reason is that the Fed will truly be forced to tighten only when so many people get so rich with Tesla and NFTs that they simply stop working and we literally can’t buy groceries anymore because the truck driver has decided he doesn’t want to be the fool who goes to work when the better bet is to just watch your money grow on Robinhood. The current shortages are bad, but not bad enough, yet.

It wouldn’t surprise me if sp500 goes up another 10% – 50% in a blow off top, but I am not playing it. We are in a mania and that’s what happens.

Stock market is excessive on every measure except relative to bond rates. Inflation will force up interest rates and then it will be the pop heard around the world.

How could competent leaders even allow this much margin debt? Much less the 0 interest rates, borrowing, debt, and money printing? It’s corruption, in plain sight, and in your face. Bend over.

We would really be better off with caged monkeys pushing the buttons.

Central banks have a poor report card. I think it might be the typical human nature of groups.

Usually an organization is formed to benefit society, but after 50 years or so the group becomes more about it’s on well being and not about the original mission. It’s everywhere. Business, church, government agencies. What big agency is transparent? They all have to protect themselves.

And why shouldn’t the young people go for broke? They are staring at a future devoid of hope. Going for broke is the most rational decision under those conditions.

JeffD,

Interesting perspective…you might be right.

All of my kids are now in their 30s and all assume that they will have zero pensions or SS when they get to be my age. They’re investing in hard assets and staying out of debt.

They’re not resentful, just pragmatic.

Trade you…. Mine are in their 40s and dumber than a box of rocks…

My only son committed suicide this last year.Be thankful for your rocks.

rankinfile,

So sorry to hear that. My condolences.

Any decent economist will tell you that incentives matter. The USA created a system with all the wrong incentives.

It’s the same psychology that shows you why poor people buy lottery tickets. If you buy a ticket and you lose, you’re still broke. If you win, you’ve won more money than you could ever reasonably hope to earn in your lifetime.

Most people who win the lottery end up broke again. It’s not easy to be a successful lottery winner. (I’m not joking – psychologically most people are not prepared to handle being suddenly wealthy, make poor choices or get scammed and lose it. Child actors have similar problems. Lottery payouts > 1x annual minimum wage should be forbidden.)

I’d like to try

Same situation with many young athletes fortunate enough to be drafted into the professional leagues. They’re only a fraction of 1% of the available talent pool that make it that far, and their careers, especially in the NFL, don’t last that long.

Many of their advisors (the ethical ones at least) tell them to treat their sudden success as if they just won the lottery, and plan accordingly.

For further guidance, I’d watch film director Billy Corben’s classic documentary “Broke”

Most people do not have the emotional nor the financial maturity to handle large sums of money that come their way suddenly…

From athletes to the stimmie/hand out crowd…

Once the money is gone, it’s reversion to mean…

I’m seeing this in some of the young people around me. Some are questioning the practical value of a college education versus the student debt it comes with. Some have gone all in on crypto because they saw what the financial crisis did to their parents in 08 and they don’t trust the system of traditional investments.

Recently Goldman Sachs published a report noting the antiwork movement (which is comprised of people of all ages) which could threaten the long term labor force.

I’m always interested in what the young folk around me are saying, doing, thinking because I’ve learned that demographics are one of the biggest driving forces behind long term market patterns.

I’m going out on a limb and predict that the young generation is going to discover the value of what they now still call “boomer rocks” (gold).

If stocks, bonds and crypto evaporate into oblivion, what are they going to trust after that? Back to the basics.

The funny thing is that with vaulted physical gold now tradable on the blockchain and spendable as money, some crypto folks are now starting to see it as just another “crypto”, though one that is more stable.

Most of the 10,000+ crypto currencies are crap, but the blockchain technology that has emerged from it is very useful for facilitating transactions in real stuff (like gold).

I think this will effectively reintroduce the gold standard. Not because the government does it (unlikely), but because people themselves will embrace gold currencies because they offer stable and reliable value and are just as easy to use as fiat.

