Flattened-out fish-hook-shaped recovery of demand?

By Wolf Richter for WOLF STREET.

Passenger revenues collapsed by 94% to just $681 million, United Airlines disclosed in its Q2 earnings report today. Other operating revenues plunged by 37% to $392 million, but cargo was hot, rising 36% to $402 million “by serving strategic international cargo-only missions and optimizing aircraft capacity with low passenger demand.” All combined, revenues collapsed by 87%.

This has now become the serenade by airlines to investors. United follows Delta in it: Revenues have totally collapsed, and we’re in an existential crisis, and we’re cutting costs and capacity like maniacs, and we need to shed tens of thousands of employees, to reduce our cash burn, but we’ve raised many billions of dollars from you all (thank you) and from taxpayers, and we will duly burn this cash during this crisis.

United burned $40 million a day in Q2. It expects to reduce this cash burn to $25 million a day in Q3 – about $2.3 billion in the quarter – and reduce it further in Q4.

United said today it has slashed operating costs by 54%” compared to Q2 last year; this includes expenses for fuel, which were down 90%, aircraft maintenance down 74%, landing fees down 35%, and its largest line item, salaries down 29%.

Those are huge cuts. Earlier in July, in a dreary assessment of the airline industry and traffic, including a renewed decline in ticket sales starting in late June, United announced 36,000 “involuntary furloughs” on or after October 1 if it can’t entice those employees to leave voluntarily beforehand.

Despite the cost cuts, United lost $2 billion in the quarter.

And it said that it expects its system capacity in Q3 to still be down by 65% compared to Q3 last year. And it will cancel flights and adjust capacity “until it sees signs of a recovery in demand.”

United is also noted to be among the US airlines that have so far refused to block the middle seat to reservations, and that will pack passengers like sardines into its planes if it can find enough passengers.

But passengers are still hard to find. United expects a load factor in July of only 45%. And it expects that less than 15% of its flights in July to have over 70% of the seats filled.

United said that it has raised $16 billion since the beginning of the crisis – edging past Delta which said that it had raised $15 billion – “through debt offerings, stock issuances and the CARES Act Payroll Support Program grant and loan, among other items.”

These “other items” of raising funds include sale-lease-back transactions with BOC Aviation, the state-owned aircraft leasing giant headquartered in Singapore. The aircraft subject to these sale-leaseback transactions are six Boeing 787-9 and 16 Boeing 737 MAX scheduled to deliver in 2020 – if and when Boeing resumes delivery of the 737 MAX.

When will this fiasco finally abate?

The answers keep getting worse. United now “expects demand to remain suppressed until the availability of a widely accepted treatment and/or vaccine for COVID-19.”

Alas, that may take a while.

Despite numerous announcements of “promising results” of early trials or experiments of various treatments or vaccines, mainly for the purpose of goosing the share prices of select companies and the market overall, an effective and safe vaccine that is “widely available” may not happen “until the second half of 2021 or even later,” according to Lazard’s Global Healthcare Industry Leaders Study.

The study surveyed 184 executives and 37 investors “across pharmaceuticals and biotech, medical technology and health care services – representing many of the world’s largest health care entities, as well as smaller public and private companies and prominent investment firms.”

The key for an effective and safe vaccine is that it needs to not only exist but also be “widely available.” The study found that “almost three in four” of these respondents “believe an effective and safe vaccine will not be widely available until the second half of 2021 or even later.”

And in terms of fining a safe and effective treatment, only 49% of these healthcare leaders said that there is a better than even chance that such a treatment can even be found.

So, for United Airlines to stake the demand recovery on the wide availability of a safe and effective vaccine and/or treatment will require some longer-term patience.

The flattened-out fish-hook recovery.

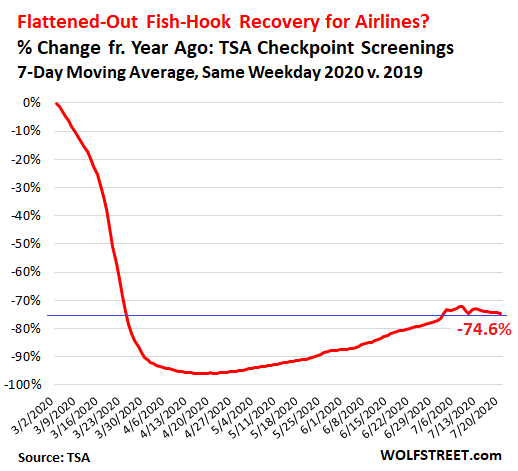

The TSA checkpoint screenings, which track how many people enter daily into the security zones at US airports, are now declining again, after the renewed outbreaks of the virus caused both United and Delta warn about re-declining ticket sales.

On Monday, TSA checkpoint screenings were down -73.6% compared to Monday in the same week last year. This was worse than Monday last week (-73.3%) and down from the best day, July 8 (-72.3%).

The seven-day moving average, which irons out the day-to-day volatility, has edged down to -74.6%, worse than where it had been on July 2. These are not the ingredients of a V-shaped recovery for plane travel and for airlines, but maybe something like a flattened-out fish-hook-shaped recovery.

Offering incentives to employees in order to entice them to depart voluntarily is all the rage now – given that the airlines, having accepted federal bailout funds, cannot lay off their employees until October 1.

United said that “more than 6,000 employees” had accepted its offer to depart. At Southwest Airlines, 33% of its flight attendants and 24% of its pilots had reportedly accepted its offers of early retirement or long-term leave. Delta said that at least 17,000 of its employees and over 2,200 pilots had accepted its packages for early retirement or voluntary separation, at a cost of $3.3 billion. Turns out, airlines can use those federal bailout funds to pay for incentives to get those employees to depart voluntarily.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nothing else matter…thank you FED, you guys have completely broke reality. 87% decline in revenue and the UAL is yet up today, welcome to this new F up normal.

Problem is you are viewing the exchanges as a market. They are not. Yhey are simply inflation hedges at this point.

It’s not just the FED. Money from the other printing presses is finding it’s way here.

This is not to say that the formerly known “makets” will remain this way, but it is the function for the time being.

