More signs of a move from the cities to the suburbs? Supply of houses is tight; condos are piling up.

By Wolf Richter for WOLF STREET.

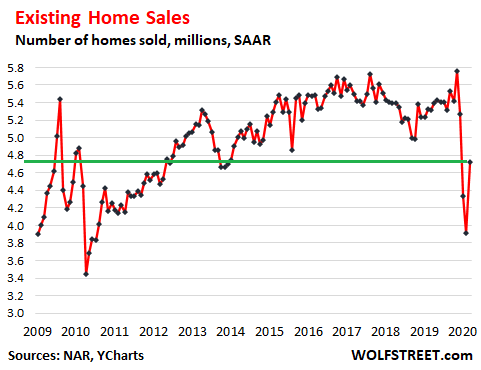

Sales of existing homes (closed transactions of single-family houses, townhomes, condos, and co-ops) in June fell 11.3% compared to June last year, to a “seasonally adjusted annual rate” of 4.72 million homes, according to the National Association of Realtors. Sales were down 18% from the recent peak in February. On a month-to-month basis, sales bounced off 20.7% from the historic lockdown-low in May (historic data via YCharts):

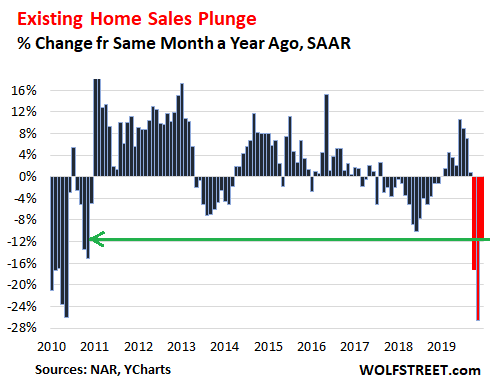

The 11.3% year-over-year drop in the seasonally adjusted annual rate of sales was the sharpest drop, after the plunges in April and May, since April 2011 (historic data via YCharts):

Sales fell in all regions, compared to June last year:

- Northeast: -27.9%

- Midwest: -13.4%

- South: -4.0%

- West: -13.6%

Condo sales in deep trouble, house sales drop less, compared to June last year:

- Single-family houses: -9% year-over-year, to 4.28 million units seasonally adjusted annual rate.

- Condos and co-ops: -22.8% year-over-year to 440,000 units seasonally adjusted annual rate.

From the big cities to the suburbs?

This is a theme that is now propagated widely, and anecdotal evidence has been accumulating to support it, including the continued massive weakness in condo sales (-22.8% year-over-year in June after having plunged 41% in May). These “closed sales” in June reflect contracts signed largely in May and April, so it’s early to draw conclusion about a long-term trend.

The NAR report also mentions this from-the-city-to-the-suburb theme as a possibility:

“Homebuyers considering a move to the suburbs is a growing possibility after a decade of urban downtown revival. Greater work-from-home options and flexibility will likely remain beyond the virus and any forthcoming vaccine.”

There had been a huge surge over those ten years in high-rise construction in city centers – condos and apartments, and mostly higher-end. High-density living has its advantages, including short or no commutes, being close to lots of things to do, particularly in lively walkable city cores. High-rise living can also offer panoramic views.

But the pandemic has shed a very different light on this type of living arrangement, and it makes intuitive sense to see a move from the city centers to the suburbs, especially now with commutes no longer being an issue for some people as they have switched to work-from-home, with the expectation that this will largely remain in place going forward.

Prices rise for single-family houses, barely tick up for condos.

The median price of all types of homes – meaning half sold for more and half sold for less – rose 3.5% from a year ago to $295,000.

- Single-family houses: +3.5% to $298,000.

- Condos and co-ops: +1.4% to $262,700.

Inventory of houses is tight, but condos are piling up.

Unsold inventory of homes that are for sale and that haven’t been pulled off the market yet ticked up in June from May to 1.57 million homes, but remains 18% below where it was in June last year. Potential sellers are still not putting their properties on the market, given the uncertainties, the issues related to showing a home during a pandemic, the facts of forbearance that over 8 million homeowners have entered into, and other considerations.

But in some markets, this is now changing. For example, in San Francisco, a flood of homes has come on the market, and inventories have ballooned to the highest levels since the housing bust.