I don’t understand why gold backed crypto hasn’t taken off more than anything. It would be such a perfect answer and has all the benefits of crypto … but with actual value backing it up! Perfect!

I like the Warren Buffett analogy that their job as a manager is to be a good swimmer no matter if the tide is going in or out.

Same is true of life. Your job is to try to achieve your goals. Sometimes the economic tides are against you and sometimes they help you.

I still remember a young black guy that came to our upper middle class neighborhood cold calling on home owners to see if they needed their gutters cleaned out. You got to try to make it happen

I feel like this will either end with an everything crash or hyperinflation, but how do we know which one is more likely to happen? I really do not like the thought of living through Weinmer, Zimbabwe, or Venezuela style inflation, and would vote for a crash if given the choice.

What you should be worried about are the political ramifications of a Wiemar because it’s coming to a town and city near you. National socialism is rising in Germany and going global.

Complete with a demand for one religion.

Climate Death Cult?

“The Rise and Fall of the Third Reich” was published about 60 years ago. I suppose there are not many Americans around who have actually read the book. But I would certainly recommend Chapter 3: “Versailles, Weimar and the Beer Hall Putsch”. (Yes, Weimar is spelled ei not ie).

I have an original copy in excellent condition purchased at Goodwill for $2. Misspelled to avoid censors, can’t talk about the Bavarian without it being suppressed. Funny how he is still the most written about historical figure by far.

Austrian. Not Bavarian.

He was such a heinous figure that I don’t allow his name to appear on this site. And I certainly don’t allow the numerous off-handed ridiculous parallels people like to draw between some living figure and him. These kinds of comparisons make him look cute.

If you try to dodge the “censors,” you’re making my life harder, and soon ALL of your posts will go into moderation. Stick to the commenting guidelines, no war mongering, no Hitler-ing, no-Nazi-nothing, and I’m not interested in anyone’s version of history.

Here are the commenting guidelines. You may want to review them:

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

‘Weimar and the Beer Hall Putsch”.

Does the Putsch ‘coupe or attempt to overthrow the govt’ remind you of anything?

Nick,

It reminds me that unnecessary govt overreach turned the Bavarian into a major political figure.

The current pursuit of Mr. Bannon is going to catapult him into the WH in the future. I don’t know why the dims can’t see that.

WR: I didn’t know you banned mention of the name. You can either delete my comment or change name to he and his. Actually just pls delete but I must mention that all historians agree that his sentence was a slap on the wrist.

I took a college history class on the Third Reich.. Had a great teacher who covered the subject well. We had to read a biography about one of the female prison camps. One of the university’s teachers had been in there when young.

She stopped by the class and talked about it. I can still see her ID number tattooed on her arm. Made it very real to us spoiled kids

For the people who have been around longer than me and have experienced more highs and lows. When stocks tank is there a scenario that has existed in the past where it did not take housing down with it? The consensus among Real Estate agents I have talked to lately is that this RE market has 3 to 5 more years to run.

Look up “Case Shiller Index” at Wiki.

Baseline is 1890 = 100

Then overlay it with a stock prices chart from the same period.

Fed has S&P-Case Shiller Index chart too but it is conveniently truncated at the left.And one gets the impression that house prices only soar (surge,skyrocket,whatever).

Housing didn’t used to be leveraged much. Now with excessive leverage housing is a risk asset like stocks. Is there any asset that hasn’t been made a risk asset?

Gold ?

Probably because all Central Banks & Big Operators try their best to make gold appear obsolete and irrelevant.

Hence its price gently fluctuates around $1800 per troy oz mark.After reaching ATH of $860 in the late 70’s then All Time Low of $260 in the early 00’s and again ATH of $2600 a couple of years ago.

As long rates stay low, it’s safe to go!

In “modern times”, it’s only happened in the 1930’s and 2008.