This isn’t the first go round. If 1.2 trillion made stocks rocket post-2008, why wouldn’t you believe that a massively larger stimulus would do the same thing in multiples.

By severing the relationship between true underlying economic performance (say, idiotic PE inflation) and individual stock “price” those prices are made more volatile (because they are anchored less and less to the company’s actual economic performance and more and more to fleeting mob psychology generated by huffing the Fed’s spray paint).

Major, deadly problems are created at the macro level too but I’ll leave it at the individual company level for now.

Two business owners in KY (PBS), one complaining about McConnell’s ‘liability’ clause, and the other defending it. Covid liability is an open ended commitment. Assuming, one said, that the owner is following protocol, the government assumes damage claims from litigation. which is mostly the hospital charges, but may also include loss of life and disability claims. They are currently negotiating. while socialism and the free market converge.

Socialism and a free market is converging like a speeding freight train converges with you standing in the middle of the tracks.

This is going to get very interesting…….if Biden gets in and inflation picks up…….Shelton will be gathering the forces to jack rates up to the moon.

All in the name of fiscal responsibility……..LOL.

Inflation?

Deflation more likely.

Obviously.

Interest rates will not go up. Too many governments and powerful entities owe too much money.

Interesting dilemma between the need for inflation vs corporate insolvency.

Right now it appears both to be winning.. Yet they lead to such different outcomes.

I imagine it will be the bond market that decides which way things go. Probably not by choice. Will the bond holders sell and put that money into stocks or will the stock holders panic and sell hoping to preserve their capital?

Actually neither seems very appealing to me right now.

No reason to travel, if everything will be shut down, when you get there. For a lot of places/cities, not sure if you would want to see them when they aren’t lively, it might ruin what might be your first impression. Natural sights are the only real good option. But, between everything being shut down and work from home, there will be a lot more fat and lazy people.

This.

Not necessarily true about fat and lazy people – one of the few things left to do is exercise. Jogging, biking, walking – including walking the new puppy everyone just got, hiking, camping, etc. are all more popular.

Don’t forget about working that neo-serf’s non-victory garden ….

US airlines are among the most hated companies in the country. I would rather have a colonoscopy without anesthesia than fly on a US airline. I would be thrilled to see every one of them go bankrupt and disappear. Let new companies or foreign carriers take over.

Seconded. Once you have been a Singapore Airlines frequent flyer there is no going back.

With the exception of southwest airlines?Somehow I like them and can’t wish them bad.

I agree. SWA is employee-owned. When you see pilots coming back through the cabin after a flight to assist the cleaning crew to remove trash etc – it is refreshing and speaks of team effort. I do hope they come out of this OK.

AGREE with you folks re SWA: After waayy too many flights for biz, as mentioned by some on Wolf’s wonderful website, IMHO SWA is the best!

Always been treated by all the folks at SWA as if, in fact, I was a human being, and not just another number/idiot as was the case with so many other so called airlines in the last few decades…Not going to mention the many ”perks” given by their staff when they saw I was VN vet,,, honoring that in spite of the very bad reception SO many of us received when we arrived back in USA, a real shame on WE the PEEDONs who had no idea what they were doing…

Course, I was highly prejudiced by my treatment in the early and late 1950s era when flying with mom and pop, and receiving really great service on the DC3s and subsequent…

Yup, service on the old Ford Trimotors was completely different. My toes would get cold though.

This might be a good area for U.S. airlines to invest for a thriving business, if the we can down on our knees and beg foregivness…

Iran and China have quietly drafted a sweeping economic and security partnership that would clear the way for billions of dollars of Chinese investments in energy and other sectors. The projects, including airports, high-speed railways and subways, would touch the lives of millions of Iranians. China would develop free-trade zones in Maku, in northwestern Iran; in Abadan, where the Shatt al-Arab river flows into the Persian Gulf, and on the gulf island Qeshm. The document also describes deepening military cooperation, potentially giving China a foothold in a region.

Oh I forget, not possible. Trade is banned btwn US and Iran.

At most, tariffs have been put up to respond (20 years late) to China’s multi trillion dollar abuse of international trade norms (using fiscally authoritarian domestic policies to massively prevent the bilateral balancing of trade).

Oh puhleazzzzze… It’s only “trade norms” when a very capitalistic economy (China) is kicking USA’s butt due to U.S. having NO economic plan.

So let’s look at this from a technical standpoint: China: 7th five year plan / USA: doesn’t have a FIVE MINUTE plan (unless catering to K Street counts). China: extensive infrastructure investments, including high speed rail, new airports, deep water ports, and a highway system unimaginable in the U.S. USA: crumbling infrastructure from the 70’s. Oh I almost forgot, Logan did get a new runway after a 30 year fight, just too short to use. China: investing globally including Belt-Road initiative. U.S.: well ya, let’s pull out of TPP and think that 330 million mostly obese idiots can rule the world forever vs. 7 billion (very hard working) folks.

Technicality, practicality, and realistically; FACTS are, 330 million people will not rule the world forever (yes they have nukes now too), especially fat lazy idiots living on Big Mac’s wanting to exclude India’s brain trust, or our beloved farmers, all living on government welfare, can be bought for their coveted electoral votes.

The false narrative of so called democracy is a gerrymandered system which in reality is no longer a democracy. It’s compromised by a rigged electoral college system and a failed senatorial system with CA & NY only having equal weight with WV and WY. Duh?

So what is really “authoritarian”? Cas127 sees and hears only what he/she wants to see/hear apparently.

USA can flout the BS narrative of “American Exceptionalism” , but that is mostly living life in the rear view mirror. The infrastructure is a disaster in the USA but hey Roe V. and stacking the court is tops on the agenda here.

So sorry to say, exceptionalism… it is not

What is exceptional is 30 kids in a Shanghai Starbucks at 5 AM daily studying like hell for a HIGH SCHOOL entrance exam, all speaking 2-3 languages (vs. ya… our all important HS football) and India’s IIT pumping out engineers, mathematicians and scientists, PREVIOUSLY all bound for the USA.