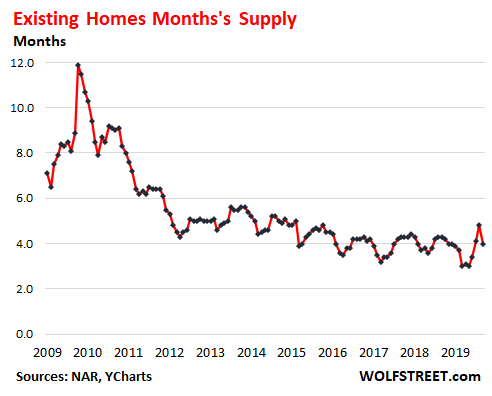

Supply of all types of homes for sale at the current rate of sales ticked down to 4.0 months, from 4.8 months in May, and from 4.3 months in June last year, thereby returning into the range of the past few years. But there is now large divergence between supply of single-family houses and condos:

- Supply of single-family houses: 3.8 months

- Supply of condos: 5.3 months.

In San Francisco, sellers are suddenly coming out of the woodwork. And the housing market is having a moment. Read... “Pent-up Supply” Floods San Francisco Housing Market, Most Since Housing Bust

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In Canada, the real estate scammers are using data from higher priced listings to state that all real estate went up from Re/max data. So all housing prices are now higher everywhere .

By $177 per day in 2020

Sorry, it’s $117/day in 2020.

Try pricing that in real money Gold Not funny money which is headed to worthless very quickly It won’t look so great I assure you

I went through this in the late 70s with high inflation Thought I was getting rich flipping real estate but actually all I was doing was keeping up with inflation It’s an illusion of wealth

Meanwhile my silver hoard is up 18% in less than a week

I also remember the 70s inflation. But this time there ain’t gonna be no Paul Volker raising interest rates to 12% to stop the price spiral. And I also still have my silver hoard from those years. Maybe those silver dimes and quarters I separated from my change will finally pay off after 50 years.

SLV is now on the Robintrack top 20 for popularity changes. They’re buying into the hype created by salesmen promising riches.

Is there any way to determine how many of these condos are Airbnb? Makes sense that many of them are. No visitors…gotta unload the payments through a sale.

Another factor affecting downtown real estate sales/values are the recent demonstrations/riots/looting/social unrest. Would you want to live in downtown Seattle or Portland in this environment? No thanks.

I wouldn’t want to live in those places at any time to be honest but I guess that’s just one mans opinion

Poland or Hungary are my favs lately

Vietnam has gotten attention lately, from non corporate outlets. A nation that follows policy that benefits it’s people instead of corporate and the rich, so expect the media to ignore it. It’s becoming a retirement destination I hear in part due to high quality low cost healthcare. And their a world showcase near or at top in handling Covid. Real estate still affordable but word is spreading and that’s changing.

“Real estate still affordable but word is spreading and that’s changing.”

Really?

A foreigner can buy and own real estate in Vietnam?

Foreigners create a legal entity to buy the real estate. Another thing about Vietnam is that it’s a fairly young country. The West killed much of its would be 65+ population back in the day.

Foreigners can ‘buy’ real estate in Vientnam, but they don’t own it.

They lease it for 50 years and then can renew the lease again.

Thanks, but no thanks regardless of the prices.

Vietnam follows policies that benefit it’s people? Is this the same country from which came those people who were found suffocated to death in the back of a coyote driven truck in South England in Fall 2019? These victims, whose parents back home were too scared to talk about their dead loved ones forr fear of retribution by the communist government / police?

“You can trust a communist, to be a communist.”

timbers: here’s a useful country / govt guide.

If you see people desperately clinging to helicopter landing gear in order to leave a country

or

if you see people being shot for attempting to leave a country….

it’s probably a bad country with a bad govt.

If you see a country that people will risk their lives to get into, it’s probably a relatively good country with a relatively good govt.

If the bold type at the top says, “We love you, everyone is equal, everything is free! Welcome!” but the tiny type at the bottom says “You can never leave, millions slaughtered”, it’s probably a place run by bad people.

If you believe this information to be incorrect, please by all means, go out in the field and report back your findings.