“The consensus among Real Estate agents I have talked to lately is that this RE market has 3 to 5 more years to run.”

Red, that is the funniest thing I’ve heard in a long time. Systemic delusion!

Let’s see a couple of upticks in the 30yr…

Fannie and Freddie backing mortgages up to $1 Million…

I can hear the keys being thrown in the mail box as I type…..

People who have mortgages at these low rates won’t be mailing in any keys if future rates go up.

House sales and new mortgages will slow.

Those who have debt will be pretty happy.

josap, you’re forgetting the fact that if future rates go up, the values of their houses tank. they are incentivized to walk away. many did in 2009, and i don’t see any reason to think they won’t do it again.

Do they even sense that the real estate market is broken …. and the Fed did it?

The Fed buys MBSs, lending money to the mortgage industry, 3% below current inflation. NEVER EVER happened before….and who else would do such a thing….and why?

And people in their homes CAN sell their largest hard asset in an inflation…..nor can they find a place to live if they did.

should read CAN NOT sell their largest hard asset in an inflation

Red – all real estate is local. When the dot-com bubble crashed in 2000-2001, the national housing market was okay but the SF Bay Area market tanked. When the 1990 recession hit, and then the post-cold-war “peace dividend” (MIC downsizing) took place, the national housing market was okay but the LA area market was hit hard. In the mid-1980s the national housing market was okay but the “oil patch” state economies were all hammered by the oil bust, with house prices dropping calamitously as jobs disappeared and people fled the area.

It’s hard to say what will happen in the next crash, but it’s an Everything Bubble and everything is more tightly coupled than it used to be. I’d guess that most people saving up to buy a house are using the stock market to try to get enough for a downpayment. So if the stock market drops the down payments go away and the buyers at the bottom end are gone. If the stock market drops as interest rates also rise, it’s a double-whammy for housing. But if this happens in the context of strong wage growth (which in my mind is not necessarily inflation, but a reversion to the mean in terms of wages/GDP), that’s a different scenario than the market has seen since the 1970s. There might also be a strong preference shift from stocks/bonds to real assets which could favor housing.

“It’s difficult to make predictions, especially about the future.” – Yogi Berra

If you come to a fork in the stock market, take it.

“A nickel ain’t worth a dime anymore.”

All real estate is local true. But this time real estate is high because of cheap money.

If the rates spike up all real restate.would be impacted.

The rate won’t hike only for certain locations.

In the 1960-70’s real estate was rising very slowly, it was never in decline in good areas, while the stock market was dead. In places where industry was disappearing, it was in a bad decline, coal, steel, rail, and auto regions.

“Staples Center is getting a new name for Christmas: Crypto.com Arena.

The downtown Los Angeles venue — home of the Lakers, Clippers, Kings and Sparks — will wear the new name for 20 years …” LA Times, 11/16

See, nothing’s going to happen to cryptos in the next 20 years – 20 YEARS! I can’t see what could possibly go wrong…

Are not cryptos plummeting right now according to Coindesk

20 – all of them,with only one exception ?

Or it is just a preparation for the next ruthless round of soaring ?

Well, the root word of crypto is ‘cry’.

Or crypt.

They gonna get me one way or another.And they did.

After BTC started fluctuating wildly I keep all my cryptos in form of USDC which is kept on par with USD.

Last year transaction fees were 35-38 cents.Yesterday they skyrocketed to $9.USDC is piggybacking on Ethereum and fees are the same.

F… them all

Brent, it’s always about the FEES!

@Anthony A.

Yeah,they fooled me big time…

It was my firm conviction that crypto fees should be very low or non-existent…

Back in the good old days (2012-13) I stared in wild wonder at the 13 cents BTC transaction fee. WTF ??? And always chose the zero fee option.I am in no rush… I can wait 4 hours to be icluded in the BTC block…

So much for my firm convictions 😁

Crypt “ooooooh” no

Minute Maid Park in Houston was named Enron Field before the flame out. Stadium names are easily changed.