Better get your head out of the sand Cas and take trips across India, China, and heck even Mexico and see money being spent on infrastructure vs. handouts. There you will see exceptionalism in action vs. some nice press pieces for the electorate. None of their exceptionalism is “authoritarian domestic policies to massively prevent the bilateral balancing of trade” but its the grit that once existed in the USA, pre K street, pre religious right whackos, pre gerrymandering, pre spend like drunken sailors republicans (yes… Bill Clinton produced the surplus), pre trillion dollar deficits in good economic times.

Game over USA. Game is very much on in the TPP world… absent USA of course with its very stable genius at the helm.

Oh… almost forgot the USA’s “exceptionalism” in Covid response. Once again, the numbers do not lie!

Good one WWT,,, and I, for one agree with many of your sentiments/implications…

Teaching at a couple of so called ”high” schools a few decades ago and finding kids at at least 16 (min age for my classes)not able to do simple addition and subtraction, etc.,

and then able to bring them up to at least what I learned by 4th grade in the 50s, made me really concerned about the level of education in USA then,,, then, later/more recently, working with folks with Masters Degrees who could not make a coherent sentence in “Standard English” made me into the paranoid I am today about USA going forward…

OH, wait,,, paranoia is defined as ”unreasonable fear”,,, clearly not the case today in USA,,, eh folks??

Time and enough, though clearly time is short to INSIST that all laws, rules from laws, regulations, etc., etc., are completely blind to ”race, gender, age, colour, religion,” and each and every such divisive metric/measure of who WE the PEEDONs are,,, and focus only on merit.

WWT,

There is plenty to legitimately criticize about America, but an ignorant mash note to CCP 5 year plans, which have created huge amounts of politically directed, economically pointless infrastructure is not particularly convincing.

No one knows the Chinese system for what it is (and is not) better than the Chinese people, a large number of whom break Chinese “law” on foreign exchange in order to get some fraction of their savings out from under the arbitrary thumb of the permanent Chinese political class.

For whom, people like you are useful idiots, reclining back on half understood economics circa 1986.

Nobody knows better what their “leadership” is, better than the Chinese people.

Certainly not you.

The truth is that the Chinese gvt has long forced, under threat of imprisonment, its exporters to convert export proceeds (mostly USD) into Yuan (because domestic currency can be directly manipulated by domestic gvts…see US Fed).

Starting 20+ years ago, this broke the intl trade circuit…those politically imprisoned export proceeds could not (and were not, to the tune of trillions) be recycled into US exports, thereby bringing intl trade into closer balance.

Rather, the Chinese exporters’ USD proceeds were de facto confiscated into Yuan, thereby forcibly driving Yuan interest rates down, and firing up the oceans of CCP politically directed infrastructure “invts” (including multiple ghost cities) you give a tongue bath to.

The people who actually earned the money, the Chinese exporters? They could obey the CCP, or, be shot.

The forced conversion of USD Chinese export proceeds into CCP controlled Yuan, also had the necessary effect of goosing up the Yuan money supply, imposing increased inflation among Chinese consumers…allowing the CCP to screw their own population a second time…entirely in the service of CCP dictated “development”.

Rather than regurgitating half learned “free trade” *theories*, “Wise”, spend ten minutes reviewing the actual history and empirical outcomes of the past 30 (really, 50) yrs of intl trade and try to engage a few brain cells.

As I said above, there is more than enough to criticize about the US…but to salute the CCP with poorly examined, galvanically responsive invocations of “free trade”, “free trade” divorced from what has actually been going on is…idiotic.

CAs127:

Really?

Or, by not playing by the West’s rules of capitalistic engagement????

The Chinese are cleaning our clock in foreign policies and we have no solutions whatsoever because we are tied to a racist, corrupt, completely dominant version of “engaging in trade” with our “partners”.

Just look at the US’s record with the Latin and South American countries over the decades and see how money flows hardly ever reached down to the “commons”.

The only thing we know is “sanctions” on those who will not subserve themselves to our trade policies.

And, it continues to this day.

The future is in the East. The West is entering a new Dark Ages

led by Trump and Biden. Rugged individualism will be the downfall of the West. Cooperation and Social Discipline will save the East.

Yeah, but who wants to live in that future?

Just last year I went a backpacking trip with 12 other non obese Americans who all grew up, as I did, with the ideals of rugged individualism. The cooperation was natural, unforced, and a true delight.

Source?

Two weeks ago, a friend of mine took a business trip from Portland, OR (aka Moscow – or what Moscow used to be that is- on the Willamette) to SF. He was one of six passengers on the plane. I can’t even imagine how quickly a plane like that is air bound unlike being packed like sardines !

V1- rotate – positive rate 1, 2, 3. That fast.

I think that we are passing into the stage of grief when we no longer are in denial. This is a national tragedy.

Our best hope is that our entrepreneurs can declare bankruptcy, get rid of most of their debts, and move on. Many businesspersons have failed in the past and then later on succeeded. America now needs its entrepreneurs to succeed again in future years.

On that note, many small business owners are confused and think that they will not qualify for Chapter 7 bankruptcy individually, because their revenues used to be huge and were huge for the first part of this year. However, that is not how bankruptcy rules work.

There is no Chapter 7 relief for entities: they just go into it to die. Moreover, the creditors may be able to pursue the owners if they can pierce the corporate veil. However, that does not happen often.

Moreover, if your NET income (revenues after expenses) is low enough this year, even though you might have owned a successful business before with huge revenues, you may qualify for Chapter 7 bankruptcy relief next year, which will discharge most of your debts. There are also some exceptions to the Chapter 7 means test.

Chapter 13 is more limited, because huge debts may disqualify you from getting it. Many business owners now have such huge debts. However, if you qualify, the discharge that you can get in Chapter 13 is a super-discharge, which can clean out even some problematic debts. On the other hand, the plan will require you to make monthly payments.

At any rate, if you go into bankruptcy, keep in mind that the bankruptcy trustee is happy for you (with family help for example) to buy back your equipment, etc. They are not in a good position to sell such at high prices and are happy to accept low offers: used equipment is also often not in demand, even if it was very expensive when new.