At least Poland and Hungary still believe and seem to be fighting for traditional values, at least for now…

Finland is not fighting for any values. They are just the norm of life :) Average real estate is very affordable. Health care is free for all.

Yes, and so is Russia.

lmao “traditional values” aka scared of change and need a daddy authoritarian figure to make them feel better. the most cucked of populaces

To Neplusultra: in latin this literally means “no more beyond” (I took 3 years of Latin). So, by your own nom de plume, going “beyond” tradition suggests disaster for society. In fact, in this “anything goes society” the fate similiar to that of the dodo bird is not far off. History has proven this over the millenia. You are not doing honor to your name !!!

I was in the biggest u-haul store in the western suburbs of Portland yesterday getting some boxes. For the last 7 years or so this store has had a glut of trucks and boxes as it has been on the inbound end of one way moves from everywhere else. Yesterday the box showroom looked like one of the grocery stores they stumble on to in the tv show , ” The Walking Dead.” Could only get a few boxes, less than I needed. I asked the dude behind the counter, ” is the shortage from supply or demand.” Not be an economist he answered, ” we are getting huge shipments in everyday dude.” Then I asked if his one way rentals were mostly inbound or outbound and he answered, ” almost all outbound dude.” I guess that solves the box mystery.

On Cape Cod, I have heard from brokers that June was an all time record for sales volume. Several houses in my area which have been on and off the market for years have finally found buyers. Now not much inventory left and I hear lots of buyers looking.

As for the urban shift, I believe COVID is just accelerating an inevitable trend of Millennials moving to the suburbs as they start to have families. Having spent most of my adult life in large cities, I have noticed when people get into their thirties there seems to be a natural progression from urban life to suburban. I have noticed it with all my peers and I ultimately made the move myself.

I see some headwinds for condos and rental properties in city centers. For several years now, Boston seemed to have no shortage of rental properties available. I have spoken with real estate investors about this and the back up plan for many of these rental properties is to flip them into condos as Millennial renters accumulate some savings to become property owners. A different back up plan might be needed now.

“As for the urban shift, I believe COVID is just accelerating an inevitable trend of Millennials moving to the suburbs as they start to have families. Having spent most of my adult life in large cities, I have noticed when people get into their thirties there seems to be a natural progression from urban life to suburban. I have noticed it with all my peers and I ultimately made the move myself.”

This is obvious to anyone with 1/2 a brain. But the MSM was convinced that millenials would live in downtown lofts forever. Remember all those MILLENIALS ARE CHANGING X articles? The premise was that millenials would stay 27 forever. They’d never marry, never have kids, never do anything other than live in condos, drink $15 craft beer and eat at overpriced “fusion” restaurants. Funny how all that changes when you hit 35 huh?

The only real difference between millenials and GenX/Boomers is they waited a bit longer for the transition. My friends started getting married having kids and buying houses in their late 20s or early 30s. Millenials did it in their mid 30s. It was delayed a few years but the path is still the same.

With how long it takes to graduate from university and pay loans? It makes sense. Getting married when you just graduated and still owe a lot of money is really stupid. And if you do not have a university degree, just an equivalent one then it just takes longer to get enough money to consid6 marriage to ge a thing you can afford.

Wonder how sea side communities will fair market wise that are considered desirable but are highly compressed, like Ptown or my previous neighborhood in Quincy’s Hough’s Neck.

Wolf,

Hmm…CA sales volume was off 39% yoy in May…we’ll see the June report in 2.5 weeks…

https://journal.firsttuesday.us/home-sales-volume-and-price-peaks/692/

Methodologies, reporting areas, and reporting periods differ, but my guess is that the NAR errs on the “bag of baloney” side.

A person has to have a very, very, very sunny view of the economic implications of more or less shutting down the US economy for 3+ months to be wading into the leveraged money world of SFH right now…

Hell, even the Vegas compulsive gambler market is estimated to be 40% off in June…

Completely different headline at happy fun-time Barrons;

“Existing-Home Sales Leapt 21% in June. Expect More Gains”

“Sales of previously owned homes surged 21% in June from a month earlier, to a seasonally adjusted annual rate of 4.72 million, the National Association of Realtors said Wednesday. That’s a record pace as sales snapped a three-month stretch of declines as mortgage rates tumble”.