Mile High stadium in Denver is on its 4th name in 20 years, 2 of the 3 previous names went bankrupt (Invesco and Sports Authority)

There’s a lesson to be learned in there. Nah, ain’t gonna happen.

How about The FED Arena?

If that’s true, that might be a sign of the top in Bitcoin. It’s kind of funny how we get so excited about new technology in digital age. Think about how small they are compared to indoor plumbing or electricity or automobile.

VIX has been rising since 2018. The put call ratio is also very low which is bearish, meaning more call buyers. The VIX can rise along with stocks and did so in the late 90’s but this current rise is quite a ways along. After 99′ the VIX went sideways during the stock market correction. VIX does have a tendency to trend and right now its trending higher. Something will happen.

Let’s see how AI and program algos get out of this one if it rolls over….

If you’re on the sidelines, in cash, and looking for an entry point to go long, wait for the day of weeping and gnashing of teeth, the day when the S&P pierces the 666 bottom and closes on the day’s low.

Last time Buffet wrote an article in the Wall Street journal telling you when to go in. I think he missed bottom by a month or two. He might be dead by the time bottom rolls around.

It’s easier if you have a perpetual holding period like Buffet though. When things fall below 100 year trend line you might as well buy.

Now, on to the Accounting game that is pro salaries, and depreciated contracts, in conjunction with expensed salaries…

and to pro golf purses written off as Charity and Advertising…

I invest in the stock market, but I never go on margin.

Buffet advice to retail investors. Following these two rules has saved me from wipe out. Never short. Never buy on margin. I have been tempted, but I thought he knows more than me.

I was tempted to short Tesla at $200, but thankfully had his wisdom in my ear.

I was tempted to use a levered index before tech bust. Dodge a bullet.

Another good truism. It feels best just before it is over.

“He who sells what isn’t his’n

Must buy it back or go to pris’n”

– “Reminiscences of a Stock Operator”

Meanwhile, Weimar Boy Powell is STILL pumping $105 BILLION per month in QE. This guy is a deranged, dangerous financial terrorist who should be stopped at any and all cost.

Well, DC, the ball is in your court!

MT

Barking dogs don’t bite.

Have you been out yappin’, sniffin’ crotches again?

The carpenter is back.

The onus is on CONgress, not me. The clock is ticking, and the longer they allow this the worse it will be. It’s an emergency that they’re willfully ignoring – or too stupid to recognize. Regardless, the fate of the entire country is at stake.

correct. while the failure of government at every level would justify an uprising: “that whenever any form of government becomes destructive to these ends, it is the right of the people to alter or to abolish it,” there isn’t the political support for it now.

Love your service. Sent a check by mail.

Keep up the fine work!

Wouldn’t a sideways market be enough to crush a lot of the call buyers? May not even need a crash.

I think it will happen like Mississippi bubble. Some people went over and said this swamp land isn’t worth squat and went back and told the truth.

Somebody important is going to tell the truth and it’s all going to be over.

I have to say that this may not be as big a disaster as it looks… and it LOOKS bad!

But the younger people that I know who are “playing around” in the market (Crypto, Reddit, etc.) are just using Fun Money to do it with. They have been cooped up from the Pandemic and this is something they can do at home on their computers. I doubt they will be devastated if the market tanks.

BUT THE REST OF AMERICA will not be so lucky. As other WolfStreet commenters have pointed out, pension funds and 401Ks are relying on stock market gains to make up for lost bond yields. WHEN the stock market tanks the young people who are “playing around” right now are not coming back. So it is hard to see what moves the stock market higher after it tanks… because there won’t be any Millennial support for a decade or so.

Some of you with kids in their 20s and 30s might want to query them and see if what I am saying holds up. Fun Money or Rent Money?