Given what has happened, I suspect that used restaurant equipment, for example, will be widely available and cheap next year, so you may be able to buy back your own equipment cheaply. Then, eventually, once we have a cure, you may become successful again, with much reduced debt load.

I forgot to insert at the beginning this text:

I do not believe that it is practical to bail out all large businesses like airlines. Even if the US government took a stake, if this pandemic were to last through 2021, we would be burning taxpayer money with no hope of recouping it. Unfortunately, that will mean that some of the businesses that were not over-leveraged but in an unlucky industry will fail along with those incompetently over-leveraged.

If I were in the government, I would focus on assisting small businesspersons. Per dollar of aid, they can limit their expenses and may survive or may be able to re-start after a bankruptcy with small loans. Of course, large numbers of their landlords (who are often over-leveraged and bankster owned) will fail as more and more of their tenants declare bankruptcy or move out. It will be a new economy.

It takes a minimum 18 months to startup an airline.

Oh, I don’t know about that. I refer you to the The Grace L. Ferguson Airline and Storm Door Co.

“I think that we are passing into the stage of grief when we no longer are in denial.”

I wonder that the “stage of grief” is under still “in denial”, and when we’ve passed through the penny will drop, or rather, the market will fall, and we’ll enter the ‘stage of reality’.

But there’s the Fed pulling the wool over our eyes and maintaining a “stage of denial”. And then there’s Wolf, the agent of open your eyes and see!

I know who I’m banking with.

This confirms exactly my worst suspicions about US airlines: their corporate culture has grown so stale they have literally no idea how to go forward and, very much like politicians, they have started to flash the magic vaccine as a way to get out of the hole they dug for themselves.

Look at airlines like Wizz Air of Hungary: at the height of the epidemic, when they had just a handful of aircraft flying directly under contract from the Hungarian government they were planning not just for the present recovery phase but beyond, including getting into the ultra-competitive Western European market. They may be backed by one of those much hated PE firms (Indigo Partners) but they have a plan, whether it’s right or wrong. United has… they are not even bluffing: they have got nothing so they dragged out the fetish called “vaccine” and are shaking it in front of people to cover up for their shocking lack of leadership.

US airlines are the equivalent of Raphus cucullatus aka the dodo bird. Its ancestors were close relatives of the pigeons: fast and powerful fliers. Then they settled on Mauritius: no natural predators, an agreeable climate… and they devolved so much as to become unrecognizable. So when a bunch of hungry sailors arrived, they were literally easy pickings.

The only thing that stands between American, Delta and United and ending up like the dodo bird is the FAA ferociously restricting access to the rich internal US market, but even that will not last forever.

MC01,

It seems you still don’t get this, but there is practically NO DEMAND for flying in the US. Demand is down about 75% from a year ago – still, four months after the crisis began. That kind of collapse in demand, if it lasts long enough, is generally a life-ending experience for a company. That’s what the chart shows you: a 75% collapse in demand.

Why are you blaming the airlines for this collapse in demand? As you might know, we’ve got a huge outbreak going on here.

Americans are blocked from flying to many international destinations. People from many countries aren’t allowed to enter the US. Domestically, people don’t want to fly either. Most business trips are off the table. Video conferencing has taken over.

Airlines have to adjust to this collapse in demand – whether YOU approve of it or not is irrelevant. And this demand in the US is down about 75% from a year ago.

Until recently, the narrative from the White House has been that this virus is a hoax and a way by Democrats to engineer a coup, or whatever BS, and that masks were part of this. The White House has politicized the virus and the wearing of masks. That was the top-down narrative, and some people believed this BS and it turned them reckless.

As a result of this catastrophic political narrative early on, that people believed, we now have huge outbreaks in the US, and deaths have started to surge again. Hospitals in some of those areas are overwhelmed. Now, over half the people in those hospitals are under 40. Refrigerated morgue trailers are parked outside the hospitals.

The White House, including Trump himself, have now done a complete 180, and they’re pushing people to wear masks and they’re acknowledging that this is serious. But the 180 came too late.

And guess what? Given this mega-outbreak now unfolding, demand for flying is starting to decline again, and ticket sales are falling again. And that’s not the fault of airlines, but of the political narrative early on in the crisis.

Wolf,

You’re beating the wrong horse.

MC01 is neither dense nor a villain. Speaking from significant expertise, he accurately describes the ancient and decadent management culture of US airlines, now made obvious and more corrosive by the COVID-generated demand collapse.

In an actual free-market economy, these corrupt corporations would disappear.

I’m very cynical about US airlines. You can blame them for just about everything, but you cannot blame them for the collapse in demand. Add their reaction to it (rapid large-scale shrinkage and grabbing all the cash they can get) is the way of surviving this crisis. And they might still not all survive.

I remember talking to an Eastern Airlines pilot back in the 1980’s. He had put in his 20+ years and had invested heavily in Eastern. He landed up losing both his job and his investment.

With the expected layoffs and maybe bankruptcies, I expect many of the current airline employees to suffer the fate of the Eastern pilot. How bad could it get in terms of income, pensions, and hits to the economy. Does anybody have any idea?

How bad? 70% of US GDP is conspicuous consumption. So just think about that. So people in financial pain are not going to buy $1000 dollar cell phones, go out to eat and buy stuff.

It’s Great Depression level territory.

I wasn’t asking about the general case, I know it’s bad already.

My question was more about the hit on the economy created by the airline sector, in terms of loss of income, lost pensions, regional economic impact, GDP, etc.

Airline business history- By about 2000 or 2008?, basically every US carrier had been bankrupt except Southwest.

The experience of Eastern was just sort of the first of this wave. Currently, pay and pensions for airline employees are but a shadow of their former self.

I know a lot of the pilots have “diversified accordingly”.

I was in an Uber about a year ago in Atlanta. The driver was a second year Delta pilot, flying regional jets. He had not come from the air force or navy, so did not have the experience to command a higher starting salary on bigger jets. He was earning about $40K/year from Delta and supplementing his income from Uber.

I believe that after the bankruptcy and re-org, I think it was United, some of the pilots are receiving only 40% of the pension they anticipated after decades of working.