And interest rates are going nowhere until 2023,…

“As the Federal Reserve continues to offer extraordinary accommodation in order to help the U.S. economy bounce back from pandemic-driven shutdowns and weather the health crisis that lingers, Fed Chairman Jerome Powell has said he wouldn’t even think about raising interest rates until 2023”.

Gold and silver are doing great right now.

That’s where the importance of checking YoY vs MoM comes into play. Different stories with the “same data” (sales from X ago). More months are likely needed to see if it’s just a cooling period vs. a potential trend change. (seems unlikely given how badly the US screwed the pooch on coronavirus response)

It seems that downtown living is not very safe anymore. However, most people still have to go to work instead of working from home. Gas will be likely very expensive once economy recovers. In addition, there are usually more single family houses in suburbs. Property taxes are likely on the rise. Suburban life may not be affordable in a few years.

I plan to buy a house in the next couple of years. It is difficult to decide where to buy.

Rents in NYC are now being quoted by number of bedrooms. A $3000 three bedroom will be quoted as $1000 per roommate. Nice of them to do the math for you.

It’s a sign of the times, they know families can’t afford these apts unless they have multiple incomes. BTW, a $3000 three bedroom in NYC is now considered cheap. Don’t expect a good neighborhood for that money.

I seem to have lost my copy of the constitution. Can you point out which section says everyone is guaranteed to live in an apartment in Manhattan, roommate free, if they so choose?

I mean come on dude. Living with roommates in NYC has been going on forever. It’s not a sign of the times. I lived there 20-ish years ago right after college (Jesus I’m getting old) and guess what? I had a roommate. And I was making pretty good money at that time. Everyone in my circle of friends/co-workers had roommates. It was just the way it was. Only difference was nobody whined about it like they do today.

Don’t get your panties in a twist. I was simply pointing out that the landlords are going out of their way to obscure the actual rent.

When I lived in NYC, we could always afford the rent on one income and landlords didn’t lie. The rent was just higher than everywhere else.

“landlords didn’t lie”

Who is anyone lying? $3K for a 3 bedroom is $1K per roommate is it not?

It’s like car ads that say $350/mo instead of $30K. It’s not lying, it’s recognition of the fact the vast majority of people buy based on payment vs buying based on the price. And it’s the same in NYC. The vast majority of people have roommates so it makes sense to advertize the cost per roommate since that is what most people care about, their share of the rent, not the total cost.

JSRG,

Actually, I’ve seen videos where they do just that. They quote the fractional rate, then later explain it as they show the apt.

“Only difference was nobody whined about it like they do today.”

Well, I am going to call BS on this part at least…insanely high rents have been a central obsession of adult NYC conversations since time immemorial…

“A $3000 three bedroom will be quoted as $1000 per roommate.”

Wait until they start quoting it by individual limb…a “mere $500 per leg”

The whole hyped up, hothouse NYC renting ecosystem (broker’s fees, conduits for kickbacks, were only eliminated…this year…) appears fairly insane to the rest of the US…sans SF.

I don’t care what they outlaw. In NYC you don’t get a good apt without paying key money to somebody.

An architect friend is working on some luxury apartments that are designed for multi-millennial living. Three master bedrooms w/ common kitchen. Each rented separately. I call these match.com apartments.

Or, Covid Collectors.

I think they call that student housing.

Yes, I’m just outside the city in Nassau and $3350 gets a dark, small 2 bedroom at about 1000 sf. Can’t wait to leave that crapy, dirty, overcrowded, crime ridden sh@!hole called NYC

“On a month-to-month basis, sales bounced off 20.7% from the historic lockdown-low in May (historic data via YCharts):”

This is the highest percent growth ever, or at least since this metric has been tracked. Talk about burying the lede!

I can tell you anecdotally in my burg, June and July have been ridiculous for real estate. One example, my neighbor across the street listed his house about this time last year. I thought it was really over priced. And I was right, it ended up not selling. A couple of streets over, essentially the same house was listed for 10% more and it went pending in a few days. This just recently happened, in early July.

The low end, anything under $500K is sold in a matter of hours if not days.