An entire generation has been taught to BORROW and not SAVE…

Starting with college debt, and maybe ending with margin debt

The Fed has misdirected people, a cattle drive of sorts….and we know what happens at the end of a cattle drive…

the cowboys get drunk and the cattle slaughtered

And the bartender (Wall Street) goes home wealthy and well fed ?

My 25 year old daughter is keen to chase yield in the stock market….I’ve tried to dissuade her from jumping in now….they need to buy a home (at the worst time in recorded history) 🙄 to get out from under rent payments

The young generation has only known a roaring stock market in which every small dip is consistently backstopped, so the collapse is going to be a real shock.

Fortunately for them, they have little to lose and a lot of time to rebuild afterwards. If I was 25, I would wish for a collapse asap.

No, cheap energy is running out. By 2030 there will be real resource constraints. Young people will also bear the brunt of global warming.

WTP,

Try to explain risk management…

And that if she risks it, she better be prepared to lose the last few years of her life and start over from zero ( or worse) again…

If she’s willing to risk it, then go for it…

The internet is not as smart as the younger folks think it is…

Except for this little corner :)

Any major asset crash will not happen in a vacuum. It’s not like a neutron bomb where the financial system will implode but the real economy will remain mostly unaffected.

An actual end of the mania (as opposed to early 2000, the GFC or COVID last year) will be followed by a massive economic depression. If the government can’t keep the markets from crashing and it doesn’t come close to full recovery, they won’t be able to stop a depression and noticeably declining living standards either.

I anticipate the same formula since WWII will be tried (on steroids) with massive deficit spending but it will be even less effective at some point than it is now.

It will matter a lot even to those who have little wealth. They will almost certainly be worse off than those who do precisely because they have almost no property.

The FED is political, the want to change Society and have done.

They have encouraged mass reckless speculation, migration, homelessness, massive wealth in-equality, social rioting, debt slavery….. whilst letting Wall Street gorge on money, bonuses, whilst stealing from the old and prudent in society. They should all be in jail.

The trouble is that they have the keys to the jail cells.

Under its watch, the Fed has inflated the biggest asset price bubbles of all time. Housing is now unaffordable for a whole generation, investors are forced to take risks they done want to, pension funds have no hope of meeting their future required rate of return, wealth inequality has grown to unconscionable levels.

Yet the Fed identified China housing as a systemic risk to the US economy. One of the worst examples of deflecting blame and refusing to take any responsibility for their own problems in the history of financial markets.

You can take all kind of risks when you are messing with other people’s savings.

During the hyperinflation of Wiemar Germany, and later Nazi Germany, shares still held their value better than the currency which became worthless.

In the case of the USA, do you think an deflationary depression is going to occur (like the “great depression”), or an inflationary collapse (like countless African and South American countries)?

I’m betting the USA is going to act “American” and go the way of hyperinflation and currency collapse.

“During the hyperinflation of Wiemar Germany, and later Nazi Germany, shares still held their value better than the currency which became worthless.”

In Weimar, shares first lost about 80% of their value in the (very) high inflation period before it turned into true hyperinflation.

It was said at the low point in the German stock market you could have bought the Mercedes-Benz company for the price of about 400 of its cars.

How about a combination of both?

My prediction is an asset crash first which will cause a credit contraction followed by spiking prices.

Absent a major war or natural disaster, there won’t be anything close to Weimar style hyperinflation in the US any time soon.

The US is a credit based financial system and most “money” is debt. With current leverage and debt levels, no one can prevent credit deflation from happening first.

Moreover, no one can make it happen (the FRB is not a person) and no one with any influence has any motive to do so anyway. The real world is not populated by economic robots who are going to just stand around while the FRB “prints to infinity”, as even a hint of it would cause a credit collapse first.

I am trying to do exactly opposite of what Fed wants me to do. Have no debt. Live modestly. Have oodles of savings and have precious metals and a gold miner. It’s hopefully going to survive more of the same or deflation or high inflation.

A “potentially destabilizing outcome could emerge”???