MCO1:

I envy you living in Italy. At least you have a choice versus rail. I just saw a program on the Smithsonian featuring two different trains with service from Milan to Naples at 300 kph. We have fly or drive.

And in OZ:

Sydney Airport (ASX: SYD) current price: A$5.50 and a market cap of A$12.56 billion. Trailing PE of 31.1.

Low of A$4.37 so up about 25% from the low of the year.

Passenger numbers at Sydney Airport for June (before the Melbourne lockdown started) compared to the year before:

140,000 domestic passengers down 93.3%

32,000 international passengers down 97.6%

And as above the company still has a market cap of over A$12 billion.

Qantas Airlines (ASX:QAN) current price A$3.67 and a market cap of $7.08 billion. Trailing PE of 7.1.

Low of A$2.03. Recent high of A$4.95 on June 10. Borrowed billions and raised money from a share placement.

(Are our hundreds of thousands of Frequent Flyer miles worth anything?)

Webject (ASX: WEB) a travel agent. Current price is $A3.02. Market cap of A$1.03 billion.

Up from a low of $2.25 and recent high of $4.76 on June 9. Trailing PE of 9.4. Same as Qantas with regard to capital raisings.

Flight Centre (ASX: FLT). Another travel agent. Closing price of A$10.82 and a market cap of A$2.2 billion. Trailing PE of 5.5.

Low of $A8.52 and a recent high of A$17.52 on 9 June.

Ditto with regard to cap raisings as previous two companies. Lots of news with regard to this company for charging huge refunding fees on previously booked travel……..somewhat resolved.

So with the travel and toursim industry basically dead as far as the international aspect is concerned in Oz and with 25% of the country on lockdown (Victoria), one can only imagine why these companies are trading at these prices.

(Virgin Australia filed for bankruptcy a little while back)

Of course every time there is some virus news about a vaccine, these companies’ shares jump up and can often be found on the best gainers list.

Crazy world and I haven’t even mentioned companies such as Afterpay (APT – up 193.7% and a PE ratio of zip), Carsales (CAR), or Xero (XRO – up 49% and PE ratio of 4159) or how about Domino’s Pizza (DMP)?

A$74.63 with a one year gain of 99.76% and a PE ratio of 49.1…………….

Best place to be on the ASX at the moment is the gold companies, especially small explorers. Gold price in $AU 2598. No COVID problems so far, no sovereign risk.

Qantas is effectively dead in the water: they have no plans to restart meaningful international operations for almost a year.

In the meantime China Southern, Emirates and Qatar Airways are all gearing up to serve the Asia to Australia market: somebody will have to buy all that obscenely overpriced real estate “all cash” after a furious bidding war, otherwise Australia will find herself in serious troubles. ;-)

Joking (but not much) aside, all the airlines that have no plans for the future bar “muddle through” will find themselves in very deep troubles down the road. Qantas appears to belong to this category: the protected internal Australian market may save their skin for a while, but their international competitors are already smelling blood.

@MC01

Is airtravel to Australia likely to pick up much anytime soon?

The ‘second wave’ has hit, the result of poor quarantine procedures, raising the perspective of an endless round of lockdowns, even ‘hard’ lockdowns’ in imitation of the Chinese, but much less efficiently organised

The Government is unlikely to initiate even the proposed ‘airbridge’ with NZ

Rumour has it Gvmt is afraid above all of a brain drain

Plus Aus has got into a serious enough spat with China, and encouraged what appears to be concerted attacks on influential Chinese immigrants and their allies

Many less China students, no tourists, no businessmen…

High Level Real Estate will suffer, also the general economy

The current lockdown and spread of the virus is a direct result of the piss poor policies emplemented by the State Labor government at hotel quarantines and the huge BLM demo which they allowed to go ahead. (Even the left wing rag the THE AGE finally admitted it.)

These policies allowed the virus to get out into the community.

Then once they screwed up and decided that track and trace were too difficult, they forced the lockdown on Melbourne.

Universities are in big trouble in Australia as they moved from a model of education to a business model of getting as many foreign (read Chinese) students as possible.

Lack of students has hit them, the real estate market that caters to those types of renters/buyers, and consumption.

Somewhat perverse is that many of the students that came also would work their alloted number of hours under their visa and then a whole bunch more ‘off the books’ for cash at a much reduced rate under the legal minimum wage.

So this has had both a positive and negative impact on the unemployment rate. The lockdown is going to increase the ‘official’ unemployment rate next month, but with all sorts of bs going on in the market with the government programs, the numbers are all fake anyway.

So far there has been a very limited impact on the overall price of RE in Oz. Domain reported a 2% fall in the June quarter with prices still up 10.5% YoY in Sydney and 6.9% in Melbourne.

Latest data shows Sydney at $1,034,843 and Melbourne at $824,580 for houses. Of course those figures are skewed by the high priced suburbs in and near the CBD especially in Melbourne.

There are huge price differences across the city and even in smaller areas. You can buy a crap shack south of the highway for around A$500,000 in the suburb I live, but that will at least double that in price in the village area for a knockdown, and the triple that or more just a few streets north of where I live.

There is one house that has been listed for sale for ages which just had its price reduced to A$950,000 – (6 bedrooms!) and has been vacant for well over a year now just outside the village area. There must be somethng ‘wrong’ with the house…………

There is a nifty new house around the corner from that for A$1.2 million and in the village there are a couple for sale at $A1.7 – $2.1 million.

There is only one house at $3.3 million for sale in the upper range as all the rest have been recently sold. (last couple of sales were $2.8 and $2.2 million both in the village)

There are a couple of blocks of land for sale between A$808,000 and $894,000 (490 sqaure meters to 552 square meters) in the village so better be quick!!!

Townhouse prices are all over the place and I’ve given up making and sense of them.

PS: Went for my morning walk with my mask on and only saw one person – a jogger on the other side of the street without a mask as they are not required to wear one. (Now how dumb is that?)

What happens if no effective vaccine is created? i think in light of the information regarding the disappearance of antibodies in people who had the virus, we may have no choice but to have to live with the virus, much like the common cold or flu.