Dear Penthouse…

The dark NAR PR flack/troll JSRG grasped me roughly in his embrace…culminating my home sale in a matter of minutes…over and over again…

“Pay no attention to the documented 40% April sales decline in California,” he rasped, “We make our own world!”

I bet housing prices will rise 50-100% in the next couple of years. The writing is on the wall, that’s why everyone is buying now. Interest rates can only go lower because the alternative is not politically feasible. All of the excess PPP and stimulus money goes directly into housing and stocks, the only two viable investments.

50-100% is nothing if the value of the Dollar is cut in half from here onwards.

Food inflation alone will hurt a lot of people.

Plant a garden……………

Yeah, they were planting arugula in CHAZ.

US Real estate is worth around $35 trillion, same as the stock market, or about $100,000 for every man, woman, and child. I often see the statistic that the average adult in the US is worth $400,000, which seems about right. When the markets double in value and you double your wealth, you have gained nothing. The only way you make progress is by increasing your percentage of the total. If you’re starting out with significantly less than $400,000 and you think we might be in the late stages of a financial Ponzi game, it might be in your interest to just quit working and say “forget it, I’m not playing a game where the odds are stacked against me. I’m not working anymore, just give me my UBI.”

CA SFH home sales volumes fell by 40% plus from 2006 to any time after 2006…during max ZIRP.

So, should we expect 25% of 2006 volume during Uber ZIRP 2020?

I predict median CA home prices of $50,000,000 due to low, low rates…of course, only one house will have sold…but it will still be the median!!.

When the inevitable taxes go up in CA. The value of everything in CA will fall.

Should they repeal prop 13, housing values would collapse, and they would be right back where they started.

Bingo. Although I disagree with your timing.

Zillow is showing 240 combined foreclosures and pre-foreclosures in my area. We are supposed to be one of the hottest housing markets in the country. I am seeing lower prices and reduced prices on a lot of properties and many over 180 on market

Where? Just curious.

Closing on a nice existing home outside Frisco Tx and considering the high $$$$$ in the surrounding area, I feel fortunate to get it for the very low 300’s. Finally able to recover from the home loss that occurred in the Great Recession of 08, and not paying rent anymore.

It would be interesting to see exactly how many open units are left in all of these SF condos. If that hasn’t started already, there is going to be tremendous pressure to lower these prices on unsold units. After all, the developers can’t afford to sit on those forever.

But I don’t know if that’ll bring in buyers. People will tend to think there is always more to drop the second the first drop happens. Then it might end up prolonging the cycle since no one wants to buy and then see their property value decrease because the developer couldn’t get enough buyers. (yes, it is just a home to live in, but I don’t know how many people will see it that way)

I also wonder what this means for the Treasure Island development project. Guessing that’s on hold or cancelled.

Add in the mix of what this could do to property taxes in the city, it’s going to be a very dynamic situation. Like I said before, perhaps the city could start considering buying some of these condos and turning them into below market rate housing (given all of the constant inequality talk that comes out the SF city council, I’m surprised none has floated this idea yet) or may be just pass ordinance to force the developers to do so.

I wonder what happens if the developers just decide to walk away from some of these unfinished projects.

MCH,

In case you haven’t seen this yet…

Bay Area condo median prices, June, % changes from year ago, by county:

San Francisco: -6.6%

San Mateo: -7.8%

Santa Clara: -10.9%

Contra Costa: -4.8%

Alameda: -1.5%

Talking about specific projects, our own Pisa Tower must be worth zero right now.

I feel sorry for people who were bamboozled into buying a unit in our soon-to-be tourist attraction. This has been an incredible nightmare. I’d just let the bank have it (in our non-recourse state).

I confirm. I watch Santa Clara townhouse prices (are those lumped in with condos?) and they have dropped since last year, and appear to still be dropping. They’re back at 2016 values now for the most part.

Thanks Wolf, that data on condo is particularly interesting. May I ask where the data came from?

The highest drop is in San Mateo and Santa Clara counties, technically the heart of silicon valley. (ok, technically, Santa Clara county is the heart, and San Mateo just connects it to SF, but San Mateo has a whole swath of high tech and biotech companies, including Oracle, Visa, Gilead, EA, and whole bunch of others)

This seem to indicate that the valley is suffering even more than SF, which is interesting, since SC and SM could be considered much more suburban. But as has been pointed out previously, one could move to Monterey or Santa Cruz and get away from the valley traffic and rat race.