No, the destabilization comes with altitude. A boulder balanced at the top of a mountain peak is already unstable. It doesn’t become unstable as a result of rolling downhill.

This whole “Build Back Broke People” plan this administration has undertaken is an epic failure. I feel so bad for young people in this country. Twice in the past week while traveling I have been at the fuel station and had a young man comment to me on the spiking prices. I can tell they’re really hurting. I consider all of the politicians and central bankers who have created this situation to be pure scvm of the earth, not even worthy of the spit in my mouth.

It’s been how many days since the infrastructure bill passed?

BBB hasn’t passed yet. Not sure what bad deeds have been done as of today.

All the politicians have their eyes on Xmas vacations. Nothing done for a good while.

Explain exactly how the infrastructure bill is causing soaring gas prices.

That’s easy. Brokeback Boy is in office, with his Build Back Broke People rhetoric.

At least the margin spikes which precede market corrections / crashes seem to allow some amount of time to liquidate.

This one comes down on/about Nov 2022 and not because of political elections. Historical math. Should be good times until then.

It’s all momentum nowadays. The markets seem flooded with liquidity and the music is still playing. Maybe someday fundamentals will matter again but I’ve never seem such ridiculousness. Hail to the lesser fool though the amount of people that are going to be hurt is maddening.

Good info though the charts are not log format and there are none with ratios (not sure what would be a good ratio to put these raw figures against, to gdp maybe?) so it can be a bit unclear how bad (or not) really this all is.

That would help put all these big numbers in perspective.

Thank you, a great report!

On top of this gargantuan margin debt, there are a few new dynamics in play now that could make things even worse.

Remember the meme stocks on Wallstreetbets reddit that pushed a few hedge funds over the edge? (helped by other hedge funds that joined the reddit “apes”). A social media craze that inflicted billions of dollars of losses on some hedge funds….

What if these guys not only sell their stocks but actively starts SHORTING the markets, or specific vulnerable parts of it? (junk bond ETFs for example). The “apes” themselves probably don’t have the muscle to move the markets by themselves, but hedge funds that smell blood have. And they will likely join in, like the previous time. A new social media craze will let it snowball. This is new dynamics that wasn’t there in previous crises. I’m not saying this will happen, but it could. Many on reddit have a zeal to bring the system down, because they feel they have little to lose themselves and the only way to get ahead is a moonshot, which shorting an obvious marker bubble could provide.

Another underappreciated risk could be crypto. It now has a total market cap of $2.6T (!). If that bubble collapses, will it cause contagion? I don’t know how much crypto is bought directly on margin, but if people think it represents real wealth, they will have been more comfortable taking on other debt, which then becomes problematic.

The difference with the stock market bubble is that crypto routinely loses 80% every now and then, and that there is no expectation of the Fed backstopping it. It is a bit of a parallel universe, but $2.6T evaporating must have some real world effects. It could be a pretty heavy domino when it falls.

Hm, I don’t think there’s 2.6T invested in Crypto. It’s all marginal. Say there’s 50 crypto coins out there. If someone were to sell one at a higher valuation than the last, then the other 49 are magically granted the same valuation. That however does not mean that everyone bought in at the highest valuation.

The greater issue is leverage, but that’s true across asset markets.

How will investors play the seasonal COVID resurgence in the USA and around the world? Austria a harbinger of things to come? Lockdowns on the way? More stimmies? Already the price of oil seems to be on the retreat.

There are 32 year old stock brokers who have never seen a Bear Market

(Covid sell off excluded)

And an entire generation has been taught to borrow and not save.

Both due to Fed policy….an unelected cabal who taxes us (promote inflation) though we have no representation with them.

They “digitally mint” in degrees never conceived of before, and outside the realm and duty of the temporary calming of markets, instead in promoting markets.

Taxing and minting are Congressional powers and may not be delegated.

In my mind, every investment must be able to weather a severe recession without going bankrupt or needing a bailout. Everything else is just excessive risk taking.