If antibodies last for 3-4 weeks, how many vaccines would be needed? Is it worth it then? What will be the effect on people receiving multiple vaccines in an annual period?

Ask Goldman Sachs. I saw somebody mention their forecast (March 2020) that this pandemics would last 1.5 years.

I’d say we are clearly closer to 1.5 years than to 1.5 months, maybe Sachs will do another forecast for your question. I am too lazy to google this.

As for me, I see the outcome somewhere between Bad and Horrible.

But hey, let’s be optimist, humans survived a lot of horrible events in the past.

Tom,

Antibodies for CCP-19 last alot longer than a month. For people who weren’t very effected in the first place, their immune systems keep a blueprint of CCP-19, but, may not keep a stockpile of antibodies for very long, instead the antibodies are produced on demand. This is normal for less threatening viruses (even if it’s threatening to other people). Every time someone would get sick from CCP-19 they would be less effected, unless they get old or their immune system becomes compromised.

The possibility of there being no CCP-19 vaccine is unlikely, but possible. The vaccine would probably last something like 2+ years. If no vaccine works, instead they have to develop an antiviral and other medications, which, reduce the severity of CCP-19, possibly down to almost nothing. There is also the possibility that existing medications might work, if this is the case, they can largely skip parts of the testing and start to distribute it right away.

I’ve yet to hear of a virologist who thinks a vaccine for any coronavirus will actually work, mainly because they tend to mutate so fast that a vaccine may only give you three months of cover at best.

That, of course, assumes that the objective of the mandatory jabs will be to “protect” us from…the common cold. In reality, the RNA-altering vaccine they are going to roll out could serve all sorts of other objectives, least of which could be the patenting of the human genome. How do I invest in that?

In one of the few things they got right. The Supreme Court already banned patenting naturally occurring genes, including human genes.

While, it’s technically possible for congress to overturn the ban, it would have huge backlash, especially internationally.

Not the same critter, but we have had about 40 yrs to develop a HIV

vaccine.

If its gonna take 40+yrs for a vaccine, forget being a pilot.

Be a plumber! We need you now!!

We can’t keep up with new construction, let alone service the

new stay @ home culture. The germ phobia that the media has created

is a b**ch on our septic systems. I would assume our central sewers as well.

Then again, its all good for our “bottom” line. Covid on folks.

Serious question. Can a 60 years old, here in the US, retrain to become a plumber, and actually get hired?

The flu vaccine has at best a 60% success rate. And yet we don’t lock the world down every fall as flu season begins. People have to understand that there is risk in life and no vaccine, or lockdown, or mask or social distancing will ever eliminate that risk.

In 2017 about 41,000 folks died from the flu in the US. So far, in 6 months, we’ve lost over 140,000 and significantly increasing. No one expects lockdown, or masks, or social distancing to ELIMINATE risk, we expect it to REDUCE risk, hopefully substantially.

In Australia:

(Remember we are in the middle of winter here.)

“Health authorities say social distancing, travel bans and other guidelines have also led to a dramatic drop in seasonal influenza cases and deaths.

In the first five months of 2019 — a particularly severe flu season — the national total of laboratory-confirmed influenza cases reached 74,176.

But Immunisation Coalition data shows the number of cases in 2020 has plummeted since coronavirus lockdowns were introduced — from 20,032 cases in the first three months, to 504 in April and May.

Australian Medical Association (AMA) SA president Dr Chris Moy said the number of flu deaths prevented since the coronavirus pandemic began was probably “quite significant”.

But until the end of last month, federal authorities had only been alerted to 36 “laboratory-confirmed influenza-associated deaths” in 2020, according to the Australian Influenza Surveillance Report.

https://www.abc.net.au/news/2020-06-13/flu-cases-drop-amid-coronavirus-restrictions-statistics-show/12332204

Guess that it would a similar situation in many other countries around the world as well.

@Lisa Hooker

There’s no good choice here, there are bad choices only, deciding which is or may be the best bad choice is not easy

Lockdown, & the other measures, might restrain slow even reduce Covid, but will increase poverty which will result in all kinds of health and other problems (to mention only poverty as resulting from lockdown et al)

Measuring mortality only is very difficult – establishing parameters for deciding between this or that measure even more difficult

Well said Sir, at last an honest assessment of the situation, cowering in fear of the future or accepting the new challenges offered that is the choice we must face, head on.

We will be better served by paying close attention to pharmaceutical treatments for serious cases rather than pinning everything on the quite possibly deluded hope of a timely, safe, vaccine.

Effective drug strategies may well reduce the risk for the average healthy person, even the elderly, to an acceptable level, even if somewhat higher than might be wished, thus allowing the return to a functioning society and economy.

The daily announcements of ‘promising’ vaccine trials here there and everywhere are becoming rather tedious, and are also unwise psychologically, given the length of time they must spend in development.

Xabier, you are right on target. Stress effective treatment (which already exists) and put the dubious prospect of an effective vaccine on the back burner. Truly successful viruses tend to mutate into less virulent forms, since those that kill their hosts don’t do nearly as well as those whose hosts survive and allow them to spread.

Our grandparents, pre-antibiotics, lived with ‘acceptable’ levels of risk. Not eager to throw their lives away, of course, but they knew the score.

We, however, tend to have a ridiculous expectation of ‘everything curable’ until we fall apart in our late 70’s or 80’s.

Hoping for a safe mass vaccine by late 2020 or early 2021 is like hoping for a knock-out blow that would destroy both Japan and Germany in 1942 – it’s just not going to happen. In fact, a vaccine looks rather less likely than a D-day.

Emphasis on sensible mask use in crowded environments, treatments with established, and generally cheap, pharmaceuticals, general health and fitness, and consideration and help for those who are most vulnerable – is surely the pragmatic and level-headed way to face this.

MESO has the RIGHT stuff for ADRS…..

its already bringing down death rate…….expect news soon….

“…shed tens of thousands of employees.”

This is an existential crisis for all of us, not just the airlines as companies. Ouch.

Deflation, or Inflation?, both, first we will have a period of deflation lasting maybe 12-18 months, then inflation will rear its ugly head and slowly begin galloping out of control, and we mustn’t forget stagflation, expect a period of that as well.