SC county has been hit harder by C19, and has had a bunch of BLM protest hit it a while back. SM is not surprising considering how many condos they’ve erected along the tracks with Caltrain. Amazingly, there are still empty lot at this juncture. I am guess Alameda and Contra Costa are probably holding up because their prices didn’t go bonkers in the first place.

https://car.sharefile.com/share/view/s8819b5087854989b

Thank you Wolf. Glad to see that we can get reliable source of data.

Condos are rarely if ever a good investment. You don’t really own anything and with the astronomical Condo/HOA fees thrown down the toiler veery month, you might as well rent.

My view is always rent apartments buy houses. Buying apartments makes zero sense.

To me the fees are less of the issue; it’s more that you have to follow the condo association’s stupid rules and get their permission to do anything in your unit.

I always say that condos are all of the responsibility and risk of home ownership with none of the benefits.

My brother and his wife bought a $150k lot and built a small $350k house on stilts near the beach. They pedaled their bikes to the beach.

Local real estate prices went up this year instead of down.

StevieLee

“My brother and his wife bought a $150k lot and built a small $350k house on stilts near the beach.”

Well, depending what “beach” their small 350k house currently has it’s “stilts” sunk into, there’s a very reasonable chance that they may be literally ‘underwater’ within the next decade or two via the escalating effects of climate change.

“Local real estate prices went up this year instead of down.”

But..I’m willing to bet that the actual elevation of their precarious “house on stilts” did NOT go “up this year”, but in fact, went noticeably “down”

Really?

A house on stilts is going to be ‘underwater” within the next decade?

Sounds more like to me that somebody has been drinking something other than water.

Clowns walk with stilts and buildings sit on piles. Sea rise is estimated in inches per 100 years.

I certainly hope it is a lot more than ”inches per 100 years Derek.

Most recent RE investment in a very nice very mixed in all ways small city in FL with our elevation approx 45 feet above current sea level.

We bought here with the expectation and hope that all the global warming deniers are wrong wrong wrong, so our grandchildren will have waterfront property by the time they retire…

And, to be sure, we think the flooding in the your ami area is just a result of the usual ”king tides” that have been happening there for eva,,, and same with the many parcels plotted 1930ish on the west coast of FL that are now in approx 3-5 feet of water at ”dead low” tide!!

We natives here can continue to hope that the alarmists are way too conservative in the computer models they continue to construct that show only a few feet,,, and that the actual rise will be more in line with what it was just a few thousand years ago, when the ”Florida Ridge” gradually rose from the sea, eh?

Maybe Wolf is anticipating the same thing happening to his place in SF, though from the photos he has posted, it seems he or his grands will still have to walk a few blocks to the water…

With official government unemployment at around 11% and with Shadow Stats unemployment at around 31%, I split the difference and come up with around 21% unemployment. I just don’t see (long term) how home prices can hold steady or go up.

Just my $0.02

I don’t see how real estate will keep rising as well. Unless all the demand comes from REITs using govt money to keep prices high and renters enslaved. If so, the instability will be off the charts.

Wait for 3-4 months till all the sprinkling of Billions/Trillions wears off.

The feed back from any sector of the Economy is completely distorted.

Big disconnect between the reality and the narrative from perception managers.

How many of these will have ‘steady jobs in the post covid 19 Economy? How many home owners already in deep debt, will be able to service mortgage and also CC, auto loans and student loans?

Wait for the LOW tide to get the better picture!

Extra UI is about to end (and how long can states keep their side up? Already they are facing massive cuts). Make of this disincentive to work what you will, but the end of it will be massively deflationary. A lot of jobs won’t come back and even more will be lost due to this huge income hit. The rich are saving income much more aggressively according to stats. Are they the ones piling into stocks right now? It looks more and more like money velocity is just going to keep sinking like a rock while money flows are diverted into panic hoarding assets even while their underlying value in the real economy is eviscerated.