I was involved in aviation from age 18 until my early forties, both full and part time, until I finally woke up, packed it in, and got a ‘real job’ as they say. I have many friends who went ‘airlines’, and many other friends who remained in the more fun and flying end of things as utility pilots (firefighting etc), or in rotary. Many died along the way, but when we survivors meet up the common statements are; ‘the smart ones got out’, or the ‘lucky ones’ ended up with a pension they still collect. (hasn’t been robbed yet).

I learned one key thing about all aviation markets. There’s a new sucker born every minute who is just chomping at the bit to show the World how to really run a profitable aviation business, whether it is maintenance, leasing, or operations. In other words, they come and go, and more will come. There is always someone willing to finance things. Always.

Let them fail. When this virus is over new airlines (to use a trumpesque phrase) will ‘magically appear like the virus never happened’. Used and new aircraft will magically appear for lease or sale at remarkable terms, and there is always a surfeit of flight crew lusting after their own buttons, zippers, and shoulder stripes. (I wore coveralls or jeans). And just like magic, taxpayer paid for airports and navigation infrastructure never went away.

It doesn’t have to be United, Delta, or whatever name. Whether the customers fill the seats, that’s another matter. Personally, I don’t think there will ever be the discretionary income or debt options for the same recent travel frenzy level this past decade.

In my Province (BC) alone, I can name more failed airlines than current ones operating. I’m sure every other reader can as well. They will come again, of that there is no doubt.

“There’s a new sucker born every minute who is just chomping at the bit to show the World how to really run a profitable aviation business,”

Sounds like Hollywood!

There is *never* a shortage of ignorant money waiting to be incinerated in the glamour industries.

And…I have long suspected the spiffy uniforms were a big part of the appeal, Cap’n…put epaulettes on your Uber drivers and they might get some of that heavily-automated-bus-driver-in-the-sky respect/awe…

“heavily-automated bus driver in the sky”? I am not a pilot, but a very keen observer of many things aviation. I have nothing but the utmost respect for the skilled professional flight crews who make it their primary mission to get planeloads of travelers, families, etc. safely to their destinations. Your quip is demeaning and belittling. Hope that you made it in jest.

Flight crews (usually) take their jobs seriously, but most aspects of flights are much more heavily automated than is generally perceived.

And the bus driver analogy is far from unknown among flight crews themselves (who know more about the job than anyone)

When I was a High School, I wanted to be a test pilot.

Passed the flight physical and everything.

The problem was, as far back as the 1970s, you could see

that there just were too few good jobs in aviation and

too many people who wanted to be a pilot.

Nothing has changed. I guess I was one of the smart ones. . .

Wolf, I am a big fan of your site. As you can see I am a composer Juilliard grad. A large career in NYC. I am a deep newbie to your world I study it often with confusion.

Can you explain one thing to me? How can china supply countries with billions in aid and yet I read from you and others how wobbly their economy is. And they have inequality as well greatly appreciate a short response I am in need of some information.,

“how wobbly their economy is.”

Not so much wobbly (the CCP has trillions in foreign reserves) as built upon practices that have expropriated their own citizens (through currency restrictions, consumer demand suppression, and inflation) and subverted intl trade relationships in ways that are now (finally) being responded to.

China has built a trade empire, but in ways that make its continued accelerated growth open to serious question.

Millions of Chinese don’t smuggle tens of billions out of China every year because they trust the CCP so unblinkingly.

The US has very serious problems too (basically the inverse reflection of Chinese pathologies).

What is wobbly, is the whole current regime/levels of intl trade…because they were built upon poorly sustainable deceptions/distortions created by their respective gvts, in order to serve the interests of those gvts.

The People’s Bank of China (PBOC) , China’s equivalent of our Federal Reserve, are even more profligate counterfeiters than those clowns in the Eccles Building. They have printed about four times as much fraudulent funds as the Feds. Last time i heard, the number was 32Trillion.

if you’re member of the big club you’ll continue to get bailed out. Maybe big inflation coming down the road. Silver just might be the canary in the mine as it’s gone from 18 to 23 in a week!

Yes it has but Silver is also vastly undervalued and has been since 2011 The gold/ Silver ratio which historically should run around 20 to 1 was recently 120 to 1 Crazy stuff Silver is finally playing catch up And it’s about time

Silver isn’t valued, it is traded. It is the trader’s metal. Remember $5 silver for years in the 70’s? Remember the Hunt’s trading it up to $50 in the early 80’s. Don’t confuse lasting value with trading.

Yes LH, I do remember both: I was in London for the boxing day sales when the Hunt bros tried to ‘corner the market’ in AG, not realizing that Russia had something like 12MM oz on hand,,,

Made some profit by calling CA to buy as soon as I saw what was happening, sold it before the crash when Russia came in, something like 3 days!

What fun it was to watch and play with the hundred oz bars!!

I remember that time well as that was the start of the demise of heirloom silverware sets! Many got pawned and eventually melted down.

At least two of the vaccines moving forward (Moderna, Oxford) have side effects that make a significant percent (80%) of receivers feel unwell (like a flu!) for several days. This is in the young, strong, healthy cohort being tested.

If this effect persists into the final vaccine, uptake of the vaccine may be far less than necessary to produce the desired herd immunity, especially given the percentage that say they won’t take any vaccine, the younger people who won’t because they do not fear the disease, the potential cost factor, and with the people who are not well enough to tolerate the vaccine given the side effects.

https://www.wired.com/story/covid-19-vaccines-with-minor-side-effects-could-still-be-pretty-bad/

Re early retirement. One would think that senior personnel who are close to retirement anyway would likely be tempted. So there go the senior pilots and mechanics, to be replaced by the younger, cheaper ones. A comforting thought when contemplating travel…. especially in Boings.

When I was a kid growing up in the SF Bay Area in the 1960’s and 1970’s, almost every kid I knew had never been on an airplane flight. I had two relatives who made once-in-a-lifetime trips to Europe. One of them had immigrated from there decades before.

Most families vacationed by car. Nobody complained about it. Some people think the quality of life and the standard of living were higher then, than now.

Road Warrior was an extremely rare animal. They did exist, but at very high level of management like senior VP or above. Business seemed to go along just fine with legions of Road Warriors.

There are three vaccines in phase 3 trials after a Chinese company began clinical trials in Brazil recently. China is accused of espionage in hacking US and other nation’s research facilities. Delivery of small quantities of vaccines might start as early as September, or by the end of the year. They might have to reduce the regulatory burdens to save lives. 30,000 doses of Remdesivir were shipped to Florida in an effort to reduce the length of hospital stays .there. Hidalgo County, TX ordered a complete shutdown only to be opposed by their governor.

It’s a good thing we have the pharmaceutical companies on the job looking to help mankind, cough$, cough$ . Their press release depts are larger than their labs, promising miracles and stock valuation. Imagine all the mice, monkeys, and other creatures (plus humans) who get to try out their speedy cures.

It’s not 2021, but years before the fallout of this pandemic is passed. No one can work together and it’s profit before anything else. I don’t like to sound pessimistic but it’s not about the virus, it’s the people running this show.

its why folks like you should stay out of the sector, I have made 1000% since March in biotech….you have to know what your buying and understand how the market works…posted comments here on why it was the place to be for next 8 months

TSA daily checkpoints are around 750K right now. It was under 100K in April. It was 2.5M at this time in 2019. So certainly way below where it should be, but it’s going in the right direction.

Just Some Random Guy,

The TSA reported this morning that checkpoint screenings were down to 530,421, down 78.8% from a year ago, and back where it was on June 25. This is going the wrong way:

One thing that very few people have addressed is the possibility of this virus being with us longer than a year or two.

“So many people are looking at it, a cure is bound to be found!!!” Well a lot of people also engaged in the following:

1. Solving death

2. Turning something into Gold.

3. Self driving car.

4. Name your own science fiction project here.

Just because a lot of brilliant people are looking at a problem, does not mean that problem will be solved.

Then what??

I protest against your point “3. Self driving car.”.

Technologie is already here, the economic equation (including the cost of legal work still to complete) is not here yet.

In many countries a human is still cheaper then 10K autodriving kit.

And you know what? There are people that actually like to drive (something hard to beleive for many).

Two friends have friends who are flying in the next few weeks. One has friend coming to visit, and the other will spend the weekend with her friend, after she goes flying in a separate trip. I told them to self quarantine me. These are Ca. women, liberal, socially concerned and temporarily oblivious. Someone also tells me a hotel in Vegas is offering $35 rooms. Cheap airfares and cheap rooms may be economically advantageous and even necessary, but this violates virus protocol and the CDC should get out ahead of it.

Those self quarantine orders are a joke. First off it’s physically impossible to do that when flying. Getting from the airport to your AirBnb breaks the quarantine right off the bat as soon as you enter an Uber. And to get to the Uber from the gate, you’re going to interact with a few hundred people inside the terminal. It’s a ludicrous idea all the way around.

And then once at the Airbnb, how do you police it? Are you going to have a cop (who is now defunded) stay outside everyone’s door for 14 days to make sure nobody leaves? It’s all on the honor system and as know people are not honorable.

All correct and I am going to isolate myself from these friends now, and that is sad for me. If you hang with people who fly I am not hanging with you.

Unfortunately, COVID is not even the biggest threat we face. As the economy deteriorates, historically, people turn to socialism as a solution.

The money the government is freely giving away now will add substantially to the debt and have to be serviced in the future.

The Democratic party is already floating a so called “wealth tax” which if implemented will eventually give the government power to manipulate the wealth of every American. We are sliding towards a socialist / communist state, and the end of everything America once stood for.

We are now in a forth turning, and that means a period of turmoil and a struggle for our very existence. There is no guarantee we will emerge from this period looking anything like what we are now.

“But passengers are still hard to find. United expects a load factor in July of only 45%.”

Is United cutting flights or cancelling routes, or even closing hubs yet? I’ve read the airlines ‘lose’ the route if they don’t fly it.

I will be making a plane trip to NYC in late august for a circumstance I can’t get out of and have been pushing off for months. My wife has obtained a stock of high end N95 masks, and a couple of pairs of goggles and a couple of disposable tyvek coat things. The airline I will be flying does not sell the middle seats. But we have gone from the choice of 3 airlines with daily nonstop flights from Portland to NYC to only one airline that flys non-stop 3 times a week and that flight is a red-eye. So the flying choices are much much smaller than before. When I return I will quarantine in the A-loft hotel that is right next to the building where we live for 7 days , lucky room rates are super cheap. No person in their right mind would do all this unless they have to.

I’m a willing flier but I have no place to go. Three of my flights were canceled this year by Norwegian Airlines, and I can’t reschedule do to travel restrictions. It’s apparent that besides domestics airlines, whole industries are collapsing as a result of collapse(s) in demand. Would it have helped demand if we had all worn masks from the beginning? Doubtful. Walk into any crowded flight, event, or shopping area (if you can find one) and show me one person wearing his or her mask correctly, or even the correct type of mask, for the duration. You won’t find one.

Had two trips planned this year with a tour group, one to Amsterdam, the other to the Caribbean, both were cancelled by them. Although they refunded my money, the airlines refused to refund, instead offering a credit for future travel, redeemable within one year. What are the odds I’ll get bent over as the airlines file for bankruptcy?

I got a little more than half my money back for two rt business class tickets from Los Angeles to Paris, including two carry-on pugs, that fell into a very narrow window of opportunity in terms of the EU pet health voucher forms, rabies vaccines, upon entry. Oh well, it’s better than nothing, which was what I expected.

We’re sitting on a ticket like that to Japan. Free to change, but we can’t get our money back. My understanding is that in a bankruptcy, if it gets that far, we will be unsecured creditors, way down the line with lots of other unsecured creditors.

Your wife can go to Japan.

You can’t.

She could use one of the tickets.

Even she has to quarantine for 14 days, can’t use mass transit from the airport (someone has to pick her up), etc. And since she would only go for 9 days, it’s a no-go.

Healthcare “leaders” as predictors of Medicine?

Seriously?

That’s not serious.