In the pearl district of Portland there is a fancy condo building ( by Portland Standards) with units from 1-2.5 million dollars. There are maybe 50 units in the building and in the last month 12 have come on the market and none have sold. Not sure if it is a coincidence but last month the protest mob, surrounding a 4 block area around it with barricades and declared it an autonomous zone, only lasted for about 12 hours but it might have had an effect.

Home sales are down. Probably Covid.

Just read Tesla’s release. It clarifies to me the pointlessness of looking in the rear view mirror and attempting to analyse just released numbers when trying to making a judgment on value.

Tesla is a vehicle manufacturer that held revenues y/y while exploding gross margins to 26% from 18% and all the while showing an operating margin of 5.4% in a covid Qtr where everyone has been locked up at home gazing at their screens for 3 straight months.

Charlie Munger once said that a lot of financial types spend all day analysing everything… but they never stop to think.

Chanos and Einhorn et al.. Number crunchers lacking in vision. They make millions for being wrong most of the time. Nice work if you can get it.

$428 million of its gross profit of $1.32 billion (= 1/3) came from pollution credits, not from selling cars. Hence the 25% gross margin.

Without those $428 million in pollution credits, it would have had a net loss of $324 million.

Yeah, I know, I know, Tesla is in the business of selling pollution credits, not cars…

Is actually on the business of sucking out investors money.

Like Netflix does.

Does it even remotely surprise anyone at this point that after hours Tesla went up 5%. I’d say that this is a perfect shorting opportunity, but the years have been smeared with the blood of short sellers thinking that Tesla is going to die after this.

After all, who dares to go against Jesus Musk at this point.

Contrast this to MSFT, which beat top and bottom line, and fell 2%. Go figure.

P.S. Wolf, when are you going to talk about gold again, you had I think two articles on it last year or the year before, and then you stopped. Gold and Silver are going to be the new Teslas, be ready to be Robinhooded.

It’s BTC all over again.

It’s just a matter of whether it’s BTC 12K or BTC 20K.

Rowen,

BTC has one thing going for it. Manufactured Scarcity. You can’t say that about cars

Rentals (houses 2br) are as few as after the 2017 fires here in Sonoma County (Petaluma) and the prices have moved up.

Wish that Wolf or maybe Tom Stone would revisit the northbay re scene soon.

Wolf you are showing up in several of my news feeds – it appears your quality journalism is finding a wider field -Bravo!

There is no escaping this. Cities and the suburbs will all feel the pain eventually.

Re taxes and maintenance costs of a suburban home will catch many off guard. Although lifestyle will pay for itself. Until you have to commute to a physical address vs an IP address…

Cities are broke and they will eventually be forced to raise the taxes on real estate all throughout the state. Although in the last 5 years NYC has doubled the real estate taxes already…

Vacant apartment units – vouchers will be introduced for all types of housing including homeless and Landlords will have to except.

Gated zip codes is the way of the future. Make your zip code great again will be the slogan and you will have armed guards at the entrance once past the guards the pearly gates open to land of no graffiti, no nonsense, high end retail, organic supermarkets all carrying plastic bags.

Automation combined with Covid will eliminate the middle class. Get ready for a new demographic ” the upper poverty class”!

Thanks to Zoom- Bill why are we paying Bob so much? Bob we letting your $150k salary go buddy… Its this tier of employee that will never find the same level of pay for work.

“upper poverty class” living in poverty but with a paid for Benz and your old office clothes.

This is just the beginning, teachers are being allowed to go into retirement if they qualify for being highly at risk, schools are going digital.

Upper poverty class will have digital schools preparing the kids for a jobless future what’s free college matter if you cant get a job? MMT already here –

Free housing, unlimited Netflix, Amazon vouchers to get all you need. Endless prescriptions to deal will all your troubles. This is what will unfold over the decade.

Very rich vs very poor no inbetween and the only real place to hide will require real money to buy!

Sounds like a world as evsioned in a movie not too long ago.. OBLIVION

When talking about housing the value is only the price that the buyer will pay.

Worth is an overused term.

Good time to be holding Au and AG.

Especially long dated Calls

Any takers on which markets get nationalized? I would put banks right at the top, but housing is a close second. Ca is already intervening on the issue of rent control. Subsidized housing was common after GFC, section 8, you could live in your own house. It might soon be the norm.